UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For

the fiscal year ended

OR

FOR THE TRANSITION PERIOD FROM TO

Commission

File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code: +

Securities registered pursuant to Section 12(b) of the Act:

| (Title of each class) | Trading Symbol(s) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐

The

aggregate market value of the common stock held by non-affiliates of Intec Pharma Ltd. (the “Predecessor”), the Registrant’s

predecessor, based on the closing price of the ordinary shares of the Predecessor on the Nasdaq Capital Market on June 30, 2021, was

$

The number of shares of Registrant’s common stock outstanding as of March 16, 2022:

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

| 2 |

ABOUT THIS ANNUAL REPORT

All references to “we,” “us,” “our,” “Indaptus Therapeutics”, “Indaptus”, “the Company” and “our company”, in this Annual Report on Form 10-K, or our Annual Report, are to Indaptus Therapeutics, Inc. (formerly Intec Parent, Inc.) and, where appropriate, its consolidated subsidiaries Intec Pharma Ltd. and Decoy Biosystems, Inc. References to “Intec Parent” refer to Intec Parent, Inc., the successor of Intec Pharma Ltd. following the Domestication Merger, references to “Intec Israel” refer to Intec Pharma Ltd., the predecessor of Indaptus prior to the Domestication Merger, and references to “Decoy” refer to Decoy Biosystems, Inc., the entity acquired by Indaptus in connection with the Merger described below in “Item 1. Business—Historical Background and Corporate Structure”. All references to “common stock” and “share capital” refer to common stock and share capital of Indaptus. Our historical results do not necessarily indicate our expected results for any future periods. Any discrepancies in any table between totals and sums of the amounts listed are due to rounding. Unless otherwise indicated, or the context otherwise requires, references in this Annual Report to financial and operational data for a particular year refer to the fiscal year of our Company ended December 31 of that year.

| 3 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements about our expectations, beliefs or intentions regarding, among other things, our product development efforts, business, financial condition, results of operations, strategies, plans and prospects. In addition, from time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,” “may,” “should,” “anticipate,” “could,” “might,” “seek,” “target,” “will,” “project,” “forecast,” “continue” or their negatives or variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical matters. These forward-looking statements may be included in, among other things, various filings made by us with the Securities and Exchange Commission, or the SEC, press releases or oral statements made by or with the approval of one of our authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements, including, but not limited to, the factors summarized below:

| ● | our plans to develop and potentially commercialize our technology; | |

| ● | the timing and cost of our planned investigational new drug application and any clinical trials; | |

| ● | the completion and receipt of favorable results in any clinical trials; | |

| ● | our ability to obtain and maintain regulatory approval of any product candidate; | |

| ● | our ability to protect and maintain our intellectual property and licensing arrangements; | |

| ● | Our ability to develop, manufacture and commercialize our product candidates; | |

| ● | the risk of product liability claims, the availability of reimbursement, the influence of extensive and costly government regulation; and | |

| ● | our estimates regarding future revenue, expenses capital requirements and the need for additional financing following the Merger. |

We believe these forward-looking statements are reasonable; however, these statements are only current predictions and are subject to known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in this Annual Report in greater detail under the heading “Risk Factors” and elsewhere in this Annual Report. Given these uncertainties, you should not rely upon forward-looking statements as predictions of future events.

All forward-looking statements attributable to us or persons acting on our behalf speak only as of the date hereof and are expressly qualified in their entirety by the cautionary statements included in this Annual Report. We undertake no obligations to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, except as required by law. In evaluating forward-looking statements, you should consider these risks and uncertainties and not place undue reliance on our forward-looking statements.

| 4 |

EXPLANATORY NOTE

Market data and certain industry data and forecasts used throughout this Annual Report were obtained from market research databases, consultant surveys commissioned by us, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys commissioned by us and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. We have relied on certain data from third-party sources, including internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this Annual Report, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this Annual Report. Notwithstanding the foregoing, we remain responsible for the accuracy and completeness of the historical information presented in this Annual Report, as of the date on the front cover of this Annual Report.

| 5 |

PART I

Item 1. Business.

Overview

We are a pre-clinical biotechnology company developing a novel and patented systemically-administered anti-cancer and anti-viral immunotherapy. We have evolved from more than a century of immunotherapy advances. Our approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system activating signals that can be administered safely intravenously. Our patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria, with reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cellular components of innate and adaptive immunity. This approach has led to broad anti-tumor and anti-viral activity, including safe, durable anti-tumor response synergy with each of five different classes of existing agents, including checkpoint therapy, targeted antibody therapy and low-dose chemotherapy in pre-clinical models. Tumor eradication by our technology has demonstrated activation of both innate and adaptive immunological memory and, importantly, does not require provision of or targeting a tumor antigen in pre-clinical models. We have carried out successful GMP manufacturing of our lead clinical candidate, Decoy20, and completed other IND-enabling studies.

Unlike many competitor products, our technology does not depend on targeting with or to a specific antigen, providing broad applicability across multiple indications. Our products are designed to have a much shorter half-life and produce less systemic exposure than small molecule, antibody or human cell-based therapies, potentially reducing the risk of non-specific auto-immune reactions. Our technology produces single agent activity and/or combination therapy-based durable responses of lymphoma, hepatocellular, colorectal and pancreatic tumors and is also active against hepatitis B virus (HBV) and HIV infection in standard pre-clinical models. We have carried out a Pre-IND meeting with the US FDA, plans to file an IND in the first half of 2022 and then initiate in 2022 a Phase 1 clinical trial targeting tumors that exhibit low durable response rates to current immunotherapy. Target indications include, but not limited to, colorectal, hepatocellular (± HBV), bladder, cervical and pancreatic carcinoma, which according to GLOBOCAN 2020, account in the aggregate for 23% of yearly cancer cases and over 28% of yearly cancer deaths world-wide.

Historically, we have operated virtually with a team of highly experienced consultants and advisors, carrying out research and development at contract research organizations. We have a broad patent portfolio with 33 granted patents and 16 pending patent applications. Since our inception, we have funded our operations primarily through public and private offerings of our equity securities.

We are a smaller reporting company, and we will remain a smaller reporting company until the fiscal year following the determination that our common stock held by non-affiliates is more than $250 million measured on the last business day of our second fiscal quarter, or our annual revenues are more than $100 million during the most recently completed fiscal year and our common stock held by non-affiliates is more than $700 million measured on the last business day of our second fiscal quarter. Similar to emerging growth companies, smaller reporting companies are able to provide simplified executive compensation disclosure, are exempt from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, and have certain other reduced disclosure obligations, including, among other things, being required to provide only two years of audited financial statements and not being required to provide selected financial data, supplemental financial information or risk factors.

Our principal executive offices are located at 3 Columbus Circle, 15th Floor, New York, NY 10019 and our telephone number is (347) 480-9760. Our website address is http://www.indaptusrx.com. The information contained on, or that can be accessed through, our website is neither a part of nor incorporated into this Annual Report. We have included our website address in this Annual Report solely as an inactive textual reference.

We use our investor relations website (https://indaptusrx.com/investors/) as a channel of distribution of Company information. The information we post through this channel may be deemed material. Accordingly, investors should monitor our website, in addition to following our press releases, SEC filings and public conference calls and webcasts. The contents of our website are not, however, a part of this Annual Report.

| 6 |

Background

Approved immunotherapies, such as Interluekin-2, Interferon-alpha and the more recently approved “checkpoint” and CAR-T therapies produce durable responses in a few percent to about fifty percent of patients across about a dozen out of over one hundred different types of cancer. Although checkpoint therapies are able to effectively cure many previously incurable patients, only about 15% of patients receiving this type of therapy respond. The main limitation of existing immunotherapies is that they each activate only one or a small number of key steps in either the innate or adaptive immune system, but there is general agreement that highly efficient cancer immunotherapy will require activation of both innate and adaptive immunity. The human body’s innate and adaptive immune systems are each capable of cell-mediated destruction of tumors if the tumor cells are recognized as foreign or damaged. Activation of innate and adaptive responses is also dependent on immune cells sensing the presence of “danger.” The most potent immune cell activating danger signals are released by bacteria and viruses in the setting of infection, and include agonists of immune cell receptors, such as Toll-Like (TLR), NOD and STING. Bacterial danger signals, including TLR agonists are called pathogen-associated molecular patterns (PAMPs) and can activate both innate and adaptive immune cells, including antigen-presenting cells, promoting innate (NK, macrophage) and adaptive (T cell-mediated) destruction of tumors.

The oldest form of cancer immunotherapy involves the provision of decoy danger signals from bacteria. It was based on the long-standing observation of tumor regression in the setting of bacterial infection. Treatment of cancer patients with heat-killed bacteria (“Coley’s toxins”) was established in 1891 and used for 70 years with significant success. For example, ≥5-year survival was reported for 45% of 432 inoperable sarcoma, lymphoma, melanoma, and carcinoma patients. Despite this success, several limitations led to the abandonment of this approach by the pharmaceutical industry. Although there was an indication that Coley’s toxins worked best when administered intravenously (i.v.), it was too toxic when given by this route, limiting the approach to local administration, which produced highly variable results. Another limitation was lack of knowledge about the mechanism of action, preventing optimization and standardization of manufacturing, leading to another source of variability in clinical response. Due to this high variability, Coley’s toxins was not grandfathered-in as an approved drug by the FDA in 1963 and was supplanted by radiation and chemotherapy, despite the fact that these more modern approaches rarely produce durable responses in advanced cancer patients.

Scientists now understand the mechanism of action of Coley’s toxins. Gram-negative bacteria contain multiple immune-stimulating danger signals, including TLR agonists such as lipopolysaccharide (LPS). Bacteria and purified or mono-specific TLR agonists, including LPS derivatives, have been validated and approved for prevention and treatment of early stage cancer. However, a safe and effective TLR agonist-based approach for advanced cancer has been elusive, possibly due to limitations in the ability of intratumorally administered, mono-specific TLR agonists to induce potent, systemic anti-tumor immune responses. In addition, the intratumoral approach is not feasible with all tumor types or patients. Our hypothesis is that an effective TLR agonist-based immunotherapy for advanced cancer will require invention of a packaged, multi-TLR agonist or multi-danger signal product that is modified or attenuated to allow safe i.v. administration.

Our Approach

Our patented approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and associated anti-tumor immune responses can be achieved by using intact bacteria, containing multiple PAMPs, which have been attenuated so that they can be administered safely intravenously. Because LPS appears to be the most important contributor to both toxicity and efficacy, our patented products are single strains of killed, non-pathogenic Gram-negative bacteria that have been treated to kill the bacteria and significantly reduce, but not completely eliminate, the cell surface lipopolysaccharide (LPS)-endotoxin activity. Our products are designed to have enhanced i.v. safety and sufficient residual LPS to synergize with other PAMPs in the bacteria to efficiently prime innate and adaptive immune pathways. This leads to broad anti-tumor responses, including safe, synergistic regressions and durable responses with five different classes of existing anti-tumor agents, including checkpoint therapy, targeted antibody therapy and low-dose chemotherapy. Tumor eradication by our technology produces both innate and adaptive immunological memory and, importantly, does not require provision of an exogenous tumor antigen, probably due to the ability of LPS and other PAMPS to activate dendritic cells that have already captured a tumor antigen.

| 7 |

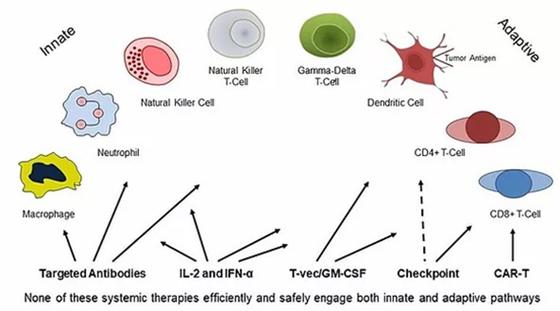

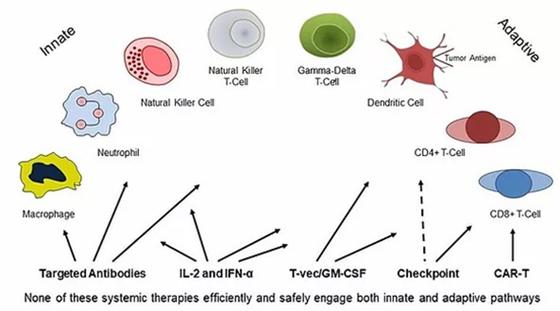

All immune cells can participate in killing of tumors and viruses. As illustrated below, current therapies activate only one or a small subset of both pathways and cure only a small percentage of patients.

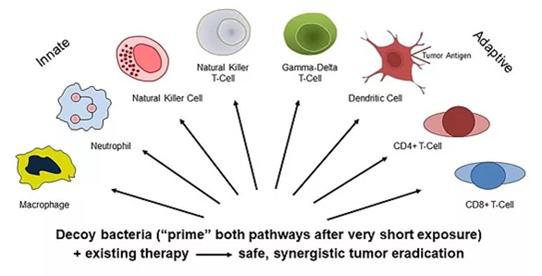

Our bacteria, however, are engineered to synergize with existing therapies to activate both innate and adaptive immune cells, inducing efficient anti-tumor immune responses with a wide safety margin. Induction of adaptive anti-tumor immune responses and immunological memory by our bacteria does not require an exogenous tumor antigen.

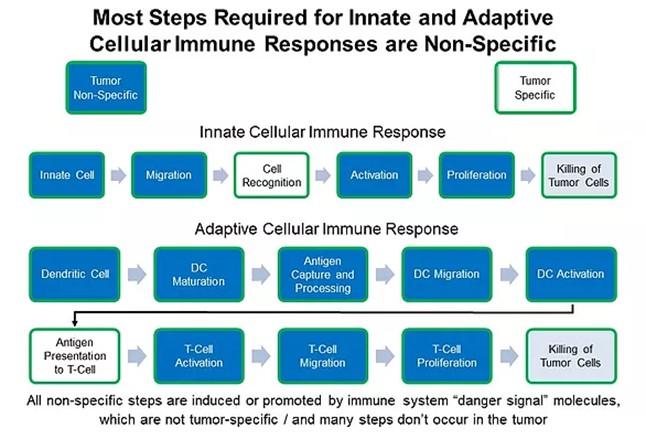

Innate and adaptive immune responses require identification of a tumor as foreign or not self. However, most steps required for migration and activation of immune cells are unrelated to the tumor or are tumor non-specific. All innate and adaptive non-specific steps are induced or promoted by immune system “danger signal” molecules, such as those found in our bacteria. Bacteria-derived danger signals are also able to enhance the processing and recognition of tumor antigens, which are frequently present, but not “seen” by the immune system.

| 8 |

Results

We have developed patented treatment methods (and associated patented compositions) for attenuation and killing of non-pathogenic, Gram-negative bacteria (33 issued or granted patents). Indaptus treated bacteria induce significantly less systemic toxicity than untreated bacteria but are still able to activate innate and adaptive immune responses. Despite exhibiting reduced in vivo pyrogenicity and toxicity, our bacteria are able to induce cytokine and chemokine secretion from mouse and human immune cells at levels comparable to those seen with untreated bacteria. Our bacteria are also able to synergize with human immune cells to kill human tumor cells in vitro.

We have observed significant single agent anti-tumor activity and/or combination therapy-mediated regression with durable response of established non-Hodgkin’s lymphoma, as well as colorectal, hepatocellular and pancreatic carcinoma in pre-clinical syngeneic and human tumor xenograft models. Our bacteria safely synergize with each of five different classes of approved agents, including checkpoint therapy, targeted antibodies, low-dose chemotherapy, non-steroidal anti-inflammatory drugs (NSAIDs) and cytokines to induce tumor regression, providing significant flexibility for targeting of diverse types of cancer. Our technology eradicates tumors via activation of both innate (NK cell) and adaptive (CD4+ and CD8+ T cell) mechanisms, producing both innate and adaptive immunological memory. Tumor eradication occurs at non-toxic doses of our bacteria, with a very wide (10 to ≥33-fold) therapeutic index. Significant mechanism of action information has also been obtained, via gene expression analysis with treated tumors and plasma cytokine analysis, demonstrating that our combination technology turns “cold” tumors into “hot” tumors and induces, activates or recruits innate and adaptive genes, cells and pathways. Immune cell pre-depletion studies have demonstrated that both innate (NK) and adaptive (CD4 T and CD8 T) immune cells are involved in tumor eradication. We have also demonstrated significant single agent activity against chronic Hepatitis B virus (HBV) and human immunodeficiency virus (HIV) infection in standard pre-clinical models.

| 9 |

We have carried out successful GMP manufacturing and stability studies with our lead product, Decoy20. In addition, IND-enabling multi-dose toxicology studies have completed and have not produced sustained induction of factors that are associated with cytokine release syndrome. We plan to file an IND in the first half of 2022 and then initiate in 2022 a Phase 1 clinical trial with solid tumor patients.

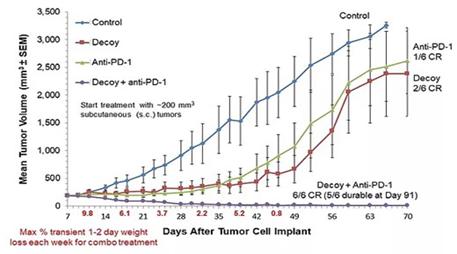

The chart above demonstrates that our bacteria synergize with Anti-PD-1 Checkpoint therapy to regress established mouse hepatocellular carcinoma (HCC) Tumors. All mice (all groups) received a low-dose, non-steroidal anti-inflammatory drug (NSAID/Indomethacin), which increases the number of regressions in the combination setting. Most regressions were durable, with 5/6 combination regressions stable through termination at Day 91 and in a repeat experiment through termination at Day 143 (see next Figure below) (CR = complete response or complete regression). The repeat experiment also produced safe, 5/6 or 6/6 durable regressions per group over a 33-fold Indaptus concentration range, demonstrating a very wide therapeutic index. Similar tumor eradication results have been obtained by combining our bacteria with low-dose chemotherapy in a mouse non-Hodgkin’s lymphoma model. Eradication of established non-Hodgkin’s lymphoma tumors by our technology has also been observed with human tumor xenografts, via activation of the innate immune system. Development and preclinical efficacy characterization of a systemically administered multiple Toll-like receptor (TLR) agonist for antitumor immunotherapy [abstract]. In: Proceedings of the Fourth CRI-CIMT-EATI-AACR International Cancer Immunotherapy Conference: Translating Science into Survival; Sept 30-Oct 3, 2018; New York, NY. Philadelphia (PA): AACR; Cancer Immunol Res 2019;7(2 Suppl):Abstract nr B178.

| 10 |

The chart above illustrates that the synergistic tumor eradication by our and Anti-PD-1 produces immunological memory. Established tumors were regressed in 11 mice by combination treatment as in the Figure above and then the mice were re-challenged with fresh HCC tumor cells, without further treatment. All of the new tumors were rejected. Similar results have been obtained by combining our bacteria with low-dose chemotherapy in a non-Hodgkin’s lymphoma model.

Business Strategy

Our mission is to enhance and expand curative cancer immunotherapy for patients with unresectable or metastatic solid tumors and lymphomas, which are responsible for approximately 90% of all cancer deaths. We intend to initiate a Phase 1 clinical trial in 2022 with advanced solid tumor patients. The trial will include a dose escalation to determine the side-effect profile and recommended Phase 2 dose, an expansion with tumor types that may be responsive, and a Phase 1b combination trial with Checkpoint Therapy, targeted antibodies and/or low-dose chemotherapy. Its business strategy includes:

| ● | Adding operational, financial and management information systems and personnel, including personnel to support our planned product development and commercialization efforts, as well as to support our transition to a public reporting company; | |

| ● | Filing an IND in the first half of 2022 and then initiating in 2022 a Phase 1 clinical trial for Decoy20, targeting solid tumors and possibly also hepatocellular carcinoma-associated HBV infection; | |

| ● | Expanding our bacterial product platform to target additional types of cancer, as well as additional infectious diseases; | |

| ● | Maintaining, expanding and protecting our intellectual property portfolio; and | |

| ● | Seeking regulatory approvals for any product candidates that successfully complete clinical trials. |

Competitive Advantages

Our bacteria contain multiple constituents, capable of priming or activating many of the cellular components of both innate and adaptive immunity, but have been attenuated by a patented process to reduce the potential for over-stimulation of the immune system and consequential induction of undesirable autoimmune reactions. Our bacteria are also likely to be cleared very quickly by the liver and spleen, which may further reduce the risk of non-specific autoimmune side effects, relative to other types of immunotherapy that are designed for continuous exposure. We believe a short Indaptus exposure is sufficient to act alone and as a “primer” to enhance other products. Additionally, Our products can be manufactured by a highly cost-efficient process, potentially providing accelerated patient access in both developed and developing geographical regions.

| 11 |

Governmental Regulation

We operate in a highly regulated industry that is subject to significant federal, state, local and foreign regulation. Its present and future business strategy has been, and will continue to be, subject to a variety of laws including, the FDCA, subject to a variety of laws including, the FDCA and the Public Health Service Act (PHSA), among others.

The FDCA, PHSA, and other federal and state statutes and regulations govern the testing, manufacturing, safety, effectiveness, labeling, storage, record keeping, approval, advertising and promotion of our products. As a result of these laws and regulations, product development and product approval processes are very expensive and time-consuming.

FDA Approval Process

In the United States, pharmaceutical products, including biologics, are subject to extensive regulation by the FDA. The FDCA and other federal and state statutes and regulations, govern, among other things, the research, development, testing, manufacturing, storage, record keeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring and reporting, sampling, and import and export of pharmaceutical products. Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending NDAs or BLAs, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties, and criminal prosecution.

Pharmaceutical product development in the United States typically involves preclinical laboratory and animal tests, the submission to the FDA of an IND, which must become effective before clinical testing may commence, and adequate and well-controlled clinical trials to establish the safety and effectiveness of the drug or biologic for each indication for which FDA approval is sought. Satisfaction of FDA pre-market approval requirements typically takes many years and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease.

Pre-clinical tests include laboratory evaluation as well as animal trials to assess the characteristics and potential pharmacology and toxicity of the product. The conduct of the pre-clinical tests must comply with federal regulations and requirements including good laboratory practices. The results of pre-clinical testing are submitted to the FDA as part of an IND along with other information, including information about product chemistry, manufacturing and controls, and a proposed clinical trial protocol. Long term pre-clinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted.

A 30-day waiting period after the submission of each IND is required prior to the commencement of clinical testing in humans. If the FDA has not objected to the IND within this 30-day period, the clinical trial proposed in the IND may begin.

Clinical trials involve the administration of the investigational drug to healthy volunteers or patients under the supervision of a qualified investigator. Clinical trials must be conducted in compliance with federal regulations and good clinical practices, or GCP, as well as under protocols detailing the objectives of the trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. Each protocol involving testing on U.S. patients and subsequent protocol amendments must be submitted to the FDA as part of the IND.

The FDA may order the temporary or permanent discontinuation of a clinical trial at any time or impose other sanctions if it believes that the clinical trial is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. The clinical trial protocol and informed consent information for patients in clinical trials must also be submitted to an institutional review board (“IRB”) for approval. An IRB may also require the clinical trial at the site to be halted, either temporarily or permanently, for failure to comply with the IRB’s requirements, or may impose other conditions.

| 12 |

Clinical trials to support NDAs or BLAs, which are applications for marketing approval, are typically conducted in three sequential Phases, but the Phases may overlap. In oncology Phase 1 trials, the investigational drug candidate is typically given to cancer patients who have failed all approved products in order to assess metabolism, pharmacokinetics, pharmacological actions, side effects associated with increasing doses and, if possible, early evidence on effectiveness. Phase 2 usually involves trials in a limited patient population, to determine the effectiveness of the investigational drug for a particular indication or indications, dosage tolerance and optimum dosage, and identify common adverse effects and safety risks.

If an investigational cancer drug demonstrates significant evidence of effectiveness and an acceptable safety profile in Phase 2 evaluations, it may be considered for accelerated approval, although more often, Phase 3 clinical trials are undertaken to obtain additional information about clinical efficacy and safety in a larger number of patients, typically at geographically dispersed clinical trial sites, to permit the FDA to evaluate the overall benefit-risk relationship of the investigational drug and to provide adequate information for its labeling.

After completion of the required clinical testing, an NDA or, in the case of a biologic, a BLA, is prepared and submitted to the FDA. FDA approval of the marketing application is required before marketing of the product may begin in the United States. The marketing application must include the results of all preclinical, clinical and other testing and a compilation of data relating to the product’s pharmacology, chemistry, manufacture, and controls.

The FDA has 60 days from its receipt of an NDA or BLA to determine whether the application will be accepted for filing based on the agency’s threshold determination that it is sufficiently complete to permit substantive review. Once the submission is accepted for filing, the FDA begins an in-depth review. The FDA has agreed to certain performance goals in the review of marketing applications. Most such applications for non-priority drug products are reviewed within ten months. The review process may be extended by the FDA for three additional months to consider new information submitted during the review or clarification regarding information already provided in the submission. The FDA may also refer applications for novel drug products or drug products that present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved. The FDA is not bound by the recommendation of an advisory committee, but it generally follows such recommendations. Before approving a marketing application, the FDA will typically inspect one or more clinical sites to assure compliance with GCP.

Additionally, the FDA will inspect the facility or the facilities at which the drug product is manufactured. The FDA will not approve the NDA or, in the case of a biologic, the BLA unless compliance with GMP is satisfactory and the marketing application contains data that provide substantial evidence that the product is safe and effective in the indication studied. Manufacturers of biologics also must comply with FDA’s general biological product standards.

After the FDA evaluates the NDA or BLA and the manufacturing facilities, it issues an approval letter or a complete response letter. A complete response letter outlines the deficiencies in the submission and may require substantial additional testing or information in order for the FDA to reconsider the application. If and when those deficiencies have been addressed in a resubmission of the marketing application, the FDA will re-initiate their review. If the FDA is satisfied that the deficiencies have been addressed, the agency will issue an approval letter. The FDA has committed to reviewing such resubmissions in two or six months depending on the type of information included. It is not unusual for the FDA to issue a complete response letter because it believes that the drug product is not safe enough or effective enough or because it does not believe that the data submitted are reliable or conclusive.

An approval letter authorizes commercial marketing of the drug product with specific prescribing information for specific indications. As a condition of approval of the marketing application, the FDA may require substantial post-approval testing and surveillance to monitor the drug product’s safety or efficacy and may impose other conditions, including labeling restrictions, which can materially affect the product’s potential market and profitability. Once granted, product approvals may be withdrawn if compliance with regulatory standards is not maintained or problems are identified following initial marketing.

| 13 |

Other Regulatory Requirements

FDA Post-Approval Requirements

Once an NDA or BLA is approved, a product will be subject to certain post-approval requirements. For instance, the FDA closely regulates the post-approval marketing and promotion of therapeutic products, including standards and regulations for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities involving the internet.

Biologics may be marketed only for the approved indications and in accordance with the provisions of the approved labeling. Changes to some of the conditions established in an approved application, including changes in indications, labeling, or manufacturing processes or facilities, require submission and FDA approval of a new BLA or BLA supplement, before the change can be implemented. A BLA supplement for a new indication typically requires clinical data similar to that in the original application, and the FDA uses the same procedures and actions in reviewing BLA supplements as it does in reviewing BLAs. We cannot be certain that the FDA or any other regulatory agency will grant approval for our product candidate for any other indications or any other product candidate for any indication on a timely basis, if at all.

Adverse event reporting and submission of periodic reports is required following FDA approval of a BLA. The FDA also may require post-marketing testing, known as Phase IV testing, risk evaluation and mitigation strategies, and surveillance to monitor the effects of an approved product or place conditions on an approval that could restrict the distribution or use of the product. In addition, quality control as well as product manufacturing, packaging, and labeling procedures must continue to conform with cGMP after approval. Manufacturers and certain of their subcontractors are required to register their establishments with the FDA and certain state agencies, and are subject to periodic unannounced inspections by the FDA during which the agency inspects manufacturing facilities to assess compliance with GMP. Accordingly, manufacturers must continue to expend time, money and effort in the areas of production and quality control to maintain compliance with GMP. Regulatory authorities may withdraw product approvals or request product recalls if a company fails to comply with regulatory standards, if it encounters problems following initial marketing, or if previously unrecognized problems are subsequently discovered.

Competition

The pharmaceutical and biotechnology industries are characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary products. While we believe that our technology, knowledge and scientific resources provide us with certain competitive advantages, we face competition from many sources including pharmaceutical and biotechnology companies, academic institutions, governmental agencies and public and private research institutions. Many of these competitors may have access to greater capital and resources than us. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel. Any product candidates that we successfully develop and commercialize will compete with new immunotherapies that may become available in the future. Our competitors include larger and better funded biopharmaceutical, biotechnology and therapeutics companies, specifically companies focused on cancer immunotherapies, such as Amgen, Inc., AstraZeneca plc, BMS, Genentech, Inc., GlaxoSmithKline PLC, Merck & Co., Inc., Novartis AG, Pfizer Inc., Roche Holding Ltd and Sanofi S.A. In contrast, many of these companies are developing immunotherapeutics which may have potential to be used in concert with Decoy20 and in this regard, we view them as potentially complimentary.

With respect to our lead candidate Decoy20, there are a number of companies that are developing possible treatments for cancer, however, we believe we are the only company using systemic administration of killed, non-pathogenic Gram-negative bacteria with reduced lipopolysaccharide-endotoxin to stimulate innate and adaptive immune system pathways.

Our success will be based in part upon our ability to successfully commercialize Decoy20 and to identify, develop and manage a portfolio of therapeutics that are safer and more effective than competing products in our target indications. Our market opportunity has the potential to be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, have fewer side effects, are more convenient or are less expensive than any therapeutics we may develop. Our competitive position will also be dependent upon our ability to attract and retain qualified personnel, to obtain patent protection or otherwise develop proprietary products or processes, and protect our intellectual property, and to secure sufficient capital resources for the period between technological conception and commercial sales. The availability of reimbursement from government and other third-party payors will also significantly affect the pricing and competitiveness of our products. Our competitors may also obtain FDA or other regulatory approval for their products more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market.

| 14 |

Intellectual Property

Our success depends, at least in part, on our ability to protect our proprietary technology and intellectual property, and to operate without infringing or violating the proprietary rights of others. We rely on a combination of patent, trademark, trade secret and copyright laws, know-how, intellectual property licenses and other contractual rights (including confidentiality and invention assignment agreements) to protect our proprietary technology and intellectual property, including related intellectual property rights.

Patents

As of March 1, 2022, we own 33 granted patents and 16 pending patent applications to use within our field of business. Our patents and patent applications generally relate to compositions and methods for treating cancer and infectious diseases, and our patents and any patents that issue from our pending patent applications are expected to expire at various dates between 2033 and 2039.

We intend to submit patent applications for each new product and technology that we develop. The patent outlook for companies like ours is generally uncertain and may involve complex legal and factual questions. Our ability to maintain and consolidate our proprietary position for our technology will depend on our success in obtaining effective claims and enforcing those claims once granted. We do not know whether any of our patent applications or any patent applications that we may license will result in the issuance of any patents. Our issued patents and those that may be issued in the future, or patents that we may exclusively license, may be challenged, narrowed, circumvented or found to be invalid or unenforceable, which could limit our ability to stop competitors from marketing related products or the length of term of patent protection that we may have for our products. We cannot be certain that we were the first to invent the inventions claimed in our owned patents or patent applications. In addition, our competitors may independently develop similar technologies or duplicate any technology developed by us, and the rights granted under any issued patents may not provide us with any meaningful competitive advantages against these competitors. Furthermore, because of the extensive time required for development, testing and regulatory review of a potential product, it is possible that, before any of our products can be commercialized, any related patent may expire or remain in force for only a short period following commercialization, thereby reducing any advantage of the patent.

Trade Secrets and Confidential Information

In addition to patents, we rely on trade secrets and know-how to develop and maintain our competitive position. Trade secrets and know-how can be difficult to protect. We rely on, among other things, confidentiality and invention assignment agreements to protect our proprietary know-how and other intellectual property that may not be patentable, or that we believe is best protected by means that do not require public disclosure. For example, we require our employees to execute confidentiality agreements in connection with their employment relationships with us, and to disclose and assign to us inventions conceived in connection with their services to us. However, there can be no assurance that these agreements will be enforceable or that they will provide us with adequate protection. We also seek to preserve the integrity and confidentiality of our data, trade secrets and know-how by maintaining physical security of our premises and physical and electronic security of our information technology systems.

We may be unable to obtain, maintain and protect the intellectual property rights necessary to conduct our business, and may be subject to claims that we infringe or otherwise violate the intellectual property rights of others, which could materially harm our business. For a more comprehensive summary of the risks related to our intellectual property, see “Item 1A. Risk Factors — Risks Related to Our Intellectual Property.”

| 15 |

Environmental Matters

We are subject to various environmental, health and safety laws and regulations, including those governing air emissions, water and wastewater discharges, noise emissions, the use, management and disposal of hazardous materials and wastes and the cleanup of contaminated sites. In addition, all of our laboratory personnel participate in instruction on the proper handling of chemicals, including hazardous substances before commencing employment, and during the course of their employment with us. In addition, all information with respect to any chemical substance that we use is filed and stored as a Material Safety Data Sheet, as required by applicable environmental regulations. Based on information currently available to us, we do not expect environmental costs and contingencies to have a material adverse effect on us. The operation of our facilities, however, entails risks in these areas. Significant expenditures could be required in the future if we are required to comply with new or more stringent environmental or health and safety laws, regulations or requirements.

We believe that our business, operations and facilities are being operated in compliance in all material respects with applicable environmental and health and safety laws and regulations.

Human Capital Management

As of December 31, 2021, we have five full-time employees. None of our employees are represented by labor unions or covered by collective bargaining agreements.

We believe that our future success will depend, in part, on our continued ability to attract, hire and retain qualified personnel. In particular, we depend on the skills, experience and performance of our senior management and research personnel. We compete for qualified personnel with other biotechnology, medical device, pharmaceutical and healthcare companies, as well as universities and non-profit research institutions.

We provide competitive compensation and benefits programs to help meet the needs of our employees. In addition to salaries, these programs (which vary by country/region and employment classification) include incentive compensation plan, pension, healthcare and insurance benefits, paid time off, and family leave, among others. We also use targeted equity-based grants with vesting conditions to facilitate retention of personnel, particularly for our key employees.

The success of our business is fundamentally connected to the well-being of our people. Accordingly, we are committed to the health and safety of our employees including safety measures that are required for the COVID-19 pandemic and that comply with government regulations.

We consider our relations with our employees to be good.

Historical Background and Corporate Structure

Intec Israel was established and incorporated in Israel on October 23, 2000 as a private Israeli company under the name Orly Guy Ltd. In February 2001, Intec Israel’s name was changed to Intec Pharmaceuticals (2000) Ltd. Intec Israel’s research and development activities began originally through a private partnership, Intec Pharmaceutical Partnership I.P.P, a general Israeli partnership, formed on September 21, 2000. Its operations were transferred in full to Intec Israel at the beginning of 2002 in return for the allocation of shares in Intec Israel to the partners in the partnership, pro rata with their ownership in the partnership. In March 2004, Intec Israel changed its corporate name to Intec Pharma, Ltd. In February 2010, Intec Israel successfully completed an initial public offering in Israel on the Tel Aviv Stock Exchange, or TASE and in August 2015 Intec Israel completed an initial public offering in the U.S.

Indaptus (formerly Intec Parent) was established and incorporated in Delaware on February 24, 2021 as a private Delaware corporation and wholly owned subsidiary of Intec Israel.

On March 15, 2021, Indaptus, Domestication Merger Sub Ltd., an Israeli company and a wholly owned subsidiary of Indaptus, or Domestication Merger Sub, Dillon Merger Subsidiary, Inc., or Merger Sub, and Decoy Biosystems, Inc., a Delaware corporation, or Decoy, entered into an Agreement and Plan of Merger Agreement, or the Merger Agreement, whereby upon satisfaction of certain closing conditions set forth in the Merger Agreement, including consummation of the Domestication Merger (as defined herein), Merger Sub was to merge with and into Decoy, with Decoy being the surviving entity and a wholly owned subsidiary of Indaptus, or the Merger.

| 16 |

On April 27, 2021, Indaptus, Intec Israel and Domestication Merger Sub entered into an Agreement and Plan of Merger, or the Domestication Merger Agreement, pursuant to which Intec Israel was to domesticate as a wholly owned subsidiary of a Delaware corporation by Domestication Merger Sub merging with and into Intec Israel, with Intec Israel being the surviving entity and a wholly owned subsidiary of Indaptus, or the Domestication Merger.

On June 21, 2021, Intec Israel held a special meeting of shareholders, or the Special Meeting, to consider certain proposals related to the Domestication Merger and the Merger. Each of Intec Israel’s proposals was approved at the Special Meeting by the requisite vote of Intec Israel shareholders.

On July 27, 2021, Intec Israel, Indaptus and Domestication Merger Sub completed the Domestication Merger pursuant to the terms and conditions of the Domestication Merger Agreement, whereby Domestication Merger Sub merged with and into Intec Israel, with Intec Israel being the surviving entity and a wholly-owned subsidiary of Indaptus. To effect the Domestication Merger, Intec Israel ordinary shares, having no par value per share, or Intec Israel Shares, outstanding immediately prior to the Domestication Merger converted, on a one-for-one basis, into shares of Indaptus’ common stock, $0.01 par value per share, and all options and warrants to purchase Intec Israel Shares outstanding immediately prior to the Domestication Merger were exchanged for equivalent securities of Indaptus. As a result of the Domestication Merger, Intec Israel continued to possess all of its assets, rights, powers and property as constituted immediately prior to the Domestication Merger and continued to be subject to all of its debts, liabilities and obligations as constituted immediately prior to the Domestication Merger.

On August 3, 2021, Indaptus changed its name from Intec Parent, Inc. to Indaptus Therapeutics, Inc. and completed the Merger following the satisfaction or waiver of the conditions set forth in the Merger Agreement.

At the effective time of the Merger, each share of Decoy common stock (including shares issuable upon the conversion of Decoy SAFEs (Simple Agreements for Future Equity) and Decoy preferred stock, par value $0.001 per share, into Decoy common stock) converted into 2.654353395 shares of our common stock, par value $0.01 per share. In addition, at the effective time of the Merger, each outstanding and unexercised Decoy stock option converted into a stock option exercisable for that number of shares of our common stock subject to such option and the exercise price being appropriately adjusted to reflect the exchange ratio. Immediately following closing of the Merger there were 5,405,970 shares of our common stock outstanding, with pre-merger Decoy stockholders owning approximately 65.6% and pre-merger Intec Israel shareholders owning approximately 34.4% of our common stock. The figures above do not give effect to shares issuable upon the exercise of our outstanding warrants or options. Assuming the exercise in full of the pre-funded warrants sold in the August 2021 Private Placement (as defined below), there would have been 8,133,243 shares of our common stock outstanding.

Following completion of the Merger, shares of our common stock commenced trading at market open on August 4, 2021 on the Nasdaq Capital Market under the name “Indaptus Therapeutics, Inc.” and ticker symbol “INDP”.

In connection with the completion of the Merger, on August 4, 2021, our board determined to wind down the Accordion Pill business of Intec Israel. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations —Winding Down of Accordion Pill Business”.

Available Information

We maintain a corporate website at http://www.indaptusrx.com. Copies of our reports on Forms 10-K, Forms 10-Q and Forms 8-K, may be obtained, free of charge, electronically through our corporate website at http://www.indaptusrx.com as soon as reasonably practicable after we file such material electronically with, or furnish to, the SEC. All of our SEC filings are also available on our website at http://www.indaptusrx.com, as soon as reasonably practicable after having been electronically filed or furnished to the SEC. The public may read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. The information on our website is not, and will not be deemed, a part of this Annual Report or incorporated into any other filings we make with the SEC.

| 17 |

Item 1A. Risk Factors.

You should carefully consider the factors described below, together with all of the other information contained in this Annual Report, including the audited consolidated financial statements and the related notes included in this Annual Report beginning on page F-1, before deciding whether to invest in our common stock. If any of the risks discussed below actually occur, our business, financial condition, operating results and cash flows could be materially adversely affected. The risks described below are not the only risks facing us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. This could cause the trading price of our common stock to decline, and you may lose all or part of your investment.

Summary Risk Factors

The principal factors and uncertainties that make investing in our common stock risky, include, among others:

Risks Related to Our Financial Position and Capital Resources

| ● | We are a pre-clinical-stage company, has a limited operating history, is not currently profitable, does not expect to become profitable in the near future and may never become profitable. | |

| ● | Given our lack of current cash flow, we will need to raise additional capital; however, it may be unavailable to us or, even if capital is obtained, may cause dilution or place significant restrictions on our ability to operate our business. |

Risks Related to Our Business, Industry and Regulatory Requirements

| ● | We are dependent on the success of one or more of our current product candidates and we cannot be certain that any of them will receive regulatory approval or be commercialized. | |

| ● | If development of our product candidates does not produce favorable results, we and our collaborators, if any, may be unable to commercialize these products. | |

| ● | We expect to continue to incur significant research and development expenses, which may make it difficult for us to attain profitability. | |

| ● | Our product candidates may cause undesirable side effects that could delay or prevent their regulatory approval or commercialization or have other significant adverse implications on our business, financial condition and results of operations. | |

| ● | Our efforts to discover product candidates beyond our current product candidates may not succeed, and any product candidates we recommend for clinical development may not actually begin clinical trials. | |

| ● | Delays in the commencement or completion of clinical trials could result in increased costs to us and delay our ability to establish strategic collaborations. | |

| ● | A pandemic, epidemic or outbreak of an infectious disease, such as COVID-19, may materially and adversely affect our business and operations. | |

| ● | Our product candidates are subject to extensive regulation under the FDA, the EMA or comparable foreign authorities, which can be costly and time consuming, cause unanticipated delays or prevent the receipt of the required approvals to commercialize our product candidates. | |

| ● | If our competitors have product candidates that are approved faster, marketed more effectively, are better tolerated, have a more favorable safety profile or are demonstrated to be more effective than our product candidates, our commercial opportunity may be reduced or eliminated. | |

| ● | We are subject to a multitude of manufacturing risks, any of which could substantially increase our costs and limit supply of our product candidates. | |

| ● | The commercial success of our product candidates depends upon their market acceptance among physicians, patients, healthcare payors and the medical community. | |

| ● | We are highly dependent on our current senior management. If we fail to retain current members of our senior management and scientific personnel, or to attract and keep additional key personnel, we may be unable to successfully develop or commercialize our product candidates. |

Risks Related to Our Reliance on Third Parties

| ● | We rely on third parties to conduct our preclinical studies and clinical trials and perform other tasks. If these third parties do not successfully carry out their contractual duties, meet expected deadlines, or comply with regulatory requirements, we may not be able to obtain regulatory approval for or commercialize our product candidates and our business, financial condition and results of operations could be substantially harmed. | |

| ● | We rely completely on third parties to manufacture our preclinical and clinical supplies, and our business, financial condition and results of operations could be harmed if those third parties fail to provide us with sufficient quantities of product, or fail to do so at acceptable quality levels or prices. | |

| ● | Any collaboration arrangement that we may enter into in the future may not be successful, which could adversely affect our ability to develop and commercialize our current and potential future product candidates. | |

| ● | If we are unable to develop our own commercial organization or enter into agreements with third parties to sell and market our product candidates, we may be unable to generate significant revenues. |

| 18 |

Risks Related to Our Intellectual Property

| ● | We may not be able to protect our proprietary or licensed technology in the marketplace. | |

| ● | Obtaining and maintaining patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent agencies, and our patent protection for licensed patents, pending patent applications and potential future patent applications and patents could be reduced or eliminated for non-compliance with these requirements. | |

| ● | We may infringe the intellectual property rights of others, which may prevent or delay our product development efforts and prevent us from commercializing or increase the costs of commercializing our products. | |

| ● | Any claims or lawsuits relating to infringement of intellectual property rights brought by or against us will be costly and time consuming and may adversely affect our business, financial condition and results of operations. | |

| ● | Changes in U.S. patent law could diminish the value of patents in general, thereby impairing our ability to protect our products. |

Risks Related to Ownership of Our Common Stock

| ● | We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine. | |

| ● | The market price of our common stock is volatile and you may sustain a complete loss of your investment. | |

| ● | Maintaining and improving our financial controls and the requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members. | |

| ● | Failure to maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 could have a material adverse effect on our share price. | |

| ● | Sales of a substantial number of our shares in the public market by our existing shareholders could cause our share price to decline. | |

| ● | Raising additional capital would cause dilution to our existing shareholders and may restrict our operations or require it to relinquish rights. | |

| ● | We are a smaller reporting company and, as a result of the reduced disclosure and governance requirements applicable to such companies, our shares of common stock may be less attractive to investors. |

Risks Related to Our Financial Position and Capital Requirements

We are a pre-clinical-stage company, has a limited operating history, is not currently profitable, does not expect to become profitable in the near future and may never become profitable.

We are a pre-clinical-stage biotechnology company focused primarily on developing a novel and patented systemically-administered anti-cancer and anti-viral immunotherapy. All of our product candidates are in the pre-clinical development stage and none of our product candidates have been approved for marketing or are being marketed or commercialized.

As a result, we have no meaningful historical operations upon which to evaluate our business and prospects and has not yet demonstrated an ability to obtain marketing approval for any of our product candidates or successfully overcome the risks and uncertainties frequently encountered by companies in the biopharmaceutical industry. As a result, we have not been profitable and has incurred significant operating losses in every reporting period since our inception. For the years ended December 31, 2021, and 2020 we reported net losses of approximately $7.7 million and approximately $3.6 million, respectively, and had an accumulated deficit of approximately $15.7 million as of December 31, 2021.

For the foreseeable future, we expect to continue to incur losses, which will increase significantly from historical levels as we expand our development activities, seeks regulatory approvals for our product candidates, and begins to commercialize them if they are approved by the FDA, the European Medicines Agency, or the EMA, or comparable foreign authorities. Even if we succeed in developing and commercializing one or more product candidates, we may never become profitable.

Given our lack of current cash flow, we will need to raise additional capital; however, it may be unavailable to us or, even if capital is obtained, may cause dilution or place significant restrictions on our ability to operate our business.

Since we will be unable to generate sufficient, if any, cash flow to fund our operations for the foreseeable future, we will need to seek additional equity or debt financing to provide the capital required to maintain or expand our operations.

There can be no assurance that we will be able to raise sufficient additional capital on acceptable terms or at all. If such additional financing is not available on satisfactory terms, or is not available in sufficient amounts, we may be required to delay, limit or eliminate the development of business opportunities and our ability to achieve our business objectives, our competitiveness, and our business, financial condition and results of operations may be materially adversely affected. In addition, we may be required to grant rights to develop and market product candidates that it would otherwise prefer to develop and market itself. Our inability to fund our business could lead to the loss of your investment.

| 19 |

Our future capital requirements will depend on many factors, including, but not limited to:

| ● | the scope, rate of progress, results and cost of our clinical trials, preclinical studies and other related activities; | |

| ● | the timing of, and the costs involved in, obtaining regulatory approvals for any of our current or future product candidates; | |

| ● | the number and characteristics of the product candidates it seeks to develop or commercialize; | |

| ● | the cost of manufacturing clinical supplies, and establishing commercial supplies, of our product candidates; | |

| ● | the cost of commercialization activities if any of our current or future product candidates are approved for sale, including marketing, sales and distribution costs; | |

| ● | the expenses needed to attract and retain skilled personnel; | |

| ● | the costs associated with being a public company; | |

| ● | the amount of revenue, if any, received from commercial sales of our product candidates, should any of our product candidates receive marketing approval; and | |

| ● | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing possible patent claims, including litigation costs and the outcome of any such litigation. |

If we raise additional capital by issuing equity securities, the percentage ownership of our existing stockholders may be reduced, and accordingly these stockholders may experience substantial dilution. We may also issue equity securities that provide for rights, preferences and privileges senior to those of our common stock. Given our need for cash and that equity issuances are the most common type of fundraising for similarly situated companies, the risk of dilution is particularly significant for our stockholders.

Risks Related to Our Business, Industry and Regulatory Requirements

We are dependent on the success of one or more of our current product candidates and we cannot be certain that any of them will receive regulatory approval or be commercialized.

We have spent significant time, money and effort on the development of our lead product candidate, Decoy20. As a result, our business is largely dependent on the commencement of and success of the Decoy20 and our ability to complete the development of, obtain regulatory approval for, and successfully commercialize Decoy20 in a timely manner. The commencement of a Phase 1 clinical trial with solid tumor patients for Decoy20 is dependent, in part, upon the success of an Investigational New Drug, or an IND, application that we plan to file with the FDA in the first half of 2022. There can be no assurance regarding the outcome of the IND. The process to develop, obtain regulatory approval for and commercialize Decoy20 is long, complex, costly and uncertain as to our outcome.

To date, no clinical trials designed to provide proof of efficacy, or to provide sufficient evidence of safety, have been completed with any of our product candidates. All of our product candidates will require additional development, including clinical trials as well as further preclinical studies to evaluate their toxicology and optimize their formulation and regulatory clearances before they can be commercialized. Positive results obtained during early development do not necessarily mean later development will succeed or that regulatory clearances will be obtained. Our development efforts may not lead to commercial products, either because our product candidates fail to be safe and effective or because we have inadequate financial or other resources to advance our product candidates through the clinical development and approval processes. If any of our product candidates fail to demonstrate safety or efficacy at any time or during any phase of development, we would experience potentially significant delays in, or be required to abandon, development of the product candidate.

We do not anticipate that any of our current product candidates will be eligible to receive regulatory approval from the FDA, the EMA or comparable foreign authorities and begin commercialization for a number of years, if ever. Even if we ultimately receive regulatory approval for any of these product candidates, we or our potential future partners, if any, may be unable to commercialize them successfully for a variety of reasons. These include, for example, the availability of alternative treatments, lack of cost-effectiveness, the cost of manufacturing the product on a commercial scale and competition with other products. The success of our product candidates may also be limited by the prevalence and severity of any adverse side effects. If we fail to commercialize one or more of our current product candidates, we may be unable to generate sufficient revenues to attain or maintain profitability, and our financial condition may decline.

| 20 |

If development of our product candidates does not produce favorable results, we and our collaborators, if any, may be unable to commercialize these products.

To receive regulatory approval for the commercialization of product candidates that we may develop, adequate and well-controlled clinical trials must be conducted to demonstrate safety and efficacy in humans to the satisfaction of the FDA, the EMA and comparable foreign authorities. In order to support marketing approval, these agencies typically require successful results in one or more Phase 2 and/or Phase 3 clinical trials, which our current product candidates have not yet reached and may never reach. The development process is expensive, can take many years and has an uncertain outcome. Failure can occur at any stage of the process. We may experience numerous unforeseen events during, or as a result of, the development process that could delay or prevent commercialization of our current or future product candidates, including the following:

| ● | clinical trials may produce negative or inconclusive results; | |

| ● | preclinical studies conducted with product candidates during clinical development to, among other things, further evaluate their toxicology, carcinogenicity and pharmacokinetics and optimize their formulation may produce unfavorable results; | |

| ● | patient recruitment and enrollment in clinical trials may be slower than we anticipate; | |

| ● | costs of development may be greater than we anticipate; | |

| ● | our product candidates may cause undesirable side effects that delay or preclude regulatory approval or limit their commercial use or market acceptance, if approved; | |

| ● | collaborators who may be responsible for the development of our product candidates may not devote sufficient resources to these clinical trials or other preclinical studies of these candidates or conduct them in a timely manner; or | |

| ● | we may face delays in obtaining regulatory approvals to commence one or more clinical trials. |

Success in early development does not mean that later development will be successful because, for example, product candidates in later-stage clinical trials may fail to demonstrate sufficient safety and efficacy despite having progressed through initial clinical trials.

In the future, we or any potential future collaborative partner will be responsible for establishing the targeted endpoints and goals for development of our product candidates. These targeted endpoints and goals may be inadequate to demonstrate the safety and efficacy levels required for regulatory approvals. Even if we believe data collected during the development of our product candidates are promising, such data may not be sufficient to support marketing approval by the FDA, the EMA or comparable foreign authorities. Further, data generated during development can be interpreted in different ways, and the FDA, the EMA or comparable foreign authorities may interpret such data in different ways than we or our collaborators do. Our failure to adequately demonstrate the safety and efficacy of our product candidates would prevent our receipt of regulatory approval, and ultimately the potential commercialization of these product candidates.

Since we do not currently possess the resources necessary to independently develop and commercialize our product candidates or any other product candidates that we may develop, we may seek to enter into collaborative agreements to assist in the development and potential future commercialization of some or all of these assets as a component of our strategic plan. However, our discussions with potential collaborators may not lead to the establishment of collaborations on acceptable terms, if at all, or it may take longer than expected to establish new collaborations, leading to development and potential commercialization delays, which would adversely affect our business, financial condition and results of operations.

| 21 |

We expect to continue to incur significant research and development expenses, which may make it difficult for us to attain profitability.

We expect to expend substantial funds in research and development, including preclinical studies and clinical trials of our product candidates, and to manufacture and market any product candidates in the event they are approved for commercial sale. We also may need additional funding to develop or acquire complementary companies, technologies and assets, as well as for working capital requirements and other operating and general corporate purposes. Moreover, our planned increases in staffing will dramatically increase our costs in the near and long-term.

However, our spending on current and future research and development programs and product candidates for specific indications may not yield any commercially viable products. Due to our limited financial and managerial resources, we must focus on a limited number of research programs and product candidates and on specific indications. Our resource allocation decisions may cause it to fail to capitalize on viable commercial products or profitable market opportunities.

Because the successful development of our product candidates is uncertain, we are unable to precisely estimate the actual funds we will require to develop and potentially commercialize them. In addition, we may not be able to generate sufficient revenue, even if we are able to commercialize any of our product candidates, to become profitable.

Our product candidates may cause undesirable side effects that could delay or prevent their regulatory approval or commercialization or have other significant adverse implications on our business, financial condition and results of operations.

Undesirable side effects observed in supportive preclinical studies or in clinical trials with our product candidates could interrupt, delay or halt their development and could result in the denial of regulatory approval by the FDA, the EMA or comparable foreign authorities for any or all targeted indications or adversely affect the marketability of any such product candidates that receive regulatory approval. In turn, this could eliminate or limit our ability to commercialize our product candidates. Since the mechanism of action of our product candidates depends on stimulation of the immune system, there is the potential for over-stimulation or undesirable immune reactions.

Our product candidates may exhibit adverse effects in preclinical toxicology studies and adverse interactions with certain drugs. There are also risks associated with additional requirements the FDA, the EMA or comparable foreign authorities may impose for marketing approval with regard to a particular disease.