UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to______

Commission file number: 001-39292

Butterfly Network, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 84-4618156 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

530 Old Whitfield Street

Guilford, Connecticut 06437

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (203) 689-5650

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Class A common stock, $0.0001 Par Value Per Share | BFLY | The New York Stock Exchange | ||

| Warrants to purchase one share of Class A common stock, each at an exercise price of $11.50 per share | BFLY WS | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | x |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s voting and non-voting equity held by non-affiliates of the registrant (without admitting that any person whose securities are not included in such calculation is an affiliate) computed by reference to the price at which the Units were last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $418 million. As of such date, only our Units were publicly traded.

As of March 1, 2021, the registrant had 164,862,472 shares of Class A common stock outstanding and 26,426,937 shares of Class B common stock outstanding.

TABLE OF CONTENTS

1

EXPLANATORY NOTE

Following the completion of the fiscal year ended December 31, 2020 covered by this Annual Report on Form 10-K, on February 12, 2021 (the “Closing Date”), Longview Acquisition Corp., a Delaware corporation (“Longview” and after the Business Combination described herein, the “Company”), consummated a business combination (the “Business Combination”) pursuant to the terms of the Business Combination Agreement, dated as of November 19, 2020 (the “Business Combination Agreement”), by and among Longview, Clay Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and Butterfly Network, Inc., a Delaware corporation (“Legacy Butterfly”).

Immediately upon the consummation of the Business Combination and the other transactions contemplated by the Business Combination Agreement (collectively, the “Transactions”, and such completion, the “Closing”), Merger Sub merged with and into Legacy Butterfly, with Legacy Butterfly surviving the business combination as a wholly-owned subsidiary of Longview (the “Merger”). In connection with the Transactions, Longview changed its name to “Butterfly Network, Inc.” and Legacy Butterfly changed its name to “BFLY Operations, Inc.”

As a consequence of the Business Combination, each share of Longview Class B common stock that was issued and outstanding as of immediately prior to the effective time of the Merger (the “Effective Time”) was converted, on a one-for-one basis, into a share of the Company’s Class A common stock. The Business Combination had no effect on the Longview Class A common stock that was issued and outstanding as of immediately prior to the Effective Time, which continues to remain outstanding.

As a consequence of the Merger, at the Effective Time, (i) each share of Legacy Butterfly capital stock (other than the Legacy Butterfly Series A preferred stock) that was issued and outstanding immediately prior to the Effective Time was automatically canceled and converted into the right to receive 1.0383 shares of the Company’s Class A common stock, rounded down to the nearest whole number of shares; (ii) each share of Legacy Butterfly Series A preferred stock that was issued and outstanding immediately prior to the Effective Time was automatically canceled and converted into the right to receive 1.0383 shares of the Company’s Class B common stock, rounded down to the nearest whole number of shares; (iii) each option to purchase shares of Legacy Butterfly common stock, whether vested or unvested, that was outstanding and unexercised as of immediately prior to the Effective Time was assumed by the Company and became an option (vested or unvested, as applicable) to purchase a number of shares of the Company’s Class A common stock equal to the number of shares of Legacy Butterfly common stock subject to such option immediately prior to the Effective Time multiplied by 1.0383, rounded down to the nearest whole number of shares, at an exercise price per share equal to the exercise price per share of such option immediately prior to the Effective Time divided by 1.0383 and rounded up to the nearest whole cent; (iv) each Legacy Butterfly restricted stock unit outstanding immediately prior to the Effective Time was assumed by the Company and became a restricted stock unit with respect to a number of shares of the Company’s Class A common stock, rounded to the nearest whole share, equal to the number of shares of Legacy Butterfly common stock subject to such Legacy Butterfly restricted stock unit immediately prior to the Effective Time multiplied by 1.0383; and (v) the principal amount plus accrued but unpaid interest, if any, on the Legacy Butterfly convertible notes outstanding as of immediately prior to the Effective Time was automatically canceled and converted into the right to receive shares of the Company’s Class A common stock, with such shares of the Company’s Class A common stock calculated by dividing the outstanding principal plus accrued interest, if any, of each Legacy Butterfly convertible note by $10.00, rounded down to the nearest whole number of shares.

In addition, on February 12, 2021, Longview filed the Second Amended and Restated Certificate of Incorporation (the “Restated Certificate”) with the Secretary of State of the State of Delaware, which became effective simultaneously with the Effective Time. As a consequence of filing the Restated Certificate, the Company adopted a dual class structure, comprised of the Company’s Class A common stock, which is entitled to one vote per share, and the Company’s Class B common stock, which is entitled to 20 votes per share. The Company’s Class B common stock has the same economic terms as the Company’s Class A common stock, but is subject to a “sunset” provision if Jonathan M. Rothberg, Ph.D., the founder of Legacy Butterfly and Chairman of the Company (“Dr. Rothberg”), and other permitted holders of the Company’s Class B common stock collectively cease to beneficially own at least twenty percent (20%) of the number of shares of the Company’s Class B common stock (as such number of shares is equitably adjusted in respect of any reclassification, stock dividend, subdivision, combination or recapitalization of the Company’s Class B common stock) collectively held by Dr. Rothberg and permitted transferees of the Company’s Class B common stock as of the Effective Time.

In addition, concurrently with the execution of the Business Combination Agreement, on November 19, 2020, Longview entered into subscription agreements (the “Subscription Agreements”) with certain institutional investors (the “PIPE Investors”), pursuant to which the PIPE Investors purchased, immediately prior to the Closing, an aggregate of 17,500,000 shares of Longview Class A common stock at a purchase price of $10.00 per share (the “PIPE Financing”).

2

The total number of shares of the Company’s Class A common stock outstanding immediately following the Closing was approximately 164,862,472, comprising (i) 95,633,661 shares of the Company’s Class A common stock issued to Legacy Butterfly stockholders (other than certain holders of Legacy Butterfly Series A preferred stock) and holders of Legacy Butterfly convertible notes in the Merger, (ii) 17,500,000 shares of the Company’s Class A common stock issued in connection with the Closing to the PIPE Investors pursuant to the PIPE Financing, (iii) 10,350,000 shares of the Company’s Class A common stock issued to holders of shares of Longview Class B common stock outstanding at the Effective Time and (iv) 41,378,811 shares of Longview Class A common stock outstanding at the Effective Time. The total number of shares of the Company’s Class B common stock issued at the Closing was approximately 26,426,937. Following the Closing, as of the Closing Date, Dr. Rothberg holds approximately 76.2% of the combined voting power of the Company. Accordingly, Dr. Rothberg and his permitted transferees control the Company and the Company is a controlled company within the meaning of the corporate governance standards of the New York Stock Exchange (the “NYSE”).

Unless the context otherwise requires, references in this Annual Report on Form 10-K to “we,” “us,” “our” and the “Company” refer to Butterfly Network, Inc. and its subsidiaries following the Business Combination, and references to “Legacy Butterfly” and “Longview” refer to Butterfly Network, Inc. and Longview Acquisition Corp. and their subsidiaries, respectively, prior to the Business Combination.

3

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that relate to future events or our future financial performance regarding, among other things, the plans, strategies and prospects, both business and financial, of the Company. These statements are based on the beliefs and assumptions of the Company’s management team. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or similar expressions. The forward-looking statements are based on projections prepared by, and are the responsibility of, the Company’s management. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

| · | our rapid growth may not be sustainable and depends on our ability to attract and retain customers; |

| · | our business could be harmed if we fail to manage our growth effectively; |

| · | the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and our ability to grow and manage growth profitably and retain our key employees; |

| · | our projections are subject to risks, assumptions, estimates and uncertainties; |

| · | our business is subject to a variety of U.S. and foreign laws, which are subject to change and could adversely affect our business; |

| · | the success, cost and timing of our product development activities; |

| · | the potential attributes and benefits of our products and services; |

| · | our ability to obtain and maintain regulatory approval for our products, and any related restrictions and limitations of any approved product; |

| · | our ability to identify, in-license or acquire additional technology; |

| · | our ability to maintain our existing license, manufacturing and supply agreements; |

| · | our ability to compete with other companies currently marketing or engaged in the development of ultrasound imaging devices, many of which have greater financial and marketing resources than us; |

| · | the size and growth potential of the markets for our products and services, and the ability of each to serve those markets, either alone or in partnership with others; |

| · | the pricing of our products and services and reimbursement for medical procedures conducted using our products and services; |

| · | changes in applicable laws or regulations; |

| · | our estimates regarding expenses, revenue, capital requirements and needs for additional financing; |

| · | our ability to raise financing in the future; |

| · | our financial performance; |

| · | failure to protect or enforce our intellectual property rights could harm our business, results of operations and financial condition; |

| · | the ability to maintain the listing of our Class A common stock on the NYSE; |

| · | economic downturns and political and market conditions beyond our control could adversely affect our business, financial condition and results of operations; and |

| · | the impact of the COVID-19 pandemic on our business. |

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this Annual Report on Form 10-K are more fully described in Item 1A under the heading “Risk Factors.” The risks described under the heading “Risk Factors” are not exhaustive. Other sections of this Annual Report on Form 10-K, such as the description of our Business set forth in Item 1 and our Management’s Discussion and Analysis of Financial Condition and Results of Operations set forth in Item 7 describe additional factors that could adversely affect the business, financial condition or results of operations of the Company. New risk factors emerge from time to time, and it is not possible to predict all such risk factors, nor can the Company assess the impact of all such risk factors on its business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements, which speak only as of the date hereof. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. The Company undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

4

Summary of Risk Factors

Our business is subject to numerous risks and uncertainties that you should consider before investing in our securities. Some of the principal risk factors are summarized below:

| · | We have a limited operating history on which to assess the prospects for our business, we have generated limited revenue from sales of our products, and we have incurred losses since inception. We anticipate that we will continue to incur significant losses for at least the next several years as we continue to commercialize our existing products and services and seek to develop and commercialize new products and services. |

| · | We may need to raise additional funding to expand the commercialization of our products and services and to expand our research and development efforts. This additional financing may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product commercialization or development efforts or other operations. |

| · | Our success depends upon market acceptance of our products and services, our ability to develop and commercialize existing and new products and services and generate revenues, and our ability to identify new markets for our technology. |

| · | Medical device development is costly and involves continual technological change, which may render our current or future products obsolete. |

| · | We will be dependent upon the success of our sales and customer acquisition and retention strategies. |

| · | If we do not successfully manage the development and launch of new products, we will not meet our long term forecasts, and operating and financial results and condition could be adversely affected. |

| · | We will need to expand our organization, and we may experience difficulties in recruiting needed additional employees and consultants, which could disrupt our operations. |

| · | We have limited experience in marketing and selling our products and related services, and if we are unable to successfully commercialize our products and related services, our business and operating results will be adversely affected. |

| · | Pricing pressures from contract suppliers or manufacturers on which we rely may impose pricing pressures. |

| · | We may experience manufacturing problems or delays that could limit the growth of our revenue or increase our losses. |

| · | We rely on limited or sole suppliers for some of the materials and components used in our products, and we may not be able to find replacements or immediately transition to alternative suppliers, which could have a material adverse effect on our business, financial condition, results of operations and reputation. |

| · | If we do not successfully optimize and operate our sales and distribution channels or we do not effectively expand and update infrastructure, our operating results and customer experience may be negatively impacted and we may have difficulty achieving market awareness and selling our products in the future. |

| · | The market for our products and services is new, rapidly evolving, and increasingly competitive, as the healthcare industry in the United States is undergoing significant structural change, which makes it difficult to forecast demand for our products and services. |

| · | The COVID-19 pandemic has and could continue to negatively affect various aspects of our business, make it more difficult for us to meet our obligations to our customers, and result in reduced demand for our products and services, which could have a material adverse effect on our business, financial condition, results of operations, or cash flows. |

| · | We will incur increased costs and demands upon management as a result of complying with the laws and regulations affecting public companies, which could adversely affect our business, results of operations, and financial condition. |

| · | We are subject to extensive government regulation, which could restrict the development, marketing, sale and distribution of our products and could cause us to incur significant costs. |

| · | There is no guarantee that the U.S. Food and Drug Administration, or FDA, will grant 510(k) clearance or pre-market approval, or PMA, of our future products, and failure to obtain necessary clearances or approvals for our future products would adversely affect our ability to grow our business. |

5

| · | If we fail to obtain regulatory clearances in other countries for existing products or products under development, we will not be able to commercialize these products in those countries. |

| · | We may be subject to enforcement action if we engage in improper or off-label marketing or promotion of our products, including fines, penalties and injunctions. |

| · | Because we do not require training for users of our current products, although they are limited under FDA’s marketing clearances to use by trained healthcare practitioners, there exists a potential for misuse of these products, which could ultimately harm our reputation and business. |

| · | We are subject to complex and evolving U.S. and foreign laws and regulations regarding privacy, data protection, and other matters. Many of these laws and regulations are subject to change and uncertain interpretation, and could result in claims, changes to our business practices, monetary penalties, increased cost of operations, or declines in customer growth or engagement, or otherwise harm our business. |

| · | Cybersecurity risks and cyber incidents could result in the compromise of confidential data or critical data systems and give rise to potential harm to customers, remediation and other expenses, expose us to liability under HIPAA, consumer protection laws, or other common law theories, subject us to litigation and federal and state governmental inquiries, damage our reputation, and otherwise be disruptive to our business and operations. |

| · | If we are unable to protect our intellectual property, our ability to maintain any technological or competitive advantage over our competitors and potential competitors would be adversely impacted, and our business may be harmed. |

| · | We may need or may choose to obtain licenses from third parties to advance our research or allow commercialization of our current or future products, and we cannot provide any assurances that we would be able to obtain such licenses. |

| · | We face the risk of product liability claims and may be subject to damages, fines, penalties and injunctions, among other things. |

These and other material risks we face are described more fully in Item 1A, Risk Factors, which investors should carefully review prior to making an investment decision with respect to the Company or its securities.

6

All brand names or trademarks appearing in this report are the property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this report is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owners. Unless the context requires otherwise, references in this report to the “Company,” “we,” “us,” and “our” refer to Butterfly Network, Inc. and its wholly-owned subsidiaries.

| Item 1. | BUSINESS |

Overview

Prior to February 12, 2021, we were a blank check company incorporated as a Delaware corporation and formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. On February 12, 2021, we completed the Business Combination pursuant to the Business Combination Agreement dated November 19, 2020 that we entered into with Legacy Butterfly. Upon the completion of the Business Combination, we changed our name to “Butterfly Network, Inc.” and the business of Legacy Butterfly became our business.

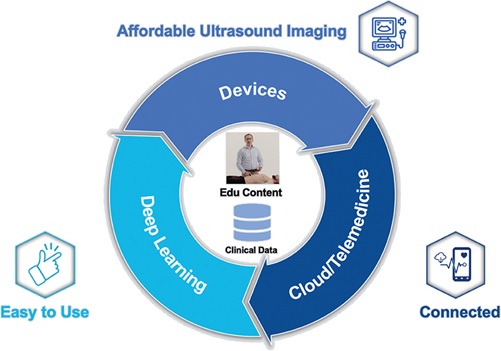

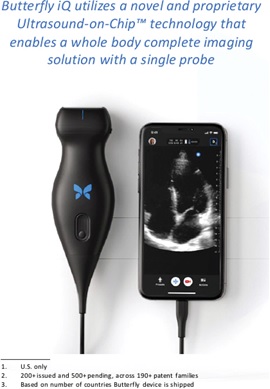

We are an innovative digital health business with a mission of democratizing healthcare by making medical imaging accessible to everyone around the world. Powered by our proprietary Ultrasound-on-Chip™ technology, our solution addresses the needs of point of care imaging with a unique combination of software and hardware technology. Butterfly iQ, followed by our recently launched Butterfly iQ+, is our first product powered by Butterfly’s Ultrasound-on-Chip™, and is the only ultrasound transducer that can perform “whole-body imaging” in a single handheld probe using semiconductor technology. Our Ultrasound-on-Chip™ reduces the cost of manufacturing, while our software is intended to make the product easy to use and fully integrated with the clinical workflow, accessible on a user’s smartphone, tablet, and almost any hospital computer system connected to the Internet. Through our portable proprietary, handheld solution, protected by a robust intellectual property portfolio and empowered in part by its proprietary software and Artificial Intelligence (“AI”), Butterfly aims to enable earlier detection throughout the body and remote management of health conditions around the world.

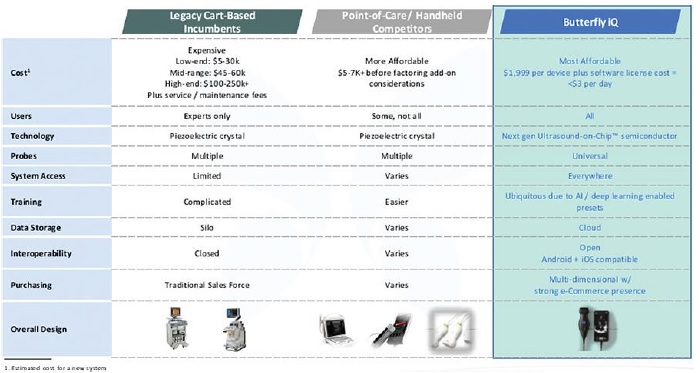

Digital health is systematically changing the way healthcare practitioners deliver care by increasing access and significantly reducing patient care costs. Butterfly iQ+ is designed for this new wave of medical care with an easy-to-use interface that portrays ultrasound images on your smartphone in real-time. Historically, the global ultrasound market has been dominated by traditional cart-based devices. These devices are accessible only to highly specialized, highly trained technicians and are located predominantly in hospitals, imaging centers, and physicians’ offices. Many healthcare institutions throughout the world lack the facilities and capital necessary to acquire and maintain expensive cart-based devices and cannot afford the highly trained individuals required to operate them. Traditional cart-based equipment typically ranges from $45,000 to $60,000 per new device in the mid-range and is required to be operated by trained healthcare professionals. More recently, we have seen the introduction of Point-of-Care Ultrasound (“POCUS”) devices with an average price point of $21,000, based on $5,000 to $7,000 per probe, generally requiring two to three probes to cover a comparable range of cleared indications to the single probe Butterfly iQ+. However, these POCUS devices are limited by their application of the same 60 year-old piezoelectric crystal technology with which the traditional cart-based devices operate, leaving limited opportunity for future progress. Although still required to be operated by trained healthcare practitioners, we believe that Butterfly iQ+ is the next generation of point-of-care devices that will further drive costs down and expand the current approximately $8 billion ultrasound imaging market.

In 2018, Legacy Butterfly commercially launched Butterfly iQ, the world’s first handheld, single-probe, whole-body ultrasound system using semiconductor technology that is commercially available, and in 2020, Legacy Butterfly launched the Butterfly iQ+ with additional features and improved performance. Since then, the Butterfly iQ and Butterfly iQ+ has been shipped to more than 30,000 medical professionals globally. Butterfly iQ+’s price through our eCommerce website is $1,999 per device, making it a high-quality and affordable alternative to the costly traditional cart-based equipment and other handheld devices currently on the market. Powered by our Ultrasound-on-Chip™, Butterfly’s high-performance imaging capabilities support fast and confident clinical decision-making. Butterfly iQ+ is comprised of both durable hardware and dynamic software solutions designed to make ultrasound imaging accessible to all healthcare practitioners, including nurses. In the future, we hope to develop and introduce an even more advanced product that can ultimately be used by patients to self-scan ultrasound images with a device and transfer these images to doctors electronically in real-time.

The Butterfly iQ+ is an affordable solution that is designed to help healthcare practitioners save time in their diagnosis and treatment of patients, not only improving overall patient outcomes but also increasing direct revenue per patient encounter while reducing the need for external imaging or specialist referrals. We believe the adoption of the Butterfly iQ and iQ+ device by healthcare practitioners is a positive for all healthcare system stakeholders. Through our ongoing collaborations with the healthcare community, we are continuing to optimize our software ecosystem, including by harnessing AI to develop additional clinical and product advancements for our users. We believe that these efforts could drive ease-of-use for image acquisition, improve analysis, and expand its most utilized features with extensive quality control. Our AI has and is expected to continue to allow us to develop programs that guide and educate healthcare practitioners on how to utilize the Butterfly iQ+ device, with the goal of improving their clinical impact and productivity globally.

7

Legacy Butterfly received 510(k) clearance from the U.S. Food and Drug Administration, or FDA, in 2017 for the Butterfly iQ, which was commercially launched in 2018, and thereafter commercially launched the Butterfly iQ+ under the same 510(k) in 2020. Our ultrasound system has been cleared by the FDA for the following uses: peripheral vessel (including carotid, deep vein thrombosis and arterial studies), procedural guidance, small organs (including thyroid, scrotum and breast), cardiac, abdominal, urology, fetal/obstetric, gynecological, musculoskeletal (conventional), musculoskeletal (superficial) and opththalmic.

Butterfly iQ+ is commercially available in over 20 countries, including the United States, Canada, Australia, New Zealand, throughout greater Europe and in parts of Latin America. Our commercialization strategy is predicated on three primary channels. Namely, we have an eCommerce website through which we sell our Butterfly iQ+ to healthcare practitioners in these geographies. We also have a targeted enterprise salesforce focused on large healthcare system-wide implementations. Lastly, we have distributor, veterinary and affiliate relationships to unlock additional channels to supplement our direct and eCommerce sales. We market our products through our targeted sales organization, which is engaged in sales efforts and promotional activities primarily to health systems or institutions. Outside the United States, we also market our products directly to healthcare institutions. In the United States, we sell to or have agreements in place with most of the top 100 U.S. healthcare systems. Moreover, positive feedback about Butterfly iQ+ among practitioners has historically been a significant driver of sales, as healthcare practitioners share their appreciation for Butterfly iQ within their medical communities, which has yielded a strong net promoter score. A net promoter score is a metric used as a measure of customer satisfaction and word of mouth referrals. A strong net promoter score has been shown to correlate with revenue growth relative to competitors. We calculate our net promoter score by asking our customers the following question: “How likely are you to recommend Butterfly iQ to a friend or colleague” on a scale of 1 (not at all likely) through 10 (extremely likely)? Respondents rating us 6 or below are considered “Detractors,” 7 or 8 are considered “Passives,” and 9 or 10 are considered “Promoters.” To calculate our net promoter score, we subtract the percentage of Detractors from the percentage of Promoters. For example, if 50% of respondents were Promoters and 10% were Detractors, our net promoter score would be 40. We measure net promoter score continuously among cloud users by automatically sending net promoter score survey emails to these users three months after they create their Butterfly user account and every six months thereafter. Because our net promoter score is measured continuously it is subject to fluctuation; however, our net promoter score historically has remained strong. As of March 1, 2021, our net promoter score was 64 (USA) and reflects responses received since we began collecting net promoter score data in 2019, including multiple responses from users that respond to our survey over time. Net promoter scores vary broadly by industry, with averages generally ranging from 18 (health insurance) to 47 (tablet computers) based on data published in 2016 by Satmetrix, co-developer of Net Promoter®. Within technology industries, the top net promoter scores correspond to well-known businesses such as Amazon (66), Apple (66) and Netflix (64) according to Satmetrix. We believe that this method of calculation aligns with medical device industry standards and that this metric is meaningful for investors because of the correlation between net promoter score and future growth.

Outside of our core commercial geographies, Butterfly iQ+ is also being utilized in over 45 low resource settings around the world, where we have partnerships with non-governmental organizations like the Bill & Melinda Gates Foundation to deliver our technology to underserved communities. Currently, we have over 30 global health partnerships in place with organizations that align with our mission to democratize medical imaging and bring lifesaving medical imaging to patients, often for the first time.

Legacy Butterfly was founded in 2011 by Dr. Jonathan Rothberg, a serial entrepreneur who received the Presidential Medal of Technology & Innovation in 2016 for inventing a novel next generation DNA sequencing method and has founded more than 10 healthcare/technology companies, including 454 Life Sciences, Ion Torrent and CuraGen. Legacy Butterfly has raised over $400 million in equity investments and partnership milestones from leading institutional investors, including Baillie Gifford, and strategic partners, including the Bill & Melinda Gates Foundation.

Legacy Butterfly sold and shipped approximately 20,200 devices in the year ended December 31, 2020, an increase from approximately 12,900 devices in the year ended December 31, 2019, representing a growth rate of approximately 56.2% year over year. Legacy Butterfly generated total revenue of $46.3 million and $27.6 million in the years ended December 31, 2020 and 2019, respectively. Legacy Butterfly also incurred net losses of $162.7 million and $99.7 million for the years ended December 31, 2020 and 2019.

Our Competitive Strengths

We believe that our competitive strengths include the following:

| · | Large Global Ultrasound Market and Potential to Expand to a Larger Market of Healthcare Practitioners and Patients. We believe our solution addresses an unmet need across an addressable market of 40 million healthcare practitioners, including approximately 12 million medical doctors and approximately 28 million nurses and midwives worldwide. We believe our solution can address this market, which is significantly larger than the existing $8 billion ultrasound market, because our solution not only provides a next generation alternative to legacy cart-based systems, but more importantly empowers practitioners who desire to modernize their healthcare practice with a diagnostic device and software system that is smart, mobile, interoperable, and easy to use. Furthermore, existing handheld devices, which only comprise 3% of the global ultrasound units as of 2017, have been unable to satisfy demands of users because they are often using outdated technology, which leads to higher cost, reduced imaging capacity, lack of user-friendly interfaces, and difficulties with integration with other systems. |

8

The low penetration from handheld devices in a sizable market provides us with significant opportunity for growth. We also believe that the portability, ease-of-use, fast frame rates and other differentiating features of our ultrasound imaging technology could be attractive to consumers. We believe our differentiated Butterfly iQ handheld device and our growing user base of Butterfly iQ practitioners, with sales to or agreements with most of the top 100 U.S. healthcare systems and across more than 40 countries, position us well to compete in the existing ultrasound market and to potentially expand into emerging markets.

| · | Our Innovative Technology is Well-Positioned for a Health Economy Focused on Affordability and Access to Care. We believe the small, handheld size, relatively low cost, quality imaging, and interface designed for ease-of-use are attractive to healthcare systems that seek to contain healthcare costs and improve access to care, when compared to the limitations and expense of traditional cart-based systems and existing handheld devices. These attributes also allow the use of our Butterfly iQ+ by practitioners beyond traditional health system environments to pre-hospital settings, urgent care clinics, long-term care and rehabilitation centers, dialysis centers, ambulatory surgery centers, veterinary clinics and emerging markets. In time, we believe these attributes could also be attractive to health-centric consumers, which could allow us to potentially further expand beyond traditional healthcare environments to the home and alternate sites of care should appropriate marketing authorizations be obtained for such intended uses. The advantages of our technology align with recent industry trends, including the shift to in-home medical care, affordability, harnessing of AI / Big Data, collaboration through the cloud, disruptive medical innovation, and increasing access to care. In addition, by expanding the settings in which medical imaging can be done, the Butterfly iQ+ device may provide opportunities for earlier detection and prevention of disease, while reducing cost. This aligns with the focus on consumer health empowerment, wellness, and acceleration of value-based care, all of which are themes seen consistently in the healthcare industry today. |

| · | Our Proprietary, Disruptive and Revolutionary Product is Designed to Address an Unmet Need in the Medical Imaging Market. Legacy Butterfly is the first company to have successfully put ultrasound on a semiconductor chip. This novel and proprietary Ultrasound-on-Chip™ technology enables whole-body complete ultrasound imaging with a single probe. We are continuing to improve our software by harnessing AI with a goal to drive ease-of-use for image acquisition, improve analysis, guide and educate practitioners, and provide quality control. As a result of utilizing these technologies, our Butterfly iQ product has a small, hand-held size, low cost, and simple user interface, making ultrasound technology more accessible outside of large healthcare institutions. This contrasts sharply to existing systems that are built using often expensive piezoelectric crystal technology, which can lead to high upfront costs and thereby constrain access and usage. |

Additionally, the technology driving the Butterfly iQ and Butterfly iQ+ devices may be able to continually scale and improve if Moore’s Law, which is a historical trend that the number of transistors on an integrated circuit will increase over time, remains accurate. For example, the Butterfly iQ+, which was commercially launched in October 2020, is much less expensive to produce, yet has faster frame rates and further enhanced interoperability than the Butterfly iQ, which was commercially launched in 2018, and we expect these trends to continue in future products. One aspect of our software strategy is our Software Development Kit, or SDK, which is meant to provide a governed ecosystem for third parties to create content and applications that will serve to enrich the overall software ecosystem and deliver additional clinical and product advancements for our users. To date, we are working with partners, including the Bill & Melinda Gates Foundation, to build applications on our SDK that we expect to then validate, obtain any necessary marketing authorizations for, and deploy to our users. The SDK is important to our software strategy and overall mission of democratizing medical imaging. Through these product enhancements, and SDK specifically, we believe our solution will be the primary platform for point of care ultrasound, functioning as an operating system in which new features can continually be built onto and a central component of all handheld imaging.

We expect to continue development of the hardware with product offerings that may include enhanced performance, improved image quality and alternative form factors.

Furthermore, as of December 31, 2020, we owned approximately 280 issued patents and approximately 540 pending patent applications. In total, we own approximately 175 patent families directed to its ultrasound products, including manufacturing, circuit components, and add-on features.

9

| · | Strong Topline Growth, with Subscription-based Recurring Revenue to Enable Long-Term Expansion in Gross Margin. Since the commercial launch of the Butterfly iQ device in 2018, Legacy Butterfly has experienced strong topline growth. Legacy Butterfly’s total revenue for the years ended December 31, 2020 and 2019 was $46.3 million and $27.6 million, respectively, representing an increase of $18.7 million. We continue to seek to grow our user base of Butterfly iQ practitioners and our enterprise sales to health systems to help us further penetrate the global ultrasound market. During the year ended December 31, 2020, Legacy Butterfly’s product revenue represented approximately 82.9% of its total revenue for the year, and subscription revenue represented the remaining 17.1% of its total revenue for the year. As our devices continue to be adopted by more healthcare practitioners and practitioners in the Butterfly network continue to use our devices, we expect total subscription revenue to increase and that our subscription revenue will become an increasingly important contributor to our overall revenue. Because the cost and associated expenses to maintain our software are less than the costs and associated expenses of manufacturing and selling our device, we also anticipate an improvement in our gross margin over time. Additionally, we believe that the recurring nature of subscription revenue should be subject to less period-to-period fluctuation than our product revenue. Because our AI-backed software enables interoperability, mobility, and ease-of-use for scanning, we have been able to execute software-only sales deals with enterprise customers, and we expect to continue to do so in the future. This further reduces fluctuation of our revenue and continues to improve our margin. Finally, as we continue to enhance our product to become the primary platform for point-of-care ultrasound, we expect that add-on features and platform-associated accessories will generate additional revenue at minimal cost, continuing to create margin improvement, while increasing growth. |

| · | Visionary founder backed by strong executive leadership team and experienced financial partner with deep expertise in healthcare. Legacy Butterfly’s Founder and our Chairman, Dr. Jonathan Rothberg, has dedicated his career to enabling breakthrough technologies to revolutionize healthcare. He has founded more than 10 healthcare/ technology companies and has received numerous awards, including the Presidential Medal of Technology & Innovation in 2016. He is supported by a world-class management team, including our executive officers and other senior management, with approximately 140 years of collective experience in healthcare and consumer end-markets. We believe this leadership team positions us well as a disruptive force in revolutionizing medical imaging. In addition, Longview’s sponsor, Longview Investors LLC, (the “Sponsor”) an affiliate of Glenview Capital Management, LLC (“Glenview”), brings to the Company extensive public market experience in the healthcare industry with a long-term orientation across provider, payor, distributor and medical product companies. |

Our Strategies

We believe that our strategies include the following:

| · | Innovation: Unwavering commitment to leading edge technical innovation. As the first semiconductor-based point-of-care ultrasound, the Butterfly iQ and iQ+ solution is a leading part of the medical imaging revolution. Through leveraging this novel technology, our solution can process and store high quality images that can then be transferred between systems, an interoperability valued by customers in today’s current market. We believe that with our current solution, we have created a new standard for medical imaging and we are focused on remaining on the leading edge of technical innovation. We believe our solution is only the first step in our development and we plan to continually improve this product and expand our product and service offerings. We recently launched the next-generation product Butterfly iQ+ in October 2020, which has improved image quality, durability, and new functionalities such as bi-plane and needle visualization through Needle VizTM technology and 3D scanning. |

We plan to develop future applications, subject to appropriate marketing authorization, to leverage our unique hardware foundation and commitment to improving our software using AI. Simultaneously, we plan to enhance our device’s software capabilities, pursuing marketing authorizations as necessary, with new features such as anatomical labeling, image quality improvements, and further workflow automations, in order to more deeply integrate our platform with hospital systems. Additionally, our SDK allows users to create content and applications on our platform that, subject to validation and any necessary marketing authorization, can be deployed across all users, further enhancing our software offerings. In this way, our solution will continue to innovate naturally, as well as through our enhancements to our proprietary technology. In order to pave the way for the potential future at-home use of Butterfly iQ+ and other future form factors, we anticipate we will need to validate the at-home applications through focused clinical trials and also seek additional marketing authorizations.

We believe these hardware developments, along with our software enhancements and user education initiatives, will bring ultrasound to new markets and users. We believe that with our differentiated and continually expanding solution, we can drive user adoption in new markets. Beyond these hardware and software product roadmaps, we plan to use the “Butterfly Labs” innovation center to develop new innovative products, services and software applications, leveraging our core technology and platform capabilities.

10

| · | Democratization: Enabling universal adoption of personal medical imaging. We believe the mobility, ease-of-use, affordability, and interoperability of our solution offer a compelling and differentiated alternative to existing devices and have broad applicability across new areas of unmet need. With these differentiating characteristics, our solution not only provides a next generation alternative to legacy cart-based ultrasound systems, but expands the addressable market into a significant amount of new ultrasound scan settings. Our initial customers consist of primary care physicians, emergency doctors, and anesthesiologists, all of whom may have access to a shared ultrasound system, but purchase our product in order to have their own device to carry with them as they practice. Based on their interest and adoption of our solution, we view our global addressable market as 40 million healthcare practitioners, consisting of 12 million medical doctors and 28 million nurses and midwives, significantly greater than the $8 billion traditional ultrasound market. |

We have only begun to penetrate this healthcare practitioner market and plan to continue to grow this through continually increasing adoption and maintaining high user retention. Initially, we have focused on the approximately three million medical practitioners across anesthesiology, primary care, medical education, emergency medicine, hospital medicine, musculoskeletal treatments, and urology as well as five million nurses in our core geographies. Currently, our device is commercially available in over 20 countries including the United States, Canada, Australia, New Zealand, throughout greater Europe and in parts of Latin America. With such a large addressable market, we believe we can expand successfully over time into geographies across Latin America and Asia, as well as other geographies in Europe, the Middle East and Africa.

We believe our device’s affordability (all-in hardware and software estimated cost of less than $3 per day over an illustrative 3 year ownership period with Butterfly’s individual user license software subscription), mobility, and ease-of-use, will drive further penetration and adoption in our existing markets and geographies. We believe our roadmap for product enhancements will supplement this penetration as well as provide avenues for expansion to new markets. One of our largest growth opportunities is the potential expansion into remote patient monitoring and products designed for use in the home, subject to appropriate marketing authorizations. This potential market contains more than 100 million patients with chronic diseases in the United States alone, including more than 25 million patients in the United States with urinary incontinence, more than 5 million patients in the United States with congestive heart failure, and approximately 500,000 patients in the United States in need of regular dialysis. We believe that, subject to appropriate marketing authorization, this technology could enable patient-driven scanning for monitoring of chronic disease. We believe our application-based platform allows for even further personalization to improve health outcomes over time. Eventually, as these applications are deployed across the whole user base, we believe this would create a cycle, leading to more product enhancement and drawing in more users. Ultimately, we strive to create a solution that will be the primary operating system for all ultrasound scanning.

We believe that through the penetration of the existing addressable market, and the potential subsequent expansion into new markets and geographies that currently do not use medical imaging technology, we can bring the adoption of medical imaging to greater scale than ever achieved before.

| · | Creating value socially, clinically, and economically. Our mission is to democratize healthcare through providing access to medical imaging at an affordable cost. Because the Butterfly iQ+ is mobile and easy-to-use, healthcare practitioners can expand their use of ultrasound outside of traditional settings, increasing convenience for both practitioners and patients. Additionally, frequent and easier access to scanning has the potential to allow practitioners to detect malignancies earlier and thereby, recommend earlier medical intervention. This could improve health outcomes, while avoiding expensive treatments, generating economic value for both the patient and payor, which is aligned with the healthcare mega-trend of value-based care. As our device reaches new markets and new users and, with appropriate marketing authorizations, enables more direct interaction with patients, including remote patient monitoring, we believe this trend will accelerate, further improving outcomes and reducing costs. This reduction of costs has the potential to create economic value for the whole healthcare system across all clinical applications and markets where ultrasound scanning is used. |

In addition to social impact, we believe our solution will also have significant clinical impact. Through our software solution, empowered by AI, users can upload scanned images to our HIPAA-compliant cloud, which has unlimited storage, links to hospital and office systems, and can be accessed from a desktop computer. This allows practitioners to access and transfer their scanned images in a seamless and secure way, leading to additional opportunities for observation and therefore, we believe, earlier diagnosis and treatment. Furthermore, our solution delivers billing codes directly in the user interface application following scanning, both enhancing practitioner compliance adherence and increasing revenue in fee-for-scan environments. In these ways, we believe the technology behind our solution and the data that it is able to gather can provide new and meaningful clinical insights.

Beyond optimizing care in developed markets, our solution has the potential to expand into markets and geographies that traditionally have restricted access to care, through its mobility, ease-of-use and affordability. By providing an imaging solution that can connect to practitioners remotely and backing this solution with continued clinical investment, we believe our solution can significantly increase access to healthcare, empowering healthcare practitioners to not only help their patients live safer and healthier lives but also provide medical imaging to patients who otherwise would not have access or could not afford it. We plan to reach these markets primarily through non-profits, non-government organizations, or NGOs, and in some cases, military and paramedic channels. We believe the accessibility our solution brings could have a profound social impact on these markets.

11

| · | Obsessed by customer success, deploying differentiated channel go-to-market approaches. Our primary focus is our users’ and customers’ satisfaction, which has yielded a strong net promoter score of 64 (USA). Word of mouth is the number one driver of sales currently. We intend to grow through providing excellent customer service coupled with our differentiated and evolving product offering. We have approximately eight customer service representatives, dedicated to educating healthcare practitioners on the unique features of our solution, and we have also published numerous training videos and tutorials in response to frequently asked questions. We have invested heavily in building out and educating our salesforce and sales support teams, and plan to continue to do so, with the ultimate goal of creating an intuitive and informative customer experience. As we continue to grow, we plan to expand on our educational tools and resources for our customers to guide them in using our products. We believe that we can build a community of users around our solution to share insights, techniques, and new regulatory compliant ways of applying our solution, all of which we believe will continue to drive adoption and retention. |

Furthermore, to increase customer accessibility to our device, we sell through multiple channels, including eCommerce; enterprise (direct); and distributor, veterinary and affiliates. With its interoperability, image transfer / storage, and mobility / remote-monitoring capabilities, our solution can integrate and connect with critical healthcare interfaces such as EMR and imaging systems, critical to coordinated delivery of care. This has helped us to build relationships with and make sales to or agreements with most of the top 100 U.S. healthcare systems, leading to many of our large volume enterprise (direct) sales. Additionally, our sales channel and support has strengthened these relationships. These relationships have increased user accessibility to our solution and the breadth of our network.

As we continue to simplify enterprise workflow and develop relationships with larger health systems, we have experienced an increase in the proportion of our sales from enterprise sales compared to eCommerce. Because institutions often make decisions to purchase on a system-wide level, enterprise sales typically generate economies of scale with larger volumes and larger numbers of users, while also increasing user retention. The enterprise channel also yields a higher subscription price, which further increases our profitability on devices and subscriptions sold. We are working towards increasingly integrated solutions to maximize our value to large healthcare customers, as well as continuing to improve our sales and support infrastructure. Our ability to connect and govern traditional third party ultrasound systems gives enterprise customers a solution to the governance and workflow challenges that have limited the utilization and billing of point of care imaging devices. Enterprise customers deploying our solution can benefit from a streamlined clinical workflow that reduces the exam documentation burden typically associated with traditional ultrasound systems. By adopting Butterfly Enterprise software, customers can responsibly manage and optimize value from their fleets of point of care imaging devices.

During the year ended December 31, 2020, Legacy Butterfly’s device sales generated approximately 82.9% of its revenue, with its subscription revenue comprising the remaining 17.1%. As adoption of our devices increases through further penetration and healthcare practitioners in the Butterfly network continue to use our devices, we expect our revenue mix to shift toward subscriptions. Because the cost and associated expenses to maintain our software are less than the costs and associated expenses of manufacturing and selling our device, we anticipate an improvement in margin over time.

| · | Talent inspired and unified by mission. With over approximately 140 years of collective experience in healthcare and consumer end-markets among our executive officers and senior management, our management team is unified by our mission to democratize healthcare by making medical imaging accessible globally. We seek to execute at scale the vision of Legacy Butterfly’s Founder and our Chairman, Dr. Jonathan Rothberg. Our President and Chief Executive Officer, Todd M. Fruchterman, M.D., Ph.D. has extensive experience in the healthcare industry, most recently as Group President, Reliability Solutions at Flex Ltd., and prior to that in various leadership roles at 3M Company, including President and General Manager, Medical Solutions, the largest division of the company, and as President and General Manager, Critical & Chronic Care Solutions, Senior Vice President R&D, Regulatory Affairs, Chief Technology Officer, and Chief Medical Officer. Dr. Rothberg and Dr. Fruchterman are supported by a leadership team with many years of technology, consumer and healthcare experience at leading companies, including Amazon, MedStar Health, Optum and Medtronic. We plan to continue to add talented and experienced members to our team and maintain our commitment to our mission of democratizing healthcare by making medical imaging accessible globally. |

12

We are also supported by long-term investors that share this commitment to our mission. Longview’s Sponsor, an affiliate of Glenview, brings to the Company extensive public market experience in the healthcare industry with a long-term orientation across provider, payor, distributor and medical product companies. Our long-term investors include Baillie Gifford, The Bill & Melinda Gates Foundation and Fosun Industrial Co., Limited, and other investors that have invested in us to promote and enable our vision.

Finally, to enact our vision, we have developed strong relationships with healthcare institutions as we have sold to or have agreements with most of the top 100 United States health systems. We believe these institutions and our relationships with them are key elements that underpin our ability to achieve our mission. Together with these institutions, we have the potential to bring our imaging solution to millions of patients, reducing healthcare costs and improve outcomes on an enormous scale.

Industry & Market Opportunity

Medical imaging has existed for over 100 years with the purpose of effectively diagnosing and treating patients. The global ultrasound market has historically consisted of the legacy cart-based incumbents and more recently developed point-of-care / handheld devices. Built using expensive piezoelectric crystal technology, these legacy systems limit wider access and usage due to high upfront costs. Legacy cart-based incumbent devices that are used in traditional hospital systems have a mid-range price point of $45,000 to $60,000 per new system, in addition to burdensome maintenance or service contracts. These devices are often siloed within hospitals and health systems requiring referrals and coordination between different departments, and extensive training for the personnel that operate them, limiting utilization of these devices. Limited IT integration and interoperability capabilities have resulted in image archives that are difficult to move between systems, presenting yet another barrier to care coordination and optimization. The point-of-care / handheld competitors are less expensive than legacy cart-based systems, with price points ranging from $5,000 to $7,000 per probe, generally requiring two to three probes to cover a comparable range of cleared indications to the single probe Butterfly iQ+. Historically, these competitive point-of-care / handheld competitors lack the AI capabilities that the Butterfly iQ+ provides healthcare practitioners and are less core focal points of large capital equipment focused sales forces, which creates a unique opportunity for us to not only disrupt and take market share in the existing market, but create and be the leader in new markets.

Between these legacy cart-based incumbent devices and the point-of-care / handheld competitors, the global ultrasound market in 2017 was valued at approximately $8 billion, consisting of $6 billion in equipment and $2 billion in services. This market is currently limited to traditional scan settings in developed markets, such as hospitals, niche doctor offices, and imaging centers. Per IHI Markit data, less than 3% of global ultrasound units are handheld devices. General Electric, Phillips, Canon Medical Systems (f/k/a Toshiba), Hitachi and Siemens Healthineers are the top five incumbent ultrasound players.

Through development of our proprietary technology, we were the first company to successfully put ultrasound on a semiconductor chip and connect it to an iPhone, tablet or Android for ease-of-use. This has allowed us to create a solution that has the potential to disrupt the current ultrasound market and significantly expand the total addressable market beyond its current limitations. Butterfly iQ+ takes a small form factor, allowing the user to transport the device anywhere. Butterfly iQ+’s price through our eCommerce website is $1,999 per device and when factoring in an illustrative single-user software subscription license over a three year period is estimated to be less than $3 per day, which enables a material return on investment for healthcare practitioners given common pre-existing CPT codes ranging from $20-150. Finally, our software harnesses AI designed to drive ease-of-use for image acquisition, improve analysis, guide and educate healthcare practitioners, and provide quality control. The Butterfly iQ is designed to be intuitive and greatly reduces the amount of training needed for operation, thereby expanding the ultrasound user base to non-experts, and eventually to patients directly, subject to clearance of at-home uses by the appropriate regulatory authorities. We believe the mobility, affordability, and ease-of-use characteristics of the device will empower users to operate the Butterfly iQ device outside traditional scan settings, such as pre-hospital environments, urgent care clinics, long-term care and rehabilitation centers, dialysis centers, ambulatory surgery centers, veterinary clinics, and potentially, the home, all in both developed and emerging markets. We believe that the Butterfly iQ can greatly increase accessibility to medical imaging and enable the development of new ultrasound markets with expanded users (practitioners and patients) and scan settings globally that are uncommon or nonexistent today.

13

By increasing accessibility to medical technology outside of traditional settings, the Butterfly iQ has the potential to significantly expand the current total addressable market for medical imaging. We believe there is strong interest from healthcare practitioners to utilize handheld ultrasound devices in their day-to-day work, as primary care practitioners represent our largest group of users. We believe the Butterfly iQ device has the potential to reach up to 40 million global healthcare practitioners, across both developed and emerging markets. Of the approximately 40 million global healthcare practitioners, we view a subset of approximately eight million as our initial target market, which is comprised of approximately three million medical doctors across anesthesiology, primary care, medical education, emergency medicine, hospital medicine, musculoskeletal, and urology, as well as approximately five million nurses, defined as one-third of the nurses and midwives, all within our core geographies of North America, Asia, Europe and Latin America. Beyond this initial market, we believe there are approximately nine million additional medical doctors (12 million total) and approximately 23 million additional nurses and midwives (approximately 28 million total) that would benefit from use of handheld ultrasound devices.

Furthermore, as patient-focused, value-based care delivery models continue to scale, we believe handheld ultrasound devices will find a potential market with at-home medical personnel and, subject to appropriate marketing authorizations, with patients directly.

Products & Services

We provide a complete solution to address an unmet need in point-of-care medical imaging through a unique combination of hardware and software services. Our hardware is powered by the first and only currently available ultrasound on a semiconductor chip. Our software addresses the traditional ease-of-use challenges and the complex clinical workflow throughout a patient’s care pre-and post-examination. Our integrated system with EMRs provides healthcare practitioners with a tool that enables fast and confident clinical decision-making.

14

As a diagnostic tool with broad applicability across numerous medical specialties, Butterfly iQ+ has the potential to serve as the go-to device for healthcare practitioners in determining approaches to treatment. We believe there is strong applicability for ultrasound devices across anesthesiology, primary care, medical education, emergency medicine, hospital medicine, musculoskeletal, and urology. Historically, technology and excessive costs have limited the use of ultrasound devices. As new technology has catalyzed the mobility and ubiquity of medical imaging, the range of uses for ultrasound devices has greatly expanded. This momentum is supported by clinical evidence that shows that use of ultrasound devices in this modality can improve patient health outcomes, while significantly lowering the cost of care. The high cost of ultrasound imaging has deterred some medical professionals from utilizing these devices to prevent the unnecessary costs on providers or patients. However, the Butterfly iQ device offers providers the use of these images at a low cost that may promote early detection of patient malignancies that, in turn, reduces costs for providers and reduces the need for external imaging, specialist referrals, and emergency room visits. High-risk patients who suffer from congestive heart failure and pulmonary diseases will be able to receive regular ultrasound imaging at a low cost, which is associated with reduced emergency visits and overall patient costs.

Our Ultrasound-on-Chip™ technology enables whole-body complete ultrasound imaging with a single probe, as the Butterfly iQ and iQ+ have a frequency range that enables our device to produce ultrasound imaging anywhere on the body. Our solution is the only ultrasound transducer that can perform whole-body imaging in a single handheld probe using semiconductor technology. In addition, the 60 year-old piezoelectric crystal technology used in existing devices has been less affordable and has not been able to achieve the same versatility or system interoperability. Because our device is portable, practitioners can easily carry this device with them, providing access to ultrasound virtually anywhere. While currently our device is used in traditional scan settings, such as hospitals, imaging centers, and physicians’ offices, we believe our device’s mobility will enable expansion to pre-hospital settings, urgent care clinics, long-term care and rehabilitation centers, dialysis centers, ambulatory surgery centers, veterinary clinics, and, subject to marketing authorization, homes.

We currently sell the Butterfly iQ+ device through our eCommerce website, with an optional accompanying software membership at various prices depending on the type of subscription. We offer a Pro subscription with one user license included, a Pro Team subscription with five user licenses included, and an enterprise subscription with tiered level pricing. We also sell accessories that supplement our device, including a carrying case, charger (complimentary with the purchase of the device), holster, and cable accessories. Legacy Butterfly has been selling the first generation Butterfly iQ since 2018 and launched the second generation Butterfly iQ+ in October 2020.

15

Our Butterfly iQ+ device connects directly to an iPhone or Android smartphone and tablet to provide its imaging and software features for more than two consecutive hours and charges to full battery in approximately five hours. Our proprietary software harnesses AI designed to drive ease-of-use for image acquisition and improved analysis, further used to guide and educate practitioners, as well as provide quality control. The Butterfly iQ+ has 20 pre-set settings generated in part with AI that optimize images obtained from scanning different areas of the body. Within the Butterfly application, users can utilize five imaging modes, including B-Mode, Color Doppler, M-Mode Power Doppler and Pulsed Wave Doppler, as well as additional measuring tools and obstetrician calculations. These features allow healthcare practitioners to perform surface area and volume measurements on the anatomical objects that are imaged and can use color Doppler to identify movement of fluid, similar to features provided by legacy products in the market. For the obstetric clinicians, the device tools can perform gestational age and amniotic fluid index calculations. We believe these pre-set settings and intuitive operation features through smartphones will enable healthcare practitioners who are not medical imaging experts to adopt our device, expanding our user base beyond the traditional, limited ultrasound user base. This traditional base of ultrasound users has been limited because existing ultrasound devices often require unique environments and extensive training to operate, while the Butterfly iQ+ device can be used by general and other healthcare practitioners across the healthcare industry.

16

3D Bladder scan with AI-based Auto Bladder Volume tool /

Education and Image Storage /

Color Doppler tool

Through our software subscription options, users can upload scanned images to our HIPAA-compliant cloud, which has unlimited storage and links to hospital and office systems, allowing for seamless transfer of images that can also be accessed from a desktop computer. As telemedicine continues to make headway through our healthcare system, our software application features TeleGuidance, which is the world’s first integrated ultrasound telemedicine platform. This tool, if eventually approved, would allow a remote, trained healthcare practitioner to view the ultrasound imaging through the smartphone application and live video. Our platform also features education tools to enable users to quickly gain proficiency in conducting exams. As we continue to expand on these features, our software updates are implemented real-time, equipping users with new features and techniques with each update.

17

Our Butterfly iQ+ device is competitively priced at $1,999 per device through our eCommerce website, and combined with our standard single-user software license, the total estimated cost of use amounts to a daily average of less than $3, assuming an illustrative three year ownership period. This compares to the cost of $5,000 to $7,000 per device for point-of-care / handheld competitors, generally requiring two to three probes to cover a comparable range of cleared indications to the single probe Butterfly iQ+, and pricing of legacy cart-based incumbents, which are $5,000 to $30,000 per new device on the low end and can be as much as $100,000 to $250,000 per new device on the high end, before service and maintenance fees. Additionally, the Butterfly iQ+ device’s remote capabilities, interoperability with other systems, ease-of-use, and affordability allow trained practitioners to perform ultrasounds from any location where healthcare is provided and we believe will eventually increase the user base to consumers and non-experts should the appropriate marketing authorizations be obtained for such intended uses, in accordance with our mission to democratize healthcare by increasing accessibility to medical imaging. We believe this user base expansion and subsequent adoption is our largest growth driver and represents the forefront of a medical imaging revolution.

Furthermore, we believe our device’s ability to perform ultrasound outside of traditional environments and by non-expert users will allow for prevention and earlier detection and enable healthcare practitioners outside of traditional environments to use ultrasound to make more precise diagnosis of malignancies. This provides patients with faster access to treatment, ultimately reducing cost and improving patient health outcomes. The reduced cost will also result from lower-cost medical professionals performing diagnosis, enabled by the device’s intuitive user interface. We believe our device is also more convenient for patients, as the device can be brought to the patient at the bedside (or, subject to future marketing authorizations, to their home), thereby reducing or eliminating patient wait times while providing secure patient image access. With our device’s differentiating characteristics, we believe our business is aligned with long-term healthcare mega-trends, most notably the acceleration of value-based and patient-centric approach to care.

We believe that the software and analytics capabilities of our solution coupled with the next generation Butterfly iQ+ device empowers smarter and expanded scanning and compliant coding and documentation that can generate both incremental revenue for healthcare systems and independent practitioners, but also reduce costs for payers from earlier detection and prevention of adverse downstream events due to suboptimal care decisions or treatment complications. The Butterfly iQ+ leverages pre-existing, routine CPT codes that enable healthcare providers and practitioners to obtain per-scan reimbursement in the specialties of anesthesiology, cardiology, critical care, emergency medicine, endocrinology and ultrasound-guided procedures. We intend to pursue incremental, new or expansionary CPT codes for reimbursement in future scan categories and categories concurrent to support the successful go-to-market strategy of the product pipeline.

Product Roadmap

Our product roadmap will continue to position us as a leading disruptor in the medical imaging market and remote patient monitoring market, which we believes consists of over 100 million patients in the United States alone. As the first semi-conductor based point-of-care ultrasound, the original Butterfly iQ product launched in 2018 was a differentiated product. We plan to continually improve this product, which will allow us to continue to innovate up the performance curve. A first step to this was the launch of the next-generation product Butterfly iQ+ in 2020, which has improved image quality, industry-leading durability, and new functionalities such as bi-plane needle visualization through Needle VizTM technology and 3D scanning.

We expect to continue development of the hardware with product offerings that may include enhanced performance, improved image quality and alternative form factors.

18

In addition to our hardware innovations, we employ a team of computer scientists focused on developing software features that enhance our device’s user interface and increase ease-of-use to continue to expand our user base. Through our intuitive features and continued user education initiatives, we expect to generate high adoption rates among healthcare practitioners and further expand our user base into the patient’s home subject to obtaining the appropriate marketing authorizations. Furthermore, we believe our SDK will continue to drive additional enhancements generated by our user base, simultaneously increasing the applicability of our solution and driving adoption and retention in our addressable market.