00003203352020FYFALSEus-gaap:AccountingStandardsUpdate201601Memberus-gaap:AccountingStandardsUpdate201602Memberus-gaap:AccountingStandardsUpdate201613MemberP3YP15Y00003203352020-01-012020-12-31iso4217:USD00003203352020-06-30xbrli:shares00003203352021-02-1800003203352020-12-3100003203352019-12-310000320335gl:PartnershipInterestFairValueOptionMembersrt:PartnershipInterestMember2020-12-310000320335gl:PartnershipInterestFairValueOptionMembersrt:PartnershipInterestMember2019-12-31iso4217:USDxbrli:shares0000320335us-gaap:LifeInsuranceSegmentMember2020-01-012020-12-310000320335us-gaap:LifeInsuranceSegmentMember2019-01-012019-12-310000320335us-gaap:LifeInsuranceSegmentMember2018-01-012018-12-310000320335us-gaap:HealthInsuranceProductLineMember2020-01-012020-12-310000320335us-gaap:HealthInsuranceProductLineMember2019-01-012019-12-310000320335us-gaap:HealthInsuranceProductLineMember2018-01-012018-12-310000320335us-gaap:OtherInsuranceProductLineMember2020-01-012020-12-310000320335us-gaap:OtherInsuranceProductLineMember2019-01-012019-12-310000320335us-gaap:OtherInsuranceProductLineMember2018-01-012018-12-3100003203352019-01-012019-12-3100003203352018-01-012018-12-310000320335gl:SecuritiesMember2020-01-012020-12-310000320335gl:SecuritiesMember2019-01-012019-12-310000320335gl:SecuritiesMember2018-01-012018-12-310000320335us-gaap:OtherInvestmentsMember2020-01-012020-12-310000320335us-gaap:OtherInvestmentsMember2019-01-012019-12-310000320335us-gaap:OtherInvestmentsMember2018-01-012018-12-310000320335us-gaap:PreferredStockMember2017-12-310000320335us-gaap:CommonStockMember2017-12-310000320335us-gaap:AdditionalPaidInCapitalMember2017-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310000320335us-gaap:RetainedEarningsMember2017-12-310000320335us-gaap:TreasuryStockMember2017-12-3100003203352017-12-3100003203352017-01-012017-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2017-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310000320335us-gaap:PreferredStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2017-12-310000320335us-gaap:CommonStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2017-12-310000320335us-gaap:AdditionalPaidInCapitalMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2017-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310000320335us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2017-12-310000320335us-gaap:TreasuryStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2017-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2017-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310000320335us-gaap:RetainedEarningsMember2018-01-012018-12-3100003203352019-04-012019-06-300000320335us-gaap:TreasuryStockMember2018-01-012018-12-310000320335us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310000320335us-gaap:CommonStockMember2018-01-012018-12-310000320335us-gaap:PreferredStockMember2018-12-310000320335us-gaap:CommonStockMember2018-12-310000320335us-gaap:AdditionalPaidInCapitalMember2018-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000320335us-gaap:RetainedEarningsMember2018-12-310000320335us-gaap:TreasuryStockMember2018-12-3100003203352018-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2018-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310000320335us-gaap:PreferredStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310000320335us-gaap:CommonStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310000320335us-gaap:AdditionalPaidInCapitalMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000320335us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310000320335us-gaap:TreasuryStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000320335us-gaap:RetainedEarningsMember2019-01-012019-12-3100003203352019-07-012019-09-300000320335us-gaap:TreasuryStockMember2019-01-012019-12-310000320335us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000320335us-gaap:CommonStockMember2019-01-012019-12-310000320335us-gaap:PreferredStockMember2019-12-310000320335us-gaap:CommonStockMember2019-12-310000320335us-gaap:AdditionalPaidInCapitalMember2019-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000320335us-gaap:RetainedEarningsMember2019-12-310000320335us-gaap:TreasuryStockMember2019-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2019-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000320335us-gaap:PreferredStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2019-12-310000320335us-gaap:CommonStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2019-12-310000320335us-gaap:AdditionalPaidInCapitalMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2019-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000320335us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2019-12-310000320335us-gaap:TreasuryStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2019-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2019-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000320335us-gaap:RetainedEarningsMember2020-01-012020-12-310000320335us-gaap:TreasuryStockMember2020-01-012020-12-310000320335us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000320335us-gaap:CommonStockMember2020-01-012020-12-310000320335us-gaap:PreferredStockMember2020-12-310000320335us-gaap:CommonStockMember2020-12-310000320335us-gaap:AdditionalPaidInCapitalMember2020-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000320335us-gaap:RetainedEarningsMember2020-12-310000320335us-gaap:TreasuryStockMember2020-12-31gl:segmentxbrli:pure0000320335gl:LowIncomeHousingCreditsAndCertainLimitedPartnershipsMember2020-01-012020-12-3100003203352016-01-012016-12-310000320335srt:MinimumMembersrt:PartnershipInterestMember2020-01-012020-12-310000320335srt:MaximumMembersrt:PartnershipInterestMember2020-01-012020-12-310000320335us-gaap:LoanParticipationsAndAssignmentsMember2020-01-012020-12-310000320335gl:LoanParticipationAndAssignmentsUnfundedLoanCommitmentMember2020-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustmentMembergl:AccountingStandardsUpdate201613AdjustmentForCommercialLoanParticipationsMemberus-gaap:RetainedEarningsMember2019-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustmentMembergl:AccountingStandardsUpdate201613AdjustmentForAgentDebitBalancesMemberus-gaap:RetainedEarningsMember2019-12-310000320335us-gaap:ParticipatingMortgagesMember2019-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335us-gaap:ParticipatingMortgagesMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2019-12-310000320335us-gaap:ParticipatingMortgagesMember2020-12-310000320335us-gaap:EquipmentMembersrt:MinimumMember2020-01-012020-12-310000320335us-gaap:EquipmentMembersrt:MaximumMember2020-01-012020-12-310000320335us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2020-01-012020-12-310000320335us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2020-01-012020-12-310000320335gl:EmployeeMemberus-gaap:StockOptionMembergl:ThreeYearVestingPeriodMembergl:TorchmarkCorporation2018IncentivePlanMember2020-01-012020-12-310000320335gl:EmployeeMemberus-gaap:StockOptionMembergl:TorchmarkCorporation2018IncentivePlanMembergl:FiveYearVestingPeriodMember2020-01-012020-12-310000320335us-gaap:StockOptionMembersrt:DirectorMembergl:TorchmarkCorporation2018IncentivePlanMember2020-01-012020-12-310000320335us-gaap:StockOptionMembergl:TorchmarkCorporation2018IncentivePlanMember2020-01-012020-12-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2017-12-310000320335gl:DeferredAcquisitionCostsMember2017-12-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2017-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-12-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-01-012018-12-310000320335gl:DeferredAcquisitionCostsMember2018-01-012018-12-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2018-01-012018-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-01-012018-12-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-12-310000320335gl:DeferredAcquisitionCostsMember2018-12-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-01-012019-12-310000320335gl:DeferredAcquisitionCostsMember2019-01-012019-12-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-12-310000320335gl:DeferredAcquisitionCostsMember2019-12-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-01-012020-12-310000320335gl:DeferredAcquisitionCostsMember2020-01-012020-12-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310000320335gl:DeferredAcquisitionCostsMember2020-12-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-01-012020-12-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-01-012019-12-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-01-012018-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2020-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMember2020-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:FinancialMember2020-12-310000320335gl:UtilitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-12-310000320335gl:EnergyMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-12-310000320335gl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:CollateralizedDebtObligationsMember2020-12-310000320335us-gaap:FixedMaturitiesMembergl:OtherAssetBackedSecuritiesMember2020-12-310000320335us-gaap:FixedMaturitiesMember2020-12-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:FinancialMember2019-12-310000320335gl:UtilitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335gl:EnergyMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335gl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:CollateralizedDebtObligationsMember2019-12-310000320335us-gaap:FixedMaturitiesMembergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:FixedMaturitiesMember2020-01-012020-12-310000320335us-gaap:FixedMaturitiesMember2019-01-012019-12-310000320335us-gaap:FixedMaturitiesMember2018-01-012018-12-310000320335us-gaap:PolicyLoansMember2020-01-012020-12-310000320335us-gaap:PolicyLoansMember2019-01-012019-12-310000320335us-gaap:PolicyLoansMember2018-01-012018-12-310000320335us-gaap:OtherLongTermInvestmentsMember2020-01-012020-12-310000320335us-gaap:OtherLongTermInvestmentsMember2019-01-012019-12-310000320335us-gaap:OtherLongTermInvestmentsMember2018-01-012018-12-310000320335us-gaap:ShortTermInvestmentsMember2020-01-012020-12-310000320335us-gaap:ShortTermInvestmentsMember2019-01-012019-12-310000320335us-gaap:ShortTermInvestmentsMember2018-01-012018-12-310000320335us-gaap:FairValueOptionOtherEligibleItemsMember2020-01-012020-12-310000320335us-gaap:FairValueOptionOtherEligibleItemsMember2019-01-012019-12-310000320335us-gaap:FairValueOptionOtherEligibleItemsMember2018-01-012018-12-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2020-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMember2020-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMember2020-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:FinancialMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Membergl:FinancialMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:FinancialMember2020-12-310000320335gl:UtilitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335gl:UtilitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335gl:UtilitiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-12-310000320335gl:EnergyMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335gl:EnergyMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335gl:EnergyMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-12-310000320335gl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335gl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335us-gaap:FairValueInputsLevel3Membergl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CollateralizedDebtObligationsMember2020-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CollateralizedDebtObligationsMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMemberus-gaap:CollateralizedDebtObligationsMember2020-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Membergl:OtherAssetBackedSecuritiesMember2020-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Membergl:OtherAssetBackedSecuritiesMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMembergl:OtherAssetBackedSecuritiesMember2020-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMember2020-12-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:FinancialMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Membergl:FinancialMember2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:FinancialMember2019-12-310000320335gl:UtilitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335gl:UtilitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335gl:UtilitiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335gl:EnergyMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335gl:EnergyMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335gl:EnergyMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335gl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335gl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:FairValueInputsLevel3Membergl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CollateralizedDebtObligationsMember2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CollateralizedDebtObligationsMember2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMemberus-gaap:CollateralizedDebtObligationsMember2019-12-310000320335us-gaap:CollateralizedDebtObligationsMember2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Membergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Membergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMembergl:OtherAssetBackedSecuritiesMember2019-12-310000320335gl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:FairValueInputsLevel3Member2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:AssetBackedSecuritiesMember2017-12-310000320335us-gaap:CollateralizedDebtObligationsMember2017-12-310000320335us-gaap:CorporateDebtSecuritiesMember2017-12-310000320335us-gaap:AssetBackedSecuritiesMember2018-01-012018-12-310000320335us-gaap:CollateralizedDebtObligationsMember2018-01-012018-12-310000320335us-gaap:CorporateDebtSecuritiesMember2018-01-012018-12-310000320335us-gaap:AssetBackedSecuritiesMember2018-12-310000320335us-gaap:CollateralizedDebtObligationsMember2018-12-310000320335us-gaap:CorporateDebtSecuritiesMember2018-12-310000320335us-gaap:AssetBackedSecuritiesMember2019-01-012019-12-310000320335us-gaap:CollateralizedDebtObligationsMember2019-01-012019-12-310000320335us-gaap:CorporateDebtSecuritiesMember2019-01-012019-12-310000320335us-gaap:AssetBackedSecuritiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMember2019-12-310000320335us-gaap:AssetBackedSecuritiesMember2020-01-012020-12-310000320335us-gaap:CollateralizedDebtObligationsMember2020-01-012020-12-310000320335us-gaap:CorporateDebtSecuritiesMember2020-01-012020-12-310000320335us-gaap:AssetBackedSecuritiesMember2020-12-310000320335us-gaap:CollateralizedDebtObligationsMember2020-12-310000320335us-gaap:CorporateDebtSecuritiesMember2020-12-310000320335us-gaap:FairValueInputsLevel3Membergl:PrivatePlacementNotesMember2020-12-310000320335us-gaap:FairValueInputsLevel3Membergl:PrivatePlacementNotesMembersrt:MinimumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputDiscountRateMember2020-12-310000320335us-gaap:FairValueInputsLevel3Membergl:PrivatePlacementNotesMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MaximumMemberus-gaap:MeasurementInputDiscountRateMember2020-12-310000320335us-gaap:FairValueInputsLevel3Membergl:PrivatePlacementNotesMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:WeightedAverageMemberus-gaap:MeasurementInputDiscountRateMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2020-12-310000320335us-gaap:MeasurementInputQuotedPriceMembergl:ValuationTechniquePresentValueMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2020-12-310000320335us-gaap:MeasurementInputQuotedPriceMembergl:ValuationTechniquePresentValueMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMembersrt:WeightedAverageMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:CollateralizedDebtObligationsMember2020-12-310000320335us-gaap:FairValueInputsLevel3Membersrt:MinimumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:CollateralizedDebtObligationsMemberus-gaap:MeasurementInputDiscountRateMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MaximumMemberus-gaap:CollateralizedDebtObligationsMemberus-gaap:MeasurementInputDiscountRateMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:CollateralizedDebtObligationsMembersrt:WeightedAverageMemberus-gaap:MeasurementInputDiscountRateMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:MeasurementInputDiscountRateMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:WeightedAverageMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:MeasurementInputDiscountRateMember2020-12-310000320335us-gaap:FairValueInputsLevel3Member2020-12-31gl:Issuegl:issuer0000320335us-gaap:ExternalCreditRatingInvestmentGradeMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2020-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2020-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2020-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CorporateDebtSecuritiesMembergl:FinancialMember2020-12-310000320335gl:UtilitiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CorporateDebtSecuritiesMember2020-12-310000320335gl:EnergyMemberus-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CorporateDebtSecuritiesMember2020-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMembergl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMember2020-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CorporateDebtSecuritiesMember2020-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CollateralizedDebtObligationsMember2020-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMembergl:OtherAssetBackedSecuritiesMember2020-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMember2020-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-12-310000320335us-gaap:CorporateDebtSecuritiesMembergl:FinancialMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-12-310000320335gl:UtilitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-12-310000320335gl:EnergyMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-12-310000320335gl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-12-310000320335us-gaap:ExternalCreditRatingNonInvestmentGradeMemberus-gaap:CollateralizedDebtObligationsMember2020-12-310000320335us-gaap:ExternalCreditRatingNonInvestmentGradeMembergl:OtherAssetBackedSecuritiesMember2020-12-310000320335us-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2019-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2019-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CorporateDebtSecuritiesMembergl:FinancialMember2019-12-310000320335gl:UtilitiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310000320335gl:EnergyMemberus-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMembergl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CollateralizedDebtObligationsMember2019-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMembergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMember2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMembergl:FinancialMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335gl:UtilitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335gl:EnergyMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335gl:OtherCorporateSectorsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335us-gaap:ExternalCreditRatingNonInvestmentGradeMemberus-gaap:CollateralizedDebtObligationsMember2019-12-310000320335us-gaap:ExternalCreditRatingNonInvestmentGradeMembergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-01-012020-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:FixedMaturitiesMember2020-01-012020-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-01-012020-12-310000320335us-gaap:OtherDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:FixedMaturitiesMember2020-01-012020-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-01-012020-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-01-012020-12-310000320335us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-01-012020-12-310000320335us-gaap:OtherDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-01-012020-12-310000320335us-gaap:OtherDebtSecuritiesMember2020-01-012020-12-310000320335stpr:TX2020-12-310000320335stpr:NY2020-12-310000320335stpr:MI2020-12-310000320335stpr:CA2020-12-310000320335stpr:OH2020-12-310000320335stpr:FL2020-12-310000320335us-gaap:CreditConcentrationRiskMembergl:InvestmentPortfolioMemberus-gaap:CorporateDebtSecuritiesMember2020-01-012020-12-310000320335us-gaap:OtherInvestmentsMember2020-12-310000320335us-gaap:OtherInvestmentsMember2019-12-310000320335us-gaap:CommercialMortgageBackedSecuritiesMembersrt:PartnershipInterestMember2020-12-310000320335us-gaap:CommercialMortgageBackedSecuritiesMembersrt:PartnershipInterestMember2019-12-310000320335us-gaap:CommercialMortgageBackedSecuritiesMembersrt:PartnershipInterestMember2020-01-012020-12-310000320335gl:OpportunisticCreditMembersrt:PartnershipInterestMember2020-12-310000320335gl:OpportunisticCreditMembersrt:PartnershipInterestMember2019-12-310000320335gl:OpportunisticCreditMembersrt:PartnershipInterestMember2020-01-012020-12-310000320335gl:InfrastructureEquityMembersrt:PartnershipInterestMember2020-12-310000320335gl:InfrastructureEquityMembersrt:PartnershipInterestMember2019-12-310000320335gl:InfrastructureEquityMembersrt:PartnershipInterestMember2020-01-012020-12-310000320335srt:PartnershipInterestMember2020-12-310000320335srt:PartnershipInterestMember2019-12-310000320335gl:MixedUseMemberus-gaap:ParticipatingMortgagesMember2020-12-310000320335gl:MixedUseMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335srt:OfficeBuildingMemberus-gaap:ParticipatingMortgagesMember2020-12-310000320335srt:OfficeBuildingMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:HospitalityMemberus-gaap:ParticipatingMortgagesMember2020-12-310000320335gl:HospitalityMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335us-gaap:ParticipatingMortgagesMembergl:RetailPropertyMember2020-12-310000320335us-gaap:ParticipatingMortgagesMembergl:RetailPropertyMember2019-12-310000320335us-gaap:ParticipatingMortgagesMembersrt:MultifamilyMember2020-12-310000320335us-gaap:ParticipatingMortgagesMembersrt:MultifamilyMember2019-12-310000320335srt:IndustrialPropertyMemberus-gaap:ParticipatingMortgagesMember2020-12-310000320335srt:IndustrialPropertyMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335us-gaap:ParticipatingMortgagesMemberstpr:CA2020-12-310000320335us-gaap:ParticipatingMortgagesMemberstpr:CA2019-12-310000320335stpr:VAus-gaap:ParticipatingMortgagesMember2020-12-310000320335stpr:VAus-gaap:ParticipatingMortgagesMember2019-12-310000320335us-gaap:ParticipatingMortgagesMemberstpr:NY2020-12-310000320335us-gaap:ParticipatingMortgagesMemberstpr:NY2019-12-310000320335us-gaap:ParticipatingMortgagesMemberstpr:FL2020-12-310000320335us-gaap:ParticipatingMortgagesMemberstpr:FL2019-12-310000320335us-gaap:ParticipatingMortgagesMemberstpr:PA2020-12-310000320335us-gaap:ParticipatingMortgagesMemberstpr:PA2019-12-310000320335gl:OtherGeographicalLocationMemberus-gaap:ParticipatingMortgagesMember2020-12-310000320335gl:OtherGeographicalLocationMemberus-gaap:ParticipatingMortgagesMember2019-12-31gl:loan0000320335us-gaap:ParticipatingMortgagesMember2018-12-310000320335srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ParticipatingMortgagesMember2018-12-310000320335us-gaap:ParticipatingMortgagesMember2020-01-012020-12-310000320335us-gaap:ParticipatingMortgagesMember2019-01-012019-12-310000320335us-gaap:ParticipatingMortgagesMemberus-gaap:RiskLevelLowMember2020-12-310000320335us-gaap:ParticipatingMortgagesMemberus-gaap:RiskLevelMediumMember2020-12-310000320335us-gaap:ParticipatingMortgagesMemberus-gaap:RiskLevelHighMember2020-12-31gl:guarantee0000320335us-gaap:LetterOfCreditMember2020-12-3100003203352020-11-2500003203352020-11-24gl:lease0000320335gl:EquipmentLeaseGuaranteesMember2020-12-31gl:state0000320335us-gaap:HealthInsuranceProductLineMember2019-12-310000320335us-gaap:HealthInsuranceProductLineMember2018-12-310000320335us-gaap:HealthInsuranceProductLineMember2017-12-310000320335us-gaap:HealthInsuranceProductLineMember2020-12-310000320335us-gaap:LifeInsuranceSegmentMember2020-12-310000320335us-gaap:LifeInsuranceSegmentMember2019-12-310000320335us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-01-012020-12-310000320335us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-01-012019-12-310000320335us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2018-01-012018-12-310000320335gl:CorporateBondSecuritiesFinancialMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335gl:CorporateBondSecuritiesFinancialMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335us-gaap:FairValueInputsLevel3Membergl:CorporateBondSecuritiesFinancialMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesFinancialMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Membergl:CorporateBondSecuritiesUtilitiesMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membergl:CorporateBondSecuritiesUtilitiesMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesUtilitiesMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesUtilitiesMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Membergl:CorporateBondSecuritiesEnergyMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membergl:CorporateBondSecuritiesEnergyMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesEnergyMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesEnergyMember2020-12-310000320335gl:CorporateBondSecuritiesOtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335gl:CorporateBondSecuritiesOtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335gl:CorporateBondSecuritiesOtherMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335gl:CorporateBondSecuritiesOtherMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ExchangeTradedFundsMember2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMember2020-12-310000320335gl:OtherBondsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335gl:OtherBondsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335gl:OtherBondsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335gl:OtherBondsMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335gl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335gl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335us-gaap:FairValueInputsLevel3Membergl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:GuaranteedAnnuityContractMember2020-12-310000320335us-gaap:ShortTermInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335us-gaap:ShortTermInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335us-gaap:ShortTermInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335gl:OtherMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMember2020-12-310000320335us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310000320335gl:CorporateBondSecuritiesFinancialMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335gl:CorporateBondSecuritiesFinancialMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:FairValueInputsLevel3Membergl:CorporateBondSecuritiesFinancialMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesFinancialMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Membergl:CorporateBondSecuritiesUtilitiesMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membergl:CorporateBondSecuritiesUtilitiesMember2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesUtilitiesMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesUtilitiesMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Membergl:CorporateBondSecuritiesEnergyMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membergl:CorporateBondSecuritiesEnergyMember2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesEnergyMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesEnergyMember2019-12-310000320335gl:CorporateBondSecuritiesOtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335gl:CorporateBondSecuritiesOtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335gl:CorporateBondSecuritiesOtherMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335gl:CorporateBondSecuritiesOtherMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ExchangeTradedFundsMember2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMember2019-12-310000320335gl:OtherBondsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335gl:OtherBondsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335gl:OtherBondsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335gl:OtherBondsMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335gl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335gl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:FairValueInputsLevel3Membergl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:GuaranteedAnnuityContractMember2019-12-310000320335us-gaap:ShortTermInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:ShortTermInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:ShortTermInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335gl:OtherMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2019-12-310000320335us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310000320335us-gaap:FundedPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:QualifiedPlanMember2020-12-310000320335us-gaap:FundedPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:QualifiedPlanMember2019-12-310000320335us-gaap:NonqualifiedPlanMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-12-310000320335us-gaap:NonqualifiedPlanMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310000320335us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310000320335us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310000320335us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-01-012018-12-310000320335us-gaap:PensionPlansDefinedBenefitMember2018-12-310000320335gl:NotesDueMayFifteenTwoThousandTwentyThreeMember2020-12-310000320335gl:NotesDueMayFifteenTwoThousandTwentyThreeMember2019-12-310000320335gl:SeniorNotesDue2022Member2020-12-310000320335gl:SeniorNotesDue2022Member2019-12-310000320335gl:SeniorNotesDueSeptember152028Member2020-12-310000320335gl:SeniorNotesDueSeptember152028Member2019-12-310000320335gl:SeniorNotesDueAugust152030Member2020-12-310000320335gl:SeniorNotesDueAugust152030Member2019-12-310000320335gl:JuniorSubordinatedDebenturesDue2056Member2020-12-310000320335gl:JuniorSubordinatedDebenturesDue2056Member2019-12-310000320335gl:JuniorSubordinatedDebenturesDue2057Member2020-12-310000320335gl:JuniorSubordinatedDebenturesDue2057Member2019-12-310000320335gl:TermLoanMember2020-12-310000320335gl:TermLoanMember2019-12-310000320335us-gaap:CommercialPaperMember2020-12-310000320335us-gaap:CommercialPaperMember2019-12-310000320335srt:SubsidiariesMembergl:SeniorNotesDue2022Membersrt:ConsolidationEliminationsMember2020-12-310000320335us-gaap:LineOfCreditMember2020-08-24gl:extensionOption0000320335us-gaap:LineOfCreditMember2020-08-242020-08-240000320335us-gaap:ShortTermDebtMember2020-12-310000320335us-gaap:ShortTermDebtMember2019-12-310000320335gl:TermLoanDue2021Member2020-07-312020-07-310000320335gl:TermLoanDue2021Member2020-09-300000320335gl:TermLoanMember2020-04-092020-04-090000320335gl:TermLoanMember2020-04-090000320335gl:TermLoanMember2020-04-152020-04-150000320335gl:TermLoanMember2020-08-172020-08-170000320335gl:TermLoanMember2020-08-262020-08-2600003203352020-08-262020-08-260000320335gl:SeniorNotesDueAugust152030Memberus-gaap:SeniorNotesMember2020-08-210000320335gl:SeniorNotesDueAugust152030Memberus-gaap:SeniorNotesMember2020-09-030000320335gl:SeniorNotesDueAugust152030Memberus-gaap:SeniorNotesMember2020-08-212020-08-210000320335gl:SeniorNotesDueAugust152030Memberus-gaap:SeniorNotesMember2020-09-032020-09-030000320335us-gaap:SeniorNotesMember2020-09-032020-09-030000320335us-gaap:CommonStockMemberus-gaap:PerformanceSharesMember2018-01-012018-12-310000320335us-gaap:CommonStockMemberus-gaap:PerformanceSharesMember2019-01-012019-12-310000320335us-gaap:CommonStockMemberus-gaap:PerformanceSharesMember2020-01-012020-12-310000320335gl:StockRepurchasePlanMember2020-01-012020-12-310000320335gl:StockRepurchasePlanforAntiDilutiveEffectMember2020-01-012020-12-310000320335gl:StockRepurchasePlanMember2019-01-012019-12-310000320335gl:StockRepurchasePlanforAntiDilutiveEffectMember2019-01-012019-12-310000320335gl:StockRepurchasePlanMember2018-01-012018-12-310000320335gl:StockRepurchasePlanforAntiDilutiveEffectMember2018-01-012018-12-310000320335us-gaap:StockOptionMembergl:DirectorsMembersrt:DirectorMember2020-01-012020-12-310000320335gl:Employee10YearGrantsMemberus-gaap:StockOptionMembergl:EmployeeMember2020-01-012020-12-310000320335us-gaap:StockOptionMembersrt:DirectorMembersrt:DirectorMember2020-01-012020-12-310000320335us-gaap:StockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:DirectorMembersrt:DirectorMember2020-01-012020-12-310000320335us-gaap:StockOptionMembergl:Employee7YearGrantsMembergl:EmployeeMember2020-01-012020-12-310000320335us-gaap:StockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMembergl:Employee7YearGrantsMembergl:EmployeeMember2020-01-012020-12-310000320335us-gaap:StockOptionMembergl:Employee7YearGrantsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembergl:EmployeeMember2020-01-012020-12-310000320335us-gaap:StockOptionMembergl:SharebasedCompensationAwardTrancheFourMembergl:Employee7YearGrantsMembergl:EmployeeMember2020-01-012020-12-310000320335gl:Employee10YearGrantsMemberus-gaap:StockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMembergl:EmployeeMember2020-01-012020-12-310000320335gl:Employee10YearGrantsMemberus-gaap:StockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembergl:EmployeeMember2020-01-012020-12-310000320335gl:Employee10YearGrantsMemberus-gaap:StockOptionMembergl:SharebasedCompensationAwardTrancheFourMembergl:EmployeeMember2020-01-012020-12-310000320335gl:Employee10YearGrantsMemberus-gaap:StockOptionMembergl:SharebasedCompensationAwardTrancheFiveMembergl:EmployeeMember2020-01-012020-12-310000320335gl:Employee10YearGrantsMemberus-gaap:StockOptionMembergl:SharebasedCompensationAwardTrancheSixMembergl:EmployeeMember2020-01-012020-12-310000320335us-gaap:EmployeeStockOptionMember2020-01-012020-12-310000320335us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000320335us-gaap:EmployeeStockOptionMember2018-01-012018-12-310000320335gl:RestrictedStockRestrictedStockUnitsAndPerformanceSharesMember2020-01-012020-12-310000320335gl:RestrictedStockRestrictedStockUnitsAndPerformanceSharesMember2019-01-012019-12-310000320335gl:RestrictedStockRestrictedStockUnitsAndPerformanceSharesMember2018-01-012018-12-310000320335srt:MinimumMember2020-01-012020-12-310000320335srt:MaximumMember2020-01-012020-12-310000320335gl:RangeOneMember2020-01-012020-12-310000320335gl:RangeOneMember2020-12-310000320335gl:RangeTwoMember2020-01-012020-12-310000320335gl:RangeTwoMember2020-12-310000320335gl:RangeThreeMember2020-01-012020-12-310000320335gl:RangeThreeMember2020-12-310000320335gl:RangeFourMember2020-01-012020-12-310000320335gl:RangeFourMember2020-12-310000320335gl:RangeFiveMember2020-01-012020-12-310000320335gl:RangeFiveMember2020-12-310000320335gl:RangeSixMember2020-01-012020-12-310000320335gl:RangeSixMember2020-12-310000320335gl:SevenYearTermMember2020-01-012020-12-310000320335gl:SevenYearTermMember2019-01-012019-12-310000320335gl:SevenYearTermMember2018-01-012018-12-310000320335gl:TenYearTermMember2020-01-012020-12-310000320335gl:TenYearTermMember2019-01-012019-12-310000320335gl:TenYearTermMember2018-01-012018-12-310000320335gl:UnvestedOptionsMember2020-12-310000320335gl:UnvestedOptionsMember2019-12-310000320335gl:UnvestedOptionsMember2020-01-012020-12-310000320335gl:UnvestedOptionsMember2019-01-012019-12-310000320335us-gaap:RestrictedStockMembergl:EmployeeMember2020-01-012020-12-310000320335us-gaap:RestrictedStockMembersrt:DirectorMember2020-01-012020-12-310000320335srt:DirectorMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000320335us-gaap:PerformanceSharesMember2020-01-012020-12-310000320335us-gaap:PerformanceSharesMember2019-02-282019-02-280000320335us-gaap:PerformanceSharesMember2020-02-262020-02-260000320335us-gaap:PerformanceSharesMemberus-gaap:SubsequentEventMember2021-02-242021-02-240000320335us-gaap:PerformanceSharesMembersrt:MinimumMember2019-12-310000320335us-gaap:PerformanceSharesMembersrt:MaximumMember2019-12-310000320335us-gaap:PerformanceSharesMembersrt:MinimumMember2020-12-310000320335us-gaap:PerformanceSharesMembersrt:MaximumMember2020-12-310000320335gl:DirectorsRestrictedStockMember2020-01-012020-12-310000320335gl:DirectorsRestrictedStockMember2019-01-012019-12-310000320335gl:DirectorsRestrictedStockMember2018-01-012018-12-310000320335gl:DirectorsRestrictedStockUnitsIncludingDividendEquivalentsMember2020-01-012020-12-310000320335gl:DirectorsRestrictedStockUnitsIncludingDividendEquivalentsMember2019-01-012019-12-310000320335gl:DirectorsRestrictedStockUnitsIncludingDividendEquivalentsMember2018-01-012018-12-310000320335us-gaap:PerformanceSharesMember2019-01-012019-12-310000320335us-gaap:PerformanceSharesMember2018-01-012018-12-310000320335gl:ExecutivesRestrictedStockMember2017-12-310000320335gl:ExecutivePerformanceSharesMember2017-12-310000320335gl:DirectorsRestrictedStockMember2017-12-310000320335gl:DirectorsRestrictedStockUnitsMember2017-12-310000320335gl:ExecutivesRestrictedStockMember2018-01-012018-12-310000320335gl:ExecutivePerformanceSharesMember2018-01-012018-12-310000320335gl:DirectorsRestrictedStockUnitsMember2018-01-012018-12-310000320335gl:ExecutivesRestrictedStockMember2018-12-310000320335gl:ExecutivePerformanceSharesMember2018-12-310000320335gl:DirectorsRestrictedStockMember2018-12-310000320335gl:DirectorsRestrictedStockUnitsMember2018-12-310000320335gl:ExecutivesRestrictedStockMember2019-01-012019-12-310000320335gl:ExecutivePerformanceSharesMember2019-01-012019-12-310000320335gl:DirectorsRestrictedStockUnitsMember2019-01-012019-12-310000320335gl:ExecutivesRestrictedStockMember2019-12-310000320335gl:ExecutivePerformanceSharesMember2019-12-310000320335gl:DirectorsRestrictedStockMember2019-12-310000320335gl:DirectorsRestrictedStockUnitsMember2019-12-310000320335gl:ExecutivesRestrictedStockMember2020-01-012020-12-310000320335gl:ExecutivePerformanceSharesMember2020-01-012020-12-310000320335gl:DirectorsRestrictedStockUnitsMember2020-01-012020-12-310000320335gl:ExecutivesRestrictedStockMember2020-12-310000320335gl:ExecutivePerformanceSharesMember2020-12-310000320335gl:DirectorsRestrictedStockMember2020-12-310000320335gl:DirectorsRestrictedStockUnitsMember2020-12-310000320335gl:AmericanIncomeExclusiveMembergl:LifeSegmentMember2020-01-012020-12-310000320335gl:AmericanIncomeExclusiveMembergl:HealthSegmentMember2020-01-012020-12-310000320335gl:AmericanIncomeExclusiveMembergl:AnnuitySegmentMember2020-01-012020-12-310000320335gl:AmericanIncomeExclusiveMember2020-01-012020-12-310000320335gl:DirectResponseMembergl:LifeSegmentMember2020-01-012020-12-310000320335gl:HealthSegmentMembergl:DirectResponseMember2020-01-012020-12-310000320335gl:AnnuitySegmentMembergl:DirectResponseMember2020-01-012020-12-310000320335gl:DirectResponseMember2020-01-012020-12-310000320335gl:LibertyNationalExclusiveMembergl:LifeSegmentMember2020-01-012020-12-310000320335gl:HealthSegmentMembergl:LibertyNationalExclusiveMember2020-01-012020-12-310000320335gl:AnnuitySegmentMembergl:LibertyNationalExclusiveMember2020-01-012020-12-310000320335gl:LibertyNationalExclusiveMember2020-01-012020-12-310000320335gl:UnitedAmericanIndependentMembergl:LifeSegmentMember2020-01-012020-12-310000320335gl:UnitedAmericanIndependentMembergl:HealthSegmentMember2020-01-012020-12-310000320335gl:UnitedAmericanIndependentMembergl:AnnuitySegmentMember2020-01-012020-12-310000320335gl:UnitedAmericanIndependentMember2020-01-012020-12-310000320335gl:FamilyHeritageMembergl:LifeSegmentMember2020-01-012020-12-310000320335gl:FamilyHeritageMembergl:HealthSegmentMember2020-01-012020-12-310000320335gl:FamilyHeritageMembergl:AnnuitySegmentMember2020-01-012020-12-310000320335gl:FamilyHeritageMember2020-01-012020-12-310000320335gl:DistributionChannelOtherMembergl:LifeSegmentMember2020-01-012020-12-310000320335gl:DistributionChannelOtherMembergl:HealthSegmentMember2020-01-012020-12-310000320335gl:DistributionChannelOtherMembergl:AnnuitySegmentMember2020-01-012020-12-310000320335gl:DistributionChannelOtherMember2020-01-012020-12-310000320335gl:LifeSegmentMember2020-01-012020-12-310000320335gl:HealthSegmentMember2020-01-012020-12-310000320335gl:AnnuitySegmentMember2020-01-012020-12-310000320335gl:AmericanIncomeExclusiveMembergl:LifeSegmentMember2019-01-012019-12-310000320335gl:AmericanIncomeExclusiveMembergl:HealthSegmentMember2019-01-012019-12-310000320335gl:AmericanIncomeExclusiveMembergl:AnnuitySegmentMember2019-01-012019-12-310000320335gl:AmericanIncomeExclusiveMember2019-01-012019-12-310000320335gl:DirectResponseMembergl:LifeSegmentMember2019-01-012019-12-310000320335gl:HealthSegmentMembergl:DirectResponseMember2019-01-012019-12-310000320335gl:AnnuitySegmentMembergl:DirectResponseMember2019-01-012019-12-310000320335gl:DirectResponseMember2019-01-012019-12-310000320335gl:LibertyNationalExclusiveMembergl:LifeSegmentMember2019-01-012019-12-310000320335gl:HealthSegmentMembergl:LibertyNationalExclusiveMember2019-01-012019-12-310000320335gl:AnnuitySegmentMembergl:LibertyNationalExclusiveMember2019-01-012019-12-310000320335gl:LibertyNationalExclusiveMember2019-01-012019-12-310000320335gl:UnitedAmericanIndependentMembergl:LifeSegmentMember2019-01-012019-12-310000320335gl:UnitedAmericanIndependentMembergl:HealthSegmentMember2019-01-012019-12-310000320335gl:UnitedAmericanIndependentMembergl:AnnuitySegmentMember2019-01-012019-12-310000320335gl:UnitedAmericanIndependentMember2019-01-012019-12-310000320335gl:FamilyHeritageMembergl:LifeSegmentMember2019-01-012019-12-310000320335gl:FamilyHeritageMembergl:HealthSegmentMember2019-01-012019-12-310000320335gl:FamilyHeritageMembergl:AnnuitySegmentMember2019-01-012019-12-310000320335gl:FamilyHeritageMember2019-01-012019-12-310000320335gl:DistributionChannelOtherMembergl:LifeSegmentMember2019-01-012019-12-310000320335gl:DistributionChannelOtherMembergl:HealthSegmentMember2019-01-012019-12-310000320335gl:DistributionChannelOtherMembergl:AnnuitySegmentMember2019-01-012019-12-310000320335gl:DistributionChannelOtherMember2019-01-012019-12-310000320335gl:LifeSegmentMember2019-01-012019-12-310000320335gl:HealthSegmentMember2019-01-012019-12-310000320335gl:AnnuitySegmentMember2019-01-012019-12-310000320335gl:AmericanIncomeExclusiveMembergl:LifeSegmentMember2018-01-012018-12-310000320335gl:AmericanIncomeExclusiveMembergl:HealthSegmentMember2018-01-012018-12-310000320335gl:AmericanIncomeExclusiveMembergl:AnnuitySegmentMember2018-01-012018-12-310000320335gl:AmericanIncomeExclusiveMember2018-01-012018-12-310000320335gl:DirectResponseMembergl:LifeSegmentMember2018-01-012018-12-310000320335gl:HealthSegmentMembergl:DirectResponseMember2018-01-012018-12-310000320335gl:AnnuitySegmentMembergl:DirectResponseMember2018-01-012018-12-310000320335gl:DirectResponseMember2018-01-012018-12-310000320335gl:LibertyNationalExclusiveMembergl:LifeSegmentMember2018-01-012018-12-310000320335gl:HealthSegmentMembergl:LibertyNationalExclusiveMember2018-01-012018-12-310000320335gl:AnnuitySegmentMembergl:LibertyNationalExclusiveMember2018-01-012018-12-310000320335gl:LibertyNationalExclusiveMember2018-01-012018-12-310000320335gl:UnitedAmericanIndependentMembergl:LifeSegmentMember2018-01-012018-12-310000320335gl:UnitedAmericanIndependentMembergl:HealthSegmentMember2018-01-012018-12-310000320335gl:UnitedAmericanIndependentMembergl:AnnuitySegmentMember2018-01-012018-12-310000320335gl:UnitedAmericanIndependentMember2018-01-012018-12-310000320335gl:FamilyHeritageMembergl:LifeSegmentMember2018-01-012018-12-310000320335gl:FamilyHeritageMembergl:HealthSegmentMember2018-01-012018-12-310000320335gl:FamilyHeritageMembergl:AnnuitySegmentMember2018-01-012018-12-310000320335gl:FamilyHeritageMember2018-01-012018-12-310000320335gl:DistributionChannelOtherMembergl:LifeSegmentMember2018-01-012018-12-310000320335gl:DistributionChannelOtherMembergl:HealthSegmentMember2018-01-012018-12-310000320335gl:DistributionChannelOtherMembergl:AnnuitySegmentMember2018-01-012018-12-310000320335gl:DistributionChannelOtherMember2018-01-012018-12-310000320335gl:LifeSegmentMember2018-01-012018-12-310000320335gl:HealthSegmentMember2018-01-012018-12-310000320335gl:AnnuitySegmentMember2018-01-012018-12-310000320335us-gaap:OperatingSegmentsMembergl:LifeSegmentMember2020-01-012020-12-310000320335gl:HealthSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310000320335us-gaap:OperatingSegmentsMembergl:AnnuitySegmentMember2020-01-012020-12-310000320335us-gaap:OperatingSegmentsMembergl:InvestmentSegmentMember2020-01-012020-12-310000320335us-gaap:CorporateNonSegmentMember2020-01-012020-12-310000320335us-gaap:MaterialReconcilingItemsMember2020-01-012020-12-310000320335us-gaap:OperatingSegmentsMembergl:LifeSegmentMember2019-01-012019-12-310000320335gl:HealthSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310000320335us-gaap:OperatingSegmentsMembergl:AnnuitySegmentMember2019-01-012019-12-310000320335us-gaap:OperatingSegmentsMembergl:InvestmentSegmentMember2019-01-012019-12-310000320335us-gaap:CorporateNonSegmentMember2019-01-012019-12-310000320335us-gaap:MaterialReconcilingItemsMember2019-01-012019-12-310000320335us-gaap:OperatingSegmentsMembergl:LifeSegmentMember2018-01-012018-12-310000320335gl:HealthSegmentMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310000320335us-gaap:OperatingSegmentsMembergl:AnnuitySegmentMember2018-01-012018-12-310000320335us-gaap:OperatingSegmentsMembergl:InvestmentSegmentMember2018-01-012018-12-310000320335us-gaap:CorporateNonSegmentMember2018-01-012018-12-310000320335us-gaap:MaterialReconcilingItemsMember2018-01-012018-12-310000320335us-gaap:OperatingSegmentsMembergl:LifeSegmentMember2020-12-310000320335gl:HealthSegmentMemberus-gaap:OperatingSegmentsMember2020-12-310000320335us-gaap:OperatingSegmentsMembergl:AnnuitySegmentMember2020-12-310000320335us-gaap:OperatingSegmentsMembergl:InvestmentSegmentMember2020-12-310000320335us-gaap:CorporateNonSegmentMember2020-12-310000320335us-gaap:OperatingSegmentsMembergl:LifeSegmentMember2019-12-310000320335gl:HealthSegmentMemberus-gaap:OperatingSegmentsMember2019-12-310000320335us-gaap:OperatingSegmentsMembergl:AnnuitySegmentMember2019-12-310000320335us-gaap:OperatingSegmentsMembergl:InvestmentSegmentMember2019-12-310000320335us-gaap:CorporateNonSegmentMember2019-12-3100003203352020-01-012020-03-3100003203352020-04-012020-06-3000003203352020-07-012020-09-3000003203352020-10-012020-12-3100003203352019-01-012019-03-3100003203352019-10-012019-12-310000320335srt:ParentCompanyMember2020-12-310000320335srt:ParentCompanyMember2019-12-310000320335srt:ParentCompanyMember2020-01-012020-12-310000320335srt:ParentCompanyMember2019-01-012019-12-310000320335srt:ParentCompanyMember2018-01-012018-12-310000320335srt:ParentCompanyMember2018-12-310000320335srt:ParentCompanyMember2017-12-310000320335srt:ParentCompanyMemberus-gaap:SeriesAPreferredStockMember2020-12-310000320335gl:SixPointFiveZeroPercentageCumulativePreferredStockSeriesMembersrt:ParentCompanyMember2020-12-310000320335gl:SixPointFiveZeroPercentageCumulativePreferredStockSeriesMembersrt:ParentCompanyMember2020-01-012020-12-310000320335gl:SevenPointOneFivePercentageCumulativePreferredStockSeriesMembersrt:ParentCompanyMember2020-12-310000320335gl:SevenPointOneFivePercentageCumulativePreferredStockSeriesMembersrt:ParentCompanyMember2020-01-012020-12-310000320335us-gaap:AccidentAndHealthInsuranceSegmentMember2020-01-012020-12-310000320335us-gaap:AccidentAndHealthInsuranceSegmentMember2019-01-012019-12-310000320335us-gaap:AccidentAndHealthInsuranceSegmentMember2018-01-012018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

[ ☒ ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

[ ☐ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-08052

GLOBE LIFE INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 63-0780404 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

3700 South Stonebridge Drive, McKinney, TX | | 75070 |

| (Address of principal executive offices) | | (Zip Code) |

972-569-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on

which registered |

| Common Stock, $1.00 par value per share | GL | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

| | | | Emerging growth company | | ¨ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ¨ |

Indicate by checkmark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No x

As of June 30, 2020, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $7.7 billion based on the closing sale price as reported on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding at February 18, 2021 |

| Common Stock, $1.00 par value per share | | 103,283,402 shares |

DOCUMENTS INCORPORATED BY REFERENCE

| | | | | | | | |

| Document | | Parts Into Which Incorporated |

| Proxy Statement for the Annual Meeting of Stockholders to be held on April 29, 2021 (Proxy Statement) | | Part III |

Globe Life Inc.

Table of Contents

| | | | | | | | | | | |

| | | | Page |

| | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

| Item 5. | | |

| Item 6. | | |

| | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| Item 15. | | |

Part I

Item 1. Business

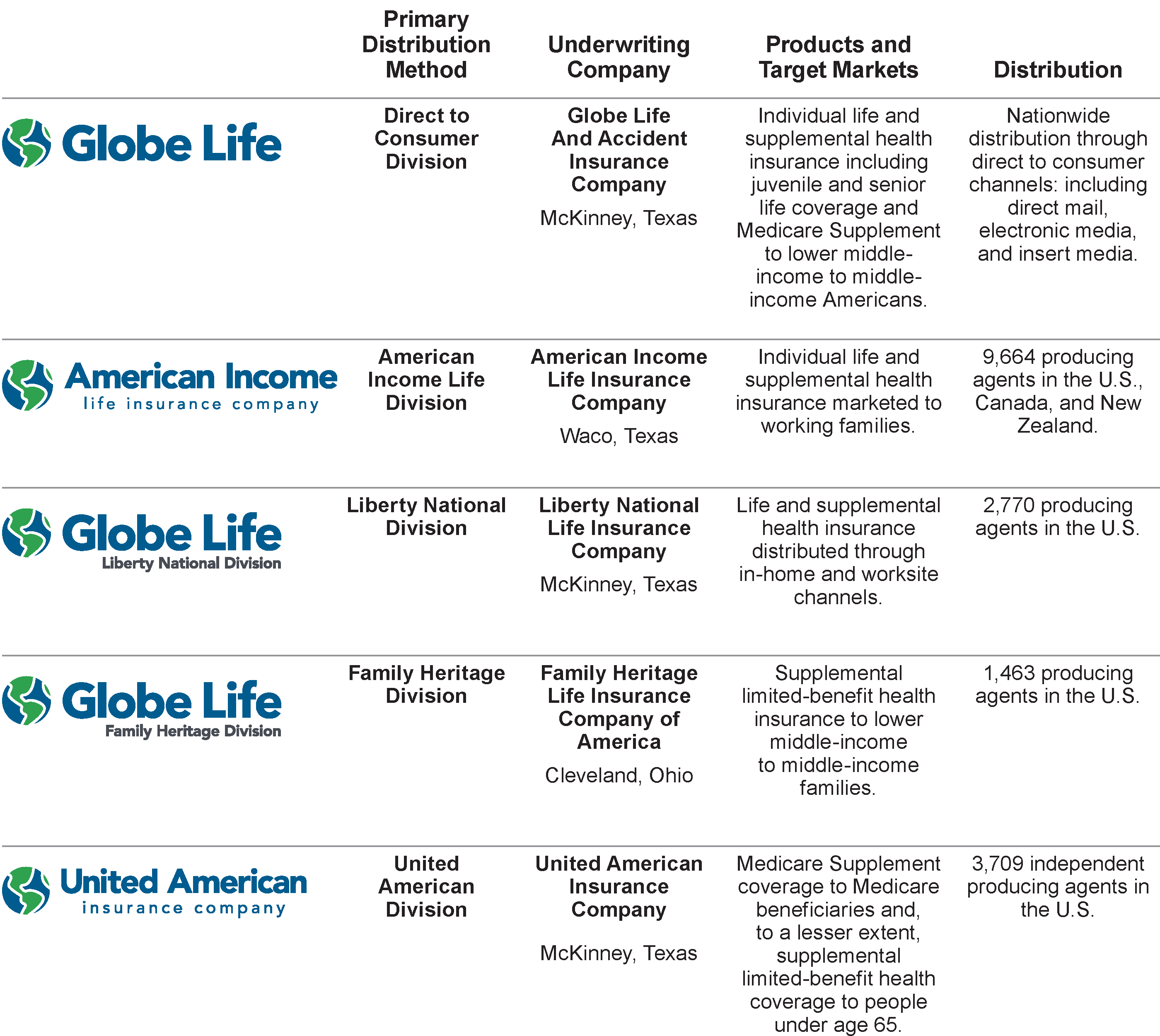

Globe Life and the Company refer to Globe Life Inc., an insurance holding company incorporated in Delaware in 1979, and its subsidiaries and affiliates. Its primary subsidiaries are Globe Life And Accident Insurance Company, American Income Life Insurance Company, Liberty National Life Insurance Company, Family Heritage Life Insurance Company of America, and United American Insurance Company.

Effective August 8, 2019, Torchmark Corporation changed its corporate name to Globe Life Inc. The New York Stock Exchange (NYSE) ticker was changed to "GL" on August 9, 2019. The name change is part of a brand alignment strategy which will enhance the Company's ability to build name recognition with potential customers and agent recruits through the use of a single brand. The underwriting companies owned by Globe Life Inc. (the Parent Company) will continue to exist as legal entities, but over a period of time will go to market under the Globe Life name to leverage branding initiatives implemented at Globe Life And Accident Insurance Company in recent years.

Globe Life's website is: www.globelifeinsurance.com. Globe Life makes available free of charge through its website, its annual report on Form 10-K, its quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after they have been electronically filed with or furnished to the Securities and Exchange Commission. Other information included in Globe Life's website is not incorporated into this filing.

Insurance

Life Insurance

The distribution channels for life insurance products include direct to consumer, exclusive agents, and independent agents. These methods are described in greater detail within the primary marketing distribution channel chart as seen above. The following table presents annualized premium in force for the three years ended December 31, 2020 by distribution method:

| | | | | | | | | | | | | | | | | |

| | Annualized Premium in Force(1) (Dollar amounts in thousands) |

| 2020 | | 2019 | | 2018 |

Direct to Consumer | $ | 881,012 | | | $ | 831,739 | | | $ | 812,780 | |

| Exclusive agents: | | | | | |

| American Income | 1,325,293 | | | 1,220,483 | | | 1,129,384 | |

| Liberty National | 318,545 | | | 309,792 | | | 300,846 | |

| Independent agents: | | | | | |

| United American | 9,314 | | | 10,211 | | | 11,094 | |

| Other | 205,785 | | | 209,403 | | | 210,624 | |

| $ | 2,739,949 | | | $ | 2,581,628 | | | $ | 2,464,728 | |

Globe Life's insurance subsidiaries write a variety of nonparticipating ordinary life insurance products. These include traditional whole life, term life, and other life insurance. The Company does not currently sell interest-sensitive whole life products. The following tables present selected information about Globe Life's life insurance products.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annualized Premium in Force (Dollar amounts in thousands) |

| | 2020 | | 2019 | | 2018 |

| Amount | | % of

Total | | Amount | | % of

Total | | Amount | | % of

Total |

| Whole life: | | | | | | | | | | | |

| Traditional | $ | 1,857,106 | | | 68 | | | $ | 1,737,794 | | | 67 | | | $ | 1,643,122 | | | 67 | |

| Interest-sensitive | 36,297 | | | 1 | | | 38,691 | | | 2 | | | 41,414 | | | 2 | |

Term | 716,698 | | | 26 | | | 683,869 | | | 26 | | | 671,840 | | | 27 | |

Other | 129,848 | | | 5 | | | 121,274 | | | 5 | | | 108,352 | | | 4 | |

| $ | 2,739,949 | | | 100 | | | $ | 2,581,628 | | | 100 | | | $ | 2,464,728 | | | 100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Policy Count and Average Face Amount Per Policy (Dollar amounts in thousands) |

| 2020 | | 2019 | | 2018 |

| Policy Count | | Average Face Amount per Policy | | Policy Count | | Average Face Amount per Policy | | Policy Count | | Average Face Amount per Policy |

| Whole life: | | | | | | | | | | | |

| Traditional | 8,717,785 | | | $ | 14.7 | | | 8,477,406 | | | $ | 14.2 | | | 8,112,745 | | | $ | 13.9 | |

| Interest-sensitive | 199,975 | | | 20.3 | | | 208,822 | | | 20.3 | | | 209,948 | | | 20.6 | |

Term | 4,526,172 | | | 15.1 | | | 4,313,709 | | | 14.8 | | | 4,459,850 | | | 14.9 | |

Other | 408,859 | | | 14.3 | | | 399,365 | | | 13.7 | | | 376,632 | | | 12.9 | |

| 13,852,791 | | | $ | 14.9 | | | 13,399,302 | | | $ | 14.5 | | | 13,159,175 | | | $ | 14.3 | |

Health Insurance

The following table presents Globe Life's health insurance annualized premium in force for the three years ended December 31, 2020 by distribution channel.

| | | | | | | | | | | | | | | | | |

| | Annualized Premium in Force (Dollar amounts in thousands) |

| 2020 | | 2019 | | 2018 |

Direct to Consumer | $ | 77,522 | | | $ | 78,229 | | | $ | 79,325 | |

| Exclusive agents: | | | | | |

| Liberty National | 196,534 | | | 197,163 | | | 201,294 | |

| American Income | 104,701 | | | 96,447 | | | 88,237 | |

| Family Heritage | 338,309 | | | 312,479 | | | 290,186 | |

| Independent agents: | | | | | |

| United American | 476,296 | | | 454,720 | | | 414,656 | |

| $ | 1,193,362 | | | $ | 1,139,038 | | | $ | 1,073,698 | |

Globe Life offers Medicare Supplement and limited-benefit supplemental health insurance products that include primarily critical illness and accident plans. These products are designed to supplement health coverage that applicants already own. Medicare Supplements are offered to enrollees in the traditional fee-for-service Medicare program. Medicare Supplement plans are standardized by federal regulation and are designed to pay deductibles and co-payments not paid by Medicare.

The following table presents supplemental health annualized premium in force information for the three years ended December 31, 2020 by product category.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Annualized Premium in Force (Dollar amounts in thousands) |

| 2020 | | 2019 | | 2018 |

| Amount | | % of

Total | | Amount | | % of

Total | | Amount | | % of

Total |