Vanguard Large-Cap Index Fund

Summary Prospectus

April 26, 2024

Investor Shares

Vanguard Large-Cap Index Fund Investor Shares (VLACX)

The Fund’s statutory Prospectus and Statement of Additional Information dated April 26, 2024, as may be amended or supplemented, are incorporated into and made part of this Summary Prospectus by reference.

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund online at www.vanguard.com/prospectus and https://personal.vanguard.com/us/literature/reports/MFs. You can also obtain this information at no cost by calling 800-662-7447 or by sending an email request to online@vanguard.com.

The Securities and Exchange Commission (SEC) has not approved or disapproved these

securities or passed upon the adequacy of this prospectus. Any representation to the

contrary is a criminal offense.

Investment Objective

The Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks.

Fees and Expenses

The following tables describe the fees and expenses you may pay if you buy, hold, and sell Investor Shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and example below.

Shareholder Fees

(Fees paid directly from your investment)

(Fees paid directly from your investment)

|

|

|

|

Sales Charge (Load) Imposed on Purchases

|

None

|

|

Purchase Fee

|

None

|

|

Sales Charge (Load) Imposed on Reinvested Dividends

|

None

|

|

Redemption Fee

|

None

|

|

Account Service Fee Per Year

(for certain fund account balances below $5,000,000)

|

$25

|

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

(Expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

Management Fees

|

0.15

%

|

|

12b-1 Distribution Fee

|

None

|

|

Other Expenses

|

0.02

%

|

|

Total Annual Fund Operating Expenses

|

0.17

%

|

1

Example

The following example is intended to help you compare the cost of investing in the Fund’s Investor Shares with the cost of investing in other mutual funds. It illustrates the hypothetical expenses that you would incur over various periods if

you were to invest $10,000 in the Fund’s shares. This example assumes that the shares provide a return of 5% each year and that total annual fund operating expenses remain as stated in the preceding table. You would incur these hypothetical expenses whether or not you were to redeem your investment at the end of the given period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$17

|

$55

|

$96

|

$217

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in more taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund

operating expenses or in the previous expense example, reduce the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 2% of the average value of its portfolio.

Principal Investment Strategies

The Fund employs an indexing investment approach designed to track the performance of the CRSP US Large Cap Index (the Index), a broadly diversified index of large U.S. companies representing approximately the top 85% of the U.S. market capitalization. The Fund attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the

Index, holding each stock in approximately the same proportion as its weighting in the Index.

Principal Risks

An investment in the Fund could lose money over short or long periods of time. You should expect the Fund’s share price and total return to fluctuate within a wide range. The Fund is subject to the following risks, which could affect the Fund’s performance:

• Stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of

falling prices. The Fund’s target index tracks a subset of the U.S. stock market,

which could cause the Fund to perform differently from the overall stock market.

2

In addition, the Fund’s target index may, at times, become focused in stocks of a

particular market sector, which would subject the Fund to proportionately higher exposure to the risks of that sector.

• Investment style risk, which is the chance that returns from large-capitalization stocks will trail returns from the overall stock market. Large-cap stocks tend to

go through cycles of doing better—or worse—than other segments of the stock market or the stock market in general. These periods have, in the past, lasted for

as long as several years.

• Index replicating risk, which is the chance that the Fund may be prevented from holding one or more securities in the same proportion as in its target index.

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

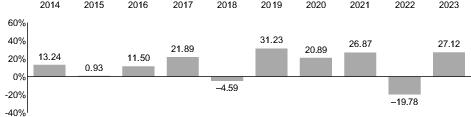

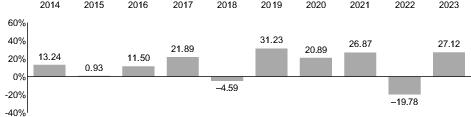

Annual Total Returns

The following bar chart and table are intended to help you understand the risks of

investing in the Fund. The bar chart shows how the performance of the Fund’s Investor Shares has varied from one calendar year to another over the periods shown. The table shows how the average annual total returns of the Investor Shares compare with those of the Fund’s target index and other comparative indexes, which have investment characteristics similar to those of the Fund. Keep in mind that the Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447.

3

Annual Total Returns — Vanguard Large-Cap Index Fund Investor Shares

During the periods shown in the bar chart, the highest and lowest returns for a calendar quarter were:

|

|

Total Return

|

Quarter

|

|

Highest

|

21.37

%

|

June 30, 2020

|

|

Lowest

|

-19.44

%

|

March 31, 2020

|

Average Annual Total Returns for Periods Ended December 31, 2023

|

|

1 Year

|

5 Years

|

10 Years

|

|

Vanguard Large-Cap Index Fund Investor Shares

|

|

|

|

|

Return Before Taxes

|

27.12

%

|

15.46

%

|

11.77

%

|

|

Return After Taxes on Distributions

|

26.69

|

15.04

|

11.32

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

16.31

|

12.40

|

9.67

|

|

CRSP US Large Cap Index

(reflects no deduction for fees, expenses, or taxes)

|

27.28

%

|

15.64

%

|

11.95

%

|

|

Dow Jones U.S. Total Stock Market Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes)

|

26.06

|

15.05

|

11.40

|

Actual after-tax returns depend on your tax situation and may differ from those shown in the preceding table. When after-tax returns are calculated, it is assumed that the shareholder was in the highest individual federal marginal income tax bracket at the time of each distribution of income or capital gains or

upon redemption. State and local income taxes are not reflected in the calculations. Please note that after-tax returns are not relevant for a shareholder who holds fund shares in a tax-deferred account, such as an individual retirement account or a 401(k) plan. Also, figures captioned Return After Taxes on Distributions and Sale of Fund Shares may be higher than other figures for the same period if a capital loss occurs upon redemption and results in an assumed tax deduction for the shareholder.

Investment Advisor

The Vanguard Group, Inc. (Vanguard)

4

Portfolio Managers

Michelle Louie, CFA, Portfolio Manager and Principal of Vanguard. She has co-managed the Fund since 2021.

Walter Nejman, Portfolio Manager at Vanguard. He has co-managed the Fund since 2016.

Purchase and Sale of Fund Shares

You may purchase or redeem shares online through our website (vanguard.com), by mail (The Vanguard Group, P.O. Box 982901, El Paso, TX 79998-2901), or by telephone (800-662-2739). Investor Shares are generally available only to Vanguard funds that operate as funds of funds and to certain retirement plan clients that receive recordkeeping services from Vanguard. Financial intermediaries, institutional clients, and Vanguard-advised clients should contact Vanguard for information on special eligibility rules that may apply

to them regarding Investor Shares. If you are investing through an intermediary, please contact that firm directly for more information regarding your eligibility.

If you are investing through an employer-sponsored retirement or savings plan, your plan administrator or your benefits office can provide you with detailed information on how you can invest through your plan.

Tax Information

The Fund’s distributions may be taxable as ordinary income or capital gain. If you

are investing through a tax-advantaged account, such as an IRA or an employer-sponsored retirement or savings plan, special tax rules apply.

Payments to Financial Intermediaries

The Fund and its investment advisor do not pay financial intermediaries for sales

of Fund shares.

5

CFA® is a registered trademark owned by CFA Institute.

Center for Research in Security Prices, LLC (CRSP®) and its third-party suppliers have exclusive proprietary rights in the CRSP® Index Data, which has been licensed for use by Vanguard but is and shall remain valuable intellectual property owned by, and/or licensed

to, CRSP®. The Vanguard Funds are not sponsored, endorsed, sold or promoted by CRSP®, The University of Chicago, or The University of Chicago Booth School of Business and neither

CRSP®, The University of Chicago, or The University of Chicago Booth School of Business,

make any representation regarding the advisability of investing in the Vanguard Funds.

Vanguard Large-Cap Index Fund Investor Shares—Fund Number 307

To request additional information about the Fund, please visit vanguard.com or contact us at 800-662-7447.

© 2024 The Vanguard Group, Inc. All rights reserved.

Vanguard Marketing Corporation, Distributor.

SP 307 042024