UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

(Exact name of registrant as specified in its charter)

| ||

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

NONE

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

No ◻ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ◻ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

No ◻ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

No ◻ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ◻ | |||

Non-accelerated filer ◻ | Smaller reporting company | ||

Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act).

Yes | No ⌧ |

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter (August 17, 2019). $

The number of shares outstanding of the registrant's common stock, as of the latest practicable date.

Documents Incorporated by Reference:

Portions of Kroger’s definitive proxy statement for its 2020 annual meeting of shareholders, which shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates, are incorporated by reference into Part III of this Report.

The Kroger Co.

Form 10-K

For the Fiscal Year Ended February 1, 2020

Table of Contents

PART I

FORWARD LOOKING STATEMENTS.

This Annual Report on Form 10-K contains forward-looking statements about our future performance. These statements are based on our assumptions and beliefs in light of the information currently available to us. These statements are subject to a number of known and unknown risks, uncertainties and other important factors, including the risks and other factors discussed in “Risk Factors” below, that could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward looking statements. Such statements are indicated by words such as “achieve,” “affect,” “believe,” “committed,” “continue,” “could,” “deliver,” “effect,” “estimate,” “expects,” “future,” “growth,” “intends,” “likely,” “may,” “model,” “plan,” “position,” “range,” “result,” “strategy,” “strong,” “trend,” “will” and “would,” and similar words or phrases. Moreover, statements in the sections entitled Risk Factors, Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), and elsewhere in this report regarding our expectations, projections, beliefs, intentions or strategies are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended.

Various uncertainties and other factors could cause actual results to differ materially from those contained in the forward-looking statements. These include:

| ● | The extent to which our sources of liquidity are sufficient to meet our requirements may be affected by the state of the financial markets and the effect that such condition has on our ability to issue commercial paper at acceptable rates. Our ability to borrow under our committed lines of credit, including our bank credit facilities, could be impaired if one or more of our lenders under those lines is unwilling or unable to honor its contractual obligation to lend to us, or in the event that global pandemics, including the novel coronavirus, natural disasters or weather conditions interfere with the ability of our lenders to lend to us. Our ability to refinance maturing debt may be affected by the state of the financial markets. |

| ● | Our ability to achieve sales, earnings and incremental First-In, First-Out (“FIFO”) operating profit goals may be affected by: COVID-19 related factors, risks and challenges, including among others, the length of time that the pandemic continues, the temporary inability of customers to shop due to illness, quarantine, or other travel restrictions or financial hardship, shifts in demand away from discretionary or higher priced products to lower priced products, or stockpiling or similar pantry-filling activities, reduced workforces which may be caused by, but not limited to, the temporary inability of the workforce to work due to illness, quarantine, or government mandates, or temporary store closures due to reduced workforces or government mandates; labor negotiations or disputes; changes in the types and numbers of businesses that compete with Kroger; pricing and promotional activities of existing and new competitors, including non-traditional competitors, and the aggressiveness of that competition; Kroger's response to these actions; the state of the economy, including interest rates, the inflationary and deflationary trends in certain commodities, changes in tariffs, and the unemployment rate; the effect that fuel costs have on consumer spending; volatility of fuel margins; changes in government-funded benefit programs and the extent and effectiveness of any COVID-19 stimulus packages; manufacturing commodity costs; diesel fuel costs related to Kroger's logistics operations; trends in consumer spending; the extent to which Kroger's customers exercise caution in their purchasing in response to economic conditions; the uncertainty of economic growth or recession; changes in inflation or deflation in product and operating costs; stock repurchases; Kroger's ability to retain pharmacy sales from third party payors; consolidation in the healthcare industry, including pharmacy benefit managers; Kroger's ability to negotiate modifications to multi-employer pension plans; natural disasters or adverse weather conditions; the effect of public health crises or other significant catastrophic events, including the coronavirus; the potential costs and risks associated with potential cyber-attacks or data security breaches; the success of Kroger's future growth plans; the ability to execute on Restock Kroger; and the successful integration of merged companies and new partnerships. |

| ● | Our ability to achieve these goals may also be affected by our ability to manage the factors identified above. Our ability to execute our financial strategy may be affected by our ability to generate cash flow. |

| ● | Our effective tax rate may differ from the expected rate due to changes in laws, the status of pending items with various taxing authorities, and the deductibility of certain expenses. |

We cannot fully foresee the effects of changes in economic conditions on our business.

2

Other factors and assumptions not identified above, including those discussed in Item 1A of this Report, could also cause actual results to differ materially from those set forth in the forward-looking information. Accordingly, actual events and results may vary significantly from those included in, contemplated or implied by forward-looking statements made by us or our representatives. We undertake no obligation to update the forward-looking information contained in this filing.

ITEM 1. | BUSINESS. |

The Kroger Co. (the “Company” or “Kroger”) was founded in 1883 and incorporated in 1902. As of February 1, 2020, we are one of the largest retailers in the world based on annual sales. We also manufacture and process some of the food for sale in our supermarkets. We maintain a web site (www.thekrogerco.com) that includes additional information about the Company. We make available through our web site, free of charge, our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and our interactive data files, including amendments. These forms are available as soon as reasonably practicable after we have filed them with, or furnished them electronically to, the SEC.

Our revenues are predominately earned and cash is generated as consumer products are sold to customers in our stores, fuel centers and via our online platforms. We earn income predominantly by selling products at price levels that produce revenues in excess of the costs to make these products available to our customers. Such costs include procurement and distribution costs, facility occupancy and operational costs and overhead expenses. Our fiscal year ends on the Saturday closest to January 31. All references to 2019, 2018 and 2017 are to the fiscal years ended February 1, 2020, February 2, 2019 and February 3, 2018, respectively, unless specifically indicated otherwise.

EMPLOYEES

As of February 1, 2020, Kroger employed approximately 435,000 full- and part-time employees. A majority of our employees are covered by collective bargaining agreements negotiated with local unions affiliated with one of several different international unions. There are approximately 360 such agreements, usually with terms of three to five years.

STORES

As of February 1, 2020, Kroger operated, either directly or through its subsidiaries, 2,757 supermarkets under a variety of local banner names, of which 2,270 had pharmacies and 1,567 had fuel centers. We offer Pickup (also referred to as ClickList®) and Harris Teeter ExpressLane™— personalized, order online, pick up at the store services — at 1,989 of our supermarkets and provide home delivery service to 97% of Kroger households. Approximately 54% of our supermarkets were operated in Company-owned facilities, including some Company-owned buildings on leased land. Our current strategy emphasizes self-development and ownership of real estate. Our stores operate under a variety of banners that have strong local ties and brand recognition. Supermarkets are generally operated under one of the following formats: combination food and drug stores (“combo stores”); multi-department stores; marketplace stores; or price impact warehouses.

The combo store is the primary food store format. They typically draw customers from a 2-2.5 mile radius. We believe this format is successful because the stores are large enough to offer the specialty departments that customers desire for one-stop shopping, including natural food and organic sections, pharmacies, general merchandise, pet centers and high-quality perishables such as fresh seafood and organic produce.

Multi-department stores are significantly larger in size than combo stores. In addition to the departments offered at a typical combo store, multi-department stores sell a wide selection of general merchandise items such as apparel, home fashion and furnishings, outdoor living, electronics, automotive products and toys.

Marketplace stores are smaller in size than multi-department stores. They offer full-service grocery, pharmacy and health and beauty care departments as well as an expanded perishable offering and general merchandise area that includes apparel, home goods and toys.

3

Price impact warehouse stores offer a “no-frills, low cost” warehouse format and feature everyday low prices plus promotions for a wide selection of grocery and health and beauty care items. Quality meat, dairy, baked goods and fresh produce items provide a competitive advantage. The average size of a price impact warehouse store is similar to that of a combo store.

SEGMENTS

We operate supermarkets and multi-department stores throughout the United States. Our retail operations, which represent 97% of our consolidated sales, is our only reportable segment. We aggregate our operating divisions into one reportable segment due to the operating divisions having similar economic characteristics with similar long-term financial performance. In addition, our operating divisions offer customers similar products, have similar distribution methods, operate in similar regulatory environments, purchase the majority of the merchandise for retail sale from similar (and in many cases identical) vendors on a coordinated basis from a centralized location, serve similar types of customers, and are allocated capital from a centralized location. Our operating divisions are organized primarily on a geographical basis so that the operating division management team can be responsive to local needs of the operating division and can execute company strategic plans and initiatives throughout the locations in their operating division. This geographical separation is the primary differentiation between these retail operating divisions. The geographical basis of organization reflects how the business is managed and how our Chief Executive Officer, who acts as our chief operating decision maker, assesses performance internally. All of our operations are domestic. Revenues, profits and losses and total assets are shown in our Consolidated Financial Statements set forth in Item 8 below.

MERCHANDISING AND MANUFACTURING

Our Brands products play an important role in our merchandising strategy. Our supermarkets, on average, stock over 16,000 private label items. Our Brands products are primarily produced and sold in three “tiers.” Private Selection® is one of our premium quality brands, offering customers culinary foods and ingredients that deliver amazing eating experiences. The Kroger® brand, which represents the majority of our private label items, is designed to consistently satisfy and delight customers with quality products that exceed or meet the national brand in taste and efficacy, as well as with unique and differentiated products. Big K®, Check This Out…® and Heritage Farm® are some of our value brands, designed to deliver good quality at a very affordable price. In addition, we continue to grow natural and organic Our Brands offerings with Simple Truth® and Simple Truth Organic®. Both Simple Truth and Simple Truth Organic are free from a defined list of artificial ingredients that customers have told us they do not want in their food, and the Simple Truth Organic products are USDA certified organic.

Approximately 31% of Our Brands units and 42% of the grocery category Our Brands units sold in our supermarkets are produced in our food production plants; the remaining Our Brands items are produced to our strict specifications by outside manufacturers. We perform a “make or buy” analysis on Our Brands products and decisions are based upon a comparison of market-based transfer prices versus open market purchases. As of February 1, 2020, we operated 35 food production plants. These plants consisted of 16 dairies, 9 deli or bakery plants, five grocery product plants, two beverage plants, one meat plant and two cheese plants.

SEASONALITY

The majority of our revenues are generally not seasonal in nature. However, revenues tend to be higher during the major holidays throughout the year. Additionally, certain significant events including inclement weather systems, particularly winter storms, tend to affect our sales trends.

4

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following is a list of the names and ages of the executive officers and the positions held by each such person. Except as otherwise noted, each person has held office for at least five years. Each officer will hold office at the discretion of the Board for the ensuing year until removed or replaced.

Name |

| Age |

| Recent Employment History |

Mary E. Adcock | 44 | Ms. Adcock was elected Senior Vice President effective May 1, 2019 and is responsible for the oversight of several Kroger retail divisions. From June 2016 to April 2019, she served as Group Vice President of Retail Operations. Prior to that, she served as Vice President of Operations for Kroger’s Columbus Division from November 2015 to May 2016 and as Vice President of Merchandising for the Columbus Division from March 2014 to November 2015. From February 2012 to March 2014, Ms. Adcock served as Vice President of Natural Foods Merchandising and from October 2009 to February 2012, she served as Vice President of Deli/Bakery Manufacturing. Prior to that, Ms. Adcock held several leadership positions in the manufacturing department, including human resources manager, general manager and division operations manager. Ms. Adcock joined Kroger in 1999 as human resources assistant manager at the Country Oven Bakery in Bowling Green, Kentucky. | ||

Stuart W. Aitken | 48 | Mr. Aitken was elected Senior Vice President in February 2019 and served as Group Vice President from June 2015 to February 2019. He is responsible for leading Kroger’s alternative profit businesses, including Kroger’s data analytics subsidiary, 84.51° LLC and Kroger Personal Finance. Prior to joining Kroger, he served as the chief executive officer of dunnhumby USA, LLC from July 2010 to June 2015. Mr. Aitken has over 15 years of marketing, academic and technical experience across a variety of industries, and held various leadership roles with other companies, including Michaels Stores and Safeway, Inc. | ||

Robert W. Clark | 54 | Mr. Clark was named Senior Vice President of Supply Chain, Manufacturing and Sourcing in May 2019. He was elected Senior Vice President of Merchandising in March 2016. From March 2013 to March 2016, he served as Group Vice President of Non-Perishables. Prior to that, he served as Vice President of Merchandising for Kroger’s Fred Meyer division from October 2011 to March 2013. From August 2010 to October 2011 he served as Vice President of Operations for Kroger’s Columbus division. Prior to that, from May 2002 to August 2010, he served as Vice President of Merchandising for Kroger’s Fry’s division. From 1985 to 2002, Mr. Clark held various leadership positions in store and district management, as well as grocery merchandising. Mr. Clark began his career with Kroger in 1985 as a courtesy clerk at Fry’s. | ||

Yael Cosset | 46 | Mr. Cosset was elected Senior Vice President and Chief Information Officer in May 2019 and is responsible for leading Kroger’s digital strategy, focused on building Kroger’s presence in the marketplace in digital channels, personalization and e-commerce. Prior to that, Mr. Cosset served as Group Vice President and Chief Digital Officer from January 2017 to April 2019. Before that, he served as Chief Commercial Officer and Chief Information Officer of 84.51° LLC from April 2015 to December 2016. Prior to joining Kroger, Mr. Cosset served in several leadership roles at dunnhumby USA, LLC from 2009 to 2015, including Executive Vice President of Consumer Markets and Global Chief Information Officer. | ||

5

Michael J. Donnelly | 61 | Mr. Donnelly was elected Executive Vice President and Chief Operating Officer in December 2017. Prior to that, he was Executive Vice President of Merchandising from September 2015 to December 2017, and Senior Vice President of Merchandising from July 2011 to September 2015. Before that, Mr. Donnelly held a variety of key management positions with Kroger, including President of Ralphs Grocery Company, President of Fry’s Food Stores, and Senior Vice President, Drug/GM Merchandising and Procurement. Mr. Donnelly joined Kroger in 1978 as a clerk. | ||

Carin L. Fike | 51 | Ms. Fike was elected Vice President and Treasurer effective April 2017. Prior to that, she served as Assistant Treasurer from March 2011 to April 2017. Before that, Ms. Fike served as Director of Investor Relations from December 2003 to March 2011. Ms. Fike began her career with Kroger in 1999 as a manager in the Financial Reporting department after working with PricewaterhouseCoopers from 1995 to 1999, where most recently she was an audit manager. | ||

Todd A. Foley | 50 | Mr. Foley was elected Vice President and Corporate Controller effective April 2017. Before that, he served as Vice President and Treasurer from June 2013 to April 2017. Prior to that, Mr. Foley served as Assistant Corporate Controller from March 2006 to June 2013, and Controller of Kroger’s Cincinnati/Dayton division from October 2003 to March 2006. Mr. Foley began his career with Kroger in 2001 as an audit manager in the Internal Audit Department after working for PricewaterhouseCoopers from 1991 to 2001, where most recently he was a senior audit manager. | ||

Joseph A. Grieshaber, Jr. | 62 | Mr. Grieshaber was elected Senior Vice President in June 2019 and is responsible for sales, promotional and category planning for center store, fresh foods, and general merchandise categories. Prior to this, he served as President of Kroger’s Fred Meyer division since March 2017, the Columbus division President from March 2015 to March 2017, and the Dillons division President from July 2010 to March 2015. In August 2003, Mr. Grieshaber was named Kroger’s Group Vice President of Perishables Merchandising and Procurement. From 1995 to 2003, he served various leadership roles, including district management and Meat Merchandising in the Michigan Division and Vice President of Merchandising in the Columbus Division. Mr. Grieshaber began his career with Kroger in 1983 as a store manager trainee in Nashville. | ||

Calvin J. Kaufman | 57 | Mr. Kaufman was elected Senior Vice President in June 2017, and is responsible for the oversight of several Kroger retail divisions. From July 2013 to June 2017, he served as President of the Louisville division. Prior to that, he served as President of Kroger Manufacturing and Our Brands from June 2008 to June 2013, and Group Vice President of Fred Meyer Logistics from September 2005 to May 2008. Mr. Kaufman held various positions in Logistics after joining Kroger in the Fred Meyer division in September 1994. | ||

Timothy A. Massa | 53 | Mr. Massa was elected Senior Vice President of Human Resources and Labor Relations in June 2018. Prior to that, he served as Group Vice President of Human Resources and Labor Relations from June 2014 to June 2018. Mr. Massa joined Kroger in October 2010 as Vice President, Corporate Human Resources and Talent Development. Prior to joining Kroger, he served in various Human Resources leadership roles for 21 years at Procter & Gamble, most recently serving as Global Human Resources Director of Customer Business Development. | ||

6

Stephen M. McKinney | 63 | Mr. McKinney was elected Senior Vice President in March 2018, and is responsible for the oversight of several Kroger retail divisions. From October 2013 to March 2018, he served as President of Kroger’s Fry’s Food Stores division. Prior to that, he served as Vice President of Operations for the Ralphs division from October 2007 to September 2013, and Vice President of Operations for the Southwest division from October 2006 to September 2007. From 1988 to 1998, Mr. McKinney served in various leadership positions in the Fry’s Food Stores division, including store manager, deli director, and executive director of operations. From 1981 to 1998, Mr. McKinney held several roles with Florida Choice Supermarkets, a former Kroger banner, including store manager, buyer, and field representative. He started his career with Kroger in 1981 as a clerk with Florida Choice. | ||

W. Rodney McMullen | 59 | Mr. McMullen was elected Chairman of the Board effective January 1, 2015, and Chief Executive Officer effective January 1, 2014. Prior to that, he served as President and Chief Operating Officer from August 2009 to December 2013. Prior to that he was elected Vice Chairman in June 2003, Executive Vice President, Strategy, Planning and Finance in January 2000, Executive Vice President and Chief Financial Officer in May 1999, Senior Vice President in October 1997, and Group Vice President and Chief Financial Officer in June 1995. Before that he was appointed Vice President, Control and Financial Services in March 1993, and Vice President, Planning and Capital Management in December 1989. Mr. McMullen joined Kroger in 1978 as a part-time stock clerk. | ||

Gary Millerchip | 48 | Mr. Millerchip was elected Senior Vice President and Chief Financial Officer effective April 2019. Prior to this, he serviced as Chief Executive Officer for Kroger Personal Finance since joining Kroger in 2008. Before coming to Kroger he was responsible for the Royal Bank of Scotland (RBS) Personal Credit Card business in the United Kingdom. He joined RBS in 1987 and held leadership positions in Sales & Marketing, Finance, Change Management, Retail Banking Distribution Strategy and Branch Operations during his time there. | ||

Erin S. Sharp | 62 | Ms. Sharp has served as Group Vice President of Manufacturing since June 2013. She joined Kroger in 2011 as Vice President of Operations for Kroger’s Manufacturing division. Before joining Kroger, Ms. Sharp served as Vice President of Manufacturing for the Sara Lee Corporation. In that role, she led the manufacturing and logistics operations for the central region of their U.S. Fresh Bakery Division. Ms. Sharp has over 30 years of experience supporting food manufacturing operations. | ||

Mark C. Tuffin | 60 | Mr. Tuffin has served as Senior Vice President since January 2014, and is responsible for the oversight of several of Kroger’s retail divisions. Prior to that, he served as President of Kroger’s Smith’s division from July 2011 to January 2014. From September 2009 to July 2011, Mr. Tuffin served as Vice President of Transition, where he was responsible for implementing an organizational restructuring initiative for Kroger’s retail divisions. He joined Kroger’s Smith’s division in 1996 and served in a series of leadership roles, including Vice President of Merchandising from September 1999 to September 2009. Mr. Tuffin held various positions with other supermarket retailers before joining Smith’s in 1996. | ||

7

Christine S. Wheatley | 49 | Ms. Wheatley was elected Group Vice President, Secretary and General Counsel in May 2014. She joined Kroger in February 2008 as Corporate Counsel, and became Senior Attorney in 2010, Senior Counsel in 2011, and Vice President in 2012. Before joining Kroger, Ms. Wheatley was engaged in the private practice of law for 11 years, most recently as a partner at Porter Wright Morris & Arthur in Cincinnati. |

COMPETITIVE ENVIRONMENT

For the disclosure related to our competitive environment, see Item 1A under the heading “Competitive Environment.”

ITEM 1A. | RISK FACTORS. |

There are risks and uncertainties that can affect our business. The significant risk factors are discussed below. The following information should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which includes forward-looking statements and factors that could cause us not to realize our goals or meet our expectations.

COMPETITIVE ENVIRONMENT

The operating environment for the food retailing industry continues to be characterized by intense price competition, expansion, increasing fragmentation of retail and online formats, entry of non-traditional competitors and market consolidation. In addition, evolving customer preferences and the advancement of online, delivery, ship to home, and mobile channels in our industry enhance the competitive environment. We must anticipate and meet these evolving customer preferences and continue to implement technology, software and processes to be able to conveniently and cost-effectively fulfill customer orders. Providing flexible fulfillment options and implementing new technology is complex and may not meet customer preferences. If we are not successful in offsetting increased cost of fulfilling orders outside of our traditional in-store channel with efficiencies, cost-savings or expense reductions, our results of operations could be adversely affected. If we do not anticipate customer preferences or fail to quickly adapt to these changing preferences, our sales and profitability could be adversely affected. If we are unable to make, improve, or develop relevant customer-facing technology in a timely manner, our ability to compete and our results of operations could be adversely affected.

We are continuing to enhance the customer connection with investments in our competitive moats of today – which are product freshness and quality, Our Brands, and personalized rewards – and our competitive moat of tomorrow, the seamless ecosystem we are building. If we are unable to enhance the foregoing customer connection, our ability to compete and our financial condition, results of operations, or cash flows could be adversely affected. We believe our Restock Kroger plan provides a balanced approach that will enable us to meet the wide-ranging needs and expectations of our customers. However, we may be unsuccessful in implementing Restock Kroger, including our alternative profit strategy and our cost savings initiatives, which could adversely affect our relationships with our customers, our market share and business growth, and our operations and results. The nature and extent to which our competitors respond to the evolving and competitive industry by developing and implementing their competitive strategies could adversely affect our profitability.

PRODUCT SAFETY

Customers count on Kroger to provide them with safe food and drugs and other merchandise. Concerns regarding the safety of the products that we sell could cause shoppers to avoid purchasing certain products from us, or to seek alternative sources of supply even if the basis for the concern is outside of our control. Any lost confidence on the part of our customers would be difficult and costly to reestablish. Any issue regarding the safety of items we sell, regardless of the cause, could have a substantial and adverse effect on our reputation, financial condition, results of operations, or cash flows.

8

LABOR RELATIONS

A majority of our employees are covered by collective bargaining agreements with unions, and our relationship with those unions, including a prolonged work stoppage affecting a substantial number of locations, could have a material adverse effect on our results.

We are a party to approximately 360 collective bargaining agreements. Upon the expiration of our collective bargaining agreements, work stoppages by the affected workers could occur if we are unable to negotiate new contracts with labor unions. A prolonged work stoppage affecting a substantial number of locations could have a material adverse effect on our results. Further, if we are unable to control health care, pension and wage costs, or if we have insufficient operational flexibility under our collective bargaining agreements, we may experience increased operating costs and an adverse effect on our financial condition, results of operations, or cash flows.

DATA AND TECHNOLOGY

Our business is increasingly dependent on information technology systems that are complex and vital to continuing operations, resulting in an expansion of our technological presence and corresponding risk exposure. If we were to experience difficulties maintaining or operating existing systems or implementing new systems, we could incur significant losses due to disruptions in our operations.

Through our sales and marketing activities, we collect and store some personal information that our customers provide to us. We also gather and retain information about our associates in the normal course of business. Under certain circumstances, we may share information with vendors that assist us in conducting our business, as required by law, or otherwise in accordance with our privacy policy.

Our technology systems are vulnerable to disruption from circumstances beyond our control. Cyber-attackers may attempt to access information stored in our or our vendors’ systems in order to misappropriate confidential customer or business information. Although we have implemented procedures to protect our information, and require our vendors to do the same, we cannot be certain that our security systems will successfully defend against rapidly evolving, increasingly sophisticated cyber-attacks as they become more difficult to detect and defend against. Further, a Kroger associate, a contractor or other third party with whom we do business may in the future circumvent our security measures in order to obtain information or may inadvertently cause a breach involving information. In addition, hardware, software or applications we may use may have inherent defects or could be inadvertently or intentionally applied or used in a way that could compromise our information security.

Our continued investment in our information technology systems may not effectively insulate us from potential attacks, breaches or disruptions to our business operations, which could result in a loss of customers or business information, negative publicity, damage to our reputation, and exposure to claims from customers, financial institutions, regulatory authorities, payment card associations, associates and other persons. Any such events could have an adverse effect on our business, financial condition and results of operations and may not be covered by our insurance. In addition, compliance with privacy and information security laws and standards may result in significant expense due to increased investment in technology and the development of new operational processes and may require us to devote significant management resources to address these issues. The costs of attempting to protect against the foregoing risks and the costs of responding to cyber-attacks are significant. Following a cyber-attack , our and/or our vendors’ remediation efforts may not be successful, and a cyber-attack could result in interruptions, delays or cessation of service, and loss of existing or potential customers. In addition, breaches of our and/or our vendors’ security measures and the unauthorized dissemination of sensitive personal information or confidential information about us or our customers could expose our customers’ private information and our customers to the risk of financial or medical identity theft, or expose us or other third parties to a risk of loss or misuse of this information, and result in investigations, regulatory enforcement actions, material fines and penalties, loss of customers, litigation or other actions which could have a material adverse effect on our brands, reputation, business, financial condition, results of operations, or cash flows.

9

Data governance failures can adversely affect our reputation and business. Our business depends on our customers’ willingness to entrust us with their personal information. Events that adversely affect that trust, including inadequate disclosure to our customers of our uses of their information, failing to keep our information technology systems and our customers’ sensitive information secure from significant attack, theft, damage, loss or unauthorized disclosure or access, whether as a result of our action or inaction (including human error) or that of our business associates, vendors or other third parties, could adversely affect our brand and reputation and operating results and also could expose and/or has exposed us to mandatory disclosure to the media, litigation (including class action litigation), governmental investigations and enforcement proceedings, material fines, penalties and/or remediation costs, and compensatory, special, punitive and statutory damages, consent orders, and/or injunctive relief, any of which could adversely affect our businesses, financial condition, results of operations, or cash flows. Large scale data breaches at other entities increase the challenge we and our vendors face in maintaining the security of our information technology systems and proprietary information and of our customers’ information. There can be no assurance that such failures will not occur, or if any do occur, that we will detect them or that they can be sufficiently remediated.

The use of data by our business and our business associates is highly regulated. Privacy and information-security laws and regulations change, and compliance with them may result in cost increases due to, among other things, systems changes and the development of new processes. If we or those with whom we share information fail to comply with laws and regulations, such as the California Consumer Privacy Act (CCPA), our reputation could be damaged, possibly resulting in lost business, and we could be subjected to additional legal risk or financial losses as a result of non-compliance.

PAYMENT SYSTEMS

We accept payments using a variety of methods, including cash and checks, and select credit and debit cards. As we offer new payment options to our customers, we may be subject to additional rules, regulations, compliance requirements, and higher fraud losses. For certain payment methods, we pay interchange and other related acceptance fees, along with additional transaction processing fees. We rely on third parties to provide payment transaction processing services for credit and debit cards. It could disrupt our business if these companies become unwilling or unable to provide these services to us. We are also subject to evolving payment card association and network operating rules, including data security rules, certification requirements and rules governing electronic funds transfers. For example, we are subject to Payment Card Industry Data Security Standards (“PCI DSS”), which contain compliance guidelines and standards with regard to our security surrounding the physical and electronic storage, processing and transmission of individual cardholder data. If our internal systems are breached or compromised, we may be liable for card re-issuance costs, subject to fines and higher transaction fees and lose our ability to accept card payments from our members, and our business, financial condition, results of operations, or cash flows could be adversely affected.

INDEBTEDNESS

Our indebtedness could reduce our ability to obtain additional financing for working capital, mergers and acquisitions or other purposes and could make us vulnerable to future economic downturns as well as competitive pressures. If debt markets do not permit us to refinance certain maturing debt, we may be required to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness. Changes in our credit ratings, or in the interest rate environment, could have an adverse effect on our financing costs and structure.

LEGAL PROCEEDINGS AND INSURANCE

From time to time, we are a party to legal proceedings, including matters involving personnel and employment issues, personal injury, antitrust claims and other proceedings. Other legal proceedings purport to be brought as class actions on behalf of similarly situated parties. Some of these proceedings could result in a substantial loss to Kroger. We estimate our exposure to these legal proceedings and establish accruals for the estimated liabilities, where it is reasonably possible to estimate and where an adverse outcome is probable. Assessing and predicting the outcome of these matters involves substantial uncertainties. Adverse outcomes in these legal proceedings, or changes in our evaluations or predictions about the proceedings, could have a material adverse effect on our financial results. Please also refer to the “Legal Proceedings” section in Item 3 and the “Litigation” section in Note 13 to the Consolidated Financial Statements.

10

We use a combination of insurance and self-insurance to provide for potential liability for workers’ compensation, automobile and general liability, property, director and officers’ liability, and employee health care benefits. Any actuarial projection of losses is subject to a high degree of variability. Changes in legal claims, trends and interpretations, variability in inflation rates, changes in the nature and method of claims settlement, benefit level changes due to changes in applicable laws, insolvency of insurance carriers, and changes in discount rates could all affect our financial condition, results of operations, or cash flows.

MULTI-EMPLOYER PENSION OBLIGATIONS

As discussed in more detail below in “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Critical Accounting Policies-Multi-Employer Pension Plans,” Kroger contributes to several multi-employer pension plans based on obligations arising under collective bargaining agreements with unions representing employees covered by those agreements. We believe that the present value of actuarially accrued liabilities in most of these multi-employer plans substantially exceeds the value of the assets held in trust to pay benefits, and we expect that Kroger’s contributions to those funds will increase over the next few years. A significant increase to those funding requirements could adversely affect our financial condition, results of operations, or cash flows. Despite the fact that the pension obligations of these funds are not the liability or responsibility of the Company, except as noted below, there is a risk that the agencies that rate our outstanding debt instruments could view the underfunded nature of these plans unfavorably, or adjust their current views unfavorably, when determining their ratings on our debt securities. Any downgrading of our debt ratings likely would adversely affect our cost of borrowing and access to capital.

We also currently bear the investment risk of two multi-employer pension plans in which we participate. In addition, we have been designated as the named fiduciary of these funds with sole investment authority of the assets of these funds. If investment results fail to meet our expectations, we could be required to make additional contributions to fund a portion of or the entire shortfall, which could have an adverse effect on our business, financial condition, results of operations, or cash flows.

INTEGRATION OF NEW BUSINESS AND STRATEGIC ALLIANCES

We enter into mergers, acquisitions and strategic alliances with expected benefits including, among other things, operating efficiencies, procurement savings, innovation, sharing of best practices and increased market share that may allow for future growth. Achieving the anticipated benefits may be subject to a number of significant challenges and uncertainties, including, without limitation, whether unique corporate cultures will work collaboratively in an efficient and effective manner, the coordination of geographically separate organizations, the possibility of imprecise assumptions underlying expectations regarding potential synergies, capital requirements, and the integration process, unforeseen expenses and delays, and competitive factors in the marketplace. We could also encounter unforeseen transaction and integration-related costs or other circumstances such as unforeseen liabilities or other issues. Many of these potential circumstances are outside of our control and any of them could result in increased costs, decreased revenue, decreased synergies and the diversion of management time and attention. If we are unable to achieve our objectives within the anticipated time frame, or at all, the expected benefits may not be realized fully or at all, or may take longer to realize than expected, which could have an adverse effect on our business, financial condition and results of operations, or cash flows.

FUEL

We sell a significant amount of fuel, which could face increased regulation and demand could be affected by concerns about the effect of emissions on the environment as well as retail price increases. We are unable to predict future regulations, environmental effects, political unrest, acts of terrorism, disruptions to the economy, including but not limited to the COVID-19 pandemic, and other matters that may affect the cost and availability of fuel, and how our customers will react, which could adversely affect our financial condition, results of operations, or cash flows.

11

ECONOMIC CONDITIONS

Our operating results could be materially impacted by changes in overall economic conditions that impact consumer confidence and spending, including discretionary spending. Future economic conditions affecting disposable consumer income such as employment levels, business conditions, changes in housing market conditions, the availability of credit, interest rates, tax rates, the impact of natural disasters or acts of terrorism or pandemics, such as the spread of the novel coronavirus, COVID-19, and other matters could reduce consumer spending. Increased fuel prices could also have an effect on consumer spending and on our costs of producing and procuring products that we sell. We are unable to predict how the global economy and financial markets will perform. If the global economy and financial markets do not perform as we expect, it could adversely affect our financial condition, results of operations, or cash flows.

WEATHER AND NATURAL DISASTERS

A large number of our stores and distribution facilities are geographically located in areas that are susceptible to hurricanes, tornadoes, floods, droughts and earthquakes. Weather conditions and natural disasters could disrupt our operations at one or more of our facilities, interrupt the delivery of products to our stores, substantially increase the cost of products, including supplies and materials and substantially increase the cost of energy needed to operate our facilities or deliver products to our facilities. Adverse weather and natural disasters could materially affect our financial condition, results of operations, or cash flows.

COVID-19

On March 11, 2020, the World Health Organization announced that infections of the coronavirus (COVID-19) had become a pandemic, and on March 13, the U.S. President announced a National Emergency relating to the disease. There is a possibility of widespread infection in the United States and abroad, with the potential for catastrophic impact. National, state and local authorities have recommended social distancing and imposed or are considering quarantine and isolation measures on large portions of the population, including mandatory business closures. These measures, while intended to protect human life, are expected to have serious adverse impacts on domestic and foreign economies of uncertain severity and duration. The effectiveness of economic stabilization efforts, including proposed government payments to affected citizens and industries, is uncertain. Some economists are predicting the United States may enter a recession as a result of the pandemic.

Our business may be negatively impacted by the fear of exposure to or actual effects of a disease outbreak, epidemic, pandemic or similar widespread public health concern, such as reduced travel or recommendations or mandates from governmental authorities to avoid large gatherings or to self-quarantine as a result of the coronavirus pandemic. These impacts include but are not limited to:

| ● | Increased costs due to short-term significant increases in customer traffic and demand spikes; |

| ● | Failure of third parties on which we rely, including our suppliers, contract manufacturers, contractors, commercial banks, joint venture partners and external business partners to meet their obligations to the company, or significant disruptions in their ability to do so which may be caused by their own financial or operational difficulties and may adversely impact our operations; |

| ● | Supply chain risks such as scrutiny or embargoing of goods produced in infected areas; |

| ● | Reduced workforces which may be caused by, but not limited to, the temporary inability of the workforce to work due to illness, quarantine, or government mandates; |

| ● | Temporary store closures due to reduced workforces or government mandates; or |

| ● | Reduced consumer traffic and purchasing which may be caused by, but not limited to, the temporary inability of customers to shop with us due to illness, quarantine or other travel restrictions, or financial hardship, shifts in demand from discretionary or higher priced products to lower priced products, or stockpiling or similar pantry-loading activities. |

12

Any of the foregoing factors, or other cascading effects of the coronavirus pandemic that are not currently foreseeable, could materially increase our costs, negatively impact our sales and damage the Company’s financial condition, results of operations, cash flows and its liquidity position, possibly to a significant degree. The duration of any such impacts cannot be predicted because of the sweeping nature of the COVID-19 pandemic.

GOVERNMENT REGULATION

Our stores are subject to various laws, regulations, and administrative practices that affect our business. We must comply with numerous provisions regulating, among other things, health and sanitation standards, food labeling and safety, equal employment opportunity, minimum wages, licensing for the sale of food, drugs, and alcoholic beverages, and new provisions relating to the COVID-19 pandemic. We cannot predict future laws, regulations, interpretations, administrative orders, or applications, or the effect they will have on our operations. They could, however, significantly increase the cost of doing business. They also could require the reformulation of some of the products that we sell (or manufacture for sale to third parties) to meet new standards. We also could be required to recall or discontinue the sale of products that cannot be reformulated. These changes could result in additional record keeping, expanded documentation of the properties of certain products, expanded or different labeling, or scientific substantiation. Any or all of these requirements could have an adverse effect on our financial condition, results of operations, or cash flows.

ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

None.

ITEM 2. | PROPERTIES. |

As of February 1, 2020, we operated approximately 2,800 owned or leased supermarkets, distribution warehouses and food production plants through divisions, subsidiaries or affiliates. These facilities are located throughout the United States. While our current strategy emphasizes ownership of real estate, a substantial portion of the properties used to conduct our business are leased.

We generally own store equipment, fixtures and leasehold improvements, as well as processing and food production equipment. The total cost of our owned assets and finance leases at February 1, 2020, was $45.8 billion while the accumulated depreciation was $24.0 billion.

We lease certain store real estate, warehouses, distribution centers, office space and equipment. While our current strategy emphasizes ownership of store real estate, we operate in leased facilities in approximately half of our store locations. Lease terms generally range from 10 to 20 years with options to renew for varying terms at our sole discretion. Certain leases also include options to purchase the leased property. Leases with an initial term of 12 months or less are not recorded on the balance sheet. Certain leases include escalation clauses or payment of executory costs such as property taxes, utilities or insurance and maintenance. Rent expense for leases with escalation clauses or other lease concessions are accounted for on a straight-line basis over the lease term. Our lease agreements do not contain any material residual value guarantees or material restrictive covenants. Certain properties or portions thereof are subleased to others for periods generally ranging from one to 20 years. For additional information on lease obligations, see Note 10 to the Consolidated Financial Statements.

ITEM 3. | LEGAL PROCEEDINGS. |

Various claims and lawsuits arising in the normal course of business, including suits charging violations of certain antitrust, wage and hour, or civil rights laws, as well as product liability cases, are pending against the Company. Some of these suits purport or have been determined to be class actions and/or seek substantial damages. Any damages that may be awarded in antitrust cases will be automatically trebled. Although it is not possible at this time to evaluate the merits of all of these claims and lawsuits, nor their likelihood of success, we believe that any resulting liability will not have a material adverse effect on our financial position, results of operations, or cash flows.

13

We continually evaluate our exposure to loss contingencies arising from pending or threatened litigation and believe we have made provisions where it is reasonably possible to estimate and where an adverse outcome is probable. Nonetheless, assessing and predicting the outcomes of these matters involves substantial uncertainties. We currently believe that the aggregate range of loss for our exposures is not material. It remains possible that despite our current belief, material differences in actual outcomes or changes in our evaluation or predictions could arise that could have a material adverse effect on our financial condition, results of operations, or cash flows.

ITEM 4. | MINE SAFETY DISCLOSURES. |

Not applicable.

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our common stock is listed on the New York Stock Exchange under the symbol “KR.” As of March 25, 2020, there were 26,407 shareholders of record.

During 2019, we paid two quarterly cash dividends of $0.14 per share and two quarterly cash dividends of $0.16 per share. During 2018, we paid two quarterly cash dividends of $0.125 per share and two quarterly cash dividends of $0.14 per share. On March 1, 2020, we paid a quarterly cash dividend of $0.16 per share. On March 12, 2020, we announced that our Board of Directors declared a quarterly cash dividend of $0.16 per share, payable on June 1, 2020, to shareholders of record at the close of business on May 15, 2020. We currently expect to continue to pay comparable cash dividends on a quarterly basis, that will increase over time, depending on our earnings and other factors, including approval by our Board.

For information on securities authorized for issuance under our existing equity compensation plans, see Item 12 under the heading “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

14

PERFORMANCE GRAPH

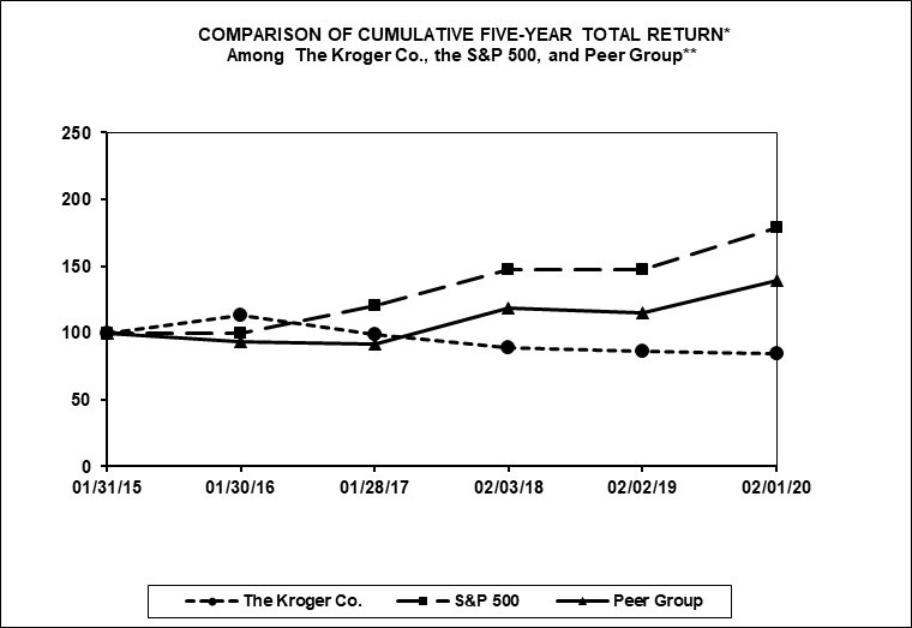

Set forth below is a line graph comparing the five-year cumulative total shareholder return on our common shares, based on the market price of the common shares and assuming reinvestment of dividends, with the cumulative total return of companies in the Standard & Poor’s 500 Stock Index and a peer group composed of food and drug companies.

Base | INDEXED RETURNS |

| |||||||||||

Period | Years Ending |

| |||||||||||

Company Name/Index |

| 2014 |

| 2015 |

| 2016 |

| 2017 |

| 2018 |

| 2019 |

|

The Kroger Co. |

| 100 |

| 113.63 |

| 98.98 |

| 88.69 |

| 86.45 |

| 84.67 | |

S&P 500 Index |

| 100 |

| 99.33 |

| 120.06 |

| 147.48 |

| 147.40 |

| 179.17 | |

Peer Group |

| 100 |

| 93.30 |

| 91.76 |

| 118.54 |

| 115.13 |

| 138.93 | |

Kroger’s fiscal year ends on the Saturday closest to January 31.

Data supplied by Standard & Poor’s.

The foregoing Performance Graph will not be deemed incorporated by reference into any other filing, absent an express reference thereto.

* Total assumes $100 invested on January 31, 2015, in The Kroger Co., S&P 500 Index, and the Peer Group, with reinvestment of dividends.

** The Peer Group consists of Costco Wholesale Corp., CVS Health Corporation, Etablissements Delhaize Freres Et Cie Le Lion (“Groupe Delhaize”, which is included through July 22, 2016 when it merged with Koninklijke Ahold), Koninklijke Ahold Delhaize NV (changed name from Koninklijke Ahold after merger with Groupe Delhaize), Supervalu Inc. (included through October 19, 2018 when it was acquired by United Natural Foods), Target Corp., Walmart Inc., Walgreens Boots Alliance Inc. (formerly, Walgreen Co.), Whole Foods Market Inc. (included through August 28, 2017 when it was acquired by Amazon.com, Inc.).

15

The following table presents information on our purchases of our common shares during the fourth quarter of 2019.

ISSUER PURCHASES OF EQUITY SECURITIES

| Total Number of | Approximate Dollar |

| ||||||||

Shares | Value of Shares |

| |||||||||

Purchased as | that May Yet Be |

| |||||||||

Part of Publicly | Purchased Under |

| |||||||||

Total Number | Average | Announced | the Plans or |

| |||||||

of Shares | Price Paid | Plans or | Programs (4) |

| |||||||

Period (1) |

| Purchased (2) |

| Per Share |

| Programs (3) |

| (in millions) |

| ||

First period - four weeks | |||||||||||

November 10, 2019 to December 7, 2019 |

| 224,436 | $ | 26.95 |

| 211,551 | $ | 1,000 | |||

Second period - four weeks | |||||||||||

December 8, 2019 to January 4, 2020 |

| 7,844,559 | $ | 28.43 |

| 7,832,894 | $ | 787 | |||

Third period — four weeks | |||||||||||

January 5, 2020 to February 1, 2020 |

| 7,117,032 | $ | 28.49 |

| 7,117,032 | $ | 600 | |||

Total |

| 15,186,027 | $ | 28.43 |

| 15,161,477 | $ | 600 | |||

16

ITEM 6. | SELECTED FINANCIAL DATA. |

The following table presents our selected consolidated financial data for each of the last five fiscal years.

Fiscal Years Ended |

| |||||||||||||||

| February 1, |

| February 2, |

| February 3, |

| January 28, |

| January 30, |

| ||||||

2020 | 2019 | 2018 | 2017 | 2016 |

| |||||||||||

(52 weeks) | (52 weeks) | (53 weeks) | (52 weeks) | (52 weeks) |

| |||||||||||

(In millions, except per share amounts) |

| |||||||||||||||

Sales | $ | 122,286 | $ | 121,852 | $ | 123,280 | $ | 115,337 | $ | 109,830 | ||||||

Net earnings including noncontrolling interests | $ | 1,512 | $ | 3,078 | $ | 1,889 | $ | 1,957 | $ | 2,049 | ||||||

Net earnings attributable to The Kroger Co. | $ | 1,659 | $ | 3,110 | $ | 1,907 | $ | 1,975 | $ | 2,039 | ||||||

Net earnings attributable to The Kroger Co. per diluted common share | $ | 2.04 | $ | 3.76 | $ | 2.09 | $ | 2.05 | $ | 2.06 | ||||||

Total assets | $ | 45,256 | $ | 38,118 | $ | 37,197 | $ | 36,505 | $ | 33,897 | ||||||

Long-term liabilities, including obligations under finance leases | $ | 22,440 | $ | 16,009 | $ | 16,095 | $ | 16,935 | $ | 14,128 | ||||||

Total shareholders’ equity — The Kroger Co. | $ | 8,602 | $ | 7,886 | $ | 6,931 | $ | 6,698 | $ | 6,820 | ||||||

Cash dividends per common share | $ | 0.600 | $ | 0.530 | $ | 0.490 | $ | 0.450 | $ | 0.395 | ||||||

Note: This information should be read in conjunction with MD&A and the Consolidated Financial Statements.

Fiscal year 2015, 2016, 2018 and 2019 each include 52 weeks. Fiscal year 2017 includes 53 weeks.

Total assets and long-term liabilities, including obligations under finance leases, were impacted in 2019 by the adoption of ASU 2016-02, “Leases,” as further described in Notes 10 and 18 to the Consolidated Financial Statements. Prior period amounts were not adjusted and continue to be reported in accordance with our historic accounting policies.

Products and services related primarily to Kroger Personal Finance and Media, which were historically accounted for as an offset to operating, general and administrative expenses (“OG&A”), are classified as a component of sales as of the beginning of fiscal year 2019, except for certain amounts in Media, which are netted against merchandise costs. The prior-year amounts have been reclassified to conform to current-year presentation with the exception of 2016 and 2015, which were not material and not adjusted for the sales reclassification. See Item 7, Supplemental Information for additional details.

Fiscal year ended February 2, 2019 includes the gain on sale of our convenience store business unit. Additionally, refer to Note 17 to the Consolidated Financial Statements for disclosure of disposals of businesses.

Refer to Note 2 to the Consolidated Financial Statements for disclosure of business combinations and their effect on the Consolidated Statements of Operations and the Consolidated Balance Sheets.

17

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

The following discussion and analysis of financial condition and results of operations of The Kroger Co. should be read in conjunction with the “Forward-looking Statements” section set forth in Part I and the “Risk Factors” section set forth in Item 1A of Part I. MD&A is provided as a supplement to, and should be read in conjunction with, our Consolidated Financial Statements and the accompanying notes thereto contained in Item 8 of this report, as well as Part II, Item 7 “Management's Discussion and Analysis of Financial Condition and Results of Operations” of our Form 10-K for the year ended February 2, 2019, which provides additional information on comparisons of fiscal years 2018 and 2017.

OUR BUSINESS

The Kroger Co. was founded in 1883 and incorporated in 1902. As of February 1, 2020, Kroger is one of the world’s largest retailers, as measured by revenue, operating 2,757 supermarkets under a variety of local banner names in 35 states and the District of Columbia. Of these stores, 2,270 have pharmacies and 1,567 have fuel centers. We offer Pickup (also referred to as ClickList®) and Harris Teeter ExpressLane™ — personalized, order online, pick up at the store services — at 1,989 of our supermarkets and provide home delivery service to 97% of Kroger households. We also operate an online retailer.

We operate 35 food production plants, primarily bakeries and dairies, which supply approximately 31% of Our Brands units and 42% of the grocery category Our Brands units sold in our supermarkets; the remaining Our Brands items are produced to our strict specifications by outside manufacturers.

Our revenues are predominately earned and cash is generated as consumer products are sold to customers in our stores, fuel centers and via our online platforms. We earn income predominately by selling products at price levels that produce revenues in excess of the costs we incur to make these products available to our customers. Such costs include procurement and distribution costs, facility occupancy and operational costs, and overhead expenses. Our retail operations, which represent 97% of our consolidated sales, is our only reportable segment.

On January 27, 2020, Lucky’s Market filed a voluntary petition in the Bankruptcy Court seeking relief under the Bankruptcy Code. Lucky’s Market is included in our Consolidated Balance Sheet for 2018 and our Consolidated Statements of Operations in all periods in 2017 and 2018 and through January 26, 2020. Refer to Note 17 to the Consolidated Financial Statements for additional information.

On April 26, 2019, we completed the sale of our Turkey Hill Dairy business for total proceeds of $225 million. Turkey Hill Dairy is included in our Consolidated Balance Sheet for 2018 and our Consolidated Statements of Operations in all periods in 2017 and 2018 and through April 25, 2019.

On March 13, 2019, we completed the sale of our You Technology business to Inmar for total consideration of $565 million, including $396 million of cash and $64 million of preferred equity received upon closing. We are also entitled to receive other cash payments of $105 million over five years. The transaction includes a long-term service agreement for Inmar to provide us digital coupon services. You Technology is included in our Consolidated Balance Sheet for 2018 and our Consolidated Statements of Operations in all periods in 2017 and 2018 and through March 12, 2019.

On June 22, 2018, we closed our merger with Home Chef by purchasing 100% of the ownership interest in Home Chef, for $197 million net of cash and cash equivalents of $30 million, in addition to future earnout payments of up to $500 million over five years that are contingent on achieving certain milestones. Home Chef is included in our ending Consolidated Balance Sheet for 2018 and 2019 and in our Consolidated Statements of Operations from June 22, 2018 through February 2, 2019 and all periods in 2019. See Note 2 to the Consolidated Financial Statements for more information related to our merger with Home Chef.

On April 20, 2018, we completed the sale of our convenience store business unit for $2.2 billion. The convenience store business is included in our Consolidated Statements of Operations in all periods in 2017 and through April 19, 2018.

18

USE OF NON-GAAP FINANCIAL MEASURES

The accompanying Consolidated Financial Statements, including the related notes, are presented in accordance with generally accepted accounting principles (“GAAP”). We provide non-GAAP measures, including FIFO gross margin, FIFO operating profit, adjusted net earnings and adjusted net earnings per diluted share because management believes these metrics are useful to investors and analysts. These non-GAAP financial measures should not be considered as an alternative to gross margin, operating profit, net earnings and net earnings per diluted share or any other GAAP measure of performance. These measures should not be reviewed in isolation or considered as a substitute for our financial results as reported in accordance with GAAP.

We calculate FIFO gross margin as FIFO gross profit divided by sales. FIFO gross profit is calculated as sales less merchandise costs, including advertising, warehousing, and transportation expenses, but excluding the Last-In, First-Out (“LIFO”) charge. Merchandise costs exclude depreciation and rent expenses. FIFO gross margin is an important measure used by management as management believes FIFO gross margin is a useful metric to investors and analysts because it measures our day-to-day merchandising and operational effectiveness.

We calculate FIFO operating profit as operating profit excluding the LIFO charge. FIFO operating profit is an important measure used by management as management believes FIFO operating profit is a useful metric to investors and analysts because it measures our day-to-day operational effectiveness.

The adjusted net earnings and adjusted net earnings per diluted share metrics are important measures used by management to compare the performance of core operating results between periods. We believe adjusted net earnings and adjusted net earnings per diluted share are useful metrics to investors and analysts because they present more accurate year-over-year comparisons for our net earnings and net earnings per diluted share because adjusted items are not the result of our normal operations. Net earnings for 2019 include the following, which we define as the “2019 Adjusted Items:”

| ● | Charges to operating, general and administrative expenses (“OG&A”) of $135 million, $104 million net of tax, for obligations related to withdrawal liabilities for certain multi-employer pension funds; $80 million, $61 million net of tax, for a severance charge and related benefits; $412 million including $305 million attributable to The Kroger Co., $225 million net of tax, for impairment of Lucky’s Market; $52 million, $37 million net of tax, for transformation costs, primarily including 35 planned store closures; and a reduction to OG&A of $69 million, $49 million net of tax, for the revaluation of Home Chef contingent consideration (the “2019 OG&A Adjusted Items”). |

| ● | Gains in other income (expense) of $106 million, $80 million net of tax, related to the sale of Turkey Hill Dairy; $70 million, $52 million net of tax, related to the sale of You Technology; and $157 million, $119 million net of tax, for the mark to market gain on Ocado Group plc (“Ocado”) securities (the “2019 Other Income (Expense) Adjusted Items”). |

Net earnings for 2018 include the following, which we define as the “2018 Adjusted Items:”

| ● | Charges to OG&A of $155 million, $121 million net of tax, for obligations related to withdrawal liabilities for certain local unions of the Central States multi-employer pension fund; $33 million, $26 million net of tax, for the revaluation of Home Chef contingent consideration; and $42 million, $33 million net of tax, for an impairment of financial instrument (the “2018 OG&A Adjusted Items”). We had initially received the financial instrument in 2016 with no cash outlay as part of the consideration for entering into agreements with a third party. |

| ● | A reduction to depreciation and amortization expenses of $14 million, $11 million net of tax, related to held for sale assets (the “2018 Depreciation Adjusted Item”). |

| ● | Gains in other income (expense) of $1.8 billion, $1.4 billion net of tax, related to the sale of our convenience store business unit and $228 million, $174 million net of tax, for the mark to market gain on Ocado securities. |

19

Net earnings for 2017 include the following, which we define as the “2017 Adjusted Items:”

| ● | Charges to OG&A of $550 million, $360 million net of tax, for obligations related to withdrawing from and settlements of withdrawal liabilities for certain multi-employer pension funds; $184 million, $117 million net of tax, related to the voluntary retirement offering (“VRO”); and $110 million, $74 million net of tax, related to the Kroger Specialty Pharmacy goodwill impairment (the “2017 OG&A Adjusted Items”). |

| ● | A reduction to depreciation and amortization expenses of $19 million, $13 million net of tax, related to held for sale assets (the “2017 Depreciation Adjusted Item”). |

| ● | A reduction to income tax expense of $922 million primarily due to the re-measurement of deferred tax liabilities and the reduction of the statutory rate for the last five weeks of the fiscal year from the Tax Cuts and Jobs Act ("Tax Act") (the “2017 Tax Expense Adjusted Item”). |

| ● | A charge in other income (expense) of $502 million, $335 million net of tax, related to a company-sponsored pension plan termination. |

In addition, net earnings for 2017 include $119 million, $79 million net of tax, due to a 53rd week in fiscal year 2017 (the “Extra Week”).

EXECUTIVE SUMMARY – OUR PATH TO DELIVERING CONSISTENT AND ATTRACTIVE TOTAL SHAREHOLDER RETURN

In 2019, we delivered on the total shareholder return model that we outlined at our Investor Day in November 2019 and are positioned to deliver on our total shareholder return model of the future. We also delivered on our guidance for identical sales without fuel, adjusted net earnings per diluted share and adjusted FIFO operating profit. We are using the power of Kroger’s stable and growing supermarket business to create meaningful incremental operating profit through the alternative profit stream businesses, positioning our business for long-term growth. By executing against the Restock Kroger framework, we are repositioning our business by widening and deepening our competitive moats. The four main areas of the Restock Kroger framework – Redefine the Customer Experience, Partner to Create Value, Develop Talent and Live Our Purpose – continue to be a top strategic priority for us. Our model is built upon a strong and durable base driven by our retail supermarket, fuel, and health and wellness businesses. We continue to generate strong free cash flow and are being disciplined in how we deploy it to deliver strong and attractive total shareholder returns.

Our financial strategy is to continue to use our strong free cash flow to invest in the business to drive long-term sustainable growth through the identification of high-return projects that support our strategy. We will allocate capital toward driving profitable sales growth in stores and digital, improving productivity, and building a seamless digital ecosystem and supply chain. At the same time, we are committed to maintaining our net debt to adjusted EBITDA range of 2.30 to 2.50 in order to keep our current investment-grade debt rating. We also expect to continue to grow our dividend over time, reflecting the confidence we have in our free cash flow, and will continue to return excess cash to investors via share repurchases. We expect our model to deliver improved operating results over time and continued strong free cash flow, which will translate into a consistently strong and attractive total shareholder return over the long-term of 8% to 11%. Our full-year 2019 results demonstrated clear progress toward delivering on this model. Restock Kroger is the right strategic framework to deliver both our 2020 guidance and to position Kroger for sustainable growth and total shareholder return.

20

The following table provides highlights of our financial performance:

Financial Performance Data

($ in millions, except per share amounts)

| Percentage |

| |||||||

2019 | Change | 2018 | |||||||

Sales | $ | 122,286 | 0.4 | % | $ | 121,852 | |||

Net earnings attributable to The Kroger Co. | 1,659 | (46.7) | % | 3,110 | |||||

Adjusted net earnings attributable to The Kroger Co. |

| 1,786 | 2.3 | % |

| 1,745 | |||

Net earnings attributable to The Kroger Co. per diluted common share |

| 2.04 | (45.7) | % |

| 3.76 | |||

Adjusted net earnings attributable to The Kroger Co. per diluted common share | 2.19 | 3.8 | % |

| 2.11 | ||||

Operating profit | 2,251 | (13.9) | % | 2,614 | |||||

Adjusted FIFO operating profit | 2,995 | 4.0 | % | 2,880 | |||||

Reduction in total debt, including obligations under finance leases | 1,153 | 220.3 | % | 360 | |||||

Share repurchases | 465 | (76.9) | % | 2,010 | |||||

Dividends paid | 486 | 11.2 | % | 437 | |||||

Dividends paid per common share | 0.600 | 13.2 | % | 0.530 | |||||

Identical sales excluding fuel | 2.0 | % | N/A | 1.8 | % | ||||

FIFO gross margin rate, excluding fuel and Adjusted Items, bps decrease | (0.23) | N/A | (0.55) | ||||||

OG&A rate, excluding fuel and Adjusted Items, bps increase (decrease) | (0.29) | N/A | 0.07 | ||||||

OVERVIEW

Notable items for 2019 are:

Shareholder Return

| ● | Net earnings attributable to The Kroger Co. per diluted common share of $2.04. |

| ● | Adjusted net earnings attributable to The Kroger Co. per diluted common share of $2.19. |

| ● | We returned $951 million to shareholders from share repurchases and dividend payments. |

| ● | Over the last 12 months, we decreased total debt, including obligations under finance leases, by $1.2 billion. |

Other Financial Results

| ● | Identical sales, excluding fuel, increased 2.0% in 2019. |

| ● | Digital revenue grew 29% in 2019, driven by Pickup and Delivery sales growth. Digital revenue growth has moderated primarily due to cycling our merger with the Home Chef business. Digital revenue primarily includes revenue from all curbside pickup locations, online sales delivered to customer locations and products shipped to customer locations. |

| ● | Alternative profit streams grew over $100 million in 2019 compared to 2018, meeting our expectations. Kroger’s ecosystem fuels the growth of adjacent alternative profit streams like Kroger Personal Finance, customer data insights, and media businesses that are essential components of Restock Kroger. These businesses comprise a significant portion of Kroger’s overall alternative profit stream portfolio. They are dependent on a core supermarket business to deliver sustainable, long-term growth and profitability. |

Significant Events

| ● | During the fourth quarter of 2019, we recognized transformation costs of $52 million, $37 million net of tax, primarily including 35 planned store closures. |

21

| ● | During the third quarter of 2019, we approved and implemented a plan to reorganize certain portions of our division management structure, resulting in a charge for severance and related benefits of $80 million, $61 million net of tax. This reorganization is expected to increase operational effectiveness and reduce overhead costs while maintaining a high quality customer experience. |