falseFY20220000315858YesYesNoNoP4Y0.200.200000315858bvh:ClassAndBCommonStockMember2021-08-310000315858us-gaap:CommonClassBMember2021-01-012021-12-310000315858us-gaap:CommonClassAMember2021-01-012021-12-310000315858bvh:CashTenderMember2022-12-012022-12-3100003158582020-07-012020-07-3100003158582020-01-012020-07-310000315858us-gaap:RetainedEarningsUnappropriatedMember2022-12-310000315858us-gaap:ParentMember2022-12-310000315858us-gaap:NoncontrollingInterestMember2022-12-310000315858us-gaap:AdditionalPaidInCapitalMember2022-12-310000315858us-gaap:RetainedEarningsUnappropriatedMember2021-12-310000315858us-gaap:ParentMember2021-12-310000315858us-gaap:NoncontrollingInterestMember2021-12-310000315858us-gaap:AdditionalPaidInCapitalMember2021-12-310000315858us-gaap:RetainedEarningsUnappropriatedMember2020-12-310000315858us-gaap:ParentMember2020-12-310000315858us-gaap:NoncontrollingInterestMember2020-12-310000315858us-gaap:AdditionalPaidInCapitalMember2020-12-310000315858us-gaap:RetainedEarningsUnappropriatedMember2019-12-310000315858us-gaap:ParentMember2019-12-310000315858us-gaap:NoncontrollingInterestMember2019-12-310000315858us-gaap:AdditionalPaidInCapitalMember2019-12-310000315858us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000315858us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310000315858us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310000315858us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310000315858us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310000315858us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-12-310000315858us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310000315858us-gaap:CommonClassBMemberus-gaap:CommonStockMember2019-12-310000315858us-gaap:CommonClassAMemberus-gaap:CommonStockMember2019-12-310000315858us-gaap:RestrictedStockMember2021-01-012021-12-310000315858us-gaap:RestrictedStockMemberbvh:TwoThousandFourteenPlanMember2020-01-012020-12-310000315858us-gaap:RestrictedStockMember2020-01-012020-12-310000315858bvh:TwoThousandFourteenPlanMemberus-gaap:CommonClassBMemberbvh:AcceleratedDueToSpinOffMember2022-12-310000315858bvh:TwoThousandFourteenPlanMemberus-gaap:CommonClassAMemberbvh:AcceleratedDueToSpinOffMember2022-12-310000315858bvh:TwoThousandFourteenPlanMember2020-12-310000315858us-gaap:RestrictedStockMemberbvh:IncentivePlan2021Memberus-gaap:CommonClassAMember2022-12-310000315858us-gaap:RestrictedStockMember2021-12-310000315858us-gaap:RestrictedStockMemberbvh:IncentivePlan2021Memberus-gaap:CommonClassAMember2021-07-310000315858us-gaap:RestrictedStockMemberus-gaap:SubsequentEventMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-182023-01-180000315858us-gaap:RestrictedStockMemberus-gaap:SubsequentEventMember2023-01-182023-01-180000315858bvh:IncentivePlan2021Member2022-01-012022-12-310000315858us-gaap:RestrictedStockMemberbvh:IncentivePlan2021Memberus-gaap:CommonClassAMember2021-07-012022-12-310000315858bvh:June32021Memberus-gaap:RestrictedStockMemberbvh:IncentivePlan2021Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-01-012021-12-310000315858bvh:June32021Memberus-gaap:RestrictedStockMemberbvh:IncentivePlan2021Memberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310000315858bvh:January192022Memberus-gaap:RestrictedStockMemberbvh:IncentivePlan2021Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-01-012021-12-310000315858bvh:June32021Memberus-gaap:RestrictedStockMemberbvh:IncentivePlan2014Member2021-01-012021-12-310000315858us-gaap:RestrictedStockMemberbvh:IncentivePlan2021Memberus-gaap:CommonClassAMember2022-01-012022-12-310000315858us-gaap:RestrictedStockMemberbvh:IncentivePlan2021Memberus-gaap:CommonClassAMember2021-01-012021-12-310000315858us-gaap:RestrictedStockMemberus-gaap:SubsequentEventMember2023-01-180000315858us-gaap:RestrictedStockMember2022-10-310000315858us-gaap:RestrictedStockMember2022-01-310000315858us-gaap:RestrictedStockMember2021-06-300000315858us-gaap:RestrictedStockMemberus-gaap:SubsequentEventMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-182023-01-180000315858srt:MaximumMemberbvh:June32021Memberus-gaap:RestrictedStockMemberbvh:IncentivePlan2021Member2022-01-012022-12-310000315858bvh:October192022Memberus-gaap:RestrictedStockMemberbvh:IncentivePlan2021Member2022-01-012022-12-310000315858bvh:January192022Memberus-gaap:RestrictedStockMemberbvh:IncentivePlan2021Member2022-01-012022-12-310000315858srt:MinimumMember2022-01-012022-12-310000315858srt:MaximumMember2022-01-012022-12-310000315858srt:MinimumMemberbvh:June32021Memberus-gaap:RestrictedStockMemberbvh:IncentivePlan2014Member2021-01-012021-12-310000315858bvh:January192022Memberus-gaap:RestrictedStockMemberbvh:IncentivePlan2021Memberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310000315858bvh:January212020Memberus-gaap:RestrictedStockMemberbvh:IncentivePlan2014Member2020-01-012020-12-310000315858us-gaap:IntersegmentEliminationMember2022-01-012022-12-310000315858us-gaap:CorporateNonSegmentMember2022-01-012022-12-310000315858us-gaap:IntersegmentEliminationMember2021-01-012021-12-310000315858us-gaap:CorporateNonSegmentMember2021-01-012021-12-310000315858us-gaap:IntersegmentEliminationMember2020-01-012020-12-310000315858us-gaap:CorporateNonSegmentMember2020-01-012020-12-310000315858us-gaap:OperatingSegmentsMemberbvh:CostReimbursementsMember2022-01-012022-12-310000315858bvh:ResortAndClubManagementRevenueMember2022-01-012022-12-310000315858bvh:OtherRevenueMember2022-01-012022-12-310000315858bvh:FeeBasedSalesCommissionRevenueMember2022-01-012022-12-310000315858bvh:AdministrativeFeesAndOtherMember2022-01-012022-12-310000315858us-gaap:OperatingSegmentsMemberbvh:CostReimbursementsMember2021-01-012021-12-310000315858bvh:ResortAndClubManagementRevenueMember2021-01-012021-12-310000315858bvh:OtherRevenueMember2021-01-012021-12-310000315858bvh:FeeBasedSalesCommissionRevenueMember2021-01-012021-12-310000315858bvh:AdministrativeFeesAndOtherMember2021-01-012021-12-310000315858us-gaap:OperatingSegmentsMemberbvh:CostReimbursementsMember2020-01-012020-12-310000315858bvh:ResortAndClubManagementRevenueMember2020-01-012020-12-310000315858bvh:OtherRevenueMember2020-01-012020-12-310000315858bvh:FeeBasedSalesCommissionRevenueMember2020-01-012020-12-310000315858bvh:AdministrativeFeesAndOtherMember2020-01-012020-12-310000315858bvh:NotesPayableToBbxCapitalMember2021-12-012021-12-310000315858bvh:SyndicatedWarehouseFacilityMember2022-01-012022-12-310000315858bvh:PacificWesternFacilityMember2022-01-012022-12-310000315858bvh:OtherNonRecourseReceivableBackedNotesPayableMember2022-01-012022-12-310000315858bvh:LibertyBankFacilityMember2022-01-012022-12-310000315858bvh:OtherNonRecourseReceivableBackedNotesPayableMember2021-01-012021-12-310000315858bvh:AbdoCompaniesInc.Member2022-01-012022-12-310000315858bvh:AbdoCompaniesInc.Member2021-01-012021-12-310000315858bvh:AbdoCompaniesInc.Member2020-01-012020-12-310000315858srt:MinimumMemberus-gaap:SoftwareDevelopmentMember2022-01-012022-12-310000315858srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2022-01-012022-12-310000315858srt:MinimumMemberus-gaap:LandBuildingsAndImprovementsMember2022-01-012022-12-310000315858srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310000315858srt:MinimumMemberus-gaap:ComputerEquipmentMember2022-01-012022-12-310000315858srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2022-01-012022-12-310000315858srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2022-01-012022-12-310000315858srt:MaximumMemberus-gaap:LandBuildingsAndImprovementsMember2022-01-012022-12-310000315858srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310000315858srt:MaximumMemberus-gaap:ComputerEquipmentMember2022-01-012022-12-310000315858us-gaap:TransportationEquipmentMember2022-01-012022-12-310000315858us-gaap:TransportationEquipmentMember2022-12-310000315858us-gaap:LeaseholdImprovementsMember2022-12-310000315858us-gaap:LandBuildingsAndImprovementsMember2022-12-310000315858us-gaap:FurnitureAndFixturesMember2022-12-310000315858us-gaap:ComputerEquipmentMember2022-12-310000315858us-gaap:TransportationEquipmentMember2021-12-310000315858us-gaap:LeaseholdImprovementsMember2021-12-310000315858us-gaap:LandBuildingsAndImprovementsMember2021-12-310000315858us-gaap:FurnitureAndFixturesMember2021-12-310000315858us-gaap:ComputerEquipmentMember2021-12-310000315858us-gaap:RetainedEarningsUnappropriatedMember2021-01-012021-12-310000315858bvh:TrustMemberbvh:BxgReceivablesNoteTrust2022Member2022-01-012022-12-310000315858bvh:TwoThousandTwentyTwoTermSecuritizationMemberbvh:ClassMember2022-04-282022-04-280000315858bvh:TwoThousandTwentyTwoTermSecuritizationMemberbvh:ClassCMember2022-04-282022-04-280000315858bvh:TwoThousandTwentyTwoTermSecuritizationMemberbvh:ClassBMember2022-04-282022-04-280000315858bvh:TwoThousandTwentyTwoTermSecuritizationMember2022-04-282022-04-280000315858stpr:FLbvh:VoiInventoryMember2022-10-012022-10-310000315858stpr:FLbvh:PropertyAndEquipmentMember2022-10-012022-10-310000315858stpr:FL2022-10-012022-10-310000315858bvh:BassProMember2022-12-012022-12-310000315858bvh:BassProMember2021-12-012021-12-310000315858bvh:BassProMember2021-01-012021-01-310000315858bvh:BassProMember2020-01-012020-01-310000315858us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000315858us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2022-12-310000315858bvh:FinancingReceivablesEqualToGreaterThan91DaysPastDueMember2022-12-310000315858bvh:FinancingReceivables31To60DaysPastDueMember2022-12-310000315858bvh:FinancingReceivables1To30DaysPastDueMember2022-12-310000315858bvh:FinancingReceivable6190DaysPastDueMember2022-12-310000315858us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2021-12-310000315858bvh:FinancingReceivablesEqualToGreaterThan91DaysPastDueMember2021-12-310000315858bvh:FinancingReceivables31To60DaysPastDueMember2021-12-310000315858bvh:FinancingReceivables1To30DaysPastDueMember2021-12-310000315858bvh:FinancingReceivable6190DaysPastDueMember2021-12-310000315858bvh:NotesPayableToRelatedPartiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000315858bvh:NotesPayableToRelatedPartiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000315858bvh:NotesPayableToRelatedPartiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000315858bvh:NotesPayableToRelatedPartiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000315858bvh:BluegreenBigCedarVacationsLlcMember2022-01-012022-12-310000315858bvh:BluegreenMember2021-01-012021-12-310000315858bvh:BluegreenBigCedarVacationsLlcMember2021-01-012021-12-310000315858bvh:BluegreenMember2020-01-012020-12-310000315858bvh:BluegreenBigCedarVacationsLlcMember2020-01-012020-12-310000315858bvh:BluegreenMemberbvh:BluegreenMemberbvh:BluegreenMember2021-05-050000315858bvh:BluegreenMemberbvh:BluegreenBigCedarVacationsLlcMemberbvh:BluegreenMember2022-12-310000315858us-gaap:NoncontrollingInterestMember2022-01-012022-12-310000315858bvh:BbxCapitalMember2022-01-012022-12-310000315858bvh:BbxCapitalMember2021-01-012021-12-310000315858bvh:BbxCapitalMember2020-01-012020-12-310000315858bvh:NewYorkUrbanMember2021-04-022021-04-020000315858bvh:NewYorkUrbanMembersrt:MinimumMember2019-10-072019-10-070000315858bvh:BassProMember2022-12-310000315858bvh:BassProMember2021-12-310000315858bvh:NotesPayableToRelatedPartiesMember2022-12-310000315858bvh:QuorumPurchaseFacilityMember2022-12-310000315858bvh:FifthThirdSyndicatedLineOfCreditAndFifthThirdSyndicatedTermLoanMember2022-02-012022-02-280000315858us-gaap:RevolvingCreditFacilityMemberbvh:FifthThirdSyndicatedLineOfCreditAndFifthThirdSyndicatedTermLoanMember2022-02-280000315858bvh:WoodbridgeMemberus-gaap:JuniorSubordinatedDebtMemberbvh:LevittCapitalTrustIIvMember2022-12-310000315858bvh:BluegreenMemberus-gaap:JuniorSubordinatedDebtMemberbvh:BluegreenStatutoryTrustIViMember2022-12-310000315858us-gaap:AccountingStandardsUpdate202004Memberbvh:LiborIndexedJuniorSubordinatedDebenturesMember2022-12-310000315858bvh:WoodbridgeMemberus-gaap:JuniorSubordinatedDebtMemberbvh:LevittCapitalTrustIIvMember2021-12-310000315858bvh:BluegreenMemberus-gaap:JuniorSubordinatedDebtMemberbvh:BluegreenStatutoryTrustIViMember2021-12-310000315858bvh:NotesPayableToBbxCapitalMember2021-12-310000315858us-gaap:NotesPayableOtherPayablesMemberbvh:BluegreenMember2020-01-012020-12-310000315858bvh:FicoScoreTotalMember2022-12-310000315858bvh:FicoScoreOtherMember2022-12-310000315858bvh:FicoScoreTotalMember2021-12-310000315858bvh:FicoScoreOtherMember2021-12-310000315858bvh:VoiNotesReceivableSecuritizedMember2022-12-310000315858bvh:VoiNotesReceivableNonSecuritizedMember2022-12-310000315858bvh:VoiNotesReceivableSecuritizedMember2021-12-310000315858bvh:VoiNotesReceivableNonSecuritizedMember2021-12-310000315858us-gaap:RestrictedStockMember2022-12-310000315858us-gaap:RestrictedStockMember2022-01-012022-12-310000315858us-gaap:SubsequentEventMember2023-02-150000315858us-gaap:RetainedEarningsUnappropriatedMember2022-01-012022-12-310000315858us-gaap:SubsequentEventMember2023-02-152023-02-150000315858bvh:BbxCapitalInc.Memberus-gaap:OtherOperatingIncomeExpenseMember2020-01-012020-12-310000315858bvh:BbxCapitalInc.Memberus-gaap:InterestIncomeMember2020-01-012020-12-310000315858bvh:BbxCapitalInc.Memberbvh:NetGainsLossOnSalesOfAssetsMember2020-01-012020-12-310000315858bvh:BbxCapitalInc.Memberus-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310000315858bvh:BbxCapitalInc.Memberbvh:TradeSalesMember2020-01-012020-12-310000315858bvh:BbxCapitalInc.Memberbvh:SalesOfRealEstateInventoryMember2020-01-012020-12-310000315858bvh:BbxCapitalInc.Memberbvh:ImpairmentLossesMember2020-01-012020-12-310000315858bvh:ParticipantsContributionsNotExceeding3401KMember2022-01-012022-12-310000315858bvh:ParticipantsContributionsInExcess3ButNotInExcessOf5401KMember2022-01-012022-12-310000315858srt:MinimumMemberbvh:ParticipantsContributionsInExcess3ButNotInExcessOf5401KMember2022-01-012022-12-310000315858srt:MaximumMemberbvh:ParticipantsContributionsNotExceeding3401KMember2022-01-012022-12-310000315858srt:MaximumMemberbvh:ParticipantsContributionsInExcess3ButNotInExcessOf5401KMember2022-01-012022-12-310000315858bvh:BbxCapitalMember2022-12-310000315858bvh:LinesOfCreditAndNotesPayableMember2022-12-310000315858bvh:LinesOfCreditAndNotesPayableMember2021-12-310000315858srt:MinimumMemberbvh:QuorumPurchaseFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858srt:MaximumMemberbvh:QuorumPurchaseFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:TwoThousandTwentyTwoTermSecuritizationMemberbvh:ClassMember2022-04-280000315858bvh:TwoThousandTwentyTwoTermSecuritizationMemberbvh:ClassCMember2022-04-280000315858bvh:TwoThousandTwentyTwoTermSecuritizationMemberbvh:ClassBMember2022-04-280000315858srt:MinimumMemberbvh:QuorumPurchaseFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858srt:MaximumMemberbvh:QuorumPurchaseFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858us-gaap:NotesPayableOtherPayablesMemberbvh:BluegreenMember2020-04-180000315858us-gaap:NotesPayableOtherPayablesMemberbvh:BluegreenMember2020-04-170000315858bvh:WoodbridgeMembersrt:MinimumMemberus-gaap:JuniorSubordinatedDebtMemberbvh:LevittCapitalTrustIIvMember2022-12-310000315858bvh:WoodbridgeMembersrt:MaximumMemberus-gaap:JuniorSubordinatedDebtMemberbvh:LevittCapitalTrustIIvMember2022-12-310000315858bvh:BluegreenMembersrt:MinimumMemberus-gaap:JuniorSubordinatedDebtMemberbvh:BluegreenStatutoryTrustIViMember2022-12-310000315858bvh:BluegreenMembersrt:MaximumMemberus-gaap:JuniorSubordinatedDebtMemberbvh:BluegreenStatutoryTrustIViMember2022-12-310000315858srt:MinimumMemberbvh:NbaReceivablesFacilityMember2022-12-310000315858srt:MinimumMemberbvh:LibertyBankFacilityMember2022-12-310000315858bvh:FifthThirdSyndicatedLineOfCreditAndFifthThirdSyndicatedTermLoanMemberbvh:LiborFloorMember2022-02-280000315858bvh:WoodbridgeMembersrt:MinimumMemberus-gaap:JuniorSubordinatedDebtMemberbvh:LevittCapitalTrustIIvMember2021-12-310000315858bvh:WoodbridgeMembersrt:MaximumMemberus-gaap:JuniorSubordinatedDebtMemberbvh:LevittCapitalTrustIIvMember2021-12-310000315858bvh:BluegreenMembersrt:MinimumMemberus-gaap:JuniorSubordinatedDebtMemberbvh:BluegreenStatutoryTrustIViMember2021-12-310000315858bvh:BluegreenMembersrt:MaximumMemberus-gaap:JuniorSubordinatedDebtMemberbvh:BluegreenStatutoryTrustIViMember2021-12-310000315858bvh:FifthThirdSyndicatedLineOfCreditAndFifthThirdSyndicatedTermLoanMemberus-gaap:MediumTermNotesMember2022-02-280000315858bvh:NotesPayableToBbxCapitalMember2020-09-300000315858us-gaap:NotesPayableOtherPayablesMemberbvh:BluegreenMember2015-04-300000315858bvh:PanamaCityAcquisitionLoanMemberbvh:SofrPlusMember2022-10-012022-10-310000315858bvh:PanamaCityAcquisitionLoanMemberbvh:SofrFloorMember2022-10-012022-10-310000315858bvh:UntilExpirationOfRevolvingAdvancePeriodMemberbvh:SyndicatedWarehouseFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-09-012022-09-300000315858bvh:AfterExpirationOfRevolvingAdvancePeriodMemberbvh:SyndicatedWarehouseFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-09-012022-09-300000315858srt:MinimumMemberbvh:FifthThirdSyndicatedLineOfCreditAndFifthThirdSyndicatedTermLoanMemberbvh:SofrPlusMember2022-02-012022-02-280000315858srt:MinimumMemberbvh:FifthThirdSyndicatedLineOfCreditAndFifthThirdSyndicatedTermLoanMemberbvh:CreditSpreadAdjustmentMember2022-02-012022-02-280000315858srt:MaximumMemberbvh:FifthThirdSyndicatedLineOfCreditAndFifthThirdSyndicatedTermLoanMemberbvh:SofrPlusMember2022-02-012022-02-280000315858srt:MaximumMemberbvh:FifthThirdSyndicatedLineOfCreditAndFifthThirdSyndicatedTermLoanMemberbvh:CreditSpreadAdjustmentMember2022-02-012022-02-280000315858srt:MinimumMemberbvh:FifthThirdSyndicatedLineOfCreditAndFifthThirdSyndicatedTermLoanMember2022-02-012022-02-280000315858srt:MaximumMemberbvh:FifthThirdSyndicatedLineOfCreditAndFifthThirdSyndicatedTermLoanMember2022-02-012022-02-280000315858srt:MinimumMemberus-gaap:JuniorSubordinatedDebtMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-12-310000315858srt:MinimumMemberbvh:PacificWesternFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-12-310000315858srt:MaximumMemberus-gaap:JuniorSubordinatedDebtMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-12-310000315858srt:MaximumMemberbvh:PacificWesternFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-12-310000315858bvh:UntilExpirationOfRevolvingAdvancePeriodMemberbvh:SyndicatedWarehouseFacilityMemberbvh:SofrPlusMember2022-01-012022-12-310000315858bvh:AfterExpirationOfRevolvingAdvancePeriodMemberbvh:SyndicatedWarehouseFacilityMemberbvh:SofrPlusMember2022-01-012022-12-310000315858bvh:PacificWesternFacilityMemberbvh:SofrPlusMember2022-01-012022-12-310000315858bvh:PacificWesternFacilityMemberbvh:SofrFloorMember2022-01-012022-12-310000315858bvh:NbaReceivablesFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-12-310000315858bvh:LibertyBankFacilityMemberus-gaap:PrimeRateMember2022-01-012022-12-310000315858bvh:CostOfVoisMember2022-01-012022-12-310000315858bvh:CostOfVoisMember2021-01-012021-12-310000315858bvh:CostOfVoisMember2020-01-012020-12-310000315858bvh:DecreaseInClassBCommonStockScenarioTwoMemberus-gaap:CommonClassBMember2022-12-310000315858bvh:DecreaseInClassBCommonStockScenarioThreeMemberus-gaap:CommonClassBMember2022-12-310000315858bvh:DecreaseInClassBCommonStockScenarioOneMemberus-gaap:CommonClassBMember2022-12-310000315858us-gaap:CommonClassBMember2021-12-310000315858us-gaap:CommonClassAMember2021-12-310000315858bvh:BluegreenMember2020-08-012020-08-3100003158582019-12-3100003158582020-12-310000315858bvh:PanamaCityPropertyAndOtherResortAssetsMember2022-10-012022-10-310000315858bvh:BbxCapitalMember2022-12-310000315858bvh:BbxCapitalMember2021-12-310000315858bvh:SubsidiesToCertainHoasMember2022-12-310000315858bvh:SubsidiesToCertainHoasMember2021-12-3100003158582022-06-300000315858us-gaap:CommonClassBMember2023-02-090000315858us-gaap:CommonClassAMember2023-02-090000315858bvh:DecreaseInClassBCommonStockScenarioTwoMemberus-gaap:CommonClassBMember2022-01-012022-12-310000315858bvh:DecreaseInClassBCommonStockScenarioTwoMemberus-gaap:CommonClassAMember2022-01-012022-12-310000315858bvh:DecreaseInClassBCommonStockScenarioOneMemberus-gaap:CommonClassBMember2022-01-012022-12-310000315858bvh:DecreaseInClassBCommonStockScenarioOneMemberus-gaap:CommonClassAMember2022-01-012022-12-310000315858us-gaap:CommonClassBMember2022-01-012022-12-310000315858us-gaap:CommonClassAMember2022-01-012022-12-310000315858bvh:NotesReceivableSecuredByVoisMember2022-01-012022-12-310000315858bvh:NotesReceivableSecuredByVoisMember2021-01-012021-12-310000315858bvh:BxgReceivablesNoteTrust2022Member2022-01-012022-12-310000315858bvh:BluegreenMember2021-01-012021-12-310000315858bvh:BluegreenMember2020-01-012020-12-310000315858us-gaap:ParentMember2022-01-012022-12-310000315858us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000315858us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-12-310000315858bvh:ClassAndBCommonStockMember2022-03-012022-03-310000315858bvh:CashTenderMemberus-gaap:CommonClassAMember2022-12-012022-12-310000315858us-gaap:CommonClassAMember2021-05-050000315858bvh:BluegreenVacationsHoldingCorpBvhMemberus-gaap:CommonClassAMember2021-05-050000315858bvh:TwoThousandFourteenPlanMember2020-01-012020-12-310000315858bvh:BassProMember2019-06-012019-06-300000315858bvh:BassProAndCabelaMember2021-01-012021-12-310000315858bvh:SalesOfVoisMember2022-01-012022-12-310000315858bvh:SalesOfVoisMember2021-01-012021-12-310000315858bvh:SalesOfVoisMember2020-01-012020-12-310000315858bvh:BassProAndCabelaMember2022-01-012022-12-310000315858bvh:PanamaCityAcquisitionLoanMember2022-10-310000315858bvh:PacificWesternFacilityMember2022-12-310000315858bvh:LibertyBankFacilityMember2022-12-310000315858bvh:QuorumPurchaseFacilityMemberbvh:InterestRateAt4.95Member2022-12-310000315858bvh:QuorumPurchaseFacilityMemberbvh:InterestRateAt4.75Member2022-12-310000315858us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310000315858us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310000315858bvh:TwoThousandSixteenTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:TwoThousandSeventeenTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:TwoThousandFifteenTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:TwoThousandEighteenTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:TwentyTwentyTwoTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:TwentyTwentyTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:SyndicatedWarehouseFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:QuorumPurchaseFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:PacificWesternFacilityMemberbvh:RecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:NbaReceivablesFacilityMemberbvh:RecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:NbaReceivablesFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:LibertyBankFacilityMemberbvh:RecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:LibertyBankFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:TwoThousandThirteenTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:TwoThousandSixteenTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:TwoThousandSeventeenTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:TwoThousandFifteenTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:TwoThousandEighteenTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:TwentyTwentyTermSecuritizationMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:SyndicatedWarehouseFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:QuorumPurchaseFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:PacificWesternFacilityMemberbvh:RecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:PacificWesternFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:NbaReceivablesFacilityMemberbvh:RecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:NbaReceivablesFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:LibertyBankFacilityMemberbvh:RecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:LibertyBankFacilityMemberbvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:RecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:NonRecourseReceivableBackedNotesPayableMember2021-12-310000315858bvh:BassProAndCabelaMember2019-06-012019-06-300000315858srt:PresidentMemberbvh:ClassAndBCommonStockMember2022-12-310000315858bvh:LessThan601Member2022-12-310000315858bvh:FicoScoreNoScoreMember2022-12-310000315858bvh:FicoScoreGreaterThan701Member2022-12-310000315858bvh:FicoScore601700Member2022-12-310000315858bvh:LessThan601Member2021-12-310000315858bvh:FicoScoreNoScoreMember2021-12-310000315858bvh:FicoScoreGreaterThan701Member2021-12-310000315858bvh:FicoScore601700Member2021-12-3100003158582020-08-300000315858stpr:CO2022-07-012022-07-310000315858bvh:TwoThousandTwentyTwoTermSecuritizationMember2022-01-012022-12-310000315858bvh:CabelaMember2022-01-012022-12-310000315858bvh:BassProMember2022-01-012022-12-310000315858bvh:BassProAndCabelaMember2022-12-310000315858us-gaap:RetainedEarningsUnappropriatedMember2020-01-012020-12-310000315858us-gaap:NoncontrollingInterestMember2020-01-012020-12-310000315858bvh:BluegreenMember2022-01-012022-12-310000315858bvh:NewYorkUrbanMember2019-11-200000315858bvh:NewYorkUrbanMember2021-04-020000315858us-gaap:AccountingStandardsUpdate202004Memberbvh:ReceivableBackedNotesPayableAndLinesOfCreditMember2022-12-310000315858us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000315858us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000315858us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000315858us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000315858bvh:PanamaCityAcquisitionLoanMember2022-10-012022-10-310000315858bvh:FloridaNolSrlyLimitationMember2022-12-310000315858bvh:FederalNolSrlyLimitationMember2022-12-310000315858us-gaap:JuniorSubordinatedDebtMember2021-12-310000315858us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-01-012021-12-310000315858us-gaap:ParentMember2021-01-012021-12-310000315858us-gaap:NoncontrollingInterestMember2021-01-012021-12-310000315858us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000315858bvh:SyndicatedWarehouseFacilityMember2022-12-310000315858bvh:NbaReceivablesFacilityMember2022-12-310000315858bvh:SyndicatedWarehouseFacilityMember2022-09-300000315858bvh:TwoThousandTwentyTwoTermSecuritizationMember2022-04-2800003158582021-01-012021-12-310000315858bvh:QualifiedTimeshareLoansMemberbvh:LibertyBankFacilityMember2022-12-310000315858bvh:NonConformingQualifiedTimeshareLoansMemberbvh:LibertyBankFacilityMember2022-12-310000315858bvh:PacificWesternFacilityEligibleBReceivablesMember2022-12-310000315858bvh:PacificWesternFacilityEligibleaReceivablesMember2022-12-310000315858bvh:BluegreenMemberbvh:TwoThousandThirteenTermSecuritizationMember2022-01-012022-12-310000315858bvh:BbxCapitalMemberbvh:OtherFederalTaxCreditsSrlyLimitationMember2022-12-310000315858bvh:BbxCapitalMemberbvh:NonFloridaStateNolsBluegreenMember2022-12-310000315858bvh:BbxCapitalMemberbvh:FloridaNolSrlyLimitationMember2022-12-310000315858bvh:BbxCapitalMemberbvh:FloridaNolSection382LimitationMember2022-12-310000315858bvh:BbxCapitalMemberbvh:FederalNolSrlyLimitationMember2022-12-310000315858bvh:BbxCapitalMemberbvh:FederalNolSection382LimitationMember2022-12-310000315858bvh:NonFloridaStateNolsBluegreenMember2022-12-310000315858us-gaap:OperatingSegmentsMemberbvh:SalesOfVoisAndFinancingMember2022-01-012022-12-310000315858us-gaap:OperatingSegmentsMemberbvh:ResortOperationsAndClubManagementMember2022-01-012022-12-310000315858us-gaap:OperatingSegmentsMember2022-01-012022-12-310000315858us-gaap:OperatingSegmentsMemberbvh:SalesOfVoisAndFinancingMember2021-01-012021-12-310000315858us-gaap:OperatingSegmentsMemberbvh:ResortOperationsAndClubManagementMember2021-01-012021-12-310000315858us-gaap:OperatingSegmentsMember2021-01-012021-12-310000315858us-gaap:OperatingSegmentsMemberbvh:SalesOfVoisAndFinancingMember2020-01-012020-12-310000315858us-gaap:OperatingSegmentsMemberbvh:ResortOperationsAndClubManagementMember2020-01-012020-12-310000315858us-gaap:OperatingSegmentsMember2020-01-012020-12-310000315858bvh:BbxCapitalInc.Memberbvh:RecoveriesFromLoanLossesNetMember2020-01-012020-12-310000315858us-gaap:JuniorSubordinatedDebtMember2022-12-310000315858bvh:WoodbridgeMembersrt:MinimumMemberus-gaap:JuniorSubordinatedDebtMemberbvh:LevittCapitalTrustFourMember2022-01-012022-12-310000315858bvh:WoodbridgeMembersrt:MaximumMemberus-gaap:JuniorSubordinatedDebtMemberbvh:LevittCapitalTrustFourMember2022-01-012022-12-310000315858bvh:BluegreenMembersrt:MinimumMemberus-gaap:JuniorSubordinatedDebtMember2022-01-012022-12-310000315858bvh:BluegreenMembersrt:MaximumMemberus-gaap:JuniorSubordinatedDebtMember2022-01-012022-12-310000315858bvh:NotesPayableToBbxCapitalMember2022-12-310000315858bvh:RecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:NonRecourseReceivableBackedNotesPayableMember2022-12-310000315858bvh:CostReimbursementsMember2022-01-012022-12-310000315858bvh:CostReimbursementsMember2021-01-012021-12-310000315858bvh:CostReimbursementsMember2020-01-012020-12-310000315858bvh:OtherFeeBasedServicesRevenueMember2022-01-012022-12-310000315858bvh:OtherFeeBasedServicesRevenueMember2021-01-012021-12-310000315858bvh:OtherFeeBasedServicesRevenueMember2020-01-012020-12-310000315858us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-01-012022-12-310000315858us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-01-012021-12-310000315858bvh:BassProAndCabelaMember2019-06-300000315858bvh:PointIncentivesMember2022-12-310000315858bvh:OwnerProgramsMember2022-12-310000315858bvh:DeferredRevenueVacationPackagesMember2022-12-310000315858bvh:PointIncentivesMember2021-12-310000315858bvh:OwnerProgramsMember2021-12-310000315858bvh:DeferredRevenueVacationPackagesMember2021-12-310000315858bvh:BluegreenMember2021-05-052021-05-050000315858bvh:BluegreenMember2022-12-310000315858bvh:BluegreenBigCedarVacationsLccMember2022-12-310000315858bvh:BluegreenBigCedarVacationsLccMember2021-12-310000315858bvh:BluegreenMember2021-05-100000315858bvh:BluegreenMember2021-05-050000315858bvh:BluegreenMember2021-05-050000315858us-gaap:CommonClassBMember2022-12-310000315858us-gaap:CommonClassAMember2022-12-310000315858bvh:PanamaCityAcquisitionLoanMember2022-12-310000315858bvh:FifthThirdSyndicatedTermLoanMember2022-12-310000315858bvh:FifthThirdSyndicatedLocMember2022-12-310000315858bvh:FifthThirdSyndicatedTermLoanMember2021-12-310000315858bvh:FifthThirdSyndicatedLocMember2021-12-310000315858bvh:BluegreenStatutoryTrustTwoMember2021-02-2800003158582022-01-012022-12-3100003158582015-01-012015-12-310000315858bvh:BbxCapitalInc.Member2020-01-012020-12-3100003158582022-12-3100003158582021-12-310000315858us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-01-012020-12-310000315858us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-01-012020-12-310000315858us-gaap:ParentMember2020-01-012020-12-310000315858us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-3100003158582020-01-012020-12-31iso4217:USDxbrli:sharesiso4217:USDbvh:itembvh:itemxbrli:purexbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission file number 001-09071

BLUEGREEN VACATIONS HOLDING CORPORATION

(Exact name of registrant as specified in its charter)

| | | | |

| Florida | | 59-2022148 | |

| (State or other jurisdiction of | | (I.R.S. Employer | |

| incorporation or organization) | | Identification No.) | |

4960 Conference Way North, Suite 100, Boca Raton, FL 33431

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (561) 912-8000

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Class A Common Stock, $0.01 par value | BVH | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: Class B Common Stock, $0.01 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ¨ | Accelerated Filer x |

Non-accelerated filer o | Smaller reporting company x |

| Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2022, the last day of the registrant’s most recently completed second fiscal quarter, was $312.8 million (based on the closing sale price of the registrant’s Class A common stock on that date on the New York Stock Exchange).

The number of shares outstanding of each of the registrant’s classes of common stock as of March 9, 2023 is as follows:

Class A Common Stock of $.01 par value, 13,373,666 shares outstanding.

Class B Common Stock of $.01 par value, 3,664,117 shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2023 Annual Meeting of Shareholders, expected to be filed with the Securities and Exchange Commission pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended within 120 days after December 31, 2022, are incorporated by reference into Part III of this Annual Report on Form 10-K.

BLUEGREEN VACATIONS HOLDING CORPORATION

FORM 10-K TABLE OF CONTENTS

YEAR ENDED DECEMBER 31, 2022

PART I

Except as otherwise noted or where the context requires otherwise, references in this Annual Report on Form 10-K to, “the Company,” “we,” “us” and “our” refer to Bluegreen Vacations Holding Corporation, together with its consolidated subsidiaries, including Bluegreen Vacations Corporation and its consolidated subsidiaries (“Bluegreen”). References to “BVH” or the “Parent company” refer to Bluegreen Vacations Holding Corporation at its parent company only level.

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include all statements that do not relate strictly to historical or current facts and can be identified by the use of words such as “anticipates,” “estimates,” “expects,” “intends,” “plans,” “believes,” “projects,” “predicts,” “seeks,” “will,” “should,” “would,” “may,” “could,” “outlook,” “potential,” and similar expressions or words and phrases of similar import. Forward-looking statements include, among others, statements relating to the Company’s future financial performance, business prospects and strategy, anticipated financial position, liquidity and capital needs, including conditions surrounding, and the impact of, interest rate increases and the Coronavirus Disease of 2019 (“COVID-19”) pandemic, and other similar matters. These statements are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Actual results may differ materially from those expressed in, or implied by, the forward-looking statements as a result of various factors, including, among others, the following:

BVH has limited sources of cash and is dependent upon distributions from Bluegreen to fund its costs of operations;

risks associated with the Company’s indebtedness, including that the Company will be required to utilize cash flow to service its indebtedness, that indebtedness may make the Company more vulnerable to economic downturns, and that indebtedness may subject the Company to covenants and restrictions on its operations and activities as well as the payment of dividends;

risks associated with the adverse impact of economic conditions, including the impact of the COVID-19 pandemic, supply chain constraints, labor shortages, rising interest rates and inflationary trends on the Company’s operations and results, including its sales of vacation packages, the price and liquidity of the Company’s Class A Common Stock and Class B Common Stock, the performance of the Company’s vacation ownership interest (“VOI”) notes receivable, and the Company’s ability to obtain additional capital, including the risk that if the Company needs or otherwise believes it is advisable to issue debt or equity securities or to incur indebtedness in order to fund the Company’s operations or investments, it may not be able to issue any such securities or obtain such indebtedness on favorable terms or at all, and any issuance could result in the dilution of the interests of the Company’s current shareholders;

risks relating to the availability of financing, the Company’s ability to sell, securitize or borrow against its VOI notes receivable on acceptable terms, and the Company’s ability to successfully increase its credit facility capacity or enter into capital market transactions or other alternatives to provide for sufficient available cash for a sustained period of time;

risks associated with adverse conditions in the stock market, the public debt market, and other capital markets and the impact of such conditions on the Company, as well as risks associated with any failure by the Company to maintain compliance with the listing requirements of the New York Stock Exchange (the “NYSE”), which include, among other things, a minimum average closing price, share volume, and market capitalization;

risks related to potential business expansion or pursuing other strategic opportunities, such as potential resort, land and development activity acquisitions, including that they may involve significant costs and the incurrence of significant indebtedness and may not be successful and that the Company’s efforts and expenses, including those aimed at enhancing the experience of Bluegreen Vacation Club Members, may be greater than anticipated and may not result in the benefits anticipated;

risks relating to public health issues, including that Bluegreen’s business was adversely impacted by the COVID-19 pandemic and any resurgence or future pandemic may have similar or worse effects, and the COVID-19 pandemic may continue to have adverse effects, including due to changes in consumer behavior and preferences, and result in potential future increases in default and delinquency rates;

adverse changes to, expirations or terminations of, or interruptions in, and other risks relating to the Company’s business and strategic relationships, management contracts, exchange networks or other strategic marketing alliances, including the expiration of the Company’s business relationship with Bass Pro at the end of 2024 or that the relationships with Bass Pro and Choice Hotels may not be as profitable as anticipated, or at all, or otherwise not result in the anticipated benefits;

the risks of the real estate market and the risks associated with real estate development, including a decline in real estate values and a deterioration of other conditions relating to the real estate market and real estate development and the risks associated with the Company’s ability to maintain sufficient or desired amounts of VOI inventory for sale;

risks associated with the Company’s ability to comply with applicable regulations, and the costs of compliance efforts or a failure to comply, including risks associated with the Company’s ability to maintain the integrity of internal or customer data, the failure of which could result in damage to its reputation and/or subject the Company to costs, fines or lawsuits;

risks associated with adverse trends or disruptions in economic conditions generally or in the vacation ownership, vacation rental and travel industries, the Company’s ability to compete effectively in the highly competitive vacation ownership industry and against hotel and other hospitality and lodging alternatives and decreased demand from prospective purchasers of VOIs;

risks associated with the Company’s customers’ compliance with their payment obligations under financing provided by the Company, including due to rising interest rates, inflationary trends and the increased presence and efforts of “timeshare-exit” firms; the risk that actions which the Company has taken or may take in response to the efforts of “timeshare-exit” firms may not be successful; and the impact of defaults on the Company’s operating results and liquidity position;

risks associated with the ratings of third-party rating agencies, including the impact of any downgrade on the Company’s ability to obtain, renew or extend credit facilities, or otherwise raise funds;

changes in the Company’s business model and marketing efforts, plans or strategies, which may cause marketing expenses to increase or adversely impact its operating results and financial condition, and such expenses as well as the Company’s investments, including investments in new and expanded sales offices, and other sales and marketing initiatives, including screening methods, data driven analysis, and the restructuring of certain marketing operations during 2022, which include a transition to virtual, unmanned kiosks at certain locations, may not achieve the desired results;

risks associated with technology and factors which may impact the Company’s telemarketing efforts, including cell phone technologies that identify or block marketing vendor calls and regulatory changes;

risks associated with the Company’s relationships with third-party developers, including that third-party developers who provide VOIs to be sold by the Company pursuant to fee-based or just-in-time arrangements may not provide VOIs when planned and that may not fulfill their obligations to the Company or to the homeowners associations that maintain the resorts they developed;

risks associated with legal proceedings and regulatory proceedings, examinations or audits of the Company’s operations, including claims of noncompliance with applicable regulations or for development related defects, and the impact they may have on the Company’s financial condition and operating results;

risks associated with audits of the Company or its subsidiaries’ tax returns, including that they may result in the imposition of additional taxes;

environmental liabilities, including claims with respect to mold or hazardous or toxic substances, and their impact on the Company’s financial condition and operating results;

risks that natural disasters, including hurricanes, earthquakes, fires, floods and windstorms, and other acts of God and conditions beyond the control of the Company may adversely impact the Company’s financial condition and operating results, including due to any damage to physical assets or interruption of access to physical assets or operations resulting therefrom, and the frequency or severity of natural disasters may increase due to climate change or other factors;

risks of cybersecurity threats, including the potential misappropriation of assets or confidential information, corruption of data or operational disruptions;

the updating of, and developments with respect to information technology and computer systems, including the cost of updating technology and the impact that any failure to keep pace with developments in technology could have on the Company’s operations or competitive position, and the Company’s information technology expenditures may not result in the expected benefits;

the Company may not pay dividends in the future when or in the amount expected, or at all; and

the preparation of financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) involves making estimates, judgments and assumptions, and any changes in estimates, judgments and assumptions used could have a material adverse impact on the financial condition and operating results of the Company.

Reference is also made to the other risks and uncertainties discussed in the “Risk Factors” section of, and elsewhere in, this Annual Report on Form 10-K, including those inherent to the Company’s business and the vacation ownership industry and risks related to ownership of the Company’s stock.

These and other risks and uncertainties disclosed in this Annual Report on Form 10-K are not necessarily all of the important factors that could cause the Company’s actual results to differ materially from those expressed in or implied by any of the forward-looking statements. Other unknown or unpredictable factors could cause actual results to differ materially from those expressed in or implied by any of the forward-looking statements. In addition, past performance may not be indicative of future results, and comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, and all such information should only be viewed as historical data.

Given these uncertainties, you are cautioned not to place undue reliance on forward-looking statements. You should read this Annual Report on Form 10-K with the understanding that actual future results, levels of activity, performance, trends, and events and circumstances may be materially different from what the Company expects. The Company qualifies all forward-looking statements by these cautionary statements.

Forward-looking statements speak only as of the date of this Annual Report on Form 10-K.

Market and Industry Data

Market and industry data used in this Annual Report on Form 10-K have been obtained from the Company’s internal surveys, industry publications, unpublished industry data and estimates, discussions with industry sources and other currently available information. The sources for this data include, without limitation, the American Resort Development Association. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of such information. The Company has not independently verified such data. Similarly, the Company’s internal surveys, while believed by the Company to be reliable, have not been verified by any independent sources. Accordingly, such data may not prove to be accurate. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements contained in this Annual Report on Form 10-K, as described above.

Trademarks, Service Marks and Trade Names

The Company owns or has rights to use a number of registered and common law trademarks, trade names and service marks in connection with its business, including, but not limited to, Bluegreen, Bluegreen Resorts, Bluegreen Vacations, Bluegreen Traveler Plus, Bluegreen Vacation Club, Bluegreen Wilderness Club at Big Cedar and the Bluegreen Logo. This Annual Report on Form 10-K also refers to trademarks, trade names and service marks of other organizations. Without limiting the generality of the preceding sentence, World Golf Village is registered by World Golf Foundation, Inc.; Big Cedar, Cabela’s and Bass Pro Shops are registered by Bass Pro Trademarks, LP; RCI is registered by RCI, LLC; Ascend, Ascend Hotel Collection, Ascend Resort Collection, Choice Privileges, Comfort Inn, Comfort Suites, Quality Inn, Sleep Inn, Clarion, Clarion Pointe, Cambria hotels, MainStay Suites, Woodspring Suites, Econo Lodge and Rodeway Inn are registered by Choice Hotels International, Inc.; and Suburban Extended Stay Hotel is registered by Suburban Franchise Systems, Inc. All trademarks, service marks or trade names referred to in this Annual Report on Form 10-K are the property of their respective holders. Solely for convenience, the trademarks, trade names and service marks referred to in this Annual Report on Form 10-K appear without the ® and

™ symbols, but such references are not intended to indicate in any way that the owner will not assert, to the fullest extent under applicable law, all rights to such trademarks, trade names and service marks.

Summary of Risk Factors

The following is a summary of the material risks described in Part I, Item 1A “Risk Factors” of this Annual Report on Form 10-K. While the Company believes that the risks described in the “Risk Factors” section are those that are material to investors, other factors not presently known to the Company or that it currently believes are immaterial may also adversely affect the Company, perhaps materially. The following summary should not be considered an exhaustive summary of the material risks facing the Company, and it should be read in conjunction with the “Risk Factors” section and the other information contained in this Annual Report on Form 10-K. The items discussed below and in the “Risk Factors” section of this Annual Report on Form 10-K involve or contain forward-looking statements. You should refer to the explanation of the qualifications and limitations on forward-looking statements described above.

Risks Related to BVH at its Holding Company Level and to Ownership of its Class A Common Stock and Class B Common Stock

BVH is a holding company which primarily relies on dividends from Bluegreen to service its debt, including its outstanding $50.0 million note to BBX Capital, and to fund its other cash requirements.

The relative fixed voting percentages of our Class A Common Stock and Class B Common Stock and the control position of Alan B. Levan, John E. Abdo, Jarett S. Levan and Seth M. Wise may have an adverse impact on the market price of such securities.

Provisions in our Amended and Restated Articles of Incorporation and Bylaws may make it difficult for a third party to acquire us and could impact the price of the Company’s Class A Common Stock and Class B Common Stock.

Acquisitions may reduce earnings, require additional financing and expose the Company to additional risks.

Substantial sales of our Class A Common Stock or Class B Common Stock (or the perception of future sales) could adversely affect the market price of such securities.

The Company may not pay dividends in the future when or in the amount expected, or at all.

Risks Related to Bluegreen and its Business

Bluegreen is subject to the business, financial and operating risks inherent to the vacation ownership and hospitality industries, including travel, public health and discretionary spending.

Bluegreen’s business and operations, including its ability to market VOIs, may be adversely affected by general economic conditions and conditions affecting the vacation ownership industry and the availability of financing.

Bluegreen may not be able to compete successfully in the highly competitive vacation ownership industry.

Bluegreen generates significant sales from its strategic partnerships and relationships and is subject to risks related to those partnerships and arrangements, including that they may be terminated or not renewed, and may not be as successful as anticipated.

Bluegreen is subject to risks related to its ability to comply with applicable laws, rules and regulations, the costs of compliance or any failure to comply, and changes in laws, rules and regulations.

Bluegreen’s business and results may be impacted if financing is not available on favorable terms, or at all.

Bluegreen’s results and liquidity would be adversely impacted if it experiences increased defaults on its notes receivable portfolio.

The ratings of third-party rating agencies could adversely impact Bluegreen’s ability to obtain, renew or extend credit facilities, or otherwise raise funds.

Bluegreen may not market products and services successfully or efficiently.

Bluegreen may be unable to develop or acquire VOI inventory or enter into and maintain fee-based relationships to source VOI inventory.

Bluegreen is subject to risks associated with its management of resort properties and, with respect to properties not managed by Bluegreen, risks associated with its dependence on the managers of those resorts.

Bluegreen may not continue to participate in, and Bluegreen’s customers may not be satisfied with its, exchange networks and other strategic alliances.

Bluegreen’s business and results could be adversely impacted if maintenance costs increase and there is resistance to increases in maintenance fees.

Strategic transactions which Bluegreen may pursue may not be successful and may have adverse impacts, including diversion of management attention and the incurrence of significant expenses.

The resale market for VOIs could adversely affect Bluegreen’s business.

Bluegreen’s insurance policies may not cover potential losses, including losses relating to hurricanes, other natural disasters or closures in connection with public health issues.

Bluegreen’s business may be adversely impacted by negative publicity, including information spread through social media.

Risks Related to the Real Estate Market and Real Estate Development

Bluegreen is subject to the risks of the real estate market and real estate development, including a decline in real estate values, a deterioration of other conditions relating to the real estate market and real estate development, and potential environmental liabilities.

Risks Related to our Indebtedness

The Company’s, including Bluegreen’s, indebtedness could limit its activities and adversely impact its results and financial condition.

Changes to and replacement of the LIBOR benchmark interest rate could adversely affect the Company’s, including Bluegreen’s, results of operations and liquidity.

Risks Related to Technology, Privacy and Intellectual Property Rights

Bluegreen would be adversely impacted if it fails to maintain the integrity of internal or customer data.

Bluegreen may not be able to keep pace with technological developments, and the cost involved in updating technology may be significant.

A failure to protect Bluegreen or its business partners’ intellectual property rights could adversely affect Bluegreen’s business.

General Risks

Legal and regulatory proceedings could adversely affect the Company’s financial condition and operating results.

The loss of key management or personnel could adversely affect the Company’s business.

The preparation of the Company’s financial statements in accordance with GAAP involves estimates, judgments and assumptions, as to which there are inherent uncertainties, and changes thereto could adversely impact the Company’s operating results and financial condition.

The Company’s stock price may be volatile or may decline regardless of the Company’s operating performance.

A failure to maintain proper and effective internal controls could have adverse impacts.

The Company’s shareholders’ interests may be diluted by future stock issuances.

If securities or industry analysts do not publish research or publish unfavorable research about the Company’s business, the Company’s stock price and trading volume could decline.

Item 1. Business.

Overview

The Company’s sole activities relate to the activities of Bluegreen, a leading vacation ownership company that markets and sells VOIs and manages resorts in popular leisure and urban destinations. Bluegreen, which was previously a 93% owned subsidiary of the Company became a wholly owned subsidiary of the Company in May 2021.

On September 30, 2020, the Company completed its spin-off of BBX Capital, Inc. (“BBX Capital”). BBX Capital was a wholly owned subsidiary of the Company prior to the spin-off and became a separate public company as a result

of the spin-off. BBX Capital holds all of the historical business and investments of the Company other than the Company’s investment in Bluegreen. BBX Capital and its subsidiaries are presented as discontinued operations in the Company’s financial statements.

In connection with the spin-off, the Company’s name was changed from BBX Capital Corporation to Bluegreen Vacations Holding Corporation. The Company also issued a $75.0 million note payable to BBX Capital (of which $50.0 million remained outstanding at December 31, 2022). The note accrues interest at a rate of 6% per annum and requires payments of interest on a quarterly basis. Under the terms of the note, the Company has the option in its discretion to defer interest payments under the note, with interest on the entire outstanding balance thereafter to accrue at a cumulative, compounded rate of 8% per annum until such time as the Company is current on all accrued payments under the note, including deferred interest. All remaining outstanding amounts under the note will become due and payable in September 2025 or earlier upon the occurrence of certain other events.

On May 5, 2021, the Company acquired approximately 7% of outstanding shares of Bluegreen’s common stock not previously owned by the Company through a statutory short-form merger under Florida law. In connection with the merger, Bluegreen’s shareholders (other than the Company) received 0.51 shares of the Company’s Class A Common Stock for each share of Bluegreen’s common stock that they held at the effective time of the merger (subject to rounding up of fractional shares). The Company issued approximately 2.66 million shares of its Class A Common Stock in connection with the merger. As a result of the completion of the merger, Bluegreen became a wholly owned subsidiary of the Company and its common stock was no longer publicly traded.

In July 2020, the Company effected a one-for-five reverse split of its Class A Common Stock and Class B Common Stock. Share and per share amounts set forth herein have been retroactively adjusted to reflect the one-for-five reverse stock split as if it had occurred as of January 1, 2020.

Our Business

Bluegreen is a leading vacation ownership company that markets and sells VOIs and manages resorts in popular leisure and urban destinations. Bluegreen’s resort network includes 46 Club Resorts (resorts in which owners in the Bluegreen Vacation Club (“Vacation Club”) have the right to control and use most of the units in connection with their VOI ownership) and 23 Club Associate Resorts (resorts in which owners in the Vacation Club have the right to use only a limited number of units in connection with their VOI ownership). These Club Resorts and Club Associate Resorts are primarily located in high-volume, “drive-to” vacation locations, including Orlando, Las Vegas, Myrtle Beach, Charleston and New Orleans, among others. In addition, in October 2022 Bluegreen purchased a resort located in Panama City Beach, Florida. Bluegreen expects this resort to be available for use by Bluegreen Vacation Club owners in 2023. Through Bluegreen’s points-based system, the approximately 218,000 owners in the Vacation Club have the flexibility to stay at units available at any of Bluegreen’s resorts and have access to over 11,400 other hotels and resorts through partnerships and exchange networks. Bluegreen’s sales and marketing platform is currently supported by marketing relationships with nationally-recognized consumer brands, such as Bass Pro and Choice Hotels. The Company believes these marketing relationships have helped generate sales within its core demographic, as described below.

The Vacation Club has grown from approximately 170,000 owners as of December 31, 2012 to approximately 218,000 owners as of December 31, 2022. The average Vacation Club owner is 48 years old and has an average annual household income of approximately $84,000. According to U.S. census data, households with an annual income of $50,000 to $100,000 represent approximately 28% of the total population. Bluegreen believes its ability to effectively scale the transaction size to suit its customer, as well as its high-quality, conveniently-located, “drive-to” resorts are key factors in attracting its core target demographic.

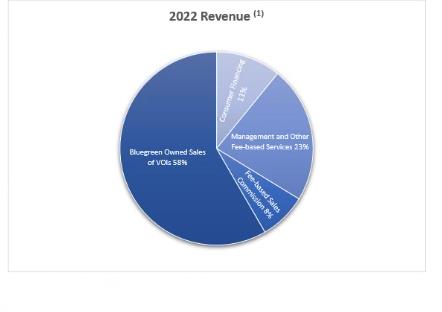

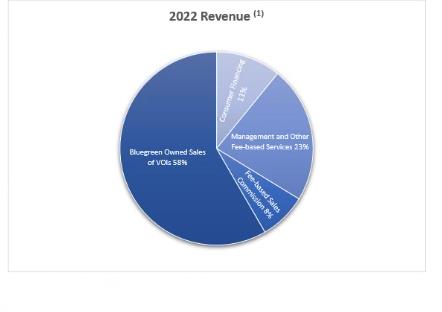

(1)Excludes “Other Income, Net”.

The COVID-19 pandemic caused significant disruptions in international and U.S. economies and markets, and had an unprecedented impact on the travel and hospitality industries, including a material adverse impact on Bluegreen’s results, especially during 2020 and to a lesser extent in 2021, as previously described in the Company’s filings with the SEC. Bluegreen believes that the increase in sales of VOIs in 2022 reflect the recovery from the pandemic and high demand for domestic travel despite ongoing COVID-19 cases and higher interest rates and inflationary trends. While we hope that improvements in the travel and leisure industry continue, the impact of economic challenges and public health concerns on the Bluegreen’s business and operating results is uncertain.

Products

Vacation Ownership Interests

Since entering the vacation ownership industry in 1994, Bluegreen has generated over 807,000 VOI sales transactions. Vacation Club owners receive an annual or biennial allotment of “points” in perpetuity (supported by an underlying deeded VOI held in trust for the owner) that may be used to stay at any of Bluegreen’s Club Resorts and Club Associate Resorts. Vacation Club owners can use their points to stay in resorts for varying lengths of time, starting at a minimum of two nights. The number of points required for a stay at a resort depends on a variety of factors, including resort location, size of the unit, vacation season and the days of the week. Under this system, Vacation Club owners can select vacations according to their schedules, space needs and available points. Subject to certain restrictions and fees, Vacation Club owners are typically allowed to carry over any unused points for one year and to “borrow” points from the next year.

Each of Bluegreen’s Club Resorts and Club Associate Resorts is managed by an HOA, which is governed by a board of directors or trustees. The board hires a management company to which it delegates many of the responsibilities of the HOA, including landscaping, security, housekeeping, garbage collection, utilities, insurance procurement, laundry and repairs and maintenance. Vacation Club owners pay annual maintenance fees which cover the costs of operating all of the resorts in the Vacation Club system, including fees for real estate taxes and reserves for capital improvements. If a Vacation Club owner does not pay such charges, his or her use rights may be suspended and ultimately terminated, subject to the applicable lender’s first mortgage lien, if any, on such owner’s VOI. Bluegreen provides management services to 50 resorts and the Vacation Club through contractual arrangements with HOAs. Bluegreen has historically had a 100% renewal rate on management contracts from Club Resorts.

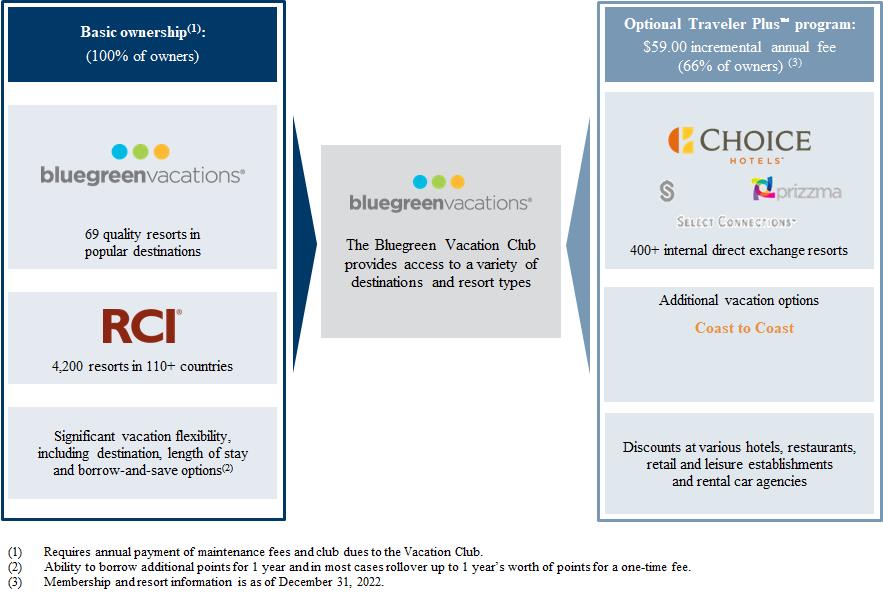

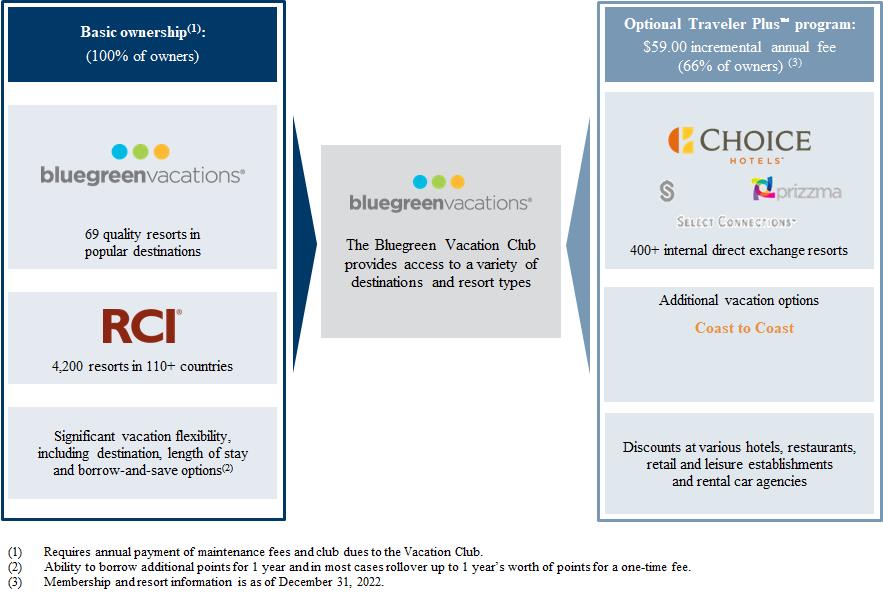

The Vacation Club’s points-based platform offers owners significant flexibility. As reflected in the chart below, basic Vacation Club ownership entitles owners to use their points to stay at any of Bluegreen’s Club Resorts and Club

Associate Resorts, as well as to access more than 4,200 resorts available through the Resort Condominiums International, LLC (“RCI”) exchange network. For a nominal annual fee and transaction fees, Vacation Club owners can join and utilize the Traveler Plus program, which enables them to use their points to access an additional 48 direct exchange resorts, and other vacation experiences. Traveler Plus members can also directly use their Vacation Club points for stays in Choice Hotels’ Ascend Hotel Collection properties and Cambria Hotels and other benefits. Overall, there are more than 7,000 hotels in the Choice Hotels network, located in over 40 countries and territories, and Choice Hotels’ brands include the Ascend Hotel Collection, Comfort Inn, Comfort Suites, Quality Inn, Sleep Inn, Clarion, Clarion Pointe, Cambria Hotels and Suites, MainStay Suites, Suburban Extended Stay Hotel, Econo Lodge, Rodeway Inn, WoodSpring Suites and Everhome Suites. In addition, Vacation Club owners can convert their Vacation Club points into Choice Privileges points, which can be used for stays in Choice Hotels’ properties. Bluegreen remains focused on providing value to its Vacation Club owners through enhanced product offerings, new resort locations, broader vacation experiences and technological improvements, all designed to increase guest satisfaction.

Approximately 66% of Vacation Club owners were enrolled in Traveler Plus as of December 31, 2022.

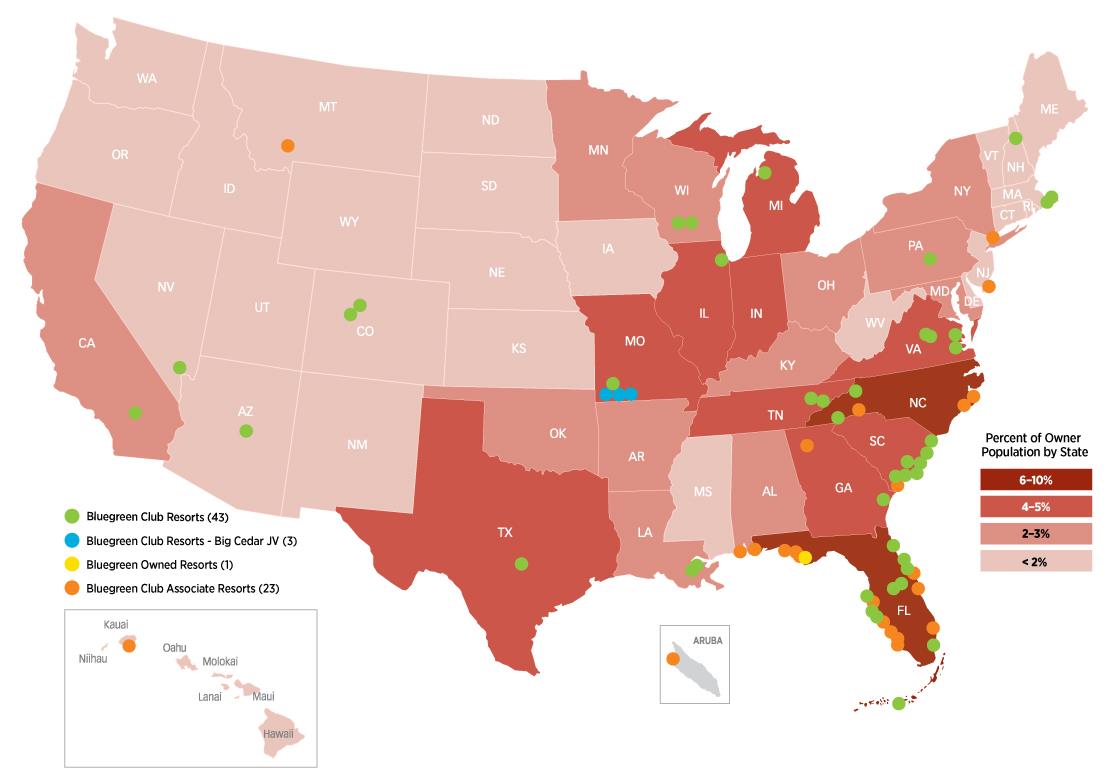

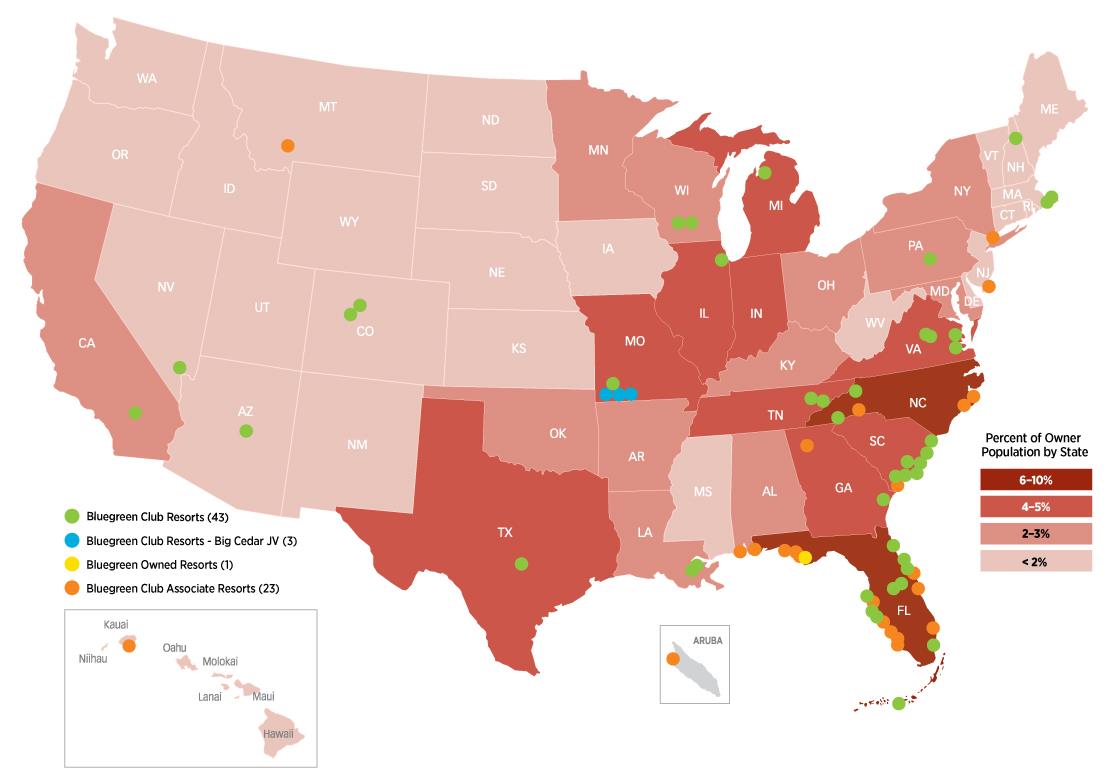

Vacation Club Resort Locations

As shown in the map below, Vacation Club resorts are primarily located on the U.S. East Coast and Midwest. The 48 direct-exchange resorts available to Traveler Plus members are concentrated along the West Coast and Hawaii. The Company believes that, together, this provides a broad geographic offering of resorts available to Vacation Club owners.

Vacation Club resorts are primarily “drive-to” resort destinations as approximately 88% of Bluegreen’s Vacation Club owners live within a four-hour drive of at least one resort. Bluegreen resorts are generally located in popular vacation destinations, such as Florida, South Carolina, North Carolina, Tennessee, Virginia, Texas, Louisiana, and Nevada, and represent a diverse mix of resort and urban destinations, allowing Vacation Club owners the ability to customize their vacation experience. In addition, Bluegreen expects to offer Vacation Club owners access to our new Panama City Beach resort in 2023.

Bluegreen’s resort network also offers a diverse mix of experiences and accommodations. Unlike some of Bluegreen’s competitors that maintain static brand design standards across resorts and geographies, Bluegreen seeks to design resorts that capture the uniqueness of a particular location. The goal of Bluegreen’s resorts is to offer an authentic experience and connection to the resorts’ unique and varied locations.

Bluegreen resorts typically feature condominium-style accommodations with amenities such as fully equipped kitchens, entertainment centers and in-room laundry appliances. Many resorts feature a clubhouse (including a pool, game room and lounge), hotel-type staff and concierge services.

Bluegreen also owns a 51% interest in Bluegreen/Big Cedar Vacations, which develops, markets and sells VOIs at three premier wilderness-themed resorts adjacent to Table Rock Lake near Branson, Missouri: The Bluegreen Wilderness Club at Big Cedar, The Cliffs at Long Creek and Paradise Point. The remaining 49% interest in Bluegreen/Big Cedar Vacations is held by Big Cedar, LLC, an affiliate of Bass Pro. As a result of Bluegreen’s controlling interest in Bluegreen/Big Cedar Vacations, the Company’s consolidated financial statements include the results of operations and financial condition of Bluegreen/Big Cedar Vacations.

Vacation Club Resorts

| | | | | | | | |

| | Club Resorts | | Location | | Total

units (1) | Managed

by

Bluegreen (2) | Sales

center (5) |

1 | | Cibola Vista Resort and Spa | | Peoria, Arizona | | 343 | ü | ü |

2 | | The Club at Big Bear Village | | Big Bear Lake, California | | 38 | ü | |

3 | | The Innsbruck Aspen | | Aspen, Colorado | | 17 | ü | |

4 | | Streamside Cedar Resort | | Vail, Colorado | | 46 | ü | |

5 | | Via Roma Beach Resort | | Bradenton Beach, Florida | | 28 | ü | |

6 | | Daytona SeaBreeze | | Daytona Beach Shores, Florida | | 78 | ü | ü |

7 | | Resort Sixty-Six | | Holmes Beach, Florida | | 28 | ü | |

8 | | The Hammocks at Marathon | | Marathon, Florida | | 58 | ü | |

9 | | The Fountains, Lake Eve and Oasis Lakes | | Orlando, Florida | | 842 | ü | ü |

10 | | Orlando’s Sunshine Resort I & II | | Orlando, Florida | | 84 | ü | |

11 | | Casa del Mar Beach Resort | | Ormond Beach, Florida | | 118 | ü | |

12 | | Grande Villas at World Golf Village & The Resort at World Golf Village | | St. Augustine, Florida | | 214 | ü | ü |

13 | | Bluegreen at Tradewinds | | St. Pete Beach, Florida | | 160 | ü | ü |

14 | | Solara Surfside (6) | | Surfside, Florida | | 60 | ü | |

15 | | Studio Homes at Ellis Square | | Savannah, Georgia | | 28 | ü | ü |

16 | | The Hotel Blake | | Chicago, Illinois | | 160 | ü | ü |

17 | | Bluegreen Club La Pension | | New Orleans, Louisiana | | 64 | ü | |

18 | | Marquee | | New Orleans, Louisiana | | 94 | ü | ü |

19 | | The Breakers | | Dennis Port, Massachusetts | | 52 | ü | |

20 | | The Soundings Seaside Resort | | Dennis Port, Massachusetts | | 69 | ü | |

21 | | Mountain Run at Boyne & Hemlock | | Boyne Falls, Michigan | | 205 | ü | ü |

22 | | The Falls Village | | Branson, Missouri | | 293 | ü | ü |

23 | | Paradise Point Resort (4) | | Hollister, Missouri | | 150 | ü | |

24 | | Bluegreen Wilderness Club at Big Cedar (4) | | Ridgedale, Missouri | | 445 | ü | ü |

25 | | The Cliffs at Long Creek (4) | | Ridgedale, Missouri | | 106 | ü | |

26 | | Bluegreen Club 36 | | Las Vegas, Nevada | | 476 | ü | ü |

27 | | South Mountain Resort | | Lincoln, New Hampshire | | 116 | ü | ü |

28 | | Blue Ridge Village I,II and III | | Banner Elk, North Carolina | | 132 | ü | |

29 | | Club Lodges at Trillium | | Cashiers, North Carolina | | 58 | ü | |

30 | | The Suites at Hershey | | Hershey, Pennsylvania | | 78 | ü | |

31 | | The Lodge Alley Inn | | Charleston, South Carolina | | 90 | ü | ü |

32 | | King 583 | | Charleston, South Carolina | | 50 | ü | |

33 | | Carolina Grande | | Myrtle Beach, South Carolina | | 118 | ü | ü |

34 | | Harbour Lights | | Myrtle Beach, South Carolina | | 324 | ü | ü |

35 | | Horizon at 77th | | Myrtle Beach, South Carolina | | 88 | ü | |

36 | | SeaGlass Tower | | Myrtle Beach, South Carolina | | 136 | ü | |

37 | | Shore Crest Vacation Villas I & II | | North Myrtle Beach, South Carolina | | 240 | ü | ü |

38 | | MountainLoft I & II | | Gatlinburg, Tennessee | | 394 | ü | ü |

39 | | Laurel Crest | | Pigeon Forge, Tennessee | | 298 | ü | ü |

40 | | Eilan Hotel and Spa | | San Antonio, Texas | | 163 | ü | ü |

41 | | Shenandoah Crossing | | Gordonsville, Virginia | | 136 | ü | ü |

42 | | Bluegreen Wilderness Traveler at Shenandoah | | Gordonsville, Virginia | | 146 | ü | |

43 | | BG Patrick Henry Square | | Williamsburg, Virginia | | 130 | ü | ü |

44 | | Parkside Williamsburg Resort | | Williamsburg, Virginia | | 107 | ü | |

45 | | Bluegreen Odyssey Dells & Pirate's Lodge | | Wisconsin Dells, Wisconsin | | 92 | ü | |

46 | | Christmas Mountain Village | | Wisconsin Dells, Wisconsin | | 381 | ü | ü |

| | | | Total Units | | 7,533 | | |

| | | | | | |

| | Club Associate Resorts | | Location | | Managed by Bluegreen (2) |

1 | | Paradise Isle Resort | | Gulf Shores, Alabama | | |

2 | | Shoreline Towers Resort | | Gulf Shores, Alabama | | |

3 | | La Cabana Beach Resort & Casino (3) | | Oranjestad, Aruba | | |

4 | | Dolphin Beach Club | | Daytona Beach Shores, Florida | | ü |

5 | | Fantasy Island Resort II | | Daytona Beach Shores, Florida | | ü |

6 | | Mariner’s Boathouse and Beach Resort | | Fort Myers Beach, Florida | | |

7 | | Tropical Sands Resort | | Fort Myers Beach, Florida | | |

8 | | Windward Passage Resort | | Fort Myers Beach, Florida | | |

9 | | Gulfstream Manor | | Gulfstream, Florida | | ü |

10 | | Outrigger Beach Club | | Ormond Beach, Florida | | |

11 | | Landmark Holiday Beach Resort | | Panama City Beach, Florida | | |

12 | | Ocean Towers Beach Club | | Panama City Beach, Florida | | |

13 | | Panama City Resort & Club | | Panama City Beach, Florida | | |

14 | | Surfrider Beach Club | | Sanibel Island, Florida | | |

15 | | Petit Crest Villas and Golf Club Villas at Big Canoe | | Marble Hill, Georgia | | |

16 | | Pono Kai Resort | | Kapaa (Kauai), Hawaii | | |

17 | | Lake Condominiums at Big Sky | | Big Sky, Montana | | |

18 | | Foxrun Townhouses | | Lake Lure, North Carolina | | |

19 | | Sandcastle Village II | | New Bern, North Carolina | | |

20 | | Waterwood Townhouses | | New Bern, North Carolina | | |

21 | | Bluegreen at Atlantic Palace | | Atlantic City, New Jersey | | |

22 | | The Manhattan Club | | New York, New York | | |

23 | | Players Club | | Hilton Head Island, South Carolina | | |

(1)Represents the total number of units at the Club Resort. Owners in the Vacation Club have the right to use most of the units at each Club Resort in connection with their VOI ownership.

(2)Resorts managed by Bluegreen Resorts Management, Inc., Bluegreen’s wholly-owned subsidiary (“Bluegreen Resorts Management”).

(3)This resort is managed by Casa Grande Cooperative Association I, which has contracted with Bluegreen Resorts Management to provide management consulting services to the resort. The services provided by Bluegreen Resorts Management to this resort pursuant to such agreement are similar in nature to, but less extensive than, the services provided by Bluegreen or its subsidiaries to the other resorts listed in the table as “Managed by Bluegreen.” Further, Vacation Club owners can access most of the units at this resort.

(4)This resort is developed, marketed and sold by Bluegreen/Big Cedar Vacations.

(5)In addition to the sales centers identified in the table, Bluegreen also operates a sales center in Memphis, Tennessee.

(6)This resort and sales center are temporarily closed.

As previously described, in addition to resorts listed above, in October 2022, Bluegreen purchased a resort located in Panama City Beach, Florida. Bluegreen expects this resort to be available for use by Bluegreen Vacation Club owners in 2023.

Marketing and Sale of Inventory

VOI sales are typically generated by attracting prospective customers (“guests”) to tour a resort and attend a sales presentation (a “guest tour”). Bluegreen’s sales and marketing platforms utilize a variety of methods to attract prospective customers, drive guest tour flow and sell VOIs in its Vacation Club. Bluegreen utilizes marketing alliances with nationally-recognized brands, which provide access to venues which target consumers generally matching Bluegreen’s core demographic. To a lesser extent, guests are also sourced through programs which generate leads at high-traffic venues and in high-density tourist locations and events, as well as through referrals from existing owners and other guests at Bluegreen’s properties.

Many of Bluegreen’s marketing programs intended to attract prospective customers involve the sale of a discounted vacation package that typically includes a two to three night stay in close proximity to one of Bluegreen’s sales offices and requires participation in a guest tour. Vacation packages may be sold either in retail brick and mortar establishments, such as Bass Pro and Cabela’s stores and malls, through Bluegreen’s call transfer program with Choice, or via telemarketing. During the year ended December 31, 2022, Bluegreen sold approximately 169,000 vacation packages and 25% of its VOI sales were made to guests who had previously purchased a vacation package and attended a guest tour. As of December 31, 2022, Bluegreen had a pipeline of over 165,000 vacation packages sold to new customers. While there is no assurance that this will continue to be the case, prior to the impact of COVID-19 on travel, historically approximately 40% to 42% of vacation packages resulted in guest tours at one of Bluegreen’s