00015842070000025598FALSEFALSE20192019FYFY—--12-31--12-31P12MP3YP1YP1YP3YP1YP3Y0001584207omf:SpringleafFinanceCorporationMember2019-01-012019-12-3100015842072019-01-012019-12-31iso4217:USD00015842072019-06-28xbrli:shares00015842072020-01-310001584207omf:SpringleafFinanceCorporationMember2020-01-310001584207omf:SpringleafFinanceCorporationMember2019-06-280001584207us-gaap:ConsumerLoanMember2019-12-3100015842072019-12-3100015842072018-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-310001584207us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-31iso4217:USDxbrli:shares00015842072018-01-012018-12-3100015842072017-01-012017-12-310001584207us-gaap:CommonStockMember2018-12-310001584207us-gaap:AdditionalPaidInCapitalMember2018-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001584207us-gaap:RetainedEarningsMember2018-12-310001584207us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001584207us-gaap:RetainedEarningsMember2019-01-012019-12-310001584207us-gaap:CommonStockMember2019-12-310001584207us-gaap:AdditionalPaidInCapitalMember2019-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001584207us-gaap:RetainedEarningsMember2019-12-310001584207us-gaap:CommonStockMember2017-12-310001584207us-gaap:AdditionalPaidInCapitalMember2017-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001584207us-gaap:RetainedEarningsMember2017-12-3100015842072017-12-310001584207us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001584207us-gaap:RetainedEarningsMember2018-01-012018-12-310001584207us-gaap:CommonStockMember2016-12-310001584207us-gaap:AdditionalPaidInCapitalMember2016-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMember2016-12-310001584207us-gaap:RetainedEarningsMember2016-12-3100015842072016-12-310001584207us-gaap:AdditionalPaidInCapitalMember2017-01-012017-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-01-012017-12-310001584207us-gaap:RetainedEarningsMember2017-01-012017-12-3100015842072019-10-012019-12-3100015842072019-04-012019-06-3000015842072019-01-012019-03-3100015842072019-07-012019-09-300001584207omf:SpringleafFinanceCorporationMember2019-12-310001584207omf:SpringleafFinanceCorporationMember2018-12-310001584207us-gaap:ConsumerLoanMemberomf:SpringleafFinanceCorporationMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207us-gaap:ConsumerLoanMemberomf:SpringleafFinanceCorporationMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-310001584207omf:SpringleafFinanceCorporationMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207omf:SpringleafFinanceCorporationMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-310001584207omf:SpringleafFinanceCorporationMember2018-01-012018-12-310001584207omf:SpringleafFinanceCorporationMember2017-01-012017-12-310001584207us-gaap:CommonStockMemberomf:SpringleafFinanceCorporationMember2018-12-310001584207us-gaap:AdditionalPaidInCapitalMemberomf:SpringleafFinanceCorporationMember2018-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMemberomf:SpringleafFinanceCorporationMember2018-12-310001584207us-gaap:RetainedEarningsMemberomf:SpringleafFinanceCorporationMember2018-12-310001584207us-gaap:AdditionalPaidInCapitalMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207omf:SpringleafConsumerLoanHoldingCompanyMemberus-gaap:AdditionalPaidInCapitalMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207omf:SpringleafConsumerLoanHoldingCompanyMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207us-gaap:RetainedEarningsMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207us-gaap:CommonStockMemberomf:SpringleafFinanceCorporationMember2019-12-310001584207us-gaap:AdditionalPaidInCapitalMemberomf:SpringleafFinanceCorporationMember2019-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMemberomf:SpringleafFinanceCorporationMember2019-12-310001584207us-gaap:RetainedEarningsMemberomf:SpringleafFinanceCorporationMember2019-12-310001584207us-gaap:CommonStockMemberomf:SpringleafFinanceCorporationMember2017-12-310001584207us-gaap:AdditionalPaidInCapitalMemberomf:SpringleafFinanceCorporationMember2017-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMemberomf:SpringleafFinanceCorporationMember2017-12-310001584207us-gaap:RetainedEarningsMemberomf:SpringleafFinanceCorporationMember2017-12-310001584207omf:SpringleafFinanceCorporationMember2017-12-310001584207us-gaap:AdditionalPaidInCapitalMemberomf:SpringleafFinanceCorporationMember2018-01-012018-12-310001584207us-gaap:AdditionalPaidInCapitalMemberomf:SpringleafFinanceCorporationMemberomf:OneMainGeneralServicesCorporationMember2018-01-012018-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMemberomf:SpringleafFinanceCorporationMemberomf:OneMainGeneralServicesCorporationMember2018-01-012018-12-310001584207omf:SpringleafFinanceCorporationMemberomf:OneMainGeneralServicesCorporationMember2018-01-012018-12-310001584207omf:SpringleafMortgageHoldingCompanyMemberus-gaap:AdditionalPaidInCapitalMemberomf:SpringleafFinanceCorporationMember2018-01-012018-12-310001584207omf:SpringleafMortgageHoldingCompanyMemberomf:SpringleafFinanceCorporationMember2018-01-012018-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMemberomf:SpringleafFinanceCorporationMember2018-01-012018-12-310001584207us-gaap:RetainedEarningsMemberomf:SpringleafFinanceCorporationMember2018-01-012018-12-310001584207us-gaap:CommonStockMemberomf:SpringleafFinanceCorporationMember2016-12-310001584207us-gaap:AdditionalPaidInCapitalMemberomf:SpringleafFinanceCorporationMember2016-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMemberomf:SpringleafFinanceCorporationMember2016-12-310001584207us-gaap:RetainedEarningsMemberomf:SpringleafFinanceCorporationMember2016-12-310001584207omf:SpringleafFinanceCorporationMember2016-12-310001584207us-gaap:AdditionalPaidInCapitalMemberomf:SpringleafFinanceCorporationMember2017-01-012017-12-310001584207us-gaap:AccumulatedOtherComprehensiveIncomeMemberomf:SpringleafFinanceCorporationMember2017-01-012017-12-310001584207us-gaap:RetainedEarningsMemberomf:SpringleafFinanceCorporationMemberomf:SpringleafFinanceManagementCorporationMember2017-01-012017-12-310001584207omf:SpringleafFinanceCorporationMemberomf:SpringleafFinanceManagementCorporationMember2017-01-012017-12-310001584207us-gaap:RetainedEarningsMemberomf:SpringleafFinanceCorporationMember2017-01-012017-12-310001584207omf:SpringleafConsumerLoanHoldingCompanyMemberomf:SpringleafFinanceCorporationMember2018-01-012018-12-310001584207omf:SpringleafConsumerLoanHoldingCompanyMemberomf:SpringleafFinanceCorporationMember2017-01-012017-12-310001584207omf:OneMainHoldingsIncMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207omf:OneMainHoldingsIncMemberomf:SpringleafFinanceCorporationMember2018-01-012018-12-310001584207omf:OneMainHoldingsIncMemberomf:SpringleafFinanceCorporationMember2017-01-012017-12-310001584207omf:SpringleafMortgageHoldingCompanyMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207omf:SpringleafMortgageHoldingCompanyMemberomf:SpringleafFinanceCorporationMember2017-01-012017-12-310001584207omf:SpringleafFinanceCorporationMemberomf:OneMainGeneralServicesCorporationMember2019-01-012019-12-310001584207omf:SpringleafFinanceCorporationMemberomf:OneMainGeneralServicesCorporationMember2017-01-012017-12-31xbrli:pure0001584207us-gaap:MajorityShareholderMember2019-12-310001584207omf:ApolloVrdeGroupMember2018-01-012018-12-310001584207omf:AffiliatesOfFortressOrAIGMember2018-01-012018-12-310001584207srt:ConsolidationEliminationsMember2019-12-310001584207srt:ConsolidationEliminationsMember2018-12-310001584207srt:ConsolidationEliminationsMember2019-01-012019-12-310001584207srt:ConsolidationEliminationsMember2018-01-012018-12-310001584207srt:ConsolidationEliminationsMember2017-01-012017-12-310001584207srt:ConsolidationEliminationsMemberomf:SpringCastlePortfolioMember2018-01-012018-12-310001584207srt:ConsolidationEliminationsMemberomf:SpringCastlePortfolioMember2017-01-012017-12-310001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMember2019-07-012019-07-010001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMember2019-07-010001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMember2019-09-230001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMember2019-09-232019-09-230001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207srt:AffiliatedEntityMember2018-12-310001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceIncMemberomf:SpringleafFinanceCorporationMember2018-12-310001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceIncMemberomf:SpringleafMortgageHoldingCompanyMember2018-12-310001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMemberomf:SpringleafMortgageHoldingCompanyMember2019-01-012019-12-310001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMemberomf:SpringleafMortgageHoldingCompanyMember2018-01-012018-12-310001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMemberomf:SpringleafMortgageHoldingCompanyMember2017-01-012017-12-310001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMember2019-01-012019-01-010001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMemberomf:IntercompanyAgreementsMemberomf:OneMainConsumerLoanIncMember2018-01-012018-06-300001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMemberomf:IntercompanyAgreementsMemberomf:OneMainConsumerLoanIncMember2018-01-012018-12-310001584207srt:AffiliatedEntityMemberomf:SpringleafFinanceCorporationMemberomf:IntercompanyAgreementsMemberomf:OneMainConsumerLoanIncMember2017-01-012017-12-310001584207omf:ServicesAgreementMemberomf:SpringleafFinanceCorporationMemberomf:OneMainGeneralServicesCorporationMembersrt:SubsidiariesMember2018-01-012018-12-310001584207omf:ServicesAgreementMemberomf:SpringleafFinanceCorporationMemberomf:OneMainGeneralServicesCorporationMembersrt:SubsidiariesMember2017-01-012017-12-31omf:payment0001584207omf:RetailSalesFinanceRetailSalesContractsservicedexternallyMembersrt:MaximumMember2019-01-012019-12-310001584207omf:RetailSalesFinanceRetailSalesContractsservicedexternallyMember2019-01-012019-12-31omf:deferment0001584207us-gaap:CreditCardReceivablesMember2019-01-012019-12-310001584207us-gaap:AccountingStandardsUpdate201613Membersrt:ScenarioForecastMember2020-01-010001584207us-gaap:RetainedEarningsMemberus-gaap:AccountingStandardsUpdate201613Membersrt:ScenarioForecastMember2020-01-010001584207us-gaap:ConsumerLoanMembersrt:MinimumMember2019-01-012019-12-310001584207us-gaap:ConsumerLoanMembersrt:MaximumMember2019-01-012019-12-310001584207us-gaap:ConsumerLoanMember2018-12-310001584207stpr:TXus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-12-310001584207stpr:TXus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207stpr:TXus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-12-310001584207stpr:TXus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberstpr:NCus-gaap:GeographicConcentrationRiskMember2019-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberstpr:NCus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberstpr:NCus-gaap:GeographicConcentrationRiskMember2018-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberstpr:NCus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMemberstpr:CA2019-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMemberstpr:CA2019-01-012019-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMemberstpr:CA2018-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMemberstpr:CA2018-01-012018-12-310001584207stpr:PAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-12-310001584207stpr:PAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207stpr:PAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-12-310001584207stpr:PAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberstpr:FLus-gaap:GeographicConcentrationRiskMember2019-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberstpr:FLus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberstpr:FLus-gaap:GeographicConcentrationRiskMember2018-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberstpr:FLus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207stpr:OHus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-12-310001584207stpr:OHus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207stpr:OHus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-12-310001584207stpr:OHus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207stpr:ILus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-12-310001584207stpr:ILus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207stpr:ILus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-12-310001584207stpr:ILus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207stpr:GAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-12-310001584207stpr:GAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207stpr:GAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-12-310001584207stpr:GAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207stpr:INus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-12-310001584207stpr:INus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207stpr:INus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-12-310001584207stpr:INus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207stpr:VAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-12-310001584207stpr:VAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207stpr:VAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-12-310001584207stpr:VAus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207stpr:TNus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-12-310001584207stpr:TNus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207stpr:TNus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-12-310001584207stpr:TNus-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberomf:OtherStatesNotDisclosedDomainus-gaap:GeographicConcentrationRiskMember2019-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberomf:OtherStatesNotDisclosedDomainus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberomf:OtherStatesNotDisclosedDomainus-gaap:GeographicConcentrationRiskMember2018-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberomf:OtherStatesNotDisclosedDomainus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-12-310001584207us-gaap:LoansAndFinanceReceivablesMemberus-gaap:GeographicConcentrationRiskMember2018-01-012018-12-310001584207us-gaap:UnlikelyToBeCollectedFinancingReceivableMember2019-12-310001584207us-gaap:NonperformingFinancingReceivableMember2019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:FinancingReceivables1To29DaysPastDueMember2019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:FinancingReceivables1To29DaysPastDueMember2018-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2018-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2018-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PerformingFinancingReceivableMember2019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PerformingFinancingReceivableMember2018-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:NonperformingFinancingReceivableMemberomf:FinancingReceivables90To179DaysPastDueMember2019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:NonperformingFinancingReceivableMemberomf:FinancingReceivables90To179DaysPastDueMember2018-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:NonperformingFinancingReceivableMemberomf:FinancingReceivablesEqualToGreaterThan180DaysPastDueMember2019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:NonperformingFinancingReceivableMemberomf:FinancingReceivablesEqualToGreaterThan180DaysPastDueMember2018-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:NonperformingFinancingReceivableMember2019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:NonperformingFinancingReceivableMember2018-12-310001584207us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2019-12-310001584207us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2018-12-310001584207us-gaap:ConsumerLoanMember2017-12-310001584207us-gaap:ConsumerLoanMember2016-12-310001584207us-gaap:ConsumerLoanMember2019-01-012019-12-310001584207us-gaap:ConsumerLoanMember2018-01-012018-12-310001584207us-gaap:ConsumerLoanMember2017-01-012017-12-310001584207us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2017-12-310001584207us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2016-12-310001584207us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2019-01-012019-12-310001584207us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2018-01-012018-12-310001584207us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2017-01-012017-12-310001584207omf:OtherReceivablesMember2019-01-012019-12-310001584207omf:OtherReceivablesMember2018-01-012018-12-310001584207omf:OtherReceivablesMember2017-01-012017-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:ContractualInterestRateReductionMember2019-01-012019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:ContractualInterestRateReductionMember2018-01-012018-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:ContractualInterestRateReductionMember2017-01-012017-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PrincipalForgivenessMember2019-01-012019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PrincipalForgivenessMember2018-01-012018-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:PrincipalForgivenessMember2017-01-012017-12-31omf:account0001584207omf:OtherReceivablesMemberus-gaap:ContractualInterestRateReductionMember2019-01-012019-12-310001584207omf:OtherReceivablesMemberus-gaap:ContractualInterestRateReductionMember2018-01-012018-12-310001584207omf:OtherReceivablesMemberus-gaap:ContractualInterestRateReductionMember2017-01-012017-12-310001584207omf:OtherReceivablesMemberus-gaap:PrincipalForgivenessMember2019-01-012019-12-310001584207omf:OtherReceivablesMemberus-gaap:PrincipalForgivenessMember2018-01-012018-12-310001584207omf:OtherReceivablesMemberus-gaap:PrincipalForgivenessMember2017-01-012017-12-310001584207omf:OtherReceivablesMember2018-12-310001584207omf:OtherReceivablesMember2019-12-310001584207omf:OtherReceivablesMember2017-12-310001584207omf:OtherReceivablesMember2016-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:FinancialAssetAcquiredWithCreditDeteriorationMember2019-12-310001584207us-gaap:ConsumerLoanMemberus-gaap:FinancialAssetAcquiredWithCreditDeteriorationMember2018-12-310001584207omf:February2019RealEstateLoanSaleMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2019-02-280001584207omf:February2019RealEstateLoanSaleMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2019-02-012019-02-280001584207omf:December2018RealEstateLoanSaleMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2018-12-310001584207omf:December2018RealEstateLoanSaleMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2019-02-012019-02-280001584207omf:RemainingRealEstateLoansHeldForSaleMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2018-01-012018-12-310001584207us-gaap:USTreasuryAndGovernmentMember2019-12-310001584207us-gaap:USStatesAndPoliticalSubdivisionsMember2019-12-310001584207us-gaap:CommercialPaperMember2019-12-310001584207us-gaap:ForeignGovernmentDebtSecuritiesMember2019-12-310001584207us-gaap:CorporateDebtSecuritiesMember2019-12-310001584207us-gaap:ResidentialMortgageBackedSecuritiesMember2019-12-310001584207us-gaap:CommercialMortgageBackedSecuritiesMember2019-12-310001584207us-gaap:CollateralizedDebtObligationsMember2019-12-310001584207us-gaap:USTreasuryAndGovernmentMember2018-12-310001584207us-gaap:USStatesAndPoliticalSubdivisionsMember2018-12-310001584207omf:CertificatesofDepositandCommercialPaperMember2018-12-310001584207us-gaap:ForeignGovernmentDebtSecuritiesMember2018-12-310001584207us-gaap:CorporateDebtSecuritiesMember2018-12-310001584207us-gaap:ResidentialMortgageBackedSecuritiesMember2018-12-310001584207us-gaap:CommercialMortgageBackedSecuritiesMember2018-12-310001584207us-gaap:CollateralizedDebtObligationsMember2018-12-31omf:investment0001584207us-gaap:AssetBackedSecuritiesMember2019-12-310001584207us-gaap:AssetBackedSecuritiesMember2018-12-310001584207us-gaap:PreferredStockMember2019-12-310001584207us-gaap:PreferredStockMember2018-12-310001584207us-gaap:CommonStockMember2019-12-310001584207us-gaap:CommonStockMember2018-12-310001584207us-gaap:CustomerRelationshipsMember2019-12-310001584207us-gaap:TradeNamesMember2019-12-310001584207us-gaap:IntangibleAssetsArisingFromInsuranceContractsAcquiredInBusinessCombinationMember2019-12-310001584207us-gaap:LicensingAgreementsMember2019-12-310001584207us-gaap:OtherIntangibleAssetsMember2019-12-310001584207us-gaap:CustomerRelationshipsMember2018-12-310001584207us-gaap:TradeNamesMember2018-12-310001584207us-gaap:IntangibleAssetsArisingFromInsuranceContractsAcquiredInBusinessCombinationMember2018-12-310001584207us-gaap:LicensingAgreementsMember2018-12-310001584207us-gaap:OtherIntangibleAssetsMember2018-12-310001584207us-gaap:IntangibleAssetsArisingFromInsuranceContractsAcquiredInBusinessCombinationMember2019-01-012019-12-310001584207us-gaap:LicensingAgreementsMember2018-01-012018-12-310001584207us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2019-12-310001584207us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001584207us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2018-12-310001584207us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2018-12-310001584207us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:JuniorSubordinatedDebtMember2019-12-310001584207us-gaap:JuniorSubordinatedDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001584207us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:JuniorSubordinatedDebtMember2018-12-310001584207us-gaap:JuniorSubordinatedDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2018-12-310001584207us-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310001584207us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001584207us-gaap:CarryingReportedAmountFairValueDisclosureMember2018-12-310001584207us-gaap:EstimateOfFairValueFairValueDisclosureMember2018-12-310001584207us-gaap:SeniorNotesMember2019-01-012019-12-310001584207us-gaap:SeniorNotesMember2018-01-012018-12-310001584207us-gaap:SeniorNotesMember2017-01-012017-12-310001584207us-gaap:SeniorNotesMember2019-12-310001584207us-gaap:SeniorNotesMember2018-12-310001584207us-gaap:JuniorSubordinatedDebtMember2019-01-012019-12-310001584207us-gaap:JuniorSubordinatedDebtMember2018-01-012018-12-310001584207us-gaap:JuniorSubordinatedDebtMember2017-01-012017-12-310001584207us-gaap:JuniorSubordinatedDebtMember2019-12-310001584207us-gaap:JuniorSubordinatedDebtMember2018-12-310001584207us-gaap:SeniorNotesMemberomf:SecuritizationMembersrt:MinimumMember2019-12-310001584207us-gaap:SeniorNotesMembersrt:MaximumMemberomf:SecuritizationMember2019-12-310001584207us-gaap:MediumTermNotesMemberus-gaap:SeniorNotesMembersrt:MinimumMember2019-12-310001584207us-gaap:MediumTermNotesMemberus-gaap:SeniorNotesMembersrt:MaximumMember2019-12-310001584207us-gaap:JuniorSubordinatedDebtMemberomf:SpringleafFinanceCorporationMember2019-12-310001584207us-gaap:SeniorNotesMemberomf:SecuritizationMember2019-12-310001584207us-gaap:MediumTermNotesMemberus-gaap:SeniorNotesMember2019-12-310001584207us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:JuniorSubordinatedDebtMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207us-gaap:SeniorNotesMemberomf:SeniorNotes6.125PercentDue2024Memberomf:SpringleafFinanceCorporationMember2019-02-220001584207us-gaap:SeniorNotesMemberomf:SeniorNotes6.125PercentDue2024Memberomf:SpringleafFinanceCorporationMember2019-07-020001584207omf:SeniorNotes5.25PercentDue2019Memberus-gaap:SeniorNotesMemberomf:SpringleafFinanceCorporationMember2019-03-250001584207omf:SeniorNotes5.25PercentDue2019Memberus-gaap:SeniorNotesMemberomf:SpringleafFinanceCorporationMember2019-03-252019-03-250001584207omf:SeniorNotes5.25PercentDue2019Memberus-gaap:SeniorNotesMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207us-gaap:SeniorNotesMemberomf:SeniorNotes6.00PercentDue2020Memberomf:SpringleafFinanceCorporationMember2019-03-150001584207us-gaap:SeniorNotesMemberomf:SeniorNotes6.00PercentDue2020Memberomf:SpringleafFinanceCorporationMember2019-04-152019-04-150001584207us-gaap:SeniorNotesMemberomf:SeniorNotes6.00PercentDue2020Memberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207us-gaap:SeniorNotesMemberomf:SeniorNotes6.625PercentDue2028Memberomf:SpringleafFinanceCorporationMember2019-05-090001584207omf:SeniorNotes5375PercentDue2029Memberus-gaap:SeniorNotesMemberomf:SpringleafFinanceCorporationMember2019-11-070001584207omf:OneMainFinancialHoldingsLLCMemberus-gaap:SeniorNotesMemberomf:OMFHNotes2019Member2018-12-31omf:redemption0001584207omf:OneMainFinancialHoldingsLLCMember2018-01-012018-12-310001584207omf:OneMainFinancialHoldingsLLCMemberus-gaap:SeniorNotesMemberomf:OMFHNotes2021Member2018-12-310001584207omf:OneMainFinancialHoldingsLLCMemberus-gaap:SeniorNotesMemberomf:OMFHNotes2019Member2018-01-012018-12-310001584207omf:OneMainFinancialHoldingsLLCMemberus-gaap:SeniorNotesMemberomf:OMFHNotes2021Member2018-01-012018-12-310001584207omf:OneMainFinancialHoldingsLLCMemberus-gaap:SeniorNotesMember2018-01-012018-12-310001584207us-gaap:JuniorSubordinatedDebtMemberomf:SpringleafFinanceCorporationMember2007-01-310001584207us-gaap:JuniorSubordinatedDebtMemberomf:SpringleafFinanceCorporationMember2007-01-012007-01-310001584207us-gaap:CashAndCashEquivalentsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207us-gaap:CashAndCashEquivalentsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-310001584207us-gaap:ConsumerLoanMemberomf:LoansandLeasesReceivableNetofDeferredIncomeMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207us-gaap:ConsumerLoanMemberomf:LoansandLeasesReceivableNetofDeferredIncomeMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-310001584207omf:AllowanceForFinanceReceivableLossesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207omf:AllowanceForFinanceReceivableLossesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-310001584207omf:RestrictedCashandCashEquivalentsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207omf:RestrictedCashandCashEquivalentsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-310001584207us-gaap:OtherAssetsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207us-gaap:OtherAssetsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-310001584207us-gaap:LongTermDebtMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207us-gaap:LongTermDebtMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-310001584207us-gaap:OtherLiabilitiesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-310001584207us-gaap:OtherLiabilitiesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-12-310001584207us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-01-012019-12-310001584207us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2018-01-012018-12-310001584207us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2017-01-012017-12-310001584207srt:MinimumMember2019-01-012019-12-310001584207srt:MaximumMember2019-01-012019-12-31omf:facility0001584207us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMembersrt:MinimumMember2019-01-012019-12-310001584207us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMembersrt:MaximumMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-01-012019-12-310001584207us-gaap:OtherOperatingIncomeExpenseMember2019-10-012019-12-310001584207omf:OneMainHoldingsIncMember2018-04-012018-06-300001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberomf:PayabletoOMHMember2019-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberomf:PayabletoOMHMember2018-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberomf:ThirdPartyBeneficiariesMember2019-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberomf:ThirdPartyBeneficiariesMember2018-12-310001584207omf:NonFinancialGuaranteeInsuranceSegmentMember2019-12-310001584207omf:NonFinancialGuaranteeInsuranceSegmentMember2018-12-310001584207omf:NonAffiliatedEntityMember2019-12-310001584207omf:NonAffiliatedEntityMember2018-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2015-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2016-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2017-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2018-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2015Member2019-12-31omf:claim0001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2016-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2017-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2018-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortdurationInsuranceContractsAccidentYear2016Member2019-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2017-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2018-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortDurationInsuranceContractsAccidentYear2017Member2019-12-310001584207us-gaap:ShortDurationInsuranceContractsAccidentYear2018Memberus-gaap:FinancialGuaranteeInsuranceSegmentMember2018-12-310001584207us-gaap:ShortDurationInsuranceContractsAccidentYear2018Memberus-gaap:FinancialGuaranteeInsuranceSegmentMember2019-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2019-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMember2019-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMember2018-12-310001584207us-gaap:FinancialGuaranteeInsuranceSegmentMember2017-12-310001584207us-gaap:OtherShortdurationInsuranceProductLineMember2019-12-310001584207us-gaap:OtherShortdurationInsuranceProductLineMember2018-12-310001584207us-gaap:OtherShortdurationInsuranceProductLineMember2017-12-310001584207omf:YosemiteInsuranceCompanyMemberus-gaap:PropertyLiabilityAndCasualtyInsuranceSegmentMember2019-01-012019-12-310001584207omf:YosemiteInsuranceCompanyMemberus-gaap:PropertyLiabilityAndCasualtyInsuranceSegmentMember2018-01-012018-12-310001584207omf:YosemiteInsuranceCompanyMemberus-gaap:PropertyLiabilityAndCasualtyInsuranceSegmentMember2017-01-012017-12-310001584207us-gaap:PropertyLiabilityAndCasualtyInsuranceSegmentMemberomf:TritonInsuranceCompanyMember2019-01-012019-12-310001584207us-gaap:PropertyLiabilityAndCasualtyInsuranceSegmentMemberomf:TritonInsuranceCompanyMember2018-01-012018-12-310001584207us-gaap:PropertyLiabilityAndCasualtyInsuranceSegmentMemberomf:TritonInsuranceCompanyMember2017-01-012017-12-310001584207omf:MeritLifeInsuranceCoMemberomf:LifeAndAccidentAndHealthInsuranceSegmentMember2019-01-012019-12-310001584207omf:MeritLifeInsuranceCoMemberomf:LifeAndAccidentAndHealthInsuranceSegmentMember2018-01-012018-12-310001584207omf:MeritLifeInsuranceCoMemberomf:LifeAndAccidentAndHealthInsuranceSegmentMember2017-01-012017-12-310001584207omf:AmericanHealthandLifeInsuranceCompanyMemberomf:LifeAndAccidentAndHealthInsuranceSegmentMember2019-01-012019-12-310001584207omf:AmericanHealthandLifeInsuranceCompanyMemberomf:LifeAndAccidentAndHealthInsuranceSegmentMember2018-01-012018-12-310001584207omf:AmericanHealthandLifeInsuranceCompanyMemberomf:LifeAndAccidentAndHealthInsuranceSegmentMember2017-01-012017-12-310001584207us-gaap:PropertyLiabilityAndCasualtyInsuranceSegmentMemberomf:TritonInsuranceCompanyMember2019-12-310001584207us-gaap:PropertyLiabilityAndCasualtyInsuranceSegmentMemberomf:TritonInsuranceCompanyMember2018-12-310001584207omf:MeritLifeInsuranceCoMemberomf:LifeAndAccidentAndHealthInsuranceSegmentMember2019-12-310001584207omf:MeritLifeInsuranceCoMemberomf:LifeAndAccidentAndHealthInsuranceSegmentMember2018-12-310001584207omf:AmericanHealthandLifeInsuranceCompanyMemberomf:LifeAndAccidentAndHealthInsuranceSegmentMember2019-12-310001584207omf:AmericanHealthandLifeInsuranceCompanyMemberomf:LifeAndAccidentAndHealthInsuranceSegmentMember2018-12-310001584207omf:OneMainInsuranceSubsidiariesMember2019-01-012019-12-310001584207omf:OneMainInsuranceSubsidiariesMember2019-12-310001584207omf:OneMainHoldingsIncMemberomf:AmericanHealthandLifeInsuranceCompanyMember2018-01-012018-12-310001584207omf:MeritLifeInsuranceCoMemberomf:SpringleafFinanceCorporationMember2018-01-012018-12-310001584207omf:OneMainHoldingsIncMemberomf:AmericanHealthandLifeInsuranceCompanyMember2017-01-012017-12-310001584207omf:OneMainHoldingsIncMemberomf:AmericanHealthandLifeInsuranceCompanyMember2019-01-012019-12-310001584207omf:OneMainHoldingsIncMemberomf:TritonInsuranceCompanyMember2019-01-012019-12-310001584207omf:OneMainHoldingsIncMemberomf:TritonInsuranceCompanyMember2018-01-012018-12-310001584207omf:OneMainHoldingsIncMemberomf:TritonInsuranceCompanyMember2017-01-012017-12-310001584207omf:MeritLifeInsuranceCoMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207omf:MeritLifeInsuranceCoMemberomf:SpringleafFinanceCorporationMember2017-01-012017-12-310001584207omf:YosemiteInsuranceCompanyMemberomf:SpringleafFinanceCorporationMember2019-01-012019-12-310001584207omf:YosemiteInsuranceCompanyMemberomf:SpringleafFinanceCorporationMember2018-01-012018-12-310001584207omf:YosemiteInsuranceCompanyMemberomf:SpringleafFinanceCorporationMember2017-01-012017-12-31omf:class0001584207omf:OneMainHoldingsIncMember2019-12-310001584207us-gaap:PerformanceSharesMember2019-01-012019-12-310001584207us-gaap:PerformanceSharesMember2018-01-012018-12-310001584207us-gaap:PerformanceSharesMember2017-01-012017-12-310001584207us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001584207us-gaap:RestrictedStockUnitsRSUMember2018-01-012018-12-310001584207us-gaap:RestrictedStockUnitsRSUMember2017-01-012017-12-310001584207us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-12-310001584207us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310001584207us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310001584207us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-01-012019-12-310001584207us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310001584207us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310001584207us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-12-310001584207us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001584207us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001584207us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2017-12-310001584207us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-12-310001584207us-gaap:AccumulatedTranslationAdjustmentMember2017-12-310001584207us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-01-012018-12-310001584207us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-01-012018-12-310001584207us-gaap:AccumulatedTranslationAdjustmentMember2018-01-012018-12-310001584207us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2016-12-310001584207us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2016-12-310001584207us-gaap:AccumulatedTranslationAdjustmentMember2016-12-310001584207us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2017-01-012017-12-310001584207us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-01-012017-12-310001584207us-gaap:AccumulatedTranslationAdjustmentMember2017-01-012017-12-310001584207us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-01-012019-12-310001584207us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-01-012018-12-310001584207us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2017-01-012017-12-310001584207us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310001584207us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-01-012018-12-310001584207us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-01-012017-12-310001584207us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001584207us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001584207us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2017-01-012017-12-310001584207us-gaap:StateAndLocalJurisdictionMember2019-12-310001584207us-gaap:StateAndLocalJurisdictionMember2018-12-310001584207omf:StateDeferredTaxAssetsMember2019-01-012019-12-310001584207srt:MinimumMember2019-12-310001584207srt:MaximumMember2019-12-310001584207country:US2019-01-012019-12-310001584207country:US2018-01-012018-12-310001584207country:US2017-01-012017-12-310001584207us-gaap:PensionPlansDefinedBenefitMembercountry:US2019-01-012019-12-310001584207us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001584207us-gaap:PensionPlansDefinedBenefitMember2018-12-310001584207us-gaap:PensionPlansDefinedBenefitMember2017-12-310001584207us-gaap:PensionPlansDefinedBenefitMember2016-12-310001584207us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001584207us-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001584207us-gaap:PensionPlansDefinedBenefitMember2017-01-012017-12-310001584207us-gaap:PensionPlansDefinedBenefitMember2019-12-310001584207us-gaap:UnfundedPlanMemberus-gaap:NonqualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001584207us-gaap:UnfundedPlanMemberus-gaap:NonqualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001584207us-gaap:UnfundedPlanMemberus-gaap:NonqualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2017-12-310001584207us-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001584207us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2019-12-310001584207us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2019-12-310001584207us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2019-12-310001584207us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2019-12-310001584207us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2019-12-310001584207us-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2019-12-310001584207us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2019-12-310001584207us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2019-12-310001584207us-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberomf:InvestmentGradeSecuritiesMember2019-12-310001584207omf:InvestmentGradeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207omf:InvestmentGradeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:FairValueInputsLevel12And3Memberomf:InvestmentGradeSecuritiesMember2019-12-310001584207omf:HighYieldSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310001584207omf:HighYieldSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207omf:HighYieldSecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:FairValueInputsLevel12And3Memberomf:HighYieldSecuritiesMember2019-12-310001584207us-gaap:FairValueInputsLevel1Member2019-12-310001584207us-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:FairValueInputsLevel12And3Member2019-12-310001584207us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2018-12-310001584207us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2018-12-310001584207us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2018-12-310001584207us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2018-12-310001584207us-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2018-12-310001584207us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2018-12-310001584207us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2018-12-310001584207us-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberomf:InvestmentGradeSecuritiesMember2018-12-310001584207omf:InvestmentGradeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207omf:InvestmentGradeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:FairValueInputsLevel12And3Memberomf:InvestmentGradeSecuritiesMember2018-12-310001584207omf:HighYieldSecuritiesMemberus-gaap:FairValueInputsLevel1Member2018-12-310001584207omf:HighYieldSecuritiesMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207omf:HighYieldSecuritiesMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:FairValueInputsLevel12And3Memberomf:HighYieldSecuritiesMember2018-12-310001584207us-gaap:FairValueInputsLevel1Member2018-12-310001584207us-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:FairValueInputsLevel12And3Member2018-12-310001584207omf:NonEmployeeDirectorsMember2016-05-252016-05-25omf:numberOfEmployees0001584207us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2019-01-012019-12-310001584207srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001584207us-gaap:RestrictedStockMember2019-12-310001584207omf:ServiceBasedAwardsMember2019-01-012019-12-310001584207omf:ServiceBasedAwardsMember2018-01-012018-12-310001584207omf:ServiceBasedAwardsMember2017-01-012017-12-310001584207omf:ServiceBasedAwardsMember2018-12-310001584207omf:ServiceBasedAwardsMember2019-12-310001584207us-gaap:PerformanceSharesMembersrt:MinimumMember2019-01-012019-12-310001584207srt:MaximumMemberus-gaap:PerformanceSharesMember2019-01-012019-12-310001584207us-gaap:PerformanceSharesMember2019-01-012019-12-310001584207us-gaap:PerformanceSharesMember2017-01-012017-12-310001584207us-gaap:PerformanceSharesMember2018-01-012018-12-310001584207us-gaap:PerformanceSharesMember2018-12-310001584207us-gaap:PerformanceSharesMember2019-12-310001584207omf:IncentiveUnitsMember2017-01-012017-12-310001584207omf:IncentiveUnitsMember2019-01-012019-12-310001584207us-gaap:OperatingSegmentsMemberomf:ConsumerAndInsuranceSegmentMember2019-01-012019-12-310001584207us-gaap:CorporateNonSegmentMember2019-01-012019-12-310001584207us-gaap:MaterialReconcilingItemsMember2019-01-012019-12-310001584207us-gaap:OperatingSegmentsMemberomf:ConsumerAndInsuranceSegmentMember2019-12-310001584207us-gaap:CorporateNonSegmentMember2019-12-310001584207us-gaap:MaterialReconcilingItemsMember2019-12-310001584207us-gaap:OperatingSegmentsMemberomf:ConsumerAndInsuranceSegmentMember2018-01-012018-12-310001584207us-gaap:CorporateNonSegmentMember2018-01-012018-12-310001584207us-gaap:MaterialReconcilingItemsMember2018-01-012018-12-310001584207us-gaap:OperatingSegmentsMemberomf:ConsumerAndInsuranceSegmentMember2018-12-310001584207us-gaap:CorporateNonSegmentMember2018-12-310001584207us-gaap:MaterialReconcilingItemsMember2018-12-310001584207us-gaap:OperatingSegmentsMemberomf:ConsumerAndInsuranceSegmentMember2017-01-012017-12-310001584207us-gaap:CorporateNonSegmentMember2017-01-012017-12-310001584207us-gaap:MaterialReconcilingItemsMember2017-01-012017-12-310001584207us-gaap:OperatingSegmentsMemberomf:ConsumerAndInsuranceSegmentMember2017-12-310001584207us-gaap:CorporateNonSegmentMember2017-12-310001584207us-gaap:MaterialReconcilingItemsMember2017-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2019-12-310001584207omf:CertificatesofDepositandCommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207omf:CertificatesofDepositandCommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207omf:CertificatesofDepositandCommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207omf:CertificatesofDepositandCommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207omf:NonUSgovernmentandgovernmentsponsoredentitiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207omf:NonUSgovernmentandgovernmentsponsoredentitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207omf:NonUSgovernmentandgovernmentsponsoredentitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207omf:NonUSgovernmentandgovernmentsponsoredentitiesMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CommercialMortgageBackedSecuritiesMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedDebtObligationsMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedDebtObligationsMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedDebtObligationsMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:CollateralizedDebtObligationsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207us-gaap:BondsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207us-gaap:BondsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:BondsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:BondsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PreferredStockMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PreferredStockMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PreferredStockMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PreferredStockMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommonStockMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommonStockMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommonStockMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:CommonStockMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel3Member2019-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2018-12-310001584207omf:CertificatesofDepositandCommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207omf:CertificatesofDepositandCommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207omf:CertificatesofDepositandCommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207omf:CertificatesofDepositandCommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207omf:NonUSgovernmentandgovernmentsponsoredentitiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207omf:NonUSgovernmentandgovernmentsponsoredentitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207omf:NonUSgovernmentandgovernmentsponsoredentitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207omf:NonUSgovernmentandgovernmentsponsoredentitiesMemberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CommercialMortgageBackedSecuritiesMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedDebtObligationsMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedDebtObligationsMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedDebtObligationsMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:CollateralizedDebtObligationsMemberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207us-gaap:BondsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207us-gaap:BondsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:BondsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:BondsMemberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PreferredStockMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PreferredStockMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PreferredStockMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PreferredStockMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommonStockMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommonStockMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommonStockMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:CommonStockMemberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel3Member2018-12-310001584207us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2018-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-12-310001584207us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-12-310001584207us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-12-310001584207us-gaap:FairValueMeasurementsNonrecurringMember2019-12-310001584207us-gaap:FairValueMeasurementsNonrecurringMember2019-01-012019-12-310001584207us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2018-12-310001584207us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2018-12-310001584207us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2018-12-310001584207us-gaap:FairValueMeasurementsNonrecurringMember2018-12-310001584207us-gaap:FairValueMeasurementsNonrecurringMember2018-10-012018-12-310001584207us-gaap:MeasurementInputDiscountRateMembersrt:MinimumMember2019-12-310001584207srt:MaximumMemberus-gaap:MeasurementInputDiscountRateMember2019-12-310001584207srt:WeightedAverageMemberus-gaap:MeasurementInputDiscountRateMember2019-12-310001584207us-gaap:MeasurementInputDiscountRateMembersrt:MinimumMember2018-12-310001584207srt:MaximumMemberus-gaap:MeasurementInputDiscountRateMember2018-12-310001584207srt:WeightedAverageMemberus-gaap:MeasurementInputDiscountRateMember2018-12-310001584207us-gaap:MeasurementInputDefaultRateMembersrt:MinimumMember2019-12-310001584207srt:MaximumMemberus-gaap:MeasurementInputDefaultRateMember2019-12-310001584207srt:WeightedAverageMemberus-gaap:MeasurementInputDefaultRateMember2019-12-310001584207us-gaap:MeasurementInputDefaultRateMembersrt:MinimumMember2018-12-310001584207srt:MaximumMemberus-gaap:MeasurementInputDefaultRateMember2018-12-310001584207srt:WeightedAverageMemberus-gaap:MeasurementInputDefaultRateMember2018-12-3100015842072018-10-012018-12-3100015842072018-07-012018-09-3000015842072018-04-012018-06-3000015842072018-01-012018-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the fiscal year ended December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from to

Commission file number

001-36129 (OneMain Holdings, Inc.)

001-06155 (Springleaf Finance Corporation)

ONEMAIN HOLDINGS, INC.

SPRINGLEAF FINANCE CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware (OneMain Holdings, Inc.) | | | | 27-3379612 |

Indiana (Springleaf Finance Corporation) | | | | 35-0416090 |

| (State of incorporation) | | | | (I.R.S. Employer Identification No.) |

601 N.W. Second Street, Evansville, IN 47708

(Address of principal executive offices) (Zip code)

(812) 424-8031

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | | | | | | | |

| OneMain Holdings, Inc.: | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | OMF | | New York Stock Exchange |

| Springleaf Finance Corporation: None | | | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

OneMain Holdings, Inc. Yes ☑ No ☐

Springleaf Finance Corporation Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

OneMain Holdings, Inc. Yes ☐ No ☑

Springleaf Finance Corporation Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

OneMain Holdings, Inc. Yes ☑ No ☐

Springleaf Finance Corporation Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

OneMain Holdings, Inc. Yes ☑ No ☐

Springleaf Finance Corporation Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| OneMain Holdings, Inc.: | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

| Springleaf Finance Corporation: | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☑ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

OneMain Holdings, Inc. ☐

Springleaf Finance Corporation ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

OneMain Holdings, Inc. Yes ☐ No ☑

Springleaf Finance Corporation Yes ☐ No ☑

The aggregate market value of the voting and non-voting common equity of OneMain Holdings, Inc. held by non-affiliates as of the close of business on June 28, 2019 was $2,596,092,195. All of Springleaf Finance Corporation’s common stock is held by OneMain Holdings, Inc. The registrant is directly owned by OneMain Holdings, Inc.

At January 31, 2020, there were 136,194,462 shares of OneMain Holdings, Inc.'s common stock, $0.01 par value, outstanding.

At January 31, 2020, there were 10,160,021 shares of Springleaf Finance Corporation's common stock, $0.50 par value, outstanding.

This annual report on Form 10-K (“Annual Report”) is a combined report being filed separately by two different registrants: OneMain Holdings, Inc. and Springleaf Finance Corporation. Springleaf Finance Corporation’s equity securities are owned directly by OneMain Holdings, Inc. The information in this Annual Report on Form 10-K is equally applicable to OneMain Holdings, Inc. and Springleaf Finance Corporation, except where otherwise indicated. Springleaf Finance Corporation meets the conditions set forth in General Instructions I(1)(a) and (b) of Form 10-K and, to the extent applicable, is therefore filing this form with a reduced disclosure format.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III (Items 10, 11, 12, 13, and 14) of this Annual Report on Form 10-K is incorporated by reference from OneMain Holdings, Inc.'s Definitive Proxy Statement for its 2020 Annual Meeting to be filed with the Securities and Exchange Commission pursuant to Regulation 14A.

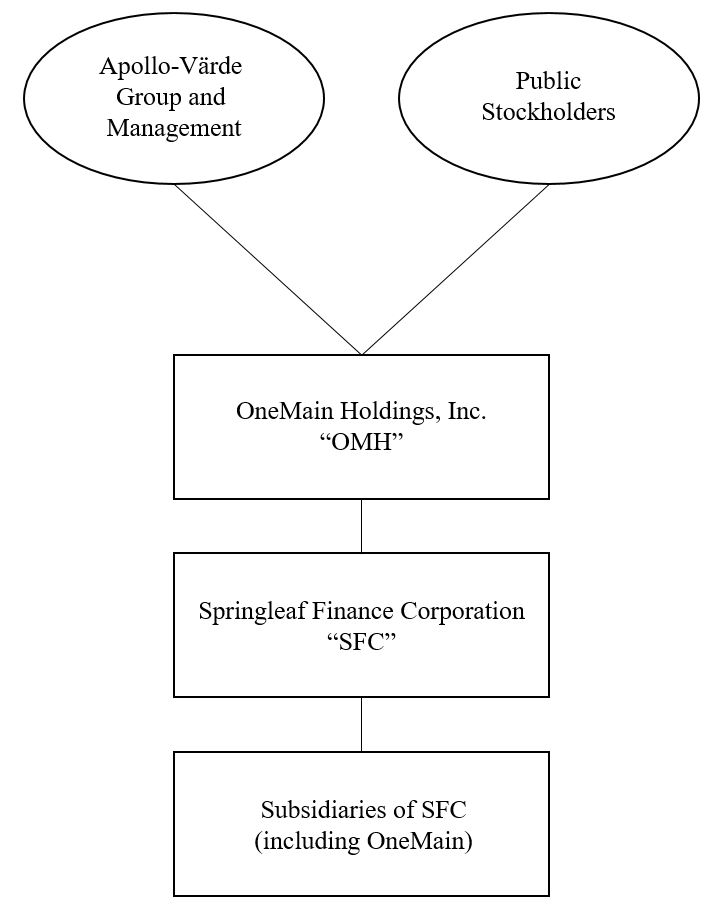

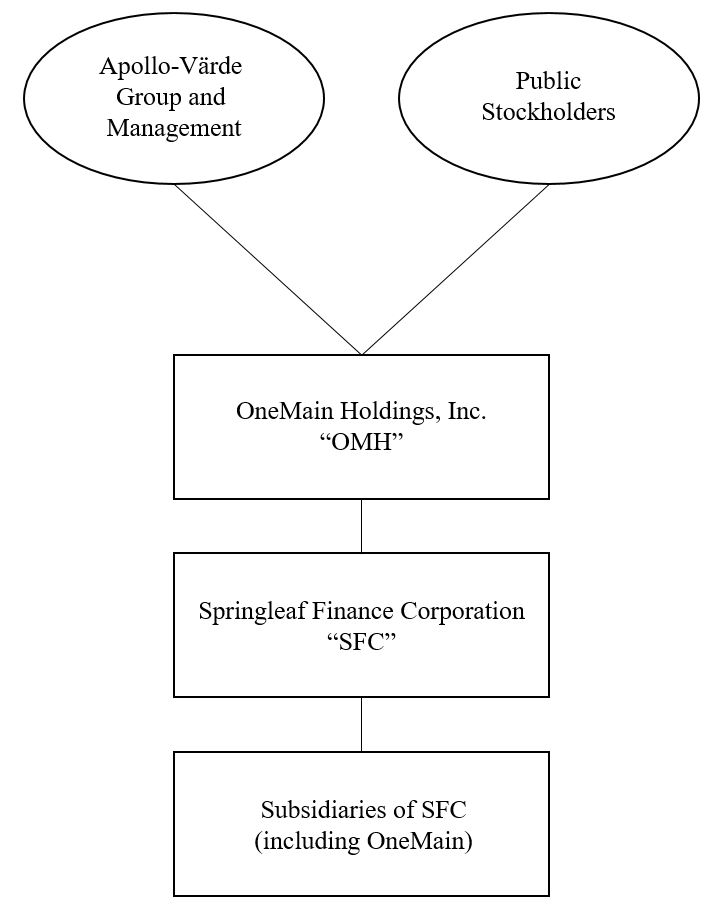

This report combines the Annual Reports on Form 10-K for the year ended December 31, 2019 for OneMain Holdings, Inc. (“OMH”), and its wholly-owned direct subsidiary, Springleaf Finance Corporation (“SFC”). The information in this Annual Report on Form 10-K is equally applicable to OMH and SFC, except where otherwise indicated.

OMH and SFC is each filing on its own behalf all the information contained in this report that relates to OMH and SFC, respectively. Each registrant is not filing any information that does not relate to its own entity and therefore makes no representation to any such information.

OMH is a financial services holding company whose subsidiaries engage in the consumer finance and insurance businesses. Prior to the completion of the merger described below, OMH’s direct subsidiary was Springleaf Finance, Inc. (“SFI”).

On September 20, 2019, SFC entered into a merger agreement with its direct parent, SFI, to merge SFI with and into SFC, with SFC as the surviving entity. The merger was effective in SFC's consolidated financial statements as of July 1, 2019. As a result of SFI's merger with and into SFC, SFC became a wholly-owned direct subsidiary of OMH.

OMH and SFC are referred to in this report, collectively with their subsidiaries, whether directly or indirectly owned, as “the Company,” “we,” “us,” or “our.”

Management operates OMH and SFC as one enterprise and believes that combining the Annual Reports on Form 10-K into a single report will result in the following benefits:

•Facilitate a better understanding by the investors of OMH and SFC by presenting the business in the same manner as management views and operates the business;

•Provide a straightforward presentation by removing duplicate disclosures as substantially all the disclosures for OMH and SFC are the same; and

•Create time and cost efficiencies through the preparation of one combined report instead of two separate reports.

There are nominal differences between OMH and SFC, and to help investors understand these differences, this report presents the following as separate notes or sections for OMH and SFC:

•Consolidated Financial Statements;

•Note 2 - Reconciliation of Springleaf Finance Corporation Results to OneMain Holdings, Inc. Results;

•Note 13 - Capital Stock and Earnings Per Share (OMH Only);

•Note 15 - Income Taxes; and

•Note 16 - Leases and Contingencies

This report also includes separate Item 9A (Controls and Procedures) and separate certifications for OMH and SFC in order to establish that the Chief Executive Officer and the Chief Financial Officer of each entity have made the requisite certifications and that OMH and SFC are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934, as amended, and 18 U.S.C. §1350.

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Financial Statements of OneMain Holdings, Inc. and Subsidiaries: | |

| | |

| | |

| | |

| | |

| | |

| Financial Statements of Springleaf Finance Corporation and Subsidiaries: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

GLOSSARY

Terms and abbreviations used in this report are defined below.

| | | | | | | | |

| Term or Abbreviation | | Definition |

| | |

| Omnibus Plan | | OneMain Holdings, Inc. Amended and Restated 2013 Omnibus Incentive Plan, effective May 25, 2016, under which equity-based awards are granted to selected management employees, non-employee directors, independent contractors, and consultants |

| | |

| 30-89 Delinquency ratio | | net finance receivables 30-89 days past due as a percentage of net finance receivables |

| 401(k) Plan | | OneMain 401(k) Plan, previously defined as the Springleaf Financial Services 401(k) Plan |

| 5.25% SFC Notes due 2019 | | $700 million of 5.25% Senior Notes due 2019 issued by SFC on December 3, 2014, guaranteed by OMH and redeemed in full on March 25, 2019 |

| 5.375% SFC Notes due 2029 | | $750 million of 5.375% Senior Notes due 2029 issued by SFC on November 7, 2019 and guaranteed by OMH |

| | |

| 6.00% SFC Notes due 2020 | | $300 million of 6.00% Senior Notes due 2020 issued by SFC on May 29, 2013, guaranteed by OMH and redeemed in full on April 15, 2019 |

| | |

| 6.125% SFC Notes due 2024 | | $1.0 billion of 6.125% Senior Notes due 2024 issued by SFC on February 22, 2019 and $300 million of 6.125% Senior Notes due 2024 issued by SFC on July 2, 2019 and, in each case, guaranteed by OMH |

| 6.625% SFC Notes due 2028 | | $800 million of 6.625% Senior Notes due 2028 issued by SFC on May 9, 2019 and guaranteed by OMH |

| | |

| | |

| | |

| A&S | | Acquisitions and Servicing |

| ABO | | accumulated benefit obligation |

| ABS | | asset-backed securities |

| Accretable yield | | the excess of the cash flows expected to be collected on the purchased credit impaired finance receivables over the discounted cash flows |

| Adjusted pretax income (loss) | | a non-GAAP financial measure used by management as a key performance measure of our segment |

| AHL | | American Health and Life Insurance Company, an insurance subsidiary of OneMain |

| AIG | | AIG Capital Corporation, a subsidiary of American International Group, Inc. |

| AIG Share Sale Transaction | | sale by SFH of 4,179,678 shares of OMH common stock pursuant to an Underwriting Agreement entered into February 21, 2018 among OMH, SFH and Morgan Stanley & Co. LLC |

| Annual Report | | this Annual Report on Form 10-K of OMH and SFC for the fiscal year ended December 31, 2019, filed with the SEC on February 14, 2020 |

| AOCI | | Accumulated other comprehensive income (loss) |

| Apollo | | Apollo Global Management, LLC and its consolidated subsidiaries |

| Apollo-Värde Group | | an investor group led by funds managed by Apollo and Värde |

| Apollo-Värde Transaction | | the purchase by the Apollo-Värde Group of 54,937,500 shares of OMH common stock from SFH pursuant to the Share Purchase Agreement for an aggregate purchase price of approximately $1.4 billion in cash on June 25, 2018 |

| ASC | | Accounting Standards Codification |

| ASU | | Accounting Standards Update |

| Average daily debt balance | | average of debt for each day in the period |

| Average net receivables | | average of monthly average net finance receivables (net finance receivables at the beginning and end of each month divided by two) in the period |

| BPS | | basis points |

| C&I | | Consumer and Insurance |

| CDO | | collateralized debt obligations |

| CEO | | chief executive officer |

| CFO | | chief financial officer |

| CFPB | | Consumer Financial Protection Bureau |

| Citigroup | | CitiFinancial Credit Company |

| | |

| CMBS | | commercial mortgage-backed securities |

| Compensation Committee | | the committee of the OMH Board of Directors, which oversees OMH's compensation programs |

| Contribution | | On June 22, 2018, SFC entered into a Contribution Agreement with SFI, a wholly-owned subsidiary of OMH. Pursuant to the Contribution Agreement, Independence was contributed by SFI to SFC. |

| | |

| | | | | | | | |

| Term or Abbreviation | | Definition |

| | |

| December 2018 Real Estate Loan Sale | | SFC and certain of its subsidiaries sold a portfolio of real estate, classified in finance receivables held for sale, for aggregate cash proceeds of $100 million on December 21, 2018. |

| Dodd-Frank Act | | the Dodd-Frank Wall Street Reform and Consumer Protection Act |

| DOI | | Department of Insurance |

| ERISA | | Employee Retirement Income Security Act of 1974 |

| Excess Retirement Income Plan | | Springleaf Financial Services Excess Retirement Income Plan |

| Exchange Act | | Securities Exchange Act of 1934, as amended |

| FASB | | Financial Accounting Standards Board |

| February 2019 Real Estate Loan Sale | | SFC and certain of its subsidiaries sold a portfolio of real estate loans with a carrying value of $16 million, classified in finance receivables held for sale, for aggregate cash proceeds of $19 million on February 5, 2019 |

| | |