Table of Contents

As filed with the U.S. Securities and Exchange Commission on July 24, 2023

Registration No. 333-272476

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PIXIE DUST TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

| Japan | 8731 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Pixie Dust Technologies, Inc.

2-20-5 Kanda Misaki-cho, Chiyoda-ku

Tokyo, 101-0061, Japan

Tel: +81(0)3-5244-4880

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

Tel: (800) 221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Barbara A. Jones Greenberg Traurig, LLP 1840

Century Park East, Los Angeles, CA 90067 Tel: (310) 586-7773 |

Koji Ishikawa Greenberg Traurig Tokyo Law Offices Meiji Yasuda Seimei Building, 21F 2-1-1 Marunouchi, Chiyoda-ku Tokyo 100-0005, Japan Tel: +81(0)3-4510-2200 |

Lawrence Venick Loeb & Loeb LLP 2206-19 Jardine House 1 Connaught Place Central Hong Kong SAR Tel: (852) 3923-1111 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging Growth Company ☑

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities, nor a solicitation of an offer to buy these securities, in any jurisdiction where the offer, solicitation, or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 24, 2023

PRELIMINARY PROSPECTUS

Pixie Dust Technologies, Inc.

2,000,000 American Depositary Shares

Representing 2,000,000 Common Shares

This is the initial public offering of our common shares, no par value, represented by American Depositary Shares (“ADSs”). Each ADS represents one common share. We are offering 2,000,000 ADSs. We currently expect the initial public offering price to be between $9.00 and $10.00 per ADS.

We are also seeking to register the issuance of (i) warrants (which are stock acquisition rights under Japanese laws) to purchase up to 69,000 ADSs (the “Representative’s Warrants”) to the underwriters (assuming the exercise of the over-allotment option by the Underwriters in full) as well as (ii) 69,000 common shares underlying such ADSs issuable upon exercise by the underwriters of the Representative’s Warrants at an exercise price per ADS equal to 125% of the initial public offering price.

Prior to this offering, there has been no public market for our common shares or the ADSs. We have applied to list the ADSs on the Nasdaq Capital Market (“Nasdaq”) under the symbol “PXDT.” If we do not meet all of Nasdaq’s initial listing criteria and obtain approval for the listing, we will not complete this offering.

We are organized under the laws of Japan. We are a “foreign private issuer” and an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, under applicable U.S. federal securities laws, and are eligible for reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer.”

Shionogi & Co., Ltd., one of our strategic alliance partners and shareholders, has indicated an interest in purchasing up to $5.0 million of the ADSs offered in this offering at the public offering price. Suzuyo Shoji Co., Ltd., an entity associated with one of our shareholders, has indicated an interest in purchasing up to approximately $2.1 million of the ADSs offered in this offering at the public offering price. JENESIS Co., Ltd., another strategic alliance partner, has indicated an interest in purchasing up to $0.5 million of the ADSs offered in this offering at the public offering price. Additionally, JNS Holdings Inc., the parent company of JENESIS Co., Ltd., has indicated an interest in purchasing up to $0.5 million of the ADSs offered in this offering at the public offering price. These investors are collectively referred to herein as our “Cornerstone Investors.” If each of the Cornerstone Investors purchases the maximum amount they have indicated an interest in purchasing, and assuming an initial public offering price of $9.50 per ADS (which is the midpoint of the price range set forth herein), the Cornerstone Investors are expected to purchase an aggregate of 852,632 ADSs, which constitutes approximately 42.6% of the 2,000,000 ADSs offered in this offering. Based on the maximum amounts the Cornerstone Investors have indicated an interest in purchasing, none of them is expected, individually, to beneficially own more than 5% of our outstanding common shares following this offering, including JENESIS Co., Ltd. and its affiliate JNS Holdings Inc., taken together.

The underwriters will receive the same underwriting discount on any ADSs purchased by the Cornerstone Investors as they will from any other ADSs sold to the public in this offering. Because indications of interest are not binding agreements or commitments to purchase, the Cornerstone Investors may determine to purchase fewer ADSs than they have indicated or not to purchase any ADSs in this offering, and the underwriters could determine to sell more, less, or no ADSs to any of them. As a result, the underwriters may allocate such ADSs to other investors in this offering.

Investing in the ADSs involves a high degree of risk. Before buying any of the ADSs, you should carefully read the discussion of material risks of investing in the ADSs in “Risk Factors” beginning on page 16 of this prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per ADS | Total | |||||||

| Initial public offering price |

$ | ● | $ | ● | ||||

| Underwriting discounts and commissions(1) |

$ | ● | $ | ● | ||||

| Proceeds to us (before expenses) |

$ | ● | $ | ● | ||||

| (1) | See “Underwriting — Commissions and Discounts” for additional information regarding compensation payable to the underwriters. |

We have granted the underwriters an option to purchase up to 300,000 additional ADSs from us at the public offering price, less underwriting discounts and commissions, for 45 days after the date of this prospectus to cover over-allotments, if any.

The underwriters expect to deliver the ADSs to purchasers on or about ●, 2023.

Boustead Securities, LLC

The date of this prospectus is ●, 2023.

Table of Contents

| Page | ||||

| iii | ||||

| v | ||||

| 1 | ||||

| 16 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 61 | ||||

| 64 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

66 | |||

| 81 | ||||

| 108 | ||||

| 112 | ||||

| 120 | ||||

| 123 | ||||

| 125 | ||||

| 132 | ||||

| 141 | ||||

| 143 | ||||

| 150 | ||||

| 163 | ||||

| 164 | ||||

| 164 | ||||

| 164 | ||||

| 165 | ||||

| F-1 | ||||

i

Table of Contents

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us. Neither we nor the underwriters have authorized anyone to provide you with information that is different, and neither we nor the underwriters take any responsibility for, and provide any assurance as to the reliability of, any information, other than the information in this prospectus and any free writing prospectus prepared by us. We are offering to sell the ADSs, and seeking offers to buy the ADSs, only in jurisdictions where such offers and sales are permitted. This prospectus is not an offer to sell, or a solicitation of an offer to buy, the ADSs in any jurisdictions where, or under any circumstances under which, the offer, sale, or solicitation is not permitted. The information in this prospectus and in any free writing prospectus prepared by us is accurate only as of the date on its respective cover, regardless of the time of delivery of this prospectus or any free writing prospectus or the time of any sale of the ADSs. Our business, results of operations, financial condition, or prospects may have changed since those dates.

Before you invest in the ADSs, you should read the registration statement (including the exhibits thereto and the documents incorporated by reference therein) of which this prospectus forms a part.

For investors outside of the United States: Neither we nor the underwriters have done anything that would permit this offering, or the possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus.

Notice to prospective investors in Japan: The ADSs have not been and will not be registered pursuant to Article 4, Paragraph 1 of the Financial Instruments and Exchange Act. Accordingly, none of the ADSs nor any interest therein may be offered or sold, directly or indirectly, in Japan or to, or for the benefit of, any “resident” of Japan (which term as used herein means any person resident in Japan, including any corporation or other entity organized under the laws of Japan), or to others for re-offering or resale, directly or indirectly, in Japan or to or for the benefit of a resident of Japan, except pursuant to an exemption from the registration requirements of, and otherwise in compliance with, the Financial Instruments and Exchange Act and any other applicable laws, regulations, and ministerial guidelines of Japan in effect at the relevant time.

ii

Table of Contents

As used in this prospectus, unless the context otherwise requires or otherwise states, references to “Pixie,” “our company,” the “Company,” “we,” “us,” “our,” and similar references refer to Pixie Dust Technologies, Inc., a joint stock corporation with limited liability organized under the laws of Japan. We refer to our common shares as “common shares” or “common stock,” unless the context otherwise requires. We sometimes refer to our common shares as “equity interests” when described on an aggregate basis.

Our functional currency and reporting currency is the Japanese yen (“JPY” or “¥”). The terms “dollar,” “USD,” “US$” or “$” refer to U.S. dollars, the legal currency of the United States. Convenience translations included in this prospectus of Japanese yen into U.S. dollars have been made at the exchange rate of ¥148.63 = US$1.00, which was the foreign exchange rate on October 31, 2022 as reported by the U.S. Federal Reserve in is weekly release on November 7, 2022 (www.federalreserve.gov/releases/h10/2022/).

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). Our fiscal year ends on April 30 of each year as does our reporting year. Our most recent fiscal year ended on April 30, 2022. See Note 2 to our audited financial statements as of and for the year ended April 30, 2022, included elsewhere in this prospectus, for a discussion of the basis of presentation, functional currency, and translation of financial statements.

On April 12, 2023, our board of directors approved a six hundred-for-one forward split of all our issued and outstanding common shares with effect from April 28, 2023 (the “Share Split”). All historical share amounts and share price information presented in this prospectus have been proportionally adjusted to reflect the impact of the Share Split.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

Market and Industry Data

This prospectus contains references to market data and industry forecasts and projections, which were obtained or derived from publicly available information, reports of governmental agencies, market research reports, and industry publications and surveys. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties and risks regarding the other forward-looking statements in this prospectus due to a variety of factors, including those described in the section entitled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the forecasts and estimates.

Select Scientific and Technical Terms

As used herein, the terms set forth below shall have the meanings, or are explained as follows:

“Mechanobiology” refers to the study of how biological components, such as cells, tissues, and organs, can sense and respond to mechanical cues to regulate numerous biological processes, including development, differentiation, physiology, and diseases. For example, companies unrelated to us have used mechanobiology to develop a variety of products, from consumer products such as massage tools that can be used to stimulate the growth of collagen in the face to medical devices such as ultrasonic vibrations to accelerate healing.

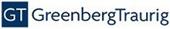

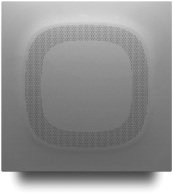

“Metamaterials” refers to materials engineered with properties not found in nature. These materials usually have artificially designed structures smaller than the wavelength of the targeted waves, such as light or sound.

iii

Table of Contents

“Sensory and metamaterial technologies” refers to technologies to complement or enhance the human senses and to design and develop materials that respond to waves as intended.

“Spatial analysis data” refers to information that is related to specific locations or geographic areas and is used to understand the patterns and relationships that exist within those areas.

“Spatial materials” refers to products to be displayed or placed on walls and other surfaces that contribute to the design and control of the spatial environment.

“Ultrasonic waves” refers to sound waves that have a frequency greater than the upper limit of human hearing, with frequencies that range from 20 kilohertz (kHz) to several gigahertz (GHz), depending on the application.

“Wave technology” refers to our proprietary technology that can be used to emit waves to affect an object, measure waves to obtain and analyze information about an object or develop products that interfere with waves to achieve desired effects.

iv

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this prospectus, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as “may”, “will”, “should”, “believe”, “expect”, “could”, “intend”, “plan”, “anticipate”, “estimate”, “continue”, “predict”, “project”, “potential”, “target,” “goal,” or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies, and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed in this prospectus under the headings “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Our Business” may cause our actual results, performance, or achievements to differ materially from any future results, performance, or achievements expressed or implied by the forward-looking statements in this prospectus. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements in this prospectus include:

| • | our expectations regarding our revenue, expenses, and other operating results; |

| • | our efforts to successfully develop and commercialize our technologies and related products; |

| • | the implementation of our strategic plans for our business and products and product candidates; |

| • | the size of the market opportunity for our products and product candidates and our ability to maximize those opportunities; |

| • | our ability to obtain and maintain any needed regulatory approval of our product candidates; |

| • | our expectations regarding success in testing for our product candidates; |

| • | the costs and success of our marketing efforts, and our ability to promote our brands; |

| • | our expectations regarding our ability, and that of our manufacturers, to manufacture our products; |

| • | our competitive position and the development of and projections relating to our competitors or our industry; |

| • | our ability to obtain adequate financing in the future on terms acceptable to us; |

| • | our ability to consummate strategic transactions, which may include acquisitions, mergers, dispositions, or investments; |

| • | our ability to identify and successfully enter into strategic collaborations in the future, and our assumptions regarding any potential revenue that we may generate thereunder; |

| • | our ability to exploit the intellectual property rights jointly owned with our collaborators in a manner beneficial to us; |

| • | our ability to obtain, maintain, protect, and enforce intellectual property protection for our technologies and related products and services, and the scope of such protection; |

| • | our ability to operate our business without infringing, misappropriating, or otherwise violating the intellectual property or proprietary rights of third parties; |

| • | general economic conditions and events and the impact they may have on us and our customers; |

v

Table of Contents

| • | our ability to respond to national disasters, such as earthquakes and tsunamis, and to global pandemics, such as COVID-19; |

| • | the regulatory environment in which we operate; |

| • | our plans with respect to use of proceeds from this offering; |

| • | our ability to attract and retain qualified key management and technical personnel; and |

| • | our expectations regarding the time during which we will be an emerging growth company and a foreign private issuer. |

Given the foregoing risks and uncertainties, you are cautioned not to place undue reliance on the forward-looking statements in this prospectus. The forward-looking statements contained in this prospectus are not guarantees of future performance and our actual results of operations and financial condition may differ materially from such forward-looking statements. In addition, even if our results of operations and financial condition are consistent with the forward-looking statements in this prospectus, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this prospectus speaks only as of the date of this prospectus. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this prospectus, whether as a result of new information, future events, or otherwise, after the date of this prospectus.

vi

Table of Contents

This summary highlights selected information presented in greater detail elsewhere in this prospectus. This summary does not include all the information you should consider before investing in the ADSs. You should read this summary together with the more detailed information appearing elsewhere in this prospectus, including our audited and unaudited financial statements and related notes and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” elsewhere in this prospectus. Some of the statements in this summary and elsewhere in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-looking Statements.”

Business Overview

We aim to create and commercialize innovative consumer personal care products and spatial materials through the utilization of mechanobiology and metamaterials in combination with our core proprietary wave technology that employs sound and light waves. Mechanobiology is an emerging field of research that studies how biological systems respond to mechanical stimuli. Mechanobiological research findings have the potential to be used to develop new health care and personal care options. Metamaterials are artificially engineered materials that have properties not found in nature. These properties are achieved by carefully designing the structure of the metamaterial at the sub-wavelength scale. Metamaterials can be used to manipulate electromagnetic waves, such as light and radio waves, in novel ways, such as negative refraction to light. Our wave control technologies consist of a system of methodologies to manipulate the common behaviors of sound and light in abstract layers as desired, and to utilize the unique attributes of sound and light for innovative personal care and industrial products.

While wave control technology has the potential for a variety of applications, we currently focus our development efforts in two principal fields: Personal Care & Diversity and Workspace & Digital Transformation. We focus our research and development on commercializing technologies that we believe will, among other things, provide personal care benefits and that will improve physical limitations through sensory and metamaterial technologies. As an emerging growth company, we have yet to generate significant revenue from any commercialization of our proprietary technologies or products.

In the Personal Care & Diversity field, we are working to develop technologies to enhance personal care and quality of life. We have launched three personal care products in Japan, our principal market, over the past six months: SonoRepro, an ultrasonic non-contact vibrotactile stimulation scalp care device in November 2022; VUEVO, a series of directional voice arrival detection devices for individuals with deaf and hard-of-hearing (“DHH”) in March 2023; and kikippa, an acoustic stimulation device functioning as a speaker in April 2023. Our products have been developed, and are marketed and sold, as personal care products. They are not marketed, nor intended to be used, as medical devices. In Japan, medical devices require compliance with the Act on Securing Quality, Efficacy and Safety of Products Including Pharmaceuticals and Medical Devices (“PMDA”) and are regulated by the Pharmaceuticals and Medical Devices Agency (“PMD Agency”) and the Ministry of Health, Labor and Welfare, which require registration and approval and compliance with marketing requirements, among other things. If any of our products were to be characterized as a medical device by the Japanese regulators, we may be required to seek regulatory approval and could face penalties for not obtaining such approval. As we continue our product research and development, we may create new products or an extension of an existing product that may qualify as a medical device in Japan or other jurisdictions. In such event, we would seek the requisite regulatory approval in Japan and any other applicable jurisdictions for such products in the future.

In the Workspace & Digital Transformation field, we are working to develop technologies for sensing and controlling space. We launched iwasemi, a sound-absorbing metamaterial in Japan in July 2022, and conducted a

1

Table of Contents

“soft” launch of selected versions of our iwasemi product to key professionals in the United States, such as architectural and interior design firms, in March 2023. Additionally, we are continuing our development of hackke, a location positioning technology, and KOTOWARI, a technology providing spatial analysis data; however, we currently do not have any specific timeline for commercializing these products.

In the next few years, we plan to focus our efforts on marketing and expanding the features of SonoRepro, kikippa, VUEVO, and iwasemi, particularly in our principal market of Japan. As part of our sales strategy, we may offer third-party products that complement our own products. For instance, we obtained a license to sell a medication for treatment of hair loss, which we intend to co-market with our personal scalp care device, SonoRepro. We intend to continue to explore such opportunities to provide comprehensive solutions to our customers.

In 2014, Dr. Yoichi Ochiai, our Chief Executive Officer and Dr. Takayuki Hoshi, our Chief Research Officer, developed “Pixie Dust,” a three-dimensional acoustic levitation technology, which enables the movement of objects in three dimensions by using ultrasonic control. Previously, ultrasonic waves had only been used to levitate objects and make them move in two dimensions. Since then, we have continued to work on overcoming the challenges in manipulating waves by improving the efficiency and performance of the computer processing required to control waves and making the circuit boards more sophisticated, as well as on applying our wave control technology to product developments and innovation.

Our Company was founded in 2017 by Dr. Ochiai, Dr. Hoshi, and Mr. Taiichiro Murakami, our Chief Operating Officer, to explore better ways to integrate academic and industry resources to develop and commercialize applications of our wave control technology. Since our Company’s inception, we have actively pursued industry-academia collaborations to generate new technologies that can be applied to real-world uses. In doing so, we have prioritized developing products that we believe have potential for wide applicability in the marketplace. We have also sought to accelerate the commercialization of the new products by collaborating with established companies in the relevant industries. Our research efforts aim to develop both advanced technologies and new products and services that can meet real-life needs and help to address social issues facing the global society, such as issues arising from an aging population, as well as to generate added value for our stakeholders.

To date, we have generated revenues primarily from commissioned research and development (“R&D”) and solution services we have provided for other companies including under our collaboration arrangements. However, as we expand our marketing and sales efforts for our products, we expect revenue from product sales to contribute an increasing proportion of our revenues over time. For our fiscal years ended April 30, 2021 and April 30, 2022, we generated revenues of ¥512,772 thousand and ¥636,265 thousand ($4,281 thousand), respectively, and incurred net losses of ¥759,484 thousand and ¥1,109,468 thousand ($7,465 thousand), respectively. For the six months period ended October 31, 2021 and October 31, 2022, we have generated revenues of ¥179,213 thousand and ¥158,639 thousand ($1,067 thousand), respectively, and have incurred net losses of ¥624,957 thousand and ¥885,000 thousand ($5,954 thousand), respectively.

Our Strategy

Our goal is to continue to develop and commercialize innovative and practical products by applying our control wave technology. In this effort, we plan to:

| • | Focus our sales efforts in establishing our brands and implementing customized marketing strategy for each of our main products. In the next few years, we plan to focus on further commercialization of SonoRepro, kikippa, VUEVO, and iwasemi, particularly in our principal market of Japan. We intend to implement customized marketing strategies for each of these products depending on the nature and features of the product and to tailor initiatives to the product’s target audience. With respect to SonoRepro, VUEVO, and kikippa, we plan to position and market them as consumer personal care products for everyday use. We plan to adopt a multi-faceted, consumer-driven marketing strategy for |

2

Table of Contents

| these products including establishing distributor and retailer networks and leveraging online and print media and social media including our dedicated websites. With respect to iwasemi, we plan to market this product primarily through growing the awareness of iwasemi among architectural firms, construction companies, and other distributors and consultants of construction materials. In addition, as for all of these products, we plan to leverage our collaborative relationships with our R&D collaborators, which are established companies in the relevant industries, to jointly market these products. |

| • | Maximize the commercial potential of our technology applications with simultaneous revenue models. We plan to commercialize our products by simultaneously pursuing four revenue models (sales model, subscription model, lease model, and licensing model), which we believe will provide us the flexibility and long-term sustainability to monetize our technology applications. We expect to generate most of our commercialization revenue from our current products through the sales model and the subscription model. To date, we have only applied the licensing model to iwasemi HX-a. |

| • | Continue to develop and leverage our collaborative relationships with academia and the industry in R&D and marketing our products. We have benefited from our collaborations with academic institutions and industry collaborators, which contributed ideas and funds to our development and research endeavors. We intend to continue to leverage our established relationships and develop new collaborations in developing and commercializing our products. In particular, we intend to leverage our industry collaborators’ reputation, distribution channels, and service and support in raising market awareness and expanding sales of our products. |

| • | Drive innovation to increase applications of our wave control technology and upgrade our products. We plan to continue to invest in research and development to bring innovative and practical products and solutions to our customers. This may include new data, new features, new applications, and new services for our existing products and product candidates. As we continue our research, we may create new products or an extension of an existing product that may be subject to registration and approval as a medical device under the PMDA in Japan or in other jurisdictions. In such event, we would either modify our product so that it would not be subject to such compliance or, alternatively, proceed to seek the requisite regulatory approval. |

Summary Risk Factors

There are a number of risks that you should carefully consider before making an investment decision regarding this offering. These risks are discussed more fully in the section entitled “Risk factors” beginning on page 16 of this prospectus. You should read and carefully consider these risks and all of the other information in this prospectus, including the financial statements and the related notes thereto included in this prospectus, before deciding whether to invest in the ADSs. If any of these risks actually occur, our business, financial condition, operating results and cash flows could be materially adversely affected. In such case, the trading price of the ADSs would likely decline, and you may lose all or part of your investment. These risk factors include, but are not limited to:

Risks Related to Our Company and Our Business

| • | We are an emerging growth company and have a limited operating history, which may make it difficult to evaluate our current business and predict our future performance. |

| • | We have a history of operating losses and we do not expect to be profitable for the foreseeable future. There is substantial doubt concerning our ability to continue as a going concern. |

| • | We may need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute current shareholders’ ownership interests. |

3

Table of Contents

| • | Our ability to increase revenue and achieve profitability will depend on the successful commercialization of our products and product candidates, including SonoRepro, kikippa, VUEVO, and iwasemi in the next one to three years, and our product and product candidates may not be successfully commercialized, or we may experience delays in achieving market acceptance, which could negatively impact our business. |

| • | We operate in a very competitive business environment, and if we are unable to compete successfully against our existing or potential competitors, our business, financial condition, and results of operations may be adversely affected. |

| • | We have generated most of our revenues from providing commissioned research and development and solution services including under our collaboration agreements and have had significant customer concentration, and this concentration may continue if we fail to diversify our customer base by successfully commercializing our products and product candidates. |

| • | We are subject to risks related to our reliance on collaboration arrangements to fund development and commercialization of certain of our products or product candidates, and our financial results may be adversely impacted if such collaborations do not lead to the commercialization of products. |

| • | We currently rely, and expect to continue to rely, on third parties to conduct many aspects of our product manufacturing and distribution, and these third parties may terminate these agreements or not perform satisfactorily. |

| • | We are highly dependent on our senior management team and key personnel and our business could be harmed if we are unable to attract and retain personnel necessary for our success. |

| • | We are exposed to the risk of natural disasters, unusual weather conditions, pandemic outbreaks such as COVID-19, political events, war, terrorism, and unfavorable macroeconomic conditions such as inflation, which could disrupt business and limit our ability to grow our business and negatively affect our results of operations. |

| • | Our long-term success depends, in part, on our ability to market and sell our products to customers located outside of Japan and our future international operations could expose us to risks that could have a material adverse effect on our business, operating results, and financial condition. |

Risks Related to Government Regulation

| • | We currently do not, and do not plan in the near future to, market our consumer personal care products, including SonoRepro, VUEVO, and kikippa, as medical devices. If we fail to comply with the government regulations relating to the promotion of such products, or to obtain any required approvals on a timely basis, we may incur fines, penalties, and consumer lawsuits and our business and growth prospects may be negatively impacted. |

| • | Changes in government regulations and trade policies may materially and adversely affect our sales and results of operations. |

Risks Related to Our Intellectual Property

| • | The failure to enforce and maintain our patents, trademarks and protect our other intellectual property could materially adversely affect our business. |

| • | We rely substantially on our trademarks and trade names. If our trademarks and trade names are not adequately protected, then we may not be able to build name recognition in our markets of interest and our business may be harmed. |

4

Table of Contents

| • | Our obligations under our existing or future product development and commercialization collaboration agreements may limit our ability to exploit intellectual property rights that are important to our business. Further, if we fail to comply with our obligations under our existing or future collaboration agreements, or otherwise experience disruptions to our business relationships with our prior, current, or future collaborators, we could lose intellectual property rights that are important to our business. |

Risks Related to Cybersecurity

| • | Security breaches, loss of data, and other disruptions could compromise sensitive information related to our business, prevent us from accessing critical information or expose us to liability, which could adversely affect our business and our reputation. |

| • | Cybersecurity breaches and other disruptions or failures in our information technology systems could compromise our information, result in the unauthorized disclosure of confidential customer, employee, Company and business partners’ information, damage our reputation, and expose us to liability, which could negatively impact our business. |

Risks Related to this Offering and Ownership of the ADSs

| • | We are an “emerging growth company” and, as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, our common shares and the ADSs may be less attractive to investors. |

| • | As a “foreign private issuer” we are permitted, and intend, to follow certain home country corporate governance and other practices instead of otherwise applicable SEC and Nasdaq requirements, which may result in less protection than is accorded to investors under rules applicable to domestic U.S. issuers. |

| • | The requirements of being a public company may strain our resources and divert management’s attention. |

| • | We have identified material weaknesses in our internal control over financial reporting. If our remediation of these material weaknesses is not effective, or if we identify additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results in a timely manner, which may adversely affect investor confidence in our Company. |

| • | The market price of the ADSs may be volatile or may decline regardless of our operating performance, and you may not be able to resell your ADSs at or above the public offering price. |

Risks Related to Japan

| • | We are incorporated in Japan, and it may be more difficult to enforce judgments against us that are obtained in courts outside of Japan. |

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to reporting companies that make filings with the U.S. Securities and Exchange Commission (the “SEC”). For so long as we remain an emerging growth company, we will not be required to, among other things:

| • | present more than two years of audited financial statements and two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure in our registration statement of which this prospectus forms a part; |

5

Table of Contents

| • | have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); |

| • | disclose certain executive compensation related items; and |

| • | seek shareholder non-binding advisory votes on certain executive compensation matters and golden parachute arrangements, to the extent applicable to our Company as a foreign private issuer. |

The JOBS Act also permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result, our financial statements may not be comparable to companies that comply with public company effective dates.

We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the completion of this offering, (ii) the last day of the fiscal year during which we have total annual gross revenue of at least $1.235 billion, (iii) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which means the market value of our common shares that are held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter, and (iv) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

In addition, upon the consummation of this offering, we will report in accordance with the rules and regulations applicable to a “foreign private issuer.” As a foreign private issuer, we will take advantage of certain provisions under the rules that allow us to follow the laws of Japan for certain corporate governance matters. Even when we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Exchange Act; |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events; and |

| • | Regulation Fair Disclosure (“Regulation FD”), which regulates selective disclosures of material information by issuers. |

As a foreign private issuer, we will have four months after the end of each fiscal year (April 30) to file our annual report on Form 20-F with the SEC. In addition, our executive officers, directors, and principal shareholders will be exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act.

Foreign private issuers, like emerging growth companies, are exempt from certain more stringent executive compensation disclosure rules. As such, even when we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will continue to be exempt from the more stringent compensation disclosures required of public companies that are not a foreign private issuer.

6

Table of Contents

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies:

| (i) | the majority of our executive officers or directors are U.S. citizens or residents; |

| (ii) | more than 50% of our assets are located in the United States; or |

| (iii) | our business is administered principally in the United States. |

In this prospectus, we have taken advantage of certain of the reduced reporting requirements as a result of being an emerging growth company and a foreign private issuer. Accordingly, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold equity interests. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

Recent Developments

Share Capital Reorganization

On March 22, 2023, all our issued and outstanding convertible preferred shares including 1,111 Series AA convertible preferred shares, 4,600 Series A convertible preferred shares, 404 Series BB convertible preferred shares, 3,688 Series B convertible preferred shares and 1,923 Series C convertible preferred shares converted into common shares on a one-to-one basis (the “Conversion”).

On March 27, 2023, our stockholders approved a capital reduction to simplify our Company’s capital structure. This resolution has resulted in the reduction of our Company’s registered capital amount for common stock from ¥1,189,380 thousand to ¥100,000 thousand, effective from April 30, 2023. Additionally, on March 31, 2023, our stockholders adopted a resolution to reduce the total number of authorized shares of our Company from 1,000,000 shares to 86,904 shares with effect as of the same day.

On April 12, 2023, our board of directors approved a six hundred-for-one forward split of all our issued and outstanding common shares with effect from April 28, 2023.

Preliminary Financial Data for the Year Ended April 30, 2023

The preliminary financial results for the year ended April 30, 2023 set forth below have been prepared in accordance with U.S. GAAP, but are unreviewed and unaudited and do not present all information necessary for an understanding of our operations for the year then ended. Our estimates are based solely on information available to us as of the date of this prospectus. Actual results for the year ended April 30, 2023 remain subject to the completion of management’s final reviews and our other financial closing procedures and may differ from these estimated preliminary results due to the completion of our financial closing procedures, final adjustments, and other developments that may arise during the review process. It is unlikely that our actual audited financial statements and related notes as of and for the year ended April 30, 2023 will be available prior to the completion of this offering, and consequently may not be available to you prior to your decision whether to invest in this offering.

These estimates should not be viewed as a substitute for our full annual financial statements prepared in accordance with U.S. GAAP. Accordingly, you should not place undue reliance on this preliminary data. These estimated preliminary results are not necessarily indicative of any future period and should be read in conjunction with “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the financial statements and related notes thereto included elsewhere in this prospectus.

7

Table of Contents

The preliminary financial data for the year ended April 30, 2023 included in this prospectus has been prepared by and is the responsibility of our management. Our independent auditor, Baker Tilly US, LLP, has not audited, reviewed, compiled or performed any procedures with respect to the preliminary financial data. Accordingly, Baker Tilly US, LLP does not express an opinion or any other form of assurance with respect thereto.

| • | The unaudited, preliminary total revenue for the year ended April 30, 2023 is expected to be approximately ¥705,955 thousand ($4,750 thousand), representing a projected increase of approximately ¥69,690 thousand from the total revenue for the year ended April 30, 2022. Such increase was primarily due to the revenue from new products launched in the year ended April 30, 2023, partially offset by a decrease in commissioned research and solution service revenues. |

| • | The unaudited, preliminary total cost of revenue is expected to be approximately ¥142,925 thousand ($962 thousand) for the year ended April 30, 2023, representing a projected decrease of approximately ¥63,679 thousand from the total cost of revenue for the year ended April 30, 2022. Such decrease was primarily due to the Company’s ability to leverage existing research results for commissioned research, partially offset by an increase in the cost of product sales related to the launch of new products in the year ended April 30, 2023. |

| • | The unaudited, preliminary total operating expenses are expected to be approximately ¥2,520,218 thousand ($16,956 thousand) for the year ended April 30, 2023, representing a projected increase of approximately ¥992,841 thousand from the total operating expenses for the year ended April 30, 2022. Such increase was primarily due to the increases in advertising expenses related to new products and marketing fees. |

| • | The unaudited, preliminary net loss is expected to be to approximately ¥1,942,139 thousand ($13,067 thousand) for the year ended April 30, 2023, representing a projected increase of approximately ¥832,671 thousand from the net loss for the year ended April 30, 2022. |

This Recent Developments section includes “forward-looking statements.” All statements contained herein other than statements of historical facts, including, without limitation, statements regarding our expectations regarding our financial and operating results for the year ended April 30, 2023, and our future financial and business performance, are forward-looking statements. The words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under the heading “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” included in this prospectus.

Corporate Information

Our Company was originally incorporated in Japan on May 10, 2017.

Our agent for service of process in the United States is Cogency Global Inc. Our principal executive offices are located at 2-20-5 Kanda Misaki-cho, Chiyoda-ku, Tokyo 101-0061, Japan, and our main telephone number is +81(0)3-5244-4880. Our website is https://pixiedusttech.com/. The information contained in, or that can be accessed through, our website is not incorporated by reference into, and is not a part of, this prospectus. You should not consider any information on our website to be a part of this prospectus or use any such information in your decision on whether to purchase the ADSs. We have included our website address in this prospectus solely for informational purposes.

8

Table of Contents

Trademarks

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. As of May 31, 2023, we had 53 registered trademarks and 66 trademark applications. “Pixie Dust Technologies” is registered in Japan, the United States and with the World Intellectual Property Organization. The other registered trademarks are currently only registered in Japan. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or food products in this prospectus is not intended to imply a relationship with, or endorsement or sponsorship by, these other parties. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

9

Table of Contents

| Issuer |

Pixie Dust Technologies, Inc. |

| ADSs Offered by Us |

2,000,000 ADSs (or 2,300,000 ADSs if the underwriters exercise in full the option to purchase additional ADSs). |

| Offering Price |

We currently expect the initial public offering price to be between $9.00 and $10.00 per ADS. |

| ADSs to be Outstanding Immediately After this Offering |

2,000,000 ADSs (or 2,300,000 ADSs if the underwriters exercise in full their option to purchase additional ADSs). |

| Common Shares to be Outstanding Immediately After this Offering(1) |

15,035,600 common shares (or 15,335,600 common shares if the underwriters exercise in full their option to purchase additional ADSs). |

| Common Shares |

Our share capital consists of common shares. Each common share shall be entitled to one vote on all matters subject to shareholders’ vote. |

| Option to Purchase Additional ADSs |

We have granted to the underwriters an option to purchase up to 300,000 additional ADSs from us at the initial public offering price less the underwriting discounts and commissions, to cover over-allotments, if any, for a period of 45 days from the date of this prospectus. |

| Representative’s Stock Acquisition Rights |

We will issue to Boustead Securities, LLC, the representative of the underwriters (the “Representative”), or its permitted designees the warrants (which are stock acquisition rights under Japanese laws) to purchase up to 69,000 ADSs (the “Representative’s Warrants”) if the underwriters exercise their over-allotment option in full. The Representative’s Warrants will have an exercise price equal to 125% of the price per ADS sold in this offering. |

| The ADSs |

Each ADS represents one common share. The ADSs are evidenced by American depositary receipts (“ADRs”) issued by The Bank of New York Mellon, as the depositary. |

| The depositary will be the holder of the common shares underlying the ADSs, and you will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary, and owners and beneficial owners of ADSs from time to time. |

| You may surrender your ADSs to the depositary to withdraw the common shares underlying your ADSs. The depositary will charge you a fee for such an exchange. |

| We may amend or terminate the deposit agreement for any reason without your consent. If an amendment becomes effective, you will be bound by the deposit agreement, as amended, if you continue to hold your ADSs. |

10

Table of Contents

| To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, a form of which is an exhibit to the registration statement to which this prospectus forms a part. |

| Depositary |

The Bank of New York Mellon |

| Use of Proceeds |

We estimate that the net proceeds to us from this offering will be approximately $14.9 million (or $17.5 million if the underwriters exercise in full their option to purchase additional ADSs), assuming an initial public offering price of $9.50 per ADS (which is the midpoint of the price range set forth on the cover page of this prospectus), after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. |

| We currently intend to use the net proceeds from this offering to support development and commercialization of our technologies and related products, as well as for other working capital and general corporate purposes. See “Use of Proceeds.” |

| Lock-ups |

We, our directors, corporate auditors, executive officers, employees and certain of our existing shareholders have agreed with the underwriters not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of, or otherwise dispose of, any of our securities for a period of up to 12 months following the closing of this offering, subject to certain exceptions. See “Underwriting — Lock-up Agreements” for more information. |

| Listing |

We have applied to list the ADSs on Nasdaq under the symbol “PXDT.” If we do not meet all of Nasdaq’s initial listing criteria and obtain approval for the listing, we will not complete this offering. |

| Indications of Interest |

The Cornerstone Investors have, severally and not jointly, indicated an interest in purchasing up to an aggregate of approximately $8.1 million of the ADSs offered in this offering at the initial public offering price and on the same terms and conditions as the other purchasers in this offering. If each of the Cornerstone Investors purchases the maximum amount they have indicated an interest in purchasing, and assuming an initial public offering price of $9.50 per ADS (which is the midpoint of the price range set forth on the cover page of this prospectus), the Cornerstone Investors are expected to purchase an aggregate of 852,632 ADSs, which constitutes approximately 42.6% of the 2,000,000 ADSs offered in this offering. Based on the maximum amounts the Cornerstone Investors have indicated an interest in purchasing, none of them is expected, individually, to beneficially own more than 5% of our outstanding common shares following this offering, including JENESIS Co., Ltd. and its affiliate JNS Holdings Inc., taken together. The underwriters will receive the same underwriting discount on any ADSs purchased by the Cornerstone Investors as they will from any other ADSs sold to the public in this offering, and any such ADSs would not be subject to a lock-up. |

11

Table of Contents

Because these indications of interest are not binding agreements or commitments to purchase, the Cornerstone Investors could determine to purchase more, less, or no ADSs in this offering, and the underwriters could determine to sell more, less, or no ADSs to any of the Cornerstone Investors. As a result, the underwriters may allocate such ADSs to other investors in this offering.

| Risk Factors |

Investing in the ADSs is highly speculative and involves a high degree of risk. You should carefully read and consider the information set forth under the heading “Risk Factors” beginning on page 16, and all other information contained in this prospectus, before deciding to invest in the ADSs. |

| (1) | The number of common shares that will be outstanding after this offering is based on 13,035,600 common shares outstanding immediately prior to the completion of this offering and excludes: |

| (a) | up to 300,000 ADSs issuable upon the exercise in full by the underwriters of their option to purchase additional ADSs from us; |

| (b) | up to an aggregate of 1,276,800 common shares issuable upon the exercise of stock options outstanding, at a weighted-average exercise price of ¥147,173 ($990.19) per option (each option can be exercised for 600 shares of common stock) and |

| (c) | up to an aggregate of 69,000 common shares issuable upon the exercise of the Representative’s Warrants as described above. |

Unless otherwise indicated, all information contained in this prospectus assumes:

| • | no exercise of the option granted to the underwriters to purchase up to 300,000 additional ADSs in connection with this offering. |

12

Table of Contents

Summary Financial Information and Operating Data

The following tables set forth our summary financial information as of and for the years ended April 30, 2021 and 2022 and the six months ended October 31, 2021 and 2022. You should read the following summary financial information in conjunction with, and it is qualified in its entirety by reference to, our audited financial statements and the related notes thereto, our unaudited condensed financial statements and the related notes thereto, and the sections entitled “Capitalization”, “Selected Financial Information and Operating Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, each of which are included elsewhere in this prospectus.

Our summary statement of operations information for the years ended April 30, 2021 and 2022, and our related summary balance sheet information as of April 30, 2021, and 2022, have been derived from our audited financial statements as of and for the years ended April 30, 2021 and 2022, prepared in accordance with U.S. GAAP, which are included elsewhere in this prospectus.

Our summary statement of operations information for the six months ended October 31, 2021 and 2022, and our related summary balance sheet information as of October 31, 2022, have been derived from our unaudited condensed financial statements as of and for the six months ended October 31, 2022, prepared in accordance with U.S. GAAP, which are included elsewhere in this prospectus.

13

Table of Contents

Our historical results for the periods presented below are not necessarily indicative of the results to be expected for any future periods.

| (in thousands, except per share amounts) |

Year ended April 30, | Six months ended October 31, | ||||||||||||||||||||||

| 2021(¥) | 2022(¥) | 2022($)(1) | 2021(¥) | 2022(¥) | 2022($)(1) | |||||||||||||||||||

| Statement of Operations |

||||||||||||||||||||||||

| Revenue: |

||||||||||||||||||||||||

| Services |

¥ | 512,772 | ¥ | 636,265 | $ | 4,281 | ¥ | 179,213 | ¥ | 121,866 | $ | 820 | ||||||||||||

| Products |

— | — | — | — | 36,773 | 247 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenue |

512,772 | 636,265 | 4,281 | 179,213 | 158,639 | 1,067 | ||||||||||||||||||

| Cost and Expenses: |

||||||||||||||||||||||||

| Cost of services |

136,390 | 206,604 | 1,391 | 71,258 | 23,121 | 155 | ||||||||||||||||||

| Cost of products |

— | — | — | — | 24,053 | 162 | ||||||||||||||||||

| Research and development |

601,731 | 694,072 | 4,670 | 364,465 | 339,283 | 2,283 | ||||||||||||||||||

| Selling, general and administrative expenses |

525,158 | 832,994 | 5,604 | 360,962 | 643,892 | 4,332 | ||||||||||||||||||

| Other operating expenses, net |

— | 311 | 2 | 311 | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total costs and expenses |

1,263,279 | 1,733,981 | 11,667 | 796,996 | 1,030,349 | 6,932 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loss from operations |

(750,507 | ) | (1,097,716 | ) | (7,386 | ) | (617,783 | ) | (871,710 | ) | (5,865 | ) | ||||||||||||

| Interest expense |

(17,672 | ) | (24,777 | ) | (167 | ) | (11,662 | ) | (13,423 | ) | (90 | ) | ||||||||||||

| Other income |

8,695 | 13,025 | 88 | 4,488 | 133 | 1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loss before income taxes |

(759,484 | ) | (1,109,468 | ) | (7,465 | ) | (624,957 | ) | (885,000 | ) | (5,954 | ) | ||||||||||||

| Income tax expense |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

¥ | (759,484 | ) | ¥ | (1,109,468 | ) | $ | (7,465 | ) | ¥ | (624,957 | ) | ¥ | (885,000 | ) | $ | (5,954 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Weighted-average shares outstanding used to compute net loss per share, basic and diluted (2) |

6,000,000 | 6,000,000 | 6,000,000 | 6,000,000 | 6,000,000 | 6,000,000 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss per share attributable to common stockholders, basic and diluted (2) |

¥ | (126.58 | ) | ¥ | (184.91 | ) | $ | (1.24 | ) | ¥ | (104.16 | ) | ¥ | (147.50 | ) | $ | (0.99 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Weighted-average shares outstanding used to compute pro forma net loss per share, basic and diluted (unaudited) (2)(3) |

13,035,600 | 13,035,600 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited) (2)(3) |

¥ | (67.89 | ) | $ | (0.46 | ) | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

14

Table of Contents

| (in thousands) | As of April 30, | As of October 31, | October 31, 2022 |

|||||||||||||||||||||

| 2021(¥) | 2022(¥) | 2022($)(1) | 2022(¥) | 2022($)(1) | Pro Forma (¥) |

|||||||||||||||||||

| Balance Sheet Information: |

||||||||||||||||||||||||

| Total assets |

¥ | 4,541,714 | ¥ | 3,789,682 | $ | 25,497 | ¥ | 5,410,219 | $ | 36,401 | ||||||||||||||

| Total liabilities |

¥ | 1,802,969 | ¥ | 2,160,405 | $ | 14,535 | ¥ | 2,431,301 | $ | 16,358 | ||||||||||||||

| Stockholders’ Equity: |

||||||||||||||||||||||||

| Series C convertible preferred stock, no par value; no shares authorized; no shares issued and outstanding at April 30, 2022 and 1,153,800 shares authorized; 1,153,800 shares issued and outstanding; aggregate liquidation preference of ¥4,357,518 ($29,318) at October 31, 2022; no shares authorized, no shares issued and outstanding at October 31, 2022, pro forma (unaudited)(2)(3) |

— | — | — | 1,089,380 | 7,329 | — | ||||||||||||||||||

| Series B convertible preferred stock, no par value; 2,212,800 shares authorized; 2,212,800 shares issued and outstanding; aggregate liquidation preference of ¥7,791,269 ($52,421) at April 30, 2022 and October 31, 2022; no shares authorized, no shares issued and outstanding at October 31, 2022, pro forma (unaudited)(2)(3) |

— | — | — | — | — | — | ||||||||||||||||||

| Series BB convertible preferred stock, no par value; 242,400 shares authorized; 242,400 shares issued and outstanding; aggregate liquidation preference of ¥199,963 ($1,345) at April 30, 2022 and October 31, 2022; no shares authorized, no shares issued and outstanding at October 31, 2022, pro forma (unaudited)(2)(3) |

— | — | — | — | — | — | ||||||||||||||||||

| Series A convertible preferred stock, no par value; 2,760,000 shares authorized; 2,760,000 shares issued and outstanding; aggregate liquidation preference of ¥862,500 ($5,803) at April 30, 2022 and October 31, 2022; no shares authorized, no shares issued and outstanding at October 31, 2022, pro forma (unaudited)(2)(3) |

— | — | — | — | — | — | ||||||||||||||||||

| Series AA convertible preferred stock, no par value; 666,600 shares authorized; 666,600 shares issued and outstanding; aggregate liquidation preference of ¥37,303 ($251) at April 30, 2022 and October 31, 2022; no shares authorized, no shares issued and outstanding at October 31, 2022, pro forma (unaudited)(2)(3) |

— | — | — | — | — | — | ||||||||||||||||||

| Common stock, no par value; 46,260,600 shares authorized; 6,000,000 shares issued and outstanding at April 30, 2022 and 45,106,800 shares authorized; 6,000,000 shares issued and outstanding at October 31, 2022; 52,142,400 shares authorized, 13,035,600 shares issued and outstanding at October 31, 2022, pro forma (unaudited)(2)(3) |

100,000 | 100,000 | 673 | 100,000 | 673 | 100,000 | ||||||||||||||||||

| Additional paid-in capital |

3,946,038 | 3,946,038 | 26,549 | 5,091,299 | 34,255 | 6,180,679 | ||||||||||||||||||

| Accumulated deficit |

(1,307,293 | ) | (2,416,761 | ) | (16,260 | ) | (3,301,761 | ) | (22,214 | ) | (3,301,761 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total stockholders’ equity |

2,738,745 | 1,629,277 | 10,962 | 2,978,918 | 20,043 | 2,978,918 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Liabilities and Stockholders’ Equity |

¥ | 4,541,714 | ¥ | 3,789,682 | $ | 25,497 | ¥ | 5,410,219 | $ | 36,401 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | For convenience, the Japanese yen amounts are expressed in U.S. dollars at the exchange rate of ¥148.63 = US$1.00, which was the foreign exchange rate on October 31, 2022 as reported by the U.S. Federal Reserve in is weekly release on November 7, 2022 (www.federalreserve.gov/releases/h10/2022/). |

| (2) | These figures have been retroactively adjusted to give effect to the Share Split and reduction of authorized shares. See Note 2, “Summary of Significant Accounting Policies” to our audited financial statements for the years ended April 30, 2021 and 2022 included elsewhere in this prospectus for further detail. |

| (3) | On March 22, 2023, the Company’s issued and outstanding shares of convertible preferred stock were all converted into common stock on a one-to-one basis, which resulted in a total registered capital amount of ¥1,189,380 thousand for common stock. On March 27, 2023, upon the resolution of the stockholders, a reduction of the registered capital amount for common stock was approved in accordance with the Companies Act, with an effective date of April 30, 2023. As a result, ¥1,089,380 thousand of registered capital for common stock was reclassified to additional paid-in capital. The unaudited pro forma stockholders’ equity as of October 31, 2022 has been computed to give effect to the automatic conversion of the convertible preferred stock and the capital reduction. Unaudited pro forma basic and diluted net loss per share is computed to give effect to the automatic conversion of the Company’s outstanding convertible preferred stock into shares of common stock as if such conversion had occurred at the beginning of the period presented. |

15

Table of Contents

An investment in the ADSs is highly speculative and involves a high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties. You should carefully consider the factors described below, together with all the other information contained in this prospectus, including the audited and unaudited financial statements and the related notes included in this prospectus, before deciding whether to invest in the ADSs. These risk factors are not presented in the order of importance or probability of occurrence. If any of the following risks occurs, our business, financial condition and results of operations could be materially and adversely affected. In that event, the market price of the ADSs could decline, and you could lose part or all your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary note regarding forward-looking statements.”

Summary of Risk Factors

Risks Related to Our Company and Our Business

| • | We are an emerging growth company and have a limited operating history, which may make it difficult to evaluate our current business and predict our future performance. |

| • | We have a history of operating losses and we do not expect to be profitable for the foreseeable future. There is substantial doubt concerning our ability to continue as a going concern. |

| • | We may need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute current shareholders’ ownership interests. |

| • | Our ability to increase revenue and achieve profitability will depend on the successful commercialization of our products and product candidates, including SonoRepro, kikippa, VUEVO, and iwasemi in the next one to three years, and our product and product candidates may not be successfully commercialized, or we may experience delays in achieving market acceptance, which could negatively impact our business. |

| • | We operate in a very competitive business environment, and if we are unable to compete successfully against our existing or potential competitors, our business, financial condition, and results of operations may be adversely affected. |

| • | We have generated most of our revenues from providing commissioned research and development and solution services including under our collaboration agreements and have had significant customer concentration, and this concentration may continue if we fail to diversify our customer base by successfully commercializing our products and product candidates. |

| • | We are subject to risks related to our reliance on collaboration arrangements to fund development and commercialization of certain of our products or product candidates, and our financial results may be adversely impacted if such collaborations do not lead to the commercialization of products. |

| • | We currently rely, and expect to continue to rely, on third parties to conduct many aspects of our product manufacturing and distribution, and these third parties may terminate these agreements or not perform satisfactorily. |

| • | We are highly dependent on our senior management team and key personnel and our business could be harmed if we are unable to attract and retain personnel necessary for our success. |

| • | We are exposed to the risk of natural disasters, unusual weather conditions, pandemic outbreaks such as COVID-19, political events, war, terrorism, and unfavorable macroeconomic conditions such as inflation, which could disrupt business and limit our ability to grow our business and negatively affect our results of operations. |

16

Table of Contents