UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00126

AB RELATIVE VALUE FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2023

Date of reporting period: October 31, 2023

ITEM 1. REPORTS TO STOCKHOLDERS.

OCT 10.31.23

ANNUAL REPORT

AB RELATIVE VALUE FUND

| Investment Products Offered | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed | |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| FROM THE PRESIDENT |

|

Dear Shareholder,

We’re pleased to provide this report for the AB Relative Value Fund (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

At AB, we’re striving to help our clients achieve better outcomes by:

| + | Fostering diverse perspectives that give us a distinctive approach to navigating global capital markets |

| + | Applying differentiated investment insights through a connected global research network |

| + | Embracing innovation to design better ways to invest and leading-edge mutual-fund solutions |

Whether you’re an individual investor or a multibillion-dollar institution, we’re putting our knowledge and experience to work for you every day.

For more information about AB’s comprehensive range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in AB mutual funds—and for placing your trust in our firm.

Sincerely,

Onur Erzan

President and Chief Executive Officer, AB Mutual Funds

| abfunds.com | AB RELATIVE VALUE FUND | 1 | |

ANNUAL REPORT

December 6, 2023

This report provides management’s discussion of fund performance for the AB Relative Value Fund for the annual reporting period ended October 31, 2023.

The Fund’s investment objective is long-term growth of capital.

NAV RETURNS AS OF OCTOBER 31, 2023 (unaudited)

| 6 Months | 12 Months | |||||||

| AB RELATIVE VALUE FUND | ||||||||

| Class A Shares | -1.69% | 0.51% | ||||||

| Class C Shares | -2.02% | -0.13% | ||||||

| Advisor Class Shares1 | -1.50% | 0.78% | ||||||

| Class R Shares1 | -1.71% | 0.39% | ||||||

| Class K Shares1 | -1.71% | 0.64% | ||||||

| Class I Shares1 | -1.64% | 0.74% | ||||||

| Class Z Shares1, 2 | -1.65% | 0.68% | ||||||

| Russell 1000 Value Index | -4.22% | 0.13% | ||||||

| 1 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 2 | The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the Financial Highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

INVESTMENT RESULTS

The table above shows the Fund’s performance compared with its benchmark, the Russell 1000 Value Index, for the six- and 12-month periods ended October 31, 2023.

All share classes of the Fund, with the exception of Class C shares, outperformed the benchmark for the 12-month period, before sales charges. Overall, security selection and sector allocation were positive, relative to the benchmark. Security selection within financials and consumer discretionary contributed, while selection within technology and energy detracted. Gains from overweights to technology and industrials were partially offset by losses from an underweight to communication services and an overweight to health care.

During the six-month period, all share classes of the Fund outperformed the benchmark, before sales charges. Both security selection and sector allocation were positive. Security selection within health care and financials

| 2 | AB RELATIVE VALUE FUND |

abfunds.com | |

contributed the most, while selection within consumer discretionary and consumer staples detracted. Contributions from an underweight to utilities and an overweight to industrials offset losses from an overweight to health care and an underweight to communication services.

The Fund did not use derivatives during either period.

MARKET REVIEW AND INVESTMENT STRATEGY

US and international stocks rose and emerging-market stocks declined during the 12-month period ended October 31, 2023. Although aggressive central bank tightening—led by the US Federal Reserve (the “Fed”)—pressured global equity markets, stocks rallied amid signs of easing inflation and as central banks began to pause rate hikes. During the period, the collapse of select US regional banks, China’s faltering economic recovery, concern over a broadening United Auto Workers strike and the looming risk of a US government shutdown later in the year weighed on results. Stronger-than-expected third-quarter economic growth supported the Fed’s commitment to higher-for-longer rates which triggered a rapid rise in bond yields—especially the 10-year US Treasury note, which briefly crossed the 5% threshold for the first time in 16 years. Headwinds from higher Treasury yields, conflict in the Middle East and mixed third-quarter earnings weighed on investor sentiment globally. As the period ended, equity markets rallied, led by a rebound in technology shares and earnings surprises across a range of sectors in the US. Within large-cap markets, both growth- and value-oriented stocks rose, but growth significantly outperformed value, led by the technology sector and artificial intelligence optimism. Large-cap stocks rose and outperformed small-cap stocks which declined, by a wide margin.

The Fund’s Senior Investment Management Team (the “Team”) remains committed to using bottom-up research to build a Fund composed of well-managed companies that are attractively valued relative to their long-term earnings power. The Team’s objective is to find companies that stand out and deploy capital wisely, allowing these companies to grow dividends and enhance the long-term value of their shares.

INVESTMENT POLICIES

The Fund invests primarily in the equity securities of US companies that the Adviser believes are trading at attractive valuations that have strong or improving business models. The Adviser monitors the fundamental performance of the Fund’s investments for signs of future financial success. The Adviser relies heavily upon the fundamental analysis and research of its dedicated investment team for the Fund in conducting research and making investment decisions. The team initially screens a primary research universe of largely US companies for

(continued on next page)

| abfunds.com | AB RELATIVE VALUE FUND | 3 | |

attractive security valuation and business model characteristics. Once appropriate candidates have been identified for further analysis, the team conducts fundamental research to better understand the company’s business model. In evaluating a company for potential inclusion in the Fund, the Adviser takes into account many factors that it believes bear on the company’s ability to perform in the future, including attractive free cash flow valuations, high levels of profitability, stable-to-improving balance sheets, and management teams that are good stewards of shareholder capital.

The Adviser recognizes that the perception of “value” is relative and often defined by the future economic performance of the company. As a result of how individual companies are valued in the market, the Fund may be attracted to investments in companies with different market capitalizations (i.e., large-, mid- or small-capitalization) or companies engaged in particular types of businesses, although the Fund does not intend to concentrate in any particular sectors or industries. At any period in time, the Fund’s portfolio emphasis upon particular industries or sectors will be a by-product of the stock selection process rather than the result of assigned targets or ranges.

The Fund may enter into derivatives transactions, such as options, futures contracts, forwards and swaps. The Fund may use options strategies involving the purchase and/or writing of various combinations of call and/or put options, including on individual securities and stock indices, futures contracts (including futures contracts on individual securities and stock indices) or shares of exchange-traded funds. These transactions may be used, for example, in an effort to earn extra income, to adjust exposure to individual securities or markets, or to protect all or a portion of the Fund’s portfolio from a decline in value, sometimes within certain ranges.

| 4 | AB RELATIVE VALUE FUND |

abfunds.com | |

DISCLOSURES AND RISKS

Benchmark Disclosure

The Russell 1000® Value Index is unmanaged and does not reflect fees and expenses associated with the active management of a mutual fund portfolio. The Russell 1000 Value Index represents the performance of large-cap value companies within the US. An investor cannot invest directly in an index or average, and their results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Market Risk: The value of the Fund’s investments will fluctuate as the stock or bond market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness) and regional and global conflicts, that affect large portions of the market. It includes the risk that a particular style of investing may be underperforming the market generally.

Capitalization Risk: Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small- and mid-capitalization companies may have additional risks because these companies may have limited product lines, markets or financial resources.

Derivatives Risk: Derivatives may be difficult to price or unwind and leveraged so that small changes may produce disproportionate losses for the Fund. A short position in a derivative instrument involves the risk of a theoretically unlimited increase in the value of the underlying asset, which could cause the Fund to suffer a potentially unlimited loss. Derivatives, especially over-the-counter derivatives, are also subject to counterparty risk, which is the risk that the counterparty (the party on the other side of the transaction) on a derivative transaction will be unable or unwilling to honor its contractual obligations to the Fund.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results. Some of these techniques may incorporate, or rely upon, quantitative models, but there is no guarantee that these models will generate accurate forecasts, reduce risk or otherwise perform as expected.

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

| abfunds.com | AB RELATIVE VALUE FUND | 5 | |

DISCLOSURES AND RISKS (continued)

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.abfunds.com.

All fees and expenses related to the operation of the Fund have been deducted. Net asset value (“NAV”) returns do not reflect sales charges; if sales charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares and a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

| 6 | AB RELATIVE VALUE FUND |

abfunds.com | |

HISTORICAL PERFORMANCE

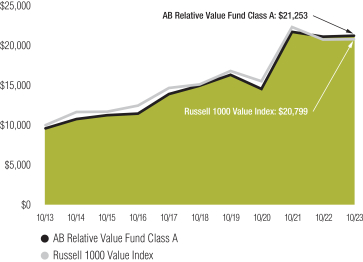

GROWTH OF A $10,000 INVESTMENT IN THE FUND (unaudited)

10/31/2013 TO 10/31/2023

This chart illustrates the total value of an assumed $10,000 investment in AB Relative Value Fund Class A shares (from 10/31/2013 to 10/31/2023) as compared to the performance of the Fund’s benchmark. The chart reflects the deduction of the maximum 4.25% sales charge from the initial $10,000 investment in the Fund and assumes the reinvestment of dividends and capital gains distributions.

| abfunds.com | AB RELATIVE VALUE FUND | 7 | |

HISTORICAL PERFORMANCE (continued)

AVERAGE ANNUAL RETURNS AS OF OCTOBER 31, 2023 (unaudited)

| NAV Returns | SEC Returns (reflects applicable sales charges) |

|||||||

| CLASS A SHARES | ||||||||

| 1 Year | 0.51% | -3.80% | ||||||

| 5 Years | 7.28% | 6.36% | ||||||

| 10 Years | 8.31% | 7.83% | ||||||

| CLASS C SHARES | ||||||||

| 1 Year | -0.13% | -1.06% | ||||||

| 5 Years | 6.49% | 6.49% | ||||||

| 10 Years1 | 7.52% | 7.52% | ||||||

| ADVISOR CLASS SHARES2 | ||||||||

| 1 Year | 0.78% | 0.78% | ||||||

| 5 Years | 7.53% | 7.53% | ||||||

| 10 Years | 8.59% | 8.59% | ||||||

| CLASS R SHARES2 | ||||||||

| 1 Year | 0.39% | 0.39% | ||||||

| 5 Years | 7.01% | 7.01% | ||||||

| 10 Years | 8.04% | 8.04% | ||||||

| CLASS K SHARES2 | ||||||||

| 1 Year | 0.64% | 0.64% | ||||||

| 5 Years | 7.29% | 7.29% | ||||||

| 10 Years | 8.33% | 8.33% | ||||||

| CLASS I SHARES2 | ||||||||

| 1 Year | 0.74% | 0.74% | ||||||

| 5 Years | 7.53% | 7.53% | ||||||

| 10 Years | 8.59% | 8.59% | ||||||

| CLASS Z SHARES2 | ||||||||

| 1 Year | 0.68% | 0.68% | ||||||

| 5 Years | 7.57% | 7.57% | ||||||

| 10 Years | 8.62% | 8.62% | ||||||

The Fund’s current prospectus fee table shows the Fund’s total annual operating expense ratios as 0.94%, 1.69%, 0.69%, 1.32%, 1.02%, 0.69% and 0.61% for Class A, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursement agreements reduced the Fund’s total annual operating expenses (excluding acquired fund fees and expenses other than the advisory fees of any AB mutual funds in which the Fund may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs) to 0.90%, 1.65%, 0.65%, 1.15%, 0.90% and 0.65% for Class A, Class C, Advisor Class, Class R, Class K and Class I shares, respectively. These waivers/reimbursements may not be terminated prior to February 28, 2024, and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

(footnotes continued on next page)

| 8 | AB RELATIVE VALUE FUND |

abfunds.com | |

HISTORICAL PERFORMANCE (continued)

| 1 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 2 | These share classes are offered at NAV to eligible investors and their SEC returns are the same as their NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| abfunds.com | AB RELATIVE VALUE FUND | 9 | |

HISTORICAL PERFORMANCE (continued)

SEC AVERAGE ANNUAL RETURNS

AS OF THE MOST RECENT CALENDAR QUARTER-END

SEPTEMBER 30, 2023 (unaudited)

| SEC Returns (reflects applicable sales charges) |

||||

| CLASS A SHARES | ||||

| 1 Year | 11.63% | |||

| 5 Years | 5.91% | |||

| 10 Years | 8.61% | |||

| CLASS C SHARES | ||||

| 1 Year | 14.75% | |||

| 5 Years | 6.05% | |||

| 10 Years1 | 8.30% | |||

| ADVISOR CLASS SHARES2 | ||||

| 1 Year | 16.96% | |||

| 5 Years | 7.10% | |||

| 10 Years | 9.37% | |||

| CLASS R SHARES2 | ||||

| 1 Year | 16.60% | |||

| 5 Years | 6.60% | |||

| 10 Years | 8.83% | |||

| CLASS K SHARES2 | ||||

| 1 Year | 16.81% | |||

| 5 Years | 6.88% | |||

| 10 Years | 9.12% | |||

| CLASS I SHARES2 | ||||

| 1 Year | 17.05% | |||

| 5 Years | 7.13% | |||

| 10 Years | 9.40% | |||

| CLASS Z SHARES2 | ||||

| 1 Year | 17.01% | |||

| 5 Years | 7.17% | |||

| Since Inception | 9.32% | |||

| 1 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 2 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 10 | AB RELATIVE VALUE FUND |

abfunds.com | |

EXPENSE EXAMPLE

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| abfunds.com | AB RELATIVE VALUE FUND | 11 | |

EXPENSE EXAMPLE (continued)

| Beginning Account Value May 1, 2023 |

Ending Account Value October 31, 2023 |

Expenses Paid During Period* |

Annualized Expense Ratio* |

Total Expenses Paid During Period+ |

Total Annualized Expense Ratio+ |

|||||||||||||||||||

| Class A | ||||||||||||||||||||||||

| Actual |

$ | 1,000 | $ | 983.10 | $ | 4.45 | 0.89 | % | $ | 4.50 | 0.90 | % | ||||||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,020.72 | $ | 4.53 | 0.89 | % | $ | 4.58 | 0.90 | % | ||||||||||||

| Class C | ||||||||||||||||||||||||

| Actual |

$ | 1,000 | $ | 979.80 | $ | 8.18 | 1.64 | % | $ | 8.23 | 1.65 | % | ||||||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,016.94 | $ | 8.34 | 1.64 | % | $ | 8.39 | 1.65 | % | ||||||||||||

| Advisor Class | ||||||||||||||||||||||||

| Actual |

$ | 1,000 | $ | 985.00 | $ | 3.20 | 0.64 | % | $ | 3.25 | 0.65 | % | ||||||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,021.98 | $ | 3.26 | 0.64 | % | $ | 3.31 | 0.65 | % | ||||||||||||

| Class R |

||||||||||||||||||||||||

| Actual |

$ | 1,000 | $ | 982.90 | $ | 5.70 | 1.14 | % | $ | 5.75 | 1.15 | % | ||||||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,019.46 | $ | 5.80 | 1.14 | % | $ | 5.85 | 1.15 | % | ||||||||||||

| Class K | ||||||||||||||||||||||||

| Actual |

$ | 1,000 | $ | 982.90 | $ | 4.45 | 0.89 | % | $ | 4.50 | 0.90 | % | ||||||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,020.72 | $ | 4.53 | 0.89 | % | $ | 4.58 | 0.90 | % | ||||||||||||

| Class I | ||||||||||||||||||||||||

| Actual |

$ | 1,000 | $ | 983.60 | $ | 3.20 | 0.64 | % | $ | 3.25 | 0.65 | % | ||||||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,021.98 | $ | 3.26 | 0.64 | % | $ | 3.31 | 0.65 | % | ||||||||||||

| Class Z | ||||||||||||||||||||||||

| Actual |

$ | 1,000 | $ | 983.50 | $ | 3.05 | 0.61 | % | $ | 3.10 | 0.62 | % | ||||||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,022.13 | $ | 3.11 | 0.61 | % | $ | 3.16 | 0.62 | % | ||||||||||||

| * | Expenses are equal to each classes’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | Assumes 5% annual return before expenses. |

| + | In connection with the Fund’s investments in affiliated/unaffiliated underlying portfolios, the Fund incurs no direct expenses, but bears proportionate shares of the fees and expenses (i.e., operating, administrative and investment advisory fees) of the affiliated/unaffiliated underlying portfolios. The Adviser has contractually agreed to waive its fees from the Fund in an amount equal to the Fund’s pro rata share of certain acquired fund fees and expenses of the affiliated underlying portfolios. The Fund’s total expenses are equal to the classes’ annualized expense ratio plus the Fund’s pro rata share of the weighted average expense ratio of the affiliated/unaffiliated underlying portfolios in which it invests, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| 12 | AB RELATIVE VALUE FUND |

abfunds.com | |

PORTFOLIO SUMMARY

October 31, 2023 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $1,704.0

TEN LARGEST HOLDINGS2

| Company | U.S. $ Value | Percent of Net Assets |

||||||

| Elevance Health, Inc. | $ | 78,406,128 | 4.6 | % | ||||

| Philip Morris International, Inc. | 67,255,617 | 3.9 | ||||||

| Berkshire Hathaway, Inc. – Class B | 67,146,779 | 3.9 | ||||||

| JPMorgan Chase & Co. | 63,324,308 | 3.7 | ||||||

| Regeneron Pharmaceuticals, Inc. | 56,589,598 | 3.3 | ||||||

| Mastercard, Inc. – Class A | 56,460,780 | 3.3 | ||||||

| QUALCOMM, Inc. | 55,441,033 | 3.3 | ||||||

| Wells Fargo & Co. | 50,744,611 | 3.0 | ||||||

| Gilead Sciences, Inc. | 49,804,570 | 2.9 | ||||||

| Cencora, Inc. | 43,645,409 | 2.6 | ||||||

| $ | 588,818,833 | 34.5 | % | |||||

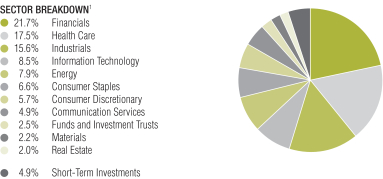

| 1 | The Fund’s sector breakdown is expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. |

| 2 | Long-term investments. |

Please note: The sector classifications presented herein are based on the Global Industry Classification Standard (GICS) which was developed by Morgan Stanley Capital International and Standard & Poor’s. The components are divided into sector, industry group, and industry sub-indices as classified by the GICS for each of the market capitalization indices in the broad market. These sector classifications are broadly defined. The “Portfolio of Investments” section of the report reflects more specific industry information and is consistent with the investment restrictions discussed in the Fund’s prospectus.

| abfunds.com | AB RELATIVE VALUE FUND | 13 | |

PORTFOLIO OF INVESTMENTS

October 31, 2023

| Company | Shares | U.S. $ Value | ||||||

|

|

||||||||

| COMMON STOCKS – 92.4% |

||||||||

| Financials – 21.7% |

||||||||

| Banks – 7.1% |

||||||||

| Bank OZK |

183,644 | $ | 6,576,292 | |||||

| JPMorgan Chase & Co. |

455,374 | 63,324,308 | ||||||

| Wells Fargo & Co. |

1,275,952 | 50,744,611 | ||||||

|

|

|

|||||||

| 120,645,211 | ||||||||

|

|

|

|||||||

| Capital Markets – 0.7% |

||||||||

| Houlihan Lokey, Inc. |

62,689 | 6,301,498 | ||||||

| Raymond James Financial, Inc. |

64,292 | 6,136,029 | ||||||

|

|

|

|||||||

| 12,437,527 | ||||||||

|

|

|

|||||||

| Financial Services – 10.1% |

||||||||

| Berkshire Hathaway, Inc. – Class B(a) |

196,721 | 67,146,779 | ||||||

| Fiserv, Inc.(a) |

375,060 | 42,663,075 | ||||||

| Mastercard, Inc. – Class A |

150,022 | 56,460,780 | ||||||

| PayPal Holdings, Inc.(a) |

121,640 | 6,300,952 | ||||||

|

|

|

|||||||

| 172,571,586 | ||||||||

|

|

|

|||||||

| Insurance – 3.8% |

||||||||

| American International Group, Inc. |

249,688 | 15,308,371 | ||||||

| Axis Capital Holdings Ltd. |

597,478 | 34,115,994 | ||||||

| MetLife, Inc. |

241,351 | 14,483,473 | ||||||

|

|

|

|||||||

| 63,907,838 | ||||||||

|

|

|

|||||||

| 369,562,162 | ||||||||

|

|

|

|||||||

| Health Care – 17.4% |

| |||||||

| Biotechnology – 8.6% |

||||||||

| Amgen, Inc. |

156,867 | 40,110,892 | ||||||

| Gilead Sciences, Inc. |

634,130 | 49,804,570 | ||||||

| Regeneron Pharmaceuticals, Inc.(a)(b) |

72,561 | 56,589,598 | ||||||

|

|

|

|||||||

| 146,505,060 | ||||||||

|

|

|

|||||||

| Health Care Providers & Services – 8.8% |

||||||||

| Cencora, Inc. |

235,730 | 43,645,409 | ||||||

| Cigna Group (The) |

48,728 | 15,066,698 | ||||||

| Elevance Health, Inc. |

174,201 | 78,406,128 | ||||||

| Quest Diagnostics, Inc. |

102,518 | 13,337,592 | ||||||

|

|

|

|||||||

| 150,455,827 | ||||||||

|

|

|

|||||||

| 296,960,887 | ||||||||

|

|

|

|||||||

| Industrials – 15.6% |

||||||||

| Aerospace & Defense – 3.2% |

||||||||

| Curtiss-Wright Corp. |

33,949 | 6,749,401 | ||||||

| RTX Corp. |

335,135 | 27,276,637 | ||||||

| Textron, Inc. |

263,298 | 20,010,648 | ||||||

|

|

|

|||||||

| 54,036,686 | ||||||||

|

|

|

|||||||

| Air Freight & Logistics – 0.3% |

||||||||

| Expeditors International of Washington, Inc. |

42,439 | 4,636,461 | ||||||

|

|

|

|||||||

| 14 | AB RELATIVE VALUE FUND |

abfunds.com | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

|

|

||||||||

| Building Products – 1.5% |

||||||||

| Allegion PLC |

151,350 | $ | 14,886,786 | |||||

| Builders FirstSource, Inc.(a) |

95,244 | 10,335,879 | ||||||

|

|

|

|||||||

| 25,222,665 | ||||||||

|

|

|

|||||||

| Construction & Engineering – 0.9% |

||||||||

| EMCOR Group, Inc. |

74,020 | 15,296,233 | ||||||

|

|

|

|||||||

| Electrical Equipment – 2.9% |

||||||||

| Emerson Electric Co. |

285,019 | 25,358,140 | ||||||

| nVent Electric PLC |

498,381 | 23,987,078 | ||||||

|

|

|

|||||||

| 49,345,218 | ||||||||

|

|

|

|||||||

| Machinery – 3.2% |

||||||||

| Dover Corp. |

115,000 | 14,944,250 | ||||||

| Middleby Corp. (The)(a) |

41,921 | 4,731,623 | ||||||

| PACCAR, Inc. |

290,281 | 23,956,891 | ||||||

| Westinghouse Air Brake Technologies Corp. |

109,782 | 11,639,088 | ||||||

|

|

|

|||||||

| 55,271,852 | ||||||||

|

|

|

|||||||

| Professional Services – 1.7% |

||||||||

| Maximus, Inc. |

206,713 | 15,445,595 | ||||||

| Robert Half, Inc. |

187,163 | 13,994,178 | ||||||

|

|

|

|||||||

| 29,439,773 | ||||||||

|

|

|

|||||||

| Trading Companies & Distributors – 1.9% |

||||||||

| Ferguson PLC |

167,350 | 25,135,970 | ||||||

| MSC Industrial Direct Co., Inc. – Class A |

72,143 | 6,835,549 | ||||||

|

|

|

|||||||

| 31,971,519 | ||||||||

|

|

|

|||||||

| 265,220,407 | ||||||||

|

|

|

|||||||

| Information Technology – 8.5% |

||||||||

| Communications Equipment – 1.9% |

||||||||

| Cisco Systems, Inc. |

605,544 | 31,567,009 | ||||||

|

|

|

|||||||

| Electronic Equipment, Instruments & Components – 0.4% |

||||||||

| IPG Photonics Corp.(a) |

72,339 | 6,213,920 | ||||||

|

|

|

|||||||

| IT Services – 2.0% |

||||||||

| Accenture PLC – Class A |

100,675 | 29,909,535 | ||||||

| EPAM Systems, Inc.(a) |

22,326 | 4,857,468 | ||||||

|

|

|

|||||||

| 34,767,003 | ||||||||

|

|

|

|||||||

| Semiconductors & Semiconductor Equipment – 4.2% |

||||||||

| QUALCOMM, Inc. |

508,680 | 55,441,033 | ||||||

| Taiwan Semiconductor Manufacturing Co., Ltd. (Sponsored ADR) |

191,299 | 16,511,017 | ||||||

|

|

|

|||||||

| 71,952,050 | ||||||||

|

|

|

|||||||

| 144,499,982 | ||||||||

|

|

|

|||||||

| abfunds.com | AB RELATIVE VALUE FUND | 15 | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

|

|

||||||||

| Energy – 7.9% |

||||||||

| Energy Equipment & Services – 1.0% |

||||||||

| ChampionX Corp. |

209,300 | $ | 6,446,440 | |||||

| Helmerich & Payne, Inc.(b) |

255,358 | 10,104,516 | ||||||

|

|

|

|||||||

| 16,550,956 | ||||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels – 6.9% |

||||||||

| Chevron Corp. |

248,007 | 36,142,060 | ||||||

| ConocoPhillips |

183,952 | 21,853,498 | ||||||

| EOG Resources, Inc. |

211,299 | 26,676,499 | ||||||

| Phillips 66 |

290,122 | 33,094,216 | ||||||

|

|

|

|||||||

| 117,766,273 | ||||||||

|

|

|

|||||||

| 134,317,229 | ||||||||

|

|

|

|||||||

| Consumer Staples – 6.6% |

||||||||

| Consumer Staples Distribution & Retail – 2.7% |

||||||||

| BJ’s Wholesale Club Holdings, Inc.(a)(b) |

198,546 | 13,524,954 | ||||||

| Walmart, Inc. |

197,590 | 32,288,182 | ||||||

|

|

|

|||||||

| 45,813,136 | ||||||||

|

|

|

|||||||

| Tobacco – 3.9% |

||||||||

| Philip Morris International, Inc. |

754,325 | 67,255,617 | ||||||

|

|

|

|||||||

| 113,068,753 | ||||||||

|

|

|

|||||||

| Consumer Discretionary – 5.6% |

||||||||

| Automobile Components – 1.1% |

||||||||

| BorgWarner, Inc. |

543,357 | 20,049,873 | ||||||

|

|

|

|||||||

| Distributors – 1.4% |

||||||||

| LKQ Corp. |

535,536 | 23,520,741 | ||||||

|

|

|

|||||||

| Household Durables – 0.4% |

||||||||

| DR Horton, Inc. |

65,184 | 6,805,210 | ||||||

|

|

|

|||||||

| Specialty Retail – 2.7% |

||||||||

| Lowe’s Cos., Inc. |

80,426 | 15,326,783 | ||||||

| Ross Stores, Inc. |

263,540 | 30,562,734 | ||||||

|

|

|

|||||||

| 45,889,517 | ||||||||

|

|

|

|||||||

| 96,265,341 | ||||||||

|

|

|

|||||||

| Communication Services – 4.9% |

||||||||

| Diversified Telecommunication Services – 1.7% |

||||||||

| Comcast Corp. – Class A |

681,313 | 28,131,414 | ||||||

|

|

|

|||||||

| Entertainment – 0.7% |

||||||||

| Electronic Arts, Inc. |

98,530 | 12,197,029 | ||||||

|

|

|

|||||||

| Interactive Media & Services – 2.5% |

||||||||

| Alphabet, Inc. – Class C(a) |

344,825 | 43,206,572 | ||||||

|

|

|

|||||||

| 83,535,015 | ||||||||

|

|

|

|||||||

| 16 | AB RELATIVE VALUE FUND |

abfunds.com | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

|

|

||||||||

| Materials – 2.2% |

||||||||

| Chemicals – 1.5% |

||||||||

| LyondellBasell Industries NV – Class A |

147,950 | $ | 13,351,008 | |||||

| PPG Industries, Inc. |

94,530 | 11,605,448 | ||||||

|

|

|

|||||||

| 24,956,456 | ||||||||

|

|

|

|||||||

| Metals & Mining – 0.7% |

||||||||

| BHP Group Ltd. (Sponsored ADR)(b) |

212,091 | 12,101,913 | ||||||

|

|

|

|||||||

| 37,058,369 | ||||||||

|

|

|

|||||||

| Real Estate – 2.0% |

||||||||

| Specialized REITs – 2.0% |

||||||||

| Public Storage |

27,070 | 6,461,880 | ||||||

| Weyerhaeuser Co. |

985,098 | 28,262,461 | ||||||

|

|

|

|||||||

| 34,724,341 | ||||||||

|

|

|

|||||||

| Total Common Stocks |

1,575,212,486 | |||||||

|

|

|

|||||||

| INVESTMENT COMPANIES – 2.5% |

| |||||||

| Funds and Investment Trusts – 2.5% |

| |||||||

| iShares Russell 1000 Value ETF –

Class E(b)(c) |

287,300 | 42,066,466 | ||||||

|

|

|

|||||||

| SHORT-TERM INVESTMENTS – 4.9% |

| |||||||

| Investment Companies – 4.9% |

| |||||||

| AB Fixed Income Shares, Inc. – Government Money Market Portfolio – Class AB, 5.27%(c)(d)(e) |

83,794,160 | 83,794,160 | ||||||

|

|

|

|||||||

| Total Investments Before Security Lending Collateral for Securities Loaned –

99.8% |

1,701,073,112 | |||||||

|

|

|

|||||||

| INVESTMENTS OF CASH COLLATERAL FOR SECURITIES LOANED – 0.1% |

||||||||

| Investment Companies – 0.1% |

| |||||||

| AB Fixed Income Shares, Inc. – Government Money Market Portfolio – Class AB, 5.27%(c)(d)(e) |

1,685,009 | 1,685,009 | ||||||

|

|

|

|||||||

| Total Investments – 99.9% (cost $1,515,566,624) |

1,702,758,121 | |||||||

| Other assets less liabilities – 0.1% |

1,279,446 | |||||||

|

|

|

|||||||

| Net Assets – 100.0% |

$ | 1,704,037,567 | ||||||

|

|

|

|||||||

| abfunds.com | AB RELATIVE VALUE FUND | 17 | |

PORTFOLIO OF INVESTMENTS (continued)

| (a) | Non-income producing security. |

| (b) | Represents entire or partial securities out on loan. See Note E for securities lending information. |

| (c) | To obtain a copy of the fund’s shareholder report, please go to the Securities and Exchange Commission’s website at www.sec.gov. Additionally, shareholder reports for AB funds can be obtained by calling AB at (800) 227-4618. |

| (d) | Affiliated investments. |

| (e) | The rate shown represents the 7-day yield as of period end. |

Glossary:

ADR – American Depositary Receipt

ETF – Exchange Traded Fund

REIT – Real Estate Investment Trust

See notes to financial statements.

| 18 | AB RELATIVE VALUE FUND |

abfunds.com | |

STATEMENT OF ASSETS & LIABILITIES

October 31, 2023

| Assets |

| |||

| Investments in securities, at value |

| |||

| Unaffiliated issuers (cost $1,430,087,455) |

$ | 1,617,278,952 | (a) | |

| Affiliated issuers (cost $85,479,169 – including investment of cash collateral for securities loaned of $1,685,009) |

85,479,169 | |||

| Cash |

2,290 | |||

| Receivable for investment securities sold |

30,960,049 | |||

| Unaffiliated dividends receivable |

1,202,809 | |||

| Receivable for capital stock sold |

740,823 | |||

| Affiliated dividends receivable |

386,535 | |||

|

|

|

|||

| Total assets |

1,736,050,627 | |||

|

|

|

|||

| Liabilities |

| |||

| Payable for investment securities purchased |

27,659,837 | |||

| Payable for collateral received on securities loaned |

1,685,009 | |||

| Payable for capital stock redeemed |

1,092,919 | |||

| Advisory fee payable |

713,624 | |||

| Distribution fee payable |

282,065 | |||

| Transfer Agent fee payable |

80,624 | |||

| Administrative fee payable |

28,085 | |||

| Directors’ fees payable |

3,240 | |||

| Accrued expenses |

467,657 | |||

|

|

|

|||

| Total liabilities |

32,013,060 | |||

|

|

|

|||

| Net Assets |

$ | 1,704,037,567 | ||

|

|

|

|||

| Composition of Net Assets |

| |||

| Capital stock, at par |

$ | 2,912,342 | ||

| Additional paid-in capital |

1,417,740,969 | |||

| Distributable earnings |

283,384,256 | |||

|

|

|

|||

| Net Assets |

$ | 1,704,037,567 | ||

|

|

|

|||

Net Asset Value Per Share—27 billion shares of capital stock authorized, $.01 par value

| Class | Net Assets | Shares Outstanding |

Net Asset Value |

|||||||||

|

|

||||||||||||

| A | $ | 1,225,466,913 | 210,207,644 | $ | 5.83 | * | ||||||

|

|

||||||||||||

| C | $ | 22,969,454 | 3,948,147 | $ | 5.82 | |||||||

|

|

||||||||||||

| Advisor | $ | 349,685,295 | 59,268,088 | $ | 5.90 | |||||||

|

|

||||||||||||

| R | $ | 4,169,567 | 726,924 | $ | 5.74 | |||||||

|

|

||||||||||||

| K | $ | 10,882,164 | 1,889,784 | $ | 5.76 | |||||||

|

|

||||||||||||

| I | $ | 31,837,433 | 5,313,689 | $ | 5.99 | |||||||

|

|

||||||||||||

| Z | $ | 59,026,741 | 9,879,927 | $ | 5.97 | |||||||

|

|

||||||||||||

| (a) | Includes securities on loan with a value of $36,681,078 (see Note E). |

| * | The maximum offering price per share for Class A shares was $6.09 which reflects a sales charge of 4.25%. |

See notes to financial statements.

| abfunds.com | AB RELATIVE VALUE FUND | 19 | |

STATEMENT OF OPERATIONS

Year Ended October 31, 2023

| Investment Income |

| |||||||

| Dividends |

| |||||||

| Unaffiliated issuers (net of foreign taxes withheld of $761,839) |

$ | 36,466,239 | ||||||

| Affiliated issuers |

4,519,904 | |||||||

| Interest |

1,626 | |||||||

| Securities lending income |

80,117 | |||||||

| Other income |

13,272 | $ | 41,081,158 | |||||

|

|

|

|||||||

| Expenses |

| |||||||

| Advisory fee (see Note B) |

10,197,648 | |||||||

| Distribution fee—Class A |

3,286,035 | |||||||

| Distribution fee—Class C |

265,700 | |||||||

| Distribution fee—Class R |

25,011 | |||||||

| Distribution fee—Class K |

30,563 | |||||||

| Transfer agency—Class A |

1,328,799 | |||||||

| Transfer agency—Class C |

27,713 | |||||||

| Transfer agency—Advisor Class |

408,708 | |||||||

| Transfer agency—Class R |

12,130 | |||||||

| Transfer agency—Class K |

26,747 | |||||||

| Transfer agency—Class I |

29,330 | |||||||

| Transfer agency—Class Z |

15,273 | |||||||

| Printing |

154,011 | |||||||

| Custody and accounting |

147,365 | |||||||

| Registration fees |

138,305 | |||||||

| Administrative |

86,337 | |||||||

| Audit and tax |

59,238 | |||||||

| Legal |

58,477 | |||||||

| Directors’ fees |

40,959 | |||||||

| Miscellaneous |

76,167 | |||||||

|

|

|

|||||||

| Total expenses |

16,414,516 | |||||||

| Less: expenses waived and reimbursed by the Adviser (see Notes B & E) |

(883,871 | ) | ||||||

|

|

|

|||||||

| Net expenses |

15,530,645 | |||||||

|

|

|

|||||||

| Net investment income |

25,550,513 | |||||||

|

|

|

|||||||

| Realized and Unrealized Gain (Loss) on Investment Transactions | ||||||||

| Net realized gain on investment transactions |

99,082,007 | |||||||

| Net change in unrealized appreciation (depreciation) of investments |

(108,770,464 | ) | ||||||

|

|

|

|||||||

| Net loss on investment transactions |

(9,688,457 | ) | ||||||

|

|

|

|||||||

| Net Increase in Net Assets from Operations |

$ | 15,862,056 | ||||||

|

|

|

|||||||

See notes to financial statements.

| 20 | AB RELATIVE VALUE FUND |

abfunds.com | |

STATEMENT OF CHANGES IN NET ASSETS

| Year Ended October 31, 2023 |

Year Ended October 31, 2022 |

|||||||

| Increase (Decrease) in Net Assets from Operations | ||||||||

| Net investment income |

$ | 25,550,513 | $ | 22,390,227 | ||||

| Net realized gain on investment transactions |

99,082,007 | 127,576,427 | ||||||

| Net change in unrealized appreciation (depreciation) of investments |

(108,770,464 | ) | (210,141,222 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets from operations |

15,862,056 | (60,174,568 | ) | |||||

| Distributions to Shareholders |

||||||||

| Class A |

(99,014,464 | ) | (136,386,986 | ) | ||||

| Class C |

(1,790,480 | ) | (2,451,273 | ) | ||||

| Advisor Class |

(32,789,450 | ) | (41,574,707 | ) | ||||

| Class R |

(363,737 | ) | (578,744 | ) | ||||

| Class K |

(1,211,797 | ) | (1,593,163 | ) | ||||

| Class I |

(2,566,694 | ) | (4,259,346 | ) | ||||

| Class Z |

(4,257,067 | ) | (5,122,650 | ) | ||||

| Capital Stock Transactions | ||||||||

| Net increase (decrease) |

(63,534,104 | ) | 108,348,035 | |||||

|

|

|

|

|

|||||

| Total decrease |

(189,665,737 | ) | (143,793,402 | ) | ||||

| Net Assets | ||||||||

| Beginning of period |

1,893,703,304 | 2,037,496,706 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 1,704,037,567 | $ | 1,893,703,304 | ||||

|

|

|

|

|

|||||

See notes to financial statements.

| abfunds.com | AB RELATIVE VALUE FUND | 21 | |

NOTES TO FINANCIAL STATEMENTS

October 31, 2023

NOTE A

Significant Accounting Policies

AB Relative Value Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 (the “1940 Act”) as a diversified, open-end management investment company. The Fund offers Class A, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares. Class B and Class T shares have been authorized but currently are not offered. Class A shares are sold with a front-end sales charge of up to 4.25% for purchases not exceeding $1,000,000. With respect to purchases of $1,000,000 or more, Class A shares redeemed within one year of purchase may be subject to a contingent deferred sales charge of 1%. Class C shares are subject to a contingent deferred sales charge of 1% on redemptions made within the first year after purchase, and 0% after the first year of purchase. Class C shares automatically convert to Class A shares eight years after the end of the calendar month of purchase. Class R and Class K shares are sold without an initial or contingent deferred sales charge. Advisor Class, Class I and Class Z shares are sold without an initial or contingent deferred sales charge and are not subject to ongoing distribution expenses. All nine classes of shares have identical voting, dividend, liquidation and other rights, except that the classes bear different distribution and transfer agency expenses. Each class has exclusive voting rights with respect to its distribution plan. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund.

1. Security Valuation

Portfolio securities are valued at market value determined on the basis of market quotations or, if market quotations are not readily available or are unreliable, at “fair value” as determined in accordance with procedures approved by and under the oversight of the Fund’s Board of Directors (the “Board”). Pursuant to these procedures, AllianceBernstein L.P. (the “Adviser”) serves as the Fund’s valuation designee pursuant to Rule 2a-5 of the 1940 Act. In this capacity, the Adviser is responsible, among other things, for making all fair value determinations relating to the Fund’s portfolio investments, subject to the Board’s oversight.

In general, the market values of securities which are readily available and deemed reliable are determined as follows: securities listed on a national

| 22 | AB RELATIVE VALUE FUND |

abfunds.com | |

NOTES TO FINANCIAL STATEMENTS (continued)

securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the last traded price from the previous day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed or over the counter (“OTC”) market put or call options are valued at the mid level between the current bid and ask prices. If either a current bid or current ask price is unavailable, the Adviser will have discretion to determine the best valuation (e.g., last trade price in the case of listed options); open futures are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; U.S. Government securities and any other debt instruments having 60 days or less remaining until maturity are generally valued at market by an independent pricing vendor, if a market price is available. If a market price is not available, the securities are valued at amortized cost. This methodology is commonly used for short term securities that have an original maturity of 60 days or less, as well as short term securities that had an original term to maturity that exceeded 60 days. In instances when amortized cost is utilized, the Valuation Committee (the “Committee”) must reasonably conclude that the utilization of amortized cost is approximately the same as the fair value of the security. Factors the Committee will consider include, but are not limited to, an impairment of the creditworthiness of the issuer or material changes in interest rates. Fixed-income securities, including mortgage-backed and asset-backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker-dealers. In cases where broker-dealer quotes are obtained, the Adviser may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security. Swaps and other derivatives are valued daily, primarily using independent pricing services, independent pricing models using market inputs, as well as third party broker-dealers or counterparties. Open-end mutual funds are valued at the closing net asset value per share, while exchange traded funds are valued at the closing market price per share.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value as deemed appropriate by the Adviser. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value

| abfunds.com | AB RELATIVE VALUE FUND | 23 | |

NOTES TO FINANCIAL STATEMENTS (continued)

pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities. To account for this, the Fund generally values many of its foreign equity securities using fair value prices based on third party vendor modeling tools to the extent available.

2. Fair Value Measurements

In accordance with U.S. GAAP regarding fair value measurements, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability (including those valued based on their market values as described in Note A.1 above). Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| • | Level 1—quoted prices in active markets for identical investments |

| • | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Where readily available market prices or relevant bid prices are not available for certain equity investments, such investments may be valued based on similar publicly traded investments, movements in relevant indices since last available prices or based upon underlying company fundamentals and comparable company data (such as multiples to earnings or other multiples to equity). Where an investment is valued using an observable input, such as another publicly traded security, the investment will be classified as Level 2. If management determines that an adjustment is appropriate based on restrictions on resale, illiquidity or uncertainty, and such adjustment is a

| 24 | AB RELATIVE VALUE FUND |

abfunds.com | |

NOTES TO FINANCIAL STATEMENTS (continued)

significant component of the valuation, the investment will be classified as Level 3. An investment will also be classified as Level 3 where management uses company fundamentals and other significant inputs to determine the valuation.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of October 31, 2023:

| Investments in |

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Assets: |

||||||||||||||||

| Common Stocks(a) |

$ | 1,575,212,486 | $ | – 0 | – | $ | – 0 | – | $ | 1,575,212,486 | ||||||

| Investment Companies |

42,066,466 | – 0 | – | – 0 | – | 42,066,466 | ||||||||||

| Short-Term Investments |

83,794,160 | – 0 | – | – 0 | – | 83,794,160 | ||||||||||

| Investments of Cash Collateral for Securities Loaned in Affiliated Money Market Fund |

1,685,009 | – 0 | – | – 0 | – | 1,685,009 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

1,702,758,121 | – 0 | – | – 0 | – | 1,702,758,121 | ||||||||||

| Other Financial Instruments(b) |

– 0 | – | – 0 | – | – 0 | – | – 0 | – | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 1,702,758,121 | $ | – 0 | – | $ | – 0 | – | $ | 1,702,758,121 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | See Portfolio of Investments for sector classifications. |

| (b) | Other financial instruments are derivative instruments, such as futures, forwards and swaps, which are valued at the unrealized appreciation (depreciation) on the instrument. Other financial instruments may also include swaps with upfront premiums, written options and written swaptions which are valued at market value. |

3. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required. The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and net unrealized appreciation/depreciation as such income and/or gains are earned.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s financial statements.

| abfunds.com | AB RELATIVE VALUE FUND | 25 | |

NOTES TO FINANCIAL STATEMENTS (continued)

4. Investment Income and Investment Transactions

Dividend income is recorded on the ex-dividend date or as soon as the Fund is informed of the dividend. Interest income is accrued daily. Investment transactions are accounted for on the date the securities are purchased or sold. Investment gains or losses are determined on the identified cost basis. Non-cash dividends, if any, are recorded on the ex-dividend date at the fair value of the securities received. The Fund amortizes premiums and accretes discounts as adjustments to interest income. The Fund accounts for distributions received from REIT investments or from regulated investment companies as dividend income, realized gain, or return of capital based on information provided by the REIT or the investment company.

5. Class Allocations

All income earned and expenses incurred by the Fund are borne on a pro-rata basis by each outstanding class of shares, based on the proportionate interest in the Fund represented by the shares of such class, except for class specific expenses which are allocated to the respective class. Realized and unrealized gains and losses are allocated among the various share classes based on respective net assets.

6. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

NOTE B

Advisory Fee and Other Transactions with Affiliates

Under the terms of the investment advisory agreement, the Fund pays the Adviser an advisory fee at an annual rate of .55% of the first $2.5 billion, .45% of the next $2.5 billion and .40% in excess of $5 billion, of the Fund’s average daily net assets. The fee is accrued daily and paid monthly. The Adviser has agreed to waive its fees and bear certain expenses to the extent necessary to limit total operating expenses (excluding acquired fund fees and expenses other than the advisory fees of any AB mutual funds in which the Fund may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs) on an annual basis (the “Expense Caps”) to .90%, 1.65%, .65%, 1.15%, .90%, .65% and .65% of the daily average net assets for the Class A, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively. The Expense Caps will remain in effect until February 28, 2024 and then

| 26 | AB RELATIVE VALUE FUND |

abfunds.com | |

NOTES TO FINANCIAL STATEMENTS (continued)

may be extended by the Adviser for additional one-year terms. For the year ended October 31, 2023, such reimbursements/waivers amounted to $773,819.

Pursuant to the investment advisory agreement, the Fund may reimburse the Adviser for certain legal and accounting services provided to the Fund by the Adviser. For the year ended October 31, 2023, the reimbursement for such services amounted to $86,337.

The Fund compensates AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Adviser, under a Transfer Agency Agreement for providing personnel and facilities to perform transfer agency services for the Fund. ABIS may make payments to intermediaries that provide omnibus account services, sub-accounting services and/or networking services. Such compensation retained by ABIS amounted to $693,524 for the year ended October 31, 2023.

AllianceBernstein Investments, Inc. (the “Distributor”), a wholly-owned subsidiary of the Adviser, serves as the distributor of the Fund’s shares. The Distributor has advised the Fund that it has retained front-end sales charges of $14,879 from the sale of Class A shares and received $2,304 and $3,050 in contingent deferred sales charges imposed upon redemptions by shareholders of Class A and Class C shares, respectively, for the year ended October 31, 2023.

The Fund may invest in AB Government Money Market Portfolio (the “Government Money Market Portfolio”) which has a contractual annual advisory fee rate of .20% of the portfolio’s average daily net assets and bears its own expenses. The Adviser had contractually agreed to waive .10% of the advisory fee of Government Money Market Portfolio (resulting in a net advisory fee of .10%) until August 31, 2023. Effective September 1, 2023, the Adviser has contractually agreed to waive .05% of the advisory fee of Government Money Market Portfolio (resulting in a net advisory fee of .15%) until August 31, 2024. In connection with the investment by the Fund in Government Money Market Portfolio, the Adviser has contractually agreed to waive its advisory fee from the Fund in an amount equal to the Fund’s pro rata share of the effective advisory fee of Government Money Market Portfolio, as borne indirectly by the Fund as an acquired fund fee and expense. For the year ended October 31, 2023, such waiver amounted to $105,026.

| abfunds.com | AB RELATIVE VALUE FUND | 27 | |

NOTES TO FINANCIAL STATEMENTS (continued)

A summary of the Fund’s transactions in AB mutual funds for the year ended October 31, 2023 is as follows:

| Fund |

Market Value 10/31/22 (000) |

Purchases at Cost (000) |

Sales Proceeds (000) |

Market Value 10/31/23 (000) |

Dividend Income (000) |

|||||||||||||||

| Government Money Market Portfolio |

$ | 83,218 | $ | 730,514 | $ | 729,938 | $ | 83,794 | $ | 4,520 | ||||||||||

| Government Money Market Portfolio* |

1,582 | 329,934 | 329,831 | 1,685 | 31 | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Total |

$ | 85,479 | $ | 4,551 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| * | Investments of cash collateral for securities lending transactions (see Note E). |

NOTE C

Distribution Services Agreement

The Fund has adopted a Distribution Services Agreement (the “Agreement”) pursuant to Rule 12b-1 under the Investment Company Act of 1940. Under the Agreement, the Fund pays distribution and servicing fees to the Distributor at an annual rate of up to .30% of the Fund’s average daily net assets attributable to Class A shares, 1% of the Fund’s average daily net assets attributable to Class C shares, .50% of the Fund’s average daily net assets attributable to Class R shares and .25% of the Fund’s average daily net assets attributable to Class K shares. There are no distribution and servicing fees on the Advisor Class, Class I and Class Z shares. The fees are accrued daily and paid monthly. Payments under the Agreement in respect of Class A shares are currently limited to an annual rate of .25% of Class A shares’ average daily net assets. The Agreement provides that the Distributor will use such payments in their entirety for distribution assistance and promotional activities. Since the commencement of the Fund’s operations, the Distributor has incurred expenses in excess of the distribution costs reimbursed by the Fund in the amounts of $11,915,960, $296,532 and $262,108 for Class C, Class R and Class K shares, respectively. While such costs may be recovered from the Fund in future periods so long as the Agreement is in effect, the rate of the distribution and servicing fees payable under the Agreement may not be increased without a shareholder vote. In accordance with the Agreement, there is no provision for recovery of unreimbursed distribution costs incurred by the Distributor beyond the current fiscal year for Class A shares. The Agreement also provides that the Adviser may use its own resources to finance the distribution of the Fund’s shares.

| 28 | AB RELATIVE VALUE FUND |

abfunds.com | |

NOTES TO FINANCIAL STATEMENTS (continued)

NOTE D

Investment Transactions

Purchases and sales of investment securities (excluding short-term investments) for the year ended October 31, 2023 were as follows:

| Purchases | Sales | |||||||

| Investment securities (excluding U.S. government securities) |

$ | 1,350,942,019 | $ | 1,492,671,728 | ||||

| U.S. government securities |

– 0 | – | – 0 | – | ||||

The cost of investments for federal income tax purposes, gross unrealized appreciation and unrealized depreciation are as follows:

| Cost |

$ | 1,528,967,848 | ||

|

|

|

|||

| Gross unrealized appreciation |

$ | 210,597,459 | ||

| Gross unrealized depreciation |

(36,807,186 | ) | ||

|

|

|

|||

| Net unrealized appreciation |

$ | 173,790,273 | ||

|

|

|

1. Derivative Financial Instruments

The Fund may use derivatives in an effort to earn income and enhance returns, to replace more traditional direct investments, to obtain exposure to otherwise inaccessible markets (collectively, “investment purposes”), or to hedge or adjust the risk profile of its portfolio.

The Fund did not engage in derivatives transactions for the year ended October 31, 2023.

2. Currency Transactions

The Fund may invest in non-U.S. Dollar-denominated securities on a currency hedged or unhedged basis. The Fund may seek investment opportunities by taking long or short positions in currencies through the use of currency-related derivatives, including forward currency exchange contracts, futures and options on futures, swaps, and other options. The Fund may enter into transactions for investment opportunities when it anticipates that a foreign currency will appreciate or depreciate in value but securities denominated in that currency are not held by the Fund and do not present attractive investment opportunities. Such transactions may also be used when the Adviser believes that it may be more efficient than a direct investment in a foreign currency-denominated security. The Fund may also conduct currency exchange contracts on a spot basis (i.e., for cash at the spot rate prevailing in the currency exchange market for buying or selling currencies).

| abfunds.com | AB RELATIVE VALUE FUND | 29 | |

NOTES TO FINANCIAL STATEMENTS (continued)

NOTE E

Securities Lending

The Fund may enter into securities lending transactions. Under the Fund’s securities lending program, all loans of securities will be collateralized continually by cash collateral and/or non-cash collateral. Non-cash collateral will include only securities issued or guaranteed by the U.S. government or its agencies or instrumentalities. If the Fund cannot sell or repledge any non-cash collateral, such collateral will not be reflected in the portfolio of investments. If a loan is collateralized by cash, the Fund will be compensated for the loan from a portion of the net return from the income earned on cash collateral after a rebate is paid to the borrower (in some cases, this rebate may be a “negative rebate” or fee paid by the borrower to the Fund in connection with the loan), and payments are made for fees of the securities lending agent and for certain other administrative expenses. If the Fund receives non-cash collateral, the Fund will receive a fee from the borrower generally equal to a negotiated percentage of the market value of the loaned securities. The Fund will have the right to call a loan and obtain the securities loaned at any time on notice to the borrower within the normal and customary settlement time for the securities. While the securities are on loan, the borrower is obligated to pay the Fund amounts equal to any dividend income or other distributions from the securities; however, these distributions will not be afforded the same preferential tax treatment as qualified dividends. The Fund will not be able to exercise voting rights with respect to any securities during the existence of a loan, but will have the right to regain ownership of loaned securities in order to exercise voting or other ownership rights. Collateral received and securities loaned are marked to market daily to ensure that the securities loaned are secured by collateral. The lending agent currently invests the cash collateral received in Government Money Market Portfolio, an eligible money market vehicle, in accordance with the investment restrictions of the Fund, and as approved by the Board. The collateral received on securities loaned is recorded as an asset as well as a corresponding liability in the statement of assets and liabilities. The collateral will be adjusted the next business day to maintain the required collateral amount. The amounts of securities lending income from the borrowers and Government Money Market Portfolio are reflected in the statement of operations. When the Fund earns net securities lending income from Government Money Market Portfolio, the income is inclusive of a rebate expense paid to the borrower. In connection with the cash collateral investment by the Fund in Government Money Market Portfolio, the Adviser has agreed to waive a portion of the Fund’s share of the advisory fees of Government Money Market Portfolio, as borne indirectly by the Fund as an acquired fund fee and expense. When the Fund lends securities, its investment performance will continue to reflect changes in the value of the securities loaned. A principal risk of lending portfolio securities is that the borrower may fail to return the loaned

| 30 | AB RELATIVE VALUE FUND |

abfunds.com | |

NOTES TO FINANCIAL STATEMENTS (continued)

securities upon termination of the loan and that the collateral will not be sufficient to replace the loaned securities. The lending agent has agreed to indemnify the Fund in the case of default of any securities borrower.

A summary of the Fund’s transactions surrounding securities lending for the year ended October 31, 2023 is as follows:

| Government Money Market Portfolio |

||||||||||||||||||||||

| Market Value of Securities on Loan* |

Cash Collateral* |

Market Value of Non-Cash Collateral* |

Income from Borrowers |

Income Earned |

Advisory Fee Waived |

|||||||||||||||||

| $ | 36,681,078 | $ | 1,685,009 | $ | 35,880,629 | $ | 49,122 | $ | 30,995 | $ | 5,026 | |||||||||||

| * | As of October 31, 2023. |

NOTE F

Capital Stock

Each class consists of 3,000,000,000 authorized shares. Transactions in capital shares for each class were as follows:

| Shares | Amount | |||||||||||||||||||||||

| Year Ended October 31, 2023 |

Year Ended October 31, 2022 |

Year Ended October 31, 2023 |

Year Ended October 31, 2022 |

|||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Class A |

|

|||||||||||||||||||||||

| Shares sold |

6,939,137 | 9,190,027 | $ | 41,745,340 | $ | 59,378,317 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Shares issued in reinvestment of dividends and distributions |

14,740,957 | 18,664,995 | 87,266,464 | 120,202,565 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Shares converted from Class C |

443,475 | 501,228 | 2,674,243 | 3,231,856 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Shares redeemed |

(24,418,261 | ) | (20,327,466 | ) | (147,070,947 | ) | (128,756,211 | ) | ||||||||||||||||

|

|

||||||||||||||||||||||||

| Net increase (decrease) |

(2,294,692 | ) | 8,028,784 | $ | (15,384,900 | ) | $ | 54,056,527 | ||||||||||||||||

|

|

||||||||||||||||||||||||

| Class C |

|

|||||||||||||||||||||||

| Shares sold |

528,110 | 1,290,961 | $ | 3,202,054 | $ | 8,247,420 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Shares issued in reinvestment of dividends and distributions |

272,553 | 356,319 | 1,618,963 | 2,305,384 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Shares converted to Class A |

(443,478 | ) | (501,032 | ) | (2,674,243 | ) | (3,231,856 | ) | ||||||||||||||||

|

|

||||||||||||||||||||||||

| Shares redeemed |

(753,171 | ) | (828,695 | ) | (4,580,557 | ) | (5,274,861 | ) | ||||||||||||||||

|

|

||||||||||||||||||||||||

| Net increase (decrease) |

(395,986 | ) | 317,553 | $ | (2,433,783 | ) | $ | 2,046,087 | ||||||||||||||||

|

|

||||||||||||||||||||||||

| abfunds.com | AB RELATIVE VALUE FUND | 31 | |

NOTES TO FINANCIAL STATEMENTS (continued)

| Shares | Amount | |||||||||||||||||||||||

| Year Ended October 31, 2023 |

Year Ended October 31, 2022 |

Year Ended October 31, 2023 |

Year Ended October 31, 2022 |

|||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Advisor Class |

|

|||||||||||||||||||||||

| Shares sold |

13,514,577 | 26,232,690 | $ | 82,002,653 | $ | 169,039,930 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Shares issued in reinvestment of dividends and distributions |

4,414,465 | 5,528,565 | 26,354,358 | 35,935,670 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Shares redeemed |

(26,778,051 | ) | (23,939,922 | ) | (161,723,866 | ) | (151,325,989 | ) | ||||||||||||||||

|

|

||||||||||||||||||||||||

| Net increase (decrease) |

(8,849,009 | ) | 7,821,333 | $ | (53,366,855 | ) | $ | 53,649,611 | ||||||||||||||||

|

|

||||||||||||||||||||||||

| Class R |

|

|||||||||||||||||||||||

| Shares sold |

158,175 | 173,331 | $ | 947,043 | $ | 1,089,171 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Shares issued in reinvestment of dividends and distributions |

62,390 | 91,284 | 363,736 | 578,743 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Shares redeemed |

(314,978 | ) | (384,187 | ) | (1,851,132 | ) | (2,383,887 | ) | ||||||||||||||||

|

|

||||||||||||||||||||||||