Exhibit 99.2

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

This management’s discussion and analysis of financial position and results of operations (“MD&A”) is prepared as of August 29, 2023 and should be read in conjunction with the unaudited condensed interim consolidated financial statements of Foremost Lithium Resource & Technology Ltd. (“Foremost” or the “Company”) for the period ended June 30, 2023 with the related notes thereto. The condensed interim consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”).

All dollar amounts included therein and in the following MD&A are expressed in Canadian dollars except where noted.

Further information regarding the Company and its operations are filed electronically on the System for Electronic Document Analysis and Retrieval (SEDAR+) in Canada and can be obtained from www.sedarplus.ca.com.

On August 22, 2023, the Company began trading on the Nasdaq Capital Market under the symbols "FMST" and "FMSTW".

Forward-Looking Statements

Except for statements of historical facts relating to the Company, this MD&A contains "forward-looking statements" within the meaning of applicable securities legislation. These forward-looking statements are made as of the date of this MD&A and the Company does not intend and does not assume any obligation to update these forward-looking statements, except as required by applicable securities laws.

Forward-looking statements may include, but are not limited to, statements with respect to the future price of metals, the estimation of mineral resources, the realization of mineral resource estimates, the timing and amount of future exploration programs, capital expenditures, success of exploration activities, permitting timelines, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, limitations on insurance coverage, the completion of transactions and future listings and regulatory approvals. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information in this MD&A includes, among other things, disclosure regarding: the Company’s mineral properties as well as its outlook, statements with respect to the success of exploration activities, permitting timelines, costs and expenditure requirements for additional capital, regulatory approvals, as well as the information under the headings "Overall Performance”, “Liquidity” and “Capital Resources”.

In making the forward looking statements in this MD&A, the Company has applied certain factors and assumptions that it believes are reasonable, including that there is no material deterioration in general business and economic conditions; that the timing, costs and results of the Company’s proposed exploration programs are consistent with the Company’s current expectations; that the Company receives regulatory and governmental approvals and permits for its properties on a timely basis; that the Company is able to obtain financing for its properties on reasonable terms and on a timely basis; that the Company is able to procure equipment and supplies in sufficient quantities and on a timely basis; that engineering and exploration timetables and capital costs for the Company’s exploration plans are not incorrectly estimated or affected by unforeseen circumstances or adverse weather conditions; that any environmental and other proceedings or disputes are satisfactorily resolved.

However, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors may include, among others, actual results of current and proposed exploration activities; actual results of reclamation activities; future metal prices; accidents, labor disputes, adverse weather conditions, unanticipated geological formations and other risks of the mining industry; delays in obtaining governmental or regulatory approvals or financing or in the completion of exploration activities, as well as those factors discussed in the section entitled "Risks and Uncertainties" in this MD&A. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

| Page 1 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

The technical information in this MD&A has been reviewed by Lindsay Bottomer, P. Geo, and Mark Fedikow, P. Geo. Both are Qualified Persons as defined by Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43- 101”).

Date

This MD&A is dated as of August 29, 2023.

Description of business

Foremost Lithium Resource & Technology Ltd. is an exploration stage company that is primarily engaged in the hard-rock exploration and acquisition of lithium properties in Canada.

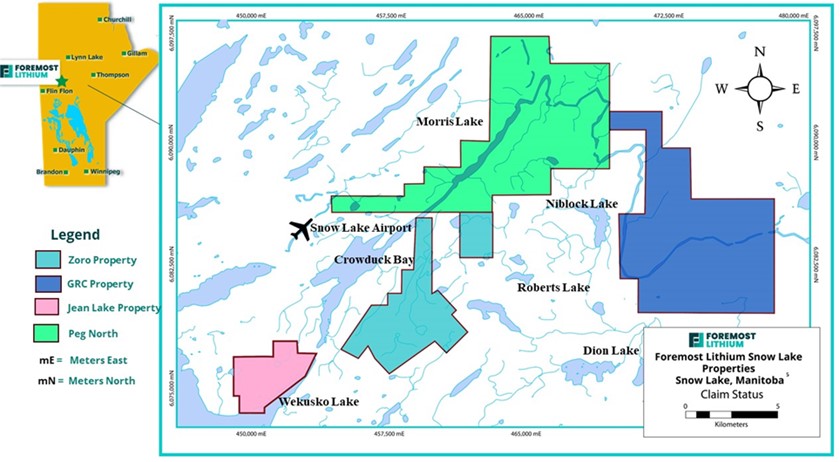

The Company’s goal is to become a strategic supplier of battery-grade LiOH to supply the growing electric vehicle battery and battery storage markets. The Company holds or has options to acquire interests in mining claims covering over 43,000 acres (17,500 hectares) primed for exploration with four main core Lithium Lane Properties, which are Zoro, Peg North, Grass River, and Jean Lake, in addition to the Jol Property, located in the province of Manitoba, Canada. Foremost’s secondary ambition is pursuing precious metal exploration on its Winston Property located in New Mexico, USA.

The four Lithium Lane Properties are the Company’s material properties, while the Winston Property, and Jol Property mining claim in Manitoba, Canada, are non-material properties.

Figure 1. - Claims Map of Foremost’s Lithium Lane Properties

| Page 2 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

SUBSIDIARIES

The Company currently has two subsidiaries, Sequoia Gold & Silver Ltd., a British Columbia Company, and Sierra Gold & Silver Ltd, a New Mexico company (“Sierra”). Sierra holds the Company’s Winston property in New Mexico, USA.

mineral properties

LITHIUM

The Zoro Lithium Project

The Zoro Lithium project totals approximately 3,390 hectares located near the east shore of Wekusko Lake in west-central Manitoba, approximately 20 km east of the mining town of Snow Lake, 249 km southeast of Thompson and 571 km northeast of Winnipeg and is comprised of the Zoro 1 claim, the Green Bay Lithium Claims, (Manitoba claims) and the Zoro North claims.

Zoro 1 Claim (Snow Lake, Manitoba, Canada)

The Zoro 1 claim totals approximately 52 hectares in size and was purchased for the price of 140,000 common shares of the Company, $50,000 cash, and a non-interest-bearing promissory note for $100,000 (paid). In addition, the Company paid a finder’s fee of 20,000 common shares to an arm’s length third party in connection with the acquisition of the Zoro 1 claim. The company has earned 100% undivided interest. interest. Further details of the Company’s acquisition of the Zoro 1 claim are included in the Financial Statements and Annual Filings.

Zoro North and Green Bay Lithium Claims (Snow Lake, Manitoba, Canada)

The Company has earned a 100% interest in all lithium-bearing pegmatite dykes on 15 additional claims in Manitoba by paying $250,000 in cash and issuing $250,000 in shares (54,494 shares issued). The claims include The Zoro North, and Green Bay Property.

The property is subject to a 2% NSR. The Company can acquire an undivided fifty percent interest in the NSR, being one-half of the NSR or a 1% Net Smelter Return from Strider Resources (“Strider”) by making a $1,000,000 cash payment to Strider, together with all accrued but unpaid NSR at the time, prior to the commencement of commercial production.

During the option period, the Company is responsible for carrying out and administering exploration, development, and mining work on the property and for maintaining the property in good standing.

Grass River Claims (“GRC”) (Snow Lake, Manitoba, Canada)

During January 2022, the Company announced the acquisition of The Grass River Claims, located in the historic mining district of Snow Lake Manitoba, 6.5 kilometres east of the Zoro lithium property. The Grass River Claims (“GRC”) consist of 29 claims totaling 15,664 acres and hosts 10 pegmatites exposed in outcrop and 7 drill-indicated spodumene-bearing pegmatite dykes. At the time, this acquisition, significantly expanded the Company’s Snow Lake Lithium project by 130% to an amalgamated 26,276 acres making the Company the second largest lithium focused exploration company in Snow Lake.

Jol Lithium Claim (Snow Lake, Manitoba, Canada)

In July 2022, the Company entered into an agreement to acquire a 100% interest in the MB3530 claim in the Snow Lake area in Manitoba. To earn the interest, the Company paid $8,000 and issued 364 common shares. The property is subject to a 2% NSR.

MB3530 encompasses 25 hectares (62 acres) situated due North from the Company’s Jean Lake project and due West of the Company’s Zoro project.

| Page 3 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Peg North Claims (Snow Lake, Manitoba, Canada)

In July 2022, the Company entered into an option agreement to acquire a 100% interest in the Peg North claims located in the historic Snow Lake mining district in Manitoba. To earn the interest, the Company will pay $750,000 in cash (paid $200,000) and $750,000 in shares (issued 23,598 shares valued at $200,000) and incur $3,000,000 of exploration expenditures. The property is subject to a 2% NSR.

The Peg North Claims consist of 28 claims hosting five known pegmatite dykes, [Cerny, et. al.1981] and captures the northern extension of the Crowduck Bay Fault and surrounding area, known for its lithium-enriched pegmatite dyke clusters. The acquisition pursuant to the Option Agreement will significantly expand the Company’s Snow Lake lithium holdings by 16,697 acres (6,757 hectares) to an amalgamated 43,276 acres (17,513 hectares) in the prospective Snow Lake pegmatite fields.

Exploration at the Zoro Lithium Project, Snow Lake, Manitoba

On July 3, 2019, the Company announced assay results from the fifth drilling program at its Zoro Lithium Project, near Snow Lake, Manitoba. 3,054 metres of drilling in 22 holes identified five new pegmatite dykes, bringing the total to (13) thirteen. Drilling has also extended the limits of high-grade lithium-bearing pegmatite at Dyke 8, now intersected by six holes from two drilling campaigns.

Zoro includes thirteen (13) identified pegmatite dykes. Diamond drilling, prospecting, and sampling programs conducted in 2016 through 2019 confirmed the presence of the spodumene bearing pegmatites. Five drill programs have been completed to date with lithium assays reporting in all holes. Metallurgical studies were undertaken on material collected from four 2018 drill holes at Dyke 1. The Company previously assessed the amount of high-grade lithium in Dyke 1 through a 2017/2018 winter drill program, reaching the dyke’s deeper levels (>150 metres). Additionally, the winter drill program was expanded to Dykes 5 and 7, to test historic results and recent assay results from trench and outcrop sampling of both dykes. During the 2017/18 winter drill program, the Company also discovered a previously unknown spodumene bearing pegmatite dyke. The discovery was made during the 2,472-metre, 19-hole drill program, as described in Company’s news releases on January 19 and February 13, 2018. The discovery of this additional dyke was made by drill-testing a Mobile Metal Ions (MMI) soil geochemical anomaly bringing the total of known high-grade lithium mineralized spodumene pegmatite dykes on the Zoro Lithium Project to eight. Further results from the winter drill program included narrow intercepts from shallow drill holes testing Dykes 2, 5 and 7. Of these, Dyke 5, tested by drill hole FAR18-30, intersected 1 metre of 1.2% Li2O. Overall the results for each of these dykes were consistent with historic exploration results. The Company has posted the results of all drill programs and laboratory testing on its website at www.foremostlithium.com

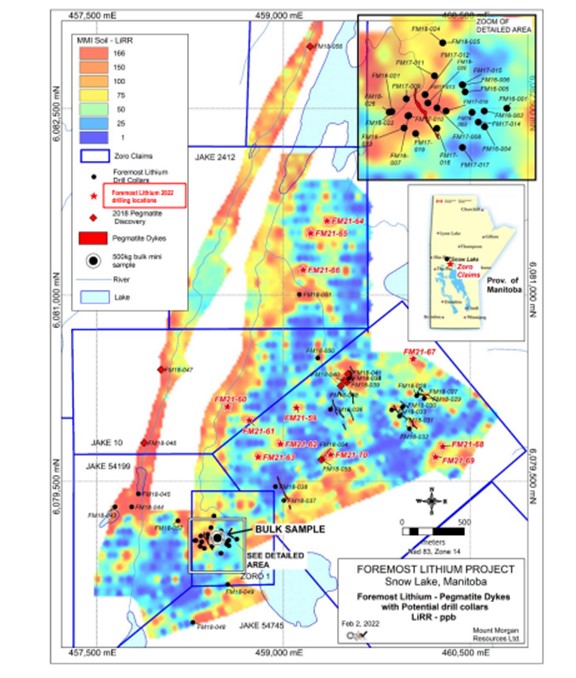

Soil Geochemical Surveys

The successful drill testing of a Mobile Metal Ions (“MMI”) soil geochemical anomaly in 2017 and the discovery of high-grade Dyke 8 has provided the rationale for expanding these surveys to the remainder of the property. A helicopter-assisted crew of field technicians extended the current MMI survey coverage on the property with the collection of 784 soil samples. The new 2018 data has defined numerous extensions to anomalies identified in previous MMI surveys on the Project, thereby increasing the target size for diamond drilling. A total of 18 new targets have been delineated and were the focus of the contracted March 2022 1,500-metre drill program. 12 new targets were identified in December 2021 of which the top 10 shall be drill tested by the Manitoba Mining Development Fund subsidized March 2022 drill program.

Geological Mapping

A helicopter-assisted geological mapping crew has undertaken the first new mapping on the Zoro lithium Project area since the 1950s. The project was undertaken to provide an interpretation of the geological setting of the spodumene- bearing pegmatite dykes and any post-depositional structural overprints that may have affected the current location of the dykes. The mapping project was augmented by a drill core sampling program with the intent of assessing mineralogical and geochemical tools for vectoring towards additional pegmatites on the property. Both aspects of this summer’s work formed the basis of an M.Sc. thesis program undertaken at the University of Western Ontario under the guidance of Professor Robert Linnen and Dr. Tania Martins of the Manitoba Geological Survey. A preliminary map at a scale of 1:4000 has been produced and establishes the geological setting for 8 known spodumene-bearing pegmatite dykes on the property. Mineralogical studies are ongoing.

| Page 4 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Metallurgical Drill Core Sampling

The Company completed additional drill core sampling from Dyke 1 on the Zoro Lithium Project in 2020 to provide material for the metallurgical survey, which was completed by SGS Mineral Services at their Lakefield facility. A 2020 peer reviewed technical publication co-authored with SGS Mineral Services concluded that spodumene-bearing pegmatite from Zoro Dyke 1 can be processed using industry standard metallurgy to produce a 6% battery-grade lithium (Li2O) concentrate1.

Tantalum Potential

The 2016 intersection of 0.113% tantalum (Ta2O5) in drill hole DDH FAR16-001 and the presence of elevated tantalum assays on the property has encouraged the Company to further evaluate tantalum potential. The mineral tantalite (Mn, Fe) (Ta, Nb)2O6 is the primary source of the metal tantalum. It is a dark blue gray, dense, and very hard mineral rarely found in pegmatites and is used in the electronics industry for capacitors and high-power resistors. It is also used to make alloys to increase strength, ductility, and corrosion resistance. The metal is used in dental and surgical instruments and implants, as it causes no immune response.

NI 43-101 Technical Report

On July 9, 2018, the Company announced that it had received the first ever resource estimate for Dyke 1 on its Zoro Lithium Property. Dyke 1 contains an inferred resource of 1,074,567 tonnes grading 0.91% Li2O, 182 ppm Be, 198 ppm Cs, 51 ppm Ga, 1212 ppm Rb, and 43 ppm Ta (at a cut-off of 0.3% Li2O). Dyke 1 is open at depth and to the north and south where additional exploration is ongoing. The estimate has an effective date of July 6, 2018, and was prepared by Scott Zelligan P. Geo., an independent resource geologist of Coldwater, Ontario. Dyke 1 is one of eight known spodumene- mineralized pegmatite dykes on the property. The remaining dykes are currently the object of ongoing exploration including drill-testing. Inferred Mineral Resources are not Mineral Reserves. Mineral resources which are not mineral reserves do not have demonstrated economic viability. There has been insufficient exploration to define the inferred resources as an indicated or measured mineral resource, however, it is reasonably expected that most of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. There is no guarantee that any part of the mineral resources discussed herein will be converted into a mineral reserve in the future. Please refer to the Company’s new release dated July 9, 2018, for further details regarding this resource estimate and the methodologies, procedures and assumptions used to estimate same. The Company has filed the NI 43-101 Technical Report on SEDAR.

Chain of Custody, Quality Control and Quality Assurance, and Data Verification

Drill core for assay purposes was sawn in half after logging and core mark-up by the Company’s geologist. Samples were collected based on an appropriate sample interval and washed to remove mud from cutting the core with the core saw. The core sample was placed into a clear plastic bag and the sample number written on the bag. An assay tag was inserted into the sample bag, one tag was inserted into the core box marking the sample location and the third tag was retained in storage. All core samples were placed into a white vinyl pail with a sample inventory, labeled and stored in a locked facility until enough samples were available for shipping. At this point the sample pails were taken to the local shipping company and loaded into a sealed transport truck. A bill of lading was signed by the geologist after the number of sample pails were counted and the shipping address confirmed. Receipt of the sample pails was acknowledged by the assay laboratory. Blanks, duplicate samples, and internal standard reference materials were included with each sample batch.

All data used to estimate the above reported mineral resource estimate, including sampling, analytical, and test data, has been verified by Scott Zelligan, P.Geo., from the original sources. This includes a site visit to the Zoro Lithium Project, review of previously drilled intervals in person, and a comparison of the drill hole database to drill logs and assay certificates.

A Permit to Extract a Bulk Sample

On January 6, 2022, the Company announced that it has received a permit from the Province of Manitoba to extract a 500kg bulk sample from Dyke 1 on its Zoro Lithium Property. A 2020 peer reviewed technical publication co-authored with SGS Mineral Services concluded that spodumene-bearing pegmatite from Zoro Dyke 1 can be processed using industry standard metallurgy to produce a 6% battery-grade lithium (Li2O) concentrate [1]. The goal for the upcoming 500 kg bulk sample is to demonstrate that pegmatite from the Company’s Zoro Lithium Project is suitable to produce battery-grade lithium hydroxide (LiOH) thereby making it viable to market its lithium to strategic partners prior to development.

_______________________________

1 Grammatikopoulos, T., Aghamrian, M., Fedikow, M.A.F. and Mayo, T. (2020), “Mineralogical Characterization and preliminary beneficiation of the Zoro lithium project, Manitoba, Canada; Https://DOI.org/10.1007/S42461-020-00299-2.

| Page 5 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Drill Program

On February 8, 2022, the Company announced an upcoming 1500 metre diamond drill program scheduled to commence in the first week of March in 2022 on its 100% percent owned Zoro Lithium Project in Snow Lake, Manitoba. Prior to this upcoming 2022 drill program, a total of fifty-eight historic diamond drill holes had been drilled on the Zoro property. From the previous 2018 drilling campaign, 8 lithium mineralized spodumene pegmatite dykes were documented on the property. Of these Dyke 1 and Dyke 8 are the most prominent and remain open at depth and along strike to perform additional in-fill drilling and delineate additional tonnage of resource.

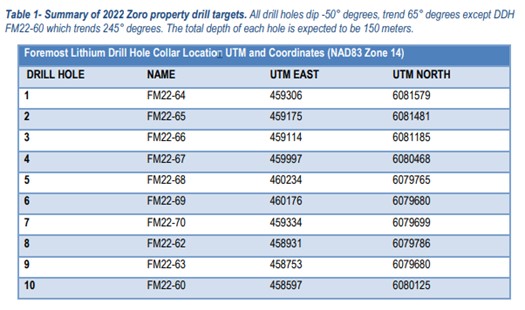

On March 14, 2022, the Company announced that field operations had commenced with a ten (10) diamond drill hole (“DDH”) 1,500-meter program. This is the first drilling program for the Company since 2018. The focus of this drill program was to test ten (10) new spodumene pegmatite targets on the Zoro project. Drill core samples were shipped to Activation Laboratories (Ancaster, Ontario) for assaying services. Drill and helicopter pads for each of the 10 holes were cut and prepared by Moss Line cutting of Snow Lake.

Table 1 and Figure 2 illustrate the specific drill targets that were tested in 2022 for lithium oxide (Li2O%) mineralization. The expected host rocks for the lithium mineralization are spodumene-bearing pegmatite dykes. The locations of the drill holes are indicated by the RED STARS on Figure 2.

| Page 6 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Figure 2. Map of the Zoro Lithium Project, Snow Lake area, Manitoba. Red stars indicate new 2022 drill targets identified with Mobile Metal Ions (MMI) Technology, a proven advanced soil geochemical exploration technique. Solid black lines are lithium-bearing pegmatites on the property.

On April 26, 2022, the Company announced it had completed a ten-hole 1,509-metre drill program designed to test Mobile Metal Ion (“MMI”) soil geochemical anomalies and assess the deeper levels of high-grade spodumene pegmatite Dyke 8 discovered in 2018. The drilling contract was completed by Bodnar Drilling Ltd. of Ste. Rose du Lac and helicopter support was provided by Gogal Air Services Ltd. of Snow Lake. Both Bodnar and Gogal Air are Manitoba corporations.

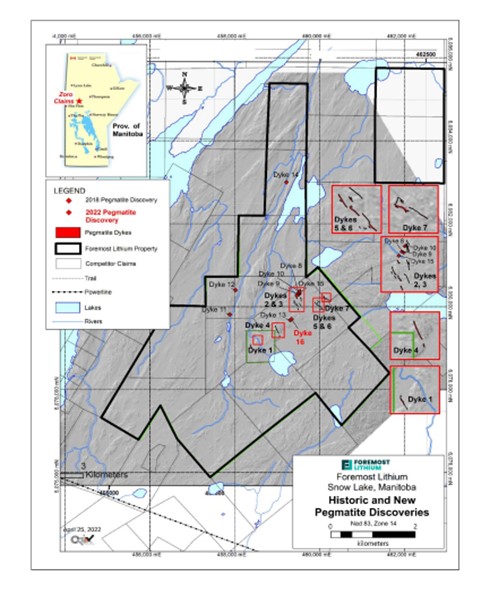

Dyke 16 Discovery

The sixteenth (16th) spodumene-bearing pegmatite dyke on the Zoro property was intersected by two drill holes. DDH FM22-70 drilled at -50 degrees inclination. Two pegmatite intercepts totaling 4.9 metres with up to 15% light green spodumene crystal aggregates. A second hole, DDHFM22-70B was drilled at a steeper inclination of -65 degrees to undercut the first pegmatite intersection. This hole intersected a five-metre intercept of the same spodumene mineralized pegmatite as hole FM22-70. The host rock to these pegmatites is a fine-grained foliated basalt.

| Page 7 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Figure 3. DDH FM22-70 drilled at -70 degrees inclination intersected two pegmatite dykes totalling 4.9 metres with up to 15% light green spodumene crystal aggregates.

The location of dyke 16 is illustrated in relation to all previous pegmatite dykes on the Zoro property in Figure 4 below.

Figure 4. Map of Zoro property showing the locations of newly discovered spodumene-bearing pegmatite dykes.

High-grade spodumene pegmatite Dyke 8 was discovered on the Zoro property in 2018 by the drill testing a Mobile Metal Ions soil geochemical anomaly. Drill hole Far18-35 testing the MMI anomaly intersected 36.5 m of spodumene-bearing pegmatite. Assay results from hole FAR18-35 included three separate intercepts of high-grade lithium including 12.3 m of 1.1% Li2O, 4.4 m of 1.2 % Li2O, and 2.2 m of 1.5% Li2O.

| Page 8 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

In 2022 DDHFM22-71 was drilled at -65 degrees to undercut the 2018 pegmatite intersections. A 4.5- metre spodumene-bearing pegmatite was intersected between 70.45 and 75.89 metres before being truncated by a fault [see Figure 3]. This intercept is 37 metres below the previous 2018 drill intercepted Dyke 8 spodumene mineralization. A further pegmatite was intersected below the fault between 84.4 and 86.65 metres [see Figures 5 and 6].

Figure 5. A 4.5 metre spodumene-bearing pegmatite was intersected between 70.45 and 75.89 metres before being truncated by a fault.

Figure 6. A further pegmatite was intersected below the fault between 84.4 and 86.65 metres in Dyke 8.

To date, Dyke 8 has drill indicated dimensions of 120 m in length, 5-15 m in width and has been drilled to a depth of 157 m below surface.

After logging, all spodumene-bearing pegmatite intercepts were sawn in half and one half of the core shipped to Activation Laboratories (Ancaster, Ontario) for multielement analysis. The analysis of the 2022 core samples will be consistent with previous years analytical program. This includes “UT-7” lithium and related metal analysis by ICP-MS after total dissolution by sodium pyrophosphate fusion.

Dyke 16

DDH FM22-70 intersected spodumene-bearing pegmatite between 32.44 m and 35.80 m. Assay results vary from 0.04% to 1.33% Li2O in 4 core samples over 3.36 m. DDHFM22-70B, drilled to undercut the first pegmatite intercept, intersected 4.92 m of spodumene-bearing pegmatite with lithium contents varying from 0.04% to 1.05% Li2O in 5 core samples (Table 1).

Related metal concentrations in Dyke 16 for Cs (225-476 ppm), Nb (74.9-116.2 ppm) and Ta (28.3-89.7 ppm) compare favourably with those for Dyke 1.

| Page 9 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Dyke 8

High-grade spodumene pegmatite Dyke 8 was discovered on the Zoro property in 2018 by the drill testing of a Mobile Metal Ions soil geochemical anomaly. Discovery hole Far18-35 intersected 36.5 m of spodumene-bearing pegmatite including individual intercepts of 12.3 m of 1.1% Li2O, 4.4 m of 1.2 % Li2O, and 2.2 m of 1.5% Li2O.

DDHFM22-71 undercut the original 2018 pegmatite discovery and intersected three discrete pegmatites. A spodumene-bearing pegmatite was intersected between 70.45 and 75.89 m, a second between 84.4 m and 86.65 m and a third between 148.75 m and 152.65 m. Host rocks include fine-grained, variably altered, and foliated basalt +/- pyroxene.

Assay results from the first pegmatite intersection vary from 0.05%-0.86% Li2O in 5 core samples over 5.44 m and 0.05% Li2O in each of 2 core samples over 2.25 m from the second pegmatite intersection (Table 1). A third pegmatite intersected over 3.91 m in DDHFM22-071 assayed 0.09-0.21% Li2O with the highest concentrations for related metals Cs (1440 ppm) and Nb (137.9 ppm); cf. sample 423028; Table 2). Tantalum analyses from Dyke 8 core samples vary between 30.2 ppm and 88.5 ppm.

| Table 2. Summary of NQ core assay results for lithium and related metals from spodumene-bearing | |||||||||

| pegmatites and pegmatites without visible spodumene, 2022 Zoro lithium property drill program. | |||||||||

| Analysis by Actlabs procedure UT-7 that combines a total sodium peroxide fusion with ICP-MS finish. | |||||||||

| Dyke 16 | |||||||||

| DDHFM22-070 | NQ Core Sample | Depth (m) | Width (m) | Li ppm | Li20% | Cs ppm | Nb ppm | Ta ppm | |

| 423011 | 32.44-33.24 | 0.8 | 203 | 0.04 | 296 | 137 | 86.6 | ||

| 423012 | 33.24-34.0 | 0.76 | 1040 | 0.22 | 226 | 116.2 | 89.7 | ||

| 423013 | 34.0-35.0 | 1 | 6220 | 1.33 | 260 | 84.3 | 58.8 | ||

| 423014 | 35.0-35.8 | 0.8 | 4000 | 0.86 | 253 | 97.1 | 47.4 | ||

| DDHFM22-070B | |||||||||

| 423015 | 43.21-44.0 | 0.79 | 200 | 0.04 | 395 | 107.9 | 65.3 | ||

| 423016 | 44.0-45.0 | 1.0 | 3030 | 0.65 | 225 | 74.9 | 28.3 | ||

| 423017 | 45.0-46.0 | 1.0 | 4890 | 1.05 | 319 | 113.3 | 35.7 | ||

| 423018 | 46.0-47.0 | 1.0 | 4460 | 0.96 | 301 | 111.5 | 35.7 | ||

| 423019 | 47.0-48.13 | 1.13 | 4030 | 0.86 | 476 | 106.5 | 61.9 | ||

| Dyke 8 | |||||||||

| DDHFM22-071 | |||||||||

| 423021 | 70.45-71.30 | 0.85 | 563 | 0.12 | 328 | 99.9 | 63.1 | ||

| 423022 | 71.30-72.30 | 1.0 | 4030 | 0.86 | 384 | 57.1 | 30.2 | ||

| 423023 | 72.30-73.30 | 1.0 | 1770 | 0.38 | 562 | 61.3 | 46.2 | ||

| 423024 | 73.30-74.27 | 0.97 | 1170 | 0.25 | 362 | 92.6 | 52.8 | ||

| 423025 | 75.20-75.89 | 0.69 | 659 | 0.14 | 565 | 135 | 55.2 | ||

| 423026 | 84.40-85.50 | 1.10 | 275 | 0.05 | 330 | 49.6 | 31.6 | ||

| 423027* | 85.5-86.65 | 1.15 | 246 | 0.05 | 414 | 62.8 | 34.3 | ||

| 423028* | 148.74-149.4 | 0.65 | 1000 | 0.21 | 1440 | 137.9 | 88.5 | ||

| 423029* | 150.76-151.7 | 0.94 | 440 | 0.09 | 777 | 67.3 | 32.8 | ||

| 423031* | 151.7-152.65 | 0.95 | 429 | 0.09 | 539 | 90.4 | 59.3 | ||

| Note: * Refers to no visible spodumene observed in core sample | |||||||||

| Page 10 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Bulk Sample

On May 26, 2022, the Company announced that it has contracted XPS Expert Process Solutions (a Glencore company) to develop a process to develop and refine spodumene concentrate (SC6 technical specification) into a saleable battery-grade lithium hydroxide product. The contractual relationship reflects the Company’s commitment to deliver battery grade lithium hydroxide to supply an integrated EV battery ecosystem to energize the electrification of the transportation sector.

The Company’s initial 2020 metallurgical test work, done in conjunction with SGS Canada Inc, indicated that it is possible that Heavy Liquids Separation (HLS) combined with magnetite separation can be used to produce a high-grade (close to 6% Li2O) lithium spodumene concentrate after the rejection of iron silicate minerals therefore, most of the spodumene should be amenable to recovery by HLS and/or flotation. The mineralogical characteristics of the Zoro Dyke 1 pegmatite highlight the economic potential of the project. These preliminary findings suggest that the Company’s Zoro property contains lithium resources meeting industry and market specifications. The new project with XPS and SGS will utilize a more robust 500 kg sample size which will allow us to confirm that it is feasible to convert the 6% Li2O from Zoro to Lithium hydroxide (LiOH) which is the compound for which the Electric Vehicle makers / giga factories have unprecedented demand.

The project was undertaken at XPS’s Falconbridge, Canada facility and SGS Canada Inc.'s Lakefield, Canada facility. The project included a single stage Dense Media Separation (DMS), flotation, pyrometallurgy, and hydrometallurgy. Phase 1 including evaluating the potential purity and recovery of lithium from concentrates to ultimately improve commercial understanding and provide data for the generation of a continuous pilot process. The objective of Phase 1 is to produce a technical specification SC6 spodumene concentrate. SC6 is an inorganic material that can be further refined for use in the manufacturing of batteries, ceramics, glass, grease, and various lithium products.

Results of Test Work

Final test results confirmed in March of 2023, that Dense Media Separation (“DMS”) and flotation of DMS middlings together, achieved a global lithium recovery of 81.6% at a spodumene concentrate grade of 5.88% Li2O. Pyrometallurgical and hydrometallurgical testing on the DMS spodumene concentrate have shown that the final product is amenable to a flowsheet, capable of producing both battery grade lithium products, Lithium Carbonate (Li2CO3) and Lithium Hydroxide (LiOH).

The Zoro Dyke 1 metallurgical program investigated the feasibility of lithium beneficiation by dense media and dry magnetic separation with the goal of producing a 6% Li2O concentrate from a Master Composite, at a fairly coarse particle size of -12.7/+0.5 mm. Completed HLS, DMS, and dry magnetic separation test work confirms that heavy liquid separation (HLS) demonstrates excellent potential for the recovery of an on-spec lithium concentrate from the Master Composite by dense media separation. The global lithium recovery to a cumulative HLS non-magnetic sink product at an interpolated 6% Li2O grade was high at 73.5%, at a projected SG cut point of 2.88. Results from HLS testing were confirmed in the DMS pilot plant. DMS processing followed by dry magnetic separation produced a 5.93% Li2O spodumene concentrate, at a global lithium recovery of 66.9%, in approximately 27% of the mass which is in good agreement with the HLS results. The iron contents in the final lithium concentrates from both HLS and DMS were slightly above the 1% Fe2O3 requirement, but still acceptable for subsequent hydrometallurgical lab testing. Further improvements on the recovery of lithium can be realized by incorporating flotation and wet high-intensity magnetic separation (WHIMS) in the flowsheet to treat the DMS middlings and -0.5 mm fines. Favourable metallurgical characteristics and processing of the Dyke 1 mineralogically representative bulk sample have been confirmed by this two-phase program. The result provides confidence in the metallurgical character of spodumene-bearing pegmatite as exploration proceeds on the Zoro Property.

Hidden Lake, Yellowknife, NWT

In February 2018, the Company entered into an option agreement (the “Hidden Lake Option Agreement”) with 92 Resources Corp (“92 Resources”, now Patriot Battery Metals Ltd.) to acquire up to 90% interest in the Hidden Lake Lithium project, Northwest Territories (the “Hidden Lake Project”).

The Hidden Lake Project consists of five contiguous mineral claims totaling approximately 1,659 hectares within the central parts of the Yellowknife Lithium Pegmatite Belt along Highway 4, approximately 40 km east of Yellowknife. 92 Resources’ 2016 exploration results returned 1.90% Li2O over 9 metres and grab samples up to 3.3% Li2O. Metallurgical test work has produced a high-grade mineral concentrate of 6.16% Li2O with an average spodumene lithium content of per cent lithium (8.2% Li2O). 92 Resources also channel sampled four dykes extensively which range between 275 and 790 metres in length and up to about 10 metres in width which returned an average lithium concentration of 1.03% Li2O for the 308 samples with surface samples up to 3.3% Li2O. Due to the success of 92 Resources’ programs, preliminary metallurgical test work and scoping lithium extraction tests were conducted. The scoping test work achieved an overall extraction of 97%, indicating that industry standard lithium extraction techniques applied to typical spodumene concentrates are applicable to concentrates produced from the pegmatites at Hidden Lake. The Hidden Lake Project is easily road accessible and its proximity to infrastructure provides for numerous development advantages.

| Page 11 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Under the terms of the Hidden Lake Option Agreement, the Company can earn up to 90% interest in the Hidden Lake Project as follows:

| a) | the consideration for the initial 60% interest: |

| i. | cash payment of $50,000 upon execution of the agreement (paid). |

| ii. | issuance of 11,112 common shares (issued and valued at $225,000) upon execution of the agreement. |

| iii. | exploration expenditures of $500,000 to be incurred by January 22, 2019 (completed). |

| b) | the consideration for an additional 10% interest (70% total): |

| i. | issuance of common shares with a fair market value of $250,000 based on the average market price to a maximum of $75 per share by January 22, 2019 (not issued as the Company decided not to add to its 60% interest as at December 31, 2018). |

| ii. | additional exploration expenditures of $500,000 to be incurred by January 22, 2020. |

| c) | the consideration for an additional 10% interest (80% total): |

| i. | issuance of common shares with a fair market value of $300,000 based on the average market price to a maximum of $75 per share by January 22, 2020. |

| ii. | additional exploration expenditures of $600,000 to be incurred by January 22, 2021. |

| d) | the consideration for an additional 10% interest (90% total): |

| i. | issuance of common shares with a fair market value of $400,000 based on the average market price to a maximum of $75 per share by January 22, 2021. |

| ii. | additional exploration expenditures of $700,000 to be incurred by January 22, 2022. |

The Company chose not to accelerate the exercise of the option beyond the initial 60% interest. The Company may now opt to form a joint venture with 92 Resources on a 60:40 basis, the Company will be responsible for funding the initial $1,000,000 in joint venture expenditures, after which costs are shares on a 60:40 basis.

During the year ended March 31, 2020, the Company wrote-off $870,046 of the carrying value of the Hidden Lake property to $Nil due to lack of plans for exploration because of limited funding.

On November 7, 2022, the Company signed a binding term sheet with respect to the sale of its 60% interest in the Hidden Lake Project in Yellowknife, NWT for $3,500,000 to an arm’s length party. The Company has received a $100,000 non-refundable deposit in connection with signing the term sheet. The closing of the transaction and receipt of the remaining $3,400,000 of the purchase price is expected to occur within 30 days, subject to the parties entering and approving definitive binding documentation, final due diligence by the purchaser, receipt of applicable third-party consents and other customary conditions for a transaction of this nature.

On December 1, 2022, the Company completed the sale of its 60% interest in its Hidden Lake Project in Yellowknife, NWT for $3,500,000 to Youssa PTY Ltd., an Australian private Company.

Exploration at the Hidden Lake Project, Northwest Territories

In May 2018, the Company announced it had mobilized a drill rig to its Hidden Lake Project targeting high-grade lithium-bearing pegmatites with an initial minimum 1,100 metre diamond drilling campaign. Far signed the drill contract with Northtech Drilling for the program. Great Slave Helicopters provided helicopter support for the drill program which was managed in the field by Henry Lole of Dahrouge Consulting. Previous channel sampling at Hidden Lake conducted by 92 Resources returned grades as high as 3.3% Li2O at surface. The Company has completed a 1,100-metre drill program, with the goal of defining continuity of mineralization at depth. A total of 197 core samples were collected and were submitted to SGS Mineral Services (Lakefield) for lithium and multi-element analysis.

| Page 12 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Results indicate each of the targeted pegmatite dykes, HL-001 through HL-003 and D-12, is marked by high-grade Li2O assays of 1.0% to 2.0% over widths that vary between 2.0 m and 9.2 m. The high-grade nature of these spodumene- mineralized pegmatites coupled with the demonstrated favourable metallurgical characteristics demonstrated by previous operators makes these drill results significant. Although this drill campaign targeted four dykes, the Hidden Lake Project itself hosts a swarm of at least ten lithium- bearing spodumene pegmatite dykes that have been identified by previous explorers. See News Release dated February 2, 2021. Very recent mineralogical evaluation and metallurgical testing of samples from the Hidden Lake pegmatites by SGS Mineral Services (Vancouver) indicates a lithium concentrate of >6% Li2O with a recovery of 97% are achievable. These results indicate the Hidden Lake pegmatites can be treated using standard industry practices for spodumene beneficiation.

Jean Lake Lithium-Gold Project, Manitoba, Canada

The Jean Lake Property is situated southwest of the Thompson Brother Trend in west-central Manitoba 15 kilometers east of the historic town of Snow Lake, Manitoba, Canada, east end of the prolific Paleoproterozoic Flin Flon-Snow Lake greenstone belt. The Jean Lake property was first prospected in 1931 by Peter Kobar, who optioned the property to Sherritt Gordon Mines Ltd (SGM). A 1942 exploration program by SGM consisted of 19 shallow drill holes resulting in the discovery of three spodumene-bearing pegmatite dykes, SGM-1, -2 and -3. The SGM-3 pegmatite, now referred to as the Beryl dyke or B1, was re-discovered beneath 80 years of organic and inorganic debris by prospecting on the Jean Lake property in 2021.

The Jean Lake Property consists of 5 mineral claims covering approximately 2,476 acres (1,002 hectares). On July 30, 2021, the Company entered into an option agreement with Mount Morgan Resources Ltd. to acquire a 100% interest in the Jean Lake lithium-gold project located in Manitoba.

The option agreement provides for the Company to earn a 100% interest over 4 years by cash payments and share issuances to Mount Morgan Resources Ltd. and exploration expenditures as follows:

| a) | $25,000 cash (paid) and common shares of the Company having a value of $25,000 (5,000 shares issued) on or before August 1, 2021. |

| b) | $50,000 cash (paid), $50,000 in common shares (6,704 shares issued) and $50,000 exploration expenditures (incurred) on or before July 30, 2022. |

| c) | $50,000 cash (paid), $50,000 in common shares and $100,000 (accumulated) exploration expenditures by July 30, 2023 (incurred). |

| d) | $50,000 cash, $50,000 in common shares and $150,000 (accumulated) exploration expenditures by July 30, 2024 (incurred). |

| e) | $75,000 cash, $75,000 in common shares and $200,000 (accumulated) exploration expenditures by July 30, 2025 (incurred). |

Once the Company earns the interest, the Company will grant a 2% NSR to Mount Morgan Resources Ltd. The NSR may be reduced to 1% by the Company’s payment of $1,000,000 to the NSR holder.

Exploration at the Jean Lake Lithium-Gold Project, Manitoba

On December 9, 2021, the Company announced the commencement of a UAV-borne magnetic survey over the Jean Lake property where high-grade lithium pegmatite dyke was rediscovered in August of 2021 shortly after the property was optioned. Assay results from two locations on the “Beryl” or B1pegmatite gave a range of 3.89-5.17% Li2O in five samples collected from blasted trenched material. The trench and spodumene-bearing pegmatite dyke were exposed for mapping and sampling after approximately 80 years of accumulated organic debris was removed.

An Unmanned Aerial Vehicle or “UAV”-assisted magnetic survey was flown by EarthEx Geophysical Solutions Inc. (Selkirk, Manitoba) at 25 m line-spacing with 250 metre tie-lines over the Jean Lake property. A total of 500-line km was flown. The survey commenced November 29 (2021) and despite some weather delays was completed on December 13th, 2021. The orientation of the flight lines was designed to assess the magnetic signatures of lithium-bearing pegmatites in and along the Beryl Lithium Trend on the Jean Lake property. The superior spatial precision of the UAV-acquired magnetic data will provide an assessment of the depth to source, dip of the body, and the overall shape and size of the body which will assist subsequent diamond drill targeting. Results of the survey will be released in the Company’s news releases. The magnetic survey was followed up with a Lidar survey in the spring of 2022 after the snowpack melted.

| Page 13 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

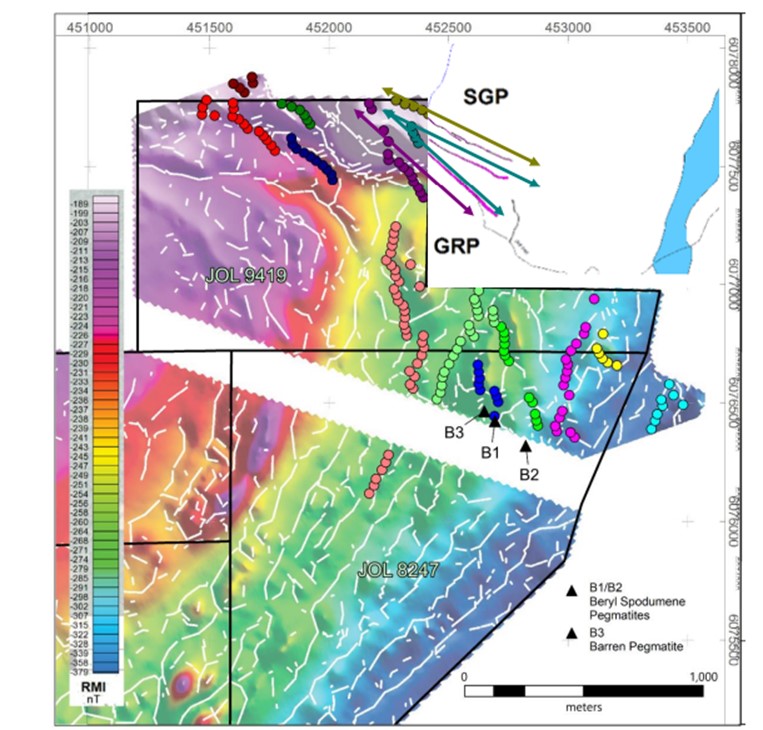

On March 1, 2022, the Company reported initial data from the UAV magnetic survey over the Jean Lake property. Images from EarthEx Geophysical Solutions Inc. (“EarthEx”) magnetic data identified several highly prospective targets which correlate with the previously identified Beryl pegmatite dykes (B1and B2) which assayed between 3.89% - 5.17% Li2O. The locations of the B1 pegmatite dyke, including locations B2 and B3 representing outcrop exposing pegmatite potentially hosted within the B1 dyke, are annotated with the magnetic data in Figure 1. The white lines on Figure 1are the preliminary interpretation of the magnetic low lineaments from a Centre for Exploration Targeting (“CET”) analysis and overly the magnetic “low” picks layer. The coincidence of the trends of magnetic lows with the Beryl pegmatites and their extension along a trend recognized for its association with high-grade lithium pegmatites is highly encouraging.

On April 14, 2022, the Company announced final interpreted results from the Unmanned Aerial Vehicle, (“UAV”) magnetic survey over the Jean Lake property. Jean Lake is the Company’s 100% owned 1,002-hectare (2,476-acre) property situated in Snow Lake, Manitoba, Canada. The North-East sector of the Company’s Jean Lake property abuts the Sherritt Gordon (“SG”) and Grass River (“GRP”) pegmatites of Snow Lake Lithium.

Final images from EarthEx Geophysical Solutions Inc. (“EarthEx”) magnetic data identified fourteen (14) high priority structural targets for further exploration work in the northern portion of the Jean Lake property. Fourteen sets of independently colored lines are final interpretations of the magnetic low lineaments from a Centre for Exploration Targeting (“CET”) analysis and overlay the magnetic “low” picks layer. The coincidence of the magnetic lows with the Beryl Pegmatite provides additional exploration targets and is highly encouraging. Of particular importance, Target 11 (BLUE) and Target 10 (GREEN) directly match the previously identified Beryl Pegmatite dykes (B1 and B2). The locations of the B1 and B2 Beryl Pegmatite dykes are annotated with the magnetic data in Figure 7.

Figure 7. Magnetic image covering the Jean Lake property. The gap in the image is due to the location of the hydroelectric power line that crosses the property. Location B-1 assayed 3.89% Li2O and connects with target 11; and Location B2 (red circle) assayed 5.17% Li2O and connects with Target 10.

| Page 14 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Figure 7 builds upon Figure 8 now showing Snow Lake Lithium’s SG and GRP spodumene pegmatites as per their disclosed interim drilling results from March 10th, 2022 [1]. There are multiple features which appear to connect the High Priority Targets, known pegmatite dykes and interpreted lineaments on the Foremost Lithium and Snow Lake Lithium properties.

Figure 8. Foremost Lithium’s Jean Lake magnetic survey results with overlays of Snow Lake Lithium’s SG and GRC pegmatites

Exploration Program

Two field crews were mobilized to prospect (14) high priority targets defined as magnetically low and structurally recessive lineaments. These lineaments host the beryl pegmatites, have similar orientations as the SGM and Grass River lithium pegmatites of Snow Lake Resources and were interpreted as high priority exploration targets. The lineaments were defined by an Unmanned Aerial Vehicle (UAV Drone) assisted high-resolution geophysical survey and Centre of Exploration Targeting “CET” analysis of the acquired data (see March 1, 2022, news release). The linear trend of magnetic lows defined on the Jean Lake property by the UAV borne survey are interpreted as the magnetic signature of the coarse spodumene bearing Sherritt Gordon #1 and #2 and the Grass River pegmatite dykes currently being explored and developed by Snow Lake Resources Ltd. There are also linear trends of magnetic lows associated with the high-grade Beryl pegmatites which were drill tested.

| Page 15 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

The lineaments were prospected, and rock chip sampled and assayed for lithium and related elements where exposure was permissive. Where the lineaments are overburden covered, Mobile Metal Ion (“MMI”) soil geochemical surveys were initiated and sent for analyses to SGS Canada Inc. Burnaby (B.C.). The UAV-borne magnetic and Lidar surveys were flown by EarthEx Geophysical Solutions Inc. (Selkirk, Manitoba) with financial support from the Manitoba Mineral Development Fund.

On October 17, 2022, the Company commenced preparations for a winter diamond drill program. The drill targets were to include the high-grade spodumene-bearing Beryl pegmatite dykes where grab sample assays of 3.89% and 5.17% Li2O were received from pegmatite dyke B1 and 3.81%, 4.09% and 4.74% Li2O from pegmatite dyke B2 in August 2021.

On November 21, 2022, the Company announced that it received a work permit from the Mining Permit office of the Manitoba Government and had finalized plans to begin a 24-hole, 3,000 metre diamond drill program on its 100% owned Jean Lake Lithium Project located near the historic mining town of Snow Lake, west-central Manitoba commencing on December 02, 2022. The Company signed a drill contract with BRL Drilling Ltd. (Temagami, Ontario), air support, core storage and preparation facilities in Snow Lake were provided by Gogal Air Services, drill pads were cut by Moss Line Cutting Ltd. (Snow Lake) and field technical support was provided by Golden Frost Exploration (Oakbank, Manitoba). Assay samples from drill core were shipped to Activation Laboratories (“ACTLABS”; Ancaster, Ontario) for lithium and related element analysis using analytical approach UT-7 after a total sodium peroxide fusion.

Foremost’s Exploration and Development Approach

The Company follows the same scientific methodical approach on all its lithium projects for future exploration and drill programs. Valuable tools and steps include:

UAV-Borne Magnetic Surveys

On November 3, 2022, the Company completed a UAV-assisted high-resolution airborne magnetic survey on its “Lithium Lane” Properties near the historic mining town of Snow Lake, west-central Manitoba. Foremost contracted EarthEx Geophysical Solutions Inc. (Selkirk, Manitoba), which flew a total of 7,472.7-line km over the entire 43,276-acre/17,513 hectares land package.

Magnetometer Survey Details

The drone magnetometer surveys (Figures 9 and 10) were flown with a flightline azimuth of 070º and flightline spacing of 25m. Tie lines were established at 250m spacing. Each property survey and the number of line km flown include:

| 1. | Grass River Lithium Property: Survey was conducted between April 14 and May 27, 2022, and comprised 2,734.1-line km. |

| 2. | Zoro Lithium Property: Survey was conducted between May 28 and June 15, 2022, and comprised 1,264.7-line km. |

| 3. | Jean Lake Property: Survey was conducted between November 29, 2021, and December 20, 2021, and comprised 483.4-line km. |

| 4. | Peg North Property: Survey was conducted between June 15th, 2022, and October 6th, 2022, and comprised 2990.5-line km. |

| Page 16 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Figure 9. A magnetometer towed by a UAV or drone measuring the magnetic signature of the rocks on the ground over the Zoro Lithium Property.

Figure 10. A magnetometer towed by a UAV or drone measuring the magnetic signature of the rocks on the ground over the Zoro Lithium Property.

| Page 17 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

UAV-flown high resolution magnetic data lends itself very well to defining new prospective drill targets (Figures 1 and 2 above) based on precise and high-resolution data. The UAV system’s resolution has provided excellent litho-structural detail over all Foremost’s Lithium Lane Properties and has generated detailed 3D models of the magnetic sources on the properties. The magnetic survey can provide valuable exploration information such as depth to source, dip of the body as well as the overall shape and morphology of the lithological unit. The resolution of the survey allows targeting of bedrock structures which may host lithium pegmatite deposits, which when coupled with 3D products from inversion of magnetic survey data provides an excellent source of information for Foremost Lithium to define drill-targets on their property based on their magnetic signatures including both magnetic and nonmagnetic targets.

GOLD AND SILVER

Winston Property, New Mexico, USA

The Company controls, subject to certain underlying royalties, a 100% interest in the Winston property located in Sierra County, New Mexico, USA (the “Winston Property”). The Winston Property is comprised of 149 unpatented lode mining claims (the “LG Claims”), the Ivanhoe and Emporio patented mining claims (the “Ivanhoe/Emporio Claims”) and four unpatented mining claims (the “Little Granite Claims”) and is prospective for gold and silver.

In accordance with the terms and condition of the underlying purchase agreement to complete the acquisition of the Ivanhoe/Emporia claims, the Company is required to pay the original owner of the claims the remaining purchase price of US$361,375 (US$42,000 paid). Before the remaining purchase price is paid in full, the Company is subject to a minimum monthly royalty payment based on monthly average silver price which reduces the remaining purchase price once paid. The accrued minimum monthly royalty payments outstanding as of June 30, 2023, totals US$237,125 (March 31, 2023 – US$225,125). The agreement also entitles the owner to a permanent production royalty of 2% of NSR.

On December 14, 2022, the Company announced that it has acquired 100% interest of Little Granite Claims in the Winston Group of Properties Gold/Silver Project.

The Winston Property is in good standing.

Exploration at the Winston Property, New Mexico, USA

The Little Granite Mine is a high-grade epithermal silver-gold system which was last explored in the early 1980s. In addition to Little Granite, Far Resources also controls the core claims covering the nearby Ivanhoe-Emporio Mines, which may represent an attractive bulk mineable gold target. The historic mines are hosted by north-south orientated vein systems which display characteristics typical of low sulphidation epithermal style mineralisation. This style of mineralisation hosts some of the highest-grade precious metal mines worldwide, including Sleeper (Nevada), Creede (Colorado), Fruta del Norte (Ecuador) and Hishikari (Japan). The mineralisation in the Winston area is believed to be Tertiary in age and related to the Rio Grande Rift. The Black Range District was mined extensively in the 1880s but has seen little activity since.

Michael Feinstein, PhD, CPG, of Mineoro Explorations LLC is assisting the Company with their exploration campaign aimed at targeting the bonanza zone of the Little Granite Epithermal Vein System. Existing data will be integrated with structure, alteration, and geochemistry in a 3D model. The host volcanic stratigraphy of the Gila and dominant structural control of the Rio Grande Rift provide excellent context for the emplacement of well-developed vein systems.

The Company mobilized a field crew to the Winston project in early October of 2020. The crew evaluated the best options for access and logistical support of the planned Phase 1 program focused on the Little Granite Mine area. The Phase 1 program consisted of soil and rock geochemical sampling, geological mapping with particular focus on structural controls of the silver-gold mineralisation and possibly ground geophysics and terrain mapping using a drone as disclosed in the April 23, 2021, news release.

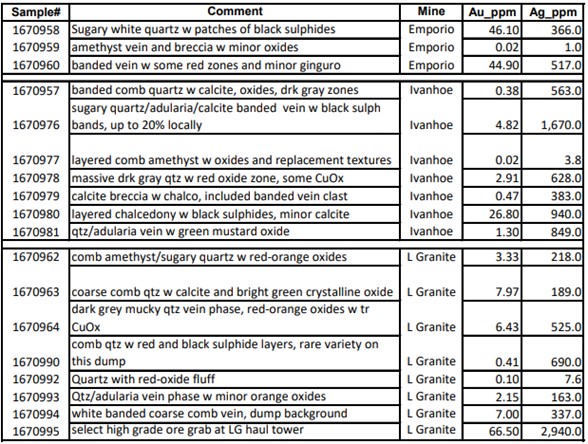

On February 4, 2021, the Company reported the results of recent sampling on its wholly owned Winston Project in New Mexico. High grade gold and silver values were confirmed from three historic mines, Ivanhoe, Emporia and Little Granite, in the south part of the company’s land holdings. Twenty ore characterisation samples from these three mines returned peak values of 66.5 g/t gold and 2940 g/t silver from Little Granite, 26.8 g/t gold and 1670 g/t silver from Ivanhoe and 46.1 g/t gold and 517 g/t silver from Emporia.

| Page 18 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Detailed sample results are listed below. The samples were obtained as part of the initial geological evaluation of the property, during which mine environs, workings and dumps were walked and inspected to collect representative samples of the different styles of mineralisation. High grade mineralisation was confirmed at the Little Granite, Ivanhoe and Emporia mine sites.

These samples were collected by Dr. Michael Feinstein of Mineoro Explorations during three visits to the project between October and December of 2020. Numerous samples were collected throughout the project area, and historic mine sites were visited several times. Multiple, overlapping phases of alteration and mineralisation are evident throughout as illustrated in the sample photos following. The ore characterization samples were collected to better understand which phases are of greatest economic interest. The results confirm that earlier reports of high-grade silver and gold values from historic workings have legitimacy and justify a major exploration program using modern methods to define the nature and size of mineralisation.

| Page 19 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Current plans for follow-up work include additional geochemical sampling, geological mapping, and claim staking. The acquisition of detailed imagery and surface terrane models are being investigated as a precursor to project and target scale geophysical surveys.

All samples were collected by Mineoro Explorations and securely maintained through to submission to the ALS Minerals laboratory in Tuscon. Samples were analysed by Fire Assay and ICP-MS. Internal laboratory QA/QC protocols were followed and 5% external standards are submitted with all sample batches.

Results of Operations

Expenses incurred for three months ended June 30, 2023

During the three months ended June 30, 2023, the Company earned no revenue and had a comprehensive loss of $608,178 (2022 – $767,986).

Total expenses before other items for the three months ended June 30, 2023, were $618,030 compared to $759,563 for the corresponding three months ended June 30, 2022.

| Page 20 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

The table below details the significant changes in major expenditures from 2023 and 2022.

| Expenses | Three Months Ended June 30, 2023 | Three Months Ended June 30, 2022 |

Explanation for Change Increase / Decrease in Expenses |

| Consulting | 30,581 | 129,045 | Decreased due to decreased business advisory services rendered in the current period. |

| Management and director fees | 135,000 | 56,318 | Increased due to fees paid to new directors and CFO. |

| Office expense | 11,295 | 25,058 | Decreased due to a decrease in general expenses in the current period. |

| Professional Fees | 331,157 | 154,214 | Increased primarily due to an increase in legal fees relating to the Company pursuing a listing on the NASDAQ, changes in management, name change and financing. |

|

Share-based payments |

15,787 | 331,548 | Decreased due to reduced share options and PSU’s granted and vesting through the current period. |

| Transfer agent and filing fees | 39,118 | 6,894 | Increased primarily due to an increase in filing fees relating to the Company pursuing a listing on the NASDAQ, changes in management, name change and financing. |

| Travel | 4,184 | 13,559 | Decreased due to decreased travel during the current period. |

The Company incurred a $350 unrealized gain on long-term investments during the three months ended June 30, 2023 (2022 – loss of $5,000) related the value of certain shares of Alchemist Mining Inc. being held by the Company for investment purposes. See Note 4 of the Company’s Financial Statements accompanying this MD&A.

Summary of Quarterly Results

A summary of selected financial information for the eight most recently completed quarters is set out below and should be read in conjunction with the Company’s condensed interim consolidated Interim Financial Statements and related notes for such periods (Note 2):

| Three Months Ended | Three Months Ended | Three Months Ended | Three Months Ended | Three Months Ended | Three Months Ended | Three Months Ended | Three Months Ended | |||||||||||||||||||||||||

| Jun 30, 2023 | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | June 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | Sep 30, 2021 | |||||||||||||||||||||||||

| Revenue | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Expenses | 618,030 | 390,807 | 1,814,129 | 882,298 | 759,563 | 2,860,767 | 826,797 | 128,491 | ||||||||||||||||||||||||

| Total comprehensive loss (income) | 608,178 | (115,705 | ) | (2,154,228 | ) | 751,616 | 767,986 | 3,034,432 | 746,581 | 123,152 | ||||||||||||||||||||||

| Income (loss) per share – basic and diluted (1) | (0.15 | ) | (0.03 | ) | 0.55 | (0.20 | ) | (0.21 | ) | (0.87 | ) | (0.23 | ) | (0.04 | ) | |||||||||||||||||

| Total assets | 13,110,859 | 13,300,444 | 13,530,636 | 10,376,744 | 9,802,357 | 7,918,078 | 7,704,225 | 6,940,821 | ||||||||||||||||||||||||

| Total liabilities | 3,130,028 | 2,912,822 | 2,841,312 | 2,900,781 | 2,633,408 | 1,176,332 | 1,433,198 | 982,819 | ||||||||||||||||||||||||

| Total equity | $ | 9,980,831 | $ | 10,387,622 | $ | 10,689,324 | $ | 7,475,963 | $ | 7,168,949 | $ | 6,741,746 | $ | 6,271,027 | $ | 5,860,193 | ||||||||||||||||

| Weighted average number of common shares outstanding (1) | 3,975,666 | 3,968,847 | 3,943,682 | 3,815,069 | 3,620,185 | 3,515,420 | 3,274,558 | 3,167,545 | ||||||||||||||||||||||||

Note 1: Based on the weighted average number of common shares outstanding during the period.

Note 2: During the year ended March 31, 2022, management determined that there was an error pertaining to exploration and evaluation and accounts payable and accrued liabilities. This error was a result of the under accrual of option payments required on the Company’s Winston mineral property. Quarterly total assets and total liabilities have been restated as compared to the amounts reported in our previously issued quarterly MD&A and condensed quarterly financial statements. There were no impacts on operating income or net income from these changes, and no changes in working capital and cash flow.

| Page 21 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

During the quarter ended June 30, 2023, expenses increased to $618,030 compared to $390,807 for the quarter ended March 31, 2023. The increase was primarily attributable to management fees of $135,000 (March 31, 2023 - $111,250), professional fees of $331,157 (March 31, 2023 - $385,945) and share-based payments of $15,787 (March 31, 2023 – expense reversal of $501,462).

During the quarter ended March 31, 2023, expenses decreased to $390,807 compared to $1,814,129 for the quarter ended December 31, 2022. The decrease was primarily attributable to management fees of $111,250 (December 31, 2022 - $189,000), professional fees of $385,945 (December 31, 2022 - $676,854) and share-based payments reversal of $501,462 (December 31, 2022 – expense of $776,916).

During the quarter ended December 31, 2022, expenses increased to $1,814,129 compared to $882,298 for the quarter ended September 30, 2022. The increase was primarily attributable to management fees of $189,000 (September 30, 2022 - $83,251), professional fees of $676,854 (September 30, 2022 - $359,961) and share-based payments of $776,916 (September 30, 2022 - $208,426).

During the quarter ended September 30, 2022, expenses increased to $882,298 compared to $759,563 for the quarter ended June 30, 2022. The increase was primarily attributable to investor relations of $67,967 (June 30, 2022 - $28,252), management fees of $83,251 (June 30, 2022 - $56,318), and professional fees of $359,961 (June 30, 2022 - $154,214).

During the quarter ended June 30, 2022, expenses decreased to $759,563 compared to $2,860,767 for the quarter ended March 31, 2022. The decrease was primarily attributable to management fees of $56,318 (March 31, 2022 - $61,885), share-based payments of $331,548 (March 31, 2022 - $2,333,019), and forgiveness of debt $Nil (March 31, 2022 - $100,355).

During the quarter ended March 31, 2022, expenses increased to $2,860,767 compared to $826,797 for the quarter ended December 31, 2021. The increase was primarily attributable to management fees of $61,885 (December 31, 2021 - $213,179), share-based payments of $2,333,019 (December 31, 2021 - $149,200), and forgiveness of debt $100,355 (December 31, 2021 - $Nil).

During the quarter ended December 31, 2021, expenses increased to $826,797 compared to $128,491 for the quarter ended September 30, 2021. The increase was primarily attributable to investor relations of $137,434 (September 30, 2021 - $14,003) due to the Company’s effort to raising awareness in the market, management fees of $213,179 (September 30, 2021 - $50,100), professional fees of $143,049 (September 30, 2021 - $21,858) due to an increase in legal fees relating to the replacement of the board of directors and change in management and share-based payments of $149,200 (September 30, 2021 - $Nil) for options granted.

During the quarter ended September 30, 2021, expenses decreased to $128,491 compared to $257,690 for the quarter ended June 30, 2021. The decrease was primarily attributable to consulting of $16,711 (June 30, 2021 - $73,656) due to the timing of consulting fees recorded, investor relations of $14,003 (June 30, 2021 - $70,000) and professional fees of $21,858 (June 30, 2021 - $41,753).

Liquidity AND GOING CONCERN

The condensed interim consolidated financial statements were prepared on a going concern basis which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. As at June 30, 2023, the Company has had significant losses. In addition, the Company has not generated revenues from operations. The Company has financed its operations primarily through the issuance of common shares and short-term loans. The Company continues to seek capital through various means including the issuance of equity and/or debt. These circumstances cast significant doubt as to the ability of the Company to meet its obligations as they come due, and accordingly, the appropriateness of the use of accounting principles applicable to a going concern. These financial statements do not include adjustments to amounts and classifications of assets and liabilities that might be necessary should the Company be unable to continue operations.

| Page 22 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

The Company’s business financial condition and results of operations may be further negatively affected by economic and other consequences from Russia’s military action against Ukraine and the sanctions imposed in response to that action in late February 2022. While the Company expects any direct impacts, of the pandemic and the war in the Ukraine, to the business to be limited, the indirect impacts on the economy and on the mining industry and other industries in general could negatively affect the business and may make it more difficult for it to raise equity or debt financing. There can be no assurance that the Company will not be impacted by adverse consequences that may be brought about on its business, results of operations, financial position and cash flows in the future.

In order to continue as a going concern and to meet its corporate objectives, the Company will require additional financing through debt or equity issuances or other available means. Although the Company has been successful in the past in obtaining financing, there is no assurance that it will be able to obtain adequate financing in the future or that such financing will be on terms advantageous to the Company.

| As at June 30, 2023 | As at March 31, 2023 | |||||||

| Working capital deficit | $ | (2,846,633 | ) | $ | (2,117,473 | ) | ||

| Deficit | $ | (18,477,289 | ) | $ | (17,869,111 | ) | ||

Net cash used in operating activities for the period ended June 30, 2023 was $196,730 compared to $519,261 during the period ended June 30, 2022. The difference was primarily due to the interest on loan payable, share-based payment expense related to options and changes in non-cash working capital items.

Net cash used in investing activities for the period ended June 30, 2023 was $299,284, compared to $1,378,763 used during the period ended June 30, 2022, and consisted of acquisition costs and property expenditures during the period.

Net cash used in financing activities for the period ended June 30, 2023 was $33,907 compared to $1,932,245 cash provided during the period ended June 30, 2022. The decrease was due to proceeds from loan proceed, private placements and from warrants exercised during the comparative period and loan interest and lease payments during the current period ..

The Company is continuing its exploration program and will use its available working capital to continue this work. It is likely that the Company will need to obtain additional debt/equity financing in order to carry out further exploration programs on its properties depending on the results of recent exploration and to satisfy its business and property commitments for the ensuing year. The Company intends to rely on equity or debt financing from arm’s length parties to fund its operations for the upcoming year. The Company may find it necessary to issue shares to settle some of its existing debt obligations. There are no assurances that the Company will be successful in raising the necessary funds to maintain its current operations and explore its properties on commercially reasonable terms or at all.

Capital Resources

As of the date of the MD&A, the Company is continuing its exploration programs on the Zoro, Jean Lake, Peg North, Grass River Lithium Projects and Jol Lithium property. The Company intends to use available working capital and may issue additional common shares to cover the cost of this program.

The Company also has certain ongoing option/property payments and maintenance fees/taxes associated with its Zoro, Jean Lake, Grass River, and the Winston Property as more particularly described in “Overall Performance” above.

During the period from April 1, 2023 to August 29, 2023, the Company:

| · | issued 10,700 common shares valued at $85,600 pursuant to the acquisition of the Lac Simard South Property. |

| · | issued 13,072 common shares valued at $100,000 pursuant to the second option payment of the Peg North Property. |

| Page 23 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Contractual Obligations

Other than described in “Capital Resources” and certain stock option and consulting agreements, the Company does not presently have any other material contractual obligations. See “Transactions with Related Parties”.

Off-Balance Sheet Arrangements

The Company does not utilize off-balance sheet arrangements.

TRANSACTIONS WITH RELATED PARTIES

| For the period ended June 30, 2023 | ||||||||||||

| Paid or accrued to: | Management and director fees | Consulting fees | Total | |||||||||

| Key management personnel: | ||||||||||||

| Former CFO and current Director | $ | 9,000 | - | $ | 9,000 | |||||||

| CEO | 45,000 | - | 45,000 | |||||||||

| An Officer of the Company | - | 30,000 | 30,000 | |||||||||

| Current CFO | 18,000 | - | 18,000 | |||||||||

| Director | 15,000 | - | 15,000 | |||||||||

| Director | 9,000 | - | 9,000 | |||||||||

| Director | 9,000 | - | 9,000 | |||||||||

| $ | 105,000 | $ | 30,000 | $ | 135,000 | |||||||

During the period ended June 30, 2023, the Company’s stock-based compensation expense included $Nil (March 31, 2023 - $804,016) relating to stock-options and PSU’s granted to current and former directors, officers and companies controlled by them and vested through the period.

During the year ended March 31, 2023, the Company entered into a loan agreement with a related party to borrow $1,145,520, inclusive of a prior advance of $145,520 (“Initial Advance”) included in accounts payable and accrued liabilities owing to a director of the Company. The loan accrues interest at a rate of 11.35% (amended on May 1, 2023 from 8.35%), payable monthly, and matures on May 10, 2024 (amended from May 10, 2023). The Company paid an aggregate of $16,000 in interest during the period ended June 30, 2023.

The amounts due to related parties included in accounts payable and accrued liabilities are as follows:

| As at June 30, 2023 | As at March 31, 2023 | |||||||

| Due to corporation owned by a former CEO | $ | 27,000 | $ | 27,000 | ||||

| Due to a former CFO | 3,262 | 3,262 | ||||||

| Due to a former director of the Company | 18,000 | 18,000 | ||||||

| Due to the CEO | 80,713 | 31,500 | ||||||

| Officer, for expenses | 165,686 | 24,813 | ||||||

| Due to a director | 5,250 | 5,250 | ||||||

| Due to a director | 3,000 | - | ||||||

| Due to a director | 3,150 | 3,150 | ||||||

| $ | 306,061 | $ | 112,975 | |||||

The amounts due are unsecured, non-interest bearing, and have no specific terms of repayment.

Proposed Transactions

Save as disclosed herein, there are no asset or business acquisitions, or dispositions currently being proposed by the directors or senior management of the Company that will have a material effect on the financial condition, results of operations or cash flows of the Company.

| Page 24 of 28 |

Foremost Lithium Resource & Technology Ltd.

Management Discussions and Analysis

Period Ended June 30, 2023

Changes in Accounting Policies including Initial Adoption

Please refer to the condensed interim consolidated financial statements on www.sedar.com.

Financial and Other Instruments

Capital and Financial Risk Management

Capital management.

The Company’s objective when managing capital is to safeguard the entity’s ability to continue as a going concern.

In the management of capital, the Company monitors its adjusted capital which comprises all components of equity (i.e. capital stock, reserves and deficit).

The Company sets the amount of capital in proportion to risk. The Company manages the capital structure and adjusts it in the light of changes in economic conditions and the risk characteristics of the underlying assets. To maintain or adjust the capital structure, the Company may issue Common Shares through private placements. The Company is not exposed to any externally imposed capital requirements.

The Company’s overall strategy remains unchanged from fiscal year 2022 (see the Annual Filings).

Fair value

Fair value estimates of financial instruments are made at a specific point in time, based on relevant information about financial markets and specific financial instruments. As these estimates are subjective in nature, involving uncertainties and matters of significant judgment, they cannot be determined with precision. Changes in assumptions can significantly affect estimated fair values.

Financial instruments measured at fair value are classified into one of three levels in the fair value hierarchy according to the relative reliability of the inputs used to estimate the fair values. The three levels of the fair value hierarchy are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities.

Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and

Level 3 – Inputs that are not based on observable market data.

The fair value of the Company’s long-term investment constitutes a Level 1 fair value measurement.

The carrying value of cash, current portion of net investment in sublease, current portion of lease obligation, short-terms loan payable, long-terms loan payable and accounts payable and accrued liabilities approximate their fair value because of the short-term nature of these instruments.

Financial risk factors

The Company’s risk exposures and the impact on the Company’s financial instruments are summarized below:

Credit risk