Q:Did the TLGY Board obtain a third-party valuation or fairness opinion in determining whether or notto proceed with the Business Combination?

A: | No. The TLGY Board did not obtain a third-party valuation or fairness opinion in connection with its determination to approve the Business Combination. However, TLGY’s management and the members of the TLGY Board have substantial experience in evaluating the financial merits of companies across a variety of industries and the Board concluded that this experience and background enabled them to make the necessary analyses and determinations regarding the Business Combination and its terms. For purposes of determining the ultimate valuation reflected in the non-binding term sheet and definitive Merger Agreement, TLGY considered financial due diligence materials prepared by professional advisors, the SPAC merger markets, and financial and market data information on selected comparable companies; marketing reports prepared by analysts in the industry in which Verde operates; initial investor feedback on Verde and the proposed transactions; current information and forecast projections provided by Verde’s management; and the financial terms set forth in the Merger Agreement. |

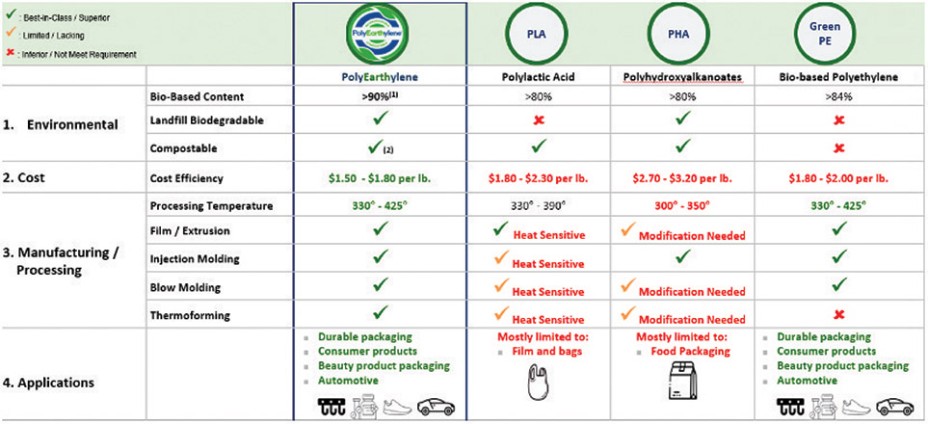

TLGY conducted an initial comparable companies’ analysis on July 21, 2022 and the data points were frequently updated on an “as needed” basis to facilitate the negotiation with Verde up until the execution of the Merger Agreement. The list of initial comparable companies included the following peer companies:Novozymes A/S, Croda International Plc, Corbion N.V., PureCycle Technologies, Inc., Danimer Scientific, Inc., and Origin Materials, Inc. The criteria used to select the initial comparable companies included operations in the field of alternative plastic solutions, such as PLA, PHA and other biobased plastic technologies, and plastic-related fermentation technologies; proximity to early stage companies and market capitalisation.The list of comparable peer companies was subsequently refined to the following peer companies: PureCycle Technologies, Inc., Danimer Scientific, Inc., Origin Materials, Inc. These peer companies remained as comparable companies based on their proximity to early/ growth stage companies, market capitalization and biobased plastic technologies. The valuation matrix adopted included LTM, FY24 and FY25 EV/Revenue and EV/EBITDA multiples.

For a more detailed description of the process by which the parties to the transaction agreed upon a $365 million valuation for Verde and the TLGY Board’s consideration of Verde’s projected financial information and other data in connection with ultimately approving the transaction and determining that the transaction satisfied the 80% test (related to the minimal value of target company relative to the assets in trust of a special purpose acquisition company, or SPAC, like TLGY), see “Business Combination Proposal — Background to the Business Combination” and “— The TLGY Board’s Reasons for the Business Combination.”

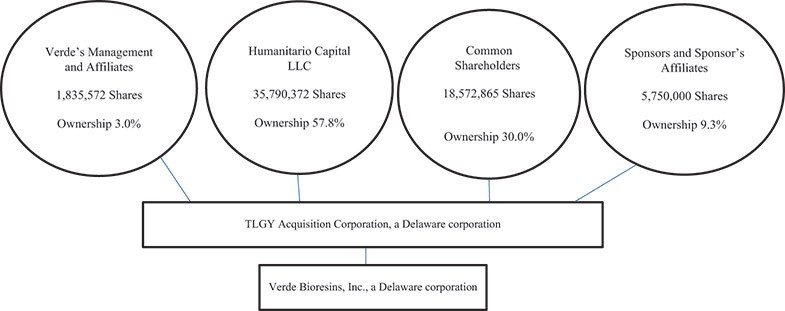

Q. | What will the organizational structure of Verde PubCo be following the Business Combination? |

A. | The diagram below depicts a simplified version of the current organizational structure of Verde: |

14