Preliminary Pricing Supplement dated March 8, 2021

|

Preliminary Pricing Supplement

(To the Prospectus dated August 1, 2019, the Prospectus Supplement dated August 1, 2019, the Underlying

Supplement dated August 1, 2019 and the Prospectus Supplement Addendum dated February 18, 2021) |

Filed Pursuant to Rule 424(b)(2)

Registration No. 333—232144

|

|

$[●]

Callable Contingent Coupon Notes due March 14, 2023

Linked to the Nasdaq-100 Index®

Global Medium-Term Notes, Series A

|

|

Issuer:

|

Barclays Bank PLC

|

|

Denominations:

|

Minimum denomination of $1,000, and integral multiples of $1,000 in excess thereof

|

|

Initial Valuation Date:

|

March 9, 2021

|

|

Issue Date:

|

March 12, 2021

|

|

Final Valuation Date:*

|

March 9, 2023

|

|

Maturity Date:*

|

March 14 2023

|

|

Reference Asset:

|

The Nasdaq-100 Index® (Bloomberg ticker symbol “NDX Index”)

|

|

Payment at Maturity:

|

If the Notes are not redeemed prior to scheduled maturity, and if you hold the Notes to maturity, you will receive on the Maturity Date a cash payment per $1,000 principal amount Note that you hold (in each case, in addition to any Contingent Coupon that may be payable on such date) determined as follows:

■

If the Final Value of the Reference Asset is greater than or equal to the Barrier Value, you will receive a payment of $1,000 per $1,000 principal amount Note

■

If the Final Value of the Reference Asset is less than the Barrier Value, you will receive an amount per $1,000 principal amount Note calculated as follows:

$1,000 + [$1,000 × Reference Asset Return of the Reference Asset]

If the Notes are not redeemed prior to scheduled maturity, and if the Final Value of the Reference Asset is less than the Barrier Value, your Notes will be fully exposed to the decline of the Reference Asset from the Initial Value. You may lose up to 100.00% of the principal amount of your Notes at maturity.

Any payment on the Notes, including any repayment of principal, is not guaranteed by any third party and is subject to (a) the creditworthiness of Barclays Bank PLC and (b) the risk of exercise of any U.K. Bail-in Power (as described on page PS-4 of this pricing supplement) by the relevant U.K. resolution authority. If Barclays Bank PLC were to default on its payment obligations or become subject to the exercise of any U.K. Bail-in Power (or any other resolution measure) by the relevant U.K. resolution authority, you might not receive any amounts owed to you under the Notes. See “Consent to U.K. Bail-in Power” and “Selected Risk Considerations” in this pricing supplement and “Risk Factors” in the accompanying prospectus supplement for more information.

|

|

Consent to U.K. Bail-in Power:

|

Notwithstanding any other agreements, arrangements or understandings between Barclays Bank PLC and any holder or beneficial owner of the Notes, by acquiring the Notes, each holder and beneficial owner of the Notes acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority. See “Consent to U.K. Bail-in Power” on page PS-4 of this pricing supplement.

|

|

|

Initial Issue Price(1)

|

Price to Public

|

Agent’s Commission(2)

|

Proceeds to Barclays Bank PLC

|

|

Per Note

|

$1,000

|

100.00%

|

0.60%

|

99.40%

|

|

Total

|

$[●]

|

$[●]

|

$[●]

|

$[●]

|

|

(1)

|

Because dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all selling concessions, fees or commissions, the public offering price for investors purchasing the Notes in such fee-based advisory accounts may be between $994.00 and $1,000 per Note. Investors that hold their Notes in fee-based advisory or trust accounts may be charged fees by the investment advisor or manager of such account based on the amount of assets held in those accounts, including the Notes.

|

|

(2)

|

Our estimated value of the Notes on the Initial Valuation Date, based on our internal pricing models, is expected to be between $940.00 and $986.90 per Note. The estimated value is expected to be less than the initial issue price of the Notes. See “Additional Information Regarding Our Estimated Value of the Notes” on page PS—5 of this pricing supplement.

|

|

(3)

|

Barclays Capital Inc. will receive commissions from the Issuer of up to $6.00 per $1,000 principal amount Note. Barclays Capital Inc. will use these commissions to pay variable selling concessions or fees (including custodial or clearing fees) to other dealers. Barclays Capital Inc. will pay from these commissions a structuring fee of up to $1.00 per $1,000 principal amount Note. In no case will the total amount of selling concessions, structuring and other distribution related fees exceed $6.00 per $1,000 principal amount Note.

|

|

Terms of the Notes, Continued

|

|

|

Early Redemption at the Option of the Issuer:

|

The Notes cannot be redeemed for the first six months after the Issue Date. We may redeem the Notes (in whole but not in part) at our sole discretion without your consent at the Redemption Price set forth below on any Call Valuation Date. No further amounts will be payable on the Notes after they have been redeemed.

|

|

Contingent Coupon:*

|

$25.00 per $1,000 principal amount Note, which is 2.50% of the principal amount per Note (based on 10.00% per annum rate)

If the Closing Value of the Reference Asset on an Observation Date is greater than or equal to the Coupon Barrier Value, you will receive a Contingent Coupon on the related Contingent Coupon Payment Date. If the Closing Value of the Reference Asset on an Observation Date is less than the Coupon Barrier Value, you will not receive a Contingent Coupon on the related Contingent Coupon Payment Date.

|

|

Observation Dates:*

|

The 9th calendar day of each March, June, September and December during the term of the Notes, beginning in June 2021, provided that the final Observation Date will be the Final Valuation Date

|

|

Contingent Coupon Payment Dates:*

|

With respect to any Observation Date, the third business day after such Observation Date, provided that the Contingent Coupon Payment Date with respect to the Final Valuation Date will be the Maturity Date

|

|

Call Valuation Dates:*

|

Each Observation Date during the term of the Notes, beginning in September 2021 and ending in and including December 2022. If we exercise our early redemption option on a Call Valuation Date, we will provide written notice to the trustee on such Call Valuation Date.

|

|

Call Settlement Date:*

|

The Contingent Coupon Payment Date following the Call Valuation Date on which we exercise our early redemption option

|

|

Initial Value:

|

[●], the Closing Value on the Initial Valuation Date

|

|

Coupon Barrier Value:

|

[●], 70.00% of its Initial Value (rounded to two decimal places)

|

|

Barrier Value:

|

[●], 70.00% of its Initial Value (rounded to two decimal places)

|

|

Final Value:

|

The Closing Value on the Final Valuation Date

|

|

Redemption Price:

|

$1,000 per $1,000 principal amount Note that you hold, plus the Contingent Coupon that will otherwise be payable on the Call Settlement Date

|

|

Reference Asset Return:

|

The performance of the Reference Asset from the Initial Value to the Final Value, calculated as follows:

Final Value — Initial Value

Initial Value |

|

Closing Value:

|

The term “Closing Value” means the closing level of the Reference Asset, as further described under “Reference Assets—Indices—Special Calculation Provisions” in the prospectus supplement, rounded to two decimal places (if applicable).

|

|

Calculation Agent:

|

Barclays Bank PLC

|

|

CUSIP / ISIN:

|

06748EEE9 / US06748EEE95

|

|

|

●

|

Prospectus dated August 1, 2019:

|

|

●

|

Prospectus Supplement dated August 1, 2019:

|

|

●

|

Underlying Supplement dated August 1, 2019:

|

|

●

|

Prospectus Supplement Addendum dated February 18, 2021:

|

|

●

|

You do not seek an investment that produces fixed periodic interest or coupon payments or other non-contingent sources of current income, and you can tolerate receiving few or no Contingent Coupons over the term of the Notes in the event the Closing Value of the Reference Asset falls below the Coupon Barrier Value on one or more of the specified Observation Dates.

|

|

●

|

You understand and accept that you will not participate in any appreciation of the Reference Asset, which may be significant, and that your return potential on the Notes is limited to the Contingent Coupons, if any, paid on the Notes.

|

|

●

|

You can tolerate a loss of a significant portion or all of the principal amount of your Notes, and you are willing and able to make an investment that may have the full downside market risk of an investment in the Reference Asset.

|

|

●

|

You do not anticipate that the Closing Value of the Reference Asset will fall below the Coupon Barrier Value on any Observation Date or below its Barrier Value on the Final Valuation Date.

|

|

●

|

You understand and accept that you will not be entitled to receive dividends or distributions that may be paid to holders of a Reference Asset or any securities to which a Reference Asset provides exposure, nor will you have any voting rights with respect to a Reference Asset or any securities to which a Reference Asset provides exposure.

|

|

●

|

You understand and accept the risks that (a) you will not receive a Contingent Coupon if the Closing Value of the Reference Asset is less than the Coupon Barrier Value on an Observation Date and (b) you will lose some or all of your principal at maturity if the Final Value of the Reference Asset is less than the Barrier Value.

|

|

●

|

You understand and are willing and able to accept the risks associated with an investment linked to the performance of the Reference Asset.

|

|

●

|

You are willing and able to accept the risk that the Notes may be redeemed prior to scheduled maturity and that you may not be able to reinvest your money in an alternative investment with comparable risk and yield.

|

|

●

|

You can tolerate fluctuations in the price of the Notes prior to scheduled maturity that may be similar to or exceed the downside fluctuations in the value of the Reference Asset.

|

|

●

|

You do not seek an investment for which there will be an active secondary market, and you are willing and able to hold the Notes to maturity if the Notes are not redeemed.

|

|

●

|

You are willing and able to assume our credit risk for all payments on the Notes.

|

|

●

|

You are willing and able to consent to the exercise of any U.K. Bail-in Power by any relevant U.K. resolution authority.

|

|

●

|

You seek an investment that produces fixed periodic interest or coupon payments or other non-contingent sources of current income, and/or you cannot tolerate receiving few or no Contingent Coupons over the term of the Notes in the event the Closing Value of the Reference Asset falls below the Coupon Barrier Value on one or more of the specified Observation Dates.

|

|

●

|

You seek an investment that participates in the full appreciation of the Reference Asset rather than an investment with a return that is limited to the Contingent Coupons, if any, paid on the Notes.

|

|

●

|

You seek an investment that provides for the full repayment of principal at maturity, and/or you are unwilling or unable to accept the risk that you may lose some or all of the principal amount of the Notes in the event that the Final Value of the Reference Asset falls below the Barrier Value.

|

|

●

|

You anticipate that the Closing Value of the Reference Asset will decline during the term of the Notes such that the Closing Value of the Reference Asset will fall below the Coupon Barrier Value on one or more Observation Dates and/or the Final Value of the Reference Asset will fall below the Barrier Value.

|

|

●

|

You do not understand and/or are unwilling or unable to accept the risks associated with an investment linked to the performance of the Reference Asset.

|

|

●

|

You are unwilling or unable to accept the risk that the Notes may be redeemed prior to scheduled maturity.

|

|

●

|

You seek an investment that entitles you to dividends or distributions on, or voting rights related to a Reference Asset or any securities to which a Reference Asset provides exposure.

|

|

●

|

You cannot tolerate fluctuations in the price of the Notes prior to scheduled maturity that may be similar to or exceed the downside fluctuations in the value of the Reference Asset.

|

|

●

|

You seek an investment for which there will be an active secondary market, and/or you are unwilling or unable to hold the Notes to maturity if the Notes are not redeemed.

|

|

●

|

You prefer the lower risk, and therefore accept the potentially lower returns, of fixed income investments with comparable maturities and credit ratings.

|

|

●

|

You are unwilling or unable to assume our credit risk for all payments on the Notes.

|

|

●

|

You are unwilling or unable to consent to the exercise of any U.K. Bail-in Power by any relevant U.K. resolution authority.

|

|

■

|

Hypothetical Initial Value of the Reference Asset: 100.00*

|

|

■

|

Hypothetical Coupon Barrier Value of the Reference Asset: 70.00 (70.00% of the hypothetical Initial Value set forth above)*

|

|

■

|

Hypothetical Barrier Value of the Reference Asset: 70.00 (70.00% of the hypothetical Initial Value set forth above)*

|

|

■

|

You hold the Notes to maturity, and the Notes are NOT redeemed prior to scheduled maturity.

|

|

Final Value

|

Reference Asset Return

|

Payment at Maturity**

|

|

$150.00

|

50.00%

|

$1,000.00

|

|

$140.00

|

40.00%

|

$1,000.00

|

|

$130.00

|

30.00%

|

$1,000.00

|

|

$120.00

|

20.00%

|

$1,000.00

|

|

$110.00

|

10.00%

|

$1,000.00

|

|

$100.00

|

0.00%

|

$1,000.00

|

|

$90.00

|

-10.00%

|

$1,000.00

|

|

$80.00

|

-20.00%

|

$1,000.00

|

|

$70.00

|

-30.00%

|

$1,000.00

|

|

$60.00

|

-40.00%

|

$600.00

|

|

$50.00

|

-50.00%

|

$500.00

|

|

$40.00

|

-60.00%

|

$400.00

|

|

$30.00

|

-70.00%

|

$300.00

|

|

$20.00

|

-80.00%

|

$200.00

|

|

$10.00

|

-90.00%

|

$100.00

|

|

$0.00

|

-100.00%

|

$0.00

|

|

●

|

Your Investment in the Notes May Result in a Significant Loss—The Notes differ from ordinary debt securities in that the Issuer will not necessarily repay the full principal amount of the Notes at maturity. If the Notes are not redeemed prior to scheduled maturity, and if the Final Value of the Reference Asset is less than the Barrier Value, your Notes will be fully exposed to the decline of the Reference Asset from the Initial Value. You may lose up to 100.00% of the principal amount of your Notes.

|

|

●

|

Potential Return is Limited to the Contingent Coupons, If Any, and You Will Not Participate in Any Appreciation of The Reference Asset—The potential positive return on the Notes is limited to the Contingent Coupons, if any, that may be payable during the term of the Notes. You will not participate in any appreciation in the value of the Reference Asset, which may be significant, even though you will be exposed to the depreciation in the value of the Reference Asset if the Notes are not redeemed and the Final Value of the Reference Asset is less than the Barrier Value.

|

|

●

|

You May Not Receive Any Contingent Coupon Payments on the Notes—The Issuer will not necessarily make periodic coupon payments on the Notes. You will receive a Contingent Coupon on a Contingent Coupon Payment Date only if the Closing Value of the Reference Asset on the related Observation Date is greater than or equal to the Coupon Barrier Value. If the Closing Value of the Reference Asset on an Observation Date is less than the Coupon Barrier Value, you will not receive a Contingent Coupon on the related Contingent Coupon Payment Date. If the Closing Value of the Reference Asset is less than the Coupon Barrier Value on each Observation Date, you will not receive any Contingent Coupons during the term of the Notes.

|

|

●

|

The Notes Are Subject to Volatility Risk—Volatility is a measure of the degree of variation in the price of an asset (or level of an index) over a period of time. The amount of any coupon payments that may be payable under the Notes is based on a number of factors, including the expected volatility of the Reference Asset. The amount of such coupon payments will be paid at a per annum rate that is higher than the fixed rate that we would pay on a conventional debt security of the same tenor and is higher than it otherwise would have been had the expected volatility of the Reference Asset been lower. As volatility of the Reference Asset increases, there will typically be a greater likelihood that (a) the Closing Value of the Reference Asset on one or more Observation Dates will be less than the Coupon Barrier Value and (b) the Final Value of the Reference Asset will be less than the Barrier Value.

|

|

●

|

Early Redemption and Reinvestment Risk—While the original term of the Notes is as indicated on the cover of this pricing supplement, the Notes may be redeemed prior to maturity, as described above, and the holding period over which you may receive any coupon payments that may be payable under the Notes could be as short as approximately six months.

|

|

●

|

If the Notes Are Not Redeemed Prior to Scheduled Maturity, the Payment at Maturity, If Any, is Based Solely on the Closing Value of the Reference Asset on the Final Valuation Date—If the Notes are not redeemed prior to scheduled maturity, the Final Value of the Reference Asset will be based solely on the Closing Value on the Final Valuation Date, and your payment at maturity, if any, will be determined based solely on the performance of the Reference Asset from the Initial Valuation Date to the Final Valuation Date. Accordingly, if the value of the Reference Asset drops on the Final Valuation Date, the payment at maturity on the Notes, if any, may be significantly less than it would have been had it been linked to the value of the Reference Asset at any time prior to such drop.

|

|

●

|

Contingent Repayment of Any Principal Amount Applies Only at Maturity or upon Any Redemption—You should be willing to hold your Notes to maturity or any redemption. Although the Notes provide for the contingent repayment of the principal amount of your Notes at maturity, provided that the Final Value of the Reference Asset is greater than or equal to the Barrier Value, or upon any redemption, if you sell your Notes prior to such time in the secondary market, if any, you may have to sell your Notes at a price that is less than the principal amount even if at that time the value of the Reference Asset has increased from the Initial Value. See “Many Economic and Market Factors Will Impact the Value of the Notes” below.

|

|

●

|

Owning the Notes is Not the Same as Owning A Reference Asset or Any Securities to which A Reference Asset Provides Exposure—The return on the Notes may not reflect the return you would realize if you actually owned a Reference Asset or any securities to which a Reference Asset provides exposure. As a holder of the Notes, you will not have voting rights or rights to receive dividends or other distributions or any other rights that holders of a Reference Asset or any securities to which a Reference Asset provides exposure may have.

|

|

●

|

Tax Treatment—Significant aspects of the tax treatment of the Notes are uncertain. You should consult your tax advisor about your tax situation. See “Tax Considerations” below.

|

|

●

|

Credit of Issuer—The Notes are unsecured and unsubordinated debt obligations of the Issuer, Barclays Bank PLC, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Notes, including any repayment of principal, is subject to the ability of Barclays Bank PLC to satisfy its obligations as they come due and is not guaranteed by any third party. As a result, the actual and perceived creditworthiness of Barclays Bank PLC may affect the market value of the Notes, and in the event Barclays Bank PLC were to default on its obligations, you may not receive any amounts owed to you under the terms of the Notes.

|

|

●

|

You May Lose Some or All of Your Investment If Any U.K. Bail-in Power Is Exercised by the Relevant U.K. Resolution Authority—Notwithstanding any other agreements, arrangements or understandings between Barclays Bank PLC and any holder or beneficial owner of the Notes, by acquiring the Notes, each holder and beneficial owner of the Notes acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority as set forth under “Consent to U.K. Bail-in Power” in this pricing supplement. Accordingly, any U.K. Bail-in Power may be exercised in such a manner as to result in you and other holders and beneficial owners of the Notes losing all or a part of the value of your investment in the Notes or receiving a different security from the Notes, which may be worth significantly less than the Notes and which may have significantly fewer protections than those typically afforded to debt securities. Moreover, the relevant U.K. resolution authority may exercise the U.K. Bail-in Power without providing any advance notice to, or requiring the consent of, the holders and the beneficial owners of the Notes. The exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority with respect to the Notes will not be a default or an Event of Default (as each term is defined in the senior debt securities indenture) and the trustee will not be liable for any action that the trustee takes, or abstains from taking, in either case, in accordance with the exercise of the U.K. Bail-in Power by the relevant U.K. resolution authority with respect to the Notes. See “Consent to U.K. Bail-in Power” in this pricing supplement as well as “U.K. Bail-in Power,” “Risk Factors—Risks Relating to the Securities Generally—Regulatory action in the event a bank or investment firm in the Group is failing or likely to fail could materially adversely affect the value of the securities” and “Risk Factors—Risks Relating to the Securities Generally—Under the terms of the securities, you have agreed to be bound by the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority” in the accompanying prospectus supplement.

|

|

●

|

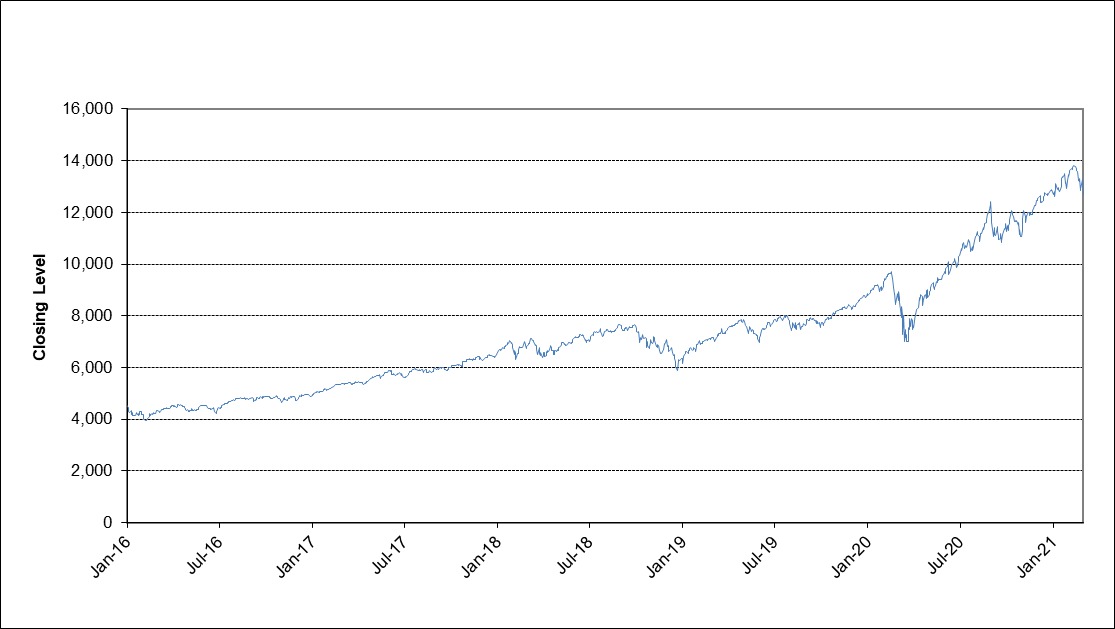

Historical Performance of the Reference Asset Should Not Be Taken as Any Indication of the Future Performance of the Reference Asset Over the Term of the Notes—The value of the Reference Asset has fluctuated in the past and may, in the future, experience significant fluctuations. The historical performance of the Reference Asset is not an indication of the future performance of the Reference Asset over the term of the Notes. Therefore, the performance of the Reference Asset over the term of the Notes may bear no relation or resemblance to the historical performance of athe Reference Asset.

|

|

●

|

The Reference Asset Reflects the Price Return of the Securities Composing the Reference Asset, Not the Total Return—The return on the Notes is based on the performance of the Reference Asset, which reflects changes in the market prices of the securities composing the Reference Asset. The Reference Asset is not a "total return index” that, in addition to reflecting those price returns, would also reflect dividends paid on the securities composing the Reference Asset. Accordingly, the return on the Notes will not include such a total return feature.

|

|

●

|

The Notes Are Subject to Risks Associated with Non-U.S. Securities Markets—Certain component securities of the NDX Index are issued by non-U.S. companies in non-U.S. securities markets. Investments in securities linked to the value of such non-U.S. equity securities, such as the Notes, involve risks associated with the securities markets in the home countries of the issuers of those non-U.S. equity securities, including risks of volatility in those markets, governmental intervention in those markets and cross shareholdings in companies in certain countries. Also, there is generally less publicly available information about companies in some of these jurisdictions than there is about U.S. companies that are subject to the reporting requirements of the SEC, and generally non-U.S. companies are subject to accounting, auditing and financial reporting standards and requirements and securities trading rules different from those applicable to U.S. reporting companies. The prices of securities in non-U.S. markets may be affected by political, economic, financial and social factors in those countries, or global regions, including changes in government, economic and fiscal policies and currency exchange laws.

|

|

●

|

Adjustments to the Reference Asset Could Adversely Affect the Value of the Notes—The sponsor of the Reference Asset may add, delete, substitute or adjust the securities composing the Reference Asset or make other methodological changes to the Reference Asset that could affect its value. The Calculation Agent will calculate the value to be used as the Closing Value of the Reference Asset in the event of certain material changes in or modifications to the Reference Asset. In addition, the sponsor of the Reference Asset may also discontinue or suspend calculation or publication of the Reference Asset at any time. Under these circumstances, the Calculation Agent may select a successor index that the Calculation Agent determines to be comparable to the Reference Asset or, if no successor index is available, the Calculation Agent will determine the value to be used as the Closing Value of the Reference Asset. Any of these actions could adversely affect the value of the Reference Asset and, consequently, the value of the Notes. See “Reference Assets—Indices—Adjustments Relating to Securities with an Index as a Reference Asset” in the accompanying prospectus supplement.

|

|

●

|

We and Our Affiliates May Engage in Various Activities or Make Determinations That Could Materially Affect the Notes in Various Ways and Create Conflicts of Interest—We and our affiliates play a variety of roles in connection with the issuance of the Notes, as described below. In performing these roles, our and our affiliates’ economic interests are potentially adverse to your interests as an investor in the Notes.

|

|

●

|

The Estimated Value of Your Notes is Expected to be Lower Than the Initial Issue Price of Your Notes—The estimated value of your Notes on the Initial Valuation Date is expected to be lower, and may be significantly lower, than the initial issue price of your Notes. The difference between the initial issue price of your Notes and the estimated value of the Notes is a result of certain factors, such as any sales commissions to be paid to Barclays Capital Inc. or another affiliate of ours, any selling concessions, discounts, commissions or fees (including any structuring or other distribution related fees) to be allowed or paid to non-affiliated intermediaries, the estimated profit that we or any of our affiliates expect to earn in connection with structuring the Notes, the estimated cost which we may incur in hedging our obligations under the Notes, and estimated development and other costs which we may incur in connection with the Notes.

|

|

●

|

The Estimated Value of Your Notes Might be Lower if Such Estimated Value Were Based on the Levels at Which Our Debt Securities Trade in the Secondary Market—The estimated value of your Notes on the Initial Valuation Date is based on a number of variables, including our internal funding rates. Our internal funding rates may vary from the levels at which our benchmark debt securities trade in the secondary market. As a result of this difference, the estimated value referenced above might be lower if such estimated value were based on the levels at which our benchmark debt securities trade in the secondary market.

|

|

●

|

The Estimated Value of the Notes is Based on Our Internal Pricing Models, Which May Prove to be Inaccurate and May be Different from the Pricing Models of Other Financial Institutions—The estimated value of your Notes on the Initial Valuation Date is based on our internal pricing models, which take into account a number of variables and are based on a number of subjective assumptions, which may or may not materialize. These variables and assumptions are not evaluated or verified on an independent basis. Further, our pricing models may be different from other financial institutions’ pricing models and the methodologies used by us to estimate the value of the Notes may not be consistent with those of other financial institutions which may be purchasers or sellers of Notes in the secondary market. As a result, the secondary market price of your Notes may be materially different from the estimated value of the Notes determined by reference to our internal pricing models.

|

|

●

|

The Estimated Value of Your Notes Is Not a Prediction of the Prices at Which You May Sell Your Notes in the Secondary Market, if any, and Such Secondary Market Prices, If Any, Will Likely be Lower Than the Initial Issue Price of Your Notes and May be Lower Than the Estimated Value of Your Notes—The estimated value of the Notes will not be a prediction of the prices at which Barclays Capital Inc., other affiliates of ours or third parties may be willing to purchase the Notes from you in secondary market transactions (if they are willing to purchase, which they are not obligated to do). The price at which you may be able to sell your Notes in the secondary market at any time will be influenced by many factors that cannot be predicted, such as market conditions, and any bid and ask spread for similar sized trades, and may be substantially less than our estimated value of the Notes. Further, as secondary market prices of your Notes take into account the levels at which our debt securities trade in the secondary market, and do not take into account our various costs related to the Notes such as fees, commissions, discounts, and the costs of hedging our obligations under the Notes, secondary market prices of your Notes will likely be lower than the initial issue price of your Notes. As a result, the price at which Barclays Capital Inc., other affiliates of ours or third parties may be willing to purchase the Notes from you in secondary market transactions, if any, will likely be lower than the price you paid for your Notes, and any sale prior to the Maturity Date could result in a substantial loss to you.

|

|

●

|

The Temporary Price at Which We May Initially Buy The Notes in the Secondary Market And the Value We May Initially Use for Customer Account Statements, If We Provide Any Customer Account Statements At All, May Not Be Indicative of Future Prices of Your Notes—Assuming that all relevant factors remain constant after the Initial Valuation Date, the price at which Barclays Capital Inc. may initially buy or sell the Notes in the secondary market (if Barclays Capital Inc. makes a market in the Notes, which it is not obligated to do) and the value that we may initially use for customer account statements, if we provide any customer account statements at all, may exceed our estimated value of the Notes on the Initial Valuation Date, as well as the secondary market value of the Notes, for a temporary period after the initial Issue Date of the Notes. The price at which Barclays Capital Inc. may initially buy or sell the Notes in the secondary market and the value that we may initially use for customer account statements may not be indicative of future prices of your Notes.

|

|

●

|

Lack of Liquidity—The Notes will not be listed on any securities exchange. Barclays Capital Inc. and other affiliates of Barclays Bank PLC intend to make a secondary market for the Notes but are not required to do so, and may discontinue any such secondary market making at any time, without notice. Barclays Capital Inc. may at any time hold unsold inventory, which may inhibit the development of a secondary market for the Notes. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. Because other dealers are not likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which Barclays Capital Inc. and other affiliates of Barclays Bank PLC are willing to buy the Notes. The Notes are not designed to be short-term trading instruments. Accordingly, you should be willing and able to hold your Notes to maturity.

|

|

●

|

Many Economic and Market Factors Will Impact the Value of the Notes—The value of the Notes will be affected by a number of economic and market factors that interact in complex and unpredictable ways and that may either offset or magnify each other, including:

|

|

o

|

the market price of, dividend rate on and expected volatility of the Reference Asset or the components of the Reference Asset, if any;

|

|

o

|

the time to maturity of the Notes;

|

|

o

|

interest and yield rates in the market generally;

|

|

o

|

a variety of economic, financial, political, regulatory or judicial events;

|

|

o

|

supply and demand for the Notes; and

|

|

o

|

our creditworthiness, including actual or anticipated downgrades in our credit ratings.

|