Table of Contents

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| ☒ | Smaller reporting company | |||||

| Emerging growth company | ||||||

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

EXPLANATORY NOTE

As previously disclosed, on January 23, 2023, Rockley Photonics Holdings Limited (the “Company”) filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”) to implement a “pre-packaged” plan of reorganization (the “Plan”) in order to facilitate the restructuring of the Company. On January 24, 2023, the Company’s ordinary shares, $0.000004026575398 par value per share, trading symbol “RKLY”, and its public warrants, with each whole warrant then exercisable for one ordinary share at an exercise price of $11.50 per share, trading symbol “RKLY.WS” were suspended from trading on the New York Stock Exchange (the “NYSE”). On February 21, 2023, the Company’s ordinary shares and its public warrants were delisted from the NYSE. Accordingly, the Company does not have any securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”).

On March 10, 2023, the Bankruptcy Court entered an order (i) approving the adequacy of the Company’s disclosure statement and (ii) confirming the Plan (the “Confirmation Order”), attached hereto as Exhibit 2.1. The Plan became effective on March 14, 2023 (the “Effective Date”). Upon the filing of this Annual Report on Form 10-K, the Company intends to file a Form 15 to suspend its periodic reporting obligations under Sections 12(g) and 15(d) of the Exchange Act.

On or about March 14, 2023, in connection with the Plan, the Registrant’s ordinary shares were cancelled and no ordinary shares are outstanding as of the date of this annual report on Form 10-K. Except as provided in the Plan, all other equity, debt, convertible equity, and convertible debt of any kind issued by the Company were cancelled and are no longer outstanding as of the date of this annual report on Form 10-K. It is anticipated that the Company will be dissolved following the closing of the bankruptcy case in accordance with the Plan and Cayman law.

Unless specifically noted or the context clearly requires otherwise, all information set forth in this annual report on Form 10-K relates to the Company as it existed as of December 31, 2022 and prior to the Company’s bankruptcy filing, and does not, and is not intended and should not be read to, reflect the business, financial condition, and results of operations of the Company after the bankruptcy filing, nor of any other entity, including any entity which may result from the bankruptcy proceedings.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding Rockley Photonics Holdings Limited’s (the “Company”) future expectations, beliefs, plans, prospects, objectives, and assumptions regarding future events or performance, as well as the Company’s strategies, future operations, financial position, and estimated future financial results and anticipated costs. The words “anticipate,” “believe,” “continue,” “could,” “enable,” “estimate,” “eventual,” “expect,” “future,” “intend,” “may,” “might,” “opportunity,” “outlook,” “plan,” “possible,” “position,” “potential,” “predict,” “project,” “revolutionize,” “seem,” “should,” “trend,” “will,” “would,” and other terms that predict or indicate future events, trends, or expectations, and similar expressions or the negative of such expressions may identify forward-looking statements, but the absence of these words or terms does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Annual Report on Form 10-K are based on information available as of the date of this Annual Report on Form 10-K, and current expectations, forecasts, and assumptions, (whether or not identified herein), and involve a number of risks and uncertainties. Accordingly, forward-looking statements in this Annual Report on Form 10-K should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Forward-looking statements in this report include, but are not limited to, statements regarding the following:

| • | Rockley’s bankruptcy proceedings and restructuring; |

| • | Rockley’s strategy, future operations, financial position, estimated revenue and losses, projected costs, prospects and plans; |

| • | the implementation, market acceptance, and success of Rockley’s business model; |

| • | developments and expectations relating to Rockley’s competitors, target markets, and industry; |

| • | Rockley’s future capital requirements and sources and uses of cash; |

| • | Rockley’s ability to obtain funding for its product development plans, execution of its business strategy, and its operations; |

| • | Rockley’s business, product development plans, and opportunities; |

| • | the outcome of any known and unknown litigation and regulatory proceedings; |

| • | Rockley’s anticipated financial outlook or information, anticipated growth rate, and market opportunities; |

| • | Rockley’s plans to commercialize its products and services, and anticipated timing thereof; |

ii

Table of Contents

| • | Rockley’s expectations as to when it may generate sufficient revenue from the sale of its products and services to cover expansion plans, operating expenses, working capital, and capital expenditures; |

| • | the development status and anticipated timeline for commercial production of Rockley’s products; |

| • | Rockley’s plans for products under development and future products and anticipated features and benefits thereof; |

| • | the status and expectations regarding Rockley’s customer and strategic partner relationships, and potential customer and strategic partner relationships; |

| • | the total addressable markets for Rockley’s products and technology; |

| • | the ability of Rockley to increase market share in its existing markets or any new markets it may enter; |

| • | Rockley’s ability to obtain any required regulatory approvals, including any required Food and Drug Administration (“FDA”) approvals, in connection with its anticipated products and technology; |

| • | Rockley’s ability to maintain an effective system of internal control over financial reporting; |

| • | Rockley’s ability to maintain and protect its intellectual property; |

| • | Rockley’s success in retaining or recruiting, or changes required in, officers, key employees, or directors; the ability of Rockley to manage its growth effectively; |

| • | the ability of Rockley to achieve and maintain profitability in the future; and |

| • | the impact of the COVID-19 pandemic. |

Forward-looking statements are subject to several risks and uncertainties (many of which are beyond the Company’s control) or other assumptions that may cause actual results or performance to differ materially from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed below under the headings “Risk Factor Summary” and Item 1.A. “Risk Factors”.

iii

Table of Contents

Risk Factor Summary

Unless specifically noted or the context clearly requires otherwise, all information set forth in this annual report on Form 10-K relates to the Company as it existed as of December 31, 2022 and prior to the Company’s bankruptcy proceedings and does not, and is not intended and should not be read to, reflect the business, financial condition, and results of operations of any other entity, including any entity which may result from the bankruptcy proceedings.

The following risk factor summary should be read together with the more detailed discussion of risks and uncertainties set forth in the “Risk Factors” section of this report.

Risks Related to the Company’s Business and Industry; Customer-Related Risks

| • | If the Company does not fully develop or commercialize its products and services, or if such products and services experience significant delays, the Company’s business, financial condition, and results of operation will be materially and adversely affected; |

| • | If the end products into which the Company’s products are incorporated are not fully developed and commercialized or do not achieve widespread market acceptance, or if such products experience delays, cancellations, or reductions, or if the Company’s products are not selected for inclusion in its customers’ end products, are not adopted in other industry verticals or use cases, or are not adopted by leading consumer and medical device companies, the Company’s business will be materially and adversely affected; |

| • | Changes to our product offerings (cancellation of a product line or significant changes in requirements) |

| • | The Company’s forecasts and projections are based upon assumptions, analyses, and internal estimates developed by the Company’s management. If these assumptions, analyses, or estimates prove to be incorrect or inaccurate, the Company’s actual operating results may differ materially from those forecasted or projected; |

| • | If the Company is unable to manage its growth or scale its operations, its business and operating results could be materially and adversely affected; |

| • | Market opportunity estimates and growth forecasts are subject to significant uncertainty and are based on assumptions and estimates (for example on cost, volume, and ASP) that may not prove to be accurate; |

| • | The Company’s international operations expose it to operational, financial, and regulatory risks, which could harm the Company’s business; |

| • | The Company is susceptible to supply shortages, long lead times for components, and supply changes, any of which could disrupt its supply chain and could delay deliveries of its products to customers, which in turn could adversely affect the Company’s business, results of operations, and financial condition; |

| • | If the Company is unable to sell its products to its target customers, including large corporations with substantial negotiating power, or is unable to enter into agreements with customers and suppliers on satisfactory terms, its prospects and results of operations will be adversely affected; |

| • | The Company currently depends on a few large customers for a substantial portion of its revenue. The loss of, or a significant reduction in, orders from the Company’s customers, or the Company’s failure to diversify its customer base, could significantly reduce its revenue and adversely impact the Company’s operating results; |

| • | Because the Company does not anticipate long-term purchase commitments with its customers, orders may be cancelled, reduced, or rescheduled with little or no notice, which in turn exposes the Company to inventory risk, and may cause its business and results of operations to suffer; and |

Regulatory, Intellectual Property, Infrastructure, Cybersecurity and Privacy Risks

| • | The Company’s failure to comply with applicable governmental export and import control laws and regulations, including those related to the use, distribution, and sale of its products, U.S. Food and Drug Administration clearance or approval requirements, or privacy, data protection, and information security requirements in the jurisdictions in which the Company operates could materially harm its business and operating results; |

| • | The Company may not be able to adequately protect or enforce its intellectual property rights or prevent unauthorized parties from copying or reverse engineering its products or technology. Further, the Company’s intellectual property applications, including patent applications, may not be approved or granted; and |

| • | A network or data security incident or disruption or performance issues with the Company’s network infrastructure could harm its brand, reputation, and business, as well as its operating results. |

iv

Table of Contents

PART I

Unless specifically noted or the context clearly requires otherwise, all information set forth in this annual report on Form 10-K relates to the Company as it existed as of December 31, 2022 and prior to the Company’s bankruptcy proceedings and does not, and is not intended and should not be read to, reflect the business, financial condition, and results of operations of any other entity, including any entity which may result from the bankruptcy proceedings.

Item 1. Business

INFORMATION ABOUT ROCKLEY

The following discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this section, the terms “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “predict,” “potential,” “plan,” “anticipate,” “seek,” “future,” “strategy,” “likely,” or the negative of these terms, and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these or any other forward-looking statements. These risks and uncertainties include, but are not limited to, those risks set forth under “Risk Factors.” Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on current expectations and reflect management’s opinions only as of the date hereof. These forward-looking statements speak only as of the date of hereof. Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based.

Rockley®, RayDriver™, RPFabric™, RPStack™, Topanga™, LightDriver™, SpectraCloud™, SpectraSense™, VitalSpex™, Bioptx™, and clinic-on-the-wrist™ are among the trademarks, registered trademarks, or service marks owned by Rockley.

Company Overview

We have developed a comprehensive range of silicon photonics technologies that have both the power and the flexibility to support a wide range of potential applications. Our silicon-photonics platform will incorporate several key components to support these solutions, including photonic integrated circuits and associated modules, sensors, and end-to-end solutions. We expect that our immediate focus over the next two years will be on developing and commercializing our products for incorporation in consumer wearables, medical devices, and dedicated solutions for the healthcare market.

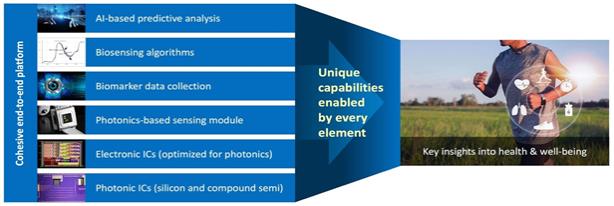

The summation of our technologies and manufacturing expertise is Rockley’s “cohesive end-to-end platform.” Our end-to-end platform encompasses photonic integrated circuits (“PICs”) in silicon with integrated III-V devices (devices incorporating certain conductor elements that offer superior electronic properties, such as lasers), application-specific electronic integrated circuits (“ASICs”), and photonic and electronic co-packaging, which are all supported by and coupled with biosensing algorithms, AI, cloud analytics, firmware/software, system architecture, and hardware design.

With this unique sensing platform, we believe we can reshape several important markets of the healthcare sector such as consumer wellness, long term health trend monitoring, patient monitoring, early disease detection, nutrition management and the treatment of certain chronic diseases. Our biosensing platform is designed to enable multiple applications using our non-invasive, continuous, multi-modal biomarker monitoring capabilities. Our target biomarkers for consumer healthcare include lactate, alcohol, glucose (indicator), hydration, blood pressure, blood oxygen and core body temperature, among others.

Our end-to-end solutions include hardware with the potential to detect multiple biomarkers, related algorithms, cloud-based analytics and artificial intelligence (“AI”). We have shipped early engineering samples to some of our customers to support research and development efforts.

Our platform has been built upon our silicon photonics technology, which enables highly advanced sensor performance, power, resolution, and formfactor. This technology has the potential to allow monitoring devices, currently the size of clinical laboratory machines, to be miniaturized to the size of a wearable device. We believe that this miniaturization capability has the potential to unlock additional applications in consumer electronics and medical devices. Our technology is built on over 260 patents and over nine years of product development.

We have established a manufacturing ecosystem based upon our wholly-owned, proprietary processes in several areas. We believe that this manufacturing ecosystem will support rapid scalability.

As we do not currently have any products in commercial production, our current customer relationships are in the following stages: (a) customers with whom we are “engaged,” or in discussions with, regarding potential product features for incorporation into such customer’s end products, or (b) customers with whom we are “contracted,” where we have non-binding MOUs or development and supply agreements. These MOUs and development and supply agreements provide a general framework for our transactions with the customer and typically provide that we will develop and deliver new products meeting the customer’s specifications. There are no binding purchase commitments under our MOUs and supply agreements. We currently anticipate that sales of our products will be primarily made pursuant to standard purchase orders, which orders may be cancelled, reduced, changed, or rescheduled with little or no notice or penalty.

1

Table of Contents

Product Applications and Development Status

We believe that our innovative and differentiated silicon photonics platform positions us to make photonics-based solutions increasingly pervasive, while unlocking previously unaddressed applications. Consequently, we believe that the potential applications for our technology will be wide-ranging. Leveraging the flexibility and power of our innovative silicon photonics platform, we believe that we are positioned to become a leading supplier of end-to-end solutions (including integrated optical components, algorithms, data analytics, and AI) for dynamic, high-growth market sectors, including consumer sensors, medtech and healthcare.

Figure 1: Rockley end-to-end sensing platform

To date, we have been engaged in developing customer-specific designs of our silicon photonics chipsets and modules for incorporation into our consumer electronics customers’ end products. We are working with leading customers in the medtech market to deliver a standalone wrist-wearable product for targeted use cases. In parallel, we are shaping and developing our own standard offerings that could have different shapes and form factors. Currently, we do not have any of our own end products in commercial production.

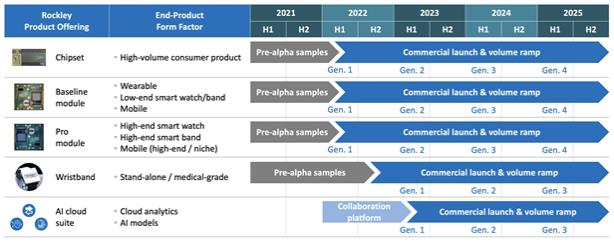

Figure 2: Product development and commercial roadmap

Healthcare: Consumer Wearables

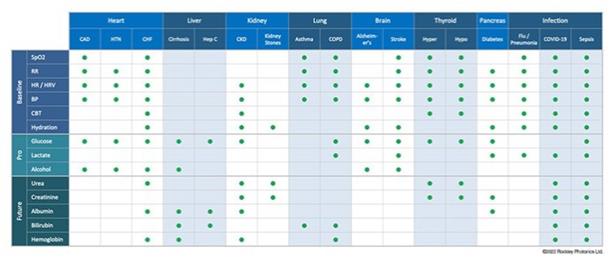

We believe the high-density optical integration capabilities of our platform can personalize healthcare monitoring of multiple biomarkers and can significantly improve how individuals track and monitor their health and well-being. Our VitalSpex™ biomarker sensing platform will address the consumer wearable market. Further, as part of our product offering, we believe that our cloud-based analytics and AI platform will offer further insight by leveraging data collected through our unique and broad sensing platform and will provide meaningful and actionable insights to end users. Our plans for the VitalSpex™ biomarker sensing platform include a Baseline module and a Pro module, each of which will have a wide array of current and potential applications, as shown in the figure below. Depending on the needs of each customer and market trends, multiple generations of products could be built on each of these platforms addressing different set of biomarkers, form factors, performance specifications, and potential use cases.

2

Table of Contents

Figure 3: Targeted biomarker sensing capabilities

These products are intended to address the needs of the consumer market and will provide information about general health and wellness. (i.e., they do not require regulatory approval for offered applications and end uses.) As we move forward, we intend to monitor and comply with regulations to the extent they become applicable to us, including any requirements for clearance by the U.S. Food and Drug Administration (FDA) and/or other regulatory bodies.

Healthcare: Medical Devices

Our Bioptx™ healthcare sensing platform will address the medical and professional healthcare market. We plan to incorporate our biomarker sensing technology into existing devices (such as medical patches, wearable bands, and other monitoring devices) to provide additional biomarker sensing capabilities not currently available to consumers. Also, as part of the Bioptx product offering, we intend to deliver a complete standalone finished product with targeted use cases for healthcare and health monitoring.

We believe that these product offerings will enhance point-of-care and remote monitoring and will have the potential to ultimately transform and disrupt the delivery of patient monitoring and healthcare. In the medical device space, we currently anticipate that we will develop two types of devices: an advisory device that will not need regulatory clearance and a clinical device that will need regulatory clearance from the FDA or other regulatory bodies.

These products are still under development. Even though there can be no assurance that these product development efforts will succeed or that, even if developed, these products will be approved by regulators or achieve widespread market acceptance, we believe that there are significant market opportunities in addition to our consumer wearables applications.

Data Communications: Transceiver Chipsets and Co-Packaged Optics

Data centers, which are the nerve centers of the digital economy, require interconnected communications for which we believe our datacom chipset technology offers several advantages. Business, entertainment, vital medical research, and other aspects of daily life are in many ways connected to hyperscale data centers, which in turn rely on cost-effective, power-efficient optical communication links. Whether incorporated in pluggable optical transceiver modules or in co-packaged optics, we believe hyperscale data centers will benefit from the unique advantages that our silicon photonics platform has to offer. Furthermore, we believe our go-to-market approach of partnering with Transceiver manufacturers and Switch/Networking equipment OEM companies has economic benefits over participating directly in this margin-sensitive market. By selling/licensing our assets/technology, we offer the third party the opportunity to create an economically compelling solution without any margin stacking while Rockley can keep expenses low/minimal and benefit from upfront/ongoing fees. Note that given Jiangsu Hengtong Optic-Electric Co., Ltd. (a shareholder in our joint venture partner) was placed on the “Entity List” by the U.S. Bureau of Industry and Security (BIS) of the U.S. Department of Commerce in December 2021, we have widened our potential partner network significantly and are evaluating various options for this business.

Other Applications

We believe that our silicon photonic platform is suited for delivering the sensing capabilities needed for machine perception and interrogation at depth, which has become increasingly necessary in industrial automation, robotic vision (including surgical applications), safety, and other autonomous applications. Finely tuned light, delivered through a PIC via a free-space aperture or fiber optic interconnect with accompanying detection receiver capabilities, enables substantially better capabilities than previously available technology, such as frequency modulated continuous wave (“FMCW”) LiDAR for automotive safety solutions, as well as future autonomous vehicle offerings. Our team has extensive experience in the design of PICs for use in the LiDAR domain, and we have prototyped the key components of the system and demonstrated their superior performance. Although we believe the inflection point for LiDAR and the automotive market may be approaching, we plan to leverage our core technology readiness and economies of scale from our consumer business to position ourselves for this potential market opportunity.

3

Table of Contents

Market Opportunity

Health and Wellness

There is growing demand for miniaturized, wearable solutions that offer an affordable way to provide key insights into a person’s health and well-being, outside the clinical environment. Delivering relevant insights will require non-invasive, continuous, real-time sensing and measurement of multiple biomarkers, coupled with advanced analytics to interpret the data. We believe that this demand is driven and will continue to be driven by two major market and secular trends:

| • | Consumer health and well-being awareness. While there is an existing market for athletes in training and for highly active and health-conscious users, there has been an increasing global consumer focus on preventative healthcare, with users desiring greater control and visibility over their own health and well-being. In parallel, amid the proliferation of wearable technologies with emerging health monitoring capabilities, there is greater demand for more sophisticated and comprehensive sensing technology that can measure and track a broad range of conditions and biomarkers. Generating a holistic view of the human body through access to multiple biomarkers will enable a more sophisticated ability to monitor and track general trends of changing health conditions. This has the potential to help physicians identify health conditions and possible disease states earlier and allow for more affordable prevention measures and effective patient treatment, perhaps long before requiring aggressive disease management. More recently, COVID-19 has had a profound impact on the way consumers perceive their need for “at-home” monitoring solutions. |

| • | Treatment of chronic conditions and disease care. With increased life expectancies, a growing number of chronic conditions and diseases has placed a strain on healthcare systems. Furthermore, non-invasive monitoring solutions for chronic conditions have historically been costly and available only in a medical facility. With our potential for delivering individual non-invasive wearable monitoring solutions, we believe that we have a great opportunity to impact patients’ compliance with healthcare guidance and subsequent efficient treatment of patients, which will lead to better quality of life and drastic reductions in the overall cost of healthcare. Non-invasive, continuous monitoring also has the potential to detect and possibly prevent chronic conditions and diseases at a much earlier stage, resulting in reduced overall healthcare cost. |

We believe that existing monitoring and sensing technologies are not capable of delivering on the needs of consumers and healthcare professionals. Meeting these needs require solutions that provide access to a broad range of biomarkers non-invasively; that can be miniaturized and operate with power low enough to be integrated into consumer wearables, medical patches, and other compact form factors; and that can scale cost effectively to high volumes. We believe that our silicon photonics-based platform is poised to serve at the confluence of the above two market and secular trends.

Beyond these opportunities, we believe there may be significant potential for us in the field of genomics. As the field of genomics grows, as shown in the development of personalized medicines and treatment, the value and effectiveness are enhanced when genomic information is combined and processed along with continuous biomarker monitoring for the users. We believe this emerging field could play to the strengths of our platform and potentially represents a high-value growth opportunity for the future.

Data Communications

Datacenter operators continue to build and upgrade their datacenter infrastructure to meet the continuing growth in public, private, and hybrid cloud capacity. As these datacenters rely heavily on fiber optics to interconnect compute, storage, accelerators and other resources, this trend is reflected with substantial growth in demand in the high-speed Ethernet optics. The market segment that we are primarily targeting comprises 400Gb/s and 800Gb/s. We believe our silicon photonics platform is well positioned to address this market with highly integrated Si PICs and class leading III-V technology to implement the optical functionality required for such transceiver modules. We believe that our platform will provide a substantial cost advantage over conventional discrete-optics-based solutions, as well as over competing integrated photonics solutions due to our platform’s inherent benefits.

Competitive Advantages

We believe our silicon photonics solutions and technology offer the following key healthcare monitoring benefits:

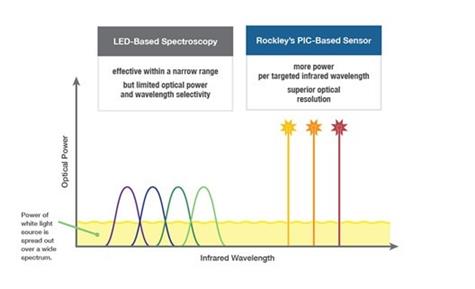

| • | Superior sensing performance. Our silicon photonics-based spectrometer chip provides up to one million times higher resolution, approximately one thousand times higher accuracy, and approximately one hundred times broader spectral range than existing LED-based solutions, based on product analysis undertaken by Rockley comparing the Rockley silicon photonics-based spectrometer chip to existing LED-based solutions. We believe that our unique silicon photonics technology and the entire product ecosystem we are developing will make our end-to-end offerings in the health and wellness domain difficult to replicate. Current optical-based sensing solutions rely on LED-based sensing (PPG signals for SpO2, heart rate, heart rate variability, breath rate, and blood pressure). However, there are many biomarkers present in the body (such as in blood or interstitial fluid) that are not detectable in the visible LED range. We believe that our silicon photonics technology delivers several ingredients that will be required to bring a powerful and meaningful product into the healthcare market: the accuracy and width of our wavelength span in the infrared spectrum, the capability of our silicon photonics solutions to integrate many wavelengths, and the high signal-to-noise ratio (“SNR”) generated by our chips. |

4

Table of Contents

Figure 4: Enabling a new class of sensor by combining visible light and infrared

| • | Flexible platform architecture. We have designed our platform from the ground up and, leveraging our team’s extensive experience, have developed a highly flexible platform architecture. As a result, we believe our innovative platform architecture will allow us to easily configure core building blocks to produce a wide range of functional components and modules for high-volume applications across a broad range of market sectors. |

| • | Differentiated biomarker sensing algorithms and analytics. Our biomarker detection algorithms are optimized for our unique and optimized hardware technology platform. We believe that the data analytics and biomarker processing capabilities of our AI / cloud offering will further expand our ability to offer additional insights into a person’s health. |

| • | Deep understanding of market opportunity and customer priorities. We are developing many applications and systems with our silicon photonics solutions that are driven by industry leaders in the consumer sensors, healthcare, and data communications markets. Through our established relationships with industry leaders, we have consistently demonstrated our ability to address their technological challenges. As a result, we have signed memoranda of understanding and have contracted with several industry leaders in wearable consumer technology to establish product specifications and desirable features. We believe we are well-positioned to develop high-volume optical sensing modules and algorithms for their emerging architectures. We have ongoing, collaborative discussions with consumer wearables, healthcare, and communication companies and original equipment manufacturers (“OEM”) and module and component vendors to address their next-generation product offering to end users. |

| • | Fabless, scalable business model with manufacturing process expertise and ownership. We plan to operate in a fabless business model by using third-party foundries to manufacture and test our products. We believe that outsourcing our product manufacturing and test processes and procedures simplifies our operations, significantly reduces capital commitments, and provides greater flexibility to respond to new market opportunities and scale with our customer demand. We also believe this approach will allow us to invest and focus our resources on proprietary process development and sales and marketing efforts. |

| • | Highly differentiated manufacturing process. Our manufacturing processes in several key areas (PICs, III-V actives, Integration) are unique and well-suited to meeting our customers’ economic and performance needs for their applications. In particular, we believe our silicon PIC process on multi-micron thick Silicon-On-Insulator (“SOI”) is a key differentiator. Our manufacturing processes utilize standard semiconductor manufacturing equipment but are optimized for photonics performance through incorporating innovative features to facilitate easier integration and packaging. |

| • | Extensive intellectual property portfolio. We believe our extensive intellectual property provides us with a significant competitive advantage. Our know-how is based on over 30 years of leadership in the development and commercialization of silicon photonics, and we have established strong and deep technical foundations and expertise for high-volume product delivery that would be difficult for a competitor to replicate. |

| • | Established and committed foundry partner network. We have built a high-volume foundry network comprised of strategic partners who share our growth vision, and our engineering team continues to work to push new boundaries in photonic component manufacturing processes. |

Our high-performance optical sensing products and technology with broad biomarker detection capabilities, combined with the power of our algorithms and AI platform, enable us to target unmet needs and challenges in the health and wellness markets. We have ongoing formal and informal collaborative discussions with industry and technology leaders in consumer sensor, healthcare, and data communications companies, with original equipment manufacturer (“OEMs”), and with module and component vendors concerning the design of architectures and products to address existing and next-generation applications. Based on these interactions, we believe that we are one of a limited number of suppliers to these companies for the type of products we plan to sell, and in some cases, we may be the sole supplier for certain applications.

5

Table of Contents

Our Strategy

Our strategy is to become the leading global provider of sensing products that incorporate integrated optical modules with supporting electronics, software, application algorithms, and cloud-based AI platforms for high-volume and high-margin applications in dynamic high-growth market sectors and for use-case specific opportunities with a focus on medtech and healthcare. Key elements of our strategy include:

| • | Extend our silicon photonics leadership. We intend, through continuous platform engineering and advanced research and development, to continue driving innovation in the silicon photonics market and to improve the performance of our current solutions across a variety of key metrics, including size, power, and signal quality. Such innovation will be a key to opening new market opportunities. |

| • | Identify and promote new and emerging applications for our technologies. We are actively engaged with our science and technology partners to explore new potential markets and applications for our technology. We intend to continue to collaborate with our partners to understand the challenges in their end-product roadmaps and to demonstrate how our technologies can help them design and enable innovative solutions. |

| • | Develop our product portfolio. Beginning with our first target products in the consumer and medtech domains and for on-the-wrist applications, we intend to develop and broaden our product portfolio by continuing to invest in research and development so we can expand our platform capabilities as well as enhance our existing product roadmap. We are actively conducting research and development on other form factors and domains. We believe our differentiated technology will play an important role in delivering products for remote patient monitoring needs and for other niche markets such as diet and weight management, women’s health, and early detection and monitoring of chronic diseases such as diabetes. |

| • | Continue forming strategic partnerships in products and applications: Working with our partners, we have developed many potential product application opportunities with our unique technology that can be researched and unlocked in the future. Our partners operate in various domains such as hardware development, algorithm development, AI, and clinical research. |

| • | Continue to attract and acquire new customers. We intend to expand our customer base beyond our 17 existing customers in consumer electronics and medtech by focusing on direct dialogue with large strategic accounts, as well as by partnering with large distributors and resellers, when necessary. We believe this multi-track strategy will allow us to provide differentiated solutions to a broad array of customers. |

| • | Sustain margin through expansion of our products into higher-end markets. We intend to use our technological expertise to deliver higher value and high product margins. In addition, we intend to continue to reduce our costs through operational improvements and supply-chain management initiatives. |

Our Technology Platform and Product Offerings

Our solutions leverage our developed knowledge of silicon photonics, application science, and our innovative platform architecture to address high-volume applications in the consumer sensors, medtech and healthcare. We believe our leadership position in developing silicon photonics-based sensing solutions is a result of the following core strengths:

| • | We have developed a unique and proprietary silicon photonics platform technology that addresses a broad set of requirements in the healthcare and wellness industries. |

| • | Our custom multi-micron-waveguide photonics-optimized process with integrated III-V semiconductor actives brings multiple competitive advantages in terms of performance and manufacturability, offering lower waveguide losses, higher waveguide power handling, polarization independence, ubiquitous integration of III-V actives in their native known-good-die form, ultra-broad-band performance, and lower sensitivity to manufacturing variations while enabling compact circuitry with high integration densities. |

6

Table of Contents

Figure 5: Rockley spectrophotometer chip solution, as compared to conventional LED- and spectrometer-based solutions

Additional key points concerning the photonics technology include the following:

| • | The optical-loss-per-unit distance is much lower than for other technologies, enabling lower-power solutions and/or larger-scale PICs, which enables a high signal-to-noise ratio and hence high-fidelity signal detection and helps reduce overall power consumption; |

| • | The platform provides broadband performance and is suitable for the visible, short-wave, and mid-infrared bands. This is a key enabler for sensing applications that other platforms cannot serve. Broadband optical performance also enables sensing a large optical spectrum to cover a wide range of measurands; |

| • | The platform is well suited to power-efficient integration of III-V waveguide devices such as lasers and modulators that also have a multi-micron mode size. Low-loss coupling from III-V to Si waveguide drives down power consumption for long battery life; |

| • | A larger waveguide is much less sensitive to manufacturing variations that can affect its shape and hence its refractive index, thereby achieving much better center wavelength registration than small waveguides enabling accurate wavelength filters. The large waveguides also offer a much higher optical power handling capability than small waveguides; |

| • | Rockley’s waveguides exhibit low dispersion (low signal distortion) and low polarization dependent loss (simplifying receiver architectures in particular); |

| • | Strong optical confinement enables tight packing of waveguides and sharp waveguide bends, thereby yielding dense layout capability and compact PICs. Compact PIC layouts result in small chip sizes to fit within consumer device form factors and reduce product cost; |

| • | Accurate wavelength targeting enables using many finely-spaced wavelengths for accurate detection; |

| • | Known-good-die integration of active elements improved yields, which leads to cost-effective solutions. |

The following are the key components of our end-to-end (full-stack) platform model:

| • | Photonic integrated circuits in silicon with integrated III-V: The design and large-scale manufacturing of silicon photonic PICs and integration of active “III-V” elements onto these PICs are the foundational competencies of Rockley. These PICs are manufactured using our proprietary and highly differentiated process flow deployed at our foundry partners; |

| • | Application-specific integrated circuits (“ASICs”): The design of electronic ICs to complement our PICs and facilitate their integration into a specific end-product is the second key component of our platform offering. The ICs are designed in volume complementary metal-oxide-semiconductor (“CMOS”) or bipolar CMOS (“BiCMOS”) technology nodes using standard design flows and are manufactured at volume-scale foundries; |

| • | Photonic & electronic co-packaging: The next layer of the stack conjoins photonic and electronic ICs into opto-electronic engines through advanced co-packaging technologies, including 2.5D and 3D integration. Such dense integration is key and enables us to achieve the energy efficiency and physical size requirements for our core use cases. We partner with specialized packaging houses to provide the capacity required for serving consumer markets; |

| • | System architecture & hardware design: We have built deep expertise in architecting photonic systems for sensing solutions in healthcare and wellness, machine vision, and data communications. This enables us to go beyond making chips and allows us to deliver higher value-add photonic subsystems, modules, and chipsets that fit seamlessly into our end-product partners’ designs; |

7

Table of Contents

| • | Firmware/software: Any system requires some degree of firmware and software to operate and inter-operate, and our photonic systems are no exception. We have in-house expertise to develop the necessary firmware and software to complement our hardware offerings and facilitate system integration, testing, and monitoring by our customers; and |

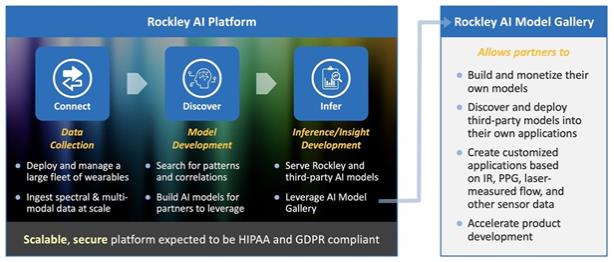

| • | Sensing algorithms, AI, and cloud analytics: At the highest level of the stack, we develop algorithms, AI models, and cloud-based infrastructure to gain deeper insights into health and wellness trends from the volume of sensor data collected by our wearable modules. |

Figure 6: Rockley cloud analytics and AI

We believe the key benefits that our solutions can provide to our customers are as follows:

| • | Broad set of biomarkers with data analytics. Leveraging our unique integrated solution, we enable the detection and monitoring of multiple biomarkers. Analyzing the underlying spectral data with our growing base of machine learning and AI models has the potential to provide further insights into a person’s health; |

| • | Low power and small footprint. In each of the markets that we expect to serve, the power budget of the overall system is a key consideration. Power consumption greatly impacts system operation cost, footprint, and cooling requirements and is increasingly becoming a point of focus for our current customers and for other market participants that we are targeting as future customers. We believe that our silicon photonics solutions enable our customers to implement system architectures that reduce overall system power consumption. Moreover, in many of our applications, we are able to design and deliver semiconductors that have a smaller footprint and therefore reduce the overall system size; and |

| • | Faster time to market. To meet our customers’ time-to-market requirements, we work closely with them early in their design cycles and are actively involved in their development processes. Our hardware, algorithm, data analytics, and AI roadmaps provide flexibility in meeting our customers’ schedules. |

Rockley’s Silicon Photonics Toolbox Elements

Rockley’s proprietary silicon photonics platform covers a unique end-to-end solution, including generation of the light, manipulation of the light (modulation, multiplexing), radiation out of the module, and collection and processing of the returned light. The following provides an overview of the key components of our platform:

| • | Lasers: Our lasers offer precise wavelength control and robust power efficiency. The waveguide platform allows efficient wafer-scale integration of laser-devices through a flip-chip process; |

| • | Modulators and detectors: We have developed optical modulators and detectors that are ultra-compact, power-efficient and high-speed, capable of handling high data rates and a broad range of wavelengths; |

| • | Combiners and splitters: Our platform is capable of wavelength division multiplexing (“WDM”) and demultiplexing, enabling in excess of 100 wavelengths on a single optical path; |

| • | Fiber optic coupling: Our PIC contains on-chip embedded interfaces to the optical fibers. These interfaces allow the fiber to be passively attached directly to the PIC without external light coupling elements; |

| • | Free-space optics: Our platform allows for efficient light coupling from free space into and out of the photonics circuits, with either edge or perpendicular coupling. This feature enables a broad range of sensing applications; |

| • | Photonic integrated circuits: Our development platform enables integration of light sources, active devices, passive devices, and optical coupling elements into a single compact silicon chip; |

8

Table of Contents

| • | Wafer-scale processing: Our silicon photonics platform enables high throughput wafer-scale processing of monolithic and multi-die structures for chip-on-wafer integration; |

| • | Interface electronics: We have in-house design expertise for custom analog circuitry to translate high-speed data streams into signals that actuate the PICs (drivers) and receive signals from them (amplifiers). This is complemented by our digital design capability for device control, signal processing, and interfaces to our customers systems; and |

| • | Packaged assembly: The assembly of electrical ASICs, PICs, and fiber optics (if needed) into a single, highly integrated product requires a test and manufacturing flow that enables high-volume scale. |

Further application-based expertise is focused on the following:

| • | Tissue optics design: Our sensing module products will include probe and hardware design to optimize sensing through the skin; |

| • | Biomarker application: Our sensing algorithms are being developed through various levels of validation to provide state-of-the-art sensing capabilities, from proof of concept in the lab to clinical validation in human studies; and |

| • | Applied data science: Our AI and cloud analytics will aggregate, analyze, and assess spectral data from our sensing products to extract additional insights and algorithm improvements. |

Current Product Offerings

We have developed two separate product offerings to address our target markets: (i) VitalSpex (consume domain); and (ii) Bioptx (healthcare and medtech).

In respect of the VitalSpex biomarker sensing platform:

| • | We will target applications in the consumer health and wellness industry and expect strong customer engagement in the consumer electronics and wearables market. The VitalSpex platform represents a breakthrough that will empower consumer electronic devices, primarily personal wearables, smartphones and homecare devices, with the capacity for new powerful healthcare and wellness monitoring; |

| • | The VitalSpex line will include a range of hardware and software solutions that enable non-invasive, continuous, and real-time monitoring of multiple biomarkers, from modules and chipsets that can be integrated into a wearable form factor to cloud analytics and artificial intelligence (AI); |

| • | The VitalSpex line will include a Baseline module, which will target the measurement of core body temperature, body, hydration, blood pressure, and more, and a Pro module, which will add the measurement of alcohol, lactate, and glucose trends. Our first health monitoring product offering is expected to launch in the second half of 2022; and |

| • | The VitalSpex Baseline and Pro modules will each combine existing LED-based optical sensing with Rockley’s proprietary infrared optical sensing to expand the range of biomarkers that wearable devices can measure. Our VitalSpex modules will include the hardware and software capabilities to collect information available and relevant to the target biomarkers. |

| • | We also plan to offer additional cloud-based subscription services that enhance the capabilities of the VitalSpex platform. |

In respect of the Bioptx healthcare sensing platform:

| • | The Bioptx platform will target medical institutions, such as hospitals, research clinics, pharmaceutical companies, medical device manufacturers, and other healthcare providers, offering them the ability to monitor the general health and wellness of individuals. The measurement capabilities of the Bioptx platform the potential to transform healthcare by providing real-time insights into a variety of health conditions and by enabling early detection of multiple disease states; |

| • | The Bioptx platform will include a range of hardware and software solutions that enable non-invasive, continuous, and real-time monitoring of multiple biomarkers, from a stand-alone wearable wristband to cloud analytics and artificial intelligence (AI); |

| • | The Bioptx platform will include Baseline products (for core body temperature, body, hydration, blood pressure, and more) and Pro products (which will add the measurement of alcohol, lactate, and glucose trends). Our first health monitoring product offering is expected to ship in the second half of 2022; |

| • | We also plan to offer additional cloud-based subscription services that enhance the capabilities of the Bioptx platform; |

| • | The intended markets for Bioptx products, including our wristband, are markets in the medical professional healthcare domain (i.e., not consumer) that require an optimized and dedicated solution for health monitoring. tracking, and detection; and |

| • | We expect that our customers will initially use the Bioptx platform to monitor the general wellness of individuals under care or in studies. After products in the Bioptx line receive approval from the FDA or other regulatory bodies, we anticipate that customers will expand product use into preventive and diagnostic care, such as remote patient monitoring and diagnosis. |

9

Table of Contents

Future Product Capabilities

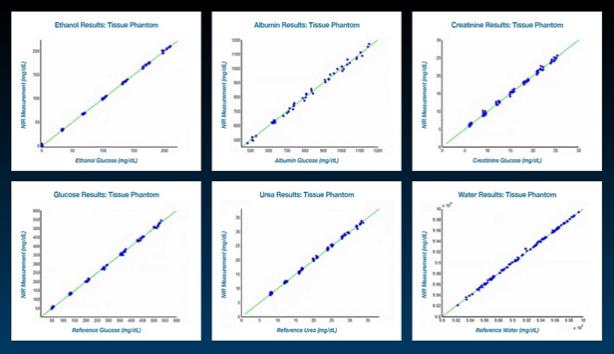

We plan to incorporate our biomarker sensing technology into a range of existing devices, such as patches, wearable bands, and other monitoring devices, to provide additional biomarker measurement capabilities not currently available. We continuously research, evaluate, and prioritize the addition of new biomarkers into our product offerings, with the objective of providing more valuable information and improving health insights. Our broad range of addressable biomarkers are at various stage of validation and demonstration, from proven science to miniaturization. The chart below illustrates a few examples of biomarkers for which we have validated their addressability using its IR wavelengths.

Figure 7: Lab validation of Rockley’s sensing technology

These biomarkers along a few others we are investigating are key in early detection, prevention, and monitoring of major chronic illnesses, as illustrated in the table below:

Figure 8: Disease detection and management potential of Rockley’s biomarker sensing platform

These products are still under development, and there can be no assurance that these product development efforts will succeed or that, even if developed, that these products will achieve widespread market acceptance.

10

Table of Contents

Customers

Our customers’ design cycle from initial engagement to volume shipment typically ranges from three to five years, with product life cycles of two years or more. For many of our products, which are technically complex, we must engage early with our customers’ technical staff. To ensure an adequate level of early engagement, our sales, marketing, and development engineers must work closely with our customers and channel partners to understand, identify, and propose solutions to meet their systems’ challenges. We work closely with our customers to anticipate end customer market needs. In some cases, we work with ecosystem partners to better understand market trends and new requirements that are being placed on our end customers.

We believe that our existing commercial relationships with leading consumer and medtech customers validate our unique technology and the business opportunity at hand. Our near-term commercial focus is on a robust pipeline in consumer devices, medical devices, and life sciences companies.

To date, we have generated revenue primarily from non-recurring engineering (“NRE”) and development services for customer-specific designs of silicon photonics chipsets for incorporation into customers’ end products.

We work closely with our end customers throughout their design cycles and will develop long-term relationships as our differentiated technology becomes embedded into their products. For example, we currently hold a development and supply agreement with one customer since 2017 and have successfully designed and delivered critical sample chips to them. As a result, we believe we are well-positioned to be designed into their product roadmaps and develop next-generation solutions for their future products. Because many of our target customers or their OEMs are located in North America and Asia Pacific, we anticipate that a majority of our future revenue will come from sales in these regions. Although a large percentage of our sales are made to customers in North America, we believe that a significant number of the systems and devices designed by these customers will incorporate our semiconductor products which are then sold to end-users globally. We expect that once our modules are commercially available, we will enter into standard supply agreements with each of these parties.

Manufacturing

Our Proprietary Production and Manufacturing Ecosystem

We have built, and plan to continue to develop, a global manufacturing ecosystem designed with the ability to scale in a rapid and efficient manner. Several key areas within this manufacturing ecosystem run on our proprietary process and manufacturing technologies and are protected by our intellectual property portfolio. We possess end-to-end control over design, manufacturing and packaging processes, algorithms, and software. Our disciplined and systematic documentation and protection of critical know-how, trade secrets, and proprietary information further underpins our manufacturing ecosystem. To the best of our knowledge, there are no other turnkey options with the components and technologies needed to put together our sensing product. In addition to the intellectual property arrangements, we also have commercial exclusivity agreements with some of the key manufacturing ecosystem partners to prevent replication of this capability.

In addition to providing what we believe to be unmatched capabilities at the product level, our platform and the associated technology have been designed from bottom up to consider the relative ease and cost of manufacturing and scaling. Elements like waveguide dimensions for ease of wafer fabrication and high yields, robust and position tolerant coupling strategies for III-V integration, wafer scale back-end activities for III-V manufacturing, and all known good die integration at the module are integral to the product and the process technology. These elements are covered by the intellectual property which we have licensed to partners in our manufacturing ecosystem.

Manufacturing Model Overview

We plan to operate a fabless business model and use third-party foundries and Outsource Assembly & Test (OSAT) contractors to produce our products. In several key areas, our third-party partners operate a proprietary process wholly owned by us and protected by our intellectual property portfolio. This outsourced manufacturing approach allows us to focus our resources on the design, sale, and marketing of our products. In addition, we believe that outsourcing many of our manufacturing and assembly activities provides us with the flexibility needed to respond to new market opportunities and scale for customer demand, simplifies our operations, and significantly reduces our capital commitments.

We believe our fabless model will allow us to scale in a capex efficient manner. We have contracted with global tier-1 foundries, including Skywater (“SW”) for silicon PICs and wafer-scale III-V device integration and testing. This US based foundry is qualified for health, consumer and defense applications and has the capacity to meet our production needs. Our high-volume III-V semiconductor foundry is consumer and telecom qualified, supports very high volumes, and runs fully automated processes at one of the largest wafer scale in III-V manufacturing globally. Finally, our global IC foundry supplier handles the manufacturing of the electronic integrated circuits for our sensing modules. The foundry is used by most major consumer OEMs and is qualified for the ultra-high volume process node that we have chosen.

| • | Raw Materials and Wafer Supply: The starting raw materials (SOI wafers) for our silicon photonics have been customized by world leading silicon providers for the Rockley proprietary specification. For the active III-V components, we have arrangements in place with the world’s leading epitaxial wafer supplier. We also have volume ready suppliers for commercial off-the shelf-components (“COTS”) that go into the visible sensing and the overall module. |

11

Table of Contents

| • | Wafer Fabrication: Our SOI wafers are converted into fully processed silicon photonics PIC wafers at Skywater. The process used by SW is wholly owned by Rockley and licensed for use by SW only in Rockley products. The process design kit (“PDK”) for this process is developed and maintained by us and constitutes our intellectual property. |

For the III-V active components, epitaxial materials are processed into finished wafers at a world leading dedicated III-V foundry making detectors, lasers and LEDs using state-of-the-art wafer-scale levels of automation. We have adapted the base process technology from this foundry to incorporate the previously discussed elements that allow for ease of integration into our platform and ease of manufacturing. These elements are exclusively for use in Rockley products.

Finally, for ASIC manufacturing, we use a standard process node and PDK provided to us by Taiwan Semiconductor Manufacturing Company, Limited. While the manufacturing process is widely used in high volume (good for product economics), the design know-how belongs to Rockley. The custom ASIC matches our silicon photonics platform optimally for low noise, low power and high level of integration.

| • | Chipset and module integration: The chipset integration of the III-V active components into the silicon PICs is done at wafer scale and using passive alignment techniques that are uniquely enabled in our platform. Furthermore, we have ensured that the III-V components are in arrays of devices (reduces amount of alignment and integration activities) and on pretested known good die (“KGD”) which ensures very high compounded yields. The process intellectual property (“IP”) is developed and owned by Rockley and the integration is currently done in the UK at pilot production volumes, with plans to outsource higher volume in the future. |

We have development and supply agreements in place with our key suppliers. These agreements cover the development program, economic framework, IP licenses, exclusivity terms and other matters. Although we have commenced long-term supply agreement discussions in parallel with the detailed manufacturing ramp discussions, we do not currently have any long-term supply agreements in place and transact business with our third-party suppliers on a purchase-order basis with no minimum supply obligations on their part. We have designed our manufacturing partner network to be resilient by having multiple sources of supply for several key processes/components and we have plans for the appropriate inventory and stocking strategies to mitigate risks to our ramp plans.

Commitment to Quality

We are committed to excellence by creating class-leading silicon photonics-based products and services. We intend to meet or exceed our global customer expectations by executing the following:

| • | Creating long-lasting, trusting, and mutually beneficial relationships with customers and partners; |

| • | Establishing a full understanding of our customers’ requirements and ensuring our products and services meet their expectations; |

| • | Building a team of highly trained, empowered, and accountable employees; |

| • | Innovating in the creation of technology that drives our products and services; |

| • | Improving the effectiveness and efficiency of our quality management system through review of results, learning, and enhancement on a continual basis |

We achieved ISO 9001:2015 certification in January 2022. We subject our third-party manufacturing contractors to rigorous qualification requirements to meet the high quality and reliability standards required of our products. We carefully qualify each of our partners and their processes. Our engineers work closely with our foundries (we even have teams embedded at partners sites in some critical areas) and other contractors to perfect the in-house processes, increase yield, lower manufacturing costs, and improve product quality. See “Risk Factors – Risks Related to Rockley’s Business and Industry” for a discussion of risks related to the semiconductor industry and Rockley’s manufacturing processes and foundry relationships.

Research and Development

We believe that our future success depends on our ability to develop new products for both existing and new markets, development enhancements to our products once developed or if and when commercially launched, to stay ahead of our competition by being leaders in extending the boundaries of our technologies. As a result, a significant amount of our operating expenses has been allocated towards next-generation platform development. Our research and development efforts are focused primarily on extending the functionality and addressable markets of our integrated photonics platform, as well as continually increasing its performance, efficiency, and volume manufacturing competitiveness. We have assembled a core team of experienced engineers and systems designers with an extremely broad range of skill sets across different disciplines who conduct research and development activities in the United States and various European locations, and we are supported by partnerships with leading research institutions and consumer electronics and medical devices companies. As of December 31, 2022, we had 230 employees globally with over 80% of our workforce focused on research, product development, and engineering.

Competition

The global optical components and full-stack solution market in general, and the consumer sensor, healthcare, and data communications markets in particular are highly competitive. We expect competition to increase and intensify as additional companies enter our target markets. Our competitors range from large, international companies offering a wide range of services and

12

Table of Contents

optical components, such as LEDs, lasers, detectors, or PICs, to smaller companies specializing in narrow vertical markets. We expect competition in our target markets to increase in the future as existing competitors improve or expand their product offerings and as new competitors enter these markets. However, we believe that we are currently the only provider with the capability to integrate the technologies, features, and performance required by customers in our target markets. We believe that our unique silicon-photonic-based platform and the entire product ecosystem that we have developed around it will make our end-to-end offerings in the health and wellness domain difficult to replicate and provide us with a significant competitive moat. We believe this will be particularly true as we incorporate our AI and cloud-based offerings, currently under development.

Intellectual Property

We rely on a combination of intellectual property rights, including patents, trade secrets, copyrights and trademarks, and contractual protections, to protect our core technology and intellectual property. As of December 31, 2022, we had 262 issued patents and 310 other patent applications pending worldwide. The 114 issued and allowed patents in the United States expire in the years beginning in 2022 through 2040. Many of our issued patents and pending patent applications relate to sensors and sensor chips, and we have extensive geographic coverage over numerous relevant technology domains.

In addition to our own intellectual property, we also use third-party licensors for certain technologies embedded in our silicon photonics solutions. These are typically non-exclusive contracts provided under paid-up licenses. These licenses are generally perpetual or automatically renewed for as long as we continue to pay any maintenance fees that may be due. To date, maintenance fees have not constituted a significant portion of our annual capital expenditures. We have entered into a number of licensing arrangements pursuant to which we license third-party technologies. We do not believe our business is dependent to any significant degree on any individual third-party license.

We generally control access to and use of our confidential information and trade secrets through the use of internal and external controls, including contractual protections with employees, contractors, and customers. We rely in part on the laws of the United States and international laws to protect our work. All employees and consultants are required to execute confidentiality agreements in connection with their employment and consulting relationships with us. We also require them to agree to disclose and assign to us all inventions conceived or made in connection with the employment or consulting relationship. However, we cannot guarantee that we have entered into such agreements with every such party, and we may not have adequate remedies in case of a breach of any such agreements. Our trade secrets could be disclosed to our competitors or others may independently develop substantially equivalent technologies or otherwise gain access to our trade secrets. Trade secrets can be difficult to protect and some courts inside and outside of the United States are less willing or unwilling to protect trade secrets.

Government Regulation

Healthcare-Related Regulation

Our solutions may be incorporated into multi-application, health-related sensing, and monitoring applications, including healthcare consumer wearables. Accordingly, the end products into which our solutions are incorporated may be subject to FDA and similar or related regulations, and demand for these end products or future regulated products could be adversely affected if such end products do not comply with applicable requirements. Although our target market is consumer wellness rather than medical, we intend to monitor and comply with regulations to the extent they become applicable to us, including any requirements for FDA clearance. Certain healthcare-related products may be regulated by the FDA and corresponding state regulatory agencies in the United States and separate governmental authorities outside of the United States. In the United States, the medical device industry is regulated by governmental authorities, principally the FDA and corresponding state regulatory agencies. Before a new regulated product or a significant modification to an existing medical device may be marketed or sold in the United States, it must comply with FDA Quality Management System regulations, and must obtain regulatory clearance or approval from the FDA, unless an exemption from pre-market review applies. In addition, certain future software functionality, whether standalone or embedded in existing or future devices, may be regulated as a medical device and require pre-market review and clearance or approval by the FDA. The process of obtaining regulatory clearances or approvals to market a medical device can be costly and time consuming, and our end customers may not be able to obtain these clearances or approvals on a timely basis, or at all, for future products. Any delay in, or failure to receive or maintain, clearance or approval for any medical device products under development could prevent us from generating revenue from our solutions incorporated into these products.

Medical devices are also subject to numerous ongoing compliance requirements under the regulations of the FDA and corresponding state regulatory agencies, which can be costly and time consuming. For example, under FDA regulations medical device manufacturers are required to, among other things: (i) establish a quality management system to help ensure that their products consistently meet applicable requirements and specifications; (ii) establish and maintain procedures for receiving, reviewing, and evaluating complaints; (iii) establish and maintain a corrective and preventive action procedure; (iv) report certain device-related adverse events and product problems to the FDA; and (v) report to the FDA the removal or correction of a distributed product. If our solutions are incorporated into any medical device products of our end customers and these customers experience any product problems requiring reporting to the FDA or otherwise fail to comply with applicable FDA regulations or the regulations of corresponding state regulatory agencies, it could harm our ability to sell our solutions. In addition, if our end customers in the healthcare market are subject to enforcement actions such as fines, civil penalties, injunctions, recalls of products, delays in the introduction of products into the market, and refusal of the FDA or other regulators to grant future clearances or approvals, it could harm our reputation, business, operating results, and financial condition. In addition, in the United States, the FDA has taken the position that device manufacturers are prohibited from promoting their products other than for the uses and indications set forth in the approved product labeling, and any failure to comply could subject our end customers to significant civil or criminal exposure, administrative obligations and costs, and/or other potential penalties from, and/or agreements with, the federal government.

13

Table of Contents

Government regulations outside the United States have, and may continue to, become increasingly stringent and common. In the European Union, for example, the European Union Medical Device Regulation was published in 2017 and, when it entered into full force in 2020, included significant additional pre-market and post-market requirements. Penalties for regulatory non-compliance could be severe, including fines and revocation or suspension of a company’s business license, mandatory price reductions, and criminal sanctions. Future laws and regulations may have a material adverse effect on our end customers in the healthcare market, which in turn may negatively impact our ability to sell our solutions and otherwise harm our business and financial results.

Export Regulation

Our business activities are also subject to various restrictions under U.S. export and similar laws and regulations, as well as various economic and trade sanctions administered by the U.S. Treasury Department’s Office of Foreign Assets Control. Further, various countries regulate the import of certain technology and have enacted or could enact laws that could limit our ability to provide customers with our products in those countries.

We are also subject to various domestic and international anti-corruption laws, such as the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act, as well as other similar anti-bribery and anti-kickback laws and regulations. These laws and regulations generally prohibit companies, their employees, and their intermediaries from authorizing, offering, providing, and/or accepting improper payments or other benefits for improper purposes. Although we take precautions to prevent violations of these laws, our exposure for violating these laws increases as our international presence expands and as we increase sales and operations in foreign jurisdictions.

New legislation or regulation, the application of laws from jurisdictions whose laws do not currently apply to our business, or the application of existing laws and regulations to technology in the wearables industry generally could result in significant additional compliance costs and responsibilities for our business.

Privacy

We are or may become subject to a variety of laws and regulations in the United States and abroad regarding privacy, data protection, and data security. These laws and regulations are continuously evolving and developing. The scope and interpretation of the laws that are or may be applicable to us are often uncertain and may be conflicting, particularly with respect to foreign laws.

In particular, there are numerous U.S. federal, state, and local laws and regulations and foreign laws and regulations regarding privacy and the collection, sharing, use, processing, disclosure, and protection of personal data. Such laws and regulations often have changes in scope, may be subject to differing interpretations, and may be inconsistent among different jurisdictions. For example, the General Data Protection Regulation (the “GDPR”), which became effective in May 2018, includes operational requirements for companies that receive or process personal data of residents of the European Union that are broader and more stringent than those previously in place in the European Union. The GDPR includes significant penalties for non-compliance, including fines of up to €20 million or 4% of total worldwide revenue. Additionally, in June 2018, California enacted the California Consumer Privacy Act (the “CCPA”), which became effective in January 2020. The CCPA requires covered companies to provide California consumers with new disclosures and expands the rights afforded consumers regarding their data. Fines for noncompliance may be up to $7,500 per violation. We cannot currently estimate the potential impact of the CCPA on our business or operations.

Additionally, we rely on various legal mechanisms for transferring certain personal data outside of the European Economic Area, or EEA, including the EU-U.S. Privacy Shield Framework, or Privacy Shield, and EU Standard Contractual Clauses, or SCCs. If we fail or are perceived to fail to meet the Privacy Shield principles or our obligations under the SCCs, or if any of these legal mechanisms for transferring data from the EEA are invalidated by European courts or otherwise become defunct, European Union data protection authorities or the U.S. Federal Trade Commission, or FTC, could bring enforcement actions seeking to prohibit or suspend our data transfers or alleging unfair or deceptive practices. In such cases, we could be required to make potentially expensive changes to our information technology infrastructure and business operations, and we could face legal liability, fines, negative publicity, and resulting loss of business.