UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10‑K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001‑38176

Venator Materials PLC

(Exact name of registrant as specified in its charter)

|

England and Wales |

98‑1373159 |

|

(State or other jurisdiction |

(I.R.S. Employer Identification No.) |

|

of incorporation or organization) |

|

Titanium House, Hanzard Drive, Wynyard Park,

Stockton-On-Tees, TS22, 5FD, United Kingdom

+44 (0) 1740 608 001

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Ordinary Shares, $0.001 Par Value per Share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES ☐ NO ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

YES ☐ NO ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES ☑ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES ☑ NO ☐

Indicated by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b‑2 of the Exchange Act. (Check one):

|

Large accelerated |

Accelerated |

Non-accelerated |

Smaller reporting |

Emerging growth |

|

|

|

(Do not check if a smaller reporting company) |

||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act).

YES ☐ NO ☑

The registrant has elected to use December 31, 2017 as the calculation date, which was the last trading date of the registrant’s most recently completed quarterly period, because on June 30, 2017 (the last business day of the registrant’s second fiscal quarter), the registrant was a privately-held company. The aggregate market value of the ordinary shares held by non-affiliates as of the last business day of the registrant’s most recently completed fourth fiscal quarter (based on the closing price of $22.12 on December 29, 2017 reported by the New York Stock Exchange) was approximately $1,058,297,468.

As of February 16, 2018, the registrant had outstanding 106,399,937 ordinary shares, $0.001 par value per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant’s Definitive Proxy Statement for the 2018 Annual General Meeting of Shareholders may be incorporated by reference into Part III of this Form 10‑K. Alternatively, we may include such information in an amendment to this annual report on Form 10-K.

VENATOR MATERIALS PLC AND SUBSIDIARIES

2017 ANNUAL REPORT ON FORM 10‑K

TABLE OF CONTENTS

1

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information set forth in this report contains “forward-looking statements” within the meaning the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. All statements other than historical factual information are forward-looking statements, including without limitation statements regarding: projections of revenue, expenses, profit, margins, tax rates, tax provisions, cash flows, pension and benefit obligations and funding requirements, our liquidity position or other projected financial measures; management’s plans and strategies for future operations, including statements relating to anticipated operating performance, cost reductions, construction cost estimates, restructuring activities, new product and service developments, competitive strengths or market position, acquisitions, divestitures, spin-offs, or other distributions, strategic opportunities, securities offerings, share repurchases, dividends and executive compensation; growth, declines and other trends in markets we sell into; new or modified laws, regulations and accounting pronouncements; legal proceedings, environmental, health and safety (“EHS”) matters, tax audits and assessments and other contingent liabilities; foreign currency exchange rates and fluctuations in those rates; general economic and capital markets conditions; the timing of any of the foregoing; assumptions underlying any of the foregoing; and any other statements that address events or developments that we intend or believe will or may occur in the future. In some cases, forward-looking statements can be identified by terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “estimates” or “intends” or the negative of such terms or other comparable terminology, or by discussions of strategy. We may also make additional forward-looking statements from time to time. All such subsequent forward-looking statements, whether written or oral, by us or on our behalf, are also expressly qualified by these cautionary statements.

Forward-looking statements are based on certain assumptions and expectations of future events which may not be accurate or realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond our control. Important factors that may materially affect such forward-looking statements and projections include:

|

· |

volatile global economic conditions; |

|

· |

cyclical and volatile titanium dioxide (“TiO2”) products markets; |

|

· |

highly competitive industries and the need to innovate and develop new products; |

|

· |

increased manufacturing regulations for some of our products, including the outcome of the pending potential classification of TiO2 as a carcinogen in the European Union (“EU”) or any increased regulatory scrutiny; |

|

· |

disruptions in production at our manufacturing facilities and our ability to cover resulting costs, including construction costs, and lost revenue with insurance proceeds, including at our TiO2 manufacturing facility in Pori, Finland; |

|

· |

fluctuations in currency exchange rates and tax rates; |

|

· |

price volatility or interruptions in supply of raw materials and energy; |

|

· |

changes to laws, regulations or the interpretation thereof; |

|

· |

significant investments associated with efforts to transform our business; |

|

· |

differences in views with our joint venture participants; |

|

· |

high levels of indebtedness; |

|

· |

EHS laws and regulations; |

|

· |

our ability to obtain future capital on favorable terms; |

|

· |

seasonal sales patterns in our product markets; |

|

· |

legal claims against us, including antitrust claims; |

|

· |

our ability to adequately protect our critical information technology systems; |

|

· |

economic conditions and regulatory changes following the likely exit of the United Kingdom (the “U.K.”) from the EU; |

|

· |

failure to maintain effective internal controls over financial reporting and disclosure; |

|

· |

our indemnification of Huntsman and other commitments and contingencies; |

|

· |

financial difficulties and related problems experienced by our customers, vendors, suppliers and other business partners; |

|

· |

failure to enforce our intellectual property rights; |

|

· |

our ability to effectively manage our labor force; |

2

|

· |

conflicts, military actions, terrorist attacks and general instability; and |

|

· |

our ability to realize the expected benefits of our separation from Huntsman. |

All forward-looking statements, including, without limitation, management’s examination of historical operating trends, are based upon our current expectations and various assumptions. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them, but there can be no assurance that management’s expectations, beliefs and projections will result or be achieved. All forward-looking statements apply only as of the date made. We undertake no obligation to publicly update or revise forward-looking statements whether because of new information, future events or otherwise, except as required by securities and other applicable law.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in or contemplated by this report. Any forward-looking statements should be considered in light of the risks set forth in the “Part I. Item 1A. Risk Factors.”

3

General

This report includes information with respect to market share, industry conditions and forecasts that we obtained from internal industry research, publicly available information (including industry publications and surveys), and surveys and market research provided by consultants. We have not independently verified any of the data from third‑party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, our internal research and forecasts are based upon our management’s understanding of industry conditions, and such information has not been verified by any independent sources. The industry in which we operate is subject to a high degree of uncertainty and risks and such data and risks are subject to change, including those discussed under “Risk Factors” and “Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the sources described above.

Except when the context otherwise requires or where otherwise indicated, (1) all references to “Venator,” the “Company,” “we,” “us” and “our” refer to Venator Materials PLC and its subsidiaries, or, as the context requires, the historical Pigments and Additives business of Huntsman, (2) all references to “Huntsman” refer to Huntsman Corporation, our controlling shareholder, and its subsidiaries, (3) all references to the “Titanium Dioxide” segment or business refer to the TiO2 business of Venator, or, as the context requires, the historical Pigments and Additives segment of Huntsman and the related operations and assets, liabilities and obligations, (4) all references to the “Performance Additives” segment or business refer to the functional additives, color pigments, timber treatment and water treatment businesses of Venator, or, as the context requires, the Pigments and Additives segment of Huntsman and the related operations and assets, liabilities and obligations, (5) all references to “other businesses” refer to certain businesses that Huntsman retained in connection with the separation and that are reported as discontinued operations in our consolidated and combined financial statements, (6) all references to “Huntsman International” refer to Huntsman International LLC, a wholly-owned subsidiary of Huntsman and the entity through which Huntsman operates all of its businesses, (7) all references to the “HHN” refer to Huntsman (Holdings) Netherlands B.V., a wholly-owned subsidiary of Huntsman and the Huntsman entity that owns our ordinary shares, (8) we refer to the internal reorganization prior to our initial public offering (“IPO”), the separation transactions initiated to separate the Venator business from Huntsman’s other businesses, including the entry into and effectiveness of the separation agreement and ancillary agreements, and the Senior Credit Facilities and Senior Notes, including the use of the net proceeds of the Senior Credit Facilities (as defined below) and the Senior Notes (as defined below), which were used to repay intercompany debt we owed to Huntsman and to pay related fees and expenses, as the “separation” and (9) the “Rockwood acquisition” refers to Huntsman’s acquisition of the performance and additives and TiO2 businesses of Rockwood Holdings, Inc. ("Rockwood") completed on October 1, 2014.

Overview

We are a leading global manufacturer and marketer of chemical products that improve the quality of life for downstream consumers and promote a sustainable future. Our products comprise a broad range of innovative chemicals and formulations that bring color and vibrancy to buildings, protect and extend product life, and reduce energy consumption. We market our products globally to a diversified group of industrial customers through two segments: Titanium Dioxide, which consists of our TiO2 business, and Performance Additives, which consists of our functional additives, color pigments, timber treatment and water treatment businesses. We are a leading global producer in many of our key product lines, including TiO2, color pigments and functional additives, a leading North American producer of timber treatment products and a leading European producer of water treatment products. We operate 26 facilities, employ approximately 4,500 associates worldwide and sell our products in more than 110 countries.

We operate in a variety of end markets, including industrial and architectural coatings, construction materials, plastics, paper, printing inks, pharmaceuticals, food, cosmetics, fibers and films and personal care. Within these end markets, our products serve approximately 6,900 customers globally. Our production capabilities allow us to manufacture a broad range of functional TiO2 products as well as specialty TiO2 products that provide critical

4

performance for our customers and sell at a premium for certain end-use applications. Our color pigments, functional additives and timber treatment products provide essential properties for our customers’ end-use applications by enhancing the color and appearance of construction materials and delivering performance benefits in other applications such as corrosion and fade resistance, water repellence and flame suppression. We believe that our global footprint and broad product offerings differentiate us from our competitors and allow us to better meet our customers’ needs.

For the year ended December 31, 2017, we had total revenues of $2,209 million. Adjusted EBITDA for the year ended December 31, 2017 was $387 million for our Titanium Dioxide segment and $72 million for our Performance Additives segment.

Our Titanium Dioxide and Performance Additives segments have been transformed in recent years and we have established ourselves as a market leader in each of the industries in which we operate. We invested approximately $1.3 billion in our Titanium Dioxide and Performance Additives segments from January 1, 2014 to December 31, 2017 on acquisitions, restructuring and integration. We continue to implement additional business improvements within our Titanium Dioxide and Performance Additives businesses. As a result of these efforts, we believe we are well-positioned to capitalize on the continued strength of the TiO2 market and related growth opportunities.

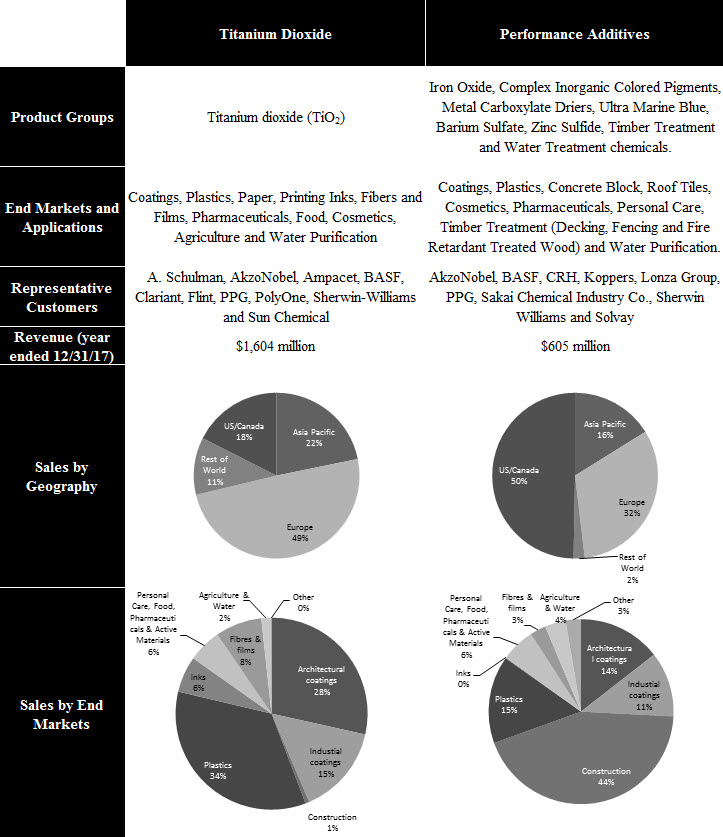

The table below summarizes the key products, end markets and applications, representative customers, revenues and sales information by segment as of December 31, 2017.

5

For additional information about our business segments, including related financial information, see “Part II. Item 8. Financial Statements and Supplementary Data—Note 24. Operating Segment Information” and “Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

6

Recent Developments

Initial Public Offering and Separation

On August 8, 2017, we completed our IPO of 26,105,000 ordinary shares, par value $0.001 per share (the “ordinary shares”) which included 3,405,000 ordinary shares issued upon the exercise in full by the underwriters of their option to purchase additional shares, at a public offering price of $20.00 per share. All of the ordinary shares were sold by Huntsman, and we did not receive any proceeds from the offering. In conjunction with our IPO, Venator assumed the Titanium Dioxide and Performance Additives businesses of Huntsman and the related assets, liabilities, obligations and operations and entered into a separation agreement to effect the separation of this business from Huntsman. Prior to our IPO, Venator was a wholly-owned subsidiary of Huntsman. The ordinary shares began trading August 3, 2017 on the New York Stock Exchange under the symbol “VNTR.”

In connection with our IPO and the separation, Venator and Huntsman entered into certain agreements that allocated between Venator and Huntsman the various assets, employees, liabilities and obligations that were previously part of Huntsman and that govern various interim and ongoing relationships between the parties.

On August 15, 2017, we registered 14,025,000 ordinary shares on Form S‑8 which are reserved for issuance in connection with awards under our 2017 Stock Incentive Plan (the “LTIP”).

On December 4, 2017, we completed a secondary public offering of 21,764,800 ordinary shares. On January 3, 2018, the underwriters purchased an additional 1,948,955 ordinary shares pursuant to their over-allotment option. All of the ordinary shares were sold by Huntsman through HHN, and we did not receive any proceeds from the offering. Following our secondary public offering, including the partial exercise of the underwriters’ option to purchase additional shares, Huntsman owns approximately 53% of Venator’s outstanding ordinary shares.

Senior Credit Facilities and Senior Notes

On August 8, 2017, in connection with the IPO and the separation, we entered into new financing arrangements and incurred new debt, including borrowings of $375 million under a new senior secured term loan facility with a maturity of seven years (the “Term Loan Facility”). In addition to the Term Loan Facility, we entered into a $300 million asset-based revolving lending facility with a maturity of five years (the “ABL Facility” and, together with the Term Loan Facility, the “Senior Credit Facilities”). On July 14, 2017, in connection with the IPO and the separation, our subsidiaries Venator Finance S.à.r.l. and Venator Materials LLC (the “Issuers”), issued $375 million in aggregate principal amount of 5.75% of Senior Notes due 2025 (the “Senior Notes”). Promptly following consummation of the separation, the proceeds of the Senior Notes were released from escrow and Venator used the net proceeds of the Senior Notes and borrowings under the Term Loan Facility to repay approximately $732 million of net intercompany debt owed to Huntsman and to pay related fees and expenses of approximately $18 million.

Pori Fire

On January 30, 2017, our TiO2 manufacturing facility in Pori, Finland experienced fire damage and we continue to repair the facility. Prior to the fire, 60% of the site capacity produced specialty products which, on average, contributed greater than 75% of the site EBITDA from January 1, 2015 through January 30, 2017. The Pori facility had a nameplate capacity of 130,000 metric tons per year, which represented approximately 17% of our total TiO2 nameplate capacity and approximately 2% of total global TiO2 demand. We are currently operating at 20% of total prior capacity producing specialty products, and we intend to restore manufacturing of the balance of these more profitable specialty products by the end of 2018. The remaining 40% of site capacity is more commoditized and, based on current market and economic conditions, associated costs and projected returns, we currently expect to rebuild this portion of the facility, but do not expect it to be reintroduced into the market prior to 2020.

We have recorded a loss of $31 million for the write-off of fixed assets and lost inventory in cost of goods sold in our consolidated and combined statements of operations for the year ended December 31, 2017. In addition, we recorded a loss of $21 million of costs for cleanup of the facility in cost of goods sold through December 31, 2017. The

7

site is insured for property damage as well as business interruption losses subject to retained deductibles of $15 million and 60 days, respectively, with an aggregate limit of $500 million. Due to prevailing strong market conditions, our TiO2 selling prices continue to improve and our business is benefitting from the resulting improved profitability and cash flows. This also has the effect of increasing our total anticipated business interruption losses from the Pori site. We currently believe the combination of increased TiO2 profitability and recently estimated reconstruction costs will result in combined business interruption losses and reconstruction costs in excess of our $500 million aggregate insurance limit. We currently estimate that the total cost to rebuild the Pori facility (including the commodity portion) will exceed the limits of our insurance policy by as much as $325 million, or up to $375 million when providing additional contingency for the upper limits of our current design and construction cost estimates. This amount results from the increased contribution from insurance towards business interruption together with increased costs associated with the faster than normal build schedule of the specialty products portion of the facility, and greater equipment replacement costs as compared to lower equipment repair costs than previously estimated. We expect to account for our uncovered costs as capital expenditures and fund them from cash from operations, which will decrease our liquidity in the periods those costs in excess of our insurance limits are incurred. Based on current and anticipated market conditions, we currently expect our business interruption losses to be fully reimbursed within our insurance policy limits through 2019. However, these are preliminary estimates based on a number of significant assumptions, and as a result uninsured costs could exceed current estimates. Factors that could materially impact our current estimates include our actual future TiO2 profitability and related impact on our business interruption losses; the accuracy of our current property damage estimates; the actual costs and timing of our reconstruction efforts; market and other factors impacting our reconstruction of the commoditized portion of the facility; our ability to secure government subsidies related to our reconstruction efforts; and a number of other significant market and facility-related assumptions. Please see “Item 1A. Risk Factors—Risks Relating to our Business— Disruptions in production at our manufacturing facilities, including our Pori facility, may have a material adverse impact on our business, results of operations and/or financial condition.” We have established a process with our insurer to receive timely advance payments for the continued reconstruction of the facility as well as lost profits for business interruption losses, subject to policy limits. We expect to have pre-funded cash on our balance sheet resulting from these advance insurance payments. We have agreed with our insurer to have monthly meetings to review relevant site activities and interim claims as well as regular progress payments.

The fire at our Pori facility did not have a material impact on our 2017 fourth quarter operating results as losses incurred were offset by insurance proceeds. We received $253 million of non-refundable partial progress payments from our insurer through December 31, 2017 and we received an additional $62 million payment on January 10, 2018. During 2017, we recorded $187 million of income related to property damage and business interruption insurance recoveries in cost of goods sold in our consolidated and combined statements of operations to offset property damage and business interruption losses recorded during the period. In addition, we recorded $68 million as deferred income in accrued liabilities as of December 31, 2017 for insurance proceeds received for costs not yet incurred. The difference between payments received from our insurers of $253 million and the sum of income of $187 million and deferred income of $68 million is related to the foreign exchange movements of the United States (“U.S.”) Dollar against the Euro during 2017.

If we experience delays in construction or equipment procurement relative to the expected restart of the Pori facility, or we lose customers to alternative suppliers or our insurance proceeds do not timely cover our property damage and other losses, or if our actual costs exceed our estimates, our business may be adversely impacted. See “Item 1A. Risk Factors—Risks Related to Our Business—Disruptions in production at our manufacturing facilities, including our Pori facility, may have a material adverse impact on our business, results of operations and/or financial condition.”

Our Business

We manufacture TiO2, functional additives, color pigments, timber treatment and water treatment products. Our broad product range, coupled with our ability to develop and supply specialized products into technically exacting end-use applications, has positioned us as a leader in the markets we serve. In 2014, Huntsman acquired the performance additives and TiO2 businesses of Rockwood, broadening our specialty TiO2 product offerings and adding significant scale and capacity to our TiO2 facilities. The Rockwood acquisition positioned us as a leader in the specialty and differentiated TiO2 industry segments, which includes products that sell at a premium and have more stable margins. The Rockwood acquisition also provided us with complementary functional additives, color pigments, timber treatment and water treatment businesses. We have 26 manufacturing facilities operating in 10 countries with a total nameplate

8

production capacity of approximately 1.3 million metric tons per year. We operate eight TiO2 manufacturing facilities in Europe, North America and Asia and 18 color pigments, functional additives, water treatment and timber treatment manufacturing and processing facilities in Europe, North America, Asia and Australia. For the year ended December 31, 2017, our revenues were $2,209 million. We believe further improvements in TiO2 margins should result in increased profitability and cash flow generation.

Titanium Dioxide Segment

TiO2 is derived from titanium-bearing ores and is a white inert pigment that provides whiteness, opacity and brightness to thousands of everyday items, including coatings, plastics, paper, printing inks, fibers, food and personal care products. We are one of the top producers of TiO2, which collectively account for a significant portion of global TiO2 production capacity. The remaining producers are primarily single-plants that focus on regional sales. We are among the largest global TiO2 producers, with nameplate production capacity of approximately 782,000 metric tons per year. We are able to manufacture a broad range of TiO2 products from functional to specialty. Our specialty products generally sell at a premium into specialized applications such as fibers, catalysts, food, pharmaceuticals and cosmetics. Our production capabilities are distinguished from some of our competitors because of our ability to manufacture TiO2 using both sulfate and chloride manufacturing processes, which gives us the flexibility to tailor our products to meet our customers’ needs. By operating both sulfate and chloride processes, we also have the ability to use a wide range of titanium feedstocks, which enhances the competitiveness of our manufacturing operations, by providing flexibility in the selection of raw materials. This helps insulate us from price fluctuations for any particular feedstock and allows us to manage our raw material costs.

We own a portfolio of brands including the TIOXIDE®, HOMBITAN®, HOMBITEC®, UVTITAN® and ALTIRIS® ranges, which are produced in our eight manufacturing facilities around the globe. We service over 1,800 customers in most major industries and geographic regions. Our global manufacturing footprint allows us to service the needs of both local and global customers, including A. Schulman, AkzoNobel, Ampacet, BASF, Clariant, DSM, Flint, PPG, PolyOne, Sherwin-Williams and Sun Chemical.

There are two manufacturing processes for the production of TiO2, the sulfate process and the chloride process. We believe that the chloride process accounts for approximately 45% of global production capacity. Our production capabilities are distinguished from some of our competitors because of our ability to manufacture TiO2 using both sulfate and chloride manufacturing processes, which gives us the flexibility to tailor our products to meet our customers’ needs. Most end-use applications can use pigments produced by either process, although there are markets that prefer pigment from a specific manufacturing route—for example, the inks market prefers sulfate products and the automotive coatings market prefers chloride products. Regional customers typically favor products that are available locally. The sulfate process produces TiO2 in both the rutile and anatase forms, the latter being used in certain high-value specialty applications.

Once an intermediate TiO2 pigment has been produced using either the chloride or sulfate process, it is “finished” into a product with specific performance characteristics for particular end-use applications. Co-products from both processes require treatment prior to disposal to comply with environmental regulations. In order to reduce our disposal costs and to increase our cost competitiveness, we have developed and marketed the co-products of our Titanium Dioxide segment. We sell approximately 60% of the co-products generated by our business.

We have an established broad customer base and have successfully differentiated ourselves by establishing ourselves as a market leader in a variety of niche market segments where the innovation and specialization of our products is rewarded with higher growth prospects and strong customer relationships.

|

Product Type |

|

Rutile TiO2 |

|

Anatase TiO2 |

|

Nano TiO2 |

|

Characteristics |

|

Most common form of TiO2. Harder and more durable crystal |

|

Softer, less abrasive pigment, preferred for some specialty applications |

|

Ultra-fine TiO2 and other TiO2 specialties |

|

Applications |

|

Coatings, printing inks, PVC window frames, plastic masterbatches |

|

Cosmetics, pharmaceuticals, food, polyester fibers, polyamide fibers |

|

Catalysts and cosmetics |

9

Performance Additives Segment

Functional Additives. Functional additives are barium and zinc based inorganic chemicals used to make colors more brilliant, coatings shine, plastic more stable and protect products from fading. We believe we are the leading global manufacturer of zinc and barium functional additives. The demand dynamics of functional additives are closely aligned with those of functional TiO2 given the overlap in applications served, including coatings and plastics.

|

Product Type |

|

Barium and Zinc Additives |

|

Characteristics |

|

Specialty pigments and fillers based on barium and zinc chemistry |

|

Applications |

|

Coatings, films, paper and glass fiber reinforced plastics |

Color Pigments. We are a leading global producer of colored inorganic pigments for the construction, coating, plastics and specialty markets. We are one of three global leaders in the manufacture and processing of liquid, powder and granulated forms of iron oxide color pigments. We also sell natural and synthetic inorganic pigments and metal carboxylate driers. The cost effectiveness, weather resistance, chemical and thermal stability and coloring strength of iron oxide make it an ideal colorant for construction materials, such as concrete, brick and roof tile, and for coatings and plastics. We produce a wide range of color pigments and are the world’s second largest manufacturer of technical grade ultramarine blue pigments, which have a unique blue shade and are widely used to correct colors, giving them a desirable clean, blue undertone. These attributes have resulted in ultramarine blue being used world-wide for polymeric applications such as construction plastics, food packaging, automotive polymers, consumer plastics, coatings and cosmetics.

Our products are sold under a portfolio of brands that are targeted to the construction sector such as DAVIS COLORS®, GRANUFIN® and FERROXIDE® and the following brands HOLLIDAY PIGMENTS, COPPERAS RED® and MAPICO® focused predominantly on the coatings and plastics sectors.

Our products are also used by manufacturers of colorants, rubber, paper, cosmetics, pet food, digital ink, toner and other industrial uses delivering benefits in other applications such as corrosion protection and catalysis.

Our construction customers value our broad product range and benefit from our custom blending, color matching and color dosing systems. Our coatings customers benefit from a consistent and quality product.

|

|

|

|

|

|

|

|

|

|

|

Product Type |

|

Iron Oxides |

|

Ultramarines |

|

Specialty Inorganic |

|

Driers |

|

Characteristics |

|

Powdered, granulated or in liquid form are synthesized using a range of feedstocks |

|

Range of ultramarine blue and violet and also manganese violet pigments |

|

Complex inorganic pigments and cadmium pigments |

|

A range of metal carboxylates and driers |

|

Applications |

|

Construction, coatings, plastics, cosmetics, inks, catalyst and laminates |

|

Predominantly used in plastics, coatings and cosmetics |

|

Coatings, plastics and inks |

|

Predominantly coatings |

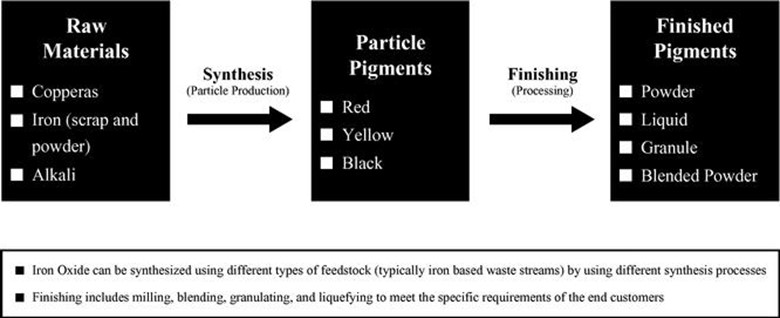

Iron oxide pigment’s cost effectiveness, weather resistance, chemical and thermal stability and coloring strength make it an ideal colorant for construction materials, such as concrete, brick and roof tile, and for coatings such as paints and plastics. We are one of the three largest synthetic inorganic color pigments producers which together represent more than 50% of the global market for iron oxide pigments. The remaining market share consists primarily of competitors based in China.

Made from clay, our ultramarine blue pigments are non-toxic, weather resistant and thermally stable. Ultramarine blue is used world-wide for food contact applications. Our synthetic ultramarines are permitted for unrestricted use in certain cosmetics applications. Ultramarine blue is used extensively in plastics and the paint industry. We focus on supplying our customers with technical grade ultramarine blues and violets to high specification markets such as the cosmetics industry.

10

Copperas, iron and alkali are raw materials for the manufacture of iron oxide pigments. They are used to produce colored pigment particles which are further processed into a finished pigment in powder, liquid, granule or blended powder form.

We are now commissioning a new production facility in Augusta, Georgia, for the synthesis of iron oxide pigments, which we purchased from Rockwood. During commissioning, the facility has experienced delays producing products at the expected specifications and quantities, causing us to question the capabilities of the Augusta technology. Based on the facility’s performance during the commissioning process, we have concluded that production capacity at our Augusta facility will be substantially lower than originally anticipated.

Timber Treatment and Water Treatment. We manufacture wood protection chemicals used primarily in residential and commercial applications to prolong the service life of wood through protection from decay and fungal or insect attack. Wood that has been treated with our products is sold to consumers through major branded retail outlets.

We manufacture our timber treatment chemicals in the U.S. and market our products primarily in North America through Viance, LLC (“Viance”), our 50%-owned joint venture with Dow Chemical (“Dow”) formed in 2007, which we acquired as part of the Rockwood acquisition. Our residential construction products such as ACQ, ECOLIFE™ and Copper Azole are sold for use in decking, fencing and other residential outdoor wood structures. Our industrial construction products such as Chromated Copper Arsenate are sold for use in telephone poles and salt water piers and pilings.

We manufacture our water treatment chemicals in Germany, and these products are used to improve water purity in industrial, commercial and municipal applications. We are one of Europe’s largest suppliers of polyaluminium chloride based flocculants with approximately 140,000 metric tons of production capacity. Our main markets are municipal and industrial waste water treatment and the paper industry.

Customers, Sales, Marketing and Distribution

Titanium Dioxide Segment

We serve over 1,500 customers through our Titanium Dioxide segment. These customers produce paints and coatings, plastics, paper, printing inks, fibers and films, pharmaceuticals, food and cosmetics.

Our ten largest customers accounted for approximately 26% of the segment’s sales in 2017 and no single TiO2 customer represented more than 10% of our sales in 2017. Approximately 85% of our TiO2 sales are made directly to customers through our own global sales and technical services network. This network enables us to work directly with

11

our customers and develop a deep understanding of our customers’ needs and to develop valuable relationships. The remaining 15% of sales are made through our distribution network. We maximize the reach our distribution network by utilizing specialty distributors in selected markets.

Larger customers are typically served via our own sales network and these customers often have annual volume targets with associated pricing mechanisms. Smaller customers are served through a combination of our global sales teams and a distribution network, and the route to market decision is often dependent upon customer size and end application.

Our focus is on marketing products and services to higher growth and higher value applications. For example, we believe that our Titanium Dioxide segment is well-positioned to benefit from growth sectors, such as fibers and films, catalysts, cosmetics, pharmaceuticals and food, where customers’ needs are complex resulting in fewer companies that have the capability to support them. We maximize reach through specialty distributors in selected markets. Our focused sales effort, technical expertise, strong customer service and local manufacturing presence have allowed us to achieve leading market positions in a number of the countries where we manufacture our products.

Performance Additives Segment

We serve over 3,500 customers through our Performance Additives segment. These customers produce materials for the construction industry, as well as coatings, plastics, pharmaceutical, personal care and catalyst applications.

Our ten largest customers accounted for approximately 13% of the segment’s sales in 2017 and no single Performance Additives customer represented more than 10% of our sales in 2017. Performance Additives segment sales are made directly to customers through our own global sales and technical services network, in addition to utilizing specialty distributors. Our focused sales effort, technical expertise, strong customer service and local manufacturing presence have allowed us to achieve leading market positions in a number of the countries where we manufacture our products. We sell iron oxides primarily through our global sales force whereas our ultramarine sales are predominantly through specialty distributors. We sell the majority of our timber treatment products directly to end customers via our joint venture Viance.

Manufacturing and Operations

Titanium Dioxide Segment

As of December 31, 2017, our Titanium Dioxide segment had eight manufacturing facilities operating in seven countries with a total nameplate production capacity of approximately 782,000 metric tons per year.

|

|

|

Annual Capacity (metric tons) |

||||||

|

|

|

|

|

North |

|

|

|

|

|

Product Area |

|

EAME(1) |

|

America |

|

APAC(2) |

|

Total |

|

TiO2 |

|

647,000 |

|

75,000 |

|

60,000 |

|

782,000 |

|

(1) |

“EAME” refers to Europe, Africa and the Middle East. |

|

(2) |

“APAC” refers to the Asia-Pacific region including India. |

12

Production capacities of our eight TiO2 manufacturing facilities are listed below. Approximately 80% of our TiO2 capacity is in Western Europe.

|

|

|

Annual Capacity (metric tons) |

||||||||

|

|

|

|

|

North |

|

|

|

|

|

|

|

Site |

|

EAME(1) |

|

America |

|

APAC |

|

Total |

|

Process |

|

Greatham, U.K. |

|

150,000 |

|

|

|

|

|

150,000 |

|

Chloride TiO2 |

|

Pori, Finland(3) |

|

130,000 |

|

|

|

|

|

130,000 |

|

Sulfate TiO2 |

|

Uerdingen, Germany |

|

107,000 |

|

|

|

|

|

107,000 |

|

Sulfate TiO2 |

|

Duisburg, Germany |

|

100,000 |

|

|

|

|

|

100,000 |

|

Sulfate TiO2 |

|

Huelva, Spain |

|

80,000 |

|

|

|

|

|

80,000 |

|

Sulfate TiO2 |

|

Scarlino, Italy |

|

80,000 |

|

|

|

|

|

80,000 |

|

Sulfate TiO2 |

|

Lake Charles, Louisiana(2) |

|

|

|

75,000 |

|

|

|

75,000 |

|

Chloride TiO2 |

|

Teluk Kalung, Malaysia |

|

|

|

|

|

60,000 |

|

60,000 |

|

Sulfate TiO2 |

|

Total |

|

647,000 |

|

75,000 |

|

60,000 |

|

782,000 |

|

|

|

(1) |

Excludes a sulfate plant in Umbogintwini, South Africa, which closed in the fourth quarter of 2016, and our TiO2 finishing plant in Calais, France. |

|

(2) |

This facility is owned and operated by Louisiana Pigment Company L.P. (“LPC”), a manufacturing joint venture that is owned 50% by us and 50% by Kronos Worldwide, Inc. (“Kronos”). The capacity shown reflects our 50% interest in LPC. |

|

(3) |

On January 30, 2017, our TiO2 manufacturing facility in Pori, Finland experienced fire damage and we continue to repair the facility. Prior to the fire, 60% of the site capacity produced specialty products which, on average, contributed greater than 75% of the site EBITDA from January 1, 2015 through January 30, 2017. The Pori facility had a nameplate capacity of 130,000 metric tons per year, which represented approximately 17% of our total TiO2 nameplate capacity and approximately 2% of total global TiO2 demand. We are currently operating at 20% of total prior capacity producing specialty products, and we intend to restore manufacturing of the balance of these more profitable specialty products by the end of 2018. The remaining 40% of site capacity is more commoditized and based on current market and economic conditions, associated costs and projected returns, we currently expect to rebuild this portion of the facility, but do not expect it to be reintroduced into the market prior to 2020. |

Performance Additives Segment

As of December 31, 2017, our Performance Additives segment had 18 manufacturing facilities operating in seven countries with a total nameplate production capacity of approximately 530,000 metric tons per year.

|

|

|

Annual Capacity (metric tons) |

||||||

|

|

|

|

|

North |

|

|

|

|

|

Product Area |

|

EAME |

|

America(1) |

|

APAC |

|

Total |

|

Functional additives |

|

100,000 |

|

|

|

|

|

100,000 |

|

Color pigments |

|

85,000 |

|

45,000 |

|

20,000 |

|

150,000 |

|

Timber treatment |

|

|

|

140,000 |

|

|

|

140,000 |

|

Water treatment |

|

140,000 |

|

|

|

|

|

140,000 |

|

Total |

|

325,000 |

|

185,000 |

|

20,000 |

|

530,000 |

|

(1) |

Excludes a color pigments plant in St. Louis, Missouri which was closed in the fourth quarter of 2017. |

Joint Ventures

LPC is our 50%-owned joint venture with Kronos. We share production offtake and operating costs of the plant with Kronos, though we market our share of the production independently. The operations of the joint venture are under the direction of a supervisory committee on which each partner has equal representation. Our investment in LPC is accounted for using the equity method.

13

Viance is our 50%-owned joint venture with Dow. Viance markets our timber treatment products. Our joint venture interest in Viance was acquired as part of the Rockwood acquisition. The joint venture sources all of its products through a contract manufacturing arrangement at our Harrisburg, North Carolina facility, and we bear a disproportionate amount of working capital risk of loss due to the supply arrangement whereby we control manufacturing on Viance’s behalf. As a result, we concluded that we are the primary beneficiary and began consolidating Viance upon the Rockwood acquisition.

Pacific Iron Products Sdn Bhd is our 50%-owned joint venture with Coogee Chemicals Pty. Ltd. that manufactures products for Venator. It was determined that the activities that most significantly impact its economic performance are raw material supply, manufacturing and sales. In this joint venture we supply all the raw materials through a fixed cost supply contract, operate the manufacturing facility and market the products of the joint venture to customers. Through a fixed price raw materials supply contract with the joint venture we are exposed to the risk related to the fluctuation of raw material pricing. As a result, we concluded that we are the primary beneficiary.

Raw Materials

Titanium Dioxide Segment

The primary raw materials used in our Titanium Dioxide segment are titanium-bearing ores.

|

|

|

Titanium Dioxide |

|

Primary raw materials |

|

Titanium-bearing ore, sulfuric acid, chlorine |

The primary raw materials that are used to produce TiO2 are various types of titanium feedstock, which include ilmenite, rutile, titanium slag (chloride slag and sulfate slag) and synthetic rutile. The world market for titanium-bearing ores has a diverse range of suppliers with the four largest accounting for approximately 40% of global supply. The majority of our titanium-bearing ores are sourced from India, Africa, Canada and Norway. Ore accounts for approximately 50% of TiO2 variable manufacturing costs, while utilities (electricity, gas and steam), sulfuric acid and chlorine collectively account for approximately 22% of variable manufacturing costs.

The majority of the titanium-bearing ores market is transacted on short-term contracts, or longer-term volume contracts with market-based pricing re-negotiated several times per year. This form of market-based ore contract provides flexibility and responsiveness in terms of pricing and quantity obligations. We expect that there may be modest increases in raw material costs in our Titanium Dioxide segment in the near term.

Performance Additives Segment

Our primary raw materials for our Performance Additives segment are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional |

|

Color Pigments |

|

Timber |

|

Water |

|

Primary raw materials |

|

Barium and zinc based inorganics |

|

Iron oxide particles, scrap iron, copperas, alkali |

|

DCOIT, copper, monoethanolamine |

|

Aluminum oxide |

The primary raw materials for functional additives production are barite and zinc. We currently source material barite from China, where we have long standing supplier relationships and pricing is negotiated largely on a purchase by purchase basis. The quality of zinc required for our business is mainly mined in Australia but can also be sourced from Canada and South America. The majority of our zinc is sourced from two key suppliers with whom we have long standing relationships.

We source our raw material for the majority of our color pigments business from China, the U.S., France and Italy. Key raw materials are iron powder and metal scrap that are sourced from various mid-size and smaller producers primarily on a spot contract basis.

14

The primary raw materials for our timber treatment business are dichloro-octylisothiazolinone (“DCOIT”) and copper. We source the raw materials for the majority of our timber treatment business from China and the U.S. DCOIT is sourced on a long term contract whereas copper is procured from various mid-size and larger producers primarily on a spot contract basis.

The primary raw materials for our water treatment business are aluminum hydroxide, hydrochloric acid and nitric acid, which are widely available from a number of sources and typically sourced through long-term contracts. We also use sulfuric acid which we source internally.

Competition

The global markets in which our business operates are highly competitive and vary according to segment.

Titanium Dioxide Segment

Competition within the standard grade TiO2 market is based on price, product quality and service. Our key competitors are The Chemours Company, Tronox Limited, Kronos and Cristal each of which is a major global producer with the ability to service all global markets and Henan, a Chinese TiO2 producer. If any of our current or future competitors develops proprietary technology that enables them to produce products at a significantly lower cost, our technology could be rendered uneconomical or obsolete. Moreover, the sulfate based TiO2 technology used by our Titanium Dioxide segment is widely available. Accordingly, barriers to entry, apart from capital availability, may be low and the entrance of new competitors into the industry may reduce our ability to capture improving margins in circumstances where capacity utilization in the industry is increasing.

Competition within the specialty TiO2 market and the color pigments market is based on customer service, technical expertise in the customers’ applications, product attributes (such as product form and quality), and price. Product quality is particularly critical in the technically demanding applications in which we focus as inconsistent product quality adversely impacts consistency in the end-product. Our primary competitors within specialty TiO2 include Fuji Titanium Industry, Kronos and Precheza.

Performance Additives Segment

Competition within the functional additives market is primarily based on application know-how, brand recognition, product quality and price. Key competitors for barium-based additives include Solvay S.A., Sakai Chemical Industry Co., Ltd., 20 Microns Ltd., and various Chinese barium producers. Key competitors for zinc-based additives include various Chinese lithopone producers.

Our primary competitors within color pigments include Lanxess AG, Cathay Pigments Group, Ferro Corporation and Shanghai Yipin Pigments Co., Ltd.

Competition within the timber treatment market is based on price, customer support services, innovative technology, including sustainable solutions and product range. Our primary competitors are Lonza Group and Koppers Inc. Competition within the water treatment market is based on proximity to customers and price. Our primary competitors are Kemira Oyj and Feralco Group.

Intellectual Property

Proprietary protection of our processes, apparatuses, and other technology and inventions is important to our businesses. When appropriate, we file patent and trademark applications, often on a global basis, for new product development technologies. For example, we have obtained patents and trademark registrations covering relevant jurisdictions for our new solar reflecting technologies (ALTIRIS® pigments) that are used to keep colored surfaces cooler when they are exposed to the sun. We own a total of approximately 978 issued patents and pending patent applications and 970 trademark registrations and applications for registration. Our patent portfolio includes

15

approximately 66 issued U.S. patents, 701 patents issued in countries outside the U.S., and 211 pending patent applications, worldwide.

We hold numerous patents and, while a presumption of validity exists with respect to issued U.S. patents, we cannot assure that any of our patents will not be challenged, invalidated, circumvented or rendered unenforceable. Furthermore, we cannot assure the issuance of any pending patent application, or that if patents do issue, that these patents will provide meaningful protection against competitors or against competitive technologies. Additionally, our competitors or other third parties may obtain patents that restrict or preclude our ability to lawfully produce or sell our products in a competitive manner.

We also rely upon unpatented proprietary know-how and continuing technological innovation and other trade secrets to develop and maintain our competitive position. There can be no assurance, however, that confidentiality and other agreements into which we enter and have entered will not be breached, that they will provide meaningful protection for our trade secrets or proprietary know-how, or that adequate remedies will be available in the event of an unauthorized use or disclosure of such trade secrets and know-how. In addition, there can be no assurance that others will not obtain knowledge of these trade secrets through independent development or other access by legal means.

In addition to our own patents, patent applications, proprietary trade secrets and know-how, we are a party to certain licensing arrangements and other agreements authorizing us to use trade secrets, know-how and related technology and/or operate within the scope of certain patents owned by other entities. We also have licensed or sub-licensed intellectual property rights to third parties.

Certain of our products are well-known brand names. Some of these registrations and applications include filings under the Madrid system for the international registration of marks and may confer rights in multiple countries. However, there can be no assurance that the trademark registrations will provide meaningful protection against the use of similar trademarks by competitors, or that the value of our trademarks will not be diluted. In our Titanium Dioxide segment, we consider our TIOXIDE®, HOMBITAN®, HOMBITEC®, UVTITAN®, HOMBIKAT™, DELTIO® and ALTIRIS® trademarks to be valuable assets. In our Performance Additives segment, we consider BLANC FIXE™, GRANUFIN®, SACHTOLITH®, FERROXIDE®, ECOLIFE™ and NICASAL® trademarks to be valuable assets.

Please also see the section entitled “Part III. Item 13. Certain Relationships and Related Party Transactions, and Director Independence.”

Research and Development

We support our businesses with a major commitment to research and development, technical services and process engineering improvement. We believe innovation is critical in providing customer satisfaction and in maintaining sustainability and competitiveness in markets in which we participate. Our research and development and technical services facilities are in Wynyard, U.K. and Duisburg, Germany. Much of our research and development is focused on solutions that address significant emerging trends in the market.

The research and development team maintains a vibrant pipeline of new developments that are closely aligned with the needs of our customers. Approximately 7% of the 2017 revenues generated by TiO2 originate from products launched in the last five years. In the specialty markets, which have demanding and dynamic requirements, more than 19% of revenues are generated from products commercialized in the last five years. We believe we are recognized by our customers as the leading innovator in applications such as printing inks, performance plastics, cosmetics, food and fibers, and we believe they view our products in these applications as benchmarks in the industry. Our innovations include the development of different pigmentary properties, such as enhanced glossiness and opacity in ink products, as well as new dosage forms of TiO2. In addition, our expertise has also enabled us to unlock additional functionality from the TiO2 crystal and our teams are at the leading edge of innovations in UV absorption technology that is critical to the development of sunscreens, as well as the optimization of TiO2 particles for use in catalytic processes that strip pollutants from exhaust gases and help to remove nitrogen and sulfur contaminants from refinery process streams.

16

For the years ended December 31, 2017, 2016 and 2015, we spent $16 million, $15 million and $17 million, respectively, on research and development.

Geographic Data

For sales revenue and long-lived assets by geographic areas, see “Part II. Item 8. Financial Statements and Supplementary Data—Note 24. Operating Segment Information” of this report.

Environmental, Health and Safety Matters

General

We are subject to extensive federal, state, local and international laws, regulations, rules and ordinances relating to occupational health and safety, process safety, pollution, protection of the environment and natural resources, product management and distribution, and the generation, storage, handling, transportation, treatment, disposal and remediation of hazardous substances and waste materials. In the ordinary course of business, we are subject to frequent environmental inspections and monitoring and occasional investigations by governmental enforcement authorities. In the U.S., these laws include the Resource Conservation and Recovery Act (“RCRA”), the Occupational Safety and Health Act, the Clean Air Act (“CAA”), the Clean Water Act, the Safe Drinking Water Act, and Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), as well as the state counterparts of these statutes.

In addition, our production facilities require operating permits that are subject to renewal, modification and, in certain circumstances, revocation. Actual or alleged violations of safety laws, environmental laws or permit requirements could result in restrictions or prohibitions on plant operations or product distribution, substantial civil or criminal sanctions, or injunctions limiting or prohibiting our operations altogether. In addition, some environmental laws may impose liability on a strict, joint and several basis. Moreover, changes in environmental regulations could inhibit or interrupt our operations, or require us to modify our facilities or operations and make significant environmental compliance expenditures. Accordingly, environmental or regulatory matters may cause us to incur significant unanticipated losses, costs or liabilities. Information related to EHS matters may also be found in other areas of this report including “Item 1A. Risk Factors,” and “Part II, Item 8, Financial Statements—Note 21. Commitments and Contingencies—Other Proceedings and Note 22. Environmental, Health and Safety Matters.”

We are subject to a wide array of laws governing chemicals, including the regulation of chemical substances and inventories under the Toxic Substances Control Act (“TSCA”) in the U.S., the Registration, Evaluation and Authorization of Chemicals (“REACH”) in Europe and the Classification, Labelling and Packaging Regulation (“CLP”) regulation in Europe. Analogous regimes exist in other parts of the world, including China, South Korea, and Taiwan. In addition, a number of countries where we operate, including the U.K., have adopted rules to conform chemical labeling in accordance with the globally harmonized system. Many of these foreign regulatory regimes are in the process of a multi-year implementation period for these rules. For example, the Globally Harmonised System (“GHS”) established a uniform system for the classification, labeling and packaging of certain chemical substances and the European Chemicals Agency (“ECHA”) is currently in the process of determining if certain chemicals should be proposed to the European Commission to receive a carcinogenic classification.

Certain of our products are being evaluated under CLP regulation and their classification could negatively impact sales. On May 31, 2016, the French Agency for Food, Environmental and Occupational Health and Safety (“ANSES”) submitted a proposal to ECHA that would classify TiO2 as a Category 1B Carcinogen classification presumed to have carcinogenic potential for humans by inhalation. We, together with other companies, relevant trade associations and the European Chemical Industry Council (“Cefic”), submitted comments opposing any classification of TiO2 as carcinogenic, based on evidence from multiple epidemiological studies covering more than 24,000 production workers at 18 TiO2 manufacturing sites over several decades that found no increased incidence of lung cancer as a result of workplace exposure to TiO2 and other scientific studies that concluded that the response to lung overload studies with poorly soluble particles upon which the ANSES proposed classification is based is unique to the rat and is not seen in other animal species or humans. On June 8, 2017, ECHA’s Committee for Risk Assessment (“RAC”) announced its conclusion that certain evidence meets the criteria under CLP to classify TiO2 as a Category 2 Carcinogen (described by

17

the EU regulation as appropriate for “suspected human carcinogens”) for humans by inhalation, but found such evidence not sufficiently convincing to classify TiO2 in Category 1B (“presumed” to have carcinogenic potential for humans), as was originally proposed by ANSES. The RAC formally adopted the conclusion on September 14, 2017. The European Commission will now evaluate the RAC report in deciding what, if any, regulatory measures should be taken. We, Cefic and others expect to continue to advocate with the European Commission that the RAC’s report should not justify other than minimal regulatory measures for the reasons stated above, among others. If the European Commission were to subsequently adopt the Category 2 Carcinogen classification, it could require that many end-use products manufactured with TiO2 be classified as containing a potential carcinogenic component, which could negatively impact public perception of products containing TiO2, limit the marketability of and demand for TiO2 or products containing TiO2 and potentially have spill-over, restrictive effects under other EU laws, e.g., those affecting medical and pharmaceutical applications, cosmetics, food packaging and food additives. Such classifications would also affect manufacturing operations by subjecting us to new workplace safety requirements that could significantly increase costs. Finally, the classification of TiO2 as a Category 2 Carcinogen could lead the ECHA to evaluate other products with similar particle size characteristics such as iron oxides or functional additives for carcinogenic potential by inhalation for humans as well, which may ultimately have similar negative impacts to other of our products if classified as potentially carcinogenic. In addition, under the separation agreement, we are required to indemnify Huntsman for any liabilities relating to our TiO2 operations.

Environmental, Health and Safety Systems

We are committed to achieving and maintaining compliance with all applicable EHS legal requirements, and we have developed policies and management systems that are intended to identify the multitude of EHS legal requirements applicable to our operations, enhance compliance with applicable legal requirements, improve the safety of our employees, contractors, community neighbors and customers and minimize the production and emission of wastes and other pollutants. We cannot guarantee, however, that these policies and systems will always be effective or that we will be able to manage EHS legal requirements without incurring substantial costs. Although EHS legal requirements are constantly changing and are frequently difficult to comply with, these EHS management systems are designed to assist us in our compliance goals while also fostering efficiency and improvement and reducing overall risk to us.

Environmental Remediation

We have incurred, and we may in the future incur, liability to investigate and clean up waste or contamination at our current or former facilities or facilities operated by third parties at which we may have disposed of waste or other materials. Similarly, we may incur costs for the cleanup of waste that was disposed of prior to the purchase of our businesses. Under some circumstances, the scope of our liability may extend to damages to natural resources. Based on available information, we believe that the costs to investigate and remediate known contamination will not have a material effect on our financial statements. At the current time, we are unable to estimate the total cost to remediate contaminated sites.

Under CERCLA and similar state laws, a current or former owner or operator of real property in the U.S. may be liable for remediation costs regardless of whether the release or disposal of hazardous substances was in compliance with law at the time it occurred, and a current owner or operator may be liable regardless of whether it owned or operated the facility at the time of the release. Outside the U.S., analogous contaminated property laws, such as those in effect in France, can hold past owners and/or operators liable for remediation at former facilities. We have not been notified by third parties of claims against us for cleanup liabilities at former facilities or third party sites, including, but not limited to, sites listed under CERCLA.

Under the RCRA in the U.S. and similar state laws, we may be required to remediate contamination originating from our properties as a condition to our hazardous waste permit. Some of our manufacturing sites have an extended history of industrial chemical manufacturing and use, including on-site waste disposal. We are aware of soil, groundwater or surface contamination from past operations at some of our sites, and we may find contamination at other sites in the future. Similar laws exist in a number of locations in which we currently operate, or previously operated, manufacturing facilities.

18

The EU has recently announced a review of the Environmental Liability Directive (“ELD”) and a continuation of the soil thematic strategy. Two potential aims of these initiatives are the inclusion of historically contaminated sites into the scope of the ELD and making soil an environmental receptor. These changes could have a negative impact on our assets and liabilities by designating soils containing substances as being contaminated that are not now so designated. These sites would then require investigation and potential remediation.

The Chinese Law on Soil Pollution Prevention and Control is expected in 2018 and may designate soil as a receptor capable of being harmed by contaminating substances. The implications are that such soils would require investigation and potential remediation.

Climate Change

Globally, our operations are increasingly subject to regulations that seek to reduce emissions of Greenhouse Gases (“GHGs”), such as carbon dioxide and methane, which may be contributing to changes in the earth’s climate. At the Durban negotiations of the Conference of the Parties to the Kyoto Protocol in 2012, a limited group of nations, including the EU, agreed to a second commitment period for the Kyoto Protocol, an international treaty that provides for reductions in GHG emissions. More significantly, the EU Emissions Trading System (“ETS”), established pursuant to the Kyoto Protocol to reduce GHG emissions in the EU, continues in its third phase. The European Parliament has used a process to formalize “backloading”—the withholding of GHG allowances during 2012‑2016 until 2019‑2020—to prop up carbon prices. As backloading is only a temporary measure, a sustainable solution to the imbalance between supply and demand requires structural changes to the ETS. The European Commission proposed to establish a market stability reserve to address the current surplus of allowances and improve the system’s resilience. The reserve will start operating in 2019, although recently the European Commission has indicated that it may move up the reserves start date and increase the rate at which the reserve removes allowances from the ETS. In addition, the EU has recently announced the binding target to reduce domestic GHG emissions by at least 40% below the 1990 level by 2030. The EU has set a binding target of increasing the share of renewable energy to at least 27% of the EU’s energy consumption by 2030, and additional proposals have been made to increase the target to 35%.

In addition, at the 2015 United Nations Framework Convention on Climate Change in Paris, the U.S. and nearly 200 other nations entered into an international climate agreement, which entered into effect in November 2016 (the “Paris Agreement”). Although the agreement does not create any binding obligations for nations to limit their GHG emissions, it does include pledges to voluntarily limit or reduce future emissions. However, in August 2017 the U.S. informed the United Nations that it is withdrawing from the Paris Agreement. The Paris Agreement provides for a four year exit process.

Federal climate change legislation in the U.S. appears unlikely in the near‑term. As a result, domestic efforts to curb GHG emissions will continue to be led by the U.S. Environmental Protection Agency’s (the “EPA”) GHG regulations and similar programs of certain states. To the extent that our domestic operations are subject to the EPA’s GHG regulations and/or state GHG regulations, we may face increased capital and operating costs associated with new or expanded facilities. Significant expansions of our existing facilities or construction of new facilities may be subject to the CAA’s requirements for pollutants regulated under the Prevention of Significant Deterioration and Title V programs. Some of our facilities are also subject to the EPA’s Mandatory Reporting of Greenhouse Gases rule, and any further regulation may increase our operational costs.

The EPA previously issued its final Clean Power Plan rules that establish carbon pollution standards for power plants, called CO2 emission performance rates, in 2015. The Clean Power Plan is currently being challenged in the D.C. Circuit. The EPA formally proposed to repeal the Clean Power Plan on October 10, 2017, and issued a notice on December 18, 2017 seeking comments on a potential future replacement rule. The proposed rule states that EPA has not yet determined whether the agency will propose a new rule to regulate GHG emissions from power plants, but that it will make a decision within the near future. Several states have already announced their intention to challenge any repeal of the Clean Power Plan. It is not yet clear what changes, if any, will result from the EPA’s proposal, whether or how the courts will rule on the legality of the Clean Power Plan, the EPA’s repeal of the rules, or any future replacement. If the EPA successfully repeals the Clean Power Plan, individual states could independently pursue similar rules. Regulation of GHG emissions from the power sector has the ability to affect the long-term price and supply of electricity and natural

19

gas and demand for products that contribute to energy efficiency and renewable energy. This in turn could result in increased costs to purchase energy, additional capital costs for installation or modification of GHG emitting equipment, and additional costs associated directly with GHG emissions (such as cap and trade systems or carbon taxes), which are primarily related to energy use. Future regulation of GHGs has the potential to increase our operating costs.

We are already managing and reporting GHG emissions, to varying degrees, as required by law for our sites in locations subject to Kyoto Protocol obligations and/or ETS requirements. Although these sites are subject to existing GHG legislation, few have experienced or anticipate significant cost increases as a result of these programs, although it is possible that GHG emission restrictions may increase over time. Potential consequences of such restrictions include capital requirements to modify assets to meet GHG emission restrictions and/or increases in energy costs above the level of general inflation, as well as direct compliance costs. Currently, however, it is not possible to estimate the likely financial impact of potential future regulation on any of our sites.

Finally, it should be noted that some scientists have concluded that increasing concentrations of GHGs in the earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts, floods and other extreme climatic events. If any of those effects were to occur, they could have an adverse effect on our assets and operations. For example, our operations in low lying areas may be at increased risk due to flooding, rising sea levels or disruption of operations from more frequent and severe weather events.

Employees

As of December 31, 2017, we employed approximately 4,500 associates in our operations around the world. We believe our relations with our employees are good.

Executive Officers of the Registrant

The following table sets forth information, as of February 23, 2018, regarding the individuals who are our executive officers.

|

Name |

|

Age |

|

Position(s) at Venator |

|

Simon Turner |

|

54 |

|

President and Chief Executive Officer |

|

Kurt Ogden |

|

49 |

|

Senior Vice President and Chief Financial Officer |

|

Russ Stolle |

|

55 |

|

Senior Vice President, General Counsel and Chief Compliance Officer |

|

Mahomed Maiter |

|

56 |

|

Senior Vice President, White Pigments |

|

Jan Buberl |

|

42 |

|

Vice President, Color Pigments and Timber Treatment |

|

Antje Gerber |

|

51 |

|

Vice President, Specialty Business |

|

Phil Wrigley |

|

51 |

|

Vice President, EHS and Manufacturing Excellence |

Simon Turner has served as President and Chief Executive Officer and as a director of Venator since the second quarter of 2017. Mr. Turner served as Division President, Pigments & Additives, at Huntsman from November 2008 to August 2017, Senior Vice President, Pigments & Additives, from April 2008 to November 2008, Vice President of Global Sales from September 2004 to April 2008 and General Manager Co-Products and Director Supply Chain and Shared Services from July 1999 to September 2004. Prior to joining Huntsman, Mr. Turner held various positions with Imperial Chemical Industries PLC (“ICI”).