|

|

|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

Form 10-K

x Annual Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For

the fiscal year ended June 30, 2014

or

o Transition Report Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the transition period

from

to

Commission file number

0-5151

|

|

|

FLEXSTEEL INDUSTRIES, INC. |

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

Minnesota |

|

42-0442319 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

385 Bell Street, Dubuque, Iowa |

|

52001 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: |

|

(563) 556-7730 |

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

|

|

|

|

Title of each class |

|

Name of each exchange on which registered |

Common Stock, $1.00 Par Value |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of

the Act:

None

(Title of Class)

|

|

Yes o No x

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

|

|

|

|

|

|

Large accelerated filer o |

Accelerated filer x |

Non-accelerated filer o |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting stock held by non-affiliates, computed by reference to the last sales price on December 31, 2013 (which was the last business day of the registrant’s most recently completed second quarter) was $147,778,235.

Indicate the number of shares outstanding of each of the registrant’s classes of Common Stock, as of the latest practicable date. 7,370,735 Common Shares ($1 par value) as of August 21, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

In Part

III, portions of the registrant’s 2014 Proxy Statement to be filed with the

Securities and Exchange Commission within 120 days of the Registrant’s fiscal

year end.

1

PART I

Cautionary Statement Relevant to Forward-Looking Information for the Purpose of “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995

The Company and its representatives may from time to time make written or oral forward-looking statements with respect to long-term goals or anticipated results of the Company, including statements contained in the Company’s filings with the Securities and Exchange Commission and in its reports to stockholders.

Statements, including those in this Annual Report on Form 10-K, which are not historical or current facts, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. There are certain important factors that could cause our results to differ materially from those anticipated by some of the statements made herein. Investors are cautioned that all forward-looking statements involve risk and uncertainty. Some of the factors that could affect results are the cyclical nature of the furniture industry, supply chain disruptions, litigation, the effectiveness of new product introductions and distribution channels, the product mix of sales, pricing pressures, the cost of raw materials and fuel, retention and recruitment of key employees, actions by governments including laws, regulations, taxes and tariffs, inflation, the amount of sales generated and the profit margins thereon, competition (both U.S. and foreign), credit exposure with customers, participation in multi-employer pension plans and general economic conditions. For further information regarding these risks and uncertainties, see the “Risk Factors” section in Item 1A of this Annual Report on Form 10-K.

The Company specifically declines to undertake any obligation to publicly revise any forward-looking statements that have been made to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

|

|

|

|

Item 1. |

Business |

|

|

|

General |

|

Flexsteel Industries, Inc. and Subsidiaries (the “Company”) was incorporated in 1929 and is one of the oldest and largest manufacturer, importer and marketer of residential and commercial upholstered and wood furniture products in the United States. Product offerings include a wide variety of upholstered and wood furniture such as sofas, loveseats, chairs, reclining and rocker-reclining chairs, swivel rockers, sofa beds, convertible bedding units, occasional tables, desks, dining tables and chairs and bedroom furniture. The Company’s products are intended for use in home, office, hotel, healthcare and other commercial applications. A featured component in most of the upholstered furniture is a unique steel drop-in seat spring from which our name “Flexsteel” is derived. The Company distributes its products throughout the United States through the Company’s sales force and various independent representatives. |

|

|

|

The Company operates in one reportable segment, furniture products. Our furniture products business involves the distribution of manufactured and imported products consisting of a broad line of upholstered and wooden furniture for residential and commercial markets. Set forth below is information for the past three fiscal years showing the Company’s net sales attributable to each of the areas of application: |

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

FOR THE YEARS ENDED JUNE 30, |

|

|||||||

|

|

|

2014 |

|

2013 |

|

2012 |

|

|||

|

Residential |

|

$ |

359,565 |

|

$ |

311,214 |

|

$ |

275,442 |

|

|

Commercial |

|

|

78,978 |

|

|

74,975 |

|

|

76,647 |

|

|

|

|

$ |

438,543 |

|

$ |

386,189 |

|

$ |

352,089 |

|

|

|

|

Manufacturing and Offshore Sourcing |

|

|

|

We operate manufacturing facilities that are located in Arkansas, California, Georgia, Iowa, Mississippi and Juarez, Mexico. These manufacturing operations are integral to our product offerings and distribution strategy by offering smaller and more frequent product runs of a wider product selection. We identify and eliminate manufacturing inefficiencies and adjust manufacturing schedules on a daily basis to meet customer requirements. We have established relationships with key suppliers to ensure prompt delivery of quality component parts. Our production includes the use of selected offshore component parts to enhance our value in the marketplace. |

|

We integrate our manufactured products with finished products acquired from offshore suppliers who can meet our quality specification and scheduling requirements. We will continue to pursue and refine this blended strategy, offering customers manufactured goods, products manufactured utilizing imported component parts, and ready-to-deliver imported products. This blended focus on products allows the Company to provide a wide range of price points, styles and product categories to satisfy customer requirements. |

2

|

|

|

Competition |

|

The furniture industry is highly competitive and includes a large number of U.S. and foreign manufacturers and distributors, none of which dominates the market. The markets in which we compete include a large number of relatively small manufacturers; however, certain competitors have substantially greater sales volumes than we have. Our products compete based on style, quality, price, delivery, service and durability. We believe that our manufacturing and sourcing capabilities, facility locations, commitment to customers, product quality, delivery, service and value and experienced production, sales, marketing and management teams, are our competitive advantages. |

|

|

|

Seasonality |

|

The Company’s business is not considered seasonal. |

|

|

|

Foreign Operations |

|

The Company makes minimal export sales. At June 30, 2014, the Company had approximately 90 employees located in Asia to inspect and coordinate the delivery of purchased products. |

|

|

|

Customer Backlog |

|

The approximate backlog of customer orders believed to be firm as of the end of the current fiscal year and the prior two fiscal years were as follows (in thousands): |

|

|

|

|

|

|

|

June 30, 2014 |

|

June 30, 2013 |

|

June 30, 2012 |

|

$45,000 |

|

$43,300 |

|

$38,700 |

|

|

|

Raw Materials |

|

The Company utilizes various types of wood, fabric, leather, filling material, high carbon spring steel, bar and wire stock, polyurethane and other raw materials in manufacturing furniture. While the Company purchases these materials from numerous outside suppliers, both U.S. and foreign, it is not dependent upon any single source of supply. The costs of certain raw materials fluctuate, but all continue to be readily available. |

|

|

|

Working Capital Practices |

|

For a discussion of the Company’s working capital practices, see “Liquidity and Capital Resources” in Item 7 of this Annual Report on Form 10-K. |

|

|

|

Industry Factors |

|

The Company has exposure to actions by governments, including tariffs, see “Risk Factors” in Item 1A of this Annual Report on Form 10-K. |

|

|

|

Government Regulations |

|

The Company is subject to various local, state, and federal laws, regulations and agencies that affect businesses generally, see “Risk Factors” in Item 1A of this Annual Report on Form 10-K. |

|

|

|

Environmental Matters |

|

The Company is subject to environmental laws and regulations with respect to product content and industrial waste, see “Risk Factors” in Item 1A and “Legal Proceedings” in Item 3 of this Annual Report on Form 10-K. |

|

|

|

Trademarks and Patents |

|

The Company owns the American and Canadian improvement patents to its Flexsteel seat spring, as well as patents on convertible beds. The Company has patents and owns certain trademarks in connection with its furniture products, which are due to expire on dates ranging from 2014-2031. |

3

|

|

|

It is not common in the furniture industry to obtain a patent for a furniture design. If a particular design of a furniture manufacturer is well accepted in the marketplace, it is common for other manufacturers to imitate the same design without recourse by the furniture manufacturer who initially introduced the design. Furniture products are designed by the Company’s own design staff and through the services of third-party designers. New models and designs of furniture, as well as new fabrics, are introduced continuously. In the last three fiscal years, these design activities involved the following expenditures (in thousands): |

|

|

|

|

|

Fiscal Year Ended June 30, |

|

Expenditures |

|

2014 |

|

$2,820 |

|

2013 |

|

$2,520 |

|

2012 |

|

$2,310 |

|

|

|

Employees |

|

The Company had 1,350 employees as of June 30, 2014, including 220 employees that are covered by collective bargaining agreements. Management believes it has good relations with employees. |

|

|

|

Website and Available Information |

|

Our website is located at www.flexsteel.com. Information on the website does not constitute part of this Annual Report on Form 10-K. |

|

|

|

A copy of the Company’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission (“SEC”), other SEC reports filed or furnished and our Guidelines for Business Conduct are available, without charge, on the Company’s website at www.flexsteel.com or by writing to the Office of the Secretary, Flexsteel Industries, Inc., P. O. Box 877, Dubuque, IA 52004-0877. |

|

|

|

The executive officers of the Company, their ages, positions (in each case as of August 19, 2014), and the year they were first elected or appointed an officer of the registrant, are as follows: |

|

|

|

|

|

Name (age) |

|

Position (date first became officer) |

|

Karel K. Czanderna (58) |

|

President & Chief Executive Officer (2012) |

|

Timothy E. Hall (56) |

|

Senior Vice President-Finance, Chief Financial Officer, Secretary & Treasurer (2000) |

|

Jeffrey T. Bertsch (59) |

|

Senior Vice President of Corporate Services (1989) |

|

Julia K. Bizzis (57) |

|

Senior Vice President Strategic Growth (2013) |

|

Donald D. Dreher (64) |

|

Senior Vice President (2004) |

|

James R. Richardson (70) |

|

Senior Vice President of Residential Sales and Marketing (1979) |

|

|

|

|

Item 1A. |

Risk Factors |

Our business is subject to a variety of risks. You should carefully consider the risk factors detailed below in conjunction with the other information contained in this Annual Report on Form 10-K. Should any of these risks actually materialize, our business, financial condition, and future prospects could be negatively impacted. There may be additional factors that are presently unknown to us or that we currently believe to be immaterial that could affect our business.

Our business information systems could be impacted by disruptions and security breaches.

The Company employs information technology systems to support its global business. Security breaches and other disruptions to the Company’s information technology infrastructure could interfere with the Company’s operations, compromise information belonging to the Company and its customers and suppliers, and expose the Company to liability which could adversely impact the Company’s business and reputation. In the ordinary course of business, the Company relies on information technology networks and systems to process, transmit and store electronic information, and to manage or support a variety of business processes and activities. Additionally, the Company collects and stores certain data, including proprietary business information, and may have access to confidential or personal information in certain of our businesses that is subject to privacy and security laws, regulations and customer-imposed controls. While security breaches and other disruptions to the Company’s information technology networks and infrastructure could happen, none have occurred to date that have had a material impact to the Company. There may be other challenges and risks as the Company upgrades and standardizes its business information systems. Any such events could result in legal claims or proceedings, liability or penalties under privacy laws, disruption in operations, and damage to the Company’s reputation, which could adversely affect the Company’s business.

Our operations may be impacted by various business interruptions.

Uncharacteristic or significant weather conditions, natural disasters, political or civil unrest in the countries in which we operate and source products from can cause property damage or interrupt our business operations. These events can lead to damaged property, lost sales or lost customers and could adversely affect our short-term results of operations.

4

If we are unable to obtain bank credit or generate cash flow from our operations, our financial position, liquidity and results of operations could suffer.

We are dependent on a stable, liquid and well-functioning financial system to fund our operations and capital investments. Our continued access to these markets depends on multiple factors including the condition of capital markets, our operating performance and maintaining a strong balance sheet. If we lose our ability to generate cash flow from operations or our availability to borrow with our financial institutions to meet capital and operational needs, our liquidity and results of operations could suffer.

Our products are considered deferrable purchases for consumers during economic downturns. Prolonged negative economic conditions could impact our business.

Economic downturns and prolonged negative economic conditions could affect consumer spending habits by decreasing the overall demand for home furnishings and commercial products. These events could impact retailers, offices, hospitality, recreational vehicle seating and healthcare businesses resulting in an impact on our business. A recovery in our sales could lag significantly behind a general economic recovery due to the deferrable nature and relatively significant cost of home furnishings and commercial products purchases.

Our future success depends on our ability to manage our global supply chain.

We acquire raw materials, component parts and certain finished products from external suppliers, both U.S. and foreign. Many of these suppliers are dependent upon other suppliers in countries other than where they are located. This global interdependence within our supply chain is subject to delays in delivery, availability, quality and pricing (including tariffs) of products. The delivery of goods from these suppliers may be delayed by customs, labor issues, changes in political, economic and social conditions, laws and regulations. Unfavorable fluctuations in price, quality, delivery and availability of these products could negatively affect our ability to meet demands of our customers and have a negative impact on product margin.

Competition from U.S. and foreign finished product manufacturers may adversely affect our business, operating results or financial condition.

The furniture industry is very competitive and fragmented. We compete with U.S. and foreign manufacturers and distributors. As a result, we may not be able to maintain or raise the prices of our products in response to competitive pressures or increasing costs. Also, due to the large number of competitors and their wide range of product offerings, we may not be able to significantly differentiate our products (through styling, finish and other construction techniques) from those of our competitors. As a result, we are continually subject to the risk of losing market share, which may lower our sales and earnings.

Our failure to anticipate or respond to changes in consumer or designer tastes and fashions in a timely manner could adversely affect our business and decrease our sales and earnings.

Furniture is a styled product and is subject to rapidly changing consumer and end-user trends and tastes and is highly fashion oriented, and if we are not able to acquire sufficient fabric variety, or if we are unable to predict or respond to changes in fashion trends, we may lose sales and have to sell excess inventory at reduced prices.

Our success depends on our ability to recruit and retain key employees.

If we are not successful in recruiting and retaining key employees or experience the unexpected loss of key employees, our operations may be negatively impacted.

Future costs of complying with various laws and regulations may adversely impact future operating results.

Our business is subject to various laws and regulations which could have a significant impact on our operations and the cost to comply with such laws and regulations could adversely impact our financial position, results of operations and cash flows. In addition, failure to comply with such laws and regulations, even inadvertently, could produce negative consequences which could adversely impact our operations.

Terms of collective bargaining agreements and labor disruptions could adversely impact our results of operations.

Terms of collective bargaining agreements that prevent us from competing effectively could adversely affect our financial condition, results of operations and cash flows. We are committed to working with those groups to avert or resolve conflicts as they arise. However, there can be no assurance that these efforts will be successful.

5

Due to our participation in multi-employer pension plans, we may have exposures under those plans that could extend beyond what our obligations would be with respect to our employees.

We participate in, and make periodic contributions to, three multi-employer pension plans that cover union employees. Multi-employer pension plans are managed by trustee boards comprised of participating employer and labor union representatives, and the employers participating in a multi-employer pension plan are jointly responsible for maintaining the plan’s funding requirements. Based on the most recent information available to us, we believe that the present value of actuarially accrued liabilities in the multi-employer pension plans substantially exceeds the value of the assets held in trust to pay benefits. As a result of our participation, we could experience greater volatility in our overall pension funding obligations. Our obligations may be impacted by the funded status of the plans, the plans’ investment performance, changes in the participant demographics, financial stability of contributing employers and changes in actuarial assumptions.

Our future results may be affected by various legal proceedings and compliance risk, including those involving product liability, environmental, or other matters.

We face the business risk of exposure to product liability claims in the event that the use of any of our products results in personal injury or property damage. In the event any of our products prove to be defective, we may be required to recall or redesign such products. We are also subject to various laws and regulations relating to environmental protection and the discharge of materials into the environment. We could incur substantial costs, including legal expenses, as a result of the noncompliance with, or liability for cleanup or other costs or damages under, environmental laws. Given the inherent uncertainty of litigation, these various legal proceedings and compliance matters could have a material impact on our business, operating results or financial condition.

|

|

|

|

Item 1B. |

Unresolved Staff Comments |

|

None. |

|

|

|

|

|

Item 2. |

Properties |

The Company owns the following facilities as of June 30, 2014:

|

|

|

|

|

|

|

|

Location |

|

Approximate |

|

Principal Operations |

|

|

Harrison, Arkansas |

|

221,000 |

|

|

Manufacturing |

|

Riverside, California |

|

305,000 |

|

|

Manufacturing and Distribution |

|

Dublin, Georgia |

|

300,000 |

|

|

Manufacturing |

|

New Paris, Indiana |

|

168,000 |

|

|

Held for sale |

|

Huntingburg, Indiana |

|

691,000 |

|

|

Distribution |

|

Dubuque, Iowa |

|

719,000 |

|

|

Manufacturing and Distribution |

|

Dubuque, Iowa |

|

40,000 |

|

|

Corporate Office |

|

Starkville, Mississippi |

|

349,000 |

|

|

Manufacturing |

|

Lancaster, Pennsylvania |

|

216,000 |

|

|

Distribution |

The Company leases the following facilities as of June 30, 2014:

|

|

|

|

|

|

|

|

Location |

|

Approximate |

|

Principal Operations |

|

|

Cerritos, California |

|

32,000 |

|

|

Distribution |

|

Riverside, California |

|

65,000 |

|

|

Distribution |

|

Ferdinand, Indiana |

|

101,000 |

|

|

Distribution |

|

Louisville, Kentucky |

|

15,000 |

|

|

Administrative Offices |

|

Juarez, Mexico |

|

225,000 |

|

|

Manufacturing |

The Company’s operating plants are well suited for their manufacturing purposes and have been updated and expanded from time to time as conditions warrant. Management believes there is adequate production and distribution capacity at the Company’s facilities to meet present market demands.

The Company leases showrooms for displaying its products in the furniture markets in High Point, North Carolina and Las Vegas, Nevada.

6

|

|

|

|

Item 3. |

Legal Proceedings |

Indiana Civil Litigation – In December 2013, the Company entered into a confidential agreement to settle the Indiana Civil Litigation. In February 2014, the Company paid $6.25 million to Plaintiffs to settle the matter without admission of wrongdoing. The Company continues to believe that it did not cause or contribute to the contamination.

The Company will continue to pursue the recovery of defense and settlement costs from insurance carriers. Based on policy language and jurisdiction, insurance coverage is in question. The Company filed an appeal to the Iowa Supreme Court regarding two adverse opinions of an Iowa District Court regarding coverage issues. The Iowa Court of Appeals reversed the District Court, ruling in favor of the Company, and the Iowa Supreme Court denied further review. The cases have now been returned to the Iowa District Court for further proceedings.

|

|

|

|

Item 4. |

Mine Safety Disclosures |

|

None. |

|

PART II

|

|

|

|

Item 5. |

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Share Investment Performance

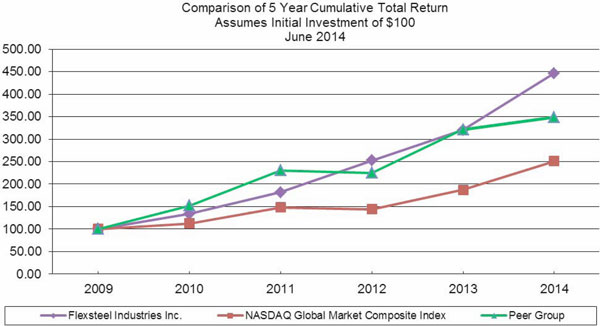

The following graph shows changes over the past five-year period in the value of $100 invested in: (1) Flexsteel’s common stock; (2) The NASDAQ Global Market; and (3) an industry peer group of the following: American Woodmark Corp, Bassett Furniture Ind., Dixie Group Inc., Ethan Allen Interiors Inc., Hooker Furniture Corp., iRobot Corp., Johnson Outdoors Inc., Kimball International, Knoll Inc., La-Z-Boy Inc., Lifetime Brands Inc., Patrick Industries Inc., and Select Comfort Corp.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 |

|

2010 |

|

2011 |

|

2012 |

|

2013 |

|

2014 |

|

||||||

|

Flexsteel |

|

100.00 |

|

|

133.88 |

|

|

181.69 |

|

|

252.65 |

|

|

320.13 |

|

|

446.85 |

|

|

|

Peer Group |

|

100.00 |

|

|

152.33 |

|

|

230.26 |

|

|

224.73 |

|

|

322.00 |

|

|

348.35 |

|

|

|

NASDAQ |

|

100.00 |

|

|

112.55 |

|

|

148.28 |

|

|

143.73 |

|

|

187.07 |

|

|

251.34 |

|

|

The NASDAQ Global Select Market is the principal market on which the Company’s common stock is traded.

7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sale Price of Common Stock * |

|

Cash Dividends |

|

||||||||||||||

|

|

|

Fiscal 2014 |

|

Fiscal 2013 |

|

|

|||||||||||||

|

|

|

High |

|

Low |

|

High |

|

Low |

|

Fiscal 2014 |

|

Fiscal 2013 |

|

||||||

|

First Quarter |

|

$ |

25.96 |

|

$ |

22.27 |

|

$ |

23.28 |

|

$ |

18.68 |

|

$ |

0.15 |

|

$ |

0.15 |

|

|

Second Quarter |

|

|

31.65 |

|

|

22.51 |

|

|

23.44 |

|

|

19.01 |

|

|

0.15 |

|

|

0.15 |

|

|

Third Quarter |

|

|

38.63 |

|

|

25.77 |

|

|

26.29 |

|

|

21.15 |

|

|

0.15 |

|

|

0.15 |

|

|

Fourth Quarter |

|

|

40.44 |

|

|

30.61 |

|

|

25.43 |

|

|

18.56 |

|

|

0.15 |

|

|

0.15 |

|

|

|

|

|

* |

Reflects the market price as reported on The NASDAQ Global Market through January 2, 2013 and on The NASDAQ Global Select Market thereafter. |

The Company estimates there were approximately 4,000 holders of common stock of the Company as of June 30, 2014. There were no repurchases of the Company’s common stock during the quarter ended June 30, 2014. The payment of future cash dividends is within the discretion of our Board of Directors and will depend, among other factors, on our earnings, capital requirements and operating and financial condition.

|

|

|

|

Item 6. |

Selected Financial Data |

The selected financial data presented below should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in Item 8 of this Annual Report on Form 10-K and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 of this Annual Report on Form 10-K. The selected consolidated statements of income data of the Company is derived from the Company’s consolidated financial statements.

Five-Year Review

(Amounts in thousands, except certain ratios and per

share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

2013 |

|

2012 |

|

2011 |

|

2010 |

|

|||||

|

SUMMARY OF OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

438,543 |

|

$ |

386,189 |

|

$ |

352,089 |

|

$ |

339,426 |

|

$ |

326,466 |

|

|

Cost of goods sold |

|

|

338,280 |

|

|

295,720 |

|

|

266,810 |

|

|

262,124 |

|

|

251,685 |

|

|

Operating income |

|

|

22,286 |

|

|

20,271 |

|

|

20,246 |

|

|

15,864 |

|

|

17,529 |

|

|

Interest and other income |

|

|

1,514 |

|

|

610 |

|

|

422 |

|

|

343 |

|

|

361 |

|

|

Interest expense |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

439 |

|

|

Income before income taxes |

|

|

23,800 |

|

|

20,881 |

|

|

20,668 |

|

|

16,207 |

|

|

17,451 |

|

|

Income tax provision |

|

|

8,810 |

|

|

7,730 |

|

|

7,600 |

|

|

5,790 |

|

|

6,650 |

|

|

Net income (1) (2) (3) |

|

|

14,990 |

|

|

13,151 |

|

|

13,068 |

|

|

10,417 |

|

|

10,801 |

|

|

Earnings per common share: (1) (2) (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

2.07 |

|

|

1.87 |

|

|

1.93 |

|

|

1.56 |

|

|

1.63 |

|

|

Diluted |

|

|

2.00 |

|

|

1.80 |

|

|

1.86 |

|

|

1.50 |

|

|

1.61 |

|

|

Cash dividends declared per common share |

|

$ |

0.60 |

|

$ |

0.60 |

|

$ |

0.45 |

|

$ |

0.30 |

|

$ |

0.20 |

|

|

SELECTED DATA AS OF JUNE 30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

7,231 |

|

|

7,041 |

|

|

6,781 |

|

|

6,693 |

|

|

6,608 |

|

|

Diluted |

|

|

7,511 |

|

|

7,326 |

|

|

7,008 |

|

|

6,929 |

|

|

6,697 |

|

|

Total assets |

|

$ |

210,213 |

|

$ |

192,539 |

|

$ |

181,672 |

|

$ |

164,677 |

|

$ |

157,670 |

|

|

Property, plant and equipment, net |

|

|

31,900 |

|

|

32,145 |

|

|

29,867 |

|

|

21,387 |

|

|

21,614 |

|

|

Capital expenditures |

|

|

4,187 |

|

|

6,225 |

|

|

10,939 |

|

|

2,573 |

|

|

1,251 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital (current assets less current liabilities) |

|

|

128,644 |

|

|

113,699 |

|

|

103,744 |

|

|

100,683 |

|

|

90,800 |

|

|

Shareholders’ equity |

|

$ |

166,735 |

|

$ |

151,237 |

|

$ |

139,442 |

|

$ |

128,573 |

|

$ |

117,612 |

|

|

SELECTED RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income, as a percent of sales |

|

|

3.4 |

|

|

3.4 |

|

|

3.7 |

|

|

3.1 |

|

|

3.3 |

|

|

Current ratio |

|

|

4.5 to 1 |

|

|

4.2 to 1 |

|

|

4.3 to 1 |

|

|

4.6 to 1 |

|

|

3.9 to 1 |

|

|

Return on ending shareholders’ equity |

|

|

9.0 |

|

|

8.7 |

|

|

9.4 |

|

|

8.1 |

|

|

9.2 |

|

|

Average number of employees |

|

|

1,380 |

|

|

1,320 |

|

|

1,280 |

|

|

1,320 |

|

|

1,400 |

|

|

|

|

|

(1) |

Fiscal 2014 net income and per share amounts include litigation settlement costs of $3.9 million (after tax) or $0.52 per share. |

|

(2) |

Fiscal 2013 net income and per share amounts include executive transition costs of $0.8 million (after tax) or $0.11 per share. |

|

(3) |

Fiscal 2011 net income and per share amounts include charges consisting of employee separation costs and inventory write down related to closing a manufacturing facility of $1.0 million (after tax) or $0.15 per share. |

8

|

|

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

General

The following analysis of the results of operations and financial condition of the Company should be read in conjunction with the consolidated financial statements and related notes included elsewhere in this Annual Report on Form 10-K.

Critical Accounting Policies

The discussion and analysis of the Company’s consolidated financial statements and results of operations are based on consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States of America. Preparation of these consolidated financial statements requires the use of estimates and judgments that affect the reported results. The Company uses estimates based on the best information available in recording transactions and balances resulting from business operations. Estimates are used for such items as collectability of trade accounts receivable and inventory valuation. Ultimate results may differ from these estimates under different assumptions or conditions.

Accounts receivable allowances – the Company establishes accounts receivable allowances to reduce trade accounts receivable to an amount that reasonably approximates their net realizable value. The Company’s accounts receivable allowances consist of an allowance for doubtful accounts which is established through review of open accounts, historical collection, and historical write-off amounts and an allowance for estimated returns on sales of the Company’s products which is based on historical product returns, as well as existing product return authorizations. The Company records a provision against revenue for estimated returns on sales of our products in the same period that the related revenues are recognized. The amount ultimately realized from trade accounts receivable may differ from the amount estimated in the consolidated financial statements.

Inventories – the Company values inventory at the lower of cost or net realizable value. The Company’s inventory valuation reflects markdowns for the excess of the cost over the amount expected to be realized and considers obsolete and excess inventory. Markdowns establish a new cost basis for the Company’s inventory. Subsequent changes in facts or circumstances do not result in the reversal of previously recorded markdowns or an increase in that newly established cost basis.

Revenue recognition – is when both product ownership and the risk of loss have transferred to the customer, collectability is reasonably assured, and the Company has no remaining obligations. The Company’s ordering process creates persuasive evidence of the sale arrangement and the sales price is determined. The delivery of the goods to the customer completes the earnings process. Net sales consist of product sales and related delivery charge revenue, net of adjustments for returns and allowances. Shipping and handling costs are included in cost of goods sold.

Recently Issued Accounting Pronouncements

See Item 8. Note 1 to the Company’s consolidated financial statements.

Results of Operations

The following table has been prepared as an aid in understanding the Company’s results of operations on a comparative basis for the fiscal years ended June 30, 2014, 2013 and 2012. Amounts presented are percentages of the Company’s net sales.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR THE YEARS ENDED JUNE 30, |

|

|||||||

|

|

|

2014 |

|

2013 |

|

2012 |

|

|||

|

Net sales |

|

|

100.0 |

% |

|

100.0 |

% |

|

100.0 |

% |

|

Cost of goods sold |

|

|

(77.1 |

) |

|

(76.6 |

) |

|

(75.8 |

) |

|

Gross margin |

|

|

22.9 |

|

|

23.4 |

|

|

24.2 |

|

|

Selling, general and administrative |

|

|

(16.4 |

) |

|

(18.2 |

) |

|

(18.4 |

) |

|

Litigation settlement costs |

|

|

(1.4 |

) |

|

— |

|

|

— |

|

|

Operating income |

|

|

5.1 |

|

|

5.2 |

|

|

5.8 |

|

|

Interest and other income |

|

|

0.3 |

|

|

0.2 |

|

|

0.1 |

|

|

Income before income taxes |

|

|

5.4 |

|

|

5.4 |

|

|

5.9 |

|

|

Income tax provision |

|

|

(2.0 |

) |

|

(2.0 |

) |

|

(2.2 |

) |

|

Net income |

|

|

3.4 |

% |

|

3.4 |

% |

|

3.7 |

% |

9

Fiscal 2014 Compared to Fiscal 2013

Net sales for fiscal 2014 were $438.5 million compared to $386.2 million in the prior fiscal year, an increase of 13.6%. For the fiscal year ended June 30, 2014, residential net sales were $359.6 million compared to $311.2 million for the year ended June 30, 2013, an increase of 15.5%. The residential net sales increase of $48.3 million for the year ended June 30, 2014 resulted from capturing demand for upholstered and ready-to-assemble products. Commercial net sales were $79.0 million for the year ended June 30, 2014, an increase of 5.3% from net sales of $75.0 million for the year ended June 30, 2013.

Gross margin for the fiscal year ended June 30, 2014 was 22.9% compared to 23.4% for the prior fiscal year. The decrease in the current fiscal year was primarily due to price discounting on certain case goods to address changing customer requirements.

Selling, general and administrative expenses (SG&A) for the fiscal year ended June 30, 2014 were 16.4% of net sales compared to 18.2% in the prior fiscal year. The Company incurred approximately $2.1 million of legal defense costs during the current fiscal year which has been recorded in SG&A expense. The Company received reimbursements of legal defense costs of approximately $2.8 million from insurers which has been reflected as a reduction of legal expenses in SG&A expenses for the current fiscal year. The prior fiscal year included $2.3 million in legal defense costs.

In December 2013, the Company entered into an agreement to settle the Indiana civil litigation in order to eliminate the ongoing costs and distraction of the litigation. In February 2014, the Company contributed $6.25 million to the settlement as part of an agreement. In reaching the agreement, the Company did not admit any wrongdoing and believes that it did not cause or contribute to the contamination at issue. This amount is recorded as litigation settlement costs in the consolidated statements of income.

The effective tax rate was 37% for fiscal years ended June 30, 2014 and 2013.

The fiscal year 2014 net income increased $1.8 million to $15.0 million, the highest ever reported for the Company. The number of diluted shares increased during fiscal 2014 due to additional shares outstanding and the impact of more dilutive stock options at June 30, 2014 based on the Company’s higher stock trading price, resulting in the Company reporting diluted earnings per share of $2.00 for fiscal year 2014 versus $1.80 for fiscal year 2013. All earnings per share amounts are on a diluted basis.

Fiscal 2013 Compared to Fiscal 2012

Net sales for fiscal 2013 were $386.2 million compared to $352.1 million in the prior fiscal year, an increase of 10%. For the fiscal year ended June 30, 2013, residential net sales were $311.2 million compared to $275.4 million for the year ended June 30, 2012, an increase of 13.0%. The residential net sales increase of $35.8 million was primarily due to growth from existing customers and products, and expansion of product portfolio and customer base. Commercial net sales were $75.0 million for the year ended June 30, 2013, a decrease of 2.2% from net sales of $76.7 million for the year ended June 30, 2012.

Gross margin for the fiscal year ended June 30, 2013 was 23.4% compared to 24.2% for the prior fiscal year. During fiscal year 2013 the Company’s expenses related to workers compensation and health insurance programs were approximately $1.5 million higher than in fiscal 2012, impacting gross margin by 0.4%.

Selling, general and administrative expenses for the fiscal year ended June 30, 2013 were 18.2% of net sales compared to 18.4% in the prior fiscal year. Fiscal year 2013 includes executive transition costs of $1.3 million or 0.4% of net sales.

The effective tax rate for the fiscal year ended June 30, 2013 was 37.0% compared to 36.8% for fiscal year 2012. The change in effective tax rate is primarily due to the lower benefit of the Domestic Manufacturing Deduction under Internal Revenue Code Section 199 (DMD), which provides a tax benefit on U.S. based manufacturing, and the limitation on executive compensation deduction.

The fiscal year 2013 net income increased $0.1 million to $13.2 million. The number of diluted shares increased during fiscal 2013 due to additional shares outstanding and the impact of the Company’s higher stock trading price on outstanding options, resulting in the Company reporting diluted earnings per share of $1.80 for fiscal year 2013 versus $1.86 for fiscal year 2012.

10

Liquidity and Capital Resources

Working capital (current assets less current liabilities) at June 30, 2014 was $128.6 million as compared to $113.7 million at June 30, 2013. Significant changes in working capital during fiscal year 2014 included increases in cash of $11.2 million, inventories of $5.5 million and accounts receivable of $2.5 million. The higher inventory levels support anticipated increased sales volume in upholstered and ready-to-assemble product categories.

The Company’s main source of liquidity is cash and cash flows from operations. As of June 30, 2014 and 2013, the Company had cash totaling $22.2 million and $10.9 million, respectively. The Company maintains a credit agreement which provides short-term working capital financing up to $25.0 million with interest of LIBOR plus 1%, including up to $4.0 million of letters of credit. Letters of credit outstanding at June 30, 2014 totaled $2.7 million, leaving borrowing availability of $22.3 million. The Company did not utilize any borrowing availability under the credit facility during the year other than the aforementioned letters of credit. The credit agreement expires June 30, 2016. At June 30, 2014, the Company was in compliance with all of the financial covenants contained in the credit agreement.

An officer of the Company is a director at a bank where the Company maintains an unsecured $8.0 million line of credit, with interest at prime minus 2%, and where its routine banking transactions are processed. The Company did not utilize any borrowing availability during the year and no amount was outstanding on the line of credit at June 30, 2014. In addition, the supplemental retirement plans assets, held in a Rabbi Trust, of $3.8 million are administered by this bank’s trust department. The Company receives no special services or pricing on the services performed by the bank due to the directorship of this officer.

Cash increased by $11.2 million during fiscal year 2014 with net cash provided by operating activities of $16.2 million driven primarily by net income of $15.0 million and proceeds received from stock option exercises of $2.4 million, partially offset by capital expenditures of $4.2 million and payment of dividends of $4.3 million.

Net cash provided by operating activities was $16.2 million and $5.9 million in fiscal year 2014 and 2013, respectively. Net income of $15.0 million was the primary driver of net cash provided by operating activities in fiscal year 2014 and reflects the cash paid for litigation settlement costs. The Company had net income of $13.2 million that included $4.9 million in non-cash charges in fiscal year 2013 and was offset by cash utilized for operating assets and liabilities of $12.2 million.

Net cash used in investing activities was $4.4 million and $6.0 million in fiscal years 2014 and 2013, respectively. Capital expenditures were $4.2 million and $6.2 million during fiscal years 2014 and 2013, respectively.

Net cash used in financing activities was $0.6 million and $2.9 million in fiscal years 2014 and 2013, respectively, primarily for the payment of dividends of $4.3 million and $4.2 million, partially offset by proceeds from issuance of common stock of $2.4 million and $1.1 million and excess tax benefit from stock-based payment arrangements of $1.4 million and $ 0.2 million in fiscal years 2014 and 2013, respectively.

The Company expects that capital expenditures for fiscal year 2015 will include approximately $35-$40 million for purchasing and equipping a Midwest Distribution Center and $6.0 million for other operating capital primarily for delivery and manufacturing equipment and information technology infrastructure. Management believes that the Company has adequate cash, cash flows from operations and credit arrangements to meet its operating and capital requirements for fiscal year 2015. In the opinion of management, the Company’s liquidity and credit resources provide it with the ability to react to opportunities as they arise, to pay quarterly dividends to its shareholders, and to purchase productive capital assets that enhance safety and improve operations.

At June 30, 2014, the Company has no long-term debt obligations and therefore, no contractual interest payments are included in the table below. The following table summarizes the Company’s contractual obligations at June 30, 2014 and the effect these obligations are expected to have on the Company’s liquidity and cash flow in the future (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

1 Year |

|

2 - 3 |

|

4 - 5 |

|

More than |

|

|||||

|

Operating lease obligations |

|

$ |

12,081 |

|

$ |

2,781 |

|

$ |

4,139 |

|

$ |

3,508 |

|

$ |

1,653 |

|

|

Supplemental retirement plans |

|

|

4,089 |

|

|

693 |

|

|

— |

|

|

— |

|

|

3,396 |

|

|

Total contractual obligations |

|

|

16,170 |

|

|

3,474 |

|

|

4,139 |

|

|

3,508 |

|

|

5,049 |

|

The long-term portion of the contractual obligations associated with the Company’s supplemental retirement plans are included in the table above under more than five years as the Company cannot predict when the events that trigger payment will occur. At June 30, 2014, the Company had no capital lease obligations, and no purchase obligations for raw materials or finished goods. The purchase price on all open purchase orders was fixed and denominated in U.S. dollars. Additionally, the Company has excluded the uncertain tax positions from the above table, as the timing of payments, if any, cannot be reasonably estimated.

11

Financing Arrangements

See Note 6 to the consolidated financial statements of this Annual Report on Form 10-K.

Outlook

Due to existing strong order backlog and positive order trends the Company expects top line growth will continue into fiscal year 2015. Growth is expected from existing customers and products, and through expanding our product portfolio and customer base. The Company believes this growth will be led by increased demand for upholstered and ready-to-assemble products. The Company is confident in its ability to take advantage of market opportunities.

The Company has started two multi-year initiatives designed to enhance customer experience and increase shareholder value. In anticipation of future growth we are implementing a logistics strategy, and are assessing our business information requirements. Consistent with the logistics strategy and subject to closing, the Company will be investing $35-$40 million to purchase and equip a Midwest distribution center. We are still in the preliminary stages of the business information system assessment. The timing and level of additional investment required for these initiatives will be evaluated as the projects progress. Other operating capital expenditures are estimated at $6.0 million for fiscal 2015. The Company believes it has adequate working capital, ability to generate cash flow and borrowing capabilities to execute the two multi-year initiatives.

The Company remains committed to its core strategies, which include providing a wide range of quality product offerings and price points to the residential and commercial markets, combined with a conservative approach to business. We will maintain our focus on a strong balance sheet through emphasis on cash flow and increasing profitability. We believe these core strategies are in the best interest of our shareholders.

|

|

|

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

General – Market risk represents the risk of changes in the value of a financial instrument, derivative or non-derivative, caused by fluctuations in interest rates, foreign exchange rates and equity prices. As discussed below, management of the Company does not believe that changes in these factors could cause material fluctuations in the Company’s results of operations or cash flows. The ability to import furniture products can be adversely affected by political issues in the countries where suppliers are located, disruptions associated with shipping distances and negotiations with port employees. Other risks related to furniture product importation include government imposition of regulations and/or quotas; duties and taxes on imports; and significant fluctuation in the value of the U.S. dollar against foreign currencies. Any of these factors could interrupt supply, increase costs and decrease earnings.

Inflation – Increased operating costs are reflected in product or services pricing with any limitations on price increases determined by the marketplace. Inflation or other pricing pressures could impact raw material costs, labor costs and interest rates which are important components of costs for the Company and could have an adverse effect on our profitability, especially where increases in these costs exceed price increases on finished products.

Foreign Currency Risk – During fiscal years 2014, 2013 and 2012, the Company did not have sales, purchases, or other expenses denominated in foreign currencies. As such, the Company is not directly exposed to market risk associated with currency exchange rates and prices.

Interest Rate Risk – The Company’s primary market risk exposure with regard to financial instruments is changes in interest rates. At June 30, 2014, the Company did not have any debt outstanding.

|

|

|

|

Item 8. |

Financial Statements and Supplementary Data |

12

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of Flexsteel Industries, Inc.

We have audited the accompanying consolidated balance sheets of Flexsteel Industries, Inc. and subsidiaries (the “Company”) as of June 30, 2014 and 2013, and the related consolidated statements of income, comprehensive income, changes in shareholders’ equity, and cash flows for each of the three years in the period ended June 30, 2014. Our audits also included the financial statement schedule listed in the Index at Item 15. These financial statements and financial statement schedule are the responsibility of the Company’s management. Our responsibility is to express an opinion on the financial statements and financial statement schedule based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of Flexsteel Industries, Inc. and subsidiaries as of June 30, 2014 and 2013, and the results of their operations and their cash flows for each of the three years in the period ended June 30, 2014, in conformity with accounting principles generally accepted in the United States of America. Also, in our opinion, such financial statement schedule, when considered in relation to the basic consolidated financial statements taken as a whole, presents fairly, in all material respects, the information set forth therein.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company’s internal control over financial reporting as of June 30, 2014, based on the criteria established in Internal Control — Integrated Framework (1992) issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated August 27, 2014 expressed an unqualified opinion on the Company’s internal control over financial reporting.

/s/ DELOITTE & TOUCHE LLP

Minneapolis, Minnesota

August 27, 2014

13

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of Flexsteel Industries, Inc.

We have audited the internal control over financial reporting of Flexsteel Industries, Inc. and subsidiaries (the “Company”) as of June 30, 2014, based on criteria established in Internal Control — Integrated Framework (1992) issued by the Committee of Sponsoring Organizations of the Treadway Commission. The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Annual Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed by, or under the supervision of, the company’s principal executive and principal financial officers, or persons performing similar functions, and effected by the company’s board of directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of the inherent limitations of internal control over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may not be prevented or detected on a timely basis. Also, projections of any evaluation of the effectiveness of the internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of June 30, 2014, based on the criteria established in Internal Control — Integrated Framework (1992) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements and financial statement schedule as of and for the year ended June 30, 2014 of the Company and our report dated August 27, 2014 expressed an unqualified opinion on those consolidated financial statements and financial statement schedule.

/s/ Deloitte & Touche LLP

Minneapolis, Minnesota

August 27, 2014

14

FLEXSTEEL INDUSTRIES,

INC. AND SUBSIDIARIES

Consolidated Balance

Sheets

(Amounts in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

||||

|

|

|

2014 |

|

2013 |

|

||

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

|

Cash |

|

$ |

22,176 |

|

$ |

10,934 |

|

|

Trade Receivables - less allowances: 2014, $1,370; 2013, $1,560 |

|

|

38,536 |

|

|

36,075 |

|

|

Inventories |

|

|

97,940 |

|

|

92,417 |

|

|

Deferred income taxes |

|

|

4,230 |

|

|

4,970 |

|

|

Other |

|

|

2,528 |

|

|

4,805 |

|

|

Total current assets |

|

|

165,410 |

|

|

149,201 |

|

|

NONCURRENT ASSETS: |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

31,900 |

|

|

32,145 |

|

|

Deferred income taxes |

|

|

2,170 |

|

|

1,190 |

|

|

Other assets |

|

|

10,733 |

|

|

10,003 |

|

|

TOTAL |

|

$ |

210,213 |

|

$ |

192,539 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

Accounts payable - trade |

|

$ |

15,818 |

|

$ |

13,927 |

|

|

Accrued liabilities: |

|

|

|

|

|

|

|

|

Payroll and related items |

|

|

8,452 |

|

|

7,836 |

|

|

Insurance |

|

|

4,602 |

|

|

4,667 |

|

|

Other |

|

|

7,894 |

|

|

9,072 |

|

|

Total current liabilities |

|

|

36,766 |

|

|

35,502 |

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

Supplemental retirement plans |

|

|

3,396 |

|

|

2,414 |

|

|

Other liabilities |

|

|

3,316 |

|

|

3,386 |

|

|

Total liabilities |

|

|

43,478 |

|

|

41,302 |

|

|

COMMITMENTS AND CONTINGENCIES (Note 12) |

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

Cumulative preferred stock - $50 par value; authorized 60,000 shares; outstanding - none |

|

|

|

|

|

|

|

|

Undesignated (subordinated) stock - $1 par value; authorized 700,000 shares; outstanding - none |

|

|

|

|

|

|

|

|

Common stock - $1 par value; authorized 15,000,000 shares; outstanding 2014, 7,370,735 shares; 2013, 7,106,723 shares |

|

|

7,371 |

|

|

7,107 |

|

|

Additional paid-in capital |

|

|

15,386 |

|

|

10,615 |

|

|

Retained earnings |

|

|

145,234 |

|

|

134,606 |

|

|

Accumulated other comprehensive loss |

|

|

(1,256 |

) |

|

(1,091 |

) |

|

Total shareholders’ equity |

|

|

166,735 |

|

|

151,237 |

|

|

TOTAL |

|

$ |

210,213 |

|

$ |

192,539 |

|

See accompanying Notes to Consolidated Financial Statements.

15

FLEXSTEEL INDUSTRIES,

INC. AND SUBSIDIARIES

Consolidated Statements

of Income

(Amounts in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the years ended June 30, |

|

|||||||

|

|

|

2014 |

|

2013 |

|

2012 |

|

|||

|

Net sales |

|

$ |

438,543 |

|

$ |

386,189 |

|

$ |

352,089 |

|

|

Cost of goods sold |

|

|

(338,280 |

) |

|

(295,720 |

) |

|

(266,810 |

) |

|

Gross margin |

|

|

100,263 |

|

|

90,469 |

|

|

85,279 |

|

|

Selling, general and administrative |

|

|

(71,727 |

) |

|

(70,198 |

) |

|

(65,033 |

) |

|

Litigation settlement costs |

|

|

(6,250 |

) |

|

— |

|

|

— |

|

|

Operating income |

|

|

22,286 |

|

|

20,271 |

|

|

20,246 |

|

|

Interest and other income |

|

|

1,514 |

|

|

610 |

|

|

422 |

|

|

Income before income taxes |

|

|

23,800 |

|

|

20,881 |

|

|

20,668 |

|

|

Income tax provision |

|

|

(8,810 |

) |

|

(7,730 |

) |

|

(7,600 |

) |

|

Net income |

|

$ |

14,990 |

|

$ |

13,151 |

|

$ |

13,068 |

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

7,231 |

|

|

7,041 |

|

|

6,781 |

|

|

Diluted |

|

|

7,511 |

|

|

7,326 |

|

|

7,008 |

|

|

Earnings per share of common stock: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

2.07 |

|

$ |

1.87 |

|

$ |

1.93 |

|

|

Diluted |

|

$ |

2.00 |

|

$ |

1.80 |

|

$ |

1.86 |

|

|

Cash dividends declared per common share |

|

$ |

0.60 |

|

$ |

0.60 |

|

$ |

0.45 |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the years ended June 30, |

|

|||||||

|

|

|

2014 |

|

2013 |

|

2012 |

|

|||

|

Net income |

|

$ |

14,990 |

|

$ |

13,151 |

|

$ |

13,068 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains on securities in supplemental retirement plans |

|

|

674 |

|

|

452 |

|

|

141 |

|

|

Reclassification of realized gain on supplemental retirement plans to other income |

|

|

(1,316 |

) |

|

(356 |

) |

|

(146 |

) |

|

Unrealized (losses) gains on securities in supplemental retirement plans before taxes(1) |

|

|

(642 |

) |

|

96 |

|

|

(5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax benefit (expense) related to securities in supplemental retirement plans (losses) gains |

|

|

244 |

|

|

(36 |

) |

|

2 |

|

|

Net unrealized gains (losses) on securities in supplemental retirement plans |

|

|

(398 |

) |

|

60 |

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Minimum pension liability |

|

|

376 |

|

|

787 |

|

|

(1,771 |

) |

|

Income tax (expense) benefit related to minimum pension Liability |

|

|

(143 |

) |

|

(299 |

) |

|

670 |

|

|

Net minimum pension liability |

|

|

233 |

|

|

488 |

|

|

(1,101 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive (loss) income, net of tax |

|

|

(165 |

) |

|

548 |

|

|

(1,104 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

|

$ |

14,825 |

|

$ |

13,699 |

|

$ |

11,964 |

|

|

|

|

|

|

|

(1) |

See Note 9 to the Consolidated Financial Statements |

See accompanying Notes to Consolidated Financial Statements.

16

FLEXSTEEL INDUSTRIES,

INC. AND SUBSIDIARIES

Consolidated Statements

of Changes in Shareholders’ Equity

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Par |

|

Additional |

|

Retained |

|

Accumulated |

|

Total |

|

|||||

|

Balance at June 30, 2011 |

|

$ |

6,711 |

|

$ |

6,698 |

|

$ |

115,699 |

|

$ |

(535 |

) |

$ |

128,573 |

|

|

Issuance of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock options exercised, net |

|

|

156 |

|

|

761 |

|

|

— |

|

|

— |

|

|

917 |

|

|

Unrealized gain on available for sale investments, net of tax |

|

|

— |

|

|

— |

|

|

— |

|

|

(3 |

) |

|

(3 |

) |

|

Long-term incentive compensation |

|

|

39 |

|

|

761 |

|

|

— |

|

|

— |

|

|

800 |

|

|

Stock-based compensation |

|

|

— |

|

|

256 |

|

|

— |

|

|

— |

|

|

256 |

|

|

Minimum pension liability adjustment, net of tax |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,101 |

) |

|

(1,101 |

) |

|

Cash dividends declared |

|

|

— |

|

|

— |

|

|

(3,068 |

) |