0001841925False2023FYP3YP2Y0.11558690.1502629http://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrent00018419252023-01-012023-12-3100018419252023-06-30iso4217:USD0001841925us-gaap:CommonClassAMember2024-02-26xbrli:shares0001841925indi:CommonClassVMember2024-02-2600018419252023-12-3100018419252022-12-31iso4217:USDxbrli:shares0001841925us-gaap:CommonClassAMember2023-12-310001841925us-gaap:CommonClassAMember2022-12-310001841925indi:CommonClassVMember2022-12-310001841925indi:CommonClassVMember2023-12-310001841925us-gaap:ProductMember2023-01-012023-12-310001841925us-gaap:ProductMember2022-01-012022-12-310001841925us-gaap:ProductMember2021-01-012021-12-310001841925us-gaap:ServiceMember2023-01-012023-12-310001841925us-gaap:ServiceMember2022-01-012022-12-310001841925us-gaap:ServiceMember2021-01-012021-12-3100018419252022-01-012022-12-3100018419252021-01-012021-12-310001841925us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310001841925us-gaap:CommonStockMemberindi:CommonClassVMember2020-12-310001841925us-gaap:AdditionalPaidInCapitalMember2020-12-310001841925us-gaap:RetainedEarningsMember2020-12-310001841925us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001841925us-gaap:ParentMember2020-12-310001841925us-gaap:NoncontrollingInterestMember2020-12-3100018419252020-12-310001841925us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-01-012021-12-310001841925us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001841925us-gaap:ParentMember2021-01-012021-12-310001841925us-gaap:RetainedEarningsMember2021-01-012021-06-100001841925us-gaap:ParentMember2021-01-012021-06-100001841925us-gaap:NoncontrollingInterestMember2021-01-012021-06-1000018419252021-01-012021-06-100001841925us-gaap:CommonStockMemberindi:CommonClassVMember2021-01-012021-12-310001841925us-gaap:RetainedEarningsMember2021-01-012021-12-310001841925us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001841925us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001841925us-gaap:RetainedEarningsMember2021-06-112021-12-310001841925us-gaap:ParentMember2021-06-112021-12-310001841925us-gaap:NoncontrollingInterestMember2021-06-112021-12-3100018419252021-06-112021-12-310001841925us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001841925us-gaap:CommonStockMemberindi:CommonClassVMember2021-12-310001841925us-gaap:AdditionalPaidInCapitalMember2021-12-310001841925us-gaap:RetainedEarningsMember2021-12-310001841925us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001841925us-gaap:ParentMember2021-12-310001841925us-gaap:NoncontrollingInterestMember2021-12-3100018419252021-12-310001841925us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-12-310001841925us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001841925us-gaap:ParentMember2022-01-012022-12-310001841925us-gaap:CommonStockMemberindi:CommonClassVMember2022-01-012022-12-310001841925us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001841925us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001841925us-gaap:RetainedEarningsMember2022-01-012022-12-310001841925us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001841925us-gaap:CommonStockMemberindi:CommonClassVMember2022-12-310001841925us-gaap:AdditionalPaidInCapitalMember2022-12-310001841925us-gaap:RetainedEarningsMember2022-12-310001841925us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001841925us-gaap:ParentMember2022-12-310001841925us-gaap:NoncontrollingInterestMember2022-12-310001841925us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-12-310001841925us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001841925us-gaap:ParentMember2023-01-012023-12-310001841925us-gaap:CommonStockMemberindi:CommonClassVMember2023-01-012023-12-310001841925us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001841925us-gaap:CommonClassAMemberindi:GEOSemiconductorIncMemberus-gaap:CommonStockMember2023-01-012023-12-310001841925us-gaap:AdditionalPaidInCapitalMemberindi:GEOSemiconductorIncMember2023-01-012023-12-310001841925us-gaap:ParentMemberindi:GEOSemiconductorIncMember2023-01-012023-12-310001841925us-gaap:NoncontrollingInterestMemberindi:GEOSemiconductorIncMember2023-01-012023-12-310001841925indi:GEOSemiconductorIncMember2023-01-012023-12-310001841925us-gaap:CommonClassAMemberindi:ExalosMemberus-gaap:CommonStockMember2023-01-012023-12-310001841925us-gaap:AdditionalPaidInCapitalMemberindi:ExalosMember2023-01-012023-12-310001841925us-gaap:ParentMemberindi:ExalosMember2023-01-012023-12-310001841925us-gaap:NoncontrollingInterestMemberindi:ExalosMember2023-01-012023-12-310001841925indi:ExalosMember2023-01-012023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001841925us-gaap:ParentMemberindi:SiliconRadarGmbHMember2023-01-012023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:NoncontrollingInterestMember2023-01-012023-12-310001841925indi:SiliconRadarGmbHMember2023-01-012023-12-310001841925us-gaap:RetainedEarningsMember2023-01-012023-12-310001841925us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001841925us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310001841925us-gaap:CommonStockMemberindi:CommonClassVMember2023-12-310001841925us-gaap:AdditionalPaidInCapitalMember2023-12-310001841925us-gaap:RetainedEarningsMember2023-12-310001841925us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001841925us-gaap:ParentMember2023-12-310001841925us-gaap:NoncontrollingInterestMember2023-12-3100018419252022-08-260001841925indi:AtTheMarketOfferingMember2022-08-262022-08-2600018419252022-08-272023-12-310001841925us-gaap:CommonClassAMember2022-08-272023-12-310001841925us-gaap:CommonClassAMemberindi:SinceInceptionMember2023-12-310001841925indi:AtTheMarketOfferingMember2022-08-272023-12-310001841925us-gaap:CommonClassAMember2023-01-012023-12-310001841925us-gaap:WarrantMember2023-10-200001841925us-gaap:WarrantMember2023-10-202023-10-20xbrli:pure0001841925us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-10-202023-10-200001841925indi:TenderedWarrantsMember2023-10-200001841925indi:TenderedWarrantsMember2023-10-202023-10-200001841925us-gaap:CommonClassAMember2023-10-200001841925us-gaap:CommonClassAMember2023-10-202023-10-200001841925indi:UntenderedWarrantsMember2023-11-090001841925us-gaap:CommonClassAMember2023-11-092023-11-090001841925indi:GEOSemiconductorIncMember2023-02-092023-02-090001841925us-gaap:CommonClassAMemberindi:GEOSemiconductorIncMember2023-02-092023-02-090001841925us-gaap:CommonClassAMemberindi:GEOSemiconductorIncMember2023-02-092023-02-090001841925us-gaap:CommonClassAMemberindi:GEOSemiconductorIncMember2023-02-090001841925indi:SiliconRadarGmbHMember2023-02-212023-02-210001841925indi:SiliconRadarGmbHMemberus-gaap:CommonClassAMember2023-02-212023-02-210001841925indi:SiliconRadarGmbHMemberindi:PurchasePriceEquityConsiderationMember2023-02-012023-02-280001841925indi:SiliconRadarGmbHMemberus-gaap:CommonClassAMember2023-09-180001841925us-gaap:CommonClassAMemberindi:ExalosAGMember2023-09-182023-09-180001841925indi:EquityConsiderationIssuedMemberus-gaap:CommonStockMemberindi:ExalosAGMember2023-09-182023-09-180001841925us-gaap:CommonClassAMemberindi:ExalosAGMember2023-09-180001841925indi:ExalosAGMember2023-09-180001841925indi:ThunderBridgeAcquisitionIILtdMember2021-06-092021-06-090001841925us-gaap:CommonClassAMemberindi:ThunderBridgeAcquisitionIILtdMember2021-06-092021-06-090001841925us-gaap:CommonClassAMemberindi:ThunderBridgeAcquisitionIILtdMember2021-06-090001841925us-gaap:CommonClassAMember2021-06-092021-06-090001841925indi:ThunderBridgeAcquisitionIILtdMemberindi:PrivatePlacementWarrantsMember2021-06-090001841925indi:WorkingCapitalWarrantsMember2023-01-012023-12-3100018419252021-06-102021-06-100001841925us-gaap:CommonClassAMember2021-06-102021-06-100001841925indi:CommonUnitClassGMember2021-06-102021-06-100001841925us-gaap:CommonClassAMemberindi:EmbryConvertibleSubordinatedNotesPayableOneMemberus-gaap:ConvertibleDebtMember2021-06-092021-06-090001841925us-gaap:CommonClassCMemberindi:EmbryConvertibleSubordinatedNotesPayableTwoMemberus-gaap:ConvertibleDebtMember2021-06-092021-06-090001841925indi:CommonUnitClassCDEAndFMember2021-06-0900018419252021-06-100001841925indi:CommonUnitClassAMemberindi:ConversionOfClassAUnitsMember2021-06-102021-06-100001841925us-gaap:CommonClassAMemberindi:ConversionOfClassAUnitsMember2021-06-102021-06-100001841925indi:ConversionOfClassAUnitsMemberindi:CommonClassVMember2021-06-102021-06-100001841925indi:CommonUnitClassBMemberindi:ConversionOfClassBUnitsMember2021-06-102021-06-100001841925us-gaap:CommonClassAMemberindi:ConversionOfClassBUnitsMember2021-06-102021-06-100001841925us-gaap:CommonClassAMemberindi:CommonUnitClassBMember2021-06-102021-06-1000018419252021-06-090001841925indi:EscrowSharesMember2021-06-102021-06-100001841925indi:EarnoutSharesMember2021-06-102021-06-10indi:member00018419252021-06-302021-06-300001841925us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-06-102021-06-100001841925us-gaap:AdditionalPaidInCapitalMember2021-06-102021-06-100001841925us-gaap:CommonClassAMemberus-gaap:ConvertibleDebtMemberus-gaap:CommonStockMemberindi:EmbryConvertibleSubordinatedNotesPayableMember2021-06-102021-06-100001841925us-gaap:AdditionalPaidInCapitalMemberus-gaap:ConvertibleDebtMemberindi:EmbryConvertibleSubordinatedNotesPayableMember2021-06-102021-06-100001841925indi:PublicWarrantsMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-06-102021-06-100001841925indi:PublicWarrantsMemberus-gaap:AdditionalPaidInCapitalMember2021-06-102021-06-100001841925us-gaap:CommonClassAMemberus-gaap:SecuritiesSubjectToMandatoryRedemptionMemberus-gaap:CommonStockMember2021-06-102021-06-100001841925us-gaap:SecuritiesSubjectToMandatoryRedemptionMemberus-gaap:CommonStockMemberindi:CommonClassVMember2021-06-102021-06-100001841925us-gaap:AdditionalPaidInCapitalMemberus-gaap:SecuritiesSubjectToMandatoryRedemptionMember2021-06-102021-06-100001841925us-gaap:CommonStockMemberindi:CommonClassVMember2021-06-102021-06-100001841925us-gaap:CommonClassAMember2023-06-200001841925us-gaap:CommonClassAMember2023-06-210001841925indi:AyDeeKayLLCMember2023-12-310001841925indi:AyDeeKayLLCMemberindi:WuxiIndieMicroelectronicsLtdMember2023-12-3100018419252023-01-012023-06-300001841925srt:MinimumMember2023-12-310001841925srt:MaximumMember2023-12-310001841925indi:ProductionMasksMember2023-12-31indi:segment00018419252022-01-010001841925indi:InitialCashConsidationMemberindi:ExalosAGMemberindi:CashConsiderationPaidMember2023-09-012023-09-300001841925indi:SiliconRadarGmbHMemberindi:InitialCashConsidationMemberindi:CashConsiderationPaidMember2023-02-012023-02-280001841925indi:InitialCashConsidationMemberindi:GEOSemiconductorIncMemberindi:CashConsiderationPaidMember2023-03-012023-03-310001841925indi:InitialCashConsidationMemberindi:SymeoMemberindi:CashConsiderationPaidMember2022-01-012022-01-310001841925indi:CashConsiderationAccuralMemberindi:CashConsiderationAccuralMemberindi:ExalosAGMember2023-09-012023-09-300001841925indi:SiliconRadarGmbHMemberindi:CashConsiderationAccuralMemberindi:CashConsiderationAccuralMember2023-02-012023-02-280001841925indi:CashConsiderationAccuralMemberindi:CashConsiderationAccuralMemberindi:GEOSemiconductorIncMember2023-03-012023-03-310001841925indi:CashConsiderationAccuralMemberindi:SymeoMember2022-01-012022-01-310001841925indi:ExalosAGMember2023-09-012023-09-300001841925indi:SiliconRadarGmbHMember2023-02-012023-02-280001841925indi:GEOSemiconductorIncMember2023-03-012023-03-310001841925indi:SymeoMember2022-01-012022-01-310001841925indi:SiliconRadarGmbHMemberindi:EquityConsiderationIssuedMemberus-gaap:CommonStockMember2023-02-012023-02-280001841925indi:EquityConsiderationIssuedMemberindi:GEOSemiconductorIncMemberus-gaap:CommonStockMember2023-03-012023-03-310001841925indi:EquityConsiderationIssuedMemberindi:SymeoMemberus-gaap:CommonStockMember2022-01-012022-01-310001841925indi:EquityConsiderationIssuableMemberus-gaap:CommonStockMemberindi:ExalosAGMember2023-09-012023-09-300001841925indi:EquityConsiderationIssuableMemberindi:SiliconRadarGmbHMemberus-gaap:CommonStockMember2023-02-012023-02-280001841925indi:EquityConsiderationIssuableMemberindi:GEOSemiconductorIncMemberus-gaap:CommonStockMember2023-03-012023-03-310001841925indi:EquityConsiderationIssuableMemberindi:SymeoMemberus-gaap:CommonStockMember2022-01-012022-01-310001841925indi:ExalosAGMember2023-12-310001841925indi:SiliconRadarGmbHMember2023-12-310001841925indi:GEOSemiconductorIncMember2023-12-310001841925indi:SymeoMember2023-12-310001841925us-gaap:TechnologyBasedIntangibleAssetsMemberindi:ExalosAGMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001841925indi:GEOSemiconductorIncMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001841925indi:SymeoMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001841925indi:ExalosAGMemberus-gaap:InProcessResearchAndDevelopmentMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:InProcessResearchAndDevelopmentMember2023-12-310001841925indi:GEOSemiconductorIncMemberus-gaap:InProcessResearchAndDevelopmentMember2023-12-310001841925indi:SymeoMemberus-gaap:InProcessResearchAndDevelopmentMember2023-12-310001841925us-gaap:CustomerRelationshipsMemberindi:ExalosAGMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:CustomerRelationshipsMember2023-12-310001841925us-gaap:CustomerRelationshipsMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:CustomerRelationshipsMemberindi:SymeoMember2023-12-310001841925us-gaap:OrderOrProductionBacklogMemberindi:ExalosAGMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:OrderOrProductionBacklogMember2023-12-310001841925indi:GEOSemiconductorIncMemberus-gaap:OrderOrProductionBacklogMember2023-12-310001841925indi:SymeoMemberus-gaap:OrderOrProductionBacklogMember2023-12-310001841925us-gaap:TradeNamesMemberindi:ExalosAGMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:TradeNamesMember2023-12-310001841925us-gaap:TradeNamesMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:TradeNamesMemberindi:SymeoMember2023-12-310001841925indi:ADKLLCMember2023-01-012023-12-310001841925indi:ExalosAGMember2023-01-012023-12-310001841925srt:MaximumMemberindi:ExalosAGMember2023-09-180001841925indi:ContingentConsiderationTrancheOneMemberindi:ExalosAGMember2023-09-180001841925indi:ContingentConsiderationTrancheOneMemberindi:ExalosAGMember2023-09-182023-09-180001841925indi:ContingentConsiderationTrancheTwoMemberindi:ExalosAGMember2023-09-180001841925indi:GEOSemiconductorIncMember2023-07-072023-07-070001841925indi:GEOSemiconductorIncMember2023-10-012023-12-310001841925indi:ContingentConsiderationTrancheOneMembersrt:MaximumMemberindi:GEOSemiconductorIncMember2023-02-090001841925indi:ContingentConsiderationTrancheOneMemberindi:GEOSemiconductorIncMember2023-02-090001841925indi:ContingentConsiderationTrancheOneMemberindi:GEOSemiconductorIncMember2023-02-092023-02-090001841925indi:ContingentConsiderationTrancheTwoMembersrt:MaximumMemberindi:GEOSemiconductorIncMember2023-02-090001841925indi:ContingentConsiderationTrancheTwoMemberindi:GEOSemiconductorIncMember2023-02-090001841925indi:ContingentConsiderationTrancheOneMemberindi:GEOSemiconductorIncMemberus-gaap:CommonStockMember2023-12-310001841925indi:ContingentConsiderationTrancheTwoMemberindi:GEOSemiconductorIncMemberus-gaap:CommonStockMember2023-12-310001841925indi:GEOSemiconductorIncMember2023-03-032023-12-310001841925indi:GEOSemiconductorIncMember2022-01-012022-12-310001841925indi:SiliconRadarGmbHMembersrt:MaximumMember2023-02-210001841925indi:SiliconRadarGmbHMemberindi:ContingentConsiderationTrancheOneMember2023-02-210001841925indi:SiliconRadarGmbHMemberindi:ContingentConsiderationTrancheOneMember2023-02-212023-02-210001841925indi:SiliconRadarGmbHMemberindi:ContingentConsiderationTrancheTwoMember2023-02-210001841925indi:SiliconRadarGmbHMemberindi:ContingentConsiderationTrancheTwoMember2023-02-212023-02-210001841925indi:SiliconRadarGmbHMembersrt:MinimumMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001841925indi:SiliconRadarGmbHMembersrt:MaximumMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001841925indi:SymeoMember2022-01-042022-01-040001841925indi:SymeoPromissoryNoteMemberus-gaap:LoansPayableMemberindi:SymeoMember2022-01-040001841925indi:CashConsiderationAccuralMemberindi:SymeoMember2022-01-042022-01-040001841925indi:ContingentConsiderationTrancheOneMemberindi:SymeoMember2022-01-040001841925indi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2022-01-040001841925indi:SymeoMember2023-01-012023-12-310001841925us-gaap:CommonClassAMemberindi:SymeoMember2023-10-262023-10-260001841925indi:PurchasePriceEquityConsiderationMemberindi:SymeoMember2023-10-262023-10-260001841925indi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2023-12-310001841925indi:SymeoMember2022-01-040001841925srt:RestatementAdjustmentMemberindi:SymeoMember2023-12-310001841925indi:SymeoMemberus-gaap:TechnologyBasedIntangibleAssetsMember2022-01-040001841925srt:RestatementAdjustmentMemberindi:SymeoMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001841925us-gaap:InProcessResearchAndDevelopmentMemberindi:SymeoMember2022-01-040001841925srt:RestatementAdjustmentMemberus-gaap:InProcessResearchAndDevelopmentMemberindi:SymeoMember2023-12-310001841925us-gaap:InProcessResearchAndDevelopmentMemberindi:SymeoMember2023-12-310001841925us-gaap:CustomerRelationshipsMemberindi:SymeoMember2022-01-040001841925srt:RestatementAdjustmentMemberus-gaap:CustomerRelationshipsMemberindi:SymeoMember2023-12-310001841925indi:SymeoMemberus-gaap:OrderOrProductionBacklogMember2022-01-040001841925srt:RestatementAdjustmentMemberindi:SymeoMemberus-gaap:OrderOrProductionBacklogMember2023-12-310001841925us-gaap:TradeNamesMemberindi:SymeoMember2022-01-040001841925srt:RestatementAdjustmentMemberus-gaap:TradeNamesMemberindi:SymeoMember2023-12-310001841925indi:SymeoMember2022-10-012022-12-31indi:technology0001841925srt:MinimumMemberindi:SymeoMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001841925indi:SymeoMembersrt:MaximumMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001841925indi:ProductionToolingMember2023-12-310001841925indi:ProductionToolingMember2022-12-310001841925indi:LaboratoryEquipmentMember2023-12-310001841925indi:LaboratoryEquipmentMember2022-12-310001841925srt:MinimumMemberus-gaap:OfficeEquipmentMember2023-12-310001841925us-gaap:OfficeEquipmentMembersrt:MaximumMember2023-12-310001841925us-gaap:OfficeEquipmentMember2023-12-310001841925us-gaap:OfficeEquipmentMember2022-12-310001841925us-gaap:LeaseholdImprovementsMember2023-12-310001841925us-gaap:LeaseholdImprovementsMember2022-12-310001841925us-gaap:ConstructionInProgressMember2023-12-310001841925us-gaap:ConstructionInProgressMember2022-12-310001841925us-gaap:DevelopedTechnologyRightsMember2023-12-310001841925us-gaap:DevelopedTechnologyRightsMember2022-12-310001841925us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001841925us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310001841925us-gaap:CustomerRelationshipsMember2023-12-310001841925us-gaap:CustomerRelationshipsMember2022-12-310001841925indi:IntellectualPropertyLicensesMember2023-12-310001841925indi:IntellectualPropertyLicensesMember2022-12-310001841925us-gaap:TradeNamesMember2023-12-310001841925us-gaap:TradeNamesMember2022-12-310001841925us-gaap:OrderOrProductionBacklogMember2023-12-310001841925us-gaap:OrderOrProductionBacklogMember2022-12-310001841925us-gaap:InProcessResearchAndDevelopmentMember2023-12-310001841925us-gaap:InProcessResearchAndDevelopmentMember2022-12-310001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2023-12-310001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2022-12-310001841925indi:PromissoryNoteDue2023Member2023-12-310001841925indi:PromissoryNoteDue2023Member2022-12-310001841925us-gaap:LineOfCreditMemberindi:TeraXionLineOfCreditMember2023-12-310001841925us-gaap:LineOfCreditMemberindi:TeraXionLineOfCreditMember2022-12-310001841925us-gaap:LoansPayableMember2023-12-310001841925us-gaap:LoansPayableMember2022-12-310001841925us-gaap:SecuredDebtMember2023-12-310001841925us-gaap:SecuredDebtMember2022-12-310001841925us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001841925us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMemberindi:InitialPurchasersMember2022-11-160001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberindi:AdditionalNotesMemberus-gaap:SeniorNotesMember2022-11-160001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2022-11-170001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2022-11-210001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2022-11-212022-11-210001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:DebtInstrumentRedemptionPeriodOneMembersrt:MinimumMemberus-gaap:SeniorNotesMember2022-11-212022-11-21indi:tradingDay0001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SeniorNotesMember2022-11-212022-11-210001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMembersrt:MinimumMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2022-11-212022-11-210001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2022-11-212022-11-210001841925indi:ConvertibleSeniorNotesDue2027Member2023-12-310001841925indi:ConvertibleSeniorNotesDue2027Member2022-12-310001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2023-01-012023-12-310001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2022-01-012022-12-310001841925us-gaap:CommonClassAMember2022-01-012022-12-310001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMembersrt:MaximumMember2022-11-210001841925us-gaap:SecuredDebtMemberindi:PacWestTermLoanAndRevolvingLineOfCreditMemberus-gaap:LineOfCreditMember2015-01-310001841925us-gaap:SecuredDebtMemberindi:PacWestTermLoanAndRevolvingLineOfCreditMemberus-gaap:LineOfCreditMemberus-gaap:PrimeRateMember2015-01-312015-01-310001841925us-gaap:RevolvingCreditFacilityMemberindi:PacWestTermLoanAndRevolvingLineOfCreditMemberus-gaap:LineOfCreditMemberus-gaap:PrimeRateMember2015-01-312015-01-310001841925us-gaap:RevolvingCreditFacilityMemberindi:PacWestTermLoanAndRevolvingLineOfCreditMemberus-gaap:LineOfCreditMember2015-01-310001841925us-gaap:LineOfCreditMemberindi:AmendedPacWestTermLoanAndRevolvingLineOfCreditMember2021-11-050001841925us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberindi:AmendedPacWestTermLoanAndRevolvingLineOfCreditMember2021-11-012021-11-050001841925us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberindi:AmendedPacWestTermLoanAndRevolvingLineOfCreditMember2021-11-050001841925us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberindi:PacWestRevolvingLineOfCreditMember2021-11-052021-11-050001841925indi:PacWestTermLoanAndRevolvingLineOfCreditMemberus-gaap:LineOfCreditMember2021-12-310001841925us-gaap:RevolvingCreditFacilityMemberindi:PacWestTermLoanAndRevolvingLineOfCreditMemberus-gaap:LineOfCreditMember2021-12-310001841925us-gaap:LineOfCreditMemberindi:TeraXionLineOfCreditMember2021-10-12iso4217:CAD0001841925us-gaap:LineOfCreditMemberus-gaap:PrimeRateMemberindi:TeraXionLineOfCreditMember2021-10-122021-10-120001841925us-gaap:LineOfCreditMemberindi:TeraXionLineOfCreditMember2021-10-122021-10-120001841925indi:TeraXionLineOfCreditUsedAsSecuritizationMemberus-gaap:LineOfCreditMember2023-12-310001841925indi:TeraXionLineOfCreditUsedAsSecuritizationMemberus-gaap:LineOfCreditMember2022-12-310001841925us-gaap:RevolvingCreditFacilityMemberindi:TeraXionLineOfCreditUsedAsSecuritizationMemberus-gaap:LineOfCreditMember2023-12-310001841925indi:CITICGroupCorporationLtdMemberindi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMember2022-01-19iso4217:CNY0001841925indi:CITICGroupCorporationLtdMemberindi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMember2022-06-212022-06-210001841925indi:CITICGroupCorporationLtdMemberindi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMember2022-06-210001841925indi:CITICGroupCorporationLtdMemberindi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMember2022-12-310001841925indi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMemberindi:NetherlandsChinaBusinessCouncilMember2020-10-150001841925indi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMemberindi:NetherlandsChinaBusinessCouncilMember2021-04-292021-04-290001841925indi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMemberindi:NetherlandsChinaBusinessCouncilMember2021-04-290001841925indi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMemberindi:NetherlandsChinaBusinessCouncilMember2021-10-182021-10-180001841925indi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMemberindi:NetherlandsChinaBusinessCouncilMember2021-10-180001841925indi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMemberindi:NetherlandsChinaBusinessCouncilMember2022-04-270001841925indi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMemberindi:NetherlandsChinaBusinessCouncilMember2022-06-242022-06-240001841925indi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMemberindi:NetherlandsChinaBusinessCouncilMember2022-06-240001841925indi:ShortTermLoanAgreementMemberus-gaap:LoansPayableMemberindi:NetherlandsChinaBusinessCouncilMember2022-12-310001841925indi:SymeoPromissoryNoteMemberus-gaap:LoansPayableMember2022-01-040001841925indi:SymeoPromissoryNoteMemberus-gaap:LoansPayableMember2022-12-310001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2015-01-310001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:SeniorNotesMember2021-01-012021-12-310001841925indi:OtherDebtMember2023-01-012023-12-310001841925indi:OtherDebtMember2022-01-012022-12-310001841925indi:OtherDebtMember2021-01-012021-12-310001841925indi:PublicWarrantsMember2023-12-310001841925us-gaap:CommonClassBMember2021-06-092021-06-090001841925indi:PrivatePlacementWarrantsMember2021-06-090001841925indi:PrivatePlacementWarrantsMember2023-12-310001841925indi:PublicWarrantsMember2023-01-012023-12-310001841925indi:PublicWarrantsMembersrt:MinimumMember2023-12-310001841925indi:PublicWarrantsMember2021-06-100001841925indi:PrivateWarrantsMember2023-12-310001841925indi:PrivateWarrantsMember2021-06-100001841925srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember2023-11-092023-11-0900018419252023-01-012023-11-090001841925indi:MilestoneTwoEarnoutSharesMember2021-06-102021-06-100001841925indi:MilestoneOneEarnoutSharesMember2021-06-102021-06-100001841925srt:MinimumMemberindi:MilestoneOneEarnoutSharesMember2021-06-100001841925srt:MaximumMemberindi:MilestoneOneEarnoutSharesMember2021-06-100001841925indi:CitySemiconductorIncMember2020-05-132020-05-130001841925indi:ContingentConsiderationTrancheOneMemberindi:CitySemiconductorIncMember2020-05-132020-05-130001841925indi:ContingentConsiderationTrancheOneMemberindi:CitySemiconductorIncMember2021-05-310001841925indi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2020-05-132020-05-130001841925indi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2023-04-012023-04-300001841925indi:ContingentConsiderationTrancheTwoMemberus-gaap:CommonStockMemberindi:CitySemiconductorIncMember2023-04-012023-04-300001841925indi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2023-12-310001841925indi:ONDesignIsraelLtdMember2021-10-012021-10-010001841925indi:ContingentConsiderationTrancheOneMemberindi:ONDesignIsraelLtdMember2021-10-010001841925indi:ContingentConsiderationTrancheOneMemberindi:ONDesignIsraelLtdMember2021-10-012021-10-010001841925indi:ContingentConsiderationTrancheTwoMemberindi:ONDesignIsraelLtdMember2021-10-010001841925indi:ContingentConsiderationTrancheTwoMemberindi:ONDesignIsraelLtdMember2021-10-012021-10-010001841925indi:ContingentConsiderationTrancheOneMemberindi:ONDesignIsraelLtdMember2023-12-310001841925indi:ContingentConsiderationTrancheTwoMemberindi:ONDesignIsraelLtdMember2023-12-310001841925indi:ContingentConsiderationTrancheOneMemberindi:ONDesignIsraelLtdMember2022-12-310001841925indi:SiliconRadarGmbHMember2023-02-210001841925indi:SiliconRadarGmbHMemberus-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheOneMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheTwoMember2023-12-310001841925indi:GEOSemiconductorIncMember2023-03-030001841925indi:ContingentConsiderationTrancheOneMemberindi:GEOSemiconductorIncMember2023-12-310001841925indi:ContingentConsiderationTrancheTwoMemberindi:GEOSemiconductorIncMember2023-12-310001841925indi:ContingentConsiderationTrancheOneMemberindi:ExalosAGMember2023-12-310001841925indi:ContingentConsiderationTrancheTwoMemberindi:ExalosAGMember2023-12-310001841925indi:FinancialInstrumentsSubjectToMandatoryRedemptionIssuedIn2020Member2021-01-012021-12-310001841925indi:FinancialInstrumentsSubjectToMandatoryRedemptionIssuedIn2020Member2023-12-310001841925indi:FinancialInstrumentsSubjectToMandatoryRedemptionIssuedIn2021Member2021-04-012021-04-3000018419252021-06-210001841925us-gaap:ForeignExchangeForwardMember2023-12-310001841925us-gaap:ForeignExchangeForwardMember2022-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheOneMemberindi:ExalosAGMember2023-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheOneMemberindi:ExalosAGMember2023-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheOneMemberindi:ExalosAGMember2023-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheTwoMemberindi:ExalosAGMember2023-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheTwoMemberindi:ExalosAGMember2023-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheTwoMemberindi:ExalosAGMember2023-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheOneMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheOneMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheOneMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheTwoMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheTwoMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheTwoMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:GEOSemiconductorIncMemberindi:IndemnityHoldbackMember2023-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:GEOSemiconductorIncMemberindi:IndemnityHoldbackMember2023-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:GEOSemiconductorIncMemberindi:IndemnityHoldbackMember2023-12-310001841925indi:GEOSemiconductorIncMemberindi:IndemnityHoldbackMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheOneMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheOneMember2023-12-310001841925indi:SiliconRadarGmbHMemberindi:ContingentConsiderationTrancheOneMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheTwoMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheTwoMember2023-12-310001841925indi:SiliconRadarGmbHMemberindi:ContingentConsiderationTrancheTwoMember2023-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2023-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2023-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2023-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2023-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2023-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2023-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:PrivateWarrantsMember2022-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:PrivateWarrantsMember2022-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:PrivateWarrantsMember2022-12-310001841925indi:PrivateWarrantsMember2022-12-310001841925indi:PublicWarrantsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001841925indi:PublicWarrantsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001841925indi:PublicWarrantsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001841925indi:PublicWarrantsMember2022-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2022-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2022-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2022-12-310001841925indi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2022-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheOneMemberindi:SymeoMember2022-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheOneMemberindi:SymeoMember2022-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheOneMemberindi:SymeoMember2022-12-310001841925indi:ContingentConsiderationTrancheOneMemberindi:SymeoMember2022-12-310001841925us-gaap:FairValueInputsLevel1Memberindi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2022-12-310001841925us-gaap:FairValueInputsLevel2Memberindi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2022-12-310001841925us-gaap:FairValueInputsLevel3Memberindi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2022-12-310001841925indi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2022-12-310001841925indi:SymeoPromissoryNoteMemberus-gaap:LoansPayableMemberus-gaap:FairValueInputsLevel1Memberindi:SymeoMember2022-12-310001841925indi:SymeoPromissoryNoteMemberus-gaap:FairValueInputsLevel2Memberus-gaap:LoansPayableMemberindi:SymeoMember2022-12-310001841925indi:SymeoPromissoryNoteMemberus-gaap:LoansPayableMemberus-gaap:FairValueInputsLevel3Memberindi:SymeoMember2022-12-310001841925indi:SymeoPromissoryNoteMemberus-gaap:LoansPayableMemberindi:SymeoMember2022-12-310001841925us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:ValuationTechniqueOptionPricingModelMember2022-12-310001841925us-gaap:MeasurementInputCommodityMarketPriceMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheOneMemberindi:ExalosAGMember2023-12-310001841925us-gaap:MeasurementInputCommodityFuturePriceMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheOneMemberindi:ExalosAGMember2023-12-310001841925us-gaap:MeasurementInputCommodityMarketPriceMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheTwoMemberindi:ExalosAGMember2023-12-310001841925us-gaap:MeasurementInputCommodityFuturePriceMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheTwoMemberindi:ExalosAGMember2023-12-310001841925us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheOneMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheOneMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheTwoMemberindi:GEOSemiconductorIncMember2023-12-310001841925us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheTwoMemberindi:GEOSemiconductorIncMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheOneMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheOneMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheTwoMember2023-12-310001841925indi:SiliconRadarGmbHMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheTwoMember2023-12-310001841925us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2023-12-310001841925us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheTwoMemberindi:CitySemiconductorIncMember2022-12-310001841925us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheOneMemberindi:SymeoMember2022-12-310001841925us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2023-12-310001841925us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:ContingentConsiderationTrancheTwoMemberindi:SymeoMember2022-12-310001841925us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberindi:SymeoMember2022-12-310001841925indi:WuxiIndieMicroelectronicsLtdMemberus-gaap:PrivatePlacementMember2022-11-292022-11-290001841925indi:WuxiIndieMicroelectronicsLtdMemberus-gaap:PrivatePlacementMember2022-11-29iso4217:CNYxbrli:shares0001841925indi:AyDeeKayLLCMemberindi:WuxiIndieMicroelectronicsLtdMember2022-11-280001841925indi:AyDeeKayLLCMemberindi:WuxiIndieMicroelectronicsLtdMember2022-11-2900018419252023-12-012023-12-310001841925indi:WuxiLongTermIncentivePlanMember2023-12-012023-12-310001841925indi:WuxiLongTermIncentivePlanMember2023-12-310001841925us-gaap:CommonClassAMembersrt:MaximumMember2022-11-160001841925indi:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMemberus-gaap:CommonClassAMemberus-gaap:SeniorNotesMembersrt:MaximumMember2022-11-160001841925indi:CommonUnitClassAMember2021-06-100001841925us-gaap:CommonClassAMemberindi:CommonUnitClassAMember2021-06-102021-06-100001841925indi:CommonUnitClassAMemberindi:CommonClassVMember2021-06-102021-06-100001841925indi:CommonUnitClassBMember2021-06-100001841925indi:CommonUnitClassBMemberindi:CommonClassVMember2021-06-102021-06-100001841925indi:CommonUnitClassCMember2021-06-100001841925indi:CommonUnitClassCMemberus-gaap:CommonClassAMember2021-06-102021-06-100001841925indi:CommonUnitClassCMemberindi:CommonClassVMember2021-06-102021-06-100001841925indi:CommonUnitClassDMember2021-06-100001841925us-gaap:CommonClassAMemberindi:CommonUnitClassDMember2021-06-102021-06-100001841925indi:CommonUnitClassDMemberindi:CommonClassVMember2021-06-102021-06-100001841925indi:CommonUnitClassEMember2021-06-100001841925us-gaap:CommonClassAMemberindi:CommonUnitClassEMember2021-06-102021-06-100001841925indi:CommonUnitClassEMemberindi:CommonClassVMember2021-06-102021-06-100001841925indi:CommonUnitClassFMember2021-06-100001841925us-gaap:CommonClassAMemberindi:CommonUnitClassFMember2021-06-102021-06-100001841925indi:CommonClassVMemberindi:CommonUnitClassFMember2021-06-102021-06-100001841925indi:CommonUnitClassGMember2021-06-100001841925us-gaap:CommonClassAMemberindi:CommonUnitClassGMember2021-06-102021-06-100001841925indi:CommonUnitClassGMemberindi:CommonClassVMember2021-06-102021-06-100001841925indi:CommonUnitsExceptCommonUnitClassHMember2021-06-100001841925us-gaap:CommonClassAMemberindi:CommonUnitsExceptCommonUnitClassHMember2021-06-102021-06-100001841925indi:CommonUnitsExceptCommonUnitClassHMemberindi:CommonClassVMember2021-06-102021-06-100001841925srt:ScenarioPreviouslyReportedMemberindi:CommonUnitClassAMember2020-12-310001841925srt:ScenarioPreviouslyReportedMemberindi:CommonUnitClassBMember2020-12-310001841925indi:CommonUnitClassCMembersrt:ScenarioPreviouslyReportedMember2020-12-310001841925srt:ScenarioPreviouslyReportedMemberindi:CommonUnitClassDMember2020-12-310001841925srt:ScenarioPreviouslyReportedMemberindi:CommonUnitClassEMember2020-12-310001841925srt:ScenarioPreviouslyReportedMemberindi:CommonUnitClassFMember2020-12-310001841925srt:ScenarioPreviouslyReportedMemberindi:CommonUnitClassGMember2020-12-310001841925indi:CommonUnitClassHMember2021-06-100001841925srt:ScenarioPreviouslyReportedMemberindi:CommonUnitClassHMember2020-12-310001841925srt:ScenarioPreviouslyReportedMember2020-12-310001841925indi:CommonUnitClassAMember2007-02-092007-02-090001841925indi:CommonUnitClassCMember2012-12-282012-12-280001841925indi:CommonUnitClassCMember2012-12-280001841925indi:CommonUnitClassAMember2023-12-310001841925indi:CommonUnitClassCMember2023-12-310001841925indi:CommonUnitMemberindi:CommonUnitClassBMember2021-06-090001841925indi:CommonUnitMemberindi:CommonUnitClassBMember2021-06-100001841925indi:CommonUnitClassDMember2015-07-242015-07-240001841925indi:CommonUnitClassDMember2015-07-240001841925indi:CommonUnitClassDMemberindi:IndividualInvestorMember2015-08-282015-08-280001841925indi:CommonUnitClassDMemberindi:IndividualInvestorMember2015-08-280001841925indi:CommonUnitClassEMember2017-07-252017-07-250001841925indi:CommonUnitClassEMember2017-07-250001841925indi:TrinityTermLoanMemberindi:CommonClassGMemberindi:CommonWarrantMember2018-03-310001841925indi:PacWestTermLoanAndRevolvingLineOfCreditMemberus-gaap:LineOfCreditMemberindi:CommonWarrantMember2018-04-300001841925indi:TrinityTermLoanMemberus-gaap:LoansPayableMemberindi:CommonClassGMemberindi:CommonWarrantMember2018-04-300001841925indi:TrinityTermLoanMemberus-gaap:LoansPayableMemberindi:CommonClassGMemberindi:CommonWarrantMember2020-10-010001841925indi:PacWestMemberindi:CommonUnitClassGMemberindi:PrivateWarrantsMember2021-02-030001841925indi:PacWestMemberindi:CommonUnitClassGMemberindi:PrivateWarrantsMember2021-06-080001841925indi:CommonUnitClassFMember2018-06-012018-06-300001841925indi:CommonUnitClassFMember2018-06-300001841925indi:CitySemiconductorIncMemberindi:CommonUnitClassHMember2020-05-012020-05-310001841925indi:CommonUnitClassAMember2023-01-012023-12-31indi:vote0001841925indi:ClassCDEAndFUnitsMember2023-01-012023-12-310001841925indi:AyDeeKayLLCMember2022-12-310001841925indi:AyDeeKayLLCMemberindi:WuxiIndieMicroelectronicsLtdMember2022-12-310001841925country:US2023-01-012023-12-310001841925country:US2022-01-012022-12-310001841925country:US2021-01-012021-12-310001841925country:CN2023-01-012023-12-310001841925country:CN2022-01-012022-12-310001841925country:CN2021-01-012021-12-310001841925srt:EuropeMember2023-01-012023-12-310001841925srt:EuropeMember2022-01-012022-12-310001841925srt:EuropeMember2021-01-012021-12-310001841925currency:KRW2023-01-012023-12-310001841925currency:KRW2022-01-012022-12-310001841925currency:KRW2021-01-012021-12-310001841925indi:NorthAmericaExcludingUnitedStatesMember2023-01-012023-12-310001841925indi:NorthAmericaExcludingUnitedStatesMember2022-01-012022-12-310001841925indi:NorthAmericaExcludingUnitedStatesMember2021-01-012021-12-310001841925indi:AsiaPacificExcludingChinaMember2023-01-012023-12-310001841925indi:AsiaPacificExcludingChinaMember2022-01-012022-12-310001841925indi:AsiaPacificExcludingChinaMember2021-01-012021-12-310001841925srt:SouthAmericaMember2023-01-012023-12-310001841925srt:SouthAmericaMember2022-01-012022-12-310001841925srt:SouthAmericaMember2021-01-012021-12-3100018419252024-01-012023-12-310001841925us-gaap:SalesRevenueNetMemberindi:CustomerAMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001841925us-gaap:SalesRevenueNetMemberindi:CustomerAMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001841925us-gaap:SalesRevenueNetMemberindi:CustomerAMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001841925indi:LargestCustomerOneMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001841925us-gaap:AccountsReceivableMemberindi:LargestCustomerTwoMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001841925indi:A2021OmnibusEquityIncentivePlanMember2021-06-102021-06-100001841925indi:A2021OmnibusEquityIncentivePlanMember2022-06-222022-06-220001841925indi:A2021OmnibusEquityIncentivePlanMember2022-06-220001841925us-gaap:CommonClassAMemberindi:A2021OmnibusEquityIncentivePlanMember2023-06-212023-06-210001841925us-gaap:CommonClassAMemberindi:A2021OmnibusEquityIncentivePlanMember2023-06-220001841925indi:A2021OmnibusEquityIncentivePlanMember2023-12-310001841925indi:A2021OmnibusEquityIncentivePlanMember2023-07-012023-07-010001841925indi:A2021OmnibusEquityIncentivePlanMemberindi:Section16OfficersMember2023-07-012023-07-010001841925indi:A2021OmnibusEquityIncentivePlanMemberindi:NonSection16OfficersMember2023-07-012023-07-010001841925indi:A2021OmnibusEquityIncentivePlanMember2023-01-012023-12-310001841925indi:A2023EmploymentInducementAwardPlanMemberus-gaap:CommonClassAMember2023-03-220001841925indi:A2023EmploymentInducementAwardPlanMember2022-06-222022-06-220001841925indi:A2023EmploymentInducementAwardPlanMemberus-gaap:CommonClassAMember2023-06-210001841925indi:A2023EmploymentInducementAwardPlanMemberus-gaap:CommonClassAMember2023-12-310001841925indi:A2023EmploymentInducementAwardPlanMemberus-gaap:CommonClassAMember2023-01-012023-12-310001841925indi:A2023EmploymentInducementAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001841925us-gaap:RestrictedStockUnitsRSUMemberindi:A2021OmnibusEquityIncentivePlanMember2023-01-012023-12-310001841925indi:ProfitInterestMember2023-01-012023-12-310001841925us-gaap:CommonClassAMemberindi:ProfitInterestMember2023-12-310001841925indi:CommonUnitsMemberindi:ProfitInterestMember2023-12-310001841925us-gaap:ShareBasedCompensationAwardTrancheOneMemberindi:ProfitInterestMember2023-01-012023-12-310001841925indi:ProfitInterestMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-012023-12-310001841925us-gaap:RestrictedStockMember2023-01-012023-12-310001841925us-gaap:CommonClassAMemberus-gaap:RestrictedStockMember2021-01-290001841925indi:CommonUnitsMemberus-gaap:RestrictedStockMember2021-01-290001841925us-gaap:RestrictedStockMember2021-01-292021-01-290001841925us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-12-310001841925us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-012023-12-310001841925us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-01-292021-01-290001841925us-gaap:RestrictedStockMember2021-01-292021-12-090001841925indi:UnvestedEarnOutSharesMember2023-12-310001841925us-gaap:CostOfSalesMember2023-01-012023-12-310001841925us-gaap:CostOfSalesMember2022-01-012022-12-310001841925us-gaap:CostOfSalesMember2021-01-012021-12-310001841925us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001841925us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001841925us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001841925us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001841925us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001841925us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001841925indi:A2022OmnibusEquityIncentivePlanMember2022-01-012022-12-310001841925indi:A2022OmnibusEquityIncentivePlanMember2021-01-012021-12-310001841925indi:A2022OmnibusEquityIncentivePlanMember2023-01-012023-12-310001841925indi:ProfitInterestMember2021-12-310001841925indi:ProfitInterestMember2022-01-012022-12-310001841925indi:ProfitInterestMember2022-12-310001841925indi:A2023EmploymentInducementIncentivePlanMember2023-01-012023-12-310001841925indi:ProfitInterestMember2023-12-310001841925indi:A2023EmploymentInducementIncentivePlanMember2022-12-310001841925indi:A2023EmploymentInducementIncentivePlanMember2023-12-310001841925indi:A2021OmnibusEquityIncentivePlanMember2021-01-012021-12-310001841925indi:A2021OmnibusEquityIncentivePlanMember2021-12-310001841925indi:A2021OmnibusEquityIncentivePlanMember2022-01-012022-12-310001841925indi:A2021OmnibusEquityIncentivePlanMember2022-12-310001841925us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001841925us-gaap:EmployeeStockOptionMemberindi:A2021OmnibusEquityIncentivePlanMember2022-01-012022-12-310001841925us-gaap:EmployeeStockOptionMember2023-12-310001841925us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001841925indi:A2023EmploymentInducementAwardPlanMember2023-01-012023-12-310001841925indi:TeraXionIncMember2021-10-122021-10-120001841925us-gaap:EmployeeStockOptionMemberindi:TeraXionIncMember2021-10-012021-10-310001841925us-gaap:EmployeeStockOptionMemberindi:TeraXionIncMember2021-10-122021-10-120001841925indi:TeraXionOptionPlanMember2021-12-310001841925indi:TeraXionOptionPlanMember2021-01-012021-12-310001841925indi:TeraXionOptionPlanMember2022-01-012022-12-310001841925indi:TeraXionOptionPlanMember2022-12-310001841925indi:TeraXionOptionPlanMember2023-01-012023-12-310001841925indi:TeraXionOptionPlanMember2023-12-310001841925indi:ClassBUnvestedUnitsMember2023-01-012023-12-310001841925indi:ClassBUnvestedUnitsMember2022-01-012022-12-310001841925indi:ClassBUnvestedUnitsMember2021-01-012021-12-310001841925us-gaap:PhantomShareUnitsPSUsMember2023-01-012023-12-310001841925us-gaap:PhantomShareUnitsPSUsMember2022-01-012022-12-310001841925us-gaap:PhantomShareUnitsPSUsMember2021-01-012021-12-310001841925us-gaap:RestrictedStockMember2023-01-012023-12-310001841925us-gaap:RestrictedStockMember2022-01-012022-12-310001841925us-gaap:RestrictedStockMember2021-01-012021-12-310001841925indi:ConvertibleStockMember2023-01-012023-12-310001841925indi:ConvertibleStockMember2022-01-012022-12-310001841925indi:ConvertibleStockMember2021-01-012021-12-310001841925indi:PublicWarrantsMember2023-01-012023-12-310001841925indi:PublicWarrantsMember2022-01-012022-12-310001841925indi:PublicWarrantsMember2021-01-012021-12-310001841925indi:PrivateWarrantsMember2023-01-012023-12-310001841925indi:PrivateWarrantsMember2022-01-012022-12-310001841925indi:PrivateWarrantsMember2021-01-012021-12-310001841925us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001841925us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001841925us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001841925indi:DerivativeLiabilityMember2023-01-012023-12-310001841925indi:DerivativeLiabilityMember2022-01-012022-12-310001841925indi:DerivativeLiabilityMember2021-01-012021-12-310001841925indi:EscrowSharesMember2023-01-012023-12-310001841925indi:EscrowSharesMember2022-01-012022-12-310001841925indi:EscrowSharesMember2021-01-012021-12-310001841925indi:ConvertibleDebtIntoClassACommonSharesMember2023-01-012023-12-310001841925indi:ConvertibleDebtIntoClassACommonSharesMember2022-01-012022-12-310001841925indi:ConvertibleDebtIntoClassACommonSharesMember2021-01-012021-12-310001841925indi:AyDeeKayLLCMember2022-12-310001841925us-gaap:DomesticCountryMember2023-12-310001841925us-gaap:StateAndLocalJurisdictionMember2023-12-310001841925us-gaap:ForeignCountryMemberus-gaap:StateAdministrationOfTaxationChinaMember2023-12-310001841925us-gaap:ForeignCountryMemberus-gaap:FederalMinistryOfFinanceGermanyMember2023-12-310001841925us-gaap:ForeignCountryMemberus-gaap:CanadaRevenueAgencyMember2023-12-310001841925us-gaap:ForeignCountryMemberindi:CanadaRevenueAgencyQuebecMember2023-12-310001841925indi:CorporateAndManufacturingFacilitiesMember2023-12-310001841925indi:AlisoViejoHeadquartersMember2015-10-310001841925indi:AlisoViejoHeadquartersMember2015-07-012015-07-31utr:sqft0001841925indi:AlisoViejoHeadquartersMember2015-07-310001841925indi:AlisoViejoHeadquartersMember2015-08-012015-08-010001841925indi:AlisoViejoHeadquartersMember2023-01-012023-12-310001841925indi:AustinTexasDesignCenterMember2021-10-310001841925indi:AustinTexasDesignCenterMember2021-10-012021-10-310001841925indi:DetroitOperatingLeaseMember2021-05-310001841925indi:DetroitOperatingLeaseMember2021-05-012021-05-310001841925indi:SanJoseCaliforniaMember2023-04-300001841925indi:SanJoseCaliforniaMember2023-04-012023-04-300001841925indi:ScotlandDesignCenterFacilityMember2015-10-310001841925indi:ScotlandDesignCenterFacilityMember2020-01-012020-01-310001841925indi:HaifaIsraelMember2015-10-310001841925indi:HaifaIsraelMember2022-02-012022-02-280001841925indi:AustinTexasDesignCenterMember2023-08-310001841925indi:AustinTexasDesignCenterMember2023-08-012023-08-310001841925indi:TeraXionOfficeBuildingMember2021-10-012021-10-310001841925indi:AustinTexasDesignCenterMember2023-09-300001841925indi:AustinTexasDesignCenterMember2023-09-302023-09-300001841925indi:ShanghaiChinaMember2022-11-012022-11-300001841925indi:SuzhouChinaMember2022-11-300001841925indi:SuzhouChinaMember2022-11-012022-11-300001841925srt:MinimumMemberindi:FacilityLeasesMember2023-12-310001841925indi:FacilityLeasesMembersrt:MaximumMember2023-12-310001841925indi:FacilityLeasesMember2023-12-3100018419252023-11-030001841925country:US2023-12-310001841925country:US2022-12-310001841925country:CA2023-12-310001841925country:CA2022-12-310001841925country:DE2023-12-310001841925country:DE2022-12-310001841925country:CN2023-12-310001841925country:CN2022-12-310001841925country:IL2023-12-310001841925country:IL2022-12-310001841925country:CH2023-12-310001841925country:CH2022-12-310001841925indi:RestOfWorldMember2023-12-310001841925indi:RestOfWorldMember2022-12-310001841925indi:KineticTechnologiesMemberus-gaap:SubsequentEventMember2024-01-252024-01-250001841925indi:AdjustmentHoldbackMemberindi:KineticTechnologiesMemberus-gaap:SubsequentEventMember2024-01-250001841925indi:KineticTechnologiesMemberindi:IndemnityHoldbackMemberus-gaap:SubsequentEventMember2024-01-250001841925indi:KineticTechnologiesMemberindi:SubjectToAchievementOfCertainProductionBasedMilestonesMemberus-gaap:SubsequentEventMember2024-01-250001841925indi:KineticTechnologiesMemberindi:SubjectToAchievementOfCertainProductionBasedMilestonesMemberus-gaap:SubsequentEventMember2024-01-252024-01-250001841925indi:SubjectToAchievementOfCertainRevenueBasedMilestonesMemberindi:KineticTechnologiesMemberus-gaap:SubsequentEventMember2024-01-250001841925indi:SubjectToAchievementOfCertainRevenueBasedMilestonesMemberindi:KineticTechnologiesMemberus-gaap:SubsequentEventMember2024-01-252024-01-2500018419252023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________

FORM 10-K

__________________________________________________________________

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

Commission file number 001-40481

__________________________________________________________________

INDIE SEMICONDUCTOR, INC.

__________________________________________________________________

(Exact name of registrant as specified in its charter) | | | | | |

Delaware | 88-1735159 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

32 Journey Aliso Viejo, California | 92656 |

(Address of Principal Executive Offices) | (Zip Code) |

(949) 608-0854

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on

which registered |

| Class A common stock, par value $0.0001 per share | | INDI | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the Registrant on June 30, 2023, based on the closing price of $9.40 for shares of the Registrant’s Class A common stock as reported by the Nasdaq Stock Market LLC, was approximately $1.3 billion. Shares of common stock beneficially owned by each executive officer, director, and holder of more than 10% of our common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s Class A and Class V common stock as of February 26, 2024, was 164,524,940 (excluding 1,725,000 Class A shares held in escrow and 52,127 Class A shares subject to restricted stock awards) and 18,694,328, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement (the “2024 Proxy Statement”) for the registrant’s 2024 Annual Meeting of Stockholders are incorporated by reference into Part III, Items 10, 11, 12, 13 and 14 of this Form 10-K. This Proxy Statement will be filed within 120 days after the end of the fiscal year covered by this report.

None.

| | | | | | | | | | | | | | | | | | | | | | | |

| Auditor Firm ID: | 185 | | Auditor Name: | KPMG LLP | | Auditor Location: | Irvine, CA |

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” (within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended). Such statements include, but are not limited to, statements regarding the Company’s future business and financial performance and prospects, and other statements identified by words such as “will likely result,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “plan,” “project,” “outlook,” “should,” “could,” “may” or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of the Company’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the anticipated results or other expectations expressed in or implied by such forward-looking statements as a result of various factors, including among others, the following: macroeconomic conditions, including inflation, rising interest rates and volatility in the credit and financial markets; the Company’s reliance on contract manufacturing and outsourced supply chain and the availability of semiconductors and manufacturing capacity; competitive products and pricing pressures; the Company’s ability to win competitive bid selection processes and achieve additional design wins; the impact of any acquisitions the Company has made or may make, including its ability to successfully integrate acquired businesses and risks that the anticipated benefits of any acquisitions may not be fully realized or take longer to realize than expected; management’s ability to develop, market and gain acceptance for new and enhanced products and expand into new technologies and markets; trade restrictions and trade tensions; political or economic instability in the Company’s target markets; and the impact of the ongoing conflict in Ukraine and the Middle East and additional factors disclosed under “Risk Factors” in Part I, Item 1A herein, as such risk factors may be amended, supplemented or superseded from time to time in the Company’s other public reports filed with the SEC. indie cautions that the foregoing list of factors is not exclusive.

All information set forth herein speaks only as of the date hereof, and the Company disclaims any intention or obligation to update any forward-looking statements made in this report or in its other public filings, whether as a result of new information, future events or otherwise, except as required by law.

References in this Annual Report on Form 10-K to “indie,” the “Company,” “we,” “us,” and “our” refer to indie Semiconductor, Inc., a Delaware corporation, and its consolidated subsidiaries, or (in the case of references prior to the consummation of the business combination (the “Transaction”) with Thunder Bridge Acquisition II, Ltd. (“TB2”) in June 2021) to our predecessor Ay Dee Kay, LLC, a California limited liability company (“ADK LLC”). All references to U.S. dollar amounts are in thousands, other than share amounts, per share amount or the context otherwise requires.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | |

| | |

| | |

Item 1A. | Risk Factors | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

PART I

ITEM 1. BUSINESS

Company Overview

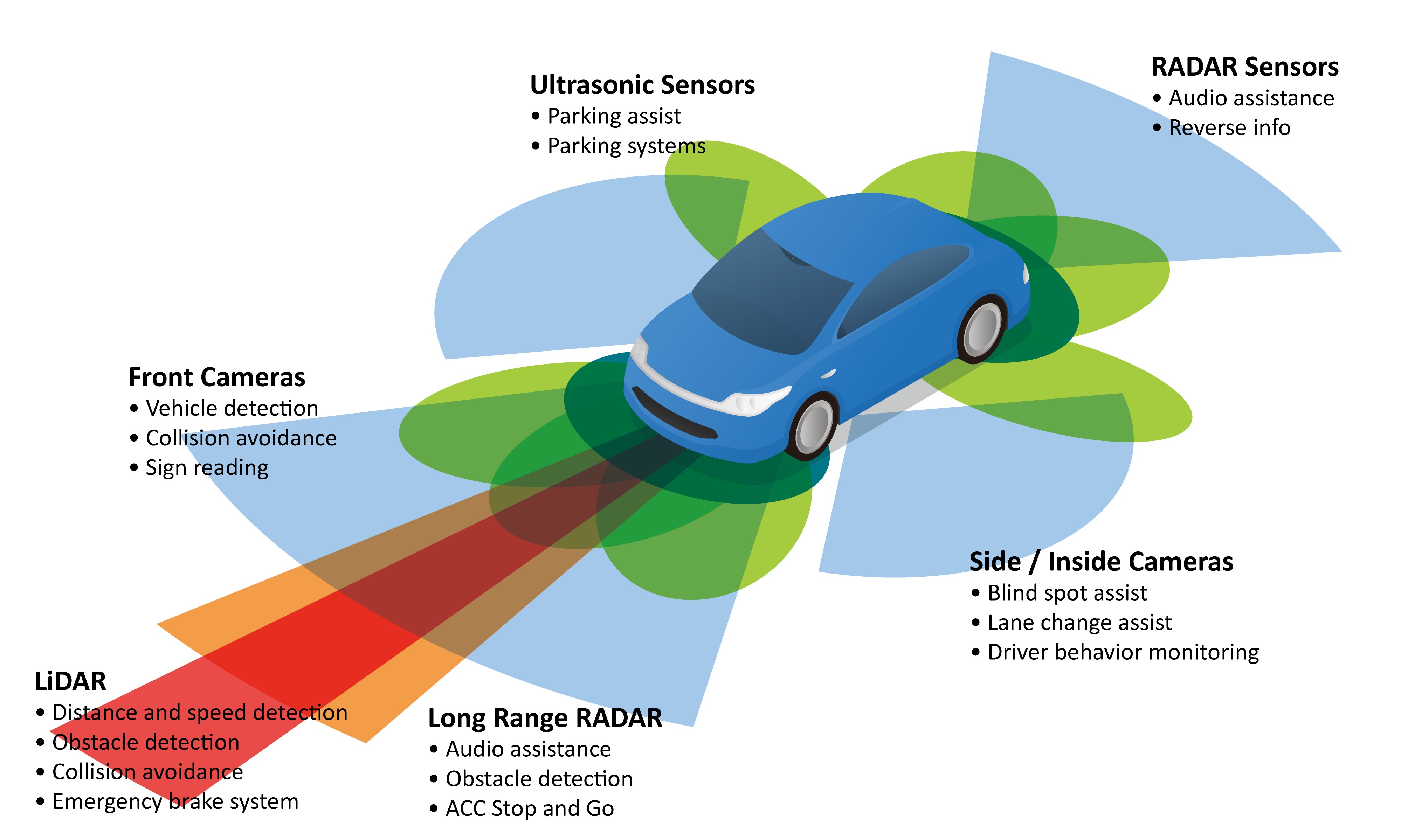

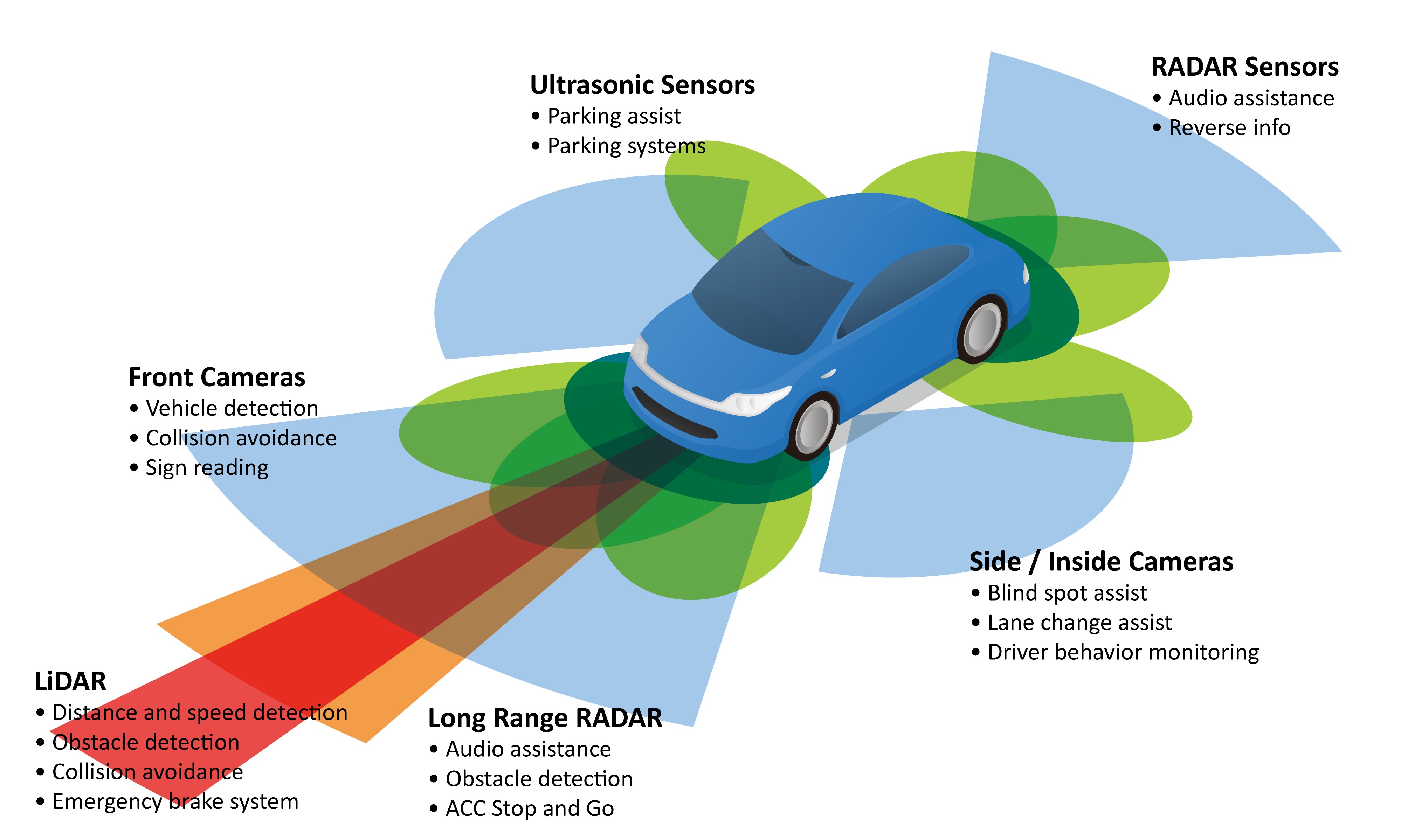

indie offers highly innovative automotive semiconductors and software solutions for Advanced Driver Assistance Systems (“ADAS”), driver automation, in-cabin, user experience (including connected car) and electrification applications. The Company focuses on edge sensors across multiple modalities spanning light detection and ranging (“LiDAR”), radar, ultrasound and computer vision. These functions represent the core underpinnings of both electric and automated vehicles, while the advanced user interfaces are transforming the in-cabin experience to mirror and seamlessly connect to the mobile platforms people rely on every day. indie is an approved vendor to Tier 1 automotive suppliers and its platforms can be found in marquee automotive manufacturers around the world.

Through innovative analog, digital and mixed-signal integrated circuits (“ICs”) with software running on the embedded processors, we are developing a differentiated, market-leading portfolio of automotive products. Our technological expertise, including cutting-edge design capabilities and packaging skillsets, together with our deep applications knowledge and strong customer relationships, have enabled us to cumulatively ship over 300 million semiconductor devices since our inception.

Our go-to-market strategy focuses on collaborating with key customers and partnering with Tier 1s via aligned product development, in pursuit of solutions addressing the automotive industry’s highest growth applications. We leverage our core capabilities in system-level hardware and software integration to develop highly integrated, ultra-compact and power efficient solutions. Further, our products meet or exceed the quality standards set by the more than 25 global automotive manufacturers who utilize our devices today.

With a global footprint, we support leading customers from our design and application centers located in North and South America, Middle East, Asia and Europe, where our local teams work closely on their unique design requirements.

Recent Acquisitions

Kinetic Technologies

On January 25, 2024 (the “Deal Closing Date”), indie and ADK LLC completed an Asset Purchase Agreement (the “APA”), carving out certain assets, including R&D personnel and intellectual properties (“IP”) from Kinetic Technologies (“Kinetic”), in support of a custom product development for a North American electric vehicle OEM. The closing consideration consisted of (i) $4.5 million in cash as the initial cash consideration, subject to adjustments for an adjustment holdback amount of $0.5 million and an indemnity holdback amount of $0.8 million, payable after the 18-month anniversary of the Deal Closing Date in shares of Class A common stock, par value $0.0001 (the “Class A common stock”), (ii) $3.0 million of total contingent considerations, payable in cash or Class A common stock, subject to achievement of certain production based milestones 24 months after the Deal Closing Date, and (iii) $2.5 million of contingent considerations, payable in cash or Class A common stock, subject to achievement of a revenue based milestone 12 months after the Deal Closing Date. The purchase price is subject to working capital and other adjustments as provided the APA.

Exalos AG

On September 18, 2023, Ay Dee Kay Ltd. (“indie UK”) completed its acquisition of all of Exalos AG, a Swiss corporation (“Exalos”), pursuant to the Share Sale and Purchase Agreement by and among indie UK, indie and all of the stockholders of Exalos, whereby indie UK acquired all of the outstanding common shares of Exalos. The closing consideration consisted of (i) the issuance by indie of 6,613,786 shares of Class A common stock, with a fair value of $42.8 million; (ii) a contingent consideration with fair value of $13.2 million at closing, payable in cash, subject to Exalos’ achievement of certain revenue-based milestones through September 30, 2025; and (iii) a holdback of $2.5 million subject to final release 12 months from the acquisition date payable in shares of Class A common stock. The purchase price is subject to working capital and other adjustments as provided in the Share Sale and Purchase Agreement.

Silicon Radar

On February 21, 2023, Symeo GmbH (“Symeo”), a wholly-owned subsidiary of indie, completed its acquisition of all of the outstanding capital stock of Silicon Radar GmbH (“Silicon Radar”). The acquisition was consummated pursuant to a Share Purchase Agreement by and among Symeo, indie and the holders of the outstanding capital stock of Silicon Radar. The closing consideration consisted of (i) $9.2 million in cash (including debt payable at closing and net of cash acquired), (ii) the issuance

by indie of 982,445 shares of Class A common stock at closing, with a fair value of $9.8 million and (iii) a contingent consideration with fair value of $9.2 million at closing, payable in cash or in Class A common stock, subject to Silicon Radar’s achievement of certain revenue-based milestones through February 21, 2025. The purchase price is subject to working capital and other adjustments as provided in the Share Purchase Agreement.

GEO Semiconductor Inc.

On February 9, 2023, we entered into an Agreement and Plan of Merger, pursuant to which Gonzaga Merger Sub Inc., a Delaware corporation and indie’s wholly-owned subsidiary, will merge with and into GEO Semiconductor Inc., a Delaware corporation (“GEO”), with GEO surviving as a wholly-owned subsidiary of indie (the “Merger”). The aggregate consideration for this transaction consisted of (i) $93.4 million in cash (including accrued cash consideration at closing and net of cash acquired); (ii) the issuance by indie of 6,868,768 shares of Class A common stock at closing, with a fair value of $75.6 million; (iii) 1,907,180 shares of Class A common stock at closing, with a fair value of $21.0 million payable in the next 24-month period after closing; and (iv) contingent considerations with fair value of $59.3 million at closing payable in cash or in Class A common stock, subject to achieving certain GEO-related revenue targets through September 30, 2024. The purchase price is subject to working capital and other adjustments as provided in the Agreement and Plan of Merger. The transaction was completed on March 3, 2023.

Symeo GmbH

On October 21, 2021, we entered into a definitive agreement with Analog Devices (“ADI”) to acquire Symeo. The acquisition was approved by the German government on January 4, 2022 and closed on the same day. The total consideration paid for this acquisition consisted of (i) $8.7 million in cash at closing, net of cash acquired; (ii) a $10.0 million promissory note payable in January 2023 with a fair market value of $9.7 million; and (iii) an equity-based earn-out of up to 858,369 shares of Class A common stock based on future revenue growth. The fair market value of this equity-based earn-out was $7.8 million on January 4, 2022.

Warrant Exchange

On September 22, 2023, we announced the commencement of an exchange offer (the “Offer”) and consent solicitation (the “Consent Solicitation”) relating to our outstanding (i) Public Warrants to purchase shares of Class A common stock and (ii) Private Warrants to purchase shares of Class A common stock (together with the Public Warrants, the “Warrants”).

The Offer and the Consent Solicitation expired at 11:59 p.m., Eastern Time on October 20, 2023. Upon expiration of the Offer and the Consent Solicitation, 24,658,461 Warrants, or approximately 90.0% of the outstanding Warrants, were tendered. Subsequently, we issued 7,027,517 shares of Class A common stock, or an exchange ratio of 0.285, for the Warrants tendered in the Offer on October 25, 2023. Additionally, we received the approval of approximately 89.8% of the outstanding Warrants to amend the warrant agreement governing the Warrants (the “Amendment No. 2”), which exceeds a majority of the outstanding warrants required to effect the Amendment No. 2. This amendment permitted us to require that each Warrant that remained outstanding upon settlement of the Exchange Offer to be converted into 0.2565 shares of Class A common stock, which was a ratio 10.0% less than the exchange ratio applicable to the Exchange Offer.

We completed the exchange of the remaining 2,741,426 untendered Warrants on November 9, 2023 through issuance of 703,175 shares of Class A common stock. As a result of the completion of the Exchange Offer and the exchange for the remaining untendered Warrants, the Warrants were suspended from trading on the Nasdaq Stock Market LLC as of the close of business on November 8, 2023, and delisted.

Execution of At-The-Market Agreement

On August 26, 2022, we entered into an At Market Issuance Agreement (“ATM Agreement”) with B. Riley Securities, Inc., Craig-Hallum Capital Group LLC and Roth Capital Partners, LLC (collectively as “Sales Agents”) relating to shares of our Class A common stock. In accordance with the terms of the ATM Agreement, we may offer and sell shares of our Class A common stock and having an aggregate offering price of up to $150.0 million from time to time through the Sales Agents, acting as our agent or principal. We implemented this program for the flexible access it provides to the capital markets. As of December 31, 2023, and since the inception of the program, indie raised gross proceeds of $70.3 million and issued 7,351,259 shares of Class A common stock at an average per-share sales price of $9.57, incurred issuance costs of $1.5 million, and had approximately $79.7 million available for future issuances under the ATM Agreement.

During the year ended December 31, 2023, indie raised gross proceeds of $53.1 million and issued 5,219,500 shares of Class A common stock at an average per-share sales price of $10.18. For the year ended December 31, 2023, indie incurred total issuance costs of $1.1 million.

Reverse Recapitalization with Thunder Bridge Acquisition II

On June 10, 2021, we completed a series of transactions (the “Transaction”) with Thunder Bridge Acquisition II, Ltd (“TB2”) pursuant to the Master Transactions Agreement dated December 14, 2020, as amended on May 3, 2021 (the “MTA”). In connection with the Transaction, Thunder Bridge II Surviving Pubco, Inc, a Delaware corporation (“Surviving Pubco”), was formed to be the successor public company to TB2, TB2 was domesticated into a Delaware corporation and merged with and into a merger subsidiary of Surviving Pubco. Additionally, we consummated a Private Investment in Public Equity (“PIPE”) financing, pursuant to which Surviving Pubco issued 15 million Class A common shares, generating net proceeds of $150 million as a result of the Transaction. Also, on June 10, 2021, Surviving Pubco changed its name to indie Semiconductor, Inc., and listed our shares of Class A common stock on The Nasdaq Stock Market LLC under the symbol “INDI.”

The Transaction was accounted for as a reverse recapitalization in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”). indie is deemed to be the accounting predecessor of the combined business and is the successor registrant for U.S. Securities and Exchange Commission (“SEC”) purposes, meaning that our financial statements for previous periods will be disclosed in the registrant’s future periodic reports filed with the SEC. The most significant change in our reported financial position and results of operations was gross cash proceeds of $399.5 million from the merger transaction, which includes $150.0 million in gross proceeds from the PIPE financing that was consummated in conjunction with the Transaction. The increase in cash was offset by transaction costs incurred in connection with the Transaction of approximately $43.5 million plus the retirement of indie’s long-term debt of $15.6 million. Approximately $29.8 million of the transaction costs and all of indie’s long-term debt were paid as of June 30, 2021. Approximately $21.8 million of the transaction costs paid as of June 30, 2021 were paid by TB2 as part of the closing of the Transaction. The remainder of the transaction costs were paid in the third quarter of 2021.

Industry Overview

At the highest level, semiconductors can be classified either as discrete devices, such as individual transistors, or integrated circuits (“ICs”), where a number of transistors and other components are combined to form a more complicated electronic subsystem. ICs can be divided into three primary categories: digital, analog, and mixed-signal. Digital ICs, such as memory devices and microprocessors, can store or perform arithmetic functions with data. Analog ICs, by contrast, handle real-world signals such as temperature, pressure, light, sound or speed, and also perform power management functions such as regulating or converting voltages for electronic devices. Mixed-signal ICs combine digital and analog functions onto a single chip and play an important role in bridging real-world inputs into the digital domain.

Historically, growth in the semiconductor industry has been driven by content expansion in computing, mobile and consumer electronics. However, research analysts anticipate that as each of these markets approaches saturation, the automotive sector will become one of the fastest growing opportunities. Specifically, according to IHS, the global automotive semiconductor market, which was valued at $67 billion in 2022, is projected to reach $131 billion by 2029.

indie’s Market Opportunity