| Preliminary Pricing Supplement (To the Prospectus dated August 31, 2010 and the Prospectus Supplement dated May 27, 2011) |

Filed Pursuant to Rule 424(b)(2) Registration No. 333-169119 |

The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement and the accompanying prospectus, prospectus supplement and index supplement do not constitute an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Pricing Supplement dated December 10, 2012

|

$[—]

Callable Contingent Coupon Notes due December 17, 2014

Linked to the Common Stock of Apple Inc.

Global Medium-Term Notes, Series A, No. E-7666 |

Terms used in this preliminary pricing supplement, but not defined herein, shall have the meanings ascribed to them in the prospectus supplement.

| Issuer: |

Barclays Bank PLC | |

| Initial Valuation Date: |

December 10, 2012 | |

| Issue Date: |

December 13, 2012 | |

| Final Valuation Date: |

December 10, 2014* | |

| Maturity Date: |

December 17, 2014** | |

| Reference Asset: |

Common Stock of Apple Inc. (Bloomberg ticker symbol “AAPL UQ <Equity>”). | |

| Denominations: |

Minimum denomination of $1,000, and integral multiples of $1,000 in excess thereof | |

| Contingent Coupon: |

On each quarterly Contingent Coupon Payment Date, unless the Notes have been previously redeemed (pursuant to the “Early Redemption at the Option of the Issuer” provision), you will receive a quarterly contingent coupon equal to 2.25% (9.00% per annum) of the principal amount of your Notes if and only if the Closing Price of the Reference Asset on the related Valuation Date is greater than or equal to its Coupon Barrier Price. If the Closing Price of the Reference Asset on a quarterly Valuation Date is less than its Coupon Barrier Price, you will not receive a contingent coupon on the related quarterly Contingent Coupon Payment Date, and if the Closing Price of the Reference Asset is less than its Coupon Barrier Price on all Valuation Dates, you will not receive any contingent coupon payments over the term of the Notes. | |

| Valuation Dates: |

March 11, 2013, June 10, 2013, September 10, 2013, December 10, 2013, March 10, 2014, June 10, 2014, September 10, 2014 and December 10, 2014 (the “final valuation date”), subject to postponement if such date is not a Trading Day or for certain market disruption events. | |

| Contingent Coupon Payment Dates:** | The contingent coupon payment date for any Valuation Date will be the fifth Business Day after such Valuation Date, provided that the contingent coupon payment date for the Final Valuation Date will be the Maturity Date. | |

| Early Redemption at the Option of the Issuer: |

The Issuer may redeem your Notes (in whole but not in part) at its sole discretion without your consent at the Redemption Price set forth below on any quarterly Contingent Coupon Payment Date, provided the Issuer gives at least five Business Days’ prior written notice to the trustee. If the Issuer exercises its redemption option, the quarterly Contingent Coupon Payment Date on which the Issuer so exercises the redemption option will be referred to as the “Early Redemption Date”. | |

| Redemption Price: | If the Issuer exercises its redemption option, you will receive on the applicable Early Redemption Date a cash payment equal to 100% of the principal amount of your Notes together with any Contingent Coupon payment that may be due on such date. | |

| Physical Settlement at the Option of the Issuer: |

If a Knock-In Event occurs AND we have elected to exercise our physical settlement option, you will receive on the Maturity Date an amount of shares of the Reference Asset equal to the Physical Delivery Amount (and, if applicable, a cash payment in respect of the Fractional Share Amount) as described below under “Payment at Maturity”. | |

| Payment at Maturity: | If your Notes are not early redeemed by us pursuant to the “Early Redemption at the Option of the Issuer” provisions, you will receive (subject to our credit risk) on the Maturity Date, in addition to any Contingent Coupon that may be due on such date, a payment determined as follows:

• If a Knock-In Event does not occur, you will receive a cash payment of $1,000 per $1,000 principal amount Note;

• If (i) a Knock-In Event occurs AND (ii) we have not elected to exercise our physical settlement option, you will receive an amount in cash calculated per $1,000 principal amount Note as follows:

$1,000 + [$1,000 × Reference Asset Return]

• If (i) a Knock-In Event occurs AND (ii) we have elected to exercise our physical settlement option, you will receive (a) an amount of shares of the Reference Asset equal to the Physical Delivery Amount and (b) a cash payment equal to the Fractional Share Amount times the Final Price.

If a Knock-In Event occurs, you will lose some or all of the principal amount of your Notes. If a Knock-In Event occurs and we have not elected to exercise our physical settlement option, the portion of your principal that you receive at maturity will be fully exposed to any decline from the Initial Price to the Final Price. If a Knock-In Event occurs and we have exercised our physical settlement option, the market value of the shares of the Reference Asset that you receive is expected to be substantially less than the value of your original investment.

Any payment on the Notes, including any payment due at maturity, is subject to the creditworthiness of the Issuer and is not guaranteed by any third party. For a description of risks with respect to the ability of Barclays Bank PLC to satisfy its obligations as they come due, see “Credit of Issuer” in this preliminary pricing supplement. | |

| Reference Asset Return: |

The performance of the Reference Asset from the Initial Price to the Final Price, calculated as follows:

Final Price – Initial Price Initial Price | |

| Initial Price:**** | [—], the Closing Price of the Reference Asset on the Initial Valuation Date. | |

| Final Price:**** | The Closing Price of the Reference Asset on the Final Valuation Date. | |

| Coupon Barrier Price****: | [—], the Initial Price multiplied by 57.50% rounded to the nearest cent. | |

| Knock-In Barrier Price:**** | [—], the Initial Price multiplied by 57.50% rounded to the nearest cent. | |

| Knock-In Event: | A Knock-In Event occurs if, as determined by the Calculation Agent, the Final Price of the Reference Asset is less than the Knock-In Barrier Price. | |

| Physical Delivery Amount:**** | [—], which is a number of shares of the Reference Asset equal to $1,000 divided by the Initial Price, rounded down to the nearest whole number. | |

| Fractional Share Amount:**** | [—], which is equal to the number of fractional shares of the Reference Asset resulting from dividing $1,000 by the Initial Price. | |

| Closing Price: | With respect to the Reference Asset on a Trading Day, the official closing price per share of the Reference Asset as displayed on Bloomberg Professional® service page “AAPL:UQ <Equity>” or any successor page on Bloomberg Professional® service or any successor service, as applicable.

In certain circumstances, the closing price per share of the Reference Asset will be based on the alternate calculation as described in “Reference Assets—Share Adjustments Relating to Securities with an Equity Security as the Reference Asset” in the accompanying prospectus supplement. | |

| Trading Day: | A day, as determined by the Calculation Agent, on which the primary exchange or market of trading for shares of the Reference Asset are open for trading and trading is generally conducted on such market or exchange. | |

| Business Day: | Any day that is a Monday, Tuesday, Wednesday, Thursday or Friday that is not a day on which banking institutions in New York City or London generally, are authorized or obligated by law or executive order to close. | |

|

Calculation Agent: |

Barclays Bank PLC | |

| CUSIP/ISIN: | 06741JVQ9 and US06741JVQ92 | |

| * | Subject to postponement in the event of a market disruption event, as described under “Reference Assets—Equity Securities—Market Disruption Events Relating to Securities with an Equity Security as the Reference Asset” in the prospectus supplement. |

| ** | Subject to postponement in the event of a market disruption event as described under “Terms of the Notes—Maturity Date”, “Reference Assets—Equity Securities—Market Disruption Events Relating to Securities with an Equity Security as the Reference Asset” in the prospectus supplement. |

| *** | If such day is not a Business Day, payment will be made on the immediately following Business Day with the same force and effect as if made on the specified date. No additional interest will accrue as a result of delayed payment. |

| **** | Subject to adjustment as described under “Reference Assets—Equity Securities—Share Adjustments Relating to Securities with an Equity Security as the Reference Asset” in the prospectus supplement. |

Investing in the Notes involves a number of risks. See “Risk Factors” beginning on page S-6 of the prospectus supplement and “Selected Risk Considerations” beginning on page PPS-8 of this preliminary pricing supplement.

The Notes will not be listed on any U.S. securities exchange or quotation system. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this preliminary pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The Notes constitute our direct, unconditional, unsecured and unsubordinated obligations and are not deposit liabilities of Barclays Bank PLC and are not insured by the U.S. Federal Deposit Insurance Corporation or any other governmental agency of the United States, the United Kingdom or any other jurisdiction.

| Price to Public |

Agent’s Commission‡ |

Proceeds to Barclays Bank PLC | ||||

| Per Note |

100% | 1.50% | 98.50% | |||

| Total |

$ | $ | $ |

| ‡ | Barclays Capital Inc. will receive commissions from the Issuer equal to 1.50% of the principal amount of the notes, or $15.00 per $1,000 principal amount, and may retain all or a portion of these commissions or use all or a portion of these commissions to pay selling concessions or fees to other dealers. Accordingly, the percentage and total proceeds to Issuer listed herein is the minimum amount of proceeds that Issuer receives. |

You may revoke your offer to purchase the Notes at any time prior to the pricing as described on the cover of this preliminary pricing supplement. We reserve the right to change the terms of, or reject any offer to purchase the Notes prior to their pricing. In the event of any changes to the terms of the Notes, we will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we may reject your offer to purchase.

ADDITIONAL TERMS SPECIFIC TO THE NOTES

You should read this preliminary pricing supplement together with the prospectus dated August 31, 2010, as supplemented by the prospectus supplement dated May 27, 2011 relating to our Global Medium-Term Notes, Series A, of which these Notes are a part. This preliminary pricing supplement, together with the documents listed below, contains the terms of the Notes and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth under “Risk Factors” in the prospectus supplement, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes.

You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| • | Prospectus dated August 31, 2010: |

http://www.sec.gov/Archives/edgar/data/312070/000119312510201448/df3asr.htm

| • | Prospectus Supplement dated May 27, 2011: |

http://www.sec.gov/Archives/edgar/data/312070/000119312511152766/d424b3.htm

Our SEC file number is 1-10257. As used in this preliminary pricing supplement, the “Company,” “we,” “us,” or “our” refers to Barclays Bank PLC.

PPS-2

HYPOTHETICAL EXAMPLES OF AMOUNTS PAYABLE ON THE NOTES

Hypothetical Examples of Quarterly Contingent Coupon Payments that May Be Payable During the Term of the Notes

The payment of a quarterly Contingent Coupon on any quarterly Contingent Coupon Payment Date will be dependent on the Closing Price of the Reference Asset on the related Valuation Date relative to its Coupon Barrier Price. If the Closing Price of the Reference Asset on a Valuation Date is less than its Coupon Barrier Price, then there will not be a quarterly Contingent Coupon made on the corresponding quarterly Contingent Coupon Payment Date. Alternatively, if the Closing Price of the Reference Asset on such Valuation Date is greater than or equal to its corresponding Coupon Barrier Price, then a quarterly Contingent Coupon will be made on the corresponding quarterly Contingent Coupon Payment Date. If the Closing Price of the Reference Asset on each Valuation Date is less than its Coupon Barrier Price, then no quarterly Contingent Coupon Payments will be made over the term of the Notes. If the Issuer exercises the “Early Redemption at the Option of the Issuer”, then no Contingent Coupons will be payable following the date of such exercise.

Quarterly Contingent Coupon Calculations

Step 1: Determine Whether the Closing Price of the Reference Asset on the Valuation Date is Greater than or Equal to its Coupon Barrier Level.

The Calculation Agent will take the Closing Price of the Reference Asset on the Valuation Date and evaluate it relative to its Coupon Barrier Price (that is, whether the Closing Price on that day is greater than or equal to its applicable Coupon Barrier Price). If the Closing Price of the Reference Asset is greater than or equal to its Coupon Barrier Price, a quarterly Contingent Coupon will be due (as calculated in Step 2 below) and payable on the corresponding quarterly Contingent Coupon Payment Date. If the Closing Price of the Reference Asset is less than the Coupon Barrier Price of such Reference Asset, then no quarterly Contingent Coupon will be due on the corresponding quarterly Contingent Coupon Payment Date.

Step 2: Calculate the Quarterly Contingent Coupon Payment, if Any:

If on the respective Valuation Date, the Closing Price of the Reference Asset is greater than or equal to its Coupon Barrier Price, we will pay a quarterly Contingent Coupon equal to 2.25% (9.00% per annum) of the stated principal amount; otherwise no quarterly Contingent Coupon will be due on the corresponding quarterly Contingent Coupon Payment Date. The quarterly Contingent Coupon will be calculated as follows:

$1,000 × 2.25% = $22.50

No adjustments to the amount of the quarterly Contingent Coupon will be made in the event a quarterly Contingent Coupon Payment Date is not a Business Day. Payment will be made on the immediately following Business Day with the same force and effect as if made on the specified date.

The tables and examples below illustrate the determination as to whether a quarterly Contingent Coupon will be made with respect to a series of 8 hypothetical Valuation Dates. The hypothetical examples set forth below are based on the following additional assumptions: a quarterly Contingent Coupon equal to 2.25% (9.00% per annum) of the stated principal amount; a Coupon Barrier Price equal to 57.50% of the Initial Value; the Notes are held until the Maturity Date and the Issuer has not exercised the “Early Redemption at the Option of the Issuer”; and no Market Disruption Event with respect to the Reference Asset has occurred or is continuing on any Valuation Date, including the Final Valuation Date. Numbers in the table and examples below have been rounded for ease of analysis. The examples below also do not take into account the effects of applicable taxes.

Table 1 During the Term of the Notes, On Certain Valuation Dates, the Closing Price of the Reference Asset has been Less Than its Coupon Barrier Price and on Certain Valuation Dates, the Closing Price of the Reference Asset has been Greater than or Equal to its Coupon Barrier Price. As a Result, During the Term of the Notes on Certain Valuation Dates a Quarterly Contingent Coupon Will Be Due (on the Related Contingent Coupon Payment Date) and On Other Valuation Dates, No Quarterly Contingent Coupon Will Be Due.

| Valuation Dates |

Is the Closing Price of the Reference Asset Below its Coupon Barrier Price?1 |

Will a Contingent Coupon be Due on the related Contingent Coupon Payment Date?2 |

Contingent Coupon Payment (per $1,000 principal amount)3 | |||

| First |

No | Yes | $22.50 | |||

| Second |

Yes | No | $0.00 | |||

| Third |

Yes | No | $0.00 | |||

| Fourth |

No | Yes | $22.50 | |||

| Fifth |

Yes | No | $0.00 | |||

| Sixth |

No | Yes | $22.50 | |||

| Seventh |

No | Yes | $22.50 | |||

| Eighth (Final Valuation Date) |

Yes | No | $0.00 |

PPS-3

During the Term of the Notes, the Total Contingent Coupon Payments received per Note: $90.00

| 1 | The Coupon Barrier Price is equal to 57.50% of its Initial Value. |

| 2 | A quarterly Contingent Coupon will be due if the Closing Price of the Reference Asset on the related Valuation Date is greater than or equal to its Coupon Barrier Price. |

| 3 | The quarterly Contingent Coupon payment per Note equals 2.25% (9.00% per annum) of the $1,000 principal amount. |

Table 2 With Respect to Each Valuation Date, the Closing Price of the Reference Asset Has Been Greater than or Equal to its Coupon Barrier Price. This Example Illustrates the Maximum Possible Contingent Coupon Payments that Would be Due During the Term of the Notes.

| Valuation Dates |

Is the Closing Price of the Reference Asset Below its Coupon Barrier Price?1 |

Will a Contingent Coupon be Due on the related Contingent Coupon Payment Date?2 |

Contingent Coupon Payment (per $1,000 principal amount)3 | |||

| First |

No | Yes | $22.50 | |||

| Second |

No | Yes | $22.50 | |||

| Third |

No | Yes | $22.50 | |||

| Fourth |

No | Yes | $22.50 | |||

| Fifth |

No | Yes | $22.50 | |||

| Sixth |

No | Yes | $22.50 | |||

| Seventh |

No | Yes | $22.50 | |||

| Eighth (Final Valuation Date) |

No | Yes | $22.50 |

During the Term of the Notes, the Total Contingent Coupon Payments received per Note: $180.00

| 1 | The Coupon Barrier Price is equal to 57.50% of its Initial Value. |

| 2 | A quarterly Contingent Coupon will be due if the Closing Price of the Reference Asset on the related Valuation Date is greater than or equal to its Coupon Barrier Price. |

| 3 | The quarterly Contingent Coupon payment per Note equals 2.25% (9.00% per annum) of the $1,000 principal amount. |

Table 3 With Respect to Each Valuation Date, the Closing Price of the Reference Asset Has Been Less than its Coupon Barrier Price. This Example Illustrates the Minimum Possible Contingent Coupon Payments that Would be Due During the Term of the Notes, Which is $0.00.

| Valuation Dates |

Is the Closing Price of the Reference Asset Below its Coupon Barrier Price?1 |

Will a Contingent Coupon be Due on the related Contingent Coupon Payment Date?2 |

Contingent Coupon Payment (per $1,000 principal amount)3 | |||

| First |

Yes | No | $0.00 | |||

| Second |

Yes | No | $0.00 | |||

| Third |

Yes | No | $0.00 | |||

| Fourth |

Yes | No | $0.00 | |||

| Fifth |

Yes | No | $0.00 | |||

| Sixth |

Yes | No | $0.00 | |||

| Seventh |

Yes | No | $0.00 | |||

| Eighth (Final Valuation Date) |

Yes | No | $0.00 |

During the Term of the Notes, the Total Contingent Coupon Payments received per Note: $0.00

| 1 | The Coupon Barrier Price is equal to 57.50% of its Initial Value. |

| 2 | A quarterly Contingent Coupon will be due if the Closing Price of the Reference Asset on the related Valuation Date is greater than or equal to its Coupon Barrier Price. |

| 3 | The quarterly Contingent Coupon payment per Note equals 2.25% (9.00% per annum) of the $1,000 principal amount. |

PPS-4

Hypothetical Examples of Payments Due at Maturity Assuming a Range of Reference Asset Returns

The following table illustrates a hypothetical range of payments at maturity (excluding the final contingent coupon payment that may be due on the Notes) assuming a range of Reference Asset Returns. The hypothetical examples set forth below are for illustrative purposes only. The numbers appearing in the following table and examples have been rounded for ease of analysis. The following examples do not take into account any tax consequences from investing in the Notes. These examples also make the following assumptions:

| • | Initial Price of the Reference Asset: $547.28 |

| • | Knock-in Barrier Price: $314.69 (which is 57.50% of the assumed Initial Price set forth above, rounded to the nearest cent) |

| • | Physical Delivery Amount: 1 share (which is equal to $1,000 divided by the assumed Initial Price set forth above, rounded down to the nearest whole share) |

| • | Fractional Share Amount: 0.82722 (which is the amount of fractional shares resulting from dividing $1,000 by the assumed Initial Price set forth above). In lieu of any fractional share amount that you would otherwise receive in respect of any Note, at maturity investors will receive an amount in cash equal to the value of such fractional share based on the Final Price. |

| • | The Notes are not redeemed by us prior to maturity, as described under “Early Redemption at the Option of the Issuer” on the cover page of this preliminary pricing supplement. |

| Final Price ($) |

Reference Asset Return |

Payment at Maturity (per $1,000 principal amount Note)* |

Physical Delivery Amount (per $1,000 principal amount Note) |

Fractional Share Amount (per $1,000 principal amount Note) | ||||

| 1094.56 |

100.00% | $1,000.00 | N/A | N/A | ||||

| 1039.83 |

90.00% | $1,000.00 | N/A | N/A | ||||

| 985.10 |

80.00% | $1,000.00 | N/A | N/A | ||||

| 930.38 |

70.00% | $1,000.00 | N/A | N/A | ||||

| 875.65 |

60.00% | $1,000.00 | N/A | N/A | ||||

| 820.92 |

50.00% | $1,000.00 | N/A | N/A | ||||

| 766.19 |

40.00% | $1,000.00 | N/A | N/A | ||||

| 711.46 |

30.00% | $1,000.00 | N/A | N/A | ||||

| 656.74 |

20.00% | $1,000.00 | N/A | N/A | ||||

| 602.01 |

10.00% | $1,000.00 | N/A | N/A | ||||

| 574.64 |

5.00% | $1,000.00 | N/A | N/A | ||||

| 547.28 |

0.00% | $1,000.00 | N/A | N/A | ||||

| 519.92 |

-5.00% | $1,000.00 | N/A | N/A | ||||

| 492.55 |

-10.00% | $1,000.00 | N/A | N/A | ||||

| 465.19 |

-15.00% | $1,000.00 | N/A | N/A | ||||

| 437.82 |

-20.00% | $1,000.00 | N/A | N/A | ||||

| 383.10 |

-30.00% | $1,000.00 | N/A | N/A | ||||

| 314.69 |

-42.50% | $1,000.00 | N/A | N/A | ||||

| 273.64 |

-50.00% | $500.00 | 1*** | 0.82722 ¥ ($226.36) | ||||

| 218.91 |

-60.00% | $400.00 | 1*** | 0.82722 ¥ ($181.09) | ||||

| 164.18 |

-70.00% | $300.00 | 1*** | 0.82722 ¥ ($135.81) | ||||

| 109.46 |

-80.00% | $200.00 | 1*** | 0.82722 ¥ ($90.55) | ||||

| 54.73 |

-90.00% | $100.00 | 1*** | 0.82722 ¥ ($45.27) | ||||

| 0.00 |

-100.00% | $0.00 | 0 | 0.82722 ¥ ($0.00) |

| * | Excluding the final contingent coupon payment that may be due on the Notes. |

| ** | Assumes that we have not elected to exercise our physical settlement option, as described on the cover page of this preliminary pricing supplement. |

| *** | Assumes that we have elected to exercise our physical settlement option at maturity and, as such, in lieu of a cash payment at maturity, investors will receive (per Note) a number of whole shares equal to $1,000 divided by the assumed Initial Price set forth above, rounded down to the nearest whole share. In addition, investors will receive the cash value of any fractional share amount. |

| ¥ | The cash value of such fractional share is provided in the parenthetical. |

PPS-5

The following examples illustrate how the payments at maturity set forth in the table above are calculated:

Example 1: The Reference Asset increases from an Initial Price of $547.28 to a Final Price of $602.01.

Because the Final Price is greater than the Knock-In Barrier Price, a Knock-In Event does not occur. The investor will receive at maturity, in addition to the final Contingent Coupon, a cash payment of $1,000 per $1,000 principal amount Note.

Example 2: The Reference Asset decreases from an Initial Price of $547.28 to a Final Price of $492.55.

Although the Final Price is less than the Initial Price, the Final Price is above the Knock-In Barrier Price. Because the Final Price is above the Knock-In Barrier Price, a Knock-In Event does not occur. Accordingly, investor will receive at maturity, in addition to final Contingent Coupon, a cash payment of $1,000 per $1,000 principal amount Note.

Example 3: The Reference Asset decreases from an Initial Price of $547.28 to a Final Price of $273.64 (resulting in the occurrence of a Knock-In Event) and we do not exercise our option to physically settle the Notes.

Because the Final Price is less than the Knock-In Barrier Price, a Knock-In Event has occurred. Accordingly, assuming that we have not exercised our option to physically settle the Notes, the investor receives a cash payment at maturity of $500.00 per $1,000 principal amount Note, calculated as follows:

$1,000 + [$1,000 × Reference Asset Return]

$1,000 + [$1,000 × -50.00%] = $500.00

Example 4: The Reference Asset decreases from an Initial Price of $547.28 to a Final Price of $273.64 (resulting in the occurrence of a Knock-In Event) and we exercise our option to physically settle the Notes.

Because the Final Price is less than the Knock-In Barrier Price, a Knock-In Event has occurred. Accordingly, assuming that we exercise our option to physically settle the Notes, the investor receives at maturity (in addition to the final contingent coupon payment), for each $1,000 principal amount Note that they hold, 1 share of the Reference Asset (equal to the Physical Delivery Amount) plus a cash payment of $226.36 (equal to the Fractional Share Amount times the Final Price).

SELECTED PURCHASE CONSIDERATIONS

| • | Market Disruption Events and Adjustments—The Valuation Dates, the Maturity Date and the payment at maturity are subject to adjustment as described in the following sections of the prospectus supplement: |

| • | For a description of what constitutes a market disruption event with respect to the Reference Asset as well as the consequences of that market disruption event, see “Reference Assets—Equity Securities—Market Disruption Events Relating to Securities with an Equity Security as the Reference Asset”; and |

| • | For a description of further adjustments that may affect the Reference Asset, see “Reference Assets—Equity Securities—Share Adjustments Relating to Securities with an Equity Security as the Reference Asset”. |

| • | Material U.S. Federal Income Tax Considerations— The material tax consequences of your investment in the Notes are summarized below. The discussion below supplements the discussion under “Certain U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement. Except as noted under “Non-U.S. Holders” below, this section applies to you only if you are a U.S. holder (as defined in the accompanying prospectus supplement) and you hold your Notes as capital assets for tax purposes and does not apply to you if you are a member of a class of holders subject to special rules or are otherwise excluded from the discussion in the prospectus supplement (for example, if you did not purchase your Notes in the initial issuance of the Notes). In addition, this discussion does not apply to you if you purchase your Notes for less than the principal amount of the Notes. |

The United States federal income tax consequences of your investment in the Notes are uncertain and the Internal Revenue Service could assert that the Notes should be taxed in a manner that is different than described below. Pursuant to the terms of the Notes, Barclays Bank PLC and you agree, in the absence of a change in law or an administrative or judicial ruling to the contrary, to characterize your Notes as a contingent income bearing executory contract with respect to the Reference Asset.

If your Notes are properly treated as a contingent income bearing executory contract, it would be reasonable (i) to treat any quarterly contingent coupon payments you receive on the Notes as items of ordinary income taxable in accordance with your

PPS-6

regular method of accounting for U.S. federal income tax purposes and (ii) to recognize capital gain or loss upon the sale, redemption or maturity of your Notes (subject to the discussion below regarding the receipt of shares of the Reference Asset at maturity) in an amount equal to the difference (if any) between the amount you receive at such time (other than amounts attributable to a quarterly contingent coupon payment) and your basis in the Notes for U.S. federal income tax purposes. Such gain or loss should generally be long-term capital gain or loss if you have held your Notes for more than one year, and otherwise should generally be short-term capital gain or loss. Short-term capital gains are generally subject to tax at the marginal tax rates applicable to ordinary income. Any character mismatch arising from your inclusion of ordinary income in respect of the quarterly contingent coupon payments and capital loss (if any) upon the sale, redemption or maturity of your Notes may result in adverse tax consequences to you because an investor’s ability to deduct capital losses is subject to significant limitations. Moreover, in the event you receive shares of the Reference Asset upon the maturity of the Notes, such loss may be deferred (as described in the following paragraph).

If you receive shares of the Reference Asset upon the maturity of your Notes, it is not clear whether the receipt of shares of the Reference Asset should be treated as (i) a taxable settlement of the Notes followed by a purchase of the shares or (ii) a tax-free purchase of the shares pursuant to the original terms of the Notes. Accordingly, you should consult your tax advisor about the tax consequences to you of receiving shares of the Reference Asset upon the maturity of your Notes. If the receipt of the shares is treated as a taxable settlement of the Notes followed by a purchase of the shares, you should (i) recognize capital loss in an amount equal to the difference between the fair market value of the shares you receive at such time plus the cash received in lieu of a fractional share, if any, and your tax basis in the Notes, and (ii) take a basis in such shares in an amount equal to their fair market value at such time. If, alternatively, the receipt of shares of the Reference Asset upon the maturity of your Notes is treated as a tax-free purchase of the shares, (i) the receipt of shares of the Reference Asset upon maturity of your Notes should not give rise to the current recognition of loss at such time, (ii) you should take a carryover basis in such shares equal to the basis you had in your Notes (determined as described below, less the basis attributable to a fractional share, if any), and (iii) if you receive cash in lieu of a fractional share upon the stock settlement of such Notes, you should recognize short-term capital loss equal to the difference between the amount of cash you receive and your tax basis in the fractional share. In general, your tax basis in your Notes will be equal to the price you paid for the Notes. Your holding period in the shares you receive upon the maturity of your Notes will begin on the day after you receive such shares.

In the opinion of our special tax counsel, Sullivan & Cromwell LLP, it would be reasonable to treat your Notes in the manner described above. This opinion assumes that the description of the terms of the Notes in these preliminary terms is materially correct.

NO STATUTORY, JUDICIAL OR ADMINISTRATIVE AUTHORITY DIRECTLY DISCUSSES HOW YOUR NOTES SHOULD BE TREATED FOR U.S. FEDERAL INCOME TAX PURPOSES. AS A RESULT, THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF YOUR INVESTMENT IN THE NOTES ARE UNCERTAIN. ACCORDINGLY, WE URGE YOU TO CONSULT YOUR TAX ADVISOR AS TO THE TAX CONSEQUENCES OF INVESTING IN THE NOTES.

Alternative Treatments. As discussed further in the accompanying prospectus supplement, the Treasury Department and the Internal Revenue Service are actively considering various alternative treatments that may apply to instruments such as the Notes, possibly with retroactive effect. Other alternative treatments for your Notes may also be possible under current law. For example, it is possible that the Notes could be treated as debt instruments subject to the special tax rules governing contingent payment debt instruments. Under the contingent payment debt instrument rules, you generally would be required to accrue interest on a current basis in respect of the Notes over their term based on the comparable yield and projected payment schedule for the Notes and pay tax accordingly, even though these amounts may exceed the quarterly contingent coupon payments (if any) that are made on the Notes. You would also be required to make adjustments to your accruals if the actual amounts that you receive in any taxable year differ from the amounts shown on the projected payment schedule. In addition, any gain you may recognize on the sale, redemption or maturity of the Notes would be taxed as ordinary interest income and any loss you may recognize on the sale, redemption or maturity of the Notes would generally be ordinary loss to the extent of the interest you previously included as income without an offsetting negative adjustment and thereafter would be capital loss. You should consult your tax advisor as to the special rules that govern contingent payment debt instruments.

It is also possible that your Notes could be treated as an investment unit consisting of (i) a debt instrument that is issued to you by us and (ii) a put option in respect of the Reference Asset that is issued by you to us. You should consult your tax advisor as to the possible consequences of this alternative treatment.

In addition, it is possible that (i) you should not include the quarterly contingent coupon payments (if any) in income as you receive them and instead you should reduce your basis in your Notes by the amount of the quarterly contingent coupon

PPS-7

payments that you receive; (ii) you should not include the quarterly contingent coupon payments (if any) in income as you receive them and instead, upon the sale, redemption or maturity of your Notes, you should recognize short-term capital gain or loss in an amount equal to the difference between (a) the amount of the quarterly contingent coupon payments made to you over the term of the Notes (including the quarterly contingent coupon payment received at redemption or maturity or the amount of cash that you receive upon a sale that is attributable to the quarterly contingent coupon payments to be paid on the Notes) and (b) the excess (if any) of (1) the amount you paid for your Notes over (2) the amount of cash you receive upon the sale, redemption or maturity (excluding the quarterly contingent coupon payment received at redemption or maturity or the amount of cash that you receive upon a sale that is attributable to the quarterly contingent coupon payments to be paid on the Notes); or (iii) if a quarterly contingent coupon payment is made at redemption or maturity, such quarterly contingent coupon payment should not separately be taken into account as ordinary income but instead should increase the amount of capital gain or decrease the amount of capital loss that you recognize at redemption or maturity.

You should consult your tax advisor with respect to these possible alternative treatments.

For a further discussion of the tax treatment of your Notes as well as other possible alternative characterizations, please see the discussion under the heading “Certain U.S. Federal Income Tax Considerations—Certain Notes Treated as Forward Contracts or Executory Contracts” in the accompanying prospectus supplement. You should consult your tax advisor as to the possible alternative treatments in respect of the Notes. For additional, important considerations related to tax risks associated with investing in the Notes, you should also examine the discussion in “Selected Risk Considerations—The U.S. federal income tax treatment of an investment in the Notes is uncertain”, in these preliminary terms.

“Specified Foreign Financial Asset” Reporting. Under legislation enacted in 2010, owners of “specified foreign financial assets” with an aggregate value in excess of $50,000 (and in some circumstances, a higher threshold) may be required to file an information report with respect to such assets with their tax returns. “Specified foreign financial assets” generally include any financial accounts maintained by foreign financial institutions, as well as any of the following (which may include your Notes), but only if they are not held in accounts maintained by financial institutions: (i) stocks and securities issued by non-U.S. persons, (ii) financial instruments and contracts held for investment that have non-U.S. issuers or counterparties and (iii) interests in foreign entities. Holders are urged to consult their tax advisors regarding the application of this legislation to their ownership of the Notes.

Non-U.S. Holders. Barclays currently does not withhold on payments to non-U.S. holders. However, if Barclays determines that there is a material risk that it will be required to withhold on any such payments, Barclays may withhold on any quarterly contingent coupon payments at a 30% rate, unless you have provided to Barclays (i) a valid Internal Revenue Service Form W-8ECI or (ii) a valid Internal Revenue Service Form W-8BEN claiming tax treaty benefits that reduce or eliminate withholding. If Barclays elects to withhold and you have provided Barclays with a valid Internal Revenue Service Form W-8BEN claiming tax treaty benefits that reduce or eliminate withholding, Barclays may nevertheless withhold up to 30% on quarterly contingent coupon payments it makes to you if there is any possible characterization of the payments that would not be exempt from withholding under the treaty.

In addition, the Treasury Department has issued proposed regulations under Section 871(m) of the Internal Revenue Code which could ultimately require us to treat all or a portion of any payment in respect of your Notes as a “dividend equivalent” payment that is subject to withholding tax at a rate of 30% (or a lower rate under an applicable treaty). However, such withholding would potentially apply only to payments made after December 31, 2013. You could also be required to make certain certifications in order to avoid or minimize such withholding obligations, and you could be subject to withholding (subject to your potential right to claim a refund from the Internal Revenue Service) if such certifications were not received or were not satisfactory. You should consult your tax advisor concerning the potential application of these regulations to payments you receive with respect to the Notes when these regulations are finalized.

An investment in the Notes involves significant risks. Investing in the Notes is not equivalent to investing directly in the Reference Asset. These risks are explained in more detail in the “Risk Factors” section of the prospectus supplement, including the risk factors discussed under the following headings:

| • | “Risk Factors—Risks Relating to All Securities”; |

| • | “Risk Factors—Additional Risks Relating to Securities with Reference Assets That Are Equity Securities or Shares or Other Interests in Exchange-Traded Funds, That Contain Equity Securities or Shares or Other Interests in Exchange-Traded Funds or That Are Based in Part on Equity Securities or Shares or Other Interests in Exchange-Traded Funds”; |

PPS-8

| • | “Risk Factors—Additional Risks Relating to Notes Which Are Not Characterized as Being Fully Principal Protected or Are Characterized as Being Partially Protected or Contingently Protected”; and |

| • | “Risk Factors—Additional Risks Relating to Notes with a Barrier Percentage or a Barrier Level”. |

In addition to the risks described above, you should consider the following:

| • | Your Investment in the Notes May Result in a Significant Loss; No Principal Protection—The Notes do not guarantee any return of principal. If the Final Price of the Reference Asset is less than the Knock-In Barrier Price, a Knock-In Event will occur. If a Knock-In Event occurs and we do not exercise our option to physically settle your Notes, the amount of your principal that you receive at maturity will be fully exposed to the decline of the Reference Asset from the Initial Price to the Final Price. If a Knock-In Event occurs and we exercise our option to physically settle your Notes, you will receive an amount of shares of the Reference Asset with a market value that is expected to be substantially less than the initial value of your investment. As such, you may lose some or all of your investment in the Notes. |

| • | Potential Early Exit—While the original term of the Notes is as indicated on the cover page of this preliminary pricing supplement, the Issuer may redeem your Notes (in whole but not in part) at its sole discretion without your consent at the Redemption Price on any quarterly Contingent Coupon Payment Date during the term of the Notes, beginning on the first Contingent Coupon Payment Date scheduled to occur in March 2013, provided the Issuer gives at least five Business Days’ prior written notice to the trustee. If the Issuer exercises its redemption option, you will receive on the applicable Early Redemption Date a cash payment equal to 100% of the principal amount of your Notes together with any Contingent Coupon that may be due on such date. This amount may be less than the payment that you would have otherwise been entitled to receive at maturity, and you may not be able to reinvest any amounts received on the Early Redemption Date in a comparable investment with similar risk and yield. No additional payments will be due after the Early Redemption Date. The Issuer’s right to redeem the Notes may also adversely impact your ability to sell your Notes and the price at which they may be sold. The Issuer’s election to redeem the Notes may further limit your ability to sell your Notes and realize any market appreciation of the value of your Notes. |

| • | You Will Not Receive More Than the Principal Amount of Your Notes at Maturity—At maturity, you will not receive more than the principal amount of your Notes, even if the Reference Asset Return is positive. The total payment you receive over the term of the Notes will never exceed the principal amount of your Notes plus the Contingent Coupon payments, if any, paid during the term of the Notes. |

| • | Potential Return Limited to the Quarterly Contingent Coupon Payments—The return on the Note is limited to the quarterly Contingent Coupons payment(s), if any, that may be due during the term of the Notes. You will not participate in any appreciation in the value of the Reference Asset. Moreover, a quarterly Contingent Coupon will not be due on any quarterly Contingent Coupon Payment Date if the Closing Price of Reference Asset is below its Coupon Barrier Price on the respective Valuation Date. As such, it is possible that you will not receive any Contingent Coupon payments during the term of the Notes. |

| • | The Determination of Whether a Knock-In Event Occurs is Not Based on the Price of the Reference Asset at any Time Other than the Closing Price on the Final Valuation Date—A Knock-In Event occurs if the Final Price of the Reference Asset is below its Knock-In Barrier. The determination of whether a Knock-In Event occurs is therefore not based on any price of the Reference Asset at any time other than the Closing Price on the Final Valuation Date. If the price of the Reference Asset drops precipitously on the Final Valuation Date such that a Knock-In Event occurs, the value of the payment at maturity on your Notes that you receive (whether in the form of a cash payment or shares of the Reference Asset), if any, will be significantly less than it would have been had your payment at maturity been linked to the price of the Reference Asset at a time prior to such drop. |

| • | Credit of Issuer—The Notes are senior unsecured debt obligations of the issuer, Barclays Bank PLC and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Notes depends on the ability of Barclays Bank PLC to satisfy its obligations as they come due and is not guaranteed by any third party. In the event Barclays Bank PLC were to default on its obligations, you may not receive any amounts owed to you under the terms of the Notes. |

| • | Holding the Notes is not the Same as Owning Directly the Reference Asset; No Dividend Payments or Voting Rights—As a holder of the Notes, you will not have voting rights or rights to receive cash dividends or other distributions or other rights that holders of shares of the Reference Asset would have. |

| • | Suitability of the Notes for Investment—You should reach a decision whether to invest in the Notes after carefully considering, with your advisors, the suitability of the Notes in light of your investment objectives and the specific information set out in this preliminary pricing supplement, the prospectus supplement and the prospectus. Neither the Issuer nor any dealer participating in the offering makes any recommendation as to the suitability of the Notes for investment. |

| • | Single Equity Risk—The price of the Reference Asset can rise or fall sharply due to factors specific to the Reference Asset and its issuer, such as stock price volatility, earnings, financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as well as general market factors, such as general stock market volatility and levels, interest rates and economic and political conditions. We urge you to review financial and other information filed periodically with the SEC by the issuer of the Reference Asset. We have not undertaken any independent review or due diligence of the issuer’s SEC filings or of any other publicly available information regarding the issuer. |

PPS-9

| • | Historical Performance of the Reference Asset Should Not Be Taken as Any Indication of the Future Performance of the Reference Asset Over the Term of the Notes—The historical performance of the Reference Asset is not an indication of the future performance of that Reference Asset over the term of the Notes. Therefore, the performance of the Reference Asset over the term of the Notes may bear no relation or resemblance to the historical performance of the Reference Asset. |

| • | Lack of Liquidity—The Notes will not be listed on any securities exchange. Barclays Capital Inc. and other affiliates of Barclays Bank PLC intend to make a secondary market for the Notes but are not required to do so, and may discontinue any such secondary market making at any time, without notice. Barclays Capital Inc. may at any time hold unsold inventory, which may inhibit the development of a secondary market for the Notes. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. Because other dealers are not likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which Barclays Capital Inc. and other affiliates of Barclays Bank PLC are willing to buy the Notes. The Notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your Notes to maturity. |

| • | Certain Built-In Costs Are Likely to Adversely Affect the Value of the Notes Prior to Maturity—While the payment at maturity described in this preliminary pricing supplement is based on the full principal amount of your Notes, the original issue price of the Notes includes the agent’s commission and the cost of hedging our obligations under the Notes through one or more of our affiliates. As a result, the price, if any, at which Barclays Capital Inc. and other affiliates of Barclays Bank PLC will be willing to purchase Notes from you in secondary market transactions will likely be lower than the price you paid for your Notes, and any sale prior to the Maturity Date could result in a substantial loss to you. |

| • | Potential Conflicts—We and our affiliates play a variety of roles in connection with the issuance of the Notes, including acting as calculation agent and hedging our obligations under the Notes. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the Notes. |

| • | Taxes—The U.S. federal income tax treatment of the Notes is uncertain and the Internal Revenue Service could assert that the Notes should be taxed in a manner that is different than described above. As discussed further in the accompanying prospectus supplement, the Internal Revenue Service issued a notice in 2007 indicating that it and the Treasury Department are actively considering whether, among other issues, you should be required to accrue interest over the term of an instrument such as the Notes at a rate that may exceed the quarterly contingent coupon payments (if any) that you receive on the Notes and whether all or part of the gain you may recognize upon the sale, redemption or maturity of an instrument such as the Notes could be treated as ordinary income. Similarly, the Internal Revenue Service and the Treasury Department have current projects open with regard to the tax treatment of pre-paid forward contracts, contingent notional principal contracts and other derivative contracts. While it is impossible to anticipate how any ultimate guidance would affect the tax treatment of instruments such as the Notes (and while any such guidance may be issued on a prospective basis only), such guidance could be applied retroactively and could in any case (i) increase the likelihood that you will be required to accrue income even if you do not receive any payments with respect to the Notes until redemption or maturity and (ii) require you to accrue income in excess of any quarterly contingent coupon payments you receive on the Notes. The outcome of this process is uncertain. In addition, any character mismatch arising from your inclusion of ordinary income in respect of the quarterly contingent coupon payments and capital loss (if any) upon the sale, redemption or maturity of your Notes may result in adverse tax consequences to you because an investor’s ability to deduct capital losses is subject to significant limitations. You should consult your tax advisor as to the possible alternative treatments in respect of the Notes. |

| • | Many Economic and Market Factors Will Impact the Value of the Notes—In addition to the price of the Reference Asset on any day and the factors set forth above, the value of the Notes will be affected by a number of economic and market factors that may either offset or magnify each other, including: |

| • | the expected volatility of the Reference Asset; |

| • | the time to maturity of the Notes; |

| • | the dividend rate on the Reference Asset; |

| • | interest and yield rates in the market generally; |

| • | a variety of economic, financial, political, regulatory or judicial events; |

| • | supply and demand for the Notes; and |

| • | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

PPS-10

DESCRIPTION OF THE COMMON STOCK OF APPLE INC.

According to publicly available information, Apple Inc. and its subsidiaries (collectively, the “Company”) design, manufacture and market mobile communication and media devices, personal computers, and portable digital music players, and sell a variety of related software, services, peripherals, networking solutions, and third-party digital content and applications. The Company sells its products through its retail and online stores, as well as through its direct sales force and third-party cellular network carries, wholesalers and retailers.

You are urged to read the following section in the accompanying prospectus supplement: “Reference Assets—Equity Securities—Reference Asset Issuer and Reference Asset Information”. Companies with securities registered under the Securities Exchange Act of 1934, as amended, which is commonly referred to as the “Exchange Act”, and the Investment Company Act of 1940, as amended, which is commonly referred to as the “’40 Act”, are required to periodically file certain financial and other information specified by the SEC. Information provided to or filed with the SEC electronically can be accessed through a website maintained by the SEC. The address of the SEC’s website is http://www.sec.gov. Information provided to or filed with the SEC pursuant to the Exchange Act or the ’40 Act by the Company can be located by reference to its SEC file number:000-10030, or its CIK Code: 0000320193

The summary information above regarding the Company comes from the issuer’s SEC filings. You are urged to refer to the SEC filings made by the Company and to other publicly available information (such as the Company’s annual report) to obtain an understanding of the Company’s business and financial prospects. The summary information contained above is not designed to be, and should not be interpreted as, an effort to present information regarding the financial prospects of any issuer, including the Company, or any trends, events or other factors that may have a positive or negative influence on those prospects or as an endorsement of any particular issuer.

Information from outside sources is not incorporated by reference in, and should not be considered part of, this preliminary pricing supplement or any accompanying prospectus or prospectus supplement. We have not undertaken any independent review or due diligence of the Company’s SEC filings or of any other publicly available information regarding the Company.

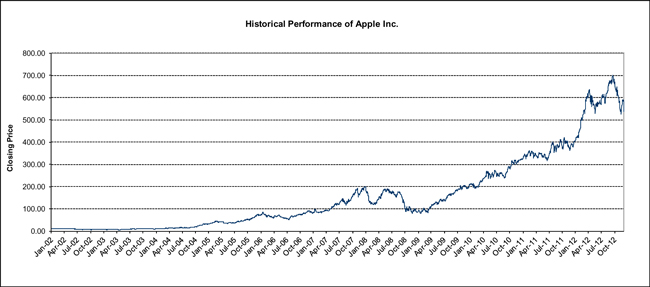

Historical Performance of the Common Stock of Apple Inc.

The following table sets forth the high and low intraday prices, as well as end-of-quarter Closing Prices, of the common stock of Apple Inc. during the periods indicated below.

| Quarter/Period Ending |

Quarterly High |

Quarterly Low |

Quarterly Close |

|||||||||

| March 30, 2007 |

$ | 97.80 | $ | 81.90 | $ | 92.91 | ||||||

| June 29, 2007 |

$ | 127.60 | $ | 89.60 | $ | 122.04 | ||||||

| September 28, 2007 |

$ | 155.00 | $ | 111.62 | $ | 153.54 | ||||||

| December 31, 2007 |

$ | 202.96 | $ | 150.64 | $ | 198.08 | ||||||

| March 31, 2008 |

$ | 200.20 | $ | 115.44 | $ | 143.50 | ||||||

| June 30, 2008 |

$ | 192.24 | $ | 144.54 | $ | 167.44 | ||||||

| September 30, 2008 |

$ | 180.91 | $ | 100.61 | $ | 113.66 | ||||||

| December 31, 2008 |

$ | 116.40 | $ | 79.16 | $ | 85.35 | ||||||

| March 31, 2009 |

$ | 109.90 | $ | 78.20 | $ | 105.12 | ||||||

| June 30, 2009 |

$ | 146.40 | $ | 103.90 | $ | 142.43 | ||||||

| September 30, 2009 |

$ | 188.89 | $ | 134.42 | $ | 185.37 | ||||||

| December 31, 2009 |

$ | 213.94 | $ | 180.76 | $ | 210.86 | ||||||

| March 31, 2010 |

$ | 237.48 | $ | 190.26 | $ | 234.93 | ||||||

| June 30, 2010 |

$ | 279.00 | $ | 199.35 | $ | 251.53 | ||||||

| September 30, 2010 |

$ | 294.73 | $ | 235.56 | $ | 283.75 | ||||||

| December 31, 2010 |

$ | 326.65 | $ | 277.77 | $ | 322.56 | ||||||

| March 31, 2011 |

$ | 364.90 | $ | 324.88 | $ | 348.45 | ||||||

| June 30, 2011 |

$ | 355.00 | $ | 310.65 | $ | 335.67 | ||||||

| September 30, 2011 |

$ | 422.85 | $ | 334.22 | $ | 381.18 | ||||||

| December 30, 2011 |

$ | 426.69 | $ | 354.27 | $ | 405.00 | ||||||

| March 30, 2012 |

$ | 621.42 | $ | 409.00 | $ | 599.47 | ||||||

| June 29, 2012 |

$ | 644.00 | $ | 528.69 | $ | 584.00 | ||||||

| September 28, 2012 |

$ | 705.07 | $ | 570.00 | $ | 667.26 | ||||||

| December 6, 2012* |

$ | 676.74 | $ | 505.76 | $ | 547.28 | ||||||

| * | For the period commencing October 1, 2012 and ending on December 6, 2012 |

PPS-11

The following graph sets forth the historical performance of the common stock of Apple Inc. based on daily Closing Prices from January 2, 2002 through December 6, 2012. The Closing Price of one share of Apple Inc. on December 6, 2012 was $547.28.

We obtained the historical trading price information set forth above from Bloomberg, L.P., without independent verification. The historical performance of the Reference Asset should not be taken as an indication of the future performance of the Reference Asset during the term of the Notes.

SUPPLEMENTAL PLAN OF DISTRIBUTION

We will agree to sell to Barclays Capital Inc. (the “Agent”), and the Agent will agree to purchase from us, the principal amount of the Notes, and at the price, specified on the cover of the related pricing supplement, the document that will be filed pursuant to

Rule 424(b) containing the final pricing terms of the Notes. The Agent will commit to take and pay for all of the Notes, if any are taken.

PPS-12