UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

OR

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed

all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant has submitted

electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The aggregate market value of the voting and non-voting common

equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid

and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal

quarter was $

As of March 17, 2021,

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement of the registrant for the 2021 Annual Meeting of Stockholders, which will be filed within 120 days of December 31, 2020, are incorporated by reference into Part III of this Annual Report on Form 10-K.

ATLAS TECHNICAL CONSULTANTS, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this Annual Report on Form 10-K that are not purely historical are forward-looking statements. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Annual Report on Form 10-K are based on our current expectations and beliefs concerning future developments and their potential effects on us. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under the heading “Risk Factors” included elsewhere in this report. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to:

| ● | the effect, impact, potential duration or other implications of the COVID-19 pandemic and any expectations we may have with respect thereto; |

| ● | the adequacy of our efforts to mitigate cybersecurity risks and threats, especially with employees working remotely due to the COVID-19 pandemic; |

| ● | our ability to raise financing in the future; |

| ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| ● | our officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business, as a result of which they would then receive expense reimbursements; |

| ● | our public securities’ potential liquidity and trading; |

| ● | changes adversely affecting the business in which we are engaged; |

| ● | the risks associated with cyclical demand for our services and vulnerability to industry, regional and national downturns; |

| ● | fluctuations in our revenue and operating results; |

| ● | unfavorable conditions or further disruptions in the capital and credit markets; |

| ● | our ability to generate cash, service indebtedness and incur additional indebtedness; |

| ● | competition from existing and new competitors; |

| ● | our ability to integrate any businesses we acquire and achieve projected synergies; |

| ● | our failure to maintain appropriate internal controls over financial reporting and disclosure controls and procedures; |

| ● | risks related to legal proceedings or claims, including liability claims; |

| ● | our dependence on third-party contractors to provide various services; |

| ● | our ability to obtain additional capital on commercially reasonable terms to fund acquisitions, expansions and our working capital needs and our ability to obtain debt or equity financing on satisfactory terms; |

| ● | safety and environmental requirements and other governmental regulations that may subject us to unanticipated costs and/or liabilities; |

| ● | general economic conditions and demand for our services; and |

| ● | our ability to fulfill our public company obligations. |

Should one or more of these risks or uncertainties materialize, they could cause our actual results to differ materially from the forward-looking statements. Forward-looking statements speak only as of the date they were made. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. You should not take any statement regarding past trends or activities as a representation that the trends or activities will continue in the future. Accordingly, you should not put undue reliance on these statements.

This Annual Report on Form 10-K includes market share data, industry data and forecasts that we obtained from internal company surveys (including estimates based on our knowledge and experience in the industry in which we operate), market research, consultant surveys, publicly available information, industry publications and surveys. These sources include, but are not limited to, IBISWorld, FMI, Engineering News Record and the American Society of Civil Engineers. Industry surveys and publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe such information is accurate and reliable, we have not independently verified any of the data from third-party sources cited or used for our management’s industry estimates, nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our position relative to our competitors or as to markets in which we operate refer to the most recent available data.

ii

Risk Factor Summary

Our business is subject to significant risks and uncertainties of which you should be aware before making an investment decision in our business. Below is a bulleted summary of our principal risk factors, however this list does not fully represent all of our known risk factors. You should take time to carefully review and consider the full discussion of our risk factors (See Item 1A. Risk Factors).

Risks Relating to Our Business and Industry

| ● | Outbreaks of diseases, including the COVID-19 global pandemic, have had an adverse effect on our business, financial condition, and our results of operations. |

| ● | We may not achieve synergies and cost savings in connection with prior or future acquisitions. |

| ● | Our continued success is dependent on hiring and retaining qualified personnel. |

| ● | Our profitability may suffer if we fail to maintain adequate utilization of our workforce. |

| ● | Our business operations and financial results may be adversely affected if we fail to successfully manage our growth strategy. |

| ● | Failure to maintain a safe work site could expose us to significant financial losses and reputational harm along with civil and criminal liabilities. |

| ● | Demand from clients is cyclical and vulnerable to economic downturns, thus a weakened economy may adversely impact our financial results. |

| ● | Our results of operations depend on new contracts and the timing of the performance of these contracts. |

| ● | Our backlog is not necessarily indicative of our future revenues or earnings. |

| ● | Our clients failing to timely pay amounts owed to us could adversely impact our business operations and financial results. |

| ● | Our services expose us to significant risks of liability, and our insurance policies may not provide adequate coverage. |

| ● | Unavailability or cancellation of third-party insurance coverage would increase our overall risk exposure and disrupt the management of our business operations. |

| ● | Catastrophic events may adversely impact our business operations. |

| ● | We engage in a highly competitive business and may lose market share, which would adversely impact our business operations. |

| ● | The nature of our contracts subject us to risks of cost overruns, which could lead to reduced profits or, in some cases, losses. |

| ● | Any disruption in government funding could adversely affect our business. |

| ● | Governmental agencies may modify or terminate our contracts at any time prior to completion and failure to replace them may result in a decline in revenue. |

| ● | Failure to comply with a variety of complex procurement rules and regulations could damage our reputation and result in our being liable for penalties. |

| ● | We are dependent on third parties to complete certain elements of our contracts. |

| ● | We may be precluded from providing certain services due to conflicts of interest. |

| ● | Failure to maintain an effective system of internal control may affect our ability to accurately report our financial results. |

| ● | An impairment charge on our goodwill could have a material adverse impact on our financial position and results of operations. |

iii

| ● | Rising inflation, interest rates and/or construction costs could reduce the demand for our services as well as decrease our profit on existing contracts. |

| ● | We are subject to professional standards, duties and statutory obligations, all of which could expose us to liability and monetary damages. |

| ● | If we fail to meet timing or performance standards on a project, we may incur a loss on that project, which would reduce our overall profitability. |

| ● | The outcome of pending and future litigation could have a material adverse impact on our business. |

| ● | Judicial determinations in favor of limiting the ability of public agencies to contract with private firms to perform government employee functions could have an adverse impact on our ability to compete for contracts and thus our financial results. |

| ● | Our actual business and financial results could differ from the estimates and assumptions that we use to prepare our financial statements, which may significantly reduce or eliminate our profits. |

| ● | Our credit agreements contain a number of restrictive covenants which could limit our ability to finance operations, acquisitions or capital needs or engage in other business activities that may be in our interest. | |

| ● | Variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly. | |

| ● | We and our clients are subject to environmental, health and safety laws and regulations that may require substantial costs to comply with and may expose us to significant penalties, damages or costs of remediation. Changes in such laws or regulations could also directly or indirectly reduce the demand for our services or make our operations more costly. |

| ● | Changes in natural resource management or infrastructure industry laws could reduce the demand for our services or make our operations more costly, which could in turn adversely impact our revenue. |

Risks Related to Our Common Stock

| ● | Our quarterly results may fluctuate significantly, which could have a materially adverse effect on the price of our common stock. |

| ● | As an “emerging growth company,” we are subject to reduced disclosure requirements which could make our common stock less attractive to investors. |

| ● | To the extent that shares of Class A common stock are issued pursuant to the terms of the Holdings LLC Agreement, the number of shares eligible for resale in the public market will increase. |

| ● | If we issue additional equity securities, our existing stockholders may experience dilution, such new securities may have rights senior to those of our common stock, and the market price of our common stock may be adversely affected. |

| ● | Provisions in our second amended and restated certificate of incorporation and Delaware law may have the effect of discouraging lawsuits against our directors and officers. |

| ● | Provisions in our second amended and restated certificate of incorporation may inhibit a takeover of us, which could limit the price investors might be willing to pay in the future for our common stock. |

| ● | Concentration of ownership of our common stock among certain large stockholders may prevent new investors from influencing significant corporate decisions or adversely affect the trading price of our common stock. |

| ● | The market price of our common stock may be affected by low trading volume. |

| ● | If securities or industry analysts adversely change their recommendations regarding our common stock or if our operating results do not meet their expectations, our stock price could decline. |

| ● | There can be no assurance that we will be able to comply with the continued listing standards of NASDAQ. |

General Risk Factors

| ● | Negative conditions in the credit and financial markets could result in liquidity problems, or increase our borrowing costs. |

| ● | Cybersecurity breaches of our systems could adversely impact our ability to operate. |

| ● | Failure to comply with federal, state, and local governmental requirements could adversely affect our business. |

| ● | Changes in tax laws could increase our tax rate and materially affect our results of operations. |

iv

PART I

ITEM 1. BUSINESS

Overview

Headquartered in Austin, Texas, Atlas Technical Consultants, Inc. (the “Company”, “we”, or “Atlas” and formerly named Boxwood Merger Corp. (“Boxwood”)) is a leading provider of professional testing, inspection, engineering, environmental, program management and consulting services, offering solutions to public and private sector clients in the transportation, commercial, water, government, education, industrial, healthcare and power markets. Our customers include government agencies (federal, state and local), quasi-public entities, schools, hospitals, utilities and airports, as well as private sector clients across many industries.

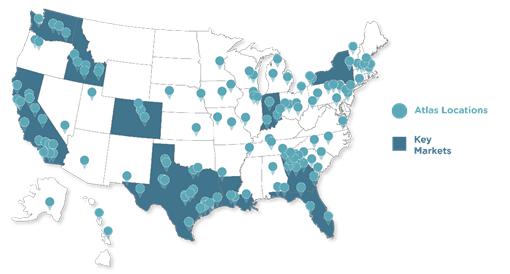

With approximately 140 offices located throughout the United States, we provide a broad range of mission-critical technical services, helping our clients test, inspect, plan, design, certify and manage a wide variety of projects across diverse end markets.

We act as a trusted advisor to our clients, helping clients design, engineer, inspect, manage and maintain civil and commercial infrastructure, servicing existing structures as well as helping to build new structures. However, we do not perform any construction and do not take any direct construction risk.

We provide a broad range of mission-critical technical services, ranging from providing inspection services in small projects to managing significant aspects of large, multi-year projects. For the year ended December 31, 2020, we:

| ● | performed approximately 40,000 projects, with average revenue per project of less than $10,000; and |

| ● | delivered approximately 90% of our revenue under “time & materials” and “cost-plus” contracts. |

We have long-term relationships with a diverse set of clients, providing a base of repeating clients, projects and revenues. Approximately 90% of our revenues were derived from clients that have used our services at least twice in the past three years and more than 95% of our revenues were generated from client relationships longer than ten years, with greater than 25% of revenues generated from relationships longer than thirty years. Examples of such long-term customers include the Georgia and Texas Departments of Transportation, U.S. Postal Service, U.S. Environmental Protection Agency, Gwinnett County Georgia, New York City Housing Authority, Stanford University, Port of Oakland, United Rentals, Inc., Speedway, Walmart Inc., and Apple Inc.

Our services require a high degree of technical expertise, as our clients rely on us to provide testing, inspection and quality assurance services to ensure that structures are designed, engineered, built and maintained in accordance with building codes, regulations and the highest safety standards. As such, our services are delivered by a highly-skilled, technical employee base that includes engineers, inspectors, scientists and other field experts. As of December 31, 2020, our technical staff represented nearly 80% of our approximately 3,200 employees. Our services are typically provided under contracts, some of which are long-term with long lead times between when contracts are signed and when our services are performed. As such, we have a significant amount of contracted backlog, providing for a high degree of visibility with respect to revenues expected to be generated from such backlog. As of December 31, 2020, our contracted backlog was estimated to be approximately $628 million. See “— Backlog” below for additional information relating to our backlog.

For the year ended December 31, 2020, we recognized approximately $468.2 million of gross revenues, ($27.6) million of net (loss) income, and $62.7 million of adjusted EBITDA.

1

Company History

Since our inception, we have strategically strengthened our capabilities and widened our footprint through organic growth and acquisitions of premier national and large regional technical service companies to create an industry-leading platform. Prior to the consummation of the Atlas Business Combination (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview”), in 2017, we sequentially acquired three regional market leaders in each of Texas (PAVETEX Engineering LLC), Georgia (Moreland Altobelli Associates, LLC), and California (Consolidated Engineering Laboratories (“CEL”)). These businesses established our core services and capabilities. In 2018, we further augmented our core services and regional leadership through the acquisitions of Piedmont Geotechnical Consultants (Georgia) and SCST, Inc. (California). In January 2019, we acquired ATC Group Services LLC, an environmental and engineering consulting services company with over 1,700 employees across North America. In the year-ended December 31, 2020, we acquired: (i) Long Engineering LLC (“LONG”), a land surveying and engineering company headquartered in Atlanta, Georgia; (ii) Alta Vista Solutions (“Alta Vista”), a key provider of transportation-related testing and inspection services headquartered in Oakland, California; and (iii) WesTest LLC (“WesTest”), a key provider of transportation-related testing and inspection services headquartered in Lakewood, Colorado. Additionally, on February 26, 2021 we entered into a definitive agreement (subject to customary closing conditions) to acquire Atlantic Engineering Laboratories, Inc. and Atlantic Engineering Laboratories of New York, Inc., a full-service materials testing and inspection firm with over 275 employees providing on-site quality control and quality assurance services in New York and New Jersey. As a result of these acquisitions of key providers of technical services, we continue to expand our national platform.

Prior to February 14, 2020, Boxwood was a special purpose acquisition company incorporated in Delaware on June 28, 2017. On February 14, 2020, the Company consummated the Atlas Business Combination pursuant to the Purchase Agreement. Following the consummation of the Atlas Business Combination, the combined company is organized in an “Up-C” structure in which the business of Atlas Intermediate Holdings LLC (“Atlas Intermediate”) and its subsidiaries is held by Atlas TC Holdings LLC (“Holdings”) and will continue to operate through the subsidiaries of Atlas Intermediate, and in which the Company’s only direct assets will consist of Holdings Units. The Company is the sole manager of Holdings in accordance with the terms of the Amended and Restated Limited Liability Company Agreement of Holdings (the “Holdings LLC Agreement”) entered into in connection with the consummation of the Atlas Business Combination.

Our Core Values

We strive to be the most sought-after infrastructure and environmental solutions provider, known for our unique values-driven approach and brought to life by the industry’s most exceptional people.

At Atlas, we apply the following core values in all that we do:

| ● | Life—We enhance quality of life. We value people and safety above all else. |

| ● | Heart—As our hallmarks, we act with compassion, empathy and respect. |

| ● | Trust—We work together as partners, doing what we say with full accountability. |

| ● | Mastery—Always striving for the highest quality, we ensure greatness inspires all our work. |

2

Focus on Sustainability and the Environment

As an infrastructure and environmental solutions provider, we are committed to applying our values help our clients to improve sustainable infrastructure and ensure a safe and healthy environment through the services we provide. We aim to assist our clients in the effective management of their environmental risks, including those related to climate change, while also minimizing our own environmental footprint.

Through our transportation and infrastructure services, we are committed to the continuous evaluation of opportunities and implementation of solutions to maximize energy efficiency, renewable energy and low-carbon technologies. Additionally, we aim to help our clients manage and respond to climate-related impacts through our disaster response and recovery services, while also contributing to community resiliency through our engineering and design services.

Industry Overview

We operate within the broader U.S. infrastructure services market, providing a diversified set of technical services to a variety of end markets. Services include, but are not limited to, testing, inspection and certification, environmental services, engineering and design and program management, construction management and quality management. The relevant addressable market for U.S. infrastructure and construction testing, inspection and certification (“TIC”) and environmental consulting is an estimated $30 billion and growing. Our clients and projects vary in size and scope and come from all sectors including U.S. federal, state, municipal and local governments, quasi-public and private clients from the education, healthcare and utilities industries, and large multinational corporations and others.

Historically, the infrastructure and construction, TIC and environmental consulting industry have exhibited growth corresponding with market tailwinds, including heightened expenditure on public infrastructure, increasing complexity of regulatory requirements, aging transportation, water and utility systems and growing outsourcing trends among public agencies and private entities. In addition to market tailwinds, the industry has additional growth potential as TIC and quality assurance continue to increase as a percentage of overall construction value.

The following key market tailwinds are expected to drive future demand for U.S. infrastructure and construction TIC and environmental consulting:

| ● | Aging infrastructure. The majority of U.S. transportation, water and utility networks are over 50 years old, requiring an estimated $5.9 trillion of spending through 2029. Roughly 43% of public roadways in the United States are in poor or mediocre condition, 7.5% of bridges are structurally deficient (and over 94,000 additional bridges nationwide have inadequate clearances or approaches), 70% of all dams will be over 50 years old by 2030 and the majority of the U.S. electric grid was built in the mid-20th century, with an intended lifespan of 50 years. |

| ● | Shift towards outsourcing. Private and public entities are increasingly outsourcing construction and environmental services in an effort to reduce costs, decrease staffing levels, provide specialized solutions and avoid non-compliance. Approximately 40% of testing and inspection services are outsourced, with the overall market for these services growing at approximately 8% year-over-year. |

| ● | Increased public spending. Over the past several years, the U.S. Congress has passed legislation aimed at increasing transportation infrastructure spend in key markets. For example, the Fixing America’s Surface Transportation Act (the “FAST Act”), passed in 2015, will continue to provide near-term funding support, as the Highway Trust Fund has enough funding to cover large outlays through 2021. Approximately $3.5 trillion in infrastructure funding has been approved through 2029, with approximately $1.37 trillion of that total allocated to surface transportation. |

| ● | Expanding state & local transportation spend. Combined state and local spending for transportation infrastructure increased from $260 billion in 2014 to a projected $300 billion in 2021 and is expected to grow at a compound annual growth rate (“CAGR”) of approximately 4% through 2023. The top three states in projected transportation infrastructure spend for 2021, California, New York and Texas, account for approximately 33% of all state and local spending nationwide and represents markets where the Company has a presence. |

| ● | Rising Environmental Expenditures. Health, safety and environmental (“HSE”) regulations have generally become increasingly stringent and complex over time amid heightened awareness of environmental issues by regulatory bodies and consumers. U.S. environmental consulting expenditures are expected to increase from $31 billion in 2020 to $41 billion in 2026. |

End Markets

The end markets we serve are characterized by various public and private clients that are faced with deteriorating asset conditions, outdated systems and expanding regulations. We operate across the entire built environment for a variety of end markets including, but not limited to, transportation, commercial, education, industrial, environmental, water, healthcare and power. Each of these end markets are experiencing tailwinds that drive ongoing maintenance and capital investment.

3

Transportation. The U.S. transportation market has experienced broad increases in federal funding for U.S. Department of Transportation initiatives. Additionally, there is a renewed focus by the current U.S. presidential administration on infrastructure investment and a growing number of government projects focused on roads, bridges and airports. The current installed transportation base is aging and both public and private entities are increasingly outsourcing testing, inspection and program management services for their assets. At the state level, our presence in Georgia, Texas, California and New York positions us to capitalize on the potential increase in infrastructure funding in these states, as these states in particular have historically demonstrated higher than average investment in transportation infrastructure. Illustrative projects in the transportation market include airports, bridges, tollways, railways, highways, waterways, ports, tunnels, pedestrian routes and others.

Commercial. Asset operators are faced with increasing complexity of, and scrutiny around, regulatory requirements, which is driving demand for turnkey solutions and the professionalization of maintenance services. Additionally, corporations are increasing investment in information technology and smart-building features, frequently undergoing corporate relocations, and exhibiting a need for bespoke and unique facilities. The increase in outdated facilities alongside new technological and logistical needs has driven additional spend for warehouse and distribution facilities, as well as development spend across sports, recreation and stadiums. Illustrative projects in the commercial market include healthcare facilities, offices, multi-family properties, retail outlets, data centers, corporate headquarters, parking structures and religious facilities.

Education. Population growth and increasing access to education is driving enrollments and creating a need for new and updated facilities. Academic institutions are placing a growing focus on environmental impacts and sustainability as seen through the implementation of smart- and green-building technologies. Illustrative projects in the education market include colleges, universities, K-12 facilities, service academies, stadiums, athletic facilities, research facilities and theatres.

Industrial and Environmental. New quality, health, safety and environmental regulations are driving demand for compliance systems and services in industrial businesses. Extreme weather requires services such as hurricane, storm and flood clean-up efforts as seen in the Carolinas, Florida and Texas. Illustrative projects in the industrial and environmental markets include manufacturing, refineries, agricultural, utilities, petrochemicals, nuclear, midstream, disaster response and mitigation, and pulp and paper.

Water. Broadening stress on the U.S. water network from outdated systems, population growth and extreme weather patterns has resulted in systems that are approaching the end of their useful lives. The aging water infrastructure must also be renovated to meet expanding government regulations and energy-efficiency standards. Illustrative projects in the water market include dams, levees, recycling facilities, drinking water, storage, inland waterways, wastewater and treatment plants.

4

Government. Over time, municipalities, local, state and federal governments are increasingly tasked with the mandate to operate on leaner, more efficient budgets. We understand the many challenges associated with development, transportation and land-use for the government sector and we use our in-depth knowledge of social, political, and economic conditions to deliver sustainable projects to the communities that we serve. We partner with our clients and all stakeholders to ensure the cost-effective use of public funds and deliver better public infrastructure projects from concept to completion. Illustrative projects include program, construction and quality management projects for county, state and federal governments, disaster relief coordination and engineering and design of roadways and bridges.

Healthcare. From acute care hospitals to alcohol and drug treatment units, we provide services to assist our clients’ compliance with the Joint Commission Environment of Care, Centers for Disease Control and Prevention (CDC), and other applicable regulatory standards. Our nationwide network enables us to mobilize quickly, often avoiding disruption to our clients’ staff and patient populations. Illustrative projects include asset tagging, compliance assessment and permitting, construction materials testing, and site assessments.

Power. Whether our clients are considering new generation development, movement away from unregulated markets with renewed investment in regulated transmission and distribution, or retirement of older, less efficient generating assets, we understand the complexities of grid improvement and expansion projects and are poised to provide services such as siting and corridor studies, permitting, and real estate/right-of-way acquisition support. We assist our clients in determining where to add capacity, plan for construction, or build a new power plant, solar array, or wind turbine field. After construction, we are positioned to support the long-term safe and regulatory compliant operation of power assets. Illustrative projects include renewable development support services, environmental services, compliance assessment and permitting and construction management.

Service Lines

Testing, Inspection and Certification (“TIC”)

Any time a structure in the built environment is designed, built, repaired, refurbished or sold, our clients require critical path services to ensure infrastructure compliance, quality and integrity. We offer a comprehensive suite of TIC services to support a vast array of assets across different types, stages of life and end markets. In 2020, our TIC services represented approximately 35% of our revenues.

Illustrative services include:

| ● | construction materials testing, including product evaluations and factory quality control services; |

| ● | non-destructive testing and evaluations, materials testing and inspection, laboratory services and geophysics; |

| ● | construction quality assurance, including quality plan development, construction engineering and inspection, and source and field inspections; |

| ● | owner verification & inspection (OVTI); |

| ● | forensic & structural investigations; and |

| ● | materials laboratory services. |

Environmental Services

Safeguarding the environment requires proactively providing sustainable solutions while understanding and assisting our clients in complying with current regulatory demands. We utilize our technical staff, specialized equipment, and long-term relationships to manage a broad range of our clients’ environmental needs and assist our clients in overcoming environmental and regulatory challenges across a wide range of industries. By integrating environmental management into our clients’ business plans and goals, we endeavor to assist them in reducing potential crisis management costs and liabilities, thereby allowing them to focus on their core competencies and improve the health and livability of their communities. We provide comprehensive solutions to our clients’ most challenging ecological issues. Through our highly trained team of engineers, geologists, hydrogeologists, archaeologists, inspectors and other specialty environmental professionals, we have the capability to manage every aspect of a project’s environmental needs. In 2020, environmental services represented roughly 33% of our revenues.

Illustrative services include:

| ● | environmental permitting, compliance assistance, auditing and compliance management system implementation; |

| ● | air quality; |

| ● | water, hazardous material permitting and registration; |

| ● | underground storage tank management; |

| ● | leak detection and repair (LDAR) program management; |

| ● | water resource management; |

| ● | industrial hygiene and building science services; and |

| ● | disaster response and recovery. |

5

Engineering and Design (“E&D”)

We offer a full-service suite of civil, transportation, structural and architectural solutions for clients ranging from private developers to large federal agencies. We utilize our specialized expertise across a variety of disciplines to offer technical and project management solutions in order to assist clients in meeting their most demanding, large-scale challenges.

Our service offerings in E&D rest upon a foundation of years of experience in the design of a broad range of transportation and civil infrastructure projects, strong lines of communication, qualified planning and design professionals, and meticulous quality control measures throughout all stages of a project’s development. Our practice of knowledge-sharing among team members promotes continuous improvement of operations and is intended to provide maximum value for the client and reduce the likelihood of unforeseen problems during construction. Our E&D business has likewise been involved in supporting transportation and infrastructure work. In 2020, E&D represented 14% of our revenues.

Illustrative services include:

| ● | civil site, transportation and geotechnical engineering; |

| ● | hydrogeology; |

| ● | water/wastewater; |

| ● | solid waste/landfill; |

| ● | land acquisition services; |

| ● | subsurface utility engineering (SUE); |

| ● | surveying & mapping; and |

| ● | geographic information system (GIS) asset inventory & assessments. |

Program Management/Construction Management/Quality Management (“PCQM”).

We provide public and private sector clients with comprehensive support in managing large-scale improvement programs. We believe in a strong work ethic of transparency and collaboration between all parties involved and are uniquely connected to the communities we serve.

Our program management experience spans a broad spectrum of industries including hospitality, healthcare, education, industrial and municipal projects throughout the United States for both public and private sector clients. We are involved with projects totaling more than $2 billion of in-place construction, and we manage large and small-scale facility improvement programs and multi-year local option sales tax programs and provide comprehensive program support. We work hand-in-hand with governments and institutions during each stage of a capital improvement program. In 2020, our PCQM service offerings made up roughly 18% of our revenues.

6

Illustrative services include:

| ● | programmatic planning & phasing; |

| ● | contract document preparation; |

| ● | bid evaluation & award analysis; |

| ● | alternative/value engineering; |

| ● | project estimating & scheduling; |

| ● | project cost/schedule control; |

| ● | contract administration; |

| ● | project management; |

| ● | community relations/affairs; |

| ● | asset management; |

| ● | construction management services; |

| ● | quality management and assurance; and |

| ● | construction engineering & inspection (CEI). |

Key Clients and Projects

We currently serve over 10,000 different clients annually. While our ten largest clients accounted for approximately 25% of our consolidated revenue during the fiscal year ended December 31, 2020, no single client accounted for more than 10% during that period, and we do not have any one client where the loss of that one client would have a material adverse effect on the Company. Although we serve a highly diverse client base, approximately 50% of our net revenues were attributable to public and quasi-public sector clients. In this regard, public sector clients include U.S. federal, state and local government departments, agencies, systems and authorities, including Departments of Transportation, educational systems and public housing authorities, while quasi-public sector clients include utility service providers and energy producers. Of our private sector clients, our largest clients are commercial companies and contractors. Although we anticipate public and quasi-public sector clients to represent the majority of our revenues for the foreseeable future, we intend to continue expanding our service offerings to private sector clients.

7

During our history in the testing and inspection business, we have worked with such clients on such well-known projects as (in alphabetical order):

| ● | Apple Campus II (Cupertino, California) |

| ● | Golden Gate Bridge (San Francisco, California) | |

| ● | Ground Zero Recovery (New York, New York) |

| ● | Harbor Bridge (Corpus Christi, Texas) |

| ● | The Grand Waikikian by Hilton (Honolulu, Hawaii) | |

| ● | Hurricane Katrina Recovery (Louisiana) |

| ● | Northwest Corridor Express Lanes (Georgia) |

| ● | Stanford University Hospital (Stanford, California) |

Contracts

We enter into contracts that contain two principal types of pricing provisions: (1) time and materials/cost-reimbursable; and (2) fixed price. For the year ended December 31, 2020, approximately 90% of our revenue was recognized from time and materials/cost-reimbursable contracts, with approximately 10% from fixed price contracts.

Cost-reimbursable contracts. Cost-reimbursable contracts consist of the following:

| ● | “Time & materials” contracts are common for smaller scale professional and technical consulting and certification service projects. Under these types of contracts, there is no predetermined fee. Instead, we negotiate hourly billing rates and charge our clients based upon actual hours expended on a project. In addition, any direct project expenditures are passed through to the client and are typically reimbursed. These contracts may have an initial not-to-exceed or guaranteed maximum price provision. |

| ● | “Cost-plus” contracts are the predominant contracting method used by U.S. federal, state and local governments. Under these types of contracts, we charge clients for our costs, including both direct and indirect costs, plus a negotiated fee. The estimated cost plus the negotiated fee represents the total contract value. |

Fixed price. Fixed price contracts consist of the following:

| ● | Fixed price contracts require us to either perform all of the work under the contract for a specified lump sum or to perform an estimated number of units of work at an agreed price per unit, with the total payment determined by the actual number of units performed. Fixed price contracts are subject to price adjustments if the scope of the project changes or unforeseen conditions arise. Fixed price contracts expose us to a number of risks not inherent in “cost-plus” and “time & materials” contracts, including underestimation of costs, ambiguities in specifications, unforeseen costs or difficulties, problems with new technologies, delays beyond our control, failures of subcontractors to perform and economic or other changes that may occur during the contract period. Many of our fixed price contracts relate to small value services, such as individual unit or very small quantity testing or inspection. |

| ● | Revenues from engineering services are recognized in accordance with the accrual basis of accounting. Revenues under cost-reimbursable contracts are recognized when services are performed or over time. |

Backlog

As of December 31, 2020, we had $628 million of backlog, of which $377 million, or approximately 60%, is expected to be recognized over the next twelve months and the majority of the balance over the next 24 months.

We analyze our backlog, which we define as fully awarded and contracted work or revenue we expect to realize for work completed, to evaluate operations and future revenue potential. Our contracted backlog includes revenue we expect to record in the future from signed contracts. In order to calculate backlog, we determine the amounts for contracted projects that are fully funded, and then determine the respective revenues expected to be realized upon completion of work. We use backlog to evaluate Company revenue growth as it typically follows growth in backlog. As backlog is not a defined accounting term, our computation of backlog may not be comparable with that of our peers. In addition, project cancellations and scope adjustments may occur from time to time. For example, certain contracts are terminable at the discretion of the client, with or without cause. These types of backlog reductions could adversely affect our revenue and margins. Our backlog for the period beyond the next twelve months may be subject to variation from the prior year as existing contracts are completed, delayed or renewed or new contracts are awarded, delayed or canceled. Accordingly, our backlog as of any particular date is an uncertain indicator of future earnings. As backlog is not a defined accounting term, our computation of backlog may not be comparable to that of our industry peers.

8

Offices

Our principal executive offices are located at 13215 Bee Cave Parkway, Building B, Suite 230, Austin, Texas 78738, which we have leased through October 2024 with annual lease terms of $0.3 million plus operating expenses over the life of the lease. We do not own any significant real property. We currently operate out of approximately 140 leased locations. Our lease terms vary from month-to-month to multi-year commitments. We do not consider any of these leased properties to be materially important to our overall operations. While we do believe it is necessary to maintain offices through which our services are coordinated, we feel there are an ample number of available office rental properties that could adequately serve our needs should we need to relocate or expand our operations.

Atlas Geographic Footprint

Human Capital Management

At Atlas, our employees are our assets; they are the very foundation of our success, the heart of our organization and the drivers of our future potential. As of December 31, 2020, we had approximately 3,200 employees, approximately 85% of which were full-time employees and approximately 80% of which represent technical staff with specialized expertise. We consider our employee relations to be good.

Our employee attrition rate for 2020 among all staff, part-time and full-time, was approximately 15%, which was higher than our attrition rate of approximately 10% for 2019 due to COVID-19-related workforce adjustments. To date, we have been able to locate and engage highly qualified employees as needed and we do not expect our growth efforts to be constrained by a lack of qualified personnel. However, our ability to attract, retain, engage and support a diverse and highly qualified workforce is essential to our future success. As such, we prioritize diversity within our employee population and proactively foster a culture of inclusion throughout our organization, and we place the health, safety and wellbeing of our employees above all else.

Focus on Diversity, Equity and Inclusion

To achieve our vision we seek to hire, develop, and promote a talented and diverse team of professionals nationwide. We believe leveraging the power of our different backgrounds, beliefs, perspectives and capabilities creates value for our Company and our shareholders.

9

At Atlas, we define diversity, equity and inclusion as follows:

| ● | Diversity is the presence of employees of different gender, race, ethnicity, sexual orientation, age, socio-economic status, and physical/mental abilities. |

| ● | Equity is the promotion of impartiality and fairness within procedures, processes, distribution of resources, and access to promotion and development. |

| ● | Inclusion is an ongoing commitment to ensure all Atlas employees experience a welcoming work environment that is devoid of discrimination and bias. |

In the third quarter of 2020, we formed the Atlas Diversity, Equity and Inclusion Council (the “DE&I Council”) comprised of employee representatives from varying backgrounds, geographic regions, functional groups and levels of seniority within our organization to focus on diversity, equity and inclusion strategy development, initiative execution and measurement of outcomes. The DE&I Council’s work is streamlined into three targeted programs: Employee Resources, Talent & Training and Community Outreach.

In the first quarter of 2021, we appointed Jamie Myers as our Chief Diversity Officer and launched seven employee resource groups (“ERGs”), which are voluntary, employee-led groups that strive to foster a diverse, inclusive workplace aligned with our core values. Our ERGs exist to provide support, career development and networking opportunities as well as create a safe space where employees can be their authentic selves. Each ERG is open to all employees and cross-collaboration across ERGs is encouraged. When we work together to foster an open, diverse workplace, mentoring and support can reshape our inclusive culture.

Atlas Employee Resource Groups

Employee Health, Safety and Wellbeing

We place the health, safety and wellbeing of our employees above all else in our business and operations. We are committed to providing a safe and healthy work environment for our team and aim to reduce risks and hazards throughout all of our offices and operations. We are committed to mitigating risks by providing health and safety training for all employees and communicating our health and safety practices throughout our business. We also comply with all applicable health and safety requirements and regulations at the local, state and national levels throughout all operations and projects.

10

At Atlas, we continuously emphasize the three underlying principles of safety:

| ● | Think Safe: make safety a thought before starting any activity or job; |

| ● | Work Safe: make safety a part of our culture; and |

| ● | Live Safe: make safety a lifestyle. |

The overall wellbeing, including the mental health, of our employees is of utmost important to us. We provide an Employee Assistance Program free of charge to all employees, through which a third party provider offers confidential guidance for personal issues that employees may be facing, including substance abuse, mental health, work, familial, financial and legal matters.

Competition

The U.S. infrastructure and construction TIC and environmental consulting market is generally highly fragmented and competitive due to the breadth of services offered and the technical complexity needed to meet increasingly stringent regulatory standards.

Industry participants compete on the strength of client relationships, expertise in local markets, technical capabilities, reputation for quality of service and reliability, and price. The ability to compete effectively also depends on employing highly skilled, qualified personnel to meet technical qualification and staffing requirements.

Barriers to entry in the industry are created by the requirement for technical capabilities, a reputation for expertise and reliability and deep relationships with both clients and prime contractors. Scale and breadth of service offerings can also be a barrier to entry for companies that do not have adequate resources or capacity to complete complex and large-scale projects. Customers are increasingly emphasizing safe work practices by placing a premium on limiting liability, creating an additional barrier to entry for those who cannot demonstrate a safety record at or above industry standards.

The firms operating in our industry range from large, global companies with broad service offerings to small-scale providers that typically service regional markets or offer specialized, niche services. Competitive dynamics in the industry are variable across end markets, localities, geographies and types and scopes of services, among other factors. With respect to engineering and design, we view our principal competitors to be AECOM, Jacobs Engineering Group Inc., NV5 Global, Inc., Parsons Corporation, Stantec Inc., Tetra Tech, Inc. and WSP Global Inc. In the area of testing and inspection, we view our principal competitors to be Applus Services, S.A., ALS Limited, Bureau Veritas S.A., Intertek Group plc and SGS S.A. With respect to professional services, we view our principal competitors to be Accenture plc, Booz Allen Hamilton Inc., CGI Inc., FTI Consulting, Inc., Huron Consulting Group Inc. and ICF International, Inc. In all of the aforementioned industries there are also other small- and mid-sized regional players with whom we compete. Our ability to compete successfully depends upon the effectiveness of our marketing efforts, the strength of our client relationships, our ability to accurately estimate costs, the quality of the work we perform, our ability to hire and train qualified personnel and our ability to obtain insurance on commercially reasonable terms.

11

Information About Our Executive Officers

Incorporated by reference from our definitive proxy statement for the 2021 Annual Meeting of Stockholders, to be filed within 120 days of our fiscal 2020 year end.

Seasonality

Due primarily to inclement weather conditions, which lead to project delays and slower completion of contracts, and a greater number of holidays in the United States, our operating results during the months of December, January and February are generally lower than our operating results during other months. As a result, our revenue and net income for the first and fourth quarters of a fiscal year may be lower than our results for the second and third quarters of a fiscal year.

Insurance and Risk Management

We maintain insurance covering professional liability and claims involving bodily injury and property damage. We consider our present limits of coverage, deductibles and reserves to be adequate. Wherever possible, we endeavor to eliminate or reduce the risk of loss on a project through the use of quality assurance and control, risk management, workplace safety and similar methods.

Risk management is an integral part of project management. We have a strict project review framework including escalation to senior management for any fixed price contracts above $5 million.

Regulation

We are regulated in a number of fields in which we operate. We contract with various U.S. governmental agencies and entities, and when working with such governmental agencies and entities, we must comply with laws and regulations relating to the formation, administration and performance of contracts. These laws and regulations contain terms that, among other things:

| ● | require certification and disclosure of all costs or pricing data in connection with various contract negotiations; |

| ● | impose procurement regulations that define allowable and unallowable costs and otherwise govern our right to reimbursement under various cost-based U.S. government contracts; and |

| ● | restrict the use and dissemination of information classified for national security purposes and the exportation of certain products and technical data. |

To help ensure compliance with these laws and regulations, employees are sometimes required to complete tailored ethics and other compliance training relevant to their position and our operations.

Legal and Environmental

From time to time, we are subject to various legal proceedings that arise out of our normal course of business or otherwise. We are not currently a party to any legal proceedings that, individually or in the aggregate, are expected to materially impact our business, financial position, results of operations and cash flows, taken as a whole.

We must comply with a number of federal, tribal, state and local laws and regulations that strictly regulate the handling, removal, treatment, transportation and disposal of toxic and hazardous substances, or that otherwise relate to health and safety or the protection of the environment. Liabilities related to environmental contamination or human exposure to hazardous substances, or a failure to comply with applicable regulations, could result in substantial costs, including clean-up costs; fines and administrative, civil or criminal sanctions; third-party claims for property damage or personal injury; or implementation of remediation activities, including investigation, assessment and short- or long-term monitoring activities.

Available Information

We make available free of charge on our website, www.oneatlas.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file such information with, or furnish it to, the SEC. These documents are also available on the SEC’s website at www.sec.gov. The information on our website is not, and shall not be deemed to be, a part of this Annual Report on Form 10-K or incorporated into any of our other filings with the SEC.

12

ITEM 1A. RISK FACTORS

RISK FACTORS

You should carefully consider the following risk factors, together with all of the other information included in this Annual Report on Form 10-K, as these risks could have a material adverse effect on our business, results of operations and financial condition.

Additionally, the risks and uncertainties described in this Annual Report on Form 10-K are not the only risks and uncertainties that we may face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business. Furthermore, the ongoing global pandemic related to COVID-19 may amplify many of the risks discussed below to which we are subject and, given the unpredictable, unprecedented and fluid nature of the pandemic, it may materially and adversely affect us in ways that are not anticipated by or known to us or that we do not currently consider to present significant risk. Therefore, at this time, we are unable to estimate the extent to which the pandemic and its related impacts will adversely affect our business, financial condition and results of operations.

Risks Relating to Our Business and Industry

Outbreaks of communicable diseases, including the ongoing global pandemic related to COVID-19, have had an adverse effect on our business, financial condition and results of operations and could in the future have, directly or indirectly, a material adverse effect on our business, financial condition and results of operations. The duration and extent to which this will impact our future financial condition and results of operations remains uncertain.

Global or national health concerns, including the outbreak of a pandemic or contagious disease, can negatively impact the global economy and, therefore, demand and pricing for our services. For example, the outbreak of the COVID-19 pandemic and the measures being taken to address and limit the spread of the virus have adversely affected the U.S. economy and financial markets, resulting in an economic downturn that has negatively impacted the demand for our services. In response to market conditions, during the second quarter of 2020, we reduced our workforce through various actions. The full impact of the COVID-19 outbreak continues to evolve.

Furthermore, the COVID-19 pandemic also raises the possibility of an extended global economic downturn and has caused volatility in financial markets, which could affect demand for our services and impact our financial condition and results of operations even after the pandemic is fully contained. For example, if a client’s financial difficulties become severe, the client may be unwilling or unable to pay our invoices in the ordinary course of business, which could adversely affect collections of both our accounts receivable and unbilled services. We continue to monitor the impact of the COVID-19 pandemic on our cash flows and on the credit and financial markets.

As a safety focused organization, since the outbreak of COVID-19 and continuing throughout the beginning of 2021, we have encouraged our employees to work from home wherever possible and to honor all shelter in place rules put forth by their state or local governments. As a result, we may have increased cybersecurity and data security risks, due to increased use of home Wi-Fi networks and virtual private networks, as well as increased disbursement of physical machines. While we continue to implement information technology controls to reduce the risk of a cybersecurity or data security breach, there is no guarantee that these measures will be adequate to safeguard all systems with an increased number of employees working remotely.

13

We are currently monitoring, and will continue to monitor, the safety of our employees during the COVID-19 pandemic. We are evaluating, and will continue to evaluate, the impact of COVID-19 on current projects, but the full effects of COVID-19 on our operations are still unknown. The duration and extent of the impact from the COVID-19 pandemic continues to be evaluated by governments and experts and depends on future developments that cannot be accurately predicted at this time, such as the severity and transmission rate of the virus, the extent and effectiveness of containment actions, the long-term efficacy of COVID-19 vaccines, the emergence of new strains of the virus and the impact of these and other factors on our employees and clients. In the event of a reinstitution of shelter-in-place orders within the cities and municipalities where we operate, our future results could be further negatively impacted and could result in the re-designation of infrastructure spending to other uses. Disruptions to capital markets due to the uncertainty surrounding the length and severity of the COVID-19 pandemic could also delay the timing of our customers’ capital projects.

Our business strategy relies in part on acquisitions to sustain our growth. Acquisitions of other companies present certain risks and uncertainties.

Our business strategy involves growth through, among other things, the acquisition of other companies. We may finance these acquisitions or other strategic investments with cash, the issuance of equity or equity-linked securities or a combination of the foregoing, and therefore any such acquisition or strategic investment could be dilutive to our existing stockholders. We try to acquire companies that we believe will strategically fit into our business and growth objectives, including, for example, our acquisition of ATC Group Services LLC in January 2019, LONG in February 2020, Alta Vista in September 2020 and WesTest in December 2020 and our February 2021 entry into a definitive agreement to acquire Atlantic Engineering Laboratories, Inc. and Atlantic Engineering Laboratories of NY, Inc. We are continuously evaluating multiple acquisition or strategic investment opportunities, some of which may be material to our results of operations and financial condition. If we are unable to successfully integrate and develop acquired businesses, we could fail to achieve anticipated synergies and cost savings, including any expected increases in revenues and operating results, which could have a material adverse effect on our financial results.

We may not be able to identify suitable acquisition or strategic investment opportunities or may be unable to obtain the required consent of our lenders and, therefore, may not be able to complete such acquisitions or strategic investments. We may incur expenses associated with sourcing, evaluating and negotiating acquisitions (including those that we do not complete), and we may also pay fees and expenses associated with financing acquisitions to investment banks and other advisors. Any of these amounts may be substantial, and together with the size, timing and number of acquisitions we pursue, may negatively affect and cause significant volatility in our financial results.

In addition, we have assumed, and may in the future assume, liabilities of the company we are acquiring. While we retain third-party advisors to assist with due diligence and consult on potential liabilities related to these acquisitions, there can be no assurances that all potential liabilities will be identified or known to us. If there are unknown liabilities or other unforeseen obligations, our business could be materially adversely affected.

We cannot assure you that we will achieve synergies and cost savings in connection with prior or future acquisitions.

We actively pursue acquisition opportunities consistent with our growth strategy. We may not achieve anticipated cost savings in connection with prior or future acquisitions within the anticipated time frames or at all. A variety of risks could cause us not to realize some or all of these expected benefits. These risks include, among others, higher than expected standalone overhead expenses, delays in the anticipated timing of activities related to cost saving initiatives and the incurrence of other unexpected costs associated with operating the acquired business. Moreover, our implementation of cost savings initiatives may disrupt our operations and performance, and our estimated cost savings from such initiatives may be based on assumptions that prove to be inaccurate. If, for any reason, the benefits we realize are less than our estimates or our improvement initiatives adversely affect our operations or cost more or take longer to implement than we project, or if our assumptions prove inaccurate, our results of operations may be materially and adversely affected.

In addition, our operating results from these acquisitions could, in the future, result in impairment charges for any of our intangible assets, including goodwill, or other long-lived assets, particularly if economic conditions worsen unexpectedly. These changes could materially adversely affect our results of operations, financial condition, stockholders’ equity, and cash flows.

If we are unable to integrate acquired businesses successfully, our business could be harmed.

As part of our business strategy to pursue accretive acquisitions, we intend to selectively pursue targets that provide complementary, low-risk services and expand our national platform. Our inability to successfully integrate future acquisitions could impede us from realizing all of the benefits of those acquisitions and could weaken our business operations. The integration process of any particular acquisition may disrupt our business and, if implemented ineffectively, may preclude realization of the full benefits expected by us and could harm our results of operations. In addition, the overall integration process may result in unanticipated problems, expenses, liabilities and competitive responses and may cause our stock price to decline.

14

The difficulties of integrating acquisitions include, among other things:

| ● | unanticipated issues in integration of information, communications and other systems; |

| ● | unanticipated incompatibility of logistics, marketing and administration methods; |

| ● | maintaining employee morale and retaining key employees; |

| ● | integrating the business cultures of both companies; |

| ● | preserving important strategic client relationships; |

| ● | consolidating corporate and administrative infrastructures and eliminating duplicative operations; and |

| ● | coordinating geographically separate organizations. |

In addition, even if the operations of an acquisition are integrated successfully, we may not realize the full benefits of such acquisition, including the synergies, cost savings or growth opportunities that we expect. These expected benefits may not be achieved within the anticipated time frame or at all.

Further, we have assumed, and may in the future assume, liabilities of the company we are acquiring. While we retain third-party advisors to assist with due diligence and consult on potential liabilities related to these acquisitions, there can be no assurances that all potential liabilities will be identified or known to us. If there are unknown liabilities or other unforeseen obligations, our business could be materially adversely affected. Acquisitions may also cause us to:

| ● | require our management to expend significant time, effort and resources; |

| ● | issue securities that would dilute our current stockholders; |

| ● | use a substantial portion of our cash resources; |

| ● | increase our interest expense, leverage and debt service requirements if we incur additional debt to fund an acquisition; |

| ● | assume liabilities, including environmental liabilities, for which we do not have indemnification from the former owners or have indemnification that may be subject to dispute or concerns regarding the creditworthiness of the former owners; |

| ● | record goodwill and non-amortizable intangible assets that are subject to impairment testing on a regular basis and potential impairment charges; |

| ● | experience volatility in earnings due to changes in contingent consideration related to acquisition liability estimates; |

| ● | incur amortization expenses related to certain intangible assets; |

| ● | lose existing or potential contracts as a result of conflict of interest issues; |

| ● | incur large and immediate write-offs; or |

| ● | become subject to litigation. |

Our continued success is dependent upon our ability to hire, retain and utilize qualified personnel.

The success of our business and our ability to operate profitably is dependent upon our ability to hire, retain and utilize qualified personnel, including engineers, architects, designers, craft personnel and corporate management professionals who have the required experience and expertise at a reasonable cost. The market for these and other personnel is competitive. From time to time, it may be difficult to attract and retain qualified individuals with the expertise, and in the timeframe, demanded by our clients, or to replace such personnel when needed in a timely manner. In certain geographic areas, for example, we may not be able to satisfy the demand for our services because of our inability to successfully hire and retain a sufficient amount of qualified personnel. Furthermore, some of our personnel hold government-granted clearance that may be required to obtain government projects. If we were to lose some or all of these personnel, they would be difficult to replace. Loss of the services of, or failure to recruit, qualified technical and management personnel could limit our ability to successfully complete existing projects and compete for new projects.

In addition, if any of our key personnel retire or otherwise leave the Company, we must have appropriate succession plans in place and successfully implement such plans, which requires devoting time and resources toward identifying and integrating new personnel into leadership roles and other key positions. Our inability to attract and retain qualified personnel or effectively implement appropriate succession plans could have a material adverse impact on our business, financial condition and results of operations.

The cost of providing our services, including the extent to which we utilize our workforce, affects our profitability. For example, the uncertainty of contract award timing can present difficulties in matching our workforce size with our contracts. If an expected contract award is delayed or not received, we could incur costs resulting from excess staff, reductions in staff, or redundancy of facilities that could have a material adverse impact on our business, financial condition and results of operations.

15

Our profitability could suffer if we are not able to maintain adequate utilization of our workforce.

The cost of providing our services, including the extent to which we utilize our workforce, affects our profitability. The rate at which we utilize our workforce is affected by several factors, including:

| ● | our ability to transition employees from completed projects to new assignments and to hire and assimilate new employees; |

| ● | our ability to forecast demand for our services and thereby maintain an appropriate headcount in each of our geographic areas and workforces; |

| ● | our ability to manage attrition; |

| ● | our need to devote time and resources to training, business development, professional development and other non-chargeable activities; |

| ● | our ability to match the skill sets of our employees to the needs of the marketplace; |

| ● | potential disengagement of employees if we overutilize our workforce, which would increase employee attrition; and |

| ● | conversely, if we underutilize our workforce, our profit margin and profitability could suffer. |

If we are not able to successfully manage our growth strategy, our business operations and financial results may be adversely affected.

Our expected future growth presents numerous managerial, administrative and operational challenges. Our ability to manage the growth of our operations will require us to continue to improve our management information systems and our other internal systems and controls. In addition, our growth will increase our need to attract, develop, motivate, and retain both our management and professional employees. The inability of our management to effectively manage our growth or the inability of our employees to achieve anticipated performance could have a material adverse effect on our business.

Construction and maintenance sites are inherently dangerous workplaces. If we, the owner, or others working at a project site fail to maintain a safe work site, we can be exposed to significant financial losses and reputational harm, as well as civil and criminal liabilities.

Construction and maintenance sites often put our employees and others in proximity to large pieces of mechanized equipment, moving vehicles, chemical and manufacturing processes and highly regulated materials in a challenging environment. If we fail to implement safety procedures, or if the procedures we implement are ineffective, or if others working at the site fail to implement and follow appropriate safety procedures, our employees and others may become injured, disabled or even lose their lives, the completion or commencement of our projects may be delayed and we may be exposed to litigation, investigations, fines, penalties or claims for damages. Unsafe work sites also have the potential to increase employee turnover, increase the cost of a project to our clients and raise our operating and insurance costs. Any of the foregoing could result in financial losses or reputational harm, which could have a material adverse impact on our business, financial condition and results of operations.

In addition, our projects can involve the handling of hazardous and other highly regulated materials, which, if improperly handled or disposed of, could subject us to civil and/or criminal liabilities. We are also subject to regulations dealing with occupational health and safety. Although we maintain functional groups whose primary purpose is to ensure we implement effective HSE work procedures throughout our organization, including construction sites and maintenance sites, the failure to comply with such regulations could subject us to liability. In addition, despite the work of our functional groups, we cannot guarantee the safety of our personnel or that there will be no damage to or loss of our work, equipment or supplies.

Our safety record is critical to our reputation. Many of our clients require that we meet certain safety criteria to be eligible to bid for contracts, and many contracts provide for automatic termination or forfeiture of some or all of our contract fees or profits in the event that we fail to meet certain measures. Accordingly, if we fail to maintain adequate safety standards, we could suffer reduced profitability or the loss of projects or clients, which could have a material adverse impact on our business, financial condition and results of operations.

16

Demand from clients is cyclical and vulnerable to economic downturns. If the economy weakens or client spending declines, our financial results may be impacted.

Demand for services from our clients is cyclical and vulnerable to economic downturns, which may result in clients delaying, curtailing or canceling proposed and existing projects. Our business traditionally lags the overall recovery in the economy. If the economy weakens or client spending declines, then our revenue, profits and overall financial condition may deteriorate.