| Preliminary Pricing Supplement (To the Prospectus dated August 31, 2010, the Prospectus Supplement dated May 27, 2011 and the Index Supplement dated May 31, 2011) |

Filed Pursuant to Rule 424(b)(2) Registration No. 333-169119 |

The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement and the accompanying prospectus, prospectus supplement and index supplement do not constitute an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Pricing Supplement dated March 25, 2013

|

$[—]

Contingent Quarterly Payment Callable Notes due April 2, 2018 Linked to the Lesser Return of the Russell 2000® Index and iShares® MSCI EAFE Index Fund

Global Medium-Term Notes, Series A, No. E-7818 |

Terms used in this preliminary pricing supplement, but not defined herein, shall have the meanings ascribed to them in the prospectus supplement.

| Issuer: | Barclays Bank PLC | |||||||||

| Initial Valuation Date: | March 27, 2013 | |||||||||

| Issue Date: | April 2, 2013 | |||||||||

| Final Valuation Date*: | March 27, 2018 | |||||||||

| Maturity Date**: | April 2, 2018 | |||||||||

| Denominations: | Minimum denomination of $1,000, and integral multiples of $1,000 in excess thereof | |||||||||

| Reference Assets: | Russell 2000® Index (the “Russell 2000 Index” or “Index”) and iShares® MSCI EAFE Index Fund (the “MSCI EAFE ETF” or “ETF”) | |||||||||

| Reference Asset |

Bloomberg Ticker | Initial Value | Barrier Value | Coupon Barrier Value | ||||||||||

| Russell 2000 Index | RTY<Index> | 943.92 | 566.35 | 613.55 | ||||||||||

| MSCI EAFE ETF | EFA UP <Equity> | $ | 58.85 | $ | 35.31 | $ | 38.25 | |||||||

| The Index and the ETF are each referred to in this preliminary pricing supplement as a “Reference Asset” and collectively as the “Reference Assets”. | ||||||||||

| Quarterly Contingent Interest Rate: | 1.90% (7.60% per annum) | |||||||||

| Quarterly Contingent Interest Payment: | On each Quarterly Contingent Interest Payment Date, unless the Notes have been previously redeemed (pursuant to the “Early Redemption at the Option of the Issuer” provision), you will receive a quarterly contingent interest payment equal to the Quarterly Contingent Interest Rate times the principal amount of your Notes if and only if the Closing Value of the Lesser Performing Reference Asset on the related Valuation Date is greater than or equal to its Coupon Barrier Value. If the Closing Value of the Lesser Performing Reference Asset on any quarterly Valuation Date is less than its Coupon Barrier Value, you will not receive any quarterly contingent interest payment on the related Quarterly Contingent Interest Payment Date, and if the Closing Value of the Lesser Performing Reference Asset is less than its Coupon Barrier Value on all Valuation Dates, you will not receive any quarterly contingent interest payments over the term of the Notes. | |||||||||

| Valuation Dates: | The 27th day of each June, September, December and March beginning on June 27, 2013 and ending on March 27, 2018 (the “final valuation date”), subject to postponement for non-Reference Asset Business Days and certain market disruption events. | |||||||||

| Quarterly Contingent Interest Payment Dates:*** | The quarterly contingent interest payment date for any Valuation Date will be the fifth Business Day after such Valuation Date, except that the quarterly contingent interest payment date for the Final Valuation Date will be the Maturity Date. | |||||||||

| Early Redemption at the Option of the Issuer: | Beginning on April 3, 2014 and each Quarterly Contingent Interest Payment Date thereafter, the Issuer may redeem your Notes (in whole but not in part) at its sole discretion without your consent at the Redemption Price set forth below, provided the Issuer gives at least five business days’ prior written notice to the trustee. If the Issuer exercises its redemption option, the Quarterly Contingent Interest Payment Date on which the Issuer so exercises the redemption option will be referred to as the “Early Redemption Date”. | |||||||||

| Redemption Price: | If the Issuer exercises its redemption option on any Quarterly Contingent Interest Payment Date that it may exercise such option (pursuant to the “Early Redemption at the Option of the Issuer” provision), you will receive on the applicable Early Redemption Date 100% of the principal amount of your Notes together with any Quarterly Contingent Interest Payment that may be due on such date. | |||||||||

| Payment at Maturity: | If your Notes are not early redeemed by us pursuant to the “Early Redemption at the Option of the Issuer” provision, you will receive (subject to our credit risk), in addition to the final Quarterly Contingent Interest Payment, a cash payment determined as follows:

• If the Final Value of the Lesser Performing Reference Asset is greater than or equal to its Barrier Value, $1,000 per $1,000 principal amount Note that you hold.

• If the Final Value of the Lesser Performing Reference Asset is less than its Barrier Value, an amount per $1,000 principal amount Note calculated as follows:

$1,000 + [$1,000 × Reference Asset Return of the Lesser Performing Reference Asset]

If the Final Value of the Lesser Performing Reference Asset is less than its Barrier Value (that is, the Final Level of the Lesser Performing Reference Asset has depreciated by more than 40.00% relative to its Initial Value), your Notes will be fully exposed to such decline. As such, you will lose some or all of your principal.

The payment at maturity will be based solely on the performance of the Lesser Performing Reference Asset (as measured from its Initial Value to its Final Value), and the performance of the Reference Asset that is not the Lesser Performing Reference Asset will not be taken into account for purposes of calculating any payment at maturity under the Notes.

Any payment on the Notes, including any payment due at maturity, is subject to the creditworthiness of the Issuer and is not guaranteed by any third party. For a description of risks with respect to the ability of Barclays Bank PLC to satisfy its obligations as they come due, see “Credit of Issuer” in this preliminary pricing supplement. | |||||||||

| Closing Value: | With respect to the Russell 2000 Index, for any Index Business Day, the closing value of the Russell 2000 Index published at the regular weekday close of trading on such date as displayed on Bloomberg Professional® service page “RTY <Index>” or any successor page on Bloomberg Professional® service or any successor service, as applicable. In certain circumstances, the closing value of the Russell 2000 Index will be based on the alternate calculation of the Russell 2000 Index as described in “Reference Assets—Adjustments Relating to Securities with the Reference Asset Comprised of an Index or Indices” of the accompanying prospectus supplement.

With respect to the MSCI EAFE ETF, for any Trading Day, the closing price per share of the ETF published at the regular weekday close of trading on such date as displayed on Bloomberg Professional® service page “EFA UP <Equity>” or any successor page on Bloomberg Professional® service or any successor service, as applicable. In certain circumstances, the Closing price of the MSCI EAFE ETF will be based on the alternate calculation of the MSCI EAFE ETF as described in “Reference Asset—Adjustments Relating to Securities with the Reference Asset Comprised of an Exchange-Traded Fund or Exchange-Traded Funds” in the accompanying prospectus supplement. | |||||||||

| Coupon Barrier Value: | With respect to a Reference Asset, 65.00% of its corresponding Initial Value. The Coupon Barrier Value for each Reference Asset is set forth in the table above, which appears under the caption “Reference Assets”. | |||||||||

| Barrier Value: | With respect to a Reference Asset, 60.00% of its corresponding Initial Value. The Barrier Value for each Reference Asset is set forth in the table above, which appears under the caption “Reference Assets”. | |||||||||

| Lesser Performing Reference Asset: | The Reference Asset with the lower Reference Asset Return, as calculated in the manner set forth below. | |||||||||

| Reference Asset Return: | With respect to each Reference Asset and with respect to each Valuation Date (including the Final Valuation Date), the performance of such Reference Asset from its Initial Value to its Closing Value on such day, calculated as follows:

Closing Value – Initial Value Initial Value | |||||||||

| Initial Value: | With respect to each Reference Asset, the Closing Value of such Reference Asset on March 21, 2013. The Initial Value for each Reference Asset set forth in the table above, which appears under the caption “Reference Assets”. | |||||||||

| Final Value: | With respect to each Reference Asset, the Closing Value of such Reference Asset on the Final Valuation Date. | |||||||||

| Index Business Day: | With respect to the Index, a day, as determined by the Calculation Agent, on which each of the relevant exchanges on which each Index component is traded is scheduled to be open for trading and trading is generally conducted on each such relevant exchange. | |||||||||

| Trading Day: | With respect to the ETF, a day, as determined by the Calculation Agent, on which the primary exchange or market of trading for shares or other interests in the ETF or the shares of any successor fund is scheduled to be open for trading and trading is generally conducted on such market or exchange | |||||||||

| Business Day: | Any day that is a Monday, Tuesday, Wednesday, Thursday or Friday that is not a day on which banking institutions in New York City or London generally, are authorized or obligated by law or executive order to close. | |||||||||

| Day Count/ Business Day Convention: | 30/360; Following, unadjusted | |||||||||

| Reference Asset Business Day: | A day that is both (i) an Index Business Day with respect to the Index and (ii) a Trading Day with respect to the ETF. | |||||||||

| Calculation Agent: | Barclays Bank PLC | |||||||||

| CUSIP/ISIN: | 06741TRM1 and US06741TRM17 | |||||||||

| * | Subject to postponement in the event of a market disruption event and as described under “Selected Purchase Considerations—Market Disruption Events” in this preliminary pricing supplement. |

| ** | Subject to postponement in the event of a market disruption event and as described under “Terms of the Notes—Maturity Date” in the accompanying prospectus supplement and “Selected Purchase Considerations—Market Disruption Events” in this preliminary pricing supplement. |

| *** | If such day is not a Business Day, payment will be made on the immediately following Business Day with the same force and effect as if made on the specified date. No interest will accrue as a result of delayed payment. |

Investing in the Notes involves a number of risks. See “Risk Factors” beginning on page S-6 of the prospectus supplement, “Risk Factors” beginning on page IS-2 of the index supplement and “Selected Risk Considerations” beginning on page PPS-10 of this preliminary pricing supplement.

The Notes will not be listed on any U.S. securities exchange or quotation system. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this preliminary pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The Notes constitute our direct, unconditional, unsecured and unsubordinated obligations and are not deposit liabilities of Barclays Bank PLC and are not insured by the U.S. Federal Deposit Insurance Corporation or any other governmental agency of the United States, the United Kingdom or any other jurisdiction.

| Price to Public |

Agent’s Commission‡ |

Proceeds to Barclays Bank PLC | ||||

| Per Note |

100% | 1.80% | 98.20% | |||

| Total |

$ | $ | $ |

| ‡ | Barclays Capital Inc. will receive commissions from the Issuer equal to 1.80% of the principal amount of the Notes, or $18.00 per $1,000 principal amount, and may retain all or a portion of these commissions or use all or a portion of these commissions to pay selling concessions or fees to other dealers. Accordingly, the percentage and total proceeds to Issuer listed herein is the minimum amount of proceeds that Issuer receives. |

You may revoke your offer to purchase the Notes at any time prior to the pricing as described on the cover of this preliminary pricing supplement. We reserve the right to change the terms of, or reject any offer to purchase the Notes prior to their pricing. In the event of any changes to the terms of the Notes, we will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we may reject your offer to purchase.

ADDITIONAL TERMS SPECIFIC TO THE NOTES

You should read this preliminary pricing supplement together with the prospectus dated August 31, 2010, as supplemented by the prospectus supplement dated May 27, 2011 and the index supplement dated May 31, 2011 relating to our Global Medium-Term Notes, Series A, of which these Notes are a part. This preliminary pricing supplement, together with the documents listed below, contains the terms of the Notes and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth under “Risk Factors” in the prospectus supplement and the index supplement, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes.

You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| • | Prospectus dated August 31, 2010: |

http://www.sec.gov/Archives/edgar/data/312070/000119312510201448/df3asr.htm

| • | Prospectus Supplement dated May 27, 2011: |

http://www.sec.gov/Archives/edgar/data/312070/000119312511152766/d424b3.htm

| • | Index Supplement dated May 31, 2011: |

http://www.sec.gov/Archives/edgar/data/312070/000119312511154632/d424b3.htm

Our SEC file number is 1-10257. As used in this preliminary pricing supplement, the “Company,” “we,” “us,” or “our” refers to Barclays Bank PLC.

HYPOTHETICAL QUARTERLY CONTINGENT INTEREST PAYMENT EXAMPLES

The payment of a Quarterly Contingent Interest Payment on any Quarterly Contingent Interest Payment Date will be dependent on the Closing Value of each Reference Asset on the related Valuation Date and the corresponding return of each Reference Asset as measured from that Valuation Date to the Initial Valuation Date. The Reference Asset with the lower Reference Asset Return on a Valuation Date will be deemed the Lesser Performing Reference Asset and the corresponding Closing Value of such Reference Asset will be evaluated relative to the Coupon Barrier Value of such Reference Asset. If the Closing Value of the Lesser Performing Reference Asset on a Valuation Date is less than its corresponding Coupon Barrier Value, then there will not be a Quarterly Contingent Interest Payment made on the corresponding Quarterly Contingent Interest Payment Date. Alternatively, if the Closing Value of the Lesser Performing Reference Asset on a Valuation Date is greater than or equal to its corresponding Coupon Barrier Value, then a Quarterly Contingent Interest Payment will be made on the corresponding Quarterly Contingent Interest Payment Date. If the Closing Value of the Lesser Performing Reference Asset on each Valuation Date is less than the corresponding Coupon Barrier Value of such Reference Asset, then no Quarterly Contingent Payments will be made over the term of the Notes. If the Issuer exercises the “Early Redemption at the Option of the Issuer”, no Quarterly Contingent Interest Payments will be made following the date of such exercise.

Quarterly Contingent Interest Payment Calculations

Step 1: Determine Which Reference Asset is the Lesser Performing Reference Asset Based on the Reference Asset Return of each Reference Asset.

To determine which Reference Asset is the Lesser Performing Reference Asset on each Valuation Date, the Calculation Agent will need to calculate the Reference Asset Return of each Reference Asset on the respective Valuation Date. The Reference Asset Return of each Reference Asset is equal to the performance of such Reference Asset as measured from its Initial Value to its Closing Value on such Valuation Date, calculated as follows:

Closing Value – Initial Value

Initial Value

PPS-2

The Reference Asset with the lowest Reference Asset Return on such Valuation Date will be deemed the Lesser Performing Reference Asset.

Step 2: Determine Whether the Closing Value of the Lesser Performing Reference Asset is Greater than or Equal to its Corresponding Coupon Barrier Value.

Upon determining which Reference Asset is the Lesser Performing Reference Asset, the Calculation Agent will take the Closing Value of such Reference Asset and evaluate it relative to its Coupon Barrier Value (that is, whether the Closing Value on that day is greater than or equal to its applicable Coupon Barrier Value). If the Closing Value of the Lesser Performing Reference Asset is greater than or equal to its corresponding Coupon Barrier Value, a Quarterly Contingent Interest Payment will be made (as calculated in Step 3 below) and payable on the corresponding Quarterly Contingent Interest Payment Date. If the Closing Value of the Lesser Performing Reference Asset is less than the corresponding Coupon Barrier Value of such Reference Asset, then no Quarterly Contingent Interest Payment will be made on the corresponding Quarterly Contingent Interest Payment Date.

Step 3: Calculate the Quarterly Contingent Interest Payment, if Any:

If on the respective Valuation Date, the Closing Value of the Lesser Performing Reference Asset is greater than or equal to its corresponding Coupon Barrier Value, we will pay a Quarterly Contingent Interest Payment equal to the Quarterly Contingent Interest Rate multiplied by the stated principal amount; otherwise no Quarterly Contingent Interest Payment will be due on the corresponding Quarterly Contingent Interest Payment Date. The Quarterly Contingent Interest Payment will be calculated as follows:

1,000 × Quarterly Contingent Interest Rate

1,000 × 1.90% = $19.00

No adjustments to the amount of the Quarterly Contingent Interest Payment calculated will be made in the event a Quarterly Contingent Interest Payment Date is not a Business Day. Payment will be made on the immediately following Business Day with the same force and effect as if made on the specified date.

Examples of Quarterly Contingent Interest Payment Calculations

The tables and examples below illustrate the determination as to whether a Quarterly Contingent Interest Payment will be made on a series of 20 hypothetical Valuation Dates. The hypothetical examples set forth below are based on the following assumptions: a total of 20 quarterly Valuation Dates; a Quarterly Contingent Interest Rate of 1.90% (7.60% per annum); the Notes are held until the Maturity Date and the Issuer has not exercised the “Early Redemption at the Option of the Issuer”; and no Market Disruption Event with respect to either of the Reference Assets has occurred or is continuing on any Valuation Date, including the Final Valuation Date. Numbers in the table and examples below have been rounded for ease of analysis. The examples below also do not take into account the effects of applicable taxes.

Table 1 During the Term of the Note, On Certain Valuation Dates, the Closing Value of the Lesser Performing Reference Asset has been Less Than its Respective Coupon Barrier Value and on Certain Valuation Dates, the Closing Value of the Lesser Performing Reference Asset has been Greater than or Equal to its Respective Coupon Barrier Value. As a Result, During the Term of the Note on Certain Quarterly Contingent Interest Payment Dates a Quarterly Contingent Interest Payment Will Be Due and On Other Quarterly Contingent Interest Payment Dates, No Quarterly Contingent Interest Payment Will Be Due.

| Valuation Dates |

Is the Closing Value of the Lesser Performing its Coupon Barrier Value?1 |

Will a Quarterly Contingent Interest Payment be Made?2 |

Quarterly Contingent Interest Rate |

Amount of Quarterly Payment (per $1,000 principal amount)3 | ||||

| First |

No | Yes | 1.90% | $19.00 | ||||

| Second |

Yes | No | 0.00% | $0.00 | ||||

| Third |

Yes | No | 0.00% | $0.00 | ||||

| Fourth |

No | Yes | 1.90% | $19.00 | ||||

| Fifth |

Yes | No | 0.00% | $0.00 | ||||

| Sixth |

No | Yes | 1.90% | $19.00 | ||||

| Seventh |

No | Yes | 1.90% | $19.00 | ||||

| Eighth |

Yes | No | 0.00% | $0.00 | ||||

| Ninth |

No | Yes | 1.90% | $19.00 | ||||

| Tenth |

No | Yes | 1.90% | $19.00 | ||||

| Eleventh |

Yes | No | 0.00% | $0.00 | ||||

| Twelfth |

Yes | No | 0.00% | $0.00 | ||||

| Thirtieth |

No | Yes | 1.90% | $19.00 | ||||

| Fourteenth |

Yes | No | 0.00% | $0.00 | ||||

| Fifteenth |

No | Yes | 1.90% | $19.00 | ||||

| Sixteenth |

No | Yes | 1.90% | $19.00 | ||||

| Seventeenth |

Yes | No | 0.00% | $0.00 | ||||

| Eighteenth |

Yes | No | 0.00% | $0.00 | ||||

| Nineteenth |

Yes | No | 0.00% | $0.00 | ||||

| Twentieth (Final Valuation Date) |

No | Yes | 1.90% | $19.00 |

Total Quarterly Contingent Interest Payments received per Note: $190.00

| 1 | For each Reference Asset, the Coupon Barrier Value is equal to 65.00% of its Initial Value. |

| 2 | A Quarterly Contingent Interest Payment will be made if the Closing Value of the Lesser Performing Reference Asset on the related Valuation Date is greater than or equal to its Coupon Barrier Value. |

| 3 | The Quarterly Contingent Interest Payment per Note equals the Quarterly Contingent Interest Rate times the $1,000 principal amount. |

PPS-3

Table 2 With Respect to Each Valuation Date, the Closing Value of the Lesser Performing Reference Asset Has Been Greater than or Equal to its Respective Coupon Barrier Value. This Example Illustrates the Maximum Possible Quarterly Contingent Interest Payments that Would be Due During the Term of the Notes.

| Valuation Dates |

Is the Closing Value of the Lesser Performing Reference Asset Below its Coupon Barrier Value?1 |

Will a Quarterly Contingent Interest Payment be Made?2 |

Quarterly Contingent Interest Rate |

Amount of Quarterly Payment (per $1,000 principal amount)3 | ||||

| First |

No | Yes | 1.90% | $19.00 | ||||

| Second |

No | Yes | 1.90% | $19.00 | ||||

| Third |

No | Yes | 1.90% | $19.00 | ||||

| Fourth |

No | Yes | 1.90% | $19.00 | ||||

| Fifth |

No | Yes | 1.90% | $19.00 | ||||

| Sixth |

No | Yes | 1.90% | $19.00 | ||||

| Seventh |

No | Yes | 1.90% | $19.00 | ||||

| Eighth |

No | Yes | 1.90% | $19.00 | ||||

| Ninth |

No | Yes | 1.90% | $19.00 | ||||

| Tenth |

No | Yes | 1.90% | $19.00 | ||||

| Eleventh |

No | Yes | 1.90% | $19.00 | ||||

| Twelfth |

No | Yes | 1.90% | $19.00 | ||||

| Thirtieth |

No | Yes | 1.90% | $19.00 | ||||

| Fourteenth |

No | Yes | 1.90% | $19.00 | ||||

| Fifteenth |

No | Yes | 1.90% | $19.00 | ||||

| Sixteenth |

No | Yes | 1.90% | $19.00 | ||||

| Seventeenth |

No | Yes | 1.90% | $19.00 | ||||

| Eighteenth |

No | Yes | 1.90% | $19.00 | ||||

| Nineteenth |

No | Yes | 1.90% | $19.00 | ||||

| Twentieth (Final Valuation Date) |

No | Yes | 1.90% | $19.00 |

Total Quarterly Contingent Interest Payments received per Note: $380.00

| 1 | For each Reference Asset, the Coupon Barrier Value is equal to 65.00% of its Initial Value. |

| 2 | A Quarterly Contingent Interest Payment will be made if the Closing Value of the Lesser Performing Reference Asset on the related Valuation Date is greater than or equal to its Coupon Barrier Value. |

| 3 | The Quarterly Contingent Interest Payment per Note equals the Quarterly Contingent Interest Rate times the $1,000 principal amount. |

PPS-4

Table 3 With Respect to Each Valuation Date, the Closing Value of the Lesser Performing Reference Asset Has Been Less than its Respective Coupon Barrier Value. This Example Illustrates the Minimum Possible Quarterly Contingent Interest Payments that Would be Due During the Term of the Notes, Which is $0.00.

| Valuation Dates |

Is the Closing Value of the Lesser Performing Reference Asset Below its Coupon Barrier Value?1 |

Will a Quarterly Contingent Interest Payment be Made?2 |

Quarterly Contingent Interest Rate |

Amount of Quarterly Contingent Interest Payment (per $1,000 principal amount)3 | ||||

| First |

Yes | No | N/A | $0.00 | ||||

| Second |

Yes | No | N/A | $0.00 | ||||

| Third |

Yes | No | N/A | $0.00 | ||||

| Fourth |

Yes | No | N/A | $0.00 | ||||

| Fifth |

Yes | No | N/A | $0.00 | ||||

| Sixth |

Yes | No | N/A | $0.00 | ||||

| Seventh |

Yes | No | N/A | $0.00 | ||||

| Eighth |

Yes | No | N/A | $0.00 | ||||

| Ninth |

Yes | No | N/A | $0.00 | ||||

| Tenth |

Yes | No | N/A | $0.00 | ||||

| Eleventh |

Yes | No | N/A | $0.00 | ||||

| Twelfth |

Yes | No | N/A | $0.00 | ||||

| Thirtieth |

Yes | No | N/A | $0.00 | ||||

| Fourteenth |

Yes | No | N/A | $0.00 | ||||

| Fifteenth |

Yes | No | N/A | $0.00 | ||||

| Sixteenth |

Yes | No | N/A | $0.00 | ||||

| Seventeenth |

Yes | No | N/A | $0.00 | ||||

| Eighteenth |

Yes | No | N/A | $0.00 | ||||

| Nineteenth |

Yes | No | N/A | $0.00 | ||||

| Twentieth (Final Valuation Date) |

Yes | No | N/A | $0.00 |

Total Quarterly Contingent Interest Payments received per Note: $0.00

| 1 | For each Reference Asset, the Coupon Barrier Value is equal to 65.00% of its Initial Value. |

| 2 | A Quarterly Contingent Interest Payment will be made if the Closing Value of the Lesser Performing Reference Asset on the related Valuation Date is greater than or equal to its Coupon Barrier Value. |

| 3 | The Quarterly Contingent Interest Payment per Note equals the Quarterly Contingent Interest Rate times the $1,000 principal amount. |

HYPOTHETICAL PAYMENT AT MATURITY CALCULATIONS

The following steps illustrate the hypothetical payment at maturity calculations. The hypothetical payment at maturity calculations set forth below are for illustrative purposes only and may not be the actual payment at maturity applicable to a purchaser of the Notes. The numbers appearing in the following table have been rounded for ease of analysis. Note that, for purposes of the hypothetical payment at maturity calculations set forth below, we are assuming that (i) the Initial Value of the Russell 2000 Index is 943.92, (ii) the Initial Value of the MSCI EAFE ETF is $58.85, (iii) the Barrier Value with respect to the Russell 2000 Index is 566.35 (the Initial Value of the Russell 2000 Index multiplied by 60.00%, rounded to the nearest hundredth), (iv) the Barrier Value with respect to the MSCI EAFE ETF is $35.31 (the Initial Value of the MSCI EAFE ETF multiplied by 60.00%, rounded to the nearest cent), and (v) the Notes are not redeemed prior to maturity pursuant to “Early Redemption at the Option of the Issuer” as described above. The calculations set forth below do not take into account any tax consequences from investing in the Notes.

Step 1: Determine Which Reference Asset is the Lesser Performing Reference Asset Based on the Reference Asset Return of each Reference Asset.

To determine which Reference Asset is the Lesser Performing Reference Asset on the Final Valuation Date, the Calculation Agent will need to calculate the Reference Asset Return of each Reference Asset on such date. The Reference Asset Return of a Reference Asset is equal to the performance of such Reference Asset from its Initial Value to its Closing Value on the Final Valuation Date (referred to as the “Final Value”), calculated by the Calculation Agent as follows:

Final Value – Initial Value

Initial Value

PPS-5

The Reference Asset with the lower Reference Asset Return will be the Lesser Performing Reference Asset and its Final Value will be evaluated relative to its Barrier Value to determine the payment due at maturity.

Step 2: Calculate the Payment at Maturity based on the Final Value and Reference Asset Return of the Lesser Performing Reference Asset.

The payment at maturity, in addition to the final Quarterly Contingent Interest Payment, if any, will depend on whether the Final Value of the Lesser Performing Reference Asset is greater than, equal to or less than the Barrier Value with respect to such Reference Asset. You will receive (subject to our credit risk) a payment at maturity equal to the principal amount of your Notes only if the Final Value of the Lesser Performing Reference Asset is greater than or equal to the Barrier Value with respect to such Reference Asset.

If the Final Value of the Lesser Performing Reference Asset is less than the Barrier Value with respect to such Reference Asset, you will receive (subject to our credit risk) a payment at maturity that is less, and possibly significantly less, than the principal amount of your Notes, calculated by the Calculation Agent as the sum of the (i) the principal amount of your Notes, plus (ii) the product of (a) the principal amount of your Notes multiplied by (b) the Reference Asset Return of the Lesser Performing Reference Asset. The payment at maturity will be based solely on the Reference Asset Return of the Lesser Performing Reference Asset and the performance of the Reference Asset Return that is not the Lesser Performing Reference Asset will not be taken into account for purposes of calculating any payment at maturity under the Notes. As such, if the Final Value of the Lesser Performing Reference Asset has depreciated by more than 40% relative to its Initial Value, you may lose some or all of the principal amount of your Notes at maturity.

The following table illustrates the hypothetical payments at maturity assuming a range of performances for the Indices:

| Index Final Value |

ETF Final Value ($) |

Index Reference Asset Return |

ETF Reference Asset Return |

Reference Asset Return of The Lesser Performing Reference Asset |

Payment at Maturity* (Not including any quarterly | |||||

| 1,935.04 |

117.70 | 105.00% | 100.00% | 100.00% | $1,000.00 | |||||

| 1,793.45 |

114.76 | 90.00% | 95.00% | 90.00% | $1,000.00 | |||||

| 1,746.25 |

105.93 | 85.00% | 80.00% | 80.00% | $1,000.00 | |||||

| 1,604.66 |

102.99 | 70.00% | 75.00% | 70.00% | $1,000.00 | |||||

| 1,557.47 |

94.16 | 65.00% | 60.00% | 60.00% | $1,000.00 | |||||

| 1,415.88 |

91.22 | 50.00% | 55.00% | 50.00% | $1,000.00 | |||||

| 1,368.68 |

82.39 | 45.00% | 40.00% | 40.00% | $1,000.00 | |||||

| 1,227.10 |

79.45 | 30.00% | 35.00% | 30.00% | $1,000.00 | |||||

| 1,179.90 |

70.62 | 25.00% | 20.00% | 20.00% | $1,000.00 | |||||

| 1,038.31 |

65.91 | 10.00% | 12.00% | 10.00% | $1,000.00 | |||||

| 943.92 |

58.85 | 0.00% | 0.00% | 0.00% | $1,000.00 | |||||

| 1,038.31 |

55.91 | 10.00% | -5.00% | -5.00% | $1,000.00 | |||||

| 1,793.45 |

55.91 | 90.00% | -5.00% | -5.00% | $1,000.00 | |||||

| 962.80 |

47.08 | 2.00% | -20.00% | -20.00% | $1,000.00 | |||||

| 707.94 |

50.02 | -25.00% | -15.00% | -25.00% | $1,000.00 | |||||

| 755.14 |

41.20 | -20.00% | -30.00% | -30.00% | $1,000.00 | |||||

| 613.55 |

41.20 | -35.00% | -30.00% | -35.00% | $1,000.00 | |||||

| 755.14 |

35.31 | -20.00% | -40.00% | -40.00% | $1,000.00 | |||||

| 519.16 |

35.31 | -45.00% | -40.00% | -45.00% | $550.00 | |||||

| 471.96 |

26.48 | -50.00% | -55.00% | -55.00% | $450.00 | |||||

| 566.35 |

23.54 | -40.00% | -60.00% | -60.00% | $400.00 | |||||

| 283.18 |

67.68 | -70.00% | 15.00% | -70.00% | $300.00 | |||||

| 235.98 |

11.77 | -75.00% | -80.00% | -80.00% | $200.00 | |||||

| 94.39 |

8.83 | -90.00% | -85.00% | -90.00% | $100.00 | |||||

| 47.20 |

0.00 | 5.00% | -100.00% | -100.00% | $0.00 |

| * | per $1,000 principal amount Note |

PPS-6

The following examples illustrate how the payments at maturity set forth in the table above are calculated:

Example 1: The Russell 2000 Index increases from an Initial Value of 943.92 to a Final Value of 1,038.31 and the MSCI EAFE ETF increases from an Initial Value of $58.85 to a Final Value of $65.91.

The Reference Asset Returns of both Reference Assets are positive. The Final Value of the Lesser Performing Reference Asset is greater than or equal to its Barrier Value and the investor receives a payment at maturity of $1,000 per $1,000 principal amount Note.

Example 2: The Russell 2000 Index increases from an Initial Value of 943.92 to a Final Value of 1,038.31 and the MSCI EAFE ETF decreases from an Initial Value of $58.85 to a Final Value of $55.91.

Because the Reference Asset Return of the Russell 2000 Index is positive and the Reference Asset Return of the MSCI EAFE ETF is negative, the MSCI EAFE ETF is the Lesser Performing Reference Asset. The Final Value of the Lesser Performing Reference Asset is equal to $55.91 which is greater than its Barrier Value of $35.31. Because the Final Value of the Lesser Performing Reference Asset is not less than its Barrier Value, the investor receives a payment at maturity of $1,000 per $1,000 principal amount Note.

Example 3: The Russell 2000 Index decreases from an Initial Value of 943.92 to a Final Value of 238.18 and the MSCI EAFE ETF increases from an Initial Value of 58.85 to a Final Value of $67.68.

Because the Reference Asset Return of the Russell 2000 Index of -70.00% is less than the Reference Asset Return of the Russell MSCI EAFE ETF of 15.00%, the Russell 2000 Index is the Lesser Performing Reference Asset. The Final Value of the Lesser Performing Reference Asset is equal to 238.18 which is less than its Barrier Value of 566.35. Because the Final Value of the Lesser Performing Reference Asset is less its Barrier Value, regardless of the positive Reference Asset Return of the MSCI EAFE ETF, the investor receives a payment at maturity of $300.00 per $1,000 principal amount Note, calculated as follows:

$1,000 + [$1,000 × Reference Asset Return of the Lesser Performing Reference Asset]

$1,000 + [$1,000 × -70.00%] = $300.00

Example 4: The Russell 2000 Index decreases from an Initial Value of 943.92 to a Final Value of 94.39 and the MSCI EAFE ETF decreases from an Initial Value of $58.85 to a Final Value of $8.83.

Because the Reference Asset Return of the Russell 2000 Index of -90.00% is lower than the Reference Asset Return of the MSCI EAFE ETF of -85.00%, the Russell 2000 Index is the Lesser Performing Reference Asset. The Final Value of the Lesser Performing Reference Asset is equal to 94.39 which is less than its Barrier Value of 566.35. Because the Final value of the Lesser Performing Reference Asset is less than its Barrier Value, the investor receives a payment at maturity of $100.00 per $1,000 principal amount Note, calculated as follows:

$1,000 + [$1,000 × Reference Asset Return of the Lesser Performing Reference Asset]

$1,000 + [$1,000 × -90.00%] = $100.00

SELECTED PURCHASE CONSIDERATIONS

| • | Market Disruption Events and Adjustments—The Valuation Dates and the Maturity Date are subject to adjustment in the event of a Market Disruption Event with respect to either Reference Asset. If the Calculation Agent determines that a Market Disruption Event occurs or is continuing in respect of either Reference Asset on the relevant Valuation Date, the relevant Valuation Date will be postponed. If such postponement occurs, the Closing Values of the Reference Assets for the relevant Valuation Date will be determined using the Closing Values of the Reference Assets on the first following Reference Asset Business Day on which no Market Disruption Event occurs or is continuing in respect of either Reference Asset. In no event, however, will the relevant Valuation Date be postponed by more than five days that would have been Reference Asset Business Days but for the occurrence of a Market Disruption Event. If the Calculation Agent determines that a Market Disruption Event occurs or is continuing in respect of either Reference Asset on such fifth day, the Calculation Agent will determine the Closing Value of either Reference Asset unaffected by such Market Disruption Event using the Closing Value of such Reference Asset on such fifth day, and will make an estimate of the Closing Value of either Reference Asset affected by such Market Disruption Event that would have prevailed on such fifth day in the absence of such Market Disruption Event. In the event that a Valuation Date (including the Final Valuation Date) is postponed, the related Quarterly Contingent Interest Payment Date (or Maturity Date, as applicable) will be the fifth Business Day (or third Business Day in the case of the Final Valuation Date), following such Valuation Date, as postponed. |

For a description of what constitutes a Market Disruption Event with respect to the Index, see “Reference Assets—Indices—Market Disruption Events for Securities with the Reference Asset Comprised of an Index or Indices of Equity Securities” in the accompanying prospectus supplement.

PPS-7

For a description of what constitutes a Market Disruption Event with respect to the ETF, see “Reference Assets—Exchange- Traded Funds—Market Disruption Events for Securities with the Reference Asset Comprised of Shares or Other Interests in an Exchange-Traded Fund or Exchange-Traded Funds Comprised of Equity Securities” in the accompanying prospectus supplement.

| • | Adjustments to the Reference Assets—The payment you will receive on any Quarterly Contingent Interest Payment Date or at maturity may subject to adjustment in certain circumstances. |

For a description of adjustments that may affect the Index, see “Reference Assets—Indices—Adjustments Relating to Securities with the Reference Asset Comprised of an Index” in the accompanying prospectus supplement;

For a description of adjustments that may affect the ETF, see “Reference Assets—Exchange-Traded Funds—Adjustments Relating to Securities with the Reference Asset Comprised of an Exchange-Traded Fund or Exchange-Traded Funds” in the accompanying prospectus supplement. In addition to those adjustments described in the accompany prospectus supplement, please note the following additional adjustments: if on or prior to the Final Valuation Date, the shares or other interests in the ETF (or any successor fund) are de-listed or the EFT (or any successor fund) is liquidated or otherwise terminated and the Calculation Agent determines that no successor fund is available, then Calculation Agent may, in its sole discretion, elect to make an adjustment to the Initial Value or the Closing Value of the ETF on any date, or any other terms of the Notes as the Calculation Agent, in its sole discretion, determines appropriate to account for the de-listing, liquidation or termination, as applicable, would have had if the Notes represented an actual interest in the ETF equivalent to the notional interest of the Notes in the ETF.

If the Calculation Agent elects not to make an adjustment as described in the preceding paragraph or determines that no adjustment that it could make will produce a commercially reasonable result, then the Calculation Agent shall cause the Maturity Date to be accelerated to the fourth business day following the date of that determination and the payment at maturity that you will receive on the Notes will be calculated as though the date of early repayment were the stated Maturity Date of the Notes and as though the Final Valuation Date were the date of de-listing, liquidation or termination, as applicable (or, if such day is not a Reference Asset Business Day, the immediately preceding day that is a Reference Asset Business Day).

As used above, the terms “successor fund” has the meanings set forth under “Reference Assets—Exchange-Traded Funds—Adjustments Relating to Securities with the Reference Asset Comprised of an Exchange-Traded Fund or Exchange-Traded Funds” in the accompanying prospectus supplement.

| • | Exposure to the Equities Comprising the Respective Reference Assets—All payments due under the Notes, if any, are linked to the Lesser Performing Reference Asset. As such, the investor may be exposed to the performance (which may be negative) of either the Russell 2000 Index or the MSCI EAFE ETF (depending on which is the Lesser Performing Reference Asset). |

The Russell 2000 Index is designed to track the performance of the small capitalization segment of the U.S. equity market.

The MSCI EAFE ETF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of publicly traded securities in the European, Australasian and Far Eastern Markets, as measured by the MSCI EAFE Index (the “EAFE Index”). For additional information regarding the Reference Assets, please see “Information Regarding the Reference Assets” in this preliminary pricing supplement.

| • | Material U.S. Federal Income Tax Considerations—The material tax consequences of your investment in the Notes are summarized below. The discussion below supplements the discussion under “Certain U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement. Except as noted under “Non-U.S. Holders” below, this section applies to you only if you are a U.S. holder (as defined in the accompanying prospectus supplement) and you hold your Notes as capital assets for tax purposes and does not apply to you if you are a member of a class of holders subject to special rules or are otherwise excluded from the discussion in the prospectus supplement (for example, if you did not purchase your Notes in the initial issuance of the Notes). In addition, this discussion does not apply to you if you purchase your Notes for less than the principal amount of the Notes. |

The U.S. federal income tax consequences of your investment in the Notes are uncertain and the Internal Revenue Service could assert that the Notes should be taxed in a manner that is different than described below. Pursuant to the terms of the Notes, Barclays Bank PLC and you agree, in the absence of a change in law or an administrative or judicial ruling to the contrary, to characterize your Notes as a contingent income-bearing executory contract with respect to the Reference Assets.

PPS-8

If your Notes are properly treated as a contingent income-bearing executory contract, it would be reasonable (i) to treat any Quarterly Contingent Interest Payments you receive on the Notes as items of ordinary income taxable in accordance with your regular method of accounting for U.S. federal income tax purposes and (ii) to recognize capital gain or loss upon the sale, redemption or maturity of your Notes in an amount equal to the difference (if any) between the amount you receive at such time (other than amounts attributable to any Quarterly Contingent Interest Payment) and your basis in the Notes for U.S. federal income tax purposes. Such gain or loss should generally be long-term capital gain or loss if you have held your Notes for more than one year, and otherwise should generally be short-term capital gain or loss. Short-term capital gains are generally subject to tax at the marginal tax rates applicable to ordinary income. Any character mismatch arising from your inclusion of ordinary income in respect of any Quarterly Contingent Interest Payments and capital loss (if any) upon the sale, redemption or maturity of your Notes may result in adverse tax consequences to you because an investor’s ability to deduct capital losses is subject to significant limitations.

In the opinion of our special tax counsel, Sullivan & Cromwell LLP, it would be reasonable to treat your Notes in the manner described above. This opinion assumes that the description of the terms of the Notes in these preliminary terms is materially correct.

NO STATUTORY, JUDICIAL OR ADMINISTRATIVE AUTHORITY DIRECTLY DISCUSSES HOW YOUR NOTES SHOULD BE TREATED FOR U.S. FEDERAL INCOME TAX PURPOSES. AS A RESULT, THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF YOUR INVESTMENT IN THE NOTES ARE UNCERTAIN. ACCORDINGLY, WE URGE YOU TO CONSULT YOUR TAX ADVISOR AS TO THE TAX CONSEQUENCES OF INVESTING IN THE NOTES.

Alternative Treatments. As discussed further in the accompanying prospectus supplement, the Treasury Department and the Internal Revenue Service are actively considering various alternative treatments that may apply to instruments such as the Notes, possibly with retroactive effect. Other alternative treatments for your Notes may also be possible under current law. For example, it is possible that the Notes could be treated as debt instruments subject to the special tax rules governing contingent payment debt instruments. Under the contingent payment debt instrument rules, you generally would be required to accrue interest on a current basis in respect of the Notes over their term based on the comparable yield and projected payment schedule for the Notes and pay tax accordingly, even though these amounts may exceed the Quarterly Contingent Interest Payments (if any) that are made on the Notes. You would also be required to make adjustments to your accruals if the actual amounts that you receive in any taxable year differ from the amounts shown on the projected payment schedule. In addition, any gain you may recognize on the sale, redemption or maturity of the Notes would be taxed as ordinary interest income and any loss you may recognize on the sale, redemption or maturity of the Notes would generally be ordinary loss to the extent of the interest you previously included as income without an offsetting negative adjustment and thereafter would be capital loss. You should consult your tax advisor as to the special rules that govern contingent payment debt instruments.

It is also possible that your Notes could be treated as an investment unit consisting of (i) a debt instrument that is issued to you by us and (ii) a put option in respect of the Reference Assets that is issued by you to us. You should consult your tax advisor as to the possible consequences of this alternative treatment.

In addition, it is possible that (i) you should not include the Quarterly Contingent Interest Payments (if any) in income as you receive them and instead you should reduce your basis in your Notes by the amount of the Quarterly Contingent Interest Payments that you receive; (ii) you should not include the Quarterly Contingent Interest Payments (if any) in income as you receive them and instead, upon the sale, redemption or maturity of your Notes, you should recognize short-term capital gain or loss in an amount equal to the difference between (a) the amount of the Quarterly Contingent Interest Payments made to you over the term of the Notes (including any Quarterly Contingent Interest Payment received at redemption or maturity or the amount of cash that you receive upon a sale that is attributable to the Quarterly Contingent Interest Payments to be made on the Notes) and (b) the excess (if any) of (1) the amount you paid for your Notes over (2) the amount of cash you receive upon the sale, redemption or maturity (excluding any Quarterly Contingent Interest Payment received at redemption or maturity or the amount of cash that you receive upon a sale that is attributable to the Quarterly Contingent Interest Payments to be made on the Notes); or (iii) if a Quarterly Contingent Interest Payment is made at redemption or maturity, such Quarterly Contingent Interest Payment should not separately be taken into account as ordinary income but instead should increase the amount of capital gain or decrease the amount of capital loss that you recognize at such time.

Furthermore, it is also possible that the Notes could be treated as notional principal contracts that are comprised of a swap component and a loan component. If the Notes were treated as notional principal contracts, you could be required to accrue income over the term of your Notes in respect of the loan component (which may exceed the Quarterly Contingent Interest Payments, if any, that are made on the Notes), and any gain or loss that you recognize upon the maturity of your Notes would generally be treated as ordinary income or loss.

PPS-9

You should consult your tax advisor with respect to these possible alternative treatments.

For a further discussion of the tax treatment of your Notes as well as other possible alternative characterizations, please see the discussion under the heading “Certain U.S. Federal Income Tax Considerations—Certain Notes Treated as Forward Contracts or Executory Contracts” in the accompanying prospectus supplement. You should consult your tax advisor as to the possible alternative treatments in respect of the Notes. For additional, important considerations related to tax risks associated with investing in the Notes, you should also examine the discussion in “Selected Risk Considerations—The U.S. federal income tax treatment of an investment in the Notes is uncertain”, in these preliminary terms.

Medicare Tax. As discussed under “Certain U.S. Federal Income Tax Considerations—Medicare Tax” in the accompanying prospectus supplement, certain U.S. holders will be subject to a 3.8% Medicare tax on their “net investment income” if their modified adjusted gross income for the taxable year is over a certain threshold. Net investment income will include any gain that a U.S. holder recognizes upon the sale, redemption or maturity of the Notes, unless such income is derived in the ordinary course of the conduct of a trade or business (other than a trade or business that consists of certain passive or trading activities). It is not clear, however, whether the Medicare tax would apply to any Quarterly Contingent Interest Payments that you receive on the Notes, unless such Quarterly Contingent Interest Payments are derived in the ordinary course of the conduct of a trade or business (in which case the Quarterly Contingent Interest Payments should be treated as net investment income if they are derived in a trade or business that consists of certain trading or passive activities and should otherwise not be treated as net investment income). Accordingly, U.S. holders that do not hold the Notes in the ordinary conduct of a trade or business should consult their tax advisors regarding the application of the Medicare tax to the Quarterly Contingent Interest Payments.

“Specified Foreign Financial Asset” Reporting. Under legislation enacted in 2010, owners of “specified foreign financial assets” with an aggregate value in excess of $50,000 (and in some circumstances, a higher threshold) may be required to file an information report with respect to such assets with their tax returns. “Specified foreign financial assets” generally include any financial accounts maintained by foreign financial institutions, as well as any of the following (which may include your Notes), but only if they are not held in accounts maintained by financial institutions: (i) stocks and securities issued by non-U.S. persons, (ii) financial instruments and contracts held for investment that have non-U.S. issuers or counterparties and (iii) interests in foreign entities. Holders are urged to consult their tax advisors regarding the application of this legislation to their ownership of the Notes.

Non-U.S. Holders. Barclays currently does not withhold on payments to non-U.S. holders. However, if Barclays determines that there is a material risk that it will be required to withhold on any such payments, Barclays may withhold on any Quarterly Contingent Interest Payments at a 30% rate, unless you have provided to Barclays (i) a valid Internal Revenue Service Form W-8ECI or (ii) a valid Internal Revenue Service Form W-8BEN claiming tax treaty benefits that reduce or eliminate withholding. If Barclays elects to withhold and you have provided Barclays with a valid Internal Revenue Service Form W-8BEN claiming tax treaty benefits that reduce or eliminate withholding, Barclays may nevertheless withhold up to 30% on any Quarterly Contingent Interest Payments it makes to you if there is any possible characterization of the payments that would not be exempt from withholding under the treaty. Non-U.S. holders will also be subject to the general rules regarding information reporting and backup withholding as described under the heading “Certain U.S. Federal Income Tax Considerations—Information Reporting and Backup Withholding—” in the accompanying prospectus supplement.

In addition, the Treasury Department has issued proposed regulations under Section 871(m) of the Internal Revenue Code which could ultimately require us to treat all or a portion of any payment in respect of your Notes, to the extent attributable to U.S. source dividends, as a “dividend equivalent” payment that is subject to withholding tax at a rate of 30% (or a lower rate under an applicable treaty). However, such withholding would potentially apply only to payments made after December 31, 2013. You could also be required to make certain certifications in order to avoid or minimize such withholding obligations, and you could be subject to withholding (subject to your potential right to claim a refund from the Internal Revenue Service) if such certifications were not received or were not satisfactory. You should consult your tax advisor concerning the potential application of these regulations to payments you receive with respect to the Notes when these regulations are finalized.

An investment in the Notes involves significant risks. Investing in the Notes is not equivalent to investing directly in the Index or ETF or the constituent components of either Reference Asset. These risks are explained in more detail in the “Risk Factors” section of the prospectus supplement, including the risk factors discussed under the following headings:

| • | “Risk Factors—Risks Relating to All Securities”; |

PPS-10

| • | “Risk Factors—Additional Risks Relating to Securities with Reference Assets That Are Equity Securities or Shares or Other Interests in Exchange-Traded Funds, That Contain Equity Securities or Shares or Other Interests in Exchange-Traded Funds or That Are Based in Part on Equity Securities or Shares or Other Interests in Exchange-Traded Funds”; |

| • | “Risk Factors—Additional Risks Relating to Securities with More Than One Reference Asset, Where the Performance of the Security Is Based on the Performance of Only One Reference Asset”; |

| • | “Risk Factors—Additional Risks Relating to Notes Which Are Not Characterized as Being Fully Principal Protected or Are Characterized as Being Partially Protected or Contingently Protected”; and |

| • | “Risk Factors—Additional Risks Relating to Notes with a Barrier Percentage or a Barrier Value”. |

In addition to the risks described above, you should consider the following:

| • | Your Investment in the Notes May Result in a Loss; No Principal Protection—The Notes do not guarantee any return of principal. The payment at maturity depends on whether the Final Value of the Lesser Performing Reference Asset is less than its Barrier Value. If the Final Value of the Lesser Performing Reference Asset is less its Barrier Value, your Notes will be fully exposed to any such decline of the Lesser Performing Reference Asset from its Initial Value to its Final Value and you may lose a portion or all of your principal. Specifically, if the Final Value of the Lesser Performing Reference Asset is less than its Barrier Value (a decline of 40% compared to its Initial Value), you will lose 1% of your principal amount for every 1% decline in the Final Value of the Lesser Performing Reference Asset as compared to its Initial Value. |

| • | If Your Notes Are Not Called Pursuant to the “Early Redemption at the Option of the Issuer” Provision, the Payment at Maturity on Your Notes will be Based Solely on the Reference Asset Return of the Lesser Performing Reference Asset—If the Notes are not redeemed by the Issuer (pursuant to the “Early Redemption at the Option of the Issuer” provision) , any payment at maturity (including any final Quarterly Contingent Interest Payment) due on your Notes will be linked solely to the Reference Asset Return of the Lesser Performing Reference Asset. As such, the payment at maturity, if any, will not reflect the performance of the Reference Asset that is not the Lesser Performing Reference Asset. For example, if the Final Value of the Lesser Performing Reference Asset is less than the its Barrier Value, even though the Reference Asset that is not the Lesser Performing Reference Asset appreciates from its Initial Value to its Final Value, the calculation of the payment at maturity will not take into account such appreciation and your Notes will be fully exposed to any decline of the Lesser Performing Reference Asset from its Initial Value to its Final Value. Similarly, if both Reference Assets have negative Reference Asset Returns, any payment at maturity will depend solely on whether the Final Value of the Lesser Performing Reference Asset is less than its respective Barrier Value and will not be limited in any way (i) by virtue of the Reference Asset Return of the other Reference Asset being greater than the Reference Asset Return of the Lesser Performing Reference Asset; or (ii) by virtue of the Final Value of the other Reference Asset not being less than its Barrier Value. Accordingly, your investment in the Notes will result in a return that is less, and may be substantially less, than an investment that is linked to the Reference Asset that is not the Lesser Performing Reference Asset. |

| • | The Payment at Maturity of Your Notes is Not Based on the Reference Asset Return of the Lesser Performing Reference Asset at Any Time Other than the Final Value on the Final Valuation Date—The Final Value of the Lesser Performing Reference Asset will be based solely on the Closing Value of the Lesser Performing Reference Asset on the Final Valuation Date (subject to adjustments as described in the accompanying prospectus supplement). Therefore, if the level or price, as the case may be, of the Lesser Performing Reference Asset fell precipitously on the Final Valuation Date, causing the Closing Value of the Lesser Performing Reference Asset to fall below its Barrier Value, the payment at maturity, if any, that you will receive for your Notes may be significantly less than it would otherwise have been had such payment been linked to the price or level, as the case may be, of either Reference Asset at any time prior to such drop. |

| • | You Will Not Receive More Than the Principal Amount of Your Notes at Maturity—At maturity, in addition to the final Quarterly Contingent Interest Payment, if any, you will not receive more than the principal amount of your Notes, even if the Reference Asset Returns of either or both of the Reference Assets is greater than 0%. The total payment you receive over the term of the Notes will never exceed the principal amount of your Notes plus the Quarterly Contingent Interest Payments, if any, paid during the term of the Notes. |

| • | Potential Return Limited to the Quarterly Contingent Interest Payments—The return on the Notes, if any, is limited to the Quarterly Contingent Interest Payment(s), if any. You will not participate in any appreciation in the level of any Reference Asset. Moreover, a Quarterly Contingent Interest Payment will not be made on any Quarterly Interest Payment Date if the Closing Value of the Lesser Performing Reference Asset is below its Coupon Barrier Value on the respective Valuation Date. It is possible that you will not receive any Quarterly Contingent Interest Payments during the term of the Notes. |

| • | Potential Early Exit—While the original term of the Notes is as indicated on the cover page of this preliminary pricing supplement, beginning on April 3, 2014 and each Quarterly Contingent Interest Payment Date thereafter, the Issuer may redeem your Notes (in whole but not in part) at its sole discretion without your consent, provided the Issuer gives at least five Business Days’ prior written notice to the trustee. If the Issuer exercises its redemption option on any Quarterly Contingent Interest Payment Date, you will receive on the applicable Early Redemption Date 100% of the principal amount of your |

PPS-11

| Notes together with any Quarterly Contingent Interest Payment that may be due on such date. This amount may be less than the payment that you would have otherwise been entitled to receive at maturity, and you may not be able to reinvest any amounts received on the Early Redemption Date in a comparable investment with similar risk and yield. No more interest will accrue after the relevant Early Redemption Date. The Issuer’s right to redeem the Notes may also adversely impact your ability to sell your Notes and the price at which they may be sold. The Issuer’s election to redeem the Notes may further limit your ability to sell your Notes and realize any market appreciation of the value of your Notes. |

| • | Credit of Issuer—The Notes are senior unsecured debt obligations of the issuer, Barclays Bank PLC and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Notes depends on the ability of Barclays Bank PLC to satisfy its obligations as they come due and is not guaranteed by any third party. In the event Barclays Bank PLC were to default on its obligations, you may not receive any amounts owed to you under the terms of the Notes. |

| • | Suitability of the Notes for Investment—You should reach a decision whether to invest in the Notes after carefully considering, with your advisors, the suitability of the Notes in light of your investment objectives and the specific information set out in this preliminary pricing supplement, the prospectus supplement, the index supplement and the prospectus. Neither the Issuer nor any dealer participating in the offering makes any recommendation as to the suitability of the Notes for investment. |

| • | No Direct Exposure to Fluctuations in Foreign Exchange Rates—The value of your Notes will not be adjusted for exchange rate fluctuations between the U.S. dollar and the currency in which the stocks composing the MSCI EAFE ETF are denominated, although any currency fluctuations could affect the performance of the MSCI EAFE ETF. Therefore, if the applicable currency appreciates or depreciates relative to the U.S. dollar over the term of the Notes, you will not receive any additional payment or incur any reduction in your payment at maturity. |

| • | Non-U.S. Securities Markets Risks—The component stocks of the MSCI EAFE ETF are issued by foreign companies in foreign securities markets. These stocks may be more volatile and may be subject to different political, market, economic, exchange rate, regulatory and other risks which may have a negative impact on the performance of the financial products linked to the Index, which may have an adverse effect on the Notes. Also, the public availability of information concerning the issuers of the component stocks of the MSCI EAFE ETF will vary depending on their home jurisdiction and the reporting requirements imposed by their respective regulators. In addition, the issuers of such component stocks may be subject to accounting, auditing and financial reporting standards and requirement that differ from those applicable to United States reporting companies. |

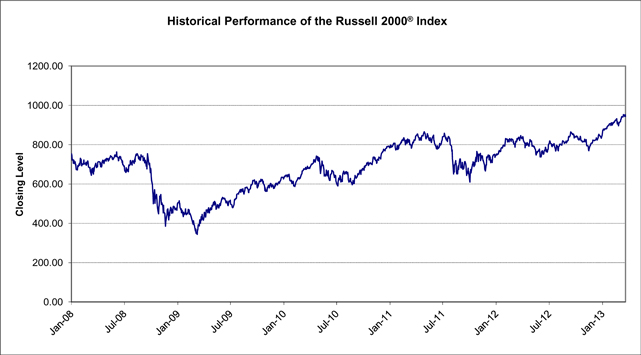

| • | Historical Performance of the Reference Assets Should Not Be Taken as Any Indication of the Future Performance of the Reference Assets Over the Term of the Notes—The historical performance of the Reference Assets is not an indication of the future performance of the Reference Assets over the term of the Notes. Therefore, the performance of the Reference Assets over the term of the Notes may bear no relation or resemblance to the historical performance of the Reference Assets. |

| • | No Dividend Payments or Voting Rights—As a holder of the Notes, you will not have voting rights or rights to receive cash dividends or other distributions or other rights that holders of securities comprising the Reference Assets would have. |

| • | Certain Features of Exchange-Traded Funds Will Impact the Value of the Notes—The Quarterly Contingent Interest Payments and the payment due at maturity is linked to the Lesser Performing Reference Asset. As such, the investor may be exposed to the performance (which may be negative) of either the Russell 2000 Index or the MSCI EAFE ETF (depending on which is the Lesser Performing Reference Asset). With regard to the performance of the ETF, it is important to note that the ETF does not fully replicate the performance of its underlying index, and the ETF may hold securities not included in its underlying index. Additionally, the value of the ETF is subject to: |

| • | The ETF may underperform its underlying index. The performance of the ETF may not replicate the performance of, and may underperform, the EAFE Index (its underlying index). Unlike its underlying index, the ETF will reflect transaction costs and fees that will reduce its relative performance. Moreover, it is also possible that the ETF may not fully replicate or may, in certain circumstances, diverge significantly from the performance of its underlying index; for example, due to the temporary unavailability of certain securities in the secondary market, the performance of any derivative instruments contained in the ETF, differences in trading hours between the ETF and its underlying index or due to other circumstances. Because the return on your Notes is linked to the performance of the ETF and not its underlying index, the return on your securities may be less than that of an alternative investment linked directly to the EAFE Index. |

| • | Management risk. This is the risk that the investment strategy for the ETF, the implementation of which is subject to a number of constraints, may not produce the intended results. |

| • | Derivatives risk. The ETF may invest in stock index futures contracts and other derivatives. A derivative is a financial contract, the value of which depends on, or is derived from, the value of an underlying asset such as a security or an index. Compared to conventional securities, derivatives can be more sensitive to changes in interest rates or to sudden fluctuations in market prices, and thus an ETF’s losses, and, as a consequence, the losses of your Notes, may be greater than if the ETF invested only in conventional securities. |

PPS-12

| • | Lack of Liquidity—The Notes will not be listed on any securities exchange. Barclays Capital Inc. and other affiliates of Barclays Bank PLC intend to make a secondary market for the Notes but are not required to do so, and may discontinue any such secondary market making at any time, without notice. Barclays Capital Inc. may at any time hold unsold inventory, which may inhibit the development of a secondary market for the Notes. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. Because other dealers are not likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which Barclays Capital Inc. and other affiliates of Barclays Bank PLC are willing to buy the Notes. The Notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your Notes to maturity. |

| • | Certain Built-In Costs Are Likely to Adversely Affect the Value of the Notes Prior to Maturity—While the payment at maturity described in this preliminary pricing supplement is based on the full principal amount of your Notes, the original issue price of the Notes includes the agent’s commission and the cost of hedging our obligations under the Notes through one or more of our affiliates. As a result, the price, if any, at which Barclays Capital Inc. and other affiliates of Barclays Bank PLC will be willing to purchase Notes from you in secondary market transactions will likely be lower than the price you paid for your Notes, and any sale prior to the Maturity Date could result in a substantial loss to you. |

| • | Potential Conflicts—We and our affiliates play a variety of roles in connection with the issuance of the Notes, including acting as calculation agent and hedging our obligations under the Notes. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the Notes. |

| • | Taxes—The U.S. federal income tax treatment of the Notes is uncertain and the Internal Revenue Service could assert that the Notes should be taxed in a manner that is different than described above. As discussed further in the accompanying prospectus supplement, the Internal Revenue Service issued a notice in 2007 indicating that it and the Treasury Department are actively considering whether, among other issues, you should be required to accrue interest over the term of an instrument such as the Notes at a rate that may exceed the Quarterly Contingent Interest Payments (if any) that you receive on the Notes and whether all or part of the gain you may recognize upon the sale, redemption or maturity of an instrument such as the Notes should be treated as ordinary income. Similarly, the Internal Revenue Service and the Treasury Department have current projects open with regard to the tax treatment of pre-paid forward contracts and contingent notional principal contracts. While it is impossible to anticipate how any ultimate guidance would affect the tax treatment of instruments such as the Notes (and while any such guidance may be issued on a prospective basis only), such guidance could be applied retroactively and could in any case (i) increase the likelihood that you will be required to accrue income in respect of the Notes even if you do not receive any payments with respect to the Notes until redemption or maturity and (ii) require you to accrue income in respect of the Notes in excess of any Quarterly Contingent Interest Payments you receive on the Notes. The outcome of this process is uncertain. In addition, any character mismatch arising from your inclusion of ordinary income in respect of any Quarterly Contingent Interest Payments and capital loss (if any) upon the sale, redemption or maturity of your Notes may result in adverse tax consequences to you because an investor’s ability to deduct capital losses is subject to significant limitations. You should consult your tax advisor as to the possible alternative treatments in respect of the Notes. |

| • | Many Economic and Market Factors Will Impact the Value of the Notes—In addition to the level or price, as the case may be, of the Reference Assets on any Reference Asset Business Day, the value of the Notes will be affected by a number of economic and market factors that may either offset or magnify each other, including: |

| • | the expected volatility of the Reference Assets; |

| • | the time to maturity of the Notes; |

| • | the market price and dividend rate on the common stocks underlying the Indices; |

| • | interest and yield rates in the market generally; |

| • | a variety of economic, financial, political, regulatory or judicial events; |

| • | supply and demand for the Notes; and |

| • | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

INFORMATION REGARDING THE REFERENCE ASSETS

Description of the Russell 2000® Index

All information regarding the Russell 2000® Index set forth in this pricing supplement reflects the policies of, and is subject to change by, Russell Investments (“Russell”), the index sponsor. The Russell 2000® Index was developed by Russell and is calculated, maintained and published by Russell. The Russell 2000® Index is reported by Bloomberg under the ticker symbol “RTY <Index>”.

The Russell 2000® Index is designed to track the performance of the small capitalization segment of the U.S. equity market. As a subset of the Russell 3000® Index (the “Russell 3000”), it consists of approximately 2,000 of the smallest companies (based on a combination of their market capitalization and the current index membership) included in the Russell 3000 and represented, as of June 30, 2012, approximately 10% of the total market capitalization of the Russell 3000. The Russell 3000, in turn, comprises the 3,000 largest U.S. companies as measured by total market capitalization, which together represented, as of December 31, 2012, approximately 98% of the investable U.S. equity market.

PPS-13

Selection of Stocks Underlying the Russell 2000® Index

Security Inclusion Criteria

| • | U.S. company. All companies eligible for inclusion in the Russell 2000® Index must be classified as a U.S. company under Russell’s country-assignment methodology. If a company is incorporated, has a stated headquarters location, and company stock trades in the same country (American Depositary Receipts and American Depositary Shares are not eligible for this purpose), then the company is assigned to its country of incorporation. If any of the three factors are not the same, Russell defines three Home Country Indicators (“HCIs”): country of incorporation, country of headquarters, and country of the most liquid exchange as defined by a two-year average daily dollar trading volume (“ADDTV”) from all exchanges within a country. After the HCIs are defined, the next step in the country assignment involves an analysis of assets by location. Russell cross-compares the primary location of the company’s assets with the three HCIs. If the primary location of its assets matches any of the HCIs, then the company is assigned to the primary location of its assets. If there is insufficient information to determine the country in which the company’s assets are primarily located, Russell will use the primary location of the company’s revenues to cross-compare with the three HCIs and assign a country in a similar manner. Beginning in 2011, Russell will use the average of two years of assets or revenues data, in order to reduce potential turnover. Assets and revenues data are retrieved from each company’s annual report as of the last trading day in May. If conclusive country details cannot be derived from assets or revenues data, Russell will assign the company to the country of its headquarters, which is defined as the address of the company’s principal executive offices, unless that country is a Benefit Driven Incorporation “BDI” country, in which case the company will be assigned to the country of its most liquid stock exchange. BDI countries include: Anguilla, Antigua and Barbuda, Bahamas, Barbados, Belize, Bermuda, British Virgin Islands, Cayman Islands, Channel Islands, Cook Islands, Faroe Islands, Gibraltar, Isle of Man, Liberia, Marshall Islands, Netherlands Antilles, Panama, and Turks and Caicos Islands. For any companies incorporated or headquartered in a U.S. territory, including countries such as Puerto Rico, Guam, and U.S. Virgin Islands, a U.S. HCI is assigned. |

| • | Trading requirements. All securities eligible for inclusion in the Russell 3000 must trade on a major U.S. exchange. Bulletin Board, pink-sheet or over-the-counter traded securities are not eligible for inclusion. |

| • | Minimum closing price. Stock must trade at or above US$1.00 on their primary exchange on the last trading day in May to be considered eligible for inclusion in the Russell 3000 during annual reconstitution or during initial public offering (IPO) eligibility. If a stock’s closing price is less than US$1.00 on the last day of May, it will be considered eligible if the average of the daily closing prices (from its primary exchange) during the month of May is equal to or greater than US$1.00. Nonetheless, a stock’s closing price (on its primary exchange) on the last trading day in May will be used to calculate market capitalization and index membership. Initial public offerings are added each quarter and must have a closing price at or above US$1.00 on the last day of their eligibility period in order to qualify for index inclusion. |

| • | Primary exchange pricing. If a stock, new or existing, does not have a closing price at or above US$1.00 (on its primary exchange) on the last trading day in May, but does have a closing price at or above US$1.00 on another major U.S. exchange, that stock will be eligible for inclusion. |

| • | Minimum total market capitalization. Companies with a total market capitalization of less than US$30 million are not eligible for the Russell 2000® Index. |

| • | Minimum available shares/float requirement. Companies with only a small portion of their shares available in the marketplace are not eligible for the Russell Indices. Companies with 5% or less will be removed from eligibility. |