UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

|

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

|

|

Not Applicable |

|

( State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of August 4, 2022, the registrant had

Table of Contents

|

|

|

Page |

|

PART I. |

|

|

|

Item 1. |

1 |

|

|

|

1 |

|

|

|

Condensed Consolidated Statements of Income (Loss) and Comprehensive Income (Loss) |

2 |

|

|

3 |

|

|

|

4 |

|

|

|

Notes to Unaudited Condensed Consolidated Financial Statements |

5 |

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

12 |

|

Item 3. |

23 |

|

|

Item 4. |

23 |

|

|

PART II. |

|

|

|

Item 1. |

24 |

|

|

Item 1A. |

24 |

|

|

Item 2. |

60 |

|

|

Item 5. |

61 |

|

|

Item 6. |

62 |

|

|

|

63 |

i

Summary of the Material and Other Risks Associated with Our Business

Our business is subject to numerous material and other risks and uncertainties. You should carefully consider the following information about these risks, together with the other information appearing elsewhere in this Quarterly Report, including our financial statements and related notes hereto. The occurrence of any of the following risks could have a material adverse effect on our business, financial condition, results of operations and future growth prospects. The risks and uncertainties described below may change over time and other risks and uncertainties, including those that we do not currently consider material, may impair our business. These risks include, but are not limited to, the following:

|

|

• |

We have incurred losses in certain years since inception and we may not be able to generate sufficient revenue to maintain profitability. |

|

|

• |

Our quarterly and annual operating results have fluctuated significantly in the past and may fluctuate significantly in the future, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations. |

|

|

• |

Our commercial success depends on the quality of our antibody discovery platform and technological capabilities and their acceptance by new and existing partners in our market. |

|

|

• |

If we cannot maintain and expand current partnerships and agreements and enter new partnership agreements that generate discovery programs for antibodies, our business could be adversely affected. |

|

|

• |

In recent periods, we have depended on a limited number of partners for our revenue, the loss of any of which could have an adverse impact on our business. |

|

|

• |

Development of a biologic molecule is inherently uncertain, and it is possible that none of the drug candidates discovered using our antibody discovery platform that are further developed by our partners will receive marketing approval or become viable commercial products, on a timely basis or at all. |

|

|

• |

The failure of our partners to meet their contractual obligations to us could adversely affect our business. |

|

|

• |

We may be unable to manage our current and future growth effectively, which could make it difficult to execute on our business strategy. |

|

|

• |

We have invested, and expect to continue to invest, in research and development efforts that further enhance our antibody discovery platform. Such investments in technology are inherently risky and may affect our operating results. If the return on these investments is lower or develops more slowly than we expect, our revenue and operating results may suffer. |

|

|

• |

Our partners have significant discretion in determining when and whether to make announcements, if any, about the status of our partnerships, including about clinical developments and timelines for advancing collaborative programs with the antibodies that we have discovered, and the price of our common shares may decline as a result of announcements of unexpected results or developments. |

|

|

• |

Our partners may not achieve projected discovery and development milestones and other anticipated key events in the expected timelines or at all, which could have an adverse impact on our business and could cause the price of our common shares to decline. |

|

|

• |

The life sciences and biotech platform technology market is highly competitive, and if we cannot compete successfully with our competitors, we may be unable to increase or sustain our revenue, or sustain profitability. |

|

|

• |

Our business has been and may continue to be adversely affected by the COVID-19 pandemic. |

|

|

• |

The ongoing military action between Russia and Ukraine and related sanctions could adversely affect our business, financial condition, and patent administration. |

|

|

• |

Our success depends on our ability to protect our intellectual property. |

|

|

• |

If we fail to establish and maintain proper and effective internal control over financial reporting, our operating results and our ability to operate our business could be harmed. |

|

|

• |

Sales of a substantial number of our common shares in the public market could cause our share price to fall significantly, even if our business is doing well. |

Investing in our common shares involves a high degree of risk. You should carefully consider the risks and uncertainties contained in Part II, Item 1A, Risk Factors, together with all other information in this Quarterly Report on Form 10-Q, including our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as our other filings with the Securities and Exchange Commission, or the SEC, before investing in our common stock. Any of the risk factors we describe below under Part II, Item 1A, Risk Factors, could adversely affect our business, financial condition or results of operations. The market price of our common stock could decline if one or more of these risks or uncertainties were to occur, which may cause you to lose all or part of the money you paid to buy our common shares. Additional risks that are currently unknown to us or that we currently believe to be immaterial may also impair our business. Certain statements below are forward-looking statements. See “Forward-Looking Information” in this Quarterly Report on Form 10-Q.

ii

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

AbCellera Biologics Inc.

Condensed Consolidated Balance Sheets

(All figures in U.S. dollars. Amounts are expressed in thousands except share data)

(Unaudited)

|

|

|

December 31, 2021 |

|

|

June 30, 2022 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

|

|

|

$ |

|

|

|

Marketable securities |

|

|

|

|

|

|

|

|

|

Total cash, cash equivalents, and marketable securities |

|

|

|

|

|

|

|

|

|

Accounts and accrued receivable |

|

|

|

|

|

|

|

|

|

Restricted cash |

|

|

|

|

|

|

|

|

|

Other current assets |

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

|

|

|

|

|

|

|

Long-term assets: |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

|

|

|

|

|

Intangible assets, net |

|

|

|

|

|

|

|

|

|

Goodwill |

|

|

|

|

|

|

|

|

|

Investments in and loans to equity accounted investees |

|

|

|

|

|

|

|

|

|

Other long-term assets |

|

|

|

|

|

|

|

|

|

Total long-term assets |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

|

|

|

$ |

|

|

|

Liabilities and shareholders' equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and other liabilities |

|

$ |

|

|

|

$ |

|

|

|

Current portion of contingent consideration payable |

|

|

|

|

|

|

|

|

|

Income taxes payable |

|

|

|

|

|

|

|

|

|

Accrued royalties payable |

|

|

|

|

|

|

|

|

|

Deferred revenue |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

|

|

|

|

Long-term liabilities: |

|

|

|

|

|

|

|

|

|

Operating lease liability |

|

|

|

|

|

|

|

|

|

Deferred revenue and grant funding |

|

|

|

|

|

|

|

|

|

Contingent consideration payable |

|

|

|

|

|

|

|

|

|

Deferred tax liability |

|

|

|

|

|

|

|

|

|

Other long-term liabilities |

|

|

|

|

|

|

|

|

|

Total long-term liabilities |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

Common shares: par value, unlimited authorized shares at December 31, 2021 and June 30, 2022: |

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

|

|

|

|

|

|

|

Accumulated other comprehensive income |

|

|

|

|

|

|

|

|

|

Accumulated earnings |

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

|

$ |

|

|

|

$ |

|

|

|

Subsequent events |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

AbCellera Biologics Inc.

Condensed Consolidated Statements of Income (Loss) and Comprehensive Income (Loss)

(All figures in U.S. dollars. Amounts are expressed in thousands except share and per share data)

(Unaudited)

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

||||||||||

|

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research fees |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Licensing revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Milestone payments |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

Royalty revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Other (income) expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (income) expense |

|

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Grants and incentives |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Total other (income) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Net earnings (loss) before income tax |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Income tax (recovery) expense |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Net earnings (loss) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

$ |

|

|

|

Foreign currency translation adjustment |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) per share attributable to common shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

$ |

|

|

|

Diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

$ |

|

|

|

Weighted-average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

2

AbCellera Biologics Inc.

Condensed Consolidated Statements of Stockholders’ Equity

(All figures in U.S. dollars. Amounts are expressed in thousands except share data)

(Unaudited)

|

|

|

Common Shares |

|

|

Additional Paid-in |

|

|

Accumulated |

|

|

Accumulated Other Comprehensive |

|

|

Total Shareholders' |

|

|||||||||

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Earnings |

|

|

Income |

|

|

Equity |

|

||||||

|

Balances as of December 31, 2021 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Shares issued and restricted stock units ("RSUs") vested under stock option plan |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Stock-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Net earnings |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Balances as of March 31, 2022 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Shares issued and restricted stock units ("RSUs") vested under stock option plan |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Stock-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

- |

|

|

|

( |

) |

|

Balances as of June 30, 2022 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

Common Shares |

|

|

Additional Paid-in |

|

|

Accumulated |

|

|

Accumulated Other Comprehensive |

|

|

Total Shareholders' |

|

|||||||||

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Earnings |

|

|

Income |

|

|

Equity |

|

||||||

|

Balances as of December 31, 2020 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

- |

|

|

$ |

|

|

|

Shares issued under stock option plan |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Stock-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Reclassification of liability classified options |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Net earnings |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Balances as of March 31, 2021 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

- |

|

|

$ |

|

|

|

Shares issued under stock option plan |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Share-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Reclassification of liability classified options |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

- |

|

|

|

( |

) |

|

Balances as of June 30, 2021 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

AbCellera Biologics Inc.

Condensed Consolidated Statements of Cash Flows

(Expressed in thousands of U.S. dollars)

(Unaudited)

|

|

|

Six months ended June 30, |

|

|||||

|

|

|

2021 |

|

|

2022 |

|

||

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

|

|

|

$ |

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation of property and equipment |

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

|

|

|

|

|

|

|

|

Amortization of operating lease right-of-use assets |

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

( |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts and accrued research fees receivable |

|

|

( |

) |

|

|

( |

) |

|

Accrued royalties receivable |

|

|

|

|

|

|

|

|

|

Income taxes payable |

|

|

( |

) |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

( |

) |

|

|

( |

) |

|

Deferred revenue |

|

|

|

|

|

|

( |

) |

|

Accrued royalties payable |

|

|

( |

) |

|

|

|

|

|

Deferred grant revenue |

|

|

|

|

|

|

|

|

|

Other assets |

|

|

( |

) |

|

|

( |

) |

|

Net cash provided by operating activities |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

( |

) |

|

|

( |

) |

|

Purchase of marketable securities |

|

|

- |

|

|

|

( |

) |

|

Proceeds from marketable securities |

|

|

- |

|

|

|

|

|

|

Receipt of grant funding |

|

|

|

|

|

|

|

|

|

Long-term investments and other assets |

|

|

( |

) |

|

|

( |

) |

|

Investment in and loans to equity accounted investees |

|

|

( |

) |

|

|

( |

) |

|

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Repayment of long-term debt and contingent consideration |

|

|

( |

) |

|

|

( |

) |

|

Proceeds from debt and exercise of stock options |

|

|

|

|

|

|

|

|

|

Payment of liability for in-licensing agreement |

|

|

( |

) |

|

|

( |

) |

|

Net cash used in financing activities |

|

|

( |

) |

|

|

( |

) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

( |

) |

|

|

( |

) |

|

Increase in cash and cash equivalents |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash, beginning of period |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash, end of period |

|

$ |

|

|

|

$ |

|

|

|

Restricted cash included in other assets |

|

|

- |

|

|

|

( |

) |

|

Total cash, cash equivalents and restricted cash shown in the statement of cash flows |

|

$ |

|

|

|

$ |

|

|

|

Supplemental disclosure of non-cash investing and financing activities |

|

|

|

|

|

|

|

|

|

Property plant and equipment in accounts payable |

|

|

- |

|

|

|

|

|

|

Right-of-use assets obtained in exchange for operating lease obligation |

|

|

|

|

|

|

( |

) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

AbCellera Biologics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(All figures in U.S. dollars. Amounts are expressed in thousands except share data)

(Unaudited)

1. Nature of operations

AbCellera Biologics Inc.’s (the “Company”) mission is to improve health with technologies that transform the way that antibody-based therapies are discovered. The Company aims to become the centralized operating system for next generation antibody discovery. The Company’s full-stack, AI-powered antibody discovery platform searches and analyzes the database of natural immune systems to find antibodies that can be developed as drugs. The Company believes its technology increases the speed and the probability of success of therapeutic antibody discovery, including enabling discovery against targets that may otherwise be intractable. The Company forges partnerships with drug developers of all sizes, from large cap pharmaceutical to small biotechnology companies.

2.

The accompanying unaudited interim condensed consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) and pursuant to the rules and regulations of the SEC for interim financial information. Accordingly, these financial statements do not include all the information and footnotes required for complete financial statements and should be read in conjunction with the audited consolidated financial statements of the Company and the accompanying notes thereto for the year ended December 31, 2021.

These unaudited interim condensed consolidated financial statements reflect all adjustments, consisting solely of normal recurring adjustments, which, in the opinion of management, are necessary for a fair presentation of results for the interim periods presented. The results of operations for the three and six months ended June 30, 2021 and 2022 are not necessarily indicative of results that can be expected for a full year. These unaudited interim condensed consolidated financial statements follow the same significant accounting policies as those described in the notes to the audited consolidated financial statements of the Company for the year ended December 31, 2021.

All amounts expressed in these condensed consolidated financial statements of the Company and the accompanying notes thereto are expressed in thousands of U.S. dollars, except for share data and where otherwise indicated. References to “$” are to U.S. dollars and references to “C$” and “CAD” are to Canadian dollars.

3. Significant accounting policies

Use of estimates

The preparation of the consolidated financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Areas of significant estimates include, but are not limited to, revenue recognition including evaluating whether contractual obligations represent distinct performance obligations, determining whether an option for additional goods or services represents a material right, allocating the transaction price to performance obligations within a contract, and assessing the recognition and possible future reversal of variable consideration, the fair value of acquired intangible assets, contingent consideration payable, and the estimates of stock-based compensation awards. The Company bases its estimates on historical experience, known trends and other market-specific or other relevant factors that it believes to be reasonable under the circumstances. On an ongoing basis, management evaluates its estimates when there are changes in circumstances, facts and experience. Changes in estimates are recorded in the period in which they become known. Actual results could significantly differ from those estimates.

COVID-19 Pandemic

With the global spread of the ongoing COVID-19 pandemic, the Company has implemented business continuity plans designed to address and mitigate the impact of the COVID-19 pandemic on its employees and its business. The Company has taken measures to secure its research and development activities, while work in its laboratories and facilities has been re-organized to reduce risk of COVID-19 transmission. Given the global economic impact, the overall disruption of global healthcare systems and the other risks and uncertainties associated with the pandemic, the Company’s business, financial condition, and results of operations could be materially adversely affected. The Company continues to closely monitor the COVID-19 pandemic as it evolves its business continuity plans and response strategy. As of the date of these condensed consolidated financial statements, the Company is not aware of any specific event or circumstance that would require the Company to update its estimates, assumptions and judgments or revise the

5

carrying value of its assets or liabilities. Actual results could differ from these estimates, and any such differences may be material to the Company’s condensed consolidated financial statements.

Recent accounting pronouncements not yet adopted

The Company has reviewed recent accounting pronouncements and concluded that they are either not applicable to the Company or that there was no material impact or no material impact is expected in the condensed consolidated financial statements as a result of future adoption.

4. Net earnings (loss) per share

Basic and diluted net earnings (loss) per share attributable to common shareholders was calculated as follows:

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

||||||||||

|

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

||||

|

Basic earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) attributable to common shareholders - basic |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

$ |

|

|

|

Weighted-average common shares outstanding - basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) per share attributable to common shareholders - basic |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) attributable to common shareholders - diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

$ |

|

|

|

Weighted-average common shares outstanding - basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock options and RSUs |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding - diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) per share attributable to common shareholders - diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

$ |

|

|

The Company’s potentially dilutive securities, which include stock options and restricted share units (“RSUs”), have been excluded from the computation of diluted net loss per share for the three months ended June 30, 2021 and June 30, 2022, as the effect would be to reduce the net loss per share. Therefore, the weighted-average number of common shares outstanding for the three months ended June 30, 2021 and June 30, 2022 used to calculate both basic and diluted net loss per share attributable to common shareholders is the same.

The Company excluded

5. Property and equipment, net

Property and equipment, net consisted of the following:

|

|

|

December 31, 2021 |

|

|

June 30, 2022 |

|

||

|

Computers |

|

$ |

|

|

|

$ |

|

|

|

Land |

|

|

|

|

|

|

|

|

|

Laboratory equipment |

|

|

|

|

|

|

|

|

|

Leasehold improvements |

|

|

|

|

|

|

|

|

|

Operating lease right-of-use assets |

|

|

|

|

|

|

|

|

|

Property and equipment |

|

|

|

|

|

|

|

|

|

Less accumulated depreciation |

|

|

( |

) |

|

|

( |

) |

|

Property and equipment, net |

|

$ |

|

|

|

$ |

|

|

6

As of December 31, 2021 and June 30, 2022, leasehold improvements include tenant improvements in progress that have not commenced depreciation in the amount of $

6. Intangible assets

Intangible assets consisted of the following:

|

|

|

June 30, 2022 |

|

|||||||||

|

|

|

Gross carrying amount |

|

|

Accumulated amortization |

|

|

Net book value |

|

|||

|

License |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Technology |

|

|

|

|

|

|

|

|

|

|

|

|

|

IPR&D |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

Amortization expense on intangible assets is estimated to be as follows for each of the next five years ended June 30:

|

|

|

Amortization Expense |

|

|

|

2023 |

|

$ |

|

|

|

2024 |

|

|

|

|

|

2025 |

|

|

|

|

|

2026 |

|

|

|

|

|

2027 |

|

|

|

|

|

|

|

$ |

|

|

7. Investments in and loans to equity accounted investees

The Company has entered into

In March, 2021, the Company made a commitment of up to CAD $

In June 2022, the Company made a commitment to Beedie for a land loan of up to CAD $

Subsequent to June 30, 2022, the Company entered into an agreement of up to CAD $

7

8. Accounts payable and other liabilities

Accounts payable and other liabilities consisted of the following:

|

|

|

December 31, 2021 |

|

|

June 30, 2022 |

|

||

|

Accounts payable and accrued liabilities |

|

$ |

|

|

|

$ |

|

|

|

Liability for in-licensing agreement |

|

|

|

|

|

|

- |

|

|

Operating lease liability |

|

|

|

|

|

|

|

|

|

Payroll liabilities |

|

|

|

|

|

|

|

|

|

Current portion of deferred grant funding |

|

|

|

|

|

|

|

|

|

Total accounts payable and other liabilities |

|

$ |

|

|

|

$ |

|

|

9. Shareholders’ equity

Sixth Amended and Restated Stock Option Plan:

The Company maintains the AbCellera Biologics Inc. Sixth Amended and Restated Stock Option Plan and our Pre-IPO Plan. Any awards granted under the Pre-IPO Plan will remain subject to the terms of our Pre-IPO Plan and applicable award agreements.

2020 Share Option and Incentive Plan:

Our 2020 Share Option and Incentive Plan, or 2020 Plan, was approved by our board of directors on November 18, 2020, and approved by our shareholders on December 1, 2020.

As of June 30, 2022, the number of shares available for issuance under the 2020 Plan was

The following table summarizes the Company’s stock option activity under the Pre-IPO Plan since December 31, 2021:

|

|

|

Number of Shares |

|

|

Weighted- Average Exercise Price |

|

||

|

Outstanding as of December 31, 2021 |

|

|

|

|

|

$ |

|

|

|

Granted |

|

|

- |

|

|

|

- |

|

|

Exercised |

|

|

( |

) |

|

|

|

|

|

Forfeited |

|

|

( |

) |

|

|

|

|

|

Outstanding as of June 30, 2022 |

|

|

|

|

|

$ |

|

|

|

Options exercisable as of June 30, 2022 |

|

|

|

|

|

|

|

|

The following table summarizes the Company’s stock option activity under the 2020 Plan since December 31, 2021:

|

|

|

Number of Shares |

|

|

Weighted- Average Exercise Price |

|

||

|

Outstanding as of December 31, 2021 |

|

|

|

|

|

$ |

|

|

|

Granted |

|

|

|

|

|

|

|

|

|

Exercised |

|

|

- |

|

|

|

- |

|

|

Forfeited |

|

|

( |

) |

|

|

|

|

|

Outstanding as of June 30, 2022 |

|

|

|

|

|

$ |

|

|

|

Options exercisable as of June 30, 2022 |

|

|

|

|

|

|

|

|

8

As part of the 2020 Plan, restricted share units (RSUs) were available to be granted and are subject to annual vesting.

|

|

|

Number of Shares |

|

|

Weighted- Average Grant Date Fair Value |

|

||

|

Outstanding as of December 31, 2021 |

|

|

|

|

|

$ |

|

|

|

Granted |

|

|

|

|

|

|

|

|

|

Vested and settled |

|

|

( |

) |

|

|

|

|

|

Forfeited |

|

|

( |

) |

|

|

|

|

|

Outstanding as of June 30, 2022 |

|

|

|

|

|

$ |

|

|

Stock-based compensation:

Stock-based compensation expense was classified in the condensed consolidated statements of income (loss) and comprehensive income (loss) as follows:

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

||||||||||

|

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

||||

|

Research and development |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Sales and marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

10. Revenue

The disaggregated revenue categories are presented on the face of the condensed consolidated statements of income (loss) and comprehensive income (loss).

Deferred revenue

Deferred revenue represents payments received for performance obligations not yet satisfied and are presented as current or long-term in the accompanying balance sheets based on the expected timing of satisfaction of the underlying goods and/or services.

Deferred revenue outstanding in each respective period is as follows:

|

|

|

December 31, 2020 |

|

|

June 30, 2021 |

|

|

December 31, 2021 |

|

|

June 30, 2022 |

|

||||

|

Deferred revenue |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

During the three and six months ended June 30, 2021, the Company recognized $

In March of 2020, the Company entered into a research collaboration and license agreement with Eli Lilly pursuant to which the Company will perform discovery research for several targets for Eli Lilly to develop and commercialize. Under the agreement, the Company is entitled to receive an aggregate of up to $

The agreement resulted in an initial upfront payment of $

Of the remaining deferred revenue balance of $

9

11. Financial instruments

Fair Value Measurements

The Company categorizes its financial assets and liabilities measured at fair value into a three-level hierarchy established by U.S. GAAP that prioritizes those inputs to valuation techniques used to measure fair value based on the degree to which they are observable. The three levels of the fair value hierarchy are as follows: Level 1 inputs are quoted prices in active markets for identical assets and liabilities; Level 2 inputs, other than quoted prices included within Level 1, are observable for the asset or liability either directly or indirectly; and Level 3 inputs are not observable in the market.

The Company’s financial instruments consist of cash and cash equivalents, restricted cash, marketable securities, accounts receivable, loans to equity accounted investees, accounts payable and accrued liabilities and royalties payable, and contingent consideration payable. The carrying values of cash and cash equivalents, restricted cash, accounts receivable, accounts payable and accrued liabilities, royalties payable, and loans to equity accounted investees approximate their fair values.

Contingent Consideration

Contingent consideration related to business acquisitions is recorded at fair value on the acquisition date and adjusted on a recurring basis for changes in its fair value. Changes in the fair value of contingent consideration liabilities can result from changes in anticipated payments and changes in assumed discount periods and rates. These inputs are unobservable in the market and are therefore categorized as Level 3 inputs. There were no changes to the valuation technique and inputs used in these fair value measurements since acquisition.

The following table presents the changes in fair value of the liability for contingent consideration:

|

Six months ended June 30, 2022 |

|

Liability at beginning of the period |

|

|

Increase (decrease) in fair value of liability for contingent consideration |

|

|

Liability at end of the period |

|

|||

|

Trianni (i) |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

TetraGenetics (ii) |

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

|

i) |

The estimated fair value of the earn-out payments relates to a specific customer license ending on April 9, 2024, was determined by estimating the payout of the expected future net cash flows associated to the specific customer license during the earn-out period. The significant assumptions include the amount and timing of projected future net revenues received by us from the specific customer license, discounted at |

|

ii) |

The estimated fair value of potential future successful milestone payouts was determined by estimating the expected future cash flows associated with the potential milestone events. The significant assumptions include the amount and timing of projected future cash flows, risk adjusted for various factors including probability of success, discounted at |

Marketable Securities

As part of the Company’s cash management strategy, the Company holds high credit quality marketable securities that are available to support the Company’s current operations.

Level 2 marketable securities in the fair value hierarchy were based on quoted market prices to the extent available or alternative pricing sources and models utilizing market observable inputs to determine fair value. There were no transfers between Level 1, Level 2 and Level 3 during the period.

10

The following table presents information about the Company’s marketable securities that are measured at fair value on a recurring basis and indicates the level of the fair value hierarchy used to determine such fair values:

|

|

|

Fair Value Measurements at June 30, 2022: |

|

|||||||||||||

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

|

Marketable securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government agencies |

|

$ |

|

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

|

|

|

Certificate of deposit |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Commercial paper |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Corporate bonds |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Asset backed securities |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

- |

|

|

$ |

|

|

12. Commitments and contingencies

From time to time, the Company may become involved in routine litigation arising in the ordinary course of business. At each reporting date, the Company evaluates whether or not a potential loss amount or a potential range of loss is probable and reasonably estimable under the provisions of the authoritative guidance that addresses accounting for contingencies. The Company does not have contingency reserves established for any litigation liabilities and any of the costs related to such legal proceedings are expensed as incurred.

The Company may enter into certain agreements with strategic partners in the ordinary course of operations that may include contractual milestone payments related to the achievement of pre-specified research, development, regulatory and commercialization events and indemnification provisions, which are common in such agreements.

Pursuant to the agreements, the Company may be obligated to make research and development and regulatory milestone payments upon the occurrence of certain events and upon receipt of royalty payments in the low single-digits to mid-twenties based on certain net sales targets. During the three and six months ended June 30, 2022, the Company has expensed approximately $

Since inception, the Company has incurred expenditures of $

13. Related Party Transaction

In addition to the loans to the equity accounted investees disclosed in Note 7, the Company had the following related party transactions:

During the second quarter, the Company engaged advisory services with a firm co-founded by a director of the Company in the amount of up to $

11

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q includes “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, as amended, and “forward-looking information” within the meaning of Canadian securities laws, or collectively, forward-looking statements. Forward-looking statements include statements that may relate to our plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs and other information that is not historical information. Many of these statements appear, in particular, under the headings “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Forward-looking statements can often be identified by the use of terminology such as “subject to”, “believe,” “anticipate,” “plan,” “expect,” “intend,” “estimate,” “project,” “may,” “will,” “should,” “would,” “could,” “can,” the negatives thereof, variations thereon and similar expressions, or by discussions of strategy. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking. In particular, these forward-looking statements include, but are not limited to:

|

|

• |

our expectations regarding the rate and degree of market acceptance of our antibody discovery platform; |

|

|

• |

companies and technologies in our industry that compete with our business; |

|

|

• |

our ability to manage and grow our business by introducing our antibody discovery platform to new partners and expanding our relationships with existing partners; |

|

|

• |

our partners ability to achieve projected discovery and development milestones and other anticipated key events, including commercial sales resulting in royalties to us, in the expected timelines or at all; |

|

|

• |

our ability to provide our partners with a full solution from target to investigational new drug, or IND, submission; |

|

|

• |

our partners ability to develop a molecule discovered by us into a viable commercial product, on a timely basis or at all; |

|

|

• |

our expectations regarding the completion of our good manufacturing practices, or GMP, facility and our manufacturing capabilities; |

|

|

• |

our ability to establish and maintain intellectual property protection for our technologies and workflows and avoid or defend against claims of patent infringement; |

|

|

• |

our ability to attract, hire and retain key personnel and to manage our future growth effectively; |

|

|

• |

our ability to obtain additional financing in future offerings; |

|

|

• |

the volatility of the trading price of our common shares; |

|

|

• |

business disruptions affecting our operations and the development of our platform due to the global COVID-19 pandemic; |

|

|

• |

the global economic impact of the ongoing conflict between Russia and Ukraine and related sanctions and market volatility; |

|

|

• |

our ability to avoid material weaknesses or significant deficiencies in our internal control over financial reporting in the future; |

|

|

• |

our expectations regarding our Passive Foreign Investment Company, or PFIC, status for our taxable year ended December 31, 2022, or any future taxable year; |

|

|

• |

our expectations regarding our recent business acquisitions and our ability to realize the intended benefits of such transactions; |

|

|

• |

our expectations regarding the use of our cash resources; |

|

|

• |

the ability of our partners to deliver royalty bearing products to the market; |

|

|

• |

our expectations about market trends; and |

|

|

• |

our ability to predict and adapt to government regulation. |

12

We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions, and expectations disclosed in the forward-looking statements. We have included important factors in the cautionary statements included in this Quarterly Report, particularly in “Summary of the Material and Other Risks Associated with Our Business” above and “Risk Factors” below, that we believe could cause actual results or events to differ materially from our forward-looking statements. We operate in a competitive and rapidly changing environment and new risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, collaborations, joint ventures, or investments we may make or enter.

Additionally, inflation generally affects us by increasing our employee-related costs and certain other expenses. Our financial condition and results of operations may also be impacted by other factors we may not be able to control, such as global supply chain disruptions, uncertain global economic conditions, global trade disputes or political instability as further discussed in the section “Risk Factors” in this Quarterly Report.

You should read this Quarterly Report and the documents that we file with the Securities and Exchange Commission, or the SEC, with the understanding that our actual future results may differ materially from what we expect. The forward-looking statements contained in this Quarterly Report are made as of the date of this Quarterly Report, and we do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Quarterly Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

This Quarterly Report includes statistical and other industry and market data that we obtained from industry publications and research, surveys, and studies conducted by third parties as well as our own estimates of potential market opportunities. All market data used in this Quarterly Report involves assumptions and limitations, and you are cautioned not to give undue weight to such data. Industry publications and third-party research, surveys, and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Our estimates of the potential market opportunities for our product candidates include several key assumptions based on our industry knowledge, industry publications, third-party research, and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While we believe that our internal assumptions are reasonable, no independent source has verified such assumptions.

We express all amounts in this Quarterly Report on Form 10-Q in U.S. dollars, except where otherwise indicated. References to “$” and “US$” are to U.S. dollars and references to “C$” and “CAD$” are to Canadian dollars.

Except as otherwise indicated, references in this Quarterly Report on Form 10-Q to “AbCellera,” the “Company,” “we,” “us” and “our” refer to AbCellera Biologics Inc. and its consolidated subsidiaries.

Impact of COVID-19

Since the start of the COVID-19 pandemic, we have taken and continue to take steps to protect our employees, business partners, vendors, and contractors. To address the multiple dimensions of the pandemic, we have been continuously monitoring the global situation, executing mitigation activities whenever and wherever required, following guidance from provincial and federal health authorities, and implementing a hybrid return to our facilities for those employees who have been working remotely.

We continue to take the following actions to address the evolving COVID-19 pandemic:

|

|

• |

We implemented comprehensive COVID-19 guidelines that are shared via our internal communication platform to provide real-time updates company-wide relying on directives from local health authorities. As information is gathered, we adapt accordingly, including work from home requirements. |

|

|

• |

We implemented protocols for employees necessary to carry out Company functions in the office and laboratory facilities including physical distancing, personal protective equipment, signage, erecting barriers between desks and lab benches, and implementing space restrictions for different areas of the facilities. |

|

|

• |

We have not been required to stop research activities due to the COVID-19 pandemic. We will continue to adapt and apply new measures as required and as directed by local health authorities. |

13

Overview

We believe that the surest path to a better future is through technological advancement and that the new frontier of technology lies at the interface of computation, engineering and biology. Our mission is to improve health with technologies that transform the way that antibody-based therapies are discovered. We aim to become the centralized operating system for next generation antibody discovery.

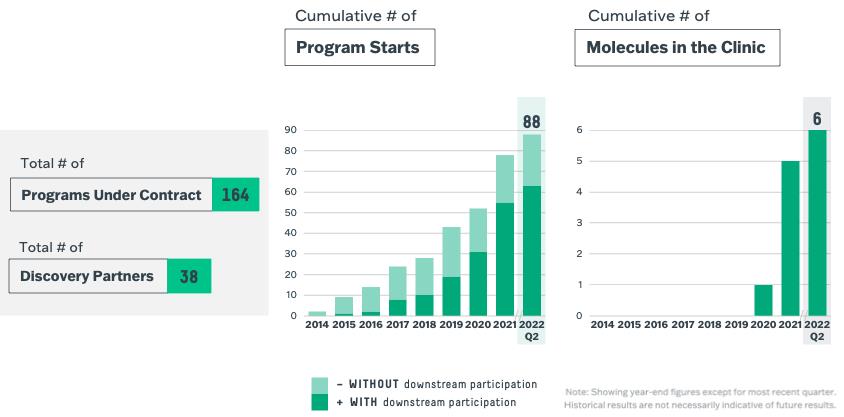

Our full-stack, artificial intelligence, or AI, powered antibody discovery platform searches and analyzes the database of natural immune systems to find antibodies that can be developed as drugs. We believe our technology increases the speed and the probability of success of therapeutic antibody discovery, including enabling discovery against targets that may otherwise be intractable. We forge partnerships with drug developers of all sizes, from large cap pharmaceutical to small biotechnology companies. We empower them to move quickly, reduce cost and tackle the toughest problems in drug development. As of June 30, 2022, we had 164 discovery programs that are either completed, in progress or under contract with 38 partners. As a recent example, in a collaboration with Eli Lilly and Company, or Lilly, we applied our technology stack to co-develop two antibody therapies to treat and prevent COVID-19. Starting from a single blood sample obtained from a convalescent patient, we and our partners identified a viable antibody drug candidate within three weeks that advanced into clinical testing 90 days after initiation of the program. Lilly progressed into these clinical trials at a greatly accelerated pace as a result of the Coronavirus Treatment Acceleration Program, which is a special emergency program for possible coronavirus therapies created by the FDA in 2020 to expedite the development of potentially safe and effective life-saving treatments to combat the COVID-19 pandemic. With respect to other or future product candidates, there is no assurance that any of our partners or collaborators will be able to advance a product candidate into clinical development on this timeframe again in the future, or at all. We initiated our partnering program in 2015 and have only had two AbCellera discovery programs and two Trianni programs result in milestone or royalty payments to us to date, and we have not yet had a program receive clinical marketing approval.

We structure our agreements in a way that is designed to align our partners’ economic interests with our own. We forge partnerships with large cap pharmaceutical companies, biotechnology companies of all sizes and non-profit and government organizations. Our partners select a target and define the antibody properties needed for therapeutic development. We provide discovery solutions to partners that have a range of discovery capabilities, from the highly enabled to the less enabled. We enable discovery against targets that have traditionally been intractable, and we accelerate programs against less difficult targets.

Our deals emphasize participation in the success and upside of future antibody therapeutics. Our partnership agreements include near-term payments for technology access, research and intellectual property rights, and downstream payments in the form of clinical and commercial milestones, and royalties on net sales. We also participate in alternative investment opportunities including equity in our business partners and various rights for deeper involvement in moving molecules forward. Longer-term we are eligible to receive additional payments upon satisfaction of clinical and commercial milestones, which we refer to as milestone payments, as well as royalties on sales of products derived from antibodies that we discover for our partners. Our discovery partnerships generally include royalty payments on net sales in the single digit to low-double digit range.

14

We generated revenue of $27.6 million and $230.4 million for the three and six months ended June 30, 2021, respectively, and $45.9 million and $362.5 million for the three and six months ended June 30, 2022, respectively. We have also grown the number of programs that we have under contract with our partners, as illustrated by the following charts.

We incurred sales and marketing expenses of $1.3 million and $3.9 million for the three and six months ended June 30, 2021, respectively, and $3.1 million and $5.5 million for the three and six months ended June 30, 2022, respectively. We are continuing to invest into our business development team and into marketing our solutions to new and existing partners.

We focus a substantial portion of our resources on research and development efforts towards deepening our technology and expertise along our technology stack, and we expect to continue to make significant investments in this area for the foreseeable future. We incurred research and development expenses of $15.0 million and $27.4 million for the three and six months ended June 30, 2021, respectively, and $26.7 million and 53.1 million for the three and six months ended June 30, 2022, respectively. We incurred general and administrative expenses of $11.2 million and $17.7 million for the three and six months ended June 30, 2021, respectively, and $14.4 million and $28.7 million of the three and six months ended June 30, 2022, respectively. We expect to continue to incur significant expenses, and we expect such expenses to increase substantially in connection with our ongoing activities, including as we:

|

|

• |

invest in research and development activities to improve our technology stack and platform; |

|

|

• |

market and sell our solutions to existing and new partners; |

|

|

• |

expand and enhance operations to deliver programs, including investments in manufacturing; |

|

|

• |

acquire businesses or technologies to support the growth of our business; |

|

|

• |

attract, hire and retain qualified personnel; |

|

|

• |

continue to establish, protect and defend our intellectual property and patent portfolio, including our ongoing litigation; and |

|

|

• |

operate as a public company. |

To date, we have financed our operations primarily from revenue from our antibody discovery partnerships in the form of revenue, government funding from grants, external borrowings, and from the issuance and sale of convertible preferred shares and notes, and common shares.

Our net loss for the three months ended June 30, 2021, was $2.3 million and our net earnings for the six months ended June 30, 2021 was $114.9 million. Our net loss for the three months ended June 30, 2022 was $6.8 million and our net earnings for the six

15

months ended June 30, 2022 was $161.8 million. As of June 30, 2022, we had accumulated earnings of $429.5 million and we had cash, cash equivalents and marketable securities totaling $1,022.3 million.

Recent Developments

In February 2022, we announced that bebtelovimab (LY-CoV1404), the second antibody developed through our collaboration with Lilly, received an Emergency Use Authorization, or EUA, from the FDA for the treatment of mild-to-moderate COVID-19. Lilly announced in February 2022 that it entered into a purchase agreement with the U.S. government to supply up to 600,000 doses of bebtelovimab no later than March 31, 2022, with an option of 500,000 additional doses no later than July 31, 2022, for at least $720 million.

In June 2022, we announced that Eli Lilly modified its purchase agreement with the U.S. government to supply an additional 150,000 doses of bebtelovimab for consideration of approximately $275 million. Eli Lilly shipped and we recognized royalty revenue on approximately half of these doses in the quarter ended June 30, 2022. The option to purchase the remaining 350,000 doses no later than September 14, 2022, remains in the agreement.

Key Factors Affecting Our Results of Operations and Future Performance

We believe that our financial performance has been, and in the foreseeable future will continue to be, primarily driven by multiple factors as described below, each of which presents growth opportunities for our business. These factors also pose important challenges that we must successfully address in order to sustain our growth and improve our results of operations. Our ability to successfully address these challenges is subject to various risks and uncertainties, including those described in Part II, Item 1A of this report, captioned “Risk Factors”.