Table of Contents

As filed with the Securities and Exchange Commission on December 21, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Quhuo Limited

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into English)

| Cayman Islands | Not Applicable | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

3rd Floor, Block D, Tonghui Building

No. 1132 Huihe South Street

Chaoyang District Beijing 100020

The People’s Republic of China

Telephone: (+86-10) 5338 4963

(Address and telephone number of registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

USA

(212) 947-7200

(Name, address, and telephone number of agent for service)

Copies to:

Elizabeth Fei Chen, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

Telephone: (212) 326-0199

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered(1)(2)(3) |

Proposed maximum aggregate offering price(4)(5) |

Amount of registration fee | ||

| Class A ordinary shares, par value US$0.0001 per share |

||||

| Preferred shares |

||||

| Debt securities |

||||

| Warrants |

||||

| Total |

US$200,000,000 | US$18,540 |

| (1) | Includes (i) securities initially offered and sold outside the United States that may be resold from time to time in the United States either as part of their distribution or within 40 days after the later of the effective date of this registration statement and the date the securities are first bona fide offered to the public and (ii) securities that may be purchased by the underwriters pursuant to an over-allotment option. These securities are not being registered for the purposes of sales outside of the United States. |

| (2) | The securities being registered also include such indeterminate number of securities as may be issued upon exercise, conversion or exchange of other securities. Separate consideration may or may not be received for securities that are issuable on exercise, conversion or exchange of other securities. |

| (3) | American depositary shares issuable upon deposit of the shares registered hereby have been registered under a separate registration statement on Form F-6 (Registration No. 333-239528). |

| (4) | The proposed maximum aggregate offering price of each class of securities will be determined from time to time by the registrant in connection with the issuance by the registrant of the securities registered hereunder and is not specified as to each class of securities pursuant to the General Instruction II.C. of Form F-3 under the Securities Act of 1933. |

| (5) | The proposed maximum aggregate offering price has been estimated solely for purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act and reflects the maximum offering price of securities registered hereunder. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated December 21, 2021

Prospectus

Quhuo Limited

Class A Ordinary Shares

Preferred Shares

Debt Securities

Warrants

We may offer and sell from time to time Class A ordinary shares, including Class A ordinary shares represented by American depositary shares, or ADSs, preferred shares, debt securities and warrants of Quhuo Limited in any combination from time to time in one or more offerings, at prices and on terms described in one or more supplements to this prospectus. The securities offered by this prospectus will have an aggregate offering price of up to US$200,000,000. The preferred shares, debt securities and warrants may be convertible into or exercisable or exchangeable for our Class A ordinary shares or other securities. This prospectus provides you with a general description of the securities we may offer.

Each time we sell the securities, we will provide a supplement to this prospectus that contains specific information about the offering and the terms of the securities. The supplement may also add, update or change information contained in this prospectus. You should carefully read this prospectus and any prospectus supplement before you invest in any of our securities.

We may sell the securities independently or together with any other securities registered hereunder through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods, on a continuous or delayed basis. See “Plan of Distribution.” If any underwriters, dealers or agents are involved in the sale of any of the securities, their names, and any applicable purchase price, fee, commission or discount arrangements between or among them, will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

The principal executive offices of Quhuo Limited is located at 3rd Floor, Block D, Tonghui Building, No. 1132 Huihe South Street, Chaoyang District, Beijing, People’s Republic of China, and its telephone number at that address is (+86-10) 5338 4963. The registered address of Quhuo Limited in the Cayman Islands is located at the offices of Maples Corporate Services Limited at PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

Our Class A ordinary shares are listed on the Nasdaq Global Market under the symbol “QH.”

Investing in our securities involves risks. We are not a Chinese operating company but a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct all of our operations through our operating entities established in the People’s Republic of China, or the PRC, primarily our variable interest entity and its subsidiaries. We do not have any equity ownership of the VIE, instead we control and receive the economic benefits of the VIE’s business operations through certain contractual arrangements. The VIE structure is used to replicate foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies, and that foreign investors may never directly hold equity interests in the Chinese operating entities. Our securities offered in this prospectus are securities of our Cayman Islands holding company that maintains service agreements with the associated operating companies.

Additionally, we are subject to certain legal and operational risks associated with the VIE’s operations in China. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material negative change in the VIE’s operations, significant depreciation of the value of our Class A ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact of such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange. The Chinese regulatory authorities could disallow our structure, which could result in a material change in our operations and the value of our securities could decline or become worthless. See the “Risk Factors” section on page 10 of this prospectus, and those contained in the applicable prospectus supplement, any related free writing prospectus and the documents we incorporate by reference in this prospectus to read about factors you should consider before investing in our securities.

This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the disclosures in this prospectus, including any prospectus supplement and documents incorporated by reference. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2021

Table of Contents

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 10 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 32 | ||||

| 32 | ||||

| 42 | ||||

| 42 | ||||

| 45 | ||||

| 47 | ||||

| 49 | ||||

| 50 | ||||

| 50 |

i

Table of Contents

You should read this prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find More Information About Us” and “Incorporation of Documents by Reference.”

In this prospectus, unless otherwise indicated or unless the context otherwise requires,

| • | “ADSs” refer to American depositary shares, each of which represents one Class A ordinary share; |

| • | “affiliated entities” refers to, collectively, the VIE and its subsidiaries; |

| • | “Companies Act” means the Companies Act (As Revised) of the Cayman Islands, as amended from time to time; |

| • | “shares” or “Class A ordinary shares” refer to our Class A ordinary shares, par value US$0.0001 per share; |

| • | “US$,” “U.S. Dollars,” “$” and “dollars” refer to the legal currency of the United States; |

| • | “VIE” refers to Beijing Quhuo Technology Co., Ltd.; and |

| • | “we,” “us,” “our company,” “our group” and “our” refer to Quhuo Limited, a Cayman Islands exempted company and its subsidiaries, consolidated VIE, and consolidated VIE’s subsidiaries. |

This prospectus is part of a registration statement on Form F-3 that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process permitted under the Securities Act of 1933, as amended, or the Securities Act. By using a shelf registration statement, we may sell our shares, debt securities and warrants or any combination of any of the foregoing having an aggregate initial offering price of up to US$200,000,000 from time to time in one or more offerings on a continuous or delayed basis. This prospectus only provides you with a summary description of these securities. Each time we sell the securities, we will provide a supplement to this prospectus that contains specific information about the securities being offered and the specific terms of that offering. The supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the prospectus supplement. Before purchasing any of the securities, you should carefully read both this prospectus and any supplement, together with the additional information described under the heading “Where You Can Find More Information About Us” and “Incorporation of Documents by Reference.”

You should rely only on the information contained or incorporated by reference in this prospectus and in any prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We will not make an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable supplement to this prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

WHERE YOU CAN FIND MORE INFORMATION ABOUT US

We are subject to periodic reporting and other informational requirements of the Exchange Act as applicable to foreign private issuers. Accordingly, we are required to file reports, including annual reports on Form 20-F, and other information with the SEC. The SEC maintains a web site at www.sec.gov that contains reports, proxy and information statements, and other information regarding registrants that make electronic filings with the SEC using its EDGAR system, and all information filed with the SEC can be obtained over the internet at this website.

1

Table of Contents

We also maintain a website at https://ir.quhuo.cn/, but information contained on, or linked from, our website is not incorporated by reference in this prospectus or any prospectus supplement. You should not regard any information on our website as a part of this prospectus or any prospectus supplement.

As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of quarterly reports and proxy statements, and officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. We will furnish Deutsche Bank Trust Company Americas, the depositary of the ADSs, with our annual reports, which will include a review of operations and annual audited consolidated financial statements prepared in conformity with U.S. GAAP, and all notices of shareholders’ meetings and other reports and communications that are made generally available to our shareholders. The depositary will make such notices, reports and communications available to holders of ADSs and, upon our request, will mail to all record holders of ADSs the information contained in any notice of a shareholders’ meeting received by the depositary from us.

This prospectus is part of a registration statement that we filed with the SEC and does not contain all the information in the registration statement. You will find additional information about us in the registration statement. Any statement made in this prospectus concerning a contract or other document of ours is not necessarily complete, and you should read the documents that are filed as exhibits to the registration statement or otherwise filed with the SEC for a more complete understanding of the document or matter. Each such statement is qualified in all respects by reference to the document to which it refers. You may inspect a copy of the registration statement through the SEC’s website at www.sec.gov.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with them. This means that we can disclose important information to you by referring you to those documents. Each document incorporated by reference is current only as of the date of such document, and the incorporation by reference of such documents shall not create any implication that there has been no change in our affairs since the date thereof or that the information contained therein is current as of any time subsequent to its date. The information incorporated by reference is considered to be a part of this prospectus and should be read with the same care. When we update the information contained in documents that have been incorporated by reference by making future filings with the SEC, the information incorporated by reference in this prospectus is considered to be automatically updated and superseded. In other words, in the case of a conflict or inconsistency between information contained in this prospectus and information incorporated by reference into this prospectus, you should rely on the information contained in the document that was filed later.

We incorporate by reference the documents listed below:

| • | our annual report on Form 20-F for the fiscal year ended December 31, 2020 filed with the SEC on May 17, 2021, or the 2020 Annual Report; |

| • | our Reports of Foreign Private Issuer on Form 6-K dated May 27, 2021, June 2, 2021, June 28, 2021, August 25, 2021, September 24, 2021; November 29, 2021 and December 21, 2021; and |

| • | with respect to each offering of the securities under this prospectus, all our subsequent annual reports on Form 20-F and any report on Form 6-K that indicates that it is being incorporated by reference that we file or furnish with the SEC on or after the date on which the registration statement is first filed with the SEC and until the termination or completion of the offering by means of this prospectus. |

Our 2020 Annual Report contains a description of our business and audited consolidated financial statements with reports by our independent auditors. The consolidated financial statements are prepared and presented in accordance with U.S. GAAP.

2

Table of Contents

Unless expressly incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to, but not filed with, the SEC. Copies of all documents incorporated by reference in this prospectus, other than exhibits to those documents unless such exhibits are specifically incorporated by reference in this prospectus, will be provided at no cost to each person, including any beneficial owner, who receives a copy of this prospectus on the written or oral request of that person made to:

Leslie Yu, Chief Executive Officer

Tel: (+86-10) 5338 4963

E-mail: leslie@meishisong.cn

3rd Floor, Block D, Tonghui Building

No. 1132 Huihe South Street, Chaoyang District

Beijing, People’s Republic of China

You should rely only on the information that we incorporate by reference or provide in this prospectus. We have not authorized anyone to provide you with different information. We are not making any offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of those documents.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any prospectus supplement, and the information incorporated by reference herein contain forward-looking statements that reflect our current expectations and views of future events. Known and unknown risks, uncertainties and other factors, including those listed under “—Risk Factors,” may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigations Reform Act of 1995.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

| • | our mission and strategies; |

| • | our future business development, financial condition and results of operations; |

| • | the expected growth of the online consumer finance market in China; |

| • | our expectations regarding demand for and market acceptance of our products and services; |

| • | our expectations regarding our relationships with borrowers and institutional partners; |

| • | competition in our industry; |

| • | general economic and business condition in China and elsewhere; |

| • | relevant government policies and regulations relating to our industry; and |

| • | the impact of COVID-19. |

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. You should thoroughly read this prospectus, any prospectus supplement and the documents that we refer to with the understanding that

3

Table of Contents

our actual future results may be materially different from and worse than what we expect. In addition, the rapidly changing nature of the online consumer finance industry results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our market. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

The forward-looking statements made in this prospectus or any prospectus supplement, or the information incorporated by reference herein relate only to events or information as of the date on which the statements are made in such document. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Overview

We are not a Chinese operating company but a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct all of our operations through our operating entities established in the PRC, including the VIE. We control and receive the economic benefits of the VIE’s business operations through certain contractual arrangements. The VIE structure is used to replicate foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies, and that foreign investors may never directly hold equity interests in the Chinese operating entities.

Additionally, we are subject to certain legal and operational risks associated with the VIE’s operations in China. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material negative change in the VIE’s operations, significant depreciation of the value of our common stock, or a complete hindrance of our ability to offer or continue to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact of such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange. The Chinese regulatory authorities could disallow our structure, which could result in a material change in our operations and the value of our securities could decline or become worthless. Our current corporate structure and business operations and the market price of our Class A ordinary shares may be affected by the newly enacted PRC Foreign Investment Law which does not explicitly classify whether VIEs that are controlled through contractual arrangements would be deemed as foreign-invested enterprises if they are ultimately “controlled” by foreign investors. Our securities offered in this prospectus are shares of our Cayman Islands holding company, and, as a shareholder of the Company, you will have an equity interest in an entity which does not have ownership of the VIE, which generates a significant portion of the consolidated revenue. Because we do not have ownership of the VIE, we must rely on the shareholders of this VIE to comply with their contractual obligations. The approval of PRC regulatory agencies may be required in connection with this offering under a PRC regulation or any new laws, rules or regulations to be enacted, and if required, we may not be able to obtain such approval.

We are a leading workforce operational solution platform in China. We provide tech-enabled, end-to-end operational solutions primarily to blue-chip on-demand consumer service businesses in industries with significant

4

Table of Contents

e-commerce exposure, including delivery, ride-hailing, housekeeping and bike-sharing. Within the on-demand consumer service ecosystem, we play a unique and indispensable role as the link between consumer service businesses and the end consumers to enable the delivery of goods, services and experiences to consumers.

To the on-demand consumer service companies that we serve, our solutions have become critical to their business strategy, operational focus and financial performance. We have established deep-rooted, long-standing partnerships with blue-chip industry customers in an increasing number of on-demand consumer service industries in China. Our platform helps industry customers mobilize a large team of workers and utilize a combination of training, performance monitoring and refinement, and incentives to transform them into skilled workers who can follow industry-specific, standardized and highly efficient service procedures. Leveraging our technology capabilities, we conduct data-driven operational analysis to assist our industry customers in improving their service quality and consumer satisfaction. As of December 31, 2020, we partnered with industry customers mostly comprising top market players in their respective industries, such as Meituan and Ele.me in the on-demand delivery industry and other chain restaurants such as KFC, Meituan Bike, Didi and Hello in the mobility-as-a-service section (including bike-sharing and ride-hailing), and Hilton Hotels and Resorts, Kingkey Group, Marriott International, and Kempinski Hotels in the hotel industry. Our geographic footprint reached 111 cities across 30 provinces, municipalities and autonomous regions in China as of December 31, 2020.

To the workers on our platform, we believe we have become a “go-to” one-stop platform that provides them with diversified, flexible earning opportunities. Workers are also attracted to our platform for career advancement prospects and various work-life support and services. We empower workers with minimal work experience to begin their career and progress with us. In the three months ended December 31, 2020, we had approximately 54,500 average monthly active workers on our platform. We believe that the size of our workforce allows us to further cement our relationship with industry customers and become their partner of choice when they enter new geographical markets or new on-demand consumer service industries. Workers on our platform are also encouraged to bring in their friends, relatives and acquaintances to continually and organically expand our workforce network. We believe that the bonds among workers on our platform can be forged by such social relations, minimizing worker turnovers and making our platform more stable.

Our ability to quickly scale up our business and effectively manage our workers rests on Quhuo+, a proprietary technology infrastructure that centralizes our operational management and streamlines our solution process. For workers in a management position, such as team leaders for our on-demand delivery solutions, Quhuo+ allows them to pinpoint workers on our platform to monitor their workload and performance, and dynamically manage staffing and maintain solution quality. With Quhuo+, team leaders are able to transcribe industry-specific KPIs obtained from industry customers into executable guidance for workers on our platform, and benchmark workforce performance across all workers and teams based on data-driven analytics to refine our solutions and optimize our operational efficiency. For rank-and-file workers, Quhuo+ allows them to review their workload, access on-the-job training and review their performance. As a result, we are able to cultivate a specialized yet flexible workforce and deploy the same workers across different industry settings based on their work schedules by, for example, allowing delivery riders on our platform to take part in our shared-bike maintenance solutions during their off-peak hours, which serves to optimize our operational cost and also diversify their earning opportunities. We have developed Quhuo+ into a scalable modular system with customizable parameters and settings to smoothly manage and transfer massive workers across different regions and industries we serve, which forms the bedrock of our highly scalable and replicable business model. As a result, we are able to scale our operations and replicate our success into greenfield regions or industries quickly and cost-effectively with minimal incremental costs on infrastructure.

Our principal executive offices are located at 3rd Floor, Block D, Tonghui Building, No. 1132 Huihe South Street, Chaoyang District, Beijing, People’s Republic of China. Our telephone number at this address is (+86-10) 5338 4963.

5

Table of Contents

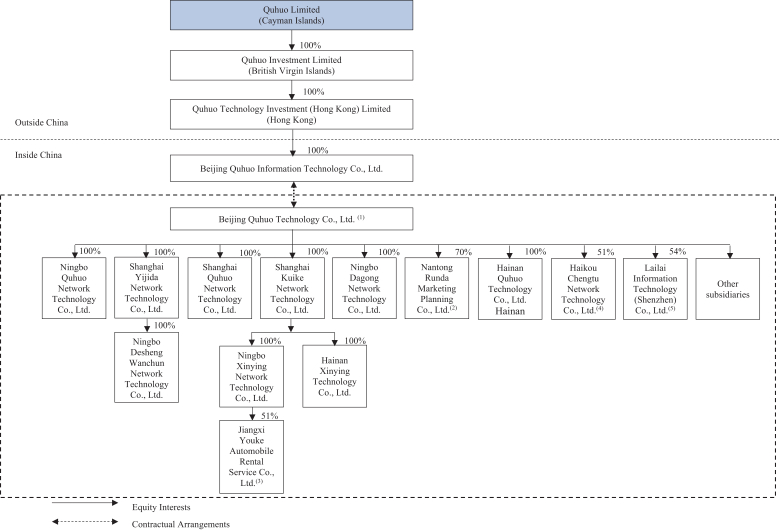

Our Current Corporate Structure

The following diagram illustrates our current corporate structure as of the date of this prospectus:

6

Table of Contents

Cash Transfer and Dividend Payment

None of our VIE and its subsidiaries have issued any dividends or distributions to respective holding companies, or to any investors as of the date of this prospectus. Our subsidiaries in the PRC generate and retain cash generated from operating activities and re-invest it in our business. In the future, cash proceeds raised from overseas financing activities may be transferred by us through our overseas holding company, Quhuo Ltd to our PRC subsidiary, Beijing Quhuo Information Technology Co., Ltd. via capital contribution and shareholder loans, as the case may be. Beijing Quhuo Information Technology Co., Ltd. will then transfer funds to our VIE and its subsidiaries to meet the capital needs of our business operations.

During each of the fiscal years ended December 31, 2020 and 2019, the only transfer of assets among Quhuo Ltd. (the Cayman Islands parent company) and its subsidiaries, including the VIE, was transfer of cash. Quhuo Ltd. provided cash to its subsidiaries either by way of capital contribution or by way of loan, from the proceeds it received from the financing. In addition, there were some loans obtained by certain Chinese subsidiaries, and those subsidiaries then loaned money to other Chinese subsidiaries to meet their working capital needs. The cash was transferred within the organization through bank wiring. During the fiscal year ended December 31, 2020, Quhuo Ltd. invested an aggregate of approximately $12 million in cash to Beijing Quhuo Information Technology Co., Ltd., which amount was then invested in Beijing Quhuo Information Technology Co., Ltd.. During fiscal year ended December 31, 2020, both Quhuo Ltd and Beijing Quhuo Information Technology Co., Ltd. transferred an aggregate of approximately $12 million in cash to Beijing Quhuo Technology Co., Ltd.

Under PRC laws and regulations, there are restrictions on the Company’s PRC subsidiaries and VIE with respect to transferring certain of their net assets to the Company either in the form of dividends, loans, or advances. Amounts restricted include paid-in capital and statutory reserve of the Company’s PRC subsidiaries and the VIE, totaling approximately RMB382.7 million (US$58.7 million) as of December 31, 2020 and totaling approximately RMB361.1 million (US$56.0 million) as of September 30, 2021.

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China. The majority of our and the VIE’s and its subsidiaries’ income is received in RMB and shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from The State Administration of the Foreign Exchange (“SAFE”) in the PRC as long as certain procedural requirements are met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders.

Cash dividends, if any, on our common stock will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax. As of the date of this prospectus, we have not made any dividends nor distributions to any U.S. investors.

Relevant PRC laws and regulations permit the PRC companies to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Additionally, the Company’s PRC subsidiary and the VIE can only distribute dividends upon approval of the shareholders after they have met the PRC requirements for appropriation to the statutory reserves. As a result of these and other restrictions under the PRC laws and regulations, our PRC subsidiary and the VIE are restricted to transfer a portion of their net assets to the Company either in the form of dividends, loans or advances. Even though the Company currently does not require any such dividends, loans or advances from the PRC subsidiary and the VIE for working capital and other funding purposes, the Company may in the future require additional cash resources from its PRC subsidiary and the VIE due to changes in business conditions, to fund future acquisitions and developments, or merely declare and pay dividends to or distributions to the Company’s shareholders.

7

Table of Contents

Cautionary Statement Regarding our Variable Interest Entity Structure

We are a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct our operations in China through our variable interest entity, or VIE. This is an offering of securities of the holding company. You are not investing in Chinese operating companies. Neither we nor our subsidiaries own any share in the VIE. Instead, we control and receive the economic benefits of the VIE’s business operation through a series of contractual agreements, or the VIE Agreements. We are subject to certain legal and operational risks associated with being based in China and having a majority of our operations in through the contractual arrangements with the VIE. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in our operations, significant depreciation of the value of our common stock, or a complete hindrance of our ability to offer or continue to offer our securities to investors and cause the value of such securities to significantly decline or be worthless. The VIE Agreements are designed to provide our wholly-foreign owned entity ( “WFOE”), with the power, rights and obligations equivalent in all material respects to those it would possess as the principal equity holder of the VIE, including absolute control rights and the rights to the assets, property and revenue of the VIE. As a result of our indirect ownership in the WFOE and the VIE Agreements, we are regarded as the primary beneficiary of the VIE. The VIE structure is used to replicate foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies, and that investors may never directly hold equity interests in the Chinese operating entities.

Because of our corporate structure, we are subject to risks due to uncertainty of the interpretation and the application of the PRC laws and regulations, including but not limited to limitation on foreign ownership of internet technology companies, and regulatory review of oversea listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the VIE Agreements. We are also subject to the risks of uncertainty about any future actions of the PRC government in this regard. Our VIE Agreements may not be effective in providing control over the VIE. We may also be subject to sanctions imposed by PRC regulatory agencies including Chinese Securities Regulatory Commission if we fail to comply with their rules and regulations. If the Chinese regulatory authorities disallow this VIE structure in the future, it will likely result in a material change in our financial performance and our results of operations and/or the value of our common stock, which could cause the value of such securities to significantly decline or become worthless. Additionally, as more stringent criteria have been imposed by the SEC and the Public Company Accounting Oversight Board recently, our securities may be prohibited from trading if our auditor cannot be fully inspected.

Additionally, we are subject to certain legal and operational risks associated with the VIE’s operations in China. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in the VIE’s operations, significant depreciation of the value of our common stock, or a complete hindrance of our ability to offer or continue to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange.

Cautionary Statement Regarding Doing Business in China

The VIE and its subsidiaries are subject to certain legal and operational risks associated with being based in China. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and as a result these risks may result in material changes in the operations of the VIE and its subsidiaries, completely hinder of our ability to offer or continue to offer our securities to investors and cause the value of our securities to significantly decline or become worthless. Recently, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severe

8

Table of Contents

and Lawful Crackdown on Illegal Securities Activities, which was available to the public on July 6, 2021. These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies. The PRC government also initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. exchange. On July 10, 2021, the State Internet Information Office issued the Measures of Cybersecurity Review (Revised Draft for Comments, not yet effective), which requires operators with personal information of more than 1 million users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. As of the date of this prospectus, our Company, the VIE and its subsidiaries have not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor has any of them received any inquiry, notice or sanction. We do not believe that our existing business will require such regulatory review. As of the date of this prospectus, our Company, the VIE and its subsidiaries have not received any inquiry, notice, warning or sanctions regarding our planned overseas listing from the China Securities Regulatory Commission or any other PRC governmental authorities. However, all of the statements and regulatory actions referenced are newly published, official guidance and related implementation rules have not been issued. It is highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. exchange. PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that require us, our subsidiaries, the VIE or its subsidiaries to obtain regulatory approval from Chinese authorities before listing in the U.S.

Cautionary Statement Regarding Holding Foreign Companies Accountable Act

The Holding Foreign Companies Accountable Act, or the HFCAA, was enacted on December 18, 2020. The HFCAA states if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit our shares or ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

Our independent registered public accounting firm that issues the audit report included in our annual report filed with the SEC, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB is required by the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and professional standards. Because we have substantial operations within the PRC and the PCAOB is currently unable to conduct full inspections of the work of our independent registered public accounting firm as it relates to those operations without the approval of the Chinese authorities, our independent registered public accounting firm is not currently inspected thoroughly by the PCAOB. This lack of PCAOB inspections in the PRC prevents the PCAOB from regularly evaluating our independent registered public accounting firm’s audits and its quality control procedures. As a result, investors may be deprived of the benefits of PCAOB inspections.

The recent developments would add uncertainties to our offering, and we cannot assure you whether Nasdaq or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial statements. It remains unclear what the SEC’s implementation process related to the December 2021 final amendments will entail or what further actions the SEC, the PCAOB or Nasdaq will take to address these issues and what impact those actions will have on U.S. companies that have significant operations in the PRC and have securities listed on a U.S. stock exchange (including a national securities exchange or over-the-counter stock market). In addition, the December 2021 final amendments and any additional actions, proceedings, or new rules resulting from these

9

Table of Contents

efforts to increase U.S. regulatory access to audit information could create some uncertainty for investors, the market price of our common stock could be adversely affected, and we could be delisted if we and our auditor are unable to meet the PCAOB inspection requirement or being required to engage a new audit firm, which would require significant expense and management time. See “Risk Factors—Proceedings instituted by the SEC against Chinese affiliates of the “big four” accounting firms, including our independent registered public accounting firm, could result in financial statements being determined to not be in compliance with the requirements of the Exchange Act.” starting on page 18.

Investing in our securities involves risk. You should carefully consider the risk factors and uncertainties described herein, and those under the heading “Item 3. Key Information—D. Risk Factors” in our most recently filed annual report on Form 20-F, which is incorporated in this prospectus by reference, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended, and in any applicable prospectus supplement and in the other documents incorporated by reference in this prospectus, before investing in any of the securities that may be offered or sold pursuant to this prospectus. These risks and uncertainties and other risks and uncertainties not presently known to us or that we currently believe are immaterial, could materially affect our business, results of operations or financial condition and cause the value of our securities to decline or become worthless.

Risks Related to Our Corporate Structure and Doing Business in the PRC

Substantial uncertainties and restrictions with respect to the political and economic policies of the PRC government and PRC laws and regulations could have a significant impact upon any business conducted in the PRC by us and accordingly on the results of our operations and financial condition.

Our business operations conducted through our PRC operating entities may be adversely affected by the current and future political environment in the PRC. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. Our ability to operate in China may be adversely affected by changes in Chinese laws and regulations. Under the current government leadership, the government of the PRC has been pursuing reform policies which have adversely affected China-based operating companies whose securities are listed in the United States, with significant policy changes being made from time to time without notice. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including, but not limited to, the laws and regulations governing our business, or the enforcement and performance of our contractual arrangements. Only after 1979 did the Chinese government begin to promulgate a comprehensive system of laws that regulate economic affairs in general, deal with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade, and encourage foreign investment in China. Although the influence of the law has been increasing, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. Also, because these laws and regulations are relatively new, and because of the limited volume of published cases and their lack of force as precedents, interpretation and enforcement of these laws and regulations involves significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. In addition, there have been constant changes and amendments of laws and regulations over the past 30 years in order to keep up with the rapidly changing society and economy in China. Because government agencies and courts provide interpretations of laws and regulations and decide contractual disputes and issues, their inexperience in adjudicating new business polices or regulations in certain less-developed areas causes uncertainty and may affect our business. Consequently, we cannot predict the future direction of Chinese legislative activities with respect to businesses with foreign investment or the effectiveness of enforcement of laws and regulations in China. The uncertainties, including new laws and regulations and changes of existing laws, as well as judicial interpretation by inexperienced officials in the agencies and courts in certain areas, may

10

Table of Contents

create problems for foreign investors. Although the PRC government has been pursuing economic reform policies for more than two decades, the PRC government continues to exercise significant control over economic growth in the PRC through the allocation of resources, control of payments in foreign currencies, monetary policy and the imposition of policies that impact particular industries in different ways. We cannot assure you that the PRC government will continue to pursue policies favoring a market-oriented economy or that existing policies will not be significantly altered, especially in the event of a change in leadership, social or political disruption or other circumstances affecting political, economic and social life in the PRC. The Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of the securities being offered. Any adverse changes in Chinese laws and regulations and the Chinese government’s significant oversight and discretion over the conduct of our business could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of our securities to significantly decline or become worthless.

If the PRC government deems that the VIE Agreements do not comply with PRC regulatory restrictions on foreign investment in the relevant industries or other laws or regulations of the PRC, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations, which could materially reduce the value of our Class A ordinary shares or cause them to become worthless.

We are a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct a substantial majority of our operations through our VIE in the PRC, Beijing Quhuo Technology Co., Ltd., in which we have no equity ownership interest and must rely on contractual arrangements to control and operate the businesses thereof. These contractual arrangements are not as effective in providing control over the VIE as direct ownership. For example, the VIE may be unwilling or unable to perform its contractual obligations under our commercial agreements. Consequently, we would not be able to conduct our operations in the manner currently planned. In addition, the VIE may seek to renew its agreements on terms that are disadvantageous to us. Although we have entered into a series of agreements that provide us with substantial ability to control the VIE, we may not succeed in enforcing our rights under them insofar as our contractual rights and legal remedies under PRC law are inadequate. In addition, if we are unable to renew these agreements on favorable terms when these agreements expire or if we are unable to enter into similar agreements with other parties, our business may not be able to operate or expand, and our operating expenses may significantly increase.

Because Quhuo Limited is an exempted company incorporated in the Cayman Islands with limited liability, it is classified as a foreign enterprise under PRC laws and regulations, and our wholly foreign-owned enterprises in the PRC will be foreign-invested enterprises. As a result of these contractual arrangements, we have control over and are the primary beneficiary of the consolidated VIE and therefore consolidate its financial results as our consolidated VIE under U.S. GAAP.

We believe that our corporate structure and contractual arrangements comply with the current applicable PRC laws and regulations, and each of the contracts among our wholly-owned PRC subsidiary, our consolidated VIE and its shareholders is valid, binding and enforceable in accordance with its terms. However, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations. Thus, the PRC governmental authorities may take a view contrary to ours. It is uncertain whether any new PRC laws or regulations relating to variable interest entity structure will be adopted or if adopted, what they would provide. PRC laws and regulations governing the validity of these contractual arrangements are uncertain and the relevant government authorities have broad discretion in interpreting these laws and regulations.

If our corporate structure and contractual arrangements are deemed by the relevant regulators that have competent authority, to be illegal, either in whole or in part, we may lose control of our consolidated VIE and may have to modify such structure to comply with regulatory requirements. However, there can be no assurance that we would be able to achieve this without material disruption to our business. Further, if our corporate

11

Table of Contents

structure and contractual arrangements are found to be in violation of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such violations, including:

| • | revoking our business and operating licenses that are related to the VIE; |

| • | levying fines on us; |

| • | confiscating any of our income that they deem to be obtained through illegal operations; |

| • | shutting down our services that are related to the VIE; |

| • | discontinuing or restricting our operations in China that are related to the VIE; |

| • | imposing conditions or requirements with which we may not be able to comply; |

| • | requiring us to change our corporate structure and contractual arrangements; |

| • | restricting or prohibiting our use of the proceeds from overseas offerings to finance our consolidated VIE’s business and operations; and |

| • | taking other regulatory or enforcement actions that could be harmful to our business. |

Furthermore, new PRC laws, rules and regulations may be introduced to impose additional requirements that may be applicable to our corporate structure and contractual arrangements. The occurrence of any of these events could materially and adversely affect our business, financial condition and results of operations and the market price of our Class A ordinary shares. In addition, if the imposition of any of these penalties or the requirement to restructure our corporate structure causes us to lose our right to direct the activities of our consolidated VIE or our right to receive its economic benefits, we would no longer be able to consolidate the financial results of such VIE in our consolidated financial statements, which may cause the value of our securities to materially decline or become worthless. Moreover, if the PRC government determines that the contractual arrangements constituting part of our VIE structure do not comply with PRC regulations, or if these regulations change or are interpreted differently in the future, our securities may decline in value or become worthless if we are unable to assert our contractual control rights over the assets of our PRC subsidiary that conducts all or substantially all of our operations.

Our current corporate structure and business operations and the market price of our Class A ordinary shares may be affected by the newly enacted Foreign Investment Law which does not explicitly classify whether VIEs that are controlled through contractual arrangements would be deemed as foreign-invested enterprises if they are ultimately “controlled” by foreign investors.

The VIE structure has been adopted by many Chinese-based companies, including us, to obtain necessary licenses and permits in the industries that are currently subject to foreign investment restrictions in China. On March 15, 2019, the National People’s Congress, China’s national legislative body approved the Foreign Investment Law, which took effect on January 1, 2020. On December 26, 2019, the PRC State Council approved the Implementation Rules of the Foreign Investment Law, which came into effect on January 1, 2020. Since they are relatively new, uncertainties exist in relation to their interpretation. The Foreign Investment Law does not explicitly classify whether variable interest entities that are controlled through contractual arrangements would be deemed as foreign-invested enterprises if they are ultimately “controlled” by foreign investors. However, it has a catch-all provision under the definition of “foreign investment” that includes investments made by foreign investors in China through other means as provided by laws, administrative regulations or the State Council. Therefore, it still leaves open the possibility of future laws, administrative regulations or provisions of the State Council providing for contractual arrangements being viewed as a form of foreign investment. Therefore, there can be no assurance that our control over our consolidated VIE through contractual arrangements will not be deemed as foreign investment in the future.

According to the Foreign Investment Law, the State Council shall promulgate or approve a list of special administrative measures for market access of foreign investments, or the Negative List. The Foreign Investment Law grants national treatment to foreign-invested entities, except for those foreign-invested entities that operate in industries specified as either “restricted” or “prohibited” from foreign investment in the Negative List. The Foreign Investment Law provides that foreign-invested entities operating in “restricted” or “prohibited”

12

Table of Contents

industries will require market entry clearance and other approvals from relevant PRC government authorities. Pursuant to the Negative List, the Company’s business does not fall within the “prohibited” category. However, since the Negative List has been adjusted and updated on an almost-annual basis in the recent years, we cannot assure you that our business will remain off of the “prohibited” category. If our control over our consolidated VIE through contractual arrangements is deemed as foreign investment in the future, and any business of our consolidated VIE is “restricted” or “prohibited” from foreign investment under the “Negative List” effective at the time, we may be deemed to be in violation of the Foreign Investment Law, the contractual arrangements that allow us to have control over our consolidated VIE may be deemed as invalid and illegal, and we may be required to unwind such contractual arrangements and/or restructure our business operations, any of which may have a material adverse effect on our business operation and the market price of our Class A ordinary shares.

Furthermore, if future laws, administrative regulations or provisions mandate further actions to be taken by companies with respect to existing contractual arrangements, we may face substantial uncertainties as to whether we can complete such actions in a timely manner, or at all. Failure to take timely and appropriate measures to address any of these or similar regulatory compliance challenges could materially and adversely affect our current corporate structure and business operations and the market price of our Class A ordinary shares.

Adverse regulatory developments in China may subject us to additional regulatory review, and additional disclosure requirements and regulatory scrutiny to be adopted by the SEC in response to risks related to recent regulatory developments in China may impose additional compliance requirements for companies like us with China-based operations, all of which could increase our compliance costs and subject us to additional disclosure requirements.

The recent regulatory developments in China, particularly with respect to restrictions on China-based companies raising capital offshore, may lead to additional regulatory review in China of our financing and capital raising activities in the United States. In addition, we may be subject to industry-wide regulations that may be adopted by the relevant PRC authorities, which may have the effect of restricting the scope of our operations in China, or causing the suspension or termination of our business operations in China entirely, all of which may materially and adversely affect our business, financial condition and results of operations. We may have to adjust, modify or completely change our business operations in response to adverse regulatory changes or policy developments, and we cannot assure you that any remedial action adopted by us can be completed in a timely, cost-efficient, or liability-free manner or at all.

On July 30, 2021, in response to the recent regulatory developments in China and actions adopted by the PRC government, the Chairman of the SEC issued a statement asking the SEC staff to seek additional disclosures from offshore issuers associated with China-based operating companies before their registration statements will be declared effective. On August 1, 2021, the China Securities Regulatory Commission stated in a statement that it had taken note of the new disclosure requirements announced by the SEC regarding the listings of Chinese companies and the recent regulatory development in China, and that both countries should strengthen communications on regulating China-related issuers. We cannot guarantee that we will not be subject to tightened regulatory review and we could be exposed to government interference in China.

Compliance with China’s new Data Security Law, Measures on Cybersecurity Review, Personal Information Protection Law (second draft for consultation), regulations and guidelines relating to the multi-level protection scheme and any other future laws and regulations may entail significant expenses and could materially affect our business.

China has implemented or will implement rules and is considering a number of additional proposals relating to data protection. China’s new Data Security Law took effect in September 2021. The Data Security Law provides that data processing activities must be conducted based on “data classification and hierarchical protection system” for the purpose of data protection and prohibits entities in China from transferring data stored in China to foreign law enforcement agencies or judicial authorities without prior approval by the Chinese government.

Additionally, China’s Cyber Security Law requires companies to take certain organizational, technical and administrative measures and other necessary measures to ensure the security of their networks and data stored on

13

Table of Contents

their networks. Specifically, the Cyber Security Law provides that China adopt a multi-level protection scheme (“MLPS”), under which network operators are required to take security protection measures to ensure that the network is free from interference, disruption or unauthorized access, and prevent network data from being disclosed, stolen or tampered with. Under the MLPS, entities’ operating information systems must conduct a thorough assessment of the risks and the conditions of their information and network systems to determine the level to which the entity’s information and network systems belong—from the lowest Level 1 to the highest Level 5—pursuant to a series of national standards on the grading and implementation of the classified protection of cyber security. The grading result will determine the set of security protection obligations that entities must comply with. Entities classified as Level 2 or above should report the grade to the relevant government authority for examination and approval.

Recently, the Cyberspace Administration of China has taken action against several Chinese internet companies in connection with their initial public offerings on U.S. securities exchanges, for alleged national security risks and improper collection and use of the personal information of Chinese data subjects. According to the official announcement, the action was initiated based on the National Security Law, the Cyber Security Law and the Measures on Cybersecurity Review, which are aimed at “preventing national data security risks, maintaining national security and safeguarding public interests.” On July 10, 2021, the Cyberspace Administration of China published a revised draft of the Measures on Cybersecurity Review, expanding the cybersecurity review to data processing operators in possession of personal information of over 1 million users if the operators intend to list their securities in a foreign country.

It is unclear at the present time how widespread the cybersecurity review requirement and the enforcement action will be and what effect they will have on our business. China’s regulators may impose penalties for non-compliance ranging from fines or suspension of operations, and this could lead to us delisting from the U.S. stock market.

Also, the National People’s Congress recently released the Personal Information Protection Law, which will become effective on November 1, 2021. The law creates a comprehensive set of data privacy and protection requirements that apply to the processing of personal information and expands data protection compliance obligations to cover the processing of personal information of persons by organizations and individuals in China, and the processing of personal information of persons outside of China if such processing is for purposes of providing products and services to, or analyzing and evaluating the behavior of, persons in China. The law also provides that critical information infrastructure operators and personal information processing entities who process personal information meeting a volume threshold to-be-set by Chinese cyberspace regulators are also required to store in China personal information generated or collected in China, and to pass a security assessment administered by Chinese cyberspace regulators for any export of such personal information. Lastly, the draft contains proposals for significant fines for serious violations of up to RMB 50 million or 5% of annual revenues from the prior year and may also be ordered to suspend any related activity by competent authorities.

Interpretation, application and enforcement of these laws, rules and regulations evolve from time to time and their scope may continually change, through new legislation, amendments to existing legislation and changes in enforcement. Compliance with the Cyber Security Law and the Data Security Law could significantly increase the cost to us of providing our service offerings, require significant changes to our operations or even prevent us from providing certain service offerings in jurisdictions in which we currently operate or in which we may operate in the future. Despite our efforts to comply with applicable laws, regulations and other obligations relating to privacy, data protection and information security, it is possible that our practices, offerings or platform could fail to meet all of the requirements imposed on us by the Cyber Security Law, the Data Security Law and/or related implementing regulations. Any failure on our part to comply with such law or regulations or any other obligations relating to privacy, data protection or information security, or any compromise of security that results in unauthorized access, use or release of personally identifiable information or other data, or the perception or allegation that any of the foregoing types of failure or compromise has occurred, could damage our reputation, discourage new and existing counterparties from contracting with us or result in investigations, fines, suspension

14

Table of Contents

or other penalties by Chinese government authorities and private claims or litigation, any of which could materially adversely affect our business, financial condition and results of operations. Even if our practices are not subject to legal challenge, the perception of privacy concerns, whether or not valid, may harm our reputation and brand and adversely affect our business, financial condition and results of operations. Moreover, the legal uncertainty created by the Data Security Law and the recent Chinese government actions could materially adversely affect our ability, on favorable terms, to raise capital, including engaging in follow-on offerings of our securities in the U.S. market.

The approval of the China Securities Regulatory Commission (“CSRC”) may be required in connection with this offering under a PRC regulation adopted in August 2006, and, if required, we cannot assure you that we will be able to obtain such approval.

The Regulations on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009, requires an overseas special purpose vehicle formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies or individuals to obtain the approval of the CSRC prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. In September 2006, the CSRC published a notice on its official website specifying documents and materials required to be submitted to it by a special purpose vehicle seeking CSRC approval of its overseas listings. However, substantial uncertainty remains regarding the scope and applicability of the M&A Rules to offshore special purpose vehicles. Currently, there is no consensus among leading PRC law firms regarding the scope and applicability of the CSRC approval requirement.

Based on our understanding of the Chinese laws and regulations in effect at the time of this prospectus, we will not be required to submit an application to the CSRC for its approval of this offering and the listing and trading of our Class A ordinary shares on Nasdaq in the context of this offering. However, there remains some uncertainty as to how the M&A Rules will be interpreted or implemented in the context of an overseas offering and our belief is subject to any new laws, rules and regulations or detailed implementations and interpretations in any form relating to the M&A Rules or overseas offering approval. We cannot assure you that relevant PRC governmental agencies, including the CSRC, would reach the same conclusion as we do.