UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended 30 September 2017 |

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission file number 001-04534

AIR PRODUCTS AND CHEMICALS, INC.

7201 Hamilton Boulevard | State of incorporation: Delaware | |

Allentown, Pennsylvania, 18195-1501 | I.R.S. identification number: 23-1274455 | |

Tel. (610) 481-4911 | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class: | Registered on: | |

Common Stock, par value $1.00 per share | New York Stock Exchange | |

2.0% Euro Notes due 2020 | New York Stock Exchange | |

0.375% Euro Notes due 2021 | New York Stock Exchange | |

1.0% Euro Notes due 2025 | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | YES | x | NO | ¨ | ||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | YES | ¨ | NO | x | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | YES | x | NO | ¨ | ||

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | YES | x | NO | ¨ | ||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | x | |||||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | Emerging growth company ¨ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | YES | ¨ | NO | x | ||

The aggregate market value of the voting stock held by non-affiliates of the registrant on 31 March 2017 was approximately $29.3 billion. For purposes of the foregoing calculations, all directors and/or executive officers have been deemed to be affiliates, but the registrant disclaims that any such director and/or executive officer is an affiliate.

The number of shares of common stock outstanding as of 31 October 2017 was 218,618,346.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the Annual Meeting of Shareholders to be held on 25 January 2018 are incorporated by reference into Part III.

AIR PRODUCTS AND CHEMICALS, INC.

ANNUAL REPORT ON FORM 10-K

For the fiscal year ended 30 September 2017

TABLE OF CONTENTS

ITEM 1. | ||

ITEM 1A. | ||

ITEM 1B. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

ITEM 5. | ||

ITEM 6. | ||

ITEM 7. | ||

ITEM 7A. | ||

ITEM 8. | ||

ITEM 9. | ||

ITEM 9A. | ||

ITEM 9B. | ||

ITEM 10. | ||

ITEM 11. | ||

ITEM 12. | ||

ITEM 13. | ||

ITEM 14. | ||

ITEM 15. | ||

2

PART I

ITEM 1 BUSINESS

Air Products and Chemicals, Inc. (“we,” “our,” “us,” the “Company,” “Air Products,” or “registrant”), a Delaware corporation originally founded in 1940, serves energy, electronics, chemicals, metals, and manufacturing customers globally with a unique portfolio of products, services, and solutions that include atmospheric gases, process and specialty gases, equipment, and services. The Company is the world’s largest supplier of hydrogen and has built leading positions in growth markets such as helium and natural gas liquefaction. As used in this report, unless the context indicates otherwise, the terms “we,” “our,” “us,” the “Company,” or “registrant” include controlled subsidiaries, affiliates, and predecessors of Air Products and its controlled subsidiaries and affiliates.

On 1 October 2016, the Company completed the spin-off of its former Electronic Materials business by distributing to Air Products shareholders on a pro rata basis all of the issued and outstanding stock of Versum Materials, Inc. ("Versum"), the entity Air Products incorporated to hold this business, which established Versum as an independent publicly traded corporation. On 3 January 2017, Air Products completed the sale of its Performance Materials business to Evonik Industries AG. The results of operations, financial condition, and cash flows for the Electronic Materials and Performance Materials businesses are presented herein as discontinued operations. On 29 March 2016, the Board of Directors approved the Company's exit of its Energy-from-Waste ("EfW") business and efforts to start up and operate the two EfW projects located in Tees Valley, United Kingdom, were discontinued. Since that time, the EfW segment has been presented as a discontinued operation.

During its fiscal year ended 30 September 2017 (“fiscal year 2017”), the Company reported its continuing operations in five reporting segments under which it managed its operations, assessed performance, and reported earnings: Industrial Gases – Americas; Industrial Gases – EMEA (Europe, Middle East, and Africa); Industrial Gases – Asia; Industrial Gases – Global; and Corporate and other.

Except as otherwise noted, the description of the Company's business below reflects the Company's continuing operations, which excludes the Electronic Materials, Performance Materials, and EfW businesses. Refer to Note 25, Business Segment and Geographic Information, and Note 3, Discontinued Operations, to the consolidated financial statements for additional details on our reportable business segments and our discontinued operations.

Industrial Gases Business

The Company’s Industrial Gases business produces atmospheric gases (oxygen, nitrogen, argon, and rare gases); process gases (hydrogen, helium, carbon dioxide, carbon monoxide, syngas, and specialty gases); and equipment for the production or processing of gases, such as air separation units and non-cryogenic generators. Atmospheric gases are produced through various air separation processes of which cryogenic is the most prevalent. Process gases are produced by methods other than air separation. For example, hydrogen is produced by steam methane reforming of natural gas or by purifying byproduct sources obtained from the chemical and petrochemical industries; and helium is produced as a byproduct of gases extracted from underground reservoirs, primarily natural gas, but also carbon dioxide purified before resale.

The Company’s Industrial Gases business is organized and operated regionally. The regional Industrial Gases segments (Americas, EMEA, and Asia) supply gases and related equipment in the relevant region to diversified customers in many industries, including those in metals, glass, chemical processing, electronics, energy production and refining, food processing, medical, and general manufacturing. Hydrogen is used by refiners to facilitate the conversion of heavy crude feedstock and lower the sulfur content of gasoline and diesel fuels. The chemicals industry uses hydrogen, oxygen, nitrogen, carbon monoxide, and syngas as feedstocks in the production of many basic chemicals. The energy production industry uses nitrogen injection for enhanced recovery of oil and natural gas and oxygen for gasification. Oxygen is used in combustion and industrial heating applications, including in the steel, certain nonferrous metals, glass, and cement industries. Nitrogen applications are used in food processing for freezing and preserving flavor and nitrogen for inerting is used in various fields, including the metals, chemical, and semiconductor industries. Helium is used in laboratories and healthcare for cooling and in other industries for pressurizing, purging, and lifting. Argon is used in the metals and other industries for its unique inerting, thermal conductivity, and other properties. Industrial gases are also used in welding and providing healthcare and are utilized in various manufacturing processes to make them more efficient and to optimize performance.

3

We distribute gases to our customers through a variety of supply modes:

Liquid Bulk—Product is delivered in bulk (in liquid or gaseous form) by tanker or tube trailer and stored, usually in its liquid state, in equipment designed and installed typically by the Company at the customer’s site for vaporizing into a gaseous state as needed. Liquid bulk sales are usually governed by three- to five-year contracts.

Packaged Gases—Small quantities of product are delivered in either cylinders or dewars. The Company operates packaged gas businesses in Europe, Asia, and Latin America. In the United States, the Company’s packaged gas business sells products (principally helium) only for the electronics and magnetic resonance imaging industries.

On-Site Gases—Large quantities of hydrogen, nitrogen, oxygen, carbon monoxide, and syngas (a mixture of hydrogen and carbon monoxide) are provided to customers, principally the energy production and refining, chemical, and metals industries worldwide who require large volumes of gases that have relatively constant demand. Gases are produced at large facilities located adjacent to customers’ facilities or by pipeline systems from centrally located production facilities and are generally governed by 15- to 20- year contracts. The Company also delivers small quantities of product through small on-site plants (cryogenic or non-cryogenic generators), typically either via a 10- to 15- year sale of gas contract or through the sale of the equipment to the customer.

Electricity is the largest cost component in the production of atmospheric gases, and natural gas is the principal raw material for hydrogen, carbon monoxide, and syngas production. We mitigate electricity and natural gas price fluctuations contractually through pricing formulas, surcharges, and cost pass-through arrangements. During fiscal year 2017, no significant difficulties were encountered in obtaining adequate supplies of power and natural gas.

The Company obtains helium from a number of sources globally, including crude helium for purification from the U.S. Bureau of Land Management's helium reserve. Qatar is a significant supplier of helium globally, providing over 25% of the world's supply. During 2017, multiple Arab states cut diplomatic ties with and closed their borders to Qatar, disrupting helium production and transportation for several weeks. Air Products' helium business was not materially affected during this initial phase of the embargo due to its diverse sourcing of crude helium, but customer demand exceeded supply during this period and supply challenges may recur prior to resolution of the embargo.

The regional Industrial Gases segments also include our share of the results of several joint ventures accounted for by the equity method. The largest of these joint ventures operate in Mexico, Italy, South Africa, India, Saudi Arabia, and Thailand.

Each of the regional Industrial Gases segments competes against three global industrial gas companies: Air Liquide S.A., Linde AG, and Praxair, Inc.; as well as regional competitors. Competition in Industrial Gases is based primarily on price, reliability of supply, and the development of industrial gas applications. In locations where we have pipeline networks, which enable us to provide reliable and economic supply of products to larger customers, we derive a competitive advantage.

Overall regional industrial gases sales constituted approximately 90% of consolidated sales in fiscal year 2017, 90% in fiscal year 2016, and 92% in fiscal year 2015. Sales of tonnage hydrogen and related products constituted approximately 24% of consolidated sales in fiscal year 2017, 21% in fiscal year 2016, and 24% in fiscal year 2015. Sales of atmospheric gases constituted approximately 45% of consolidated sales in fiscal year 2017, 46% in fiscal year 2016 and 45% in fiscal year 2015.

Industrial Gases Equipment

The Company designs and manufactures equipment for air separation, hydrocarbon recovery and purification, natural gas liquefaction ("LNG"), and liquid helium and liquid hydrogen transport and storage. The Industrial Gases–Global segment includes cryogenic and non-cryogenic equipment for air separation. The equipment is sold worldwide to customers in a variety of industries, including chemical and petrochemical manufacturing, oil and gas recovery and processing, and steel and primary metals processing. The Corporate and other segment includes two global equipment businesses, our LNG equipment business, and our liquid helium and liquid hydrogen transport and storage containers business. Steel, aluminum, and capital equipment subcomponents (compressors, etc.) are the principal raw materials in the manufacturing of equipment. Adequate raw materials for individual projects are acquired under firm purchase agreements. Equipment is produced at the Company’s manufacturing sites with certain components being procured from subcontractors and vendors. Competition in the equipment business is based primarily on technological performance, service, technical know-how, price, and performance guarantees. Sale of equipment constituted approximately 10% of consolidated sales in fiscal year 2017, 10% in fiscal year 2016, and 8% in fiscal year 2015.

4

The backlog of equipment orders was approximately $.5 billion on 30 September 2017 (as compared with a total backlog of approximately $1.1 billion on 30 September 2016) and primarily contains Air Products’ share of the multi-year contract with a joint venture in Jazan, Saudi Arabia, for the construction of an industrial gas facility that will supply gases to Saudi Arabian Oil Company ("Saudi Aramco"). Revenue from this contract is recognized under the percentage-of-completion method based on costs incurred to date compared with total estimated costs to be incurred. The Company estimates that approximately 80% of the total sales backlog as of 30 September 2017 will be recognized as revenue during fiscal year 2018, dependent on execution schedules of the relevant projects.

International Operations

The Company, through subsidiaries, affiliates, and less-than-controlling interests, conducts business in 50 countries outside the United States. Its international businesses are subject to risks customarily encountered in foreign operations, including fluctuations in foreign currency exchange rates and controls; import and export controls; and other economic, political, and regulatory policies of local governments described in Item 1A, Risk Factors, below.

The Company has majority or wholly owned foreign subsidiaries that operate in Canada; 17 European countries (including the United Kingdom, the Netherlands, and Spain); 11 Asian countries (including China, South Korea, and Taiwan); 8 Latin American countries (including Chile and Brazil); 3 African countries; and 2 Middle Eastern countries. The Company also owns less-than-controlling interests in entities operating in Europe, Asia, Africa, the Middle East, and Latin America (including Italy, Germany, China, India, Saudi Arabia, Thailand, Oman, South Africa, and Mexico).

Financial information about the Company’s foreign operations and investments is included in Note 8, Summarized Financial Information of Equity Affiliates; Note 22, Income Taxes; and Note 25, Business Segment and Geographic Information, to the consolidated financial statements included under Item 8, below. Information about foreign currency translation is included under “Foreign Currency” in Note 1, Major Accounting Policies, and information on the Company’s exposure to currency fluctuations is included in Note 13, Financial Instruments, to the consolidated financial statements, included under Item 8, below, and in “Foreign Currency Exchange Rate Risk,” included under Item 7A, below. Export sales from operations in the United States to third-party customers amounted to $64.2 million, $134.9 million, and $231.5 million in fiscal years 2017, 2016, and 2015, respectively.

Technology Development

The Company pursues a market-oriented approach to technology development through research and development, engineering, and commercial development processes. It conducts research and development principally in its laboratories located in the United States (Trexlertown, Pennsylvania); Canada (Vancouver); the United Kingdom (Basingstoke and Carrington); Spain (Barcelona); and China (Shanghai). The Company also funds and cooperates in research and development programs conducted by a number of major universities and undertakes research work funded by others, principally the United States government.

The Company’s research groups are aligned with and support the research efforts of various businesses throughout the Company. Development of technology for use within the Industrial Gases business focuses primarily on new and improved processes and equipment for the production and delivery of industrial gases and new or improved applications for industrial gas products.

Research and development expenditures were $57.8 million during fiscal year 2017, $71.6 million during fiscal year 2016, and $76.4 million in fiscal year 2015. Amounts expended on customer sponsored research activities were immaterial.

During fiscal year 2017, the Company owned approximately 532 United States patents, approximately 2,544 foreign patents, and was a licensee under certain patents owned by others. While the patents and licenses are considered important, the Company does not consider its business as a whole to be materially dependent upon any particular patent, patent license, or group of patents or licenses.

Environmental Controls

The Company is subject to various environmental laws and regulations in the countries in which it has operations. Compliance with these laws and regulations results in higher capital expenditures and costs. In the normal course of business, the Company is involved in legal proceedings under the Comprehensive Environmental Response, Compensation, and Liability Act ("CERCLA", the federal Superfund law); Resource Conservation and Recovery Act (RCRA); and similar state and foreign environmental laws relating to the designation of certain sites for investigation or remediation. The Company’s accounting policy for environmental expenditures is discussed in Note 1, Major Accounting Policies, and environmental loss contingencies are discussed in Note 17, Commitments and Contingencies, to the consolidated financial statements, included under Item 8, below.

5

The amounts charged to income from continuing operations related to environmental matters totaled $11.4 million in fiscal year 2017, $12.2 million in fiscal 2016, and $11.8 million in 2015. These amounts represent an estimate of expenses for compliance with environmental laws and activities undertaken to meet internal Company standards. Refer to Note 17, Commitments and Contingencies, to the consolidated financial statements for additional information.

The Company estimates that we spent approximately $7 million in 2017, $3 million in 2016, and $2 million in 2015 on capital projects reflected in continuing operations to control pollution. Capital expenditures to control pollution in future years are estimated to be approximately $3 million in both 2018 and 2019.

Employees

On 30 September 2017, the Company (including majority-owned subsidiaries) had approximately 15,300 employees, of whom approximately 15,000 were full-time employees and of whom approximately 10,800 were located outside the United States. The Company has collective bargaining agreements with unions at various locations that expire on various dates over the next four years. The Company considers relations with its employees to be satisfactory.

Available Information

All periodic and current reports, registration statements, and other filings that the Company is required to file with the Securities and Exchange Commission ("SEC"), including the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 (the "Exchange Act"), are available free of charge through the Company’s website at www.airproducts.com. Such documents are available as soon as reasonably practicable after electronic filing of the material with the SEC. All such reports filed during the period covered by this report were available on the Company’s website on the same day as filing.

The public may also read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy, and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Seasonality

The Company’s businesses are not subject to seasonal fluctuations to any material extent.

Inventories

The Company maintains limited inventory where required to facilitate the supply of products to customers on a reasonable delivery schedule. Inventory consists primarily of crude helium, industrial gas, and specialty gas inventories supplied to customers through liquid bulk and packaged gases supply modes.

Customers

We do not have a homogeneous customer base or end market, and no single customer accounts for more than 10% of our consolidated revenues. We do have concentrations of customers in specific industries, primarily refining, chemicals, and electronics. Within each of these industries, the Company has several large-volume customers with long-term contracts. A negative trend affecting one of these industries, or the loss of one of these major customers, although not material to our consolidated revenue, could have an adverse impact on our financial results.

Governmental Contracts

Our business is not subject to a government entity’s renegotiation of profits or termination of contracts that would be material to our business as a whole.

6

Executive Officers of the Company

The Company’s executive officers and their respective positions and ages on 16 November 2017 follow. Information with respect to offices held is stated in fiscal years.

Name | Age | Office |

M. Scott Crocco | 53 | Executive Vice President and Chief Financial Officer (became Executive Vice President and Chief Financial Officer in 2016; Senior Vice President and Chief Financial Officer in 2013; and Vice President and Corporate Controller in 2008). |

Russell A. Flugel | 48 | Vice President, Corporate Controller and Principal Accounting Officer (became Vice President, Corporate Controller and Principal Accounting Officer in 2015; Corporate Controller in 2014; Director, Accounting and Corporate Decision Support in 2013; and Director, Corporate Decision Support, Technical Accounting and Consolidation in 2011). |

Seifi Ghasemi | 73 | Chairman, President, and Chief Executive Officer (became Chairman, President and Chief Executive Officer in 2014 and previously served as Chairman and Chief Executive Officer of Rockwood Holdings, Inc. beginning in 2001). Mr. Ghasemi is a member and Chairman of the Board of Directors and the Chairman of the Executive Committee of the Board of Directors. |

Jennifer L. Grant | 45 | Vice President and Chief Human Resources Officer (became Vice President and Chief Human Resources Officer in 2013). Prior to joining Air Products, was Vice President of Human Resources for Pfizer Inc. Specialty Products and Oncology Divisions from 2009-2013. |

Sean D. Major | 53 | Executive Vice President and General Counsel (since May, 2017). Previously, Mr. Major served as Executive Vice President, General Counsel and Secretary for Joy Global since 2007. |

Corning F. Painter | 55 | Executive Vice President Industrial Gases (became Executive Vice President Industrial Gases in 2015; Senior Vice President and General Manager –Merchant Gases in 2014; Senior Vice President – Supply Chain in 2012; and Senior Vice President –Corporate Strategy and Technology in 2011. |

Dr. Samir Serhan | 56 | Executive Vice President (since December, 2016). Previously, Dr. Serhan served as President, Global HyCO, since 2014 for Praxair Inc. From 2000-2014, he worked in leadership positions in the U.S. and Germany for The Linde Group. |

ITEM 1A. RISK FACTORS

Our operations are affected by various risks, many of which are beyond our control. In evaluating investment in the Company and the forward-looking information contained in this Annual Report on Form 10-K or presented elsewhere by management from time to time, you should consider the following risk factors. Any of the following risks could have a material adverse effect on our business, operating results, financial condition, and the actual outcome of matters as to which forward-looking statements are made and could adversely affect the value of an investment in our common stock as well. While we believe we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that adversely affect our business, performance, or financial condition in the future that are not presently known, are not currently believed to be significant, or are not identified below because they are common to all businesses.

Unfavorable conditions in the global economy, the markets we serve, or the financial markets, may decrease the demand for our goods and services and adversely impact our revenues, operating results, and cash flows.

Demand for the Company’s products and services depends in part on the general economic conditions affecting the countries and markets in which the Company does business. Weak economic conditions in certain geographies and changing supply and demand balances in markets served by the Company have impacted in the past and may impact in the future demand for the Company’s products and services, in turn negatively impacting the Company’s revenues and earnings. Unfavorable conditions can depress sales, affect our margins, constrain our operating flexibility, impact efficient utilization of the Company’s manufacturing capacity, or result in charges which are unusual or nonrecurring. Excess capacity in the Company’s or its competitors’ manufacturing facilities can decrease the Company’s ability to maintain pricing and generate profits.

7

Our operating results in one or more segments may also be affected by uncertain or deteriorating economic conditions particularly germane to that segment or to particular customer markets within that segment. A decline in the industries served by our customers or adverse events or circumstances affecting individual customers can impair the ability of such customers to satisfy their obligations to the Company, resulting in uncollected receivables, unanticipated contract terminations, project delays, or inability to recover plant investments negatively impacting our financial results.

Weak overall demand or specific customer conditions may also cause customer shutdowns or default, or other inabilities to operate facilities profitably, and may force sale or abandonment of facilities and equipment or prevent projects from coming on-stream. These or other events associated with weak economic conditions or specific end market, product, or customer events may require the Company to record an impairment on tangible assets, such as facilities and equipment, or intangible assets, such as intellectual property or goodwill, which would have a negative impact on our financial results.

Our extensive international operations can be adversely impacted by operational, economic, political, security, legal risks, and currency translation, that could decrease profitability.

In 2017, over 60% of our sales were derived from customers outside the United States and many of our operations, suppliers, and employees are located outside the United States. Our growth strategy depends in part on our ability to further penetrate markets outside the United States, particularly in high-growth markets. Our operations in foreign jurisdictions may be subject to risks including exchange control regulations, import and trade restrictions, and trade policy and other potentially detrimental domestic and foreign governmental practices or policies affecting U.S. companies doing business abroad. Changing economic and political conditions within foreign jurisdictions, strained relations between countries, or imposition of international sanctions can cause fluctuations in demand, price volatility, supply disruptions, or loss of property. The occurrence of any of these risks could have a material adverse impact on our financial condition, results of operation, and cash flows.

We are actively investing significant capital and other resources in developing markets, which present special risks, including through joint ventures. Our developing market operations may be subject to greater risks than those faced by our operations in mature economies, including political and economic instability, project delay or abandonment due to unanticipated government actions, inadequate investment in infrastructure, undeveloped property rights and legal systems, unfamiliar regulatory environments, relationships with local partners, language and cultural differences and talent risks. Our contractual relationship within these jurisdictions may be subject to cancellation without full compensation for loss. Successful operation of particular facilities or projects may be disrupted by civil unrest, acts of sabotage or terrorism, and other local security concerns. Such concerns may require us to incur greater costs for security or to shut down operations for a period of time.

Because the majority of our revenue is generated from sales outside the United States, we are exposed to fluctuations in foreign currency exchange rates. Our business is primarily exposed to translational currency risk as the results of our foreign operations are translated into U.S. dollars at current exchange rates throughout the fiscal period. Our policy is to minimize cash flow volatility from changes in currency exchange rates. We choose not to hedge the translation of our foreign subsidiaries’ earnings into dollars. Accordingly, reported sales, net earnings, cash flows, and fair values have been and in the future will be affected by changes in foreign exchange rates. For a more detailed discussion of currency exposure, see Item 7A - Quantitative and Qualitative Disclosures About Market Risk, below.

Operational and project execution risks may adversely affect our operations or financial results.

The operation of our facilities, pipelines, and delivery systems inherently entails hazards that require continuous oversight and control, such as pipeline leaks and ruptures, fire, explosions, toxic releases, mechanical failures, or vehicle accidents. If operational risks materialize, they could result in loss of life, damage to the environment, or loss of production, all of which could negatively impact our ongoing operations, reputation, financial results, and cash flows. In addition, our operating results are dependent on the continued operation of our production facilities and our ability to meet customer requirements, which depends, in part, on our ability to properly maintain and replace aging assets.

8

Some of our projects involve challenging engineering, procurement and construction phases that may occur over extended time periods, sometimes up to several years. We may encounter difficulties in engineering, delays in designs or materials provided by the customer or a third party, equipment and materials delivery delays, schedule changes, delays from customer failure to timely obtain regulatory permits and rights-of-way, inability to find adequate sources of labor in the geographies where we are building new plants, weather-related delays, delays by subcontractors in completing their portion of the project and other factors, some of which are beyond our control, but which may impact our ability to complete a project within the original delivery schedule. In some cases, delays and additional costs may be substantial, and we may be required to cancel a project and/or compensate the customer for the delay. We may not be able to recover any of these costs. These factors could also negatively impact our reputation or relationships with our customers, which could adversely affect our ability to secure new contracts.

We are subject to extensive government regulation in jurisdictions around the globe in which we do business. Regulations addressing, among other things, environmental compliance, import/export restrictions, anti-bribery and corruption, and taxes, can negatively impact our financial condition, results of operation, and cash flows.

We are subject to government regulation in the United States and foreign jurisdictions in which we conducts our business. The application of laws and regulations to our business is sometimes unclear. Compliance with laws and regulations may involve significant costs or require changes in business practice that could result in reduced profitability. Determination of noncompliance can result in penalties or sanctions that could also impact financial results. Compliance with changes in laws or regulations can require additional capital expenditures or increase operating costs. Export controls or other regulatory restrictions could prevent us from shipping our products to and from some markets or increase the cost of doing so. Changes in tax laws and regulations and international tax treaties could affect the financial results of our businesses. Increasingly aggressive enforcement of anti-bribery and anti-corruption requirements, including the U.S. Foreign Corrupt Practices Act, the United Kingdom Bribery Act and the China Anti-Unfair Competition Law, could subject us to criminal or civil sanctions if a violation occurs. In addition, we are subject to laws and sanctions imposed by the U.S. or by other jurisdictions where we do business that may prohibit us or certain of our affiliates from doing business in certain countries, or restricting the kind of business that may be conducted. Such restrictions may provide a competitive advantage to competitors who are not subject to comparable restrictions or prevent us from taking advantage of growth opportunities.

Further, we cannot guarantee that our internal controls and compliance systems will always protect us from acts committed by employees, agents or our business partners (or of businesses we acquire or partner with) that would violate U.S. and/or non-U.S. laws, including the laws governing payments to government officials, bribery, fraud, kickbacks and false claims, pricing, sales and marketing practices, conflicts of interest, competition, export and import compliance, money laundering and data privacy. Any such improper actions or allegations of such acts could damage our reputation and subject us to civil or criminal investigations in the United States and in other jurisdictions and related shareholder lawsuits, could lead to substantial civil and criminal, monetary and non-monetary penalties and could cause us to incur significant legal and investigatory fees. In addition, the government may seek to hold us liable as a successor for violations committed by companies in which we invest or that we acquire.

We may be unable to successfully execute or effectively integrate acquisitions, or effectively disentangle divested businesses.

Our ability to grow revenue, earnings, and cash flow at anticipated rates depends in part on our ability to identify, successfully acquire and integrate businesses and assets at appropriate prices; and realize expected synergies and operating efficiencies. We may not be able to complete transactions on favorable terms, on a timely basis or at all. In addition, our results of operations and cash flows may be adversely impacted by the failure of acquired businesses or assets to meet expected returns, the failure to integrate acquired businesses, the inability to dispose of non-core assets and businesses on satisfactory terms and conditions, and the discovery of unanticipated liabilities or other problems in acquired businesses or assets for which we lack contractual protections or insurance. We may incur asset impairment charges related to acquisitions that do not meet expectations.

We continually assess the strategic fit of our existing businesses and may divest businesses that are deemed not to fit with our strategic plan or are not achieving the desired return on investment. These transactions pose risks and challenges that could negatively impact our business and financial statements. For example, when we decide to sell or otherwise dispose of a business or assets, we may be unable to do so on satisfactory terms within our anticipated time frame or at all. In addition, divestitures or other dispositions may dilute our earnings per share, have other adverse financial and accounting impacts and distract management, and disputes may arise with buyers. In addition, we have agreed and may in the future agree to indemnify buyers against known and unknown contingent liabilities. Our financial results could be impacted by claims under these indemnities.

9

The security of our Information Technology systems could be compromised, which could adversely affect our ability to operate.

We depend on information technology to enable us to operate efficiently and interface with customers as well as to maintain financial accuracy and efficiency. Our information technology capabilities are delivered through a combination of internal and external services and service providers. If we do not allocate and effectively manage the resources necessary to build and sustain the proper technology infrastructure, we could be subject to transaction errors, processing inefficiencies, the loss of customers, business disruptions, or the loss of or damage to our confidential business information or multiple site impact through a security breach. In addition, these systems may be damaged, disrupted or shut down due to attacks by computer hackers, computer viruses, employee error or malfeasance, power outages, hardware failures, telecommunication or utility failures, catastrophes or other unforeseen events, and in any such circumstances our system redundancy and other disaster recovery planning may be ineffective or inadequate. Security breaches of our systems (or the systems of our customers, suppliers or other business partners) could result in the misappropriation, destruction or unauthorized disclosure of confidential information or personal data belonging to us or to our employees, partners, customers or suppliers.

As with most large systems, our information technology systems have in the past been and in the future likely will be subject to computer viruses, malicious codes, unauthorized access and other cyber-attacks, and we expect the sophistication and frequency of such attacks to continue to increase. To date, we are not aware of any significant impact on our operations or financial results from such attempts; however, unauthorized access could disrupt our business operations, result in the loss of assets, and have a material adverse effect on our business, financial condition, or results of operations. Any of the attacks, breaches or other disruptions or damage described above could interrupt our operations, delay production and shipments, result in theft of our and our customers’ intellectual property and trade secrets, damage customer and business partner relationships and our reputation, or result in defective products or services, legal claims and proceedings, liability and penalties under privacy laws and increased costs for security and remediation, each of which could adversely affect our business, reputation and financial statements.

Our business involves the use, storage, and transmission of information about our employees, vendors, and customers. The protection of such information, as well as our information, is critical to us. The regulatory environment surrounding information security and privacy is increasingly demanding, with the frequent imposition of new and constantly changing requirements. We have established policies and procedures to help protect the security and privacy of this information. We also, from time to time, export sensitive customer data and technical information to recipients outside the United States. Breaches of our security measures or the accidental loss, inadvertent disclosure, or unapproved dissemination of proprietary information or sensitive or confidential data about us or our customers, including the potential loss or disclosure of such information or data as a result of fraud, trickery, or other forms of deception, could expose us, our customers, or the individuals affected to a risk of loss or misuse of this information, result in litigation and potential liability for us, damage our reputation, or otherwise harm our business.

Interruption in ordinary sources of raw material or energy supply or an inability to recover increases in energy and raw material costs from customers could result in lost sales or reduced profitability.

Hydrocarbons, including natural gas, are the primary feedstock for the production of hydrogen, carbon monoxide, and syngas. Energy, including electricity, natural gas, and diesel fuel for delivery trucks, is the largest cost component of our business. Because our industrial gas facilities use substantial amounts of electricity, energy price fluctuations could materially impact our revenues and earnings. A disruption in the supply of energy, components, or raw materials, whether due to market conditions, legislative or regulatory actions, natural events, or other disruption, could prevent us from meeting our contractual commitments, harming our business and financial results.

Our supply of crude helium for purification and resale is largely dependent upon natural gas production by crude helium suppliers. Lower natural gas production resulting from natural gas pricing dynamics, supplier operating or transportation issues (such as the Qatar embargo) or other interruptions in sales from crude helium suppliers, can reduce our supplies of crude helium available for processing and resale to customers.

We typically contract to pass through cost increases in energy and raw materials to customers, but cost variability can still have a negative impact on our results. We may be unable to raise prices as quickly as costs rise, or competitive pressures may prevent full recovery. Increases in energy or raw material costs that cannot be passed on to customers for competitive or other reasons would negatively impact our revenues and earnings. Even where costs are passed through, price increases can cause lower sales volume.

10

Catastrophic events could disrupt our operations or the operations of our suppliers or customers, having a negative impact on our business, financial results, and cash flows.

Our operations could be impacted by catastrophic events outside our control, including severe weather conditions such as hurricanes, floods, earthquakes, storms, epidemics, or acts of war and terrorism. Any such event could cause a serious business disruption that could affect our ability to produce and distribute products and possibly expose it to third-party liability claims. Additionally, such events could impact our suppliers or customers, in which event energy and raw materials may be unavailable to us, or our customers may be unable to purchase or accept our products and services. Any such occurrence could have a negative impact on our operations and financial results.

New technologies create performance risks that could impact our financial results or reputation.

We are continually developing and implementing new technologies and product offerings. Existing technologies are being implemented in products and designs or at scales beyond our experience base. These technological expansions can create nontraditional performance risks to our operations. Failure of the technologies to work as predicted or unintended consequences of new designs or uses could lead to cost overruns, project delays, financial penalties, or damage to our reputations. Large scale gasification projects may contain processes or technologies that we have not operated at the same scale or in the same combination and, although such projects generally include technologies and processes that have been demonstrated previously by others, such technologies or processes may be new to us.

Our financial results may be affected by various legal and regulatory proceedings, including those involving antitrust, tax, environmental, or other matters.

We are subject to litigation and regulatory investigations and proceedings in the normal course of business and could become subject to additional claims in the future, some of which could be material. While we seek to limit our liability in our commercial contractual arrangements, there are no guarantees that each contract will contain suitable limitations of liability or that limitations of liability will be enforceable at law. Also, the outcome of existing legal proceedings may differ from our expectations because the outcomes of litigation, including regulatory matters, are often difficult to predict reliably. Various factors or developments can lead us to change current estimates of liabilities and related insurance receivables, where applicable, or make such estimates for matters previously not susceptible to reasonable estimates, such as a significant judicial ruling or judgment, a significant settlement, significant regulatory developments, or changes in applicable law. A future adverse ruling, settlement, or unfavorable development could result in charges that could have a material adverse effect on our financial condition, results of operations, and cash flows in any particular period.

Costs and expenses resulting from compliance with environmental regulations may negatively impact our operations and financial results.

We are subject to extensive federal, state, local, and foreign environmental and safety laws and regulations concerning, among other things, emissions in the air; discharges to land and water; and the generation, handling, treatment, and disposal of hazardous waste and other materials. We take our environmental responsibilities very seriously, but there is a risk of environmental impact inherent in our manufacturing operations and transportation of our products. Future developments and more stringent environmental regulations may require us to make additional unforeseen environmental expenditures. In addition, laws and regulations may require significant expenditures for environmental protection equipment, compliance, and remediation. These additional costs may adversely affect financial results. For a more detailed description of these matters, see Item 1 - Business Environmental Controls, above.

11

Legislative, regulatory and societal responses to global climate change create financial risk.

We are the world’s leading supplier of hydrogen, the primary use of which is the production of ultra-low sulfur transportation fuels that have significantly reduced transportation emissions and helped improve human health. To make the high volumes of hydrogen needed by our customers, we use steam methane reforming, which releases carbon dioxide. Some of our operations are within jurisdictions that have or are developing regulatory regimes governing emissions of greenhouse gases ("GHG"), including carbon dioxide. These include existing coverage under the European Union Emission Trading Scheme, California and Ontario cap and trade schemes, Alberta’s Specified Gas Emitters Regulation, China’s Emission Trading Scheme pilots, South Korea’s Emission Trading Scheme, and mandatory reporting and anticipated constraints on GHG emissions under an Ontario cap and trade scheme, nation-wide expansion of the China Emission Trading Scheme, and revisions to the Alberta regulation. In addition, the U.S. Environmental Protection Agency ("EPA") requires mandatory reporting of GHG emissions and is regulating GHG emissions for new construction and major modifications to existing facilities. Some jurisdictions have various mechanisms to target the power sector to achieve emission reductions, which often result in higher power costs.

Increased public concern may result in more international, U.S. federal, and/or regional requirements to reduce or mitigate the effects of GHG. Although uncertain, these developments could increase our costs related to consumption of electric power and hydrogen production. We believe it will be able to mitigate some of the increased costs through contractual terms, but the lack of definitive legislation or regulatory requirements prevents an accurate estimate of the long-term impact these measures will have on our operations. Any legislation that limits or taxes GHG emissions could negatively impact our growth, increase our operating costs, or reduce demand for certain of our products.

Implementation of the United Kingdom’s (“UK”) exit from European Union (“EU”) membership, or recent political instability in Spain, could adversely affect our European Operations.

The UK’s exit from EU membership may adversely affect customer demand, our relationships with customers and suppliers and our European business. Although it is unknown what the terms of the United Kingdom’s future relationship with the EU will be, it is possible that there will be greater restrictions on imports and exports between the United Kingdom and EU members and increased regulatory complexities. Any of these factors could adversely affect customer demand, our relationships with customers and suppliers and our European business.

In addition, there has been recent political instability in Catalonia, Spain. We maintain an administrative office in Catalonia which provides transactional accounting and other support services for our entire European business, and fiscal year 2017 sales of approximately US$320 million were attributable to Spain. These operations could be impacted by the outcome of the current unrest.

Inability to compete effectively in a segment could adversely impact sales and financial performance.

We face strong competition from several large global competitors and many smaller regional ones in many of our business segments. Introduction by competitors of new technologies, competing products, or additional capacity could weaken demand for or impact pricing of our products, negatively impacting financial results. In addition, competitors’ pricing policies could affect our profitability or market share.

The Company could be subject to changes in its tax rates, the adoption of new U.S. or foreign tax legislation or exposure to additional tax liabilities.

The multinational nature of our business subjects us to taxation in the United States and numerous foreign jurisdictions. Due to economic and political conditions, tax rates in various jurisdictions may be subject to significant change. The company’s future effective tax rates could be affected by changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation of deferred tax assets and liabilities, or changes in tax laws or their interpretation. For example, the United States Congress is considering comprehensive tax reform which, among other things, may significantly reduce the corporate tax rate and change certain U.S. tax rules impacting the way U.S. based multinationals are taxed on foreign income. Changes to the tax system in the United States, particularly a proposed mandatory deemed repatriation tax, could have a material impact to our financial statements. The cumulative undistributed earnings that are considered to be indefinitely reinvested in foreign subsidiaries and corporate joint ventures on the consolidated balance sheets amounted to $6,032.5 as of 30 September 2017. The potential impact of the mandatory deemed repatriation proposal and other proposals is uncertain at this time, especially as the outcome of U.S. tax reform discussions is unknown. At this time, we are properly reflecting the provision for taxes on income using all current enacted global tax laws in every jurisdiction in which we operate.

12

We could incur significant liability if the distribution of Versum common stock to our stockholders is determined to be a taxable transaction.

We have received an opinion from outside tax counsel to the effect that the spin-off of Versum qualifies as a transaction that is described in Sections 355(a) and 368(a)(1)(D) of the Internal Revenue Code. The opinion relies on certain facts, assumptions, representations and undertakings from Versum and us regarding the past and future conduct of the companies’ respective businesses and other matters. If any of these facts, assumptions, representations or undertakings are incorrect or not satisfied, our shareholders and we may not be able to rely on the opinion of tax counsel and could be subject to significant tax liabilities. Notwithstanding the opinion of tax counsel we have received, the IRS could determine on audit that the spin-off is taxable if it determines that any of these facts, assumptions, representations or undertakings are not correct or have been violated or if it disagrees with the conclusions in the opinion. If the spin-off is determined to be taxable for U.S. federal income tax purposes, our shareholders that are subject to U.S. federal income tax and we could incur significant U.S. federal income tax liabilities.

ITEM 1B. UNRESOLVED STAFF COMMENTS

We have not received any written comments from the Commission staff that remain unresolved.

ITEM 2. PROPERTIES

Air Products and Chemicals, Inc. owns its principal administrative offices, which are the Company’s headquarters located in Trexlertown, Pennsylvania, as well as Hersham, England, Shanghai, China, and Santiago, Chile. The Company leases administrative offices in the United States, Spain, Malaysia, and China for its Global Business Support organization.

The following is a description of the properties used by our five business segments. We believe that our facilities are suitable and adequate for our current and anticipated future levels of operation.

Industrial Gases – Americas

This business segment currently operates from over 400 production and distribution facilities in North and South America (approximately 1/4th of which are located on owned property), and 10% of which are integrated sites that serve dedicated customers as well as merchant customers. The Company has sufficient property rights and permits for the ongoing operation of our pipeline systems in the Gulf Coast, California, and Arizona in the United States and Alberta and Ontario, Canada. Management and sales support is based in our Trexlertown and Santiago offices referred to above, and at 10 leased properties located throughout North and South America.

Hydrogen fueling stations built by the Company support commercial markets in California and Japan as well as demonstration projects in Europe and other parts of Asia.

Industrial Gases – EMEA

This business segment currently operates from over 150 production and distribution facilities in Europe, the Middle East, and Africa (approximately 1/3rd of which are on owned property). The Company has sufficient property rights and permits for the ongoing operation of our pipeline systems in the Netherlands, the United Kingdom, Belgium, France, and Germany. Management and sales support for this business segment is based in Hersham, England referred to above, Barcelona, Spain and at 12 leased regional office sites and at least 15 leased local office sites, located throughout the region.

Industrial Gases – Asia

Industrial Gases – Asia currently operates from over 170 production and distribution facilities within Asia (approximately 1/4th of which are on owned property or long duration term grants). The Company has sufficient property rights and permits for the ongoing operation of our pipeline systems in China, South Korea, Taiwan, Malaysia, Singapore, and Indonesia. Management and sales support for this business segment is based in Shanghai, China and Kuala Lumpur, Malaysia, and in 12 leased office locations throughout the region.

13

Industrial Gases – Global

Management, sales, and engineering support for this business segment is based in our principal administrative offices noted above, and an office in India.

Equipment is manufactured in Missouri, Pennsylvania, and China.

Research and development ("R&D") activities for this business segment are conducted at owned locations in the U.S. and the United Kingdom, and 4 leased locations in Canada, Europe, and Asia.

Helium is processed at multiple sites in the U.S. and then distributed to/from transfill sites globally.

Corporate and other

Corporate administrative functions are based in the Company’s administrative offices referred to above.

The Gardner Cryogenic business operates at facilities in Pennsylvania and Kansas in the United States and in France.

The LNG business operates a manufacturing facility in Florida in the United States with management, engineering, and sales support based in the Trexlertown offices referred to above and a nearby leased office.

ITEM 3. LEGAL PROCEEDINGS

In the normal course of business, the Company and its subsidiaries are involved in various legal proceedings, including contract, product liability, intellectual property, insurance, and regulatory matters. Although litigation with respect to these matters is routine and incidental to the conduct of our business, such litigation could result in large monetary awards, especially if compensatory and/or punitive damages are awarded. However, we believe that litigation currently pending to which we are a party will be resolved without any material adverse effect on our financial position, earnings, or cash flows.

From time to time, we are also involved in proceedings, investigations, and audits involving governmental authorities in connection with environmental, health, safety, competition, and tax matters.

The Company is a party to proceedings under CERCLA, the RCRA, and similar state and foreign environmental laws relating to the designation of certain sites for investigation or remediation. Presently there are approximately 32 sites on which a final settlement has not been reached where the Company, along with others, has been designated a potentially responsible party by the Environmental Protection Agency or is otherwise engaged in investigation or remediation, including cleanup activity at certain of its current and former manufacturing sites. We do not expect that any sums we may have to pay in connection with these environmental matters would have a material adverse impact on our consolidated financial position. Additional information on the Company’s environmental exposure is included under Item 1 - Business Environmental Controls.

In September 2010, the Brazilian Administrative Council for Economic Defense ("CADE") issued a decision against our Brazilian subsidiary, Air Products Brasil Ltda., and several other Brazilian industrial gas companies for alleged anticompetitive activities. CADE imposed a civil fine of R$179.2 million (approximately $57 million at 30 September 2017) on Air Products Brasil Ltda. This fine was based on a recommendation by a unit of the Brazilian Ministry of Justice, whose investigation began in 2003, alleging violation of competition laws with respect to the sale of industrial and medical gases. The fines are based on a percentage of the Company’s total revenue in Brazil in 2003.

We have denied the allegations made by the authorities and filed an appeal in October 2010 to the Brazilian courts. On 6 May 2014, our appeal was granted and the fine against Air Products Brasil Ltda. was dismissed. CADE has appealed that ruling and the matter remains pending. The Company, with advice of its outside legal counsel, has assessed the status of this matter and has concluded that, although an adverse final judgment after exhausting all appeals is possible, such a judgment is not probable. As a result, no provision has been made in the consolidated financial statements.

Other than this matter, we do not currently believe there are any legal proceedings, individually or in the aggregate, that are reasonably possible to have a material impact on our financial condition, results of operations, or cash flows. However, a future charge for regulatory fines or damage awards could have a significant impact on our net income in the period in which it is recorded.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable

14

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS,

AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock (ticker symbol APD) is listed on the New York Stock Exchange. Our transfer agent and registrar is Broadridge Corporate Issuer Solutions, Inc., P.O. Box 1342, Brentwood, New York 11717, telephone (844) 318-0129 (U.S.) or (720) 358-3595 (all other locations); website, http://shareholder.broadridge.com/airproducts; and e-mail address, shareholder@broadridge.com. As of 31 October 2017, there were 5,644 record holders of our common stock. Quarterly stock prices, as reported on the New York Stock Exchange composite tape of transactions, and dividend information for the last two fiscal years appear below. Cash dividends on the Company’s common stock are paid quarterly. It is our expectation that we will continue to pay cash dividends in the future at comparable or increased levels. The Board of Directors determines whether to declare dividends and the timing and amount based on financial condition and other factors it deems relevant.

Quarterly Stock Information

2017 | High | Low | Close | Dividend | ||||||||||||

First | $ | 150.45 | $ | 129.00 | $ | 143.82 | $ | .86 | ||||||||

Second | 149.46 | 133.63 | 135.29 | .95 | ||||||||||||

Third | 147.66 | 134.09 | 143.06 | .95 | ||||||||||||

Fourth | 152.26 | 141.88 | 151.22 | .95 | ||||||||||||

$ | 3.71 | |||||||||||||||

2016 | High | Low | Close | Dividend | ||||||||||||

First | $ | 133.78 | $ | 117.80 | $ | 121.02 | $ | .81 | ||||||||

Second | 136.88 | 106.63 | 133.99 | .86 | ||||||||||||

Third | 141.53 | 124.78 | 132.12 | .86 | ||||||||||||

Fourth | 146.82 | 127.72 | 139.84 | .86 | ||||||||||||

$ | 3.39 | |||||||||||||||

Purchases of Equity Securities by the Issuer

On 15 September 2011, the Board of Directors authorized the repurchase of up to $1.0 billion of our outstanding common stock. This program does not have a stated expiration date. We repurchase shares pursuant to Rules 10b5-1 and 10b-18 under the Securities Exchange Act of 1934, as amended, through repurchase agreements established with several brokers. There were no purchases of stock during fiscal year 2017. At 30 September 2017, $485.3 million in share repurchase authorization remained. Additional purchases will be completed at the Company’s discretion while maintaining sufficient funds for investing in its businesses and growth opportunities.

15

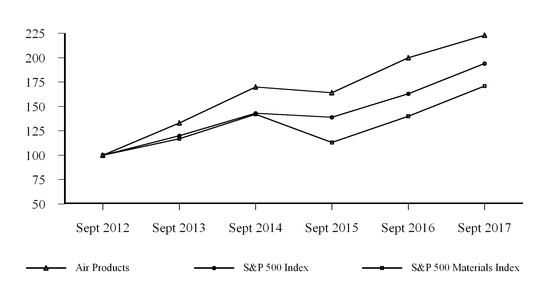

Performance Graph

The performance graph below compares the five-year cumulative returns of the Company’s common stock with those of the Standard & Poor’s 500 Index (S&P 500 Index) and the Standard & Poor’s 500 Materials Index (S&P 500 Materials Index). The figures assume an initial investment of $100 and the reinvestment of all dividends.

COMPARISON OF FIVE YEAR CUMULATIVE SHAREHOLDER RETURN

Air Products, S&P 500 Index, and S&P 500 Materials Index

Comparative Growth of a $100 Investment

(Assumes Reinvestment of All Dividends)

Sept 2012 | Sept 2013 | Sept 2014 | Sept 2015 | Sept 2016 | Sept 2017 | |

Air Products | 100 | 133 | 170 | 164 | 200 | 223 |

S&P 500 Index | 100 | 120 | 143 | 139 | 163 | 194 |

S&P 500 Materials Index | 100 | 117 | 142 | 113 | 140 | 171 |

16

ITEM 6. SELECTED FINANCIAL DATA

Unless otherwise indicated, information presented is on a continuing operations basis.

(Millions of dollars, except for share and per share data) | 2017(A) | 2016(A) | 2015(A) | 2014(A) | 2013(A) | ||||||||||

Operating Results | |||||||||||||||

Sales | $ | 8,188 | $ | 7,504 | $ | 7,824 | $ | 8,384 | $ | 8,313 | |||||

Cost of sales | 5,753 | 5,177 | 5,598 | 6,208 | 6,138 | ||||||||||

Selling and administrative | 716 | 685 | 773 | 892 | 896 | ||||||||||

Research and development | 58 | 72 | 76 | 79 | 74 | ||||||||||

Business restructuring and cost reduction actions | 151 | 35 | 180 | 11 | 98 | ||||||||||

Operating income | 1,428 | 1,530 | 1,233 | 924 | 1,149 | ||||||||||

Equity affiliates’ income(B) | 80 | 147 | 152 | 149 | 165 | ||||||||||

Income from continuing operations attributable to Air Products | 1,134 | 1,100 | 933 | 697 | 869 | ||||||||||

Net income attributable to Air Products(C) | 3,000 | 631 | 1,278 | 992 | 994 | ||||||||||

Basic earnings per common share attributable to Air Products: | |||||||||||||||

Income from continuing operations | 5.20 | 5.08 | 4.34 | 3.28 | 4.14 | ||||||||||

Net income(C) | 13.76 | 2.92 | 5.95 | 4.66 | 4.74 | ||||||||||

Diluted earnings per common share attributable to Air Products: | |||||||||||||||

Income from continuing operations | 5.16 | 5.04 | 4.29 | 3.24 | 4.09 | ||||||||||

Net income(C) | 13.65 | 2.89 | 5.88 | 4.61 | 4.68 | ||||||||||

Year-End Financial Position | |||||||||||||||

Plant and equipment, at cost | $ | 19,548 | $ | 18,660 | $ | 17,999 | $ | 18,180 | $ | 17,676 | |||||

Total assets(C)(D)(E) | 18,467 | 18,029 | 17,317 | 17,648 | 17,740 | ||||||||||

Working capital(C) | 3,388 | 1,034 | (851 | ) | 199 | 100 | |||||||||

Total debt(E)(F) | 3,963 | 5,211 | 5,856 | 6,081 | 6,231 | ||||||||||

Redeemable noncontrolling interest | — | — | — | 287 | 376 | ||||||||||

Air Products shareholders’ equity(C) | 10,086 | 7,080 | 7,249 | 7,366 | 7,042 | ||||||||||

Total equity(C) | 10,186 | 7,213 | 7,381 | 7,521 | 7,199 | ||||||||||

Financial Ratios | |||||||||||||||

Return on average Air Products shareholders’ equity(G) | 13.2 | % | 15.4 | % | 12.7 | % | 9.5 | % | 13.3 | % | |||||

Operating margin | 17.4 | % | 20.4 | % | 15.8 | % | 11.0 | % | 13.8 | % | |||||

Selling and administrative as a percentage of sales | 8.7 | % | 9.1 | % | 9.9 | % | 10.6 | % | 10.8 | % | |||||

Total debt to total capitalization(E)(F)(H) | 28.0 | % | 41.9 | % | 44.2 | % | 43.8 | % | 45.1 | % | |||||

Other Data | |||||||||||||||

Income from continuing operations including noncontrolling interests | $ | 1,155 | $ | 1,122 | $ | 966 | $ | 691 | $ | 900 | |||||

Adjusted EBITDA(I) | 2,795 | 2,622 | 2,399 | 2,275 | 2,247 | ||||||||||

Depreciation and amortization | 866 | 855 | 859 | 876 | 825 | ||||||||||

Capital expenditures on a GAAP basis(J) | 1,056 | 908 | 1,201 | 1,297 | 1,400 | ||||||||||

Capital expenditures on a non-GAAP basis(J) | 1,066 | 935 | 1,575 | 1,498 | 1,642 | ||||||||||

Cash provided by operating activities | 2,534 | 2,259 | 2,047 | 1,862 | 1,313 | ||||||||||

Cash used for investing activities | (1,418 | ) | (865 | ) | (1,147 | ) | (1,257 | ) | (1,354 | ) | |||||

Cash (used for) provided by financing activities | (2,041 | ) | (860 | ) | (960 | ) | (524 | ) | 112 | ||||||

Dividends declared per common share | 3.71 | 3.39 | 3.20 | 3.02 | 2.77 | ||||||||||

Weighted Average Common Shares – Basic (in millions) | 218 | 216 | 215 | 213 | 210 | ||||||||||

Weighted Average Common Shares – Diluted (in millions) | 220 | 218 | 217 | 215 | 212 | ||||||||||

Book value per common share at year-end | $ | 46.19 | $ | 32.57 | $ | 33.66 | $ | 34.49 | $ | 33.35 | |||||

Shareholders at year-end | 5,700 | 6,000 | 6,400 | 6,600 | 7,000 | ||||||||||

Employees at year-end(K) | 15,300 | 18,600 | 19,700 | 21,200 | 21,600 | ||||||||||

17

(A) | Unless otherwise stated, selected financial data is presented on a GAAP basis. Our operating results were impacted by certain items which management does not believe to be indicative of ongoing business trends and are excluded from the non-GAAP measure. Refer to pages 31-37 for reconciliations of the GAAP to non-GAAP measures for fiscal year 2017, 2016, and 2015. Descriptions of the excluded items appear on pages 24-26. For 2014, these items include: (i) a charge to operating income of $11 ($7 after-tax, or $.03 per share) related to business restructuring and cost reduction actions, (ii) pension settlement losses of $5 ($3 after-tax, or $.02 per share), and (iii) a goodwill and intangible asset impairment charge of $310 ($275 attributable to Air Products, after-tax, or $1.27 per share). For 2013, these items include: (i) a charge to operating income of $98 ($71 after-tax, or $.33 per share) related to business restructuring and cost reduction actions, and (ii) expenses of $10 ($6 after-tax, or $.03 per share) related to advisory costs. |

(B) | For 2017, includes the impact of a noncash impairment charge of $79.5 ($.36 per share) on our investment in Abdullah Hashim Industrial Gases & Equipment Co., Ltd. (AHG), a 25%‑owned equity affiliate in our Industrial Gases – EMEA segment. |

(C) | Information presented on a total company basis, which includes both continuing and discontinued operations. |

(D) | Reflects adoption of guidance on the presentation of deferred income taxes on a retrospective basis. Refer to Note 2, New Accounting Guidance, for additional information. |

(E) | Reflects adoption of guidance on the presentation of deferred financing costs on a retrospective basis. Refer to Note 2, New Accounting Guidance, for additional information. |

(F) | Total debt includes long-term debt, current portion of long-term debt, and short-term borrowings as of the end of the year for continuing operations. |

(G) | Calculated using income from continuing operations attributable to Air Products and five-quarter average Air Products shareholders’ equity. |

(H) | Total capitalization includes total debt for continuing operations plus total equity plus redeemable noncontrolling interest as of the end of the year. |

(I) | A reconciliation of Income from Continuing Operations on a GAAP basis to Adjusted EBITDA is presented on pages 34-36. |

(J) | Capital expenditures presented on a GAAP basis include additions to plant and equipment, investment in and advances to unconsolidated affiliates, and acquisitions. The Company utilizes a non-GAAP measure in the computation of capital expenditures and includes spending associated with facilities accounted for as capital leases and purchases of noncontrolling interests. Refer to page 39 for a reconciliation of the GAAP to non-GAAP measures for 2017, 2016, and 2015. For 2014, the GAAP measure was adjusted by $200 for spending associated with facilities accounted for as capital leases. For 2013, the GAAP measure was adjusted by $228 and $14 for spending associated with facilities accounted for as capital leases and purchases of noncontrolling interests, respectively. |

(K) | Includes full- and part-time employees from continuing and discontinued operations. |

18

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

The following discussion should be read in conjunction with the consolidated financial statements and the accompanying notes contained in this report. All comparisons in the discussion are to the corresponding prior year unless otherwise stated. All amounts presented are in accordance with U.S. generally accepted accounting principles (GAAP), except as noted. All amounts are presented in millions of dollars, except for per share data, unless otherwise indicated.

The results of our former Materials Technologies segment, which contained the Electronic Materials Division (EMD) and the Performance Materials Division (PMD), and the former Energy-from-Waste segment have been presented as discontinued operations. The results of operations and cash flows of these businesses have been removed from the results of continuing operations and segment results for all periods presented. Unless otherwise indicated, financial information is presented on a continuing operations basis. Refer to Note 3, Discontinued Operations, to the consolidated financial statements for additional information regarding the discontinued businesses.

Captions such as income from continuing operations attributable to Air Products, net income attributable to Air Products, and diluted earnings per share attributable to Air Products are simply referred to as “income from continuing operations,” “net income,” and “diluted earnings per share (EPS)” throughout this Management’s Discussion and Analysis, unless otherwise stated.

The discussion of results that follows includes comparisons to certain non-GAAP ("adjusted") financial measures. The presentation of non-GAAP measures is intended to provide investors, potential investors, securities analysts, and others with useful supplemental information to evaluate the performance of the business because such measures, when viewed together with our financial results computed in accordance with GAAP, provide a more complete understanding of the factors and trends affecting our historical financial performance and projected future results. The reconciliations of reported GAAP results to non-GAAP measures are presented on pages 31-37. Descriptions of the excluded items appear on pages 24-26.

19

BUSINESS OVERVIEW

Air Products and Chemicals, Inc. is a world-leading Industrial Gases company in operation for over 75 years. The Company’s core industrial gases business provides atmospheric and process gases and related equipment to manufacturing markets, including refining and petrochemical, metals, electronics, and food and beverage. Air Products is also the world’s leading supplier of liquefied natural gas process technology and equipment. With operations in 50 countries, in 2017 we had sales of $8.2 billion, total company assets, including assets of both continuing and discontinued operations, of $18.5 billion, and a worldwide workforce of approximately 15,300 full- and part-time employees from continuing and discontinued operations.

As of 30 September 2017, our operations were organized into five reportable business segments: Industrial Gases – Americas; Industrial Gases – EMEA (Europe, Middle East, and Africa); Industrial Gases – Asia; Industrial Gases – Global; and Corporate and other. The financial statements and analysis that follow discuss our results based on these operations. Refer to Note 25, Business Segment and Geographic Information, to the consolidated financial statements for additional details on our reportable business segments.

2017 IN SUMMARY

In 2017, we were able to focus on our core industrial gases business by completing the separation of EMD through the spin-off of Versum Materials, Inc. (Versum) and the sale of PMD to Evonik Industries AG (Evonik). Sales of $8.2 billion increased nine percent over the prior year, primarily due to volume growth from new project onstreams across our regional industrial gases businesses, underlying growth in the base business, and continued progress on the Jazan project within our Industrial Gases – Global segment, partially offset by weaker liquefied natural gas (LNG) equipment sales. We delivered operating margin of 17.4%, adjusted operating margin of 21.6%, and adjusted EBITDA margin of 34.1% as our productivity actions were offset by the impact of energy cost pass-through to customers. Diluted EPS of $5.16 increased 2% from the prior year. On a non-GAAP basis, adjusted diluted EPS of $6.31 increased 12%.

Highlights for 2017

• | Sales of $8,187.6 increased 9%, or $683.9 as underlying sales growth of 7% and higher energy and natural gas cost pass‑through to customers of 3% were partially offset by unfavorable currency impacts of 1%. Underlying sales increased primarily from higher volumes across the industrial gases businesses, including the Jazan project, partially offset by lower LNG sales in the corporate and other segment. |

• | Operating income of $1,427.6 decreased 7%, or $102.1, primarily due to a noncash goodwill and intangible asset impairment charge and higher cost reduction and asset actions, partially offset by favorable volumes and lower other costs. Operating margin of 17.4% decreased 300 bp. On a non‑GAAP basis, adjusted operating income of $1,769.6 increased 9%, or $149.7, and adjusted operating margin of 21.6% was flat. |