UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________________________________________________________

FORM 10-K

__________________________________________________________________________________

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

Commission file number: 001-38796

__________________________________________________________________________________

(Exact name of Registrant as specified in its charter)

__________________________________________________________________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

Registrant’s telephone number, including area code: (858 ) 684-1300

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||

☒ | Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2021 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $516.9 million, based on the closing price of the registrant’s common stock on the Nasdaq Global Select Market of $8.12 per share.

As of February 25, 2022, the registrant had 76,477,113 shares of common stock ($0.0001 par value) outstanding.

TABLE OF CONTENTS

2

PART I

FORWARD-LOOKING STATEMENTS AND MARKET DATA

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Section 27A of the Securities Act of 1933, as amended, or the Securities Act. All statements other than statements of historical facts contained in this annual report, including statements regarding our future results of operations and financial position, business strategies and plans, research and development plans, the anticipated timing, costs, design and conduct of our ongoing and planned preclinical studies and planned clinical trials for our product candidates, the timing and likelihood of regulatory filings and approvals for our product candidates, the impact of COVID-19 on our business, timing and likelihood of success, plans and objectives of management for future operations and future results of anticipated products, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. This annual report on Form 10-K also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this annual report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this annual report and are subject to a number of risks, uncertainties and assumptions, including those described in Part I, Item 1A, “Risk Factors.” The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

This annual report includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this annual report appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

This Annual Report also contains industry, market and competitive position data from our own internal estimates and research, as well as from independent market research, industry and general publications and surveys, governmental agencies and publicly available information. In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from the same sources, unless otherwise expressly stated or the context otherwise requires. In addition, while we believe the industry, market and competitive position data included in this report is reliable and based on reasonable assumptions, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed in in Part I, Item 1A, “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties or by us.

We maintain a website at www.gossamerbio.com, to which we regularly post copies of our press releases as well as additional information about us. Our filings with the Securities and Exchange Commission, or SEC, are available free of charge through our website as soon as reasonably practicable after being electronically filed with or furnished to the SEC. Information contained in our website does not constitute a part of this report or our other filings with the SEC.

Item 1. Business.

Overview

We are a clinical-stage biopharmaceutical company focused on discovering, acquiring, developing and commercializing therapeutics in the disease areas of immunology, inflammation and oncology. Our goal is to be an industry

3

leader in each of these therapeutic areas and to enhance and extend the lives of patients suffering from such diseases. To accomplish this goal, we have assembled a deeply experienced and highly skilled group of industry veterans, scientists, clinicians and key opinion leaders from leading biotechnology and pharmaceutical companies, as well as leading academic centers from around the world. Our collective immunology and translational discovery and development expertise serves as the foundation of our company. We intend to maintain a scientifically rigorous and inclusive corporate culture where employees strive to bring improved therapeutic options to patients.

We are pursuing product candidates with strong scientific rationale to address indications where there is both a high unmet need and an opportunity to develop best-in-class or first-in-class therapeutics. We currently have three clinical-stage product candidates, in addition to one late-stage preclinical product candidate and five additional preclinical programs.

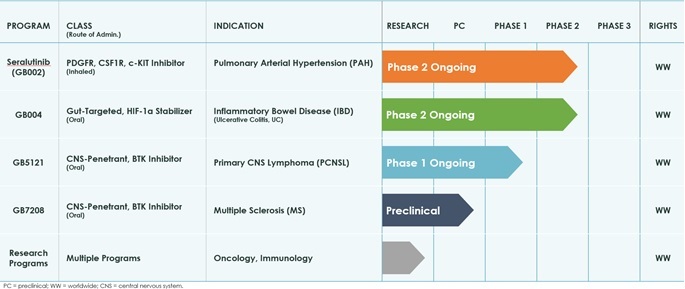

The following table summarizes our current programs:

Seralutinib (GB002: PDGFR, CSF1R and c-KIT Inhibitor)

Seralutinib, also known as GB002, is an inhaled, small molecule, platelet-derived growth factor receptor, or PDGFR, colony-stimulating factor 1 receptor, or CSF1R, and c-KIT inhibitor in development for the treatment of pulmonary arterial hypertension, or PAH. Seralutinib has been generally well tolerated in completed clinical trials. In contrast to the three classes of marketed vasodilatory therapies for PAH, we believe that seralutinib has the potential to reverse pathological remodeling by addressing mechanisms that underlie PAH. Inhaled seralutinib, which is designed to act on both isoforms of the PDGFR, α and β, as well as the CSF1R and c-KIT pathways, inhibited and reversed cellular overgrowth in lung blood vessels in multiple animal PAH models. In 2013, results from a Phase 3 clinical trial in PAH of imatinib (Gleevec), an oral tyrosine kinase inhibitor with known activity against PDGFR and c-KIT, marketed for oncology indications, showed statistically significant improvement in its primary efficacy endpoint, however serious systemic toxicities were also observed. To date, these serious toxicities have not been observed with seralutinib in our completed short-duration Phase 1 single-ascending dose / multiple ascending dose, or SAD / MAD, studies in healthy volunteers or in our two-week Phase 1b trial in PAH patients. In the Phase 1b clinical trial in PAH patients, seralutinib demonstrated rapid systemic clearance, target engagement via whole blood CSF1R stabilization assay and was generally well tolerated. We commenced the Phase 2 TORREY trial in PAH patients in December 2020. Topline results from this trial are expected in the second half of 2022, subject to developments in the ongoing COVID-19 pandemic. We in-licensed seralutinib from Pulmokine, Inc. in 2017 and retain worldwide rights. The United States Food and Drug Administration, or FDA, and the European Commission, or EC, have granted seralutinib orphan drug designation for the treatment of patients with PAH.

GB004 (Gut-Targeted HIF-1α Stabilizer)

GB004 is a gut-targeted, oral small molecule being developed for the treatment of inflammatory bowel disease, or IBD, including ulcerative colitis, or UC, and Crohn’s disease, or CD. GB004 stabilizes hypoxia-inducible factor 1α, or HIF-1α, through the inhibition of prolyl hydroxylase domains, or PHDs, key enzymes involved in HIF degradation. Preclinical data from animal models of IBD demonstrated that HIF-1α stabilization restores intestinal epithelial barrier integrity and function and results in immunomodulatory effects that we believe are important in reducing inflammation and enhancing

4

mucosal healing in IBD patients. We have completed Phase 1 SAD and MAD studies in healthy volunteers and a Phase 1b trial in patients with active UC, and GB004 has been generally well tolerated. In a 28-day Phase 1b clinical trial in patients with active UC, GB004 was well-tolerated, demonstrated a gut-targeted PK profile, showed evidence of target engagement, and initial signs of potential clinical efficacy were observed. We completed enrollment for the ongoing Phase 2 SHIFT-UC trial in patients with active mild-to-moderate UC in the fourth quarter of 2021. Topline results for the week 12 primary endpoint for this trial are expected to be publicly reported in the second quarter of 2022, and topline results for the week 36 treat-through endpoint for this trial are expected to be publicly reported in the fourth quarter of 2022. We in-licensed GB004 from Aadi Bioscience, Inc., or Aadi, in 2018 and retain worldwide rights.

GB5121 (CNS-Penetrant BTK Inhibitor)

GB5121 is an oral, irreversible, covalent, small molecule inhibitor of Bruton’s Tyrosine Kinase, or BTK, in clinical development for the treatment of primary central nervous system lymphoma, or PCNSL. GB5121 was selected based on its central nervous system, or CNS, penetration and kinase selectivity. BTK is expressed in several immune cells including B cells and myeloid cells, where it mediates signaling downstream of multiple receptors. Inhibition of BTK results in the immediate blockade and down-regulation of several cellular activities that drive autoimmunity and inflammation. Active BTK signaling is also present in many B cell malignancies. BTK inhibitors are approved in the United States to treat oncology indications. In preclinical mouse models, GB5121 has demonstrated superior CNS penetration at studied doses when compared to selected BTK inhibitors. We believe the CNS penetration observed in these preclinical studies supports the development of GB5121 as a potential therapy for the treatment of hematologic malignancies in the CNS, including PCNSL. GB5121 is currently being evaluated in a Phase 1 clinical study in healthy volunteers. We expect to initiate a global Phase 1b/2 clinical trial in PCNSL patients in the first half of 2022. GB5121 was internally developed and is wholly owned.

GB7208 (CNS-Penetrant BTK Inhibitor)

GB7208 is an oral, small molecule, BTK inhibitor in preclinical development for the treatment of multiple sclerosis, or MS. Like GB5121, GB7208 was selected based on its CNS penetration and kinase selectivity. Immune cells are believed to play an important role in the pathology of MS, and BTK inhibitors are in late-stage clinical development for the treatment of autoimmune indications, such as MS. In preclinical mouse models, GB7208 has demonstrated superior CNS penetration at studied doses, when compared to selected BTK inhibitors in development for autoimmune indications, including MS. GB7208 is currently undergoing preclinical testing, and pending the outcomes of our ongoing preclinical work, we expect to initiate a Phase 1 study in healthy volunteers in the second half of 2022. GB7208 was internally developed and is wholly owned.

Our Research Capabilities and Preclinical Programs

Including GB7208, we have six programs in preclinical development. We are continuing to build our research capabilities, specifically focusing on our areas of expertise within immunology, inflammation and oncology, in order to advance new programs into the clinic, as well as to optimize our existing programs.

Our Team

Our founders and management team have held senior positions at leading biopharmaceutical companies and possess substantial experience and expertise across the spectrum of drug discovery, development and commercialization.

Faheem Hasnain is our Co-Founder and has served as our Chief Executive Officer since November 2020 and as our Chairman since our inception. Mr. Hasnain also served as our Chief Executive Officer from our inception through July 2018 and our Executive Chairman from July 2018 through June 2019. Prior to co-founding Gossamer Bio, Mr. Hasnain served as President, CEO and as a Director of Receptos, Inc. from November 2010 to August 2015. Receptos was a public company formed in 2009 focused on developing treatments in immunology and metabolic disorders and was purchased by Celgene Corporation in August 2015. Previously, Mr. Hasnain was the President and Chief Executive Officer and a director of Facet Biotech Corporation, a biology-driven antibody company with a focus in MS and oncology. He held that position from December 2008 until the company's acquisition by Abbott Laboratories in April 2010.

Bryan Giraudo, our Chief Financial Officer and Chief Operating Officer, has extensive biotechnology and medical technology finance experience, having previously served as Senior Managing Director at Leerink Partners (now known as SVB Leerink) and Managing Director at Merrill Lynch, Pierce, Fenner & Smith Incorporated. Richard Aranda, M.D., our Chief Medical Officer, is an experienced clinician and drug developer with previous experience at Bristol Myers Squibb Company, Novo-Nordisk, Inc., Receptos and Celegene Corporation. Laura Carter, Ph.D., our Chief Scientific Officer, has over 20 years of industry experience spanning target identification and validation activities through Phase 2 clinical trials in multiple

5

therapeutic areas having previously held positions at Lycera Corporation, Medimmune, Array Biopharma and Wyeth. Christian Waage, our Executive Vice President, has meaningful management biotechnology experience, having previously held various positions at Receptos, most recently as Managing Director after its acquisition by Celgene, and served at Ardea Biosciences, Inc. as Vice President, General Counsel. Caryn Peterson, our Executive Vice President, Regulatory Affairs, has considerable experience and regulatory expertise as a Managing Director of Development & Strategic Consulting Associates, as well as management positions leading regulatory affairs at Syndax Pharmaceuticals and FeRx Incorporated.

Our Strategy

We are a clinical-stage biopharmaceutical company focused on discovering, acquiring, developing and commercializing therapeutics in the disease areas of immunology, inflammation and oncology. Our goal is to be an industry leader in each of these therapeutic areas and to enhance and extend the lives of patients suffering from such diseases. Critical components of our business strategy include:

•Create deep therapeutic centers of excellence by leveraging our immunology and translational discovery and development expertise. We currently have three clinical-stage product candidates, one late-stage preclinical product candidate, and an additional five preclinical-stage programs across the areas of immunology, inflammation and oncology. We will continue to build out our portfolio, focusing on these therapeutic areas, through both internal discovery and strategic transactions to create a diversified portfolio of early and late-stage product candidates.

•Maximize the impact of our product candidates by expanding development across multiple indications. We aim to focus our development efforts on product candidates that have the potential to treat multiple diseases and plan to develop them in additional indications where warranted. For example, we plan to develop GB004 in both UC and CD. We continue to evaluate potential neurological conditions for GB7208.

•Expeditiously generate proof-of-concept data from our preclinical programs to facilitate value creation and efficient capital deployment. We view our preclinical programs as important drivers of the long-term sustainability of our company. We plan to advance our preclinical programs to generate meaningful data to determine quickly whether each warrants clinical development.

•Leverage the drug discovery, development and commercialization expertise of our world-class team. Our executive management team and key scientific leaders have successfully discovered, developed and commercialized small molecule and biologic agents at both large and small biopharmaceutical companies. We plan to utilize this deep, broad set of expertise and experiences as we execute on our in-house discovery and development strategies and evaluate new external acquisition opportunities.

Our Product Candidates

Seralutinib (GB002: PDGFR, CSF1R and c-KIT Inhibitor)

Seralutinib, also known as GB002, is an inhaled, small molecule, PDGFR, CSF1R and c-KIT inhibitor in development for the treatment of PAH. As of December 31, 2021, seralutinib has been generally well tolerated in completed clinical trials. In contrast to the three classes of marketed vasodilatory therapies for PAH, we believe that seralutinib has the potential to reverse pathological remodeling by addressing mechanisms that underlie PAH. Inhaled seralutinib, which is designed to act on both isoforms of the PDGFR, α and β, as well as the CSF1R and c-KIT pathways, inhibited and reversed cellular overgrowth in lung blood vessels in animal PAH models. In 2013, results from a Phase 3 clinical trial in PAH of imatinib (Gleevec), an oral tyrosine kinase inhibitor with known activity against PDGFR and c-KIT, marketed for oncology indications, showed statistically significant improvement in its primary efficacy endpoint, however serious systemic toxicities were also observed. To date, these serious toxicities have not been observed with seralutinib in our completed short-duration Phase 1 SAD / MAD studies in healthy volunteers or in our two-week Phase 1b trial in PAH patients. In the Phase 1b clinical trial in PAH patients, seralutinib demonstrated rapid systemic clearance, target engagement via whole blood CSF1R stabilization assay and was generally well tolerated. We commenced the Phase 2 TORREY trial in PAH patients in December 2020. Topline results from this trial are expected in the second half of 2022, subject to developments in the ongoing COVID-19 pandemic. We in-licensed seralutinib from Pulmokine, Inc. in 2017 and retain worldwide rights. The FDA and the EC have granted seralutinib orphan drug designation for the treatment of patients with PAH.

6

Mechanism of Action

PAH is driven by abnormal cellular proliferation within and around the small blood vessels of the lung that carry blood from the right side of the heart to the lungs. Functional and structural changes in the pulmonary vasculature, known as vascular remodeling, can lead to smooth muscle cell proliferation and migration from the middle layer of the blood vessel into the inner layer. This can result in the development of plexiform and neointimal lesions that can obstruct blood flow. The obstruction of blood flow in the pulmonary vessels can also predispose patients to thrombosis, or blood clots, within these small pulmonary vessels that further blocks blood flow. This progressive obstruction of blood flow from the right side of the heart to the lungs can cause the right ventricle to fail, thus leading to severe breathlessness, reduced exercise tolerance and death. Seralutinib was designed to inhibit multiple kinases that play a role in the pathology of PAH, including PDGFRα/β, CSF1R and c-KIT.

The PDGFR is a tyrosine kinase receptor which, when activated by its agonist, induces cellular proliferation. PDGF expression is known to be particularly important to stimulating smooth muscle cell proliferation in PAH patients. PDGFRs and their ligands are both upregulated in PAH. Upregulated PDGFR signaling results in endothelial cell and fibroblast dysfunction and the proliferation and migration of smooth muscle cells. This effect results in the overgrowth and occlusion of blood vessels in the lung. Kinase inhibitors with activity against the PDGFR pathway have shown the ability to reverse PAH in animal models.

Inhaled seralutinib is designed to act on both isoforms of the PDGFR, α and β. Data from preclinical animal models and human lung histology from PAH patients suggests that it is important to inhibit both of these isoforms of the PDGF receptor. PDGFRα is highly expressed in pulmonary arteriole vascular smooth muscle cells, or PAVSMCs. Inhibiting PDGFRα may help reduce the abnormal cell proliferation of PAVSMCs that results in blood vessel thickening. PDGFRβ is more highly expressed in fibroblasts and myofibroblasts that are involved with the abnormal cell proliferation within the blood vessel that leads to the obstruction of the pulmonary arterioles. We believe inhibiting PDGFRβ is therefore important in decreasing the abnormal cell proliferation of these cell types.

The c-KIT pathway was also identified as an important growth factor involved in pulmonary vascular remodeling, particularly in the cells implicated in perivascular inflammation. An analysis of lung and pulmonary arteriole samples has also shown increased gene expression of c-KIT in idiopathic PAH. C-KIT positive endothelial cells may also secrete PDGF, and perivascular c-KIT positive mast cells have been shown to secrete pro-inflammatory cytokines and tryptase that further contribute to the inflammatory process in PAH.

Mechanistic validation of a PDGFR and c-KIT kinase inhibitor has been observed in clinical trials of imatinib (Gleevec), an oral tyrosine kinase inhibitor with known activity against the PDGFR and c-KIT pathways, which demonstrated proof-of-concept in humans in a Phase 3 clinical trial in PAH. In preclinical models, as compared to imatinib, seralutinib was a more potent inhibitor of the PDGFRα isoform, and seralutinib was a ten-fold more potent inhibitor of the PDGFRβ isoform and c-KIT.

Macrophages have also been identified as one of the most important inflammatory cells in the development and exacerbation of PAH. Macrophages, which express the CSF1 receptor, are now recognized to play an important role in PAH pathology. Activated CSF1R positive macrophages accumulate around pulmonary arterioles in PAH, which have been shown in vivo in PAH patients with positron emission tomography. Additionally, macrophage activity in PAH is associated with bone morphogenetic protein receptor type II, or BMPR2, levels. The decrease in BMPR2 characteristic of PAH results in induction of granulocyte-macrophage colony-stimulating factor, or GM-CSF, and macrophage recruitment. Notably, in the BMPR2 knock out mouse, there is significant pulmonary inflammation due to activation of tissue macrophages.

Furthermore, inflammatory macrophages secrete PDGF and stimulate pulmonary artery smooth muscle cell migration and proliferation, accelerating the feedback loop of inflammation, hyperproliferation and fibrosis that characterize PAH.

Prior PDGF Pathway Development in PAH—The IMPRES Phase 3 Clinical Trial of Imatinib

The IMPRES trial was a Phase 3 clinical trial conducted by Novartis of imatinib (Gleevec) in patients with PAH. Imatinib has known activity against multiple tyrosine kinases, including the PDGFR, c-KIT receptors and Abelson murine leukemia viral oncogene homolog 1, or c-ABL. 202 patients were enrolled in the IMPRES trial, of which 41% were being treated with prostanoids, oral phosphodiesterase type 5, or PDE5, inhibitors and oral endothelin receptor agonists, or ERAs. The trial met its primary endpoint, improvement in 6-minute walk distance, or 6MWD, versus placebo at week 24 from baseline, with statistical significance (p = 0.002). The p-value is the probability that the difference between two data sets was

7

due to chance. The smaller the p-value, the more likely the differences are not due to chance alone. In general, if the p-value is less than or equal to 0.05, the outcome is considered statistically significant.

Patients on imatinib also demonstrated statistically significant improvements in measures of hemodynamics, including pulmonary vascular resistance, or PVR, a standard measurement in the evaluation of patients with PAH. However, systemic adverse events such as bleeding and poor tolerability and frequent drug discontinuation led to a high drop-out rate within the active arm of the trial. Subdural hematomas occurred in eight patients who were also being administered oral anticoagulants during the trial. Novartis withdrew its supplemental regulatory applications in PAH in 2013 and, to our knowledge, did not pursue further development of imatinib in the indication.

Overview of Pulmonary Arterial Hypertension

PAH is a rare disease that is characterized by abnormally high blood pressure in the blood vessels carrying deoxygenated blood from the right side of the heart to the lungs and is progressive and often fatal. Symptoms include shortness of breath at rest or with minimal exertion. Other symptoms include fatigue, chest pain, dizzy spells and fainting. The progressive nature of this disease causes the right side of the heart to work much harder and eventually weaken or fail.

Patients are often evaluated by functional class, which categorizes patients by their ability to carry out physical activity and symptom severity. Worsening symptoms, and thus higher numbered functional classes, are associated with higher mortality. The four functional classes established by the World Health Organization are detailed below in Table 1.

Table 1. PAH Functional Classes

| Functional Class | Description | |||||||

| Class I | Patients with PAH, but without resulting limitation of physical activity. Ordinary physical activity does not cause undue dyspnea or fatigue, chest pain or near syncope. | |||||||

| Class II | Patients with PAH resulting in slight limitation of physical activity. They are comfortable at rest. Ordinary physical activity causes undue dyspnea or fatigue, chest pain or near syncope. | |||||||

| Class III | Patients with PAH resulting in marked limitation of physical activity. They are comfortable at rest. Less than ordinary activity causes undue dyspnea or fatigue, chest pain or near syncope. | |||||||

| Class IV | Patients with PAH with inability to carry out any physical activity without symptoms. These patients manifest signs of right heart failure. Dyspnea and/or fatigue may even be present at rest. Discomfort is increased by any physical activity. | |||||||

Additionally, recent medical society guidelines have identified intermediate and high-risk categories of PAH based on several variables including signs of right heart failure, rate of symptom progression, functional class, 6MWD, maximum oxygen consumption, NT-proBNP, which is a biomarker for heart failure and measures of right heart function.

Multiple PAH-specific treatments have been introduced in the past two decades, however PAH continues to have a high morbidity and mortality. Based on REVEAL registry data, newly diagnosed functional class III and IV patients have 5-year survival rates of 60% and 44%, respectively, while rates for previously diagnosed patients were even lower at 57% and 27%, respectively.

Overview of PAH Market

PAH most commonly affects women between the ages of 30 and 60. The true incidence and prevalence of PAH are unknown. The American Lung Association estimates that between 500 and 1,000 new cases are diagnosed each year in the US. PAH has an estimated prevalence of 70,000 patients in the US and Europe. The number of diagnosed PAH patients continues to increase, and we believe this increase is likely due to enhanced awareness and diagnosis of the disease. Total PAH drug sales worldwide in 2020 exceeded $5 billion.

Treatment Paradigm in PAH

Currently approved PAH therapies consist of three classes of vasodilators: PDE5 inhibitors (and guanylate cyclase stimulators), ERAs, and prostanoids. PDE5 inhibitors are often used in combination with ERAs as an early treatment strategy. In patients who fail to respond to combination therapy of an ERA and a PDE5 inhibitor, it is common practice to add a prostanoid. Prostanoids are also commonly used to treat patients with evidence of right heart failure. While existing treatments

8

have led to significant improvements in time to clinical worsening and other composite endpoints in PAH patients, none directly alter the underlying disease process. The effect of vasodilation, while improving blood flow through the lungs, may eventually be overtaken by the worsening cellular proliferation and arterial remodeling underlying the condition. We believe an agent with the ability to safely reverse pathological remodeling could provide utility across functional classes and risk categories.

Seralutinib Product Differentiation

Seralutinib is an inhaled kinase inhibitor designed to build on the evidence of efficacy seen in trials of imatinib while overcoming imatinib’s observed systemic safety and tolerability issues and improving on imatinib's kinase inhibitory profile. Seralutinib is designed to have a differentiated selectivity profile as compared to imatinib with increased potency against the PDGFRα isoform, ten-fold higher potency against the PDGFRβ isoform and c-KIT, and no activity against c-ABL or the tyrosine kinase, LCK. Additionally, seralutinib is multiple orders more potent against CSF1R, as compared to imatinib. We believe seralutinib has the potential to be a differentiated PAH therapeutic that may provide:

•an improved response to PDGF-driven abnormal cell proliferation in pulmonary arteries by addressing the underlying mechanism that leads to arterial wall thickening;

•a more tolerable safety profile than systemic imatinib; and

•a convenient, simple and portable inhalation methodology and delivery system.

Clinical Development History of Seralutinib

Summary of Preclinical Program

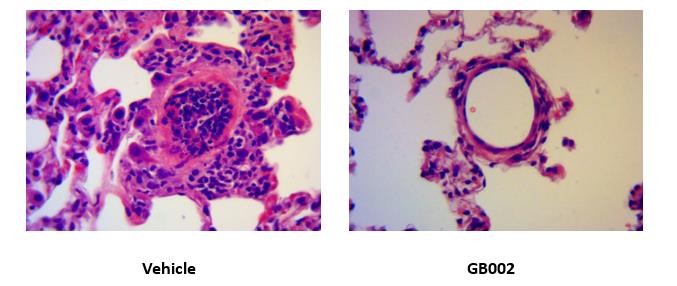

Seralutinib inhibits both PGDFR α and β, and it inhibited and reversed cell overgrowth in lung blood vessels in a rat model of PAH, as shown below in Figure 1. This rat model replicates many features of human PAH, including the abnormal cell proliferation that can block the small vessels of the lung. Seralutinib substantially reduced the occlusive lesions in the small lung blood vessels in this model. Additionally, seralutinib demonstrated a statistically significant reduction in right ventricular systolic pressure as compared to placebo.

Figure 1. Reversed Vascular Remodeling by Seralutinib Through Inhibition of PDGFR

In a separate rat model of PAH, the SU5416 hypoxia model, seralutinib demonstrated a statistically significant reduction in circulating plasma NT-proBNP compared to placebo, while the difference between imatinib and placebo was not significant for this PAH biomarker. Seralutinib also restored rat lung BMPR2 expression to healthy levels, which was a statistically significant improvement as compared to placebo and imatinib. Irregularities in BMPR2 expression have been linked to PAH.

9

Summary of Completed Phase 1a Studies

We completed Phase 1a SAD and MAD double-blind, placebo-controlled, randomized studies of orally inhaled seralutinib in 82 healthy adult volunteers. We assessed pharmacokinetics, or PK, parameters and safety. Seralutinib was well-tolerated, and there were no dose-limiting toxicities. No serious adverse events, or SAEs, were reported, and no reported adverse events, or AEs, led to study drug discontinuation. The most common AEs were throat irritation and cough, which were mild in severity and similar in incidence to placebo. Following single and multiple oral inhalations, seralutinib was rapidly absorbed into and cleared from the systemic circulation. Seralutinib exposure increased in a dose-proportional manner following single and multiple dose administration.

Summary of Completed Phase 1b PAH Clinical Trial

In December 2020, we announced initial topline results from the completed Phase 1b randomized, double-blind, placebo-controlled, multi-center trial of seralutinib in functional class II and III PAH patients. At the time of announcement, eight patients had completed the two-week blinded portion of the trial. Enrollment for this trial was temporarily paused due to the COVID-19 pandemic but was reopened in the third quarter of 2020. The primary outcome of this 2-week trial was safety and tolerability. Seralutinib was generally well tolerated in PAH patients, and all eight patients completed the 2-week study. There were no SAEs, and the most frequently reported AEs were mild-to-moderate cough and mild headache. Systemic PK was characterized by low systemic exposure and rapid drug clearance in PAH patients, which was consistent with PK data from the Phase 1a studies in healthy volunteers. Target engagement in PAH patients was demonstrated via whole blood CSF1R stabilization assay across all tested dose levels.

Upon completion of the two-week Phase 1b trial, two PAH patients were able to enroll and complete a six-month open label extension trial of seralutinib. Both patients were able to titrate up to the maximum allowed dose, 90 mg twice daily. No SAEs were reported during the extension trial. Both patients demonstrated a decrease in NT-proBNP levels from baseline, and both patients demonstrated an increase in 6-MWD from baseline.

Summary of Ongoing Phase 2 PAH Clinical Trial (TORREY Study)

In December 2020, we commenced the Phase 2 TORREY trial, a randomized, double-blind, placebo-controlled, multi-center clinical trial in PAH patients. We are enrolling approximately 80 functional class II and III PAH patients who are on background therapy, including patients on triple therapy. Patients will be randomized in a 1:1 fashion to seralutinib and placebo. Patients on the active arm will receive seralutinib at doses ranging from 45 mg twice daily to 90 mg twice daily. Patients will remain on their background PAH therapies throughout the trial. The primary endpoint of the TORREY trial is change from baseline in pulmonary vascular resistance at week 24, with a key secondary endpoint of change from baseline to week 24 in 6MWD, although the trial is not powered for statistical significance in 6MWD. We are also assessing relevant safety endpoints and exploratory endpoints, including changes in echocardiogram readings, functional class, and biomarkers, such as NT-proBNP. We have implemented COVID-19 mitigation plans related to this trial, including opening more sites, spread regionally across the globe, and incorporating countries less impacted by the pandemic. Upon completion of the 24-week TORREY trial, patients will have the option of entering a stand-alone open-label extension trial. Topline results from the TORREY trial are expected in the second half of 2022, subject to developments in the ongoing COVID-19 pandemic.

GB004 (HIF-1α Stabilizer)

GB004 is a novel, gut-targeted, oral small molecule being developed for the treatment of IBD including UC and CD. GB004 stabilizes HIF-1α through the inhibition of PHDs, key enzymes involved in HIF degradation. Preclinical data from animal models of IBD demonstrated that HIF-1α stabilization restores intestinal epithelial barrier integrity and function and results in immunomodulatory effects that we believe are important in reducing inflammation and enhancing mucosal healing in IBD patients. We have completed Phase 1 SAD and MAD studies in healthy volunteers and a Phase 1b trial in patients with active UC, and GB004 was generally well tolerated. In a 28-day Phase 1b clinical trial in patients with active UC, GB004 was well-tolerated, demonstrated a gut-targeted PK profile, showed evidence of target engagement, and initial signs of potential clinical efficacy were observed. We commenced the Phase 2 SHIFT-UC trial in patients with active mild-to-moderate UC in October 2020, and we announced that we had completed trial enrollment in the fourth quarter of 2021. Topline results for the week 12 primary endpoint for this trial are expected to be publicly reported in the second quarter of 2022, and topline results for the week 36 treat-through endpoint for this trial are expected to be publicly reported in the fourth quarter of 2022. We in-licensed GB004 from Aadi in 2018 and retain worldwide rights.

Mechanism of Action

10

Stable expression of HIF-1α results in translocation to the nucleus and induces expression of genes known to promote epithelial integrity and mucosal barrier function. When oxygen levels within the cell and tissue are normal, HIFs are rapidly degraded by PHD enzymes. However, when oxygen levels are low, as in hypoxia in inflamed intestinal epithelium, HIF-1α accumulates in the cytoplasm and translocates to the nucleus. HIF-1α binds to constitutively expressed HIF-1β in the nucleus and drives the expression of hypoxia-induced genes, which improve oxygen delivery, regulate the glycolytic pathway, reduce cellular apoptosis, and upregulate epithelial barrier integrity. The state of chronic tissue injury in patients with IBD leads to dysregulation of HIF stability, which can lead to epithelial apoptosis, disruption of the intestinal wall barrier and inflammation.

Through inhibition of PHDs, GB004 stabilizes HIF-1α in preclinical models and in studies of healthy volunteers and patients with active UC. This stabilization results in an increase in the activation of HIF-1α mediated protective pathways. In preclinical rodent models of colitis, GB004 demonstrated statistically significant restitution of the epithelial barrier and mucosal healing as compared to placebo, with similar improvements to dexamethasone, a corticosteroid used for the treatment of moderate-to-severe IBD. Gut biopsies from patients with active UC in our Phase 1b trial showed increased expression of genes associated with HIF-1α stabilization and enhanced epithelial barrier function, such as tight junction protein 1, or TJP1, and Claudin 1, or CLDN1, and evidence of reduced gut epithelial neutrophil activity in the GB004 group compared to placebo.

Modulation of HIF stability is being evaluated in other disease contexts, including in the treatment of anemia due to chronic kidney disease. The systemic PHD inhibitors being developed in this setting have on-target effects of increased erythropoietin, or EPO, and vascular endothelial growth factor, or VEGF. As this would be an undesirable effect in patients with IBD, we have designed GB004 to be gut-targeted, with multi-fold higher concentrations in the gut than in the periphery. In our Phase 1 healthy volunteer studies and in our Phase 1b trial in patients with active UC, no differences in plasma EPO or VEGF levels were observed for GB004 relative to placebo or with respect to GB004 dose.

In addition to promoting the expression of protective pathways, HIF-1α is also an important modulator of the innate and adaptive immune response. Stabilized HIF-1α increases antimicrobial peptides, factors that protect the host from infection. HIF-1α may also be critical for directly regulating immune cell function in the local inflammatory response, which may lead to the reduction of inflammation in IBD.

Overview of IBD

IBD includes UC and CD, which are characterized by chronic inflammation of the gastrointestinal, or GI, tract. Global epidemiology of IBD varies greatly from region to region. Although the incidence of IBD has remained stable or fallen in western countries over the last 2 decades, it is currently on a sharp rise in developing, newly industrialized areas. Due to the chronic nature of IBD, prevalence rates continue to grow slowly across Europe and North America, and IBD is estimated to affect up to 0.5% of the population in many countries.

Ulcerative Colitis

UC is characterized by chronic mucosal inflammation and loss of epithelial barrier function, and both contribute to disruption of local immune homeostasis in the colon. UC follows a relapsing / remitting disease course. The primary cause of UC is not precisely known but may include environmental, dietary and genetic factors, or it may be related to the gut microbiome.

Typically presenting as abdominal pain, bloody diarrhea and fecal urgency / incontinence, UC is associated with a notable psychosocial burden; the symptoms of UC negatively impact patients’ physical and mental well-being and their ability to work, socialize, and maintain relationships. This impact tends to increase with disease severity, with up to 20% of patients experiencing acute, severe UC requiring hospitalization. Notably, due to chronic inflammation associated with UC, the risk of colorectal cancer is 2.4 times higher in patients with UC as compared with the general population.

Crohn’s Disease

CD is a chronic, inflammatory condition that involves the full thickness of the wall of the GI tract and is characterized by erosions, strictures and perforations of the intestine. Symptoms include diarrhea, abdominal pain, blood in the stool, and weight loss. Maintaining symptomatic control and obtaining remission are critical to minimizing short-term and long-term complications and to improving the outcomes and quality of life for patients with CD. The natural course of CD is a progression from inflammation of the mucosa to stricture formation of the intestine and of mucosal penetration or fistula formation, with the risk of stricture and fistula increasing with the duration of CD.

11

Overview of the IBD Market

Approximately three million Americans report being diagnosed with either UC or CD. The current biologic market is dominated by the anti-TNF antibodies Humira, marketed by AbbVie Inc., and Remicade, marketed by Janssen Pharmaceuticals, Inc., or Janssen, and the growing share of the anti-integrin antibody Entyvio, marketed by Takeda Pharmaceuticals America, Inc.

Treatment Paradigm in IBD

Treatment of IBD consists mainly of immunosuppressive therapies. Treatment choices depend on the patient’s disease severity and responsiveness to therapy. Medications that treat mild-to-moderate IBD are generally well tolerated. However, as the severity of IBD increases, the potential toxicities of the medications required to manage the disease also increase. For example, treatment of mild-to-moderate patients typically starts with 5-aminosalicylic acid, or 5-ASA. For those IBD patients who do not respond to 5-ASAs, or those with more severe disease, corticosteroids are generally used to induce clinical remission. However, longer-term treatment with corticosteroids is associated with multiple adverse effects.

Patients with moderately to severely active IBD, who become nonresponsive or intolerant to corticosteroids, are treated with immunomodulators, biologics or a Janus kinase, or JAK, inhibitor. Immunomodulators show a delay in onset of action of one to three months and can result in neutropenia, pancreatitis, nephrotoxicity and hepatotoxicity. For those patients with mild-to-moderate disease who do not respond to 5-ASAs, these immunomodulatory therapies and associated toxicities and risks may not be appropriate. There exists substantial unmet need for additional mild-to-moderate treatment options. The treatment of moderate-to-severe patients is dominated by anti-TNF biologics, though the paradigm is shifting because of the approval of agents in other classes, such as anti-integrins, anti-IL-12 / -23s, S1P1 receptor modulators and JAK inhibitors.

GB004 Product Differentiation

GB004 is designed to be gut-targeted with higher intestinal exposure than systemic exposure. In IBD animal models, GB004 has demonstrated greater accumulation of HIF-1α than HIF-2α which may lead to restoration of epithelial barrier function and resolution of inflammation, while avoiding the potential adverse effects of increased EPO. In the Phase 1b trial in patients with active UC, GB004 showed rapid clearance from systemic circulation, suggesting gut-targeted PK, and multi-fold higher concentrations of drug in the gut as compared to the plasma after eight hours of dosing. Additionally, in this trial, GB004 continued to demonstrate no effects on systemic EPO or VEGF.

GB004 is distinct, and may have a differentiated profile, from the immunomodulatory or immunosuppressive mechanisms of approved IBD medicines and those in late-stage development. By reducing local inflammation and potentially restoring intestinal epithelial barrier function and restitution through GB004’s gut-targeted nature and preferential stabilization of HIF-1α, we believe GB004 could improve outcomes for IBD patients. We believe this mechanism has potential as a standalone therapeutic as well as a combination therapy with other therapeutic mechanisms in IBD.

Clinical Development History of GB004

Summary of Completed Phase 1 Clinical Studies in Healthy Volunteers

GB004 was evaluated by Aadi in a first-in-human Phase 1 SAD study in healthy male volunteers. The primary objective of the study was to evaluate the safety and tolerability of ascending dose levels of GB004 after single oral administrations. The secondary objective was to characterize PK. A total of 40 subjects were randomized into five cohorts with eight subjects each. All subjects completed the study. The five dose levels evaluated in this study were 20 mg, 60 mg, 120 mg, and 240 mg in 50 ml of solution and 240 mg in 100 ml of solution. GB004 was generally well tolerated. No SAEs occurred. There were no differences in systemic levels of VEGF and EPO between GB004 and placebo.

GB004 was also evaluated in a randomized, double-blind, placebo-controlled, MAD study to assess the safety, tolerability, PK and pharmacodynamic, or PD, effects in healthy male and female volunteers. A total of 42 subjects were randomized to GB004 or placebo. Evaluated dose levels of GB004 solution were 60 mg, 120 mg and 240 mg per day. All GB004 doses evaluated in this study were well tolerated. No SAEs occurred. The PK profile for GB004 was consistent with its intended preferential exposure in the gut. There were no differences in systemic levels of VEGF and EPO between GB004 and placebo. GB004 engaged the target and stabilized HIF-1α, as demonstrated by upregulated gene expression in the gut.

GB004 was also evaluated in a randomized, double-blind, placebo-controlled Phase 1a study to assess the safety, tolerability, PK and PD, effects of various doses and formulations in healthy male and female volunteers. Volunteers received daily doses of 120 mg solution or placebo, or up to 240 mg tablet, or up to 240 mg delayed-release tablet, or placebo for seven days. All formulations of GB004 were generally well tolerated, and in this study, the tolerability of 240 mg tablet was

12

comparable to the 120 mg solution dose. No SAEs occurred. There were no differences in systemic levels of VEGF and EPO between GB004 and placebo. In the Phase 2 SHIFT-UC trial, Gossamer is utilizing a tablet formulation of GB004.

Summary of Completed Phase 1b Clinical Trial in UC

The Phase 1b trial was designed to evaluate the safety, tolerability and PK of a 120 mg once-daily dose of GB004 in a solution formulation over a 28-day treatment period in UC patients with active disease despite treatment with 5-ASA therapy. In addition, PD and clinical activity were studied as exploratory measures. 34 patients were randomized 2:1 to receive either GB004 (n=23) or placebo (n=11). GB004 was generally well tolerated during the trial with no effects on systemic EPO or VEGF observed, relative to placebo. The most frequent AEs experienced by patients on the GB004 group were nausea and dysgeusia, all of which were mild in severity, aside from one case of moderate nausea. All patients completed the trial, except for a single patient in the GB004 group who experienced an SAE of worsening UC, which was deemed by the investigator to be unrelated to study drug.

GB004 demonstrated a gut-targeted PK profile with rapid clearance from systemic circulation and multi-fold higher concentrations of drug in the gut, as compared to the plasma after eight hours of dosing. Data from gut biopsies showed increased expression of genes associated with HIF-1α stabilization and enhanced epithelial barrier function, such as TJP1 and CLDN1, and evidence of reduced gut epithelial neutrophil activity in the GB004 group compared to placebo. While this four-week study was not powered to show differences in clinical outcomes, several encouraging trends related to treatment with GB004 were observed at day 28. Mucosal healing, defined as the achievement of both histologic remission and endoscopic improvement in the sigmoid or rectum, was observed in four of 23 patients (17.4%) in the GB004 group compared to zero of 11 patients in the placebo group. Ten of 23 patients (43.5%) in the GB004 group achieved histologic remission in either the sigmoid or rectum compared to two of 11 patients (18.2%) in the placebo group. Favorable trends were also observed in clinical response (6/20 [30.0%] vs. 2/11 [18.2%]) and improvement in the rectal bleeding sub-score (13/21 [61.9%] vs. 5/11 [45.5%]). Rectal bleeding resolution was seen in 12 of 21 (57.1%) patients receiving GB004 vs. four of 11 placebo patients (36.4%). One patient in the GB004 group achieved clinical remission; no patients in the placebo group achieved clinical remission.

Summary of Ongoing Phase 2 Clinical Trial in UC (SHIFT-UC Study)

In October 2020, we commenced the Phase 2 SHIFT-UC trial, a randomized, double-blind, placebo-controlled, multi-center clinical trial in UC patients with active mild-to-moderate UC disease, despite treatment with 5-ASA therapy. In the fourth quarter of 2021, we announced the completion of enrollment. Patients are randomized in a 1:1:1 ratio to one of two doses of GB004 in tablet form and placebo. Patients are required to remain on stable background 5-ASA therapy throughout the trial. The 12-week primary endpoint of the SHIFT-UC study is clinical remission, with secondary endpoints including clinical response, histological remission, endoscopic improvement and mucosal healing. The trial will also evaluate these endpoints at week 36. We are also assessing relevant safety endpoints and exploratory endpoints. Patients may also enter an open-label extension upon completion of the placebo-controlled period or by meeting disease activity criteria during the placebo-controlled period at or after week 12. The co-primary endpoint of the SHIFT-UC study is percentage of participants with a treatment emergent adverse event, from the first dose of the open-label extension through week 28 of the open-label extension. Topline results for the 12-week primary endpoint for the SHIFT-UC trial are expected in the second quarter of 2022. Topline results for the 36-week treat-through endpoint are expected in the fourth quarter of 2022.

GB5121 (CNS-Penetrant BTK Inhibitor)

GB5121 is an oral, irreversible, covalent, small molecule inhibitor of BTK, in clinical development for the treatment of PCNSL. GB5121 was selected based on its CNS penetration and kinase selectivity. BTK is expressed in several immune cells including B cells and myeloid cells, where it mediates signaling downstream of multiple receptors. Inhibition of BTK results in the immediate blockade and down-regulation of several cellular activities that drive autoimmunity and inflammation. Active BTK signaling is also present in many B cell malignancies. BTK inhibitors are approved in the United States to treat oncology indications. In preclinical mouse models, GB5121 has demonstrated superior CNS penetration at studied doses when compared to selected BTK inhibitors. We believe the CNS penetration observed in these preclinical studies supports the development of GB5121 as a potential therapy for the treatment of hematologic malignancies in the CNS, including PCNSL. GB5121 is currently being evaluated in a Phase 1 clinical study in healthy volunteers. We expect to initiate a global Phase 1b/2 clinical trial in PCNSL patients in the first half of 2022. GB5121 was internally developed and is wholly owned.

Mechanism of Action

BTK plays a critical and multifaceted role within the immune system. BTK is a non-receptor protein-tyrosine kinase that belongs to the TEC family of kinases. It is present in hematopoietic cells such as B cells, macrophages, neutrophils

13

and mast cells. BTK is a critical mediator of B cell receptor, or BCR, signaling and the adaptive immune response. Upon stimulation of BCR, the BTK pathway results in an increased level of intracellular calcium and activation of transcription factors involved in B cell proliferation, differentiation and survival. The pathway is also key for the proliferation, migration and survival of malignant B cells, and inhibition of this pathway has been effective in treating several hematological malignancies. BTK inhibitors are approved by the FDA for the treatment of multiple B cell lymphomas.

While BTK inhibitors provide a valuable treatment option for patients with hematologic malignancies, existing treatments may be suboptimal for the treatment of CNS disease. The blood brain barrier, or BBB, is comprised of endothelial cells that serve as a highly discriminatory boundary, separating the systemic circulation and the extracellular fluid of the CNS. The BBB effectively protects the brain from circulating pathogens, but it also restricts the ability of pharmaceutical agents from crossing from the systemic circulation into the CNS, including most BTK inhibitors. GB5121 demonstrated superior CNS penetration at studied doses in preclinical mouse models, when compared to other BTK inhibitors targeting oncological conditions.

Treatment with BTK inhibitors is associated with on-target and off-target AEs, such as rash, diarrhea, infection, bleeding, cytopenias and cardiovascular AEs, including atrial fibrillation. Molecules with modest selectivity may incur increased off-target AEs through unintended interaction with off-target kinases. Later generation BTK inhibitors have focused on minimizing off-target toxicities with increased selectivity, but limited CNS penetration makes these molecules potentially suboptimal for the treatment of CNS disease. In pre-clinical assays, GB5121 has been observed to be highly selective for BTK, and we believe that higher selectivity has the potential to limit the adverse events associated with modestly selective BTK inhibitors.

Overview of Primary CNS Lymphoma

PCNSL is a rare, aggressive form of non-Hodgkin lymphoma that originates from the brain, eyes and cerebrospinal fluid without evidence of systemic involvement. Standard lymphoma therapies are inadequate due to poor penetration of the BBB. First-line PCNSL treatment typically includes polychemotherapy on backbone high-dose methotrexate, followed by consolidative whole brain radiotherapy. Despite this treatment option, durable remission is achieved in only 50% of patients. Treatment is associated with significant neurotoxicity, and for those patients who cannot tolerate methotrexate or for those whose cancer progresses, there is no FDA approved treatment.

In human trials, ibrutinib, a non-selective BTK inhibitor with limited ability to cross the BBB, has demonstrated efficacy at high doses in recurrent or refractory PCSNL patients. We believe the high dose necessary to reach therapeutic levels in the CNS, as well as an affinity for other kinases, including EGFR, JAK3 and HER2, are likely responsible for some of the toxicities associated with ibrutinib therapy. We believe that the high specificity for BTK and high CNS penetration observed in preclinical models could potentially allow GB5121 to achieve the clinical efficacy seen with ibrutinib at lower systemic doses, which could improve tolerability. We selected GB5121 to move forward into human clinical trials based on the potency, specificity and high brain penetration observed in preclinical models.

Clinical Development History of GB5121

Summary of Ongoing Phase 1 Clinical Study

In the fourth quarter of 2021, we commenced a dose-escalating Phase 1 open-label study in healthy human volunteers to evaluate the safety, tolerability, PK and PD of GB5121 in humans. The study includes both SAD and MAD portions as well as clinical pharmacology assessments.

Summary of Planned Phase 1b/2 Clinical Trial in PCNSL

We plan to initiate the Phase 1b portion of a global Phase 1b/2 clinical trial in the first half of 2022. The Phase 1b portion of the trial will enroll patients with recurrent or refractory primary or secondary CNS lymphoma or with recurrent or refractory primary vitreoretinal lymphoma. The primary endpoints of the Phase 1b will include safety and tolerability, and the secondary endpoints will include overall response rate, or ORR, and duration of response. Phase 2 dose selection will be informed by the results from the Phase 1b. The Phase 2 portion of the of the trial will enroll recurrent or refractory PCNSL patients and is expected to initiate in the first half of 2023. The primary endpoint of the Phase 2 portion of the trial will be ORR, and secondary endpoints will include duration of response, overall survival, progression free survival, safety and tolerability.

14

GB7208 (CNS-Penetrant BTK Inhibitor)

GB7208 is an oral, small molecule, BTK inhibitor in preclinical development for the treatment of MS. Like GB5121, GB7208 was selected based on its CNS penetration and kinase selectivity. Immune cells are believed to play an important role in the pathology of MS, and BTK inhibitors are in late-stage clinical development for the treatment of autoimmune indications, such as MS. In preclinical mouse models, GB7208 has demonstrated superior CNS penetration at studied doses, when compared to selected BTK inhibitors in development for autoimmune indications, including MS. GB7208 is currently undergoing preclinical testing, and pending the outcomes of our ongoing preclinical work, we expect to initiate a Phase 1 study in healthy volunteers in the second half of 2022. GB7208 was internally developed and is wholly owned.

Our Research Capabilities and Preclinical Programs

Including GB7208, we have six programs in preclinical development. We are continuing to build our research capabilities, specifically focusing on our areas of expertise within immunology, inflammation and oncology, in order to advance new programs into the clinic, as well as to optimize our existing programs.

Competition

The biotechnology and pharmaceutical industries are characterized by rapid technological advancement, significant competition and an emphasis on intellectual property. We face potential competition from many different sources, including major and specialty pharmaceutical and biotechnology companies, academic research institutions, governmental agencies and public and private research institutions. Any product candidates that we successfully develop and commercialize will compete with current therapies and new therapies that may become available in the future. Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, have fewer or less severe side effects or more convenient than any products that we may develop. Our competitors also may obtain FDA or other regulatory approval for their products more rapidly than we do. We believe that the key competitive factors affecting the success of any of our product candidates will include efficacy, safety profile, convenience, cost, level of promotional activity devoted to them and intellectual property protection.

We expect to face competition from existing products and products in development for each of our product candidates. Seralutinib is a PDGFR, CSF1R and c-KIT inhibitor initially targeted for PAH patients. We expect competition in this patient set will include prostanoids, available in oral form as Orenitram (United Therapeutics Corporation, or United Therapeutics) and Uptravi (Janssen), by inhalation as Tyvaso (United Therapeutics), and by infusion as Remodulin (United Therapeutics). We also may face some competition from products used in class I and II patients, such as the oral PDE5 inhibitors, including Revatio (Pfizer Inc.) and Adcirca (United Therapeutics); the sGC stimulator Adempas (Bayer AG); and oral ERAs, including Tracleer (Janssen), Letairis (Gilead Sciences, Inc.) and Opsumit (Janssen). We believe that, if approved, seralutinib could be used alongside all three classes of approved therapies. PAH is also an active indication for investigational drugs, and we may face competition in the future from ralinepag (Arena Pharmaceuticals, Inc. and United Therapeutics), sotatercept (Merck & Co., Inc.), RVT-1201 (Altavant Sciences, Inc.), MK-5475 (Merck) and GMA310 (Gmax Biopharm LLC). Additionally, although not approved for the treatment of PAH, we may face competition from formulations of imatinib, including those from Tenax Therapeutics, Aerovate Therapeutics and Aerami Therapeutics / Vectura Group.

GB004 is a HIF-1α stabilizer with the potential to restore epithelial barrier function in patients with IBD. Patients with mild-to-moderate UC can initially be maintained in remission using a 5-ASA. For those patients who do not respond to 5-ASA, or those with more severe and / or extensive disease at diagnosis, corticosteroids are generally the next line of treatment. Patients who have become nonresponsive or intolerant to corticosteroids may move to azathioprine and 6-mercaptopurine. The treatment of moderate-to-severe patients is dominated by anti-TNF biologics, though the paradigm is shifting because of the approval of agents in other classes, such as anti-integrins, anti-IL-12 / -23s, S1P1 receptor modulators and JAK inhibitors.

GB5121 and GB7208 are BTK inhibitors for the treatment of oncological and immunological indications, including PCNSL and MS. There are no FDA or EMA approved therapies for refractory or recurrent PCNSL. If approved in MS, GB7208 may face competition from existing approved and investigational therapies. While no BTK inhibitors are FDA or EMA approved for the treatment of either PCNSL or MS, we believe that if approved, GB5121 and / or GB7208 may face competition from currently FDA and EMA approved BTK inhibitors Imbruvica (AbbVie Inc. / Janssen), Calquence (AstraZeneca plc) and / or Brukinsa (BeiGene, Ltd.). Our BTK inhibitors may also face competition from BTK inhibitor Velexbru (Ono Pharmaceutical Co., Ltd.), which is approved in Japan, South Korea and Taiwan for the treatment of recurrent or refractory primary central nervous system lymphoma. We may also face competition from early and late-stage investigational BTK inhibitors, including, but not limited to, evobrutinib, tolebrutinib, fenebrutinib, orelabrutinib, pirtobrutinib, rilzabrutinib and remibrutinib.

15

There may be other earlier stage clinical programs that, if approved, would compete with our product candidates. Many of our competitors have substantially greater financial, technical and human resources than we have. Additional mergers and acquisitions in the pharmaceutical industry may result in even more resources being concentrated in our competitors. Competition may increase further as a result of advances made in the commercial applicability of technologies and greater availability of capital for investment in these fields. Our success will be based in part on our ability to build and actively manage a portfolio of drugs that addresses unmet medical needs and creates value in patient therapy.

License Agreements

Pulmokine

In October 2017, we entered into a license agreement, or the Pulmokine Agreement, with Pulmokine, Inc., under which we were granted an exclusive worldwide license and sublicense to certain intellectual property rights owned or controlled by Pulmokine, including intellectual property rights co-owned by Pulmokine and Gilead Sciences, to develop and commercialize seralutinib and certain backup compounds for the treatment, prevention and diagnosis of any and all disease or conditions. We also have the right to sublicense our rights under the Pulmokine Agreement, subject to certain conditions. We are required to use commercially reasonable efforts to develop and commercialize at least one licensed product in the United States and in at least two countries in the European Union.

Under the terms of the Pulmokine Agreement, we made an upfront payment of $5.5 million and a milestone payment of $5.0 million to Pulmokine and are obligated to make future development and regulatory milestone payments of up to $58 million, commercial milestone payments of up to $45 million, and sales milestone payments of up to $190 million. We are also obligated to pay tiered royalties on sales for each licensed product, at percentages ranging from the mid-single digits to the high single-digits. In addition, if we choose to sublicense or assign to any third parties our rights under the Pulmokine Agreement with respect to a licensed product, or our seralutinib operating subsidiary undergoes a change of control, we must pay to Pulmokine a specified percentage of all revenue to be received in connection with such transaction.

Our royalty obligations and the Pulmokine Agreement will expire on a licensed product-by-licensed product and country-by-country basis on the later of ten years from the date of first commercial sale or when there is no longer a valid patent claim covering such licensed product or specified regulatory exclusivity for the licensed product in such country. The Pulmokine Agreement may be terminated in its entirety either by Pulmokine or by us in the event of an uncured material breach by the other party, in the event the other party is subject to specified bankruptcy, insolvency or similar circumstances, or in the event of a force majeure event under certain circumstances. The agreement may be terminated by Pulmokine if we commence a legal action challenging the validity or enforceability of any licensed patents. We may terminate the agreement, either in its entirety or on a product-by-product basis, in the event of potential safety or efficacy concerns affecting a licensed product.

The intellectual property rights co-owned by Pulmokine and Gilead Sciences are subject to a license agreement, or the Gilead Agreement, between Pulmokine and Gilead Sciences. Under the Gilead Agreement, Pulmokine is required to use commercially reasonable efforts to develop and commercialize at least one licensed product, which obligation can be satisfied through our development efforts required under the Pulmokine Agreement, and to pay Gilead Sciences future regulatory milestone payments and royalties. Upon termination of the Gilead Agreement for any reason, our sublicense under the Pulmokine Agreement will survive provided that we did not cause a material breach that was the basis for such termination and we agree to be bound by the terms of the Gilead Agreement.

The Pulmokine Agreement also includes a sublicense to patents concerning methods for detecting pulmonary arterial hypertension owned by The Rensselaer Center for Translational Research, Inc., or Rensselaer, and licensed to Pulmokine in an exclusive license agreement, or the Rensselaer License. Under the Rensselaer License, Pulmokine is required to use commercially reasonable efforts to develop and commercialize at least one licensed product covered by the Rensselaer patent rights, which obligation can be satisfied through our development efforts. If such obligation is not satisfied by Pulmokine or us, or the Rensselaer License is otherwise terminated for any reason, our sublicense under the Pulmokine Agreement will, at our option, either terminate or, subject to Rensselaer’s approval and our acceptance of the provisions of the Rensselaer License, convert to a license directly between us and Rensselaer.

Upon termination of the Pulmokine Agreement for any reason, all rights and licenses granted to us under the agreement will terminate and revert to Pulmokine, and in the event of certain termination events, we would grant Pulmokine worldwide rights to the terminated program.

16

Aadi Bioscience

In June 2018, we entered into a license agreement, or the Aadi Agreement, with Aerpio Pharmaceuticals, Inc., now known as Aadi, under which we were granted an exclusive worldwide license to certain intellectual property rights owned or controlled by Aadi to develop and commercialize GB004 and certain other related compounds for all applications. We also have the right to sublicense our rights under the Aadi Agreement, subject to certain conditions. We are required to use commercially reasonable efforts to develop and commercialize at least one licensed product in the United States, in at least two countries in the European Union, and in Japan, in each case for at least one of the initial indications of UC or CD. The Aadi Agreement also includes a sublicense to a patent concerning methods for treating inflammatory bowel disease owned by The Regents of the University of Colorado, or UC Regents, and licensed to Aadi in a nonexclusive license agreement, or the UC Regents License. If Aadi breaches the UC Regents License and the UC Regents terminate the license, our sublicense under the Aadi Agreement will also terminate.

Under the terms of the Aadi Agreement, we made an upfront payment of $20 million to Aadi in June 2018, which represented the purchase consideration for an asset acquisition. On May 11, 2020, we entered into an amendment to the license agreement with Aadi pursuant to which we made an upfront payment of $15.0 million to Aadi for a reduction in future milestone payments and royalties. Under the amended license agreement, we are obligated to make future approval milestone payments of up to $40.0 million and a sales milestone payment of $50.0 million. We are also obligated to pay tiered royalties on sales for each licensed product, at percentages ranging from a low- to mid-single-digits, subject to certain customary reductions. In addition, if we choose to sublicense or assign to any third parties our rights under the Aadi Agreement with respect to any licensed product or if our GB004 operating subsidiary undergoes a change of control and the value of such transaction exceeds a specified value, we have an option to pay a specified percentage of all revenue to be received in connection with such transaction, and if we exercise the option Aadi will no longer be paid the development, regulatory, commercial or sales milestones or royalties on the sales of licensed products under the agreement. If we do not exercise our buy-down option with respect to a sublicense or assignment of our rights under the Aadi Agreement or with respect to a change of control of our GB004 operating subsidiary, Aadi will have an option to receive a specified percentage of all revenue received in connection with such transaction, and if Aadi exercises the option Aadi will no longer be paid the development, regulatory, commercial or sales milestones or royalties on sales of licensed products under the agreement.

Our royalty obligations and the Aadi Agreement will expire on a licensed product-by-licensed product and country-by-country basis on the later of fifteen years from the date of first commercial sale or when there is no longer a valid patent claim covering such licensed product in such country. The agreement may be terminated either by Aadi or by us in the event of an uncured material breach by the other party or in the event the other party becomes subject to specified bankruptcy, insolvency or similar circumstances. In the event we commence a legal action challenging the validity or enforceability of any licensed patents, Aadi will have the right to terminate the agreement or elect to increase milestone and royalty payments by a specified percentage. We may terminate the agreement in the event of potential safety or efficacy concerns affecting a licensed product. Upon termination of the agreement for any reason all rights and licenses granted to us under the agreement will terminate, and in the event of certain termination events, we would grant Aadi worldwide rights to the terminated program.

Manufacturing

We currently rely on multiple third-party manufacturers for the manufacture of our product candidates for preclinical and clinical testing. We intend to rely on third-party contract manufacturers for commercial manufacturing if our product candidates receive marketing approval. Typically, there are multiple sources for all of the materials required for the manufacture of our product candidates. Our manufacturing strategy enables us to more efficiently direct financial resources to the research, development and commercialization of product candidates rather than diverting resources to internally develop manufacturing facilities. As our product candidates advance through development, we expect to enter into longer-term commercial supply agreements with key suppliers and manufacturers to fulfill and secure our production needs.

Intellectual Property