UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended | |||||

| OR | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from _______ to _______ | ||||||||

Commission File Number: | ||||||||

| (Exact name of registrant as specified in its charter) | ||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address, including zip code, of principal executive offices) | ||||||||

( | ||||||||

(Registrant's telephone number, including area code) | ||||||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ||||||||||||||

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | ||||||||||||||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act. | ||||||||||||||

| ☒ | Accelerated filer | ☐ | ||||||||||||

Non‑accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | |||||||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes | ||||||||||||||

As of April 28, 2023, there were 378,657,537 shares of the registrant’s common stock outstanding.

UNITY SOFTWARE INC.

FORM 10‑Q

For the Quarter Ended March 31, 2023

TABLE OF CONTENTS

| Page | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 6. | ||||||||

NOTE REGARDING FORWARD-LOOKING STATEMENTS AND RISK FACTOR SUMMARY

This Quarterly Report on Form 10‑Q contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical fact, including statements regarding our future results of operations or financial condition, business strategy and plans, and objectives of management for future operations are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as "aim," "anticipate," "believe," "contemplate," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "toward," "will," "would," or the negative of these words or other similar terms or expressions.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10‑Q primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating results. Readers are cautioned that these forward‑looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified and discussed in greater detail below, under "Part II, Item 1A. Risk Factors" and summarized below.

•We have a history of losses and may not achieve or sustain profitability on a GAAP basis in the future.

•The impact of macroeconomic conditions, such as inflation and actions taken by central banks to counter inflation, liquidity concerns at, and failures of, banks and other financial institutions, and potential economic recession, on our business, as well as our customers, prospects, partners, and service providers.

•We have a limited history operating our business at its current scale, including with ironSource, and as a result, our past results may not be indicative of future operating performance.

•If we are unable to retain our existing customers–including ironSource customers–and expand their use of our platform, or attract new customers, our growth and operating results could be adversely affected, and we may be required to reconsider our growth strategy.

•The markets in which we participate are competitive, and if we do not compete effectively, our business, financial condition, and results of operations could be harmed.

•Operating system platform providers or application stores may change terms of service, policies or technical requirements applicable to us or our customers, which could adversely impact our business.

•If we are unable to further expand into new industries, or if our solutions for any new industry fail to achieve market acceptance, our growth and operating results could be adversely affected, and we may be required to reconsider our growth strategy.

•Our business relies in part on strategic relationships. If we are unable to maintain favorable terms and conditions and business relations with respect to our strategic relationships, our business could be harmed.

•Our core value of putting our users first may cause us to forgo short-term gains and may not lead to the long-term benefits we expect.

•If we do not make our platform, including new versions or technology advancements, easier to use or properly train customers on how to use our platform, our ability to broaden the appeal of our platform and solutions and to increase our revenue could suffer.

•Interruptions, performance problems, or defects associated with our platform may adversely affect our business, financial condition, and results of operations.

The results, events, and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that "we believe" and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Quarterly Report on Form 10‑Q. While we believe such information provides a reasonable basis for these statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Quarterly Report on Form 10‑Q relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of this Quarterly Report on Form 10‑Q or to reflect new information, actual results, revised expectations, or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments.

Additional Information

Unless the context otherwise requires, all references in this Quarterly Report on Form 10-Q to "we," "us," "our," "our company," "Unity," and "Unity Technologies" refer to Unity Software Inc. and its consolidated subsidiaries. The Unity design logos, "Unity" and our other registered or common law trademarks, service marks, or trade names appearing in this Quarterly Report on Form 10-Q are the property of Unity Software Inc. or its affiliates.

Investors and others should note that we may announce material business and financial information using our investor relations website (www.investors.unity.com), our filings with the Securities and Exchange Commission, press releases, public conference calls, and public webcasts as means of complying with our disclosure obligations under Regulation FD. We encourage investors and others interested in our company to review the information that we make available.

| Unity Software Inc. | ||||||||

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

| UNITY SOFTWARE INC. | |||||||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||||||||||

| (In thousands, except par value) | |||||||||||

| (Unaudited) | |||||||||||

| As of | |||||||||||

| March 31, 2023 | December 31, 2022 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Short-term investments | |||||||||||

| Accounts receivable, net | |||||||||||

| Prepaid expenses and other | |||||||||||

| Total current assets | |||||||||||

| Property and equipment, net | |||||||||||

| Goodwill | |||||||||||

| Intangible assets, net | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and stockholders’ equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued expenses and other | |||||||||||

| Publisher payables | |||||||||||

| Deferred revenue | |||||||||||

| Total current liabilities | |||||||||||

| Convertible notes | |||||||||||

| Long-term deferred revenue | |||||||||||

| Other long-term liabilities | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies (Note 7) | |||||||||||

| Redeemable noncontrolling interests | |||||||||||

| Unity Software Inc. Stockholders’ equity: | |||||||||||

Common stock, $ | |||||||||||

Authorized shares - | |||||||||||

Issued and outstanding shares - | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated other comprehensive income (loss) | ( | ||||||||||

| Accumulated deficit | ( | ( | |||||||||

| Total Unity Software Inc. stockholders’ equity | |||||||||||

| Noncontrolling interest | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

| Unity Software Inc. | ||||||||

| UNITY SOFTWARE INC. | |||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||

| (In thousands, except per share data) | |||||||||||

| (Unaudited) | |||||||||||

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Revenue | $ | $ | |||||||||

| Cost of revenue | |||||||||||

| Gross profit | |||||||||||

| Operating expenses | |||||||||||

| Research and development | |||||||||||

| Sales and marketing | |||||||||||

| General and administrative | |||||||||||

| Total operating expenses | |||||||||||

| Loss from operations | ( | ( | |||||||||

| Interest expense | ( | ( | |||||||||

| Interest income and other expense, net | |||||||||||

| Loss before income taxes | ( | ( | |||||||||

| Provision for Income taxes | |||||||||||

| Net loss | ( | ( | |||||||||

| Net loss attributable to noncontrolling interest and redeemable noncontrolling interests | ( | ||||||||||

| Net loss attributable to Unity Software Inc. | $ | ( | $ | ( | |||||||

| Basic and diluted net loss per share attributable to Unity Software Inc. | $ | ( | $ | ( | |||||||

| Weighted-average shares used in computation of basic and diluted net loss per share | |||||||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

2

| Unity Software Inc. | ||||||||

| UNITY SOFTWARE INC. | |||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS | |||||||||||

| (In thousands) | |||||||||||

| (Unaudited) | |||||||||||

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Other comprehensive income (loss), net of taxes: | |||||||||||

| Change in foreign currency translation adjustment | |||||||||||

| Change in unrealized losses on short-term investments | ( | ||||||||||

| Change in unrealized losses on derivative instruments | ( | ||||||||||

| Other comprehensive income (loss) | ( | ||||||||||

| Comprehensive loss | ( | ( | |||||||||

| Net loss attributable to noncontrolling interest and redeemable noncontrolling interests | ( | ||||||||||

| Foreign currency translation attributable to noncontrolling interest and redeemable noncontrolling interests | |||||||||||

| Comprehensive loss attributable to noncontrolling interest and redeemable noncontrolling interests | ( | ||||||||||

| Comprehensive loss attributable to Unity Software Inc. | $ | ( | $ | ( | |||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

3

| Unity Software Inc. | ||||||||

| UNITY SOFTWARE INC. | |||||||||||||||||||||||||||||||||||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY | |||||||||||||||||||||||||||||||||||||||||||||||

| (In thousands, except share data) | |||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | |||||||||||||||||||||||||||||||||||||||||||||||

| Additional | Other | Unity Software Inc. | |||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Paid-In | Comprehensive | Accumulated | Stockholders' | Noncontrolling | Total | |||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Capital | Income (Loss) | Deficit | Equity | Interest (1) | Equity | ||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||

| Issuance of common stock from employee equity plans | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for settlement of RSUs | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Stock‑based compensation expense | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Adjustments to redeemable noncontrolling interest | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2023 | $ | $ | $ | $ | ( | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | |||||||||||||||||||||||||||||||||||||||||||||||

| Additional | Other | Unity Software Inc. | |||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Paid-In | Comprehensive | Accumulated | Stockholders' | Noncontrolling | Total | |||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Capital | Loss | Deficit | Equity | Interest (1) | Equity | ||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||

| Issuance of common stock from employee equity plans | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for settlement of RSUs | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Common stock issued in connection with acquisitions | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Stock‑based compensation expense | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2022 | $ | $ | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

4

| Unity Software Inc. | ||||||||

| UNITY SOFTWARE INC. | |||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||

| (In thousands) | |||||||||||

| (Unaudited) | |||||||||||

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Operating activities | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Stock-based compensation expense | |||||||||||

| Other | |||||||||||

| Changes in assets and liabilities, net of effects of acquisitions: | |||||||||||

| Accounts receivable, net | |||||||||||

| Prepaid expenses and other | ( | ||||||||||

| Other assets | |||||||||||

| Accounts payable | |||||||||||

| Accrued expenses and other | ( | ( | |||||||||

| Publisher payables | ( | ( | |||||||||

| Other long-term liabilities | ( | ( | |||||||||

| Deferred revenue | ( | ||||||||||

| Net cash provided by (used in) operating activities | ( | ||||||||||

| Investing activities | |||||||||||

| Purchases of short-term investments | ( | ( | |||||||||

| Proceeds from principal repayments and maturities of short-term investments | |||||||||||

| Purchases of non-marketable investments | ( | ||||||||||

| Purchases of property and equipment | ( | ( | |||||||||

| Business acquisitions, net of cash acquired | ( | ||||||||||

| Net cash provided by (used in) investing activities | ( | ||||||||||

| Financing activities | |||||||||||

| Proceeds from issuance of common stock from employee equity plans | |||||||||||

| Net cash provided by financing activities | |||||||||||

| Effect of foreign exchange rate changes on cash, cash equivalents, and restricted cash | |||||||||||

| Increase in cash, cash equivalents, and restricted cash | |||||||||||

| Cash and restricted cash, beginning of period | |||||||||||

| Cash, cash equivalents, and restricted cash, end of period | $ | $ | |||||||||

| Supplemental disclosure of cash flow information: | |||||||||||

| Cash paid for income taxes, net of refunds | $ | $ | |||||||||

| Cash paid for operating leases | $ | $ | |||||||||

| Supplemental disclosures of non‑cash investing and financing activities: | |||||||||||

| Fair value of common stock issued as consideration for business and asset acquisitions | $ | $ | |||||||||

| Assets acquired under operating lease | $ | $ | |||||||||

5

| Unity Software Inc. | ||||||||

The below table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the condensed consolidated balance sheets to the total of the same amounts shown on the condensed consolidated statements of cash flows (in thousands):

| As of March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash, included in prepaid and other and other assets | |||||||||||

| Total cash, cash equivalents, and restricted cash | $ | $ | |||||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

6

| Unity Software Inc. | ||||||||

UNITY SOFTWARE INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Accounting Policies

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make certain estimates, judgments, and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates, and such differences could be material to our financial position and results of operations.

2. Revenue

The following table presents our revenue disaggregated by source, which also have similar economic characteristics (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Create Solutions | $ | $ | |||||||||

| Grow Solutions | |||||||||||

| Total revenue | $ | $ | |||||||||

7

| Unity Software Inc. | ||||||||

The following table presents our revenue disaggregated by geography, based on the invoice address of our customers (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| United States | $ | $ | |||||||||

Greater China (1) | |||||||||||

EMEA (2) | |||||||||||

APAC (3) | |||||||||||

Other Americas (4) | |||||||||||

| Total revenue | $ | $ | |||||||||

(1) Greater China includes China, Hong Kong, and Taiwan.

(2) Europe, the Middle East, and Africa ("EMEA")

(3) Asia-Pacific, excluding Greater China ("APAC")

(4) Canada and Latin America ("Other Americas")

Contract Balances and Remaining Performance Obligations

Contract assets (unbilled receivables) included in accounts receivable, net, are recorded when revenue is earned in advance of customer billing schedules. Unbilled receivables totaled $35.6 million and $37.5 million as of March 31, 2023 and December 31, 2022, respectively.

Contract liabilities (deferred revenue) relate to payments received in advance of performance under the contract. Revenue recognized during the three months ended March 31, 2023 that was included in the deferred revenue balances at January 1, 2023 was $85.0 million.

Additionally, we have performance obligations associated with commitments in customer contracts to perform in the future that had not yet been recognized in our consolidated financial statements. For contracts with original terms that exceed one year, those commitments not yet recognized as of March 31, 2023, were $559.3 million and relate primarily to Create Solutions subscriptions, enterprise support, and strategic partnerships. These commitments generally extend over the next to five years and we expect to recognize approximately $249.0 million or 45 % of this revenue during the next 12 months.

8

| Unity Software Inc. | ||||||||

3. Financial Instruments

Restricted cash, cash equivalents, and short-term investments are recorded at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. To increase the comparability of fair value measures, the following hierarchy prioritizes the inputs to valuation methodologies used to measure fair value.

•Level 1—Valuations based on quoted prices in active markets for identical assets or liabilities.

•Level 2—Valuations based on quoted prices for similar assets and liabilities in active markets or inputs that are observable for the assets or liabilities, either directly or indirectly through market corroboration.

•Level 3—Valuations based on unobservable inputs reflecting our own assumptions used to measure assets and liabilities at fair value. These valuations require significant judgment.

The following table summarizes, by major security type, our restricted cash, cash equivalents, and short-term investments that are measured at fair value on a recurring basis and are categorized using the fair value hierarchy (in thousands):

| March 31, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||

| Amortized Cost | Unrealized Gains | Unrealized Losses | Fair Value | Fair Value | |||||||||||||||||||||||||

| Level 1: | |||||||||||||||||||||||||||||

| Restricted cash and cash equivalents: | |||||||||||||||||||||||||||||

| Restricted cash | $ | $ | — | $ | — | $ | $ | ||||||||||||||||||||||

| Money market funds | — | — | |||||||||||||||||||||||||||

| Time deposits | — | — | |||||||||||||||||||||||||||

| Total restricted cash and cash equivalents | $ | $ | — | $ | — | $ | $ | ||||||||||||||||||||||

| Short-term investments | |||||||||||||||||||||||||||||

| Short-term deposits | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Total short-term investments | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Nonrecurring Fair Value Measurements

We hold equity investments in certain unconsolidated entities without a readily determinable fair value. These strategic investments represent less than a 20 % ownership interest in each of the entities, and we do not have significant influence over or control of the entities. We use the measurement alternative to account for adjustments to these investments for observable transactions for the same or similar investments of the same issuer in any given quarter. If we determine an impairment has occurred, the investment is written down to fair value. As of March 31, 2023 and December 31, 2022, such equity investments totaled $31.1

4. Investment in Unity China

9

| Unity Software Inc. | ||||||||

The following table presents the changes in redeemable noncontrolling interests (in thousands):

| March 31, 2023 | |||||

| Balance at beginning of period | $ | ||||

| Net loss attributable to redeemable noncontrolling interests | ( | ||||

| Accretion for redeemable noncontrolling interests | |||||

| Foreign currency translation and foreign exchange adjustments for redeemable noncontrolling interests | |||||

| Balance at end of period | $ | ||||

5. Leases

We have operating leases for offices, which have remaining lease terms of up to ten years .

Components of lease expense were as follows (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Operating lease expense | $ | $ | |||||||||

| Short-term lease expense | |||||||||||

| Variable lease expense | |||||||||||

| Sublease income | ( | ||||||||||

| Total lease expense | $ | $ | |||||||||

Supplemental balance sheet information related to leases was as follows (in thousands, except weighted-average figures):

| As of | |||||||||||||||||

| Classification | March 31, 2023 | December 31, 2022 | |||||||||||||||

| Operating lease assets | Other assets | $ | $ | ||||||||||||||

| Current operating lease liabilities | $ | $ | |||||||||||||||

| Long-term operating lease liabilities | |||||||||||||||||

| Total operating lease liabilities | $ | $ | |||||||||||||||

As of March 31, 2023, our operating leases had a weighted-average remaining lease term of 5.5 years and a weighted-average discount rate of 4.8 %. As of December 31, 2022, our operating leases had a weighted-average remaining lease term of five years and a weighted-average discount rate of 4.0 %.

As of March 31, 2023, our lease liabilities were as follows (in thousands):

Operating Leases (1) | |||||

| Gross lease liabilities | $ | ||||

| Less: imputed interest | ( | ||||

| Present value of lease liabilities | $ | ||||

(1) Excludes future minimum payments for leases which have not yet commenced as of March 31, 2023.

As of March 31, 2023, we had entered into leases that have not yet commenced with future minimum lease payments of $14.0 million that are not yet reflected on our condensed consolidated balance sheet. These operating leases will commence in 2023 with lease terms of approximately to five years .

10

| Unity Software Inc. | ||||||||

6. Borrowings

Convertible Notes

2027 Notes

In November 2022, we issued $1.0 billion in aggregate amount of 2.0 % convertible notes due 2027 (the "2027 Notes"). The closing of the issuance and sale of the 2027 Notes (the "PIPE") occurred promptly following the closing of the transactions contemplated by the Agreement and Plan of Merger (the "Merger Agreement"), dated July 13, 2022, by and among Unity Software Inc., Ursa Aroma Merger Subsidiary Ltd., a company organized under the laws of the State of Israel and a direct wholly owned subsidiary of Unity, and ironSource Ltd., a company organized under the laws of the State of Israel ("ironSource", and such transactions, the "ironSource Merger"). The 2027 Notes were issued to certain affiliates of Silver Lake and Sequoia Capital (the “Purchasers”), pursuant to an indenture dated November 8, 2022 (the “Indenture”), in accordance with the Investment Agreement entered among the Company and certain affiliates of the Purchasers dated July 13, 2022 (the “Investment Agreement”). Proceeds from the issuance of the 2027 Notes were approximately $1.0 billion, net of debt issuance costs. The debt issuance costs are amortized to interest expense using the straight-line method, which approximates the effective interest method.

The 2027 Notes are general unsecured obligations which bear regular interest of 2.0 %. We may elect for additional interest to accrue on the 2027 Notes as the sole remedy for any failure by us to comply with certain reporting requirements under the Indenture. Holders of the 2027 Notes may receive additional interest under specified circumstances as outlined in the Indenture. Additional interest, if any, will be payable in the same manner as the regular interest, which is semiannually in arrears on May 15 and November 15 of each year, beginning on May 15, 2023. The 2027 Notes will mature on November 15, 2027 unless earlier converted, redeemed, or repurchased.

The 2027 Notes are convertible into cash, shares of our common stock, or a combination of cash and shares of our common stock, at our election, at an initial conversion rate of 20.4526 shares of common stock per $1,000 principal amount of 2027 Notes, which is equivalent to an initial conversion price of approximately $48.89 per share of our common stock. The conversion rate is subject to customary adjustments for certain events as described in the Indenture governing the 2027 Notes. Pursuant to the Investment Agreement, the Purchasers are restricted from converting the 2027 Notes prior to the earlier of (i) twelve months after the date of issuance and (ii) the consummation of a change of control of our company or entry into a definitive agreement for a transaction that, if consummated, would result in a change of control, subject to certain exceptions.

In connection with a make-whole fundamental change, as defined in the Indenture, or in connection with certain corporate events that occur prior to the maturity date or a notice of redemption, in each case as described in the Indentures, we will increase the conversion rate for a holder of the 2027 Notes who elects to convert its 2027 Notes in connection with such a corporate event or during the related redemption period in certain circumstances. Additionally, in the event of a fundamental change, subject to certain limitations described in the Indenture, holders of the 2027 Notes may require us to repurchase all or a portion of the 2027 Notes at a price equal to 100 % of the principal amount of 2027 Notes to be repurchased, plus any accrued and unpaid additional interest, if any, to, but excluding, the fundamental change repurchase date.

We accounted for the issuance of the 2027 Notes as a single liability measured at its amortized cost, as no other embedded features require bifurcation and recognition as derivatives.

Interest expense on the 2027 Notes related to regular interest and the amortization of debt issuance costs was $5.0 million for the three months ended March 31, 2023.

11

| Unity Software Inc. | ||||||||

2026 Notes

In November 2021, we issued an aggregate of $1.7 billion principal amount of 0 % Convertible Senior Notes due 2026 (the "2026 Notes"). Proceeds from the issuance of the 2026 Notes were $1.7 billion, net of debt issuance costs and cash used to purchase the capped call transactions ("Capped Call Transactions") discussed below. The debt issuance costs are amortized to interest expense using the straight-line method, which approximates the effective interest method.

The 2026 Notes are general unsecured obligations which do not bear regular interest and for which the principal balance will not accrete. The 2026 Notes will mature on November 15, 2026 unless earlier converted, redeemed, or repurchased.

The 2026 Notes are convertible into cash, shares of our common stock, or a combination of cash and shares of our common stock, at our election, at an initial conversion rate of 3.2392 shares of common stock per $1,000 principal amount of 2026 Notes, which is equivalent to an initial conversion price of approximately $308.72 per share of our common stock. The conversion rate is subject to customary adjustments for certain events as described in the indenture governing the 2026 Notes.

Interest expense on the 2026 Notes related to the amortization of debt issuance costs was $1.1 million for the three months ended March 31, 2023.

The table below summarizes the principal and unamortized debt issuance costs for the 2026 and 2027 Notes (in thousands):

| As of | |||||

| March 31, 2023 | |||||

| Convertible notes: | |||||

| Principal - 2026 Notes | $ | ||||

| Principal - 2027 Notes | |||||

| Unamortized debt issuance cost - 2026 and 2027 Notes | ( | ||||

| Net carrying amount | $ | ||||

As of March 31, 2023, no holders of the 2027 and 2026 Notes have exercised the conversion rights, and the if-converted value of the 2027 and 2026 Notes did not exceed the principal amount.

Capped Call Transactions

In connection with the pricing of the 2026 Notes, we entered into the Capped Call Transactions with certain counterparties at a net cost of $48.1 million with call options totaling approximately 5.6 million of our common shares, and expiration dates beginning on September 18, 2026 and ending on November 12, 2026. The strike price of the Capped Call Transactions is $308.72 , and the cap price is initially $343.02 per share of our common stock and is subject to certain adjustments under the terms of the Capped Call Transactions. The Capped Call Transactions are freestanding and are considered separately exercisable from the 2026 Notes.

The Capped Call Transactions are intended to reduce potential dilution to our common stock upon any conversion of the 2026 Notes and/or offset any cash payments we are required to make in excess of the principal amount of converted 2026 Notes, as the case may be, with such reduction and/or offset subject to a cap based on the cap price described above. The cost of the Capped Call Transactions was recorded as a reduction of our additional paid-in capital on our consolidated balance sheets. The Capped Call Transactions will not be remeasured as long as they continue to meet the conditions for equity classification. As of March 31, 2023, the Capped Call Transactions were not in the money and met the conditions for equity classification.

12

Table of Contents | Unity Software Inc. | |||||||

7. Commitments and Contingencies

The following table summarizes our non-cancelable contractual commitments as of March 31, 2023 (in thousands):

| Total | Remainder of 2023 | 2024‑2025 | 2026‑2027 | Thereafter | |||||||||||||||||||||||||

Operating leases (1) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Purchase commitments (2) | |||||||||||||||||||||||||||||

Convertible notes (3) | |||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

(1) Operating leases consist of obligations for real estate that are active and those that have not yet commenced.

)2) The substantial majority of our purchase commitments are related to agreements with our data center hosting providers.

(3) Convertible notes due 2026 and 2027. See Note 6, "Borrowings," of the Notes to Condensed Consolidated Financial Statements in Part I, Item 1 of this Quarterly Report on Form 10-Q for further discussion.

We expect to meet our remaining commitment.

Legal Matters

In the normal course of business, we are subject to various legal matters. We accrue a liability when management believes both that it is probable that a liability has been incurred and that the amount of loss can be reasonably estimated. We also disclose material contingencies when we believe a loss is not probable but reasonably possible. Legal costs related to such potential losses are expensed as incurred. In addition, recoveries are shown as a reduction in legal costs in the period in which they are realized. With respect to our outstanding matters, based on our current knowledge, we believe that the resolution of such matters will not, either individually or in aggregate, have a material adverse effect on our business or our condensed consolidated financial statements. However, litigation is inherently uncertain, and the outcome of these matters cannot be predicted with certainty. Accordingly, cash flows or results of operations could be materially affected in any particular period by the resolution of one or more of these matters.

Indemnifications

In the ordinary course of business, we may provide indemnifications of varying scope and terms to customers, vendors, lessors, investors, directors, officers, employees and other parties with respect to certain matters. Indemnification may include losses from our breach of such agreements, services we provide, or third-party intellectual property infringement claims. These indemnifications may survive termination of the underlying agreement and the maximum potential amount of future indemnification payments may not be subject to a cap. As of March 31, 2023, there were no known events or circumstances that have resulted in a material indemnification liability to us and we did not incur material costs to defend lawsuits or settle claims related to these indemnifications.

Letters of Credit

We had $19.9

13

| Unity Software Inc. | ||||||||

8. Stock‑Based Compensation

We recorded stock-based compensation expense related to grants to employees on our condensed consolidated statements of operations as follows (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cost of revenue | $ | $ | |||||||||

| Research and development | |||||||||||

| Sales and marketing | |||||||||||

| General and administrative | |||||||||||

| Total stock-based compensation expense | $ | $ | |||||||||

Stock Options

A summary of our stock option activity is as follows:

| Options Outstanding | |||||||||||||||||

| Stock Options Outstanding | Weighted-Average Exercise Price | Weighted-Average Remaining Contractual Term (In Years) | |||||||||||||||

| Balance as of December 31, 2022 | $ | ||||||||||||||||

| Granted | $ | ||||||||||||||||

| Exercised | ( | $ | |||||||||||||||

| Forfeited, cancelled, or expired | ( | $ | |||||||||||||||

| Balance as of March 31, 2023 | $ | ||||||||||||||||

The calculated grant-date fair value of stock options granted was estimated using the Black-Scholes option-pricing model with the following assumptions:

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Expected dividend yield | |||||||||||

| Risk-free interest rate | |||||||||||

| Expected volatility | |||||||||||

| Expected term (in years) | |||||||||||

| Fair value of underlying common stock | $ | $ | |||||||||

14

| Unity Software Inc. | ||||||||

Restricted Stock Units

A summary of our restricted stock unit ("RSU"), including Price-Vested Unit ("PVU"), activity is as follows:

| Unvested RSUs | |||||||||||

| Number of Shares | Weighted-Average Grant-Date Fair Value | ||||||||||

| Unvested as of December 31, 2022 | $ | ||||||||||

| Granted | $ | ||||||||||

| Vested | ( | $ | |||||||||

| Forfeited | ( | $ | |||||||||

| Unvested as of March 31, 2023 | $ | ||||||||||

Price-Vested Units

In October 2022, our board of directors granted to certain of our executive officers a total of 989,880 PVUs, which are RSUs for which vesting is subject to the fulfillment of both a service period that extends up to four years and the achievement of a stock price hurdle during the relevant performance period that extends up to seven years . The fair value of each PVU award is estimated using a Monte Carlo simulation that uses assumptions determined on the date of grant. During the three months ended March 31, 2023, the service period and stock price hurdle were not met.

Employee Stock Purchase Plan

The fair value of shares offered under our Employee Stock Purchase Plan (the "ESPP") was determined using the Black-Scholes option pricing model with the following weighted-average assumptions:

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Expected dividend yield | |||||||||||

| Risk-free interest rate | |||||||||||

| Expected volatility | |||||||||||

| Expected term (in years) | |||||||||||

| Estimated fair value | $ | $ | |||||||||

Additional information related to the ESPP is provided below (in thousands, except per share amounts):

| Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Share issued under the ESPP | ||||||||

| Weighted-average price per share issued | $ | $ | ||||||

9. Income Taxes

15

| Unity Software Inc. | ||||||||

Our effective tax rate for the three months ended March 31, 2023 differs from the U.S. federal statutory tax rate of 21% primarily due to the need to record a valuation allowance in the U.S. on losses and to a lesser extent, tax expense on foreign earnings taxed at different rates. In addition, the Company undertook certain tax restructuring efforts during the period that enhanced our ability to offset deferred tax liabilities in the U.S. in future periods, thereby partially reducing the need for a valuation allowance. Our effective tax rate for the three months ended March 31, 2022 differs from the U.S. federal statutory tax rate of 21% primarily due to foreign earnings taxed at different tax rates, credits and losses that cannot be benefited due to the valuation allowance on U.S., Denmark, and U.K. entities, and base-erosion and anti-abuse tax ("BEAT") mainly arising as a result of mandatory research and development capitalization under IRC Section 174.

The realization of deferred tax assets is dependent upon the generation of sufficient taxable income of the appropriate character in future periods. We regularly assess the ability to realize our deferred tax assets and establish a valuation allowance if it is more-likely-than-not that some portion of the deferred tax assets will not be realized. In performing this assessment with respect to each jurisdiction, we review all available positive and negative evidence. Primarily due to our history of losses, we believe that it is more likely than not that the deferred tax assets of our U.S. federal, certain state, Denmark, U.K., and certain non-U.S. jurisdictions will not be realized and we have maintained a full valuation allowance against such deferred tax assets.

As of March 31, 2023, we had $179.8 million of gross unrecognized tax benefits, of which $25.8 million would impact the effective tax rate, if recognized. It is reasonably possible that the amount of unrecognized tax benefits as of March 31, 2023 could increase or decrease significantly as the timing of the resolution, settlement, and closure of audits is highly uncertain. We believe that we have adequately provided for any reasonably foreseeable outcome related to our tax audits and that any settlement will not have a material impact on our financial condition and operating results at this time.

10. Net Loss per Share of Common Stock

Basic and diluted net loss per share is the same for all periods presented because the effects of potentially dilutive items were antidilutive given our net loss in each period.

The following table presents potentially dilutive common stock excluded from the computation of diluted net loss per share for the following periods (in thousands) because the impact of including them would have been antidilutive:

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Convertible notes | |||||||||||

| Stock options | |||||||||||

| Unvested RSUs and PVUs | |||||||||||

11. Subsequent Event

16

| Unity Software Inc. | ||||||||

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Please read the following discussion and analysis of our financial condition and results of operations together with our condensed consolidated financial statements and related notes included under Part I, Item 1 of this Quarterly Report on Form 10-Q. The following discussion and analysis contains forward-looking statements that involve risks and uncertainties. Forward-looking statements are statements that attempt to forecast or anticipate future developments in our business, financial condition or results of operations. When reviewing the discussion below, you should keep in mind the substantial risks and uncertainties that could impact our business. In particular, we encourage you to review the risks and uncertainties described in "Part II, Item 1A. Risk Factors" included elsewhere in this report. These risks and uncertainties could cause actual results to differ materially from those projected in forward-looking statements contained in this report or implied by past results and trends. Forward-looking statements, like all statements in this report, speak only as of their date (unless another date is indicated), and we undertake no obligation to update or revise these statements in light of future developments. See the section titled "Note Regarding Forward-Looking Statements and Risk Factor Summary" in this report.

Overview

Unity is the world’s leading platform for creating and growing interactive, real-time 3D ("RT3D") content.

Our comprehensive set of software solutions supports them through the entire development lifecycle as they build, run, and grow immersive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices.

Our platform consists of two distinct, but connected and synergistic, sets of solutions: Create Solutions and Grow Solutions.

Impact of Macroeconomic Trends

Recent negative macroeconomic factors, such as inflation, corresponding heightened interest rates and limited credit availability, the strengthening of the U.S. dollar, and continued softness of the advertising market have negatively impacted our business and may continue to do so. The impact of these macroeconomic trends remains uncertain, and we cannot reasonably estimate the impact on our future results of operations, cash flows, or financial condition. For additional details, refer to the section titled "Risk Factors."

Key Metrics

As further discussed in Item 2 of Part I, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K, we monitor the following key metrics to help us evaluate the health of our business, identify trends affecting our growth, formulate goals and objectives, and make strategic decisions.

Customers Contributing More Than $100,000 of Revenue

We had 1,322 and 1,083 customers contributing more than $100,000 of revenue in the trailing 12 months as of March 31, 2023 and 2022, respectively, demonstrating our ability to grow our revenues with existing customers, and our strong and growing penetration of larger enterprises, including AAA gaming studios and large organizations in industries beyond gaming. We also experienced an increase of these customers as a result of the ironSource Merger. While these customers represented the substantial majority of revenue for the three months ended March 31, 2023 and 2022, respectively, no one customer accounted for more than 10% of our revenue for either period.

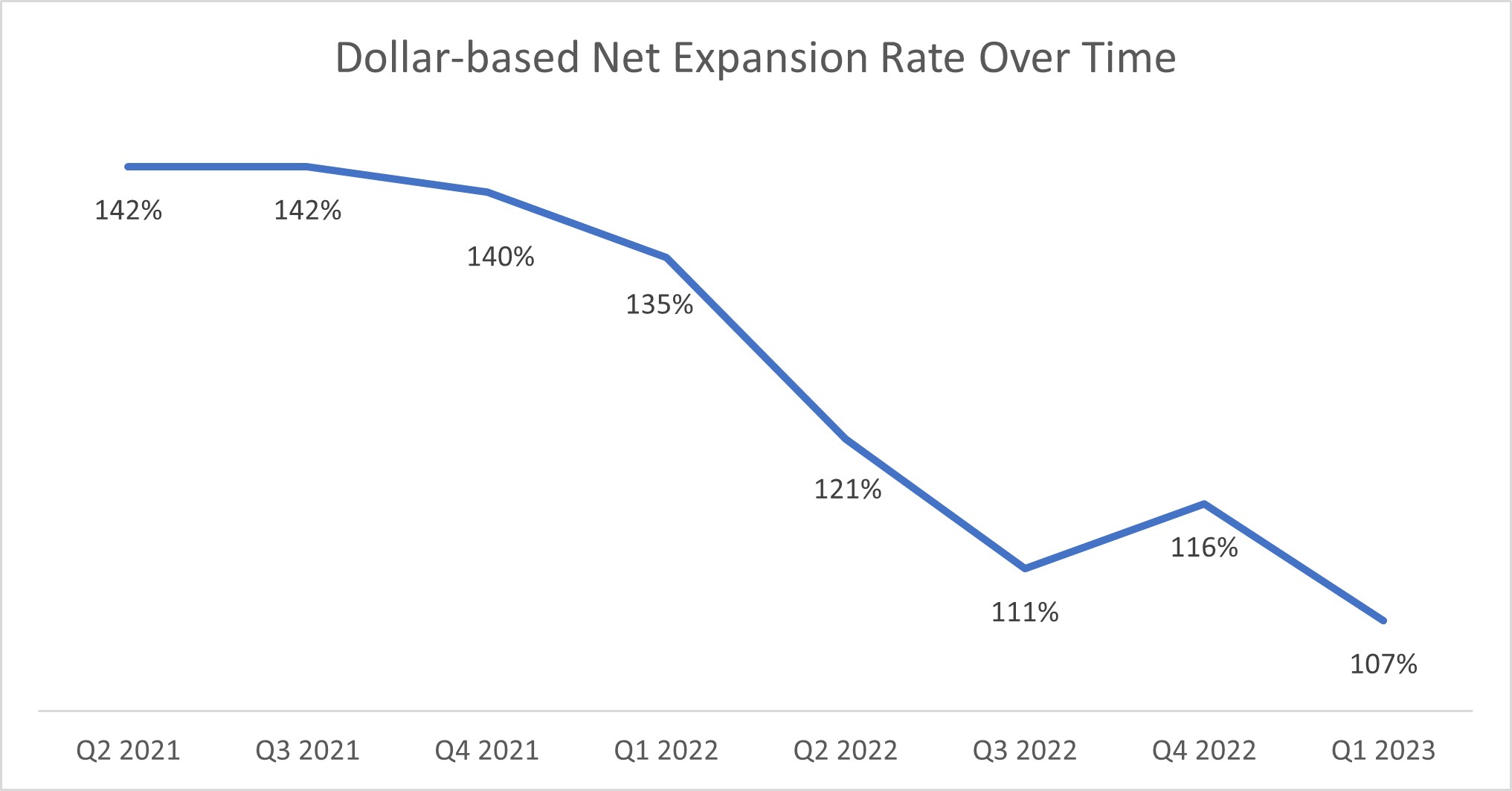

Dollar-Based Net Expansion Rate

Our ability to drive growth and generate incremental revenue depends, in part, on our ability to maintain and grow our relationships with our Create and Grow Solutions customers and to increase their use of our platform. We track our performance by measuring our dollar-based net expansion rate, which compares our Create and Grow Solutions revenue from the same set of customers across comparable periods, calculated on a trailing 12-month basis.

17

| Unity Software Inc. | ||||||||

| As of | |||||||||||

| March 31, 2023 | March 31, 2022 | ||||||||||

| Dollar-based net expansion rate | 107 | % | 135 | % | |||||||

Our dollar-based net expansion rate as of March 31, 2023 and 2022, was driven primarily by the sales of additional subscriptions and services to our existing Create Solutions customers and cross-selling our solutions to all of our customers. The decrease in dollar-based net expansion rate, compared to the comparable prior year period, is attributable to Grow Solutions and follows a similar trend to the revenue decrease seen from those solutions prior to the ironSource Merger due to softness in the advertising market.

The chart below illustrates that our dollar-based net expansion rate has been declining over the last year with a slight rebound in the fourth quarter due to the ironSource Merger. Despite this decline, we are still maintaining strong relationships with our existing customers.

18

| Unity Software Inc. | ||||||||

Results of Operations

The following table summarizes our historical consolidated statements of operations data for the periods indicated (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Revenue | $ | 500,361 | $ | 320,126 | |||||||

| Cost of revenue | 161,964 | 93,833 | |||||||||

| Gross profit | 338,397 | 226,293 | |||||||||

| Operating expenses | |||||||||||

| Research and development | 280,480 | 221,040 | |||||||||

| Sales and marketing | 216,127 | 103,939 | |||||||||

| General and administrative | 96,774 | 72,475 | |||||||||

| Total operating expenses | 593,381 | 397,454 | |||||||||

| Loss from operations | (254,984) | (171,161) | |||||||||

| Interest expense | (6,129) | (1,111) | |||||||||

| Interest income and other expense, net | 13,615 | 941 | |||||||||

| Loss before income taxes | (247,498) | (171,331) | |||||||||

| Provision for income taxes | 6,205 | 6,224 | |||||||||

| Net loss | (253,703) | (177,555) | |||||||||

The following table sets forth the components of our condensed consolidated statements of operations data as a percentage of revenue for the periods indicated:

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Revenue | 100 | % | 100 | % | |||||||

| Cost of revenue | 32 | 29 | |||||||||

| Gross margin | 68 | 71 | |||||||||

| Operating expenses | |||||||||||

| Research and development | 56 | 69 | |||||||||

| Sales and marketing | 43 | 32 | |||||||||

| General and administrative | 19 | 23 | |||||||||

| Total operating expenses | 118 | 124 | |||||||||

| Loss from operations | (51) | (53) | |||||||||

| Interest expense | (1) | — | |||||||||

| Interest income and other expense, net | 3 | — | |||||||||

| Loss before income taxes | (49) | (53) | |||||||||

| Provision for income taxes | 1 | 2 | |||||||||

| Net loss | (50) | % | (55) | % | |||||||

19

| Unity Software Inc. | ||||||||

Revenue

Create Solutions

We generate Create Solutions revenue primarily through our suite of Create Solutions subscriptions, enterprise support, professional services and cloud and hosting services. Our subscriptions provide customers access to technologies that allow them to edit, run, and iterate interactive, RT3D and 2D experiences that can be created once and deployed to a variety of platforms. Enhanced support services are provided to our enterprise customers and are sold separately from the Create Solutions subscriptions. Professional services are provided to our customers and include consulting, platform integration, training, and custom application and workflow development. Cloud and hosting services are provided to our customers to simplify and enhance the way our users access and harness our solutions.

Grow Solutions

We generate Grow Solutions revenue primarily through our monetization solutions, user acquisition offerings, and Supersonic, a game publishing service. Our monetization solutions allow publishers, original equipment manufacturers, and mobile carriers to sell available advertising inventory on their mobile applications or hardware devices to advertisers for in-application or on-device placements. Our revenue represents the amount we retain from the transaction we are facilitating through our Unified Auction and mediation platform. Supersonic provides game developers with the infrastructure and expertise to launch their mobile games and manage their growth; this is achieved through marketability testing tools, live games management tools and game design support, and optimizing the implementation of the customer's commercial model. Through Supersonic, we generate revenue from in-app advertising in published games and in some cases, in app purchase revenue.

Our total revenue is summarized as follows (in thousands):

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Create Solutions | $ | 187,369 | $ | 164,544 | |||||||

| Grow Solutions | 312,992 | 155,582 | |||||||||

| Total revenue | $ | 500,361 | $ | 320,126 | |||||||

The increase in total revenue in the three months ended March 31, 2023, compared to the comparable prior year period, was primarily due to the acquisition and inclusion of revenue from ironSource within Grow Solutions. Revenue from Create Solutions increased primarily due to growth in new customers, as well as growth among existing customers.

Cost of Revenue, Gross Profit, and Gross Margin

Cost of revenue consists primarily of hosting expenses, personnel costs (including salaries, benefits, and stock-based compensation) for employees associated with our product support and professional services organizations, allocated overhead (including facilities, information technology ("IT"), and security costs), third-party license fees, and credit card fees, as well as amortization of intangible assets, related capitalized software and depreciation of related property and equipment.

Gross profit, or revenue less cost of revenue, has been and will continue to be affected by various factors, including our product mix, the costs associated with third-party hosting services, and the extent to which we expand and drive efficiencies in our hosting costs, professional services, and customer support organizations. We expect our gross profit to increase in absolute dollars in the long term, but we expect our gross profit as a percentage of revenue, or gross margin, to fluctuate from period to period.

20

| Unity Software Inc. | ||||||||

Cost of revenue for the three months ended March 31, 2023 increased, compared to the comparable prior year period, primarily due to higher personnel-related expenses associated with increased headcount including those associated with ironSource Merger, as well as an increase of approximately $27 million in amortization expenses related to intangible assets acquired through our business acquisitions. We also experienced an increase of approximately $9 million in hosting and other third party related expenses primarily due to the inclusion of ironSource, as well as higher expenses to support increased usage of our solutions.

Operating Expenses

Our operating expenses consist of research and development, sales and marketing, and general and administrative expenses. The most significant component of our operating expenses is personnel-related costs, including salaries and wages, sales commissions, bonuses, benefits, stock-based compensation, and payroll taxes. Although personnel-related costs contributed to the majority of the increase in expense period over period primarily due to the increased headcount resulting from the ironSource Merger, we have been evaluating our headcount needs, slowing down our hiring efforts, reducing the number of managerial layers, and focusing on containing the growth rate of other expenses. For example, we incurred approximately $14 million in costs associated with headcount reductions during the quarter ended March 31, 2023 and in May, we announced that we estimate an additional amount of approximately $26 million to be substantially incurred in the second quarter of 2023.

Research and Development

Research and development expenses primarily consist of personnel-related costs for the design and development of our platform, third-party software services, professional services, and allocated overhead. We expense research and development expenses as they are incurred. We expect our research and development expenses to increase in absolute dollars and may fluctuate as a percentage of revenue from period to period as we expand our teams to develop new products, expand features and functionality with existing products, and enter new markets.

Research and development expense for the three months ended March 31, 2023 increased, compared to the comparable prior year period, primarily due to higher personnel-related expenses as headcount increased due to the ironSource Merger and to support continued product innovation. The increase was further driven, to a lesser extent, by higher hosting expenses.

Sales and Marketing

Our sales and marketing expenses consist primarily of personnel-related costs, advertising and marketing programs, including user acquisition costs and digital account-based marketing, user events such as developer-centric conferences and our annual Unite user conferences; and allocated overhead. We expect that our sales and marketing expense will increase in absolute dollars as we hire additional personnel, increase our account-based marketing, direct marketing and community outreach activities, invest in additional tools and technologies, and continue to build brand awareness. Our expenses may fluctuate as a percentage of revenue from period to period.

Sales and marketing expense for the three months ended March 31, 2023 increased, compared to the comparable prior year period, primarily due to an increase in amortization expense related to intangible assets acquired through our business acquisitions of approximately $38 million. We also experienced higher personnel-related and user acquisition costs due to the ironSource Merger, as well as increased headcount to support the growth of our sales and marketing teams.

General and Administrative

Our general and administrative expenses primarily consist of personnel-related costs for finance, legal, human resources, IT, and administrative employees; professional fees for external legal, accounting, and other professional services; and allocated overhead. We expect that our general and administrative expenses will increase in absolute dollars and may fluctuate as a percentage of revenue from period to period as we scale to support the growth of our business.

21

| Unity Software Inc. | ||||||||

General and administrative expense for the three months ended March 31, 2023 increased, compared to the comparable prior year period, primarily due to higher personnel-related expenses as headcount increased as a result of the ironSource Merger, which was partially offset by a decrease in professional fees.

Interest Expense

Interest expense consists primarily of interest expense associated with our convertible debt and amortization of debt issuance costs.

Interest expense for the three months ended March 31, 2023 increased, compared to the comparable prior year period, due to accrued interest on our 2027 notes and debt issuance costs amortization.

Interest Income and Other Expense, Net

Interest income and other expense, net, consists primarily of interest income earned on our cash, cash equivalents, and short-term investments, amortization of premium arising at acquisition of short-term investments, foreign currency remeasurement gains and losses, and foreign currency transaction gains and losses. As we have expanded our global operations, our exposure to fluctuations in foreign currencies has increased, and we expect this to continue.

Interest income and other expense, net, for the three months ended March 31, 2023 increased, compared to the comparable prior year period, primarily due to interest and dividend income earned on our money market investments and time deposit accounts.

Provision for Income Taxes

Provision for income taxes consists primarily of income taxes in certain foreign jurisdictions where we conduct business. We have a valuation allowance against certain of our deferred tax assets, including net operating loss ("NOL") carryforwards and tax credits related primarily to research and development. Our overall effective income tax rate in future periods may be affected by the geographic mix of earnings in the countries in which we operate. Our future effective tax rate may also be affected by changes in the valuation of our deferred tax assets or liabilities, or changes in tax laws, regulations, or accounting principles in the jurisdictions in which we conduct business. See Note 9, "Income Taxes," of the Notes to Condensed Consolidated Financial Statements.

Provision for income taxes for the three months ended March 31, 2023 decreased primarily due to tax benefits recognized for the three months ended March 31, 2023 from certain tax restructuring efforts during the period that enhanced our ability to offset deferred tax liabilities in the U.S. in future periods, thereby partially reducing the need for a valuation allowance.

Non-GAAP Financial Measures

To supplement our consolidated financial statements prepared and presented in accordance with GAAP we use certain non-GAAP financial measures, as described below, to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe the following non-GAAP measures are useful in evaluating our operating performance. We are presenting these non-GAAP financial measures because we believe, when taken collectively, they may be helpful to investors because they provide consistency and comparability with past financial performance.

However, non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. As a result, our non-GAAP financial measures are presented for supplemental informational purposes only and should not be considered in isolation or as a substitute for our consolidated financial statements presented in accordance with GAAP.

22

| Unity Software Inc. | ||||||||

Beginning in the first quarter of 2023, we have replaced non-GAAP gross profit, non-GAAP loss from operations, non-GAAP net loss, and non-GAAP net loss per share with adjusted gross profit and adjusted EBITDA. These measures have also been presented for the prior year period in a comparable manner.

Adjusted Gross Profit and Adjusted EBITDA

We define adjusted gross profit as GAAP gross profit excluding expenses associated with stock-based compensation, amortization of acquired intangible assets, depreciation, and restructurings and reorganizations. We define adjusted EBITDA as net income or loss excluding benefits or expenses associated with stock-based compensation, amortization of acquired intangible assets, depreciation, acquisitions, restructurings and reorganizations, interest, income tax, and other non-operating activities, which primarily consist of foreign exchange rate gains or losses.

We use adjusted gross profit and adjusted EBITDA in conjunction with traditional GAAP measures to evaluate our financial performance. We believe that adjusted gross profit and adjusted EBITDA provide our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as these metrics exclude expenses that we do not consider to be indicative of our overall operating performance.

The following table presents a reconciliation of our adjusted gross profit to our GAAP gross profit, the most directly comparable measure as determined in accordance with GAAP, for the periods presented (in thousands):

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| GAAP gross profit | $ | 338,397 | $ | 226,293 | |||||||

| Add: | |||||||||||

| Stock-based compensation expense | 18,849 | 8,794 | |||||||||

| Amortization of intangible assets expense | 34,265 | 7,555 | |||||||||

| Depreciation expense | 2,364 | 1,238 | |||||||||

| Restructuring and reorganization costs | 119 | — | |||||||||

| Adjusted gross profit | $ | 393,994 | $ | 243,880 | |||||||

| GAAP gross margin | 68 | % | 71 | % | |||||||

| Adjusted gross margin | 79 | % | 76 | % | |||||||

The following table presents a reconciliation of our adjusted EBITDA to net loss, the most directly comparable measure as determined in accordance with GAAP, for the periods presented (in thousands):

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Net loss | $ | (253,703) | $ | (177,555) | |||||||

| Stock-based compensation expense | 163,028 | 103,427 | |||||||||

| Amortization of intangible assets expense | 97,920 | 32,702 | |||||||||

| Depreciation expense | 11,640 | 8,770 | |||||||||

| Acquisition-related costs | 729 | 1,081 | |||||||||

| Restructuring and reorganization costs | 14,130 | 2,330 | |||||||||

| Interest expense | 6,129 | 1,111 | |||||||||

| Interest income and other expense, net | (13,615) | (941) | |||||||||

| Income tax expense | 6,205 | 6,224 | |||||||||

| Adjusted EBITDA | $ | 32,463 | $ | (22,851) | |||||||

23

| Unity Software Inc. | ||||||||

Free Cash Flow

We define free cash flow as net cash provided by (used in) operating activities less cash used for purchases of property and equipment. We believe that free cash flow is a useful indicator of liquidity as it measures our ability to generate cash, or our need to access additional sources of cash, to fund operations and investments.

The following table presents a reconciliation of free cash flow to net cash provided by (used in) operating activities, the most directly comparable measure as determined in accordance with GAAP, for the periods presented (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Net cash provided by (used in) operating activities | $ | (5,099) | $ | 101,300 | |||||||

| Less: | |||||||||||

| Purchases of property and equipment | (14,350) | (14,929) | |||||||||

| Free cash flow | $ | (19,449) | $ | 86,371 | |||||||

Liquidity and Capital Resources

As of March 31, 2023, our principal sources of liquidity were cash, cash equivalents, and short-term investments totaling $1.6 billion, which were primarily held for working capital purposes. Our cash equivalents and short-term investments are invested primarily in fixed income securities, while we are continuing to monitor recent developments with respect to liquidity concerns at, and failures of, banks and other financial institutions, we are not currently experiencing any limitations or restrictions on our ability to access these balances.

Our material cash requirements from known contractual and other obligations consists of our convertible notes, obligations under operating leases for office space, and contractual obligations for hosting services to support our business operations. See Part I, Item I, Note 7 — "Commitments and Contingencies" for additional discussion of our principal contractual commitments.

In connection with the ironSource Merger in November 2022, we issued the 2027 Notes, the proceeds of which were used to fund repurchases under our share repurchase program. We previously issued $1.7 billion in aggregate principal amount of 0% convertible senior notes due 2026 in November 2021 (together with the 2027 Notes, the "Notes"). See Part I, Item I, Note 6, "Borrowings" for additional discussion of the Notes.

In July 2022, our board of directors approved our Share Repurchase Program, which authorized the repurchase of up to $2.5 billion of shares of our common stock in open market transactions through November 2024. As of March 31, 2023, $1.0 billion remains available for future share repurchases under this program. We did not repurchase any shares under the Share Repurchase Program during the quarter ended March 31, 2023.

Since our inception, we have generated losses from our operations as reflected in our accumulated deficit of $2.5 billion as of March 31, 2023. We expect to continue to incur operating losses on a GAAP basis for the foreseeable future due to the investments we will continue to make in research and development, sales and marketing, and general and administrative. As a result, we may require additional capital to execute our strategic initiatives to grow our business.

24

| Unity Software Inc. | ||||||||

We believe our existing sources of liquidity will be sufficient to meet our working capital and capital expenditures for at least the next 12 months. We believe we will meet longer-term expected future cash requirements and obligations through a combination of cash flows from operating activities, available cash balances, and potential future equity or debt transactions. Our future capital requirements, however, will depend on many factors, including our growth rate; the timing and extent of spending to support our research and development efforts; capital expenditures to build out new facilities and purchase hardware and software; the expansion of sales and marketing activities; and our continued need to invest in our IT infrastructure to support our growth. In addition, we may enter into additional strategic partnerships as well as agreements to acquire or invest in complementary products, teams and technologies, including intellectual property rights, which could increase our cash requirements. As a result of these and other factors, we may choose or be required to seek additional equity or debt financing sooner than we currently anticipate. In addition, depending on prevailing market conditions, our liquidity requirements, contractual restrictions, and other factors, we may also from time to time seek to retire or purchase our outstanding debt, including the Notes, through cash purchases and/or exchanges for equity securities, in open market purchases, privately negotiated transactions or otherwise. If additional financing is required from outside sources, we may not be able to raise it on terms acceptable to us, or at all, including as a result of macroeconomic conditions such as rising interest rates, volatility in the capital markets and liquidity concerns at, or failures of, banks and other financial institutions. If we are unable to raise additional capital when required, or if we cannot expand our operations or otherwise capitalize on our business opportunities because we lack sufficient capital, our business, results of operations, and financial condition would be adversely affected.

Our changes in cash flows were as follows (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Net cash provided by (used in) operating activities | $ | (5,099) | $ | 101,300 | |||||||

| Net cash provided by (used in) investing activities | 88,111 | (35,460) | |||||||||

| Net cash provided by financing activities | 21,971 | 30,216 | |||||||||

| Effect of foreign exchange rate changes on cash, cash equivalents, and restricted cash | 3,151 | 37 | |||||||||

| Net change in cash, cash equivalents, and restricted cash | $ | 108,134 | $ | 96,093 | |||||||

Cash Used in Operating Activities

During the three months ended March 31, 2023, net cash used in operating activities was primarily due to our net loss and changes in working capital, including payment in 2023 of the corporate bonus for our fiscal year ended December 31, 2022. Our cash flows fluctuate from period to period due to revenue seasonality, timing of billings, collections, and publisher payments. Historical cash flows are not necessarily indicative of our results in any future period.

Cash Provided by Investing Activities

During the three months ended March 31, 2023, net cash provided by investing activities consisted primarily of proceeds received due to maturities of short-term investments.

Cash Provided by Financing Activities

During the three months ended March 31, 2023, net cash provided by financing activities consisted solely of proceeds from the issuance of common stock under our employee equity plans.

25

| Unity Software Inc. | ||||||||

Critical Accounting Policies and Estimates

Management's discussion and analysis of our financial condition and results of operations is based on our condensed consolidated financial statements, which have been prepared in accordance with U.S. GAAP. These principles require us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, expenses, and related disclosures. Our estimates are based on our historical experience and on various other assumptions that we believe are reasonable under the circumstances. To the extent that there are material differences between these estimates and our actual results, our future financial statements will be affected.

There have been no material changes to our critical accounting policies and estimates from those disclosed in Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 27, 2023.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Our assessment of our exposures to market risk has not changed materially since the presentation set forth in Part II, Item 7A of our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 27, 2023.

Item 4. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, we conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), as of the end of the period covered by this report.

Based on management’s evaluation, our principal executive officer and principal financial officer concluded that our disclosure controls and procedures are designed to, and are effective to, provide assurance at a reasonable level that the information we are required to disclose in reports that we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in SEC rules and forms, and that such information is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosures.

(b) Changes in Internal Control Over Financial Reporting

In November 2022, we completed the ironSource Merger. As part of our ongoing integration activities, we are in the process of incorporating internal controls over significant processes specific to ironSource that management believes are appropriate and necessary for us to report on internal controls over financial reporting as it relates to ironSource as of the end of fiscal year 2023. We expect to complete the integration activities related to internal control over financial reporting for ironSource during fiscal year 2023.