UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|||

|

☒ |

|

Smaller reporting company |

|

||

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

The aggregate market value of voting stock held by non-affiliates of the Registrant on July 27, 2023, based on the closing price of $3.15 per share of the Registrant’s common stock as reported by the New York Stock Exchange, was approximately $

1

recently completed second fiscal quarter), the Registrant was a privately held company. This calculation does not reflect a determination that certain persons are affiliates of the Registrant for any other purpose.

The number of shares of Registrant’s Common Stock outstanding as of March 22, 2024 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Surf Air Mobility Inc. 2024 Proxy Statement, to be filed with the Securities and Exchange Commission (“SEC”) within 120 days after the closing of the registrant's fiscal year are incorporated into Part III to the extent stated herein. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as part hereof.

2

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

8 |

|

Item 1A. |

20 |

|

Item 1B. |

54 |

|

Item 1C. |

54 |

|

Item 2. |

56 |

|

Item 3. |

56 |

|

Item 4. |

56 |

|

|

|

|

PART II |

|

|

Item 5. |

52 |

|

Item 6. |

52 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

53 |

Item 7A. |

66 |

|

Item 8. |

66 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

114 |

Item 9A. |

114 |

|

Item 9B. |

116 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

117 |

|

|

|

PART III |

|

|

Item 10. |

118 |

|

Item 11. |

118 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

118 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

118 |

Item 14. |

118 |

|

|

|

|

PART IV |

|

|

Item 15. |

118 |

|

Item 16. |

123 |

|

|

124 |

3

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended. All statements other than statements of historical facts contained in this Annual Report on Form 10-K may be forward-looking statements. Forward-looking statements may be identified by the use of words such as “estimate”, “plan”, “project”, “forecast”, “intend”, “will”, “expect”, “anticipate”, “believe”, “seek”, “target”, “designed to” or other similar expressions that predict or indicate future events or trends, although the absence of these words does not mean that a statement is not forward-looking. The Company cautions readers of this Annual Report on Form 10-K that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the Company’s control, that could cause the actual results to differ materially from the expected results. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity and market share, potential benefits and the commercial attractiveness to its customers of the Company’s products and services and the dependence on third-party partnerships in the development of fully-electric and hybrid-electric powertrains, and the potential success of the Company’s marketing and expansion strategies. These statements are based on various assumptions, whether or not identified in this Annual Report on Form 10-K, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied upon by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. These forward-looking statements are subject to a number of risks and uncertainties, including:

All forward-looking statements included herein attributable to the Company or any person acting on any party’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except

4

to the extent required by applicable laws and regulations, the Company undertakes no obligations to update these forward-looking statements to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect the occurrence of unanticipated events.

5

SUMMARY RISK FACTORS

Investing in our Common Stock involves numerous risks, including the risks described in “Part I, Item 1A. Risk Factors” of this Annual Report. You should carefully consider these risks before making an investment. Below are some of these risks, any one of which could materially adversely affect our business, financial condition, results of operations, and prospects.

6

7

PART 1

ITEM 1: BUSINESS

Overview

Surf Air Mobility Inc. (the “Company”, “us”, “we” or “our”) is a regional air mobility platform that aims to sustainably connect communities. We intend to accelerate the adoption of green flying by developing, together with our commercial partners, fully-electric and hybrid-electric powertrain technology to upgrade existing fleets, and by creating a financing and services infrastructure to enable this transition on an industry-wide level. We believe bringing electrified aircraft to market at scale will substantially reduce the cost and environmental impact of regional flying, and that such reductions are achievable by the end of the decade. Additionally, we believe operating as a publicly traded company and having efficient access to growth capital will allow us to accelerate the implementation of our strategic plan.

The Company was incorporated in 2021 and became the ultimate parent of both Surf Air Global Limited (“Surf Air Global”) and Southern Airways Corporation (“Southern”) in July of 2023 following the Company’s public listing on the New York Stock Exchange (“NYSE”). For 2023, which includes the full year of operations of Surf and the operations of Southern from the July 27, 2023 acquisition date, the Company’s combined network served approximately 176,131 passengers across 41 cities with approximately 31,476 departures. We expect the combination of our legacy networks will provide the basis for our expanded, nationwide regional air mobility platform.

Our predecessor company, Surf Air Global, was formed in 2016 and prior to its reorganization into Surf Air Mobility, aimed to expand the category of regional air travel, connecting underutilized regional airports and private terminals to create a “shared private” customer experience and a high frequency “commercial-like” air service, using small turboprop aircraft. Surf Air Global provided both scheduled routes and on-demand charter flights operated by third parties that operate under Part 135 of Title 14 of the U.S. Code of Federal Regulations (“Part 135”). Surf Air Global drove the early stages of development of our current efforts to develop electrified powertrain technology, including the establishment of relationships with key commercial partners who, as a group, we believe can deliver novel hardware and software solutions that can make electrified flight possible for operators across the Part 135 industry, starting with the our owned and operated fleet.

Our acquisition of Southern in July 2023 has resulted in a combined regional airline network servicing U.S. cities across the Mid-Atlantic, Gulf South, Midwest, Rocky Mountains, West Coast, New England and Hawaii. Founded in 2013 as a Delaware corporation, Southern is the largest commuter airline in the United States and the largest passenger operator of Cessna Grand Caravan EXs (“Cessna Caravans”) in the United States by scheduled departures. Southern has multi-year contracts with the U.S. federal government to operate Essential Air Service (“EAS”) routes, which ensures small communities in the United States can maintain a minimum level of scheduled air services.

At the heart of our strategy is our aim of commercializing green regional aviation at scale. We firmly believe that regional air-mobility can displace driving from its predominant position in 100-500 mile travel. There are approximately 5,000 public use airports in the U.S. creating the possibility of a dense point-to-point air network using regional aircraft. We believe that electrified aircraft, which would boast lower operating costs and emissions could be the key to unlock this electrified air-mobility market.

We are today an established regional air-mobility platform providing scheduled and on-demand regional flights to passengers across the U.S. We both operate our own flights and use ‘off fleet’ third-party aircraft to serve our customers. Together with our partners: Textron Aviation, AeroTEC, Jetstream Aviation Capital and Palantir Technologies Inc., we believe that we can catalyze the development of this regional air-mobility market by creating the technology (both hardware and software) and services required to enable this ecosystem and placing ourselves at the center of it. We envision a world where our consumer facing distribution technology is coupled with a full suite of technologies and services, which enable the development of the supply side of our industry – the operator. We call this operator facing product Aircraft-as-a-Service, which includes three elements: electrification technology, operator software suite, and aircraft financing.

Our electrification technology program aims to address the projected demand for thousands of electrified Conventional Take-Off and Landing (eCTOL) aircraft, which will be needed over the next decade to enable a new mass air-mobility market. As estimated by McKinsey & Company in 2023, the electrified regional air-mobility market could reach $75-115B by 2035 and require 18,000-36,000 new and retrofitted aircraft.

8

Our electrification strategy is to upgrade existing, prolific, regional aircraft by pursuing Supplemental Type Certificates (“STCs”) to install them with fully-electric or hybrid-electric powertrain technology, once these powertrains are fully designed and developed by us, and certified by the Federal Aviation Administration (“FAA”). Due to readiness level of key components intended for use in our powertrain, we are expecting FAA certification of our first product, a fully-electric powertrain STC for the Cessna Caravan to occur in early 2027, and our hybrid-electric Cessna Caravan STC to occur thereafter.

The Cessna Caravan is the initial cornerstone of our electrification program. The Caravan provides a large target market given its position as one of the most prolific family of aircraft in the single engine turboprop category, with approximately 3,000 aircraft in use worldwide.

Our electrification program will initially focus on the creation of fully-electric and hybrid-electric powertrains for the Cessna Caravan EX and is expected to be expanded to other variants of the Caravan family in the future. The electrified Caravans are projected to have significantly reduced operating costs and emissions. Our Caravan fleet, operated by our subsidiary Southern Airways, will act as the initial “install base” for our electrified powertrain technology, followed by our operator-customer fleets around the world.

We have relationships with industry leaders across the value chain, which we believe provide significant competitive advantages as we pursue the implementation of our electrification program. We intend to be the exclusive supplier of fully-electric and hybrid-electric propulsion systems for the Cessna Caravan to Textron Aviation Inc. (“TAI”), one of the largest general aviation original equipment manufacturers (“OEMs”) in the world by units sold.

We have also entered into a definitive agreement with our electrification and certification partner, AeroTEC, a leading aerospace engineering firm with deep experience in electronification of aircraft, to work exclusively with us to develop and obtain STCs for a series of fully-electric and hybrid-electric Cessna Caravans.

Our operator software suite is being developed in partnership with Palantir Technologies Inc. to enable the regional air-mobility market to operate at scale. We intend to provide Part 135 operators with the software tools they need to operate and grow their business successfully, an ‘operating system’ for regional aviation. Our software platform strives to provide operators with distribution, operations, maintenance, and other business applications. This is expected to include functionality such as revenue management, crew scheduling, maintenance planning, and customer analytics, to name a few.

Our software suite is expected to leverage Palantir’s large data models and AI driven systems to enhance the user’s ability to make informed decisions based on multiple first and third party data sources as well as connected aircraft. In the future, we expect that EP1 Caravan aircraft will be connected to this software suite, continuously sharing data from multiple onboard sensors, adding to the cumulative fleet data and enabling us to provide operators with trend monitoring and predictive maintenance functionalities. These are expected to reduce the cost of operations as well as improve the uptime of the EP1 system.

The third part of our Aircraft-as-a-Service product is planned to be aircraft and powertrain financing. We and Jetstream Aviation Capital, LLC (“Jetstream”) have entered into a master agreement (“Master Agreement”) to finance up to $450 million to fund the planned growth of our fleet of turboprop aircraft. We expect to deploy this capital to finance our current TAI fleet order and, once the EP1 powertrains are certified, to allow us to help operator-customers finance their EP1 upgrades and new aircraft purchases from TAI.

In addition, we, through our subsidiary Southern Airways Express, and SkyWest Airlines, Inc. (“SkyWest”) are partnered to provide a pilot hiring and training pathway. We believe this is a key relationship, which allows us to ensure a steady and predictable pilot pipeline.

Lastly, we have entered into a memorandum of understanding (“MOU”) with Signature Flight Support LLC (“Signature”) for fixed base operator (“FBO”) services (e.g. fueling, hangaring, parking and aircraft rental) at airports and the support of our existing and future network.

Our Strategy

Our future business strategy is built on six key premises:

Our strategic plan is focused on capturing a meaningful portion of the point-to-point regional air mobility market currently served by automobiles and inefficient hub-and-spoke airline business models. Based on a study published by

9

McKinsey & Company in 2023, we believe the total global market opportunity for point-to-point regional air mobility of approximately 100 - 500 miles will be approximately $75 billion to $115 billion worldwide and, based on management’s estimates, approximately $15 billion to $22 billion in the United States by 2035.

We believe this overall market opportunity captures the full value chain required to enable electrified flight through 2035, which includes ticket sales, as well as powertrain sale and maintenance, aircraft leasing and ownership and energy costs. With our ecosystem-based business model we believe we will be well-positioned to grow into adjacent revenue streams as the industry evolves.

Traditional airline approaches to analyzing addressable travel markets have used data based on origin and destination of flights to and from hub and spoke airports. We believe that an alternative approach, taking a high granularity “zip-code to zip-code” view of demand based on mobile device location data, is a more accurate assessment of the addressable market for short haul regional travel. We will continue to develop and improve this mode of analysis with the help of our software partner, Palantir, as we believe this is key to informing our business in the following ways:

We believe non-stop point-to-point regional air travel will be the initial market application and catalyst for electrified flight, and that the technology to electrify the global fleet of regional aircraft exists today. We intend to pursue STCs from the FAA for the electrification of existing aircraft, starting with certifying fully-electric and hybrid-electric powertrains for the Cessna Caravan family of aircraft, an electrified powertrain family we are calling EP1.

We believe that upgrading aircraft with large existing fleets and that are still in production, by installing into these aircraft fully-electric or hybrid-electric powertrains through an STC process is an efficient go-to-market approach.

STCs are a well-established form of modifying and upgrading already certified aircraft as opposed to a “clean sheet” design, which involves creating a completely new aircraft from the ground up. Successfully developing and certifying STCs for installation of fully-electric and hybrid-electric powertrains on existing aircraft types reduces risk, required capital investment and development time. We are taking what we believe to be a pragmatic approach, first certifying an STC with what we believe is the best technology available, with less risk and shorter timeline for certification in order to produce an aircraft capable of range, speed and performance specifications necessary to service the routes both we and our operator-customers plan to serve.

Developing and certifying our initial fully-electric and hybrid-electric powertrains will be accomplished through our commercial arrangements with AeroTEC and TAI. We have entered into exclusive arrangements with these companies to achieve certification of and commercialize fully-electric and hybrid-electric powertrains. AeroTEC is a leader in the category of aircraft we are focused on, having already flown an eCaravan demonstrator engineered to showcase all-electric flight. AeroTEC, has also designed, developed, tested and certified more than one hundred projects in the aerospace industry. We expect that our data license and exclusive collaboration, marketing and sales relationship with TAI, the Cessna Caravan OEM, will reduce the development workload and time required to achieve issuance of our STC and will assist in the introduction of the fully-electric and hybrid-electric powertrains into the market. Due to readiness level of key components intended for use in our powertrain, we believe we can obtain STC certification of the fully-electric powertrain by early 2027 and for the hybrid-electric powertrain thereafter by 2028, with commercialization of the powertrains shortly thereafter.

We are developing the EP1 hybrid-electric powertrain with our commercial partners to enable these aircraft to perform similar flights and routes as the turbine combustion model. The fully-electric version of the EP1 for Cessna Caravans is expected to reduce direct operating costs for operators by up to 50% and direct emissions by up to 100%, compared to today’s turboprop powered Cessna Caravans. We believe the first version of the fully-electric EP1 installed Caravan will be able to perform approximately 30% of the missions flown by the global Caravan fleet today. As battery

10

technology improves and subsequent generations become more energy-dense this variant’s utility will increase. We are designing this system with the generational scalability in mind.

The EP1 hybrid-electric powertrain for the Cessna Caravan is expected to reduce direct operating costs for operators by up to 25% and to reduce up to 50% of emissions, while retaining similar performance characteristics, compared to today’s turboprop powered Cessna Caravans. By using Sustainable Aviation Fuel (SAF) the hybrid-electric EP1’s emissions profile can be further improved. We believe the hybrid-electric EP1 powertrain will be able to perform approximately 90% of the missions flown by the global Caravan fleet today. We believe the increased operational flexibility of the hybrid-electric EP1 aircraft will result in a long service life, well beyond the widespread introduction of fully-electric aircraft.

Our launch products are based on existing battery technology, which we believe is a key differentiator which will allow us to go to market faster. We intend to certify a fully-electric variant first, which we believe will initially have a smaller applicable market.

Operators purchasing new Cessna Caravan aircraft and existing Cessna Caravan operators will have the ability to upgrade and convert their new and existing Cessna Caravan aircraft to EP1 fully-electric and hybrid-electric powertrain-equipped Cessna Caravans using our EP1 STC with reduced operating costs and lower emissions. We are targeting to offer EP1 powertrains to operators at an equivalent price to their current engine overhaul cost.

We will be the owner of the EP1 STC for the fully-electric and hybrid-electric powertrain and we plan to co-market and sell our EP1 fully-electric and hybrid-electric powertrains together with TAI under our exclusive sales and marketing agreement. This agreement provides for including the SAM EP1 fully-electric and hybrid-electric powertrain for the Cessna Caravan aircraft in sales and marketing materials distributed to authorized dealers, displaying the SAM EP1 fully-electric and hybrid-electric powertrains for the Cessna Caravan aircraft on our website and TAI’s, including representatives of ours and TAI at trade show booths and marketing the EP1 fully-electric and hybrid-electric powertrains for the Cessna Caravan aircraft and conversions of existing Cessna Caravan aircraft to EP1 powertrain aircraft to all owners of pre-owned Cessna Caravans.

We believe we will be able to upgrade our initial EP1 STCs to improve their performance over time as battery technology continues to improve. Based on the knowledge and experience gained from the development and certification of fully-electric and hybrid-electric powertrains for installation on the Cessna Caravan, including the proprietary software and power controls we will develop, we intend to extend or replicate our initial STC into multiple aircraft types using a variant of the same powertrain technology.

Several other models of regional aircraft could be electrified within the next five to ten year and we expect to replicate our Caravan business model to bring electrified variants of these aircraft to market.

We intend to have all of its powertrains continuously digitally connected to our technology platform and ecosystem, as part of our Aircraft-as-a-Service program. The pooling of powertrain data overtime will enable us to provide predictive maintenance and planning functionalities that will further improve the operational benefits to our operator-customers.

To support our growth and technology plans, we have established important commercial relationships with leading players involved in the aviation and technology industries, including those expected to produce components for fully-electric and hybrid-electric powertrains for aircraft. We believe our strategic relationships with TAI, AeroTEC, Jetstream, SkyWest, Signature and Palantir empower our plan. We believe the result of these relationships will be the acceleration of our ability to bring fully-electric and hybrid-electric powertrains for the Cessna Caravan to market, to create a differentiated regional travel experience of scale, and to generate substantial demand from consumers for a new form of regional travel.

We have relationships with leading players across the value chain, which we believe provides significant competitive advantages as we pursue the scaling of our point-to-point regional air mobility ecosystem and aircraft electrification.

11

Our relationships with these leading players, and our reliance on these relationships may give rise to a number of risks. See the section entitled “Risk Factors - Risks Related to Our Dependence on Third Parties - We are substantially dependent upon our relationships with our strategic partners, and we are or may be subject to risks associated with such strategic alliances. Our reliance on these arrangements, and the loss of any such alliances or arrangements or failure to identify future opportunities could affect our growth plans”.

Airframes - Textron Aviation Inc.

We intend to be TAI’s exclusive supplier of certain identified categories of battery electric and hybrid-electric propulsion systems for the Cessna Caravan for an eight-year term. Cessna Caravan aircraft with the propulsion systems installed will be co-branded as “Cessna Caravan SAM EP1”. We and TAI have entered into a sales and marketing agreement, through which TAI will market the EP1 STC through its existing Cessna Caravan sales channels. TAI will provide engineering support and a data license to facilitate our development of our STCs. We intend to become TAI’s official leasing partner for the EP1. We will purchase 90 new Cessna Caravans over a five-year period, with deliveries beginning in 2024 and with an option for up to 38 additional Cessna Caravans to be delivered over seven years.

We believe this commercial relationship with TAI, the producer of the Cessna Caravan, will help drive broad adoption of our EP1 powertrains once certified. Our ability to leverage TAI’s recognizable brand, strong market position, existing sales, marketing and distribution channels and global service network is a key differentiator versus other competitors in the space hoping to launch entirely new clean-sheet designs.

Electrified powertrain certification - AeroTEC

AeroTEC develops, tests and certifies new aircraft and other aerospace products for many of the top OEMs and Tier 1 suppliers in the aviation industry. They have a proven track record of development and integration across dozens of high profile, complex and cutting edge electrification programs including the eCaravan demonstrator, a Cessna Caravan engineered to demonstrate all electric flight.

AeroTEC is working exclusively with us under a work-for-hire contract to develop and obtain a series of Cessna Caravan STCs for hybrid and other electrified Cessna Caravans. AeroTEC will initially manage integrating the individual components from the supply chain manufacturers and the assembly process of the powertrains. We will own the STCs and all related intellectual property.

This relationship allows us to benefit from a large existing team of over 250 engineers and experts with a track record of success from having brought over 100 projects, the majority of which are certification projects, to market while also allowing us to own and control the developed STC and potentially other intellectual property. In addition, our relationship builds an initial foundation with this first aircraft type, which we believe can scale across the 9-to-30-seat turbo-prop category.

Aircraft Financing - Jetstream Aviation Capital

Jetstream is the largest global aircraft lessor focused exclusively on commercially-operated turboprop regional aircraft and engines. Jetstream works in partnership with many of the world’s leading regional airlines to provide financing solutions and market expertise across a large portfolio of turboprop aircraft and engines.

12

We and Jetstream entered into the Master Agreement regarding the principal terms of an arrangement to finance up to $450 million through a customized operating lease and sale structure that will fund the planned growth of our fleet of turboprop aircraft. We will have access to this financing facility over the next six years for both new and used Cessna Caravan and Pilatus PC-12 aircraft, subject, among other things, to the entry into separate binding sale and purchase agreements for each individual aircraft and a separate binding lease agreement for each individual aircraft.

We believe that Jetstream will bring significant expertise as a leasing partner with deep asset knowledge in sourcing and financing Cessna Caravan and Pilatus PC-12 aircraft. Jetstream also operates an engine leasing program which we intend to leverage to support the re-selling of used internal combustion engines available following an upgrade to an electrified powertrain.

Pilots - SkyWest

SkyWest is the largest regional airline in the United States. SkyWest operates under contracts for major U.S. airlines, including United Airlines, Delta Air Lines, American Airlines and Alaska Airlines, and carried more than 40 million passengers in 2023.

Since 2018, our subsidiary, Southern Airways Express, has partnered with SkyWest to provide a pilot hiring and training pathway. Over approximately 18 months, pilots graduate from first officer to captain whereupon they are committed to fly additional hours at Southern before eligibility to fly at SkyWest. Along this path, SkyWest awards pilots retention bonuses as they move through career milestones. we currently hire nearly 200 new pilots per year as a result of this partnership, which we believe is a significant competitive advantage for both our current and future network needs.

We believe the availability of new pilots and the career advancement process through the SkyWest cadet program is an attractive and currently successful pilot acquisition tool and a key differentiator for the business.

As our flight network grows, we believe that our relationship with SkyWest will be critical for maintaining consistent, reliable operations at scale and position us as a go-to pilot onboarding funnel to help mitigate and potentially reverse the effects of the current national pilot shortage.

Ground operations and Sustainable Aviation Fuel - Signature Flight Support

Signature has the world’s largest network of FBO with approximately 200 locations. Signature’s worldwide network of FBOs delivers essential support service for business and private aviation, including, among other services and amenities, refueling, hangar services, maintenance, repair and overhaul.

We and Signature have entered into an MOU for FBO services and the support of our network at existing and new Signature locations, the co-development of a standardized and exceptional end-to-end customer experience, the advancement, development and scaling of green aviation technologies and services (including SAF and electrification infrastructure) as well as co-marketing and branding opportunities across our common customer base. Additionally, we intend to collaborate on the co-development and co-investment of the technology, infrastructure and facilities required to support ground operations.

We believe a partnership with Signature will provide us access to key FBO locations at our existing and planned route locations, helping to create a consistent ground experience for our customers by leveraging their seasoned service model. Additionally, we believe Signature’s existing presence and expertise in the deployment of SAF will help us accelerate our path to fully sustainable flight.

Technology - Palantir

Palantir builds software that empowers organizations to effectively integrate their data, decisions and operations. They are focused on creating improved user experience for working with data, one that empowers people to ask and answer complex questions without requiring them to master querying languages, statistical modeling or the command line.

We have contracted with Palantir to leverage their Palantir Foundry platform to support us in scaling our growth and impact across a range of key service areas, including bookings and reservation, operator tools, operator partnership services, our pricing engine and fleet management systems. Palantir has agreed to accept either cash or Common Stock as compensation for their services.

13

Creating the proper data foundation is an important building block to support our goals of creating a fully connected airplane. We believe Palantir’s depth of professional services and production infrastructure support will be a key differentiator in delivering on our vision.

We, through our subsidiary Southern Airways Express, operate the largest passenger fleet of Cessna Caravans in the United States by scheduled departures (as of December 31, 2023) and have significant operating scale, a robust set of EAS routes contracted with the DOT and a pilot development pipeline that helps to manage national pilot shortage issues. We also currently operate a technology-forward on-demand and scheduled regional aviation platform, These two facts, along with the key strategic relationships we have secured will enable us to through our electrification and operational growth plans.

As of December 31, 2023, our combined scheduled network connected an aggregate of 41 cities in 16 U.S. states.

Sources of Air Mobility Revenue

We generate revenue from two categories of air mobility services:

Scheduled Air Service - We generate revenue from operating scheduled commercial air service flights which are sold to the public primarily on a per seat basis, as well through membership subscriptions, principally relating to two main categories of membership: All-You-Can-Fly (“AYCF”) and Pay-As-You-Fly (“PAYF”).

Of our combined fleet of 55 aircraft, 40 are Cessna Caravans as of December 31, 2023. For the year ended December 31, 2023, our total fleet averaged approximately 193 daily departures. We believe we are the largest commuter air carrier by both size of Cessna Caravan fleet and number of scheduled departures of Cessna Caravans in the United States and we believe that in the future our scale could result in an increase in the number of average daily departures, fares and load factor compared to today. With our EP1 fully-electric powertrain expected to enter service shortly after we receive certification, which we anticipate to occur early in 2027, we believe we can be the first to operate an electrified fleet of aircraft in commuter operations.

We generate revenue from EAS revenue awards from the Department of Transportation (“DOT”).

The EAS program was put into place in the United States following the Airline Deregulation Act of 1978 to ensure that small communities continued to receive a minimal level of air service. EAS revenue awards are guaranteed revenue contracts issued by the DOT with revenue earned for completed flights. The EAS program subsidizes scheduled flights to connect underserved communities with larger airline hubs. These contracts help add predictable stability to Southern’s operations from both a route and revenue planning perspective. As of May 1, 2023, the EAS market size for annual contract subsidy rates was approximately $400 million.

We are a leader in securing and renewing EAS contracts, which we believe will be a critical differentiator as we work to expand our point-to-point short haul regional air mobility network. We work with key stakeholders in the communities in which we intend to serve as well as the DOT, and we have been able to tailor air travel solutions that are responsive to the key needs of these smaller, underserved communities. We have consistently been able to differentiate ourselves to win contracts by leveraging our large scale and depth of operational expertise to offer a low cost, highly reliable service proposal.

On-Demand - We generate revenue from on-demand flights created for customers on an ad-hoc, by request basis. A small number of the on-demand flights are operated on our fleet; the majority are arranged on third-party turboprops or small jets. For the year ended December 31, 2023, we generated revenue of $21 million from on-demand operations.

Today, we offer on-demand flight booking capabilities on our consumer platform enabled by our Surf Air mobile app. This business represents a capital light source of revenue.

14

Customer Experience

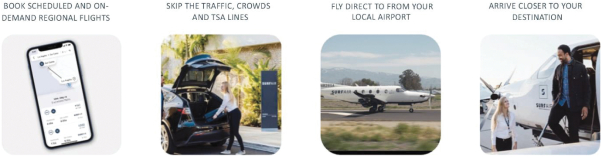

We believe that the customer experience that we have developed is a meaningful differentiating advantage. We have strived to create an exceptional flying experience solving the greatest pain points of regional commercial flying. Through our large scale, we have a substantial customer service operation to support our travelers. We intend to give our customers a stress-free and time-saving airport and travel experience.

Seamless Booking. Our customer journey begins digitally through both our booking app and website, creating a personalized air travel experience. Using the mobile app and website, customers have access to a real-time digital marketplace, which we believe enhances and simplifies the user experience. Customers can conveniently purchase tickets on existing scheduled flights or create private charters. Customers have access to an array of available aircraft to meet various travel needs.

Local Airports & Private Terminals. We operate scheduled and on-demand flights in and out of small airports and private terminals. This provides our customers with the convenience of an accessible airport closer to their origin and/or destination and the convenience of a private terminal experience. In the future, together with Signature, the world’s largest private aviation terminal operator, we intend to expand our footprint enabling us to replicate our flying experience at scale. We believe that local airports can transform into centers for pilot training, community job growth, and growth for local businesses.

Reduced Travel Times. Operating in and out of regional airports and private terminals reduces travel time for our customers. On a typical commercial flight, major airlines recommend customers arrive two hours before their departure time. In contrast, our customers typically only need to arrive 30 minutes before their flight, which results in our passengers saving approximately 1.4 to 1.6 hours per departure.

Hassle Free Experience. Our customer services and station teams offer all customers a direct touchpoint to help manage any travel related needs leading up to and on the day of the flight. Southern currently has interline agreements with major commercial airlines, including United Airlines, Inc., American Airlines, Inc., Alaska Airlines, Inc. and Hawaiian Airlines, Inc, which help coordinate baggage claim for customers who fly different airlines on various legs of their trip, assisting in a hassle free experience.

Pilot Shortage Solution. Recent and longer-term trends in the airline industry have led to a large disruption in the supply of available aircraft pilots. A reliable, predictable and adequate availability of pilots is an integral part of any airline’s ability to maintain consistent scheduling of their operations. We believe that our business model, flying under Part 135 regulation and using primarily single-engine aircraft, will enable us to be a solution to the pilot shortage by providing pilots to certify as first officers and captains earlier, and creating a talent pool that does not compete with other airlines that operate multi-engine aircraft. Furthermore, with our pilot partnership with SkyWest, we are able to ensure that hiring and retention costs are offset in part by promoting pilot career flow into the regional airline industry.

As we plan to transition to fully-electric flight, we believe we are well-positioned to manage programs designed for training pilots for any new requirements related to the operation of electrified aircraft. Through our combined leverage as suppliers of new electrified aircraft and facilitators of a pilot training pipeline, we believe we can create a program that helps to ensure an adequate supply of pilots for the introduction of electrified flight.

We believe that our current and future experience and knowledge, generated by operating our own large scheduled fleet and charter operation, combined with our partnerships and interactions with operators, brokers, lessors and OEMs puts us in a strong position to identify, create and commercialize the best electrification products and services for our evolving industry.

15

Access to Sustainable Aviation Fuel. Our relationship with Signature is expected to increase our access to SAF. Signature offers fuel throughout their FBO network as one of their base services. Signature, through their Signature Renew program, has committed to, and is already offering, SAF at select locations with plans to expand throughout their network. We expect to benefit from this existing footprint and intends to work with Signature to make SAF available more broadly in our network.

Our management team has significant experience in the aerospace and commercial aviation industry, as well as adjacent sectors, including hospitality and consumer branding. Our team brings with them previous senior level experience from a range of companies including Delta Air Lines, Fairchild Dornier, Flexjet, Lufthansa, Virgin America, and Wisk. The ongoing evolution and implementation of our strategy will be guided and overseen by an experienced and independent board of directors.

If we are able to achieve certification of fully-electric and hybrid-electric powertrains, we intend to introduce them into the market using business models which we expect will produce both one-time and recurring revenue streams. Among other steps, once developed and certified, we intend to sell or lease our electrification technology to other aircraft operators regardless of which network they serve and to work in close partnership with selected aircraft manufacturers and manufacturers of components of fully-electric and hybrid-electric propulsion systems to design and develop additional STCs. We believe operating at the center and providing valuable services across the value chain of the regional air mobility ecosystem as well as coordinating the various parties can lead to additional earning opportunities for us.

We believe there is significant value to be created by leveraging our ability to serve both customers and operators within the regional flying ecosystem. We believe this will accelerate the demand for green regional flying. By enabling new demand through our digital marketplace operations and catalyzing new supply through new technology and financing solutions, we believe we can create an ongoing cycle of growth.

We plan to invest in creating a scheduled network connecting many of the underutilized regional airports in the United States. We have developed a regional air mobility network growth plan based on mobile device and various demographic data layers, which resulted in a network growth plan across approximately 30 U.S. regional networks with approximately 200 “tier 1” routes. We intend to pursue this plan using our own air operation and by leveraging third-party air operators.

We have extensive experience using third-party operators in our scheduled and on-demand operations. As a result, we believe we will have in-depth knowledge of the success factors and key challenges facing independent operators and can facilitate operator relationships by deploying our Aircraft-as-a-Service strategy. Aircraft-as-a-Service is the product we intend to offer operators. Aircraft-as-a-Service encapsulates bundling certain aircraft ownership related costs, potentially including leasing, insurance, powertrain maintenance and operating software purchase or rental for both conventional internal combustion and/or electrified aircraft to operators with the goal of creating a recurring revenue stream.

Government Regulation

The Company will be subject to government regulation at local, state, national and international levels. The scope of these regulations is exceedingly broad, covering a wide range of subjects that includes, but is not limited to, those summarized below. Given the dynamic and rapidly evolving nature of the regulatory environment, the conduct of our business will always include a measure of risk and we may not be able to predict or control how new regulations might be written, or predict how existing regulations may be interpreted, or enforced.

Various aspects of our business, including scheduled and on-demand air service and electrification, are all impacted by interrelated but distinct regulatory frameworks.

Principal Domestic Regulatory Authorities

DOT

The U.S. Department of Transportation (the “DOT”) is the principal regulator of economic and consumer protection matters in the U.S. commercial aviation industry. The DOT licenses and oversees the operations of all carriers. This includes economic authority to conduct business as a type of air carrier, as well as consumer protection and insurance requirements that are applied to the conduct of such business. The DOT also oversees the marketing, sale and

16

performance of public charter flights (charter flights which are sold by the seat) that may be arranged by an indirect air carrier (i.e., an entity that does not operate aircraft but contracts as a principal with a direct air carrier to do so on its behalf), for the purpose of offering its chartered flights to the public that will be performed by an identified direct air carrier at a predetermined date and time (in contrast to the on-demand, or as-needed/where-needed, character of certain of our services). The DOT oversees and regulates how airlines advertise and hold out services. The DOT also oversees the sale, holding out and arrangement of single-entity charter air transportation (charter of the entire capacity of an aircraft, in contrast to public charter flights which are sold by the seat). The DOT has authority to enforce laws and regulations against engaging in “unfair” or “deceptive” practices in the sale or provision of air transportation. The DOT promulgates and enforces various other consumer protection laws and regulations to which we are subject, including requirements related to non-discriminatory access to air transportation for disabled passengers, data reporting, recordkeeping, advertising and ticket sales, among others. The DOT is also responsible for monitoring and assuring that U.S. air carriers remain fit, willing and able at all times to provide the services for which they are licensed, and that such carriers qualify continuously as citizens of the United States within the meaning of U.S. aeronautical laws and regulations.

The Company will be subject to U.S. laws regarding privacy of passenger and employee data, including as enforced by the DOT, that are not consistent in all jurisdictions where we operate and which are continually evolving, requiring ongoing monitoring and updates to our privacy and information security programs. Although we dedicate resources to manage compliance with privacy and information security obligations, the challenging and uncertain regulatory environment may pose material risks to our business, including increased operational burdens and costs, regulatory enforcement and legal claims or proceedings.

FAA

The FAA is an operating administration of the DOT and the principal regulator of safety matters in the U.S. aviation industry. The FAA’s regulations touch on many aspects of civil aviation, such as the design and manufacture of aircraft, engines, propellers, avionics and other components, including applicability of engine noise and other environmental standards; the inspection, maintenance, repair and registration of aircraft; the training, licensing or authorizing and performance of duties by pilots, flight attendants and maintenance technicians; the testing of safety-sensitive personnel for prohibited drug use or alcohol consumption; the design, construction and maintenance of runways and other airport facilities; the operation of air traffic control systems, including the management of complex air traffic at busy airport facilities; the safety certification and oversight of air carriers including their operations and maintenance; the establishment and use of safety management systems by air carriers; the promotion of voluntary systems to encourage the disclosure of data that may aid in enhancing safety; and the oversight and operational control of air carriers by their accountable managers, directors of operations, directors of maintenance and other key personnel.

TSA

The Transportation Security Administration (the “TSA”) is an administration within the U.S. Department of Homeland Security which issues security programs to air carriers and ensures that air carriers operate in a manner consistent with any security program and other requirements issued to the carrier.

Facilities

Our headquarters is located in a leased 5,500 square foot facility in Hawthorne, California. The lease of this facility expires in August 2026.

Southern’s headquarters is located in a leased workspace in Palm Beach, Florida. The lease of this facility expires in April 2025.

Human Capital/Team

As of December 31, 2023, we had 833 employees, of which 625 were full-time and 208 were part-time.

We have not experienced any work stoppages and consider our relationship with our employees to be good. Our employees are divided across various core business functions, including operations, sales and marketing, research and development, customer service and finance and administration.

None of our employees are subject to a collective bargaining agreement or represented by a labor union.

17

Commitment to Environmental, Social and Governance Leadership

We are seeking to build a regional air mobility ecosystem that will sustainably connect communities. We intend to accelerate the adoption of green flying, bringing electrified aircraft to market at scale in order to substantially reduce the cost and environmental impact of regional flying. In so doing, we believe we can make a meaningful contribution to tackling the dual challenges of congestion and climate change. We are working to build a dedicated, diverse and inclusive workforce to achieve this goal while striving to adhere to best practices in risk assessment, mitigation and corporate governance.

Our ESG efforts consist of focusing on the following:

Diversity, Equity and Inclusion

We work diligently to create a diverse, equitable and inclusive work environment. We strive to provide equal opportunities for growth, success, promotion, learning and development, and aim to achieve parity in the way we organize, assign and manage projects. We are focused on building support across all teams and individuals, with the aim that everyone has a voice, and treats each other with respect.

Intellectual Property

Our ability to protect our material intellectual property is important to our business. We seek to protect our intellectual property (including our technology and confidential information) through a combination of trademarks and trade secret protections, as well as contractual commitments and security procedures. We generally require employees and consultants to enter into confidentiality and assignment of inventions agreements and certain third parties to enter into nondisclosure agreements.

We regularly review our technology development efforts and branding strategy to identify and assess the protection of new intellectual property. We own certain trademarks important to our business, such as the “Surf Air” and “Mokulele Airlines” trademarks in the United States.

We currently own the “surfair.com” Internet domain-name registration and the “iflysouthern.com” and “mokuleleairlines.com” domain-name registrations. The regulation of domain names in the United States is subject to change. Regulatory bodies could establish additional top-level domains, appoint additional domain name registrars or modify the requirements for holding domain names. As a result, we may not be able to acquire or maintain all domain names that use the name “Surf Air” or “Southern” or are otherwise relevant to or descriptive of our business.

We have chosen to rely primarily on copyright and trade secret law in order to protect our software and have chosen not to register any copyrights in these works. However, in the United States, copyrights must be registered in order to bring a claim for infringement and to obtain certain types of remedies. Even if we decide to register a copyright in our software to bring an infringement action, the remedies and damages available to us for unauthorized use of our software may be limited.

Intellectual property laws, contractual commitments and security procedures provide only limited protection, and any of our intellectual property rights may be challenged, invalidated, circumvented, infringed or misappropriated. Further, trade secrets, know-how and other materials may be independently developed by our competitors or revealed to the public or our competitors and no longer provide protection. In addition, intellectual property laws vary from country to country. We may therefore be unable to protect certain of our technology, brands or other intellectual property in the U.S. or other jurisdictions.

We regularly review our development efforts to assess the existence and patentability of new inventions, and we are prepared to file patent applications when we determine it would benefit our business to do so.

18

Privacy and Data Protection

There are many requirements regarding the collection, use, transfer, security, storage, destruction and other processing of personally identifiable information and other data relating to individuals. Because our technology platform is an integral aspect of our business, compliance with laws governing the use, collection and processing of personal data is necessary for us to achieve our objective of continuously enhancing the user experience of our mobile application and marketing site.

We receive collect, store, process, transmit, share and use personal information and other customer data, including passenger data, and we rely in part on third parties that are not directly under our control to manage certain of these operations and to receive, collect, store, process, transmit, share and use such personal information, including payment information. A variety of federal, state, local, municipal and foreign laws and regulations, as well as industry standards (such as the payment card industry standards) govern the collection, storage, processing, sharing, use, retention and security of this information.

Corporate Information

We were originally founded in 2011 and incorporated in 2021 in Delaware. Our principal executive offices are located at 12111 S. Crenshaw Blvd., Hawthorne, CA 90250, and our telephone number is (424) 332-5480. Our website address is www.surfair.com. Our Common Stock is listed on the New York Stock Exchange under the symbol “SRFM”.

Available Information

Our Annual Report on Form 10-K, along with all other reports and amendments filed with or furnished to the SEC, are publicly available free of charge on the Investor Relations section of our website at investor.surfair.com or at www.sec.gov as soon as reasonably practicable after these materials are filed with or furnished to the SEC. We also use our website as a tool to disclose important information about the Company and comply with our disclosure obligations under Regulation Fair Disclosure. Our corporate governance guidelines, code of business conduct and ethics and Board committee charters are also posted on the Investor Relations section of our website. The information on our website (or any webpages referenced in this Annual Report on Form 10-K) is not part of this or any other report we file with, or furnish to, the SEC.

19

ITEM 1A: RISK FACTORS

You should carefully consider the risks described below in addition to the other information set forth in this Annual Report on Form 10-K, including the Management’s Discussion and Analysis of Financial Condition and Results of Operations section and the consolidated financial statements and related notes. If any of the risks and uncertainties described below actually occur or continue to occur, our business, financial condition and results of operations, and the trading price of our Common Stock could be materially and adversely affected. The risks and uncertainties described below are those that we have identified as material but are not the only risks and uncertainties we face. Our business is also subject to general risks and uncertainties that affect many other companies, including, but not limited to, overall economic and industry conditions and additional risks not currently known to us or that we presently deem immaterial may arise or become material and may negatively impact our business, reputation, financial condition, results of operations or the trading price of our Common Stock.

Risks Related to Our Financial Position and Capital Requirements

There is substantial doubt about our ability to continue as a going concern. We will need additional financing to execute our business plan, to fund our operations and to continue as a going concern.

We have incurred losses from operations, negative cash flows from operating activities and have a working capital deficit. We are currently in default of certain excise and property taxes, as well as certain debt, tax and other contractual obligations as further described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources” and “- Risks Related to our Financial Position and Capital Requirements - we have previously defaulted on our debt and other obligations and there can be no assurance that we will be able to fulfill our obligations under any current or future indebtedness we may incur”. In addition, COVID-19 related disruptions in air travel significantly impacted our business and contributed to a decrease in membership sales, flight cancellations and significant operational volatility. There can be no assurances that we can cure any defaults that remain outstanding, or if cured, that we will not default on future obligations.

Our success is largely dependent on the ability to raise debt and equity capital, increase our membership base, increase passenger loads, and continue to expand into regions profitably throughout the United States.

We have funded our operations and capital needs primarily through the net proceeds received from the issuance of various debt instruments, convertible securities and preferred and common share financing arrangements. A significant amount of funding to date has been provided by entities affiliated with a co-founder of the Company. We will need additional financing to implement our full business plan, including our plans to electrify our fleet, which is a core part of our growth strategy, and to service our ongoing operations. We are evaluating, and will continue to evaluate, strategies to obtain additional funding for future operations. These strategies may include, but are not limited to, obtaining additional equity financing, issuing additional debt, entering into other financing arrangements, or restructuring of operations to grow revenues and decrease expenses.

If we are unable to raise sufficient financing when needed or events or circumstances occur such that we do not meet our strategic plans, we will be required to seek other sources of liquidity or to take additional measures to conserve liquidity, which could include, but are not necessarily limited to, restructuring our operations and possibly divesting all or a portion of our business, reducing spending on payroll, marketing, station rent and aircraft purchases necessary for our planned network, altering or scaling back development plans, including plans to equip regional airline operations with fully-electric and hybrid electric aircraft and reducing funding or deferring of capital expenditures, any of which could have a material adverse effect on our financial position, results of operations, cash flows and ability to achieve our business objectives. These factors raise substantial doubt about our ability to continue as a going concern.

Our prospects and ongoing business activities are subject to the risks and uncertainties frequently encountered by companies in new and rapidly evolving markets. Risks and uncertainties that could materially and adversely affect our business, results of operations or financial condition include, but are not limited to the ability to raise additional capital (or financing) to fund operating losses, refinance our current outstanding debt, sustain ongoing operations, the ability to attract and maintain members, the ability to integrate, manage and grow recent acquisitions and new business initiatives, obtain and maintain relevant regulatory approvals, and the ability to measure and manage risks inherent to our business model.

Moreover, some of our vendors and suppliers likewise rely on capital raising activities to fund their operations and capital expenditures, which may be more difficult or expensive in the event of downturns in the economy or disruptions in the financial and credit markets (including as a result of the aforementioned factors that have impacted our operations). If such vendors or suppliers are unable to raise adequate capital to fund their business plans, they may not be able to

20

comply with their obligations to us, which could have a material adverse effect on our business, financial condition and results of operations.

We have incurred significant losses since our inception and expect to incur significant expenses and continuing losses for the foreseeable future. We may not be able to achieve or maintain profitability or positive cash flows.

We have incurred significant losses since the Company’s inception. We incurred net losses of $250.7 million and $74.4 million for the years ended December 31, 2023 and 2022, respectively. We expect our operating expenses to increase over the next several years as we endeavor to increase our flight cadence, hire more employees and fund third-party research and development efforts relating to the development of our electrification technology, as well as due to macroeconomic factors such as rising inflation rates. These efforts may be more costly than we expect and may not result in increased revenue or growth in our business. Any failure to increase our revenue sufficiently to keep pace with our investments and other expenses could prevent us from achieving or maintaining profitability or positive cash flow. Furthermore, if our future growth and operating performance fail to meet investor or analyst expectations, or if we continue to have negative cash flow or losses resulting from our investment in increasing our member base and passenger loads or expanding our operations into regions throughout the United States, our business, financial condition and results of operations could be materially adversely affected. Going forward, our future losses may be larger than anticipated, and we may not achieve profitability when expected, or at all. Even if we achieve profitability, we may not be able to maintain or increase profitability.

The continued growth of our business will require significant investments in the development of fully-electric and hybrid-electric powertrains, our aircraft fleet, ground-based infrastructure, information technology and marketing and sales efforts. Our current cash flow has not been sufficient to support these needs to date. We have historically had negative cash flows and a working capital deficit, and have funded our operations and capital needs to date through the proceeds received from the issuance of various debt and equity instruments. Going forward, our ability to effectively manage growth and expansion of our operations will also require us to enhance various systems, including in relation to research and development, operations and internal controls and reporting. These enhancements will require significant capital expenditures and allocation of valuable management and employee resources. If our business does not generate the level of available cash flow required to support these operations and investments, and we are not able to determine an alternative solution to obtain the funding needed for our future operations, there may be a material adverse effect on our business, financial condition and results of operations.

We may not have access to the full amount available under the Share Subscription Facility, or may not be able to draw down under the Share Subscription Facility in a timely manner (or at all) in order to meet our existing obligations.

Pursuant to the Share Subscription Facility, upon the terms of and subject to the satisfaction of certain conditions, we will have the right from time to time at our option to direct GEM to purchase up to a specified maximum amount of shares of our Common Stock, up to a maximum aggregate purchase price equal to $400 million over the duration of the Share Subscription Facility. We may request advances from GEM (“GEM Advances”) at any time in an aggregate amount of up to $100 million. We intend to draw upon the GEM Advances in 2024 and 2025 to augment our capital resources to address our capital needs. For a further description of the Share Subscription Facility and the other conditions to GEM’s commitment to purchase shares, see the section entitled, “Business - Key Agreements - Financing Arrangements - Share Subscription Facility”.

Our failure to satisfy any conditions under the Share Subscription Facility may result in our inability to request future GEM Advances or other draw downs pursuant to the Share Subscription Facility. In addition, GEM will not be obligated to (but may, at its option, choose to) purchase shares of our Common Stock to the extent such purchase would result in beneficial ownership (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder) by GEM, together with its affiliates, of more than 9.99% of our issued and outstanding Common Stock. Such beneficial ownership limitation will not apply to the GEM Advances. There can be no guarantee that we will be able to access future GEM Advances or other draw downs available under the Share Subscription Facility. Our inability to access a portion or the remaining amounts available under the Share Subscription Facility, in the absence of any other financing sources, will have a material adverse effect on our business and our ability to operate as a going concern.

Sales of shares of our Common Stock, if any, to GEM under the Share Subscription Facility will be determined by us from time to time in our sole discretion and will depend on a variety of factors, many of which are outside of our control, including, among other things, market conditions and the terms, conditions and limitations set forth in the Share Subscription Facility. We may ultimately decide to sell to GEM all, some or none of the shares of our Common Stock that may be available for us to sell to GEM pursuant to the Share Subscription Facility.

21

We have previously defaulted on our debt and other obligations and there can be no assurance that we will be able to fulfill our obligations under any current or future indebtedness we may incur.

As of December 31, 2023, we had $52.1 million in debt outstanding, representing principal related to term loans, related party promissory notes and convertible notes. The incurrence of existing or future indebtedness could have important consequences on our business, including, but not limited to:

Our ability to service our debt will depend on our future operating performance and financial results, which may be subject to factors beyond our control, including general economic, financial and business conditions. If we do not have sufficient cash flow to service our debt, we may need to refinance all or part of our existing debt, borrow more money or sell securities or assets, some or all of which may not be available at acceptable terms or at all. In addition, we may need to incur additional debt in the future in the ordinary course of business. Our current debt and any future additional debt we may incur may impose significant operating and financial restrictions. A breach of any of these restrictions could result in a default. If a default occurs, the relevant lenders could elect to accelerate payments due. If our operating performance declines, or if we are unable to comply with any restrictions, we may need to obtain amendments to our existing debt documents or waivers from the lenders to avoid default. These factors could have a material adverse effect on our business.

Further, if there were an event of default under our debt instruments or a change of control, the holders of the defaulted debt could cause all amounts outstanding with respect to that debt to be due and payable immediately and may be cross-defaulted to other debt. Our assets or cash flow may not be sufficient to fully repay borrowings under our outstanding debt instruments if accelerated upon an event of default, and there is no guarantee that we would be able to repay, refinance or restructure the payments on those debt securities.

We have previously defaulted on various debt and other obligations. Further, we are currently in default of certain excise and property taxes. See the section titled “Liquidity and Going Concern” in Note 1, Description of Business in the accompanying consolidated financial statements for further information.

Our past financial results may not be a reliable indicator of our future results. Further, our results of operations may fluctuate significantly, which makes our future results of operations difficult to predict and could cause our results of operations to fall below expectations or any guidance it may provide.

Our past financial results may not be a reliable indicator of our future results, particularly given our expected move toward fully-electric and hybrid-electric powertrain technology. Further, our quarterly and annual results of operations may fluctuate significantly, which makes it difficult for us to predict our future results of operations. As a result, comparing our results of operations on a period-to-period basis may not be meaningful. Investors should not rely on our past results as an indication of our future performance.

This variability and unpredictability could also result in our failing to meet the expectations of industry or financial analysts or investors for any period. If our revenue or results of operations fall below the expectations of analysts or investors or below any forecasts we may provide to the market, or if the forecasts we provide to the market are below the expectations of analysts or investors, the price of our Common Stock could decline substantially. Such a stock price decline could occur even when we have met any previously publicly stated revenue or earnings guidance it may provide.

Loss carryforwards and certain other tax attributes to offset future taxable income for U.S. federal income tax purposes may be significantly limited due to various circumstances, including certain possible future transactions involving the sale or issuance of Common Stock, or if taxable income does not reach sufficient levels.

Our ability to use Net Operating Loss (“NOL”) carryforwards and certain other tax attributes will depend on the amount of taxable income we generates in future periods and, as a result, certain of our NOL carryforwards and other tax attributes may expire before we can generate sufficient taxable income to use them in full. In addition, our ability to use NOL carryforwards and certain other tax attributes to offset future taxable income may be limited if we experience

22

an “ownership change” as defined in Section 382 of the Internal Revenue Code of 1986, as amended (“Section 382”). Potential future transactions involving the sale or issuance of Common Stock may increase the possibility that we will experience a future “ownership change” under Section 382. Such transactions may include the exercise of warrants, the issuance of Common Stock for cash, the conversion of any future convertible debt, the repurchase of any debt with Common Stock, the acquisition or disposition of any stock by a stockholder owning 5% or more of the outstanding shares of Common Stock, or a combination of the foregoing.

We may never realize the full value of our intangible assets or our long-lived assets causing us to record impairments that may negatively affect our financial condition and operating results.

In accordance with applicable accounting standards, we are required to test indefinite-lived intangible assets for impairment on an annual basis, or more frequently where there is an indication of impairment, and certain other assets for impairment where there is any indication that an asset may be impaired. We may be required to recognize losses in the future due to, among other factors, extreme fuel price volatility, tight credit markets, government regulatory changes, decline in the fair values of certain tangible or intangible assets.

Our contractual obligations could impair our liquidity and materially adversely affect our business, results of operations and financial condition.