Markets

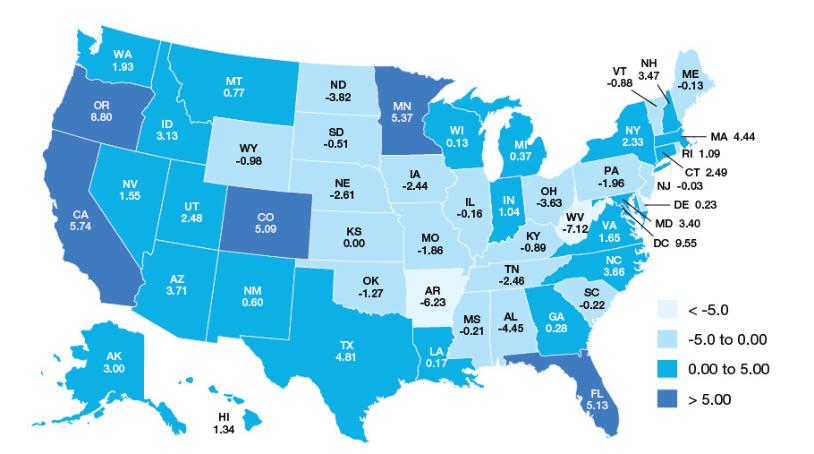

At December 31, 2020, we have active loans in 12 states and the District of Columbia with the majority of loans located in Washington, Colorado, Utah, Texas, Oregon and Idaho. We strategically focus on these states as they have exhibited strong population growth. At December 31, 2020, more than 90% of our portfolio was secured by properties located in states ranked in the top ten for migration between 2010 and 2019 according to the Census Bureau, including Washington, Colorado, Utah, Texas, Oregon and Idaho. Additionally, each of Washington, Colorado, Utah, Texas, Oregon and Idaho are non-judicial foreclosure states, which we believe encourages borrowers to comply with the loan terms and provides us the option to take control of the collateral more quickly in the event of borrower default. We continue to increase our national presence, and in this regard, began operating in the Southeast region in 2018 and the Mid-Atlantic region in 2019 and expect further expansion into states that meet our preferred criteria.

Industry and Market Opportunity

Real estate investment is a capital-intensive business that typically relies heavily on debt capital to acquire, develop, improve, construct, renovate and maintain properties. We focus on providing construction, development and investment loans for the U.S. housing and real estate industries. Due to structural changes in banking, regulation and monetary policies over the last decade, there has been a reduction in the number of lenders servicing this segment. We believe there is a significant market opportunity to originate real estate loans secured by the underlying real estate as collateral. Our management team further believes that the demand for relatively small real estate loans to construct, develop or invest in residential or, to a lesser extent commercial real estate, located in states with favorable demographic trends presents a compelling opportunity to generate attractive risk-adjusted returns.

Historically, regional and community banks were the primary providers of construction financing to smaller, private builders. Over the past several decades, there has been significant consolidation within the commercial banking industry, with the number of commercial and savings institutions having decreased by 61% and 72%, respectively, between 1992 and 2019, as reported by the FDIC. In addition, many traditional real estate lenders that competed for loan origination within our target markets have been faced with tighter capital constraints due to changing banking regulations following the 2008 financial crisis.

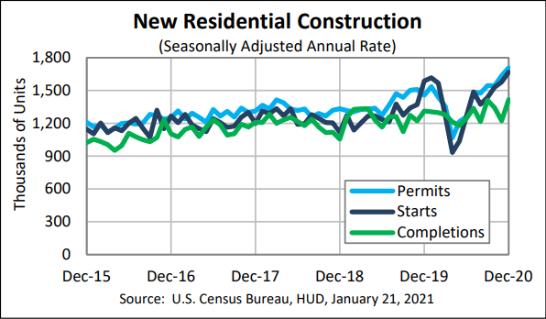

While the number of traditional banks and construction loans offered by them has steadily declined, private residential construction spending and housing starts have continued to recover from the lows following the recession of 2007 through 2009. Housing starts and completions in December 2020 were at seasonally adjusted annual rates of 1.6 and 1.4 million, respectively, an approximate five and eight percent increase from 2019. The U.S. Census Bureau and Department of Housing and Urban Development chart below illustrates historical housing permits, starts and completions from 2015 to 2020:

8