0000018230FALSE12/312023Q150http://fasb.org/us-gaap/2022#Revenueshttp://fasb.org/us-gaap/2022#Revenueshttp://fasb.org/us-gaap/2022#Revenueshttp://fasb.org/us-gaap/2022#Revenues00000182302023-01-012023-03-310000018230us-gaap:CommonStockMember2023-01-012023-03-310000018230cat:A5.3DebenturesDueSeptember152035Member2023-01-012023-03-3100000182302023-03-31xbrli:shares0000018230cat:MachineryEnergyTransportationMember2023-01-012023-03-31iso4217:USD0000018230cat:MachineryEnergyTransportationMember2022-01-012022-03-310000018230cat:FinancialProductsMember2023-01-012023-03-310000018230cat:FinancialProductsMember2022-01-012022-03-3100000182302022-01-012022-03-310000018230cat:AllOtherExcludingFinancialProductsMember2023-01-012023-03-310000018230cat:AllOtherExcludingFinancialProductsMember2022-01-012022-03-31iso4217:USDxbrli:shares00000182302022-12-310000018230cat:MachineryEnergyTransportationMember2023-03-310000018230cat:MachineryEnergyTransportationMember2022-12-310000018230cat:FinancialProductsMember2023-03-310000018230cat:FinancialProductsMember2022-12-310000018230us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-12-310000018230us-gaap:TreasuryStockMember2021-12-310000018230us-gaap:RetainedEarningsMember2021-12-310000018230us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000018230us-gaap:NoncontrollingInterestMember2021-12-3100000182302021-12-310000018230us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-01-012022-03-310000018230us-gaap:TreasuryStockMember2022-01-012022-03-310000018230us-gaap:RetainedEarningsMember2022-01-012022-03-310000018230us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310000018230us-gaap:NoncontrollingInterestMember2022-01-012022-03-310000018230us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-03-310000018230us-gaap:TreasuryStockMember2022-03-310000018230us-gaap:RetainedEarningsMember2022-03-310000018230us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000018230us-gaap:NoncontrollingInterestMember2022-03-3100000182302022-03-310000018230us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-12-310000018230us-gaap:TreasuryStockMember2022-12-310000018230us-gaap:RetainedEarningsMember2022-12-310000018230us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000018230us-gaap:NoncontrollingInterestMember2022-12-310000018230us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-01-012023-03-310000018230us-gaap:TreasuryStockMember2023-01-012023-03-310000018230us-gaap:RetainedEarningsMember2023-01-012023-03-310000018230us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000018230us-gaap:NoncontrollingInterestMember2023-01-012023-03-310000018230us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-03-310000018230us-gaap:TreasuryStockMember2023-03-310000018230us-gaap:RetainedEarningsMember2023-03-310000018230us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000018230us-gaap:NoncontrollingInterestMember2023-03-3100000182302023-04-012023-03-31xbrli:pure0000018230cat:StockOptionsandShareAppreciationRightsSARsMember2023-01-012023-03-310000018230cat:StockOptionsandShareAppreciationRightsSARsMember2023-03-310000018230cat:StockOptionsandShareAppreciationRightsSARsMember2022-01-012022-03-310000018230cat:StockOptionsandShareAppreciationRightsSARsMember2022-03-310000018230us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310000018230us-gaap:RestrictedStockUnitsRSUMember2023-03-310000018230us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-03-310000018230us-gaap:RestrictedStockUnitsRSUMember2022-03-310000018230us-gaap:PerformanceSharesMember2023-01-012023-03-310000018230us-gaap:PerformanceSharesMember2023-03-310000018230us-gaap:PerformanceSharesMember2022-01-012022-03-310000018230us-gaap:PerformanceSharesMember2022-03-310000018230us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-03-310000018230us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310000018230us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-03-310000018230us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310000018230us-gaap:DesignatedAsHedgingInstrumentMember2023-03-310000018230us-gaap:DesignatedAsHedgingInstrumentMember2022-12-310000018230us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-03-310000018230us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2022-12-310000018230us-gaap:CommodityContractMemberus-gaap:NondesignatedMember2023-03-310000018230us-gaap:CommodityContractMemberus-gaap:NondesignatedMember2022-12-310000018230us-gaap:NondesignatedMember2023-03-310000018230us-gaap:NondesignatedMember2022-12-310000018230cat:FairValueUndesignatedHedgesMemberus-gaap:ForeignExchangeContractMember2023-01-012023-03-310000018230cat:FairValueUndesignatedHedgesMemberus-gaap:ForeignExchangeContractMember2022-01-012022-03-310000018230us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-03-310000018230us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-03-310000018230cat:FairValueUndesignatedHedgesMemberus-gaap:InterestRateContractMember2023-01-012023-03-310000018230cat:FairValueUndesignatedHedgesMemberus-gaap:InterestRateContractMember2022-01-012022-03-310000018230us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-03-310000018230us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-03-310000018230cat:FairValueUndesignatedHedgesMemberus-gaap:CommodityContractMember2023-01-012023-03-310000018230cat:FairValueUndesignatedHedgesMemberus-gaap:CommodityContractMember2022-01-012022-03-310000018230us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CommodityContractMember2023-01-012023-03-310000018230us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CommodityContractMember2022-01-012022-03-310000018230cat:FairValueUndesignatedHedgesMember2023-01-012023-03-310000018230cat:FairValueUndesignatedHedgesMember2022-01-012022-03-310000018230us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-03-310000018230us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-03-310000018230cat:LongTermDebtDueWithinOneYearMember2023-03-310000018230cat:LongTermDebtDueWithinOneYearMember2022-12-310000018230cat:LongTermDebtDueAfterOneYearMember2023-03-310000018230cat:LongTermDebtDueAfterOneYearMember2022-12-310000018230us-gaap:CustomerRelationshipsMember2023-01-012023-03-310000018230us-gaap:CustomerRelationshipsMember2023-03-310000018230us-gaap:DevelopedTechnologyRightsMember2023-01-012023-03-310000018230us-gaap:DevelopedTechnologyRightsMember2023-03-310000018230us-gaap:OtherIntangibleAssetsMember2023-01-012023-03-310000018230us-gaap:OtherIntangibleAssetsMember2023-03-310000018230us-gaap:CustomerRelationshipsMember2022-01-012022-12-310000018230us-gaap:CustomerRelationshipsMember2022-12-310000018230us-gaap:DevelopedTechnologyRightsMember2022-01-012022-12-310000018230us-gaap:DevelopedTechnologyRightsMember2022-12-310000018230us-gaap:OtherIntangibleAssetsMember2022-01-012022-12-310000018230us-gaap:OtherIntangibleAssetsMember2022-12-3100000182302022-01-012022-12-310000018230cat:ConstructionIndustriesMember2022-12-310000018230cat:ConstructionIndustriesMember2023-01-012023-03-310000018230cat:ConstructionIndustriesMember2023-03-310000018230cat:ResourceIndustriesMember2022-12-310000018230cat:ResourceIndustriesMember2023-01-012023-03-310000018230cat:ResourceIndustriesMember2023-03-310000018230cat:EnergyandTransportationMember2022-12-310000018230cat:EnergyandTransportationMember2023-01-012023-03-310000018230cat:EnergyandTransportationMember2023-03-310000018230cat:OtherSegmentsMember2022-12-310000018230cat:OtherSegmentsMember2023-01-012023-03-310000018230cat:OtherSegmentsMember2023-03-310000018230us-gaap:USTreasurySecuritiesMember2023-03-310000018230us-gaap:USTreasurySecuritiesMember2022-12-310000018230cat:OtherUSGovernmentAndNonUSGovernmentDebtMember2023-03-310000018230cat:OtherUSGovernmentAndNonUSGovernmentDebtMember2022-12-310000018230us-gaap:CorporateBondSecuritiesMember2023-03-310000018230us-gaap:CorporateBondSecuritiesMember2022-12-310000018230us-gaap:AssetBackedSecuritiesMember2023-03-310000018230us-gaap:AssetBackedSecuritiesMember2022-12-310000018230us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2023-03-310000018230us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2022-12-310000018230us-gaap:ResidentialMortgageBackedSecuritiesMember2023-03-310000018230us-gaap:ResidentialMortgageBackedSecuritiesMember2022-12-310000018230us-gaap:CommercialMortgageBackedSecuritiesMember2023-03-310000018230us-gaap:CommercialMortgageBackedSecuritiesMember2022-12-310000018230us-gaap:BankTimeDepositsMember2023-03-310000018230us-gaap:BankTimeDepositsMember2022-12-310000018230country:US2023-01-012023-03-310000018230country:US2022-01-012022-03-310000018230us-gaap:ForeignPlanMember2023-01-012023-03-310000018230us-gaap:ForeignPlanMember2022-01-012022-03-310000018230us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-03-310000018230us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-03-310000018230us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-03-310000018230cat:GuaranteeWithDealerMember2023-03-310000018230cat:GuaranteeWithDealerMember2022-12-310000018230us-gaap:GuaranteeTypeOtherMember2023-03-310000018230us-gaap:GuaranteeTypeOtherMember2022-12-310000018230us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-03-310000018230us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310000018230cat:IRSinvestigationMember2017-03-022017-03-03cat:group_presidents0000018230us-gaap:ReportableSubsegmentsMember2023-01-012023-03-31cat:segments0000018230cat:NonreportableSubsegmentsMember2023-01-012023-03-310000018230cat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2023-01-012023-03-310000018230cat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2023-01-012023-03-310000018230us-gaap:EMEAMembercat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:ConstructionIndustriesMembersrt:AsiaPacificMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230us-gaap:MaterialReconcilingItemsMembercat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-03-310000018230cat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-03-310000018230cat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2023-01-012023-03-310000018230cat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2023-01-012023-03-310000018230us-gaap:EMEAMembercat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:ResourceIndustriesMembersrt:AsiaPacificMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:ResourceIndustriesMemberus-gaap:MaterialReconcilingItemsMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-03-310000018230cat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-03-310000018230cat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2023-01-012023-03-310000018230cat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2023-01-012023-03-310000018230us-gaap:EMEAMembercat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230srt:AsiaPacificMembercat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230us-gaap:MaterialReconcilingItemsMembercat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-03-310000018230cat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-03-310000018230cat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2023-01-012023-03-310000018230cat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2023-01-012023-03-310000018230us-gaap:EMEAMembercat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:FinancialProductsSegmentMembersrt:AsiaPacificMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230us-gaap:MaterialReconcilingItemsMembercat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-03-310000018230cat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-03-310000018230us-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2023-01-012023-03-310000018230us-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2023-01-012023-03-310000018230us-gaap:EMEAMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230srt:AsiaPacificMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230us-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230us-gaap:MaterialReconcilingItemsMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-03-310000018230cat:OtherSegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2023-01-012023-03-310000018230cat:OtherSegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2023-01-012023-03-310000018230us-gaap:EMEAMembercat:OtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:OtherSegmentsMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:OtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000018230cat:OtherSegmentsMemberus-gaap:MaterialReconcilingItemsMember2023-01-012023-03-310000018230us-gaap:IntersubsegmentEliminationsMemberus-gaap:CorporateNonSegmentMembersrt:NorthAmericaMember2023-01-012023-03-310000018230us-gaap:IntersubsegmentEliminationsMemberus-gaap:CorporateNonSegmentMembersrt:LatinAmericaMember2023-01-012023-03-310000018230us-gaap:EMEAMemberus-gaap:IntersubsegmentEliminationsMemberus-gaap:CorporateNonSegmentMember2023-01-012023-03-310000018230us-gaap:IntersubsegmentEliminationsMemberus-gaap:CorporateNonSegmentMembersrt:AsiaPacificMember2023-01-012023-03-310000018230us-gaap:IntersubsegmentEliminationsMemberus-gaap:CorporateNonSegmentMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMemberus-gaap:IntersubsegmentEliminationsMember2023-01-012023-03-310000018230us-gaap:IntersubsegmentEliminationsMember2023-01-012023-03-310000018230srt:NorthAmericaMember2023-01-012023-03-310000018230srt:LatinAmericaMember2023-01-012023-03-310000018230us-gaap:EMEAMember2023-01-012023-03-310000018230srt:AsiaPacificMember2023-01-012023-03-310000018230cat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2022-01-012022-03-310000018230cat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2022-01-012022-03-310000018230us-gaap:EMEAMembercat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:ConstructionIndustriesMembersrt:AsiaPacificMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230us-gaap:MaterialReconcilingItemsMembercat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMember2022-01-012022-03-310000018230cat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMember2022-01-012022-03-310000018230cat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2022-01-012022-03-310000018230cat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2022-01-012022-03-310000018230us-gaap:EMEAMembercat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:ResourceIndustriesMembersrt:AsiaPacificMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:ResourceIndustriesMemberus-gaap:MaterialReconcilingItemsMemberus-gaap:ReportableSubsegmentsMember2022-01-012022-03-310000018230cat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMember2022-01-012022-03-310000018230cat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2022-01-012022-03-310000018230cat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2022-01-012022-03-310000018230us-gaap:EMEAMembercat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230srt:AsiaPacificMembercat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230us-gaap:MaterialReconcilingItemsMembercat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMember2022-01-012022-03-310000018230cat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMember2022-01-012022-03-310000018230cat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2022-01-012022-03-310000018230cat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2022-01-012022-03-310000018230us-gaap:EMEAMembercat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:FinancialProductsSegmentMembersrt:AsiaPacificMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230us-gaap:MaterialReconcilingItemsMembercat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMember2022-01-012022-03-310000018230cat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMember2022-01-012022-03-310000018230us-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2022-01-012022-03-310000018230us-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2022-01-012022-03-310000018230us-gaap:EMEAMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230srt:AsiaPacificMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230us-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230us-gaap:MaterialReconcilingItemsMemberus-gaap:ReportableSubsegmentsMember2022-01-012022-03-310000018230us-gaap:ReportableSubsegmentsMember2022-01-012022-03-310000018230cat:OtherSegmentsMemberus-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2022-01-012022-03-310000018230cat:OtherSegmentsMemberus-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2022-01-012022-03-310000018230us-gaap:EMEAMembercat:OtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:OtherSegmentsMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:OtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000018230cat:OtherSegmentsMemberus-gaap:MaterialReconcilingItemsMember2022-01-012022-03-310000018230cat:OtherSegmentsMember2022-01-012022-03-310000018230us-gaap:IntersubsegmentEliminationsMemberus-gaap:CorporateNonSegmentMembersrt:NorthAmericaMember2022-01-012022-03-310000018230us-gaap:IntersubsegmentEliminationsMemberus-gaap:CorporateNonSegmentMembersrt:LatinAmericaMember2022-01-012022-03-310000018230us-gaap:EMEAMemberus-gaap:IntersubsegmentEliminationsMemberus-gaap:CorporateNonSegmentMember2022-01-012022-03-310000018230us-gaap:IntersubsegmentEliminationsMemberus-gaap:CorporateNonSegmentMembersrt:AsiaPacificMember2022-01-012022-03-310000018230us-gaap:IntersubsegmentEliminationsMemberus-gaap:CorporateNonSegmentMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMemberus-gaap:IntersubsegmentEliminationsMember2022-01-012022-03-310000018230us-gaap:IntersubsegmentEliminationsMember2022-01-012022-03-310000018230srt:NorthAmericaMember2022-01-012022-03-310000018230srt:LatinAmericaMember2022-01-012022-03-310000018230us-gaap:EMEAMember2022-01-012022-03-310000018230srt:AsiaPacificMember2022-01-012022-03-310000018230cat:FinancialProductsSegmentMember2023-01-012023-03-310000018230cat:FinancialProductsSegmentMember2022-01-012022-03-310000018230cat:OilAndGasCustomerMembercat:EnergyandTransportationMember2023-01-012023-03-310000018230cat:OilAndGasCustomerMembercat:EnergyandTransportationMember2022-01-012022-03-310000018230cat:PowergenerationMembercat:EnergyandTransportationMember2023-01-012023-03-310000018230cat:PowergenerationMembercat:EnergyandTransportationMember2022-01-012022-03-310000018230cat:IndustrialMembercat:EnergyandTransportationMember2023-01-012023-03-310000018230cat:IndustrialMembercat:EnergyandTransportationMember2022-01-012022-03-310000018230cat:TransportationMembercat:EnergyandTransportationMember2023-01-012023-03-310000018230cat:TransportationMembercat:EnergyandTransportationMember2022-01-012022-03-310000018230cat:EnergyandTransportationMember2022-01-012022-03-310000018230us-gaap:OperatingSegmentsMembercat:NonreportableSubsegmentsMember2023-01-012023-03-310000018230us-gaap:OperatingSegmentsMembercat:NonreportableSubsegmentsMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMembercat:CostCentersMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:CostCentersMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMembercat:CorporateCostsMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:CorporateCostsMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMembercat:TimingReconcilingItemMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:TimingReconcilingItemMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMembercat:RestructuringCostsMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:RestructuringCostsMember2022-01-012022-03-310000018230cat:InventoryCostofSalesMemberus-gaap:IntersegmentEliminationMember2023-01-012023-03-310000018230cat:InventoryCostofSalesMemberus-gaap:IntersegmentEliminationMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMembercat:PostretirementBenefitsMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:PostretirementBenefitsMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMembercat:StockBasedCompensationExpenseMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:StockBasedCompensationExpenseMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMembercat:FinancingCostsMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:FinancingCostsMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMembercat:CurrencyMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:CurrencyMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMembercat:OtherIncomeExpenseReconcilingDifferencesMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:OtherIncomeExpenseReconcilingDifferencesMember2022-01-012022-03-310000018230us-gaap:IntersegmentEliminationMembercat:OtherReconcilingItemsMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:OtherReconcilingItemsMember2022-01-012022-03-310000018230cat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-03-310000018230cat:ConstructionIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-12-310000018230cat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-03-310000018230cat:ResourceIndustriesMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-12-310000018230cat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-03-310000018230cat:EnergyandTransportationMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-12-310000018230cat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-03-310000018230cat:FinancialProductsSegmentMemberus-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-12-310000018230us-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2023-03-310000018230us-gaap:ReportableSubsegmentsMemberus-gaap:OperatingSegmentsMember2022-12-310000018230us-gaap:OperatingSegmentsMembercat:NonreportableSubsegmentsMember2023-03-310000018230us-gaap:OperatingSegmentsMembercat:NonreportableSubsegmentsMember2022-12-310000018230us-gaap:IntersegmentEliminationMembercat:CashandShortTermInvestmentsMember2023-03-310000018230us-gaap:IntersegmentEliminationMembercat:CashandShortTermInvestmentsMember2022-12-310000018230us-gaap:IntersegmentEliminationMembercat:DeferredIncomeTaxesReconcilingItemMember2023-03-310000018230us-gaap:IntersegmentEliminationMembercat:DeferredIncomeTaxesReconcilingItemMember2022-12-310000018230us-gaap:IntersegmentEliminationMembercat:GoodwillandIntangibleAssetsReconcilingItemMember2023-03-310000018230us-gaap:IntersegmentEliminationMembercat:GoodwillandIntangibleAssetsReconcilingItemMember2022-12-310000018230us-gaap:IntersegmentEliminationMembercat:PropertyPlantandEquipmentNetandOtherAssetsReconcilingItemsMember2023-03-310000018230us-gaap:IntersegmentEliminationMembercat:PropertyPlantandEquipmentNetandOtherAssetsReconcilingItemsMember2022-12-310000018230us-gaap:IntersegmentEliminationMember2023-03-310000018230us-gaap:IntersegmentEliminationMember2022-12-310000018230us-gaap:IntersegmentEliminationMembercat:LiabilitiesIncludedinSegmentAssetsReconcilingItemMember2023-03-310000018230us-gaap:IntersegmentEliminationMembercat:LiabilitiesIncludedinSegmentAssetsReconcilingItemMember2022-12-310000018230us-gaap:IntersegmentEliminationMembercat:OtherReconcilingItemsMember2023-03-310000018230us-gaap:IntersegmentEliminationMembercat:OtherReconcilingItemsMember2022-12-310000018230us-gaap:IntersegmentEliminationMembercat:NonreportableSubsegmentsMember2023-01-012023-03-310000018230us-gaap:IntersegmentEliminationMembercat:NonreportableSubsegmentsMember2022-01-012022-03-310000018230cat:FinanceReceivableMembercat:CustomerMember2022-12-310000018230cat:FinanceReceivableMembercat:DealerMember2022-12-310000018230cat:FinanceReceivableMember2022-12-310000018230cat:FinanceReceivableMembercat:CustomerMember2021-12-310000018230cat:FinanceReceivableMembercat:DealerMember2021-12-310000018230cat:FinanceReceivableMember2021-12-310000018230cat:FinanceReceivableMembercat:CustomerMember2023-01-012023-03-310000018230cat:FinanceReceivableMembercat:DealerMember2023-01-012023-03-310000018230cat:FinanceReceivableMember2023-01-012023-03-310000018230cat:FinanceReceivableMembercat:CustomerMember2022-01-012022-03-310000018230cat:FinanceReceivableMembercat:DealerMember2022-01-012022-03-310000018230cat:FinanceReceivableMember2022-01-012022-03-310000018230cat:FinanceReceivableMembercat:CustomerMember2023-03-310000018230cat:FinanceReceivableMembercat:DealerMember2023-03-310000018230cat:FinanceReceivableMember2023-03-310000018230cat:FinanceReceivableMembercat:CustomerMember2022-03-310000018230cat:FinanceReceivableMembercat:DealerMember2022-03-310000018230cat:FinanceReceivableMember2022-03-310000018230srt:NorthAmericaMembercat:FinanceReceivableMembercat:CustomerMember2023-01-012023-03-310000018230cat:FinanceReceivableMemberus-gaap:EMEAMembercat:CustomerMember2023-01-012023-03-310000018230srt:AsiaPacificMembercat:FinanceReceivableMembercat:CustomerMember2023-01-012023-03-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:CustomerMember2023-01-012023-03-310000018230srt:NorthAmericaMembercat:FinanceReceivableMembercat:CustomerMembercat:CurrentMember2023-03-310000018230cat:FinancingReceivables31to60DaysPastDueMembersrt:NorthAmericaMembercat:FinanceReceivableMembercat:CustomerMember2023-03-310000018230srt:NorthAmericaMembercat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:CustomerMember2023-03-310000018230srt:NorthAmericaMembercat:FinanceReceivableMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2023-03-310000018230cat:FinanceReceivableMemberus-gaap:EMEAMembercat:CustomerMembercat:CurrentMember2023-03-310000018230cat:FinancingReceivables31to60DaysPastDueMembercat:FinanceReceivableMemberus-gaap:EMEAMembercat:CustomerMember2023-03-310000018230cat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMemberus-gaap:EMEAMembercat:CustomerMember2023-03-310000018230cat:FinanceReceivableMemberus-gaap:EMEAMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2023-03-310000018230srt:AsiaPacificMembercat:FinanceReceivableMembercat:CustomerMembercat:CurrentMember2023-03-310000018230srt:AsiaPacificMembercat:FinancingReceivables31to60DaysPastDueMembercat:FinanceReceivableMembercat:CustomerMember2023-03-310000018230srt:AsiaPacificMembercat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:CustomerMember2023-03-310000018230srt:AsiaPacificMembercat:FinanceReceivableMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2023-03-310000018230cat:FinanceReceivableMembercat:MiningMembercat:CustomerMembercat:CurrentMember2023-03-310000018230cat:FinancingReceivables31to60DaysPastDueMembercat:FinanceReceivableMembercat:MiningMembercat:CustomerMember2023-03-310000018230cat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:MiningMembercat:CustomerMember2023-03-310000018230cat:FinanceReceivableMembercat:MiningMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2023-03-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:CustomerMembercat:CurrentMember2023-03-310000018230cat:FinancingReceivables31to60DaysPastDueMembersrt:LatinAmericaMembercat:FinanceReceivableMembercat:CustomerMember2023-03-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:CustomerMember2023-03-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2023-03-310000018230cat:FinanceReceivableMembercat:CustomerMembercat:CurrentMembercat:CaterpillarPowerFinanceMember2023-03-310000018230cat:FinancingReceivables31to60DaysPastDueMembercat:FinanceReceivableMembercat:CustomerMembercat:CaterpillarPowerFinanceMember2023-03-310000018230cat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:CustomerMembercat:CaterpillarPowerFinanceMember2023-03-310000018230cat:FinanceReceivableMembercat:CustomerMembercat:CaterpillarPowerFinanceMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2023-03-310000018230cat:FinanceReceivableMembercat:CustomerMembercat:CurrentMember2023-03-310000018230cat:FinancingReceivables31to60DaysPastDueMembercat:FinanceReceivableMembercat:CustomerMember2023-03-310000018230cat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:CustomerMember2023-03-310000018230cat:FinanceReceivableMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2023-03-310000018230srt:NorthAmericaMembercat:FinanceReceivableMembercat:CustomerMembercat:CurrentMember2022-12-310000018230cat:FinancingReceivables31to60DaysPastDueMembersrt:NorthAmericaMembercat:FinanceReceivableMembercat:CustomerMember2022-12-310000018230srt:NorthAmericaMembercat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:CustomerMember2022-12-310000018230srt:NorthAmericaMembercat:FinanceReceivableMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2022-12-310000018230cat:FinanceReceivableMemberus-gaap:EMEAMembercat:CustomerMembercat:CurrentMember2022-12-310000018230cat:FinancingReceivables31to60DaysPastDueMembercat:FinanceReceivableMemberus-gaap:EMEAMembercat:CustomerMember2022-12-310000018230cat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMemberus-gaap:EMEAMembercat:CustomerMember2022-12-310000018230cat:FinanceReceivableMemberus-gaap:EMEAMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2022-12-310000018230srt:AsiaPacificMembercat:FinanceReceivableMembercat:CustomerMembercat:CurrentMember2022-12-310000018230srt:AsiaPacificMembercat:FinancingReceivables31to60DaysPastDueMembercat:FinanceReceivableMembercat:CustomerMember2022-12-310000018230srt:AsiaPacificMembercat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:CustomerMember2022-12-310000018230srt:AsiaPacificMembercat:FinanceReceivableMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2022-12-310000018230cat:FinanceReceivableMembercat:MiningMembercat:CustomerMembercat:CurrentMember2022-12-310000018230cat:FinancingReceivables31to60DaysPastDueMembercat:FinanceReceivableMembercat:MiningMembercat:CustomerMember2022-12-310000018230cat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:MiningMembercat:CustomerMember2022-12-310000018230cat:FinanceReceivableMembercat:MiningMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2022-12-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:CustomerMembercat:CurrentMember2022-12-310000018230cat:FinancingReceivables31to60DaysPastDueMembersrt:LatinAmericaMembercat:FinanceReceivableMembercat:CustomerMember2022-12-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:CustomerMember2022-12-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2022-12-310000018230cat:FinanceReceivableMembercat:CustomerMembercat:CurrentMembercat:CaterpillarPowerFinanceMember2022-12-310000018230cat:FinancingReceivables31to60DaysPastDueMembercat:FinanceReceivableMembercat:CustomerMembercat:CaterpillarPowerFinanceMember2022-12-310000018230cat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:CustomerMembercat:CaterpillarPowerFinanceMember2022-12-310000018230cat:FinanceReceivableMembercat:CustomerMembercat:CaterpillarPowerFinanceMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2022-12-310000018230cat:FinanceReceivableMembercat:CustomerMembercat:CurrentMember2022-12-310000018230cat:FinancingReceivables31to60DaysPastDueMembercat:FinanceReceivableMembercat:CustomerMember2022-12-310000018230cat:FinanceReceivableMembercat:FinancingReceivables61to90DaysPastDueMembercat:CustomerMember2022-12-310000018230cat:FinanceReceivableMembercat:CustomerMembercat:FinancingReceivablesEqualtoGreaterthan91DaysPastDueMember2022-12-310000018230srt:LatinAmericaMembercat:FinancingReceivablesEqualToOrGreaterThan31DaysPastDueMembercat:DealerMember2022-12-310000018230srt:LatinAmericaMembercat:FinancingReceivablesEqualToOrGreaterThan31DaysPastDueMembercat:DealerMember2023-03-310000018230srt:NorthAmericaMembercat:FinanceReceivableMembercat:CustomerMember2023-03-310000018230srt:NorthAmericaMembercat:FinanceReceivableMembercat:CustomerMember2022-12-310000018230cat:FinanceReceivableMemberus-gaap:EMEAMembercat:CustomerMember2023-03-310000018230cat:FinanceReceivableMemberus-gaap:EMEAMembercat:CustomerMember2022-12-310000018230srt:AsiaPacificMembercat:FinanceReceivableMembercat:CustomerMember2023-03-310000018230srt:AsiaPacificMembercat:FinanceReceivableMembercat:CustomerMember2022-12-310000018230cat:FinanceReceivableMembercat:MiningMembercat:CustomerMember2023-03-310000018230cat:FinanceReceivableMembercat:MiningMembercat:CustomerMember2022-12-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:CustomerMember2023-03-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:CustomerMember2022-12-310000018230cat:FinanceReceivableMembercat:CustomerMembercat:CaterpillarPowerFinanceMember2023-03-310000018230cat:FinanceReceivableMembercat:CustomerMembercat:CaterpillarPowerFinanceMember2022-12-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:DealerMember2022-12-310000018230srt:LatinAmericaMembercat:FinanceReceivableMembercat:DealerMember2023-03-310000018230us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercat:OtherUSGovernmentAndNonUSGovernmentDebtMember2023-03-310000018230us-gaap:FairValueMeasurementsRecurringMembercat:OtherUSGovernmentAndNonUSGovernmentDebtMember2023-03-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310000018230us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310000018230us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueInputsLevel1Membercat:LargeCapitalizationMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230cat:LargeCapitalizationMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueInputsLevel1Membercat:SmallerCompanyMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230cat:SmallerCompanyMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230cat:REITMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-03-310000018230cat:REITMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-03-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000018230us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercat:OtherUSGovernmentAndNonUSGovernmentDebtMember2022-12-310000018230us-gaap:FairValueMeasurementsRecurringMembercat:OtherUSGovernmentAndNonUSGovernmentDebtMember2022-12-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310000018230us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310000018230us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueInputsLevel1Membercat:LargeCapitalizationMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230cat:LargeCapitalizationMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueInputsLevel1Membercat:SmallerCompanyMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230cat:SmallerCompanyMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230cat:REITMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310000018230cat:REITMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000018230us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Membercat:FinancialProductsMember2023-03-310000018230us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Membercat:FinancialProductsMember2022-12-310000018230us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-03-310000018230us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-03-310000018230us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000018230us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000018230cat:MachineryEnergyTransportationMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-03-310000018230us-gaap:FairValueInputsLevel2Membercat:MachineryEnergyTransportationMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-03-310000018230cat:MachineryEnergyTransportationMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000018230us-gaap:FairValueInputsLevel2Membercat:MachineryEnergyTransportationMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000018230us-gaap:CarryingReportedAmountFairValueDisclosureMembercat:FinancialProductsMember2023-03-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMembercat:FinancialProductsMember2023-03-310000018230us-gaap:CarryingReportedAmountFairValueDisclosureMembercat:FinancialProductsMember2022-12-310000018230us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMembercat:FinancialProductsMember2022-12-310000018230us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2023-03-310000018230us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2022-12-310000018230us-gaap:EmployeeSeveranceMemberus-gaap:OtherOperatingIncomeExpenseMember2023-01-012023-03-310000018230us-gaap:EmployeeSeveranceMemberus-gaap:OtherOperatingIncomeExpenseMember2022-01-012022-03-310000018230cat:LongwallDivestitureMemberus-gaap:OtherOperatingIncomeExpenseMember2023-01-012023-03-310000018230cat:LongwallDivestitureMemberus-gaap:OtherOperatingIncomeExpenseMember2022-01-012022-03-310000018230us-gaap:CostOfSalesMemberus-gaap:OtherRestructuringMember2023-01-012023-03-310000018230us-gaap:CostOfSalesMemberus-gaap:OtherRestructuringMember2022-01-012022-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-768

CATERPILLAR INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | | 37-0602744 |

| (State or other jurisdiction of incorporation) | | (IRS Employer I.D. No.) |

| 5205 N. O'Connor Boulevard, | Suite 100, | Irving, | Texas | 75039 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (972) 891-7700

Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report: N/A

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of each class | Trading Symbol (s) | Name of each exchange on which registered | |

| Common Stock ($1.00 par value) | CAT | New York Stock Exchange | ¹ |

| 5.3% Debentures due September 15, 2035 | CAT35 | New York Stock Exchange | |

¹ In addition to the New York Stock Exchange, Caterpillar common stock is also listed on stock exchanges in France and Switzerland.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

At March 31, 2023, 515,920,061 shares of common stock of the registrant were outstanding.

Table of Contents

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | | |

| | |

| | |

| | |

| | |

| Item 3. | Defaults Upon Senior Securities | * |

| Item 4. | Mine Safety Disclosures | * |

| Item 5. | Other Information | * |

| | |

* Item omitted because no answer is called for or item is not applicable.

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

Caterpillar Inc.

Consolidated Statement of Results of Operations

(Unaudited)

(Dollars in millions except per share data)

| | | | | | | | | | | |

| | Three Months Ended March 31 |

| | 2023 | | 2022 |

| Sales and revenues: | | | |

| Sales of Machinery, Energy & Transportation | $ | 15,099 | | | $ | 12,886 | |

| Revenues of Financial Products | 763 | | | 703 | |

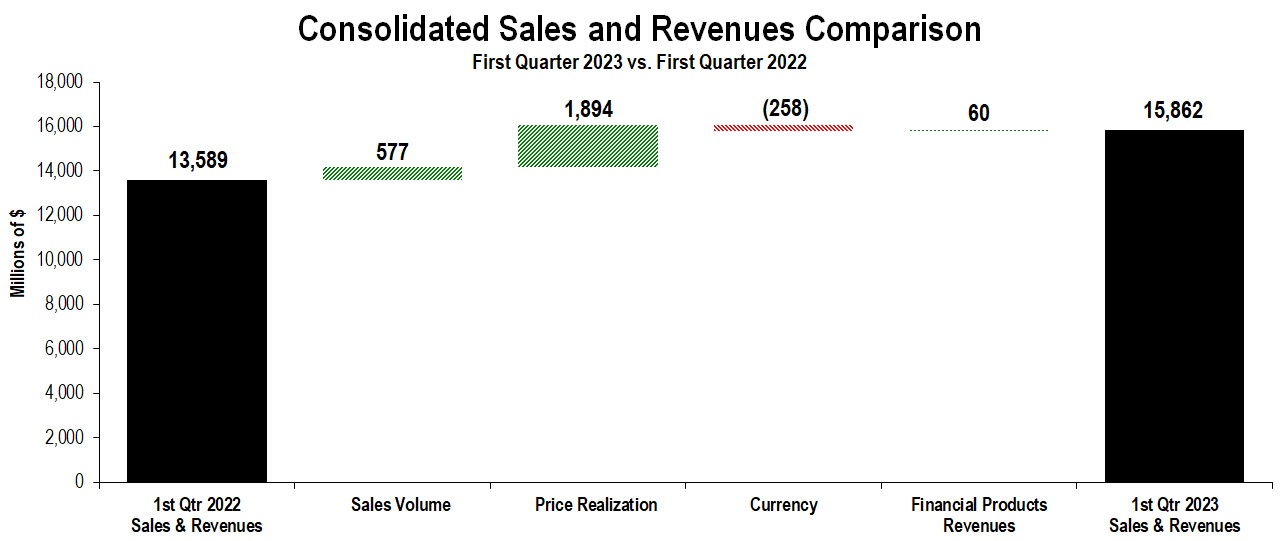

| Total sales and revenues | 15,862 | | | 13,589 | |

| | | |

| Operating costs: | | | |

| Cost of goods sold | 10,103 | | | 9,559 | |

| Selling, general and administrative expenses | 1,463 | | | 1,346 | |

| Research and development expenses | 472 | | | 457 | |

| Interest expense of Financial Products | 217 | | | 106 | |

| Other operating (income) expenses | 876 | | | 266 | |

| Total operating costs | 13,131 | | | 11,734 | |

| | | |

| Operating profit | 2,731 | | | 1,855 | |

| | | |

| Interest expense excluding Financial Products | 129 | | | 109 | |

| Other income (expense) | 32 | | | 253 | |

| | | |

| Consolidated profit before taxes | 2,634 | | | 1,999 | |

| | | |

| Provision (benefit) for income taxes | 708 | | | 469 | |

| Profit of consolidated companies | 1,926 | | | 1,530 | |

| | | |

| Equity in profit (loss) of unconsolidated affiliated companies | 16 | | | 7 | |

| | | |

| Profit of consolidated and affiliated companies | 1,942 | | | 1,537 | |

| | | |

| Less: Profit (loss) attributable to noncontrolling interests | (1) | | | — | |

| | | |

Profit 1 | $ | 1,943 | | | $ | 1,537 | |

| | | |

| Profit per common share | $ | 3.76 | | | $ | 2.88 | |

| | | |

Profit per common share – diluted 2 | $ | 3.74 | | | $ | 2.86 | |

| | | |

| Weighted-average common shares outstanding (millions) | | | |

| – Basic | 516.2 | | | 534.5 | |

– Diluted 2 | 519.4 | | | 538.3 | |

| | | |

1 Profit attributable to common shareholders.

2 Diluted by assumed exercise of stock-based compensation awards using the treasury stock method.

See accompanying notes to Consolidated Financial Statements.

Caterpillar Inc.

Consolidated Statement of Comprehensive Income

(Unaudited)

(Dollars in millions)

| | | | | | | | | | | |

| | Three Months Ended March 31 |

| | 2023 | | 2022 |

| | | |

| Profit of consolidated and affiliated companies | $ | 1,942 | | | $ | 1,537 | |

| Other comprehensive income (loss), net of tax (Note 13): | | | |

| Foreign currency translation: | 607 | | | (115) | |

| Pension and other postretirement benefits: | (2) | | | (1) | |

| Derivative financial instruments: | 84 | | | 23 | |

| Available-for-sale securities: | 22 | | | (64) | |

| | | |

| Total other comprehensive income (loss), net of tax | 711 | | | (157) | |

| Comprehensive income | 2,653 | | | 1,380 | |

| Less: comprehensive income attributable to the noncontrolling interests | (1) | | | — | |

| Comprehensive income attributable to shareholders | $ | 2,654 | | | $ | 1,380 | |

| | | |

See accompanying notes to Consolidated Financial Statements.

Caterpillar Inc.

Consolidated Statement of Financial Position

(Unaudited)

(Dollars in millions)

| | | | | | | | | | | |

| | March 31,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 6,789 | | | $ | 7,004 | |

| Receivables – trade and other | 9,230 | | | 8,856 | |

| Receivables – finance | 9,119 | | | 9,013 | |

| | | |

| Prepaid expenses and other current assets | 2,889 | | | 2,642 | |

| Inventories | 17,633 | | | 16,270 | |

| Total current assets | 45,660 | | | 43,785 | |

| | | |

| Property, plant and equipment – net | 11,973 | | | 12,028 | |

| Long-term receivables – trade and other | 1,209 | | | 1,265 | |

| Long-term receivables – finance | 11,845 | | | 12,013 | |

| | | |

| Noncurrent deferred and refundable income taxes | 2,405 | | | 2,213 | |

| Intangible assets | 694 | | | 758 | |

| Goodwill | 5,309 | | | 5,288 | |

| Other assets | 4,554 | | | 4,593 | |

| Total assets | $ | 83,649 | | | $ | 81,943 | |

| | | |

| Liabilities | | | |

| Current liabilities: | | | |

| Short-term borrowings: | | | |

| Machinery, Energy & Transportation | $ | — | | | $ | 3 | |

| Financial Products | 5,841 | | | 5,954 | |

| Accounts payable | 8,951 | | | 8,689 | |

| Accrued expenses | 4,121 | | | 4,080 | |

| Accrued wages, salaries and employee benefits | 1,368 | | | 2,313 | |

| Customer advances | 2,202 | | | 1,860 | |

| Dividends payable | — | | | 620 | |

| Other current liabilities | 3,035 | | | 2,690 | |

| Long-term debt due within one year: | | | |

| Machinery, Energy & Transportation | 37 | | | 120 | |

| Financial Products | 6,287 | | | 5,202 | |

| Total current liabilities | 31,842 | | | 31,531 | |

| | | |

| Long-term debt due after one year: | | | |

| Machinery, Energy & Transportation | 9,558 | | | 9,498 | |

| Financial Products | 15,315 | | | 16,216 | |

| Liability for postemployment benefits | 4,069 | | | 4,203 | |

| Other liabilities | 4,695 | | | 4,604 | |

| Total liabilities | 65,479 | | | 66,052 | |

| Commitments and contingencies (Notes 11 and 14) | | | |

| | | |

| Shareholders’ equity | | | |

Common stock of $1.00 par value: | | | |

Authorized shares: 2,000,000,000 Issued shares: (3/31/23 and 12/31/22 – 814,894,624) at paid-in amount | 6,546 | | | 6,560 | |

Treasury stock: (3/31/23 – 298,974,563 shares; 12/31/22 – 298,549,134 shares) at cost | (32,108) | | | (31,748) | |

| Profit employed in the business | 45,457 | | | 43,514 | |

| Accumulated other comprehensive income (loss) | (1,746) | | | (2,457) | |

| Noncontrolling interests | 21 | | | 22 | |

| Total shareholders’ equity | 18,170 | | | 15,891 | |

| Total liabilities and shareholders’ equity | $ | 83,649 | | | $ | 81,943 | |

See accompanying notes to Consolidated Financial Statements.

Caterpillar Inc.

Consolidated Statement of Changes in Shareholders’ Equity

(Unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common

stock | | Treasury

stock | | Profit

employed

in the

business | | Accumulated

other

comprehensive

income (loss) | | Noncontrolling

interests | | Total | |

| Three Months Ended March 31, 2022 | | | | | | | | | | | | |

| Balance at December 31, 2021 | $ | 6,398 | | | $ | (27,643) | | | $ | 39,282 | | | $ | (1,553) | | | $ | 32 | | | $ | 16,516 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Profit of consolidated and affiliated companies | — | | | — | | | 1,537 | | | — | | | — | | | 1,537 | | |

| Foreign currency translation, net of tax | — | | | — | | | — | | | (115) | | | — | | | (115) | | |

| Pension and other postretirement benefits, net of tax | — | | | — | | | — | | | (1) | | | — | | | (1) | | |

| Derivative financial instruments, net of tax | — | | | — | | | — | | | 23 | | | — | | | 23 | | |

| Available-for-sale securities, net of tax | — | | | — | | | — | | | (64) | | | — | | | (64) | | |

| | | | | | | | | | | | |

Dividends declared | — | | | — | | | 1 | | | — | | | — | | | 1 | | |

| | | | | | | | | | | | |

Common shares issued from treasury stock for stock-based compensation: 1,037,468 | (65) | | | 37 | | | — | | | — | | | — | | | (28) | | |

| Stock-based compensation expense | 40 | | | — | | | — | | | — | | | — | | | 40 | | |

| | | | | | | | | | | | |

Common shares repurchased: 3,571,684 1 | — | | | (720) | | | — | | | — | | | — | | | (720) | | |

| Other | (92) | | | — | | | — | | | — | | | — | | | (92) | | |

| Balance at March 31, 2022 | $ | 6,281 | | | $ | (28,326) | | | $ | 40,820 | | | $ | (1,710) | | | $ | 32 | | | $ | 17,097 | | |

| | | | | | | | | | | | |

| Three Months Ended March 31, 2023 | | | | | | | | | | | | |

| Balance at December 31, 2022 | $ | 6,560 | | | $ | (31,748) | | | $ | 43,514 | | | $ | (2,457) | | | $ | 22 | | | $ | 15,891 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Profit of consolidated and affiliated companies | — | | | — | | | 1,943 | | | — | | | (1) | | | 1,942 | | |

| Foreign currency translation, net of tax | — | | | — | | | — | | | 607 | | | — | | | 607 | | |

| Pension and other postretirement benefits, net of tax | — | | | — | | | — | | | (2) | | | — | | | (2) | | |

| Derivative financial instruments, net of tax | — | | | — | | | — | | | 84 | | | — | | | 84 | | |

| Available-for-sale securities, net of tax | — | | | — | | | — | | | 22 | | | — | | | 22 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Common shares issued from treasury stock for stock-based compensation: 1,276,331 | (66) | | | 41 | | | — | | | — | | | — | | | (25) | | |

| Stock-based compensation expense | 44 | | | — | | | — | | | — | | | — | | | 44 | | |

| | | | | | | | | | | | |

Common shares repurchased: 1,701,760 1 | — | | | (400) | | | — | | | — | | | — | | | (400) | | |

| Other | 8 | | | (1) | | | — | | | — | | | — | | | 7 | | |

| Balance at March 31, 2023 | $ | 6,546 | | | $ | (32,108) | | | $ | 45,457 | | | $ | (1,746) | | | $ | 21 | | | $ | 18,170 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

1 See Note 12 for additional information.

See accompanying notes to Consolidated Financial Statements.

Caterpillar Inc.

Consolidated Statement of Cash Flow

(Unaudited)

(Millions of dollars)

| | | | | | | | | | | |

| | Three Months Ended March 31 |

| | 2023 | | 2022 |

| Cash flow from operating activities: | | | |

| Profit of consolidated and affiliated companies | $ | 1,942 | | | $ | 1,537 | |

| Adjustments for non-cash items: | | | |

| Depreciation and amortization | 532 | | | 557 | |

| | | |

| Provision (benefit) for deferred income taxes | (191) | | | (99) | |

| Loss on divestiture | 572 | | | — | |

| Other | 117 | | | (52) | |

| Changes in assets and liabilities, net of acquisitions and divestitures: | | | |

| Receivables – trade and other | (329) | | | (372) | |

| Inventories | (1,403) | | | (1,032) | |

| Accounts payable | 477 | | | 452 | |

| Accrued expenses | 38 | | | (74) | |

| Accrued wages, salaries and employee benefits | (950) | | | (965) | |

| Customer advances | 365 | | | 311 | |

| Other assets – net | 107 | | | 99 | |

| Other liabilities – net | 296 | | | (49) | |

| Net cash provided by (used for) operating activities | 1,573 | | | 313 | |

| | | |

| Cash flow from investing activities: | | | |

| Capital expenditures – excluding equipment leased to others | (422) | | | (346) | |

| Expenditures for equipment leased to others | (328) | | | (333) | |

| Proceeds from disposals of leased assets and property, plant and equipment | 184 | | | 269 | |

| Additions to finance receivables | (3,020) | | | (2,988) | |

| Collections of finance receivables | 3,169 | | | 2,966 | |

| Proceeds from sale of finance receivables | 24 | | | 9 | |

| Investments and acquisitions (net of cash acquired) | (5) | | | (8) | |

| Proceeds from sale of businesses and investments (net of cash sold) | (14) | | | — | |

| Proceeds from sale of securities | 239 | | | 571 | |

| Investments in securities | (536) | | | (1,438) | |

| Other – net | 26 | | | (15) | |

| Net cash provided by (used for) investing activities | (683) | | | (1,313) | |

| | | |

| Cash flow from financing activities: | | | |

| Dividends paid | (620) | | | (595) | |

| Common stock issued, including treasury shares reissued | (25) | | | (28) | |

| Common shares repurchased | (400) | | | (820) | |

| | | |

| Proceeds from debt issued (original maturities greater than three months): | | | |

| Machinery, Energy & Transportation | — | | | — | |

| Financial Products | 1,517 | | | 2,131 | |

| Payments on debt (original maturities greater than three months): | | | |

| Machinery, Energy & Transportation | (90) | | | (6) | |

| Financial Products | (1,385) | | | (1,381) | |

| Short-term borrowings – net (original maturities three months or less) | (103) | | | (1,016) | |

| | | |

| Net cash provided by (used for) financing activities | (1,106) | | | (1,715) | |

| Effect of exchange rate changes on cash | (1) | | | (16) | |

| Increase (decrease) in cash, cash equivalents and restricted cash | (217) | | | (2,731) | |

| Cash, cash equivalents and restricted cash at beginning of period | 7,013 | | | 9,263 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 6,796 | | | $ | 6,532 | |

Cash equivalents primarily represent short-term, highly liquid investments with original maturities of generally three months or less.

See accompanying notes to Consolidated Financial Statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. A. Nature of operations

Information in our financial statements and related commentary are presented in the following categories:

Machinery, Energy & Transportation (ME&T) – We define ME&T as Caterpillar Inc. and its subsidiaries, excluding Financial Products. ME&T’s information relates to the design, manufacturing and marketing of our products.

Financial Products – We define Financial Products as our finance and insurance subsidiaries, primarily Caterpillar Financial Services Corporation (Cat Financial) and Caterpillar Insurance Holdings Inc. (Insurance Services). Financial Products’ information relates to the financing to customers and dealers for the purchase and lease of Caterpillar and other equipment.

B. Basis of presentation

In the opinion of management, the accompanying unaudited financial statements include all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of (a) the consolidated results of operations for the three months ended March 31, 2023 and 2022, (b) the consolidated comprehensive income for the three months ended March 31, 2023 and 2022, (c) the consolidated financial position at March 31, 2023 and December 31, 2022, (d) the consolidated changes in shareholders’ equity for the three months ended March 31, 2023 and 2022 and (e) the consolidated cash flow for the three months ended March 31, 2023 and 2022. The financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America (U.S. GAAP) and pursuant to the rules and regulations of the Securities and Exchange Commission (SEC).

Interim results are not necessarily indicative of results for a full year. The information included in this Form 10-Q should be read in conjunction with the audited financial statements and notes thereto included in our company’s annual report on Form 10-K for the year ended December 31, 2022 (2022 Form 10-K).

The December 31, 2022 financial position data included herein is derived from the audited consolidated financial statements included in the 2022 Form 10-K but does not include all disclosures required by U.S. GAAP. Certain amounts for prior periods have been reclassified to conform to the current period financial statement presentation.

Cat Financial has end-user customers and dealers that are variable interest entities (VIEs) of which we are not the primary beneficiary. Our maximum exposure to loss from our involvement with these VIEs is limited to the credit risk inherently present in the financial support that we have provided. Credit risk was evaluated and reflected in our financial statements as part of our overall portfolio of finance receivables and related allowance for credit losses. See Note 11 for further discussions on a consolidated VIE.

2. New accounting guidance

A. Adoption of new accounting standards

Supplier finance programs (ASU 2022-04) - In September 2022, the Financial Accounting Standards Board (FASB) issued guidance to enhance the transparency of supplier finance programs. The new standard requires annual disclosure of the key terms of the program, a description of where in the financial statements amounts outstanding under the program are presented, a rollforward of such amounts, and interim disclosure of amounts outstanding as of the end of each period. The guidance does not affect recognition, measurement, or financial statement presentation of supplier finance programs. The ASU was effective on January 1, 2023, except for the rollforward, which is effective on January 1, 2024. Our adoption of this guidance results in the following disclosures relating to our supplier finance programs and related obligations.

We facilitate voluntary supplier finance programs (the “Programs”) through participating financial institutions. The Programs are available to a wide range of suppliers and allow them the option to manage their cash flow. We are not a party to the agreements between the participating financial institutions and the suppliers in connection with the Programs. The range of payment terms, typically 60-90 days, we negotiate with our suppliers is consistent, irrespective of whether a supplier participates in the Programs. The amount of obligations outstanding that are confirmed as valid to the participating financial institutions for suppliers who voluntarily participate in the Programs, included in Accounts payable in the Consolidated Statement of Financial Position, were $970 million and $862 million at March 31, 2023 and December 31, 2022, respectively.

We consider the applicability and impact of all ASUs. We adopted the following ASUs effective January 1, 2023, none of which had a material impact on our financial statements:

| | | | | |

| ASU | Description |

| 2021-08 | Business combinations |

| 2022-02 | Financial instruments - Credit losses |

| 2022-06 | Reference rate reform |

B. Accounting standards issued but not yet adopted

We consider the applicability and impact of all ASUs. We assessed the ASUs and determined that they either were not applicable or were not expected to have a material impact on our financial statements.

3. Sales and revenue contract information

Trade receivables represent amounts due from dealers and end users for the sale of our products, and include amounts due from wholesale inventory financing provided by Cat Financial for a dealer’s purchase of inventory. We recognize trade receivables from dealers and end users in Receivables – trade and other and Long-term receivables – trade and other in the Consolidated Statement of Financial Position. Trade receivables from dealers and end users were $7,854 million, $7,551 million and $7,267 million as of March 31, 2023, December 31, 2022 and December 31, 2021, respectively. Long-term trade receivables from dealers and end users were $472 million, $506 million and $624 million as of March 31, 2023, December 31, 2022 and December 31, 2021, respectively.

For certain contracts, we invoice for payment when contractual milestones are achieved. We recognize a contract asset when a sale is recognized prior to invoicing. We reduce the contract asset when we invoice for payment and recognize a corresponding trade receivable. Contract assets are included in Prepaid expenses and other current assets in the Consolidated Statement of Financial Position. Contract assets were $195 million, $247 million and $187 million as of March 31, 2023, December 31, 2022 and December 31, 2021, respectively.

We invoice in advance of recognizing the sale of certain products. We recognize advanced customer payments as a contract liability in Customer advances and Other liabilities in the Consolidated Statement of Financial Position. Contract liabilities were $2,664 million, $2,314 million and $1,557 million as of March 31, 2023, December 31, 2022 and December 31, 2021, respectively. We reduce the contract liability when revenue is recognized. During the three months ended March 31, 2023 and 2022, we recognized $737 million and $437 million, respectively, of revenue that was recorded as a contract liability at the beginning of 2023 and 2022.

As of March 31, 2023, we have entered into contracts with dealers and end users for which sales have not been recognized as we have not satisfied our performance obligations and transferred control of the products. The dollar amount of unsatisfied performance obligations for contracts with an original duration greater than one year is $12.6 billion, with about one-half of the amount expected to be completed and revenue recognized in the twelve months following March 31, 2023. We have elected the practical expedient not to disclose unsatisfied performance obligations with an original contract duration of one year or less. Contracts with an original duration of one year or less are primarily sales to dealers for machinery, engines and replacement parts.

See Note 16 for further disaggregated sales and revenues information.

4. Stock-based compensation

Accounting for stock-based compensation requires that the cost resulting from all stock-based payments be recognized in the financial statements based on the grant date fair value of the award. Our stock-based compensation consists of stock options, restricted stock units (RSUs) and performance-based restricted stock units (PRSUs).

We recognized pretax stock-based compensation expense of $44 million and $40 million for the three months ended March 31, 2023 and 2022, respectively.

The following table illustrates the type and fair value of the stock-based compensation awards granted during the three months ended March 31, 2023 and 2022, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | Three Months Ended March 31, 2023 | | Three Months Ended March 31, 2022 |

| | Shares Granted | | Weighted-Average Fair Value Per Share | | Weighted-Average Grant Date Stock Price | | Shares Granted | | Weighted-Average Fair Value Per Share | | Weighted-Average Grant Date Stock Price |

| Stock options | 777,275 | | | $ | 75.79 | | | $ | 253.98 | | | 1,029,202 | | | $ | 51.69 | | | $ | 196.70 | |

| RSUs | 379,426 | | | $ | 253.98 | | | $ | 253.98 | | | 484,025 | | | $ | 196.70 | | | $ | 196.70 | |

| PRSUs | 221,869 | | | $ | 253.98 | | | $ | 253.98 | | | 258,900 | | | $ | 196.70 | | | $ | 196.70 | |

| | | | | | | | | | | |

The following table provides the assumptions used in determining the fair value of the stock-based awards for the three months ended March 31, 2023 and 2022, respectively:

| | | | | | | | | | | |

| | | |

| | Grant Year |

| | 2023 | | 2022 |

| Weighted-average dividend yield | 2.60% | | 2.60% |

| Weighted-average volatility | 31.0% | | 31.7% |

| Range of volatilities | 28.5% - 35.5% | | 25.3% - 36.8% |

| Range of risk-free interest rates | 3.92% - 5.03% | | 1.03% - 2.00% |

| Weighted-average expected lives | 7 years | | 8 years |

| | | |

As of March 31, 2023, the total remaining unrecognized compensation expense related to nonvested stock-based compensation awards was $305 million, which will be amortized over the weighted-average remaining requisite service periods of approximately 1.8 years.

5. Derivative financial instruments and risk management

Our earnings and cash flow are subject to fluctuations due to changes in foreign currency exchange rates, interest rates and commodity prices. Our Risk Management Policy (policy) allows for the use of derivative financial instruments to prudently manage foreign currency exchange rate, interest rate and commodity price exposures. Our policy specifies that derivatives are not to be used for speculative purposes. Derivatives that we use are primarily foreign currency forward, option and cross currency contracts, interest rate contracts and commodity forward and option contracts. Our derivative activities are subject to the management, direction and control of our senior financial officers. We present at least annually to the Audit Committee of the Board of Directors on our risk management practices, including our use of financial derivative instruments.

We recognize all derivatives at their fair value on the Consolidated Statement of Financial Position. On the date the derivative contract is entered into, we designate the derivative as (1) a hedge of the fair value of a recognized asset or liability (fair value hedge), (2) a hedge of a forecasted transaction or the variability of cash flow (cash flow hedge) or (3) an undesignated instrument. We record in current earnings changes in the fair value of a derivative that is qualified, designated and highly effective as a fair value hedge, along with the gain or loss on the hedged recognized asset or liability that is attributable to the hedged risk. We record in AOCI changes in the fair value of a derivative that is qualified, designated and highly effective as a cash flow hedge, to the extent effective, on the Consolidated Statement of Financial Position until we reclassify them to earnings in the same period or periods during which the hedged transaction affects earnings. We report changes in the fair value of undesignated derivative instruments in current earnings. We classify cash flows from designated derivative financial instruments within the same category as the item being hedged on the Consolidated Statement of Cash Flow. We include cash flows from undesignated derivative financial instruments in the investing category on the Consolidated Statement of Cash Flow.

We formally document all relationships between hedging instruments and hedged items, as well as the risk-management objective and strategy for undertaking various hedge transactions. This process includes linking all derivatives that are designated as fair value hedges to specific assets and liabilities on the Consolidated Statement of Financial Position and linking cash flow hedges to specific forecasted transactions or variability of cash flow.

We also formally assess, both at the hedge’s inception and on an ongoing basis, whether the designated derivatives that are used in hedging transactions are highly effective in offsetting changes in fair values or cash flow of hedged items. When a derivative is determined not to be highly effective as a hedge or the underlying hedged transaction is no longer probable, we discontinue hedge accounting prospectively, in accordance with the derecognition criteria for hedge accounting.

Foreign Currency Exchange Rate Risk