Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended April 25, 2015

COMMISSION FILE NUMBER 1-9656

LA-Z-BOY INCORPORATED

(Exact name of registrant as specified in its charter)

| MICHIGAN (State or other jurisdiction of incorporation or organization) |

38-0751137 (I.R.S. Employer Identification No.) |

|

One La-Z-Boy Drive, Monroe, Michigan (Address of principal executive offices) |

48162-5138 (Zip Code) |

Registrant's telephone number, including area code (734) 242-1444

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Shares, $1.00 Par Value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Based on the closing price on the New York Stock Exchange on October 24, 2014, the aggregate market value of Registrant's common shares held by non-affiliates of the Registrant on that date was $1,132.8 million.

The number of common shares outstanding of the Registrant was 50,500,801 as of June 9, 2015.

DOCUMENTS INCORPORATED BY REFERENCE:

- (1)

- Portions of the Registrant's Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A for its 2015 Annual Meeting of Shareholders are incorporated by reference into Part III.

LA-Z-BOY INCORPORATED

FORM 10-K ANNUAL REPORT FISCAL 2015

Note: The responses to Items 10 through 14 will be included in the Company's definitive proxy statement to be filed pursuant to Regulation 14A for the 2015 Annual Meeting of Shareholders. The required information is incorporated into this Form 10-K by reference to that document and is not repeated herein.

1

Cautionary Statement Concerning Forward-Looking Statements

La-Z-Boy Incorporated and its subsidiaries (individually and collectively, "we," "our" or the "Company") make forward-looking statements in this report, and its representatives may make oral forward-looking statements from time to time. Generally, forward-looking statements include information concerning possible or assumed future actions, events or results of operations. More specifically, forward-looking statements may include information regarding:

| — future income, margins and cash flows | — future economic performance | |

| — future growth | — industry and importing trends | |

| — adequacy and cost of financial resources | — management plans |

Forward-looking statements also include those preceded or followed by the words "anticipates," "believes," "estimates," "hopes," "plans," "intends" and "expects" or similar expressions. With respect to all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Actual results could differ materially from those we anticipate or project due to a number of factors, including: (a) changes in consumer confidence and demographics; (b) the possibility of another recession; (c) changes in the real estate and credit markets and their effects on our customers, consumers and suppliers; (d) international political unrest, terrorism or war; (e) volatility in energy and other commodities prices; (f) the impact of logistics on imports; (g) interest rate and currency exchange rate changes; (h) operating factors, such as supply, labor or distribution disruptions (i.e. port strikes); (i) changes in the domestic or international regulatory environment; (j) adoption of new accounting principles; (k) severe weather or other natural events such as hurricanes, earthquakes, flooding, tornadoes and tsunamis; (l) our ability to procure fabric rolls and leather hides or cut-and-sewn fabric and leather sets domestically or abroad; (m) information technology conversions or system failures; (n) effects of our brand awareness and marketing programs; (o) the discovery of defects in our products resulting in delays in manufacturing, recall campaigns, reputational damage, or increased warranty costs; (p) litigation arising out of alleged defects in our products; (q) unusual or significant litigation; (r) our ability to locate new La-Z-Boy Furniture Galleries® stores (or store owners) and negotiate favorable lease terms for new or existing locations; (s) the results of our restructuring actions; (t) the impact of potential goodwill or intangible asset impairments; and (u) those matters discussed in Item 1A of this Annual Report and other factors identified from time-to-time in our reports filed with the Securities and Exchange Commission. We undertake no obligation to update or revise any forward-looking statements, whether to reflect new information or new developments or for any other reason.

2

Edward M. Knabusch and Edwin J. Shoemaker started Floral City Furniture in 1927, and in 1928 the newly formed company introduced its first recliner. In 1941, we were incorporated in the state of Michigan as La-Z-Boy Chair Company, and in 1996 we changed our name to La-Z-Boy Incorporated. Today, our La-Z-Boy brand is the most recognized brand in the furniture industry.

We manufacture, market, import, distribute and retail upholstery furniture products. In addition, we import, distribute and retail accessories and casegoods (wood) furniture products. We are the leading global producer of reclining chairs and the second largest manufacturer/distributor of residential furniture in the United States. The La-Z-Boy Furniture Galleries® stores retail network is the third largest retailer of single-branded furniture in the United States. We have seven major North American manufacturing locations to support our speed to market and customization strategy.

We sell our products, primarily in the United States and Canada as well as internationally, to furniture retailers and directly to consumers through stores that we own and operate. The centerpiece of our retail distribution strategy is our network of 325 La-Z-Boy Furniture Galleries® stores and 573 Comfort Studio® locations, each dedicated to marketing our La-Z-Boy branded products. We consider this dedicated space to be "branded outlets" or "proprietary." In addition to the almost 900 branded outlets dedicated to selling La-Z-Boy product (La-Z-Boy Furniture Galleries® stores and Comfort Studios®), approximately 2,800 other dealers also sell La-Z-Boy. This includes some of the best known names in the industry, such as Art Van, Berkshire Hathaway and Slumberland. Additionally, our other brands—England, Kincaid, American Drew and Hammary—enjoy distribution through a combined 1,700 dealers. We own 110 of the La-Z-Boy Furniture Galleries® stores. The remainder of the La-Z-Boy Furniture Galleries® stores, as well as all 573 Comfort Studio® locations, are independently owned and operated. La-Z-Boy Furniture Galleries® stores help consumers furnish their homes by combining the style, comfort and quality of La-Z-Boy furniture with our available complimentary in-home design service. Comfort Studio® locations are defined spaces within larger independent retailers that are dedicated to displaying and selling La-Z-Boy branded products. In addition to the La-Z-Boy Comfort Studio® locations, our Kincaid and England operating units have their own in-store gallery programs with over 525 outlets and 1.8 million square feet of proprietary floor space. In total, our proprietary floor space includes approximately 9.5 million square feet.

During fiscal 2015, we executed our plan to restructure our casegoods business, including transitioning to an all-import model for our wood furniture. As a result of this restructuring, we ceased casegoods manufacturing at our Hudson, North Carolina facility during the second quarter of fiscal 2015, and we transitioned our remaining Kincaid and American Drew bedroom product lines to imported product. We have completed the consolidation of our casegoods showrooms and will complete the consolidation of our casegoods corporate offices in fiscal 2016. We also marketed for sale our youth furniture business, Lea Industries, in connection with the restructuring, as it did not align with our long-term strategic objectives. We were unable to find a buyer for our Lea Industries business, and instead we liquidated all the assets, consisting mostly of inventory, and ceased operations of Lea Industries during the third quarter of fiscal 2015.

Principal Products and Industry Segments

Our reportable segments are the Upholstery segment, the Casegoods segment and the Retail segment.

Upholstery Segment. Our Upholstery segment is our largest business and mainly consists of two operating units: La-Z-Boy, our largest operating unit, and our England subsidiary. Our Upholstery segment manufactures, imports, and exports upholstered furniture such as recliners and motion furniture, sofas, loveseats, chairs, sectionals, modulars, ottomans and sleeper sofas. The Upholstery

3

segment sells directly to La-Z-Boy Furniture Galleries® stores, operators of Comfort Studio® and England Custom Comfort Center locations, major dealers and other independent retailers.

Casegoods Segment. Our Casegoods segment is an importer, marketer and distributor of casegoods (wood) furniture such as bedroom sets, dining room sets, entertainment centers and occasional pieces, and also manufactures some coordinated upholstered furniture. The Casegoods segment consists of three brands: American Drew, Hammary, and Kincaid. The Casegoods segment sells primarily to major dealers, as well as La-Z-Boy Furniture Galleries® stores, along with a wide cross-section of other independent retailers.

Retail Segment. Our Retail segment consists of 110 company-owned La-Z-Boy Furniture Galleries® stores. The Retail segment primarily sells upholstered furniture, in addition to some casegoods and other accessories, to the end consumer through our retail network.

We have provided additional detailed information regarding our segments and their products in Note 16 to our consolidated financial statements and our "Management's Discussion and Analysis" section, both of which are included in this report.

Raw Materials and Parts

The principal raw materials and parts that we use in our Upholstery segment are purchased cover (primarily fabrics and leather), polyester batting and non-chlorofluorocarbonated polyurethane foam for cushioning and padding, lumber and plywood for frames, steel for motion mechanisms, and electrical components for power styles, which together account for approximately 84% of the segment's total material costs. Purchased cover is our largest raw material cost in this segment and represents about 43% of the segment's material costs. We purchase cover from a variety of sources, but we rely on a limited number of major suppliers. We purchase about 77% of our polyurethane foam from one supplier, which has several facilities across the United States that deliver to our plants. If one of these major suppliers experienced financial or other difficulties, we could experience temporary disruptions in our manufacturing process until we obtained alternate suppliers.

We purchase approximately 55% (based on cost) of our cover in a raw state (fabric rolls or leather hides) and cut and sew it into cover, and 45% in covers that have already been cut and sewn by third-party offshore suppliers to our specifications. We buy from five primary suppliers of cut-and-sewn leather and fabric products. Of the products that we import from China, two suppliers manufacture over 80% of the leather cut-and-sewn sets, and two other suppliers manufacture over 95% of the fabric products.

During fiscal 2015, materials we used in our upholstery manufacturing process increased in price by approximately 2% compared with fiscal 2014. We expect our raw material costs to be flat as a percent of sales in fiscal 2016 compared to fiscal 2015.

Our Casegoods segment is primarily an importer, marketer, and distributor of wood furniture, with some manufacturing operations for coordinated upholstered furniture. Raw materials, primarily related to our coordinated upholstery furniture, represented only about 7% of the value of our inventory in this segment and about 3% of our total raw material at the end of fiscal 2015, and mainly consisted of the same materials used in our Upholstery segment.

Casegoods Finished Goods Imports

We imported 79% of the finished wood furniture that we sold in fiscal 2015 (compared with 70% in fiscal 2014), primarily because of the low labor (both wages and benefits) and overhead costs associated with manufacturing casegoods product overseas. Due to the transition to an all-import model for our wood furniture during fiscal 2015, we are now importing 100% of the casegoods products that we offer for sale. The prices we paid for these imported products in fiscal 2015 were essentially unchanged from

4

fiscal 2014. We currently expect these prices and associated transportation costs to increase slightly in fiscal 2016 compared to fiscal 2015. Looking across our wholesale segments, imported finished goods represented 7% of our consolidated sales in both fiscal 2015 and fiscal 2014.

Seasonal Business

We believe that the demand for furniture generally reflects sensitivity to overall economic conditions, including consumer confidence, housing market conditions and unemployment rates. Historically, all of our segments have normally experienced lower sales during our first fiscal quarter. Our Upholstery segment has typically experienced its highest sales during our fourth fiscal quarter, while our Retail segment has usually experienced its highest sales during our third fiscal quarter.

Our Casegoods segment has historically experienced its highest sales in the second or fourth fiscal quarters. During fiscal 2015, however, our Casegoods segment attained its highest sales during our first fiscal quarter and its lowest sales during our fourth fiscal quarter. We believe that the change in the seasonality of our sales during fiscal 2015 was the result of delays in market introductions and other key items being out of stock at the end of fiscal 2014, which resulted in higher shipments during the first quarter of fiscal 2015. We also increased sales in the first quarter of fiscal 2015 due to heavy shipments of our discontinued product lines related to our restructuring plan. We do not believe these factors represent a change in the seasonal trend for sales of this product.

When possible, we schedule production to maintain consistent manufacturing activity throughout the year. We shut down our domestic plants for a week in July to perform routine maintenance on our equipment.

Economic Cycle and Purchasing Cycle

Upholstered furniture has a shorter life cycle than casegoods furniture because upholstered furniture is typically more fashion and design-oriented, and is often purchased one or two pieces at a time. Casegoods products, in contrast, are longer-lived and frequently purchased in groupings or "suites," resulting in a much larger cost to the consumer. As a result, casegoods sales are more sensitive to economic conditions, and upholstered furniture normally exhibits a less volatile sales pattern over an economic cycle.

Practices Regarding Working Capital Items

The following describes our significant practices regarding working capital items.

Inventory: For our upholstery segment, we maintain raw materials and work in process inventory at our manufacturing locations, and finished goods inventory at our six regional distribution centers. Our regional distribution centers allow us to streamline the warehousing and distribution processes for our La-Z-Boy Furniture Galleries® store network, including both company-owned stores and independently owned stores. Our regional distribution centers also allow us to reduce the number of individual warehouses needed to supply our retail outlets and help us reduce our inventory levels at our manufacturing and retail locations. We also maintain some finished goods inventory at our manufacturing locations, which primarily supports efficient shipping of sold orders.

We import most casegoods product to enable us to meet our customers' delivery requirements, due to the long lead times to receive product from overseas vendors. This practice results in higher levels of finished goods inventory, as a percentage of sales, of our casegoods products than our upholstery products. Our company-owned La-Z-Boy Furniture Galleries® stores maintain finished goods inventory at the stores for display purposes.

Our inventory increased $9.8 million, or 0.2 percentage point as a percent of sales, during fiscal 2015 compared with fiscal 2014. The majority of this increase was driven by raw materials in our Upholstery

5

segment as we worked to reduce out-of-stock cover options. Additionally, our inventory increased in our Retail segment due to new and acquired stores. These increases were partially offset by a reduction in inventories at our Casegoods segment as we completed our transition to an all-import model and reduced the raw material inventory required to support domestic manufacturing operations, including a $4.8 million reduction of our LIFO reserves. We will continue to manage our inventory levels to ensure they are appropriate relative to our sales, while maintaining our focus on service to our customers.

Accounts Receivable: During fiscal 2015, our accounts receivable increased $5.9 million compared with fiscal 2014, which reflected a 0.1 percentage point reduction as a percentage of sales. The increase in dollars was mainly due to higher sales in fiscal 2015. We continue to see an improvement in the financial condition of our customer base, including our independent La-Z-Boy Furniture Galleries® dealers. We monitor our customers' accounts and limit our credit exposure to certain independent dealers, and decrease our days sales outstanding where possible.

Accounts Payable: During fiscal 2015, our accounts payable decreased $10.0 million compared with fiscal 2014, and decreased 0.9 percentage point as a percentage of sales. The decrease was primarily a result of lower capital expenditures in accounts payable, as we paid for substantially all of our new world headquarters costs by the end of the fiscal 2015.

Customers

Our wholesale customers are furniture retailers located primarily throughout the United States and Canada. We did not have any single customer whose purchases amounted to more than 2% of our consolidated or Upholstery segment sales in fiscal 2015. Sales in our Upholstery and Casegoods segments are almost entirely to furniture retailers, but we sell to consumers through our company-owned La-Z-Boy Furniture Galleries® stores that make up our Retail segment.

We have formal agreements with many furniture retailers for them to display and merchandise products from one or more of our operating units and sell them to consumers in dedicated retail space, either in stand-alone stores or dedicated proprietary galleries or studios within their stores. We consider this dedicated space to be "proprietary." For our Upholstery and Casegoods segments, our fiscal 2015 customer mix based on sales was about 58% proprietary, 8% major dealers (for example, Art Van Furniture, Berkshire Hathaway, Slumberland Furniture, and Raymour & Flanigan Furniture) and 34% other independent retailers.

The success of our product distribution relies heavily on having retail floor space that is dedicated to displaying and marketing our products. Our La-Z-Boy Furniture Galleries® stores network has the largest number of proprietary stores and galleries among our operating units. In addition, we sell product through proprietary space within other retail furniture stores, primarily La-Z-Boy Comfort Studio® locations, England Custom Comfort Center locations, and Kincaid Shoppes.

Maintaining, updating, and expanding, when appropriate, our proprietary distribution network is a key part of our overall sales and marketing strategy. Our 4-4-5 initiative, through which we expect to expand the La-Z-Boy Furniture Galleries® stores network to 400 stores averaging $4 million in sales per store over the five year period that began with fiscal 2014, is a key growth strategy for us. As we continue to maintain and update our current stores, the La-Z-Boy Furniture Galleries® stores network plans to open, relocate or remodel 35 to 40 stores during fiscal 2016. All of these new stores will feature the new concept store design we developed and introduced in fiscal 2012.

We select independent dealers for our proprietary La-Z-Boy Furniture Galleries® stores network based on factors such as their management and financial qualifications and the potential for distribution in specific geographical areas. This proprietary distribution benefits La-Z-Boy, our dealers and our consumers. It enables La-Z-Boy to concentrate our marketing with sales personnel dedicated to our entire product line, and only that line and approved accessories. It allows dealers who join this

6

proprietary group to take advantage of practices that other proprietary dealers have succeeded with, and we facilitate forums for these dealers to share best practices. These La-Z-Boy Furniture Galleries® stores provide our consumers a full-service shopping experience with a large variety of product and knowledgeable sales associates and in-home design consultants.

Orders and Backlog

We typically build upholstery orders based on specific dealer orders, either for dealer stock or to fill a consumer's custom order. We have casegoods product produced primarily to our internal order, rather than a customer or consumer order, resulting in higher finished goods inventory on hand as a percentage of sales. Because the size of our backlog at a given time may not be indicative of our future sales, we do not rely entirely on backlogs to predict future sales.

For our continuing operations, as of April 25, 2015, and April 26, 2014, our Upholstery segment backlogs were approximately $71.5 million and $77.0 million, respectively, and our Casegoods segment backlogs were approximately $11.2 million and $15.4 million, respectively. Our backlogs are lower than the prior year due to being in a better inventory service position at April 25, 2015.

Competitive Conditions

We are the second largest manufacturer/distributor of residential (living and family room, bedroom, and dining room) furniture in the United States, as measured by annual sales volume.

In the Upholstery segment, our largest competitors are Ashley, Bassett Furniture, Bernhardt, Best Chair, Broyhill, Craftmaster, Ethan Allen, Flexsteel, Heritage Home Group, Klaussner, and Natuzzi.

In the Casegoods segment, our main competitors are Ashley, Bernhardt, Ethan Allen, Heritage Home Group, Hooker Furniture, Stanley Furniture, and Lacquer Craft. The Casegoods segment faces additional market pressures from foreign manufacturers entering the United States market and increased direct purchases from foreign suppliers by large United States retailers.

The La-Z-Boy Furniture Galleries® stores operate in the retail furniture industry throughout North America, and different stores have different competitors based on their geographic locations. Competitors include: Arhaus, Ashley, Bassett Furniture Direct, Crate and Barrel, Ethan Allen, Nebraska Furniture Mart, Restoration Hardware, Thomasville Home Furnishings Stores, several other regional competitors (for example Art Van Furniture, Raymour & Flanigan Furniture, and Slumberland Furniture), and family-owned independent furniture stores.

In addition to the larger competitors listed above, a substantial number of small and medium-sized companies operate within our business segments, all of which are highly competitive.

Over the past decade alternative distribution channels have increasingly affected our retail markets. Companies such as Costco, Home Depot, IKEA, Sam's Club, Target, Wal-Mart, Williams Sonoma, and others offer products that compete with some of our product lines. The increased ability of consumers to purchase furniture through various furniture manufacturers' and retailers' internet websites has also increased competition, including companies such as QVC and Wayfair that operate with lower overhead costs than a brick and mortar retailer.

Players in the home furnishings industry compete primarily on the basis of product styling and quality, customer service (product availability and delivery), and price. We compete primarily by emphasizing our brand and the value, comfort, quality, and styling of our products. In addition, we remain committed to innovation while striving to provide outstanding customer service, exceptional dealer support, and efficient on-time delivery. Maintaining, updating and expanding our proprietary distribution system is a key strategic initiative for us in striving to remain competitive. We compete in

7

the mid-to-upper-mid price point, and a shift in consumer taste and trends to lower priced products could negatively affect our competitive position.

Research and Development Activities

We provide information regarding our research and development activities in Note 1 to our consolidated financial statements, which are included in Item 8 of this report.

Trademarks, Licenses and Patents

We own several trademarks, including La-Z-Boy, our most valuable. The La-Z-Boy trademark is essential to the Upholstery and Retail segments of our business. To protect our trademarks, we have registered them in the United States and various other countries where our products are sold. These trademarks have a perpetual life, subject to renewal. We license the use of the La-Z-Boy trademark to our major international partners and dealers outside of North America. We also license the use of the La-Z-Boy trademark on contract office furniture, outdoor furniture and non-furniture products, and these arrangements enhance our brand awareness, broaden the perceptions of La-Z-Boy and create visibility of the La-Z-Boy brand in channels outside of the residential furniture industry. In addition, we license to our branded dealers the right to use our La-Z-Boy trademark in connection with the sale of our products and related services, on their signs, and in other ways, which we consider to be a key part of our marketing strategies. We provide more information about those dealers, under "Customers."

We hold a number of patents that we actively enforce, but we believe that the loss of any single patent or group of patents would not significantly affect our business.

Compliance with Environmental Regulations

Our manufacturing operations involve the use and disposal of certain substances regulated under environmental protection laws, and we are involved in a small number of remediation actions and site investigations concerning such substances. Based on a review of all currently known facts and our experience with previous environmental matters, we believe we have adequate reserves in respect of probable and reasonably estimable losses arising from environmental matters and we currently do not believe it is probable that we will have any additional loss for environmental matters that would be material to our consolidated financial statements.

Employees

We employed approximately 8,270 full-time equivalent employees as of April 25, 2015, compared with 8,300 employees at the end of fiscal 2014. We employed approximately 7,000 in our Upholstery segment, 200 in our Casegoods segment, 800 in our Retail segment, and the remaining employees as corporate personnel. We employ the majority of our employees on a full-time basis except in our Retail segment, where many of our employees are part-time.

Financial Information About Foreign and Domestic Operations and Export Sales

In fiscal 2015, our direct export sales, including sales in Canada, were approximately 13% of our total sales. We are part of a manufacturing joint venture in Thailand, which distributes furniture in Australia, New Zealand, Thailand and other countries in Asia. In addition, we participate in a sales and marketing joint venture in Asia, which sells and distributes furniture in Korea, Taiwan, Japan, India, Malaysia, and other Asian countries.

We operate a facility in Mexico which produces cut-and-sewn fabric sets for our domestic upholstery manufacturing facilities. We provide information on sales in the United States, Canada, and other countries in Note 16 to our consolidated financial statements, which are included in Item 8 of this

8

report. Our net property, plant, and equipment value in the United States was $165.7 million and $120.7 million at the end of fiscal 2015 and fiscal 2014, respectively. Our net property, plant, and equipment value in foreign countries was $8.3 million and $6.8 million in fiscal 2015 and fiscal 2014, respectively.

See Item 1A of this report for information about the risks related to our foreign operations.

Internet Availability

Our Forms 10-K, 10-Q, 8-K, and proxy statements on Schedule 14A and amendments to those reports are available free of charge through links on our internet website, www.la-z-boy.com, as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). Copies of any materials we file with the SEC can also be obtained free of charge through the SEC's website at www.sec.gov. The information on our website is not part of this report.

9

Our business is subject to a variety of risks. Interest rates, consumer confidence, housing starts and the overall housing market, increased unemployment, tightening of the financial and consumer credit markets, downturns in the economy and other general economic factors that affect many other businesses are particularly significant to us because our principal products are consumer goods.

The risks and uncertainties described below are those that we currently believe may significantly affect our business. Additional risks and uncertainties that we are unaware of or that we do not currently deem significant may also become important factors that affect us at a later date. You should carefully consider the risks and uncertainties described below, together with the other information provided in this document and our subsequent filings with the Securities and Exchange Commission. Any of the following risks could significantly and adversely affect our business, results of operations, and financial condition.

Fluctuations in the price, availability and quality of raw materials could cause delays that could result in our inability to provide goods to our customers or could increase our costs, either of which could decrease our earnings.

In manufacturing furniture, we use various types of wood, fabrics, leathers, upholstered filling material, steel, and other raw materials. Because we are dependent on outside suppliers for our raw materials, fluctuations in their price, availability and quality could have a negative effect on our cost of sales and our ability to meet our customers' demands. Competitive and marketing pressures may prevent us from passing along price increases to our customers, and the inability to meet our customers' demands could cause us to lose sales. We have a higher concentration (70%) in upholstery sales, including motion furniture, than many of our competitors, and the effects of steel, polyurethane foam, leather and fabric price increases or quantity shortages could be significant for our business. About 77% of our polyurethane foam comes from one supplier. This supplier has several facilities across the United States, but severe weather or natural disasters could result in delays in shipments of polyurethane foam to our plants.

A change in the financial condition of some of our domestic and foreign fabric suppliers could impede their ability to provide their products to us in a timely manner. Upholstered furniture is fashion oriented, and if we were unable to acquire sufficient fabric variety, or to predict or respond to changes in fashion trends, we might lose sales and have to sell excess inventory at reduced prices. Doing so would have a negative effect on our sales and earnings.

Availability of foreign sourcing and economic uncertainty in countries outside of the United States in which we operate or from which we purchase product could adversely affect our business and results of operations.

We have operations in countries outside the United States, some of which are located in emerging markets. Long-term economic and political uncertainty in some of the countries in which we operate, such as Mexico and Thailand, could result in the disruption of markets and negatively affect our business. Our Casegoods segment imports products manufactured by foreign sources, mainly in China, Vietnam and Indonesia, and our Upholstery segment purchases cut-and-sewn fabric and leather sets and some finished goods from Chinese and other foreign vendors. The majority of the cut-and-sewn leather kits that we purchase from China are from two suppliers. Our sourcing partners may not be able to produce goods in a timely fashion or the quality of their product may lead us to reject it, causing disruptions in our domestic operations and delays in our shipments to our customers.

There are other risks that are inherent in our non-U.S. operations, including the potential for changes in socio-economic conditions, changes in laws and regulations, including import, export, labor and environmental laws, port strikes, tariffs and trade barriers, monetary and fiscal policies, investments, taxation, and exchange controls. Additionally, unsettled political conditions, possible terrorist attacks,

10

organized crime and public health concerns present a risk to our non-U.S. operations. All of these items could make servicing our customers more difficult or cause disruptions in our plants that could reduce our sales, earnings, or both in the future.

Inability to maintain and enhance our brand and respond to changes in our current and potential consumers' tastes and trends in a timely manner could adversely affect our business and operating results.

The success of our business depends on our ability to maintain and enhance our brands to increase our business by retaining consumers and attracting new ones. Because furniture product is fashion oriented, changes in consumers' tastes and trends and the resultant change in our product mix could adversely affect our business and operating results. We attempt to minimize these risks by maintaining a strong advertising and marketing campaign promoting both our brands and our current product designs, styles, quality and prices. If these efforts were unsuccessful or required us to incur substantial costs, our business, operating results and financial or competitive condition could be adversely affected.

Loss of market share and other financial or operational difficulties due to competition would likely result in a decrease in our sales, earnings, and liquidity.

The residential furniture industry is highly competitive and fragmented. We compete with many other manufacturers and retailers, including online retailers, some of which offer widely advertised products, and others of which are large retail furniture dealers offering their own store-branded products. Competition in the residential furniture industry is based on quality, style of products, perceived value, price, service to the customer, promotional activities, and advertising. The highly competitive nature of the industry means we are constantly subject to the risk of losing market share, which would likely decrease our future sales, earnings and liquidity. In addition, due to the large number of competitors and their wide range of product offerings, we may not be able to differentiate our products (through styling, finish, and other construction techniques) from those of our competitors. These and other competitive pressures could result in a decrease in our sales, earnings, and liquidity.

Our current retail markets and other markets that we enter in the future may not achieve the growth and profitability we anticipate. We could incur charges for the impairment of long-lived assets if we fail to meet our earnings expectations for these markets.

From time to time we acquire retail locations and related assets, remodel and relocate existing stores, and close underperforming stores. Our assets include goodwill and other indefinite-lived intangible assets in connection with acquisitions. Profitability of acquired, remodeled, and relocated stores will depend on lease rates (for stores we lease) and retail sales and profitability justifying the costs of acquisition, remodeling, and relocation. If we do not meet our sales or earnings expectations for these stores, we may incur charges for the impairment of long-lived assets, the impairment of goodwill, or the impairment of other indefinite-lived intangible assets.

Changes in regulation of our international operations could adversely affect our business and results of operations.

Because we have operations outside of the United States and sell product in various countries, we are subject to many laws governing international relations, including the Foreign Corrupt Practices Act and the U.S. Export Administration Act. These laws include prohibitions on improper payments to government officials and restrictions on where we can do business, what products we can supply to certain countries, and what information we can provide to certain governments. Violations of these laws, which are complex, may result in criminal penalties or sanctions that could have a significant adverse effect on our business and results of operations. Although we have implemented policies and procedures designed to ensure compliance with these laws, there can be no assurance that our employees, contractors, or agents will not violate our policies.

11

We rely extensively on computer systems to process transactions, summarize results and manage our business and that of certain independent dealers. Disruptions in both our primary and back-up systems could adversely affect our business and operating results.

Our primary and back-up computer systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, security breaches, natural disasters and errors by employees. Though losses arising from some of these issues would be covered by insurance, interruptions of our critical business computer systems or failure of our back-up systems could reduce our sales or result in longer production times. If our critical business computer systems or back-up systems were damaged or ceased to function properly, we might have to make a significant investment to repair or replace them.

We have been implementing an enterprise resource planning (ERP) system in our largest operating unit over the last several years. We expect to complete the final implementation by the end of fiscal 2016. ERP implementations are complex and time-consuming projects that involve substantial expenditures on system software and implementation activities. ERP implementations also require transformation of business and financial processes in order to reap the benefits of the ERP system; any such transformation involves risks inherent in the conversion to a new computer system, including loss of information and potential disruption to our normal operations. Our business and results of operations may be adversely affected if we experience operating problems or cost overruns during the ERP implementation process, or if the ERP system and the associated process changes do not give rise to the benefits that we expect. Additionally, if we do not effectively implement the ERP system as planned or the system does not operate as intended, the effectiveness of our internal control over financial reporting could be adversely affected or our ability to assess it adequately could be delayed. Significant delays in documenting, reviewing and testing our internal control could cause us to fail to comply with our SEC reporting obligations related to our management's assessment of our internal control over financial reporting.

We may be subject to product liability claims or undertake to recall one or more products, with a negative impact on our financial results and reputation.

Millions of our products, sold over many years, are currently used by consumers. We may be named as a defendant in lawsuits instituted by persons allegedly injured while using one of our products. We have insurance that we believe is adequate to cover such claims, but we are self-insured for the first $1.5 million in liability and for all defense costs. Furthermore, such claims could damage our brands and reputation and negatively affect our operating results. In addition, regulation of consumer products has increased in recent years as the U.S. Consumer Product Safety Commission has acquired greater regulatory and enforcement power. We have voluntarily recalled products in the past, and while none of those recalls has resulted in a material expense or other significant adverse effect, it is possible that future recalls, if any, could result in additional expense, penalties, injury to our brands and reputation, and negatively impact our operating results.

Our business and our reputation could be adversely affected by the failure to protect sensitive employee, customer and consumer data or to comply with evolving regulations relating to our obligation to protect such data.

Cyber-attacks designed to gain access to sensitive information by breaching security systems of large organizations leading to unauthorized release of confidential information have occurred recently at a number of major U.S. companies despite widespread recognition of the cyber-attack threat and improved data protection methods. During fiscal 2015, we have been subject, and will likely continue to be subject, to attempts to breach the security of our networks and IT infrastructure through cyber-attack, malware, computer viruses and other means of unauthorized access. To the best of our knowledge, attempts to breach our systems have not been successful to date. A breach in our systems that resulted in the unauthorized release of sensitive data could have a material adverse effect on our reputation and lead to financial losses from remedial actions or potential liability, possibly including punitive damages. An electronic security breach resulting in the unauthorized release of sensitive data from our information systems could also materially increase the costs we already incur to protect against such risks.

12

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

We owned or leased approximately 10.5 million square feet of manufacturing, warehousing and distribution centers, office, showroom, and retail facilities, and had approximately 0.4 million square feet of idle facilities, at the end of fiscal 2015. Of the 10.5 million square feet occupied at the end of fiscal 2015, our Upholstery segment occupied approximately 6.7 million square feet, our Casegoods segment occupied approximately 1.4 million square feet, our Retail segment occupied approximately 2.0 million square feet and our Corporate and other operations occupied the balance.

Our active facilities and retail locations are located in Arkansas, California, Connecticut, Delaware, Florida, Illinois, Indiana, Kansas, Kentucky, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nevada, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Tennessee, Virginia, Wisconsin, Coahuila (Mexico), Bangkok (Thailand) and Hong Kong. All of our plants and stores are well maintained and insured. We do not expect any major land or building additions will be needed to increase capacity in the foreseeable future for our manufacturing operations. We own all of our domestic plants and our joint venture owns our Thailand plant. We lease the majority of our retail stores and regional distribution centers, as well as our manufacturing facility in Mexico and our office space in Hong Kong. For information on terms of operating leases for our properties, see Note 10 to our consolidated financial statements, which are included in Item 8 of this report.

We are involved in various legal proceedings arising in the ordinary course of our business. Based on a review of all currently known facts and our experience with previous legal matters, we have recorded expense in respect of probable and reasonably estimable losses arising from legal matters and we currently do not believe it is probable that we will have any additional loss for legal matters that would be material to our consolidated financial statements.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

13

EXECUTIVE OFFICERS OF THE REGISTRANT

Listed below are the names, ages and current positions of our executive officers and, if they have not held those positions for at least five years, their former positions during that period. All executive officers serve at the pleasure of the board of directors.

Kurt L. Darrow, age 60

- •

- Chairman, President and Chief Executive Officer since August 2011

- •

- President and Chief Executive Officer from September 2003 through August 2011

Louis M. Riccio, Jr., age 52

- •

- Senior Vice President of La-Z-Boy and Chief Financial Officer since July 2006

Mark S. Bacon, Sr., age 52

- •

- Senior Vice President of La-Z-Boy and President of La-Z-Boy Branded Business since July 2011

- •

- Senior Vice President of La-Z-Boy and Chief Retail Officer from October 2008 through July 2011

J. Douglas Collier, age 48

- •

- Senior Vice President of La-Z-Boy, Chief Marketing Officer and President, International since August 2014

- •

- Chief Marketing Officer and President, International from August 2011 through August 2014

- •

- Chief Marketing Officer from September 2008 through August 2011

Darrell D. Edwards, age 51

- •

- Senior Vice President of La-Z-Boy and Chief Supply Chain Officer since August 2014

- •

- Senior Vice President of Operations, Residential Division from May 2012 through August 2014

- •

- Vice President, Manufacturing from July 2011 through May 2012

- •

- Vice President and General Manager—Dayton, Tennessee Plant from May 2007 through July 2011

Steven M. Kincaid, age 66

- •

- Senior Vice President of La-Z-Boy and President of Casegoods since November 2003

- •

- President, Kincaid Furniture Company, Incorporated from June 1983 through April 2015

Otis S. Sawyer, age 57

- •

- Senior Vice President of La-Z-Boy and President of Non-Branded Upholstery since February 2008

- •

- President, England, Inc. since February 2008

14

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Dividend and Market Information

The New York Stock Exchange is the principal market on which our common stock is traded. The tables below show the high and low sale prices of our common stock on the New York Stock Exchange during each quarter of our last two fiscal years.

| |

|

Market Price | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Dividends Paid |

||||||||||||

| Fiscal 2015 Quarter Ended | High | Low | Close | ||||||||||

July 26 |

$ | 0.06 | $ | 26.66 | $ | 20.93 | $ | 21.63 | |||||

October 25 |

$ | 0.06 | $ | 23.42 | $ | 19.03 | $ | 21.83 | |||||

January 24 |

$ | 0.08 | $ | 27.75 | $ | 21.50 | $ | 27.36 | |||||

April 25 |

$ | 0.08 | $ | 28.38 | $ | 24.71 | $ | 27.49 | |||||

| | | | | | | | | | | | | | |

|

$ | 0.28 | |||||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| |

|

Market Price | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Dividends Paid |

||||||||||||

| Fiscal 2014 Quarter Ended | High | Low | Close | ||||||||||

July 27 |

$ | 0.04 | $ | 22.33 | $ | 17.48 | $ | 20.34 | |||||

October 26 |

$ | 0.04 | $ | 24.42 | $ | 20.12 | $ | 23.35 | |||||

January 25 |

$ | 0.06 | $ | 31.22 | $ | 22.79 | $ | 27.19 | |||||

April 26 |

$ | 0.06 | $ | 28.48 | $ | 24.04 | $ | 24.55 | |||||

| | | | | | | | | | | | | | |

|

$ | 0.20 | |||||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Our credit agreement allows us to pay dividends or purchase shares as long as we are not in default and our excess availability, as defined in the agreement, is above 17.5% of the revolving credit commitment. If excess availability falls between 12.5% and 17.5%, then to continue paying dividends or purchasing shares, we must maintain a fixed charge coverage ratio of at least 1.10 to 1.00 on a pro forma basis and not be in default. Currently we are not prohibited from paying dividends or purchasing shares. Refer to Note 9 of the consolidated financial statements in Item 8 for further discussion of our credit agreement. The payment of future cash dividends is within the discretion of our board of directors and will depend, among other factors, on our earnings, capital requirements and operating and financial condition, as well as excess availability under the credit agreement.

Shareholders

We had approximately 15,500 shareholders of record at June 9, 2015.

15

Equity Plans

The table below provides information concerning our compensation plans under which common shares may be issued.

Equity Compensation Plan Information as of April 25, 2015

| Plan category | Number of securities to be issued upon exercise of outstanding options (i) |

Weighted- average exercise price of outstanding options (ii) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (i)) (iii) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Equity compensation plans approved by Shareholders |

1,038,621 | (1) | $ | 16.15 | 4,773,497 | (2) | ||||

Note 1: These options were issued under our 2010 Omnibus Incentive Plan.

Note 2: This amount is the aggregate number of shares available for future issuance under our 2010 Omnibus Incentive Plan. The omnibus incentive plan provides for awards of stock options, restricted stock, and performance awards (awards of our common stock based on achievement of pre-set goals over a performance period) to selected key employees and non-employee directors. We have performance awards outstanding under the plan that would reduce the number of shares remaining available for future issuance under the plan by 895,639 shares, assuming the maximum performance targets were achieved.

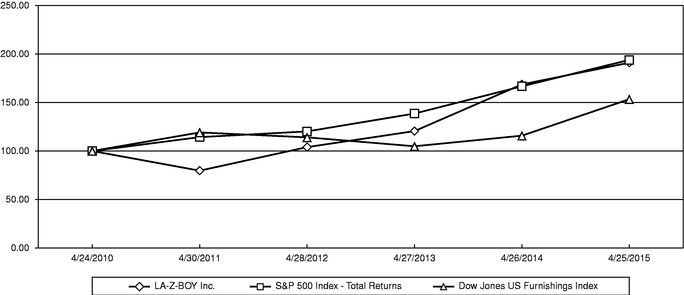

Performance Graph

The graph below shows the cumulative total return for our last five fiscal years that would have been realized (assuming reinvestment of dividends) by an investor who invested $100 on April 24, 2010 in our common shares, in the S&P 500 Composite Index and in the Dow Jones U.S. Furnishings Index.

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

April 2015

| Company/Index/Market | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

La-Z-Boy Incorporated |

$ | 100 | $ | 79.73 | $ | 104.00 | $ | 120.53 | $ | 168.68 | $ | 191.04 | |||||||

S&P 500 Composite Index |

$ | 100 | $ | 114.31 | $ | 120.21 | $ | 138.62 | $ | 166.71 | $ | 193.95 | |||||||

Dow Jones U.S. Furnishings Index |

$ | 100 | $ | 119.15 | $ | 114.08 | $ | 104.90 | $ | 115.81 | $ | 153.41 | |||||||

16

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

Our board of directors has authorized the purchase of company stock. As of April 25, 2015, 5.7 million shares remained available for purchase pursuant to this authorization. We spent $51.9 million in fiscal 2015 to purchase 2.1 million shares. During the fourth quarter of fiscal 2015, pursuant to the existing board authorization, we adopted a plan to purchase company stock pursuant to Rule 10b5-1 of the Securities Exchange Act of 1934. The plan was effective April 1, 2015. Under this plan, our broker has the authority to purchase company shares on our behalf, subject to SEC regulations and the price, market volume and timing constraints specified in the plan. The plan expires at the close of business on July 20, 2015. With the cash flows we anticipate generating in fiscal 2016, we expect to continue being opportunistic in purchasing company stock.

The following table summarizes our purchases of company stock during the fourth quarter of fiscal 2015:

| (Shares in thousands) | Total number of shares purchased |

Average price paid per share |

Total number of shares purchased as part of publicly announced plan(1) |

Maximum number of shares that may yet be purchased under the plan |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Fiscal February (January 25 - February 28, 2015) |

205 | $ | 26.84 | 205 | 6,100 | ||||||||

Fiscal March (March 1 - March 28, 2015) |

229 | $ | 25.88 | 229 | 5,871 | ||||||||

Fiscal April (March 29 - April 25, 2015) |

169 | $ | 27.61 | 169 | 5,702 | ||||||||

| | | | | | | | | | | | | | |

Fiscal Fourth Quarter of 2015 |

603 | $ | 26.69 | 603 | 5,702 | ||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

- (1)

- On October 28, 1987, our board of directors announced the authorization of the plan to repurchase company stock. The plan originally authorized 1.0 million shares, and between October 1987 and January 24, 2015, 27.0 million shares were added to the plan for repurchase. The authorization has no expiration date.

Recent Sales of Unregistered Securities

There were no sales of unregistered securities during fiscal year 2015.

17

ITEM 6. SELECTED FINANCIAL DATA.

The following table presents our selected financial data. The table should be read in conjunction with Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K. This information is derived from our audited financial statements and should be read in conjunction with those statements, including the related notes.

Consolidated Five-Year Summary of Financial Data

| (Dollar amounts in thousands) Fiscal Year Ended |

(52 weeks) 4/25/2015 |

(52 weeks) 4/26/2014 |

(52 weeks) 4/27/2013 |

(52 weeks) 4/28/2012 |

(53 weeks) 4/30/2011 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Sales |

$ | 1,425,395 | $ | 1,357,318 | $ | 1,273,877 | $ | 1,166,705 | $ | 1,115,489 | ||||||

Cost of sales |

||||||||||||||||

Cost of goods sold |

921,142 | 888,025 | 854,542 | 795,957 | 773,256 | |||||||||||

Restructuring |

(239 | ) | 4,839 | 2,480 | 13 | (162 | ) | |||||||||

| | | | | | | | | | | | | | | | | |

Total cost of sales |

920,903 | 892,864 | 857,022 | 795,970 | 773,094 | |||||||||||

| | | | | | | | | | | | | | | | | |

Gross profit |

504,492 | 464,454 | 416,855 | 370,735 | 342,395 | |||||||||||

Selling, general and administrative expense |

401,459 | 375,158 | 349,101 | 321,770 | 314,078 | |||||||||||

Restructuring |

(132 | ) | — | 151 | 268 | 650 | ||||||||||

Write-down of long-lived assets |

— | — | — | — | 4,392 | |||||||||||

| | | | | | | | | | | | | | | | | |

Operating income |

103,165 | 89,296 | 67,603 | 48,697 | 23,275 | |||||||||||

Interest expense |

523 | 548 | 746 | 1,384 | 2,346 | |||||||||||

Interest income |

1,030 | 761 | 620 | 609 | 943 | |||||||||||

Income from Continued Dumping and Subsidy Offset Act, net |

1,212 | — | — | 11,066 | 648 | |||||||||||

Other income (expense), net |

744 | 2,050 | 3,208 | (38 | ) | 402 | ||||||||||

| | | | | | | | | | | | | | | | | |

Income from continuing operations before income taxes |

105,628 | 91,559 | 70,685 | 58,950 | 22,922 | |||||||||||

Income tax expense (benefit) |

36,954 | 31,383 | 23,520 | (25,052 | ) | 7,409 | ||||||||||

| | | | | | | | | | | | | | | | | |

Income from continuing operations |

68,674 | 60,176 | 47,165 | 84,002 | 15,513 | |||||||||||

Income (loss) from discontinued operations, net of tax |

3,297 | (3,796 | ) | 17 | 4,906 | 1,860 | ||||||||||

| | | | | | | | | | | | | | | | | |

Net income |

71,971 | 56,380 | 47,182 | 88,908 | 17,373 | |||||||||||

Net (income) loss attributable to noncontrolling interests |

(1,198 | ) | (1,324 | ) | (793 | ) | (942 | ) | 6,674 | |||||||

| | | | | | | | | | | | | | | | | |

Net income attributable to La-Z-Boy Incorporated |

$ | 70,773 | $ | 55,056 | $ | 46,389 | $ | 87,966 | $ | 24,047 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net income attributable to La-Z-Boy Incorporated: |

||||||||||||||||

Income from continuing operations attributable to La-Z-Boy Incorporated |

$ | 67,476 | $ | 58,852 | $ | 46,372 | $ | 83,060 | $ | 22,187 | ||||||

Income (loss) from discontinued operations |

3,297 | (3,796 | ) | 17 | 4,906 | 1,860 | ||||||||||

| | | | | | | | | | | | | | | | | |

Net income attributable to La-Z-Boy Incorporated |

$ | 70,773 | $ | 55,056 | $ | 46,389 | $ | 87,966 | $ | 24,047 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

18

Consolidated Five-Year Summary of Financial Data (Continued)

| (Amounts in thousands, except per share data) Fiscal Year Ended |

(52 weeks) 4/25/2015 |

(52 weeks) 4/26/2014 |

(52 weeks) 4/27/2013 |

(52 weeks) 4/28/2012 |

(53 weeks) 4/30/2011 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Basic weighted average shares |

51,767 | 52,386 | 52,351 | 51,944 | 51,849 | |||||||||||

Basic net income attributable to La-Z-Boy Incorporated per share: |

||||||||||||||||

Income from continuing operations attributable to La-Z-Boy Incorporated |

$ | 1.30 | $ | 1.11 | $ | 0.87 | $ | 1.57 | $ | 0.42 | ||||||

Income (loss) from discontinued operations |

0.06 | (0.07 | ) | — | 0.09 | 0.04 | ||||||||||

| | | | | | | | | | | | | | | | | |

Basic net income attributable to La-Z-Boy Incorporated per share |

$ | 1.36 | $ | 1.04 | $ | 0.87 | $ | 1.66 | $ | 0.46 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Diluted weighted average shares |

52,346 | 53,829 | 53,685 | 52,478 | 52,279 | |||||||||||

Diluted net income attributable to La-Z-Boy Incorporated per share: |

||||||||||||||||

Income from continuing operations attributable to La-Z-Boy Incorporated |

$ | 1.28 | $ | 1.09 | $ | 0.85 | $ | 1.55 | $ | 0.41 | ||||||

Income (loss) from discontinued operations |

0.06 | (0.07 | ) | — | 0.09 | 0.04 | ||||||||||

| | | | | | | | | | | | | | | | | |

Diluted net income attributable to La-Z-Boy Incorporated per share |

$ | 1.34 | $ | 1.02 | $ | 0.85 | $ | 1.64 | $ | 0.45 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Dividends declared per share |

$ | 0.28 | $ | 0.20 | $ | 0.08 | $ | — | $ | — | ||||||

Book value of year-end shares outstanding(1) |

$ | 10.33 | $ | 10.04 | $ | 9.25 | $ | 8.46 | $ | 6.96 | ||||||

19

Consolidated Five-Year Summary of Financial Data (Continued)

| (Dollar amounts in thousands) Fiscal Year Ended |

(52 weeks) 4/25/2015 |

(52 weeks) 4/26/2014 |

(52 weeks) 4/27/2013 |

(52 weeks) 4/28/2012 |

(53 weeks) 4/30/2011 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Return on average total equity(2) |

12.9 | % | 11.8 | % | 10.0 | % | 20.7 | % | 4.4 | % | ||||||

Gross profit as a percent of sales |

35.4 | % | 34.2 | % | 32.7 | % | 31.8 | % | 30.7 | % | ||||||

Operating income as a percent of sales |

7.2 | % | 6.6 | % | 5.3 | % | 4.2 | % | 2.1 | % | ||||||

Effective tax rate(3) |

35.0 | % | 34.3 | % | 33.3 | % | (42.5 | )% | 32.3 | % | ||||||

Return on sales(3) |

4.8 | % | 4.4 | % | 3.7 | % | 7.2 | % | 1.4 | % | ||||||

Depreciation and amortization |

$ | 22,283 | $ | 23,182 | $ | 23,140 | $ | 23,486 | $ | 24,302 | ||||||

Capital expenditures |

$ | 70,319 | $ | 33,730 | $ | 25,912 | $ | 15,663 | $ | 10,540 | ||||||

Property, plant and equipment, net |

$ | 174,036 | $ | 127,535 | $ | 118,060 | $ | 114,366 | $ | 120,603 | ||||||

Working capital |

$ | 321,560 | $ | 355,291 | $ | 350,717 | $ | 350,241 | $ | 300,119 | ||||||

Current ratio(4) |

3.1 to 1 | 3.1 to 1 | 3.3 to 1 | 3.3 to 1 | 3.3 to 1 | |||||||||||

Total assets |

$ | 774,604 | $ | 771,295 | $ | 720,371 | $ | 685,739 | $ | 593,455 | ||||||

Long-term debt, excluding current portion |

$ | 433 | $ | 277 | $ | 7,576 | $ | 7,931 | $ | 29,937 | ||||||

Total debt |

$ | 830 | $ | 7,774 | $ | 8,089 | $ | 9,760 | $ | 35,057 | ||||||

Total equity |

$ | 533,100 | $ | 529,718 | $ | 491,968 | $ | 447,815 | $ | 364,140 | ||||||

Debt to equity ratio(5) |

0.2 | % | 1.5 | % | 1.6 | % | 2.2 | % | 9.6 | % | ||||||

Debt to capitalization ratio(6) |

0.2 | % | 1.4 | % | 1.6 | % | 2.1 | % | 8.8 | % | ||||||

Shareholders |

15,500 |

13,900 |

12,400 |

13,900 |

13,900 |

|||||||||||

Employees |

8,270 | 8,300 | 8,185 | 8,160 | 7,910 | |||||||||||

- (1)

- Equal

to total La-Z-Boy Incorporated shareholders' equity divided by the number of outstanding shares on the last day of the fiscal year

- (2)

- Equal

to income from continuing operations divided by average two year equity

- (3)

- Based

on income from continuing operations

- (4)

- Equal

to total current assets divided by total current liabilities

- (5)

- Equal

to total debt divided by total equity

- (6)

- Equal to total debt divided by total debt plus total equity

20

Unaudited Quarterly Financial Information Fiscal 2015

| (Amounts in thousands, except per share data) Fiscal Quarter Ended |

(13 weeks) 7/26/2014 |

(13 weeks) 10/25/2014 |

(13 weeks) 1/24/2015 |

(13 weeks) 4/25/2015 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Sales |

$ | 326,980 | $ | 365,601 | $ | 357,876 | $ | 374,938 | |||||

Cost of sales |

|||||||||||||

Cost of goods sold |

215,831 | 235,716 | 228,326 | 241,269 | |||||||||

Restructuring |

(357 | ) | (10 | ) | (9 | ) | 137 | ||||||

| | | | | | | | | | | | | | |

Total cost of sales |

215,474 | 235,706 | 228,317 | 241,406 | |||||||||

| | | | | | | | | | | | | | |

Gross profit |

111,506 | 129,895 | 129,559 | 133,532 | |||||||||

Selling, general and administrative expense |

95,015 | 99,683 | 103,393 | 103,368 | |||||||||

Restructuring |

— | 20 | (762 | ) | 610 | ||||||||

| | | | | | | | | | | | | | |

Operating income |

16,491 | 30,192 | 26,928 | 29,554 | |||||||||

Interest expense |

132 | 145 | 131 | 115 | |||||||||

Interest income |

202 | 233 | 232 | 363 | |||||||||

Income from Continued Dumping and Subsidy Offset Act, net |

— | — | — | 1,212 | |||||||||

Other income (expense), net |

(258 | ) | 152 | 805 | 45 | ||||||||

| | | | | | | | | | | | | | |

Income from continuing operations before income taxes |

16,303 | 30,432 | 27,834 | 31,059 | |||||||||

Income tax expense |

5,755 | 10,743 | 9,477 | 10,979 | |||||||||

| | | | | | | | | | | | | | |

Income from continuing operations |

10,548 | 19,689 | 18,357 | 20,080 | |||||||||

Income from discontinued operations, net of tax |

2,497 | 285 | 115 | 400 | |||||||||

| | | | | | | | | | | | | | |

Net income |

13,045 | 19,974 | 18,472 | 20,480 | |||||||||

Net (income) loss attributable to noncontrolling interests |

36 | (445 | ) | (524 | ) | (265 | ) | ||||||

| | | | | | | | | | | | | | |

Net income attributable to La-Z-Boy Incorporated |

$ | 13,081 | $ | 19,529 | $ | 17,948 | $ | 20,215 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net income attributable to La-Z-Boy Incorporated: |

|||||||||||||

Income from continuing operations attributable to La-Z-Boy Incorporated |

$ | 10,584 | $ | 19,244 | $ | 17,833 | $ | 19,815 | |||||

Income from discontinued operations |

2,497 | 285 | 115 | 400 | |||||||||

| | | | | | | | | | | | | | |

Net income attributable to La-Z-Boy Incorporated |

$ | 13,081 | $ | 19,529 | $ | 17,948 | $ | 20,215 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Diluted weighted average common shares |

52,627 | 52,723 | 52,139 | 51,616 | |||||||||

Diluted net income attributable to La-Z-Boy Incorporated per share: |

|||||||||||||

Income from continuing operations attributable to La-Z-Boy Incorporated |

$ | 0.20 | $ | 0.36 | $ | 0.34 | $ | 0.38 | |||||

Income from discontinued operations |

0.05 | 0.01 | — | 0.01 | |||||||||

| | | | | | | | | | | | | | |

Diluted net income attributable to La-Z-Boy Incorporated per share |

$ | 0.25 | $ | 0.37 | $ | 0.34 | $ | 0.39 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Dividends declared per share |

$ | 0.06 | $ | 0.06 | $ | 0.08 | $ | 0.08 | |||||

21

Unaudited Quarterly Financial Information Fiscal 2014

| (Amounts in thousands, except per share data) Fiscal Quarter Ended |

(13 weeks) 7/27/2013 |

(13 weeks) 10/26/2013 |

(13 weeks) 1/25/2014 |

(13 weeks) 4/26/2014 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Sales |

$ | 305,502 | $ | 352,271 | $ | 346,525 | $ | 353,020 | |||||

Cost of sales |

|||||||||||||

Cost of goods sold |

203,949 | 229,727 | 224,786 | 229,563 | |||||||||

Restructuring |

87 | (142 | ) | (60 | ) | 4,954 | |||||||

| | | | | | | | | | | | | | |

Total cost of sales |

204,036 | 229,585 | 224,726 | 234,517 | |||||||||

| | | | | | | | | | | | | | |

Gross profit |

101,466 | 122,686 | 121,799 | 118,503 | |||||||||

Selling, general and administrative expense |

86,701 | 96,568 | 95,915 | 95,974 | |||||||||

| | | | | | | | | | | | | | |

Operating income |

14,765 | 26,118 | 25,884 | 22,529 | |||||||||

Interest expense |

136 | 133 | 142 | 137 | |||||||||

Interest income |

180 | 176 | 183 | 222 | |||||||||

Other income (expense), net |

537 | (279 | ) | 849 | 943 | ||||||||

| | | | | | | | | | | | | | |

Income from continuing operations before income taxes |

15,346 | 25,882 | 26,774 | 23,557 | |||||||||

Income tax expense |

5,445 | 8,425 | 8,916 | 8,597 | |||||||||

| | | | | | | | | | | | | | |

Income from continuing operations |

9,901 | 17,457 | 17,858 | 14,960 | |||||||||

Income (loss) from discontinued operations, net of tax |

34 | (440 | ) | (987 | ) | (2,403 | ) | ||||||

| | | | | | | | | | | | | | |

Net income |

9,935 | 17,017 | 16,871 | 12,557 | |||||||||

Net income attributable to noncontrolling interests |

(345 | ) | (273 | ) | (388 | ) | (318 | ) | |||||

| | | | | | | | | | | | | | |

Net income attributable to La-Z-Boy Incorporated |

$ | 9,590 | $ | 16,744 | $ | 16,483 | $ | 12,239 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net income attributable to La-Z-Boy Incorporated: |

|||||||||||||

Income from continuing operations attributable to La-Z-Boy Incorporated |

$ | 9,556 | $ | 17,184 | $ | 17,470 | $ | 14,642 | |||||

Income (loss) from discontinued operations |

34 | (440 | ) | (987 | ) | (2,403 | ) | ||||||

| | | | | | | | | | | | | | |

Net income attributable to La-Z-Boy Incorporated |

$ | 9,590 | $ | 16,744 | $ | 16,483 | $ | 12,239 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Diluted weighted average common shares |

53,051 | 53,261 | 53,226 | 53,519 | |||||||||

Diluted net income attributable to La-Z-Boy Incorporated per share: |

|||||||||||||

Income from continuing operations attributable to La-Z-Boy Incorporated |

$ | 0.18 | $ | 0.32 | $ | 0.33 | $ | 0.27 | |||||

Loss from discontinued operations |

— | (0.01 | ) | (0.02 | ) | (0.04 | ) | ||||||

| | | | | | | | | | | | | | |

Diluted net income attributable to La-Z-Boy Incorporated per share |

$ | 0.18 | $ | 0.31 | $ | 0.31 | $ | 0.23 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Dividends declared per share |

$ | 0.04 | $ | 0.04 | $ | 0.06 | $ | 0.06 | |||||

22

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

We have prepared this Management's Discussion and Analysis as an aid to better understand our financial results. It should be read in conjunction with the accompanying Consolidated Financial Statements and related Notes to Consolidated Financial Statements. We begin with an introduction to our key businesses and significant operational events in fiscal 2015. We then provide discussions of our results of operations, liquidity and capital resources, and critical accounting policies.

This Management's Discussion and Analysis only reflects results of our continuing operations, unless otherwise noted. During fiscal 2014, we sold substantially all of the assets of our Bauhaus U.S.A. business unit, and we marketed for sale our youth furniture business, Lea Industries, a division of La-Z-Boy Casegoods, Inc. (formerly known as La-Z-Boy Greensboro, Inc.). We were unable to find a buyer for our Lea Industries business, and instead we liquidated all the assets, consisting mostly of inventory, and ceased operations of Lea Industries during fiscal 2015. In the accompanying financial statements, we reported the operating results of Bauhaus and Lea Industries as discontinued operations for all periods presented. For the fiscal years ended April 25, 2015, and April 26, 2014, we recorded pre-tax income of $0.9 million ($0.6 million after tax) and a pre-tax loss of $6.0 million ($3.8 million after tax), respectively, in discontinued operations related to these businesses. We previously reported results of Bauhaus as a component of our Upholstery segment, and Lea Industries as a component of our Casegoods segment.

Also in fiscal 2015, we recorded $4.2 million of pre-tax income ($2.7 million after tax) in discontinued operations related to the Continued Dumping and Subsidy Offset Act of 2000 ("CDSOA"), which provides for distribution of duties, collected by U.S. Customs and Border Protection from antidumping cases, to domestic producers that supported the antidumping petition related to wooden bedroom furniture imported from China. Of the $4.2 million pre-tax income we received, $3.8 million related to our previously owned subsidiary, American Furniture Company, Incorporated. We sold this subsidiary in fiscal 2007 and reported it as discontinued operations at that time, and our contract provided that we would receive a portion of any such duties to which that entity was entitled. The remainder of the CDSOA pre-tax income reported in discontinued operations related to Lea Industries.

Introduction

Our Business

La-Z-Boy Incorporated and its subsidiaries manufacture, market, import, distribute and retail upholstery furniture products. In addition, we import, distribute and retail accessories and casegoods (wood) furniture products. We are the leading global producer of reclining chairs and the second largest manufacturer/distributor of residential furniture in the United States. The La-Z-Boy Furniture Galleries® stores retail network is the third largest retailer of single-branded furniture in the United States. We have seven major North-American manufacturing locations to support our speed to market and customization strategy.

We sell our products, primarily in the United States and Canada as well as internationally, to furniture retailers and directly to consumers through stores that we own and operate. The centerpiece of our retail distribution strategy is our network of 325 La-Z-Boy Furniture Galleries® stores and 573 Comfort Studio® locations, each dedicated to marketing our La-Z-Boy branded products. We consider this dedicated space to be "branded outlets" or "proprietary." We own 110 of the La-Z-Boy Furniture Galleries® stores. The remainder of the La-Z-Boy Furniture Galleries® stores, as well as all 573 Comfort Studio® locations, are independently owned and operated. La-Z-Boy Furniture Galleries® stores help consumers furnish their homes by combining the style, comfort and quality of La-Z-Boy furniture with our available in-home design service. Comfort Studio® locations are defined spaces within larger independent retailers that are dedicated to displaying and selling La-Z-Boy branded

23

products. In addition to the La-Z-Boy Comfort Studio® locations, our Kincaid and England operating units have their own dedicated proprietary in-store programs with 525 outlets and 1.8 million square feet of proprietary floor space. In total, our proprietary floor space includes approximately 9.5 million square feet.

Our goal is to deliver improved sales and earnings to shareholders over the long term through execution of our strategic initiatives. The foundation of our strategic initiatives is driving sales growth in all areas of our business, but most importantly in our flagship La-Z-Boy brand. We are driving this growth through our Live Life Comfortably marketing campaign, featuring Brooke Shields as our brand ambassador. We continue to invest in this campaign, aimed at changing the image of our brand and widening La-Z-Boy's appeal among a broader consumer demographic. We also are driving growth of our La-Z-Boy brand through a steady cadence of new product introductions, including our Urban Attitudes® collection of smaller-scale furniture targeted at a more style-conscious demographic, as well as younger consumers and those living in more confined spaces in urban locations.