UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number:

(Exact name of registrant as specified in its charter)

(State of Other Jurisdiction of incorporation or Organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Name Of Each Exchange | ||

Title of Each Class | Trading Symbol(s) | On Which Registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically; every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.0405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Based on the closing price as reported on the Nasdaq Stock Market, the aggregate market value of the Registrant’s Common Stock held by non-affiliates on June 30, 2020 (the last business day of the Registrant’s most recently completed second fiscal quarter) was approximately $

Documents Incorporated by Reference

Items 10 (as to directors and Section 16(a) Beneficial Ownership Reporting Compliance), 11, 12, 13 and 14 of Part III incorporate by reference information from the registrant’s proxy statement to be filed with the Securities and Exchange Commission in connection with the solicitation of proxies for the Registrant’s 2021 Annual Meeting of Stockholders to be held on June 9, 2021.

TABLE OF CONTENTS

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (this “Annual Report”) and the documents incorporated herein by reference contain forward- looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning the Company’s possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or similar expressions.

Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. You should understand that the following important factors, among others, could affect the Company’s future results and could cause those results or other outcomes to differ materially from those expressed or implied in the Company’s forward-looking statements:

| ● | the ability to recognize the anticipated benefits of the Company’s business combination consummated on December 23, 2020 (the “Merger”) pursuant to that certain Agreement and Plan of Merger, dated July 30, 2020 (as amended by the First Amendment to the Agreement and Plan of Merger, dated as of October 12, 2020, the “Merger Agreement”), by and among PropTech Acquisition Corporation (“PTAC”), PTAC Merger Sub Corporation, a Delaware corporation and wholly-owned subsidiary of PTAC (“Merger Sub”), Porch.com, Inc. a Delaware corporation, and Joe Hanauer, in his capacity as the shareholder representative, which may be affected by, among other things, competition and the ability of the combined business to grow and manage growth profitably; |

| ● | expansion plans and opportunities, including future acquisitions or additional business combinations; |

| ● | costs related to the Merger; |

| ● | litigation, complaints, and/or adverse publicity; |

| ● | the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability; |

| ● | privacy and data protection laws, privacy or data breaches, or the loss of data; and |

| ● | the impact of the COVID-19 pandemic and its effect on the business and financial conditions of the Company. |

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this Annual Report are more fully described in the “Risk Factors” section. The risks described in “Risk Factors” are not exhaustive. New risk factors emerge from time to time and it is not possible for us to predict all such risk factors, nor can the Company assess the impact of all such risk factors on its business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. All forward- looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. The Company undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

3

PART I

Item 1. Business

Unless the context otherwise requires, references in this section to “we,” “our,” “us,” the “Company” or “Porch” generally refer to Porch Group, Inc. and its consolidated subsidiaries.

Overview

Who We Are

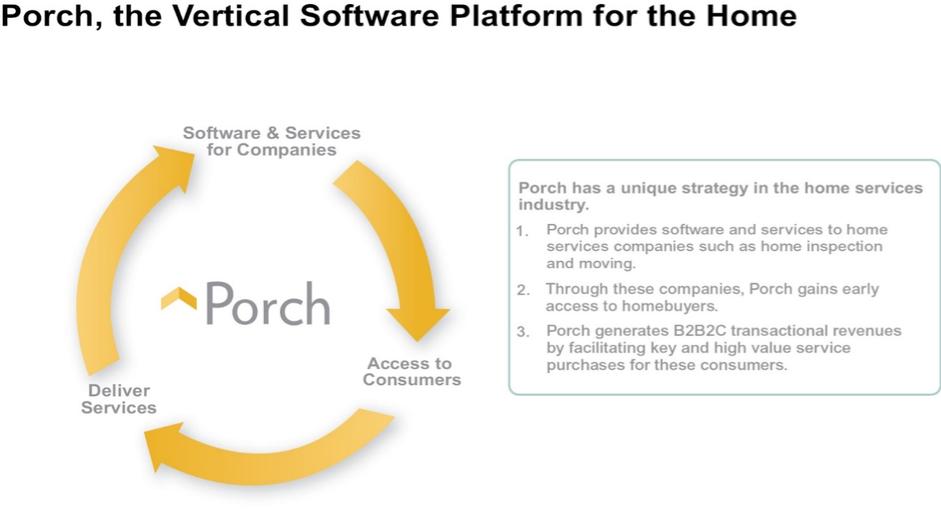

Porch is a vertical software platform for the home, providing software and services to approximately 11,000 home services companies, such as home inspectors, moving companies, utility companies, home insurance, warranty companies, and others. Porch helps these service providers grow their business and improve their customer experience. As a way to pay for the software and services, these companies connect their homebuyers to Porch, who in turn makes the moving process easier, helping consumers save time and make better decisions about critical services, including insurance, moving, security, TV/internet, home repair and improvement, and more. While some home services companies pay Porch typical software-as-a-service (“SaaS”) fees, the majority of Porch’s revenue comes from business-to-business-to-consumer (“B2B2C”) transaction revenues, with service providers such as insurance carriers or TV/internet companies paying Porch for new customer sign-ups.

Porch is the largest provider of software for certain home service verticals, such as the home inspection industry where more than a quarter of all U.S. home inspections are processed through Porch. Porch operates under a number of brands, such as Inspection Support LLC (“ISN™”), Porch’s enterprise resource planning (“ERP”) and customer relationship management (“CRM”) software, HireAHelperTM , where it provides software and demand for moving companies, Elite Insurance Group, where Porch is a licensed nationwide insurance agency, V12, which provides data and analytical solutions that allow brands to improve the performance of their marketing, iRoofing, which provides measurement software for roofers, and Porch.com, where homeowners can complete home projects.

Background and Corporate History

On December 23, 2020 (the “Closing Date”), Porch.com, Inc. and PTAC consummated the business combination pursuant to the Merger Agreement whereby Porch.com, Inc. merged with and into Merger Sub and became a wholly owned subsidiary of PTAC. On the Closing Date, PTAC changed its name from “PropTech Acquisition Corporation” to “Porch Group, Inc.” References in this section to Porch prior to the Closing Date refer to Porch.com, Inc.

We were incorporated in the State of Delaware on December 22, 2011 and officially launched as Porch.com, Inc. on September 17, 2013. We launched Porch with the goal of simplifying the homebuying, move-in, and home maintenance process. We began as a data-driven home services marketplace, delivering project requests to home improvement professionals across the country who make up part of the $460 billion North American home improvement market.1 After two (2) years of growth, and with key learnings in hand, Porch expanded its offerings by providing software and service to home services companies, transitioning to a vertical software company focused on the home. We knew that we wanted to focus on individuals making critical and high value purchase decisions at the start of their homeowning journey. We also knew that we wanted to partner with home service companies to create long-term defensible and proprietary access to these consumers. As of the end of 2020, approximately 11,000 small and large businesses — home inspectors, moving companies, large utilities, home warranty companies and more — use Porch to improve their operations, grow their business, and improve their customer experiences. These partnerships provide Porch introductions to end customers (who are largely homebuyers or existing homeowners) to help make the move and home maintenance simpler. This access is unique, wide-ranging and early in the homebuying process. Because the home inspection industry is Porch’s largest vertical with more than a quarter of all U.S. home inspections being managed in Porch’s ERP/CRM software2, Porch typically gets introduced to a homebuyer approximately six (6) weeks before their move-in day, when

1 Based on data from Global Market Insights, Inc.

2 Based on internal Porch data regarding total home inspections processed via Porch software from January 2020 through June 2020, as a percentage of total 1H 2020 home sales. “Total 1H 2020 home sales,” as used herein, represents the sum of new and existing U.S. home sales for the period from February 2020 through July 2020 (in order to account for the delay between home inspection and closing of sale), as reported by the U.S. Census Bureau (new home sales) and the National Association of Realtors (existing home sales).

4

critical purchase decisions are being made.

Throughout the last seven (7) years, Porch has established many partnerships across a number of home-related industries. Porch has also proven effective at selectively acquiring companies which can be efficiently integrated into Porch’s platform. In 2017, we significantly expanded our position in the home inspection industry by acquiring ISN™, a developer of ERP and CRM software for home inspectors. Under Porch’s ownership, ISN™ has increased its revenues approximately five-fold (5x) in the three (3) years since Porch acquired it. In November 2018, we acquired Hire A Helper, LLC (“HireAHelper™”), a provider of software and demand for moving companies. Similarly, within 18 months after being acquired by Porch, HireAHelper™ had more than doubled its revenues and achieved significant increases in profits. More recently, Porch announced acquisitions of V12, PalmTech, and iRoofing, as well as the signing of Homeowners of America which is expected to close in Q2 2021. We remain committed to pursuing attractive M&A opportunities as a key part of our growth strategy going forward as a public company.

However, as described elsewhere in part in “Risk Factors, Risks Related to Our Acquisition Strategy – We may experience risks related to acquisitions, including the HOA acquisition”, not all of our prior or future acquisitions have or will perform at the levels expected by management or stockholders from an operational, business, financial, or risk management perspective. In addition, at our stage of development we are continuing to build out capabilities in the business and functional staffing areas to assess, value, execute and integrate acquisitions – the growth and capabilities of these teams can introduce risk with respect to realizing our acquisition strategy and the value of acquisition opportunities.

The Porch Platform

Porch provides software and services to home services companies, and, through these relationships, gains unique and early access to homebuyers and homeowners, assists homebuyers and homeowners with critical services such as insurance and moving, and, in turn, Porch’s platform drives demand for other services from such companies as part of our value proposition. Porch has three types of customers: (1) home services companies, such as home inspectors, for whom Porch provides software and services and who provide introductions to homebuyers and homeowners; (2) consumers, such as homebuyers and homeowners, whom Porch assists with the comparison and provision of various critical home services, such as insurance, moving, security, TV/internet, and home repair and improvement; and (3) service providers, such as insurance carriers, moving companies, security companies and TV/internet providers, who pay Porch for new customer sign-ups.

5

Software and Services for Home Services Companies

Porch’s platform provides home services companies with software and services to help them grow their business and provide a better experience for their customers. This value proposition can be divided into three components.

First, Porch offers leading vertical-specific software that includes a wide range of functionality required by home services companies like home inspectors, roofers, and moving services providers to run a better business. These software solutions provide a wide range of functionality including configurable dashboards, calendars and scheduling, online booking, payment processing, dispatch and routing optimization, customer relations and communications, flexible reporting, industry integrations, reporting writing, quoting and more. Companies use this software for their customers and transactions, managing their employees and tracking their partners. The depth of functionality varies among industry-specific products. Because this software is used in so many aspects of day-to-day management by home services companies such as home inspectors, Porch sees very low attrition rates among our software customer base.

Second, Porch offers a Moving Concierge service that home services companies can provide to their end customers in order to improve the moving and home improvement experience. Instead of the relationship ending once the initial service is complete, home inspectors, moving companies, utilities, home warranty companies, and others can provide Porch’s Moving Concierge to assist an end customer with the remaining aspects of their move and, going forward, with ongoing home maintenance. Each Moving Concierge client is provided with a self-service dashboard through which they can manage their moving “to do” list. A Porch Moving Concierge representative will also contact the client to talk about their home inspection, answer questions, collect a review for the company, and chart out all upcoming services with which Porch can assist. Instead of selling customer data as leads, Porch helps the end customer compare prices and make decisions about critical services such as insurance (Porch is a licensed nationwide insurance agency (“EIG”) that underwrites policies for home, auto, flood and umbrella coverage), moving, security, and TV/internet. This experience creates a positive end customer experience that can benefit the home services company.

Third, Porch can help home service companies to grow their business through new customer acquisition. Porch does this through its various digital and concierge experiences and marketing solutions. Home services companies can pay for Porch’s software and certain modules with B2B SaaS fees. They also have the ability to access Porch’s core software suite for free if they provide Porch with access and introductions to their end customers by providing each with Porch’s Moving Concierge experience. This allows Porch to generate business-to-business-to-customer (“B2B2C”) transaction

6

revenues by offering high value services to end customers. The combination of this value proposition is compelling. This allows Porch to achieve a very strong home services company lifetime value to acquisition cost ratio.

Consumer Services

Porch connects consumers with home services companies nationwide and offers a full range of products and services where homeowners can, among other things: (i) compare and buy home insurance policies (along with auto, flood and umbrella policies) with competitive rates and coverage; (ii) arrange for a variety of services in connection with their move, from labor to load or unload a truck to full-service, long-distance moving services; (iii) discover and install home automation and security systems; (iv) compare internet and television options for their new home; (v) book small handyman jobs at fixed, upfront prices with guaranteed quality; and (vi) compare bids from home improvement professionals who can complete bigger jobs.

Porch focuses on the move stage of the homeowner’s journey given the concentration of high value services that are purchased during this time. During the move, Porch assists the customer with services via its Moving Concierge and moving dashboard experience. For example, after helping the consumer quickly compare a large set of options for homeowner’s insurance for the new home, Porch will bind coverage as a licensed insurance agent and connect it back to the homebuyer’s mortgage. Additionally, Porch can highlight a variety of options and pricing for any type of move, including truck, storage and labor booking. For TV and Internet service, Porch provides the consumer a wide variety of rates, options and promotions for all major TV and Internet providers in their area and activates service directly for the consumer. According to a survey conducted by Article and OnePoll, moving was the second most stressful high-stress moment in a consumer’s life (behind only loss of a job), and across each of these services, Porch helps the consumer quickly and easily select the right products for them.

After the move, Porch provides consumers with tools and resources to help them find local professionals to complete most types of home maintenance, repair and improvement projects. Homeowners simply submit a project request on the Porch website, and Porch matches the homeowner with local professionals in their area who have the skills to do the job. Porch then sends the homeowner contact details about the service professionals they have been matched with, so the homeowner can select the right person or company for the job. Professionals can create profiles on Porch.com, but we also partner with both large service provider companies as well as large networks of service providers. This enables Porch to offer consumers various high-quality options without having to build a large sales force or operate as a standalone marketplace.

Our Industry

The home is foundational to the American experience. According to data from the National Association of Realtors and the U.S. Census Bureau, there were 5.64 million existing homes sold and approximately 815,000 newly constructed homes sold in the United States in 20203. There are millions of home services companies, most of which are small businesses operating in fragmented markets, according to the U.S. Small Business Administration Office of Advocacy. For consumers, moving and maintenance can be full of pitfalls and headaches. Porch seeks to simplify the home by providing software and services to home services companies and connecting homeowners to high-quality services throughout the home lifecycle. In doing so, Porch conducts its business across a broad total addressable market (“TAM”), consisting of moving services, property and casualty (“P&C”) insurance and contractor services, with an estimated total value of approximately $320 billion4. This TAM is based on the products Porch offers today, with ample opportunity for expansion of Porch’s addressable market.

Moving Services

Porch provides three primary moving services that support homeowners during the moving process: direct moving services, security installations and TV/internet installations. Based on U.S. Census Bureau data and Porch management estimates, Porch believes the overall addressable opportunity for Porch in these three service offerings in the U.S. to be

3 National Association of Relators 2020 report.

4 National Association of Relators 2020 report.

7

approximately $4 billion. This estimate assumes that of the approximately 6 million annual home sales, approximately 20% will result in a home security purchase (according to industry estimates), which at approximately $1,100 per sale results in a $1.3 billion security installation TAM. The TV/internet installation TAM assumes all homebuyers will get some combination of TV and Internet service as an average commission per household of $114. This also assumes each home sale results in one move and that Porch can receive $314 net commission per move (which is a mix between full service moves and labor only moves), thereby creating a $1.9 billion moving service TAM. Porch bases these net commission assumptions on a review of existing customer purchasing patterns and revenue contributions.

Property and Casualty (P&C) Insurance

Through its wholly-owned licensed insurance agency, Elite Insurance Group, Porch serves customers in the P&C home, auto, flood, and umbrella insurance market. In addition, as discussed more fully under “— Our Strategies for Growth — Insurance Expansion,” Porch recently entered into a definitive agreement to acquire Homeowners of America Holding Corporation (“HOA”), a leading property and casualty insurance company focused on products in the residential homeowner space which, if completed, would result in Porch owning a managing general agent (“MGA”) and an insurance carrier, thereby significantly expanding Porch’s revenue from insurance sales. Based on U.S. home insurance annual revenues of $105B plus U.S. auto insurance annual revenues of $288B multiplied by a 20% commission, Porch believes the P&C home and auto insurance TAM is approximately $163 billion.5

Contractor Services

Contractor services is another large portion of Porch’s TAM with an estimated size of approximately $140 billion. This estimate is based on GM Insights’ $460 billion valuation of the home improvement market in 2018 and assumes 50% of projects are fully managed and coordinated by Porch with a 45% take rate ($104 billion managed services TAM) and 50% of projects are referred to third parties without any coordination by Porch for a 15% referral fee ($34 billion referral services TAM). The assumptions surrounding the percentage split between managed and outsourced projects, gross margins, and referral fees are based on Porch’s historical experience.

Mover Marketing

Mover Marketing represents Porch’s opportunity to sell marketing technology and services that help advertisers retain existing customers and attract new customers at key moments in time, such as during the homebuying process. Porch estimates this TAM in the U.S. as $8B based on 6 million homebuyers annually spending an average $9,000 during the first 3 to 6 months of the move6, and of this $54B in spend, Porch estimates that 15% will be spent on marketing to these consumers based on what it has observed in the industries it serves.

Trends and Growth in the Housing and Home Maintenance Sectors

Increasing Home Sales

As a home services platform that provides ERP and CRM software to approximately 11,000 inspection, moving and home services companies, Porch’s revenue is linked to existing home sales, which, according to the National Association of Home Builders, were at a 13-year high as of February 2020. COVID-19 significantly impacted Porch’s home inspection volumes in March and April of 2020, but by June, Porch’s volume had fully recovered to 2019 levels. Continued strong home sales are supported by historically low 30-year fixed mortgage rates and the behavior of homeowners to move and change homes. America is a mobile country, with the average American homeowner moving once every 13 years, according to the National Association of Realtors. Research from the National Association of Realtors shows several reasons for Americans moving, with the most frequent reasons being to find a new or better home, to start or transfer jobs or to establish a new family home for the first time.

5 According to IBISWorld 2020 full year data, U.S. home insurance annual revenues totaled $105 billion and U.S. auto insurance annual revenues totaled $288 billion.

6 Epsilon 2012 New Mover Report.

8

Buying a Home and Moving is Becoming More Complex

Moving is considered one of the most stressful life events. The list of decisions a buyer needs to make begin with the qualities and attributes of the new home. There is a growing list of factors that go into choosing a home, including, but not limited to, home affordability, safety, quality of schools and proximity to parks, recreational facilities, health centers and outdoor space. When purchasers do find the right home, they might face a competitive process where their bid is ultimately rejected. Once their bid is accepted, home buyers have to manage home inspections and finalize their mortgage by meeting lender requirements.

With the house purchase offer accepted, homebuyers then must deal with the complexity of and logistics of moving. Pre-move considerations include but are not limited to researching moving services, visiting new communities, booking rentals, reserving storage units, coordinating with movers on packing, transferring utilities, home cleaning, completing a change of address, purchasing home insurance, and purchasing a home warranty. Within the moving company market alone, according to the American Moving and Storage Association, there are over 7,000 companies in over 13,900 locations to choose from. Post-move considerations include but are not limited to unpacking, cleaning the new house, scheduling essential home improvements listed in the inspection report, changing locks, transferring medical records, registering vehicles, purchasing internet and setting up a security system. All of these considerations make moving a stressful and tenuous process.

Porch helps make the move simple through its Moving Concierge and related services. Homebuyers can use Porch’s self-service dashboard to compare prices for movers, provision move-related services, and manage their moving checklist. Customers are also offered a wide variety of home services. Ultimately, Porch makes moving less stressful.

Increasing Home Improvement Spending

After helping consumers with their move, Porch continues to say in touch with the movers to help with home maintenance and improvement projects. The continued growth of the home improvement spending market will have a substantial impact on Porch’s future revenues.

According to the Home Improvement Research Institute, total home improvement spending in 2019 was approximately $405 billion and grew to just short of $440 billion in 2020. Despite COVID-19, there is a strong positive economic outlook. At the federal level, the fiscal stimulus from the Bipartisan Budget Act of 2019 is expected to help drive growth through 2021. According to recently published data from the Home Improvement Research Institute, the housing and home improvement market is forecasted to return to 2019 levels by the end of 2021. By 2022, home improvement sales are projected to pass $460 billion per year.

Outsourcing of Specialized Home Improvement Projects

According to iPropertyManagement, four out of five homeowners hire a professional or licensed specialist to assist on typical home projects such as window replacements, roof repairs, heating, ventilation and air conditioning installations, and others, and 87% of home renovations utilized a service professional in 2018. Porch helps make finding these professionals easy and offers transparent pricing.

Digitalization of Home Services

According to Technavio, online on-demand home services are expected to grow at a compounded annual growth rate of over 50% from 2020 to 2024. Driving this trend is the digitally minded millennial generation that is entering the home ownership market and hiring home services professionals online. Home service professionals experiencing the benefits and scalability of connecting and engaging with consumers online, including reaching wider or targeted audiences, improving conversion rates, reducing acquisition costs, and tracking performance of marketing investments, are expected to invest more into digital offerings over time.

9

Our Competitive Strengths

Leading ERP and CRM Software with Approximately 11,000 Contracted Companies in a Diverse Set of Industries

Porch owns several leading ERP and CRM software platform brands including ISN™ for home inspectors and HireAHelper™ for moving companies. Porch provides software to approximately 11,000 companies across a number of home services verticals utilizing its various software brands.

Early Access to Demand

Porch’s early access to homebuyers allows Porch to be among the first service providers to reach out to consumers and to assist them in their moving journey prior to completing many large purchasing decisions. Home services companies have the option to opt into Porch’s customer access model and receive Porch’s software for free in exchange for access rights to their customers, thereby allowing Porch to market and offer services to these customers up to six (6) weeks in advance of their move. Porch’s customer access model represents an extremely valuable marketing tool and customer acquisition platform for home services providers, who typically rely on a change of address request that occurs near the end of the moving journey to reach out to homebuyers.

Of all of the verticals Porch operates in, the largest is the home inspection industry. Porch’s ERP and CRM software for home inspectors, is the software of choice for over 6,000 inspection companies, including most of the largest inspection companies in the U.S. These inspection companies complete over a quarter of all U.S. home inspections through Porch’s ISN™ software. Through research and development, Porch continues to invest in and strengthen the software advantage of ISN™. Moreover, Porch expects to increase the percentage of U.S. homebuyers available through its customer access model by expanding sales efforts of ISN™ and other software, and by completing acquisitions of software and service companies in the home services sector.

Porch’s other portfolio brands, including HireAHelper™ and Kandela™ also provide Porch access to customers. HireAHelper™ offers third party moving services by matching homeowners with local movers, trucks and storage containers, in addition to providing CRM software for moving companies. Kandela™ offers a leading moving concierge product for utility customers in the U.S., helping hundreds of thousands of movers through its exclusive partnerships with utilities. These brands generate incremental customer access and provide services to consumers, augmenting Porch’s competitive advantage across a broader array of home services.

Innovative Customer Access Pricing Model

Porch’s customer access model, whereby software customers utilize Porch’s software for free in exchange for providing access rights to their customers, reduces competition from traditional software providers that charge a fee and rely on that revenue to sustain their businesses. In addition to obtaining the software for free, inspection companies report higher net promoter scores after enrolling in Porch’s customer access model as Porch drives improved customer satisfaction through its concierge service at a critical time of need. As a result, ISN™ benefits from high retention rates among software customers.

Proprietary Data and Analytics

Through the services it offers, Porch has amassed a trove of proprietary data on homebuyers and their homes. Using this data, Porch intends to accelerate its investment in data science and analytics to provide more suitable services to homebuyers and improve service provider marketing opportunities. For example, Porch believes that its data could help improve Porch’s ability to predict a variety of events, including the timing and likelihood of specific purchase decisions around the home, a mover’s likelihood of switching insurance carriers or the likelihood and severity of home insurance and home warranty claims. V12, a Porch business provides software and of data solutions to help brands and SMBS acquire new customers and improve their marketing, leveraging our own proprietary mover data.

10

Strong Management Team with Extensive Merger and Acquisition Experience

Porch’s management team has significant merger and acquisition and integration experience obtained through over a hundred merger and acquisition transactions between the CEO, CFO and head of corporate development during their employment at previous companies. Porch has a strong track record of driving significant value creation from acquisitions to date. In less than 3 years after acquiring ISN™, Porch management had increased ISN’s revenues by five (5x) times. In less than 18 months after acquiring HireAHelper™, Porch had doubled its revenues. More recently, Porch announced acquisitions of V12, PalmTech, and iRoofing, as well as the signing of Homeowners of America which is expected to close in Q2 2021. Porch intends to leverage its acquisition experience by continuing to selectively pursue strategic SaaS acquisitions that strengthen Porch’s unique access to demand.

Comprehensive Service Offering

Porch offers a unique breadth and depth of home services that span the entire homeownership experience from the move to ongoing maintenance. Not only is Porch able to help a consumer with the services they need at any point in their journey with their home, but also by going deeper into select services such as insurance, moving, and handyman services for example, Porch is able to improve the consumer experience and capture more value. This ability to create value from consumers allows Porch to offer a unique and strong value proposition to companies who provide Porch access to their customers. Because we are able to drive value to the companies that use our products and services, we are more easily able to attract new business partners and invest in product development and customer support to ensure we sustain out competitive advantage.

Our Strategies for Growth

Porch plans to achieve its strategic plan by driving organic growth and executing attractive acquisition opportunities. Porch intends to continue focusing on growth that will positively impact long-term shareholder value through the following strategies:

Sell More Software and Gain Access to More Homebuyers

Porch’s software for home inspectors and other industries not only generates strong B2B SaaS revenues, it is also a valuable and low-cost customer acquisition tool that drives growth through expanded homebuyer access. Porch intends to expand its B2B SaaS fees and homeowner access by:

| ● | Increasing the number of software customers organically through expanded sales and marketing efforts and inorganically through SaaS acquisitions. See “— Selectively Pursue Strategic SaaS Acquisitions” below. |

| ● | Upsell into these software customers additional SaaS modules for B2B SaaS fees. |

| ● | Continue to realize low churn rates of software customers, while increasing B2B SaaS fees as Porch helps these companies grow. |

| ● | Increasing the percent of software customers that grant access rights to their consumers. Porch has been steadily converting more of its software customers to this option by explaining its benefits, which include increased net promoter scores for inspectors that adopt the customer access model, to inspectors during Porch’s software training program. |

11

Increase Revenue per Homebuyer

Porch intends to capitalize on its expanded homebuyer access by increasing the revenue generated from each homebuyer. Porch believes it is currently capturing approximately 1% of the $2,300 estimated potential revenue opportunity per homebuyer7 and believes that it can increase this percentage by:

| ● | Improving the digital shopping experience for consumers who prefer to purchase online. |

| ● | Increasing the percent of individuals with access rights that are called, contacted, and engaged by Porch’s Moving Concierge call center team. |

| ● | Make available additional high-margin services for these homebuyers, such as electricity setup, warranty, and solar installation. |

| ● | Improving conversion and take rates of both existing and new services by offering more competitive quotes per service so that customers do not find a better price elsewhere and more services so that customers do not need to leave the Porch ecosystem. |

| ● | Generating more revenue from certain services by handling more of the experience for the consumer, such as what Porch is doing in the insurance industry with its acquisition of HOA. |

Mover Marketing

Today, companies of all shapes and sizes advertise to movers through direct mail after the consumers have moved into their new home and change their address with the United States Postal Service. Through Porch’s early access to homebuyers, Porch can help homebuyers obtain earlier access to discounts and promotions that are typically made available to movers, while helping these brands and advertisers send direct mail to consumers in advance of their move.

On January 12, 2021, the Company acquired DataMentors Holdings, LLC d/b/a V12 Data (“V12 Data”), a leading consumer data and analytics platform with a focus on household and mover insights, data management and marketing activation, in a cash transaction for a total purchase price of $22 million payable at closing, subject to customary adjustments, plus up to $6 million of contingent purchase price payments based upon the financial performance of V12 Data during the 2021 and 2022 calendar years. In addition, the Company has agreed to provide a retention pool under the 2020 Porch Group Inc. Stock Incentive Plan of up to 100,000 shares of restricted Common Stock to retain key employees of V12 Data and contingent compensation (subject to the achievement of certain post-closing milestones) of up to an additional $6 million in cash or shares of Common Stock (at the Company’s election) to certain key employees of V12 Data. The V12 Data acquisition is expected to provide Porch with full-spectrum, enterprise-grade capabilities to capture the unique-to-the-market pre-mover marketing opportunity.

Insurance Expansion in 2021

Elite Insurance Group, Porch’s wholly owned subsidiary, is an insurance agent that is currently licensed in all 50 states. Porch intends to expand from an insurance agency to an MGA by acquiring one or more MGAs. Becoming an MGA would allow Porch to capitalize on the underwriting advantage provided by its unique insights into properties and homebuyers. The MGA structure would allow Porch to obtain higher commissions and participate in the upside of selecting good risks with lower claims. Additional potential growth opportunities for Porch’s insurance business include adding more insurance carriers as partners in certain regions of the country and adding state licenses for certain in-house insurance agents.

7 Based on Porch estimated value of potential insurance sales, security system installations, TV/internet installations, utility activation, moving services, warranty products, inspection repairs, marketing revenues and certain other services and products and Porch estimates of the frequency with which such products are purchased by homebuyers.

12

On January 13, 2021, the Company entered into a definitive agreement to acquire Homeowners of America Holding Corporation (“HOA”), a leading property and casualty insurance company focused on products in the residential homeowner space, in a cash and stock transaction with consideration consisting of (i) $100,000,000, as adjusted in accordance with the terms of the definitive agreement, of which up to $25,000,000 may be payable in Common Stock at the election of the Company (the “Stock Election”), (ii) 500,000 additional shares of Common Stock subject to the trading price of Common Stock exceeding $22.50 for twenty (20) out of thirty (30) consecutive trading days in the two (2) year period following the consummation of the HOA acquisition and (iii) a retention pool under the 2020 Porch Group, Inc. Stock Incentive Plan of shares of restricted Common Stock in an amount equal to $510,000 and up to 100,000 options for acquisition of Common Stock to retain key employees of HOA, in each case upon the terms and subject to the conditions of the definitive agreement. The HOA acquisition is subject to state insurance regulatory approval and customary closing conditions. The HOA acquisition is expected to close in the second quarter of 2021. HOA is a MGA and carrier hybrid with a strong reinsurance strategy that currently operates in six states. The HOA acquisition is expected to enable Porch to offer its own line of homeowner’s insurance alongside its existing insurance agency which partners with many other top carriers and provide consumers with flexibility and choice.

Expand into New Home Service Verticals

There are opportunities for Porch to expand organically and via mergers and acquisitions to provide software and services to additional home service verticals. In addition to the HOA and V12 Data acquisitions, Porch plans to identify and close several accretive acquisitions that expand the number of home services companies that Porch supports and increases Porch’s access to unique demand and data. As an example, the recent acquisition of iRoofing brings Porch into the roofing software market where it can help these contractors grow and improve the experience to their customers (such as by saving money on insurance once a new roof is installed). Porch has an extensive pipeline of additional acquisition targets across the home services SaaS, insurance, moving, and home technology sectors. Management maintains active discussions with potential suitable targets.

Geographic Expansion

Porch currently conducts the vast majority of its business in the United States and a small portion in Canada. While Porch expects to remain focused on the U.S. market for the next several years, in the future Porch anticipates expanding internationally into Europe, Australia, and other markets where the home sales market operates similarly to the U.S. Within the United States, Porch operates nationwide and has opportunity to expand is insurance operations and offerings across many U.S. markets.

Revenue

Porch generates revenue in three (3) ways: (i) recurring SaaS fees that companies pay us for our software and services, (ii) reoccurring B2B2C transaction revenues for move-related services, and (iii) reoccurring B2B2C and business-to-consumer (“B2C”) transaction revenues from post-move related services.

Companies which use Porch’s software and services have the option to pay Porch with SaaS fees or customer access at which time Porch generates revenue via B2B2C transactions. Because Porch gets full access to a complete base of homeowners from a company, this customer access payment method is more attractive to Porch and such companies are worth an average of six (6x) times more to Porch than SaaS fees.8

B2B2C transaction revenues for move-related services include the LTV of commissions Porch receives from insurance carriers for each new sale to a policyholder which are paid in the first year and each subsequent year that the policyholder renews, and bounties related to the sale of moving service, security, or TV/Internet service. B2B2C transaction revenues for post-move related services includes per lead, per appointment and per job fees paid by contractors and partners for customer demand.

8 Based on internal Porch calculation comparing SaaS fee from per inspection from paying subscribers and Porch estimate of total revenue generated per inspection from access subscribers in 2019.

13

Revenue for Porch generally follows seasonality of both existing home sales and home projects, with more revenue concentrated in the second and third quarters rather than the first and fourth quarters.

Sales and Marketing

We sell our software and services to companies using a variety of sales and marketing tactics. We have teams of inside sales representatives organized by vertical market who engaged directly with companies. We have enterprise sales teams which target the large named accounts in each of our vertical markets. These teams are supported by a variety of typical software marketing tactics, including both digital, in-person (such as trade shows and other events) and content marketing. Porch has been very successful at partnering with key companies in our vertical markets who have aided in sales and adoption.

For consumers, Porch largely relies on our unique and proprietary relationships with the approximately 11,000 companies using Porch’s software to provide the company with end customer access and introductions. Porch then utilizes technology, lifecycle marketing and teams in lower cost locations to operate as a Moving Concierge to assist these consumers with services. Porch has invested in limited direct-to-consumer marketing capabilities, but expects to become more advanced over time with capabilities such as digital and social retargeting.

Technology

Porch has invested significantly for many years in engineering, product, and design in order to build out our platform. We operate a modern technology stack that allows for rapid development and deployment as well as integrations. Each of our business units develops its own technology to support its products and services, leveraging both open-source and vendor supported software technology. Each of our various brands and businesses has dedicated engineering teams responsible for software development and the creation of new features to support our products and services across a full range of devices (desktop, mobile web and native mobile applications). Our engineering teams use an agile development process that allows us to deploy frequent iterative product and feature releases.

Competition

The home services industry is highly competitive, fragmented, and localized. We compete with, among others: (i) search engines and online directories for all types of home services we assist consumers with, (ii) other vertical software companies in our markets, (iii) companies who help consumers purchase insurance, moving, and other home services, and (iv) other companies which help consumers to make their homes simple. We believe that our largest competition comes from the wide variety of companies focused on reaching consumers for the purpose of helping with key high-value services such as insurance, moving, TV/Internet and other such services, as well as numerous traditional digital and non-digital service providers.

We believe that our ability to compete successfully will depend primarily upon the following factors:

| ● | the size, quality, diversity and stability of the large number of companies utilizing Porch’s software and services who give Porch early and proprietary access to homebuyers before competitors are aware; |

| ● | our ability to consistently generate home services fees and revenues through our access to homebuyers and homeowners in a cost-effective manner; |

| ● | our ability to increasingly engage with consumers directly through our platforms (rather than through search engine marketing or search engine referrals); |

| ● | the functionality of our software and services, websites and mobile applications and the attractiveness of their features and our products and services generally to home services companies and consumers, as well as our continued ability to introduce new products and services that resonate with consumers and service professionals generally; |

14

| ● | our ability to continue to build trust in and loyalty to, our various brands, particularly Porch.com, ISN™, HireAHelper™, V12, iRoofing and Elite Insurance Group; and |

| ● | the ability for us to continue to expand our platform organically and inorganically into other vertical markets and select services. |

Intellectual Property

We regard our intellectual property rights as critical to our success generally, with our trademarks, service marks and domain names being especially critical to the continued development and awareness of our brands and our marketing efforts.

We protect our intellectual property rights through a combination of trademarks, trade dress, domain name registrations, and trade secrets, as well as through contractual restrictions and reliance on federal, state and common law. We enter into confidentiality and proprietary rights agreements with employees, consultants, contractors and business partners, and employees and contractors are also subject to invention assignment provisions.

We have several registered trademarks in the United States (the most significant of which relate to our Porch™, ISN™ and HireAHelper™ brands), as well as other trademarks in Canada and Europe. We have also registered a variety of domestic and international domain names, the most significant of which relate to our Porch brand.

Government Regulation

We are subject to laws and regulations that affect companies conducting business on the Internet generally and through mobile applications, including laws relating to the liability of providers of online services for their operations and the activities of their users. As a result, we could be subject to claims based on negligence, unfair business practices, various torts and trademark and copyright infringement, among other actions.

In addition, because we receive, transmit, store and use a substantial amount of information received from or generated by consumers and service professionals, we are also impacted by laws and regulations governing privacy, the storage, sharing, use, processing, disclosure and protection of personal data and data breaches.

We are particularly sensitive to laws and regulations that adversely impact the popularity or growth in the use of the Internet and/or online products and services generally, restrict or otherwise unfavorably impact the ability or manner in which we provide our products and services, regulate the practices of third parties upon which we rely to provide our products and services and undermine open and neutrally administered Internet access. To the extent our businesses are required to implement new measures and/or make changes to our products and services to ensure compliance, our business, financial condition and results of operations could be adversely affected. Compliance with this legislation or similar or more stringent legislation in other jurisdictions could be costly, and the failure to comply could result in service interruptions and negative publicity, any or all of which could adversely affect our business, financial condition and results of operations. In addition, in December 2017, the U.S. Federal Communications Commission (“FCC”) adopted an order reversing net neutrality protections in the United States, including the repeal of specific rules against blocking, throttling or “paid prioritization” of content or services by Internet service providers. To the extent Internet service providers take such actions, our business, financial condition and results of operations could be adversely affected.

We are also subject to laws governing marketing and advertising activities conducted by/through telephone, e-mail, mobile devices and the Internet, including the TCPA, the Telemarketing Sales Rule, the CAN-SPAM Act, Section 5 of the FTC Act and similar state laws, as well as federal, state, and local laws and agency guidelines governing background screening.

15

Employees

Our core values are foundational to Porch. By staying true to: No Jerks/No Egos; Solve Each Problem; Be Ambitious; Care Deeply; and Together We Win, we have created a company where good people can do great work and drive shareholder value. These values guide us in everything we do, from individual everyday tasks to high-level strategic planning. They foster a culture of dialogue, collaboration, recognition and a sense of family that contributes to our long-term success.

Porch is organized as a decentralized operating model, which we believe allows our businesses to move quickly and entrepreneurially with a common playbook and infrastructure that benefit from shared best practices as we scale. When we acquire a company, our decentralized operating model helps us manage the costs and risks associated with integration and do not take on that risk. We integrate acquisitions 1) into our central data platform and 2) transactional monetization to drive our B2B2C revenues such as insurance.

We engage and empower our team with continued career and learning and development opportunities. Fostering a growth mindset facilitates a culture where all voices are heard and team members can take informed risks, ask questions, and seek creative solutions to tough problems. This approach helps us build a strong bench of leaders for tomorrow’s business challenges.

Our diversity, equity and inclusion efforts are based on the principle that all Porch team members can bring their whole selves to work and thrive. We have a growing Employee Resource Group (ERG) community and a commitment throughout the organization for Porch to be a supportive and inclusive environment.

As of January 2021, Porch had approximately 1,000 full-time employees and independent contractors. We believe that we generally have good relationships with our employees and contractors.

Additional Information

Our main website is www.porch.com, and our investor relations website is located at www.porchgroup.com. Neither the information on these websites, nor the information on the websites of any of our brands and businesses, is incorporated by reference into this Annual Report, or into any other filings with, or into any other information furnished or submitted to, the SEC.

Item 1A. Risk Factors

The following summary risk factors and other information included in this Annual Report should be carefully considered. The summary risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not currently known to us or that we currently deem less significant may also affect our business operations or financial results. If any of the following risks actually occur, our stock price, business, operating results and financial condition could be materially adversely affected. For more information, see below for more detailed descriptions of each risk factor.

| ● | Our brands and businesses operate in an especially competitive and evolving industry. |

| ● | We rely on our ability to reach homebuyers earlier than our competitors via proprietary relationships with home services companies and other commercial partners. Our competitors could find ways to reach homebuyers earlier than us. |

| ● | We rely on strategic relationships with third parties to provide us with personal information. |

| ● | Our future growth is dependent in part on increasing the revenue we generate from homebuyers and consumers we serve through the sale of related services. We may not succeed in these efforts. |

| ● | We rely on our ability to retain home services companies who use our software and services and our retention rates could be impacted if we are not able to sustain our competitive advantages related to our value proposition. |

| ● | If the market for SaaS software applications develops more slowly than we expect or declines, our business would be adversely affected. |

16

| ● | Our success depends, in part, on our ability to develop and monetize versions of our products and services for mobile and other digital devices. |

| ● | Our success will depend, in substantial part, on the continued migration of the home services market online. |

| ● | Litigation and regulatory actions could distract management, increase our expenses or subject us to material money damages and other remedies. |

| ● | Our insurance business is subject to state governmental regulation, which could limit the growth of our insurance business and impose additional costs on us. |

| ● | We face a variety of risks through our expansion into the insurance business. |

| ● | The business of Elite Insurance Group is commission-based and depends on our relationships with insurance providers with no long-term contractual commitments. |

| ● | Our business may also be adversely affected by downturns in the home, auto, flood and umbrella insurance industries. |

| ● | Insurance commission revenue recognition and changes within our insurance business may create a fluctuation of our business results and expose us to additional risks. |

| ● | Marketing efforts designed to drive traffic to our brands and businesses may not be successful or cost-effective. |

| ● | Our brands and businesses are sensitive to general economic events or trends, particularly those that adversely impact consumer confidence and spending behavior. |

| ● | Our success will depend, in part, on our ability to maintain and/or enhance our various brands. |

| ● | We face risks related to the number of service providers available to consumers on our platform. |

| ● | If we are unable to deliver effective customer service, it could harm our relationships with our existing home services companies, consumers, service providers and commercial partners and adversely affect our ability to attract new home services companies, consumers, service providers and commercial partners. |

| ● | We may face negative consequences from the actions and omissions of our service providers, and our terms and conditions may not adequately protect us from claims. |

| ● | Our marketing efforts are subject to a variety of federal and state regulations. |

| ● | Our moving services business is subject to state regulations and certain state regulatory structures do not address our business model for moving services. Compliance with required licensure and other regulatory requirements could be costly and any inability to comply could harm our business. |

| ● | Our primary operating subsidiary may not be qualified to do business in all jurisdictions in which we have sufficient nexus of operations to require qualification. |

| ● | The global outbreak of COVID-19 and other similar outbreaks has adversely affected our business, financial condition and results of operations. |

| ● | Our success depends, in part, on our ability to access, collect and permissibly use personal data about consumers. |

| ● | If personal, confidential or sensitive user information that we maintain and store is breached or otherwise accessed by unauthorized persons, it may be costly to mitigate and our reputation could be harmed. |

| ● | The processing, storage, use and disclosure of personal data could give rise to liabilities and increased costs. |

| ● | We are subject to payment network rules and any material modification of our payment card acceptance privileges could have a material adverse effect on our business, results of operations and financial condition. |

| ● | We may experience risks related to acquisitions, including the HOA acquisition. |

| ● | The HOA acquisition is subject to closing conditions, including certain conditions that may not be satisfied, and it may not be completed on a timely basis, or at all. Failure to complete the HOA acquisition could have material and adverse effects on us. |

| ● | The Company’s stock price may change significantly following the Merger and you could lose all or part of your investment as a result. |

| ● | Future sales, or the perception of future sales, by the Company or its stockholders in the public market following the merger could cause the market price for the Company’s common stock to decline. |

| ● | Warrants for our common stock have become exercisable, and we have called for redemption of our public warrants, which will likely result in significant near-term warrant exercises and dilution to our existing stockholders. |

| ● | Our outstanding loan under the Paycheck Protection Program may not be forgiven, which could adversely affect our financial condition or otherwise subject us to significant legal and reputational costs. |

17

| ● | The JOBS Act permits “emerging growth companies” like us to take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies. |

The summary risk factors described above should be read together with the text of the full risk factors below and in the other information set forth in this Annual Report, including our consolidated financial statements and the related notes, as well as in other documents that we file with the SEC. If any such risks and uncertainties actually occur, our business, prospects, financial condition and results of operations could be materially and adversely affected. The risks summarized above or described in full below are not the only risks that we face. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial may also materially adversely affect our business, prospects, financial condition and results of operations.

Risks Relating to the Company’s Business and Industry

Our brands and businesses operate in an especially competitive and evolving industry.

The insurance industry, moving services industry, home service industry, and software for home services companies industry are all competitive, with many existing competitors and a consistent and growing stream of new entrants, services and products. Some of our competitors are more well-established or enjoy better competitive positions with respect to certain geographical areas, consumer and service professional demographics, and/or types of services offered. Some of our competitors have stronger brand recognition, better economies of scale, more developed software platforms or other intellectual property, and/or better access to capital. In the home services space, we compete with online home services marketplaces, search engines and social media platforms that have the ability to market products and services online in a more prominent and cost-effective manner than we can, and may better tailor results with respect to products and services to individual users. In the software-as-a-service (“SaaS”) application space, we compete with existing providers of enterprise resource planning (“ERP”) and customer relationship management (“CRM”) software through both traditional software and SaaS models. Additionally, many of our competitors in the home and home-related services industries are undergoing consolidation and vertical integration. These consolidations may make it more difficult to compete with such competitors. Any of these advantages could enable these competitors to reach more consumers and service professionals than we do, offer products and services that are more appealing to consumers and service professionals than our products and services, and respond more quickly and/or cost effectively than we do to evolving market opportunities and trends, any of which could adversely affect our business, financial condition and results of operations.

In addition, since most home services marketplace products and services are offered to consumers for free, consumers can easily switch among home services offerings (or use multiple home services offerings simultaneously) at no cost to them. And while service professionals may incur additional or duplicative near-term costs, the costs for switching to a competing platform over the long term are generally not prohibitive. Low switching costs, coupled with the propensity of consumers to try new products and services generally, will most likely result in the continued emergence of new products and services, entrants and business models in the home and home-related services industry.

Our inability to compete effectively against new competitors, services or products could result in decreases in the size and level of engagement of our consumer and service professional bases, any of which could adversely affect our business, financial condition and results of operations.

We rely on our ability to reach homebuyers earlier than our competitors via proprietary relationships with home services companies and other commercial partners. Our competitors could find ways to reach homebuyers earlier than us.

Our business model allows home services companies to receive our software for free in exchange for access rights to their end customers, thereby allowing us to market and offer services to these customers very early in their move and homebuying processes. We also have relationships with commercial partners that provide us with data about consumers early in the moving process. There can be no assurances that we will continue to receive earlier access to homebuyer customers relative to our competitors. Our competitors may adopt a similar model or may develop a new model that affords them similar or earlier access. Any erosion of our competitive advantage in early access to homebuyers may impair future opportunities to monetize those customers, which in turn could adversely impact our business, financial condition and results of operations.

18

We rely on strategic relationships with third parties to provide us with personal information.

Our business model relies on our ability to access, collect and use personal information. We rely on strategic relationships with third parties to provide us with personal information, including home services companies that provide personal information in exchange for access to our ERP and CRM services and commercial partners that provide us with data about their consumers. In the future, any of these third parties could sever its relationship with us, change its data sharing policies, including making them more restrictive, or alter its own data collection practices, any of which could result in the loss of, or significant impairment to, our ability to access, collect and use personal information. These third parties could also interpret our personal information collection policies or practices as being inconsistent with their policies, which could result in the loss of our ability to collect this personal information. Any such changes could impair our ability to access, collect and use personal information and could adversely impact our business financial condition and results of operations.

Our future growth is dependent in part on increasing the revenue we generate from homebuyers and consumers we serve through the sale of related services. We may not succeed in these efforts.

Our future growth depends in part on increasing the revenue generated from each homebuyer and customer we serve. We plan on increasing this revenue by increasing the number of value-add touchpoints with consumers for whom we have access rights by offering new services and by improving conversion rates and revenue generation of both existing and new services. There can be no assurances we will be successful in these efforts. Failure to increase revenue generated may slow our growth, which could in turn have an adverse impact on our business, financial condition and results of operations.

We rely on our ability to retain home services companies who use our software and services and our retention rates could be impacted if we are not able to sustain our competitive advantages related to our value proposition.

Our customer access model, whereby home services companies use our software for free in exchange for providing access rights to their end customers, helps us gain early access to homebuyers, which, in turn, helps us generate revenue from such homebuyers. There can be no assurances that home services companies will use or retain our software and services. Our retention rates could be impacted by, among other things, more desirable software and services from competitors, software developed in house by home services companies and acquisitions, consolidations and other changes to the structure and dynamics of the home and home-related services industries that may make our ERM and CRP offerings less valuable. If adoption and retention rates of our software and services decline, our growth prospects, business, financial condition and results of operations could be impaired.

If the market for SaaS software applications develops more slowly than we expect or declines, our business would be adversely affected.

The adoption rate of SaaS business software applications may be slower among companies in the moving and home improvement industries generally and among business in those industries requiring highly customizable application software more particularly. Our success will depend to a substantial extent on the widespread adoption of SaaS business applications within the industries we serve. The expansion of the SaaS business applications market depends on a number of factors, including the cost, performance, and perceived value associated with SaaS, as well as the ability of SaaS providers to address data security and privacy concerns. If SaaS business applications do not continue to achieve market acceptance within the industries we serve, if there is a reduction in demand for SaaS business applications caused by a lack of customer acceptance, or if there are technological challenges, weakening economic conditions, data security or privacy concerns, governmental regulation, competing technologies and products, or decreases in information technology spending, it could result in decreased revenue or access to consumer personal information and our business, financial condition and results of operations could be adversely affected.

Our success will depend, in substantial part, on the continued migration of the home services market online.

We believe that the digital penetration of the home and home-related services market remains low, with the vast majority of consumers continuing to search for, select and hire service professionals offline. While many consumer

19

demographics have been and remain averse to finding service professionals online, others have demonstrated a greater willingness to purchase such services online. Whether or not service professionals turn to internet platforms will depend, in substantial part, on whether online products and services help them to better connect and engage with consumers relative to traditional offline efforts. The speed and ultimate outcome of the transition of the home and home-related services market online for consumers and service professionals is uncertain and may not occur as quickly as we expect, or at all. The failure or delay of a meaningful number of consumers and/or service professionals to migrate online and/or the return of a meaningful number of existing participants in the online home services market to offline solutions could adversely affect our business, financial condition and results of operations.

Litigation and regulatory actions could distract management, increase our expenses or subject us to material money damages and other remedies.

We are subject to various legal proceedings and claims that have arisen out of the conduct of our business and are not yet resolved, including claims alleging violations of the automated calling and/or Do Not Call restrictions of the Telephone Consumer Protection Act of 1991 (“TCPA”), claims alleging breach of contract and putative class action claims for failure to pay overtime, failure to pay compensation at the time of separation and unfair business practices in violation of California law. In the future, we may be involved from time to time in various additional legal proceedings, including, but not limited to, actions relating to breach of contract, breach of federal and state privacy laws, and intellectual property infringement, as well as regulatory investigations or civil and criminal enforcement actions that might necessitate changes to our business or operations. Regardless of whether any claims, investigations or actions against us have merit, or whether we are ultimately held liable or subject to payment of damages or penalties, claims, investigations and enforcement actions may be expensive to defend or comply with, and may divert management’s time away from our operations. If any legal proceeding, regulatory investigation or regulatory enforcement action were to result in an unfavorable outcome, it could have a material adverse effect on our business, financial position and results of operations. Any adverse publicity resulting from actual or potential litigation, regulatory enforcement actions or regulatory investigations may also materially and adversely affect our reputation, which in turn could adversely affect our business, financial condition and results of operations. See “Item 3. Legal Proceedings” for additional information with respect to material litigation and other proceedings to which we are party.

Marketing efforts designed to drive traffic to our brands and businesses may not be successful or cost-effective.

Attracting home services companies and consumers to our brands and businesses involves considerable expenditures for online and offline marketing and sales. We have made, and expect to continue to make, significant marketing expenditures, primarily for digital marketing such as paid search engine marketing, display advertising and third-party affiliate agreements. These efforts may not be successful or cost-effective.

Our ability to market our brands on any given property or channel is subject to the policies of the relevant third-party seller or publisher of advertising or marketing affiliate. As a result, we cannot assure you that these parties will not limit or prohibit us from purchasing certain types of advertising, advertising certain of our products and services and/or using one or more current or prospective marketing channels in the future. If a significant marketing channel took such an action generally, for a significant period of time and/or on a recurring basis, our business, financial condition and results of operations could be adversely affected. In addition, if we fail to comply with the policies of third-party sellers, publishers of advertising and/or marketing affiliates, our advertisements could be removed without notice and/or our accounts could be suspended or terminated, any of which could adversely affect our business, financial condition and results of operations.

In addition, our failure to respond to rapid and frequent changes in the pricing and operating dynamics of marketing channels, as well as changing policies and guidelines applicable to digital advertising, which may unilaterally be updated by search engines without advance notice, could adversely affect our digital marketing efforts and free search engine traffic. Such changes could adversely affect the placement and pricing of paid listings, as well as the ranking of our brands and businesses within search results, any or all of which could increase our marketing expenditures, particularly if free traffic is replaced with paid traffic. Additionally, our competitors may engage in marketing strategies and search engine optimization techniques that increase the relative ranking of their brands and businesses within search engine results at the expense of our rankings within such search results. This could have a negative impact on the results of our

20

search engine marketing efforts. Any or all of these events could adversely affect our business, financial condition and results of operations.

Our brands and businesses are sensitive to general economic events or trends, particularly those that adversely impact consumer confidence and spending behavior.