UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 001-38594

TILRAY, INC.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

|

82-4310622 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

1100 Maughan Road |

|

|

|

Nanaimo, BC |

|

V9X IJ2 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (844) 845-7291

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Class 2 Common Stock, $0.0001 Par Value Per Share |

|

The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

|

Emerging growth company |

☒ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of June 30, 2018, the last business day of the Registrant’s most recently completed second fiscal quarter, the Registrant was a privately-held company and there was no established public market for the Registrant’s common stock. The Registrant’s common stock began trading on The Nasdaq Global Select Market on July 19, 2018. The aggregate market value of Class 2 Common Stock held by non-affiliates of the Registrant computed by reference to the closing price of $17.00 per share of the Registrant’s common stock on July 19, 2018 was approximately $176 million.

As of March 25, 2019, there were 16,666,667 shares of the Registrant’s Class 1 Common Stock, par value $0.0001 per share, and 80,125,538 shares of the Registrant's Class 2 Common Stock, par value $0.0001 per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the definitive proxy statement to be filed by the registrant in connection with the 2019 Annual Meeting of Stockholders (the "Proxy Statement"). The Proxy Statement will be filed by the registrant with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the year ended December 31, 2018.

|

|

|

Page |

|

PART I |

|

|

|

Item 1. |

1 |

|

|

Item 1A. |

14 |

|

|

Item 1B. |

42 |

|

|

Item 2. |

42 |

|

|

Item 3. |

42 |

|

|

Item 4. |

42 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

43 |

|

|

Item 6. |

43 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

44 |

|

Item 7A. |

56 |

|

|

Item 8. |

F-1 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

58 |

|

Item 9A. |

58 |

|

|

Item 9B. |

59 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

60 |

|

|

Item 11. |

60 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

60 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

60 |

|

Item 14. |

60 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

61 |

|

|

Item 16 |

63 |

In this Annual Report on Form 10-K, “we,” “our,” “us,” “Tilray,” and “the Company” refer to Tilray, Inc. and, where appropriate, its consolidated subsidiaries. This report contains references to our trademarks and trade names and to trademarks and trade names belonging to other entities. Solely for convenience, trademarks and trade names referred to in this report may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trademarks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

i

Special Note Regarding Forward-Looking Statements

Some of the information contained in this Annual Report on Form 10-K, including information with respect to our plans and strategy for our business and related financing, includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or “forward -looking information” within the meaning of Canadian securities laws. These statements are often identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “will,” “would” or the negative or plural of these words or similar expressions or variations. Such forward-looking statements and forward-looking information are subject to a number of risks, uncertainties, assumptions and other factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by the forward-looking statements or forward-looking information. Factors that could cause or contribute to such differences include, but are not limited to, those identified in this Annual Report on Form 10-K and those discussed in the section titled “Risk Factors” set forth in Part I, Item 1A of this Annual Report on Form 10-K and in our other SEC and Canadian public filings. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Annual Report on Form 10-K and while we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements. You should not rely upon forward-looking statements or forward-looking information as predictions of future events. Furthermore, such forward-looking statements or forward-looking information speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements or forward-looking information to reflect events or circumstances after the date of such statements.

Our Vision

We aspire to lead, legitimize and define the future of our industry by building the world’s most trusted cannabis company.

We are pioneering the future of medical cannabis research, cultivation, processing and distribution globally, and are one of the leading suppliers of adult-use cannabis in Canada.

Our Beliefs

Our founders started the Company with the belief that patients and consumers should have safe access and a reliable supply of quality-tested pure, precise and predictable cannabis products.

Our company is anchored around three core beliefs:

|

• |

Medical cannabis is a mainstream medicine consumed by mainstream patients. Similarly, we believe adult-use cannabis is a mainstream product consumed by mainstream consumers; |

|

• |

We are witnessing a global paradigm shift with regard to cannabis, and because of this shift, the transformation of a multibillion dollar industry from a state of prohibition to a state of legalization; and |

|

• |

As this transformation occurs, trusted global brands, backed by multinational supply chains, will shape the future of our industry and earn the confidence of patients, consumers, healthcare practitioners and governments around the world. |

1

Our Company

We have supplied high-quality medical cannabis products to tens of thousands of patients in twelve countries spanning five continents across the globe through our subsidiaries in Australia, Canada, Germany and Latin America, and through agreements with established pharmaceutical distributors. We cultivate medical and adult-use cannabis in Canada and medical cannabis in Europe

We operate only in countries where cannabis or hemp-derived cannabinoids are legal, by which we mean the activities in those countries are permitted under all applicable federal and state or provincial and territory laws.

We have been an early leader in the development of the global medical cannabis market. We were one of the first companies to be licensed by Health Canada to cultivate and sell medical cannabis in Canada, and one of the first companies to become a licensed dealer of medical cannabis in Canada. These licenses allow us to produce and sell medical cannabis in Canada, to develop new and innovative cannabis products and to export medical cannabis products to other countries in accordance with applicable laws. The cannabis industry is expanding rapidly in Canada, with more than 150 other companies that are currently licensed, though only a few were licensed earlier than us, and there are hundreds more applications for licenses that are being processed by Health Canada. Our products have been made available in Argentina, Australia, Canada, Chile, Croatia, Cyprus, the Czech Republic, Germany, New Zealand, United Kingdom, United States and South Africa. While there are other Licensed Producers operating in multiple countries, including some licensed in Canada, and other non-cannabis companies expanding into the cannabis market internationally, we were the first company to legally export medical cannabis from North America to Africa, Australia, Europe and South America, and we were among the first companies to be licensed to cultivate and process medical cannabis in two countries, Canada and Portugal. We have successfully recruited an international advisory board consisting of world-renowned policy leaders and business leaders, to advise on our global expansion and add to our growing network of experts in their specific field of expertise.

Our company is led by a team of visionary entrepreneurs, experienced operators and cannabis industry experts as well as PhD scientists, horticulturists and extraction specialists who apply the latest scientific knowledge and technology to deliver quality-controlled, rigorously tested cannabis products on a large scale. We have made significant investments to establish Tilray as a scientifically rigorous cannabis brand, committed to quality and excellence. Recognizing the opportunity associated with growing and producing cannabis on a large scale, we have invested capital to develop innovative cultivation practices, proprietary product formulations and automated production processes. We have also invested in clinical trials and recruited a Medical Advisory Board comprised of highly accomplished researchers and physicians. We were the first cannabis company with a North American production facility to be Good Manufacturing Practices, or GMP, certified in accordance with European Medicines Agency, or EMA, standards. An internationally recognized standard, GMP certification is the primary quality standard that pharmaceutical manufacturers must meet in their production processes.

We are committed to establishing a diverse team as we continue to grow. We are proud to have one of the first women-led boards in the cannabis industry. Diversity is a priority for our company and we intend to seek out talented people from a variety of backgrounds to join our leadership team.

We believe our growth to date is a result of our global strategy, our multinational supply chain and distribution network and our methodical commitment to research, innovation, quality and operational excellence. We believe that recognized and trusted brands distributed through multinational supply chains will be best positioned to become global market leaders. Our strategy is to build these brands by consistently producing high-quality, differentiated products on a large scale.

2

Our Opportunity

We are approaching our industry from a long-term, global perspective and see opportunities to:

Build global brands that lead, legitimize and define the future of cannabis. Historically, cannabis has been an unbranded product. As the legal cannabis industry emerges in more countries around the world, we see an opportunity to create a broad-based portfolio of differentiated brands brought to market in a professional manner, that appeal to a diverse set of patients and consumers. We believe that we have the ability to develop dominant global brands and that as we develop these brands, we will expand the addressable market for our products. We believe our business has the potential to disrupt the pharmaceutical, alcohol, tobacco and functional food and beverages industries because the emergence of the legal cannabis industry may result in a shift of discretionary income and/or a change in consumer preferences in favor of cannabis products versus other products. Recognizing the potential of this disruption, several companies in these sectors have already formed partnerships or made investments to gain exposure to the legal cannabis industry, including Sandoz AG, AB InBev, Apotex Inc., Altria Group, Inc., Constellation Brands, Inc. and Imperial Brands PLC. In addition, several alcohol companies have noted in regulatory filings that legal cannabis could have an adverse impact on their business, including Boston Beer Company, Molson Coors Brewing Company, and Craft Brew Alliance, Inc. We further believe that many patients rely on medical cannabis as a substitute to opioids and other narcotics, which has been validated by our annual patient study and peer-reviewed academic research which has demonstrated that the legalization of cannabis has coincided with a decline in the use of prescription drugs. Lastly, we believe that functional food and beverages, that is, products containing or enhanced with vitamins, caffeine, electrolytes, probiotics and other additives and ingredients, will see increased competition from products containing cannabinoids, such as cannabidiol (“CBD”). For example, we believe that many consumers will choose cannabinoid-enhanced beverages in favor of sports drinks or energy drinks.

Invest in markets where cannabis products are federally legal or are expected to be federally legal. Our goal is to increase our total addressable market size as countries continue to legalize cannabis for medical access and adult-use access globally. To date, 41 countries have formally legalized medical cannabis programs for either research or patient access and two countries, including Canada, have implemented adult-use access for cannabis. The Agriculture Improvement Act of 2018, or the Farm Bill, was passed into law in the United States during December 2018, which permits the cultivation of hemp and the production of hemp-derived CBD and other cannabinoids. Combined with the growing global acceptance of hemp and hemp-derived CBD products, we believe there is a significant market opportunity in hemp and hemp-derived CBD products globally. We expect to monitor, identify and selectively invest in compelling opportunities that will strengthen our leadership position as demonstrated by our acquisition of Manitoba Harvest in February 2019.

Develop innovative products and form factors that change the way the world consumes cannabis. We believe the future of the cannabis industry lies primarily in non-combustible products that will offer patients and consumers alternatives to smoking. We see an opportunity to partner with established pharmaceutical, food, beverage and consumer product companies to develop new non-combustible form factors that will appeal to consumers who are not interested in smoking cannabis, including our beverage research partnership with AB InBev. By developing new, non-combustible products, we believe we will expand our addressable market.

Expand the availability of pure, precise and predictable medical cannabis products for patients in need around the world. Since 2014, we have seen significant increases in demand from patients and governments for pharmaceutical-grade cannabis products. We are well-positioned to expand availability of these products to more patients in more countries as medical cannabis is increasingly recognized as a viable treatment option for patients suffering from a variety of diseases and conditions. Importantly, most European countries have required that all medical products sold be sourced from GMP-certified facilities. As such, GMP-certified producers, such as us, are well-positioned to establish market share in the European medical cannabis market. Outside of our Company, we believe there are very few GMP-certified Licensed Producers.

Foster mainstream acceptance of the therapeutic potential of medical cannabis and cannabinoid-based medicines. We see an opportunity to significantly expand the global market for medical cannabis products by conducting clinical research into the safety and efficacy of medical cannabis for a diverse range of conditions. By generating clinical data demonstrating the safety and efficacy of medical cannabis and cannabinoid-based medicines for various conditions, we see an opportunity to significantly expand and dominate the global medical cannabis market.

3

Our Strengths

We are a global pioneer with a multinational supply chain and distribution network. We were the first cannabis producer to export medical cannabis from North America and legally import cannabis into the European Union. We have licenses to cultivate cannabis in Canada and Portugal. Our products have been made available in twelve countries spanning five continents, which we believe is more than any other Licensed Producer. To achieve our goal of becoming a global cannabis leader, we have signed agreements or binding letters of intent with established global industry leaders including:

|

• |

In January 2018, we entered into a supply agreement with Shoppers Drug Mart Inc. (“Shoppers Drug Mart”), Canada’s largest pharmacy chain with more than 1,200 pharmacies. |

|

• |

In December 2018, we entered into a global framework agreement with Sandoz AG, a global leader in generic pharmaceuticals and biosimilars and part of the Novartis group, to increase availability of high quality medical cannabis products across the world. This was an evolution of the existing collaboration agreement with Sandoz Canada and under the framework agreement, Sandoz AG and Tilray will work together to develop and commercialize non-smokable and non-combustible medical cannabis products. |

|

• |

In December 2018, we entered into a research partnership with AB InBev, the world’s leading brewer to research non-alcoholic beverages containing THC and CBD in Canada. AB InBev’s participation is through Labatt Breweries of Canada and Tilray’s participation is through High Park Company, which is a Canadian adult-use subsidiary. These two companies intend to invest up to $50 million each, for a total of up to $100 million in aggregate, in the joint venture. |

|

• |

In January 2019, we entered into a global revenue sharing agreement with Authentic Brands Group (“ABG”), to market and distribute a portfolio of consumer cannabis products within ABG’s brand portfolio in jurisdictions where regulations permit. ABG is the owner of more than 50 iconic brands with a global retail footprint of over 100,000 points-of-sale. |

|

• |

In February 2019, we acquired FHF Holdings Ltd. (“Manitoba Harvest”), which is the world’s largest hemp food company with a retail network of approximately 16,000 stores across North America, including Costco, Amazon, and Wal-Mart. |

We have entered into agreements to supply adult-use cannabis to nine provinces and territories. We have been expanding our product offerings and formats since the date of adult-use legalization in Canada, and we intend to continue to increase our distribution of best-in-class brands and products to the Canadian adult-use market.

We have a scientifically rigorous medical cannabis brand approved by governments to supply patients and researchers on five continents. Governments in eleven countries have issued permits allowing our medical cannabis products to be imported from Canada for distribution to patients. We believe governments have approved the importation of our products in part because of our reputation for being a scientifically rigorous medical cannabis company known for delivering safe, high-quality products. We are committed to advancing scientific knowledge about the therapeutic potential of cannabis, as demonstrated by our success receiving federal authorizations to supply cannabinoid products to clinical trials in Australia, the United States and Canada and by recruiting a Medical Advisory Board comprised of highly accomplished researchers and physicians specializing in autism, epilepsy, cancer, dermatology and neuropathic pain.

We have secured the exclusive rights to produce and distribute a broad-based portfolio of certain adult-use brands and products to Canadian consumers for the adult-use market. The brand licensing agreement between a wholly owned subsidiary of ours and a wholly owned subsidiary of Privateer Holdings provides us with intellectual property that we believe will give us a competitive advantage for the adult-use market in Canada. The brand licensing agreement includes the rights to recognized brand names and proprietary product formulations for a wide range of products.

We have a track record for continuing to innovate within our industry. We believe our commitment to research and innovation at this early stage of our industry’s development differentiates us and gives us a competitive advantage. We have invested significant capital to develop innovative cultivation practices and facilities and proprietary product formulations.

4

We have developed a rigorous, proprietary production process to ensure consistency and quality as we increase the scale of our operations globally. We pride ourselves on consistently delivering high-quality products with precise chemical compositions. We were the first cannabis company with a North American production facility to be GMP-certified in accordance with EMA standards. We believe GMP certification provides regulators and health care providers in countries new to medical cannabis with confidence that our products are a safe, high-quality choice.

We have a highly experienced management team. We believe our management team is one of the most knowledgeable and experienced in the cannabis industry. We recognize that our industry is in the early stages of its development and that we are taking a long-term, global view towards its development. Our management team has significant experience evaluating potential transactions, partnerships and other growth opportunities, and we pride ourselves on making investment decisions that we believe will allow us to grow our business over the long term. We have continued to identify and acquire talent from leading global companies to join our team. We are confident that our team has the diversity and depth of experience to propel Tilray into a global leadership position.

Our Growth Strategy

We aspire to build the world’s most trusted global cannabis company through the following key strategies:

Expanding our production capacity in North America and Europe to meet current and expected long-term demand growth. To capitalize on the market opportunity in U.S., Canada and globally, we are investing aggressively to expand our production capacity and to automate certain cultivation, processing and packaging processes to gain efficiencies as we increase the scale of our operations.

Partnering with established distributors and retailers. As the industry evolves, we believe that the distribution of medical cannabis will increasingly mirror the distribution of other pharmaceutical products. Likewise, we believe the distribution of adult-use cannabis and wellness products will increasingly mirror the distribution of other consumer packaged goods. To efficiently and rapidly increase our scale, we are partnering with established distributors and retailers globally.

Developing a differentiated portfolio of brands and products to appeal to diverse sets of patients and consumers. We have established Tilray as a global pioneer shaping the future of the medical cannabis industry by developing a portfolio of high-quality medical cannabis and cannabinoid-based products ranging from dried flower to capsules to oils to well-defined clinical preparations. We will continue to invest in a differentiated portfolio of brands and products to appeal to a wide variety of patients and consumers. We will prioritize the development of non-combustible products that offer an alternative to smoking, which we believe will account for the majority of products on the market over the long term.

Expanding the addressable medical market by investing in clinical research and winning the trust of regulators, researchers and physicians in countries new to medical cannabis. We are expanding our addressable medical market by working collaboratively with regulators to implement safe access programs for patients. We provide clinical data to physicians and researchers on the safety and efficacy of medical cannabis to foster mainstream acceptance and enhance our reputation.

Maintaining a rigorous and relentless focus on operational excellence and product quality. We have strategically invested ahead of our growth in our operations, including cultivation, manufacturing and multichannel distribution. In doing so, we have developed a quality management system that enables us to meet the requirements of regulatory agencies in the markets where we export products, while consistently delivering high-quality products. As we continue to grow, we have the opportunity to leverage these investments while maintaining the highest level of safety and quality.

Continued innovation within our industry. We have nine filed patents in the fields of cannabis processing technology, formulation, composition delivery system, and treatment methods. We also have exclusive rights to at least 20 issued or pending patents, several of which allow for a process aimed at significantly shortening the drying and curing periods. Our business partnerships have expanded to include partnerships with global, pharmaceutical companies, consumer product goods companies, distributors, and renowned research and development companies. We believe our growing partnerships with established companies will differentiate us and position us to become a dominant leader in product and process innovation and brand development. We also continue to establish partnerships with leading research institutions and our clinical trials continue to generate safety and efficacy data that can inform treatment decisions, lead to the development of new products, position us to register medicines for market authorization, and enable us to obtain insurance reimbursement where feasible.

5

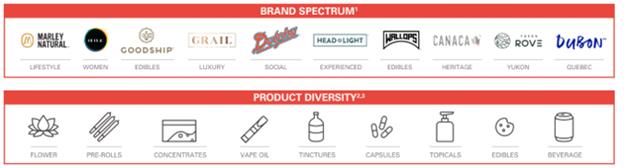

Our Brands and Products

Our brand and product strategy centers on developing a broad-based portfolio of differentiated cannabis brands and products designed to appeal to diverse sets of patients and consumers. These brands and products have been tailored to comply with all requirements introduced under Canadian adult-use legalization, such as the inclusion of health warnings on labels and restrictions on marketing, and will continue to be adapted as Canada permits a broader range of form factors in the coming months and revises its labeling and packaging requirements accordingly. Since 2010, members of our management team have been conducting research in more than a dozen countries by consulting third-party industry databases with market and consumer insights data available in various cannabis markets around the world, by commissioning proprietary third-party research and by licensing intellectual property from established cannabis brands.

Our Medical Brand: Tilray

The Tilray brand is designed to target the global medical market by offering a wide range of high-quality medical cannabis and cannabinoid-based products. We offer our products to patients, physicians, pharmacies, governments, hospitals and researchers for commercial purposes, compassionate access and clinical research.

We believe patients choose Tilray because we are a scientifically rigorous brand known for producing pure, precise and predictable medical-grade products. We have successfully grown over 50 strains of cannabis and developed a wide variety of extract products and formulations. Our global portfolio of medical cannabis products includes the following form factor platforms:

|

• |

whole flower; |

|

• |

ground flower; |

|

• |

full-spectrum oil drops and capsules; |

|

• |

purified oil drops and capsules; and |

|

• |

clinical compounds. |

Each form factor platform is divided into different product categories that correspond with the particular chemical composition of each product based on the concentration of two active ingredients: THC and CBD. For instance, our whole flower and full-spectrum oil drops and capsules are available in categories THC-Dominant, CBD-Dominant and THC and CBD Balanced.

Our product line focuses on active ingredients and standardized, well-defined preparation methods. We use formulations and delivery formats that are intended to allow for consistent and measured dosing, and we test all our products for potency and purity. Each of our commercial products are developed with comprehensive analysis and thorough documentation. We follow detailed and rigorous documentation standards not only for our own internal purposes but also because this type of documentation is required by researchers, regulators, importers and distributors.

6

We take a scientific approach to our medical-use product development, which we believe gives us credibility and respect in the medical community. We produce products that are characterized by well-defined and reproducible cannabinoid and terpene, content, formulated for stable pharmacokinetic profiles, which are customizable in a variety of formulations and available in capsule or liquid forms. We continue to conduct extensive research and development activities as well as develop and promote new products for medical use. We are also currently working with established pharmaceutical companies, such as Sandoz Canada, a division of Novartis, to develop non-combustible, co-branded products for sale in pharmacies when regulations permit.

Our Adult-Use Brands

Our wholly owned subsidiary, High Park, secured the exclusive rights from a subsidiary of Privateer Holdings to produce and distribute a broad-based portfolio of certain adult-use brands and products in Canada. The brand licensing agreement includes the rights to recognized brands and proprietary product formulations for a wide range of products. In addition to licensing certain adult-use brands from a wholly owned subsidiary of Privateer Holdings, we also developed and launched new brands for the adult-use market in Canada which are wholly owned by us, such as CANACA™, Yukon Rove™ and Dubon™.

We currently produce and distribute many of these brands and products to Canadian consumers through High Park, formed to serve the pending adult-use market in Canada, and intend to introduce additional brands and products when regulations change to permit new form factors, such as concentrates, tinctures, and edibles. Our portfolio of brands and products have been specifically adapted, and our marketing activities carefully structured, to enable us to develop our brands in an effective and compliant manner.

Retail Strategy and Brands

We have the foundation in place to be a leader in the adult-use cannabis market with High Park Company, a wholly owned subsidiary of Tilray designed to cultivate, produce, sell and distribute adult-use cannabis brands and products. High Park Company has secured the exclusive rights to produce and distribute a broad-based portfolio of adult-use brands and products in Canada through a licensing agreement, which includes the rights to recognized brands and proprietary formulations for a wide range of products. In October 2018, when the Canadian government federally legalized adult-use cannabis, High Park Company launched a number of cannabis products under various brands in the country’s largest markets, including Ontario, Quebec and British Columbia. Our understanding of the adult-use consumer is informed by extensive research, including post-adult use legalization focus groups across the country including Toronto, Vancouver and Quebec City.

We have established our portfolio and pricing strategies to compete for what we believe to be the largest adult-use consumer segments of the addressable market.

We also believe we have industry-leading customer service, supported by trained, multilingual customer service representatives available 24 hours a day, seven days a week from our Canadian call center.

The brands launched in October 2018 across Canada include:

|

• |

Grail – a super-premium cannabis brand that offers discerning connoisseurs a collection of sought-after strains and top-shelf products. |

|

• |

Irisa – a women’s brand with products that include cannabis oil drops and a massage oil designed to naturally integrate with consumers’ self-care rituals. |

|

• |

Canaca – a brand that proudly builds on its homegrown heritage with cannabis whole flower, pre-roll and oil products handcrafted by and for Canadian cannabis enthusiasts. |

7

|

• |

Dubon – “the good stuff”, a vibrantly Québécois cannabis brand and champion of inspired, creative living. Dubon offers master-crafted cannabis strains as whole flower and pre-rolls, exclusively available in Québec. |

|

• |

Yukon Rove – a cannabis brand born “wild and free” with the unique spirit of Northern-Canada. An assortment of local favorite strains will be available from Yukon Rove in whole flower and pre-rolls, exclusively in the Yukon territory. |

High Park Company launched a physical and online retail presence in October 2018 with product available for sale in British Columbia, Yukon, North West Territories, Saskatchewan, Ontario, Quebec and Prince Edward Island. In March of 2019, High Park has expanded its presence to include retail access in Alberta and Manitoba, bringing its national presence to 9 of 13 provinces and territories. In June 2019, High Park plans to launch retail availability in Nova Scotia and New Brunswick with Newfoundland expected to be the final province to receive High Park product in July 2019. As a result of this provincial roll out plan, High Park brands are anticipated to have access to the entire retail market in Canada.

Retail stores in Canada fall under two key banners:

|

|

1) |

Government-operated retail with highly regulated trade practices in British Columbia (hybrid), Quebec, New Brunswick, Nova Scotia, Prince Edward Island, Yukon, North West Territories. |

|

|

2) |

Privately-operated retail in British Columbia (hybrid), Alberta, Saskatchewan, Manitoba, Ontario and Newfoundland. |

Supporting the national coverage of retail in Canada, High Park Company has deployed a sales organization with the purpose of delivering retail optimization solutions across all government and privately-operated accounts. The sales team will lean on Customer Relationship Management (“CRM”) and trade tool support in order to maximize retail growth and deliver retailer value.

Brands licensed or developed by us or our subsidiaries include:

8

Our Operations

We are building a multinational supply chain and distribution network to capitalize on the global medical cannabis market and the adult-use market in Canada.

|

• |

Tilray North America Campus – Nanaimo, British Columbia. Our global head office is located at our Tilray North America Campus in Nanaimo. We believe that Tilray Nanaimo is one of the world’s most sophisticated, technologically advanced licensed cannabis production facilities based on the amount of capital we have invested, the amount of data we have generated about how to grow cannabis well and the standard operating procedures we have created to ensure maximum yield and product quality. Tilray Nanaimo is a 60,000-square foot facility. It houses approximately 40,000 plants in 33 cultivation rooms, five manufacturing and processing rooms and three laboratories, including an advanced extraction laboratory, all of which allow us to produce more than 50 distinct cannabis strains and various cannabis extract products. The primary purpose of Tilray Nanaimo is to continue to serve the Canadian medical market and the global medical export market for the near term. Tilray Nanaimo is licensed by Health Canada and is GMP-certified by multiple EU recognized health regulators, or Competent Authorities. It also features a patient and physician service center that is open 24 hours a day, seven days a week. At this facility we complete each step of the production process including housing mother stock, cutting clones, cultivating pre-vegetative, vegetative and flowering plants; harvesting and curing plants; securing product in the vault; trimming product; extracting cannabinoids from harvested products; analyzing products in our lab; and packaging and shipping. |

|

• |

Tilray Toronto Regional Office – Toronto, Ontario. Members of our senior leadership team are based in Toronto, along with our finance, legal, sales and marketing staff. |

|

• |

Tilray European Union Regional Office – Berlin, Germany. Our executive, finance, sales, marketing, operations and regulatory support staff for Europe are located in Berlin, Germany. |

|

• |

Tilray Australia and New Zealand Regional Office – Sydney, Australia. Our sales, marketing and operations team focused on Australia and New Zealand are based in Sydney. We have signed two government contracts with the largest states in Australia: New South Wales and Victoria to supply medical cannabis to children suffering from pediatric epilepsy. Our products are available in three major hospitals in Victoria, as well as other hospitals and pharmacies throughout Australia and New Zealand. |

|

• |

Tilray European Union Campus – Cantanhede, Portugal. In July 2017, the Portuguese National Authority of Medicines and Health Products (INFARMED) awarded Tilray a license to cultivate, import and export bulk medical cannabis. We anticipate receiving approvals for our pending manufacturing license and GMP certification in 2019, which will allow us to manufacture and distribute finished medical cannabis products. The 60 acre campus includes a 65,000-square foot outdoor cultivation plot which was harvested in the fall of 2018, a 108,000-square foot greenhouse with a first harvest completed in February 2019, and a 66,000-square foot manufacturing facility with an expected completion date in the early part of the second quarter of 2019. Tilray Portugal will serve as our primary supply source for patients in the European Union that have access to cannabis-derived products. Locating cultivation and manufacturing operations in the European Union results in easier and more cost-effective production and distribution. Although each European Union member state has its own health and drugs regulatory body, these entities have ongoing cooperation mechanisms that promote similar, though not equal, treatment for medical cannabis, which we believe will facilitate cannabis product sales from Portugal into other European countries. |

|

• |

High Park Processing Facility – London, Ontario. We entered a 10-year lease in February 2018 for a 56,000-square foot processing facility in London. We have two five-year extension options. We also have a purchase option on the property, which is exercisable in 2022 or 2027. When fully operational, this facility will handle all post-harvest processing from cannabis harvested at the High Park Farms. The High Park Processing Facility has received a processing license and we expect to receive a sales license by the end of Q2 2019. We |

9

|

expect to produce a range of products at this facility once permitted under regulations, including edibles, beverages, capsules, vaporizer oils, vape pens, tinctures, sprays, topicals, pre-rolls and dried flower products. |

|

• |

High Park Gardens (“Natura Naturals”) – Leamington, Ontario. In February 2019, we acquired a 662,000 square-foot greenhouse cultivation facility, of which 155,000 square-feet are currently licensed by Health Canada. |

Total Global Production and Processing Capacity

Once we have obtained the required amendments to our licenses to operate at the facilities described above, we believe that our total production and processing space across all facilities worldwide will total approximately 1.15 million-square feet. We believe that the maximum potential development of the parcels we currently own would be 5.5 million square feet.

Sales and Distribution

Pharmaceutical distribution and pharmacy supply agreements. We work with established pharmaceutical distributors and pharmacy suppliers to sell our products around the world.

|

• |

In Canada, we have entered into a definitive agreement to supply Shoppers Drug Mart, the largest pharmacy chain in Canada, with our cannabis products. Shoppers Drug Mart is currently distributing our products under its license to sell cannabis products for medical purposes. We believe we are one of four Licensed Producers who have entered into supply agreements with Shoppers Drug Mart. Additionally, we have signed a collaboration agreement with Sandoz Canada, a division of Novartis, to market our non-combustible products to health care practitioners and pharmacists and to co-develop new cannabis products. |

|

• |

In Germany, our products are distributed via multiple wholesalers, including Noweda, a cooperative comprised of approximately 9,000 pharmacists with a network of 16,000 pharmacies throughout Germany and one of the largest wholesalers of pharmaceutical products in Germany, to fulfill prescriptions of our medical cannabis products across Germany. |

|

• |

Elsewhere around the world, we have formed partnerships with distributors in multiple countries. Our products are currently available in twelve countries, including Argentina, Argentina, Australia, Chile, Croatia, Cyprus, the Czech Republic, New Zealand and South Africa. We have also entered into a global framework agreement with Sandoz AG, pursuant to which we will work with Sandoz AG to develop and commercialize non-smokable and non-combustible medical cannabis products internationally. |

Adult-use supply agreements. Through supply agreements and purchase orders from crown corporations or licensed retailers, we have supplied the adult-use market in Quebec, Ontario, British Columbia, Prince Edward Island, Northwest Territories, Saskatchewan and the Yukon, and anticipate providing product to additional markets in Canada this year.

Direct-to-patient (“DTP”). In Canada, medical cannabis patients order from us primarily through our e-commerce platform or over the phone. In Canada, medical cannabis is and will continue to be delivered by secured courier or other methods permitted by the Cannabis Regulations. The DTP channel accounts for the majority of our medical sales.

Wholesale. In Canada, we are also authorized under the Cannabis Regulations to wholesale bulk and finished cannabis products to other licensees under the Cannabis Regulations (“Licensed Producers”). The bulk wholesale sales and distribution channel requires minimal selling, general, administrative and fulfillment costs. We intend to pursue these wholesale sales channels as a part of our adult-use and medical-use growth strategies in Canada.

10

Our Commitment to Research and Innovation

We believe that our strength as a medical brand is rooted in our commitment to research and development. Our research and development program focuses on developing innovative products, including novel delivery systems and precisely formulated cannabinoid products, and on the creation and improvement of methods, processes and technologies that allow us to efficiently manufacture such products on a large scale.

Patents and proprietary programs. Our commitment to innovation is a core tenet. We have nine filed patents in the fields of cannabis processing technology, formulation, composition delivery system, and treatment methods. We also have exclusive rights to at least 20 issued or pending patents, several of which allow for a process aimed at significantly shortening the drying and curing periods. These patents are owned by EnWave Corporation, or EnWave; as licensee, we hold the exclusive, sublicensable right to use the technology embodied by these patents to manufacture cannabis products within Canada and Portugal, provided that certain royalty requirements are met, as well as the nonexclusive right to market and sell such products worldwide. We also have a royalty-bearing commercial sublicense with The Green Organic Dutchman Holdings Ltd (“TGOD”). The sublicense grants TGOD the right to use the technology embodied by EnWave’s patents to manufacture cannabis products. Of the EnWave patents directed to significantly shortening the cannabis drying and curing periods, the earliest expiration date is June 3, 2019. The other patents directed to either drying or dehydrating biological materials expire from approximately January 2027 to December 2032. We do not expect the expiration of one EnWave patent in 2019 to have a material effect on our current or future financial position nor to impact our future operations.

To retain exclusivity, we will also pay EnWave a minimum annual royalty rate during the term of the agreement. The minimum annual royalty is based on the amount of full microwave rated power of any EnWave equipment delivered to us.

We have developed a number of innovative and proprietary programs designed to improve efficiency and overall product quality, including: a micro-propagation program that allows for the mass production of disease-free cannabis plants; methods and formulations to improve cannabinoid bioavailability and stability; a delivery platform to allow for the quick and efficient delivery of cannabinoids in formulation; the fast preservation methods that allow for improved smell, texture and flavor of cannabis products; an integrated pest management system; proprietary plant trimming machines to minimize manufacturing waste and software improvements to optimize manufacturing, inventory and distribution processes.

Trademarks and trade dress. We invest heavily in our growing trademark portfolio and hold 19 approved or registered trademarks in a variety of countries, including Canada, the United States, the European Union, Australia, Israel and several countries in South America and Asia. We also have at least 42 additional trademarks filed and pending in several countries throughout the world. In addition, as a result of our brand licensing agreement with a former Privateer Holdings subsidiary, we have exclusive access in Canada to a number of strong marks, both registered and applied-for, including Marley Natural and Goodship.

Observational research program. We have implemented an extensive observational research program which includes large-scale prospective and cross-sectional studies in order to gather pre-clinical evidence on medical cannabis patient patterns of use, and the impact of that use on sleep, pain, mental health, quality of life, and the use of opioids/prescription drugs, alcohol, tobacco and other substances. These studies include a biennial national Canadian patient survey, the Tilray Observational Patient Study (“TOPS”), and the Medical Cannabis in Older Patients (“MCOP”) study. This research takes place in partnership with Canadian and U.S. academic institutions, and has provided insight into the use of cannabis in the treatment of headaches/migraines, anxiety, and problematic substance use, and has led to a number of publications in high ranking academic journals, including the following:

|

• |

Lucas, P., & Walsh, Z. (2017). Medical cannabis access, use, and substitution for prescription opioids and other substances: A survey of authorized medical cannabis patients. International Journal of Drug Policy, 42, 30–35. |

|

• |

Baron, E. P., Lucas, P., Eades, J., & Hogue, O. (2018). Patterns of medicinal cannabis use, strain analysis, and substitution effect among patients with migraine, headache, arthritis, and chronic pain in a medicinal cannabis cohort. The Journal of Headache and Pain, 19(1), 37. |

11

|

• |

Lucas, P., Baron, E. P., & Jikomes, N. (2019). Medical cannabis patterns of use and substitution for opioids & other pharmaceutical drugs, alcohol, tobacco, and illicit substances; results from a cross-sectional survey of authorized patients. Harm Reduction Journal, 16(1), 9. |

|

• |

Turna, J., Simpson, W., Patterson, B., Lucas, P., & Van Ameringen, M. (2019). Cannabis use behaviors and prevalence of anxiety and depressive symptoms in a cohort of Canadian medicinal cannabis users. Journal of Psychiatric Research, 111, 134–139. |

Clinical trials. Participation in clinical trials is a differentiating element of our research and development program. We believe that the development of clinical data on the use of well-characterized and properly defined cannabinoid products will increase mainstream acceptance within the medical community. As such, we have developed techniques that achieve pharmaceutical-grade Active Pharmaceutical Ingredients (“APIs”) extracted from the cannabis plant to allow Tilray to partner with select academic research partners on trials that meet regulatory agency standards. Our participation in clinical studies includes R&D on the investigational study drug to generate the Chemistry and Manufacturing Controls (“CMC”) documentation required by regulatory agencies, collation of the CMC sections our investigational study drugs, as well as providing assistance in designing the protocol and determining the formulation of the study drug. In some cases, we provide funding for the study itself and/or pharmacokinetic data on the specific study drug. Although some trials, such as the chemotherapy-induced nausea and vomiting, or CINV, trial described below, are undertaken with an aim toward market authorization, most of the trials we participate in serve to generate early phase data that can be used to support patent filings, basic prescribing data for physicians and signals of efficacy to narrow our focus for future clinical trials. We leverage our research by educating physicians about the unique benefits of cannabis-based medicines in various treatments, which we believe promotes the Tilray brand as the most trusted medical brand in the industry. Our Medical Advisory Board, consisting of experts in a variety of areas, participates in the clinical trial selection process and provides us with additional credibility as a clinical trial participant.

Clinical trials are typically conducted in phases, with Phase I establishing the safety and pharmacokinetics of the investigational study drug, Phase II further providing a signal for the drug’s efficacy and Phase III establishing statistical significance for the treatment of the disease or symptom being studied over the placebo. Below is a list of the clinical trials in which we are currently involved.

Clinical Trials

|

Country |

|

Indication |

|

Drug Product |

|

Phase |

|

No. of Participants1 |

|

Start Date1 |

|

Completion Date1 |

|

IP Owner Clinical Trial Drug |

|

IP Owner Study Results |

|

Tilray Role/ Obligations |

|

Australia |

|

Chemotherapy- induced nausea and vomiting (CINV) |

|

Capsule; combination drug product (CBD & THC) |

|

II & III |

|

Phase II: 80 Phase III: 250 |

|

Phase II: Q4 2016 Phase III: Q4 2019 |

|

Phase II: Q4 2018 Phase III: Q4 2021 |

|

Tilray |

|

Institution (with Tilray rights to use data, and Tilray option to acquire exclusive rights for market approval or Insurance reimbursement) |

|

Study drug supplier only |

|

Australia |

|

Cannabis and Driving study |

|

Vaporized dried cannabis |

|

Pilot |

|

21 |

|

Q4 2017 |

|

Q2 2018 (complete) |

|

Tilray |

|

Institution only |

|

Study drug supplier only |

|

Canada |

|

Pediatric Epilepsy (Dravet Syndrome) |

|

Oral solution; combination drug product (CBD & THC) |

|

I |

|

20 |

|

Q1 2017 |

|

Q2 2018 (complete) |

|

Tilray |

|

Institution (with Tilray option to acquire exclusive rights for market approval or insurance reimbursement) |

|

Study drug supplier, plus provider of funding ($147,000 CAD committed) |

|

Canada |

|

Post-traumatic stress disorder (PTSD) |

|

Vaporized dried cannabis |

|

II |

|

42 |

|

Q4 2016 |

|

Q2 2020 |

|

Tilray |

|

Tilray |

|

Regulatory sponsor, study drug supplier and Provider of funding ($228,000 CAD committed) |

|

USA |

|

Essential Tremor |

|

Capsules, combination drug product (CBD & THC) |

|

II |

|

20 |

|

Q1 2019 |

|

Q2 2020 |

|

Tilray |

|

Institution (with Tilray rights to use data) |

|

Study drug supplier, plus additional $20,000 USD funding |

1 See the section titled “Risk Factors”

2 Regulatory approval pending

12

Regulatory Environment

Canadian Medical and Adult-Use

Medical and adult-use cannabis in Canada is regulated under the Cannabis Regulations (“CR”), promulgated under the Cannabis Act. Both the CR and the Cannabis Act were adopted in October 2018, superseding earlier regulations that permitted commercial distribution and home cultivation of medical cannabis. Health Canada, a federal government entity, is the oversight and regulatory body for cannabis licenses in Canada. The following are the highlights of the legislation:

|

• |

allows individuals over the age of 18 to purchase, possess and cultivate limited amounts of cannabis for adult-use purposes; each province is also being permitted to adopt its own laws governing the distribution, sale and consumption of cannabis and cannabis accessory products within the province, and those laws may set lower maximum permitted quantities for individuals and higher age requirements; |

|

• |

promotion, packaging and labelling of cannabis is strictly regulated. For example, promotion is largely restricted to the place of sale, and promotions that appeal to underage individuals are prohibited; |

|

• |

currently, limited classes of cannabis, including dried cannabis and oils, are permitted for sale into the medical and adult-use markets. New classes, including edibles, topicals, and extracts (both ingested and inhaled), are expected to be permitted on or before October 17, 2019; |

|

• |

export is restricted to medical cannabis, cannabis for scientific purposes and industrial hemp; |

|

• |

sale of medical cannabis occurs largely on a direct-to-patient basis, while sale of adult-use cannabis occurs through retail-distribution models established by provincial and territorial governments; |

The retail-distribution models for adult-use cannabis vary nationwide:

|

• |

Quebec, New Brunswick, Nova Scotia and Prince Edward Island have adopted a government-run model for retail and distribution; |

|

• |

Ontario, British Columbia, Alberta, Manitoba and Newfoundland have adopted a hybrid model with some aspects, including stores, distribution and online retail being government-run while allowing for private retail; |

|

• |

Saskatchewan has announced a fully private system and; |

|

• |

the three northern territories of Yukon, Northwest Territories and Nunavut have adopted a model that mirrors their government-run liquor distribution model. |

All provinces and territories have secured supply agreements from Licensed Producers for their respective markets, and we are fulfilling adult-use supply agreements and purchase orders from various jurisdictions, consisting of: Quebec, Ontario, British Columbia, Prince Edward Island, Saskatchewan, Manitoba, Alberta, Northwest Territories, and the Yukon.

European Union Medical Use

While each country in the European Union (“EU”) has its own laws and regulations, there are many commonalities in how the medical cannabis markets for EU countries are developing. For example, to ensure quality and safe products for patients, many EU countries only permit the import and sale of medical cannabis when the manufacturer can demonstrate certification by a Competent Authority of compliance with Good Manufacturing Practice (“GMP”) standards.

The EU requires adherence to GMP standards for the manufacture of active substances and medicinal products, including cannabis products. Under the system for certification of GMP adopted in the EU, a Competent Authority of any EU member state may conduct an inspection at a drug manufacturing site and, if the GMP standards are met, a certificate of GMP compliance is issued to the manufacturer for specific elements of the manufacturing process being carried on at that site.

13

Each country in the EU will generally recognize a GMP certificate issued by any Competent Authority within the EU as evidence of compliance with GMP standards. Certificates of GMP compliance issued by a Competent Authority in another country outside of the EU will also be recognized if that country has a mutual recognition agreement with the EU.

Competitive Conditions

As of February 22, 2019, approximately 150 licenses were issued by Health Canada. To our knowledge, only a limited number of licenses are issued by Health Canada monthly, although Health Canada streamlined its license review process to respond to adult-use legalization.

Health Canada licenses are limited to individual properties. As such, if a Licensed Producer seeks to commence production at a new site, it must apply to Health Canada for a new license.

As the demand for legal cannabis increases and the application backlog with Health Canada is processed, we believe that new competitors will enter the market. The principal competitive factors on which we compete with other Licensed Producers are the quality and variety of cannabis products, brand recognition and physician familiarity.

Employees

As of December 31, 2018, we employed 688 total employees, 657 of which are full time employees and engaged contractors located in Canada, Germany, Portugal, Ireland the United States, Australia and Czech Republic, including 425 employees in research, product development, engineering and operations and logistics, 84 employees in general and administrative and 88 employees in sales and marketing. We consider relations with our employees to be good and have never experienced work stoppage. Apart from certain employees in Portugal, none of our employees are represented by a labor union or subject to a collective bargaining agreement. In Portugal, some of our employees are subject to a government-mandated collective bargaining agreement, which grants affected employees certain additional benefits beyond those required by the local labor code.

Careful consideration should be given to the following risk factors, in addition to the other information set forth in this Annual Report on Form 10-K and in other documents that we file with the SEC or publicly in Canada, in evaluating our company and our business. Investing in our securities involves a high degree of risk. If any of the following risks actually occur, our business, financial condition, results of operations and future growth prospects could be materially and adversely affected.

Risks Related to our Medical Cannabis Business and the Medical Cannabis Industry

We are dependent upon regulatory approvals and licenses for our ability to grow, process, package, store, sell and export medical cannabis and other products derived therefrom, and these regulatory approvals are subject to ongoing compliance requirements, reporting obligations and fixed terms requiring renewal.

Our ability to grow, process, package, store and sell dried cannabis and cannabis extracts, including both bottled oil and capsules, for medical purposes in Canada is dependent on our current Health Canada licenses under the Cannabis Regulations (“CR”), covering our production facility at our Tilray North America Campus in Nanaimo, British Columbia, or Tilray Nanaimo. These licenses allow us to produce dried cannabis and cannabis extracts at Tilray Nanaimo and to sell and distribute dried cannabis, bottled cannabis oil and encapsulated cannabis oil in Canada. They also allow us to import and export medical cannabis raw material and products to and from specified jurisdictions around the world, subject to obtaining, for each specific shipment, an export approval from Health Canada and an import approval from the applicable regulatory authority in the country to or from which the export or import is being made. The CR licenses for Tilray Nanaimo are valid for fixed periods and will need to be renewed at the end of such periods.

We also hold licenses under the CR covering our facilities in Enniskillen, London, and Leamington, Ontario which we intend to use to service the adult-use market. These licenses allow us to produce, sell, and distribute cannabis and/or cannabis products in Canada. These licenses are valid for fixed periods and will need to be renewed at the end of such periods.

14

Our ability to operate in our proposed facility at our Tilray European Union Campus located in Cantanhede, Portugal, or Tilray Portugal, is dependent on our current authorization for the cultivation, import and export of cannabis, and in the future will be dependent on our pending authorization (assuming such authorization is approved) for the manufacture of cannabis products and Good Manufacturing Practices, or GMP, certification, by the Portuguese National Authority of Medicines and Health Products, or INFARMED. This license is valid for a single growing season at a time and notification to INFARMED is needed to renew the license for subsequent growing seasons. All licenses are subject to ongoing compliance and reporting requirements and renewal.

We have applied for a sale license under the CR for our facility in London, Ontario, or the High Park Processing Facility. This application has not yet been approved. Any future medical cannabis production facilities that we operate in Canada will also be subject to separate licensing requirements under the CR. Although we believe that we will meet the requirements of the CR for future renewals of our existing licenses, and grants of permits under such licenses, and to obtain corresponding licenses for future facilities in Canada, there can be no assurance that existing licenses will be renewed or new licenses obtained on the same or similar terms as our existing licenses, nor can there be any assurance that Health Canada will continue to issue import or export permits on the same terms or on the same timeline, or that other countries will allow, or continue to allow, imports or exports.

Further, we are subject to ongoing inspections by Health Canada to monitor our compliance with its licensing requirements. Our existing licenses and any new licenses that we may obtain in the future in Canada or other jurisdictions may be revoked or restricted at any time in the event that we are found not to be in compliance. Should we fail to comply with the applicable regulatory requirements or with conditions set out under our licenses, should our licenses not be renewed when required, or be renewed on different terms, or should our licenses be revoked, we may not be able to continue producing or distributing medical cannabis in Canada or other jurisdictions or to export medical cannabis outside of Canada or Portugal.

In addition, we may be subject to enforcement proceedings resulting from a failure to comply with applicable regulatory requirements in Canada or other jurisdictions, which could result in damage awards, a suspension of our existing approvals, a withdrawal of our existing approvals, the denial of the renewal of our existing approvals or any future approvals, recalls of products, product seizures, the imposition of future operating restrictions on our business or operations or the imposition of civil, regulatory or criminal fines or penalties against us, our officers and directors and other parties. These enforcement actions could delay or entirely prevent us from continuing the production, testing, marketing, sale or distribution of our medical products and divert management’s attention and resources away from our business operations.

The laws, regulations and guidelines generally applicable to the medical cannabis industry in Canada and other countries may change in ways that impact our ability to continue our business as currently conducted or proposed to be conducted.

The successful execution of our medical cannabis business objectives is contingent upon compliance with all applicable laws and regulatory requirements in Canada and other jurisdictions, including the requirements of the CR in Canada, and obtaining all other required regulatory approvals for the sale, import and export of our medical cannabis products. The commercial medical cannabis industry is a relatively new industry in Canada and the CR is a regime that has only been in effect in its current form since October 2018. The effect of Health Canada’s administration, application and enforcement of the regime established by the CR on us and our business in Canada, or the administration, application and enforcement of the laws of other countries by the appropriate regulators in those countries, may significantly delay or impact our ability to participate in the Canadian medical cannabis market or medical cannabis markets outside Canada, to develop medical cannabis products and produce and sell these medical cannabis products.

Further, Health Canada or the regulatory authorities in other countries in which we operate or to which we export our medical cannabis products may change their administration, interpretation or application of the applicable regulations or their compliance or enforcement procedures at any time. Any such changes could require us to revise our ongoing compliance procedures, requiring us to incur increased compliance costs and expend additional resources. There is no assurance that we will be able to comply or continue to comply with applicable regulations.

15

Any failure on our part to comply with applicable regulations could prevent us from being able to carry on our business.

Health Canada inspectors routinely assess Tilray Nanaimo, High Park Farms and High Park Gardens for compliance with applicable regulatory requirements. Our Tilray Portugal facilities will also be inspected for compliance by applicable regulators once construction is complete, and both our Tilray Portugal facilities and our High Park Processing Facility will be subject to certain ongoing inspections and audits once licensing is complete. Furthermore, the import of our products into other jurisdictions, such as Germany and Australia, is subject to the regulatory requirements of the respective jurisdiction. Any failure by us to comply with the applicable regulatory requirements could require extensive changes to our operations; result in regulatory or agency proceedings or investigations, increased compliance costs, damage awards, civil or criminal fines or penalties or restrictions on our operations; and harm our reputation or give rise to material liabilities or a revocation of our licenses and other permits. There can be no assurance that any pending or future regulatory or agency proceedings, investigations or audits will not result in substantial costs, a diversion of management’s attention and resources or other adverse consequences to us and our business.

Our ability to produce and sell our medical products in, and export our medical products to, other jurisdictions outside of Canada is dependent on compliance with additional regulatory and other requirements.

We are required to obtain and maintain certain permits, licenses or other approvals from regulatory agencies in countries and markets outside of Canada in which we operate, or to which we export, to produce or export to, and sell our medical products in, these countries, including, in the case of certain countries, the ability to demonstrate compliance with GMP standards. Our current certification of compliance with GMP standards for production at Tilray Nanaimo and any other GMP certification that we may receive in the future subject us, or will in the future subject us, to extensive ongoing compliance reviews to ensure that we continue to maintain compliance with GMP standards. There can be no assurance that we will be able to continue to comply with these standards.

The continuation or expansion of our international operations depends on our ability to renew or secure necessary permits, licenses and other approvals. An agency’s denial of or delay in issuing or renewing a permit, license or other approval, or revocation or substantial modification of an existing permit, license or approval, could prevent us from continuing our operations in, marketing efforts in, or exports to countries other than Canada. For example, Tilray Nanaimo’s current certification of GMP compliance must be renewed via re-inspection prior to October 2020, and our failure to maintain such certification, or to comply with applicable industry quality assurance standards or receive similar regulatory certifications at any of our other facilities, may prevent us from continuing the expansion of our international operations. In addition, the export and import of medical cannabis is subject to United Nations treaties establishing country-by-country quotas and our export and import permits are subject to these quotas which could limit the amount of medical cannabis we can export to any particular country.

The long-term effect of the legalization of adult-use cannabis in Canada on the medical cannabis industry is unknown, and may have a significant negative effect upon our medical cannabis business if our existing or future medical use customers decide to purchase products available in the adult-use market instead of purchasing medical use products from us.

In June 2018, the government of Canada passed Bill C-45, or the Cannabis Act, the Canadian federal legislation allowing individuals over the age of 18 to legally purchase, process and cultivate limited amounts of cannabis for adult use in Canada. The Cannabis Act and accompanying regulations, the CR, became effective on October 17, 2018. As a result, individuals who previously relied upon the medical cannabis market to supply their medical cannabis and cannabis-based products may cease this reliance, and instead turn to the adult-use cannabis market to supply their cannabis and cannabis-based products. Factors that may influence this decision include the availability of product in each market, the price of medical cannabis products in relation to similar adult-use cannabis products, and the ease with which each market can be accessed in the individual provinces and territories of Canada. The impact of adult-use cannabis on the medical market is not yet ascertainable by us given the newness of the adult-use market in Canada, and given industry-wide supply shortages in both the medical and adult-use markets.

16

A decrease in the overall size of the medical cannabis market as a result of the legal adult-use market in Canada may reduce our medical sales and revenue prospects in Canada. Moreover, the CR regulation of cannabis for medical purposes is expected to be reviewed in light of the adult-use market. The effect on our business, and the medical cannabis market in general, of such a review is uncertain.

There has been limited study on the effects of medical cannabis and future clinical research studies may lead to conclusions that dispute or conflict with our understanding and belief regarding the medical benefits, viability, safety, efficacy, dosing and social acceptance of cannabis.

Research in Canada, the United States and internationally regarding the medical benefits, viability, safety, efficacy and dosing of cannabis or isolated cannabinoids (such as CBD and THC) remains in relatively early stages. There have been few clinical trials on the benefits of cannabis or isolated cannabinoids conducted by us or by others.

Future research and clinical trials may draw opposing conclusions to statements contained in the articles, reports and studies referenced in this Annual Report on Form 10-K, or could reach different or negative conclusions regarding the medical benefits, viability, safety, efficacy, dosing or other facts and perceptions related to medical cannabis, which could adversely affect social acceptance of cannabis and the demand for our products.

Tilray Nanaimo, High Park Farms, High Park Gardens and our High Park Processing Facility and Tilray Portugal are expected to become integral to our business and adverse changes or developments affecting any of these facilities may have an adverse impact on us.

Currently, our activities and resources are focused on the operation of Tilray Nanaimo, High Park Farms, High Park Gardens and our current licenses under the CR are specific to Tilray Nanaimo, High Park Farms, High Park Gardens and our High Park Processing Facility. Adverse changes or developments affecting these facilities, including, but not limited to, disease or infestation of our crops, a fire, an explosion, a power failure, a natural disaster or a material failure of our security infrastructure, could reduce or require us to entirely suspend our production of cannabis. A significant failure of our site security measures and other facility requirements, including any failure to comply with regulatory requirements under the CR, could have an impact on our ability to continue operating under our Health Canada licenses and our prospects of renewing our Health Canada licenses, and could also result in a suspension or revocation of these Health Canada licenses. As we produce our medical cannabis products in Tilray Nanaimo, any event impacting our ability to continue production at Tilray Nanaimo, or requiring us to delay production, would prevent us from continuing to operate our business until operations at Tilray Nanaimo could be resumed, or until we were able to commence production at another facility.