Preliminary Pricing Supplement

Dated January 3, 2018

The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement and the accompanying prospectus and prospectus supplement do not constitute an offer to sell these ETNs, and we are not soliciting an offer to buy these ETNs in any state where the offer or sale is not permitted.

|

|

|

Pricing Supplement to the Prospectus |

$[·] iPath® Series B S&P 500® VIX Short-Term FuturesTM ETN

$[·] iPath® Series B S&P 500® VIX Mid-Term FuturesTM ETN

This pricing supplement relates to two series of iPath® Exchange Traded Notes (the “ETNs”) that Barclays Bank PLC may issue from time to time. The return of one series of ETNs is linked to the performance of the S&P 500® VIX Short-Term Futures Index TR and the return of the other series of ETNs is linked to the performance of the S&P 500® VIX Mid-Term Futures Index TR (each, an “Index” and collectively, the “Indices”). The Indices are designed to provide investors with exposure to one or more maturities of futures contracts on the CBOE Volatility Index® (the “VIX Index”). The ETNs do not guarantee any return of principal at maturity and do not pay any interest during their term. Instead, you will receive a cash payment in U.S. dollars at maturity or upon early redemption based on the performance of the Index to which your ETNs are linked, less an investor fee (and, in the case of holder redemption, a redemption charge).

You may lose some or all of your principal if you invest in the ETNs. Any payment on the ETNs at or prior to maturity is not guaranteed by any third party and is subject to both the creditworthiness of Barclays Bank PLC and to the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority If Barclays Bank PLC were to default on its payment obligations or become subject to the exercise of any U.K. Bail-in Power (or any other resolution measure) by the relevant U.K. resolution authority, you might not receive any amounts owed to you under the ETNs. See “Consent to U.K. Bail-in Power” and “Risk Factors” in this pricing supplement and “Risk Factors” in the accompanying prospectus supplement for more information.

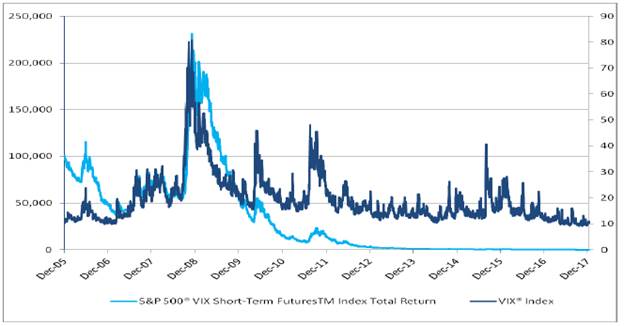

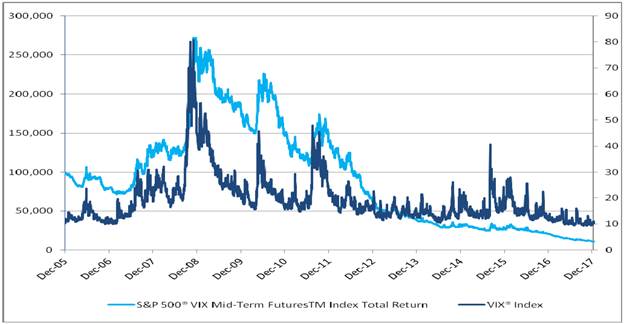

THE ETNS OFFER EXPOSURE TO FUTURES CONTRACTS OF SPECIFIED MATURITIES ON THE VIX INDEX AND NOT DIRECT EXPOSURE TO THE VIX INDEX OR ITS SPOT LEVEL. These futures contracts will not track the performance of the VIX Index. In addition, the nature of the VIX futures market has historically resulted in a significant cost to “roll” a position in the VIX futures contracts underlying the Indices. As a result, the levels of the Indices, which each track a rolling position in specified VIX futures contracts, may experience significant declines as a result of these roll costs, especially over a longer period. The VIX Index will perform differently than the Indices and, in certain cases, may have positive performance during periods where the Indices underlying your ETNs are experiencing poor performance. In turn, an investment in the ETNs may experience a significant decline in value over time, the risk of which increases the longer that the ETNs are held. For more information, see “Risk Factors” beginning on page PS-11 of this pricing supplement and “The Indices—Historical and Hypothetical Historical Performance of the Indices” on page PS-29 of this pricing supplement.

The ETNs are intended to be trading tools for sophisticated investors to manage daily trading risks and are only suitable for a very short investment horizon. The ETNs may not be suitable for all investors and should be used only by investors with the sophistication and knowledge necessary to understand the risks inherent in the relevant Index, the futures contracts that the relevant Index tracks and investments in volatility as an asset class generally. Investors should consult with their broker or financial advisor when making an investment decision and to evaluate their investment in the ETNs and should actively manage and monitor their investments in the ETNs, as frequently as daily.

Furthermore, because the investor fee reduces the amount of your return at maturity or upon redemption, and the investor fee and the redemption charge reduce the amount of your return upon early redemption, the level of the Index underlying your ETNs will need to increase significantly in order for you to receive at least the amount for which you purchased your ETNs at maturity or upon early redemption. If the increase in the level of the applicable Index is insufficient to offset the negative effect of the investor fee (and, in the case of holder redemption, the redemption charge), or the level of that Index decreases you will receive less than the amount for which you purchased your ETNs at maturity or upon early redemption.

If we were to price the ETNs for initial sale to the public as of the date of this preliminary pricing supplement, our hypothetical estimated value of each series of ETNs at the time of such initial pricing would be $[•] per ETN. See “Risk Factors” beginning on page PS-11 of this pricing supplement for risks relating to an investment in the ETNs.

The principal terms of each series of ETNs are as follows:

Issuer: Barclays Bank PLC

Series: Global Medium-Term Notes, Series A

Principal Amount per ETN: $[·] for each series of ETNs.

Inception and Issue Dates: The ETNs will be first sold on [·] (the “inception date”) and are expected to be first issued on [·] (the “issue date”).

Maturity Date: [·] (the “maturity date”)

Secondary Market, CUSIP Numbers and ISINs: We plan to apply to list each series of ETNs on a national securities exchange to be determined at the inception date. The ticker symbols, CUSIP numbers and ISINs for the respective ETNs are as follows:

|

ETNs |

Ticker Symbol |

CUSIP |

ISIN

|

|

iPath® Series B S&P 500® VIX Short-Term FuturesTM ETN |

VXXB |

[ ] |

[ ] |

|

iPath® Series B S&P 500® VIX Mid-Term FuturesTM ETN |

VXZB |

[ ] |

[ ] |

If our application for any series of ETNs is approved, to the extent that such series of ETNs is listed and an active secondary market in that series of ETNs exists, we expect that investors will purchase and sell the ETNs in that series primarily in this secondary market. We are not required to maintain any listing of any series of the ETNs on the national securities exchange on which the ETNs are initially listed or any other securities exchange.

Consent to U.K. Bail-in Power: Notwithstanding any other agreements, arrangements or understandings between Barclays Bank PLC and any holder of the ETNs, by acquiring the ETNs, each holder of the ETNs acknowledges, accepts, agrees to be bound by,

Cover Page, continued

and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority. See “Consent to U.K. Bail-in Power” on page PS-22 of this pricing supplement.

Underlying Indices

The return on each series of ETNs is linked to the performance of the relevant Index. Each Index seeks to provide investors with exposure to one or more maturities of futures contracts on the VIX Index, which reflect implied volatility of the S&P 500® at various points along the volatility forward curve. The calculation of the spot level of the VIX Index is based on prices of put and call options on the S&P 500®. Futures on the VIX Index allow investors the ability to invest in forward volatility based on their view of the future direction of movement of the VIX Index. Each index is intended to reflect the returns that are potentially available through an unleveraged investment in the futures contract or contracts on the VIX index plus the rate of interest that could be earned on reinvestment into the Index of the return on the notional value of the Index based on the 3-month U.S. Treasury rate. The S&P 500® VIX Short-Term FuturesTM Index TR targets a constant weighted average futures maturity of one month. The S&P 500® VIX Mid-Term FuturesTM Index TR targets a constant weighted average futures maturity of five months. The Indices were created by S&P Dow Jones Indices LLC (“S&P Dow Jones Indices” or the “index sponsor”). The index sponsor calculates the level of the relevant Index daily when the Chicago Board Options Exchange, Incorporated (the “CBOE”) is open (excluding holidays and weekends) and publishes it on the Bloomberg pages specified herein as soon as practicable thereafter.

Payment at Maturity

Payment at Maturity: If you hold your ETNs to maturity, you will receive a cash payment in U.S. dollars per ETN equal to the applicable closing indicative value on the final valuation date.

Closing Indicative Value: The closing indicative value for each series of ETNs on the initial valuation date will equal $[·]. On each subsequent calendar day until maturity or early redemption of the relevant series of ETNs, the closing indicative value per ETN for that series of ETNs will equal (1) the closing indicative value for that series on the immediately preceding calendar day times (2) the daily index factor for that series on such calendar day (or, if such day is not an index business day, one) minus (3) the investor fee for that series on such calendar day. An “index business day” for each Index is a day on which such Index is calculated and published by the index sponsor. If the ETNs undergo a split or reverse split, the closing indicative value will be adjusted accordingly.

Daily Index Factor: The daily index factor for each series of ETNs on any index business day will equal (1) the closing level of the Index to which those ETNs are linked on such index business day divided by (2) the closing level of the Index to which those ETNs are linked on the immediately preceding index business day.

Investor Fee: The investor fee for each series of ETNs on the initial valuation date will equal zero. On each subsequent calendar day until maturity or early redemption, the investor fee for each series of ETNs will be equal to (1) 0.89% times (2) the closing indicative value for that series on the immediately preceding calendar day times (3) the daily index factor for that series on that day (or, if such day is not an index business day, one) divided by (4) 365. Because the investor fee is calculated and subtracted from the closing indicative value on a daily basis, the net effect of the fee accumulates over time and is subtracted at the rate of 0.89% per year, which we refer to as the “investor fee rate”. Because the net effect of the investor fee is a fixed percentage of the value of each ETN, the aggregate effect of the investor fee will increase or decrease in a manner directly proportional to the value of each ETN and the amount of ETNs that are held, as applicable.

Valuation Date: A valuation date is each trading day from [·] to [·], inclusive, subject to postponement (not in excess of five trading days) due to the occurrence of a market disruption event. We refer to [·] as the “initial valuation date” and [·] as the “final valuation date” for the ETNs.

Trading Day: A trading day with respect to any series of ETNs is a day on which (1) it is a business day in New York City, (2) trading is generally conducted on the national securities exchange on which the ETNs are listed and (3) trading is generally conducted on the CBOE, in each case as determined by the calculation agent in its sole discretion.

Early Redemption

Holder Redemption: Subject to the notification requirements set forth under “Specific Terms of the ETNs – Early Redemption Procedures” in this pricing supplement, you may redeem your ETNs on any redemption date during the term of the ETNs. If you redeem your ETNs, you will receive a cash payment in U.S. dollars per ETN equal to the applicable closing indicative value on the applicable valuation date minus the redemption charge. You must redeem at least 25,000 ETNs of the same series at one time in order to exercise your right to redeem your ETNs on any redemption date. If you hold fewer than 25,000 ETNs of the same series or fewer than 25,000 ETNs of a series are outstanding, you will not be able to exercise your right to redeem your ETNs of that series. We may from time to time, in our sole discretion, reduce this minimum redemption amount on a consistent basis for all holders of the ETNs of any series.

Issuer Redemption: We may redeem any series of ETNs (in whole but not in part) at our sole discretion on any business day on or after the inception date until and including maturity. To exercise our right to redeem a series of ETNs, we must deliver notice to the holders of that series of ETNs not less than ten calendar days prior to the redemption date on which we intend to redeem that series of ETNs. If we redeem a series of ETNs, you will receive a cash payment in U.S. dollars per ETN in an amount equal to the closing indicative value of that series of ETNs on the valuation date specified by us in such notice.

Redemption Charge: The redemption charge is a one-time charge imposed upon holder redemption and is equal to 0.05% times the closing indicative value on the applicable valuation date. The redemption charge is intended to allow us to recoup the brokerage and other transaction costs that we will incur in connection with redeeming the ETNs. The proceeds we receive from the redemption charge may be more or less than such costs.

Cover Page, continued

Redemption Date: In the case of a holder redemption, the redemption date is the second business day following the applicable valuation date (which must be earlier than the final valuation date) specified in your notice of redemption. Accordingly, the final redemption date will be the second business day following the valuation date that is immediately prior to the final valuation date. In the case of an issuer redemption, the redemption date for each series of ETNs is the fifth business day after the valuation date that we specify in an issuer redemption notice for such series. Such redemption date will in no event be prior to the tenth calendar day following the date on which we deliver the redemption notice.

We intend to sell a portion of each series of ETNs on the inception date at 100% of their stated principal amount through Barclays Capital Inc., our affiliate, as principal in the initial distribution. Following the inception date, the remainder of the ETNs will be offered and sold from time to time through Barclays Capital Inc., our affiliate, as agent. Sales of each series of ETNs by us after their respective inception dates will be made at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices. Barclays Capital Inc. will not receive an agent’s commission in connection with sales of the ETNs. Please see “Supplemental Plan of Distribution” in this pricing supplement for more information.

We may use this pricing supplement in the initial sale of the ETNs. In addition, Barclays Capital Inc. or another of our affiliates may use this pricing supplement in market-making transactions in any ETNs after their initial sale. Unless we or our agent informs you otherwise in the confirmation of sale or in a notice delivered at the same time as the confirmation of sale, this pricing supplement is being used in a market-making transaction.

The ETNs are not deposit liabilities of Barclays Bank PLC and are not insured by the United States Federal Deposit Insurance Corporation or any other governmental agency of the United States, the United Kingdom or any other jurisdiction.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these ETNs or determined that this pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

![]()

Pricing Supplement dated [·]

iPath® Series B S&P 500® VIX Short-Term Futures™ ETN, issued in denominations of $[·]

iPath® Series B S&P 500® VIX Mid-Term Futures™ ETN, issued in denominations of $[·]

PRICING SUPPLEMENT

|

PS-1 | |

|

PS-11 | |

|

PS-22 | |

|

PS-23 | |

|

PS-33 | |

|

PS-34 | |

|

PS-36 | |

|

PS-42 | |

|

PS-42 | |

|

PS-43 | |

|

PS-46 | |

|

PS-47 | |

|

A-1 | |

|

B-1 | |

|

|

|

|

| |

|

|

|

|

SUMMARY |

S-1 |

|

RISK FACTORS |

S-7 |

|

U.K. BAIL-IN POWER |

S-36 |

|

TERMS OF THE NOTES |

S-39 |

|

INTEREST MECHANICS |

S-48 |

|

TERMS OF THE WARRANTS |

S-51 |

|

REFERENCE ASSETS |

S-58 |

|

BENEFIT PLAN INVESTOR CONSIDERATIONS |

S-99 |

|

PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST) |

S-101 |

|

USE OF PROCEEDS AND HEDGING |

S-110 |

|

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES |

S-111 |

|

VALIDITY OF SECURITIES |

S-131 |

|

|

|

|

| |

|

|

|

|

FORWARD-LOOKING STATEMENTS |

1 |

|

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE |

2 |

|

THE BARCLAYS BANK GROUP |

2 |

|

USE OF PROCEEDS |

3 |

|

DESCRIPTION OF DEBT SECURITIES |

4 |

|

DESCRIPTION OF WARRANTS |

23 |

|

GLOBAL SECURITIES |

35 |

|

CLEARANCE AND SETTLEMENT |

37 |

|

DESCRIPTION OF PREFERENCE SHARES |

43 |

|

DESCRIPTION OF AMERICAN DEPOSITARY SHARES |

49 |

|

DESCRIPTION OF SHARE CAPITAL |

55 |

|

TAX CONSIDERATIONS |

57 |

|

EMPLOYEE RETIREMENT INCOME SECURITY ACT |

77 |

|

PLAN OF DISTRIBUTION |

79 |

|

SERVICE OF PROCESS AND ENFORCEMENT OF LIABILITIES |

82 |

|

WHERE YOU CAN FIND MORE INFORMATION |

82 |

|

FURTHER INFORMATION |

82 |

|

VALIDITY OF SECURITIES |

83 |

|

EXPERTS |

83 |

|

EXPENSES OF ISSUANCE AND DISTRIBUTION |

84 |

|

The following is a summary of terms of two series of iPath® Exchange Traded Notes (the “ETNs”) that Barclays Bank PLC may issue from time to time, one linked to the performance of the S&P 500® VIX Short-Term FuturesTM Index TR and the other linked to the performance of the S&P 500® VIX Mid-Term FuturesTM Index TR (each, an “Index” and collectively, the “Indices”), as well as a discussion of risks and other considerations you should take into account when deciding whether to invest in the ETNs. The information in this section is qualified in its entirety by the more detailed explanations set forth elsewhere in this pricing supplement and the accompanying prospectus and prospectus supplement. References to the “prospectus” mean our accompanying prospectus, dated July 18, 2016 and references to the “prospectus supplement” mean our accompanying prospectus supplement, dated July 18, 2016, which supplements the prospectus.

We may, without your consent, create and issue additional securities having the same terms and conditions as any series of the ETNs. We may consolidate the additional securities to form a single class with the outstanding ETNs of that series. However, we are under no obligation to sell additional ETNs at any time, and if we do sell additional ETNs, we may limit such sales and stop selling additional ETNs at any time.

This section summarizes the following aspects of the ETNs:

· What are the ETNs and how do they work?

· How do you redeem your ETNs?

· What are some of the risks of the ETNs?

· Is this the right investment for you?

· What are the tax consequences?

What Are the ETNs and How Do They Work?

Each series of ETNs are medium-term notes that are senior, unsecured debt obligations of Barclays Bank PLC and are linked to the performance of an underlying Index that is designed to provide investors with exposure to |

|

one or more maturities of futures contracts on the VIX Index, which reflect implied volatility of the S&P 500® at various points along the volatility forward curve. The VIX Index is calculated based on the prices of put and call options on the S&P 500®. The two series of ETNs comprise:

· One series of ETNs that is linked to the performance of the S&P 500® VIX Short-Term FuturesTM Index TR that is calculated based on the strategy of owning a continuously rolling portfolio of one-month and two-month VIX futures to target a constant weighted average futures maturity of one month; and

· One series of ETNs that is linked to the performance of the S&P 500® VIX Mid-Term FuturesTM Index TR that is calculated based on the strategy of owning a continuously rolling portfolio of four-month, five-month, six-month and seven-month VIX futures to target a constant weighted average futures maturity of five months.

THE ETNS OFFER EXPOSURE TO FUTURES CONTRACTS OF SPECIFIED MATURITIES ON THE VIX INDEX AND NOT DIRECT EXPOSURE TO THE VIX INDEX OR ITS SPOT LEVEL. These futures contracts will not track the performance of the VIX Index. In addition, the nature of the VIX futures market has historically resulted in a significant cost to “roll” a position in the VIX futures contracts underlying the Indices. As a result, the levels of the Indices, which each track a rolling position in specified VIX futures contracts, may experience significant declines as a result of these roll costs, especially over a longer period. The VIX Index will perform differently than the Indices and, in certain cases, may have positive performance during periods where the Indices underlying your ETNs are experiencing poor performance. In turn, an investment in the ETNs may experience a significant decline in value over time, the risk of which increases the longer that the ETNs are held. For more information, see “Risk Factors” beginning on page PS-11 of this pricing supplement and “The Indices—Historical and Hypothetical Historical

|

|

Performance of the Indices” on page PS-29 of this pricing supplement.

The ETNs are intended to be trading tools for sophisticated investors to manage daily trading risks and are only suitable for a very short investment horizon. The ETNs may not be suitable for all investors and should be used only by investors with the sophistication and knowledge necessary to understand the risks inherent in the relevant Index, the futures contracts that the relevant Index tracks and investments in volatility as an asset class generally. Investors should consult with their broker or financial advisor when making an investment decision and to evaluate their investment in the ETNs and should actively manage and monitor their investments in the ETNs, as frequently as daily.

The Indices

The return on each series of ETNs is linked to the performance of the Index to which such series of ETNs is linked. Each Index seeks to provide investors with exposure to one or more maturities of futures contracts on the VIX Index, which reflect implied volatility in the S&P 500® at various points along the volatility forward curve. The VIX Index is calculated based on the prices of put and call options on the S&P 500®. Each index is intended to reflect the returns that are potentially available through an unleveraged investment in the futures contract or contracts on the VIX index plus the rate of interest that could be earned on reinvestment into the Index of the return on the notional value of the Index based on the 3-month U.S. Treasury rate. Futures on the VIX Index allow investors the ability to invest in forward volatility based on their view of the future direction or movement of the VIX Index. The index sponsor calculates the level of the relevant Index on each index business day and publishes it on the applicable Bloomberg pages specified herein as soon as practicable thereafter.

Inception, Issuance and Maturity

Each series of ETNs will be first sold on [·] (the “inception date”). Each series of the ETNs is expected to be first issued on [·] (the “issue |

|

date”), and each will be due on [·] (the “maturity date”).

Understanding the Value of the ETNs

The “stated principal amount” is $[·] per ETN, which is the initial offering price at which the ETNs will be sold on the inception date.

The “closing indicative value” per ETN for each series of ETNs is the value of the ETNs calculated by us on a daily basis and is used to determine the payment at maturity or upon early redemption. The calculation of the closing indicative value on any valuation date following the initial valuation date is based on the closing indicative value for the immediately preceding calendar day. The closing indicative value for each series of ETNs on the initial valuation date will equal $[·]. On each subsequent calendar day until maturity or early redemption of the relevant series of ETNs, the closing indicative value per ETN for such series of ETNs will equal (1) the closing indicative value for that series on the immediately preceding calendar day times (2) the daily index factor for that series on such calendar day (or, if such day is not an index business day, one) minus (3) the investor fee for that series on such calendar day.

If the ETNs undergo any splits or subsequent reverse splits, the closing indicative value will similarly be adjusted accordingly.

The “intraday indicative value” for any series of ETNs is intended to provide investors with an approximation of the effect that changes in the level of the Index underlying the ETNs during the current trading day would have on the closing indicative value of such series of ETNs from the previous day. Intraday indicative value differs from the closing indicative value in two important respects: First, intraday indicative value is based on the most recent Index level published by the index sponsor, which reflects the most recent reported sales prices for the Index components, rather than the closing indicative value of a series of ETNs for the immediately preceding calendar day. Second, the intraday indicative value only reflects the accrued investor fee for a series of ETNs at the close of business on the preceding calendar day, but does not include any adjustment for the

|

|

accrued investor fee of such series of ETNs accruing during the course of the current day.

If you sell your ETNs on the secondary market, you will receive the “trading price” for your ETNs, which may be substantially above or below the stated principal amount, closing indicative value and/or the intraday indicative value because the trading price reflects investor supply and demand for the ETNs. In addition, if you purchase your ETNs at a price which reflects a premium over the closing indicative value, you may experience a significant loss if you sell or redeem your ETNs at a time when such premium is no longer present in the market place or if we exercise our right to redeem the ETNs.

The intraday indicative value for each series of ETNs is calculated and published by [•], or a successor, under the following ticker symbols: |

|

redemption, the redemption charge), or the level of that Index decreases, you will receive less than the amount for which you purchased your ETNs at maturity or upon redemption.

How Do You Redeem Your ETNs?

We plan to apply to list both series of ETNs on a national securities exchange to be determined at the inception date. If an active secondary market in a series of ETNs exists, we expect that investors will purchase and sell the ETNs primarily in this secondary market.

To redeem your ETNs, you must instruct your broker or other person through whom you hold your ETNs to take the following steps:

· deliver a notice of holder redemption, which is attached as Annex A, to us via facsimile or email by no later than 4:00 p.m., New York City time, on the business day prior to the valuation date that you specify in such notice. If we receive your notice by the time specified in the preceding sentence, we will respond by sending you a form of confirmation of holder redemption, which is attached as Annex B;

· deliver the signed confirmation of holder redemption to us via facsimile or email in the specified form by 5:00 p.m., New York City time, on the same day. We or our affiliate must acknowledge receipt in order for your confirmation to be effective;

· instruct your Depository Trust Company (“DTC”) custodian to book a delivery vs. payment trade with respect to your ETNs on the applicable valuation date at a price equal to the applicable daily closing indicative value per ETN minus the redemption charge, facing Barclays DTC 5101; and

· cause your DTC custodian to deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m., New York City time, on the applicable redemption date (the second business day following the applicable valuation date).

Different brokerage firms may have different deadlines for accepting instructions from their | |

|

|

| ||

|

ETNs

|

Ticker | ||

|

iPath® Series B S&P 500® VIX Short-Term FuturesTM ETN |

VXXB.IV | ||

|

iPath® Series B S&P 500® VIX Mid-Term FuturesTM ETN |

VXZB.IV | ||

|

|

| ||

|

The ETN performance is linked to the performance of the Index underlying your ETNs less an investor fee (and, in the case of holder redemption, the redemption charge). There is no minimum limit to the level of the Index underlying your ETNs. Moreover, the ETNs are not principal protected. Therefore, a decrease in the level of the Index underlying your ETNs could cause you to lose up to your entire investment in the ETNs.

Furthermore, because the investor fee reduces the amount of your return at maturity or upon redemption, and the investor fee and the redemption charge reduce the amount of your return upon early redemption, the level of the Index underlying your ETNs will need to increase significantly in order for you to receive at least the amount for which you purchased your ETNs at maturity or upon redemption. If the increase in the level of the applicable Index is insufficient to offset the negative effect of the investor fee (and, in the case of holder | |||

|

customers. Accordingly, you should consult the brokerage firm through which you own your interest in the ETNs in respect of such deadlines. If we do not receive your notice of holder redemption by 4:00 p.m., New York City time, or your confirmation of holder redemption by 5:00 p.m., New York City time, on the business day prior to the applicable valuation date, your notice will not be effective and we will not redeem your ETNs on the applicable redemption date. Any redemption instructions for which we (or our affiliate) receive a valid confirmation in accordance with the procedures described above will be irrevocable.

The redemption value is determined according to a formula which relies upon the closing indicative value and will be calculated on a valuation date that will occur after the redemption notice is submitted. It is not possible to publicly disclose, or for you to determine, the precise redemption value prior to your election to redeem. The redemption value may be below the most recent intraday indicative value or closing indicative value of your ETNs at the time when you submit your redemption notice.

For more information regarding the intraday indicative value, see “Valuation of the ETNs—Intraday Indicative Value” in this pricing supplement.

What Are Some of the Risks of the ETNs?

An investment in the ETNs involves risks. Some of these risks are summarized here, but we urge you to read the more detailed explanation of risks in “Risk Factors” in this pricing supplement.

· Uncertain Principal Repayment – There is no minimum limit to the level of each Index. Moreover, the ETNs are not principal protected. Therefore, a decrease in the level of the Index underlying your ETNs could cause you to lose up to your entire investment in the ETNs. Furthermore, because the investor fee reduces the amount of your return at maturity or upon early redemption, the level of the Index underlying your ETNs will need to increase significantly in order for you to receive at least the amount for which you |

|

purchased your ETNs at maturity or upon early redemption. If the increase in the level of the Index underlying your ETNs is not sufficient to offset the negative effect of the investor fee (and, in the case of holder redemption, the redemption charge), or if the level of the Index underlying your ETNs decreases, you will receive less than the amount for which you purchased your ETNs at maturity or upon early redemption.

· Market and Volatility Risk – The return on each series of ETNs is linked to the performance of an Index which, in turn, is linked to the prices of one or more futures contracts on the VIX Index. The VIX Index measures the 30-day forward volatility of the S&P 500® as calculated based on the prices of certain put and call options on the S&P 500®. The level of the S&P 500®, the prices of options on the S&P 500®, and the level of the VIX Index may change unpredictably, affecting the value of futures contracts on the VIX Index and, consequently, the level of each Index and the value of your ETNs in unforeseeable ways.

· Issuer Redemption – Subject to the procedures described in this pricing supplement, we have the right to redeem or “call” each series of ETNs (in whole but not in part) at our sole discretion without your consent on any business day on or after the inception date until and including maturity.

· No Interest Payments – You will not receive any periodic interest payments on your ETNs.

· A Trading Market for the ETNs May Not Exist – We plan to apply to list each series of ETNs on a national securities exchange but we cannot guarantee that these applications will be approved, and a trading market for any series of the ETNs may not exist at any time. Even if there is a secondary market for the ETNs, whether as a result of any listing of the ETNs or on an over-the-counter basis, it may not provide enough liquidity to trade or sell your ETNs easily. Although certain affiliates of Barclays Bank PLC may engage in limited

|

|

purchase and resale transactions in the ETNs, they are not required to do so, and if they decide to engage in such transactions, they may stop at any time. We are not required to maintain the listing of any series of ETNs on the national securities exchange on which the ETNs are initially listed or on any other securities exchange.

Is This the Right Investment for You?

The ETNs may be a suitable investment for you if:

· You do not seek a guaranteed return of principal and you are willing to risk losing up to your entire investment in the ETNs.

· You are willing to accept the risk of fluctuations in volatility in general and in the prices of futures contracts on the VIX Index in particular.

· You are willing to accept the risks of an investment linked to the underlying Index, which tracks a rolling position in futures contracts on the VIX Index, and in particular risks associated with roll costs reflected in the level of the underlying Index.

· You believe the level of the Index underlying your ETNs will increase by an amount sufficient to offset the investor fee (and, in the case of holder redemption, the redemption charge) during the term of the ETNs.

· You seek an investment with a return linked to the forward implied volatility of the S&P 500®.

· You do not seek current income from this investment.

· You are willing and able to assume the credit risk of Barclays Bank PLC, as issuer of the ETNs, for all payments under the ETNs and understand that if Barclays Bank PLC were to default on its payment obligations or become subject to the exercise of any U.K. Bail-in Power, you might not receive any amounts due to you under the ETNs, including any repayment of principal. |

|

The ETNs may not be a suitable investment for you if:

· You seek a guaranteed return of principal and you are not willing to risk losing up to your entire investment in the ETNs.

· You are not willing to be exposed to fluctuations in volatility in general and in the prices of futures contracts on the VIX Index in particular.

· You are not willing to accept the risks of an investment linked to the underlying Index, which tracks a rolling position in futures contracts on the VIX Index, and in particular risks associated with roll costs reflected in the level of the underlying Index.

· You believe the level of the Index underlying your ETNs will decrease or will not increase by an amount sufficient to offset the investor fee (and, in the case of early redemption, the redemption charge) during the term of the ETNs

· You prefer the lower risk and therefore accept the potentially lower returns of fixed income investments with comparable maturities and credit ratings.

· You seek current income from your investment.

· You are unwilling or unable to assume the credit risk of Barclays Bank PLC, as issuer of the ETNs, for all payments under the ETNs or you are not willing to be exposed to the risk that if Barclays Bank PLC were to default on its payment obligations or become subject to the exercise of any U.K. Bail-in Power, you might not receive any amounts due to you under the ETNs, including any repayment of principal.

What Are the Tax Consequences?

Absent a change in law or an administrative or judicial ruling to the contrary, pursuant to the terms of the ETNs, by purchasing the ETNs you agree to treat the ETNs for all U.S. federal income tax purposes as a pre-paid derivative contract with respect to the relevant Index. If the ETNs are so treated, you should generally recognize capital gain or loss upon the sale, |

|

early redemption or maturity of your ETNs in an amount equal to the difference between the amount you receive at such time and your tax basis in the ETNs.

The U.S. federal income tax consequences of your investment in the ETNs are uncertain. In the opinion of our counsel, Sullivan & Cromwell LLP, the ETNs should be treated as described above. However, it is possible that the Internal Revenue Service may assert an alternative treatment. Because of this uncertainty, we urge you to consult your own tax advisor as to the tax consequences of your investment in the ETNs.

For a more complete discussion of the U.S. federal income tax consequences of your investment in the ETNs, including possible alternative treatments for the ETNs, see |

|

“Material U.S. Federal Income Tax Considerations” in this pricing supplement.

Conflicts of Interest

Barclays Capital Inc. is an affiliate of Barclays Bank PLC and, as such, has a “conflict of interest” in this offering within the meaning of Rule 5121 of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Consequently, this offering is being conducted in compliance with the provisions of FINRA Rule 5121 (or any successor rule thereto). In addition, Barclays Capital Inc. will not sell the ETNs to a discretionary account without specific written approval from the account holder. For more information, please refer to “Plan of Distribution (Conflicts of Interest)—Conflict of Interest” in the accompanying prospectus supplement. |

Hypothetical Examples

The following examples show how a series of ETNs would perform in hypothetical circumstances, assuming a starting level for the relevant Index of 100. We have included two examples in which the relevant Index has increased by approximately 68.898% at maturity, as well as two examples in which the relevant Index has decreased by approximately 32.261% at maturity. These examples highlight the behavior of the investor fee in different circumstances. Because the investor fee is deducted daily in the calculation of the closing indicative value, the absolute level of the investor fee will be dependent upon the path taken by the respective Index to arrive at its ending level. The figures in these examples have been rounded for convenience. Figures for year 10 are as of the final valuation date, and given the indicated assumptions, a holder will receive payment at maturity in the indicated amount, according to the indicated formula.

The hypothetical examples in this section do not take into account the effects of applicable taxes. The after-tax return you receive on your ETNs will depend on the U.S. tax treatment of your ETNs and on your particular circumstances. Accordingly, the after-tax rate of return of your ETNs could be different than the after-tax return of a direct investment in the Index components or the Index.

Assumptions:

|

Investor Fee Rate |

|

Days |

|

Principal |

|

Starting Index |

|

|

|

0.89% |

|

365 |

|

$100.00 |

|

100.000 |

|

|

|

A |

|

B |

|

C |

|

D |

|

E |

|

F |

|

|

Year |

|

Index Level |

|

Index Annual |

|

Yearly Fee |

|

Investor Fee |

|

Indicative Value |

|

|

A |

|

B |

|

B / B previous year |

|

C x Principal x 0.89% |

|

Running Total of D |

|

(Principal x C) – E |

|

|

0 |

|

100.000 |

|

- |

|

$0.00 |

|

$0.00 |

|

$100.00 |

|

|

1 |

|

114.655 |

|

114.65% |

|

$0.95 |

|

$0.95 |

|

$113.64 |

|

|

2 |

|

135.460 |

|

118.15% |

|

$1.10 |

|

$2.05 |

|

$133.07 |

|

|

3 |

|

153.420 |

|

113.26% |

|

$1.26 |

|

$3.30 |

|

$149.38 |

|

|

4 |

|

146.744 |

|

95.65% |

|

$1.29 |

|

$4.60 |

|

$141.61 |

|

|

5 |

|

136.305 |

|

92.89% |

|

$1.21 |

|

$5.81 |

|

$130.37 |

|

|

6 |

|

131.748 |

|

96.66% |

|

$1.14 |

|

$6.94 |

|

$124.90 |

|

|

7 |

|

120.959 |

|

91.81% |

|

$1.06 |

|

$8.00 |

|

$113.65 |

|

|

8 |

|

131.592 |

|

108.79% |

|

$1.05 |

|

$9.05 |

|

$122.55 |

|

|

9 |

|

147.405 |

|

112.02% |

|

$1.15 |

|

$10.20 |

|

$136.06 |

|

|

10 |

|

168.898 |

|

114.58% |

|

$1.29 |

|

$11.49 |

|

$154.52 |

|

|

Annualized Index Return |

|

5.38% |

| ||||||||

|

Annualized iPath® Indicative Value Return |

|

4.45% |

| ||||||||

Hypothetical Examples

|

A |

|

B |

|

C |

|

D |

|

E |

|

F |

|

|

Year |

|

Index Level |

|

Index Annual |

|

Yearly Fee |

|

Investor Fee |

|

Indicative Value |

|

|

A |

|

B |

|

B / B previous year |

|

C x Principal x 0.89% |

|

Running Total of D |

|

(Principal x C) – E |

|

|

0 |

|

100.000 |

|

- |

|

$0.00 |

|

$0.00 |

|

$100.00 |

|

|

1 |

|

95.714 |

|

95.71% |

|

$0.87 |

|

$0.87 |

|

$94.87 |

|

|

2 |

|

91.612 |

|

95.71% |

|

$0.82 |

|

$1.69 |

|

$90.00 |

|

|

3 |

|

87.686 |

|

95.71% |

|

$0.78 |

|

$2.47 |

|

$85.38 |

|

|

4 |

|

83.928 |

|

95.71% |

|

$0.74 |

|

$3.21 |

|

$80.99 |

|

|

5 |

|

75.650 |

|

90.14% |

|

$0.70 |

|

$3.91 |

|

$72.36 |

|

|

6 |

|

88.832 |

|

117.43% |

|

$0.70 |

|

$4.61 |

|

$84.21 |

|

|

7 |

|

104.312 |

|

117.43% |

|

$0.81 |

|

$5.42 |

|

$98.01 |

|

|

8 |

|

122.489 |

|

117.43% |

|

$0.94 |

|

$6.36 |

|

$114.07 |

|

|

9 |

|

143.834 |

|

117.43% |

|

$1.10 |

|

$7.46 |

|

$132.76 |

|

|

10 |

|

168.898 |

|

117.43% |

|

$1.28 |

|

$8.73 |

|

$154.52 |

|

|

Annualized Index Return |

|

5.38% |

| ||||||||

|

Annualized iPath® Indicative Value Return |

|

4.45% |

| ||||||||

Hypothetical Examples

|

A |

|

B |

|

C |

|

D |

|

E |

|

F |

|

|

Year |

|

Index Level |

|

Index Annual |

|

Yearly Fee |

|

Investor Fee |

|

Indicative Value |

|

|

A |

|

B |

|

B / B previous year |

|

C x Principal x 0.89% |

|

Running Total of D |

|

(Principal x C) – E |

|

|

0 |

|

100.000 |

|

- |

|

$0.00 |

|

$0.00 |

|

$100.00 |

|

|

1 |

|

90.016 |

|

90.02% |

|

$0.84 |

|

$0.84 |

|

$89.22 |

|

|

2 |

|

79.529 |

|

88.35% |

|

$0.74 |

|

$1.58 |

|

$78.13 |

|

|

3 |

|

70.863 |

|

89.10% |

|

$0.65 |

|

$2.24 |

|

$69.00 |

|

|

4 |

|

74.001 |

|

104.43% |

|

$0.62 |

|

$2.86 |

|

$71.41 |

|

|

5 |

|

79.197 |

|

107.02% |

|

$0.65 |

|

$3.52 |

|

$75.75 |

|

|

6 |

|

83.947 |

|

106.00% |

|

$0.69 |

|

$4.21 |

|

$79.58 |

|

|

7 |

|

90.470 |

|

107.77% |

|

$0.73 |

|

$4.94 |

|

$85.01 |

|

|

8 |

|

83.349 |

|

92.13% |

|

$0.72 |

|

$5.66 |

|

$77.62 |

|

|

9 |

|

73.963 |

|

88.74% |

|

$0.65 |

|

$6.31 |

|

$68.27 |

|

|

10 |

|

67.739 |

|

91.59% |

|

$0.58 |

|

$6.89 |

|

$61.97 |

|

|

|

|

|

|

Annualized Index Return |

|

-3.82% |

| ||||

|

|

|

|

|

Annualized iPath® Indicative Value Return |

|

-4.67% |

| ||||

Hypothetical Examples

|

A |

|

B |

|

C |

|

D |

|

E |

|

F |

|

|

Year |

|

Index Level |

|

Index Annual |

|

Yearly Fee |

|

Investor Fee |

|

Indicative Value |

|

|

A |

|

B |

|

B / B previous year |

|

C x Principal x 0.89% |

|

Running Total of D |

|

(Principal x C) – E |

|

|

0 |

|

100.000 |

|

- |

|

$0.00 |

|

$0.00 |

|

$100.00 |

|

|

1 |

|

90.284 |

|

90.28% |

|

$0.84 |

|

$0.84 |

|

$89.48 |

|

|

2 |

|

81.511 |

|

90.28% |

|

$0.75 |

|

$1.60 |

|

$80.07 |

|

|

3 |

|

73.591 |

|

90.28% |

|

$0.67 |

|

$2.27 |

|

$71.65 |

|

|

4 |

|

66.441 |

|

90.28% |

|

$0.60 |

|

$2.87 |

|

$64.12 |

|

|

5 |

|

47.022 |

|

70.77% |

|

$0.54 |

|

$3.41 |

|

$44.98 |

|

|

6 |

|

50.584 |

|

107.57% |

|

$0.41 |

|

$3.83 |

|

$47.95 |

|

|

7 |

|

54.415 |

|

107.57% |

|

$0.44 |

|

$4.27 |

|

$51.13 |

|

|

8 |

|

58.536 |

|

107.57% |

|

$0.47 |

|

$4.74 |

|

$54.51 |

|

|

9 |

|

62.970 |

|

107.57% |

|

$0.50 |

|

$5.24 |

|

$58.12 |

|

|

10 |

|

67.739 |

|

107.57% |

|

$0.53 |

|

$5.77 |

|

$61.97 |

|

|

Annualized Index Return |

|

-3.82% |

| ||||||||

|

Annualized iPath® Indicative Value Return |

|

-4.67% |

| ||||||||

|

The ETNs are senior unsecured debt obligations of Barclays Bank PLC and are not secured debt. The ETNs are riskier than ordinary unsecured debt securities. The return on a series of ETNs is linked to the performance of the Index underlying those ETNs. Investing in a series of ETNs is not equivalent to investing directly in the underlying index components, the Index itself or the VIX Index. See the section entitled “The Indices”, as well as the Index-specific sections, in this pricing supplement for more information.

This section describes the most significant risks relating to an investment in the ETNs. We urge you to read the following information about these risks, together with the other information in this pricing supplement and the accompanying prospectus and prospectus supplement, before investing in the ETNs.

You should also consider the tax consequences of investing in the ETNs, significant aspects of which are uncertain. See “Material U.S. Federal Income Tax Considerations” in this pricing supplement.

Risks Associated with Each Series of ETNs

The ETNs Do Not Guarantee Any Return of Principal, and You May Lose Some or All of Your Investment

The ETN performance is linked to the performance of the Index underlying your ETNs less an investor fee. There is no minimum limit to the level of the Index underlying your ETNs. Moreover, the ETNs are not principal protected. Therefore, a decrease in the level of the Index underlying your ETNs could cause you to lose up to your entire investment in the ETNs.

Furthermore, because the investor fee reduces the amount of your return at maturity or upon early redemption, the level of the Index underlying your ETNs will need to increase significantly in order for you to receive at least the principal amount of your ETNs at maturity or upon early redemption. If the increase in the level of the Index underlying your ETNs is insufficient to offset the negative effect of the investor fee (and, in the case of holder redemption, the redemption charge), or if the level of the Index underlying your ETNs decreases, you will receive less than the principal amount of your ETNs at maturity or upon early redemption.

|

|

The ETNs Are Subject to the Credit Risk of the Issuer, Barclays Bank PLC

The ETNs are senior unsecured debt obligations of the issuer, Barclays Bank PLC, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the ETNs depends on the ability of Barclays Bank PLC to satisfy its obligations as they come due and are not guaranteed by a third party. As a result, the actual and perceived creditworthiness of Barclays Bank PLC may affect the market value of the ETNs and, in the event Barclays Bank PLC were to default on its obligations, you may not receive the amounts owed to you under the terms of the ETNs.

We May Redeem Each Series of ETNs at Any Time on or after the Inception Date

We have the right to redeem or “call” each series of ETNs (in whole but not in part) at our sole discretion without your consent on any business day on or after the inception date until and including the maturity date. If we elect to redeem a series of ETNs, we will deliver written notice of such election to redeem to the holders of that series of ETNs not less than ten calendar days prior to the redemption date on which we intend to redeem that series of ETNs. In this scenario, the ETNs will be redeemed on the fifth business day following the valuation date specified by us in the issuer redemption notice, but in no event prior to the tenth calendar day following the date on which we deliver such notice.

If we exercise our right to redeem a series of ETNs, the payment you receive may be less than the payment that you would have otherwise been entitled to receive at maturity and may be less than the secondary market trading price of that series of ETNs. Also, you may not be able to reinvest any amounts received on the redemption date in a comparable investment. Our right to redeem the ETNs may also adversely impact your ability to sell your ETNs, and/or the price at which you may be able to sell your ETNs, particularly after delivery of the issuer redemption notice.

You Will Not Benefit from any Increase in the Level of the Underlying Index if Such Increase Is Not Reflected in the Index on the Applicable Valuation Date

If the positive effect of any increase in the level of the Index underlying your ETNs is insufficient |

|

to offset the negative effect of the investor fee (and in the case of holder redemption, the redemption charge) between the inception date and the applicable valuation date (including the final valuation date), we will pay you less than the principal amount of your ETNs at maturity or upon early redemption. This will be true even if the level of the Index underlying your ETNs as of some date or dates prior to the applicable valuation date would have been sufficiently high to offset the negative effect of the investor fee and redemption charge.

Owning the ETNs is Not the Same as Owning the Futures Contracts Included in the Underlying Index or a Security Directly Linked to the Performance of the Underlying Index due to the Negative Effect of the Investor Fee and the Redemption Charge and Other Factors Affecting the Market Value of the ETNs

The return on your ETNs will not reflect the return you would have realized if you had actually owned the futures contracts included in the Index underlying your ETNs or a security directly linked to the performance of the applicable Index and held such investment for a similar period. Any return on your ETNs includes the negative effect of the accrued investor fee (and in the case of holder redemption, the redemption charge). Furthermore, if the level of the Index underlying your ETNs increases during the term of the ETNs, the market value of the ETNs may not increase by the same amount or may even decline.

You Will Not Receive Interest Payments on the ETNs or Have Rights in Any of the Futures Contracts Included in the Index

You will not receive any periodic interest payments on your ETNs. As a holder of a series of ETNs, you will not have rights that investors in the futures contracts included in the Index underlying those ETNs may have. Your ETNs will be paid in cash, and you will have no right to receive delivery of any equity securities comprising the S&P 500®, of any dividends or distributions relating to such securities, of payment or delivery of amounts in respect of the options used to calculate the level of the VIX Index or of payment or delivery of amounts in respect of the futures contracts included in the Index underlying your ETNs. |

|

The Market Value of the ETNs May Be Influenced by Many Unpredictable Factors

The market value of your ETNs may fluctuate between the date you purchase them and the applicable valuation date. You may also sustain a significant loss if you sell your ETNs in the secondary market. We expect that generally the value of the index components and Index will affect the market value of the ETNs more than any other factor. Several other factors, many of which are beyond our control, and many of which could themselves affect the prices of the futures contracts underlying the Indices, will influence the market value of the ETNs and the payment you receive at maturity or upon early redemption, including the following:

· prevailing market prices and forward volatility levels of the U.S. stock markets, the equity securities included in the S&P 500® and the S&P 500®, and prevailing market prices of options on the S&P 500®, the VIX Index, options on the VIX Index, relevant futures contracts on the VIX Index, or any other financial instruments related to the S&P 500® and the VIX Index;

· the level of contango or backwardation in the markets for futures contracts on the VIX Index and the roll costs associated with maintaining a rolling position in such futures contracts;

· supply and demand for the ETNs, including inventory positions with Barclays Capital Inc. or any market maker and any decision we may make not to issue additional ETNs or to cease or suspend sales of ETNs from inventory;

· the time remaining to the maturity of the ETNs;

· interest rates;

· economic, financial, political, regulatory, geographical, biological or judicial events that affect the level of the underlying Index or the market price or forward volatility of the U.S. stock markets, the equity securities included in the S&P 500®, the S&P 500®, the VIX Index or the relevant futures contracts on the VIX Index;

· the perceived creditworthiness of Barclays Bank PLC;

· supply and demand in the listed and over-the-counter equity derivative markets; or |

|

· supply and demand as well as hedging activities in the equity-linked structured product markets.

These factors interrelate in complex ways, and the effect of one factor on the market value of your ETNs may offset or enhance the effect of another factor.

If You Hold Your ETNs as a Long Term Investment, It Is Likely That You Will Lose All or a Substantial Portion of Your Investment

The ETNs are only suitable for a very short investment horizon. The relationship between the level of the VIX Index and the underlying futures on the VIX Index will begin to break down as the length of an investor’s holding period increases, even within the course of a single index business day. The relationship between the level of the applicable underlying Index and the closing indicative value and intraday indicative value of the ETNs will also begin to break down as the length of an investor’s holding period increases due to the effect of accrued fees. The long term expected value of your ETNs is zero. If you hold your ETNs as a long term investment, it is likely that you will lose all or a substantial portion of your investment.

If a Market Disruption Event Has Occurred or Exists on a Valuation Date, the Calculation Agent Can Postpone the Determination of the Closing Indicative Value or the Maturity Date or a Redemption Date

The determination of the value of the ETNs on a valuation date, including the final valuation date, may be postponed if the calculation agent determines that a market disruption has occurred or is continuing on such valuation date. If such a postponement occurs, the value of the index components unaffected by the market disruption event shall be determined on the scheduled valuation date and the value of the affected index component shall be determined using the closing value of the affected index component on the first trading day after that day on which no market disruption event occurs or is continuing. In no event, however, will a valuation date for any series of ETNs be postponed by more than five trading days. As a result, the maturity date or a redemption date for a series of ETNs could also be postponed to the fifth business day following such valuation date. If a valuation date is postponed until the fifth trading day following the scheduled valuation |

|

date but a market disruption event occurs or is continuing on such day, that day will nevertheless be the valuation date and the calculation agent will make a good faith estimate in its sole discretion of the level of the relevant Index for such day. See “Specific Terms of the ETNs—Market Disruption Event” in this pricing supplement.

Postponement of a Valuation Date May Result in a Reduced Amount Payable at Maturity or Upon Early Redemption

As the payment at maturity or upon early redemption is a function of, among other things, the change in Index level on the final valuation date or applicable valuation date, as the case may be, the postponement of any valuation date may result in the application of a different change in Index level and an increase in the accrued value of the investor fee and, accordingly, decrease the payment you receive at maturity or upon early redemption.

Risks Associated with the Indices Generally

Your ETNs Are Not Linked to the VIX Index or Its Spot Level and the Value of Your ETNs May Be Less Than It Would Have Been Had Your ETNs Been Linked to the VIX Index

The value of your ETNs will be linked to the level of the underlying Indices, which offers exposure to futures contracts of specified maturities on the VIX Index and not direct exposure to the VIX Index or its spot level. These futures contracts will not track the performance of the VIX Index. Therefore, your ability to benefit from any rise or fall in the level of the VIX Index is limited. Your ETNs may not benefit from increases in the level of the VIX Index because such increases will not necessarily cause the level of VIX Index futures to rise.

The VIX Index Is a Theoretical Calculation and Is Not a Tradable Index

The VIX Index is a theoretical calculation and cannot be traded on a spot price basis. The settlement price at maturity of the VIX futures contained in the Index is based on this theoretically derived calculation. As a result the behavior of the futures contracts may be different from futures contracts whose settlement price is based on a tradable asset. |

|

Changing Prices of the Futures Contracts Included in the Index May Result in a Reduced Amount Payable at Maturity or Upon Redemption

Each underlying Index is composed of futures contracts on the VIX Index. Unlike equities, which typically entitle the holder to a continuing stake in a corporation, futures contracts normally specify a certain date for delivery of the underlying asset or for settlement in cash based on the level of the underlying asset. As the futures contracts that comprise the Indices approach expiration, they are replaced by similar contracts that have a later expiration. Thus, for example, a futures contract purchased and held in August may specify an October expiration. As time passes, the contract expiring in October may be replaced by a contract for delivery in November. This process is referred to as “rolling”. If the market for these contracts is (putting aside other considerations) in “backwardation”, which means that the prices are lower in the distant delivery months than in the nearer delivery months, the sale of the October contract would take place at a price that is higher than the price of the November contract, thereby creating a “roll yield”. The actual realization of a potential roll yield will be dependent upon the level of the related VIX Index price relative to the unwind price of the relevant VIX Index futures contract at the time of hypothetical sale of the contract. The contracts included in the Indices have not historically exhibited consistent periods of backwardation, and backwardation will most likely not exist at many, if not most times. Moreover, many of the contracts included in the Indices have historically traded in “contango” markets. Contango markets are those in which the prices of contracts are higher in the distant delivery months than in the nearer delivery months.

VIX futures have frequently exhibited very high contango in the past, resulting in a significant cost to “roll” the futures. The existence of contango in the futures markets have resulted in the past and may result in the future in negative “roll yields”, which could cause a significant and sustained decline in the level of the Index underlying your ETNs and, accordingly, significantly decrease the payment you receive at maturity or upon early redemption. Since the non-investable VIX Index is based on the price of a constantly changing portfolio of option contracts, rather than futures contracts subject to contango and |

|

backwardation, the VIX Index may experience less severe downturns or may even provide positive performance during periods where the Index underlying your ETNs is experiencing poor performance.

The Level of the VIX Index Has Historically Reverted to a Long-Term Mean Level and Any Increase in the Spot Level of the VIX Index May Be Constrained

In the past, the level of the VIX Index has typically reverted over the longer term to a historical mean, and its absolute level has been constrained within a band. It is likely that spot level of the VIX Index will continue to do so in the future, especially when the economic uncertainty recedes. When this happens, the value of futures contracts on the VIX Index is likely to decrease, reflecting the market expectation of reduced volatility in the future, and the potential upside of your investment in your ETNs may correspondingly be limited as a result.

The VIX Index Is A Measure of Forward Volatility of the S&P 500® and Your ETN Is Not Linked to the Options Used to Calculate the VIX Index, to the Actual Volatility of the S&P 500® or the Equity Securities Included in the S&P 500®, Nor Will the Return on Your ETN Be a Participation in the Actual Volatility of the S&P 500®

The VIX Index measures the 30-day forward volatility of the S&P 500® as calculated based on the prices of certain put and call options on the S&P 500®. The actual volatility of the S&P 500® may not conform to a level predicted by the VIX Index or to the prices of the put and call options included in the calculation of the VIX Index. The value of your ETNs is based on the value of the relevant futures on the VIX Index included in the Index underlying your ETNs. Your ETNs are not linked to the realized volatility of the S&P 500® and will not reflect the return you would realize if you owned the equity securities underlying the S&P 500® or if you traded the put and call options used to calculate the level of the VIX Index.

|

|

The Policies of the Index Sponsor and the CBOE and Changes That Affect the Composition and Valuation of the S&P 500®, the VIX Index or the Underlying Indices Could Affect the Amount Payable on Your ETNs and Their Market Value

The policies of the Index sponsor and the CBOE concerning the calculation of the level of the S&P 500®, the VIX Index and the underlying Indices, respectively, and any additions, deletions or substitutions of equity securities or options contracts and the manner in which changes affecting the equity securities, options contracts or futures contracts are reflected in the S&P 500®, the VIX Index or the underlying Indices, respectively, could affect the value of the underlying Indices and, therefore, the amount payable on your ETNs at maturity or upon redemption and the market value of your ETNs prior to maturity.

S&P Dow Jones Indices can add, delete or substitute the equity securities underlying the S&P 500® or make other methodological changes that could change the level of the S&P 500®. S&P Dow Jones Indices can also add, delete or substitute the futures contracts underlying the underlying Indices or make other methodological changes that could change the level of the Indices. The changing of equity securities included in the S&P 500® may affect the S&P 500®, as a newly added equity security may perform significantly better or worse than the equity security or securities it replaces. Such a change may also affect the value of the put and call options used to calculate the level of the VIX Index. The changing of the futures contracts underlying the Indices may affect the performance of the Indices in similar ways. Additionally, S&P Dow Jones Indices may alter, discontinue or suspend calculation or dissemination of the S&P 500® or any of the Indices. Any of these actions could adversely affect the value of your ETNs. S&P Dow Jones Indices has no obligation to consider your interests in calculating or revising the S&P 500® or the Indices. See “The S&P 500®” and “The Indices” below.

The CBOE can make methodological changes to the calculation of the VIX Index that could affect the value of futures contracts on the VIX Index and, consequently, the value of your ETNs. There can be no assurance that the CBOE will not change the VIX Index calculation methodology in a way which may affect the value of your ETNs. Additionally, the CBOE may alter, discontinue or suspend calculation or dissemination of the VIX Index and/or the exercise settlement value. Any of these actions could adversely affect the |

|

value of your ETNs. The CBOE has no obligation to consider your interests in calculating or revising the VIX Index or in calculating the exercise settlement value. See “The VIX Index” below.

If events such as these occur, or if the value of any underlying Index is not available or cannot be calculated because of a market disruption event or for any other reason, the calculation agent may be required to make a good faith estimate in its sole discretion of the value of such Index. The circumstances in which the calculation agent will be required to make such a determination are described more fully under “Specific Terms of the ETNs—Market Disruption Event” and “—Role of Calculation Agent”.

Changes in Law or Regulation Relating To Commodities Futures Contracts May Adversely Affect the Market Value of the ETNs and the Amounts Payable on Your ETNs

Commodity futures contracts, such as the VIX futures, are subject to legal and regulatory regimes that are in the process of changing in the United States and, in some cases, in other countries. The Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly known as the “Dodd-Frank Act”, provides for substantial changes in the regulation of the futures and over-the-counter derivatives markets. Among other things, the legislation requires that most over-the-counter transactions be executed on organized exchanges or facilities and be cleared through regulated clearing houses. This requirement has become effective for certain categories of interest rate and credit default swaps. It is anticipated that other products will become subject to the mandatory centralized execution and clearing requirement in the future. In addition, the legislation requires registration of, and imposes regulations on, swap dealers and major swap participants. The enactment of the Dodd-Frank Act could make participation in the markets more burdensome and expensive. This could adversely affect the prices of futures contracts and, in turn, the market value of the ETNs and the amounts payable on the ETNs at maturity or upon early redemption. In addition, other parts of the legislation, by increasing regulation of, and |

|

imposing additional costs on, swap transactions, could reduce trading in the swap and futures markets, which would further restrict liquidity, increase volatility and adversely affect prices, which could in turn adversely affect the value of the applicable underlying Index.

The Indices May in the Future Include Contracts That Are Not Traded on Regulated Futures Exchanges

The Indices are currently based solely on futures contracts traded on regulated futures exchanges (referred to in the United States as “designated contract markets”). If these exchange-traded futures cease to exist, any Index may also cease to exist or may in the future include over-the-counter contracts (such as swaps and forward contracts) traded on trading facilities that are subject to lesser degrees of regulation or, in some cases, no substantive regulation. As a result, trading in such contracts, and the manner in which prices and volumes are reported by the relevant trading facilities, may not be subject to the provisions of, and the protections afforded by, the U.S. Commodity Exchange Act of 1936, or other applicable statutes and related regulations, that govern trading on regulated U.S. futures exchanges, or similar statutes and regulations that govern trading on regulated foreign exchanges. In addition, many electronic trading facilities have only recently initiated trading and do not have significant trading histories. As a result, the trading of contracts on such facilities, and the inclusion of such contracts in any of the Indices, may be subject to certain risks not presented by most exchange-traded futures contracts, including risks related to the liquidity and price histories of the relevant contracts.

Historical Levels of Comparable Indices Should Not Be Taken as an Indication of the Future Performance of any Index During the Term of the ETNs

It is impossible to predict whether any Index underlying the ETNs will rise or fall. The actual performance of each Index over the term of the series of ETNs linked to that Index, as well as the amount payable at maturity or upon redemption, may bear little relation to the historical levels of comparable indices, which in most cases have been highly volatile. |

|

Changes in the Treasury Bill Rate of Interest will Affect the Value of the Indices and Your ETNs

Because the value of each Index is linked, in part, to the rate of interest that could be earned on reinvestment into the Index of the return on the notional value of the Index based on specified Treasury Bill rate, changes in the Treasury Bill rate of interest will affect the amount payable on your ETNs at maturity or upon redemption and, therefore, the market value of your ETNs. Assuming the trading prices of the index components included in the Index to which your ETNs are linked remain constant, an increase in the Treasury Bill rate of interest will increase the value of each Index and, therefore, the value of your ETNs. A decrease in the Treasury Bill rate of interest will adversely impact the value of each Index and, therefore, the value of your ETNs.

The Policies of the Index Sponsor and Changes That Affect the Composition or Valuation of the Indices or the Futures Contracts Underlying an Index Could Affect the Amount Payable on Your ETNs and Their Market Value

The policies of the index sponsor concerning the calculation of the level of each Index, additions, deletions or substitutions of index components and the manner in which changes affecting the index components are reflected in any Index could affect the levels of the Indices and, therefore, the amount payable on your ETNs at maturity or upon early redemption and the market value of your ETNs prior to maturity.

As described in “Modifications to the Indices” in this pricing supplement, the index sponsor may modify the methodology for calculating the value of any Index or make certain other changes to the way in which an Index is calculated. The index sponsor may also discontinue or suspend calculation or publication of an Index, in which case it may become difficult to determine the level of that Index. Any such changes could adversely affect the value of your ETNs.

Modifications of the methodology for determining the composition and weighting of an Index could adversely affect the amount paid in connection with or the value of the relevant ETNs, which will continue to be based on the relevant Index. In addition, if events such as these occur, or if the level of any Index is not available or cannot be calculated because of a market disruption event, |

|

or for any other reason, the calculation agent may be required to make a good faith estimate in its sole discretion of the level of that Index. The circumstances in which the calculation agent will be required to make such a determination are described more fully under “Specific Terms of the ETNs—Market Disruption Event”, “—Discontinuance or Modification of an Index” and “Specific Terms of the ETNs—Role of Calculation Agent”.

Risks Relating to Liquidity and the Secondary Market

The Estimated Value of the ETNs Is Not a Prediction of the Prices at Which the ETNs May Trade in the Secondary Market, If Any Such Market Exists, and Such Secondary Market Prices, If Any, May Be Lower Than the Principal Amount of the ETNs and May Be Lower Than Such Estimated Value of the ETNs