UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

OR

For the transition period from to

Commission File Number

(Exact name of Registrant as specified in its Charter)

| ||

(State or other jurisdiction of |

| (I.R.S. Employer |

incorporation or organization) |

| Identification No.) |

|

|

|

|

| |

| ||

(Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading symbol(s) |

| Name of each exchange on which registered |

|

| The | ||

The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting securities held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2021, was approximately $

Documents Incorporated by Reference: None.

Table of Contents

i

EXPLANATORY NOTE

On February 14, 2022, QualTek Services Inc. (f/k/a Roth CH Acquisition III Co. (“ROCR”)) (the “Company” or “QualTek”) closed its business combination (the “Business Combination”) with QualTek HoldCo, LLC (f/k/a BCP QualTek HoldCo, LLC), a Delaware limited liability company (“QualTek HoldCo”), pursuant to that certain Business Combination Agreement (the “Business Combination Agreement”) dated as of June 16, 2021, by and among (i) ROCR, (ii) Roth CH III Blocker Merger Sub, LLC, a Delaware limited liability company and wholly-owned subsidiary of ROCR (“Blocker Merger Sub”), (iii) BCP QualTek Investors, LLC, a Delaware limited liability company (the “Blocker”), (iv) Roth CH III Merger Sub, LLC, a Delaware limited liability company and wholly-owned subsidiary of ROCR (“Company Merger Sub”), (v) QualTek HoldCo and (vi) BCP QualTek, LLC, a Delaware limited liability company, solely in its capacity as representative of the Blocker’s equityholders and QualTek HoldCo’s equityholders (the “Equityholder Representative”). In connection with the consummation of the Business Combination, the Company changed its name from Roth CH Acquisition III Co. to QualTek Services Inc.

This Annual Report on Form 10-K principally describes the business and operations of the Company following the Business Combination, other than the financial statements and related Management’s Discussion and Analysis of Financial Condition and Results of Operations which describe the business, financial condition, results of operations, liquidity and capital resources of ROCR prior to the Business Combination. On April 1, 2022, we filed an amendment to our Current Report on Form 8-K, initially filed on February 16, 2022, which includes the audited consolidated financial statements of QualTek HoldCo for the year ended December 31, 2021 and related Management’s Discussion and Analysis of Financial Condition and Results of Operations. Interested parties should refer to our Current Report on Form 8-K, as amended, for more information.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995, including statements about the anticipated benefits of the Business Combination and the financial condition, results of operations, earnings outlook and prospects of QualTek. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of the Company, as applicable and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made with the SEC by the Company and include, but are not limited to, the following:

· | expectations regarding the Company’s strategies and future financial performance, including its future business plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and the Company’s ability to invest in growth initiatives and pursue acquisition opportunities; |

· | our limited operating history as a combined company makes it difficult to evaluate our current business and future prospects; |

· | our management team’s limited experience managing a public company; |

· | the highly competitive industries that the Company serves, which are also subject to rapid technological and regulatory changes, as well as customer consolidation; |

· | unfavorable market conditions, market uncertainty, public health outbreaks such as the COVID-19 pandemic and/or economic downturns; |

· | failure to properly manage projects, or project delays; |

· | failure to recover adequately on charges against project owners, subcontractors or suppliers for payment or performance; |

1

· | the loss of one or more key customers, or a reduction in their demand for the Company’s services; |

· | The Company’s backlog being subject to cancellation and unexpected adjustments; |

· | the seasonality of the Company’s business, which is affected by the spending patterns of the Company’s customers and timing of governmental permitting, as well as weather conditions and natural catastrophes; |

· | system and information technology interruptions and/or data security breaches; |

· | failure to comply with environmental laws; |

· | The Company’s significant amount of debt, which could adversely affect its business, financial condition and results of operations or could affect its ability to access capital markets in the future, and may prevent the Company from engaging in transactions that might benefit it due to its debt’s restrictive covenants; and |

· | The Company’s status as a “controlled company” within the meaning of the Nasdaq rules and, as a result, qualifying for exemptions from certain corporate governance requirements, as a result of which you will not have the same protections afforded to stockholders of companies that are subject to such requirements. |

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of the Company prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the matters addressed in this Annual Report on Form 10-K and attributable to the Company or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this Annual Report on Form 10-K to reflect the occurrence of unanticipated events.

In addition, statements that the Company “believes” and similar statements reflect the Company’s beliefs and opinions on the relevant subject. These statements are based upon information available to such party as of the date of this Annual Report on Form 10-K, and while the Company believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and these statements should not be read to indicate that the Company has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

2

PART I

Item 1. Business.

Overview

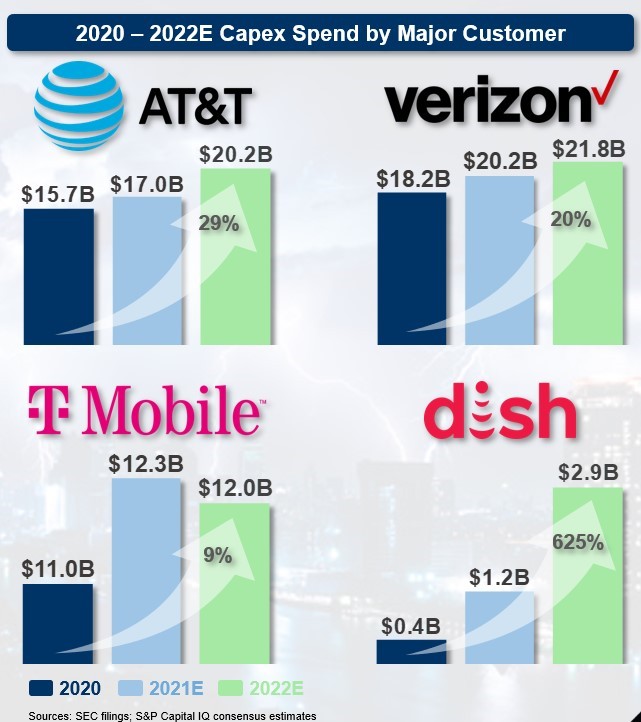

We are a technology-driven, leading provider of communications infrastructure services, power grid modernization, and renewables solutions to the North American telecommunications and utilities industries. We provide a variety of mission-critical services across the telecom and renewable energy value chain, including wireline and fiber optic terminations, wireless, fiber-to-the-home, or FTTH, and customer fulfillment activities. Our experienced management team has leveraged our technical expertise, rigorous quality and safety standards, and execution track record to establish and maintain long-standing relationships with blue-chip customers.

We operate out of two business segments: Telecom and Renewables & Recovery Logistics. Telecom consists of wireless, wireline, and power, which represented 81% of our revenues for the fiscal year ending December 31, 2021. We entered the renewable infrastructure sector with our acquisition of Fiber Network Solutions, LLC (“FNS”) in January 2021, which represented 5% of our revenues for the fiscal year ending December 31, 2021. Recovery Logistics represented 14% of our revenues for the fiscal year ending December 31, 2021.

Telecommunications

We provide a full suite of services to the telecom sector across both the wireless and wireline markets, from site acquisition and permitting to initial engineering and design to installation, maintenance, program management and fulfillment. Our core offerings consist of:

· | Engineering and construction services including the design and construction of aerial and underground fiber optic and coaxial systems for homes, businesses, cell towers, and small cells. |

· | Installation services including the placement and splicing of fiber and coaxial cable, in addition to upgrades and new site builds for cellular towers. |

· | Site acquisition services to determine the location for new sites prior to new site builds. |

· | We also provide cable and satellite fulfillment services for residential and commercial customers. These services are provided for telecom companies in connection with the maintenance or expansion of new and existing networks. |

While the telecommunications industry is naturally concentrated, we maintain customer diversification across our business segments. We have numerous long-established relationships with telephone companies, wireless carriers, multiple cable system operators and electric utilities companies, which have been built upon and cultivated through numerous Master Service Agreements (“MSAs”) that extend for periods of one or more years (majority are for three or more years, some of which have auto-renewal provisions). Blue-chip, investment grade customers including AT&T, Verizon, COX Communications, T-Mobile, Spectrum, and Comcast comprise a substantial portion of our revenue.

Within our Telecommunications segment we also provide electrical contracting, and utility construction and maintenance services. We construct and maintain overhead and underground distribution systems for municipalities, electric membership cooperatives, and electric-utility companies.

Renewables and Recovery Logistics

We entered the renewable infrastructure sector with our acquisition of FNS in January 2021. FNS is a full-service provider of fiber optic and electrical services, focusing primarily on renewable energy projects. Our capabilities in the space include expertise in wind and solar farm fiber, installation, and testing, optical ground wire (“OPGW”) & all-dielectric self-supporting, or ADSS, aerial transmission line installation, and large-scale data com solutions and installation.

In serving our customers, we provide fiber optic terminations, optical time domain reflectometer (“OTDR”) and power meter testing, fusion splicing, fiber placement, extensive fiber optic and copper infrastructure installation, cable jetting, boring and trenching, industry specific maintenance and material procurement.

3

We also provide business continuity and disaster relief services to telecommunications and power utility companies, as well as business-as-usual, or BAU, services such as generator storage and repair and cell maintenance services.

Geographic Presence

Our consolidated business has a national footprint with approximately 80 service locations across the U.S., strategically located in close proximity to major customers and growing markets. Our geographic footprint has grown to its present state both organically and through strategic acquisitions. QualTek serves markets locally through a dedicated in-house employee base of approximately 1,900 employees and a workforce of over 5,000 individuals (inclusive of in-house employees). Ultimately, we are a technology-driven provider of communications infrastructure services and solutions to the North American telecommunications and utilities industries, and we believe we are well-positioned for continued growth.

Industry Overview

Telecommunications

Significant advances in technology and rapid innovation in service offerings to data consumers have substantially increased demand for faster and more reliable wireless and wireline/fiber communications network services. Cisco’s 2020 Annual Internet Report predicts that by 2023, North Americans will have 5 billion networked devices/connections, up from 3 billion in 2018, with a nearly tripling of broadband and wireless speeds (measured in Mbps) over the same time period.

With the proliferation of mobile devices, advancements in the “internet of things,” or IoT, and segments of the workforce permanently shifting to remote work post-COVID-19, network traffic is at an all-time high and is expected to continue to grow, generating demand for both wired and wireless connectivity. Increased data usage is driven by two key dynamics: i) an increase in the number of internet-enabled devices per capita and ii) an increase in connection speed. The 2020 Cisco Report provides that devices and connections are growing faster (10% CAGR) than both the population (1% CAGR) and internet users (6% CAGR). As a result, devices and connections per household and per capita in North America are expected to grow 63%, up from 8.2 in 2018 to 13.4 by 2023.

COVID-19 has further catalyzed network traffic growth by creating permanent shifts away from the office and into the home. Per a 2020 Gartner report, 75% of companies are planning to permanently shift to remote work post COVID-19, which will continue to drive consumer demand for high-speed home office connectivity.

4

Low levels of fiber penetration and the nascent state of North American 5G deployment currently present significant opportunities for sustained growth for businesses such as QualTek:

· | Wireless: Major carriers have continued to expand wireless network capacity and density with accelerated development and planned implementation of 5G wireless technologies. The increased speed and capacity that will result from deployment of 5G technology will require additional and improved tower capacity with higher data frequencies, as well as deployment of numerous higher bandwidth small cells to “densify” network performance. Wireless technology will need to be supported by fiber backbone and as a result, many carriers have committed to investing in the fiber infrastructure buildout. |

· | Wired: Telecommunication companies have also deployed capital and initiatives to improve fiber connectivity. Only about 10-15% of total broadband connections in the U.S. are provisioned by fiber, as compared to over 50% in other developed countries such as South Korea, Sweden and Finland. Importantly, with only about 47 million U.S. homes (about 37% as per the Fiber Broadband Association) passed with fiber in 2019, over 100 million U.S. homes represent opportunities for fiber passing over the next several years, indicating a massive investment cycle that is still in early stages. |

5

Renewable and Recovery Logistics

In 2017 and 2018, solar PV and onshore wind consolidated their dominance in the renewable energy market, representing on average 77% of total finance commitments in renewable energy. The highly modular nature of these technologies, their short project development lead times, increasing competitiveness driven by technology and manufacturing improvements, and government regulations play an important role in explaining these technologies’ large share of global renewable energy investment.

6

Investment in offshore wind has picked up, attracting, on average, $21 billion a year globally between 2013 and 2018, and representing 8% of the total renewable capacity addition in 2018. According to the International Renewable Energy Agency (IRENA), offshore wind holds considerable growth potential and will have a key role to play in achieving a level of deployment to support a decarbonized growth trajectory.

The Biden administration is expected to amplify this increase in spending for renewable power projects. For example, since his first day in office, President Biden has rejoined the 2015 Paris Agreement, committed to investing $400 billion in the next ten years in clean energy and innovation, and set a goal to achieve a carbon pollution-free power sector by 2035. We believe that this will translate into significant government spending in renewables to meet this goal, and also government regulations and policies that promote spending in the renewables space across various sectors of the economy. We believe that the Biden administration’s commitment to renewable energy will create ripple effects across the nation and ultimately lead to more opportunities for us to expand our business with customers.

Competitive Strengths

Culture of Operational Excellence that Resonates with Established Blue-Chip Customer Base

QualTek analyzes and evaluates key performance metrics, from customer satisfaction to technical issues in the field, hiring processes and working capital management. We have fostered a culture of continuous improvement and our operational excellence is reflected in our ability to take market share. Our decentralized operations create multiple points of contact with our customers, including Fortune 500 companies such as AT&T, Verizon, Comcast, Blattner Energy, Kiewit, and Dish thereby generating numerous individual relationships and contract opportunities per customer.

Highly Scalable Shared Services Platform Driven by Tech-Enabled Capabilities

QualTek provides full turnkey services to its customers. Our significant investment over the years to optimize our platform and technology has created a highly scalable business ready to support continued growth. For example, a centralized shared services system provides us with a competitive advantage for operational execution of customer services, process consistency and cross division sharing of “best practices,” resulting in enhanced efficiency and scalability. To maintain this operational excellence, we conduct disciplined measuring of key performance indicators, or KPIs, with quality control for every division to ensure industry-leading execution capabilities.

Significant Revenue and Backlog Visibility

Our backlog consists of the estimated amount of revenue we expect to realize from future work on uncompleted contracts, including new contracts under which work has not begun, as well as revenue from change orders and renewal options. A significant portion of our 24-month backlog is attributable to MSAs and other service agreements, none of which require our customers to purchase a minimum amount of services and are cancelable on short or no advance notice. Backlog amounts are determined based on estimates that incorporate historical trends, anticipated seasonal impacts, experience from similar projects and estimates of customer demand based on communications with our customers.

Our long-standing relationships with blue-chip, investment grade customers enable us to understand our customers’ needs and expand our backlog. Our backlog provides long-term visibility into a recurring and growing revenue base. QualTek has significant revenue visibility given our estimated $2.1 billion two-year backlog of which $2.0 billion relates to our Telecom segment and $0.1 billion relates to our Renewables & Recovery Logistics segment.

Backlog is not a measure defined by United States generally accepted accounting principles (“GAAP”) and should be considered in addition to, but not as a substitute for, GAAP results. Participants in our industry often disclose a calculation of their backlog; however, our methodology for determining backlog may not be comparable to the methodologies used by others. There can be no assurance as to our customers’ requirements or if actual results will be consistent with the estimates included in our forecasts. As a result, our backlog as of any particular date is an uncertain indicator of future revenue and earnings.

Proven Acquisition Strategy with Successful Integration Process

Our management team has demonstrated the success of its unique M&A strategy through the successful identification and integration of nine add-ons in the last three-and-a-half years, including four during 2021. QualTek’s successful M&A history demonstrates our extensive experience in identifying synergistic targets and successfully integrating them into our platform. QualTek

7

enables a quick and seamless integration process by onboarding the target business onto QualTek’s supporting IT infrastructure, leveraging our QVision platform to standardize performance within the target business to meet the standard of quality that QualTek delivers.

Our M&A activity has also successfully diversified our revenue base across a number of high quality customers in both the telecommunication and renewable energy sectors, with continued emphasis on providing complementary service offerings to drive cross-sell and capture market share and we expect to continue acquiring target companies at accretive multiples.

World-Class Talent and Management Team

QualTek is led by highly experienced management team that is positioned to drive market share capture and capitalize on sector momentum. Our senior management team has an average of 25+ years of individual industry experience and has worked together for a considerable period of time. Our team is well suited to establish and maintain long-standing relationships with blue-chip customers as a result of our technical expertise, rigorous quality and safety standards, and execution track record.

Strategic Regional Presence across the U.S.

QualTek has a national footprint with approximately 80 strategically located service locations across the U.S. in close proximity to our major customers, allowing us to respond to customer demand swiftly and efficiently. Our presence in multiple regions gives us valuable insight into local market drivers and customer demand, thereby enabling us to provide bespoke services in each market. Due to this presence, QualTek has also built deep relationships with local customers that help drive business development, project execution, and cross-sell opportunities. QualTek serves markets locally through a dedicated in-house employee base of approximately 1,900 employees and its activities provide work for over 5,000 people through the use of subcontracting firms to access a deeper and more flexible labor pool to efficiently deliver on engagements across the region.

Growth Strategy

Expand Service Offerings & Solutions while Leveraging Contract Opportunities

QualTek’s complementary service offering creates an opportunity for us to grow our business with customers in two core ways: by winning more contracts and cross-selling services. We anticipate growth in our Telecom business as spectrum continues to become available. Additionally, we plan to cross-sell our full-suite of wireless services to our existing customer base.

In our Renewables & Recovery Logistics segment, we see significant opportunity to leverage existing customers and footprint for incremental projects. We also expect the Biden administration to promote more spending in renewables, not only through government contracts, but also in other sectors and businesses that will in turn reinvest in renewable energy solutions.

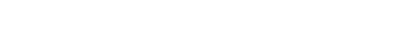

Scaled Growth Leader in the Early Stage of a Multi-Year Telecom and Renewables Infrastructure Spend Cycle

We believe that QualTek is poised to capitalize on attractive industry dynamics and tailwinds. Increasing data consumption across multiple platforms, continued growth of mobile data demand, increasing popularity of video streaming services, and continued expansion of fiber networks are all drivers of carrier demand for network infrastructure. This exponential increase in data traffic will require an upgraded network infrastructure and deeper fiber penetration to serve as the foundation for 5G wireless technology moving forward. Every major carrier, including Verizon and AT&T, has publicly committed to investing in the fiber and 5G build-out.

Continued Value Creation Through Strategic M&A

Since 2012, QualTek has successfully leveraged the experience and track record of our seasoned management team to identify and integrate tuck-in opportunities, which have aided in our growth both organically and inorganically. In the past three-and-a-half years, we have successfully acquired and integrated nine targets. Our origination process is largely centered on management’s deep relationships across the industry, which enable us to actively identify strategic targets in attractive markets or with complementary, value-added service capabilities. Thus, we have a continually evolving platform of high quality potential targets.

QualTek also has a successful history of integrating tuck-ins and providing a conducive environment for target management to achieve earnouts. We are able to leverage our proprietary technology-driven and highly scalable shared services platform to seamlessly integrate and grow the acquisition targets. Over time, we often see a reduction in our acquisition multiple (between pre-acquisition

8

EBITDA multiple and post-acquisition EBITDA multiple) as QualTek realizes significant growth synergies and expands its business with customers.

Our Services and Solutions

We are a leading, one-stop infrastructure solutions provider at the epicenter of the 5G and renewables buildout. To serve our customers, we operate in two distinct segments: Telecom, which includes our wireless and wireline engineering and construction services along with our electrical construction and maintenance services, and Renewables & Recovery Logistics.

Telecommunications

Our Telecom segment helps our clients build and maintain better, more reliable networks across the United States. We are able to provide technology-driven, field-based critical services across every stage of the network life-cycle for the telecommunications industry and power utility industry. This segment is composed of three sub-segments of services: wireless, wireline and power.

Wireless

This sub-segment operates under the brand QualTek Wireless as a turnkey provider of installation, project management, maintenance, real estate, and site acquisition to major wireless carriers. Some other services offered include:

· | Architecture and Engineering |

· | Permitting |

· | Program and Construction Management |

· | Construction and Integration |

· | Site Acquisition |

· | Real Estate |

9

Wireline

This sub-segment provides fiber optic aerial and underground installation, fiber optic splicing, termination & testing, new installation, engineering, and fulfillment services to major telecommunication companies. Other wireline services include:

· | Fiber Backhaul |

· | Aerial Installation |

· | Pole Upgrades |

· | Fiber / Copper Splicing |

· | Direction Drilling |

· | Missile Boring |

· | Trenching |

· | OTDR Test / Certification |

· | MDU Retro-Fits |

· | MTU Builds |

QualTek’s ability to implement smarter designs, increase utilization rates, and improve network performance all help lower operating expenses and increase profits for our customers. In the Wireless and Wireline sub-segments, QualTek has long-standing relationships with AT&T, Verizon, T-Mobile, Dish, Comcast, Altice, amongst many other blue-chip names.

Power

This sub-segment provides electrical contracting, and utility construction and maintenance services to municipalities, electric membership cooperatives, and electric-utility companies, including the construction and maintenance of overhead and underground distribution systems. We provide comprehensive power line services including:

| ● | New-build Distribution Line Construction |

| ● | Maintenance |

| ● | Pole Replacements |

| ● | Live-line Maintenance |

| ● | Hardening and Reliability Services |

| ● | Directional Boring |

| ● | Underground Structures |

| ● | Duct Bank Projects |

| ● | Direct-Bury Conduit |

| ● | Greenfield Residential Distribution |

10

QualTek has the experience and the resources necessary to reliably deliver quality work for even the most complex and demanding overhead and underground ventures.

Renewables & Recovery Logistics

Our Renewables & Recovery Logistics segment provides end-to-end services for clients in the renewable energy sector and supports business continuity and disaster relief for clients in the telecommunications, power utility, and renewable energy industries.

Renewables

This sub-segment operates under the brand QualTek Renewables and provides installation, testing, and maintenance for wind farms, solar farms, and fiber optic grids. Other QualTek Renewables services include:

· | Fiber Optic Terminations |

· | OTDR and Power Meter Testing |

· | Fusion Splicing |

· | Fiber Replacement |

· | Fiber Optic and Copper Infrastructure Installation |

· | Cable Jetting |

· | Boring & Trenching |

· | Wind and Solar Farm fiber, installation, and testing |

· | Large scale data communications solutions and installation |

· | OPGW & ADSS Aerial transmission line installation |

Our wind business comprises a majority of the revenue for our Renewables sub-segment for the fiscal year ending December 31, 2021. Advanced wind turbines include a large number of sensors whose signals are prone to contamination from electrical interference from lightning strikes. It is increasingly common to use fiber optics to galvanically isolate such interfaces, which is more difficult and costly with copper wires. This not only limits the damage of any lightning strikes but also can help reduce the effects of power line noise on sensitive sensor readings. Fiber optics are used for both galvanic isolation purposes and data communications. In addition, offshore turbines are often situated five plus miles from the control center on land, making routine maintenance difficult and costly. As a result, wind turbine operators increasingly rely on complex sensors to monitor efficiently and schedule routine maintenance. Fiber optic cables are the preferred choice from a reliability and ease of maintenance perspective, especially at scale.

Our solar business services help support solar power generation by ensuring that our clients’ farms are running safely and efficiently. In a solar farm power generation system, large amounts of current are generated from the heat of the sun. In order to protect the equipment from current leakage, galvanic insulation becomes important to ensure the power system’s quality and reliability. Fiber optics offer insulation protection from high-voltage/current glitches and unwanted signals into power equipment controls and communication. In addition, fiber optic communication can cover longer link distance connections compared to copper wire. As the solar farms grow in size, monitoring and controlling all the solar panels requires long link distance connections, which is only possible with fiber optic cable.

Recovery Logistics

This sub-segment operates under the brand QualTek Recovery Logistics and provides business continuity, restoration, and disaster relief services to its clients, including AT&T, Verizon, Duke Energy, Gulf Power, and Entergy, amongst others. QualTek Recovery

11

Logistics is able to deploy recovery teams from any one of QualTek’s approximately 80 locations, enabling rapid responses across North America. Some other services offered include:

· | Recovery Management |

· | Transport Logistics |

· | Temporary Shelter |

· | Network Recovery |

· | Fleet Services |

· | Energy Resources |

· | Catering |

· | Sanitation |

Through our 2018 acquisition of Recovery Logistics, LLC (“RLI”), we transformed our recovery logistics sub-segment from a regional player with concentration in the Southeast to a fully national presence with a diversified customer base which can be served out of approximately 80 locations. RLI is a leading provider of business continuity and disaster recovery operations for the telecommunications and power utility sectors. RLI helps businesses recover from unplanned events, including hurricanes, winter storms and floods.

QualTek’s recent entry into the renewable energy space positions it to capitalize on sector tailwinds. Within Renewables, there is also significant opportunity for the Company to leverage existing customer relationships, as well as its footprint, to gain traction and win incremental projects. This also applies to QualTek’s Recovery Logistics sub-segment, as the Company may be able to cross-sell recurring maintenance and recovery services to capture incremental revenue and deepen penetration with existing customer relationships. Providing recovery logistics capabilities offers another touchpoint for the Company to deliver high value-added services, underlining QualTek’s extensive repertoire of end-to-end services.

We believe that revenue will continue to be propelled by the government’s focus and spending in the Renewables space, as well as QualTek’s commitment to expanding its service offerings and customer base, specifically in its Recovery Logistics sub-segment.

Contract Overview

QualTek has numerous MSAs with blue chip customers that extend for periods of one or more years, with a majority for three or more years, some of which have automatic renewals, providing meaningful revenue visibility. Generally, the Company maintains multiple agreements with each customer as different geographies and scopes of work are individually priced. Pricing is generally based on a fixed price per unit basis with up to hundreds of units priced in a single contract. Many contracts specify discrete billing milestones for each job to be performed. As an agreed-upon milestone is achieved, QualTek may bill for the work performed. Purchase orders for discrete projects are generally issued under an MSA. This allows for quantity adjustments for the number of tasks/units that are performed with respect to a project. There are also other adjustments such as “rock adders” that accommodate changes in scope versus original engineering plans. As these adjustments are billed continuously throughout the job, they are known and often accepted by the customer as the work proceeds, substantially reducing QualTek’s risk of having cost overruns. MSAs have historically been renewed creating sticky revenue.

QualTek utilizes a disciplined approach when bidding on new contracts and will decline to bid if management believes QualTek cannot deliver the quality that meets Company standards while achieving return targets. The Company’s approach in submitting a bid that meets target returns is based on a number of factors, including, but not limited to its:

· | Experience in understanding the true scope of the work and associated margin |

· | Knowledge of local factors (i.e. resources, regional dynamics, work conditions, etc.) that will impact work to be performed |

12

· | Ability to simultaneously “lock-in” labor rates with contracts for the work to be performed on fixed price per unit basis (“back-to-back” agreements with contractors) |

· | Pass-through nature of material purchases |

Due to the Company’s turnkey capabilities and high standard for quality control, QualTek often receives requests from customers to bid on new contract opportunities.

Backlog

Our backlog consists of the estimated amount of revenue we expect to realize from future work on uncompleted contracts, including new contracts under which work has not begun, as well as revenue from change orders and renewal options. A significant portion of our 24-month backlog is attributable to MSAs and other service agreements, none of which require our customers to purchase a minimum amount of services and are cancelable on short or no advance notice. Backlog amounts are determined based on estimates that incorporate historical trends, anticipated seasonal impacts, experience from similar projects and estimates of customer demand based on communications with our customers.

QualTek maintains strong potential revenue visibility through its two-year estimated backlog. Consistent with standard practice across the industry, QualTek calculates its estimated backlog for work under MSAs and other service agreements (including issued purchase orders) based on historical trends, anticipated seasonal impacts, experience from similar projects and estimates of customer demand based on communications with our customers. We have a two-year aggregate backlog of $2.1 billion of which $2.0 billion relates to our Telecom segment and $0.1 billion relates to our Renewables & Recovery Logistics segment.

Backlog is not a measure defined by GAAP and should be considered in addition to, but not as a substitute for, GAAP results. Participants in our industry often disclose a calculation of their backlog; however, our methodology for determining backlog may not be comparable to the methodologies used by others. There can be no assurance as to our customers’ requirements or if actual results will be consistent with the estimates included in our forecasts. As a result, our backlog as of any particular date is an uncertain indicator of future revenue and earnings.

Facilities

QualTek’s headquarters are located in an approximately 39,000 square foot facility that we lease in Blue Bell, Pennsylvania. Our lease of this facility expires in 2031, and we have the option to extend the lease for an additional five-year period. QualTek has properties related to its operations in approximately 80 locations. QualTek’s management believes that its properties have been well maintained, are in good condition, and are adequate to meet our current needs.

Human Capital Resources

Our employees are critical to our success. In order to best service our customers, QualTek utilizes a hybrid in-house & contracted labor model to flex our workforce in real-time. As of December 31, 2021, the Company had a workforce of approximately 840 in the Midwest, 1,450 in the West, 600 in the Southwest, 820 in the Southeast, and 1,515 in the Northeast. The Northeast workforce included approximately 100 corporate employees that support all regions. Our executive leadership team averages over 25 years of industry or functional experience. To date, we have not experienced any work stoppages and consider our relationship with our employees to be in good standing.

Government Regulations

We are subject to state and federal laws that apply to businesses generally, including laws and regulations related to labor relations, wages, worker safety and environmental protection. While many of our customers operate in regulated industries (for example, utilities regulated by the public service commission or communications companies regulated by the Federal Communications Commission (“FCC”), we are not generally subject to such regulation and oversight.

In addition to environmental laws and regulations, as a contractor, our operations are subject to various laws, including:

· | regulations related to worker safety and health, including those established by the Occupational Safety and Health Administration and state equivalents; |

13

· | regulations related to vehicle registrations, including those of the states and the U.S. Department of Transportation; |

· | contractor licensing requirements; |

· | permitting and inspection requirements; and |

· | building and electrical codes. |

We are also subject to numerous environmental laws, regulations and programs, including the handling, transportation and disposal of non-hazardous and hazardous substances and wastes, laws governing emissions and discharges into the environment, including discharges into air, surface water, groundwater and soil, and programs related to the protection of endangered species and critical habitats.

We also are subject to laws and regulations that impose liability and cleanup responsibility for releases of hazardous substances into the environment. Under certain of these laws and regulations, liabilities can be imposed for cleanup of properties, regardless of whether we directly caused the contamination or violated any law at the time of discharge or disposal. The presence of contamination from such substances or wastes could interfere with ongoing operations or adversely affect our business.

In addition, we could be held liable for significant penalties and damages under certain environmental laws and regulations. Our contracts with customers may also impose liabilities on us regarding environmental issues that arise through the performance of our services. From time to time, we may incur unanticipated and substantial costs and obligations related to environmental compliance and/or remediation matters.

We believe we have all material licenses and permits needed to conduct operations and that we are in material compliance with all applicable regulatory and environmental requirements. We could, however, incur significant liabilities if we fail to comply with such requirements.

The potential effects of climate change on our operations is highly uncertain. Climate change may result in, among other things, changes in rainfall patterns, storm patterns and intensities and temperature levels. Our operating results are significantly influenced by weather. Therefore, major changes in weather patterns could have a significant effect on our future operating results. For example, if climate change results in significantly more adverse weather conditions in a given period, we could experience reduced productivity, which could negatively affect our revenue and profitability. Climate change could also affect our customers and the projects that they award. Demand for power projects or other projects could be negatively affected by significant changes in weather or from legislation or regulations governing climate change.

Legal Proceedings

We are from time to time subject to various claims, lawsuits and other legal and administrative proceedings arising in the ordinary course of business. Some of these claims, lawsuits and other proceedings may involve highly complex issues that are subject to substantial uncertainties, and could result in damages, fines, penalties, non-monetary sanctions or relief. We recognize provisions for claims or pending litigation when we determine that an unfavorable outcome is probable and the amount of loss can be reasonably estimated. Due to the inherent uncertain nature of litigation, the ultimate outcome or actual cost of settlement may materially vary from estimates.

Available Information

Our investor relations website address is https:\\investors.qualtekservices.com. We are required to file Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q with the SEC on a regular basis, and are required to disclose certain material events in a Current Report on Form 8-K. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The SEC’s website is located at http://www.sec.gov.

Item 1A. Risk Factors.

An investment in our securities involves a high degree of risk. You should consider carefully all of the risks described below, together with the other information contained in this Annual Report, before making a decision to invest in our securities. If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the

14

trading price of our securities could decline, and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business, financial condition and operating results. Unless the context otherwise requires, all references in this subsection to the “Company,” “we”, “us” or “our” refer to QualTek Services Inc. and its consolidated subsidiaries following the Business Combination, which was completed on February 14, 2022, other than certain historical information which refers to the business of QualTek HoldCo prior to the consummation of the Business Combination.

Risk Factor Summary

Risks Related to the Company

· | Many of the industries the Company serves are highly competitive and subject to rapid technological and regulatory changes, as well as customer consolidation, any of which could result in decreased demand for the Company’s services and adversely affect its results of operations, cash flows and liquidity. |

· | Unfavorable market conditions, market uncertainty, public health outbreaks such as the COVID-19 pandemic and/or economic downturns could reduce capital expenditures in the industries the Company serves or could adversely affect its customers, which could result in decreased demand or impair its customers’ ability to pay for the Company’s services. |

· | The Company’s failure to properly manage projects, or project delays, could result in additional costs or claims or failure to achieve actual revenue or profits when anticipated or at all, which could have a material adverse effect on the Company’s operating results, cash flows and liquidity. |

· | The Company’s failure to recover adequately on charges against project owners, subcontractors or suppliers for payment or performance could have a material adverse effect on the Company’s financial results. |

· | The Company derives a significant portion of its revenue from a few customers, and the loss of one or more of these customers, or a reduction in their demand for the Company’s services, could impair the Company’s financial performance. In addition, many of the Company’s contracts, including its service agreements, do not obligate the Company’s customers to undertake any infrastructure projects or other work with the Company, and most of the Company’s contracts may be canceled on short or no advance notice. |

· | Amounts included in the Company’s backlog may not result in actual revenue or translate into profits. The Company’s backlog is subject to cancellation and unexpected adjustments and is, therefore, an uncertain indicator of future operating results. |

· | The Company’s business is seasonal and affected by the spending patterns of the Company’s customers and timing of governmental permitting, as well as weather conditions and natural catastrophes, which exposes the Company to variations in quarterly results. |

· | The Company relies on information, communications and data systems in its operations. System and information technology interruptions and/or data security breaches could adversely affect the Company’s ability to operate and its operating results or could result in harm to its reputation. |

· | A failure to comply with environmental laws could result in significant liabilities or harm the Company’s reputation, and new environmental laws or regulations could adversely affect the Company’s business. |

· | The Company has a significant amount of debt, which could adversely affect its business, financial condition and results of operations or could affect its ability to access capital markets in the future. In addition, the Company’s debt contains restrictive covenants that may prevent it from engaging in transactions that might benefit the Company. |

15

Risk Related to the Class A Common Stock

· | The market price of the Class A common stock of the Company, $0.0001 par value per share (the “Class A Common Stock”) is likely to be highly volatile, and you may lose some or all of your investment. |

· | The Company’s business and operations could be negatively affected if it becomes subject to any securities litigation or shareholder activism, which could cause the Company to incur significant expense, hinder execution of business and growth strategy and impact its stock price. |

· | We are a “controlled company” within the meaning of the applicable rules of Nasdaq and, as a result, may qualify for exemptions from certain corporate governance requirements. To the extent we rely on such exemptions, our shareholders will not have the same protections afforded to stockholders of companies that are not controlled companies. |

· | The Company is an emerging growth company within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the Company has taken advantage of certain exemptions from disclosure requirements available to emerging growth companies; this could make the Company’s securities less attractive to investors and may make it more difficult to compare the Company’s performance with other public companies. |

Risks Related to Tax

· | Our only principal asset is our interest in QualTek HoldCo, and accordingly we will depend on distributions from QualTek HoldCo to pay dividends, taxes, other expenses, and make any payments required to be made under the Tax Receivable Agreement. |

· | The Tax Receivable Agreement will require us to make cash payments to the TRA Holders in respect of certain tax benefits and such payments may be substantial. In certain cases, payments under the Tax Receivable Agreement may (i) exceed any actual tax benefits the TRA Holders realizes or (ii) be accelerated. |

· | We could be adversely affected by changes in applicable tax laws, regulations, or administrative interpretations thereof in the United States or other jurisdictions. |

Risks Related to the Industries We Serve

Changes to laws, governmental regulations and policies, including governmental permitting processes and tax incentives, could affect demand for our services. Additionally, demand for construction services depends on industry activity and expenditure levels, which can be affected by a variety of factors. Our inability or failure to adjust to such changes or activity could result in decreased demand for our services and adversely affect our results of operations, cash flows and liquidity.

The industries we serve are subject to effects of governmental regulation, climate change initiatives and political or social activism, any of which could result in reduced demand for our services, delays in timing of construction of projects or cancellations of current or planned future projects. Many of our customers face stringent regulatory and environmental requirements and permitting processes, including governmental regulations and policies. Most of our communications customers are regulated by the FCC, and our utility customers are regulated by state public utility commissions. These agencies or governments could change their interpretation of current regulations and/or may impose additional regulations, which could have an adverse effect on our customers, reduce demand for our services and adversely affect our results of operations, cash flows and liquidity. We build renewable energy infrastructure, including wind, solar and other renewable energy facilities, for which the development may be partially dependent upon federal tax credits, existing renewable portfolio standards and other tax or state incentives. Elimination of, or changes to, existing renewable portfolio standards, tax incentives or similar environmental policies could negatively affect demand for our services.

All of the above factors could result in fewer projects than anticipated or a delay in the timing of construction of these projects and the related infrastructure, which could negatively affect demand for our services, and have a material adverse effect on our results of operations, cash flows and liquidity.

16

Many of the industries we serve are highly competitive and subject to rapid technological and regulatory changes, as well as customer consolidation, any of which could result in decreased demand for our services and adversely affect our results of operations, cash flows and liquidity.

Our industry is highly fragmented, and we compete with other companies in most of the markets in which we operate, ranging from small independent firms servicing local markets to larger firms servicing regional and national markets. We also face competition from existing and prospective customers that employ in-house personnel to perform some of the services we provide. There are relatively few barriers to entry into certain of the markets in which we operate and, as a result, any organization that has adequate financial resources and access to technical expertise and skilled personnel may become a competitor. Most of our customers’ work is awarded through bid processes, and our project bids may not be successful. Our results of operations, cash flows and liquidity could be materially and adversely affected if we are unsuccessful in bidding for projects or renewing our MSAs, or if our ability to win such projects or agreements requires that we accept lower margins.

We derive a substantial portion of our revenue from customers in industries that are subject to rapid changes in technology, governmental regulation, changing consumer demands and consolidation, such as the telecommunications industry. Technological advances in the markets we serve could render existing projects or technologies uncompetitive or obsolete and/or could alter our customers’ existing operating models.

Our failure to rapidly adopt and master new technologies as they are developed or adapt to changing customer requirements could reduce demand for our services. Additionally, consolidation among our customers could result in the loss of customer revenue or could negatively affect customer demand for the services we provide and have a material adverse effect on our results of operations, cash flows and liquidity.

Unfavorable market conditions, market uncertainty, public health outbreaks such as the COVID-19 pandemic and/or economic downturns could reduce capital expenditures in the industries we serve or could adversely affect our customers, which could result in decreased demand or impair our customers’ ability to pay for our services.

Demand for our services has been, and will likely continue to be, cyclical in nature and vulnerable to general downturns in the U.S. economy. Unfavorable market conditions, market uncertainty, public health outbreaks such as the COVID-19 pandemic and/or economic downturns could have a negative effect on demand for our customers’ services or the profitability of their services. We continually monitor our customers’ industries and their relative health compared to the economy as a whole. Our customers may not have the ability to fund capital expenditures for infrastructure or may have difficulty obtaining financing for planned projects during economic downturns. Uncertain or adverse economic conditions or the lack of availability of debt or equity financing for our customers could reduce their capital spending and/or result in project cancellations or deferrals. Any of these conditions could materially and adversely affect our results of operations, cash flows and liquidity, and could add uncertainty to our backlog determinations. Other economic factors can also negatively affect demand for our services, including economic downturns affecting our communications and customer fulfillment customers, if services are ordered at a reduced rate, or not at all. A decrease in demand for the services we provide from any of the above factors, among others, could materially and adversely affect our results of operations, cash flows and liquidity.

An impairment of the financial condition of one or more of our customers due to economic downturns, or due to the potential adverse effects of the COVID-19 pandemic on economic activity, could hinder their ability to pay us on a timely basis. In difficult economic times, some of our clients may find it difficult to pay for our services on a timely basis, increasing the risk that our accounts receivable could become uncollectible and ultimately be written off. In certain cases, our clients are project-specific entities that do not have significant assets other than their interests in the project. From time to time, it may be difficult for us to collect payments owed to us by these clients. Delays in client payments may require us to make a working capital investment, which could negatively affect our cash flows and liquidity. Our results of operations, cash flows and liquidity could be materially and adversely affected if a client fails to pay us on a timely basis or defaults in making payments on a project for which we have devoted significant resources.

Risks Related to Our Business and Operations

Our failure to properly manage projects, or project delays, including those resulting from difficult work sites and environments or delays, could result in additional costs or claims or failure to achieve actual revenue or profits when anticipated or at all, which could have a material adverse effect on our operating results, cash flows and liquidity.

Certain of our engagements involve large-scale, complex projects that may occur over extended time periods. The quality of our performance on such a project depends in large part upon our ability to manage our client relationship and the project itself, such as the

17

timely deployment of appropriate resources, including third-party contractors and our own personnel. Our results of operations, cash flows and liquidity could be adversely affected if we miscalculate the resources or time needed to complete a project with capped or fixed fees, or the resources or time needed to meet contractual milestones.

We perform work under a variety of conditions, including, but not limited to, challenging and hard to reach terrain and difficult site conditions. Performing work under such conditions can result in project delays or cancellations, potentially causing us to incur unanticipated costs, reductions in revenue or the payment of liquidated damages. In addition, some of our agreements require that we assume the risk should actual site conditions vary from those expected. Some of our projects involve challenging engineering, procurement and construction phases, which may occur over extended time periods. We may encounter difficulties in engineering, delays in designs or materials provided by the customer or a third party, equipment and material delivery delays, permitting delays, schedule changes, delays from customer failure to timely obtain rights-of-way, weather-related delays, delays by subcontractors in completing their portion of projects and governmental, market and political or other factors, some of which are beyond our control and could affect our ability to complete a project as originally scheduled. For instance, in the second half of 2021, we experienced delays in certain 5G rollout projects, including equipment delays, which are expected to delay or reduce our anticipated revenue or profits from these projects. In some cases, delays and additional costs may be substantial, and/or we may be required to cancel or defer a project and/or compensate the customer for the delay. We may not be able to recover any of such costs. Any such delays, cancellations, errors or other failures to meet customer expectations could result in damage claims substantially in excess of the revenue associated with a project. Delays or cancellations could result in additional costs or claims or failure to achieve actual revenue or profits when anticipated or at all, which could have a material adverse effect on our operating results, cash flows and liquidity, and could also negatively affect our reputation or relationships with our customers, which could adversely affect our ability to secure new contracts.

We could also encounter project delays due to local opposition, including political and social activism, which could include injunctive actions or public protests related to the siting of our projects, and such delays could adversely affect our project margins. In addition, some of our agreements require that we pay liquidated damages or other charges if we do not meet project deadlines; therefore, any failure to properly estimate or manage cost, or delays in the completion of projects, could subject us to penalties, which could adversely affect our results of operations, cash flows and liquidity. Further, any defects or errors, or failures to meet our customers’ expectations, could result in large damage claims against us. Due to the substantial cost of, and potentially long lead-times necessary to acquire certain of the materials and equipment used in our complex projects, damage claims could substantially exceed the amount we can charge for our associated services.

Our failure to recover adequately on charges against project owners, subcontractors or suppliers for payment or performance could have a material adverse effect on our financial results.

We occasionally seek reimbursement from project owners for additional costs that exceed the contract price or for amounts not included in the original contract price. Similarly, we present change orders and charges to our subcontractors and suppliers. We could incur reduced profits, cost overruns or project losses if we fail to properly document the nature of change orders or charges or are otherwise unsuccessful in negotiating an expected settlement. These types of charges can often occur due to matters such as owner- caused delays or changes from the initial project scope, which result in additional costs, both direct and indirect, or from project or contract terminations. From time to time, these charges can be the subject of lengthy and costly proceedings, and it is often difficult to accurately predict when these charges will be fully resolved. When these types of events occur and unresolved charges are pending, we may invest significant working capital in projects to cover cost overruns pending the resolution of the relevant charges. A failure to promptly recover on these types of charges could have a material adverse effect on our liquidity and financial results.

Additionally, we generally warrant the work we perform following substantial completion of a project. Warranty claims have historically not been material, but such claims could potentially increase. The costs associated with such warranties, including any warranty-related legal proceedings, could have a material adverse effect on our results of operations, cash flows and liquidity.

We may not accurately estimate the costs associated with services provided under fixed price contracts, which could impair our financial performance. Additionally, we recognize revenue for certain projects using the cost-to-cost method of accounting; therefore, variations of actual results from our assumptions could reduce our profitability.

We derive a significant portion of our revenue from fixed price MSAs and other agreements. Under these contracts, we typically set the price of our services on a per unit or aggregate basis and assume the risk that costs associated with our performance may be greater than what we estimated.

18

We also enter into contracts for specific projects or jobs that require the installation or construction of an entire infrastructure system or specified units within an infrastructure system, many of which are priced on a fixed price or per unit basis. Our profitability will be reduced if actual costs to complete a project exceed our original estimates. Our profitability is therefore dependent upon our ability to accurately estimate the costs associated with our services and our ability to execute in accordance with our plans. A variety of factors could negatively affect these estimates, including delays resulting from weather and the COVID-19 pandemic, changes in expected productivity levels, conditions at work sites differing materially from those anticipated at the time we bid on the contract and higher than expected costs of labor and/or materials. These variations, along with other risks inherent in performing fixed price contracts, could cause actual project results to differ materially from our original estimates, which could result in lower margins than anticipated, or losses, which could reduce our profitability, cash flows and liquidity.

In addition, we recognize revenue from fixed price contracts, as well as for certain projects pursuant to MSAs and other agreements, over time utilizing the cost-to-cost measure of progress, or the “cost- to- cost” method of accounting, under which the percentage of revenue to be recognized in a given period is measured by the percentage of costs incurred to date on the contract to the total estimated costs for the contract. The cost-to-cost method, therefore, relies on estimates of total expected contract costs. Contract revenue and total contract cost estimates are reviewed and revised on an ongoing basis as the work progresses. Adjustments arising from changes in the estimates of contract revenue or costs are reflected in the fiscal period in which such estimates are revised. Estimates are based on management’s reasonable assumptions, judgment and experience, but are subject to the risks inherent in estimates, including unanticipated delays or technical complications, changes in job performance, job conditions and management’s assessment of expected variable consideration. Variances in actual results from related estimates on a large project, or on several smaller projects, could be material. The full amount of an estimated loss on a contract is recognized in the period such losses are determined. Any such adjustments could result in reduced profitability and negatively affect our results of operations.

We derive a significant portion of our revenue from a few customers, and the loss of one or more of these customers, or a reduction in their demand for our services, could impair our financial performance. In addition, many of our contracts, including our service agreements, do not obligate our customers to undertake any infrastructure projects or other work with us, and most of our contracts may be canceled on short or no advance notice.

Our business is concentrated among relatively few customers, and a substantial portion of our services are provided on a non-recurring, project-by-project basis. Our revenue could significantly decline if we were to lose one or more of our significant customers, or if one or more of our customers reduce the amount of business they provide to us. For the fiscal year ended December 31, 2021, our top two customers accounted for approximately 41% and 13% of our total revenues, respectively. In addition, our results of operations, cash flows and liquidity could be negatively affected if we complete the required work on non-recurring projects and cannot replace them with similar projects. See Note 6 — Accounts Receivable, Net of Allowance, Contract Assets and Liabilities, and Customer Credit Concentration, in the notes to our audited consolidated financial statements included in our Current Report on Form 8-K/A filed with the SEC on April 1, 2022 for revenue concentration information.

We derive a significant portion of our revenue from multi-year MSAs and other agreements. Under these agreements, our customers have no obligation to undertake any infrastructure projects or other work with us. In addition, most of our contracts are cancelable on short or no advance notice. This makes it difficult to estimate our customers’ demand for our services. A significant decline in the volume of work our customers request us to perform under these service agreements could negatively affect our results of operations, cash flows and liquidity.

Some of our contracts, including our service agreements, are periodically open to public bid. We may not be the successful bidder on existing contracts that are re-bid. We could experience a reduction in revenue, profitability and liquidity if we fail to win a significant number of existing contracts upon re-bid, or, for services that are provided on a non-recurring basis, if we complete the required work under a significant number of projects and cannot replace them with similar projects. Additionally, from time to time, we enter into contracts that contain financing or other conditions that must be satisfied before we can begin work. Certain of these contracts may not result in revenue or profits if our customers are unable to obtain financing or to satisfy other conditions associated with such projects.

19

Amounts included in our backlog may not result in actual revenue or translate into profits. Our backlog is subject to cancellation and unexpected adjustments and is, therefore, an uncertain indicator of future operating results.

Our backlog consists of the estimated amount of revenue we expect to realize from future work on uncompleted contracts, including new contracts under which work has not begun, as well as revenue from change orders and renewal options. A significant portion of our 24-month backlog is attributable to MSAs and other agreements, none of which require our customers to purchase a minimum amount of services and are cancelable on short or no advance notice. The balance of our backlog is our estimate of work to be completed under contracts for specific projects. Backlog amounts are determined based on estimates that incorporate historical trends, anticipated seasonal impacts, experience from similar projects and estimates of customer demand based on communications with our customers. These estimates may prove inaccurate, which could cause estimated revenue to be realized in periods later than originally expected, or not at all. In the past, we have experienced postponements, cancellations and reductions in expected future work due to changes in our customers’ spending plans, market volatility, regulatory delays and/or other factors. There can be no assurance as to our customers’ requirements or that actual results will be consistent with the estimates included in our forecasts. As a result, our backlog as of any particular date is an uncertain indicator of future revenue and earnings. In addition, contracts included in our backlog may not be profitable. If our backlog fails to materialize, our results of operations, cash flows and liquidity would be materially and adversely affected.

Our business and operations, and the operations of our customers, may be adversely affected by epidemics or pandemics such as the COVID-19 pandemic.

We may face risks related to health epidemics and pandemics or other outbreaks of communicable diseases. The global spread of COVID-19 has created significant volatility, uncertainty and economic disruption, including significant volatility in the U.S. economy and financial markets. The extent to which the COVID-19 pandemic could affect our business, operations and financial results will depend on numerous evolving factors that we may not be able to accurately predict, including the duration and scope of the pandemic and new information that may emerge concerning the severity and effect of COVID-19, the continued emergence of new strains of COVID-19, the development and availability of effective treatments and vaccines and the speed with which they are administered to the public. Additional factors include governmental and business actions that have been and continue to be taken in response to the pandemic, including mitigation efforts such as “stay-at-home,” “shelter-in-place,” social distancing, travel restrictions and other similar orders, as well as the impact of the pandemic on the U.S. economy, global economic and market activity and actions taken in response, including from governmental stimulus efforts.

A public health epidemic or pandemic, such as the COVID-19 pandemic, poses the risk that we or our employees, customers and/or business partners may be prevented from conducting ordinary course business activities for an indefinite period of time, including due to shutdowns or cancellations that have been, and may continue to be, mandated or requested by governmental authorities or others, or that the pandemic may otherwise interrupt or affect business activities. While our business model has, thus far, proven resilient, the COVID-19 pandemic has had a negative effect on our operations, and we expect this to continue until the systemic effects that COVID-19 has had on labor, materials, supply chains, governmental response time, among others, return to pre-COVID levels. It is currently unclear how long an economic recovery could take, and we cannot predict the extent or duration of potential negative effects on our operations. We have adjusted standard operating procedures within our business operations to ensure continued employee and customer safety and are continually monitoring evolving health guidelines as well as market conditions and responding to changes as appropriate. We cannot be certain, however, that these efforts will prevent further disruption due to effects of the pandemic on business and market conditions. Additionally, we could be exposed to increased risks and costs associated with workplace health claims. To comply with health guidelines implemented to control the spread of COVID-19, we have incorporated work-at-home programs as appropriate for our administrative offices and, despite our implementation of information technology security measures, there is no guarantee that the data security and privacy safeguards we have put in place will be completely effective or that we will not encounter some of the common risks associated with employees accessing company data and systems remotely.