Exhibit 10.24

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (“Agreement”) is made as of this 5th day of June, 2018, between Res-Care, Inc. (“the Company”) and Robert Barnes (“Employee”).

WHEREAS, the Employee accepts the position of EVP and President of Residential I/DD for the Company and the Company is desirous of having Employee assume such position; and

WHEREAS, The Company and the Employee desire to execute this Agreement and agree to be bound by the terms thereof.

NOW THEREFORE, in consideration of the premises and the mutual agreements set forth herein, the parties agree as follows:

| 1. | Employment as EVP and President of Residential I/DD. As of the date hereof, the Employee shall serve as EVP and President of Residential I/DD for the Company. The Employee shall, subject to the supervision and control of the President and Chief Executive Officer of the Company (“President”), or the President’s designee (the “Supervising Officer”), serve as the EVP and President of Residential I/DD for the Company and perform such duties and exercise such powers over and with regard to the business of the Company, its affiliates and their operations as may be prescribed from time to time by the Supervising Officer. The Employee’s duties and responsibilities, post of duty, title and Supervising Officer may change from time to time by reason of changes in the needs of the Company. The Employee shall devote Employee’s best efforts and all of the Employee’s business time, energies and talents exclusively to the business of the Company and to no other business, except with the Company’s written consent, which shall not be unreasonably withheld. |

| 2. | Commencement Date. This Agreement shall commence on the date first listed above (the “Commencement Date’’). |

| 3. | Base Salary. The Company shall pay to the Employee an annual salary (the “Base Salary”), which shall be $400,000 as of the date of this Agreement, subject to applicable federal, state, and local tax withholding. Such Base Salary shall be paid to Employee in the same manner and on the same payroll schedule on which other Company employees receive payment. The Base Salary may be adjusted from time to time for changes in the Employee’s responsibilities or for market adjustments as determined by Company management. |

| 4. | Non-Equity Incentive Plan, Stock Option Plan, Other Benefit Plans. At the discretion of the Company, the Employee may be eligible for participation in any non-equity incentive plan and/or a stock option plan with respect to the Company, or the Company’s parent corporation, while employed by the Company. If eligible, the Employee will be notified by the Supervising Officer and participation in such plans will be governed not by this Agreement but by separate plan documents. Notwithstanding any provision of any non-equity incentive plan, stock option plan, or other equity plan to the contrary, the Employee shall become fully vested (to the extent not otherwise already vested) in any award(s) under such plans as of the date of a Change in Control. |

| 5. | Employment Status. The terms of the Employee’s employment with the Company shall be governed by this Agreement. The Company makes no express or implied commitment that the Employee’s employment will have a minimum or fixed term, or that the Company may take adverse employment action only for “cause.” The Employee’s employment is terminable at any time for any reason. Either the Employee or the Company may terminate the employment relationship at any time for any reason. However, the Employee agrees to give the Company not less than 30 days prior written notice of the Employee’s voluntary termination. The Employee’s duties and responsibilities and the Employee’s post of duty may change by reason of changes in the needs of the Company. |

| 6. | Disability. The Employee’s employment shall terminate hereunder at the earlier of (i) immediately upon the Company’s determination (conveyed by a notice to the Employee) that the Employee is subject to a permanent disability, and (ii) the Employee’s absence from the Employee’s duties hereunder for 180 days. “Permanent disability” for purposes of this Agreement shall mean the onset of a physical or mental disability which prevents the Employee from performing the essential functions of the Employee’s duties hereunder, which is expected to continue for 180 days or more, subject to any reasonable accommodation required by state and/or federal disability anti-discrimination laws, including, but not limited to, the Americans With Disabilities Act of 1990, as amended. During any period during which the Employee is subject to a short-term disability as determined by the Company’s short-term disability program, and prior to termination by reason of permanent disability, the Employee shall be compensated as provided in this paragraph 6. During any waiting period prior to receiving short or long-term disability payments, Employee shall be required to use available Results Driven Time Off. Once the eligibility period has been met the Employee shall continue to be paid at the Employee’s then current Base Salary until short-term disability payments to the Employee commence under any plan or program then provided and funded by the Company. If the benefits payable under any such disability plan or program do not provide 100% replacement of the Employee’s installments of Base Salary during such period, the Employee shall be paid at regular payroll intervals the difference between the periodic installments of the Employee’s then current Base Salary that would have otherwise been payable and the disability benefit paid from such disability plan or program. Upon termination of employment, the above provisions of this paragraph 6 shall no longer apply. |

| 7. | Compensation upon Termination Without Cause. As additional consideration for the continuation of the noncompetition and confidentiality covenants of the Employee in this Agreement after the Date of Termination (as defined in paragraph 11(e)) and as separation pay, if the Employee’s employment is terminated without Cause (as defined in paragraph 11(f) of this Agreement) by the Company or for Good Reason (as defined in paragraph 11(g) of this Agreement) by the Employee and if Employee signs a standard separation agreement that includes a comprehensive waiver and release, the Employee shall receive the following: (i) the Employee’s then current Base Salary for twelve (12) months after the Date of Termination (as defined in paragraph 11 (e) hereof), payable in equal installments on the same payroll schedule on which other Company employees receive payment; (ii) a portion of the Employee’s COBRA coverage premiums for twelve (12) months (or such shorter time if such coverage terminates earlier under section 4980B of the Code), provided that the Employee shall continue to pay the same amount toward the cost of such premiums as paid immediately prior to the last day of the Employee’s active employment and shall comply with applicable election and eligibility requirements; and (iii) payment of the Employee’s annual performance bonus for the year in which the Employee’s Date of Termination occurs at 100% of target, prorated based on the number of calendar days of such year elapsed through the date of the Employee’s Date of Termination, payable at the same time such bonuses are paid to other executives, but in no event later than April 1st of the year following the year in which the Employee’s Date of Termination occurs. |

| 8. | Other Termination. No pay continuation will be payable to the Employee if the Employee voluntarily terminates the Employee’s employment with the Company, or the Company terminates Employee’s employment for Cause. |

| 9. | Employee Covenants. |

| (a) | Acknowledgments. Employee acknowledges as follows: |

| (1) | Employee’s services hereunder are of a special, unique and extraordinary character and that Employee’s position with the Company places Employee in a position of confidence and trust with the operations of Company, its subsidiaries and affiliates (collectively, the “Affiliated Companies”) and allows Employee access to Confidential Information (as defined in paragraph 11(c) hereof) |

| (2) | Company has provided Employee with a unique opportunity as set forth in paragraph 1 above. |

| (3) | The nature and periods of the restrictions contained in this Agreement are fair, reasonable and necessary to protect and preserve for the Company the benefits of Employee’s employment hereunder. |

| (4) | The Affiliated Companies would sustain great and irreparable loss and damage if Employee were to breach any of such covenants. |

| (5) | The Affiliated Companies conduct and are aggressively pursuing the conduct of the Business (as defined in paragraph 11(b) of this Agreement) actively in and throughout the entire Territory (as defined in paragraph 11(a) of this Agreement). |

| (6) | The Territory is reasonably sized because the current Business of the Affiliated Companies is conducted throughout various geographic areas. The Affiliated Companies are aggressively pursuing expansion and new operations throughout such geographic area and the Affiliated Companies require the entire Territory for profitable operations. |

| (b) | Non-Compete and Non-Solicitation Covenants. Having acknowledged the statements in subparagraph (a) above, Employee covenants and agrees with the Company and the Affiliated Companies that: |

| (i) | Non-Solicitation of Employees or Others. From the Commencement Date until the Date of Termination and for twelve (12) months thereafter, (a) Employee will not directly or indirectly encourage, solicit, induce, or attempt to encourage, solicit or induce any employee, agent, contractor or representative of the Company and/or the Affiliated Companies to terminate his/her employment or contractual relationship with the Company or the Affiliated Companies (or devote less than full time efforts to Company business), and (b) Employee will not directly or indirectly hire or attempt to hire: (i) for any competitive position with any competitor any person who is an employee, agent, contractor or representative of the Company or Affiliated Companies at such time (or who has been an employee, agent, contractor or representative of the Company or Affiliated Companies at any time within the preceding 180 days) or (ii) for any position with any business any person who is an employee, agent, contractor or representative of the Company or Affiliated Companies at such time (or who has been an employee, agent, contractor or representative of the Company or Affiliated Companies at any time within the preceding 180 days) |

| (ii) | Non-Solicitation of Clients/Customers. From the Commencement Date until the Date of Termination and for twelve (12) months thereafter, Employee will not, in a competitive capacity, on behalf of any person or entity other than the Company or the Affiliated Companies, directly or indirectly: |

| a. | solicit, divert (or attempt to solicit or divert) or accept competitive business from any client, patient or customer or referral source of the Company or the Affiliated Companies: |

| b. | solicit, divert (or attempt to solicit or divert) or accept competitive business from any client, patient or customer or referral source of the Company or the Affiliated Companies with whom Employee has had contact (either directly or indirectly) or over which Employee has had responsibility at any time in the one (1) year preceding Employee’s separation or about whom Employee has obtained Confidential Information; |

| c. | solicit, divert (or attempt to solicit or divert) or accept competitive business from any identified prospective client, patient or customer or prospective referral source of the Company or Affiliated Companies; or |

| d. | solicit, divert (or attempt to solicit or divert) or accept competitive business from any identified prospective client, patient or customer or prospective referral source of the Company or Affiliated Companies with whom Employee has had contact (either directly or indirectly) or over which Employee has had responsibility at any time in the one ( 1) year preceding Employee’s separation or about whom Employee has had obtained Confidential Information. |

| (iii) | Non-competition within the Territory. From the Commencement Date until the Date of Termination and for twelve (12) months thereafter, Employee will not directly or indirectly, in a competitive capacity within the Territory, own, manage, finance, operate, control or participate in ownership, management, or operation of, act as an agent, consultant, or be employed with, any Person or entity that is engaged in the Business. For purposes of this Agreement, the term “competitive capacity” shall mean (i) performing tasks or duties similar to those Employee performed in Employee’s last year of employment at the Company or any Affiliated Company for a competitor of the Company or any Affiliated Company; (ii) managing/supervising those who, for a competitor of the Company or any Affiliated Company, perform tasks or duties similar to those which Employee performed in Employee’s last year of employment at the Company; or (iii) performing, on behalf of a competitor of the Company or any Affiliated Company, tasks or duties in which Employee utilizes any Confidential Information that Employee learned in the course of Employee’s relationship with the Company or any Affiliated Company. Employee further agrees that from the Commencement Date until the Date of Termination, Employee will not undertake any planning for or organization of any business activity that would be competitive with the Business. |

| (iv) | Tolling. In the event of a breach by Employee of this Section entitled “Non-Compete and Non-Solicitation Covenants,” then the restrictive periods referenced herein shall be tolled and shall begin to run or recommence running only at such time as the breach is alleviated or remedied. |

| (c) | Confidentiality and Non-disparagement Covenants. Having acknowledged the statements in subparagraph (a) above, Employee covenants that without limitation as to time, (i) commencing on the Commencement Date and at all times thereafter, including after the Date of Termination, Employee will not directly or indirectly disclose or use or otherwise exploit for Employee’s own benefit, or the benefit of any other Person, except as may be necessary in the performance of Employee’s duties hereunder, any Confidential Information, and (ii) commencing on the Date of Termination, Employee will not disparage or comment negatively about any of the Affiliated Companies, or their respective officers, directors, employees, policies or practices, and Employee will not discourage anyone from doing business with any of the Affiliated Companies and will not encourage anyone to withdraw their employment with any of the Affiliated Companies. |

| (d) | Defend Trade Secrets Act (DTSA) Notice. Pursuant to 18 USC § 1833(b), Employee may not be held criminally or civilly liable under any federal or state trade secret law for disclosure of a trade secret: (i) made in confidence to a government official, either directly or indirectly, or to an attorney, solely for the purpose of reporting or investigating a suspected violation of law; and/or (ii) in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. Additionally, should Employee pursue legal action against the Company for retaliation based on the reporting of a suspected violation of law, Employee may disclose a trade secret to his/her attorney and use the trade secret information in the court proceeding, so long as any document containing the trade secret is filed under seal and the individual does not disclose the trade secret except pursuant to court order. |

| (e) | Employee Certificates and Return of Company Property. Not less frequently than annually and upon the termination of Employee’s employment hereunder for any reason whatsoever, Employee shall promptly comply with Employee’s obligation to deliver a certificate, which certificate may be completed online in accordance with Company policy. Upon termination of Employee’s employment hereunder for any reason whatsoever, Employee shall promptly return to the Company any property of the Affiliated Companies then in Employee’s possession or control, including without limitation, any Confidential Information. |

| (f) | Injunctive Relief and Invalidity of any Provision. Employee acknowledges that Employee’s breach of the provisions of paragraph 9 of this Agreement will result in irreparable injury to the Company and the Affiliated Companies and that the remedy at law of such parties for such a breach will be inadequate. Accordingly, Employee agrees and consents that the Company and each of the Affiliated Companies in addition to all other remedies available to them at law and in equity, shall be entitled to seek both preliminary and permanent injunctions in a court of competent jurisdiction to prevent and/or halt a breach or threatened breach by Employee of the Agreement. If any provision of this Agreement is invalid in part or in whole, it shall be deemed to have been amended, whether as to time, area covered, or otherwise, as and to the extent required for its validity under applicable law and, as so amended, shall be enforceable. The parties further agree to execute all documents necessary to evidence such amendment. A court with jurisdiction over the matters contained in this Agreement shall have the authority to revise the language hereof to the extent necessary to make any such section or covenant of this Agreement enforceable to the fullest extent permitted by law. |

| (g) | Disclosure of Existence of Agreement. To preserve the Company’s rights under this Agreement, the Company may advise any third party of the existence of this Agreement and its terms, and Employee specifically releases and agrees to indemnify and hold the Company harmless from any liability for doing so. |

| 10. | Mutual Agreement to Arbitrate. Employee and the Company understand and agree that any existing or future dispute or claim arising out of or related to this Agreement, Employee’s employment, or the termination of such employment, will be resolved by final and binding arbitration and that no other forum for dispute resolution will be available to either party, except as to those claims identified below. The decision of the arbitrator shall be final and binding on both parties and it shall be enforceable by any court having proper jurisdiction. The arbitration proceedings shall be conducted pursuant to the Federal Arbitration Act, and in accordance with the National Rules for the Resolution of Employment Disputes of the American Arbitration Association or the Employment Arbitration Rules and Procedures adopted by Judicial Arbitration and Mediation Services (“JAMS”). Except as mutually agreed by the parties, the arbitration shall be conducted in Louisville, Kentucky. The arbitrator will have all the powers a judge would have in dealing with any question or dispute that may arise before, during and after the arbitration. Claims not covered by this agreement to arbitrate are: |

| (a) | Claims under Title VTT of the Civil Rights Act of 1964 or any tort related to or arising out of sexual assault or harassment, including assault and battery, intentional infliction of emotional distress, false imprisonment, or negligent hiring, supervision, or retention, and |

| (b) | Claims for benefits under the workers’ compensation, unemployment insurance and state disability insurance laws. |

| (c) | Claims arising out of the Company’s efforts to enforce numerical paragraph 9 of this Agreement including, but not limited to claims for injunctive relief. |

The Company agrees to bear the costs of the arbitrator’s fee and all other costs related to the arbitration, assuming such costs are not expenses that Employee would be required to bear if bringing or defending the action in a court of law. Employee and the Company shall each bear the fees and costs of their own attorneys, experts or other representatives incurred in connection with the arbitration, and the arbitrator will not have authority to award fees and costs unless a statute at issue in the dispute or other appropriate law authorizes the award of attorneys’ fees to the prevailing party, in which case the arbitrator shall have the authority to make an award of attorneys’ fees as permitted by the applicable statute or law.

| 11. | Definitions. For purposes of this Agreement: |

| (a) | The “Territory” shall mean the states in which are located the operations for which Employee is responsible and all states contiguous to such states. |

| (b) | The “Business” of the Affiliated Companies shall mean the business of providing training or job placement services, youth treatment or services, home care or periodic services to the elderly, services to persons with intellectual disabilities and other developmental disabilities, including but not limited to persons who have been dually diagnosed, services to persons with acquired brain injuries, or providing management and/or consulting services to third parties relating to any of the foregoing. |

| (c) | “Confidential Information” shall mean any business information relating to the Affiliated Companies or to the Business (whether or not constituting a trade secret), which has been or is treated by any of the Affiliated Companies as proprietary and confidential and which is not generally known or ascertainable through proper means. |

| (d) | The term “Person” shall mean an individual, a client, a partnership, an association, a corporation, a trust, an unincorporated organization, or any other business entity or enterprise. |

| (e) | The “Date of Termination” shall mean the effective date of termination from employment with the Company, for any reason. |

| (f) | As used herein, “Cause” shall mean any of the following: (i) the material misuse, embezzlement or misappropriation by Employee of the funds or property of any of the Affiliated Companies; (ii) the willful failure to disclose material financial or other material operational information relating to any of the Affiliated Companies; (iii) Employee’s breach of fiduciary duty involving personal profit; (iv) the Employee shall have (A) committed willful or repeated misconduct in, (B) failed to devote adequate time or diligence to, or (C) failed to effectively carry out or implement the performance of the Employee’s duties to the Company, and such misconduct or failure has a detrimental effect on the Company, its operations or financial conditions or goals, as reasonably determined by the Supervising Officer in good faith; (v) the material breach by the Employee of any provision of this Agreement or any written employment policy of the Affiliated Companies that is applicable to the Employee and has been previously made available to the Employee, if such breach remains uncured after notice to the Employee and a reasonable opportunity to cure (if curable); or (vi) the Employee’s conviction of, or plea of nolo contendere to, any law, rule or regulation (other than traffic violations or similar offenses). |

| (g) | As used herein, “Good Reason” shall mean (i) any material diminution of the Employee’s position, authority and duties under this Agreement; (ii) the Employee is required to relocate to an employment location that is more than 50 miles from the Employee’s current employment location; (iii) the Employee’s Base Salary rate is reduced to a level that is less than the rate paid to the Employee during the immediately prior calendar year, unless the Employee has agreed to said reduction or unless the Company makes an across-the-board reduction that applies to all executives; or (iv) the Company materially breaches any of its obligations under this Agreement. Notwithstanding the foregoing, a condition shall not be considered “Good Reason” unless (i) the Employee gives the Company written notice of such condition within thirty (30) days after the material facts regarding such condition become known to the Employee; (ii) the Company fails to cure such condition within twenty (20) days after receiving the Employee’s written notice; and (iii) the Employee terminates his employment within twenty (20) days after the expiration of the Company’s cure period. |

| (h) | A ‘Change in Control” shall mean (i) any person or entity becoming the beneficial owner, directly or indirectly, of securities of the Company representing more than (50%) percent of the total voting power of all its then outstanding voting securities; (ii) a merger or consolidation of the Company in which its voting securities immediately prior to the merger or consolidation do not represent, or are not converted into securities that represent, a majority of the voting power of all voting securities of the surviving entity immediately after the merger or consolidation; (iii) a sale of substantially all of the assets of the Company or a liquidation or dissolution of the Company; or (iv) individuals who, as of the date of the signing of this Agreement, constitute the Board of Directors (the “Incumbent Board’’) cease for any reason to constitute at least a majority of such Board; provided that any individual who becomes a director of the Company subsequent to the date of the signing of this Agreement, whose election, or nomination for election by the Company stockholders, was approved by the vote of at least a majority of the directors then in office shall be deemed a member of the Incumbent Board. |

| (i) | “Code” shall mean the Internal Revenue Code of 1986, as amended. |

| 12. | Applicable Law. This Agreement shall be governed by the laws of the Commonwealth of Kentucky, the location of the Company’s principal office. |

| 13. | Modification. This Agreement may be modified only in writing, expressly referencing this Agreement and Employee by name and signed by Employee and a Company representative. |

| 14. | Entire Agreement. This Agreement and Employee’s signed Offer Letter contain the entire agreement With respect to the subject matter hereof and supersede all prior and contemporaneous agreements, representations, and understandings of the parties, including but not limited to any prior employment agreement. |

| 15. | Notices. All notices, requests, demands and other communications required or permitted to be given or made under this Agreement shall be in writing and shall be deemed to have been given on the date of delivery personally or upon deposit in the United States mail postage prepaid by registered or certified mail, return receipt requested, to the appropriate party or parties at the addresses shown (or at such other address as shall hereafter be designated by any party to the other parties by notice given in accordance with this paragraph). Notices addressed to the Company shall be sent to the attention of the Supervising Officer. |

| 16. | Section 409A of the Code. |

(a) General. All payments under this Agreement arc intended to be exempt from, or comply with, the requirements of section 409A of the Code, to the extent applicable, and this Agreement shall be interpreted to avoid any penalty sanctions under section 409A of the Code Accordingly, all provisions herein, or incorporated by reference, shall be construed and interpreted to comply with section 409A of the Code and, if necessary, any such provision shall be deemed amended to comply with section 409A of the Code and regulations thereunder. All payments to be made upon a termination of employment under this Agreement that arc deferred compensation for purposes of section 409A of the Code may only be made upon a “separation from service” under section 409A of the Code. For purposes of section 409 A of the Code, each payment made under this Agreement shall be treated as a separate payment.

(b) Six Month Delay Rule. To the maximum extent permitted under section 409A of the Code, the benefits payable under this Agreement are intended to comply with the “short-term deferral exception” under Treas. Reg. § 1.409A-1 (b )(4), and any remaining amount is intended to comply with the “separation pay exception” under Treas. Reg. § 1.409A-l(b)(9)(iii); provided, however, any amount payable to the Employee during the six (6) month period

following the Employee’s separation from service that does not qualify within either of the foregoing exceptions and constitutes deferred compensation subject to the requirements of section 409A of the Code, then such amount(s) shall hereinafter be referred to as the “Excess Amount.” If at the time of the Employee’s separation from service, the Company’s (or any entity required to be aggregated with the Company under section 409A of the Code) stock is publicly-traded on an established securities market or otherwise and the Employee is a “specified employee” (as defined in section 409A of the Code ), then the Company shall postpone the commencement of the payment of the portion of the Excess Amount that is payable within the six (6) month period following the Employee’s separation from service with the Company for six (6) months following the Employee’s separation from service with the Company. The delayed Excess Amount shall be paid in a lump sum to the Employee within ten (10) days following the date that is six (6) months following the Employee’s separation from service with the Company. If the Employee dies during such six (6) month period and prior to the payment of the portion of the Excess Amount that is required to be delayed on account of section 409A of the Code, such Excess Amount shall be paid to the personal representative of Employee’s estate within sixty (60) days after the Employee’s death.

(c) Special Rule for Reimbursements. Any reimbursements provided under this Agreement shall be made or provided in accordance with the requirements of section 409A of the Code, including, where applicable, the requirement that (i) the amount of expenses eligible for reimbursement during a calendar year may not affect the expenses eligible for reimbursement in any other calendar year, (ii) the reimbursement of an eligible expense will be made on or before the last day of the taxable year following the year in which the expense is incurred, and (iii) the right to reimbursement is not subject to liquidation or exchange for another benefit.

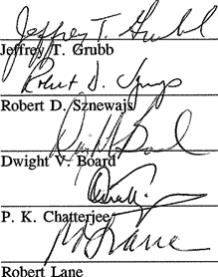

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the dates set forth below.

| /s/ Robert Barnes |

| Robert Barnes (Jun 5, 2018) |

| Employee Signature |

| Res-Care, Inc. |

| By: /s/ Sonny Terrill |

| Sonny Terrill (Jun 7, 2018) |