As filed with the U.S. Securities and Exchange Commission on August 24, 2023.

Registration No. 333-239951

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

Taman

Desa,

(Address of principal executive offices, including zip code)

Registrant’s phone number, including area code

+

How Kok Choong

Chief Executive Officer

1645 Village Center Circle, Suite 17

Las Vegas, Nevada

United States, 89134

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Lawrence S. Venick, Esq. Loeb & Loeb LLP 2206-19 Jardine House 1 Connaught Place Central, Hong Kong SAR Tel: +852.3923.1111 |

Louis Taubman, Esq. Guillaume de Sampigny, Esq. Hunter Taubman Fischer & Li LLC 950 Third Avenue, 19th Floor

New York, NY 10022 Tel: 212-530-2210 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | |

| (Do not check if a smaller reporting company) | Smaller

Reporting Company

|

|

Emerging

Growth Company

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the public offering of 1,100,000 shares of common stock of the Registrant (the “Public Offering Prospectus”) through the underwriter named on the cover page of the Public Offering Prospectus. |

| ● | Resale Prospectus. A prospectus to be used for the resale by the selling stockholders set forth therein of 30,169,516 shares of common stock of the Registrant (the “Resale Prospectus”). |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different outside and inside front covers and back covers; |

| ● | they contain different Offering sections in the Prospectus Summary section beginning on page 3; |

| ● | they contain different Use of Proceeds sections on page 22; |

| ● | a Selling Stockholder section is included in the Resale Prospectus; |

| ● | a Selling Stockholder Plan of Distribution is inserted; and |

| ● | the Legal Matters section in the Resale Prospectus on page 101 deletes the reference to counsel for the underwriter. |

The Registrant has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the selling stockholders.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED AUGUST 24, 2023 |

AGAPE ATP CORPORATION

1,100,000 of Shares of Common Stock

This is a firm commitment initial public offering of 1,100,000 of our shares of common stock, $0.0001 par value per share. We anticipate that the initial public offering price of our shares will be between US$5.50 and US$6.50 per share. The Underwriter is obligated to take and pay for all of the shares if any such shares are taken. We have granted the Underwriter a 15% over-allotment option, exercisable one or more times in whole or in part, to purchase up to 165,000 additional common stock from us at the public offering price, less the underwriting discounts, for 45 days from the closing of this offering to cover over-allotments, if any. If the Underwriter exercises the option in full, the total underwriting discounts payable will be $657,800, and the total proceeds to us, before expenses, will be $7,564,700.

Our common stock currently is quoted on the OTC Markets – Pink Sheets, operated by OTC Markets Group, under the symbol “AATP.” The last reported sale price of our common stock on the OTC Markets – Pink Sheets on May 11, 2023 was $6.00 per share.

We have applied to list our common stock on the NASDAQ Capital Market (“NASDAQ”) under the symbol “ATPC”. There can be no assurance that our application will be approved. The closing of this offering is contingent upon the successful listing of our common stock on the Nasdaq Capital Market.

Investing in our common stock is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page 8 of this prospectus for a discussion of information that should be considered before making a decision to purchase our common stock.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Price to Public | Underwriting Discount(1) | Proceeds to us (before expenses) | ||||||||||

| Per Share of Common Stock | $ | 6.50 | $ | 0.52 | $ | 5.98 | ||||||

| Total(2) | $ | 7,150,000 | $ | 657,800 | $ | 7,564,700 | ||||||

| (1) | See “Underwriting” for additional disclosure regarding underwriting compensation payable by us. |

| (2) | Assuming over-allotment option granted to the Underwriter is exercised in full. We have granted the Underwriter a 15% over-allotment option, exercisable one or more times in whole or in part, to purchase up to 165,000 additional common stock from us at the public offering price, less the underwriting discounts, for 45 days from the closing of this offering to cover over-allotments, if any. See “Underwriting” for more information. |

Delivery of the shares of common stock is expected to be made on or about , 2023.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or contained in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not, and the Underwriter has not, authorized anyone to provide you with information that is different from that contained in such prospectuses. We are offering to sell shares of our common stock, and seeking offers to buy shares of our common stock, only in jurisdictions where such offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data.

For investors outside of the United States: neither we nor the Underwriter have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

| 2 |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision.

Overview

Agape ATP Corporation provides health solution advisory services to its clients. We primarily focus our efforts on attracting customers in Malaysia. We have an advisory services center called the “ATP Zeta Health Program”, which is a health program designed to effectively prevent diseases caused by polluted environments, unhealthy dietary intake and unhealthy lifestyles, and the promotion of health. The program aims to promote improved health and longevity through a combination of modern health supplements, proper nutrition and advice from skilled nutritionists and/or dieticians. For the six months ended June 30, 2023 and 2022, our revenue was approximately $0.7 million and $0.8 million, respectively, and our gross profit was approximately $0.4 million and $0.6 million, respectively. For the years ended December 31, 2022 and 2021, our revenue was approximately $1.9 million and $1.0 million, respectively, and our gross profit was approximately $1.2 million and $0.7 million, respectively.

In order to strengthen the Company’s supply chain, on May 8, 2020, the Company acquired approximately 99.99% of Agape Superior Living Sdn Bhd, a Malaysia company (“ASL”), with the goal of securing an established network marketing sales channel that has been established in Malaysia for the past 18 years. ASL has been offering the Company’s ATP Zeta Health Program as part of its product lineup. As such, the acquisition creates synergy in the Company’s operation by boosting the Company’s retail and marketing capabilities. The acquired subsidiary allows the Company to fulfill its mission of “helping people to create health and wealth” by providing a financially rewarding business opportunity to distributors and quality products to distributors and customers who seek a healthy lifestyle.

The Company deems creating public awareness on wellness and wellbeing lifestyle as essential to enhance the provision of its health solution advisory services; and therefore, on September 11, 2020, incorporated Wellness ATP International Holdings Sdn, Bhd. (“WATP”). Upon its establishment, WATP started collaborating with ASL to carry out various wellness programs.

On November 11, 2021, Agape ATP Corporation (Labuan) formed a joint-venture entity, DSY Wellness International Sdn. Bhd. (“DSY Wellness”) with Mr. Steve Yap following which Agape ATP Corporation (Labuan) owns 60% of the equity interest of DSY Wellness, to pursue the business of providing complementary health therapies. The establishment of DSY Wellness is a further expansion of our business into the health and wellness industry. Mr. Steve Yap owns 33 proprietary formulas (the “Proprietary Formulas”) for treating non-communicable disease and the Company is currently in discussion with Mr. Steve Yap to bring the Proprietary Formulas into the company for joint commercialization. Mr. Steve Yap also has existing clients receiving traditional complimentary medicine or “TCM” in Indonesia and China.

Our Products

We offer three series of programs which consist of different services and products: ATP Zeta Health Program, ÉNERGÉTIQUE and BEAUNIQUE.

Our ATP Zeta Health Program is a health program designed to promote health and general wellbeing designed to prevent health diseases caused by polluted environments, unhealthy dietary intake and unhealthy lifestyles. The program aims to promote improved health and longevity through a combination of modern health supplements, proper nutrition and advice from skilled dieticians as well as trained members and distributors.

Our ÉNERGÉTIQUE series aims to provide a total dermal solution for a healthy skin beginning from the cellular level. The series is comprised of the Energy Mask series, Hyaluronic Acid Serum and Mousse Facial Cleanser.

Our BEAUNIQUE product series focuses on the research of our diet’s impact on modifying gene expressions in order to address genetic variations and deliver a nutrigenomic solution for every individual.

The newly established subsidiary DSY Wellness is a further expansion of our business into the health and wellness industry and aims to pursue the business of providing traditional and complementary health therapies.

Our Strategies

We intend to pursue the following strategies in order to further develop and expand our business:

| ● | Expand our product range in each of our ATP Zeta Health Program, ÉNERGÉTIQUE and BEAUNIQUE series; | |

| ● | Further penetrate existing markets; | |

| ● | Deepen our relationship with existing distributors and members; |

| 3 |

| ● | Further investment into information technology such as the establishment of an e-commerce platform; | |

| ● | Expand into other geographies outside of Malaysia; and | |

| ● | Pursue growth through acquisitions of other health and wellness service provides. |

Our Competitive Strengths

We believe the following competitive strengths contribute to our success and differentiate us from our competitors:

| ● | Well established reputation; | |

| ● | Well-established product portfolio; | |

| ● | Large, highly-motivated distributor base, supported by a successful training methodology; | |

| ● | Scalable business model; and | |

| ● | Founder-led and deeply experienced management team. |

Our Challenges

Our ability to realize our mission and execute our strategies is subject to risks and uncertainties, including those relating to our ability to:

| ● | Respond to a highly competitive market; | |

| ● | Respond to concentration risk of heavy reliance on our largest supplier for the supply of products; | |

| ● | Maintain quality product and value; | |

| ● | Create brand influence; | |

| ● | Expand our product offerings; and | |

| ● | Expand our business in Malaysia and globally. |

Please see “Risk Factors” and other information included in this prospectus for a discussion of these and other risks and uncertainties that we face.

Risk Factors

An investment in our common stock involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described in “Risk Factors” beginning on page 8, together with all of the other information contained in this prospectus, including our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus, before investing in our common stock. These risks could materially affect our business, financial condition and results of operations and cause the trading price of our common stock to decline. You could lose part or all of your investment. You should bear in mind, in reviewing this prospectus, that past experience is no indication of future performance. You should read “Special Note Regarding Forward-Looking Statements” for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus.

Corporate Information

Our principal executive offices are located at 1705 – 1708, Level 17, Tower 2, Faber Towers, Jalan Desa Bahagia, Taman Desa, Kuala Lumpur, Malaysia (Post Code: 58100). Our telephone number at this address is +(60) 327325716. Our registered office in Nevada is located at 1645 Village Center Circle, Suite 170, Las Vegas, Nevada, United States, 89134.

Our website is http://agapeatpgroup.com/. The information contained on our website or any third-party websites is not a part of this prospectus.

| 4 |

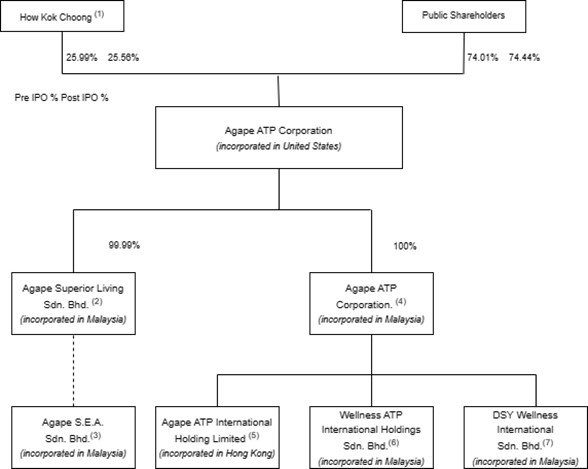

Corporate Structure

The following diagram illustrates our corporate structure as of the date of this prospectus and upon closing of this offering:

*As of the date of this prospectus.

** Upon closing of this offering and assuming no exercise of the Underwriter’s Warrants and full exercise of the over-allotment option.

Note:

| 1. | Represent 19,597,500 shares of common stock held by How Kok Choong as of the date of this prospectus and immediately after this offering, representing 25.99% and 25.56% of the common stock outstanding, respectively. |

| 2. | Agape Superior Living Sdn. Bhd. was incorporated in Kuala Lumpur, Malaysia on August 8, 2003. The remaining 0.01% was collectively held by Lim Ah Yew@Lim Soo Yew, Lor Keat Yoon and Teng Woei Wei (wife of How Kok Choong). |

| 3. | Agape S.E.A. Sdn. Bhd. was incorporated in Kuala Lumpur, Malaysia on March 4, 2004. 100% of the company’s business is transacted with Agape Superior Living Sdn. Bhd.. The company is considered a VIE of Agape Superior Living Sdn. Bhd. as the latter is the primary beneficiary since it has the following characteristics: |

| a. | The power to direct the activities of the VIE that most significantly impact the VIE’s economic performance; and | |

| b. | The obligation to absorb losses of the VIE that could potentially be significant to the VIE or the right to receive benefits from the VIE that could potentially be significant to the VIE. |

However, Agape S.E.A.’s impact to our consolidated financial statements constitutes less than 1% of our total consolidated assets and Agape S.E.A. did not contribute any revenues for us as of December 31, 2020.

| 4. | Agape ATP Corporation was incorporated in Labuan, Malaysia on March 6, 2017. |

| 5. | Agape ATP International Holding Limited was incorporated in Hong Kong on June 1, 2017. |

| 6. | Wellness ATP International Holdings Sdn. Bhd. was incorporated in Kuala Lumpur, Malaysia on September 11, 2020. |

| 7. | DSY Wellness International Sdn. Bhd. was incorporated in Kuala Lumpur, Malaysia on November 11, 2021, as a joint-venture entity between Agape ATP Corporation (Labuan) and Mr. Steve Yap. |

Conventions That Apply to This Prospectus

Unless otherwise indicated or the context otherwise requires, references in this prospectus to:

| ● | “dollar,” “USD,” “US$,” or “$” are to U.S. dollars; | |

| ● | “RM” and “Ringgit” are to the legal currency of Malaysia; and | |

| ● | “we,” “us,” “Company,” “Agape”, “Agape ATP” and “our” are to Agape ATP Corporation, the Nevada holding company, and its subsidiaries, and its consolidated affiliated entities. | |

| ● | “ASL” are to Agape Superior Living Sdn Bhd, a Malaysia company and a 99.99% owned subsidiary of Agape ATP; |

| 5 |

The Offering

| Offering Price | We currently estimate that the initial public offering price will be between US$5.50 and US$6.50 per share | |

| Common stock offered by us | 1,100,000 of shares of common stock (or 1,265,000 shares of common stock if the Underwriter exercises its over-allotment option in full) on a firm commitment basis. | |

| Common stock outstanding prior to this offering |

75,452,012 shares of common stock.

| |

| Common stock outstanding immediately after this offering |

76,552,012 shares of common stock, assuming the sale of all the shares offered in this prospectus, 76,717,012 shares of common stock if the underwriter exercise the over-allotment in full.

| |

| Gross proceeds to us, net of underwriting discount but before expenses: |

$7,564,700 assuming no exercise of the underwriter warrant and full exercise of the over-allotment option.

| |

| Over-allotment option: | We have granted to the Underwriter a 15% over-allotment option, exercisable within 45 days from the closing of this offering, to purchase up to an aggregate of 165,000 additional shares of common stock. | |

| Underwriter Warrant | We have agreed to grant to the Underwriter a warrant covering a number shares of common stock equal to 7% of the shares of common stock sold by the Underwriter in this public offering (the “Underwriter Warrant”). The Underwriter Warrant will be exercisable upon issuance and will expire on the fifth year anniversary of the date of the commencement of sales of this offering. The Underwriter Warrant and the underlying securities may not be sold, transferred, assigned, pledged, or hypothecated, or the subject of any hedging, short sale, derivative, put, or call transaction that would result in the effective economic disposition of the securities by any person for a period of 180 days beginning on the date of commencement of sales of this offering (in accordance with FINRA Rule 5110), except that they may be assigned, in whole or in part, to any officer or partner of the Underwriter, and to members of the syndicate or selling group and their respective officers or partners. The Underwriter Warrant will be exercisable at a price equal to 110% of the initial public offering price per share set forth on the cover price of this prospectus. | |

| Use of proceeds |

We plan to use the net proceeds of this offering primarily for general corporate purposes. For more information on the use of proceeds, see “Use of Proceeds” on page 22. | |

| Lock-up | We and each of, our officers, directors, and 10% or more stockholders, have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or otherwise dispose of any shares of common stock or similar securities for a period of 180 days after the date of this prospectus. See “Shares Eligible for Future Sale” and “Underwriting” for more information. | |

| Trading Market |

Our common stock currently is quoted on the OTC Markets – Pink Sheets under the symbol “AATP.” We have applied to list our common stock on the Nasdaq Capital Market under the new symbol “ATPC”. At this time, Nasdaq has not yet approved our application to list our common stock. The closing of this offering is conditioned upon Nasdaq’s final approval of our listing application, and there is no guarantee or assurance that our common stock will be approved for listing on Nasdaq.

| |

| Concentration of Ownership |

Prior to this offering, our executive officers and directors beneficially own, in the aggregate, approximately 25.99% of the outstanding shares of our common stock, which will become approximately 25.56% upon completion of this offering assuming the sale of all the shares offered in this prospectus, no exercise of the Underwriter’s Warrants and full exercise of the over-allotment option.

| |

|

Trading Symbol

|

“AATP” | |

| Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| 6 |

Summary Consolidated Financial Data

AGAPE ATP CORPORATION

The following tables summarize our historical consolidated financial data. We have derived the historical consolidated statements of operations data for the three and six months ended June 30, 2023 and 2022 from our unaudited condensed consolidated financial statements, and for the years ended December 31, 2022 and 2021 from our audited consolidated financial statements included elsewhere in this prospectus. The following summary consolidated financial data should be read in conjunction with the respective section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our condensed consolidated financial statements and related notes, and consolidated financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future, and our results for any interim period are not necessarily indicative of the results to be expected for a full fiscal year.

Consolidated Statements of Operations Data for the:

| Three Months Ended June 30, | ||||||||

| 2023 | 2022 | |||||||

| Revenue | $ | 303,935 | $ | 396,707 | ||||

| Net loss | $ | (379,449 | ) | $ | (404,344 | ) | ||

| Net loss per share – (basic and diluted) | $ | (0.00 | ) | $ | (0.01 | ) | ||

| Six Months Ended June 30, | ||||||||

| 2023 | 2022 | |||||||

| Revenue | $ | 684,703 | $ | 805,667 | ||||

| Net loss | $ | (813,524 | ) | $ | (702,790 | ) | ||

| Net loss per share – (basic and diluted) | $ | (0.01 | ) | $ | (0.01 | ) | ||

| Years Ended December 31, | ||||||||

| 2022 | 2021 | |||||||

| Revenue | $ | 1,856,564 | $ | 1,016,962 | ||||

| Net loss | $ | (1,666,079 | ) | $ | (2,524,680 | ) | ||

| Net loss per share – (basic and diluted) | $ | (0.02 | ) | $ | (0.01 | ) | ||

Consolidated Balance Sheet Data as of:

| As of | ||||||||||||

June 30, 2023 | December 31, 2022 | December 31, 2021 | ||||||||||

| Total assets | $ | 1,905,283 | $ | 2,791,749 | $ | 4,724,535 | ||||||

| Total liabilities | $ | 1,154,629 | $ | 1,229,295 | $ | 1,411,899 | ||||||

| 7 |

RISK FACTORS

Any investment in our securities involves a high degree of risk. You should carefully consider the risks described below, which we believe represent certain of the material risks to our business, together with the information contained elsewhere in this prospectus, before you make a decision to invest in our shares of common stock. Please note that the risks highlighted here are not the only ones that we may face. For example, additional risks presently unknown to us or that we currently consider immaterial or unlikely to occur could also impair our operations. If any of the following events occur or any additional risks presently unknown to us actually occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline and you could lose all or part of your investment.

Risks Related to Our Business and Industry

Our business and reputation may be affected by product liability claims, litigation, customer complaints, product tampering, food safety issues, food-borne illnesses, health threats, quality control concerns or adverse publicity relating to our products. Product liability insurance of our supplier may not cover our liability sufficiently or at all.

Like other consumer product manufacturers, the sale of our products involves an inherent risk of our products being found to be unfit for consumption or cause illness. Products may be rendered unfit for consumption due to raw materials or product contamination or degeneration, presence of microbials, illegal tampering of products by unauthorized third parties or other problems arising during the various stages of the procurement, production, transportation and storage processes. The occurrence of such problems may result in customer complaints, fines, penalties or adverse publicity causing serious damage to our reputation and brand, as well as product liability claims, other legal disputes and loss of revenues. Under certain circumstances, we may be required to recall our products. Even if a situation does not necessitate a product recall, we cannot assure you that product liability claims or other legal disputes will not be asserted against us as a result. Product liability insurance of our supplier may not cover our liability sufficiently or at all and will not cover liability that arises out of our default such as mishandling, poor storage condition and/or contamination of the products by us. As a result, a product liability or other judgment against us, or a product recall, could have a material adverse effect on our business, financial condition or results of operations.

Our business is susceptible to food-borne illnesses. We cannot assure you that we are able to effectively prevent all diseases or illnesses caused by our products or contamination of our products. Furthermore, our reliance on third-party product suppliers means that food-borne illness incidents could be caused by our suppliers outside of our control. New illnesses may develop in the future, or diseases with long incubation periods could arise that could give rise to claims or allegations on a retroactive basis. Reports in the media of instances of food-borne illnesses or health threats of our products or any of their major ingredients could adversely and significantly affect our sales, and have significant negative impact on our results of operations. This risk exists even if it were later determined that the illness or health threat in fact was not caused by our products.

In addition, adverse publicity about health and safety concerns, whether unfounded or not, may discourage consumers from buying our products. Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertion that our products caused personal injury or illness could adversely affect our reputation and our corporate and brand image. If consumers were to lose confidence in our brand and reputation, we could suffer long-term or even permanent declines in our sales and results of operation. The amount of negative news, customers complaints and claims against us may also be very costly and may divert our management’s attention from our business operation.

We operate in a highly competitive market. If we do not compete effectively, our prospects, operating results, and financial condition could be materially and adversely affected.

The health and wellness market in Malaysia is a mature and a highly competitive market, with companies offering a variety of competitive products and services. We expect competition in our market to intensify in the future as new and existing competitors introduce new or enhanced products and services that are potentially more competitive than our products and services. The health and wellness market has a multitude of participants in the domestic market, including, but not limited, to retail health supplement providers, pharmaceutical companies, and network marketing company which supply health supplement products, such as Elken Group, USANA Group, NHF Group, Young Living, Jeunesse Global Holdings LLC, USA, Shaklee Corporation, VASAYO LLC, Amway Corporation, Sami Direct, Kyäni, Inc., Melaleuca, Inc.

We believe many of our competitors and potential competitors may have significant competitive advantages, including but not limited to, longer operating histories, ability to leverage their sales efforts and marketing expenditures across a broader portfolio of products and services, larger and broader customer bases, more established relationships with a larger number of suppliers, greater brand recognition, ability to leverage stores which they may operate, and greater financial, research and development, marketing, distribution, and other capabilities and resources than we do. Our competitors and potential competitors may also be able to develop products and services that are equal or more superior to ours, achieve greater market acceptance of their products and services, and increase sales by utilizing different distribution channels than we do. Some of our competitors may aggressively discount their products in order to gain market share, which could result in pricing pressures, reduced profit margins, lost market share, or a failure to grow market share for us. If we are not able to compete effectively against our current or potential competitors, our prospects, operating results, and financial condition could be materially and adversely affected.

We are exposed to concentration risk of heavy reliance on our three largest suppliers for the supply of our products, and any shortage of, or delay in, the supply may significantly impact on our business and results of operation.

For the six months ended June 30, 2023, we purchased $116,269, $65,338 and $33,507 from three of our major suppliers, one of them being a related party, which represented approximately 47.2%, 26.5% and 13.6%, respectively, of our total purchases for such period. For the year ended December 31, 2022, we purchased $198,376, $82,434 and $79,365 from three of our major suppliers, one of them being a related party, which represented approximately 53.3%, 22.1% and 21.3%, respectively, of our total purchases for such period. For the year ended December 31, 2021, we purchased $28,969 and $27,707 from two of our major suppliers, represented approximately 47.3% and 45.2%, respectively, of our total purchases. Our business, financial condition and operating results depend on the continuous supply of products from our major suppliers and our continuous supplier-customer relationships with them. Our heavy reliance on our major suppliers for the supply of our products will have a significant impact on our business and results of operation in the event of any shortage of, or delay in the supply.

We currently do not have long term supply agreements with our three largest suppliers for the six months ended June 30, 2023, and we typically make ad hoc purchases through submission of purchase order forms. There is no assurance that our major suppliers will continue to supply their products in the quantities and timeframes required by us to meet the needs of our customers or comply with their supply agreements with us. Our product supply may also be disrupted by potential labor disputes, strike action, natural disasters or other accidents, epidemic and pandemic affecting the supplier. If our major suppliers do not supply products to us in a timely manner or in sufficient quantities, our business, financial condition and operating results may be materially and adversely affected.

| 8 |

Furthermore, in the event of any delay in delivery of the products to us, our cash flow or working capital may be materially and adversely affected as a result of the corresponding delay in delivery of our products to our customers, and hence the delay in our receipt of payment from our customers.

Our major suppliers may change their existing sales or marketing strategy in respect of the products supplied to us by changing their export strategy, reducing its sales or production volume or changing its selling prices. Consequently, there are no assurances that our major suppliers will not appoint other dealers or distributors which may compete with us in the market where we operate. Furthermore, any significant increase in the selling prices of the products which we source from our suppliers will increase our costs and may adversely affect our profit margin if we are not able to pass the increased costs on to our customers.

There are no assurances that there will be no deterioration in our relationships with our major suppliers which could affect our ability to secure sufficient supply of products for our business. In the event that our major suppliers change their sales or marketing strategy or otherwise appoint other dealers or distributors who may compete with us, our business, financial condition and operating results may be materially and adversely affected.

We could be adversely affected by a change in consumer preferences, perception and spending habits and failure to develop or enrich our product offering or gain market acceptance of our new products could have a negative effect on our business.

The market we operate is subject to changes in consumer preference, perception and spending habits. Our performance depends significantly on factors which may affect the level and pattern of consumer spending in the market we operate. Such factors include consumer preference, consumer confidence, consumer income and consumer perception of the safety and quality of our products. Media coverage regarding the safety or quality of, or diet or health issues relating to, our products or the raw materials, ingredients or processes involved in their manufacturing, may damage consumer confidence in our products. A general decline in the consumption of our products could occur as a result of change in consumer preference, perception and spending habits at any time.

Any failure to adapt our product offering to respond to such changes may result in a decrease in our sales if such changes are related to certain of our products. Any changes in consumer preference could result in lower sales of our products, put pressure on pricing or lead to increased levels of selling and promotional expenses. In any event a decrease in customer demand on our products may also result in lower sales and slow down the consumption of our inventory to a low inventory turnover level. Any of these changes could result in a material adverse effect on our business, financial conditions or results of operations.

The success of our products depends on a number of factors including our ability to accurately anticipate changes in market demand and consumer preferences, our ability to differentiate the quality of our products from those of our competitors, and the effectiveness of our marketing and advertising campaigns for our products. We may not be successful in identifying trends in consumer preferences and developing products that respond to such trends in a timely manner. We also may not be able to effectively promote our products by our marketing and advertising campaigns and gain market acceptance. If our products fail to gain market acceptance, are restricted by regulatory requirements, or have quality problems, we may not be able to fully recover our costs and expenses incurred in our operation, and our business prospects, financial condition or results of operations may be materially and adversely affected.

If we fail to maintain quality products and value, our sales are likely to be negatively affected.

Our success depends on the safety and quality of products that we obtain from our suppliers for our customers. Our future customers will identify our brand name with a certain level of quality and value. If we cannot meet this perceived value or level of quality, we may be negatively affected and our operating results may suffer. In addition, any failure on the part of our suppliers to maintain the quality of their products, will in turn substantially harm the results of our business operations, potentially forcing us to identify other suppliers or alter our business strategy significantly.

If we are unable to create brand influence, we may not be able to maintain current or attract new users and customers for our products.

Our operational and financial performance is highly dependent on the strength of our brand. We believe brand familiarity and preference will continue to have a significant role in winning customers as the decision to buy our products and services. In order to further expand our customer base, we may need to substantially increase our marketing expenditures to enhance brand awareness through various online and offline means. Moreover, negative coverage in the media of our company could threaten the perception of our brand, and we cannot assure you that we will be able to defuse negative press coverage about our company to the satisfaction of our investors, customers and suppliers. If we are unable to defuse negative press coverage about our company, our brand may suffer in the marketplace, our operational and financial performance may be negatively impacted and the price of our shares may decline.

Currently, we sell our products, with or without customization, under our brand name “ATP”, to domestic customers in Malaysia and to overseas customers. However, if our competitors initiate a lawsuit against us for infringing their trademark, we may be forced to adopt a new brand name for our products. As a result, we may incur additional marketing cost to raise awareness of such new brand name. We may also be ordered to pay a significant amount of damages, and our business, results of operations and financial condition could be materially and adversely affected.

| 9 |

We may be unable to protect our intellectual property rights.

We rely on intellectual property laws in Malaysia and other jurisdictions to protect our trademarks. We are the registered owner of two trademarks. We have recently applied to register an additional three trademarks in Malaysia. We cannot assure you that counterfeiting or imitation of our products will not occur in the future or, if it does occur, that we will be able to address the problem in a timely and effective manner. Any occurrence of counterfeiting or imitation of our products or other infringement of our intellectual property rights could negatively affect our brand and our reputation, which in turn adversely affects the results of our operations.

Litigation to prosecute infringement of our intellectual property rights could be costly and lengthy and will divert our managerial and financial resources. We will have to bear costs of the intellectual property litigation and may be unable to recover such costs from our opposite parties. Protracted litigation could also result in our customers deferring or limiting their purchase or use of or products until such litigation is resolved. The occurrence of any of the foregoing will have a material adverse effect on our business, financial condition and results of operations.

We may incur losses resulting from product liability claims or product recalls or adverse publicity relating to our products.

We may incur losses resulting from product liability claims with respect to our products supplied by our supplier. We may face claims or liabilities which may arise if there exist any defects in quality of these products or any of these products are deemed or proven to be unsafe, defective or contaminated. In the event that the use or misuse of any product distributed by us results in personal injury or death, product liability and/or indemnity claims may be brought against us, in addition to our product recalls, and the relevant regulatory authorities in the market we operate may close down some of our related operations and take administrative actions against us. If we experience any business disruption and litigation, we may incur additional costs and have to divert our management’s attention and resources on such matters, which may adversely affect our business, financial condition and results of operations.

If we are unable to successfully develop and timely introduce new products or services or enhance existing products or services, our business, financial condition and results of operations may be materially and adversely affected.

We must continually source, develop and introduce new products and services as well as improve and enhance our existing products and services to maintain or increase our sales. The success of new or enhanced products or services may depend on a number of factors including, anticipating and effectively addressing user preferences and demand, the success of our sales and marketing efforts, effective forecasting and management of products and services demands, purchase commitments, and the quality of or defects in our products. The risk of not meeting our customers’ preferences and demands through our products and services may result in a shift in market shares, as customers instead choose products and services offered by our competitors. This may result in lower sales revenue, materially and adversely affecting our business, financial condition and results of operations.

We may not be able to manage the growth of our business and our expansion plans and operations or implement our business strategies on schedule or within our budget, or at all.

We are continually executing a number of growth initiatives, strategies and operating plans designed to enhance our business. In 2023, we plan to increase our revenue stream from health solution advisory services from our “ATP Zeta Health Program”, “ENERGETIQUE” and “BEAUNIQUE” series to align with our growth strategies. The company expects the initiative to materialize in the second half of 2023, despite competition from other health and wellness brands, and challenge in recruiting due to expanding employment market. Any expansion may increase the complexity of our operations and place a significant strain on our managerial, operational, financial and human resources. Our current and planned personnel, systems, procedures and controls may not be adequate to support our future operations. We cannot assure you that we will be able to effectively manage our growth or to implement all these systems, procedures and control measures successfully. Furthermore, the anticipated benefits from these growth initiatives, strategies and operating plans are based on assumptions that may prove to be inaccurate. Moreover, we may not be able to successfully complete these growth initiatives, strategies and operating plans and realize all of the benefits that we expect to achieve or it may be more costly to do so than we anticipate. If, for any reason, we are not able to manage our growth effectively, the benefits we realize are less than our estimates or the implementation of these growth initiatives, strategies and operating plans adversely affects our operations or costs more or takes longer to effectuate than we expect, and/or if our assumptions prove to be inaccurate, our business and prospects may be materially and adversely affected.

In addition, we may seek and pursue opportunities through joint ventures or strategic partnerships for expansion from time to time, and we may face similar risks and uncertainties as listed above. Failure to properly address these risks and uncertainties may materially and adversely affect our ability to carry out acquisitions and other expansion plans, integrate and consolidate newly acquired or newly formed businesses, and realize all or any of the anticipated benefits of such expansion, which may have a material adverse effect on our business, financial condition, results of operations and prospects.

We have a limited operating history in the Malaysia health and wellness industry, which makes it difficult to evaluate our future prospects.

We launched our ATP Zeta Super Health Program business in June 2016, the same month in which our Company was incorporated, followed by our ENERGETIQUE” and “BEAUNIQUE” series in July 2018 and March 2019, respectively, and thus, we have a limited operating history. We have limited experience in most aspects of our business operation, such as sourcing products for and offering advisory services on all the three programs. As our business develops and as we respond to competition, we may continue to introduce new product and services offerings and make adjustments to our existing product line and services and to our business operation in general. Any significant change to our business model that does not achieve expected results may have a material and adverse impact on our financial condition and results of operations. It is therefore difficult to effectively assess our future prospects.

The Malaysia health and wellness industry may not develop as expected. Prospective retail and corporate customers may not be familiar with the development of the market and may have difficulties distinguishing our products from those of our competitors. Convincing prospective customers or distributors of the value of our products or services is important to the success of our business. The risk of failing to convince potential customers or distributors to purchase products or services from us may result in the failure of our business plan. Many customers or distributors may not be interested in purchasing products and services we sell because there is no certainty that our business will succeed.

You should consider our business and prospects in light of the risks and challenges we encounter or may encounter given the rapidly evolving market in which we operate and our limited operating history. These risks and challenges include our ability to, among other things:

| ● | manage our future growth; | |

| ● | increase the utilization of our products by existing and new customers; | |

| ● | maintain and enhance our relationships with customers and distributors; | |

| ● | improve our operational efficiency; | |

| ● | attract, retain and motivate talented employees; | |

| ● | cope with economic fluctuations; | |

| ● | navigate the evolving regulatory environment; and | |

| ● | defend ourselves against legal and regulatory actions. |

Our historical growth rates may not be indicative of our future growth. If we are unable to manage the growth and increased complexity of our business, fail to control our costs and expenses, or fail to execute our strategies effectively, our business and business prospects may be materially and adversely affected.

Our historical growth rates may not be indicative of our future growth, and we may not be able to generate similar growth rates in future periods. Our revenue growth may slow, or our total revenues may decline for a number of possible reasons, including change in consumers’ preferences, changes in regulations and government policies, increasing competition, emergence of alternative business models, and general economic conditions.

| 10 |

Our total revenues decreased by approximately 15.0% from approximately 0.8 million for the six months ended June 30, 2022 to approximately 0.7 million for the six months ended June 30, 2023. Our total revenues increased by approximately 82.6% from approximately 1.0 million for the year ended December 31, 2021 to approximately 1.9 million for the year ended December 31, 2022. Our gross profits decreased by approximately 28.0% from approximately $0.6 million for the six months ended June 30, 2022 to approximately $0.4 million for the six months ended June 30, 2023.

If our growth rate declines, investors’ perceptions of our business and business prospects may be materially and adversely affected and the market price of our shares could decline.

Our lack of insurance could expose us to significant costs and business disruption.

The health and wellness industry in Malaysia is a mature market. We currently do not have any product liability or disruption insurance to cover our operations in Malaysia or overseas, which, based on public information available to us relating to Malaysia-based health and wellness companies, is consistent with customary industry practice in Malaysia. We have determined that the costs of insuring for these risks and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. If we suffer any losses, damages or liabilities in the course of our business operations, we may not have adequate insurance coverage to provide sufficient funds to cover any such losses, damages or product claim liabilities. Therefore, there may be instances when we will sustain losses, damages and liabilities because of our lack of insurance coverage, which may in turn materially and adversely affect our financial condition and results of operations.

A decline in general economic condition could lead to reduced consumer demand and could negatively impact our business operation and financial condition, which in turn could have a material adverse effect on our business, financial condition and results of operations.

Our operating and financial performance may be adversely affected by a variety of factors that influence the general economy. Consumer spending habits, including spending for health related products and services we sell, are affected by, among other things, prevailing economic conditions, levels of unemployment, salaries and wage rates, prevailing interest rates, income tax rates and policies, consumer confidence and consumer perception of economic conditions. In addition, consumer purchasing patterns may be influenced by consumers’ disposable income. In the event of an economic slowdown, consumer spending habits could be adversely affected and we could experience lower net sales than expected on a quarterly or annual basis which could have a material adverse effect on our business, financial condition and results of operations.

We operate in a heavily regulated industry.

Our business is principally regulated by various laws and regulations in the market we operate, such as in Malaysia the Food Act 1983 (ACT 281) and Regulations, Control of Drugs and Cosmetics Regulations 1984 mandate authorization from the Food Safety and Quality Division and National Pharmaceutical Regulatory Agency of the Ministry of Health for our Company’s products to be sold in the country. Various registrations, certificates and/or licenses for the conduct of our business are required under the above laws, which also contain provisions for requirements on the storage, labelling, advertising and importation of some of our products.

Based on our experience, some of the laws and regulations of the place where we operate our business are subject to amendments, uncertainty in interpretation and administrative actions from time to time. Therefore, we cannot assure you that, for the implementation of our business plans and the introduction of any new product, we will be able to obtain all the necessary registrations, certificates and/or licenses. Any failure to comply with the above laws and regulations may give rise to fines, administrative penalties and/or prosecution against us, which may adversely affect our reputation, financial condition or results of operation.

| 11 |

We may be adversely affected by the performance of third-party contractors.

We engaged third-party contractors to carry out logistics services. We endeavor to engage third-party companies with a strong reputation and track record, high performance reliability and adequate financial resources. However, any such third-party contractor may still fail to provide satisfactory logistics services at the level of quality or within the timeframe required by us or our customers. While we generally require our logistics contractors to fully reimburse us for any losses arising from delay in delivery or non-delivery, our results of operation and financial condition may be adversely affected if any of the losses are not borne by them. If the performance of any third-party contractor is not satisfactory, we may need to replace such contractor or take other remedial actions, which could adversely affect the cost structure and delivery schedule of our products and services and thus have a negative impact on our reputation, financial position and business operations. In addition, as we expand our business into overseas markets, there may be a shortage of third-party contractors that meet our quality standards and other selection criteria in such locations and, as a result, we may not be able to engage a sufficient number of high-quality third-party contractors in a timely manner, which may adversely affect our delivery schedules and delivery costs and hence our business, results of operations and financial conditions.

We may need additional capital, and financing may not be available on terms acceptable to us, or at all.

There is no guarantee that in the future we will generate enough profits to support our business. Although we believe that our anticipated cash flows from operating activities together with cash on hand will be sufficient to meet our anticipated working capital requirements and capital expenditures in the ordinary course of business for the next twelve months, we cannot assure you this will be the case. We may need additional cash resources in the future if we experience changes in business conditions or other developments. We may also need additional cash resources in the future if we find and wish to pursue opportunities for investment, acquisition, capital expenditure or similar actions. If we determine that our cash requirements exceed the amount of cash and cash equivalents we have on hand at the time, we may seek to issue equity or debt securities or obtain credit facilities. The issuance and sale of additional equity would result in further dilution to our stockholders. The incurrence of indebtedness would result in increased fixed obligations and could result in operating covenants that would restrict our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all.

Adverse developments in our existing areas of operation could adversely impact our results of business, results of operations and financial condition.

Our operations are focused on utilizing our sales efforts which are principally located in Malaysia. As a result, our results of operations, cash flows and financial condition depend upon the demand for our products in Malaysia. Due to the lack of broad diversification in industry type and geographic location, adverse developments in our current segment of the industry, or our existing areas of operation, could have a significantly greater impact on our business, results of operations and financial condition than if our operations were more diversified.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: pertain to the maintenance of records in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

| 12 |

In connection with the audit of our consolidated financial statements as of December 31, 2022 and the review of our unaudited condensed consolidated financial statements as of June 30, 2023, we identified three “material weaknesses”, and other control deficiencies including significant deficiencies in our internal control over financial reporting. A “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis. The material weaknesses identified related to the Company were: (i) insufficient full-time personnel with appropriate levels of accounting knowledge and experience to monitor the daily recording of transactions, address complex U.S. GAAP accounting issues and to prepare and review financial statements and related disclosures under U.S. GAAP; (ii) lack of a functional internal audit department or personnel that monitors the consistencies of the preventive internal control procedures and lack of adequate policies and procedures in internal audit function to ensure that the Company’s policies and procedures have been carried out as planned; (iii) lack of proper IT policies and procedures developed for system change management, user access management, backup management and service organization management.

The plans for the Company’s implementation of remediation of the material weaknesses are as follows:

| (a) | With respect to Material Weakness i, the Company has employed a full-time Chief Financial Officer (“CFO”), Mr. Lee Kam Fan, with relevant U.S. GAAP and SEC reporting experience and qualifications since January 12, 2021. | |

| (b) | With respect to Material Weakness ii, we intend to form an internal audit function and have plans to hire internal auditors to strengthen our overall governance. All internal auditors will be independent of our operations and will report directly to the audit committee. We intended to form the internal audit function within the next 12 months. | |

| (c) | With respect to Material Weakness iii, we intend to hire several dedicated personnel for different roles such as AP, OS and DB. This procedure would improve the segregation of duties in AP, OS and DB. Any changes to the system will require approval by a higher level of IT management. We expect to adopt the above measures within the next 12 months. |

As a public company, we will become subject to the Sarbanes-Oxley Act of 2002. Section 404 of the Sarbanes-Oxley Act, or SOX 404, will require that we include a report from management on the effectiveness of our internal control over financial reporting in our annual report on Form 10-K and in our quarterly report on Form 10-Q if we are qualified as an accelerated filer. Our management may conclude that our internal control over financial reporting is not effective. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm, after conducting its own independent testing, may issue a report that is qualified if it is not satisfied with our internal controls or the level at which our controls are documented, designed, operated or reviewed, or if it interprets the relevant requirements differently from us. In addition, after we become a public company, our reporting obligations may place a significant strain on our management, operational and financial resources and systems for the foreseeable future. We may be unable to timely complete our evaluation testing and any required remediation.

During the course of documenting and testing our internal control procedures, in order to satisfy the requirements of SOX 404, we may identify other weaknesses and deficiencies in our internal control over financial reporting. In addition, if we fail to maintain the adequacy of our internal control over financial reporting, as these standards are modified, supplemented or amended from time to time, we may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with SOX 404. If we fail to achieve and maintain an effective internal control environment, we could suffer material misstatements in our financial statements and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our reported financial information. This could in turn limit our access to capital markets, harm our results of operations, and lead to a decline in the trading price of our shares. Additionally, ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to potential delisting from the stock exchange on which we list, regulatory investigations and civil or criminal sanctions. We may also be required to restate our financial statements from prior periods.

| 13 |

Legal disputes or proceedings could expose us to liability, divert our management’s attention and negatively impact our reputation.

We may at times be involved in potential legal disputes or proceedings during the ordinary course of business operations relating to product or other types of liability, employees’ claims, labor disputes or contract disputes that could have a material and adverse effect on our reputation, operation and financial condition. If we become involved in material or protracted legal proceedings or other legal disputes in the future, the outcome of such proceedings could be uncertain and could result in settlements or outcomes which materially and adversely affect our financial condition. In addition, any litigation or legal proceedings could incur substantial legal expenses as well as significant time and attention of our management, diverting their attention from our business and operations.

Our failure to comply with anti-corruption laws and regulations, or effectively manage our employees, customers and business partners, could severely damage our reputation, and materially and adversely affect our business, financial condition, results of operations and prospects.

We are subject to risks in relation to actions taken by us, our employees, third-party customers or third-party suppliers that constitute violations of the anti-corruption laws and regulations. While we adopt strict internal procedures and work closely with relevant government agencies to ensure compliance of our business operations with relevant laws and regulations, our efforts may not be sufficient to ensure that we comply with relevant laws and regulations at all times. If we, our employees, third-party customers or third-party suppliers violate these laws, rules or regulations, we could be subject to fines and/or other penalties. Actions by Malaysia regulatory authorities or the courts to provide an alternative interpretation of the laws and regulations or to adopt additional anti-bribery or anti-corruption related regulations could also require us to make changes to our operations. Our reputation, corporate image, and business operations may be materially and adversely affected if we fail to comply with these measures or become the target of any negative publicity as a result of actions taken by us, our employees, third-party customers or third-party suppliers.

An overall decline in the health of the economy and other factors impacting consumer spending, such as natural disasters, outbreak of viruses, illnesses, infectious diseases, contagions and the occurrence of unforeseen epidemics may affect consumer purchases, reduce demand for our products and materially harm our business, results of operations and financial condition.

Our business depends on consumer demand for our products and, consequently, is sensitive to a number of factors that influence consumer confidence and spending, including but not limited to, general current and future economic and political conditions, consumer disposable income, recession and fears of recession, unemployment, minimum wages, availability of consumer credit, consumer debt levels, interest rates, tax rates and policies, inflation, war and fears of war, inclement weather, natural disasters, terrorism, active shooter situations, outbreak of viruses, illnesses, infectious diseases, contagions and the occurrence of unforeseen epidemics (including the outbreak of the coronavirus and its potential impact on our financial results) and consumer perceptions of personal well-being and security. For example, in recent years, there have been outbreaks of epidemics in various countries, including Malaysia. Recently, there was an outbreak of a novel strain of coronavirus (COVID-19), which has spread rapidly to many parts of the world, including Malaysia. In March 2020, the World Health Organization declared the COVID-19 a pandemic. The epidemic has resulted in intermittent quarantines, travel restrictions, and the temporary closure of stores and facilities in Malaysia.

Substantially all of our revenues are concentrated in Malaysia. Consequently, our results of operations were adversely affected as a result of the implementation of Movement Control Order (MCO) by the Malaysian government. The impact on the company as a result of the MCO includes:

| ● | temporary closure of offices and travel restrictions prevented the company and our distributors from organizing offline events, which in turn stalled our marketing effort; | |

| ● | temporary suspension of product supplies to our distributors and members due supply chain disruption as our suppliers and logistics providers faced disruption and delay in their operation; and |

| 14 |

| ● | the COVID-19 outbreak has resulted in a decline in overall economic environment, which in turn lower the spending power of the consumer and consequently, the revenue of the company. |

Because of the uncertainty surrounding the COVID-19 outbreak, the financial impact related to the outbreak of and response to the coronavirus cannot be reasonably estimated at this time. There is no guarantee that our total revenues will grow or remain at the similar level year over year in the fiscal year 2023. We may have to record downward adjustments or impairment in the fair value of investments in the fiscal year 2023, if conditions have not been significantly improved and global stock markets have not recovered from recent declines.

In general, our business could be adversely affected by the effects of epidemics, pandemic or, including, but not limited to, the COVID-19, avian influenza, severe acute respiratory syndrome (SARS), the influenza A virus, Ebola virus, severe weather conditions such as flood or hazardous air pollution, or other outbreaks. In response to an epidemic, severe weather conditions, or other outbreaks, government and other organizations may adopt regulations and policies that could lead to severe disruption to our daily operations, including temporary closure of our offices and other facilities. These severe conditions may cause us and/or our partners to make internal adjustments, including but not limited to, temporarily closing down business, limiting business hours, and setting restrictions on travel and/or visits with clients and partners for a prolonged period of time. Various impact arising from a severe condition may cause business disruption, resulting in material, adverse impact to our financial condition and results of operations.

We face risks related to health epidemics, severe weather conditions and other outbreaks.

In recent years, there have been outbreaks of epidemics in various countries, including Malaysia. Recently, there was an outbreak of a novel strain of coronavirus (COVID-19), which has spread rapidly to many parts of the world, including Malaysia. In March 2020, the World Health Organization declared the COVID-19 a pandemic. The epidemic has resulted in quarantines, travel restrictions, and the temporary closure of stores and facilities in Malaysia for prolong periods.

Substantially all of our revenues are concentrated in Malaysia. Consequently, our results of operations will likely be adversely, and may be materially, affected, to the extent that the COVID-19 or any other epidemic harms the Malaysia and global economy in general. Any potential impact to our results will depend on, to a large extent, future developments and new information that may emerge regarding the duration and severity of the COVID-19 and the actions taken by government authorities and other entities to contain the COVID-19 or treat its impact, almost all of which are beyond our control. Potential impacts include, but are not limited to, the following:

| ● | temporary closure of offices, travel restrictions, financial impact of our customers or suspension supplies may negatively affect, and could continue to negatively affect, the demand for our products; | |

| ● | our customer may require additional time to pay us or fail to pay us at all, which could significantly increase the amount of accounts receivable and require us to record additional allowances for doubtful accounts. We may have to provide significant sales incentives to our sole customer during the outbreak, which may in turn materially adversely affect our financial condition and operating results; | |

| ● | any disruption of our supply chain, logistics providers or customers could adversely impact our business and results of operations, including causing us or our suppliers to cease manufacturing for a period of time or materially delay delivery to our customers, which may also lead to loss of our customers; and | |

| ● | the global stock markets have experienced, and may continue to experience, significant decline from the COVID-19 outbreak and the marketable securities that we have invested in could be materially adversely affected, which may lead to significant impairment in the fair values of our investments and in turn materially adversely affect our financial condition and operating results. |

Fluctuations in foreign currency exchange rates could have a material adverse effect on our financial results.

We earn revenues, pay expenses, own assets and incur liabilities in countries using currencies other than the U.S. dollar, including Australian Dollars, Malaysian Ringgit and Hong Kong Dollars. Since our consolidated financial statements are presented in U.S. dollars, we must translate revenues, income and expenses, as well as assets and liabilities, into U.S. dollars at exchange rates in effect during or at the end of each reporting period. Therefore, increases or decreases in the value of the U.S. dollar against other currencies affect our net operating revenues, operating income and the value of balance sheet items denominated in foreign currencies. We cannot assure you that fluctuations in foreign currency exchange rates, particularly the strengthening or weakening of the U.S. dollar against major currencies would not materially affect our financial results.

Our business depends on the continued contributions made by Dr. How Kok Choong, as our founder, chief executive officer, chief operating officer, chairman of the board of Directors, Director and secretary, the loss of who may result in a severe impediment to our business.,

Our

success is dependent upon the continued contributions made by our CEO and President, Dr. How Kok Choong. We rely on his expertise

in business operations when we are developing our business. We have no “Key Man” insurance to cover the resulting losses

in the event that any of our officer or directors should die or resign.

If Dr. How Kok Choong cannot serve the Company or is no longer willing to do so, the Company may not be able to find alternatives in a timely manner or at all. This would likely result in a severe damage to our business operations and would have an adverse material impact on our financial position and operating results. To continue as a viable operation, the Company may have to recruit and train replacement personnel at a higher cost. Additionally, if Dr. How Kok Choong joins our competitors or develops similar businesses that are in competition with our Company, our business may also be negatively impacted.

Our future success depends on our ability to attract and retain qualified long-term staff to fill management, technology, sales, marketing, and customer services positions. We have a great need for qualified talent, but we may not be successful in attracting, hiring, developing, and retaining the talent required for our success.

| 15 |

If we are not able to achieve our overall long-term growth objectives, the value of an investment in our Company could be negatively affected.

We have established and publicly announced certain long-term growth objectives. These objectives were based on, among other things, our evaluation of our growth prospects, which are generally driven by the sales potential of many product types, some of which are more profitable than others, and on an assessment of the potential price and product mix. There can be no assurance that we will realize the sales potential and the price and product mix necessary to achieve our long-term growth objectives.

We may incur losses resulting from product liability claims or product recalls or adverse publicity relating to our products.