0000277948DEF 14AFALSE00002779482022-01-012022-12-310000277948csx:HinrichsMember2022-01-012022-12-31iso4217:USD0000277948csx:FooteMember2022-01-012022-12-310000277948csx:FooteMember2021-01-012021-12-3100002779482021-01-012021-12-310000277948csx:FooteMember2020-01-012020-12-3100002779482020-01-012020-12-310000277948csx:HinrichsMemberecd:PeoMembercsx:AdjustmentExclusionOfEquityAwardsMember2022-01-012022-12-310000277948csx:FooteMemberecd:PeoMembercsx:AdjustmentExclusionOfEquityAwardsMember2020-01-012020-12-310000277948csx:FooteMemberecd:PeoMembercsx:AdjustmentExclusionOfEquityAwardsMember2021-01-012021-12-310000277948csx:FooteMemberecd:PeoMembercsx:AdjustmentExclusionOfEquityAwardsMember2022-01-012022-12-310000277948csx:AdjustmentExclusionOfEquityAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000277948csx:AdjustmentExclusionOfEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000277948csx:AdjustmentExclusionOfEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000277948csx:HinrichsMembercsx:AdjustmentInclusionOfEquityAwardsMemberecd:PeoMember2022-01-012022-12-310000277948csx:FooteMembercsx:AdjustmentInclusionOfEquityAwardsMemberecd:PeoMember2020-01-012020-12-310000277948csx:FooteMembercsx:AdjustmentInclusionOfEquityAwardsMemberecd:PeoMember2021-01-012021-12-310000277948csx:FooteMembercsx:AdjustmentInclusionOfEquityAwardsMemberecd:PeoMember2022-01-012022-12-310000277948csx:AdjustmentInclusionOfEquityAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000277948csx:AdjustmentInclusionOfEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000277948csx:AdjustmentInclusionOfEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000277948csx:HinrichsMemberecd:PeoMembercsx:ChangeInFairValueForVestedAwardsGrantedInPriorYearsMember2022-01-012022-12-310000277948csx:FooteMemberecd:PeoMembercsx:ChangeInFairValueForVestedAwardsGrantedInPriorYearsMember2020-01-012020-12-310000277948csx:FooteMemberecd:PeoMembercsx:ChangeInFairValueForVestedAwardsGrantedInPriorYearsMember2021-01-012021-12-310000277948csx:FooteMemberecd:PeoMembercsx:ChangeInFairValueForVestedAwardsGrantedInPriorYearsMember2022-01-012022-12-310000277948csx:ChangeInFairValueForVestedAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2020-01-012020-12-310000277948csx:ChangeInFairValueForVestedAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2021-01-012021-12-310000277948csx:ChangeInFairValueForVestedAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2022-01-012022-12-310000277948csx:ChangeInFairValueForUnvestedAndOutstandingAwardsGrantedInPriorYearsMembercsx:HinrichsMemberecd:PeoMember2022-01-012022-12-310000277948csx:ChangeInFairValueForUnvestedAndOutstandingAwardsGrantedInPriorYearsMembercsx:FooteMemberecd:PeoMember2020-01-012020-12-310000277948csx:ChangeInFairValueForUnvestedAndOutstandingAwardsGrantedInPriorYearsMembercsx:FooteMemberecd:PeoMember2021-01-012021-12-310000277948csx:ChangeInFairValueForUnvestedAndOutstandingAwardsGrantedInPriorYearsMembercsx:FooteMemberecd:PeoMember2022-01-012022-12-310000277948csx:ChangeInFairValueForUnvestedAndOutstandingAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2020-01-012020-12-310000277948csx:ChangeInFairValueForUnvestedAndOutstandingAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2021-01-012021-12-310000277948csx:ChangeInFairValueForUnvestedAndOutstandingAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2022-01-012022-12-310000277948csx:AdjustmentExclusionOfAwardsForfeitedDuringYearMembercsx:HinrichsMemberecd:PeoMember2022-01-012022-12-310000277948csx:AdjustmentExclusionOfAwardsForfeitedDuringYearMembercsx:FooteMemberecd:PeoMember2020-01-012020-12-310000277948csx:AdjustmentExclusionOfAwardsForfeitedDuringYearMembercsx:FooteMemberecd:PeoMember2021-01-012021-12-310000277948csx:AdjustmentExclusionOfAwardsForfeitedDuringYearMembercsx:FooteMemberecd:PeoMember2022-01-012022-12-310000277948csx:AdjustmentExclusionOfAwardsForfeitedDuringYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000277948csx:AdjustmentExclusionOfAwardsForfeitedDuringYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000277948csx:AdjustmentExclusionOfAwardsForfeitedDuringYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000277948csx:HinrichsMembercsx:DividendsPaidOnUnvestedEquityAwardsDuringYearMemberecd:PeoMember2022-01-012022-12-310000277948csx:FooteMembercsx:DividendsPaidOnUnvestedEquityAwardsDuringYearMemberecd:PeoMember2020-01-012020-12-310000277948csx:FooteMembercsx:DividendsPaidOnUnvestedEquityAwardsDuringYearMemberecd:PeoMember2021-01-012021-12-310000277948csx:FooteMembercsx:DividendsPaidOnUnvestedEquityAwardsDuringYearMemberecd:PeoMember2022-01-012022-12-310000277948csx:DividendsPaidOnUnvestedEquityAwardsDuringYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000277948csx:DividendsPaidOnUnvestedEquityAwardsDuringYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000277948csx:DividendsPaidOnUnvestedEquityAwardsDuringYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000277948csx:AggregateChangeInActuarialPresentValueOfPensionBenefitsMembercsx:HinrichsMemberecd:PeoMember2022-01-012022-12-310000277948csx:AggregateChangeInActuarialPresentValueOfPensionBenefitsMembercsx:FooteMemberecd:PeoMember2020-01-012020-12-310000277948csx:AggregateChangeInActuarialPresentValueOfPensionBenefitsMembercsx:FooteMemberecd:PeoMember2021-01-012021-12-310000277948csx:AggregateChangeInActuarialPresentValueOfPensionBenefitsMembercsx:FooteMemberecd:PeoMember2022-01-012022-12-310000277948csx:AggregateChangeInActuarialPresentValueOfPensionBenefitsMemberecd:NonPeoNeoMember2020-01-012020-12-310000277948csx:AggregateChangeInActuarialPresentValueOfPensionBenefitsMemberecd:NonPeoNeoMember2021-01-012021-12-310000277948csx:AggregateChangeInActuarialPresentValueOfPensionBenefitsMemberecd:NonPeoNeoMember2022-01-012022-12-310000277948csx:HinrichsMembercsx:AdditionOfAggregateServiceCostAndPriorServiceCostForPensionPlansMemberecd:PeoMember2022-01-012022-12-310000277948csx:AdditionOfAggregateServiceCostAndPriorServiceCostForPensionPlansMembercsx:FooteMemberecd:PeoMember2020-01-012020-12-310000277948csx:AdditionOfAggregateServiceCostAndPriorServiceCostForPensionPlansMembercsx:FooteMemberecd:PeoMember2021-01-012021-12-310000277948csx:AdditionOfAggregateServiceCostAndPriorServiceCostForPensionPlansMembercsx:FooteMemberecd:PeoMember2022-01-012022-12-310000277948csx:AdditionOfAggregateServiceCostAndPriorServiceCostForPensionPlansMemberecd:NonPeoNeoMember2020-01-012020-12-310000277948csx:AdditionOfAggregateServiceCostAndPriorServiceCostForPensionPlansMemberecd:NonPeoNeoMember2021-01-012021-12-310000277948csx:AdditionOfAggregateServiceCostAndPriorServiceCostForPensionPlansMemberecd:NonPeoNeoMember2022-01-012022-12-31000027794812022-01-012022-12-31000027794822022-01-012022-12-31000027794832022-01-012022-12-31000027794842022-01-012022-12-31000027794852022-01-012022-12-31000027794862022-01-012022-12-31000027794872022-01-012022-12-31000027794882022-01-012022-12-31000027794892022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | | | | |

| ☑ | Filed by the Registrant | | ☐ | Filed by a Party other than the Registrant |

| | | | | |

| CHECK THE APPROPRIATE BOX: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

CSX CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☑ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Our Business

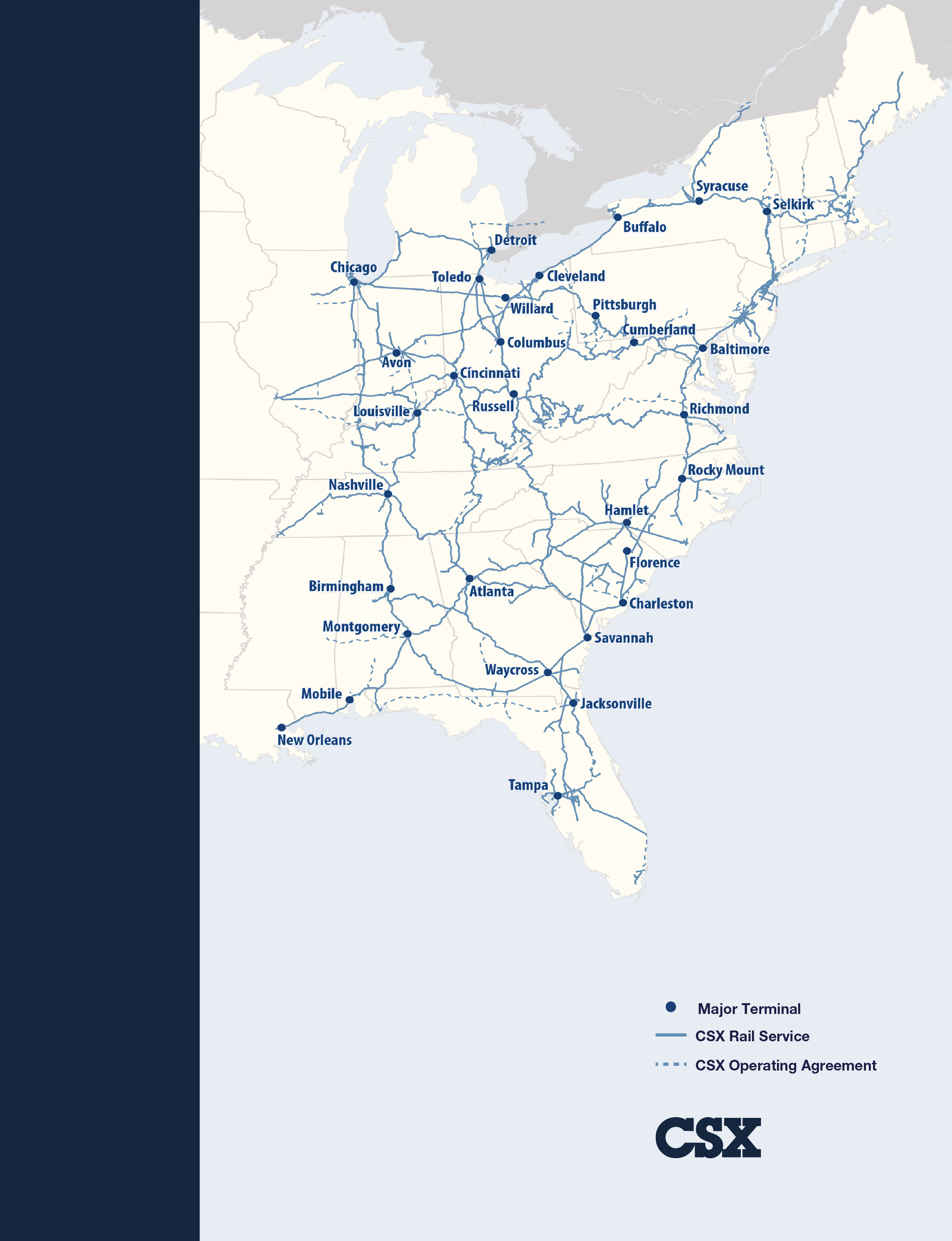

Our network serves major population centers in 26 states

east of the Mississippi River, the District of Columbia and the

Canadian provinces of Ontario and Quebec,

as well as more than 240 short-line and regional railroads,

and has access to over 70 ocean, river and lake port terminals

along the Atlantic and Gulf Coasts, the Mississippi River,

the Great Lakes and the St. Lawrence Seaway.

| | | | | | | | |

| | |

Our Vision To be the best-run

railroad in

North America | Our Purpose To capitalize on the

efficiency of rail

transportation to

serve North America |

| |

CSX by the Numbers as of December 31, 2022

| | | | | | | | | | | | | | | | | | | | |

| | Approximately | | | | More than |

| | | | | | |

195 years in operation | | 20,000 route-mile rail network | | $14.9 billion of revenue generated | | 22,500 employees |

| | | | | | |

| | | | | | |

| Approximately | | Approximately | | More than | | Approximately |

| | |

3.3 million carloads | | 3 million intermodal units

transported products

and raw materials | | 3,600 locomotives, which reduce

greenhouse gas emissions

by 75% compared to trucks | | 12.5 million tons of carbon dioxide emissions avoided by CSX customers |

| | | | | | |

| | | | | | |

March 24, 2023

Dear Shareholder,

On behalf of the Board of Directors of CSX Corporation, I am pleased to invite you to attend the Company’s 2023 Annual Meeting on May 10th at 10:00 a.m. EDT. Continuing our practice of recent years, the meeting will be held virtually, which facilitates expanded shareholder access and participation.

I look forward to our 2023 Annual Meeting, my first as CSX’s President and Chief Executive Officer, as an opportunity to share our leadership team’s vision for the Company. In support of our business growth strategy, among our primary objectives for 2023 will be advancing our sustainability initiatives, continuing to improve safety performance and further strengthening our ONE CSX cultural transformation. By making real progress across all of these efforts, CSX will be in an excellent position to drive profitable rail solutions, generate more business and deliver value on behalf of our customers, our shareholders and our employees.

Sustainable Growth Through Environmental, Social and Governance (“ESG”)

CSX views ESG considerations as fundamental to the success of our business. The environmental advantages of rail over other modes of ground transportation have emerged as an important driver of business growth; our commitment to diversity, equity and inclusion strengthens our ONE CSX workforce; and sound corporate governance reduces risk and supports shareholder confidence. Customers increasingly look to CSX and our rail-based supply chain solutions to help reduce their carbon footprint and achieve their sustainability objectives. At CSX, we prioritize communication with our customers about the efficiency benefits associated with our services, giving them the tools they need to better quantify and reduce their climate footprint and ultimately help them advance their own sustainability goals. Through the Company’s establishment of a science-based target for reducing greenhouse gas emissions and our ongoing efforts to further improve fuel conservation, CSX is widely recognized as a sustainability leader in the transportation industry.

Safety

Safety underpins CSX’s entire system of corporate values and business strategy. Every aspect of the Company’s success depends on providing a safe workplace in which employees embrace safety in their individual actions and when performing as a team. It demonstrates our respect for our employees and the value we place in their work; it reinforces our role in protecting the safety of our communities; and it

supports efficient operations and reliable service to our customers. In 2022, the Company completed its second consecutive year without a work-related employee fatality, and, in 2023, we will focus our efforts on further reducing injuries and accidents by cultivating an even greater safety-oriented mindset among both our new hires and experienced employees.

Cultural Transformation

ONE CSX is a key pillar of our long-term growth strategy. With an emphasis on enhancing communication and recognizing the role of our front-line employees in creating value for our customers and our shareholders, our cultural transformation is cultivating strong relationships with CSX’s unionized workforce and providing opportunities to work more closely with labor on solutions that improve the employee experience. At the end of 2022, the Company revised its attendance policy for operations employees to address their concerns from the recently concluded national bargaining round and build on previous revisions to the Company’s operational testing and corrective action policies. In early 2023, CSX reached agreements with four unions that provide paid sick leave for nearly 6,000 railroad workers, demonstrating the Company’s commitment to listening to our railroaders and working with their representatives to find solutions that improve their quality of life. These agreements are a direct result of the collaborative relationship CSX is working to cultivate with all the unions that represent CSX employees, and the Company will continue to pursue similar agreements with our remaining unions.

We intend to address these and other initiatives at the Company’s 2023 Annual Meeting, and we encourage your attendance. On the day of the meeting, go to www.virtualshareholdermeeting.com/CSX2023 using your web browser, then enter the 16-digit control number provided on your proxy card or voting instruction form. The number can also be found on the Notice Regarding the Availability of Proxy Materials. You are encouraged to review our 2022 CSX Annual Report to Shareholders, which includes the Company’s audited financial statements and additional information about our Company’s business.

Our proxy materials are being made available electronically in keeping with CSX’s commitment to transparency and conserving resources. Electronic distribution complies with the Securities and Exchange Commission’s “notice and access” rules in addition to being effective, efficient and more environmentally sustainable. Please refer to the Questions and Answers section of this Proxy Statement or the Annual Meeting of Shareholders section of our Investor Relations website for additional details about accessing information and the conduct of the Annual Meeting.

Whether or not you plan to attend the 2023 Annual Meeting, I encourage you to promptly submit your proxy to ensure your shares are represented and voted. CSX considers every shareholder vote important. To vote your shares by proxy, you can vote via the Internet, by telephone or by mail by returning your proxy card or voting instruction form in the postage-paid envelope provided if you requested printed proxy materials. If you submit your proxy in advance, you can still vote your shares online during the Annual Meeting should you choose to attend virtually. Please review the instructions for each of your voting options described in this Proxy Statement as well as in the Notice you received in the mail or via email.

Your participation in our Annual Meeting is appreciated by the CSX Board of Directors and our entire leadership team.

Sincerely,

JOSEPH R. HINRICHSPresident and Chief Executive Officer

| | |

|

Consistent with CSX’s commitment to environmental stewardship, resource conservation, governance and timely access to Company information, this year’s Proxy materials will be available to shareholders online. |

|

Logistics

The Annual Meeting of Shareholders (the “Annual Meeting”) of CSX Corporation (together with its subsidiaries, “CSX” or the “Company”) will be held:

| | | | | | | | | | | | | | | | | |

| Date and Time | | How to Attend the Annual Meeting | | Record Date |

| | |

Wednesday, May 10, 2023, at 10:00 a.m. EDT | If you plan to participate in the Annual Meeting, please see the instructions in the Questions and Answers section of the Proxy Statement. Shareholders will be able to listen, vote electronically and submit questions during the Annual Meeting online. There will be no physical location for shareholders to attend. Shareholders may only participate online at www.virtualshareholdermeeting.com/CSX2023. | Only shareholders of record at the close of business on March 8, 2023, which is the record date for the Annual Meeting, are entitled to vote. |

Items of Business

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| 01

To elect the 11 director nominees named in the Proxy Statement to the Company’s Board of Directors | | 02

To ratify the appointment of Ernst & Young LLP as the Independent Registered Public Accounting Firm for 2023 | | 03

To vote on an advisory (non-binding) resolution to approve the compensation for the Company’s named executive officers | | 04

To hold an advisory

(non-binding) vote on whether future votes on the compensation for the Company’s named executive officers should be held every one, two or three years | |

| | | | | | | | | | | | |

| | FOR | | | FOR | | | FOR | | | EVERY YEAR | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

The persons named as proxies will use their discretion to vote on other matters that may properly come before the Annual Meeting.

To Our Shareholders

The above matters are described in the Proxy Statement. You are urged, after reading the Proxy Statement, to vote your shares by proxy using one of the following methods: (i) vote via the Internet or by telephone; or (ii) if you requested printed proxy materials, complete, sign, date and return your proxy card or voting instruction form if you hold your shares through a broker, bank or other nominee in the postage-paid envelope provided. This proxy is being solicited on behalf of the Company’s Board of Directors.

The Notice Regarding the Availability of Proxy Materials (the “Notice”), the Proxy Statement and the Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”) are being mailed or made available to shareholders on or about March 24, 2023.

| | | | | | | | | | | | | | | | | | | | |

| By Order of the Board of Directors, | |

| Advance Voting |

NATHAN D. GOLDMAN

Executive Vice President – Chief Legal Officer and Corporate Secretary |

| Online | | By Phone | | By Mail |

| www.proxyvote.com | 1-800-690-6903 | Mark, sign, date and promptly mail the enclosed proxy card in the postage-paid envelope |

| | |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 10, 2023 The Company’s Notice for the Annual Meeting, Proxy Statement and 2022 Annual Report are available, free of charge, at www.proxyvote.com. |

|

ESG Highlights

Our commitment to environmental stewardship, social responsibility and governance best practices are critical to our mission to be a leading supplier of rail-based freight transportation in North America—one that meets customers’ needs, creates value for our shareholders and provides a safe and rewarding work environment for its employees. As the most fuel-efficient mode of freight transportation on land, rail will continue to enable significant emission reductions and help drive economic prosperity. By conducting business in a sustainable way, we demonstrate our dedication to industry-leading ESG performance that supports our customers, shareholders, employees and communities. Our ESG approach is reflective of our efforts to be responsible corporate stewards, and it is also critically embedded in our growth strategy.

We are proud of our efforts to establish CSX’s leadership on ESG action. Our development and implementation of innovative tools and technologies has enabled us to drive meaningful improvements on safety, customer experience, environmental efficiencies and employee engagement. As we move into the future and continue our emissions reduction trajectory, our focus is on creating long-term value for our people and our planet for decades to come. Our willingness to adapt, evolve and innovate has enabled CSX to deliver excellence and will continue to guide us into the future.

More Than a Decade of Industry-Leading ESG Action

| | | | | | | | |

| 2010 | | |

nAchieved first greenhouse gas (“GHG”) goal set in 2007 |

| | |

| 2011 | | |

nReleased first Corporate Social Responsibility Report nPublished sustainability strategy and set second GHG goal |

| | |

| 2012 | | |

nNamed to Corporate Responsibility Magazine’s list of “100 Most Responsible Corporate Citizens” |

| | |

| 2013 | | |

nNamed to CDP Supplier Performance Leadership Index for commitment to helping customers reduce carbon emissions and meet sustainability goals |

| | |

| 2014 | | |

nCompleted goal to plant one tree for every mile of track |

| | |

| 2015 | | |

nOpened first new transportation rail yard in 40 years, with modern systems that minimize the environmental impact of the facility |

| | |

| 2016 | | |

nAchieved second GHG goal |

| | |

| 2017 | | |

nBegan business transformation with introduction of new operating model defined by guiding principles |

| | | | | | | | |

| 2018 | | |

nSet target approved by the Science Based Targets initiative (a first for U.S. Class I railroads) to reduce GHG emissions nLaunched Pride in Service to honor those who serve and support local communities |

| | |

| 2019 | | |

nSet new Company record for fewest Federal Railroad Administration (“FRA”)-reportable personal injuries and achieved lowest injury rate of all Class I railroads |

| | |

| 2020 | | |

nIssued CSX’s first GRI, SASB and TCFD-aligned report covering 2019 ESG performance nFormed cross-functional ESG team for deeper integration and collaboration on issues across departments nDeveloped cross-functional social justice advisory roundtable to help CSX combat racial injustice |

| | |

| 2021 | | |

nIntroduced ONE CSX culture initiative, centered on each employee’s unique value and role in reaching business objectives nLaunched supplier engagement program focused on maximizing impact through value chain engagements |

| | |

| 2022 | | |

nAwaiting regulatory approval to become the first railroad to use Trip Optimizer’s Zero-to-Zero function, which extends fuel savings capabilities to low-speed operations, including starting and stopping nTested use of biofuels to run our locomotives |

ESG and Sustainable Growth

Sustainable Growth and Our Customer Experience Our Commitment to Customer Service

CSX is proud of the resiliency our customer service teams have demonstrated in recent years. Despite varying degrees of disruption in 2021, we responded to supply chain challenges in 2022 with innovative solutions and adjusted our operating plans accordingly, leading to the successful transport of 6.2 million units of freight across the United States. Recognizing that we had to quickly adapt to deliver the best-in-class service and interaction that our customers have grown to expect from CSX, we have expanded our workforce significantly and increased our customer solutions team over the past couple of years.

By continuing to invest in network capacity, customer service technology and new service offerings, CSX added to a solid operating foundation that will support future business growth by accelerating highway-to-rail freight conversion, which is a crucial step in facilitating the transition to a lower-carbon economy. Additional 2022 and early 2023 milestones include:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

|

Completion of the acquisition of Pan Am Systems, Inc., expanding CSX’s reach in the Northeastern United States, providing customers with new service possibilities | |

Identification of close to 90 growth projects across the CSX network that will have significant financial impact on CSX and the communities we serve by way of job creation and additional opportunities | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

Increased customer investment at CSX Select Sites, which are premium certified rail-served locations for industrial development and expansion. New partnerships over 2022 and early 2023 included electric-vehicle manufacturing complexes, a steel mill and a megasite property in Central South Carolina | |

Ongoing improvements to our ShipCSX customer service platform, further enhancing the value proposition of rail and supporting CSX’s strategy for capturing market share from the trucking industry | |

| | | | | | | |

| | | | | | | |

Service Innovations Enhancing Customer Experience and Results

Providing excellent customer service means investing in the tools and technologies that provide added value and efficiencies. In 2022, we continued our digital business transformation with the understanding that measures we take to improve the safety and efficiency of the railroad ultimately translate to an improved customer experience.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

Our Intermodal Terminal Reservation System allows us to ensure maximum flexibility and fluidity at terminals, with 99% of customers leveraging the technology solution to make gate reservations. | |

TRANSFLO, a CSX subsidiary that provides transloading services across our network, helps customers take advantage of the economic and environmental benefits of rail without having rail infrastructure at their facilities. | |

Our ShipCSX customer service platform allows customers to plan, ship, trace and pay for shipments quickly and securely, while streamlining terminals so shipments can arrive efficiently. | |

Our pioneering XGate System not only accelerates the pace of customer deliveries, but also reduces potential emissions from idling trucks at intermodal terminals by up to 90%. | |

| | | | | | | | |

| | | | | | | | |

ESG and Sustainable Growth

Environmental

Our Commitment to Sustainability

CSX’s commitment to advancing environmental sustainability supports our business strategy and is a part of our value proposition to our customers. At CSX, we believe that caring for our planet broadly and our communities specifically underpins our ability to best serve our customers and drive long-term prosperity. We continue to hold ourselves accountable for delivering business success while operating with a strong focus on our environmental practices.

We are extremely proud of the leadership the Company continues to demonstrate in this area, and we embrace the opportunity to develop, test and bring to scale emerging alternative fuels and other technologies that will bring about an even more sustainable future for rail. In 2020, CSX became the first railroad in the United States to align with the Science Based Targets initiative, setting a goal to reduce GHG emissions intensity by 37.3% by 2030, using 2014 as a baseline. Additionally, the Company’s efforts have been recognized by multiple environmental groups and business publications. Among these recognitions, for the 12th straight year, in 2022 CSX was again included in the Dow Jones Sustainability Indices North America, as one of five transportation companies to receive this recognition.

Progress on Our Environmental Goals

CSX remains dedicated to advancing innovative solutions and progressive action in our operations to reduce our impact on the environment as we track towards specific targets. After achieving our 2020 environmental targets, many ahead of schedule, CSX introduced a new set of 2030 goals to guide our climate efforts for the next decade. Progress on our environmental goals, more fulsome and updated detail on which will be released later this year in our 2022 ESG Report, includes:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | GHG Emissions | | | Renewables | | | Waste | | | Sustainable Operations | |

| Goal: Continue working towards our science-based target to reduce GHG emissions intensity by 37.3% against a 2014 baseline Plan: Make network and operational improvements while investing in technologies that will help transform the railroad industry Performance: Achieved 15.6% reduction in Scope 1 and 2 emissions intensity since 2014; improved fuel efficiency; piloted alternative fuels and engine enhancements to reduce fuel burn and overall emissions from locomotives | | Goal: Increase the Company’s use of renewable energy to 50% of the Scope 2 footprint Plan: Develop a viable Scope 2 strategy to include partnerships, energy audits, energy efficiency retrofits and renewable energy Performance: While CSX is working to find appropriate power purchase agreements to meet our long-term goals, we have entered into community solar agreements and are purchasing RECs to maintain forward progress | | Goal: Reduce the amount of hazardous waste generated from ongoing operations by 30% and decrease the amount of ongoing operations waste disposed in a landfill to less than 10% of volume Plan: Re-evaluate our purchasing practices, provide training to project managers and utilize product recycling wherever possible; identify those waste streams that can be reused or recycled and expand use of these alternative means of disposal Performance: Began to spearhead circularity initiatives such as our ties recycling program and terminal “Clean Sweep” clean ups throughout the year | | Goal: Expand efforts to engage our supply chain through evaluation of GHG quantification, ESG goals, and evaluation of risks and opportunities by engaging our suppliers through CDP Supply Chain Plan: Partner with suppliers to create efficiencies and positively impact our businesses, our stakeholders and the environment Performance: Engaged with top-tier suppliers through CDP Supply Chain in 2022, with 19% participation | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Advancing Our Customers’ Environmental Performance

With rail being the most sustainable mode of land-based freight transportation—given that, on average, freight railroads are three to four times more fuel efficient than trucks and produce 75% fewer GHG emissions—CSX has an opportunity to not only drive positive outcomes for the environment, but also for our customers, by helping divert incremental volumes off the highway without sacrificing reliability. Our customers are leveraging rail service now more than ever and are taking the opportunity to reduce their environmental footprint while optimizing their supply chains, especially in light of increasing consumer pressures and anticipated regulatory changes related to emissions. It is a priority at CSX to communicate with our customers about the efficiency benefits associated with our services and ultimately help our customers advance their own sustainability goals.

CSX is giving our customers the tools they need to better quantify and reduce their climate footprint, from the Carbon Calculator available on the CSX website to customized client reports that summarize carbon emissions and fuel use. CSX also offers our customers individualized allocated emissions reports suitable for GHG inventories that detail calculation methodology and audit traceability. In 2022, CSX customers avoided emitting 12.5 million tons of carbon dioxide by shipping with CSX versus truck.

ESG and Sustainable Growth

Biannually, CSX convenes our largest customers to engage firsthand with our executive team and hear from senior leadership in an intimate environment. Highway-to-rail conversion is a significant part of that dialogue, as well as value-added service expansion concerning carbon emissions reduction. Through this forum, we are able to gain additional insights into upcoming customer challenges, which will allow us to cater our services to best fit their changing needs and work together on viable solutions to both address their needs and help the environment.

Social

Cultural Transformation

| | | | | | | | | | | | | | |

To continue delivering on our company-wide vision and aspirations of attracting, developing and retaining the best people, we needed a strategy that values each individual’s contributions while instilling a sense of pride, equality and belonging. Thus, in 2021, we built on the next phase of our organizational strategy to redefine who CSX is as a company and unite and engage our employees. We developed new values to work safely, grow through innovation, lead with passion and integrity, strengthen our communities and create our future as ONE CSX. These values are core to our strategy and commitment to fostering a ONE CSX culture. ONE CSX describes the culture we aspire to create, where we operate as one team with all employees feeling empowered and able to contribute to our broader business objectives. In 2022, we launched these values and behaviors to the organization and began embedding them in our new ways of working. To achieve our business goals, CSX’s culture of safety, accountability and excellence has evolved, and must continue to do so, to include more innovative and diverse perspectives and a passion for service and create an environment where our employees think and work as ONE CSX and are able to achieve their full potential. Behaviors in action that have supported the creation of our future as ONE CSX, and which continue to support the expansion and strengthening of ONE CSX, include interconnectivity across teams to drive progress, acknowledgment of our employees’ work and contributions and investment in the development of our workforce. We have built on existing program success by expanding our employee-led business resource groups and social justice action plan. We have also introduced new elective benefits that offer comprehensive, holistic well-being. Moving forward, we will continue gathering feedback from our employees to identify our areas of strength and development and we will continue to grow our ONE CSX culture with an emphasis on building and sustaining a more diverse, engaged and motivated workforce. Our cultural transformation critically includes cultivating strong relationships with CSX’s unionized workforce and providing opportunities to work more closely with labor on solutions that improve the employee experience. At the end of 2022, the Company revised our attendance policy for operations employees to address their concerns from the recently concluded national bargaining round and build on previous revisions to the Company’s operational testing and corrective action policies. In early 2023, CSX reached agreements with four unions that provide paid sick leave for nearly 6,000 railroad workers, demonstrating the Company’s commitment to listening to our railroaders and working with their representatives to find solutions that improve their quality of life. These agreements are a direct result of the collaborative relationship CSX is working to cultivate with all the unions that represent CSX employees, and the Company will continue to pursue similar agreements with our remaining unions. | | | | |

| | | |

| | | |

| | The main message of ONE CSX is universal: We are at our best when we come together as one. The ONE CSX culture is meant to unify us across crafts, regions, and departments and requires all of us to act. ONE CSX simply boils down to working together as a team. It is an ambition and a call to action, and it is how we define the culture that we need to work towards. | |

| |

| |

| | | |

Safety

At CSX, safety encompasses every aspect of our operations, not just for our employees, but also for our customers and the communities in which we operate. All CSX employees, regardless of job function or level, are part of the CSX safety team. By putting health and safety at the center of our day-to-day operations, we strive to foster a safety culture grounded in ownership and accountability. In 2022, for the second consecutive year, CSX recorded zero work-related employee fatalities. We attribute this to our “no fatalities or life-changing events” campaign, which included a video to engage and educate employees on our commitment to safety. Across all divisions, leadership has shown their support for and focus on making this commitment a reality.

Our safety approach is an ongoing journey and it evolves and advances with time and technology. In 2022, CSX invested $1.7 billion in infrastructure maintenance and improvements to ensure safety, including in our core track, bridges and signals and in our equipment and detection technology. Moving forward, we will continue harnessing technology, like autonomous track assessment cars and drones, to innovate how we identify and avoid accident factors while adding new safeguards along the way.

Moreover, the CSX Responder Incident Training (“RIT”) program is an integral part of our commitment to safety, helping us build relationships with and train the first responders who serve the communities in which we operate. In 2022, CSX hosted 40 events across 35 cities along our network, training nearly 4,000 first responders to safely respond to potential rail emergencies through traditional, virtual and hands-on RIT exercises. We look forward to continuing to build on our RIT program and hosting the many related events already planned for 2023.

ESG and Sustainable Growth

Workforce Diversity

Rails and roads do not move freight, people do. At CSX, our employees—the number of which was more than 22,500 as of December 31, 2022, which includes approximately 17,100 employees that are members of a rail labor union—provide the foundation for our success, with each one contributing uniquely valuable perspectives and skill sets. Our employees’ contributions are what keep our Company, our customers and our communities moving forward towards our shared goals. In 2022, we continued efforts to build a workforce that reflects the communities we live in and serve, starting with our hiring practices. This included providing interviewers and hiring managers with best practices, enhanced training, which included unconscious bias content, and a new system to better identify talent while continuing to locate talent from non-traditional sources.

While we are moving in the right direction in terms of building out and sustaining a diverse workforce, we recognize there is more work to be done and are firmly committed to doing this work. As one step on our broader journey, we publicly released our 2021 EEO-1 data in our 2021 ESG Report to provide insight into the makeup of our workforce. We plan on sharing this data annually moving forward to increase transparency around how we are advancing diversity and representation across the organization.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Who We Are* | |

| | | | | Three Generations of Our Workforce | |

| | | | | | |

| 88% Overall Retention Rate 22% Diverse 5% Female | | 15 Average Years of Service | | 4% Boomers 64% Gen X 32% Gen Y/Millennials 46 Average Age | |

| | | | | | |

| | | | | | |

| Workforce Diversity# | | Management New Hires | | Management Promotions | |

| | | | | | |

| | | | |

| 22% of Total Workforce 37% of Management 19% of Union | | 46% Diverse 26% Female | | 36% Diverse 23% Female | |

| | | | | | |

| | | | | | |

| Union New Hires | | Females | | Veteran and Active-Duty Military Status | |

| | | | | | |

| | | | |

| 36% Diverse 4% Female | | 5% All Female Talent 21% of Management 2% of Union | | 3,102 Veterans, Active-Duty Military and First Responders 16% of Workforce | |

| | | | | | |

* The data reflected in this table, which is calculated as of December 31, 2022, excludes approximately 2,740 employees of certain CSX subsidiary companies due to such companies’ separate payroll systems.

# Calculated as the percentage of males of color and all females.

ESG and Sustainable Growth

CSX is proud of the many business resource groups (“BRGs”) that have been initiated by our employees to connect with colleagues who have shared interests and experiences. Each BRG is led by an executive-level sponsor, with the goal of promoting a diverse, inclusive and engaged workplace culture.

Our BRGs include: (i) ABLE Business Resource Group, which focuses on fostering a sense of belonging for those employees living with visible and invisible disabilities; (ii) African American Inclusion Group, which focuses on creating a culture that embraces inclusion and promotes African American representation at CSX; (iii) Asian Professionals for Excellence, which seeks to promote stronger working relationships between Asian and non-Asian employees; (iv) Interchange Women’s Business Resource Group, which creates forums to engage aspiring women leaders on career and leadership development; (v) LGBTQ+A(llies), which focuses on advocacy, education, policy and community outreach in support of the LGBTQ+ community and engaging family and friends who serve as allies; (vi) Military Business Resource Group, which honors and supports CSX’s veterans or active-duty military employees, Pride in Service activities and employee families when their loved ones are deployed in active military service; (vii) STEAM, which focuses on sparking interest in technology and innovation among all employees in the areas of science, technology, engineering, art and math; and, as most recently added in 2022, (viii) Hispanic Origin/Latin American (HOLA) Business Resource Group, which is committed to the engagement and professional growth of CSX’s Hispanic and Latinx employees with a focus on recruitment, development, cultural awareness and community involvement.

Commitment to Social Justice and Racial Equity

CSX is committed to social justice and racial equality—within our organization and throughout our communities. We are adding CSX’s voice to the side of anti-racism to not only meet our societal obligation but also to help strengthen our culture of inclusion. As we resolve to address social justice with purpose, we are continuing efforts with our own social justice advisory roundtable, a cross-functional group of CSX employees and leaders, to advance our efforts. This group reflects a diverse range of perspectives and expertise that has already increased dialogue around diversity, equity and inclusion at CSX and produced meaningful change for our employees and in our communities. Specifically, our social justice advisory roundtable is responsible for developing strategy and overseeing the Company’s social justice action plan. The internal portion of the plan includes specific items that directly impact employees and improve the corporate culture, ranging from anti-racism awareness seminars and development opportunities for people of color to voter education and changing potentially offensive job titles. Externally, the plan includes partnerships with organizations that promote anti-racism awareness and provide support for people and communities of color.

For example, in alignment with the Company’s strong stance against hate speech, racism and discrimination, CSX recently joined other Jacksonville organizations and business leaders to promote diversity, equity and inclusion by contributing $100,000 to the newly formed Together Strong Community Fund. Backed by multiple large Jacksonville-based companies, the fund will use education, conversation and interaction initiatives to address antisemitism and bring the community together. Moreover, in 2022, CSX partnered with the United Way of Northeast Florida to support and promote Jacksonville’s Civil Rights Conference.

Communities

At CSX, service to our communities is core to who we are and our commitment to people extends beyond our employees. Service is at the heart of every decision we make, for our customers, for our employees and for our communities. We serve the communities in which we live and operate through monetary and in-kind giving, as well as employee volunteerism opportunities. For example, in 2022, CSX contributed $200,000 to support relief and recovery efforts in the Florida and South Carolina communities affected by Hurricane Ian.

Additionally, 2022 marked the fourth full year of our signature community investment initiative, CSX Pride in Service. Pride in Service is a company-wide commitment to honor and serve the nation’s military, veterans and first responders by connecting them and their families with the support they need. CSX understands intimately the sacrifice that comes with military service, as nearly one in five CSX employees have a former or current military connection. Oftentimes, our military, veteran and first responder heroes find themselves with various hardships and financial adversity once they are no longer in the line of duty.

Overall, in 2022, CSX contributed approximately $10.4 million and nearly 12,300 volunteer hours to our communities, with $7 million of such contribution directed to causes supporting military, veterans, first responders and their families. With Pride in Service’s nonprofit partners, CSX makes possible critical financial assistance, community connections and acts of gratitude. In 2022, we reached 315,000+ service men, women and family members through our Pride in Service initiative, and we participated in 751 related service events, partnering with the following organizations:

ESG and Sustainable Growth

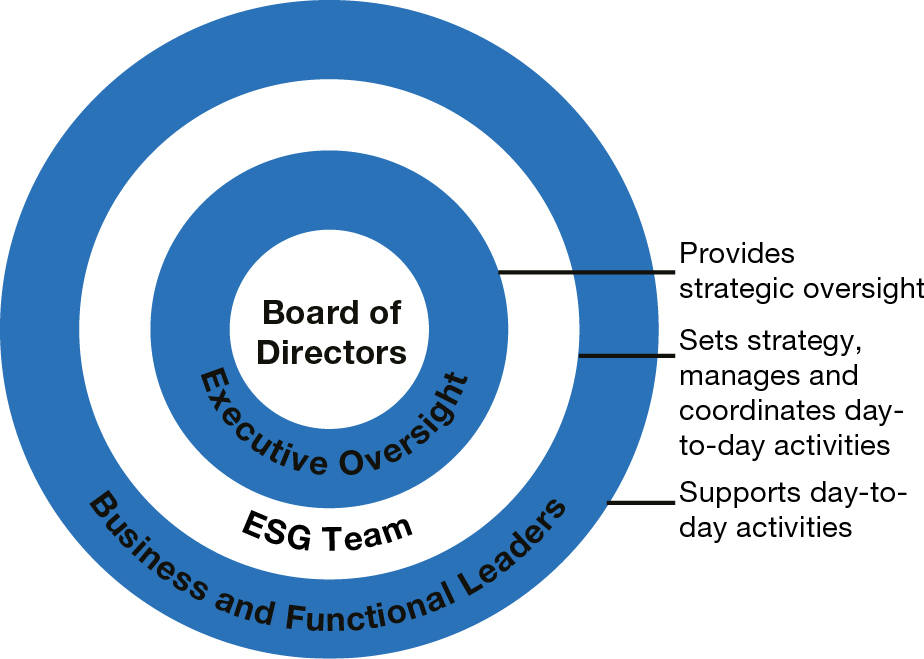

Governance Practices and Oversight

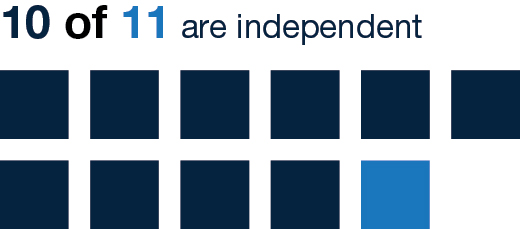

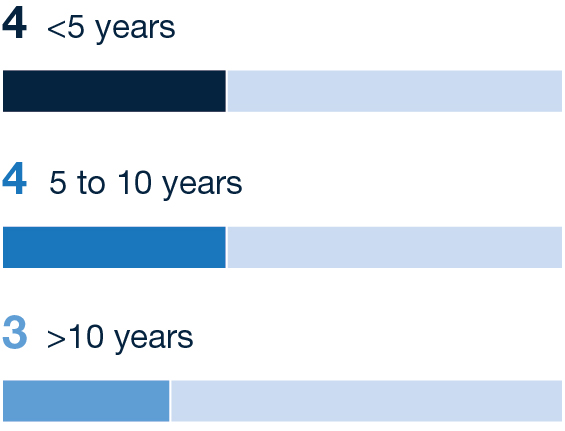

At CSX, we believe good governance practices begin with strong leaders who understand the opportunities and challenges across our business and bring diverse perspectives for how to approach them, to help make decisions that support the Company’s long-term growth and success. Our Board of Directors and executive team hold ultimate responsibility for developing and communicating CSX’s vision and purpose, overseeing the implementation of sound governance practices, upholding Company policies, codes, procedures and values and ensuring ongoing monitoring of and adherence to existing and emerging laws and regulations. Key elements of our comprehensive governance program include: annual election of directors; majority voting standard for election of directors and director resignation policy; separation of the roles of Chair of the Board of Directors and Chief Executive Officer; independent Chair of the Board of Directors; stock ownership guidelines for officers and directors; policy against hedging and pledging of CSX common stock; proxy access and rights to call special meetings; pay-for-performance alignment; and Audit Committee, Compensation and Talent Management Committee and Governance and Sustainability Committee comprised solely of independent directors.

Business Ethics

| | | | | | | | | | | | | | |

We prioritize responsible business practices not only because it is the right thing to do, but also because it helps CSX manage and respond to potential risks and opportunities that can have an impact on our business and our ability to provide value to our stakeholders. All CSX employees and officers, members of the Board of Directors and partners conducting business with or on behalf of CSX are expected to act with the highest standards of personal integrity, consistent with the ethical behaviors outlined in our Code of Ethics. This code covers a wide slate of business matters including: conflicts of interest; insider trading; confidential information misuse; discrimination and harassment; whistle-blower protection; public and employee safety; and proper use of corporate assets. In consultation with the Board of Directors, our executive leadership team develops governance policies and sets clear expectations for those across all levels of our Company. Annual ethics training, which focuses on applying the CSX Code of Ethics in daily interactions, is required for all CSX management employees and is highly encouraged for union employees. | | | | |

| | Business Ethics | |

| | | |

| | 2022 Ethics Data Highlights | |

| | | |

| | 100% Management employees trained 88% Union employees trained | |

| | | |

Cybersecurity

| | | | | | | | | | | | | | |

Strong performance and reliability of our technology systems are critical to our ability to operate safely and effectively. Our security framework is broadly integrated across the organization to enable the protection of our customers’ personal information and the integrity of our operations, our contractors and our suppliers. Our information security team is responsible for day-to-day management and strategy implementation, including equipping our systems with the latest cybersecurity tools; conducting daily vulnerability scans; regularly providing critical cybersecurity information to all application users; and facilitating the annual required cybersecurity awareness trainings.

Over the last few years, CSX has brought in Board and executive-level experts to expand oversight of our cybersecurity and technology systems. In 2019, Suzanne M. Vautrinot, a retired U.S. Air Force (“USAF”) Major General, joined our Board of Directors. Maj. Gen. (ret.) Vautrinot, who led the USAF’s Cyber Command and is currently the president of a cybersecurity strategy and technology consulting firm, provides invaluable expertise and guidance in cyber and information security management. More recently, Stephen Fortune joined CSX as Executive Vice President and Chief Digital & Technology Officer in April 2022. Mr. Fortune brings decades of experience as a corporate technology leader to the Company through his long tenure as Chief Information Officer of the global BP Group. | | | | |

| | Cybersecurity | |

| | | |

| | 2022 Cybersecurity Highlights | |

| | | |

| | 100% Management employees trained 90% Of the information security team has industry-recognized cybersecurity certification | |

| | | |

| | | | | | | | | | | | | | |

| | | | |

| | | |

| ITEM 1 Election of Directors As discussed in more detail in the “Corporate Governance” section beginning on page 19 of this Proxy Statement. | |

| | | |

|

The Board unanimously recommends a vote

FOR the election of the following director nominees. | |

| | | |

| | | |

| | | |

| COMMITTEES KEY | |

| | Chair | |

| | Audit | |

| | Compensation and Talent Management | |

| | Executive | |

| | Finance | |

| | Governance and Sustainability | |

| | |

|

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. For more complete information regarding the Company’s 2022 performance, please review the 2022 Annual Report. |

|

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | |

The Board unanimously recommends that the shareholders vote FOR this proposal. | |

| ITEM 2 Ratification of Independent Registered Public Accounting Firm As discussed in more detail in the “Audit Matters” section beginning on page 41 of this Proxy Statement. | | |

| | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | |

The Board unanimously recommends that the shareholders vote FOR this proposal. | |

| ITEM 3 Advisory (Non-Binding) Vote to Approve the Compensation of CSX’s Named Executive Officers As discussed in more detail in the “Executive Compensation” section beginning on page 45 of this Proxy Statement. | | |

| | | |

| | | | | |

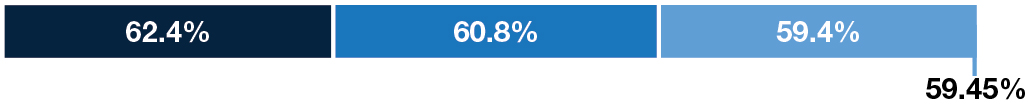

Shareholder Engagement and Responsiveness to 2022 Say-on-Pay Vote

We conduct and facilitate ongoing shareholder outreach throughout the year to ensure that the Board of Directors and management proactively understand and consider our shareholders’ views on important issues, including on our executive compensation program. In light of concerns around our 2022 “Say-on-Pay” vote and given that such vote only received approximately 60% support, well below Company expectations, our shareholder outreach and engagement efforts intensified after our 2022 Annual Meeting and were largely focused on our executive compensation program. Below is a summary of the design and breadth of these efforts, what we heard from our shareholders and what we did in response.

Comprehensive detail on these efforts, respective shareholder feedback and our response is provided in the “Say-on-Pay and Shareholder Engagement” subsection of the “Compensation Discussion and Analysis” (the “CD&A”) section beginning on page 51 of this Proxy Statement. Additional detail related to the Compensation and Talent Management Committee’s perspective on this topic is provided in the letter from the Committee beginning on page 47 of this Proxy Statement. We strongly encourage you to review each section for a more fulsome perspective on our 2022 shareholder outreach and engagement.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Conducted Spring Outreach & Identified Common Concerns Before the 2022 Annual Meeting | | | Responded to Concerns & Planned Fall Outreach | | | Conducted Fall Outreach & Considered Feedback Based on the Say-on-Pay Vote | | | Implemented Additional Responsive Actions | |

| | | | | | | | | | | |

| | | | | | | |

Contacted nine shareholders, representing approximately 34.9% of shares outstanding* Met with governance teams of seven shareholders, representing approximately 33.5% of shares outstanding* Concerns around the following issues emerged: nthe use of compensation committee discretion in our short-term incentive plan without sufficiently robust disclosures on the committee’s reasoning for applying upward individual performance adjustment(s) nthe overall quantum of CEO pay nthe proportion of our executive pay that is performance based nthe level of CEO perquisites | | Responded to concerns: ntransitioned to a new President and CEO with a compensation package that is intended to strike the appropriate balance of fairly compensating him relative to peers and other S&P 500 CEOs, while aligning with shareholder interests and expectations ncapped the new President and CEO’s personal use of corporate aircraft to $175,000 annually ncommitted to more fulsome and specific disclosure of our executive compensation program and resulting payouts nre-evaluated the circumstances under which individual performance adjustment(s) might be appropriate nreviewed the equity mix and metrics used in our long-term incentive plan | | Contacted our top 50 shareholders, comprising 41 unique firms, representing approximately 56.6% of shares outstanding* Received a declination (generally due to no questions or concerns) from or met with governance teams of 12 shareholders, representing approximately 32.1% of shares outstanding* Heard: nbroad support for the changes and caps in connection with our new President and CEO’s compensation and our commitment to provide more fulsome disclosure of rationale for our compensation decisions ndesire to see an increase in the representation of performance shares in our incentive equity mix, with one shareholder expressing a preference for the use of longer vesting periods for our equity awards | | Implemented additional responsive actions: ndetermined that the circumstances under which individual performance adjustment(s) might be appropriate should be exceptional nincreased the weighting of performance units from 50% to 60% for our 2023-2025 long-term incentive plan cycle | |

* Based on ownership figures as of March 31, 2022 for spring outreach and September 30, 2022 for fall outreach. Most meetings were led by the Chairs of our Compensation and Talent Management and Governance and Sustainability Committees, along with our Chief Legal Officer, Chief Administrative Officer and/or Head of Investor Relations and employees from these executives’ departments.

Alignment with Leading Governance Practices

The Compensation and Talent Management Committee has established an executive compensation program that incorporates leading governance principles. Highlighted below are our executive compensation practices that drive performance and support strong corporate governance.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| CSX Executive Compensation Practices Include: nSignificant percentage of executive compensation that is performance based nPerformance measures that are highly correlated to shareholder value creation nEngagement of an independent compensation consultant to review our executive compensation program and perform an annual risk assessment nSignificant share ownership requirements for Vice President-level executives and above and non-employee directors nDouble trigger in change-of-control agreements for severance payouts (i.e., change of control plus termination) nClawback policy applicable to all incentive compensation plans nInclusion of multiple financial measures in short and long-term incentive plans nUse of payout caps on short and long-term incentives | | | CSX Executive Compensation Practices Do NOT Include / Allow: nRe-pricing of underwater options without shareholder approval nExcise tax gross-ups nRecycling of shares withheld for taxes nHedging or pledging of CSX common stock nVesting of equity awards with less than a one-year period |

| | | | |

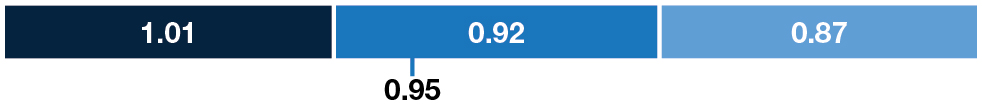

Key Business Highlights for 2022

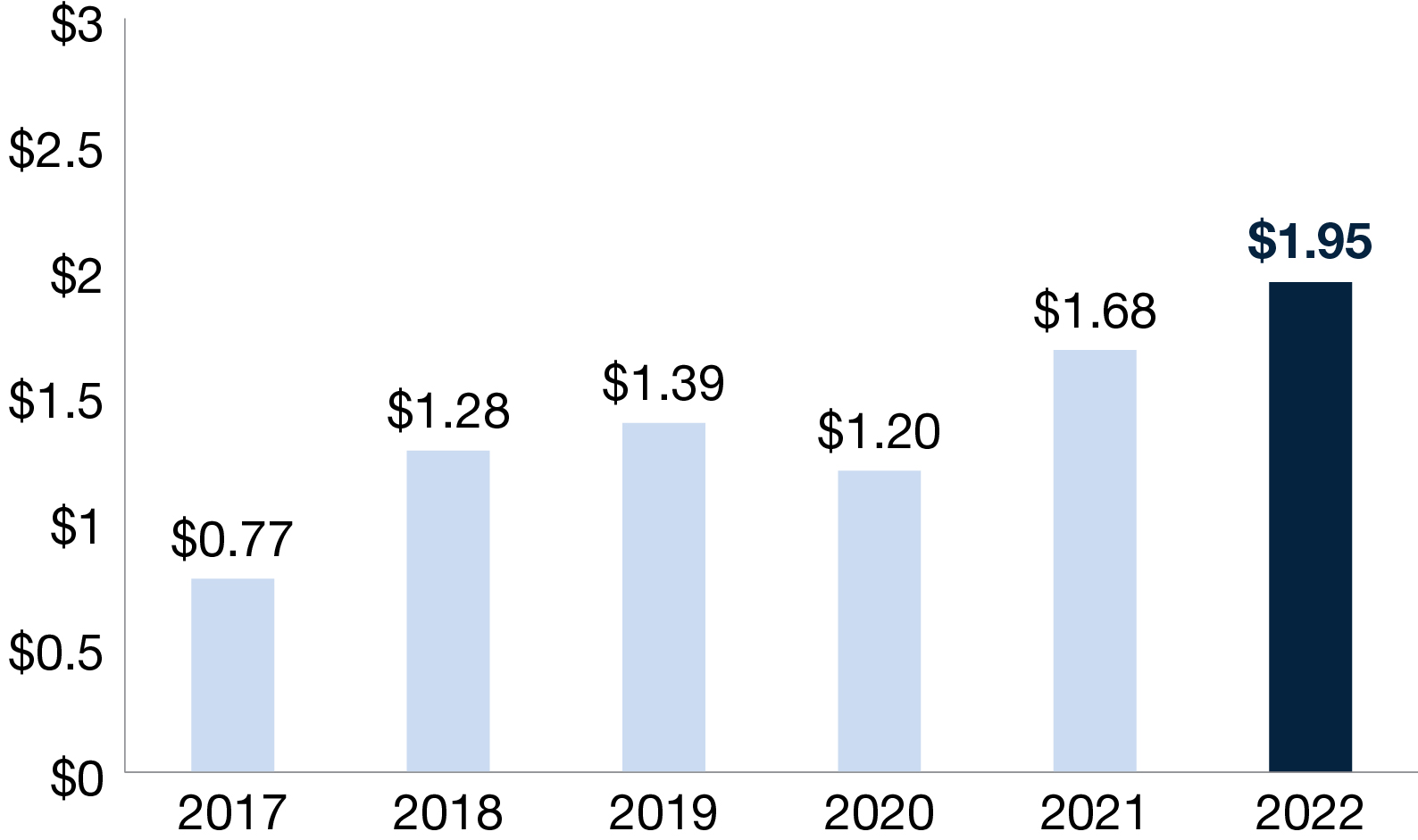

In 2022, CSX delivered operating income of $6.02 billion, up 8% compared to 2021, and our earnings per share (“EPS”) increased 16% year-over-year to $1.95. In addition, excluding the gains from our 2021 real estate transaction with the Commonwealth of Virginia, our operating income grew in line with our guidance for double-digit growth. For more information on CSX’s performance in 2022, please see the 2022 Annual Report.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

$6.02B Operating Income | | 59.5% Operating Ratio | | $1.95 Fully-Diluted EPS | | $5.58B Capital Returned to Shareholders |

Stock Performance Graph

The cumulative five-year shareholder returns on $100 invested at December 31, 2017, assuming reinvestment of dividends, are illustrated on the accompanying graph. The Company references the Standard & Poor’s 500 Stock Index (“S&P 500”), which is a registered trademark of The McGraw-Hill Companies, Inc., and the Dow Jones U.S. Transportation Average Index (“DJT”), which provide comparisons to a broad-based market index and other companies in the transportation industry.

| | |

| Comparison of Five-Year Cumulative Return |

|

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | |

The Board unanimously recommends a vote FOR the approval of the frequency of EVERY YEAR for future advisory votes on executive compensation. | |

| ITEM 4 Advisory (Non-Binding) Vote on Whether Future Votes on the Compensation for the Company’s Named Executive Officers be Held Every One, Two or Three Years As discussed in more detail in the “Executive Compensation” section beginning on page 45 of this Proxy Statement. | | |

| | | |

| | | | | |

| | | | | | | | | | | |

| | | |

| | | |

| | | |

| ITEM 1 | Election of Directors | |

| | | |

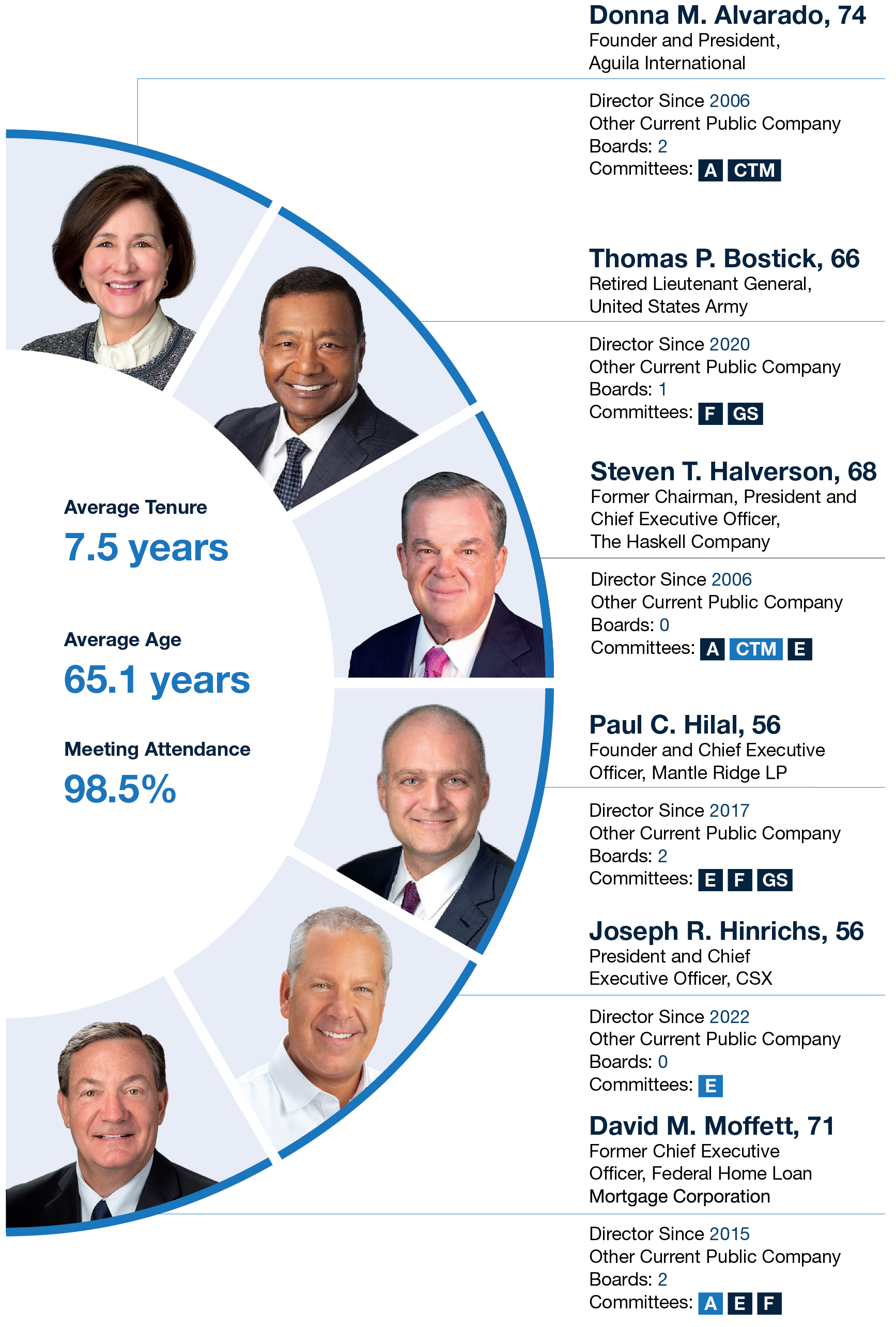

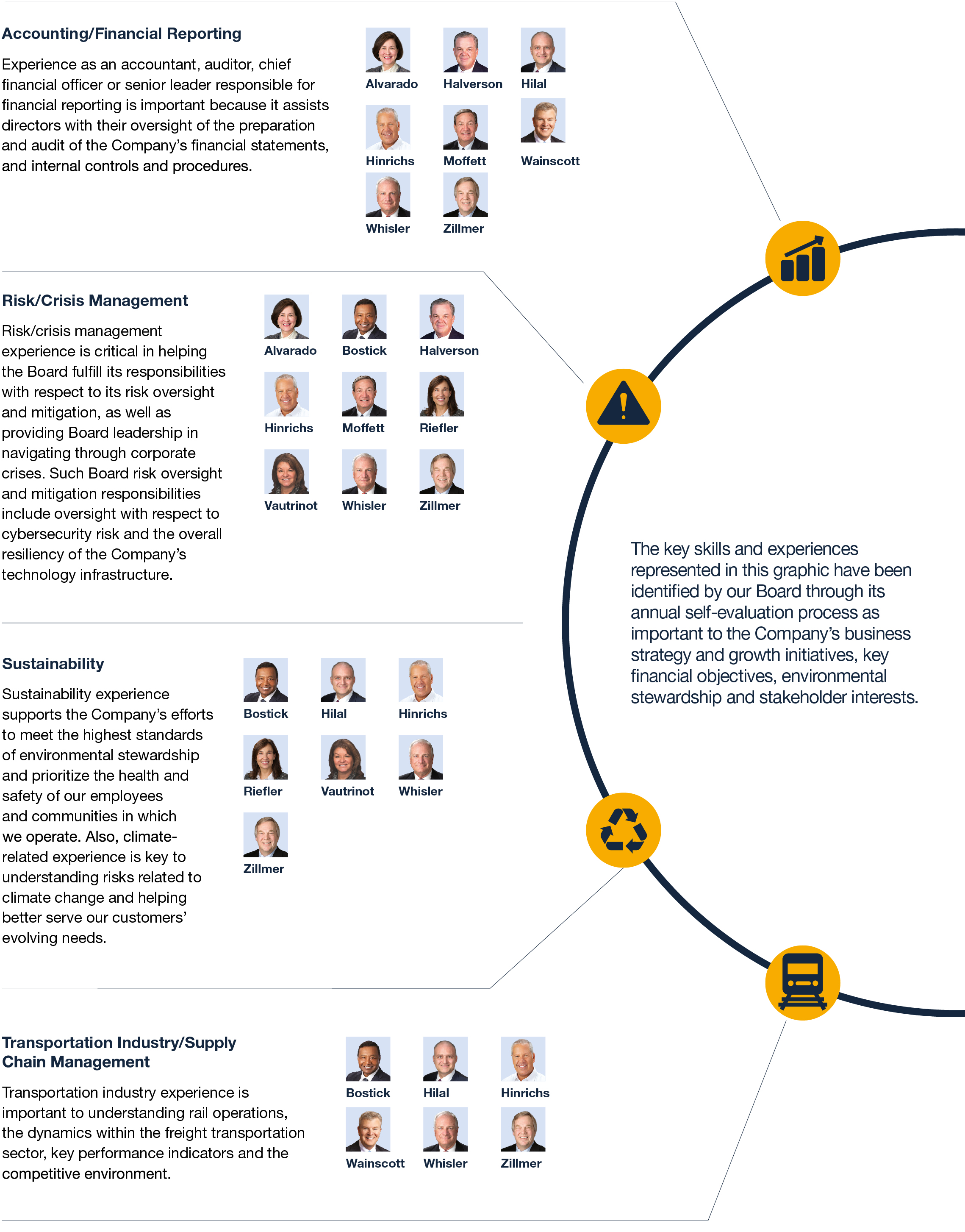

Criteria for Board Membership

Overview

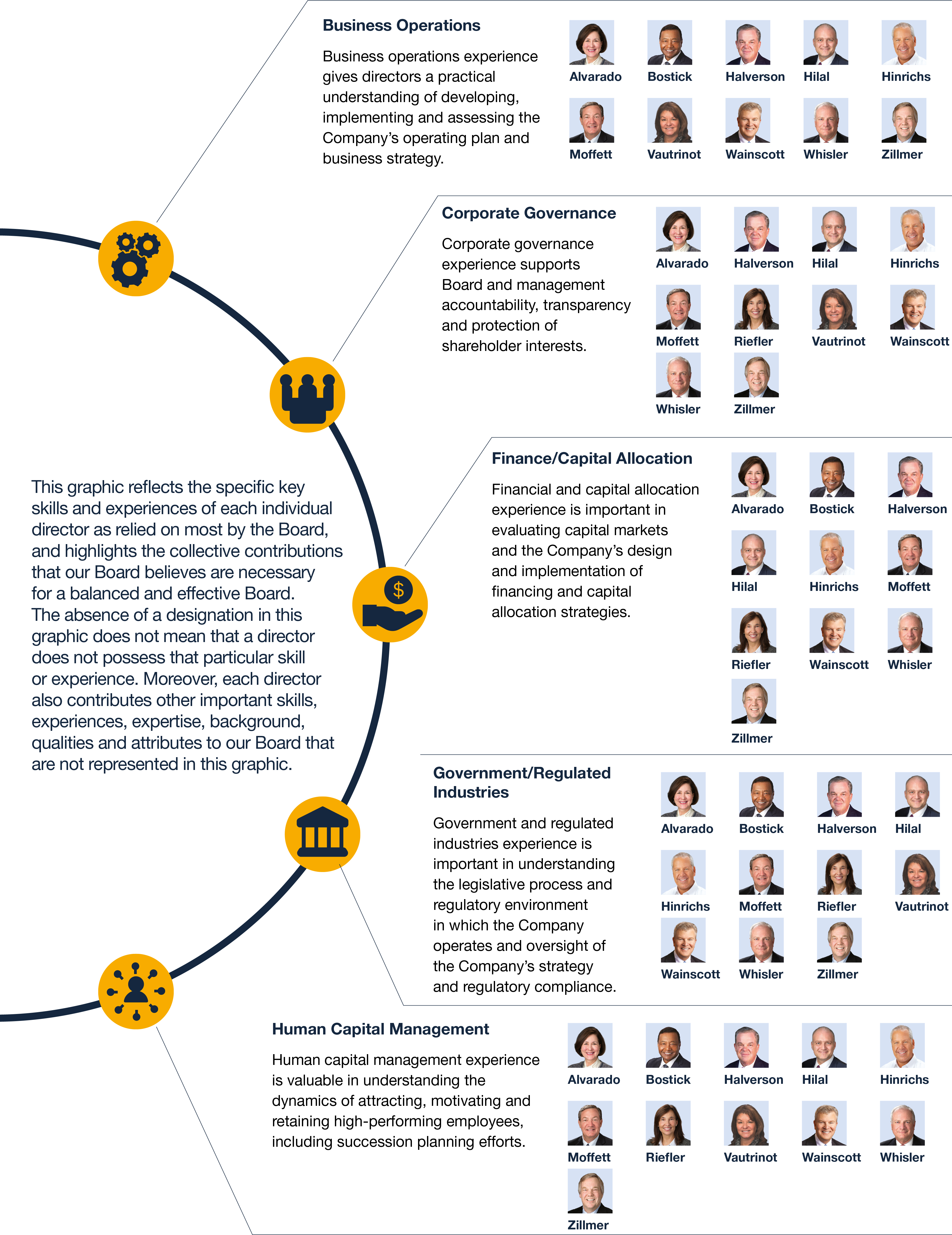

Eleven directors are to be elected to hold office until the 2024 Annual Meeting and their successors are elected and qualified. The Governance and Sustainability Committee has recommended to the Board of Directors, and the Board has approved, the persons named below as director nominees. The Board believes that each of these director nominees adds to the overall diversity of the Board, including in terms of background, skills, perspective, industries served, business matter coverage and demographics. For example, these director nominees bring a wide range of experience and expertise in management, railroad operations, financial markets, human capital and risk management. We believe that this broad representation is necessary, as each Board member is expected to be able to assess and evaluate the role and policies of the Company in the face of changing conditions in the economy, regulatory environment and customer expectations.

Additionally, nominees for Board membership are expected to be prominent individuals with demonstrated leadership ability and who possess outstanding integrity, values and judgment. Directors and nominees must be willing to devote the substantial time required to carry out the duties and responsibilities of directors. In addition, each Board member is expected to represent the broad interests of the Company and its shareholders as a group, and not any particular constituency.

With the exception of Joseph R. Hinrichs, who was appointed as the CSX President and Chief Executive Officer and a member of the Company’s Board of Directors in 2022, each of the following nominees was elected to the Board at the Company’s 2022 Annual Meeting, and each of them has exemplified proven commitment and capacity to serve on the CSX Board.

Consideration of Diversity

CSX strives to cultivate an environment that embraces teamwork and capitalizes on the value of diversity. To ensure that the Governance and Sustainability Committee’s commitment to diversity is reflected in our director qualifications and selection policies, the Board recently amended the CSX Corporate Governance Guidelines to specify that such Committee will instruct any third-party search firm to use its best efforts to include qualified candidates who reflect diverse backgrounds, including, but not limited to, diversity of race, ethnicity, national origin and gender. The Governance and Sustainability Committee recognizes the importance of maintaining a Board with a broad scope of backgrounds and expertise that will expand the views and experiences available to the Board in its deliberations. Many factors are taken into account when evaluating director nominees, including experience, skills, education, background, gender, race, ethnicity, age and other qualities and attributes. The Governance and Sustainability Committee strongly feels that candidates representing variability across these factors add to the overall diversity and viewpoints of the Board. Moreover, over the past several years, the Board has prioritized ensuring that committee chair positions are held by gender and racially/ethnically diverse Board members. Board diversity, including the diversity of our director nominees, is described in much more detail in the “Board Composition and Diversity” section on page 29 below.

Director Nominees

As of the date of this Proxy Statement, the Board has no reason to believe that any of the following director nominees will be unable or unwilling to serve. If any of the nominees named below is not available to serve as a director at the time of the Annual Meeting (an event which the Board does not now anticipate), the proxies will be voted for the election of such other person or persons as the Board may designate, unless the Board, in its discretion, reduces the size of the Board. There are no family relationships among any of these nominees or among any of the nominees and any executive officer of the Company.

Information regarding each of the director nominees follows. Each such nominee has consented to being named in this Proxy Statement and to serve if elected.

| | | | | | | | | | | |

| | | |

| | The Board unanimously recommends a vote FOR the election of the following nominees. | |

| | | |

| | | | | | | | | | | |

| | | |

| | Donna M. Alvarado, 74 Independent Director Nominee Director since 2006 |

| | | |

| | | |

| CSX Committees Audit/Compensation and Talent Management Career Highlights nFounder and current President of Aguila International, a business-consulting firm that specializes in human resources and leadership development, since 1994. nServed as President and Chief Executive Officer of Quest International, a global educational publishing company, from 1989 to 1993. nServed as Chairwoman of the Ohio Board of Regents. nAppointed to various executive and legislative staff positions at the U.S. Department of Defense and the U.S. Congress. nAppointed by President Ronald Reagan to lead the federal agency ACTION, the nation’s premier agency for civic engagement and volunteerism. Other Leadership Experience Ms. Alvarado has served on boards in the manufacturing, banking, transportation and service industries. She has also led state and national workforce policy boards. | Key Skills and Qualifications nCorporate Governance Serves as President of Aguila International and previously served as President and Chief Executive Officer of Quest International. Also serves on public company boards, including as the chair of the nominating and governance committee of each of CoreCivic, Inc. and Park National Corporation. nGovernment/Regulated Industries Served in several senior management governmental roles at both the state and federal levels. nRisk/Crisis Management Relevant experience through her roles at the U.S. Department of Defense and on audit committees of public company boards. nHuman Capital Management Expertise in human resources and leadership development through her work at Aguila International. Also served on state and national workforce policy boards. Other Current Public Company Directorships nCoreCivic, Inc. nPark National Corporation |

| | | |

| | | | | | | | | | | |

| | | |

| | Thomas P. Bostick, 66 Independent Director Nominee Director since 2020 |

| | | |

| | | |

| CSX Committees Finance/Governance and Sustainability Career Highlights nChief Executive Officer of Bostick Global Strategies, LLC, a boutique management consulting firm that specializes in areas such as government contracting, engineering, human resources, biotechnology, executive coaching, organizational operations and transformation and project management, since 2016. nServed as Chief Operating Officer and President of Intrexon Bioengineering, a division of Intrexon Corporation, which seeks to advance biologically engineered solutions to improve sustainability and efficiency, from 2016 to 2020. Led a major restructuring that resulted in Intrexon being renamed as Precigen. nRetired as a U.S. Army Lieutenant General in 2016. nServed as Chief of Engineers and Commanding General of the U.S. Army Corps of Engineers, where he was responsible for most of the nation’s civil works infrastructure and military construction. nServed as the U.S. Army’s Director of Human Resources and led the U.S. Army Recruiting Command. Other Leadership Experience Lt. Gen. (ret.) Bostick was deployed during Operation Iraqi Freedom as second in command of the 1st Calvary Division and later commanded the U.S. Army Corps of Engineers Gulf Region Division with over $18 billion in construction. He | serves as an independent trustee on the Equity and High Income Fund Board of Fidelity Investments, Inc., a privately-owned investment management company. He is an independent director on the board of Allonnia, a biotech company focused on environmental challenges, and on the board of HireVue, which uses artificial intelligence and data analytics to transform the way organizations discover, engage and hire the best talent. Key Skills and Qualifications nBusiness Operations Served as Chief Operating Officer and President of Intrexon Bioengineering, now known as Precigen, during an organizational transformation. Led the U.S. Army Corps of Engineers, the world’s largest public engineering organization. nGovernment/Regulated Industries Long-tenured service and distinguished career in commanding roles with the U.S. military. nHuman Capital Management Expertise through his service as the U.S. Army’s Director of Human Resources, leadership in the U.S. Army Recruiting Command and work at Bostick Global Strategies, LLC. nSustainability Relevant experience through his leadership and project management oversight at the U.S. Army Corps of Engineers and several companies focused on sustainability and leadership of an ESG subcommittee at Perma-Fix Environmental Services, Inc. Other Current Public Company Directorships nPerma-Fix Environmental Services, Inc. |

| | | |

| | | | | | | | | | | |

| | | |

| | Steven T. Halverson, 68 Independent Director Nominee Director since 2006 |

| | | |

| | | |

| CSX Committees Audit/Compensation and Talent Management (Chair)/Executive Career Highlights nServed as Chairman from 1999 to 2021, and President and Chief Executive Officer from 1999 to 2018, of The Haskell Company, one of the largest design-build and engineering and construction firms in the U.S. nServed as Senior Vice President of M.A. Mortenson, a national construction firm. nCurrently serves as a director of GuideWell Mutual Holding Corporation, a not-for-profit company that is the parent to a family of companies focused on advancing health care, including health insurance group Blue Cross and Blue Shield of Florida, for which Mr. Halverson also currently serves as a director. Other Leadership Experience Mr. Halverson has served as the chair of professional and business organizations such as the Construction Industry Roundtable, the Design-Build Institute of America and the National Center for Construction Education and Research. He has also served as the chair of several civic organizations, including the Florida Council of 100, the Florida Chamber of Commerce and the Jacksonville Civic | Council. He is a certified fellow of the National Association of Corporate Directors and received certification in ESG Governance from Berkley Law School. Key Skills and Qualifications nBusiness Operations Decades of relevant experience through his service as Chairman, President and Chief Executive Officer of The Haskell Company and executive positions with M.A. Mortenson, during which he gained extensive and unique insight on the national construction industry and, accordingly, the U.S. economy. nCorporate Governance Led as Chairman of The Haskell Company and the chair of various professional, business and civic organizations. nGovernment/Regulated Industries Served on multiple civic councils, through which he helped advise on and advocate for state and local economic policies. nHuman Capital Management Expertise through his long-tenured role as Chief Executive Officer and significant service on compensation committees focused on talent management. Other Current Public Company Directorships nNone |

| | | |

| | | | | | | | | | | |

| | | |

| | Paul C. Hilal, 56 Independent Director Nominee / Vice Chair of the Board Director since 2017 |

| | | |

| | | |

| CSX Committees Executive/Finance/Governance and Sustainability Career Highlights nFounder and Chief Executive Officer of Mantle Ridge LP, an investment fund formed in 2016. nServed as a partner and senior investment professional at Pershing Square Capital Management from 2006 to 2016. nServed as a director of Canadian Pacific Railway Limited from 2012 to 2016, where he was the chair of the Management Resources and Compensation Committee and a member of the Finance Committee. Other Leadership Experience Mr. Hilal currently serves on the Board of Overseers of Columbia Business School and previously served on the Board of the Grameen Foundation, an umbrella organization that helps micro-lending and micro-franchise institutions empower the world’s poorest through financial inclusion and entrepreneurship. | Key Skills and Qualifications nCorporate Governance Serves as Vice Chairman of Aramark. Has also served in board leadership positions at other public companies, including as Chairman of WorldTalk Communications. nFinance/Capital Allocation Extensive experience with leading capital management organizations, including control of his own capital management firm. Proven expertise as a value investor, capital allocator and engaged director driving shareholder value. nHuman Capital Management Relevant talent management experience through his role as a Chief Executive Officer, in senior management positions and as a director. nTransportation Industry/Supply Chain Management Railroad industry experience and perspective through his service as a director of Canadian Pacific Railway Limited. Other Current Public Company Directorships nAramark nDollar Tree |

| | | |

| | | | | | | | | | | |

| | | |

| | Joseph R. Hinrichs, 56 Management Director Nominee / President and Chief Executive Officer Director since 2022 |

| | | |

| | | |

| CSX Committees Executive (Chair) Career Highlights nServed as President of Ford Motor Company’s global automotive business from 2019 to 2020, where he led the company’s automotive operations. Previously held other positions at Ford, including President of Global Operations, from 2017 to 2019, President of the Americas, from 2012 to 2017, and President of Asia Pacific and Africa, from 2009 to 2012. nCurrently serves as: Chairman of the board of directors of Exide Technologies, a battery manufacturer and leading provider of advanced energy solutions; a venture partner at First Move Capital, an investment firm; an automotive advisory board member at Luminar Technologies, a global automotive technology company ushering in a new era of vehicle safety and autonomy; and a strategic advisor at mircroDrive, a company in the advertising services industry that provides a SaaS platform created specifically for hyper-local influencer marketing. nServed as a partner and Senior Vice President at Ryan Enterprises, a private equity group. nSpent 10 years at General Motors in various engineering and manufacturing leadership roles. nServed as Chairman of the National Minority Supplier Development Council from 2016 to 2019 and also served on the boards of CEO Climate Dialogue, Climate Leadership Council and the U.S.-China Business Council. | Other Leadership Experience Mr. Hinrichs has more than 30 years’ experience in the global automotive, manufacturing and materials planning and logistics sectors. He has served on the boards of several other companies, including Rivian Automotive, Inc., Ford Motor Credit Company and Ascend Wellness Holdings. Key Skills and Qualifications nBusiness Operations Decades of relevant experience through his senior management positions with Ford Motor Company, where he enabled Ford to execute world-class manufacturing on a global scale, and other leadership and advisory roles. nHuman Capital Management Proven track record during his tenure in leadership positions, especially at Ford Motor Company, around employee engagement, building a one-team workforce and prioritizing safety and an inclusive culture. nTransportation Industry/Supply Chain Management Extensive automotive industry experience and perspective through his service at Ford Motor Company and General Motors, which is an industry with dynamics similar to rail. nSustainability Demonstrated commitment to sustainability in his work at Ford Motor Company, advisory services to companies advancing electric vehicle adoption and leadership on climate organizations. Other Current Public Company Directorships nNone |

| | | |

| | | | | | | | | | | |

| | | |

| | David M. Moffett, 71 Independent Director Nominee Director since 2015 |

| | | |

| | | |

| CSX Committees Audit (Chair)/Executive/Finance Career Highlights nServed as Chief Executive Officer and a director of the Federal Home Loan Mortgage Corporation from 2008 until his retirement in 2009. nServed as a Senior Advisor with The Carlyle Group, one of the world’s largest and most diversified global investment firms, from 2007 to 2008. nServed as Vice Chairman and Chief Financial Officer of U.S. Bancorp from 2001 to 2007, after its merger with Firststar Corporation. nServed as Vice Chairman and Chief Financial Officer of Firststar Corporation from 1998 to 2001. nServed as Chief Financial Officer of StarBanc Corporation, a predecessor to Firststar Corporation, from 1993 to 1998. Other Leadership Experience Mr. Moffett serves as a trustee on the Board of Columbia Fund Series Trust I and Columbia Funds Variable Insurance Trust, overseeing approximately 52 funds within the Columbia Funds mutual fund complex. He also serves as a trustee for the University of Oklahoma Foundation and has served as a consultant to Bridgewater and Associates.

| Key Skills and Qualifications nCorporate Governance Substantial leadership experience as an executive and vice chair of major financial institutions and as a trustee in connection with Columbia Funds and the University of Oklahoma Foundation. nFinance/Capital Allocation Served for many years as a Chief Financial Officer in the banking industry, during which he was responsible for financial and asset management. nAccounting/Financial Reporting Extensive expertise in corporate accounting and reporting and overseeing financial statements through decades of leading financial institutions. nRisk/Crisis Management Served in senior management roles in the risk-intensive and highly regulated banking industry for more than 30 years and on audit committees of public company boards, including as the chair of the audit committee of PayPal. Other Current Public Company Directorships nPayPal Holdings, Inc. |

| | | |

| | | | | | | | | | | |

| | | |

| | Linda H. Riefler, 62 Independent Director Nominee Director since 2017 |

| | | |

| | | |