7370 |

||||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

☒ |

Smaller reporting company |

|||||

Emerging growth company |

||||||

Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per security |

Proposed maximum aggregate offering price |

Amount of registration fee(4) | ||||

Common stock(1)(2) |

22,500,000 |

$6.32(3) |

$142,200,000(3) |

$13,181.94 | ||||

Total |

$ |

$13,181.94 | ||||||

(1) |

Pursuant to Rule 416(a) of the Securities Act, there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

(2) |

The number of shares of common stock being registered represents 22,500,000 shares of common stock issued to certain qualified institutional buyers and accredited investors in private placements consummated in connection with the Business Combination. |

(3) |

Estimated solely for the purpose of calculating the registration fee, based on the average of the high and low prices of common stock, on the New York Stock Exchange on October 13, 2021 ($6.32 per share of common stock) (such date being within five business days of the date that this registration statement was first filed with the SEC). This calculation is in accordance with Rule 457(f)(1) of the Securities Act of 1933, as amended. |

(4) |

Previously paid. |

Page |

||||

| iii | ||||

| v | ||||

| 1 | ||||

| 5 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 39 | ||||

| 50 | ||||

| 74 | ||||

| 81 | ||||

| 86 | ||||

| 88 | ||||

| 93 | ||||

| 95 | ||||

| 104 | ||||

| 105 | ||||

| 108 | ||||

| 108 | ||||

| 108 | ||||

F-1 |

||||

| • | our ability to develop and introduce new products and services successfully; |

| • | our ability to compete in the market in which we operate; |

| • | our ability to meet the price and performance standards of the evolving 5G New Radio products and technologies; |

| • | our ability to expand our customer reach/reduce customer concentration; |

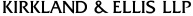

| • | our ability to grow the IoT and mobile portfolio outside of North America; |

| • | our ability to make scheduled payments on or to refinance our indebtedness; |

| • | our ability to introduce and sell new products that comply with current and evolving industry standards and government regulations; |

| • | our ability to develop and maintain strategic relationships to expand into new markets; |

| • | our ability to properly manage the growth of our business to avoid significant strains on our management and operations and disruptions to our business; |

| • | our reliance on third parties to manufacture components of our solutions; |

| • | our ability to accurately forecast customer demand and timely delivery of sufficient product quantities; |

| • | our reliance on sole source suppliers for some products and devices used in our solutions; |

| • | the continuing impact of uncertain global economic conditions on the demand for our products; |

| • | the impact of geopolitical instability on our business; |

| • | the emergence of global public health emergencies, such as the outbreak of the 2019 novel coronavirus, now known as “COVID-19,” which could extend lead times in our supply chain and lengthen sales cycles with our customers; |

| • | direct and indirect effects of COVID-19 on our employees, customers and supply chain and the economy and financial markets; |

| • | the impact that new or adjusted tariffs may have on the costs of components or our products, and our ability to sell products internationally; |

| • | our ability to be cost competitive while meeting time-to-market |

| • | our ability to meet the product performance needs of our customers in wireless broadband data access markets; |

| • | demand for software-as-a-service |

| • | our dependence on wireless telecommunication operators delivering acceptable wireless services; |

| • | the outcome of any pending or future litigation, including intellectual property litigation; |

| • | infringement claims with respect to intellectual property contained in our solutions; |

| • | our continued ability to license necessary third-party technology for the development and sale of our solutions; |

| • | the introduction of new products that could contain errors or defects; |

| • | conducting business abroad, including foreign currency risks; |

| • | the pace of 5G wireless network rollouts globally and their adoption by customers; |

| • | our ability to make focused investments in research and development; |

| • | our ability to hire, retain and manage additional qualified personnel to maintain and expand our business; |

| • | the projected financial information, anticipated growth rate, and market opportunity of KORE, and estimates of expenses and profitability; |

| • | the potential liquidity and trading of public securities; and |

| • | the ability to raise financing in the future. |

| • | Connected Health |

| • | Fleet Management |

| • | Asset Monitoring |

| • | Communication Services |

| • | Industrial IoT |

| • | KORE is dependent on new products and services, and if it is unable to successfully introduce them into the market or to effectively compete with new, disruptive product alternatives, KORE’s customer base may decline or fail to grow as anticipated. |

| • | The 5G market may take longer to materialize than KORE expects or, if it does materialize rapidly, KORE may not be able to meet the development schedule and other customer demands. |

| • | If KORE is unable to support customers with low latency and/or high throughput IoT use cases, its revenue growth and profitability will be harmed. |

| • | If KORE is unable to effectively manage its increasingly diverse and complex businesses and operations, its ability to generate growth and revenue from new or existing customers may be adversely affected. |

| • | The loss of KORE’s largest customers, particularly its single largest customer could significantly impact its revenue and profitability. |

| • | KORE’s financial condition and results of operations have been and may continue to be adversely affected by the COVID-19 pandemic. |

| • | KORE’s products are highly technical and may contain undetected errors, product defects, security vulnerabilities, or software errors. |

| • | If there are interruptions or performance problems associated with the network infrastructure used to provide KORE’s services, customers may experience service outages, this may impact its reputation and future sales. |

| • | KORE’s inability to adapt to rapid technological change in its markets could impair its ability to remain competitive and adversely affect its results of operations. |

| • | The market for the products and services that KORE offers is rapidly evolving and highly competitive. KORE may be unable to compete effectively. |

| • | If KORE is unable to protect its intellectual property and proprietary rights, its competitive position and its business could be harmed. |

| • | Failure to maintain the security of KORE’s information and technology networks, including information relating to its customers and employees, could adversely affect KORE. Furthermore, if security breaches in connection with the delivery of KORE’s services allow unauthorized third parties to obtain control or access of its solutions, KORE’s reputation, business, results of operations and financial condition could be harmed. |

| • | KORE’s internal and customer-facing systems, and systems of third parties they rely upon, may be subject to cybersecurity breaches, disruptions, or delays. |

| • | KORE is subject to evolving privacy laws in the United States and other jurisdictions that are subject to potentially differing interpretations and which could adversely impact its business and require that it incur substantial costs. |

| • | Some of KORE’s products rely on third party technologies, which could result in product incompatibilities or harm availability of its products and services. |

| • | KORE may not be able to maintain and expand its business if it is not able to hire, retain and manage additional qualified personnel. |

| • | KORE faces risks inherent in conducting business internationally, including compliance with international and U.S. laws and regulations that apply to its international operations. |

| • | KORE may be subject to legal proceedings and litigation, including intellectual property and privacy disputes, which are costly to defend and could materially harm its business and results of operations. |

| • | KORE’s management has identified internal control deficiencies that may be considered significant deficiencies or potential material weaknesses in its internal control over financial reporting. |

| • | unexpected increases in manufacturing costs; |

| • | interruptions in shipments if a third-party manufacturer is unable to complete production in a timely manner; |

| • | inability to control quality of finished products; |

| • | inability to control delivery schedules; |

| • | inability to control production levels and to meet minimum volume commitments to our customers; |

| • | inability to control manufacturing yield; |

| • | inability to maintain adequate manufacturing capacity; and |

| • | inability to secure adequate volumes of acceptable components at suitable prices or in a timely manner. |

| • | We have not historically designed and maintained the level and depth of formal accounting policies, procedures and controls over significant accounts and disclosures to achieve complete, accurate and timely financial accounting, reporting and disclosures, including segregation of duties and adequate controls related to the preparation and review of journal entries. |

| • | One of our recent acquisitions, Integron was not historically audited prior to its acquisition, and has historically relied on less mature financial processes and systems and an IT environment for which we have identified significant deficiencies and potential material weaknesses, which may affect our ability to report historical financial performance accurately and on a timely basis. The maturation of Integron’s financial processes and systems is an on-going initiative as further integrations between Integron’s operational systems and our financial systems as well as any accompanying changes in processes may be needed in the future. |

| • | We have hired a new corporate controller, and are in the process of hiring additional experienced accounting personnel with appropriate SEC public company experience and technical accounting knowledge, in addition to utilizing third-party consultants to supplement KORE’s internal resources. We are currently recruiting for these positions and expect to add these additional accounting personnel in the fourth quarter of 2021; |

| • | Management is in the process of establishing an Integron project team and charter, staffed with the appropriate manufacturing and warehouse management financial expertise to review, identify, recommend and execute the necessary operational process and system improvements to address KORE’s external and internal financial reporting requirements. The process improvements are expected to be implemented by the fourth quarter of 2021 while the required systems changes are expected to be implemented by the third quarter of 2022 or earlier if possible; and |

| • | We have engaged third-party advisors to assist with the design and implementation of a risk based internal control over financial reporting program, including disclosure controls and procedures based on the criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). This engagement will include a comprehensive risk assessment to identify the potential risks of material misstatement whether due to error or fraud in the consolidated financial statements. The results of this risk assessment will be the design and implementation of entity-level, transactional and IT general controls to mitigate any potential identified risks of material misstatements. The entity-level, transactional and IT general controls are expected to be implemented by the second quarter of 2022. At this time, KORE does not have a firm estimate for the cost of implementing the above mentioned changes. |

| • | the success of competitive services or technologies; |

| • | developments related to our existing or any future collaborations; |

| • | regulatory or legal developments in the United States and other countries; |

| • | developments or disputes concerning our intellectual property or other proprietary rights; |

| • | the recruitment or departure of key personnel; |

| • | actual or anticipated changes in estimates as to financial results, development timelines or recommendations by securities analysts; |

| • | variations in our financial results or those of companies that are perceived to be similar to us; |

| • | general economic, industry and market conditions; and |

| • | the other factors described in this “Risk Factors” section. |

| • | a limited availability of market quotations for our securities; |

| • | a determination that our common stock is a “penny stock” which will require brokers trading in our common stock to adhere to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary trading market for our common stock; |

| • | a limited amount of analyst coverage; and |

| • | a decreased ability to issue additional securities or obtain additional financing in the future. |

| • | Transaction accounting adjustments, which represent adjustments that are done in connection with the closing of the business combination, including the following: (i) the reverse recapitalization between CTAC and Maple; (ii) the net proceeds from the issuance of KORE common stock in the PIPE Investment; and (iii) the partial utilization of the Backstop Note. |

| • | Maple has the largest portion of voting rights in KORE; |

| • | Maple’s existing senior management team is comprised of senior management of KORE; |

| • | In comparison with CTAC, Maple has significantly more revenues and total assets and a larger net loss. |

| • | The operations of KORE primarily represent the operations of Maple and KORE assumes Maple’s headquarters. |

| Total shares transferred |

39,200,000 | |||

| |

|

|||

| Value per share (1) |

10.00 | |||

| |

|

|||

| Total share consideration |

$ |

392,000,000 |

||

| |

|

|||

| A-1 Preferred Stock |

86,861,830 | |||

| A Preferred Stock |

85,217,671 | |||

| B Preferred Stock |

97,835,184 | |||

| Option Cash Consideration |

4,075,000 | |||

| First LTIP Payment |

1,050,000 | |||

| Less: Preferred stock settled in common stock |

(40,000,000 | ) | ||

| |

|

|||

| Total cash consideration |

$ |

235,039,685 |

||

| |

|

|||

| Total purchase consideration |

$ |

627,039,685 |

||

| |

|

| (1) | Closing Share Consideration is calculated using $10.00 reference price. As the business combination is accounted for as a reverse recapitalization, the value per share is disclosed for informational purposes only in order to indicate the fair value of shares transferred. |

| Shares Outstanding |

% | |||||||

| Maple Stockholders |

39,200 | 54.3 | % | |||||

| |

|

|

|

|||||

| Total Maple Stockholders |

39,200 | 54.3 | % | |||||

| |

|

|

|

|||||

| CTAC Public Shares |

3,659 | 5.0 | % | |||||

| |

|

|

|

|||||

| CTAC Founder Shares |

6,698 | 9.3 | % | |||||

| |

|

|

|

|||||

| Total CTAC Shares |

10,357 | 14.3 | % | |||||

| |

|

|

|

|||||

| PIPE investors |

22,686 | 31.4 | % | |||||

| |

|

|

|

|||||

| Pro Forma KORE Common Stock at June 30, 2021 |

72,243 | 100.0 | % | |||||

| |

|

|

|

|||||

| * | Amounts and percentages exclude all Maple Options (including vested Maple Options) as they were not outstanding common stock at the time of Closing. |

As of June 30, 2021 |

||||||||||||||||||||

Maple (Historical) |

CTAC (Historical) |

Transaction Accounting Adjustments |

Pro Forma Combined |

|||||||||||||||||

| ASSETS |

||||||||||||||||||||

| Current assets: |

||||||||||||||||||||

| Cash and cash equivalents |

8,297 | 690 | 259,186 | A | 77,072 | |||||||||||||||

| 225,000 | B | |||||||||||||||||||

| (8,073 | ) | C | ||||||||||||||||||

| (25,449 | ) | D | ||||||||||||||||||

| (229,915 | ) | E | ||||||||||||||||||

| (22,000 | ) | F | ||||||||||||||||||

| (1,647 | ) | I | ||||||||||||||||||

| 93,413 | J | |||||||||||||||||||

| (222,430 | ) | K | ||||||||||||||||||

| Accounts receivable, net |

47,640 | — | 47,640 | |||||||||||||||||

| Inventories, net |

9,864 | — | 9,864 | |||||||||||||||||

| Prepaid expenses and other current assets |

14,246 | 524 | 14,770 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total current assets |

80,047 | 1,214 | 68,085 | 149,346 | ||||||||||||||||

| Non-current assets: |

||||||||||||||||||||

| Investments held in Trust Account |

— | 259,186 | (259,186 | ) | A | — | ||||||||||||||

| Restricted cash |

371 | — | 371 | |||||||||||||||||

| Property and equipment, net |

12,606 | — | 12,606 | |||||||||||||||||

| Intangible assets, net |

221,990 | — | 221,990 | |||||||||||||||||

| Goodwill |

382,428 | — | 382,428 | |||||||||||||||||

| Deferred tax asset |

119 | — | 119 | |||||||||||||||||

| Other long-term assets |

3,532 | (3,021 | ) | D | 511 | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total non-current assets |

621,046 | 259,186 | (262,207 | ) | 618,025 | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| TOTAL ASSETS |

701,093 |

260,400 |

(194,122 |

) |

767,371 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| LIABILITIES, TEMPORARY EQUITY AND STOCKHOLDERS’ DEFICIT |

||||||||||||||||||||

| Revolving credit facility |

22,000 | — | (22,000 | ) | F | — | ||||||||||||||

| Accounts payable |

23,181 | 156 | (418 | ) | D | 22,919 | ||||||||||||||

| Accrued liabilities |

12,496 | 4,647 | (4,347 | ) | D | 17,839 | ||||||||||||||

| 1,050 | G | |||||||||||||||||||

| 4,075 | H | |||||||||||||||||||

| (82 | ) | I | ||||||||||||||||||

| Income taxes payable |

199 | — | 199 | |||||||||||||||||

| Due to related parties |

— | 772 | 772 | |||||||||||||||||

| Current portion of capital lease obligations |

641 | — | 641 | |||||||||||||||||

| Current portion of deferred revenue |

7,074 | — | 7,074 | |||||||||||||||||

| Current portion of term loan payable |

3,153 | — | 3,153 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total current liabilities |

68,744 | 5,575 | (21,722 | ) | 52,597 | |||||||||||||||

As of June 30, 2021 |

||||||||||||||||||

Maple (Historical) |

CTAC (Historical) |

Transaction Accounting Adjustments |

Pro Forma Combined |

|||||||||||||||

| Non-current liabilities: |

||||||||||||||||||

| Deferred tax liabilities |

38,474 | — | 38,474 | |||||||||||||||

| Due to related parties |

1,565 | — | (1,565 | ) | I | — | ||||||||||||

| Warrant liability |

13,561 | 14,704 | (13,561 | ) | E | 450 | ||||||||||||

| (14,254 | ) | O | ||||||||||||||||

| Capital lease obligations |

362 | — | 362 | |||||||||||||||

| Term loan payable, net |

297,773 | — | 297,773 | |||||||||||||||

| Convertible note |

— | — | 93,413 | J | 93,413 | |||||||||||||

| Deferred underwriting commissions |

— | 9,071 | (9,071 | ) | C | — | ||||||||||||

| Other long-term liabilities |

4,296 | 4,296 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| Total non-current liabilities |

356,031 | 23,775 | 54,962 | 434,768 | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| TOTAL LIABILITIES |

424,775 |

29,350 |

33,240 |

487,365 |

||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| COMMITMENTS AND CONTINGENCIES |

||||||||||||||||||

| Temporary equity: |

||||||||||||||||||

| Common stock subject to possible redemption |

— | 226,049 | (226,049 | ) | N | — | ||||||||||||

| Series A Preferred Stock |

82,562 | — | (85,218 | ) | E | — | ||||||||||||

| 2,656 | M | |||||||||||||||||

| Series A-1 Preferred Stock |

83,982 | — | (86,862 | ) | E | — | ||||||||||||

| 2,880 | M | |||||||||||||||||

| Series B Preferred Stock |

95,474 | — | (97,835 | ) | E | — | ||||||||||||

| 2,361) | M | |||||||||||||||||

| Series C Preferred Stock |

16,502 | — | (16,502 | ) | E | — | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| Total temporary equity |

278,520 | — | (278,520 | ) | — | |||||||||||||

| Stockholders’ equity (deficit): |

||||||||||||||||||

| Class A Common Stock |

2 | 1 | 2 | B | 7 | |||||||||||||

| 2 | N | |||||||||||||||||

| 3 | E | |||||||||||||||||

| (1 | ) | L | ||||||||||||||||

| (2 | ) | K | ||||||||||||||||

| Class B Common Stock |

— | 1 | (1 | ) | L | — | ||||||||||||

| Additional paid-in-capital |

121,322 | 18,618 | 224,998 | B | 408,362 | |||||||||||||

| (22,877 | ) | D | ||||||||||||||||

| 226,047 | N | |||||||||||||||||

| 70,060 | E | |||||||||||||||||

| 14,254 | O | |||||||||||||||||

| (13,617 | ) | L | ||||||||||||||||

| (118 | ) | H | ||||||||||||||||

| (7,897 | ) | M | ||||||||||||||||

| (222,428 | ) | K | ||||||||||||||||

| Accumulated other comprehensive loss |

(1,834 | ) | — | (1,834 | ) | |||||||||||||

| Accumulated deficit |

(121,692 | ) | (13,619 | ) | 998 | C | (126,529 | ) | ||||||||||

| (828 | ) | D | ||||||||||||||||

| (1,050 | ) | G | ||||||||||||||||

| (3,957 | ) | H | ||||||||||||||||

| 13,619 | L | |||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| Total stockholders’ equity (deficit) |

(2,202 | ) | 5,001 | 277,207 | 280,006 | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| TOTAL LIABILITIES, TEMPORARY EQUITY AND STOCKHOLDERS’ EQUITY (DEFICIT) |

701,093 |

260,400 |

(194,122 |

) |

767,371 |

|||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

For the Six Months Ended June 30, 2021 |

||||||||||||||||||||

Maple (Historical) |

CTAC (Historical) |

Transaction Accounting Adjustments |

Pro Forma Combined |

|||||||||||||||||

| Revenue |

||||||||||||||||||||

| Revenue |

116,040 | — | — | 116,040 | ||||||||||||||||

| Cost of revenues: |

||||||||||||||||||||

| Cost of revenues |

53,709 | — | — | 53,709 | ||||||||||||||||

| Operating expenses |

||||||||||||||||||||

| Selling, general and administrative |

40,525 | 5,460 | (4,209 | ) | BB | 41,146 | ||||||||||||||

| (630 | ) | DD | ||||||||||||||||||

| Selling, general and administrative - related party |

— | 575 | (575 | ) | BB | — | ||||||||||||||

| Depreciation and amortization |

25,507 | — | 25,507 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

66,032 |

6,035 |

(5,414 |

) |

66,653 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Operating profit (loss) |

(3,701 |

) |

(6,035 |

) |

5,414 |

(4,322 |

) | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Other income (expense) |

||||||||||||||||||||

| Interest expense, including amortization of debt issuance costs, net |

(10,565 | ) | — | 601 | EE | (12,717 | ) | |||||||||||||

| 9 | FF | |||||||||||||||||||

| (2,762 | ) | GG | ||||||||||||||||||

| Change in fair value of warrant liability |

2,383 | (2,674 | ) | (2,383 | ) | HH | (82 | ) | ||||||||||||

| 2,592 | II | |||||||||||||||||||

| Investment income from Trust Account |

— | 13 | (13 | ) | KK | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) before income taxes |

(11,883 |

) |

(8,696 |

) |

3,458 |

(17,121 |

) | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Income tax provision (benefit) |

||||||||||||||||||||

| Current |

391 | — | 812 | LL | 1,203 | |||||||||||||||

| Deferred |

(4,308 | ) | — | (4,308 | ) | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total income tax provision (benefit) |

(3,917 |

) |

— |

812 |

(3,105 |

) | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

(7,966 |

) |

(8,696 |

) |

2,646 |

(14,016 |

) | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Basic and diluted weighted average shares outstanding of Class A ordinary shares |

227,433 | 26,735,238 | 72,242,919 | |||||||||||||||||

| Basic and diluted net income per share, Class A ordinary shares |

$ | (100.65 | ) | $ | — | $ | (0.19 | ) | ||||||||||||

| Basic and diluted weighted average shares outstanding of Class B ordinary shares |

— | 6,479,225 | — | |||||||||||||||||

| Basic and diluted net income per share, Class B ordinary shares |

— | (1.34 | ) | — | ||||||||||||||||

For the Year Ended December 31, 2020 |

||||||||||||||||||||

Maple (Historical) |

CTAC (Historical) |

Transaction Accounting Adjustments |

Pro Forma Combined |

|||||||||||||||||

| Revenue |

||||||||||||||||||||

| Revenue |

213,760 | — | — | 213,760 | ||||||||||||||||

| Cost of revenues: |

||||||||||||||||||||

| Cost of revenues |

97,930 | — | — | 97,930 | ||||||||||||||||

| Operating expenses |

||||||||||||||||||||

| Selling, general and administrative |

72,883 | 515 | 2,100 | AA | 81,893 | |||||||||||||||

| 819 | BB | |||||||||||||||||||

| 5,576 | CC | |||||||||||||||||||

| Selling, general and administrative - related party |

— | 158 | (158 | ) | BB | — | ||||||||||||||

| Depreciation and amortization |

52,488 | — | 52,488 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

125,371 |

673 |

8,337 |

134,381 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Operating profit (loss) |

(9,541 |

) |

(673 |

) |

(8,337 |

) |

(18,551 |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Other income (expense) |

||||||||||||||||||||

| Interest expense, including amortization of debt issuance costs, net |

(23,493 | ) | 40 | FF | (28,977 | ) | ||||||||||||||

| (5,524 | ) | GG | ||||||||||||||||||

| Change in fair value of warrant liability |

(7,485 | ) | (3,779 | ) | 7,485 | HH | (116 | ) | ||||||||||||

| 3,663 | II | |||||||||||||||||||

| Offering costs attributable to warrants |

(446 | ) | 433 | JJ | (13 | ) | ||||||||||||||

| Investment income from Trust Account |

— | 4 | (4 | ) | KK | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) before income taxes |

(40,519 |

) |

(4,894 |

) |

(2,244 |

) |

(47,657 |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Income tax provision (benefit) |

||||||||||||||||||||

| Current |

1,051 | — | (3,348 | ) | LL | (2,297 | ) | |||||||||||||

| Deferred |

(6,369 | ) | — | (6,369 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total income tax provision (benefit) |

(5,318 |

) |

— |

(3,348 |

) |

(8,666 |

) | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

(35,201 |

) |

(4,894 |

) |

1,104 |

(38,991 |

) | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Basic and diluted weighted average shares outstanding of Class A ordinary shares |

227,455 | 26,386,259 | 72,242,919 | |||||||||||||||||

| Basic and diluted net income per share, Class A ordinary shares |

$ | (273.03 | ) | $ | — | $ | (0.48 | ) | ||||||||||||

| Basic and diluted weighted average shares outstanding of Class B ordinary shares |

— | 6,355,484 | — | |||||||||||||||||

| Basic and diluted net income per share, Class B ordinary shares |

— | (0.77 | ) | — | ||||||||||||||||

1. |

Basis of Presentation |

| • | CTAC’s unaudited balance sheet as of June 30, 2021 and the related notes for the six months ended June 30, 2021, included elsewhere in this prospectus; and |

| • | Maple’s unaudited condensed balance sheet as of June 30, 2021 and the related notes for the six months ended June 30, 2021, included elsewhere in this prospectus. |

| • | CTAC’s unaudited statement of operations for the six months ended June 30, 2021 and the audited statement of operations for the period from September 8, 2020 (inception) through December 31, 2020 (as Restated) included elsewhere in this prospectus; and |

| • | Maple’s unaudited condensed statement of operations for the six months ended June 30, 2021 and the audited statement of operations for the year ended December 31, 2020 and the related notes, included elsewhere in this prospectus. |

2. |

Accounting Policies |

3. |

Adjustments to Summary Pro Forma Information |

| (A) | Reflects the reclassification of $259.2 million of marketable securities held in the trust account at the balance sheet date that becomes available to fund the business combination. |

| (B) | Represents the net proceeds from the private placement of 22.5 million shares of common stock at $10.00 per share pursuant to the PIPE Investment. |

| (C) | Reflects the settlement of $9.1 million of deferred underwriting fees for cash of $8.1 million. |

| (D) | Represents transaction costs of $30.7 million, in addition to the deferred underwriting fees noted in (C) above, inclusive of advisory, banking, printing, legal and accounting fees that were capitalized into additional paid-in capital or expensed. The unaudited pro forma combined balance sheet reflects these transaction costs as a reduction of cash of $25.4 million, as $1.8 million of transaction costs were paid prior to close, $1.9 million of transaction costs were settled in common stock, and $1.6 million of transaction costs will be paid shortly after closing. As of June 30, 2021, $4.8 million of liabilities were accrued between both CTAC and Maple and $3.0 million of transaction costs were capitalized as an asset for Maple. Adjustment to retained earnings of $0.8 million represents transaction costs not eligible for capitalization. |

| (E) | Represents recapitalization of Maple through the issuance of 34.6 million shares of KORE common stock to Maple shareholders as consideration for the reverse recapitalization, including the settlement of Maple warrants and Maple Series C preferred stock into shares of KORE common stock, and the settlement of Series A, A-1 and B Preferred shares with a redemption value of $269.9 million for cash of $229.9 million with the remaining $40.0 million of redemption value converted into common stock at $10.00 per share. In order to induce preferred shareholders to convert $40 million of redemption value to common stock, an additional 600,000 shares were issued to converting holders. Maple warrants are settled with Maple common stock prior to the reverse recapitalization. Shareholders of Maple common stock receive per share consideration of 139.1 shares of KORE Common Stock. Shareholders of Maple Series C preferred stock receive per share consideration of 152.7 shares of KORE Common Stock. |

| (F) | Reflects the debt repayment of Maple USB Revolving Credit Facility in the amount of $25.0 million net of the additional $3.0 million was drawn on the facility between the June 30, 2021 balance sheet date and the close of the transaction. |

| (G) | Reflects accrual of First LTIP to be paid after the deal closing. |

| (H) | Reflects payment of shares made in accordance with the Option Cancellation Agreement and accrual of the associated cash payment to be made after the deal closing. |

| (I) | Reflect the repayment of the historical Maple related party notes payable and accrued interest. |

| (J) | Reflects the proceeds from the Backstop Note in the amount of $95.1 million net of $1.7 million in financing fees. |

| (K) | Reflects the cash payment for redemptions of $222.4 million. |

| (L) | Reflects the elimination of CTAC’s historical equity balances to APIC. |

| (M) | Reflects the dividend accrued on Series A, Series A-1, and Series B from June 30, 2021 through the close date of September 30, 2021. |

| (N) | Reflects the reclassification $226.0 million of temporary equity to permanent equity. |

| (O) | Reflects the reclassification of public warrants with a fair value of $14.3 from a liability to equity upon the close of the business combination. |

| (AA) | Reflects expense related to the First LTIP Payment as part of the deal closing and the recognition of the Second LTIP (i.e. an amount not to exceed $1,050,000) rateably over the associated one year service period as of December 31, 2020. |

| (BB) | Reflects the reversal of capitalizable transaction costs and related party expenses which would not have been expensed and the recognition of non-capitalizable transaction cost which would have been expensed immediately had the transaction taken place January 1, 2020. |

| (CC) | Reflects an expense for the payment of cash and shares made in accordance with the Option Cancellation Agreement. |

| (DD) | Reflects the reversal of compensation costs recognized during the six months ended June 30, 2021 related to options settled in the Option Cancellation Agreement. |

| (EE) | Reflects the elimination of historical interest expense on the revolving credit facility repaid through the transaction proceeds. |

| (FF) | Reflects the elimination of historical interest expense on the related party notes repaid through the transaction proceeds. |

| (GG) | Reflects interest and amortization of debt issuance costs related to Backstop Note. |

| (HH) | Reflects the elimination of the historical change in fair value of the Maple warrant liability of $2.4 million and $(7.5) million due to the settlement of the Maple warrants through KORE Common Stock for the six months ended June 30, 2021 and year ended December 31, 2020, respectively. |

| (II) | Reflects the elimination of the historical change in fair value of the CTAC public warrant liability of $(2.6) million and $(3.7) million due to the reclassification of the public warrants from liability classified to equity instruments at the close of the business combination for the six months ended June 30, 2021 and year ended December 31, 2020, respectively. |

| (JJ) | Reflects the elimination of offering costs attributable to public warrants due to the reclassification of the public warrants from liability classified to equity instruments at the close of the business combination for the year ended December 31, 2020. |

| (KK) | Reflects the elimination of investment income and unrealized loss on the trust account. |

| (LL) | Reflects tax effects of income statement pro forma adjustments above. |

4. |

Loss per Share |

For the year ended December 31, 2020 |

For the six months ended June 30, 2021 |

|||||||

| Pro forma net loss |

(38,991 | ) | (14,016 | ) | ||||

| Premium on preferred conversion to common shares |

4,074 | — | ||||||

| |

|

|

|

|||||

| (34,917 | ) | (14,016 | ) | |||||

| Weighted average shares outstanding of common stock |

72,242,919 | 72,242,919 | ||||||

| Net loss per share (Basic and Diluted) attributable to common stockholders |

$ | (0.48 | ) | $ | (0.19 | ) | ||

| • | Connected Health |

| • | Fleet Management |

| • | Asset Monitoring |

| • | Communication Services |

| • | Industrial IoT |

| Product line |

Products |

Product description |

Primary pricing method | |||

| Connectivity 72% of Q2 2021 and full year 2020 revenue |

Connectivity as a Service (CaaS) |

• IoT Connectivity services offered through our IoT platform ‘KORE One’ |

Per subscriber per month for lifetime of device (7-10 years and growing)Long-term customer relationships | |||

| • Our connectivity solutions allow devices to seamlessly and securely connect anywhere in the world across any connected network, which we call our multiple devices, multiple locations, multiple carriers CaaS value prop | ||||||

Connectivity Enablement as a Service (CEaaS) |

• Connectivity Management Platform as a Service (or individual KORE One engine) • Cellular Core Network as a Service (cloud native HyperCore) | |||||

IoT Device Management Services |

• Outsourced platform-enabled services (e.g., logistics, configuration, device management) • Sourcing of 3rd party devices globally, device design and selection services |

Upfront fee per device or per device per month | ||||

IoT Solutions 28% of Q2 2021 and full year 2020 revenue |

IoT Security |

• KORE’s SecurityPro SaaS platform |

Per subscriber per month | |||

| Location Based Services (LBS) |

• KORE’s PositionLogic SaaS platform and LBS APIs |

| • | IoT Device Management Services |

| • | Location Based Services |

| • | IoT Security (SecurityPro) |

| • | Massive TAM and Disruptive End-Market Use Cases |

| • | KORE Touchpoints |

| • | Provides 5G connectivity and simplified management with 5G-ready eSIM and multi value proposition enabled by the proprietary KORE One platform. |

| • | Enables seamless transition to 5G with its strength in carrier relationships and experience in managing network transitions. |

| • | Accelerates 5G use cases with pre-configured solutions and an industry-specific IoT Managed Services portfolio. |

| • | Enables edge deployments with a roadmap for a fully virtualized multi-carrier gateway on the Edge (KORE Anywhere). |

| • | Enables private network deployments with a fully virtualized core network (KORE HyperCore). |

| • | Leveraging eSIM Technology . IoT-connected devices coming online, 25 billion by 2025 according to Ericsson, one of the bigger challenges to achieving this growth is current SIM card technology. Today, the vast majority of cellular connected devices are using SIM cards which are locked into a specific cellular carrier. The GSMA has helped develop a new standard called eSIM technology. eSIM or embedded universal integrated circuit card (“eUICC”) is a form of programmable SIM card. eSIM technology offers several benefits, including: |

| • | Enables devices to store multiple operator profiles on a device simultaneously and switch between them remotely. |

| • | Allows over air (remote) updates. |

| • | Permits remote SIM provisioning of any mobile device. |

| • | Delivers an effective way to significantly increase data security. |

| • | Offers protection from evolving network technologies, such as the retirement of legacy services like 2G and 3G in some cases eSIM technology plays a critical role providing secure out-of-the |

| • | For Connectivity services: T-Mobile and Vodafone; Mobile Virtual Network Operators such as Aeris and Wireless Logic; and |

| • | For IoT Solutions and Analytics: |

| • | Significant organic volume growth from existing customer base |

| • | Cross-sell and upsell KORE’s growing portfolio of IoT Solutions to our large base of Connectivity services only customers |

| • | Deepening our presence in focus industry sector pre-configured industry solutions . |

| • | Enhance “AIoT” (Artificial Intelligence + IoT) and Edge Analytics capabilities in target industries. |

| • | Drive growth through strategic, accretive acquisitions, which add key capabilities. |

| • | KORE’s Connectivity Services |

| • | CaaS |

| • | CEaaS |

| • | KORE’s IoT Solutions and Analytics |

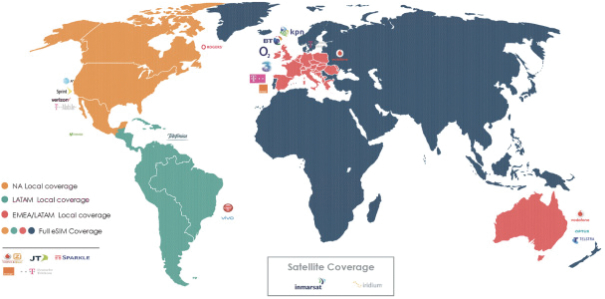

1. |

KORE One Platform |

2. |

KORE eSIM |

3. |

KORE HyperCore (Cellular Network as a Service) |

4. |

IoT Network and Application Services |

| a. | ConnectivityPro TM |

| b. | SecurityPro TM |

| c. | PositionLogic TM : in-vehicle video, cargo monitoring, safety & security etc. |

| • | Connected Health |

| • | Fleet Management |

| • | Asset Monitoring |

| • | Communication Services |

| • | Industrial IoT |

| • | Lack of readily available in-house IoT resources and expertise |

| • | Significant time required to get to market |

| • | High failure rate of IoT initiatives |

| • | A highly fragmented vendor landscape |

| • | Ecosystem that is quickly evolving and changing rapidly |

| • | Substantial and increasing regulatory/compliance issues |

| • | Interoperability and compatibility with assorted technologies |

| • | We believe KORE One is now an industry leading platform for IoT subscription and network management, and which provides us with a competitive edge in the market. |

| • | KORE has enhanced its rankings within the IoT industry analysts. |

| • | KORE’s product portfolio has expanded significantly. A few years ago KORE was primarily IoT Connectivity focused while today its product portfolio includes IoT Solutions such as IoT Deployment Services and Security Software and Services. KORE’s IoT Connectivity have also become richer through the addition of the eSIMs and “Connectivity Enablement as a Service” to the IoT Connectivity product portfolio. |

| • | IoT Solutions has increased as a proportion of KORE’s total revenue each year since 2018. In the year ended December 31, 2020, IoT Solutions represented 26% of KORE’s total revenue while in the year ended December 31, 2019, IoT Solutions represented 11% of revenue. |

| • | For IoT Connectivity T-Mobile and Vodafone; Mobile Virtual Network Operators such as Aeris and Wireless Logic; |

| • | For IoT Solutions and Analytics Integron Acquisition |

| • | Organic volume growth - leveraging the strong IoT industry growth expressed in terms of our customers’ revenue, device and data usage growth, while continuing to maintain high customer retention |

| • | Cross-sell and upsell - selling KORE’s growing portfolio of IoT solutions developed during the prior two years and going-forward, to our large base of IoT Connectivity only customers |

| • | Deepening our presence in focus industry sector - developing more of a vertical orientation in our business and deepening industry domain knowledge that will in turn allow the development and deployment of pre-configured industry solutions |

| • | Enhancing AIoT (Artificial Intelligence + IoT) and Edge Analytics capabilities |

| • | Strategic acquisitions that will allow KORE to expand our IoT solutions and advanced connectivity capabilities while ensuring a highly disciplined use of capital for such acquisitions |

| • | The number of carrier integrations (44) |

| • | KORE One platform (7 engines) |

| • | ConnectivityPro service and related APIs |

| • | eSIM technology stack/ proprietary IP |

| • | Hypercore technology |

| • | Deep industry vertical knowledge and experience ( e.g. |

| • | Breadth of solutions and analytics services |

| • | 3,400+ connectivity-only customers for cross-sell opportunities |

Six Months Ended June 30, |

Years Ended December 31, |

|||||||||||||||||||||||||||||||

2021 |

2020 |

2020 |

2019 |

|||||||||||||||||||||||||||||

| Services |

$ | 91,437 | 79 | % | $ | 83,677 | 83 | % | $ | 172,845 | 81 | % | $ | 159,425 | 94 | % | ||||||||||||||||

| Products |

24,603 | 21 | % | 17,363 | 17 | % | 40,915 | 19 | % | 9,727 | 6 | % | ||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total revenues |

$ |

116,040 |

100 |

% |

$ |

101,040 |

100 |

% |

$ |

213,760 |

100 |

% |

$ |

169,152 |

100 |

% | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Six Months Ended June 30, |

Years Ended December 31, |

|||||||||||||||||||||||||||||||

2021 |

2020 |

2020 |

2019 |

|||||||||||||||||||||||||||||

| Connectivity |

$ | 84,048 | 72 | % | $ | 75,577 | 75 | % | $ | 158,748 | 74 | % | $ | 150,358 | 89 | % | ||||||||||||||||

| IoT Solutions |

31,992 | 28 | % | 25,463 | 25 | % | 55,012 | 26 | % | 18,794 | 11 | % | ||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total revenues |

$ |

116,040 |

100 |

% |

$ |

101,040 |

100 |

% |

$ |

213,760 |

100 |

% |

$ |

169,152 |

100 |

% | ||||||||||||||||

| Period End Connections Count |

13.2 million | 10.2 million | 11.8 million | 9.7 million | ||||||||||||||||||||||||||||

| Average Connections Count for the Period |

13.1 million | 10.0 million | 10.7 million | |

9.2 million |

| ||||||||||||||||||||||||||

(in ‘000) |

For six months ended |

For the years ended |

||||||||||||||||||||||||||||||

June 30, |

Change |

December 31, |

Change |

|||||||||||||||||||||||||||||

2021 |

2020 |

Dollars |

% |

2020 |

2019 |

Dollars |

% |

|||||||||||||||||||||||||

| Cost of services |

$ | 34,037 | $ | 31,918 | 2,119 | 7 | % | $ | 64,520 | $ | 57,621 | 6,899 | 12 | % | ||||||||||||||||||

| Cost of products |

19,672 | 13,068 | 6,604 | 51 | % | 33,410 | 6,044 | 27,366 | 453 | % | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total cost of revenues |

$ |

53,709 |

$ |

44,986 |

8,723 |

19 |

% |

$ |

97,930 |

$ |

63,665 |

34,265 |

54 |

% | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

(in ‘000) |

For six months ended |

For the years ended |

||||||||||||||||||||||||||||||

June 30, |

Change |

December 31, |

Change |

|||||||||||||||||||||||||||||

2021 |

2020 |

Dollars |

% |

2020 |

2019 |

Dollars |

% |

|||||||||||||||||||||||||

| Cost of connectivity |

$ | 32,618 | $ | 30,500 | 2,118 | 7 | % | $ | 63,706 | $ | 56,139 | 7,567 | 13 | % | ||||||||||||||||||

| Cost of IoT Solutions |

21,091 | 14,486 | 6,605 | 46 | % | 34,224 | 7,526 | 26,698 | 355 | % | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total cost of revenues |

$ |

53,709 |

$ |

44,986 |

$ |

8,723 |

19 |

% |

$ |

97,930 |

$ |

63,665 |

34,265 |

54 |

% | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

(in ‘000 |

For six months ended |

For the years ended |

||||||||||||||||||||||||||||||

June 30, |

Change |

December 31, |

Change |

|||||||||||||||||||||||||||||

2021 |

2020 |

Dollars |

% |

2020 |

2019 |

Dollars |

% |

|||||||||||||||||||||||||

| Selling, general and administrative expenses |

$ | 40,525 | $ | 32,115 | 8,410 | 26 | % | $ | 72,883 | $ | 65,298 | 7,585 | 12 | % | ||||||||||||||||||

(in ‘000 |

For six months ended |

For the years ended |

||||||||||||||||||||||||||||||

June 30, |

Change |

December 31, |

Change |

|||||||||||||||||||||||||||||

2021 |

2020 |

Dollars |

% |

2020 |

2019 |

Dollars |

% |

|||||||||||||||||||||||||

| Depreciation and amortization |

$ | 25,507 | $ | 25,708 | (201 | ) | (1 | )% | $ | 52,488 | $ | 48,131 | 4,357 | 9 | % | |||||||||||||||||

For six months ended |

For the years ended |

|||||||||||||||||||||||||||||||

June 30, |

Change |

December 31, |

Change |

|||||||||||||||||||||||||||||

2021 |

2020 |

Dollars |

% |

2020 |

2019 |

Dollars |

% |

|||||||||||||||||||||||||

| Intangible asset impairment loss |

$ | — | $ | — | — | % | $ | — | $ | (3,892 | ) | (3,892 | ) | (100 | )% | |||||||||||||||||

For six months ended |

For the years ended |

|||||||||||||||||||||||||||||||

June 30, |

Change |

December 31, |

Change |

|||||||||||||||||||||||||||||

2021 |

2020 |

Dollars |

% |

2020 |

2019 |

Dollars |

% |

|||||||||||||||||||||||||

| Interest expense including amortization of debt issuance costs, net |

$ | (10,565 | ) | $ | (13,084 | ) | 2,519 | (19 | )% | $ | (23,493 | ) | $ | (24,785 | ) | 1,292 | (5 | )% | ||||||||||||||

| Change in fair value of warrant liability |

2,383 | (2,831 | ) | 5,214 | (184 | )% | (7,485 | ) | 235 | (7,720 | ) | (3,285 | )% | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total other expense |

$ |

(8,182 |

) |

$ |

(15,915 |

) |

7,733 |

49 |

% |

$ |

(30,978 |

) |

$ |

(24,550 |

) |

(6,428 |

) |

(26 |

)% | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

For six months ended |

For the years ended |

|||||||||||||||||||||||||||||||

June 30, |

Change |

December 31, |

Change |

|||||||||||||||||||||||||||||

2021 |

2020 |

Dollars |

% |

2020 |

2019 |

Dollars |

% |

|||||||||||||||||||||||||

| Income tax benefit |

$ | (3,917 | ) | $ | (3,858 | ) | (59 | ) | 2 | % | $ | (5,318 | ) | $ | (12,941 | ) | 7,623 | (59 | )% | |||||||||||||

| • | The Company used $14.3 million and provided $12.0 million of cash flows from operating activities for the six months ended June 30, 2021 and 2020, respectively. |

| • | The Company’s investment activity used $4.8 million and $5.5 million to internally develop computer software (either through internal employees or third-party service providers) for the six months ended June 30, 2021 and 2020, respectively. |

| • | The Company drew $22.0 and $21.7 million on and repaid $0.0 and $15.0 million of its revolving line of credit during the six months ended June 30, 2021 and 2020, respectively. |

| • | The Company generated $26.5 million and $14.3 million of cash flows from operating activities for the years ended December 31, 2020 and 2019, respectively. |

| • | The Company invested $10.1 million and $10.5 million to internally develop computer software (either through internal employees or third-party service providers) for the years ended December 31, 2020 and 2019, respectively. |

| • | On November 12, 2019, the Company amended its term loan with UBS in order to raise an additional $35 million. Under the amended agreement, the maturity date of the term loan (December 21, 2024) and interest rate (LIBOR plus 5.5%) remained unchanged. However, the quarterly principal repayment changed to $0.8 million. The principal and quarterly interest are paid on the last business day of each quarter, except at maturity. The Company used the additional term loan to finance the Integron Acquisition. The Company also drew $8.1 million from its revolving credit facility primarily to finance the Integron Acquisition and to support its operations immediately following the acquisition. |

| • | On November 22, 2019, the Company completed the Integron Acquisition for cash consideration of $37.5 million and issuance of 4,118 shares of common stock. |

| • | During the year ended December 31, 2020, the Company repaid $8.3 million of its revolving credit facility. |

(in 000’s) |

For the six months ended June 30, |

|||||||

2021 |

2020 |

|||||||

| Net loss |

$ | (7,966 | ) | $ | (13,826 | ) | ||

| Income tax expense (benefit) |

(3,917 | ) | (3,858 | ) | ||||

| Interest expense |

10,565 | 13,084 | ||||||

| Depreciation and amortization |

25,507 | 25,708 | ||||||

| |

|

|

|

|||||

| EBITDA |

24,189 |

21,108 |

||||||

| |

|

|

|

|||||

| Change in fair value of warrant liabilities (non-cash) |

(2,383 | ) | 2,831 | |||||

| Transformation expense |

3,750 | 3,840 | ||||||

| Acquisition and integration-related restructuring costs |

4,518 | 2,397 | ||||||

| Stock-based compensation (non-cash) |

630 | 531 | ||||||

| Foreign currency loss (gain) (non-cash) |

77 | (1,684 | ) | |||||

| Other |

296 | 110 | ||||||

| |

|

|

|

|||||

| Adjusted EBITDA |

$ |

31,077 |

$ |

29,133 |

||||

| |

|

|

|

|||||

For the years ended December 31, |

||||||||

(in 000’s) |

2020 |

2019 |

||||||

| Net loss |

$ | (35,201 | ) | $ | (23,443 | ) | ||

| Income tax expense (benefit) |

(5,318 | ) | (12,941 | ) | ||||

| Interest expense |

23,493 | 24,785 | ||||||

| Depreciation and amortization |

52,488 | 48,131 | ||||||

| |

|

|

|

|||||

| EBITDA |

35,462 |

36,532 |

||||||

| |

|

|

|

|||||

| Intangible asset impairment loss |

— | 3,892 | ||||||

| Change in fair value of warrant liabilities (non-cash) |

7,485 | (235 | ) | |||||

| Transformation expense |

7,354 | 8,959 | ||||||

| Acquisition and integration-related restructuring costs |

5,709 | 6,475 | ||||||

| Contingent carrier liability reversal (non-cash) |

— | (3,984 | ) | |||||

| Sales tax liability reversal (non-cash) |

— | (2,200 | ) | |||||

| VAT liability reversal (non-cash) |

— | (1,456 | ) | |||||

| Stock-based compensation (non-cash) |

1,161 | 1,682 | ||||||

| Other income tax liability reversal (non-cash) |

80 | 121 | ||||||

| Foreign currency loss (gain) (non-cash) |

233 | 1,440 | ||||||

| Other |

335 | (341 | ) | |||||

| |

|

|

|

|||||

| Adjusted EBITDA |

$ |

57,819 |

$ |

50,885 |

||||

| |

|

|

|

|||||

| • | each person who is known to be the beneficial owner of more than 5% of shares of Pubco Common Stock; |

| • | each of Pubco’s current named executive officers and directors; and |

| • | all current executive officers and directors of Pubco as a group. |

| Name and Address of Beneficial Owner ) |

Number of PubCo Shares |

% |

||||||

| CTAC Sponsor (our sponsor) (1) |

6,970,342 | 9.7 | % | |||||

| Entities affiliated with ABRY Partners LLC (2)(3) |

24,252,912 | 33.6 | % | |||||

| Dotmar Investments Limited (4) |

4,000,711 | 5.6 | % | |||||

| TDJ Company LLC (5) |

4,983,527 | 6.9 | % | |||||

| Directors and Executive Officers |

||||||||

| Romil Bahl |

158,804 | * | ||||||

| Puneet Pamnani |

38,065 | * | ||||||

| Bryan Lubel |

18,171 | * | ||||||

| Cheemin Bo-Linn |

— | — | ||||||

| Timothy M. Donahue |

— | — | ||||||

| Chan W. Galbato |

— | — | ||||||

| Robert P. MacInnis |

— | — | ||||||

| Michael K. Palmer |

— | — | ||||||

| Tomer Yosef-Or |

— | — | ||||||

| All Pubco directors and executive officers as a group (9 individuals) |

40,422,532 | 56.0 | % | |||||

| * | Less than one percent |

| (1) | Sponsor is the recordholder of the shares reported herein. The Sponsor is controlled by a board of managers comprised of Stephen A. Feinberg and Frank W. Bruno. Messrs. Feinberg and Bruno, as members of the board of managers of the Sponsor, have the sole right to exercise voting power with respect to the common stock held of record by the Sponsor, and have the sole right to consent to the transfer of such shares of common stock. The business address of the Sponsor is 875 Third Avenue, New York, New York 10022. |

| (2) | 21,500,782 of the shares reported herein are owned directly by ABRY Partners VII, L.P. 1,240,202 of the shares reported herein are owned directly by ABRY Partners VII Co-Investment Fund, L.P. 24,316 of the shares reported herein are owned directly by ABRY Investment Partnership, L.P. 1,288,506 of the shares reported herein are owned directly by ABRY Senior Equity IV, L.P. 199,106 of the shares reported herein are owned directly by ABRY Senior Equity Co-Investment Fund IV, L.P.P. |

| (3) | ABRY Partners VII, L.P., ABRY Partners VII Co-Investment Fund, L.P., ABRY Investment Partnership, L.P., ABRY Senior Equity IV, L.P. and ABRY Senior Equity Co-Investment Fund IV, L.P. (collectively the “ABRY Funds”) are managed and/or controlled by ABRY Partners, LLC (“ABRY I”) and ABRY Partners II, LLC (“ABRY II”) and/or their respective affiliates. ABRY I and ABRY II are investment advisors registered with the SEC. Royce Yudkoff, as managing member of ABRY I and sole member of certain of its affiliates, has the right to exercise investment and voting power on behalf of ABRY Investment Partnership, L.P. Peggy Koenig and Jay Grossman, as equal members of ABRY II and of certain of its affiliates, have the right to exercise investment and voting power on behalf of the ABRY Funds. Each of the Messrs. Yudkoff, Messrs. Grossman and Mses. Koenig disclaims any beneficial ownership of the securities held by the ABRY Funds other than to the extent of any pecuniary interest he may have therein, directly or indirectly. The business address of ABRY is 888 Boylston Street, Suite 1600, Boston, Massachusetts. |

| (4) | Dotmar Investments Limited is the recordholder of the shares reported herein. Richard Burston, as Chairman of Dotmar Investments Limited, has the right to exercise investment and voting power on behalf of Dotmar Investments Limited. Richard Burston disclaims any beneficial ownership of the securities held by the Dotmar Investments Limited other than to the extent of any pecuniary interest he may have therein, directly or indirectly. The business address of Dotmar Investments Limited is First Floor, 7 Esplanade, St Helier, Jersey JE2 3QA Channel Islands. |

| (5) | TDJ Company LLC is the recordholder of the shares reported herein. TDJ Company LLC is a wholly-owned subsidiary of Terrdian CCPC. Terence Jarman, as President of Terrdian CCPC and Administrator of TDJ Company LLC, has the right to exercise investment and voting power on behalf of each of Terrdian CCPC and TDJ LLC. Mr. Jarman disclaims any beneficial ownership of the securities held by the TDJ Company LLC, other than to the extent of any pecuniary interest he may have therein, directly or indirectly. The business address of TDJ Company LLC is 10 High Point Rd, Toronto, Ontario M3B 2A4, Canada. |

| Name |

Age |

Title | ||

| Romil Bahl |

53 | President, Chief Executive Officer and Director | ||

| Puneet Pamnani |

48 | Executive Vice President and Chief Financial Officer | ||

| Bryan Lubel |

57 | Executive Vice President, Connected Health | ||

| Cheemin Bo-Linn |

67 | Director | ||

| Timothy M. Donahue |

72 | Director | ||

| Chan W. Galbato |

58 | Director | ||

| Robert P. MacInnis |

55 | Director | ||

| Michael K. Palmer |

35 | Director | ||

| Tomer Yosef-Or |

42 | Director |

| • | the Class I directors are Timothy Donahue and Cheemin Bo-Linn and their terms will expire at the annual meeting of stockholders to be held in 2022; |

| • | the Class II directors are Michael Palmer and Chan Galbato and their terms will expire at the annual meeting of stockholders to be held in 2023; and |

| • | the Class III directors are Robert MacInnis, Tomer Yosef-Or and Romil Bahl and their terms will expire at the annual meeting of stockholders to be held in 2024. |

| • | appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; |

| • | discussing with our independent registered public accounting firm their independence from management; |

| • | reviewing with our independent registered public accounting firm the scope and results of their audit; |

| • | pre-approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

| • | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that the Company files with the SEC; |

| • | reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; and |

| • | establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters. |

| • | reviewing and setting or making recommendations to our board of directors regarding the compensation of our executive officers; |

| • | making recommendations to our board of directors regarding the compensation of our directors; |

| • | reviewing and approving or making recommendations to our board of directors regarding incentive compensation and equity-based plans and arrangements; and |

| • | appointing and overseeing any compensation consultants. |

| • | Romil Bahl, President and Chief Executive Officer; |

| • | Puneet Pamnani, Executive Vice President and Chief Financial Officer; and |

| • | Bryan Lubel, Executive Vice President, Connected Health. |

| Name and Principal Position |

Salary ($) |

Bonus ($)(1) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($)(2) |

All Other Compensation ($)(3) |

Total ($) |

||||||||||||||||||

| Romil Bahl |

750,000 | 100,000.00 | 0.00 | 982,969.00 | 36,201.00 | 1,869,170 | ||||||||||||||||||

| President and Chief Executive Officer |

||||||||||||||||||||||||

| Puneet Pamnani |

330,000 | 0.00 | 0.00 | 490,174.00 | 23,213.00 | 843,387 | ||||||||||||||||||

| Executive Vice President and Chief Financial Officer |

||||||||||||||||||||||||

| Bryan Lubel |

330,000 | 0.00 | 0.00 | 417,966.00 | 8,137.00 | 756,103 | ||||||||||||||||||

| Executive Vice President, Connected Health |

||||||||||||||||||||||||

| (1) | Mr. Bahl entered into two retention bonus agreements with KORE Wireless on March 31, 2020 and October 31, 2020, pursuant to which he received a retention bonus in an amount equal to $100,000 in the aggregate (the “ Retention Bonus |

| (2) | The amounts reported in this column represent annual cash bonuses to our named executive officers earned during the 2020 fiscal year, as further described below under “Narrative to Summary Compensation Table — 2020 Bonuses.” |

| (3) | The amounts reported in this column represent (a) the aggregate matching contributions to the KORE 401(k) Retirement Savings Plan made by the Company that vested in 2020 and (b) health insurance premiums paid by the Company on behalf of each of our named executive officers. |

| • | medical, dental and vision benefits for which the Company pays the full amount of the premiums on behalf of our named executive officers; |

| • | medical and dependent care flexible spending accounts; |

| • | short-term and long-term disability insurance and accidental death and dismemberment insurance; |

| • | life insurance; and |

| • | vacation and paid holidays. |

Option Awards |

||||||||||||||||||||||||

| Name |

Grant Date |

Vesting Commencement Date |

Number of Securities Underlying Unexercised Options (#) Exercisable (1) |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

||||||||||||||||||

| Romil Bahl |

May 7, 2018 | April 1, 2018 | 1,840 | 2,760 | 1,000 | May 7, 2028 | ||||||||||||||||||

| 1,840 | 2,760 | 1,750 | ||||||||||||||||||||||

| 1,840 | 2,760 | 2,500 | ||||||||||||||||||||||

| Puneet Pamnani |

May 7, 2018 | April 1, 2018 | 460 | 690 | 1,000 | May 7, 2028 | ||||||||||||||||||

| 460 | 690 | 1,750 | ||||||||||||||||||||||

| 460 | 690 | 2,500 | ||||||||||||||||||||||

| Bryan Lubel |

November 22, 2019 | November 22, 2019 | 184 | 736 | 1,000 | November 22, 2029 | ||||||||||||||||||

| 184 | 736 | 1,750 | ||||||||||||||||||||||

| 184 | 736 | 2,500 | ||||||||||||||||||||||

| (1) | The stock options are divided pro-rata among three class of stock options: (a) the Tranche A stock options, with an exercise price of $1,000, (b) the Tranche B stock options with an exercise price of $1,750 and (c) the Tranche C stock options, with an exercise price of $2,500. The stock options vest and become exercisable over a five-year period with respect to 20% of the shares underlying the stock option on each annual anniversary of the vesting commencement date, subject to the named executive officer’s continued service. In connection with the business combination, Maple entered into an option cancellation agreement with each of the named executive officers under which each named executive officer agreed to forfeit all vested and unvested stock options in return for cash and shares of our common stock. |

| • | each person who is known to be the beneficial owner of more than 5% of our voting shares; |

| • | each of our executive officers and directors; and |

| • | all of our executive officers and directors as a group. |

| Name and Address of Beneficial Owner ) |

Number of PubCo Shares |

% |

||||||

| CTAC Sponsor (our sponsor) (1) |

6,970,342 | 9.7 | % | |||||

| Entities affiliated with ABRY Partners LLC (2)(3) |

24,252,912 | 33.6 | % | |||||

| Dotmar Investments Limited (4) |

4,000,711 | 5.6 | % | |||||

| TDJ Company LLC (5) |

4,983,527 | 6.9 | % | |||||

| Directors and Executive Officers |

||||||||

| Romil Bahl |

158,804 | * | ||||||

| Puneet Pamnani |

38,065 | * | ||||||

| Bryan Lubel |

18,171 | * | ||||||

| Cheemin Bo-Linn |

— | — | ||||||

| Timothy M. Donahue |

— | — | ||||||

| Chan W. Galbato |

— | — | ||||||

| Robert P. MacInnis |

— | — | ||||||

| Michael K. Palmer |

— | — | ||||||

| Tomer Yosef-Or |

— | — | ||||||

| All Pubco directors and executive officers as a group (9 individuals) |

40,422,532 | 56.0 | % | |||||

| * | Less than one percent |

| (1) | Sponsor is the recordholder of the shares reported herein. The Sponsor is controlled by a board of managers comprised of Stephen A. Feinberg and Frank W. Bruno. Messrs. Feinberg and Bruno, as members of the board of managers of the Sponsor, have the sole right to exercise voting power with respect to the common stock held of record by the Sponsor, and have the sole right to consent to the transfer of such shares of common stock. The business address of the Sponsor is 875 Third Avenue, New York, New York 10022. |

| (2) | 21,500,782 of the shares reported herein are owned directly by ABRY Partners VII, L.P. 1,240,202 of the shares reported herein are owned directly by ABRY Partners VII Co-Investment Fund, L.P. 24,316 of the shares reported herein are owned directly by ABRY Investment Partnership, L.P. 1,288,506 of the shares reported herein are owned directly by ABRY Senior Equity IV, L.P. 199,106 of the shares reported herein are owned directly by ABRY Senior Equity Co-Investment Fund IV, L.P.P. |

| (3) | ABRY Partners VII, L.P., ABRY Partners VII Co-Investment Fund, L.P., ABRY Investment Partnership, L.P., ABRY Senior Equity IV, L.P. and ABRY Senior Equity Co-Investment Fund IV, L.P. (collectively the “ABRY Funds”) are managed and/or controlled by ABRY Partners, LLC (“ABRY I”) and ABRY Partners |

| II, LLC (“ABRY II”) and/or their respective affiliates. ABRY I and ABRY II are investment advisors registered with the SEC. Royce Yudkoff, as managing member of ABRY I and sole member of certain of its affiliates, has the right to exercise investment and voting power on behalf of ABRY Investment Partnership, L.P. Peggy Koenig and Jay Grossman, as equal members of ABRY II and of certain of its affiliates, have the right to exercise investment and voting power on behalf of the ABRY Funds. Each of the Messrs. Yudkoff, Messrs. Grossman and Mses. Koenig disclaims any beneficial ownership of the securities held by the ABRY Funds other than to the extent of any pecuniary interest he may have therein, directly or indirectly. The business address of ABRY is 888 Boylston Street, Suite 1600, Boston, Massachusetts. |

| (4) | Dotmar Investments Limited is the recordholder of the shares reported herein. Richard Burston, as Chairman of Dotmar Investments Limited, has the right to exercise investment and voting power on behalf of Dotmar Investments Limited. Richard Burston disclaims any beneficial ownership of the securities held by the Dotmar Investments Limited other than to the extent of any pecuniary interest he may have therein, directly or indirectly. The business address of Dotmar Investments Limited is First Floor, 7 Esplanade, St Helier, Jersey JE2 3QA Channel Islands. |

| (5) | TDJ Company LLC is the recordholder of the shares reported herein. TDJ Company LLC is a wholly-owned subsidiary of Terrdian CCPC. Terence Jarman, as President of Terrdian CCPC and Administrator of TDJ Company LLC, has the right to exercise investment and voting power on behalf of each of Terrdian CCPC and TDJ LLC. Mr. Jarman disclaims any beneficial ownership of the securities held by the TDJ Company LLC, other than to the extent of any pecuniary interest he may have therein, directly or indirectly. The business address of TDJ Company LLC is 10 High Point Rd, Toronto, Ontario M3B 2A4, Canada. |

Before the Offering |

After the Offering |

|||||||||||||||

| Name of Selling Security holders |

Number of Shares of Common Stock |

Number of Shares of Common Stock Being Offered |

Number of Shares of Common Stock |

Percentage of Outstanding Shares of Common Stock |

||||||||||||

| Spring Creek Capital, LLC (1) |

10,000,000 | 10,000,000 | — | — | ||||||||||||

| Mudrick Capital Management, L.P. (2) |

4,000,000 | 4,000,000 | — | — | ||||||||||||

| Marathon Asset Management LP (3) |

2,000,000 | 2,000,000 | — | — | ||||||||||||

| Liberty Mutual Investment Holdings LLC (4) |

1,300,000 | 1,300,000 | |

— |

|

— | ||||||||||

| BlackRock, Inc. (5) |

1,000,000 | 1,000,000 | — | — | ||||||||||||

| CVI Investments, Inc. (6) |

488,458 | 250,000 | |

238,458 |

|

* | ||||||||||

| Monashee Investment Management, LLC (7) |

600,000 | 600,000 | |

— |

|

— | ||||||||||

| Jane Street Global Trading, LLC (8) |

451,165 | 150,000 | |

301,165 |

|

* | ||||||||||

| Owl Creek Investments III, LLC (9) |

450,000 | 450,000 | |

— |

|

— | ||||||||||

| Ellington Warlander Partners LP (10) |

400,000 | 400,000 | |

— |

|

— | ||||||||||

| Venor Capital Master Fund Ltd. (11) |

400,000 | 400,000 | |

— |

|

— | ||||||||||

| Linden Capital L.P. (12) |

350,000 | 350,000 | |

— |

|

— | ||||||||||

| Walleye Opportunities Master Fund, Ltd. (13) |

350,315 | 350,000 | 315 | * | ||||||||||||

| Destinations Global Fixed Income Opportunities Fund (14) |

220,946 | 60,732 | |

160,214 |

|

* | ||||||||||

| Marshall Wace, LLP (15) |

200,000 | 200,000 | — | — | ||||||||||||

| Tech Opportunities LLC (16) |

200,000 | 200,000 | |

— |

|

— | ||||||||||

| RiverPark Strategic Income Fund (17) |

83,931 | 31,668 | |

52,263 |

|

* | ||||||||||

| Beryl Capital Partners II LP (18) |

41,917 | 41,917 | — | — | ||||||||||||

| Cohanzick Absolute Return Master Fund, Ltd (19) |

7,600 | 7,600 | |

— |

|

— | ||||||||||

| Beryl Capital Partners LP (20) |

3,407 | 3,407 | — | — | ||||||||||||

| Corbin Hedged Equity Fund, L.P. (21) |

3,290 | 3,290 | — | — | ||||||||||||

| Pinehurst Partners, L.P. (22) |

1,386 | 1,386 | — | — | ||||||||||||

| Arena Investors, LP (23) |

500,000 | 500,000 | — | — | ||||||||||||

| PlusTick Partners (QP) LP (24) |

250,000 | 200,000 | 50,000 | * | ||||||||||||

| Total |

23,302,415 | 22,500,000 | |

802,415 |

|

|

1.1% |

| ||||||||

| * | Less than 1%. |