12Management Discussion

International Business Machines Corporation and Subsidiary Companies

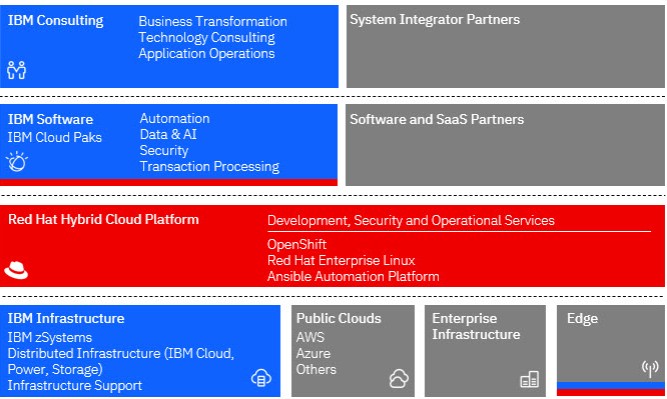

Our full technology stack helps us meet clients where they are in their digital transformations, and we offer the consulting expertise to help guide and implement the best solutions for that journey. Our rapidly growing ecosystem of cloud, independent software vendors (ISVs), hardware, network and services partners enhance the client experience and drive the value and innovation derived from IBM technologies. Our focus on hybrid cloud accelerates our open and collaborative approach to partnership.

Our hybrid cloud platform strategy drives sustained growth and financial performance: on average, every $1 of platform spend results in $3 to $5 of software revenue, $6 to $8 of services and $1 to $2 of enterprise infrastructure. The hybrid cloud opportunity represents over a $1 trillion market across software, consulting and infrastructure.

IBM’s integrated value is amplified by ensuring our existing businesses all advance the hybrid cloud value proposition to our clients. We strategically embed the Red Hat platform with our offerings: (1) IBM Software’s growing portfolio runs on Red Hat OpenShift Container Platform (OCP), (2) IBM Infrastructure solutions are optimized hybrid cloud deployments for mission-critical workloads, and (3) IBM Consulting is the leading market system integrator with hybrid cloud and Red Hat expertise to help clients transform their business and technology.

IBM Software extends the value of our hybrid cloud platform with four critical capabilities: (1) “Modernize” for agility and speed from legacy to hybrid cloud architecture, (2) “Data-driven”, predicting outcomes from distributed data and applying AI to empower predictive decision-making, real-time digital intelligence and sustainable operations, (3) “Automate” at scale to make experiences and tasks more productive and impactful, and (4) “Secure” all touchpoints, all the time, employing real-time threat insights, automated detection and orchestrated response. Red Hat, reported in our Software segment, delivers the leading open-source hybrid cloud platform and enables clients to build, secure, operate and manage any application, anywhere, from on-premises environments to multiple clouds and the edge. One hundred percent of commercial banks, telecommunication, media and technology companies in the Fortune Global 500 rely on Red Hat. Red Hat collaborates with a broad ecosystem of partners and communities comprised of millions of developers. These capabilities allow our clients to “write once, deploy anywhere” for cloud native application development and modernization. We embed the Red Hat platform with our offerings, to advance the hybrid cloud value proposition to our clients.

IBM Consulting delivers business transformation for our clients through hybrid cloud and AI technologies. Our 160,000+ professionals together with our open ecosystem of partners help clients advance digital transformation, build open hybrid cloud architectures, orchestrate critical applications across environments, and optimize key workflows and business processes. IBM Consulting drives transformative projects across different industries with its IBM Garage method. IBM Consulting has dedicated talent in practices to support IBM technology and continues to invest in the industry’s largest Red Hat practice to make hybrid cloud a foundation for innovation and business growth, enabling clients to get more value from investments. IBM Consulting has deepened its hybrid cloud consulting offerings and scaled cloud capability to 40,000+ cloud platform certifications, while accelerating the transformation journeys for its clients in 2022. IBM Consulting also captures growth by investing in practices with a wide ecosystem of partners, including AWS, Azure and major ISVs.