step-2021093000017960223/312022Q2false00017960222021-04-012021-09-30xbrli:shares0001796022us-gaap:CommonClassAMember2021-11-090001796022us-gaap:CommonClassBMember2021-11-09iso4217:USD00017960222021-09-3000017960222021-03-31iso4217:USDxbrli:shares0001796022us-gaap:CommonClassAMember2021-03-310001796022us-gaap:CommonClassAMember2021-09-300001796022us-gaap:CommonClassBMember2021-09-300001796022us-gaap:CommonClassBMember2021-03-310001796022srt:SubsidiariesMember2021-09-300001796022srt:SubsidiariesMember2021-03-310001796022step:LegacyEntitiesMember2021-09-300001796022step:LegacyEntitiesMember2021-03-310001796022step:PartnershipOfSubsidiaryMember2021-09-300001796022step:PartnershipOfSubsidiaryMember2021-03-310001796022us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-09-300001796022us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-03-310001796022step:ManagementAndAdvisoryFeesNetMember2021-07-012021-09-300001796022step:ManagementAndAdvisoryFeesNetMember2020-07-012020-09-300001796022step:ManagementAndAdvisoryFeesNetMember2021-04-012021-09-300001796022step:ManagementAndAdvisoryFeesNetMember2020-04-012020-09-300001796022step:IncentiveFeesMember2021-07-012021-09-300001796022step:IncentiveFeesMember2020-07-012020-09-300001796022step:IncentiveFeesMember2021-04-012021-09-300001796022step:IncentiveFeesMember2020-04-012020-09-300001796022step:CarriedInterestAllocationRealizedMember2021-07-012021-09-300001796022step:CarriedInterestAllocationRealizedMember2020-07-012020-09-300001796022step:CarriedInterestAllocationRealizedMember2021-04-012021-09-300001796022step:CarriedInterestAllocationRealizedMember2020-04-012020-09-300001796022step:CarriedInterestAllocationUnrealizedMember2021-07-012021-09-300001796022step:CarriedInterestAllocationUnrealizedMember2020-07-012020-09-300001796022step:CarriedInterestAllocationUnrealizedMember2021-04-012021-09-300001796022step:CarriedInterestAllocationUnrealizedMember2020-04-012020-09-3000017960222021-07-012021-09-3000017960222020-07-012020-09-3000017960222020-04-012020-09-300001796022step:LegacyCarriedInterestAllocationMember2021-07-012021-09-300001796022step:LegacyCarriedInterestAllocationMember2020-07-012020-09-300001796022step:LegacyCarriedInterestAllocationMember2021-04-012021-09-300001796022step:LegacyCarriedInterestAllocationMember2020-04-012020-09-300001796022srt:SubsidiariesMember2021-07-012021-09-300001796022srt:SubsidiariesMember2020-07-012020-09-300001796022srt:SubsidiariesMember2021-04-012021-09-300001796022srt:SubsidiariesMember2020-04-012020-09-300001796022step:LegacyEntitiesMember2021-07-012021-09-300001796022step:LegacyEntitiesMember2020-07-012020-09-300001796022step:LegacyEntitiesMember2021-04-012021-09-300001796022step:LegacyEntitiesMember2020-04-012020-09-300001796022step:PartnershipOfSubsidiaryMember2021-07-012021-09-300001796022step:PartnershipOfSubsidiaryMember2020-07-012020-09-300001796022step:PartnershipOfSubsidiaryMember2021-04-012021-09-300001796022step:PartnershipOfSubsidiaryMember2020-04-012020-09-300001796022us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-06-300001796022us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-06-300001796022us-gaap:AdditionalPaidInCapitalMember2021-06-300001796022us-gaap:RetainedEarningsMember2021-06-300001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300001796022srt:SubsidiariesMemberus-gaap:NoncontrollingInterestMember2021-06-300001796022step:LegacyEntitiesMemberus-gaap:NoncontrollingInterestMember2021-06-300001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMember2021-06-3000017960222021-06-300001796022us-gaap:RetainedEarningsMember2021-07-012021-09-300001796022srt:SubsidiariesMemberus-gaap:NoncontrollingInterestMember2021-07-012021-09-300001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMember2021-07-012021-09-300001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012021-09-300001796022us-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300001796022us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-07-012021-09-300001796022us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonClassAMember2021-07-012021-09-300001796022step:PartnershipOfSubsidiaryMemberus-gaap:CommonClassAMemberus-gaap:NoncontrollingInterestMember2021-07-012021-09-300001796022us-gaap:CommonClassAMember2021-07-012021-09-300001796022us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonClassCMember2021-07-012021-09-300001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMemberus-gaap:CommonClassCMember2021-07-012021-09-300001796022us-gaap:CommonClassCMember2021-07-012021-09-300001796022us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-07-012021-09-300001796022step:LegacyEntitiesMemberus-gaap:NoncontrollingInterestMember2021-07-012021-09-300001796022us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-09-300001796022us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-09-300001796022us-gaap:AdditionalPaidInCapitalMember2021-09-300001796022us-gaap:RetainedEarningsMember2021-09-300001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300001796022srt:SubsidiariesMemberus-gaap:NoncontrollingInterestMember2021-09-300001796022step:LegacyEntitiesMemberus-gaap:NoncontrollingInterestMember2021-09-300001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMember2021-09-300001796022us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-03-310001796022us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-03-310001796022us-gaap:AdditionalPaidInCapitalMember2021-03-310001796022us-gaap:RetainedEarningsMember2021-03-310001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001796022srt:SubsidiariesMemberus-gaap:NoncontrollingInterestMember2021-03-310001796022step:LegacyEntitiesMemberus-gaap:NoncontrollingInterestMember2021-03-310001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMember2021-03-310001796022us-gaap:RetainedEarningsMember2021-04-012021-09-300001796022srt:SubsidiariesMemberus-gaap:NoncontrollingInterestMember2021-04-012021-09-300001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMember2021-04-012021-09-300001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012021-09-300001796022us-gaap:AdditionalPaidInCapitalMember2021-04-012021-09-300001796022us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-04-012021-09-300001796022us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonClassAMember2021-04-012021-09-300001796022step:PartnershipOfSubsidiaryMemberus-gaap:CommonClassAMemberus-gaap:NoncontrollingInterestMember2021-04-012021-09-300001796022us-gaap:CommonClassAMember2021-04-012021-09-300001796022us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonClassCMember2021-04-012021-09-300001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMemberus-gaap:CommonClassCMember2021-04-012021-09-300001796022us-gaap:CommonClassCMember2021-04-012021-09-300001796022us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-04-012021-09-300001796022step:LegacyEntitiesMemberus-gaap:NoncontrollingInterestMember2021-04-012021-09-300001796022step:PartnersCapitalMember2020-06-300001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300001796022us-gaap:NoncontrollingInterestMember2020-06-3000017960222020-06-300001796022step:PartnersCapitalMember2020-07-012020-09-150001796022us-gaap:NoncontrollingInterestMember2020-07-012020-09-1500017960222020-07-012020-09-150001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012020-09-150001796022srt:SubsidiariesMemberus-gaap:NoncontrollingInterestMember2020-07-012020-09-150001796022us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-07-012020-09-150001796022us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-07-012020-09-150001796022us-gaap:AdditionalPaidInCapitalMember2020-07-012020-09-150001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMember2020-07-012020-09-150001796022us-gaap:AdditionalPaidInCapitalMember2020-09-162020-09-300001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMember2020-09-162020-09-3000017960222020-09-162020-09-300001796022us-gaap:RetainedEarningsMember2020-09-162020-09-300001796022srt:SubsidiariesMemberus-gaap:NoncontrollingInterestMember2020-09-162020-09-300001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-162020-09-300001796022us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-09-300001796022us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-09-300001796022us-gaap:AdditionalPaidInCapitalMember2020-09-300001796022us-gaap:RetainedEarningsMember2020-09-300001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300001796022srt:SubsidiariesMemberus-gaap:NoncontrollingInterestMember2020-09-300001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMember2020-09-3000017960222020-09-300001796022us-gaap:LimitedPartnerMember2020-03-310001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001796022us-gaap:NoncontrollingInterestMember2020-03-3100017960222020-03-310001796022us-gaap:LimitedPartnerMember2020-04-012020-09-150001796022us-gaap:NoncontrollingInterestMember2020-04-012020-09-1500017960222020-04-012020-09-150001796022us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-09-150001796022step:PartnersCapitalMember2020-04-012020-09-150001796022srt:SubsidiariesMemberus-gaap:NoncontrollingInterestMember2020-04-012020-09-150001796022us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-04-012020-09-150001796022us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-04-012020-09-150001796022us-gaap:AdditionalPaidInCapitalMember2020-04-012020-09-150001796022step:PartnershipOfSubsidiaryMemberus-gaap:NoncontrollingInterestMember2020-04-012020-09-1500017960222020-09-182020-09-18xbrli:pure0001796022step:OwnersMemberstep:BlockerEntitiesMember2020-09-182020-09-180001796022step:OwnersMemberus-gaap:CommonClassAMemberstep:BlockerEntitiesMember2020-09-182020-09-180001796022step:ConversionOfClassBUnitsToClassBCommonStockMember2020-09-182020-09-180001796022us-gaap:CommonClassAMemberus-gaap:IPOMember2020-09-182020-09-180001796022us-gaap:CommonClassAMemberus-gaap:IPOMember2020-09-180001796022us-gaap:IPOMember2020-09-182020-09-180001796022step:StepStoneGroupLPMemberus-gaap:IPOMember2020-09-182020-09-180001796022step:PartnershipOfSubsidiaryMemberus-gaap:CommonClassAMember2020-09-182020-09-180001796022us-gaap:CommonClassBMemberstep:PartnershipOfSubsidiaryMember2020-09-182020-09-180001796022us-gaap:CommonClassAMemberstep:GreenspringMember2021-09-012021-09-300001796022step:GreenspringMemberus-gaap:CommonClassCMember2021-09-012021-09-300001796022us-gaap:GeneralPartnerMemberstep:StepStoneGroupLPMember2020-09-182020-09-18step:vote0001796022us-gaap:CommonClassAMember2020-09-180001796022us-gaap:CommonClassBMember2020-09-180001796022step:StepStoneGroupLPMember2021-09-3000017960222021-04-010001796022srt:MinimumMember2021-04-012021-09-300001796022srt:MaximumMember2021-04-012021-09-300001796022us-gaap:AccumulatedTranslationAdjustmentMember2021-09-300001796022us-gaap:AccumulatedTranslationAdjustmentMember2021-03-310001796022us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-09-300001796022us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-03-31step:segment0001796022step:ManagementAndAdvisoryFeesNetFocusedCommingledFundsMember2021-07-012021-09-300001796022step:ManagementAndAdvisoryFeesNetFocusedCommingledFundsMember2020-07-012020-09-300001796022step:ManagementAndAdvisoryFeesNetFocusedCommingledFundsMember2021-04-012021-09-300001796022step:ManagementAndAdvisoryFeesNetFocusedCommingledFundsMember2020-04-012020-09-300001796022step:ManagementAndAdvisoryFeesNetSeparatelyManagedAccountsMember2021-07-012021-09-300001796022step:ManagementAndAdvisoryFeesNetSeparatelyManagedAccountsMember2020-07-012020-09-300001796022step:ManagementAndAdvisoryFeesNetSeparatelyManagedAccountsMember2021-04-012021-09-300001796022step:ManagementAndAdvisoryFeesNetSeparatelyManagedAccountsMember2020-04-012020-09-300001796022step:ManagementAndAdvisoryFeesNetAdvisoryAndOtherServicesMember2021-07-012021-09-300001796022step:ManagementAndAdvisoryFeesNetAdvisoryAndOtherServicesMember2020-07-012020-09-300001796022step:ManagementAndAdvisoryFeesNetAdvisoryAndOtherServicesMember2021-04-012021-09-300001796022step:ManagementAndAdvisoryFeesNetAdvisoryAndOtherServicesMember2020-04-012020-09-300001796022step:ManagementAndAdvisoryFeesNetFundReimbursementRevenuesMember2021-07-012021-09-300001796022step:ManagementAndAdvisoryFeesNetFundReimbursementRevenuesMember2020-07-012020-09-300001796022step:ManagementAndAdvisoryFeesNetFundReimbursementRevenuesMember2021-04-012021-09-300001796022step:ManagementAndAdvisoryFeesNetFundReimbursementRevenuesMember2020-04-012020-09-300001796022step:IncentiveFeesSeparatelyManagedAccountsMember2021-07-012021-09-300001796022step:IncentiveFeesSeparatelyManagedAccountsMember2020-07-012020-09-300001796022step:IncentiveFeesSeparatelyManagedAccountsMember2021-04-012021-09-300001796022step:IncentiveFeesSeparatelyManagedAccountsMember2020-04-012020-09-300001796022step:IncentiveFeesFocusedCommingledFundsMember2021-07-012021-09-300001796022step:IncentiveFeesFocusedCommingledFundsMember2020-07-012020-09-300001796022step:IncentiveFeesFocusedCommingledFundsMember2021-04-012021-09-300001796022step:IncentiveFeesFocusedCommingledFundsMember2020-04-012020-09-300001796022step:CarriedInterestAllocationSeparatelyManagedAccountsMember2021-07-012021-09-300001796022step:CarriedInterestAllocationSeparatelyManagedAccountsMember2020-07-012020-09-300001796022step:CarriedInterestAllocationSeparatelyManagedAccountsMember2021-04-012021-09-300001796022step:CarriedInterestAllocationSeparatelyManagedAccountsMember2020-04-012020-09-300001796022step:CarriedInterestAllocationFocusedCommingledFundsMember2021-07-012021-09-300001796022step:CarriedInterestAllocationFocusedCommingledFundsMember2020-07-012020-09-300001796022step:CarriedInterestAllocationFocusedCommingledFundsMember2021-04-012021-09-300001796022step:CarriedInterestAllocationFocusedCommingledFundsMember2020-04-012020-09-300001796022step:LegacyCarriedInterestAllocationSeparatelyManagedAccountsMember2021-07-012021-09-300001796022step:LegacyCarriedInterestAllocationSeparatelyManagedAccountsMember2020-07-012020-09-300001796022step:LegacyCarriedInterestAllocationSeparatelyManagedAccountsMember2021-04-012021-09-300001796022step:LegacyCarriedInterestAllocationSeparatelyManagedAccountsMember2020-04-012020-09-300001796022step:LegacyCarriedInterestAllocationFocusedCommingledFundsMember2021-07-012021-09-300001796022step:LegacyCarriedInterestAllocationFocusedCommingledFundsMember2020-07-012020-09-300001796022step:LegacyCarriedInterestAllocationFocusedCommingledFundsMember2021-04-012021-09-300001796022step:LegacyCarriedInterestAllocationFocusedCommingledFundsMember2020-04-012020-09-300001796022step:LegacyCarriedInterestAllocationFocusedCommingledFundsMember2021-09-202021-09-300001796022country:US2021-07-012021-09-300001796022country:US2020-07-012020-09-300001796022country:US2021-04-012021-09-300001796022country:US2020-04-012020-09-300001796022us-gaap:NonUsMember2021-07-012021-09-300001796022us-gaap:NonUsMember2020-07-012020-09-300001796022us-gaap:NonUsMember2021-04-012021-09-300001796022us-gaap:NonUsMember2020-04-012020-09-300001796022us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2021-09-300001796022us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2021-03-310001796022step:VariableInterestEntityNotPrimaryBeneficiarySubsidiariesMember2021-09-300001796022step:VariableInterestEntityNotPrimaryBeneficiarySubsidiariesMember2021-03-310001796022step:VariableInterestEntityNotPrimaryBeneficiaryLegacyEntitiesMember2021-09-300001796022step:VariableInterestEntityNotPrimaryBeneficiaryLegacyEntitiesMember2021-03-310001796022step:LegacyCarriedInterestAllocationMember2021-09-202021-09-3000017960222021-09-202021-09-300001796022us-gaap:SalesRevenueNetMemberstep:SeparatelyManagedAccountConcentrationRiskMemberstep:ThreeInvestmentsMember2021-09-302021-09-300001796022us-gaap:SalesRevenueNetMemberstep:SeparatelyManagedAccountConcentrationRiskMemberstep:TwoInvestmentsMember2021-03-312021-03-310001796022us-gaap:SalesRevenueNetMemberstep:TwoInvestmentsMemberstep:ComingledFundsConcentrationRiskMember2021-09-302021-09-300001796022srt:AffiliatedEntityMember2021-09-300001796022srt:AffiliatedEntityMember2021-03-310001796022us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-09-300001796022us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-09-300001796022us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-09-300001796022us-gaap:FairValueMeasurementsRecurringMember2021-09-300001796022us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-03-310001796022us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-03-310001796022us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-03-310001796022us-gaap:FairValueMeasurementsRecurringMember2021-03-310001796022step:GreenspringMember2021-07-012021-09-300001796022us-gaap:MeasurementInputDiscountRateMembersrt:MinimumMember2021-09-300001796022us-gaap:MeasurementInputDiscountRateMembersrt:MaximumMember2021-09-300001796022step:ManagementContractsMember2021-09-300001796022step:ManagementContractsMember2021-03-310001796022us-gaap:CustomerRelationshipsMember2021-09-300001796022us-gaap:CustomerRelationshipsMember2021-03-310001796022us-gaap:ServiceAgreementsMember2021-09-300001796022us-gaap:ServiceAgreementsMember2021-03-310001796022step:GreenspringMemberstep:ManagementContractsMember2021-09-200001796022us-gaap:CustomerRelationshipsMemberstep:GreenspringMember2021-09-200001796022us-gaap:ServiceAgreementsMemberstep:GreenspringMember2021-09-200001796022step:GreenspringMember2021-09-200001796022us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-09-300001796022us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-04-012021-09-300001796022step:NewYorkFederalReserveBankRateMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-04-012021-09-300001796022us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-04-012021-09-300001796022step:LIBORRateMultipliedByStatutoryReserveRateMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-04-012021-09-300001796022step:EuroInterbankOfferRateMultipliedByStatutoryReserveRateMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-04-012021-09-300001796022us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberstep:SterlingOvernightIndexAverageMember2021-04-012021-09-300001796022us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberstep:SwissAverageRateOvernightMember2021-04-012021-09-300001796022us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberstep:AUDScreenRateMultipliedByStatutoryReserveRateMember2021-04-012021-09-300001796022us-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMember2021-09-300001796022us-gaap:LineOfCreditMember2021-09-300001796022us-gaap:RestrictedStockUnitsRSUMember2021-03-310001796022us-gaap:RestrictedStockUnitsRSUMember2021-04-012021-09-300001796022us-gaap:RestrictedStockUnitsRSUMember2021-09-300001796022step:ClassB2UnitMember2021-04-012021-09-300001796022step:ClassB2UnitMember2021-09-300001796022step:GreenspringMember2021-04-012021-09-300001796022us-gaap:RestrictedStockUnitsRSUMember2021-07-012021-09-300001796022us-gaap:RestrictedStockUnitsRSUMember2020-09-162020-09-300001796022us-gaap:RestrictedStockUnitsRSUMember2021-04-012021-09-300001796022step:ClassB2UnitMember2021-07-012021-09-300001796022step:ClassB2UnitMember2020-09-162020-09-300001796022us-gaap:CommonClassAMember2020-09-162020-09-300001796022step:ClassB2UnitMember2020-09-162020-09-300001796022us-gaap:CommonClassBMember2020-09-162020-09-300001796022us-gaap:CommonClassCMember2021-09-300001796022us-gaap:CommonClassBMember2020-09-300001796022step:ManagementAndAdvisoryFeesNetMemberus-gaap:EquityMethodInvesteeMember2021-07-012021-09-300001796022step:ManagementAndAdvisoryFeesNetMemberus-gaap:EquityMethodInvesteeMember2020-07-012020-09-300001796022step:ManagementAndAdvisoryFeesNetMemberus-gaap:EquityMethodInvesteeMember2021-04-012021-09-300001796022step:ManagementAndAdvisoryFeesNetMemberus-gaap:EquityMethodInvesteeMember2020-04-012020-09-300001796022step:CarriedInterestAllocationRevenuesMemberus-gaap:EquityMethodInvesteeMember2021-07-012021-09-300001796022step:CarriedInterestAllocationRevenuesMemberus-gaap:EquityMethodInvesteeMember2020-07-012020-09-300001796022step:CarriedInterestAllocationRevenuesMemberus-gaap:EquityMethodInvesteeMember2021-04-012021-09-300001796022step:CarriedInterestAllocationRevenuesMemberus-gaap:EquityMethodInvesteeMember2020-04-012020-09-300001796022us-gaap:EquityMethodInvesteeMemberstep:LegacyCarriedInterestAllocationMember2021-07-012021-09-300001796022us-gaap:EquityMethodInvesteeMemberstep:LegacyCarriedInterestAllocationMember2021-04-012021-09-300001796022us-gaap:EquityMethodInvesteeMemberstep:LegacyCarriedInterestAllocationMember2021-09-202021-09-300001796022us-gaap:EquityMethodInvesteeMember2021-09-300001796022us-gaap:EquityMethodInvesteeMember2021-03-310001796022us-gaap:InvestorMember2021-09-300001796022us-gaap:InvestorMember2021-03-310001796022srt:AffiliatedEntityMemberstep:TaxReceivableAgreementMember2021-07-012021-09-300001796022srt:AffiliatedEntityMemberstep:TaxReceivableAgreementMember2021-04-012021-09-30step:classOfStock0001796022us-gaap:CommonClassBMember2021-04-012021-09-300001796022step:SRAMember2021-09-300001796022us-gaap:CommonClassAMember2021-09-012021-09-300001796022us-gaap:CommonClassBMember2021-09-012021-09-300001796022us-gaap:CommonClassAMember2021-06-012021-06-300001796022us-gaap:CommonClassBMember2021-06-012021-06-300001796022step:PublicOfferingMember2021-03-012021-03-310001796022us-gaap:OverAllotmentOptionMember2021-03-012021-03-310001796022step:PublicOfferingMember2021-03-310001796022us-gaap:CommonClassAMember2021-03-012021-03-310001796022us-gaap:CommonClassBMember2021-03-012021-03-310001796022step:SRAMember2020-06-012020-06-3000017960222021-08-102021-08-100001796022step:GreenspringMember2021-09-202021-09-200001796022us-gaap:CommonClassAMemberstep:GreenspringMember2021-09-202021-09-200001796022step:GreenspringMemberus-gaap:CommonClassCMember2021-09-202021-09-200001796022step:ContractualRightsManagementContractsMemberstep:GreenspringMember2021-09-200001796022step:ContractualRightsServiceAgreementsMemberstep:GreenspringMember2021-09-200001796022us-gaap:ContractualRightsMemberstep:GreenspringMember2021-09-200001796022us-gaap:ContractualRightsMemberstep:GreenspringMember2021-04-012021-09-300001796022us-gaap:RestrictedStockUnitsRSUMember2020-09-18step:city0001796022step:LegacyFundsMember2021-09-300001796022us-gaap:SubsequentEventMember2021-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q | | | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2021

or | | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________________ to ___________________________

Commission file number 001-39510

STEPSTONE GROUP INC.

(Exact name of Registrant as specified in its charter) | | | | | | | | |

| Delaware | | 84-3868757 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

450 Lexington Avenue, 31st Floor | | |

New York, NY | | 10017 |

| (Address of principal executive offices) | | (Zip Code) |

(212) 351-6100

(Registrant’s telephone number, including area code) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered | |

| Class A Common Stock, $0.001 par value per share | | STEP | | The Nasdaq Stock Market LLC | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| Emerging growth company | ☒ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of November 9, 2021, there were 55,735,256 shares of the registrant’s Class A common stock, par value $0.001, and 52,393,112 shares of the registrant’s Class B common stock, par value $0.001, outstanding.

Table of Contents | | | | | |

| Page |

| PART I - FINANCIAL INFORMATION |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| PART II - OTHER INFORMATION |

| |

| |

| |

| |

| |

| |

| |

| |

This Quarterly Report on Form 10-Q (“Form 10-Q”) includes certain information regarding the historical investment performance of our focused commingled funds and separately managed accounts. An investment in shares of our Class A common stock is not an investment in any StepStone Fund (as defined below). The StepStone Funds are separate, distinct legal entities that are not our subsidiaries. In the event of our bankruptcy or liquidation, you will have no claim against the StepStone Funds. In considering the performance information relating to the StepStone Funds contained herein, current and prospective Class A common stockholders should bear in mind that the performance of the StepStone Funds is not indicative of the possible performance of shares of our Class A common stock and also is not necessarily indicative of the future results of the StepStone Funds, even if fund investments were in fact liquidated on the dates indicated, and we cannot assure you that the StepStone Funds will continue to achieve, or that future StepStone Funds will achieve, comparable results.

Unless otherwise indicated or the context otherwise requires:

• “StepStone Group Inc.” or “SSG” refers solely to StepStone Group Inc., a Delaware corporation, and not to any of its subsidiaries;

• the “Partnership” refers solely to StepStone Group LP, a Delaware limited partnership, and not to any of its subsidiaries;

• “General Partner” refers to StepStone Group Holdings LLC, a Delaware limited liability company, and the sole general partner of the Partnership;

• “we,” “us,” “our,” the “Company,” “our company,” “StepStone” and similar terms refer to SSG and its consolidated subsidiaries, including the Partnership, following the Reorganization and IPO (each as defined below) and to the Partnership and its consolidated subsidiaries prior to the Reorganization and IPO;

• “StepStone Funds” or “our funds” refers to our focused commingled funds and our separately managed accounts including acquired Greenspring funds, for which we act as both investment adviser and general partner or managing member;

• references to the “Greenspring acquisition” refer to the acquisition of Greenspring Associates, Inc. and certain of its affiliates, “Greenspring,” that was completed on September 20, 2021;

• references to “FY,” “fiscal” or “fiscal year” are to the fiscal year ended March 31 of the applicable year;

• references to the “Reorganization” refer to the series of transactions immediately before the Company’s initial public offering (“IPO”), which was completed on September 18, 2020;

• references to “private markets allocations” or “combined AUM / AUA” refer to the aggregate amount of our assets under management (“AUM”) and our assets under advisement (“AUA”);

• references to “high-net-worth” individuals refer to individuals with net worth of over $5 million, excluding primary residence; and

• references to “mass affluent” individuals refer to individuals with annual income over $200,000 or net worth between $1 million and $5 million, excluding primary residence.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition, our names, logos and website names and addresses are owned by us or licensed by us. We also own or have the rights to copyrights that protect the content of our solutions. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Form 10-Q are listed without the ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, trade names and copyrights.

FORWARD-LOOKING STATEMENTS

This Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact, including statements regarding guidance, industry prospects or future results of operations or financial position made in this Form 10-Q are forward-looking. We use words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “future,” “intend,” “may,” “plan” and “will” and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current plans, estimates and expectations and are inherently uncertain. The inclusion of any forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated will be achieved. Forward-looking statements are subject to various risks, uncertainties and assumptions. Important factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to, global and domestic market and business conditions, our successful execution of business and growth strategies and regulatory factors relevant to our business, as well as assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity and the risks and uncertainties described in greater detail under “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2021 and in our subsequent reports filed from time to time with the U.S. Securities and Exchange Commission (“SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Form 10-Q and in our other periodic filings. We undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

StepStone Group Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share amounts) | | | | | | | | | | | |

| As of |

| September 30, 2021 | | March 31, 2021 |

| Assets | | | |

| Cash and cash equivalents | $ | 175,015 | | | $ | 179,886 | |

| Restricted cash | 1,016 | | | 3,977 | |

| Fees and accounts receivable | 34,264 | | | 32,096 | |

| Due from affiliates | 10,236 | | | 7,474 | |

Investments: | | | |

| Investments in funds | 90,325 | | | 74,379 | |

| Accrued carried interest allocations | 1,215,919 | | | 896,523 | |

Legacy Greenspring investments in funds and accrued carried interest allocations(1) | 1,208,693 | | | — | |

| Deferred income tax assets | 678 | | | 89,439 | |

| Lease right-of-use assets, net | 65,476 | | | — | |

| Other assets and receivables | 26,760 | | | 24,715 | |

| Intangibles, net | 420,132 | | | 5,491 | |

| Goodwill | 582,973 | | | 6,792 | |

Total assets | $ | 3,831,487 | | | $ | 1,320,772 | |

| Liabilities and stockholders’ equity | | | |

| Accounts payable, accrued expenses and other liabilities | $ | 69,197 | | | $ | 47,723 | |

| Accrued compensation and benefits | 65,492 | | | 34,224 | |

| Accrued carried interest-related compensation | 638,754 | | | 465,610 | |

Legacy Greenspring accrued carried interest-related compensation(1) | 989,607 | | | — | |

| Due to affiliates | 148,234 | | | 113,522 | |

| Lease liabilities | 75,806 | | | — | |

| Debt obligations | 112,644 | | | — | |

| Total liabilities | 2,099,734 | | | 661,079 | |

| Commitments and contingencies (Note 15) | | | |

| | | |

| | | |

Class A common stock, $0.001 par value, 650,000,000 authorized; 55,735,256 and 38,437,500 issued and outstanding as of September 30, 2021 and March 31, 2021, respectively | 56 | | | 38 | |

Class B common stock, $0.001 par value, 125,000,000 authorized; 52,393,112 and 56,378,831 issued and outstanding as of September 30, 2021 and March 31, 2021, respectively | 53 | | | 57 | |

| Additional paid-in capital | 525,118 | | | 188,751 | |

| Retained earnings | 158,131 | | | 60,407 | |

| Accumulated other comprehensive income | 268 | | | 155 | |

| Total StepStone Group Inc. stockholders’ equity | 683,626 | | | 249,408 | |

| Non-controlling interests in subsidiaries | 24,558 | | | 25,885 | |

Non-controlling interests in legacy Greenspring entities(1) | 219,086 | | | — | |

| Non-controlling interests in the Partnership | 804,483 | | | 384,400 | |

| Total stockholders’ equity | 1,731,753 | | | 659,693 | |

| Total liabilities and stockholders’ equity | $ | 3,831,487 | | | $ | 1,320,772 | |

(1)Reflects amounts attributable to consolidated VIEs for which the Company did not acquire any direct economic interests. See notes 5 and 14 for more information.

See accompanying notes to condensed consolidated financial statements.

StepStone Group Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands)

The following presents the portion of the condensed consolidated balances presented above attributable to consolidated variable interest entities. | | | | | | | | | | | |

| As of |

| September 30, 2021 | | March 31, 2021 |

| Assets | | | |

| Cash and cash equivalents | $ | 18,674 | | | $ | 16,833 | |

| Restricted cash | 1,016 | | | 1,074 | |

| Fees and accounts receivable | 27,829 | | | 25,282 | |

| Due from affiliates | 3,045 | | | 3,467 | |

Investments in funds | 16,216 | | | 13,658 | |

Legacy Greenspring investments in funds and accrued carried interest allocations(1) | 1,208,693 | | | — | |

| Deferred income tax assets | 678 | | | 671 | |

| Lease right-of-use assets, net | 18,424 | | | — | |

| Other assets and receivables | 3,551 | | | 4,340 | |

Total assets | $ | 1,298,126 | | | $ | 65,325 | |

| | | |

| Liabilities | | | |

| Accounts payable, accrued expenses and other liabilities | $ | 9,395 | | | $ | 10,370 | |

| Accrued compensation and benefits | 24,309 | | | 14,705 | |

Legacy Greenspring accrued carried interest-related compensation(1) | 989,607 | | | — | |

| Due to affiliates | 1,059 | | | 1,854 | |

| Lease liabilities | 18,536 | | | — | |

Total liabilities | $ | 1,042,906 | | | $ | 26,929 | |

(1)Reflects amounts attributable to consolidated VIEs for which the Company did not acquire any direct economic interests. See notes 5 and 14 for more information.

See accompanying notes to condensed consolidated financial statements.

StepStone Group Inc.

Condensed Consolidated Statements of Income (Loss) (Unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Revenues | | | | | | | |

| Management and advisory fees, net | $ | 83,583 | | | $ | 75,652 | | | $ | 161,644 | | | $ | 139,152 | |

| Performance fees: | | | | | | | |

| Incentive fees | 1,796 | | | 1,196 | | | 5,978 | | | 4,785 | |

| Carried interest allocations: | | | | | | | |

| Realized | 52,531 | | | 8,556 | | | 102,494 | | | 12,194 | |

| Unrealized | 143,855 | | | 157,509 | | | 320,254 | | | 25,369 | |

| Total carried interest allocations | 196,386 | | | 166,065 | | | 422,748 | | | 37,563 | |

Legacy Greenspring carried interest allocations(1) | — | | | — | | | — | | | — | |

| Total revenues | 281,765 | | | 242,913 | | | 590,370 | | | 181,500 | |

| Expenses | | | | | | | |

| Compensation and benefits: | | | | | | | |

| Cash-based compensation | 43,881 | | | 37,473 | | | 86,552 | | | 77,126 | |

| Equity-based compensation | 3,213 | | | 952 | | | 6,956 | | | 1,435 | |

| Performance fee-related compensation: | | | | | | | |

| Realized | 26,781 | | | 4,811 | | | 52,089 | | | 7,711 | |

| Unrealized | 74,206 | | | 78,533 | | | 159,778 | | | 9,858 | |

| Total performance fee-related compensation | 100,987 | | | 83,344 | | | 211,867 | | | 17,569 | |

Legacy Greenspring performance fee-related compensation(1) | — | | | — | | | — | | | — | |

| Total compensation and benefits | 148,081 | | | 121,769 | | | 305,375 | | | 96,130 | |

| General, administrative and other | 25,320 | | | 11,356 | | | 41,750 | | | 21,863 | |

| Total expenses | 173,401 | | | 133,125 | | | 347,125 | | | 117,993 | |

| Other income (expense) | | | | | | | |

| Investment income | 7,187 | | | 4,325 | | | 13,611 | | | 1,147 | |

Legacy Greenspring investment income(1) | — | | | — | | | — | | | — | |

| Interest income | 206 | | | 165 | | | 286 | | | 259 | |

| Interest expense | (88) | | | (5,270) | | | (94) | | | (7,327) | |

| Other income (loss) | (1,952) | | | 242 | | | (2,389) | | | 462 | |

| Total other income (expense) | 5,353 | | | (538) | | | 11,414 | | | (5,459) | |

| Income before income tax | 113,717 | | | 109,250 | | | 254,659 | | | 58,048 | |

| Income tax expense (benefit) | (14,145) | | | 881 | | | 278 | | | 2,039 | |

| Net income | 127,862 | | | 108,369 | | | 254,381 | | | 56,009 | |

| Less: Net income attributable to non-controlling interests in subsidiaries | 6,032 | | | 9,045 | | | 11,646 | | | 13,138 | |

Less: Net income attributable to non-controlling interests in legacy Greenspring entities(1) | — | | | — | | | — | | | — | |

| Less: Net income attributable to non-controlling interests in the Partnership | 59,756 | | | 100,114 | | | 139,011 | | | 43,661 | |

| Net income (loss) attributable to StepStone Group Inc. | $ | 62,074 | | | $ | (790) | | | $ | 103,724 | | | $ | (790) | |

Net income (loss) per share of Class A common stock: | | | | | | | |

| Basic | $ | 1.49 | | | $ | (0.03) | | | $ | 2.57 | | | $ | (0.03) | |

| Diluted | $ | 1.45 | | | $ | (0.03) | | | $ | 2.50 | | | $ | (0.03) | |

Weighted-average shares of Class A common stock: | | | | | | | |

| Basic | 41,745,492 | | | 29,237,500 | | | 40,401,379 | | | 29,237,500 | |

| Diluted | 45,908,361 | | | 29,237,500 | | | 44,405,055 | | | 29,237,500 | |

(1)Reflects the net effect of gross realized gains and the reversal of such amounts in unrealized gains. See notes 3, 5 and 14 for more information.

See accompanying notes to condensed consolidated financial statements.

StepStone Group Inc.

Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Net income | $ | 127,862 | | | $ | 108,369 | | | $ | 254,381 | | | $ | 56,009 | |

| Other comprehensive income: | | | | | | | |

| Foreign currency translation adjustment | 143 | | | 275 | | | 391 | | | 537 | |

| | | | | | | |

| Total other comprehensive income | 143 | | | 275 | | | 391 | | | 537 | |

| Comprehensive income before non-controlling interests | 128,005 | | | 108,644 | | | 254,772 | | | 56,546 | |

| Less: Comprehensive income attributable to non-controlling interests in subsidiaries | 6,101 | | | 9,185 | | | 11,842 | | | 13,412 | |

| Less: Comprehensive income attributable to non-controlling interests in legacy Greenspring entities | — | | | — | | | — | | | — | |

| Less: Comprehensive income attributable to non-controlling interests in the Partnership | 59,797 | | | 100,271 | | | 139,124 | | | 43,946 | |

| Comprehensive income (loss) attributable to StepStone Group Inc. | $ | 62,107 | | | $ | (812) | | | $ | 103,806 | | | $ | (812) | |

See accompanying notes to condensed consolidated financial statements.

StepStone Group Inc.

Condensed Consolidated Statements of Stockholders’ Equity (Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class A Common Stock | | Class B Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Income | | Non-Controlling Interests in Subsidiaries | | Non-Controlling Interests in Legacy Greenspring Entities | | Non-Controlling Interests in the Partnership | | Total Stockholders’ Equity |

| Balance at June 30, 2021 | | | $ | 40 | | | $ | 55 | | | $ | 205,561 | | | $ | 99,057 | | | $ | 215 | | | $ | 26,585 | | | $ | — | | | $ | 429,622 | | | $ | 761,135 | |

| Net income | | | — | | | — | | | — | | | 62,074 | | | — | | | 6,032 | | | — | | | 59,756 | | | 127,862 | |

| Other comprehensive income | | | — | | | — | | | — | | | — | | | 33 | | | 69 | | | — | | | 41 | | | 143 | |

| Contributed capital | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 21 | | | 21 | |

| Equity-based compensation | | | — | | | — | | | 1,385 | | | — | | | — | | | — | | | — | | | 1,829 | | | 3,214 | |

| Distributions | | | — | | | — | | | — | | | — | | | — | | | (7,540) | | | — | | | (18,807) | | | (26,347) | |

| Purchase of non-controlling interests | | | — | | | — | | | (657) | | | — | | | — | | | (1,502) | | | — | | | (887) | | | (3,046) | |

| Dividends declared | | | — | | | — | | | — | | | (3,000) | | | — | | | — | | | — | | | — | | | (3,000) | |

| Vesting of RSUs | | | 1 | | | — | | | (1) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Class A common stock issued for Greenspring acquisition | | | 13 | | | — | | | 267,842 | | | — | | | — | | | — | | | — | | | 290,744 | | | 558,599 | |

| Class C Partnership units issued for Greenspring acquisition | | | — | | | — | | | 64,847 | | | — | | | — | | | — | | | — | | | 70,392 | | | 135,239 | |

| Exchange of Class B units for Class A common stock and redemption of corresponding Class B common shares | | | 2 | | | (2) | | | (2) | | | — | | | — | | | — | | | — | | | — | | | (2) | |

| Initial consolidation of legacy Greenspring general partner entities | | | — | | | — | | | — | | | — | | | — | | | — | | | 219,086 | | | — | | | 219,086 | |

| Equity reallocation between controlling and non-controlling interests | | | — | | | — | | | 27,294 | | | — | | | 20 | | | 914 | | | — | | | (28,228) | | | — | |

Deferred tax effect resulting from transactions affecting ownership in the Partnership, net of amounts payable under Tax Receivable Agreements(1) | | | — | | | — | | | (41,151) | | | — | | | — | | | — | | | — | | | — | | | (41,151) | |

| Balance at September 30, 2021 | | | $ | 56 | | | $ | 53 | | | $ | 525,118 | | | $ | 158,131 | | | $ | 268 | | | $ | 24,558 | | | $ | 219,086 | | | $ | 804,483 | | | $ | 1,731,753 | |

|

| | | Class A Common Stock | | Class B Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Income | | Non-Controlling Interests in Subsidiaries | | Non-Controlling Interests in Legacy Greenspring Entities | | Non-Controlling Interests in the Partnership | | Total Stockholders’ Equity |

| Balance at March 31, 2021 | | | $ | 38 | | | $ | 57 | | | $ | 188,751 | | | $ | 60,407 | | | $ | 155 | | | $ | 25,885 | | | $ | — | | | $ | 384,400 | | | $ | 659,693 | |

| Net income | | | — | | | — | | | — | | | 103,724 | | | — | | | 11,646 | | | — | | | 139,011 | | | 254,381 | |

| Other comprehensive income | | | — | | | — | | | — | | | — | | | 82 | | | 196 | | | — | | | 113 | | | 391 | |

| Contributed capital | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 42 | | | 42 | |

| Equity-based compensation | | | — | | | — | | | 2,931 | | | — | | | — | | | 4 | | | — | | | 4,021 | | | 6,956 | |

| Distributions | | | — | | | — | | | — | | | — | | | — | | | (12,585) | | | — | | | (43,249) | | | (55,834) | |

| Purchase of non-controlling interests | | | — | | | — | | | (657) | | | — | | | — | | | (1,502) | | | — | | | (887) | | | (3,046) | |

| Dividends declared | | | — | | | — | | | — | | | (6,000) | | | — | | | — | | | — | | | — | | | (6,000) | |

| Vesting of RSUs | | | 1 | | | — | | | (1) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Class A common stock issued for Greenspring acquisition | | | 13 | | | — | | | 267,842 | | | — | | | — | | | — | | | — | | | 290,744 | | | 558,599 | |

| Class C Partnership units issued for Greenspring acquisition | | | — | | | — | | | 64,847 | | | — | | | — | | | — | | | — | | | 70,392 | | | 135,239 | |

| Exchange of Class B units for Class A common stock and redemption of corresponding Class B common shares | | | 4 | | | (4) | | | (4) | | | — | | | — | | | — | | | — | | | — | | | (4) | |

| Initial consolidation of legacy Greenspring general partner entities | | | — | | | — | | | — | | | — | | | — | | | — | | | 219,086 | | | — | | | 219,086 | |

| Equity reallocation between controlling and non-controlling interests | | | — | | | — | | | 39,159 | | | — | | | 31 | | | 914 | | | — | | | (40,104) | | | — | |

Deferred tax effect resulting from transactions affecting ownership in the Partnership, net of amounts payable under Tax Receivable Agreements(1) | | | — | | | — | | | (37,750) | | | — | | | — | | | — | | | — | | | — | | | (37,750) | |

| Balance at September 30, 2021 | | | $ | 56 | | | $ | 53 | | | $ | 525,118 | | | $ | 158,131 | | | $ | 268 | | | $ | 24,558 | | | $ | 219,086 | | | $ | 804,483 | | | $ | 1,731,753 | |

(1)See notes 10, 13 and 14 for more information.

See accompanying notes to condensed consolidated financial statements.

StepStone Group Inc.

Condensed Consolidated Statements of Stockholders’ Equity (Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Partners’ Capital | | Class A Common Stock | | Class B Common Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Income (Loss) | | Non-Controlling Interests in Subsidiaries | | Non-Controlling Interests in the Partnership | | Total Stockholders’ Equity / Partners’ Capital |

| Balance at June 30, 2020 | $ | 134,907 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 306 | | | $ | 20,848 | | | $ | — | | | $ | 156,061 | |

| Net income prior to Reorganization and IPO | 101,718 | | | — | | | — | | | — | | | — | | | — | | | 8,335 | | | — | | | 110,053 | |

| Other comprehensive income prior to Reorganization and IPO | — | | | — | | | — | | | — | | | — | | | 207 | | | 216 | | | — | | | 423 | |

| Contributed capital prior to Reorganization and IPO | 12 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 12 | |

| Equity-based compensation prior to Reorganization and IPO | 240 | | | — | | | — | | | — | | | — | | | — | | | 2 | | | — | | | 242 | |

| Distributions prior to Reorganization and IPO | (25,235) | | | — | | | — | | | — | | | — | | | — | | | (9,044) | | | — | | | (34,279) | |

| Equity reallocation between controlling and non-controlling interests prior to Reorganization and IPO | 252 | | | — | | | — | | | — | | | — | | | — | | | (252) | | | — | | | — | |

| Effect of Reorganization and purchase of units in the Partnership | (211,894) | | | 9 | | | 73 | | | 23,432 | | | — | | | (513) | | | — | | | 188,893 | | | — | |

| Issuance of Class A common stock sold in IPO, net of underwriting discounts | — | | | 20 | | | — | | | 337,778 | | | — | | | — | | | — | | | — | | | 337,798 | |

| Purchase of partnership interests with IPO net proceeds | — | | | — | | | (7) | | | (127,979) | | | — | | | — | | | — | | | — | | | (127,986) | |

| Deferred IPO costs | — | | | — | | | — | | | (2,981) | | | — | | | — | | | — | | | (6,686) | | | (9,667) | |

| Equity reallocation between controlling and non-controlling interests subsequent to Reorganization and IPO | — | | | — | | | — | | | (103,063) | | | — | | | — | | | — | | | 103,063 | | | — | |

| Deferred tax effect resulting from purchase of Class B units, net of amounts payable under Tax Receivable Agreements | — | | | — | | | — | | | (7,128) | | | — | | | — | | | — | | | — | | | (7,128) | |

| Net income (loss) subsequent to Reorganization and IPO | — | | | — | | | — | | | — | | | (790) | | | — | | | 710 | | | (1,604) | | | (1,684) | |

| Other comprehensive loss subsequent to Reorganization and IPO | — | | | — | | | — | | | — | | | — | | | (22) | | | (76) | | | (50) | | | (148) | |

| Equity-based compensation subsequent to Reorganization and IPO | — | | | — | | | — | | | 219 | | | — | | | — | | | 2 | | | 489 | | | 710 | |

| Distributions subsequent to Reorganization and IPO | — | | | — | | | — | | | — | | | — | | | — | | | (12) | | | — | | | (12) | |

| Balance at September 30, 2020 | $ | — | | | $ | 29 | | | $ | 66 | | | $ | 120,278 | | | $ | (790) | | | $ | (22) | | | $ | 20,729 | | | $ | 284,105 | | | $ | 424,395 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

StepStone Group Inc.

Condensed Consolidated Statements of Stockholders’ Equity (Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Partners’ Capital | | Class A Common Stock | | Class B Common Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Income (Loss) | | Non-Controlling Interests in Subsidiaries | | Non-Controlling Interests in the Partnership | | Total Stockholders’ Equity / Partners’ Capital |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance at March 31, 2020 | $ | 216,051 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 178 | | | $ | 20,738 | | | $ | — | | | $ | 236,967 | |

| Net income prior to Reorganization and IPO | 45,265 | | | — | | | — | | | — | | | — | | | — | | | 12,428 | | | — | | | 57,693 | |

| Other comprehensive income prior to Reorganization and IPO | — | | | — | | | — | | | — | | | — | | | 335 | | | 350 | | | — | | | 685 | |

| Contributed capital prior to Reorganization and IPO | 27 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 27 | |

| Equity-based compensation prior to Reorganization and IPO | 723 | | | — | | | — | | | — | | | — | | | — | | | 2 | | | — | | | 725 | |

| Sale of non-controlling interests prior to Reorganization and IPO | — | | | — | | | — | | | — | | | — | | | — | | | 3,308 | | | — | | | 3,308 | |

| Purchase of non-controlling interests prior to Reorganization and IPO | — | | | — | | | — | | | — | | | — | | | — | | | (3,308) | | | — | | | (3,308) | |

| Distributions prior to Reorganization and IPO | (50,424) | | | — | | | — | | | — | | | — | | | — | | | (13,161) | | | — | | | (63,585) | |

| Equity reallocation between controlling and non-controlling interests prior to Reorganization and IPO | 252 | | | — | | | — | | | — | | | — | | | — | | | (252) | | | — | | | — | |

| Effect of Reorganization and purchase of units in the Partnership | (211,894) | | | 9 | | | 73 | | | 23,432 | | | — | | | (513) | | | — | | | 188,893 | | | — | |

| Issuance of Class A common stock sold in IPO, net of underwriting discounts | — | | | 20 | | | — | | | 337,778 | | | — | | | — | | | — | | | — | | | 337,798 | |

| Purchase of partnership interests with IPO net proceeds | — | | | — | | | (7) | | | (127,979) | | | — | | | — | | | — | | | — | | | (127,986) | |

| Deferred IPO costs | — | | | — | | | — | | | (2,981) | | | — | | | — | | | — | | | (6,686) | | | (9,667) | |

| Equity reallocation between controlling and non-controlling interests subsequent to Reorganization and IPO | — | | | — | | | — | | | (103,063) | | | — | | | — | | | — | | | 103,063 | | | — | |

| Deferred tax effect resulting from purchase of Class B units, net of amounts payable under Tax Receivable Agreements | — | | | — | | | — | | | (7,128) | | | — | | | — | | | — | | | — | | | (7,128) | |

| Net income (loss) subsequent to Reorganization and IPO | — | | | — | | | — | | | — | | | (790) | | | — | | | 710 | | | (1,604) | | | (1,684) | |

| Other comprehensive loss subsequent to Reorganization and IPO | — | | | — | | | — | | | — | | | — | | | (22) | | | (76) | | | (50) | | | (148) | |

| Equity-based compensation subsequent to Reorganization and IPO | — | | | — | | | — | | | 219 | | | — | | | — | | | 2 | | | 489 | | | 710 | |

| Distributions subsequent to Reorganization and IPO | — | | | — | | | — | | | — | | | — | | | — | | | (12) | | | — | | | (12) | |

| Balance at September 30, 2020 | $ | — | | | $ | 29 | | | $ | 66 | | | $ | 120,278 | | | $ | (790) | | | $ | (22) | | | $ | 20,729 | | | $ | 284,105 | | | $ | 424,395 | |

See accompanying notes to condensed consolidated financial statements.

StepStone Group Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | | | | |

| Six Months Ended September 30, |

| 2021 | | 2020 |

| Cash flows from operating activities | | | |

| Net income | $ | 254,381 | | | $ | 56,009 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 3,626 | | | 2,767 | |

| Unrealized carried interest allocations and investment income | (329,031) | | | (24,848) | |

| Unrealized performance fee-related compensation | 159,778 | | | 9,858 | |

| | | |

| Write-off / amortization of deferred financing costs | — | | | 3,856 | |

| Equity-based compensation | 6,956 | | | 1,435 | |

| Change in deferred income taxes | (3,700) | | | 41 | |

| | | |

| Other non-cash activities | 1,852 | | | — | |

| Changes in operating assets and liabilities: | | | |

| Fees and accounts receivable | (1,897) | | | (2,365) | |

| Due from affiliates | (2,357) | | | 4,438 | |

| Other assets and receivables | 2,788 | | | 3,500 | |

| Accounts payable, accrued expenses and other liabilities | (1,514) | | | 2,796 | |

| Accrued compensation and benefits | 31,268 | | | 24,633 | |

| Accrued carried interest-related compensation | 13,367 | | | (1,841) | |

| Due to affiliates | (640) | | | 2,583 | |

| Lease right-of-use assets, net and lease liabilities | 17 | | | — | |

| Net cash provided by operating activities | 134,894 | | | 82,862 | |

| | | |

| Cash flows from investing activities | | | |

| | | |

| | | |

| Contributions to investments | (10,927) | | | (5,864) | |

| Distributions received from investments | 3,749 | | | 862 | |

| Cash paid for Greenspring acquisition, net of cash acquired | (181,529) | | | — | |

| Purchases of property and equipment | (1,321) | | | (745) | |

| Other investing activities | 31 | | | — | |

| Net cash used in investing activities | (189,997) | | | (5,747) | |

See accompanying notes to condensed consolidated financial statements.

StepStone Group Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | | | | |

| Six Months Ended September 30, |

| 2021 | | 2020 |

| Cash flows from financing activities | | | |

| | | |

| Sale of non-controlling interests | $ | — | | | $ | 3,308 | |

| Proceeds from capital contributions from non-controlling interests | 42 | | | 27 | |

| Proceeds from IPO, net of underwriting discount | — | | | 337,798 | |

| Proceeds from revolving credit facility | 185,000 | | | — | |

| Deferred financing costs | (2,356) | | | — | |

| Purchase of non-controlling interests | (3,046) | | | (131,294) | |

| Payment of deferred offering costs | (1,079) | | | (5,899) | |

| Principal payments on term loan | — | | | (147,000) | |

| Payments on revolving credit facility | (70,000) | | | — | |

| Distributions to non-controlling interests | (55,834) | | | (63,597) | |

| Dividends paid to common stockholders | (5,646) | | | — | |

| Other financing activities | (4) | | | (526) | |

| Net cash provided by (used in) financing activities | 47,077 | | | (7,183) | |

| Effect of foreign currency exchange rate changes | 194 | | | (44) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (7,832) | | | 69,888 | |

| Cash, cash equivalents and restricted cash at beginning of period | 183,863 | | | 89,939 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 176,031 | | | $ | 159,827 | |

| | | |

| Supplemental disclosures: | | | |

| | | |

| | | |

| Non-cash operating, investing, and financing activities: | | | |

| | | |

| | | |

| Accrued dividends | $ | 354 | | | $ | — | |

Deferred tax effect resulting from transactions affecting ownership in the Partnership, net of amounts payable under Tax Receivable Agreements | (37,750) | | | 7,128 | |

| Accrued deferred offering costs | — | | | 3,768 | |

| Establishment of lease liabilities in exchange for lease right-of-use assets | 79,478 | | | — | |

| Class A common stock issued for Greenspring acquisition | 558,598 | | | — | |

Class C Partnership units issued for Greenspring acquisition | 135,239 | | | — | |

| Reconciliation of cash, cash equivalents and restricted cash: | | | |

| Cash and cash equivalents | $ | 175,015 | | | $ | 156,908 | |

| Restricted cash | 1,016 | | | 2,919 | |

| Total cash, cash equivalents and restricted cash | $ | 176,031 | | | $ | 159,827 | |

See accompanying notes to condensed consolidated financial statements.

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

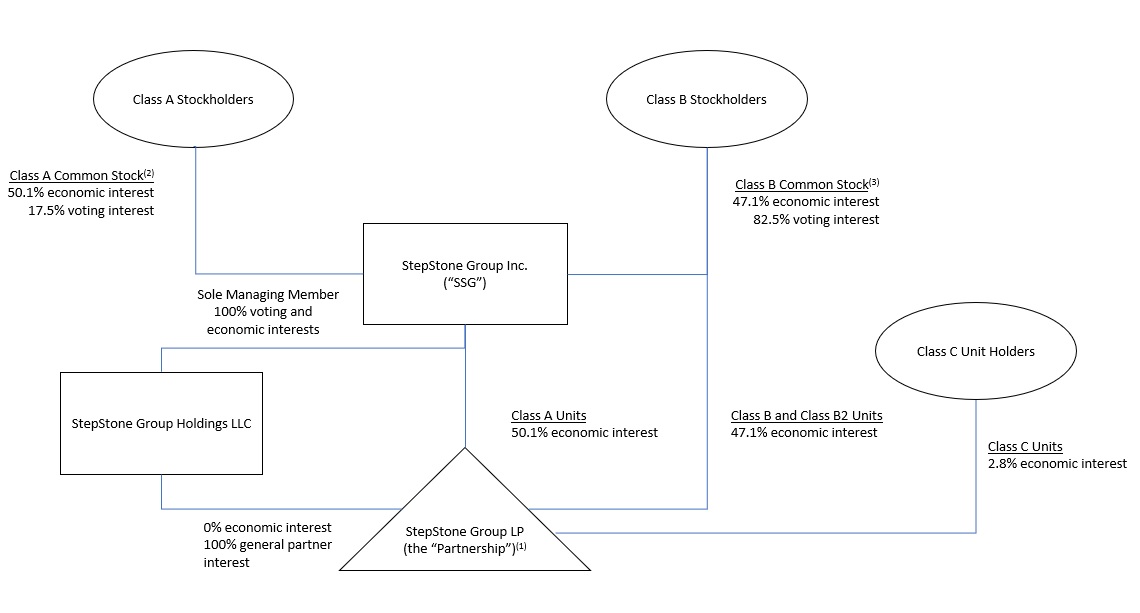

1. Organization

StepStone Group Inc. (“SSG”) was incorporated in the state of Delaware on November 20, 2019. The company was formed for the purpose of completing an initial public offering (“IPO”) in order to conduct the business of StepStone Group LP (the “Partnership”) as a publicly-traded entity. As of September 18, 2020, in connection with the Reorganization discussed below, SSG became the sole managing member of StepStone Group Holdings LLC (the “General Partner”), the general partner of the Partnership. Unless otherwise specified, “StepStone” or the “Company” refers to SSG and its consolidated subsidiaries, including the Partnership, following the Reorganization and IPO, and to the Partnership and its consolidated subsidiaries prior to the Reorganization and IPO, throughout the remainder of these notes to the condensed consolidated financial statements.

The Company is a global private markets investment firm focused on providing customized investment solutions and advisory and data services to its clients. The Company’s clients include some of the world’s largest public and private defined benefit and defined contribution pension funds, sovereign wealth funds and insurance companies, as well as prominent endowments, foundations, family offices and private wealth clients, including high-net-worth and mass affluent individuals. The Company partners with its clients to develop and build private markets portfolios designed to meet their specific objectives across the private equity, infrastructure, private debt and real estate asset classes. These portfolios utilize several types of synergistic investment strategies with third-party fund managers, including commitments to funds (“primaries”), acquiring stakes in existing funds on the secondary market (“secondaries”) and investing directly into companies (“co-investments”).

The Company, through its subsidiaries, acts as the investment advisor and general partner or managing member to separately managed accounts (“SMAs”) and focused commingled funds, including acquired Greenspring funds (collectively, the “StepStone Funds”).

Reorganization

In connection with the IPO, the Company completed certain transactions as part of a corporate reorganization (the “Reorganization”), which are described below:

•SSG amended and restated its certificate of incorporation to, among other things, provide for Class A common stock and Class B common stock.

•The Partnership amended its limited partnership agreement to, among other things, provide for Class A units and Class B units.

•The General Partner amended and restated its limited liability company agreement to, among other things, appoint SSG as the sole managing member of the General Partner.

•SSG redeemed its 100 shares of common stock outstanding.

•The Partnership effectuated a series of transactions such that certain blocker entities in which certain pre-IPO institutional investors that held partnership units in the Partnership merged with and into SSG, with SSG surviving. As a result of the mergers, the 100% owners of the blocker entities acquired 9,112,500 shares of newly issued Class A common stock of SSG.

•The Partnership classified the partnership units acquired by SSG as Class A units and reclassified the partnership units held by the continuing limited partners of the Partnership as Class B units.

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

•SSG issued to the remaining Class B unitholders one share of Class B common stock for each Class B unit that they owned in exchange for their interests in the General Partner.

•Certain of the Class B stockholders entered into a stockholders agreement pursuant to which they agreed to vote all their shares of voting stock, including Class A common stock and Class B common stock, together and in accordance with the instructions of the Class B Committee, which comprises certain members of senior management.

Initial Public Offering and Greenspring Acquisition

On September 18, 2020, SSG issued 20,125,000 shares of Class A common stock in the IPO at a price of $18.00 per share. The net proceeds from the offering totaled $337.8 million, net of underwriting discounts of $24.5 million and before offering costs of $9.7 million that were incurred by the Partnership. SSG used approximately $209.8 million of the net proceeds from the offering to acquire 12,500,000 newly issued Class A units of the Partnership and approximately $128.0 million to purchase 7,625,000 Class B units from certain of the Partnership’s existing unitholders, including certain members of senior management.

In connection with the Greenspring acquisition (see note 14), the Company issued 12,686,756 shares of its Class A common stock and the Partnership issued 3,071,519 newly created Class C units of the Partnership, each of which is exchangeable into one share of Class A common stock, in each case subject to certain adjustments and restrictions (see note 13).

Following the Reorganization and IPO, SSG became a holding company whose principal asset is a controlling financial interest in the Partnership through its ownership of all of the Partnership’s Class A units and 100% of the membership interests in the General Partner of the Partnership. SSG acts as the sole managing member of the General Partner of the Partnership and, as a result, indirectly operates and controls all of the Partnership’s business and affairs. As a result, SSG consolidates the financial results of the Partnership and reports non-controlling interests related to the Class B and Class C units of the Partnership which are not owned by SSG. The assets and liabilities of the Partnership represent substantially all of SSG’s consolidated assets and liabilities, with the exception of certain deferred income taxes and payables due to affiliates pursuant to tax receivable agreements (see note 10). Each share of Class A common stock is entitled to one vote and each share of Class B common stock is entitled to five votes. As of September 30, 2021, SSG held approximately 50.1% of the economic interest in the Partnership. As the Partnership’s limited partners exchange their Class B and Class C units into SSG’s Class A common stock in the future, SSG’s economic interest in the Partnership will increase relative to that of the Class B and Class C unit holders.

The Reorganization was considered a transaction between entities under common control. As a result, the condensed consolidated financial statements for periods prior to the Reorganization and IPO are the condensed consolidated financial statements of the Partnership as the predecessor to SSG for accounting and reporting purposes.

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information. Management believes it has made all necessary adjustments (consisting of only normal recurring items) such that the condensed consolidated financial statements are presented fairly and that estimates made in preparing the condensed consolidated financial statements are reasonable and prudent. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. The condensed consolidated financial statements include the accounts of the Company, its wholly-owned or majority-owned subsidiaries and entities in which the Company is deemed to have a direct or indirect controlling financial interest based on either a variable interest model or voting interest model. All intercompany balances and transactions have been eliminated in consolidation. These unaudited condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements included in its Annual Report on Form 10-K for the fiscal year ended March 31, 2021 filed with the Securities and Exchange Commission (“SEC”).

Certain of the StepStone Funds are investment companies that follow specialized accounting under GAAP and reflect their investments at estimated fair value. Accordingly, the carrying value of the Company’s equity method investments in such entities retains the specialized accounting.

Reclassifications

Certain prior year amounts have been reclassified to conform to the current period presentation. Amounts relating to foreign currency transaction gains and losses that were previously reported within general, administrative and other expenses have been presented within other income (loss) in the condensed consolidated statements of income.

Consolidation

The Company consolidates all entities that it controls through a majority voting interest or as the primary beneficiary of a variable interest entity (“VIE”). Under the VIE model, management first assesses whether the Company has a variable interest in an entity. In evaluating whether the Company holds a variable interest, fees received as a decision maker or in exchange for services (including management fees, incentive fees and carried interest allocations) that are customary and commensurate with the level of services provided, and where the Company does not hold other economic interests in the entity that would absorb more than an insignificant amount of the expected losses or returns of the entity, are not considered variable interests. If the Company has a variable interest in an entity, management further assesses whether that entity is a VIE, and if so, whether the Company is the primary beneficiary under the VIE model. Entities that do not qualify as VIEs are assessed for consolidation under the voting interest model. The consolidation analysis can generally be performed qualitatively; however, in certain situations a quantitative analysis may also be performed. Investments and redemptions (either by the Company, affiliates of the Company or third parties) or amendments to the governing documents of the respective StepStone Funds that are VIEs could affect the entity’s status as a VIE or the determination of the primary beneficiary.

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

Under the VIE model, an entity is deemed to be the primary beneficiary of a VIE if it holds a controlling financial interest. A controlling financial interest is defined as (a) the power to direct the activities of a VIE that most significantly affect the entity’s economic performance and (b) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the VIE. Management determines whether the Company is the primary beneficiary of a VIE at the time it becomes involved with a VIE and reconsiders that conclusion at each reporting date. When assessing whether the Company is the primary beneficiary of a VIE, management evaluates whether the Company’s involvement, through holding interests directly or indirectly in an entity or contractually through other variable interests, would give the Company a controlling financial interest. This analysis includes an evaluation of the Company’s control rights, as well as the economic interests that the Company holds in the VIE, including indirectly through related parties.

The Company provides investment advisory services to the StepStone Funds, which have third-party clients. These funds are investment companies and are typically organized as limited partnerships or limited liability companies for which the Company, through its operating subsidiaries, acts as the general partner or managing member. A limited partnership or similar entity is a VIE if the unaffiliated limited partners or members do not have substantive rights to terminate or liquidate the fund or remove the general partner or substantive rights to participate. Certain StepStone Funds are VIEs because they have not granted unaffiliated limited partners or members substantive rights to terminate the fund or remove the general partner or substantive rights to participate. The Company does not consolidate these StepStone Funds because it is not the primary beneficiary of those funds, primarily because its fee arrangements are considered customary and commensurate and thus not deemed to be variable interests, and it does not hold any other interests in those funds that are considered more than insignificant.

The Company has determined that certain of its operating subsidiaries, StepStone Group Real Assets LP (“SRA”), StepStone Group Real Estate LP (“SRE”) and Swiss Capital Alternative Investments AG (“Swiss Capital”), are VIEs, and that the Company is the primary beneficiary of each entity because it has a controlling financial interest in each entity; accordingly, the Company consolidates these entities. The assets and liabilities of the consolidated VIEs are presented gross in the condensed consolidated balance sheets. The assets of the consolidated VIEs may only be used to settle obligations of the consolidated VIEs. See note 4 for more information on both consolidated and unconsolidated VIEs.

In connection with the Greenspring acquisition, the Company, indirectly through its subsidiaries, became the sole and/or managing member of certain entities, each of which is the general partner of an investment fund (“legacy Greenspring general partner entities”). The Company did not acquire any direct economic interests attributable to the legacy Greenspring general partner entities, including legacy Greenspring investments in funds and carried interest allocations. However, certain arrangements negotiated as part of the acquisition represent variable interests that could be significant. The Company determined that the legacy Greenspring general partner entities are VIEs and it is the primary beneficiary of each such entity because it has a controlling financial interest in each entity. As a result, the Company consolidates these entities.

Non-Controlling Interests

Non-controlling interests (“NCI”) reflect the portion of income or loss and the corresponding equity attributable to third-party equity holders and employees in certain consolidated subsidiaries that are not 100% owned by the Company. Non-controlling interests are presented as separate components of stockholders’ equity on the Company’s condensed consolidated balance sheets to clearly distinguish between the Company’s interests and the economic interests of third parties and employees in those entities. Net income (loss) attributable to SSG, as reported in the condensed consolidated statements of income, is presented net of the portion of net income (loss) attributable to holders of non-controlling interests. See note 13 for more information on ownership interests in the Company.

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

Non-controlling interests in subsidiaries represent the economic interests in SRA, SRE, and Swiss Capital (the variable interest entities included in the Company’s condensed consolidated financial statements) held by third parties and employees in those entities. Non-controlling interests in subsidiaries are allocated a share of income or loss in the respective consolidated subsidiary in proportion to their relative ownership interests, after consideration of contractual arrangements that govern allocations of income or loss.

Non-controlling interests in legacy Greenspring entities represent the economic interests in the legacy Greenspring general partner entities. The Company did not acquire any direct economic interests in the legacy Greenspring general partner entities. As a result, all of the net income or loss related to the legacy Greenspring general partner entities is allocated to non-controlling interests in legacy Greenspring entities.