|

Barclays Bank PLC Market Linked Securities |

Filed Pursuant to Rule 433 Registration Statement No. 333-265158

|

|

Market Linked Securities—Callable with Contingent Coupon with Daily Observation and Contingent Downside Principal at Risk Securities Linked to the Lowest Performing of the Russell 2000® Index, the S&P 500® Index and the EURO STOXX 50® Index due June 26, 2026 Term Sheet dated June 22, 2023 to Preliminary Pricing Supplement dated June 22, 2023 (the “PPS”) |

Summary of Terms

| Issuer | Barclays Bank PLC |

| Market Measures | Russell 2000® Index (Bloomberg ticker symbol “RTY<Index>”), S&P 500® Index (Bloomberg ticker symbol “SPX<Index>”) and EURO STOXX 50® Index (Bloomberg ticker symbol “SX5E<Index>”) (each, an “Index”) |

| Pricing Date | June 23, 2023 |

| Issue Date | June 28, 2023 |

| Stated Maturity Date | June 26, 2026 |

| Principal Amount | $1,000 per security |

| Contingent Coupon Payments | With respect to each observation period, you will receive a contingent coupon payment at a per annum rate equal to the contingent coupon rate if the closing level of the lowest performing Index on each eligible trading day during such observation period is greater than or equal to its coupon threshold level. Each “contingent coupon payment,” if any, will be calculated per security as follows: ($1,000 × contingent coupon rate)/4. |

| Contingent Coupon Payment Dates | Quarterly, on the third business day following each observation period end-date; provided that the contingent coupon payment date with respect to the final observation period will be the stated maturity date |

| Contingent Coupon Rate | At least 10.10% per annum, to be determined on the pricing date |

| Optional Redemption | We may, at our option, redeem the securities, in whole but not in part, on any optional redemption date. Investors will receive on the applicable optional redemption date a cash payment per security in U.S. dollars equal to the principal amount plus any final contingent coupon payment otherwise due. |

| Observation Periods | Each observation period will consist of each day that is a trading day for at least one Index (each such day, an “eligible trading day”) from but excluding an observation period end-date to and including the following observation period end-date, provided that the first observation period will consist of each eligible trading day from but excluding the pricing date to and including the first observation period end-date. |

| Observation Period End-Dates | Quarterly, on the 23rd day of each March, June, September and December, commencing September 2023 and ending June 2026, provided that the June 2026 observation period end-date will be the final calculation day |

| Final Calculation Day | June 23, 2026 |

| Optional Redemption Dates | Quarterly, on the contingent coupon payment dates following each observation period end-date scheduled to occur from September 2023 to March 2026 |

| Maturity Payment Amount (per security) |

The maturity payment amount will equal: · if the ending level of the lowest performing Index on the final calculation day is greater than or equal to its downside threshold level: $1,000; or · if the ending level of the lowest performing Index on the final calculation day is less than its downside threshold level: $1,000 × performance factor of the lowest performing Index on the final calculation day |

| Lowest Performing Index | For any eligible trading day during an observation period, the Index with the lowest performance factor on that day |

| Performance Factor | With respect to an Index on any eligible trading day during an observation period, its closing level on such day divided by its starting level |

| Starting Level | For each Index, its closing level on the pricing date |

| Ending Level | For each Index, its closing level on the final calculation day |

| Coupon Threshold Level | For each Index, 70% of its starting level |

| Downside Threshold Level | For each Index, 60% of its starting level |

| Calculation Agent | Barclays Bank PLC |

Summary of Terms (continued)

| Denominations | $1,000 and any integral multiple of $1,000 |

| CUSIP/ISIN | 06745ML89 / US06745ML899 |

| Agent Discount | Up to 1.525%; dealers, including those using the trade name Wells Fargo Advisors (WFA), may receive a selling concession of 1.25% and WFA may receive a distribution expense fee of 0.075%. Selected dealers may receive a fee of up to 0.10% for marketing and other services. |

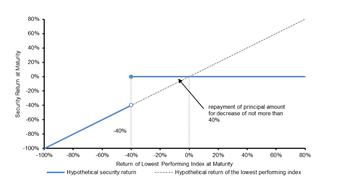

Hypothetical Payout Profile (maturity payment amount)

If the securities are not redeemed at our option prior to stated maturity and the ending level of the lowest performing Index on the final calculation day is less than its threshold level, you will lose more than 40%, and possibly all, of the principal amount of your securities at stated maturity.

Any return on the securities will be limited to the sum of your contingent coupon payments, if any, even if the closing level of the lowest performing Index on the final calculation day significantly exceeds its starting level. You will not participate in any appreciation of any Index.

Any payment on the securities, including any repayment of principal, is subject to the creditworthiness of Barclays Bank PLC and is not guaranteed by any third party.

Notwithstanding and to the exclusion of any other term of the securities or any other agreements, arrangements or understandings between Barclays Bank PLC and any holder or beneficial owner of the securities (or the trustee on behalf of the holders of the securities), by acquiring the securities, each holder and beneficial owner of the securities acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority. See “Consent to U.K. Bail-in Power” in the PPS.

The issuer’s estimated value of the securities on the pricing date, based on its internal pricing models, is expected to be between $944.40 and $974.40 per security. The estimated value is expected to be less than the original offering price of the securities. See “Additional Information Regarding Our Estimated Value of the Securities” in the PPS.

Investors should carefully review the accompanying PPS, product supplement, underlying supplement, prospectus supplement and prospectus before making a decision to invest in the securities.

PPS: http://www.sec.gov/Archives/edgar/data/312070/000095010323009114/dp195603_424b2-5051wfpps.htm

| The securities have complex features and investing in the securities involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations” in this term sheet and the accompanying PPS and “Risk Factors” in the accompanying product supplement and prospectus supplement. |

| This term sheet does not provide all of the information that an investor should consider prior to making an investment decision. |

| The securities constitute our unsecured and unsubordinated obligations. The securities are not deposit liabilities of Barclays Bank PLC and are not covered by the U.K. Financial Services Compensation Scheme or insured by the U.S. Federal Deposit Insurance Corporation or any other governmental agency or deposit insurance agency of the United States, the United Kingdom or any other jurisdiction. |

Selected Risk Considerations

An investment in the securities involves significant risks. Investing in the securities is not equivalent to investing directly in any of the securities composing the Indices. You should carefully review the risk disclosures set forth under the “Risk Factors” sections of the prospectus supplement and product supplement and the “Selected Risk Considerations” section in the accompanying PPS. The risks set forth below are discussed in detail in the “Selected Risk Considerations” section in the accompanying PPS.

| · | If We Do Not Redeem The Securities Prior to Stated Maturity, You May Lose Some Or All Of The Principal Amount Of Your Securities At Stated Maturity. |

| · | The Securities Do Not Provide For Fixed Payments Of Interest And You May Receive No Coupon Payments On One Or More Contingent Coupon Payment Dates, Or Even Throughout The Entire Term Of The Securities. |

| · | Whether You Receive A Contingent Coupon Payment On A Contingent Coupon Payment Date Will Depend On The Closing Level Of The Lowest Performing Index On Each Eligible Trading Day During The Related Observation Period |

| · | The Securities Are Subject To The Full Risks Of Each Index And Will Be Negatively Affected If Any Index Performs Poorly, Even If The Other Indices Perform Favorably. |

| · | You May Be Fully Exposed To The Decline In The Lowest Performing Index On The Final Calculation Day From Its Starting Level, But Will Not Participate In Any Positive Performance Of Any Index. |

| · | Your Return On The Securities Will Depend Solely On The Performance Of The Index That Is The Lowest Performing Index On Each Eligible Trading Day During The Observation Periods, Including The Final Calculation Day, And You Will Not Benefit In Any Way From The Performance Of The Better Performing Indices. |

| · | Higher Contingent Coupon Rates Are Associated With Greater Risk. |

| · | Our Redemption Right May Limit Your Potential To Receive Contingent Coupon Payments |

| · | You Will Be Subject To Risks Resulting From The Relationship Between The Indices. |

| · | Any Payment On The Securities Will Be Determined Based On The Closing Levels Of The Indices On The Dates Specified. |

| · | Owning The Securities Is Not The Same As Owning The Securities Composing Any Or All Of The Indices. |

| · | No Assurance That The Investment View Implicit In The Securities Will Be Successful. |

| · | The U.S. Federal Income Tax Consequences Of An Investment In The Securities Are Uncertain. |

| · | The Securities Are Subject To The Credit Risk Of Barclays Bank PLC. |

| · | You May Lose Some Or All Of Your Investment If Any U.K. Bail-In Power Is Exercised By The Relevant U.K. Resolution Authority. |

| · | The Securities Are Subject To Small-Capitalization Companies Risk With Respect To The Russell 2000® Index. |

| · | There Are Risks Associated With Investments In Securities Linked To The Value Of Non-U.S. Equity Securities With Respect To The EURO STOXX 50® Index. |

| · | The Securities Do Not Provide Direct Exposure To Fluctuations In Exchange Rates Between The U.S. Dollar And The Euro With Respect To The EURO STOXX 50® Index. |

| · | Each Index Reflects The Price Return Of The Securities Composing That Index, Not The Total Return. |

| · | We Cannot Control Actions Of Any Of The Unaffiliated Companies Whose Securities Are Included As Components Of The Indices. |

| · | We And Our Affiliates Have No Affiliation With Any Index Sponsor And Have Not Independently Verified Their Public Disclosure Of Information. |

| · | Adjustments To The Indices Could Adversely Affect The Value Of The Securities And The Amount You Will Receive At Maturity. |

| · | The Historical Performance Of The Indices Is Not An Indication Of Their Future Performance. |

| · | Potentially Inconsistent Research, Opinions Or Recommendations By Barclays Capital Inc., Wells Fargo Securities, LLC Or Their Respective Affiliates. |

| · | We, Our Affiliates And Any Other Agent And/Or Participating Dealer May Engage In Various Activities Or Make Determinations That Could Materially Affect Your Securities In Various Ways And Create Conflicts Of Interest. |

| · | The Securities Will Not Be Listed On Any Securities Exchange And We Do Not Expect A Trading Market For The Securities To Develop. |

| · | The Value Of The Securities Prior To Maturity Will Be Affected By Numerous Factors, Some Of Which Are Related In Complex Ways. |

| · | The Estimated Value Of Your Securities Is Expected To Be Lower Than The Original Offering Price Of Your Securities. |

| · | The Estimated Value Of Your Securities Might Be Lower If Such Estimated Value Were Based On The Levels At Which Our Debt Securities Trade In The Secondary Market. |

| · | The Estimated Value Of The Securities Is Based On Our Internal Pricing Models, Which May Prove To Be Inaccurate And May Be Different From The Pricing Models Of Other Financial Institutions. |

| · | The Estimated Value Of Your Securities Is Not A Prediction Of The Prices At Which You May Sell Your Securities In The Secondary Market, If Any, And Such Secondary Market Prices, If Any, Will Likely Be Lower Than The Original Offering Price Of Your Securities And May Be Lower Than The Estimated Value Of Your Securities. |

| · | The Temporary Price At Which We May Initially Buy The Securities In The Secondary Market And The Value We May Initially Use For Customer Account Statements, If We Provide Any Customer Account Statements At All, May Not Be Indicative Of Future Prices Of Your Securities. |

| Barclays Bank PLC has filed a registration statement (including a prospectus) with the SEC for the offering to which this term sheet relates. Before you invest, you should read the prospectus dated May 23, 2022, the prospectus supplement dated June 27, 2022, the product supplement no. WF-1 dated October 17, 2022, the underlying supplement dated June 27, 2022, the PPS and other documents Barclays Bank PLC has filed with the SEC for more complete information about Barclays Bank PLC and this offering. You may get these documents and other documents Barclays Bank PLC has filed for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Barclays Bank PLC or any agent or dealer participating in this offering will arrange to send you each of these documents if you request them by calling your Barclays Bank PLC sales representative, such dealer or toll-free 1-888-227-2275 (Extension 2-3430). A copy of each of these documents may be obtained from Barclays Capital Inc., 745 Seventh Avenue—Attn: US InvSol Support, New York, NY 10019. |

As used in this term sheet, “we,” “us” and “our” refer to Barclays Bank PLC. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.