Table of Contents

Exhibit 99.1

, 20

Dear Worthington Industries, Inc. Shareholder:

On September 29, 2022, we announced our intention to separate our company into two independent, publicly-traded companies. Completion of the separation will create (i) a market-leading company with premier brands in fast-growing, attractive end markets in consumer products, building products and sustainable energy solutions that will operate under a new name, Worthington Enterprises, Inc. (“New Worthington”) and (ii) a market-leading, value-added steel processing company with a differentiated capability set, sophisticated supply chain and price risk management solutions and expanded product offerings in electrical steel laminations and laser welding solutions, named Worthington Steel, Inc. (“Worthington Steel”). The separation will occur by means of a pro rata distribution of 100% of the outstanding common shares of Worthington Steel to Worthington Industries, Inc. (“Worthington”) shareholders as of the record date. Following the separation, each company is expected to be positioned to have enhanced agility and sharpened strategic focus, capital structures and capital allocation strategies that are tailored to each company’s strategy, improved shareholder value creation opportunities, and outstanding boards of directors and management teams.

Worthington Steel will be comprised of Worthington’s existing steel processing business and certain other assets and liabilities that Worthington is expected to contribute to Worthington Steel prior to the separation. As a standalone entity, Worthington Steel is expected to be a market-leading, value-added steel processor and producer of electrical steel laminations and automotive lightweighting solutions, positioned to capitalize on expanding opportunities in electrification, sustainability and infrastructure spending. Worthington Steel is expected to have a differentiated capability set and sophisticated supply chain and price risk management solutions to serve its blue chip customers, grow market share and increase margins. Worthington Steel is expected to continue leveraging the Worthington Business System to power a winning culture, higher growth and profitability through transformation, innovation and acquisitions.

New Worthington is expected to be a market-leading company with premier brands in attractive end markets in consumer products, building products and sustainable energy solutions. As a more focused company, New Worthington is expected to be well-positioned to capitalize on key trends in sustainability, technology, remodeling and construction and outdoor living. New Worthington is expected to continue to pursue a growth strategy focused on leveraging its robust new product pipeline of sustainable, tech-enabled solutions to disrupt mature markets. New Worthington is expected to continue to leverage the Worthington Business System. The new company is anticipated to have a high-margin and asset-light profile, which is expected to enable strong free cash flow generation and returns for shareholders. Further, New Worthington’s value is expected to no longer be highly correlated to the price of steel, providing the opportunity for premium sector multiples.

The separation will provide Worthington shareholders as of the record date with ownership interests in both New Worthington and Worthington Steel. The separation will be in the form of a pro rata distribution of 100% of the outstanding common shares of Worthington Steel to Worthington shareholders as of the record date. Each Worthington shareholder will receive common share(s) of Worthington Steel for every common share(s) of Worthington held on (the “record date” for the distribution).

You do not need to take any action to receive the common shares of Worthington Steel to which you are entitled as a Worthington shareholder. You also do not need to pay any consideration, to exchange or surrender your existing common shares of Worthington or take any other action in order to receive the common shares of Worthington Steel to which you are entitled.

The distribution is intended to be tax-free to Worthington shareholders as of the record date for U.S. federal income tax purposes, except for cash received in lieu of fractional common shares. You should consult your own

Table of Contents

tax advisor as to the particular consequences of the distribution to you, including the applicability and effect of any U.S. federal, state and local and non-U.S. tax laws.

I encourage you to read the information statement, which is being provided to all Worthington shareholders who held common shares of Worthington on the record date. The information statement describes the separation and the distribution in detail and contains important business and financial information about Worthington Steel.

We believe the separation is a significant and exciting step in our company’s history, and we remain committed to working on your behalf to continue to build long-term shareholder value.

| Sincerely, |

| Andy Rose |

| President and Chief Executive Officer |

| Worthington Industries, Inc. |

Table of Contents

, 20

Dear Future Worthington Steel, Inc. Shareholder:

We are excited to welcome you as a shareholder of Worthington Steel, Inc. (“Worthington Steel”). We are proud of our heritage and are committed to using our experienced management team, talented employees, outstanding brand and leading market position to establish our own independent record of strong performance.

Worthington Steel is a market-leading, value-added steel processing business with best-in-class expanded product offerings in electrical steel laminations and laser welding solutions. For the fiscal year ended May 31, 2023, the Worthington Steel business generated $3.6 billion in net sales. Worthington Steel intends to continue its balanced approach to capital allocation and maintain a strong balance sheet and a dividend policy that is consistent with the historic practices of Worthington Industries, Inc. (“Worthington”).

As a standalone company, we believe we will have a differentiated capability set and sophisticated supply chain and price risk management solutions to serve our blue chip customers, grow market share and increase margins. We intend to continue leveraging the Worthington Business System to power a winning culture, higher growth and profitability through transformation, innovation and acquisitions.

Our outstanding team has a strong Worthington legacy and seeks to make continuous improvement part of everything we do.

I personally invite you to learn more about Worthington Steel and our strategic initiatives by reading the accompanying information statement. With our strong foundation derived from Worthington, Worthington Steel is set up well for what we believe will be our best days to come.

Sincerely,

Geoff Gilmore

Chief Executive Officer

Worthington Steel, Inc.

Table of Contents

Information contained herein is subject to completion or amendment. A registration statement on Form 10 relating to these securities has been filed with the U.S. Securities and Exchange Commission under the U.S. Securities Exchange Act of 1934, as amended.

PRELIMINARY AND SUBJECT TO COMPLETION, DATED OCTOBER 25, 2023

INFORMATION STATEMENT

Worthington Steel, Inc.

This information statement is being furnished in connection with the pro rata distribution by Worthington Industries, Inc. (“Worthington”) to its shareholders of 100% of the outstanding common shares of Worthington Steel, Inc., a wholly-owned subsidiary of Worthington that will hold, directly or indirectly, the assets and liabilities associated with Worthington’s steel processing business (“Worthington Steel” or the “Company”). Upon completion of the distribution, Worthington will change its name to Worthington Enterprises, Inc. (“New Worthington”).

For every common share(s) of Worthington held of record by you as of the close of business on (the “record date” for the distribution), you will receive common share(s) of Worthington Steel. You will receive cash in lieu of any fractional common shares of Worthington Steel that you would have received after application of the above ratio.

The distribution is intended to be tax-free to Worthington shareholders for U.S. federal income tax purposes, except for cash received in lieu of fractional common shares.

No vote of Worthington shareholders is required to complete the distribution. Therefore, you are not being asked for any proxy in connection with the distribution. You also do not need to pay any consideration, to exchange or surrender your existing common shares of Worthington or to take any other action in order to receive the common shares of Worthington Steel to which you are entitled.

There is no current trading market for Worthington Steel’s common shares. Worthington Steel expects that a limited market, commonly known as a “when-issued” trading market, will develop shortly before the distribution date, and further expects that “regular-way” trading will begin on the first trading day following the distribution. Worthington Steel has applied to have its common shares authorized for listing on the New York Stock Exchange (the “NYSE”) under the symbol “WS.” Following the distribution, New Worthington will trade on the NYSE under the symbol “WOR.”

In reviewing this information statement, you should carefully consider the matters described under “Risk Factors” beginning on page 15.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this information statement is .

A Notice of Internet Availability of Information Statement Materials containing instructions describing how to access this information statement was first mailed to Worthington shareholders on or about . This information statement will be mailed to those Worthington shareholders who previously elected to receive a paper copy of such materials.

Table of Contents

| iii | ||||

| 1 | ||||

| 13 | ||||

| 15 | ||||

| 39 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

52 | |||

| 75 | ||||

| 90 | ||||

| 96 | ||||

| 123 | ||||

| 124 | ||||

| 125 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

135 | |||

| 136 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE DISTRIBUTION TO U.S. HOLDERS |

143 | |||

| 147 | ||||

| 148 | ||||

| 155 | ||||

| F-1 |

i

Table of Contents

Presentation of Information

Except as otherwise indicated or unless the context otherwise requires, references herein to: (i) “Worthington Steel,” the “Company,” “we,” “us” and “our” refer to Worthington Steel, Inc., an Ohio corporation, and its consolidated subsidiaries after giving effect to the separation or, with respect to historical information, the business and operations of Worthington’s steel processing segment that will be transferred to the Company in connection with the separation and distribution. In connection with the separation and distribution, Worthington Industries, Inc., will change its name to “Worthington Enterprises, Inc.” References herein to the terms “Worthington,” “Parent” and “New Worthington,” when used in a historical context, refer to Worthington Industries, Inc., an Ohio corporation, and its consolidated subsidiaries (including Worthington Steel and all of its subsidiaries) and, when used in the future tense, refer to Worthington Enterprises, Inc., an Ohio corporation, and its consolidated subsidiaries after giving effect to the separation and distribution.

In connection with the separation and distribution, we will enter into a series of transactions with Worthington pursuant to which Worthington will transfer the assets and liabilities of its steel processing business and certain other assets and liabilities to us in exchange for a Cash Distribution, as defined herein. As used herein: (i) the “separation” refers to the separation of the steel processing business from Worthington and the creation of a separate, publicly-traded company holding the steel processing business; and (ii) the “distribution” refers to the pro rata distribution of 100% of the common shares of Worthington Steel owned by Worthington as of the record date to Worthington shareholders. Except as otherwise indicated or unless the context otherwise requires, the information in this information statement about Worthington Steel assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution.

Market, Industry and Other Data

Unless otherwise indicated, information in this information statement concerning our industry, the industries we serve and the markets in which we operate, including our general expectations, market position, market opportunity and market share, is based on information from third-party sources and management estimates. Management estimates are derived from publicly available information and reports provided to us (including reports from S&P Global Mobility and other industry publications, surveys and forecasts), our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Management estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause future performance to differ materially from our assumptions and estimates. See “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements.”

S&P reports, data and information referenced herein (the “S&P Materials”) are the copyrighted property of S&P Global Inc. and its subsidiaries (“S&P”). The S&P Materials are from sources considered reliable; however, the accuracy and completeness thereof are not warranted, nor are the opinions and analyses published by S&P representations of fact. The S&P Materials speak as of the original publication date thereof and are subject to change without notice. S&P and other trademarks appearing in the S&P Materials are the property of S&P or their respective owners.

Trademarks and Trade Names

The name and mark, Worthington Steel, and other of our trademarks, trade names and service marks appearing in this information statement are our property or, as applicable, licensed to us, or, as applicable, are the property of Worthington. The name and mark, Worthington, New Worthington, and other trademarks, trade names and service marks of Worthington appearing in this information statement are the property of Worthington.

ii

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION

| What is Worthington Steel and why is Worthington separating Worthington Steel’s business and distributing Worthington Steel’s common shares? | Worthington Steel, which is currently a wholly-owned subsidiary of Worthington, was formed to hold Worthington’s steel processing business. The separation of Worthington Steel from Worthington and the distribution of Worthington Steel common shares are intended to provide you with equity investments in two separate, publicly-traded companies that will each be able to focus on its respective business strategies. Worthington and Worthington Steel believe that the separation will result in enhanced long-term performance of each business for the reasons discussed in “The Separation and Distribution—Background” and “The Separation and Distribution—Reasons for the Separation.” | |

| Why am I receiving this information statement? | Worthington is delivering this information statement to you because you are a holder of record of common shares of Worthington. If you are a holder of Worthington common shares as of the close of business on (the record date for the distribution), you will be entitled to receive common share(s) of Worthington Steel for every common share(s) of Worthington that you held at the close of business on such date. This information statement will help you understand how the separation and distribution will affect your investment in Worthington and your investment in us after the separation. | |

| How will the separation of Worthington Steel from Worthington work? | To accomplish the separation of Worthington Steel into a separate, publicly-traded company, Worthington will distribute 100% of our outstanding common shares to Worthington shareholders on a pro rata basis in a distribution intended to be tax-free for U.S. federal income tax purposes, except for cash received in lieu of fractional common shares. | |

| Why is the separation of Worthington Steel structured as a distribution? | Worthington believes that a distribution of our common shares to Worthington shareholders that is tax-free for U.S. federal income tax purposes is an efficient way to separate the steel processing business in a manner that will create long-term value for Worthington and its shareholders. | |

| What is the record date for the distribution? | The record date for the distribution will be . | |

| When will the distribution occur? | It is expected that 100% of our common shares will be distributed by Worthington on to holders of record of Worthington common shares as of the close of business on (the record date for the distribution). | |

| What do Worthington shareholders need to do to participate in the distribution? | Worthington shareholders as of the record date are not required to take any action to receive our common shares in the distribution, but you are urged to read this entire information statement carefully. No shareholder approval of the distribution is required, and you are not being asked for a proxy. You also do not need to pay any consideration, exchange or surrender your existing common shares of Worthington or take any other action to receive the common shares of Worthington Steel to which you are entitled. The distribution will not affect the number of outstanding common shares of Worthington or any rights of Worthington shareholders, although it will affect the market value of each outstanding common share of Worthington. | |

iii

Table of Contents

| How will common shares of Worthington Steel be issued? | You will receive our common shares through the same or substantially similar channels that you currently use to hold or trade common shares of Worthington (whether through a brokerage account, 401(k) plan or other channel). Receipt of our common shares will be documented for you in substantially the same manner that you typically receive shareholder updates, such as monthly broker statements and 401(k) statements.

If you own common shares of Worthington as of the record date, Worthington, with the assistance of Broadridge Corporate Issuer Solutions, LLC, the distribution agent, transfer agent and registrar for our common shares (“Broadridge”), will electronically distribute our common shares to you or to your brokerage firm on your behalf by way of direct registration in book-entry form. Broadridge will mail you a book-entry account statement that reflects your common shares of Worthington Steel, or your bank or brokerage firm will credit your account for such common shares. | |

| How many common shares of Worthington Steel will I receive in the distribution? | Worthington will distribute to you of our common share(s) for every common share(s) of Worthington held by you as of the record date. Based on approximately common shares of Worthington outstanding as of , assuming a distribution of 100% of our common shares and applying the distribution ratio (without accounting for cash to be issued in lieu of fractional common shares), we expect that a total of approximately of our common shares will be distributed to Worthington. See “The Separation and Distribution.” | |

| Will Worthington Steel issue fractional common shares in the distribution? | No. Worthington Steel will not issue fractional common shares in the distribution. Fractional common shares that Worthington shareholders would otherwise have been entitled to receive will be aggregated into whole common shares and sold in the public market by the distribution agent. The aggregate net cash proceeds of these sales will be distributed pro rata (based on the fractional common share such shareholder would otherwise be entitled to receive) to those shareholders who would otherwise have been entitled to receive fractional common shares. Recipients of cash in lieu of fractional common shares will not be entitled to any interest on the amounts of payment made in lieu of fractional common shares. The receipt of cash in lieu of a fractional common shares generally will be taxable to the recipient shareholders for U.S. federal income tax purposes as described in “Material U.S. Federal Income Tax Consequences of the Distribution to U.S. Holders.” | |

| What are the conditions to the distribution? | The distribution is subject to final approval by our board of directors (the “Board”) and the board of directors of Worthington (the “Worthington Board”), or a duly authorized committee thereof, as well as the following conditions:

• the transfer of assets and liabilities to us in accordance with the separation agreement will have been completed, other than assets and liabilities intended to transfer after the distribution;

• Worthington will have received an opinion of Latham & Watkins LLP, tax counsel to Worthington, regarding the qualification of the distribution, together with certain related transactions, as a reorganization under Sections 355 and |

iv

Table of Contents

| 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended (the “Code”);

• the making of a cash distribution of approximately $150.0 million (the “Cash Distribution”) from Worthington Steel to Worthington as partial consideration for the contribution of assets from Worthington to Worthington Steel in connection with the separation, and the determination by Worthington in its sole discretion that following the separation, Worthington will have no further liability or obligation whatsoever with respect to any of the financing arrangements that Worthington Steel will be entering into in connection with the separation;

• the SEC will have declared effective the registration statement on Form 10 of which this information statement forms a part, no stop order suspending the effectiveness of the registration statement will be in effect, no proceedings for such purpose will be pending before or threatened by the SEC and this information statement (or a Notice of Internet Availability) will have been mailed to Worthington shareholders;

• all actions and filings necessary or appropriate under applicable U.S. federal, U.S. state or other securities laws will have been taken and, where applicable, will have become effective or been accepted by the applicable governmental authority;

• the transaction agreements relating to the separation will have been duly executed and delivered by the parties thereto;

• the financing transactions contemplated by the separation agreement will have been completed;

• no order, injunction or decree issued by any court of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the separation, the distribution or any of the related transactions will be in effect;

• the common shares of Worthington Steel to be distributed will have been accepted for listing on the NYSE, subject to official notice of distribution;

• Worthington will have entered into a distribution agent agreement with, or provided instructions regarding the distribution to, Broadridge as distribution agent;

• all material governmental approvals necessary to consummate the distribution and to permit the operation of our business after the separation substantially as it is currently conducted will have been obtained;

• Worthington will have requested the resignation of each person who is an officer or director of Worthington Steel prior to the separation and who will continue solely as an officer or director of Worthington following the separation;

• the financing described in “Description of Certain Indebtedness” will have been completed; and |

v

Table of Contents

|

• no other event or development will have occurred or exist that, in the judgment of the Worthington Board, in its sole discretion, makes it inadvisable to effect the separation, the distribution or the other related transactions.

Neither we nor Worthington can assure you that any or all of these conditions will be met, and Worthington may also waive conditions to the distribution in its sole discretion and proceed with the distribution even if such conditions have not been met. If the distribution is completed and the Worthington Board waived any such condition, such waiver could have a material adverse effect on (i) New Worthington’s and Worthington Steel’s respective business, financial condition or results of operations, (ii) the trading price of Worthington Steel’s common shares or (iii) the ability of stockholders to sell their Worthington Steel shares after the distribution, including, without limitation, as a result of (a) illiquid trading if Worthington Steel common shares are not accepted for listing or (b) litigation relating to any injunctions sought to prevent the consummation of the distribution. If Worthington elects to proceed with the distribution notwithstanding that one or more of the conditions to the distribution has not been met, Worthington will evaluate the applicable facts and circumstances at that time and make such additional disclosure and take such other actions as Worthington determines to be necessary and appropriate in accordance with applicable law. In addition, Worthington can decline at any time to go forward with the separation and distribution. See “The Separation and Distribution—Conditions to the Distribution.” | ||

| What is the expected date of completion of the separation and distribution? | The completion and timing of the separation and distribution are dependent upon a number of conditions. It is expected that 100% of our common shares will be distributed by Worthington on to holders of record of Worthington common shares as of the close of business on (the record date for the distribution). However, no assurance can be provided as to the timing of the separation or that all conditions to the distribution will be met. | |

| Can Worthington decide to cancel the distribution of Worthington Steel common shares even if all the conditions have been met? | Yes. The distribution is subject to the satisfaction or waiver of certain conditions as described in “The Separation and Distribution—Conditions to the Distribution.” Until the distribution has occurred, Worthington has the right to terminate, modify or abandon the distribution, even if all of the conditions are satisfied. | |

| What if I want to sell my Worthington or Worthington Steel common shares? | You should consult with your financial advisor, such as your brokerage firm, bank or tax advisor. | |

| What is “regular-way” and “ex-distribution” trading of Worthington common shares? | Beginning shortly before the distribution date and continuing through the distribution date, it is expected that there will be two markets in Worthington common shares: a “regular-way” market and an “ex-distribution” market. Common shares of Worthington that trade in the “regular-way” market will trade with an entitlement to our common shares distributed pursuant to the distribution. Shares that trade in the “ex-distribution” market will trade without an entitlement to our common shares distributed pursuant to the distribution. | |

vi

Table of Contents

|

If you decide to sell any common shares of Worthington before the distribution date, you should ensure that your brokerage firm, bank or other nominee understands whether you want to sell your common shares of Worthington with or without your entitlement to our common shares distributed pursuant to the distribution. | ||

| Where will I be able to trade common shares of Worthington Steel? | Worthington Steel intends to apply to list Worthington Steel’s common shares on the NYSE under the symbol “WS.” We anticipate that trading in our common shares will begin on a “when-issued” basis shortly before the distribution date and will continue up to the distribution date. We anticipate that “regular-way” trading in our common shares will begin on the first trading day following the completion of the distribution. If trading begins on a “when-issued” basis, you may purchase or sell our common shares up to the distribution date, but your transaction will not settle until after the distribution date. We cannot predict the trading prices for our common shares before, on or after the distribution date. | |

| What will happen to the listing of Worthington common shares? | Upon completion of the distribution, Worthington will change its name to Worthington Enterprises, Inc. After the distribution, New Worthington common shares will trade on the NYSE under the symbol “WOR.” | |

| Will the number of common shares of Worthington that I own change as a result of the distribution? | No. The number of common shares of Worthington that you own will not change as a result of the distribution. | |

| Will the distribution affect the market price of my common shares of New Worthington? | Yes. As a result of the distribution, Worthington expects the trading price of common shares of New Worthington immediately following the distribution to be lower than the “regular-way” trading price of such common shares immediately prior to the distribution because the trading price will no longer reflect the value of the steel processing business. There can be no assurance that the aggregate market value of the New Worthington common shares and our common shares following the separation will be higher or lower than the market value of Worthington common shares if the separation did not occur. This means, for example, that after the distribution, the combined trading prices of one common share of New Worthington and of our common share(s) (representing the number of our common shares to be received per every one common share of Worthington in the distribution) may be equal to, greater than or less than the trading price of one common share of Worthington before the distribution. | |

| What will happen to outstanding Worthington equity-based compensation awards? | In connection with the separation and distribution, outstanding equity-based awards will generally be equitably adjusted in a manner that is intended to preserve the aggregate intrinsic value of such awards as of immediately before and after the distribution.

The specific treatment of outstanding equity-based compensation awards in connection with the separation will be governed by the employee matters agreement that we will enter into with New Worthington. See “Certain Relationships and Related Party Transactions—Agreements with New Worthington—Employee Matters Agreement—Incentive Award Adjustments” for information related to the treatment of outstanding equity-based awards. | |

vii

Table of Contents

| What are the U.S. federal income tax consequences of the separation and the distribution? | The distribution is conditioned upon, among other things, Worthington’s receipt of an opinion of Latham & Watkins LLP, tax counsel to Worthington, regarding the qualification of the distribution, together with certain related transactions, as a reorganization under Sections 355 and 368(a)(1)(D) of the Code. The opinion of tax counsel will be based on certain factual assumptions, representations and undertakings and subject to qualifications and limitations. If the distribution, together with certain related transactions, qualifies as a reorganization, then for U.S. federal income tax purposes, U.S. Holders (as defined in “Material U.S. Federal Income Tax Consequences of the Distribution to U.S. Holders”) will not recognize gain or loss or include any amount in taxable income (other than with respect to cash received in lieu of fractional common shares) as a result of the distribution. The material U.S. federal income tax consequences of the distribution are described in the section entitled “Material U.S. Federal Income Tax Consequences of the Distribution to U.S. Holders.” Each Worthington shareholder is encouraged to consult its tax advisor as to the specific tax consequences of the distribution to such shareholder, including the effect of any state, local and non-U.S. tax laws and of changes in applicable tax laws. | |

| How will I determine my tax basis in the common shares of Worthington Steel that I receive in the distribution? | For U.S. federal income tax purposes, assuming that the distribution, together with certain related transactions, qualifies as a reorganization under Sections 355 and 368(a)(1)(D) of the Code, the tax basis in the common shares of Worthington that a Worthington shareholder holds immediately prior to the distribution will be allocated between such shareholder’s common shares of New Worthington and the common shares of Worthington Steel received in the distribution (including any fractional common share interest for which cash is received) in proportion to their relative fair market values. See “Material U.S. Federal Income Tax Consequences of the Distribution to U.S. Holders” for a more detailed description of the effects of the distribution on Worthington shareholders’ tax basis in common shares of New Worthington and common shares of Worthington Steel. Each Worthington shareholder is encouraged to consult its tax advisor as to how this allocation will work based on such shareholder’s situation (including if common shares of Worthington were purchased by such shareholder at different times or for different amounts) and regarding any particular consequences of the distribution to such shareholder, including the application of state, local and non-U.S. tax laws. | |

| What will Worthington Steel’s relationship be with New Worthington following the separation? | Worthington Steel expects to enter into a separation agreement with Worthington to effect the separation and provide a framework for our relationship with New Worthington after the separation. We also expect to enter into certain other agreements, including a transition services agreement, an employee matters agreement, a tax matters agreement, a trademark license agreement, a WBS license agreement and a steel supply agreement. These agreements will govern the separation between us and Worthington of the assets, employees, services, liabilities and obligations (including their respective investments, property and employee benefits and tax-related assets and liabilities) of Worthington and its subsidiaries attributable to periods prior to, at and after the separation and will govern certain relationships between us and New Worthington after the separation. See “Certain Relationships and Related Person Transactions” and “Risk Factors—Risks Related to the Separation.” |

viii

Table of Contents

| Who will manage Worthington Steel after the separation? | Worthington Steel benefits from having in place a management team with an extensive background in the steel processing business. Led by Geoff Gilmore, who will serve as our President and Chief Executive Officer, Tim Adams, who will serve as our Vice President and Chief Financial Officer, and Jeff Klingler, who will serve as our Executive Vice President and Chief Operating Officer, Worthington Steel’s management team possesses deep knowledge of, and extensive experience in, our industry. See “Management.” | |

| Are there risks associated with owning Worthington Steel common shares? | Yes. Ownership of our common shares is subject to both general and specific risks, including those relating to our business, the industries we serve, our ongoing contractual relationships with New Worthington after the separation and our status as a separate, publicly-traded company. Ownership of our common shares is also subject to risks relating to the separation. These risks are described in the “Risk Factors” section of this information statement beginning on page 16. You are encouraged to read that section carefully. | |

| Will the rights of holders of our common shares differ from the rights of the holders of common shares of New Worthington? | Both Worthington Steel and New Worthington were incorporated under the laws of the State of Ohio. The rights of holders of our common shares are expected to be generally consistent with the rights of holders of common shares of New Worthington under each company’s respective governing documents at the time of the distribution. See “Description of Capital Stock” for a description of the rights of holders of our common shares. | |

| Does Worthington Steel plan to pay dividends? | Subject to any preferential rights of any outstanding preferred shares, holders of our common shares will be entitled to receive ratably the dividends, if any, as may be declared from time to time by our Board out of funds legally available for that purpose. If there is a liquidation, dissolution or winding up of us, holders of our common shares would be entitled to ratable distribution of our assets remaining after the payment in full of liabilities and any preferential rights of any then-outstanding preferred share. See “Dividend Policy.” | |

| Will Worthington Steel incur any indebtedness prior to or at the time of the distribution? | Yes, we anticipate having certain indebtedness upon completion of the separation. Additional details regarding such financing arrangements will be provided in subsequent amendments to this information statement. See “Description of Certain Indebtedness” and “Risk Factors—Risks Related to Our Business.” | |

| Who will be the distribution agent, transfer agent, registrar and information agent for the Worthington Steel common shares? | The distribution agent, transfer agent and registrar for our common shares will be Broadridge. Broadridge will also serve as the information agent for the distribution. For questions relating to the transfer or mechanics of the distribution, you should contact:

Broadridge Corporate Issuer Solutions, LLC 51 Mercedes Way Edgewood, NY 11717 Telephone: +1 (844) 943-0717 | |

| Where can I find more information about each of Worthington and Worthington Steel? | Before the distribution, if you have any questions relating to Worthington’s business performance, you should contact Worthington at:

Marcus Rogier Treasurer & Investor Relations Officer Worthington Industries, Inc. Telephone: +1 (614) 840-4663 Email: Marcus.Rogier@worthingtonindustries.com | |

ix

Table of Contents

|

After the distribution, Worthington Steel shareholders who have any questions relating to our business performance should contact us at:

Melissa Dykstra Vice President, Corporate Communications & Investor Relations Worthington Steel, Inc. Telephone: +1 (614) 840-4144 Email: Melissa.Dykstra@worthingtonindustries.com

We maintain an internet website at . Our website, and the information contained on or accessible through our website, is not incorporated by reference in this information statement. |

x

Table of Contents

This summary highlights information included elsewhere in this information statement and does not contain all of the information that may be important to you. You should read this entire information statement carefully, including “Risk Factors,” “Cautionary Statement Concerning Forward-Looking Statements,” “Unaudited Pro Forma Combined Financial Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our combined financial statements and the notes thereto (the “Combined Financial Statements”).

Business Summary

Overview

Worthington Steel is one of North America’s premier value-added steel processors with the ability to provide a diversified range of products and services that span a variety of end markets. We maintain market leading positions in the North American carbon flat-rolled steel and tailor welded blanks industries and, with the recent acquisition of Tempel Steel Company (“Tempel”), we are now one of the largest global producers of electrical steel laminations. Our unique offering of value-added solutions combined with our technical and market expertise rooted in our people-first philosophy has fostered deep, long-lasting relationships with our customers and furthered our position as a market leader. We believe this leading market position across multiple value-added products and services combined with strong customer relationships positions us to capitalize on expanding opportunities in electrification, sustainability, and infrastructure spending.

We believe our key investment attributes to be:

| • | Long-standing customer relationships focused on value creation and best-in-class service delivery |

| • | Manufacturing scale enabling proximity to customers and suppliers, operational efficiencies, and purchasing power |

| • | Attractive growth opportunities via strategic capital investments and/or value-enhancing acquisitions |

| • | A market-leading supplier to growing end markets |

| • | Well-positioned to capitalize on growth opportunities for our electrical steel products we expect to result from the anticipated global shift toward electrified vehicles |

For nearly 70 years, we have been delivering high quality steel processing capabilities across a variety of end-markets including automotive, heavy truck, agriculture, construction, and energy. With the ability to produce customized steel solutions, we aim to be the preferred value-added steel processor in the markets we serve by delivering highly technical, customer-specific solutions, while also providing advanced materials support and price risk management solutions to optimize customer supply chains. Our scale and operating footprint allow us to achieve an advantaged cost structure and service platform supported by a strategic operating footprint.

Our people-first philosophy is rooted in the belief that people are our most important asset, which serves as the basis for our unwavering commitment to our employees, customers, suppliers, and investors. Our primary goal is to create value for our shareholders. Built on the successful foundation of the Worthington Business System, we apply a disciplined approach to capital deployment and seek to grow earnings by optimizing our operations and supply chain, developing and commercializing new products and applications, and pursuing strategic investments and acquisitions.

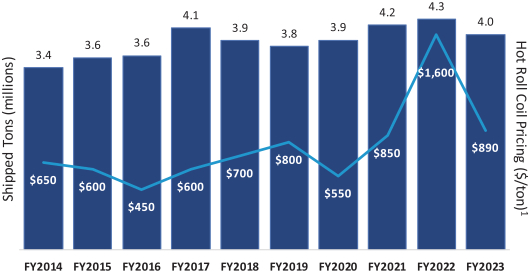

For the fiscal year ended May 31, 2023, we delivered approximately 4.0 million tons of value-added processed steel, generating net sales of $3.6 billion compared to 4.3 million tons and net sales of $4.1 billion in fiscal 2022.

1

Table of Contents

Net earnings attributable to controlling interest and adjusted earnings before interest and taxes (“adjusted EBIT”) were $87.1 million and $136.2 million, respectively, in fiscal 2023 compared to $180.4 million and $230.7 million, respectively, in fiscal 2022.

Adjusted EBIT is a non-GAAP measure used by management to assess operating performance. For further information regarding our use of this non-GAAP measure as well as a reconciliation to the most comparable GAAP measure, refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this information statement.

The following pie chart presents our net sales by end-market for the fiscal year ended May 31, 2023:

Net Sales by End Market (Fiscal 2023)

Value-Added Products and Services

We believe our diversified portfolio of products and services makes us a premier value-added steel processor in the markets we serve. We generate sales by processing and selling flat-rolled steel coils, which we source primarily from various North American steel mills, into the precise type, thickness, length, width, shape, and surface quality required by customer specifications. Our product lines and processing capabilities include:

| • | Carbon Flat-Roll Steel Processing |

| • | Electrical Steel Laminations |

| • | Tailor Welded Products |

We can sell steel on a direct basis, whereby we are exposed to the risk and rewards of ownership of the material while in our possession. Alternatively, we can also toll process steel under a fee for service arrangement whereby we process customer-owned material. Please refer to the “Business” section for more detail on “Value-Added Products and Services.”

Our Key Strengths

Strong and differentiated positions in key markets

We strive to be a collaborative partner to our customers by delivering complex and value-added solutions that meet our customers’ most demanding and performance-critical applications. We believe our portfolio of differentiated and value-added solutions is unique in the service center industry and provides for a competitive advantage that we will continue to leverage to create value for all of our stakeholders. We believe few service centers in North America offer the same breadth of value-added processing capabilities as Worthington Steel. Our market expertise extends beyond steel processing to include end-to-end supply chain management and price risk management solutions for customers seeking to develop efficient supply chains and reduce risk. In doing so, we have become one of the largest participants in North America’s steel futures market.

2

Table of Contents

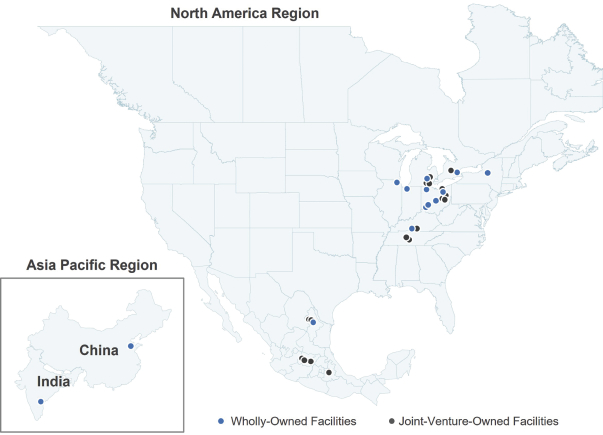

Through our TWB Company, LLC (“TWB”) joint venture, which operates 11 manufacturing facilities across North America, we believe we are the largest independent tailor welded blank operation in the region with capabilities that include mild carbon steel, advanced high strength steel and aluminum. Worthington Steel’s product offering is further differentiated by our electrical steel capabilities. With manufacturing facilities in both North America and Asia Pacific, we are one of the leading global providers of electrical steel laminations for motors, generators, and transformers.

Strong operating platform guided by the Worthington Philosophy and driven by the Worthington Business System

The backbone of our culture is the Worthington Philosophy, which was memorialized in 1968 by our founder, John H. McConnell. The Worthington Philosophy is rooted in the ‘Golden Rule,’ which serves as the basis for an unwavering commitment to our key stakeholders – our employees, customers, suppliers, and shareholders – and helps drive strong partnerships, not only with our customers and suppliers, but our employees as well.

We follow a people-first philosophy, with the primary goal of driving value creation for our shareholders. We seek to accomplish this by optimizing existing operations, commercializing value-added offerings, and pursuing strategic capital investments and acquisitions. Our employees at all levels work together under the framework of the Worthington Business System to develop cross-functional solutions across our operations, including back-office support, to drive efficiency by streamlining costs and reducing waste while maintaining the operational agility necessary to respond to the wide range of environments in which we operate.

Further, we are committed to protecting the safety and health of our workforce and the environment, while using resources in a responsible and sustainable manner, subscribing to internationally recognized measures of consistent performance metrics relating to health, safety, security, and the environment.

As outlined below, the Worthington Business System is rooted in the Worthington Philosophy and designed to drive continuous improvement through use of enabling tools and technologies that help drive results and inform our business decisions:

3

Table of Contents

Well-positioned to capitalize on growth opportunities for our electrical steel products we expect to result from the anticipated global shift toward electrified vehicles

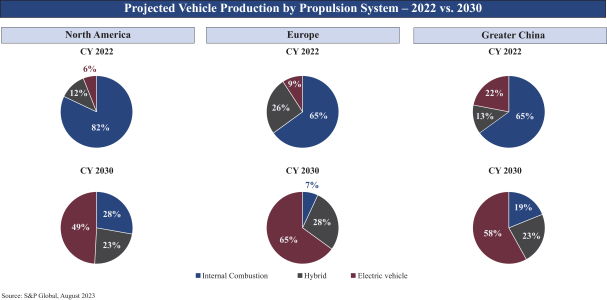

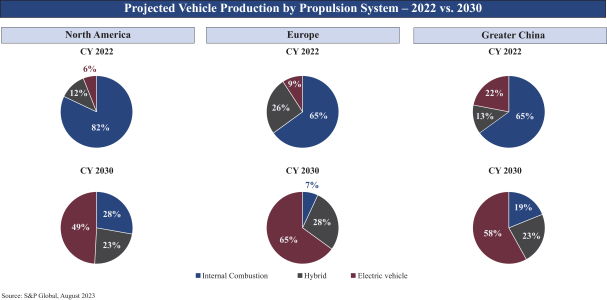

While the expected shift away from internal combustion powered vehicles may reduce demand for certain of our processed steel products in the automotive end market, we believe we are well-positioned to benefit from the anticipated once-in-a-lifetime industry tailwinds associated with the global shift to electrified vehicles over the coming decade. As one of the largest suppliers of highly engineered, precision-stamped, electrical steel laminations in the world, we aim to be the preferred supplier of electrical steel laminations to our blue-chip automobile original equipment manufacturer (OEM) customers as demand continues to grow. As shown by the chart below, battery electric and hybrid vehicles are expected to make up approximately two-thirds of all vehicles produced in North America and approximately 90% and 80% of all vehicles produced in Europe and Greater China, respectively, by 2030. Due to our leading position as a supplier of laminations in the electric generator and transformer markets, we are also well-positioned to capitalize on growth opportunities associated with expanding and modernizing the existing power infrastructure and charging network.

Worthington Steel’s operating footprint provides strategic jurisdictional advantages due to its proximity to both its suppliers and automobile OEM customer base. As a result, we are well-positioned to benefit from financial incentives in the form of tax credits and rebates for localizing the development of an electric vehicle ecosystem in North America and globally.

Deep and long-standing relationships with customers

We focus on providing superior customer service and delivering best-in-class products and services, which result in deeply entrenched and long-lasting customer relationships, many of which span decades, particularly with our automobile OEM customers. Our uniform quality control processes across downstream operations, including cold rolling, hot-dipped galvanizing, tailor welded blanking, pickling, and stamping electrical steel laminations allows us to deliver value-added and tailored products that meet our customers’ most demanding and technical applications.

Our customer relationships entail more than just steel processing. We work collaboratively with our customers to reduce material costs and provide supply chain management to minimize downstream impacts, including effective price risk management initiatives that aim to reduce risk across the entire supply chain by aligning

4

Table of Contents

customer demand with production and supply. Our Technical Services Team, composed of metallurgical engineers, material scientists and other technical experts, focus on pre-sale material specification and selection, as well as after-sale material performance, and can help customers select the best products for their specific business needs.

We believe our customer-centric approach to fostering meaningful and mutually beneficial relationships with our customers gives us a significant competitive advantage and are proud to have repeatedly received recognition from several of our blue-chip customers.

Our scale allows us to create highly efficient supply chains supported by a highly experienced workforce

We maintain an operating portfolio comprised of key manufacturing facilities and operations strategically located near both suppliers and customers, which allows us to compete effectively in our selected end-markets across numerous geographies. We have long-standing relationships with our suppliers that we believe are mutually beneficial. Furthermore, many of our sites have multiple operations under one roof, allowing us to remain dynamic and responsive to the changing demands of our customers, further minimizing in-transit work in progress inventory, and reducing logistics costs. In-house forecasting expertise generates early signals for potentially significant changes in automotive platform demand, giving us the ability to flex our operations accordingly. Our production lines are operated by a highly skilled workforce with decades of accumulated operational experience and an exceptional safety record, by industry standards. We believe our efficient supply chains and the collective knowledge base of our workforce is very difficult to replicate and is a key contributing factor in our ability to produce high-quality products and solutions on a consistent basis.

Attractive growth prospects through continued disciplined strategic capital investments and acquisitions

Applying a disciplined approach to capital deployment has been, and will continue to be, a core part of our business strategy. We have successfully used strategic capital expenditures and selective acquisitions to strengthen our competitive position, enter new markets, and accelerate growth. Recent examples of strategic capital expenditures include a $17 million project to add an additional pot to our hot-dip galvanizing line in Monroe, Michigan, to produce Type 1 aluminized steels for the automotive industry to support light weighting as well as a $3 million investment in laser welding capacity to support a new OEM battery electric vehicle and $13 million of investment in new electrical steel lamination press capacity in Mexico, China, and India to support growth in electrified vehicles.

Recent acquisitions include two completed in fiscal 2022 that have enabled us to scale our business by offering a more comprehensive range of products and services while also expanding into new markets: 1) the June 2021 acquisition of Shiloh Industries’ U.S. BlankLight business (“Shiloh”) and 2) the December 2021 acquisition of Tempel. The Shiloh acquisition has allowed us to expand both the capacity and capabilities of our tailor welded blank joint venture, TWB, while the Tempel acquisition added one of the world’s leading manufacturers of precision motor and transformer laminations for the electrical steel market.

Balance sheet strength and flexibility

We expect to maintain a flexible capital structure with modest leverage and ample liquidity that will enable us to pursue strategic investments and value-enhancing acquisitions. We anticipate having sufficient cash on hand, committed credit availability and debt capacity to execute on our business strategy and to utilize operating cash flow to strategically invest in corporate development and organic growth initiatives. A disciplined capital allocation framework and rigorous process will be applied in the evaluation of organic and acquisition opportunities with the requirement to meet stringent return criteria in order to maintain moderate leverage levels that allow us to remain operationally nimble while deploying capital to improve our return on invested capital metrics.

5

Table of Contents

Experienced and proven management team

Our leadership team consists of long-tenured leaders from Worthington who have a proven track record of delivering on growth and operational excellence through various economic cycles. The Worthington Steel leadership team will be comprised of Geoff Gilmore as Chief Executive Officer, Tim Adams as Chief Financial Officer, and Jeff Klingler as Chief Operating Officer; together they have accumulated a collective 75 years of experience at Worthington and will continue working together to create sustainable value through execution of our growth and business strategies.

Our Growth and Business Strategies

Capitalize on key growth trends

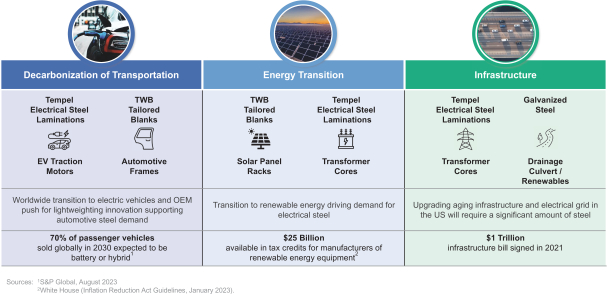

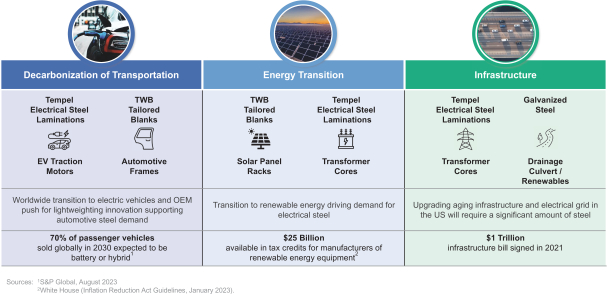

Worthington Steel is uniquely positioned to capitalize on several key growth trends, including the global decarbonization of transportation, the energy transition to renewable sources, and restoration of aging American infrastructure.

Partner with our customers to help them meet their goals and overcome supply chain challenges specific to their businesses

We collaborate with our customers across all of our end-markets to deliver solutions that meet performance-critical specifications and strive to give our customers a competitive advantage in terms of meeting fuel efficiency, strength, and safety requirements. We partner with our customers to develop tailored solutions for evolving quality and service requirements, which enables the deep, entrenched relationships with our blue-chip customer base.

Strategically grow our presence in electrical steel

The fiscal 2022 acquisition of Tempel has grown our global operating footprint in key geographic markets, which complements the continued development of the electric vehicle ecosystem. We expect to continue growing our

6

Table of Contents

portfolio of highly technical electrical steel products and capabilities with a strong local manufacturing and product development focus with the goal of capturing market share in the growing electric vehicle and transformer markets.

Drive continuous improvement through use of the Worthington Business System

We intend to continue to implement operational improvements by applying lean techniques to streamline costs and reduce waste within manufacturing, commercial, sourcing and supply chain. Through continuous improvement initiatives, we believe we can achieve improved metrics for product quality, service, delivery, workforce safety, and waste reduction to further optimize cost, productivity and efficiencies, while creating a resilient and efficient operating platform that can remain agile regardless of external market conditions.

Expand our value-added offerings and leading market positions through disciplined strategic investments and acquisitions

Following the separation, Worthington Steel will be well-positioned to expand our leading market positions and scale through organic and strategic growth initiatives. Utilizing a disciplined growth strategy, we plan to selectively seek opportunities to strengthen our existing portfolio while expanding into new metals-related value-added products and services, which will result from a combination of new product development, strategic capital expenditures, and/or acquisitions.

Alongside our efforts to optimize our existing manufacturing facilities, we have also identified opportunities to profitably add incremental production capacity to enhance our North American footprint and grow our positions in certain markets, particularly for our electrical steel products and services.

We have, and intend to continue, to evaluate various strategic capital expenditure projects that allow us to develop additional business where we already have deep expertise, relationships with prominent customers, and a strong track record of performance. We remain committed to applying a disciplined approach to evaluating any opportunity, focusing on those with exposure to high-growth, target end-markets and the potential to be immediately financially accretive.

The Separation and Distribution

The Separation and Distribution

On September 29, 2022, Worthington announced its intention to separate its steel processing business from the remainder of its businesses.

It is expected that the Worthington Board, or a duly authorized committee thereof, will approve the pro rata distribution of 100% of our issued and outstanding common shares, on the basis of of our common share(s) for every common share(s) of Worthington held as of the close of business on (the record date for the distribution).

Our Post-Separation Relationship with New Worthington

Prior to the completion of the distribution, we will be a wholly-owned subsidiary of Worthington, and all of our outstanding common shares will be owned by Worthington. Following the separation and distribution, we and New Worthington will operate as separate publicly-traded companies.

Prior to the completion of the distribution, we will enter into a separation agreement with Worthington (the “separation agreement”). We will also enter into various other agreements to provide a framework for our relationship with Worthington after the separation, including a transition services agreement, an employee

7

Table of Contents

matters agreement, a tax matters agreement, a trademark license agreement, a WBS license agreement and a steel supply agreement. These agreements will provide for the allocation between us and New Worthington of the assets, employees, services, liabilities and obligations (including their respective investments, property and employee benefits and tax-related assets and liabilities) of Worthington and its subsidiaries attributable to periods prior to, at and after the separation and will govern certain relationships between us and New Worthington after the separation. In exchange for the transfer of the assets and liabilities of Worthington’s steel processing business and certain other assets and liabilities to us, we will deliver to Worthington a Cash Distribution. For additional information regarding the separation agreement and such other agreements, please refer to sections entitled “The Separation and Distribution Agreement,” “Certain Relationships and Related Person Transactions” and “Risk Factors—Risks Related to the Separation and Our Relationship with New Worthington.”

Reasons for the Separation

The Worthington Board believes that separating its steel processing business from the remainder of Worthington is in the best interests of Worthington and its shareholders at this time for the following reasons:

| • | Enhanced Agility and Sharpened Strategic Focus. The separation will allow each company to more effectively pursue its own distinct businesses, operating priorities and strategies. The separation will enable the management teams of each of the two companies to focus on strengthening their respective core businesses and operations, more effectively address unique operating needs, and pursue distinct and targeted opportunities for long-term growth and profitability. |

| • | Tailored Capital Structures and Capital Allocation Strategies. Each company is expected to have modest leverage and ample liquidity combined with strong cash flows, providing flexibility to deploy capital toward its specific growth opportunities. As a result of the separation, we will have our own capital structure and the ability to deploy capital toward executing Worthington Steel’s distinct business strategy which may require larger capital outlays, without the need to balance both Worthington’s priorities for its other businesses and maintaining an investment grade rating. |

| • | Employee Incentives, Recruitment, and Retention. The separation will allow each company to more effectively recruit, retain, and motivate employees through stock-based compensation that more closely reflects and aligns management and employee incentives with specific growth objectives, financial goals and performance of the respective businesses. In addition, the separation will allow incentive structures and targets at each company to be better aligned with each underlying business. Following the separation, the performance of Worthington Steel’s employees will be directly tied to its performance, making it a better tool for compensating Worthington Steel’s employees. |

| • | Creation of Independent Equity Securities. The separation will create independent equity securities, affording Worthington Steel direct access to the capital markets, enabling it to use its own industry-focused stock to consummate future acquisitions or other transactions. As a result, Worthington Steel will have more flexibility to capitalize on its unique strategic opportunities. |

| • | Shareholder Value Creation Opportunities. The separation will create two more focused businesses with differentiated investment theses, making each company easier for investors to understand and appropriately value against a comparable peer set. Our business differs from the New Worthington businesses in several respects, including the exposure to steel market dynamics. We believe the separation will allow investors to evaluate the performance and future growth prospects of each company’s respective businesses and to invest in each company separately based on its distinct characteristics. The transaction would also allow Worthington Steel to target an investor base that is more knowledgeable about steel processing businesses, in line with the active investor base in its peers. |

8

Table of Contents

The Worthington Board also considered the following potentially negative factors in evaluating the separation:

| • | Loss of Joint Purchasing Power and Increased Costs. As a current part of Worthington, the steel processing business that will become our business benefits from Worthington’s size and purchasing power in procuring certain goods, services and technologies. After the separation, as a separate, independent entity, we may be unable to obtain these goods, services and technologies at prices or on terms as favorable as those Worthington obtained prior to the separation. We may also incur costs for certain functions previously performed by Worthington, such as accounting, tax, legal, human resources and other general administrative functions, that are higher than the amounts reflected in our historical financial statements, which could cause our profitability to decrease. |

| • | Disruptions to the Businesses as a Result of the Separation. The actions required to separate our and New Worthington’s respective businesses could disrupt our and New Worthington’s operations after the separation. |

| • | Increased Significance of Certain Costs and Liabilities. Certain costs and liabilities that were otherwise less significant to Worthington as a whole will be more significant for us and New Worthington, after the separation, as stand-alone companies. |

| • | One-time Costs of the Separation. We (and prior to the separation, Worthington) will incur costs in connection with the transition to being a standalone publicly-traded company that may include accounting, tax (including transaction taxes), legal and other professional services costs, recruiting and relocation costs associated with hiring or reassigning our personnel and costs to separate information systems. |

| • | Inability to Realize Anticipated Benefits of the Separation. We may not achieve the anticipated benefits of the separation for a variety of reasons, including, among others, the separation will require significant amounts of management’s time and effort, which may divert management’s attention from operating and growing our business, following the separation, we may be more susceptible to market fluctuations and other adverse events than if we were still a part of Worthington, and following the separation, our business will be less diversified than Worthington’s businesses prior to the separation. |

| • | Limitations Placed upon Us as a result of the Tax Matters Agreement. Under the tax matters agreement that we will enter into with New Worthington, we will be restricted from taking or failing to take certain actions if such action or failure to act could adversely affect the U.S. federal income tax treatment of the distribution and certain related transactions. These restrictions may limit for a period of time our ability to pursue certain transactions that we may believe to be in the best interests of our shareholders or that might increase the value of our business. |

While all of the bullets above are considered to be potentially negative factors to us, only the second, third, fourth and fifth bullets above are considered to be potentially negative factors to Worthington.

The Worthington Board concluded that the potential benefits of the separation outweighed these factors. See “The Separation and Distribution—Reasons for the Separation” and “Risk Factors.”

Description of Certain Indebtedness

We intend to enter into certain financing arrangements prior to or concurrently with the separation and distribution. Additional details regarding such financing arrangements will be provided in subsequent amendments to this information statement. See “Description of Certain Indebtedness” and “Risk Factors—Risks Related to Our Business.”

9

Table of Contents

Risk Factors Summary

An investment in our common shares is subject to a number of risks, including risks relating to the separation, the successful implementation of our strategy and the ability to grow our business. The following list of risk factors is not exhaustive. See “Risk Factors” for a more thorough description of these and other risks.

| • | The automotive and construction industries account for a significant portion of our net sales, and reduced demand from these industries could adversely affect our business. |

| • | We face intense competition which may cause decreased demand, decreased market share and/or reduced prices for our products and services. |

| • | Our operating results may be adversely affected by continued volatility in steel prices. |

| • | Our operating results may be affected by fluctuations in raw material prices and our ability to pass on increases in raw material costs to our customers. |

| • | The costs of manufacturing our products and/or our ability to meet our customers’ demands could be negatively impacted if we experience interruptions in deliveries of needed raw materials or supplies. |

| • | Our business could be harmed if we fail to maintain proper inventory levels. |

| • | The loss of significant volume from our key customers could adversely affect us. |

| • | Many of our key end markets, such as automotive and construction, are cyclical in nature. |

| • | Significant reductions in sales to any of the Detroit Three automakers, or to our automotive-related customers in general, could have a negative impact on our business. |

| • | Our business is highly competitive, and increased competition could negatively impact our financial results. |

| • | If steel prices increase compared to certain substitute materials, the demand for our products could be negatively impacted, which could have an adverse effect on our financial results. |

| • | Increasing freight and energy costs could increase our operating costs or the costs of our suppliers, which could have an adverse effect on our financial results. |

| • | The COVID-19 pandemic has significantly impacted the global economy and has had and could continue to have material adverse effects on our business, financial position, results of operations and cash flows. |

| • | The ongoing conflict between Russia and Ukraine may adversely affect our business and results of operations. |

| • | We are subject to information system security risks and systems integration issues that could disrupt our operations. |

| • | A change in the relationship between the members of any of our joint ventures may have an adverse effect on that joint venture and our financial results. |

| • | Our business requires capital investment and maintenance expenditures, and our capital resources may not be adequate to provide for all of our cash requirements. |

| • | We may be subject to legal proceedings or investigations, the resolution of which could negatively affect our results of operations and liquidity. |

| • | If we are required to raise capital in the future, we could face higher borrowing costs, less available capital, more stringent terms and tighter covenants or, in extreme conditions, an inability to raise capital. |

10

Table of Contents

| • | Our operations have historically been subject to seasonal fluctuations that may impact our cash flows for a particular period. |

| • | We have no history of operating as a separate, publicly-traded company, and our historical and pro forma financial information is not necessarily representative of the results that we would have achieved as a separate, publicly-traded company and may not be a reliable indicator of our future results. |

| • | As a separate, publicly-traded company, we may not enjoy the same benefits that we did as a part of Worthington. |

| • | If the distribution, together with certain related transactions, fails to qualify as a reorganization under Sections 355 and 368(a)(1)(D) of the Code, New Worthington and its shareholders could incur significant tax liabilities, and we could be required to indemnify New Worthington for taxes that could be material pursuant to indemnification obligations under the tax matters agreement. |

| • | We might not be able to engage in certain transactions and equity issuances following the distribution. |

| • | After the distribution, certain of our executive officers and directors may have actual or potential conflicts of interest because of their equity interests in New Worthington. |

| • | We may not achieve some or all of the expected benefits of the separation, and the separation may adversely affect our business. |

| • | We may be unable to generate sufficient cash to service all of our indebtedness and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful. |

| • | We cannot be certain that an active trading market for our common shares will develop or be sustained after the separation, and following the separation, the trading price of our common shares may fluctuate significantly. |

| • | If we are unable to implement and maintain effective internal control over financial reporting in the future, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our common shares may be negatively affected. |

| • | The obligations associated with our being a stand-alone public company will require significant resources and management attention. |

| • | The market price of our common shares may be volatile, which could cause the value of your investment to decline. |

| • | We cannot guarantee the payment of dividends on our common shares, or the timing or amount of any such dividends. |

| • | Our business is cyclical and weakness or downturns in the general economy or certain industries could have an adverse effect on our business. |

| • | Volatility in the U.S. and worldwide capital and credit markets could impact our end markets and result in negative impacts on demand, increased credit and collection risks and other adverse effects on our business. |

Corporate Information

We were incorporated in Ohio on February 28, 2023, for the purpose of holding Worthington’s steel processing business in connection with the separation and the distribution. Prior to the separation, which is expected to occur immediately prior to completion of the distribution, we had no operations. The address of our principal executive offices is 100 Old Wilson Bridge Road, Columbus, Ohio 43085. Our telephone number is (614) 438-3210.

11

Table of Contents

We maintain an internet website at . Our website, and the information contained on or accessible through our website, is not incorporated by reference in this information statement.

Reason for Furnishing this Information Statement

This information statement is being furnished solely to provide information to Worthington shareholders who will receive our common shares in the distribution. This information statement is not, and should not be construed as, an inducement or encouragement to buy or sell any securities. The information in this information statement is believed by us to be accurate as of the date set forth on its cover. Changes may occur after that date, and neither we nor Worthington will update the information except in the normal course of our and Worthington’s respective disclosure obligations and practices.

12

Table of Contents

SUMMARY HISTORICAL AND UNAUDITED PRO FORMA COMBINED FINANCIAL DATA

The following summary historical and unaudited pro forma combined financial data reflects the combined financial statements of the steel processing business of Parent. We derived the summary historical combined statement of earnings for the three months ended August 31, 2023 and 2022, and the fiscal years ended May 31, 2023, 2022, and 2021 and the summary historical combined balance sheet data as of August 31, 2023, May 31, 2023 and May 31, 2022, as set forth below, from our historical combined financial statements, which are included elsewhere in this information statement. We derived the summary unaudited pro forma combined statements of earnings for the three months ended August 31, 2023, and the fiscal year ended May 31, 2023, and the summary unaudited pro forma combined balance sheet data as of August 31, 2023, as set forth below, from our unaudited pro forma combined financial information included in the “Unaudited Pro Forma Combined Financial Information” section of this information statement.

We have historically operated as part of Parent and not as a separate, publicly traded company. Our combined financial statements have been derived from Parent’s historical accounting records and are presented on a carve-out basis. All sales, costs, assets and liabilities directly associated with our business activity are included as a component of the pro forma combined financial statements. The pro forma combined financial statements also include allocations of certain general, administrative, sales and marketing expenses and cost of sales from Parent’s corporate office and from other Worthington businesses to us and allocations of related assets, liabilities, and net parent investment, as applicable. While these allocations have been determined on a reasonable basis, the amounts are not necessarily representative of the amounts that would have been reflected in the combined financial statements had we been an entity that operated separately from Parent during the periods presented.