UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the quarterly period ended

For the transition period from ______________ to ______________

Commission

File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of

incorporation or organization) |

(IRS Employer

Identification No.) |

(Address of principal executive offices and zip code)

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was

required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

The number of shares of the registrant’s common stock outstanding as of November 14, 2023 was .

AZITRA, INC.

TABLE OF CONTENTS

| i |

PART I FINANCIAL INFORMATION

ITEM 1. Financial Statements.

AZITRA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| September 30, 2023 | December 31, 2022 | |||||||

| ASSETS | (Unaudited) | |||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Accounts receivable | ||||||||

| Tax credits receivable | ||||||||

| Income tax receivable | ||||||||

| Deferred offering costs | ||||||||

| Prepaid expenses | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Other assets | ||||||||

| Other assets | ||||||||

| Financing lease right-of-use asset | ||||||||

| Operating lease right-of-use asset | ||||||||

| Intangible assets, net | ||||||||

| Deferred patent costs | ||||||||

| Total other assets | $ | $ | ||||||

| Total assets | $ | $ | ||||||

| LIABILITIES, PREFERRED STOCK, AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | ||||||||

| Current financing lease liability | ||||||||

| Current operating lease liability | ||||||||

| Accrued expenses | ||||||||

| Contract liabilities | ||||||||

| Total current liabilities | ||||||||

| Long-term financing lease liability | ||||||||

| Long-term operating lease liability | ||||||||

| Warrant liability | ||||||||

| Convertible notes payable, net | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies (Note 13) | ||||||||

| Preferred stock: | ||||||||

| Series A convertible preferred stock; $ par value; shares authorized at September 30, 2023 and December 31, 2022; and shares issued and outstanding at September 30, 2023 and December 31, 2022 respectively; liquidation value of $ | ||||||||

| Series A-1 convertible preferred stock; $ par value; shares authorized at September 30, 2023 and December 31, 2022; and shares issued and outstanding at September 30, 2023 and December 31, 2022 respectively; liquidation value of $ | ||||||||

| Series B convertible preferred stock; $ par value; shares authorized at September 30, 2023 and December 31, 2022; and shares issued and outstanding at September 30, 3023 and December 31, 2022, respectively; liquidation value of $ | ||||||||

| Stockholders’ equity (deficit) | ||||||||

| Common stock; $ par value, shares authorized at September 30, 2023 and December 31, 2022, and shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total stockholders’ equity (deficit) | ( | ) | ||||||

| Total liabilities, preferred stock, and stockholders’ equity (deficit) | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| F-1 |

AZITRA, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

| For the Three Months | For the Three Months | For the Nine Months | For the Nine Months | |||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | |||||||||||||

| Service revenue - related party | $ | $ | $ | $ | ||||||||||||

| Total revenue | ||||||||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | ||||||||||||||||

| Research and development | ||||||||||||||||

| Total operating expenses | ||||||||||||||||

| Loss from operations | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Interest income | ||||||||||||||||

| Interest expense | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Employee retention credit | ||||||||||||||||

| Forgiveness of accounts payable | ||||||||||||||||

| Change in fair value of convertible note | ( | ) | ||||||||||||||

| Other income (expense) | ( | ) | ( | ) | ( | ) | ||||||||||

| Total other income (expense) | ( | ) | ( | ) | ||||||||||||

| Net loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Dividends on preferred stock | ( | ) | ( | ) | ( | ) | ||||||||||

| Net loss attributable to common shareholders | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Net loss per share, basic and diluted | ) | ) | ) | ) | ||||||||||||

| Weighted average common stock outstanding, basic and diluted | ||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| F-2 |

AZITRA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT (UNAUDITED)

| Series A Convertible Preferred Stock | Series A-1 Convertible Preferred Stock | Series B Convertible Preferred Stock | Common Stock | Additional

Paid-in- | Accumulated | Total Stockholders’ Equity | ||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | (Deficit) | ||||||||||||||||||||||||||||||||||

| Balance - December 31, 2021 | $ | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Exercise of stock options | — | — | — | 888 | ||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2022 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2022 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||

| Balance - September 30, 2022 | $ | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||||||||

| Series A Convertible Preferred Stock | Series A-1 Convertible Preferred Stock | Series B Convertible Preferred Stock | Common Stock | Additional

Paid-in- | Accumulated | Total Stockholders’ Equity | ||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | (Deficit) | ||||||||||||||||||||||||||||||||||

| Balance - December 31, 2022 | $ | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||||||||

| Issuance of Series B Convertible Preferred Stock | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||

| Conversion of convertible notes payable | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Conversion of preferred stock | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| Initial public offering, net of issuance costs of $ | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2023 | ( | ) | ||||||||||||||||||||||||||||||||||||||||||

| Stock based compensation expense | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||

| Balance - September 30, 2023 | $ | $ | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| F-3 |

AZITRA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| For the Nine Months Ended September 30, | ||||||||

| 2023 | 2022 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | ||||||||

| Amortization of debt discount | ||||||||

| Amortization of right-of-use assets | ||||||||

| Accrued interest on convertible notes | ||||||||

| Stock based compensation | ||||||||

| Change in fair value of warrant liability | ( | ) | ( | ) | ||||

| Change in fair value of convertible notes | ||||||||

| Forgiveness of accounts payable | ( | ) | ||||||

| Loss on disposal of property and equipment | ||||||||

| Impairment of intangible assets and patent costs | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | ||||||||

| Prepaid expenses | ( | ) | ||||||

| Other assets | ( | ) | ( | ) | ||||

| Tax credits receivable | ||||||||

| Accounts payable and accrued expenses | ( | ) | ( | ) | ||||

| Financing lease liability | ||||||||

| Operating lease liability | ( | ) | ( | ) | ||||

| Contract liabilities | ( | ) | ( | ) | ||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Cash flows from investing activities: | ||||||||

| Purchases of property and equipment | ( | ) | ( | ) | ||||

| Proceeds from sale of property and equipment | ||||||||

| Capitalization of deferred patent costs | ( | ) | ( | ) | ||||

| Capitalization of licenses | ( | ) | ( | ) | ||||

| Capitalization of patent and trademark costs | ( | ) | ( | ) | ||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from convertible notes, net of issuance costs | ||||||||

| Payment of deferred offering costs | ( | ) | ||||||

| Principal payments on finance leases | ( | ) | ||||||

| Proceeds from initial public offering, net | ||||||||

| Proceeds from exercise of stock options | ||||||||

| Net cash provided by financing activities | ||||||||

| Net change in cash and cash equivalents | ( | ) | ||||||

| Cash and cash equivalents at beginning of period | ||||||||

| Cash and cash equivalents at end of period | $ | $ | ||||||

| Supplemental disclosure of non-cash investing and financing information: | ||||||||

| Obtaining a right-of-use asset in exchange for lease liability | $ | $ | ||||||

| Obtaining a right-of-use asset in exchange for financing lease liability | $ | $ | ||||||

| Conversion of note to common stock | $ | $ | ||||||

| Conversion of note to Series B Convertible Preferred Stock | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| F-4 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Nature of Operations

Azitra, Inc. was founded on January 2, 2014. It is a synthetic biology company focused on screening and genetically engineering microbes of the skin. The mission is to discover and develop novel therapeutics to create a new paradigm for treating skin disease. The Company’s discovery platform is screened for naturally occurring bacterial cells with beneficial effects. These microbes are then genomically sequenced and engineered to make cellular therapies, recombinant therapeutic proteins, peptides and small molecules for precision treatment of dermatology diseases. On May 17, 2023, the Company changed its name to from “Azitra Inc” to “Azitra, Inc.”

The Company maintains a location in Montreal, Canada for certain research activities. This location and operations completed there remained consistent throughout 2022 and into 2023. The Company also opened a manufacturing and laboratory space in Groton, Connecticut during 2021.

Forward Stock Split, Change in Par Value, and Initial Public Offering

In

June 2023, the Company completed its initial public offering (IPO) in which it issued and sold shares of its common stock at

a price to the public of $ per share. The shares began trading on the NYSE American on June 16, 2023 under the symbol “AZTR”.

The net proceeds received by the Company from the offering were $

Immediately

prior to the effectiveness of the Company’s registration statement, the Company effected a

Going Concern Matters

The

unaudited condensed financial statements have been prepared on the going concern basis, which assumes that the Company will continue

in operation for the foreseeable future and which contemplates the realization of assets and liquidation of liabilities in the normal

course of business. However, management has identified the following conditions and events that created an uncertainty about the ability

of the Company to continue as a going concern. As of and for the nine months ended September 30, 2023, the Company has an accumulated

deficit of $

Management plans to continue to raise funds through equity and debt financing to fund operating and working capital needs; however, the Company will require a significant amount of additional funds to complete the development of its product and to fund additional losses which the Company expects to incur over the next few years. The Company is still in its clinical phase and therefore does not yet have product revenue. There can be no assurance that the Company will be successful in securing additional financing, if needed, to meet its operating needs.

These conditions and events create an uncertainty about the ability of the Company to continue as a going concern for twelve months from the date that the financial statements are available to be issued. The financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.

Reclassification

Certain prior period amounts and disclosures have been reclassified to conform to the current period’s financial presentation.

| F-5 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

2. Summary of Significant Accounting Policies

Basis of Accounting

The financial statements of the Company are prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”).

Unaudited Interim Financial Information

The unaudited interim financial statements and related notes have been prepared in accordance with U.S. GAAP for interim financial information, within the rules and regulations of the United States Securities and Exchange Commission (the “SEC”). Certain information and disclosures normally included in the annual financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. The unaudited interim financial statements have been prepared on a basis consistent with the audited financial statements and in the opinion of management, reflect all adjustments, consisting of only normal recurring adjustments, necessary for the fair presentation of the results for the interim periods presented and of the financial condition as of the date of the interim balance sheet. The financial data and the other information disclosed in these notes to the interim financial statements related to the three and nine months are unaudited. Unaudited interim results are not necessarily indicative of the results for the full fiscal year. These unaudited interim financial statements should be read in conjunction with the financial statements of the Company for the year ended December 31, 2022, and notes thereto that are included in the Company’s Registration Statement filed with the SEC on June 5, 2023.

Use of Estimates

The preparation of the financial statement in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the balance sheet. While management believes the estimates and assumptions used in the preparation of the financial statement are appropriate, actual results could differ from those estimates.

Cash and Cash Equivalents

For purposes of the balance sheets and statements of cash flows, the Company considers all cash on hand, demand deposits and all highly liquid investments with original maturities of three months or less to be cash equivalents.

Property and Equipment

Property

and equipment are recorded at cost. Depreciation is computed using the straight-line method over the estimated useful lives, which range

from

Accounts Receivable

The Company carries its accounts receivable at cost less an allowance for doubtful accounts. On a periodic basis, the Company evaluates its accounts receivable and establishes an allowance for doubtful accounts based on a history of past write-offs, collections and current conditions. There was no allowance for doubtful accounts at September 30, 2023 and December 31, 2022. Accounts receivable are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded when received.

Deferred Offering Costs

The Company capitalized deferred offering costs, which primarily consisted of direct, incremental legal, professional, accounting, and other third-party fees relating to the Company’s initial public offering. In June 2023, the Company consummated its IPO and recorded such amounts against the gross proceeds of its IPO within the statements of stockholders’ equity during the nine months ended September 30, 2023

| F-6 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Leases

In February 2016, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2016-02, Leases (“Topic 842”). ASU 2016-02 requires lessees to present right-of-use (“ROU”) assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. See Note 2 – Recently Adopted Accounting Pronouncements.

In calculating the effect of ASU 2016-02, the Company elected the transition method thereby not restating comparable periods. The Company elected to account for non-lease components as part of the lease component to which they relate. Lease accounting involves significant judgments, including making estimates related to the lease term, lease payments, and discount rate. In accordance with the guidance, the Company recognized ROU assets and lease liabilities for all leases with a term greater than 12 months. Leases are classified as either operating or financing leases based on the economic substance of the agreement.

The

Company has operating leases for buildings. Currently, the Company has 3 operating leases with a ROU asset and lease liability totaling

$

At

September 30, 2023, the Company had operating right-of-use assets with a net value of $

In

2023, the Company entered into a lease for the use of certain equipment that is classified as a finance lease. The finance lease has

a term of

Intangible Assets

Intangible assets consist of trademarks and patents. All costs directly related to the filing and prosecution of patent and trademark applications are capitalized. Patents are amortized over their respective remaining useful lives upon formal approval. Trademarks have an indefinite life.

The

Company accounts for other indefinite life intangible assets in accordance ASC Topic 350, Goodwill and Other Intangible

Assets (ASC 350). ASC 350 requires that intangible assets that have indefinite lives are required to be tested at least annually

for impairment or whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. Intangible

assets that have finite lives will continue to be amortized over their useful lives. Impairment losses relating to license

agreements were $

Deferred Patent Costs

Deferred

patent costs represent legal and filing expenses incurred related to the submission of patent applications for patents pending

approval. These deferred costs will begin to be amortized over their estimated useful lives upon the formal approval of the patent.

If the patent is not issued, the costs associated with the patent will be expensed in the year the patent was rejected. Impairment

losses relating to deferred patent costs were $

Impairment of Long-Lived Assets

In accordance with ASC Topic 360-10, Accounting for the Impairment or Disposal of Long-Lived Assets (ASC 360-10), the Company’s policy is to review its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. In connection with this review, the Company also reevaluates the periods of depreciation for these assets. The Company recognizes an impairment loss when the sum of the undiscounted expected future cash flows from the use and eventual disposition of the asset is less than its carrying amount. If an asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds the fair value of the asset, which is determined using the present value of the net future operating cash flows generated by the asset.

| F-7 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Convertible Debt and Warrant Accounting

Warrants

The Company accounts for warrants as either equity-classified or liability-classified instruments based on an assessment of the warrant’s specific terms and applicable authoritative guidance in ASC 480, Distinguishing Liabilities from Equity (“ASC 480”) and ASC 815, Derivatives and Hedging (“ASC 815”). The assessment considers whether the warrants are freestanding financial instruments pursuant to ASC 480, meet the definition of a liability pursuant to ASC 480, and whether the warrants meet all of the requirements for equity classification under ASC 815, including whether the warrants are indexed to the Company’s own common stock, among other conditions for equity classification. This assessment, which requires the use of professional judgment, is conducted at the time of warrant issuance and as of each subsequent quarterly period end date while the warrants are outstanding.

For issued warrants that meet all of the criteria for equity classification, the warrants are required to be recorded as a component of additional paid-in capital at the time of issuance. For issued warrants that do not meet all the criteria for equity classification, the warrants are required to be recorded at their initial fair value on the date of issuance, and each balance sheet date thereafter. Changes in the estimated fair value of the warrants are recognized as a non-cash gain or loss on the statements of operations under Other Income/loss.

Convertible debt

When the Company issues debt with a conversion feature, it first assesses whether the debt should be accounted for in accordance with ASC 480 – Distinguishing Liabilities from Equity. If the debt does not meet the criteria of an ASC 480 liability, the note’s conversion features require bifurcation in accordance with ASC 815 – Derivatives and Hedging. If the Company determines the embedded conversion feature requires bifurcation in accordance with ASC 815, the Company also considers if it can elect the fair value option. If the fair value option is elected, the Company records the note at its initial fair value with any subsequent changes in fair value recorded in earnings. As noted in Note 7, the Company has elected the fair value option for the 2022 Convertible Notes and will record the notes at their initial fair values with any subsequent changes in fair value recorded in earnings. The Convertible Notes were converted into the Company’s common stock on the Closing Date of the Company’s IPO.

Convertible Preferred Stock

As the Convertible Preferred stockholders have liquidation rights in the event of a deemed liquidation event that, in certain situations, are not solely within the control of the Company and would require the redemption of the then-outstanding Convertible Preferred Stock, the Company classifies the Convertible Preferred Stock in mezzanine equity on the balance sheet.

As noted in Note 8, at the Closing Date of the Company’s IPO, the Convertible Preferred stock converted into shares of the Company’s common stock.

Revenue

The Company follows the five steps to recognize revenue from contracts with customers under ASC 606, Revenue from Contracts with Customers (“ASC 606”), which are:

| ● | Step 1: Identify the contract(s) with a customer | |

| ● | Step 2: Identify the performance obligations in the contract | |

| ● | Step 3: Determine the transaction price | |

| ● | Step 4: Allocate the transaction price to the performance obligations in the contract | |

| ● | Step 5: Recognize revenue when (or as) a performance obligation is satisfied |

The Company generates service revenue through a joint development agreement with a research partner. The Company recognizes revenue related to the research and development aspects of the agreement over time using the input method as work is performed on the contract.

The Company also generates grant revenue, which represents monies received on contracts with various federal agencies and nonprofit research institutions for general research conducted by the Company to further their product development and are therefore considered contributions to the Company. The contracts are generally for periods of one year or more and can be cancelled by either party. The Company concluded that the grant arrangements do not meet the criteria to be treated as a collaborative arrangement under FASB ASC Topic 808 as the Company is the only active participant in the arrangement. The grant arrangements also do not meet the criteria for revenue recognition under Topic 606, as the U.S. Government would not meet the definition of a customer.

| F-8 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Amounts earned under these grant contracts are recorded as a reduction to research and development expense when eligible expenses are incurred and the right to payment is realizable or realized and earned. The Company believes this policy is consistent with Topic 606, to ensure that recognition reflects the transfer of promised goods or services to customers in an amount that reflects the consideration that the Company expects to be entitled to in exchange for those goods or services, even though there is no exchange as defined in Topic 606. Additionally, the Company has determined that the recognition of amounts received as costs are incurred and amounts become realizable is analogous to the concept of transfer of control of a service over time under Topic 606.

Receipts of grant awards in advance, which are payable back to the funding agency if not used in accordance with conditions in the grants related to allowable costs or receipt of funding from research partners related to service revenue arrangements before work is performed on the contract, are classified as contract liabilities in the accompanying balance sheets.

Research and Development

The

Company accounts for research and development costs in accordance with Accounting Standards Codification (ASC) subtopic 730-10, Research

and Development. Accordingly, internal research and development costs are expensed as incurred. Research and development costs consist

of costs related to labor, materials and supplies. Research and development costs incurred were $

At

September 30, 2023 and December 31, 2022, the Company has a state tax credit receivable of $

The Company accounts for stock-based compensation in accordance with ASC 718, Compensation-Stock Compensation (ASC 718). ASC 718 requires employee stock options and rights to purchase shares under stock participation plans to be accounted for at fair value. ASC 718 requires that compensation costs related to share-based payment transactions be recognized as operating expenses in the financial statements. Under this method, compensation costs for all awards granted or modified are measured at estimated fair value at date of grant and are included as compensation expense over the vesting period during which an employee provides service in exchange for the award. For awards with a performance condition that affects vesting, the Company recognizes compensation expense when it is determined probable that the performance condition will be achieved. The Company recognized the effect of forfeitures when the forfeitures occur.

The Company uses a Black-Scholes option pricing model to determine fair value of its stock options. The Black-Scholes model includes various assumptions, including the value of the underlying common stock, the expected life of stock options, the expected volatility and the expected risk-free interest rate. These assumptions reflect the Company’s best estimates, but they involve inherent uncertainties based on market conditions generally outside of the control of the Company. As a result, if other assumptions had been used, stock-based compensation cost could have been materially impacted. Furthermore, if the Company uses different assumptions for future grants, stock-based compensation cost could be materially impacted in future periods.

The Company accounts for equity instruments issued to non-employees in accordance with the provisions of ASC 718 as updated by Accounting Standards Update (ASU) No. 2018-07, Improvements to Nonemployee Share-Based Payment Accounting, which expands the scope of ASC 718 to include share-based payment transactions to non-employees.

The following assumptions are used in valuing options issued using the Black-Scholes option pricing model:

Expected Volatility. The expected volatility of the Company’s shares is estimated based on the average volatility of peer companies.

Expected Term. The expected term of options is estimated using the simplified method which is based on the vesting period and contractual term for each grant, or for each vesting-tranche for awards with graded vesting.

| F-9 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Underlying Common Stock Value. The underlying common stock value of the Company’s shares is estimated by a third-party valuation expert up until the Company’s IPO, at which time the Company utilized its trading price on the NYSE American on the date of grant.

Risk-free Interest Rate. The Company bases the risk-free interest rate on the implied yield available on a U.S. Treasury note with terms equal to the expected term of the underlying grant.

Dividend Yield. The Black-Scholes valuation model calls for a single expected dividend yield as an input. The Company has not paid dividends on Common stock in the past nor does it expect to pay dividends on Common stock in the near future. As such, the Company uses a dividend yield percentage of zero.

Income Taxes

The Company uses the liability method of accounting for income taxes, as set forth in ASC 740, Accounting for Income Taxes. Under this method, deferred tax assets and liabilities are recognized for the expected future tax consequence of temporary differences between the carrying amounts and the tax basis of assets and liabilities and net operating loss carry forwards, all calculated using presently enacted tax rates.

Management has evaluated the effect of ASC guidance related to uncertain income tax positions and concluded that the Company has no significant financial statement exposure to uncertain income tax positions at September 30, 2023 and December 31, 2022. The Company’s income tax returns have not been examined by tax authorities through December 31, 2022.

Fair Value Measurements

The Company carries certain liabilities at fair value on a recurring basis. A fair value hierarchy that consists of three levels is used to prioritize the inputs to fair value valuation techniques:

| ● | Level 1 – Inputs are based upon observable or quoted prices for identical instruments traded in active markets. |

| ● | Level 2 – Inputs are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

| ● | Level 3 – Inputs are generally unobservable and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models, and similar techniques. |

In determining fair value, the Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible as well as considers counterparty credit risk in its assessment of fair value.

Financial Instruments

The Company’s financial instruments are primarily comprised of accounts receivable, accounts payable, accrued liabilities, and long-term debt. For accounts receivable, accounts payable and accrued liabilities, the carrying amount approximates fair value due to the short-term maturities of such instruments. The estimated fair value of the Company’s long-term debt approximates carrying value.

Recent Accounting Pronouncements

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-02, Leases (Topic 842). This ASU requires a lessee to recognize a right-of-use asset and a lease liability under most operating leases in its balance sheet. The ASU is effective for annual and interim periods beginning after December 15, 2021. The Company adopted ASU 2016-02 on January 1, 2022. See Note 13 – Operating Leases.

In December 2019, the FASB issued ASU No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. This standard simplifies the accounting for income taxes through the removal of various exceptions previously provided, as well as providing additional reporting requirements for income taxes. The ASU is effective for the Company on January 1, 2022. The Company has adopted this standard effective January 1, 2022, which did not have a material impact to the financial statements.

| F-10 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

In August 2020, the FASB issued ASU No. 2020-06, Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40), which simplifies the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts on an entity’s own equity. This standard will be effective for the Company on January 1, 2024, with early adoption permitted (but no earlier than fiscal years beginning after December 15, 2020). The Company has adopted this standard effective January 1, 2021, which did not have a material impact to the financial statements.

Management does not believe that any other recently issued, but not yet effective, accounting standards could have a material effect on the accompanying financial statements. As new accounting pronouncements are issued, the Company will adopt those that are applicable under the circumstances.

3. Employee Retention Credit

The

CARES Act provides an employee retention credit (“CARES Employee Retention credit”), which is a refundable tax credit against

certain employment taxes of up to $

4. Property and Equipment

Property and equipment consisted of the following at September 30, 2023 and December 31, 2022:

| September 30, 2023 | December 31, 2022 | |||||||

| Laboratory equipment | $ | $ | ||||||

| Computers and office equipment | ||||||||

| Furniture and fixtures | ||||||||

| Leasehold improvements | ||||||||

| Building equipment | ||||||||

| Total property and equipment | ||||||||

| Less accumulated depreciation & amortization | ( | ) | ( | ) | ||||

| Total property, plant, and equipment, net | $ | $ | ||||||

Depreciation

expense was $

For

the three and nine months ended September 30, 2023 there was $

| F-11 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

5. Intangible Assets

Intangible assets consisted of the following at:

September 30, 2023:

| Estimated Useful Life | Gross Amount | Accumulated Amortization | Impairment | Net Amount | ||||||||||||||

| Trademarks | $ | $ | $ | $ | ||||||||||||||

| Patents | ||||||||||||||||||

| License agreement | ||||||||||||||||||

| Intangible assets | $ | $ | $ | $ | ||||||||||||||

December 31, 2022:

| Estimated Useful Life | Gross Amount | Accumulated Amortization | Impairment | Net Amount | ||||||||||||||

| Trademarks | $ | $ | $ | $ | ||||||||||||||

| Patents | ||||||||||||||||||

| License agreement | ||||||||||||||||||

| Intangible assets | $ | $ | $ | $ | ||||||||||||||

During

the three and nine months ended September 30, 2023, amortization expense related to intangible assets was $

6. Accrued Expenses

Accrued expenses consisted of the following at:

| September 30, 2023 | December 31, 2022 | |||||||

| Accrued expenses: | ||||||||

| Employee payroll and bonuses | $ | $ | ||||||

| Vacation | ||||||||

| Research and development projects | ||||||||

| Interest | ||||||||

| Professional fees | ||||||||

| Other | ||||||||

| Total accrued expenses | $ | $ | ||||||

The Company accrues expenses related to development activities performed by third parties based on an evaluation of services received and efforts expended pursuant to the terms of the contractual arrangements. Payments under some of these contracts depend on research and non-clinical trial milestones. There may be instances in which payments made to the Company’s vendors will exceed the level of services provided and result in a prepayment of expense. In accruing service fees, the Company estimates the period over which services will be performed and the level of effort to be expended in each period. If the actual timing of the performance of services or the level of effort varies from the estimate, the Company will adjust the accrual or prepaid expense accordingly. The Company has not experienced any material differences between accrued costs and actual costs incurred since its inception.

7. Convertible Debt

In

September 2022, the Company entered into a Convertible Note Purchase Agreement (the Agreement) to issue up to $

| F-12 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

In

February 2023, the 2022 Convertible Notes were amended to extend the maturity date to

During

April and June 2023, the 2022 Convertible Notes were further amended to extend the maturity date to

Effective

June 21, 2023, the 2022 Convertible Notes were converted to shares of the Company’s common stock equal to $

The Company accounts for the 2022 Convertible Notes under ASC 815. Under 815-15-25, the election can be at the inception of a financial instrument to account for the instrument under the fair value option under ASC 825. The Company has made such election for the 2022 Convertible Notes. Using the fair value option, the convertible promissory note is to be recorded at its initial fair value on the date of issuance, and each balance sheet date thereafter. The Company evaluates the change based on the conversion price at the current market value. When recognized, changes in the estimated fair value of the notes are recognized as a non-cash gain or loss in Other Income (Expense) on the statements of operations.

Effective

January 5, 2021, the Company entered into a Note Purchase Agreement to issue up to $

In

January 2023, the Company elected to convert the 2021 Convertible Note, including interest accrued but not yet paid of $

The Company evaluated the terms and conditions of the Note Purchase Agreement related to the 2021 Convertible Note in order to assess the accounting considerations under ASC 480 – Distinguishing Liabilities from Equity, and ASC 815 – Derivatives and Hedging. The Company determined the Convertible Note does not meet any of the criteria to be accounted pursuant to an ASC 480 liability. The Company also assessed the embedded features pursuant to the guidance in ASC 815 and determined the embedded features do not meet any of the criteria for bifurcation.

Convertible notes payable consisted of the following at:

| September 30, 2023 | December 31, 2022 | |||||||

| 2021 Convertible Note | $ | $ | ||||||

| 2022 Convertible Notes | ||||||||

| Total convertible notes | $ | $ | ||||||

There

was $

| F-13 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

8. Stockholders’ Equity

On

May 17, 2023, the Company effected a

Common Stock

At September 30, 2023 and December 31, 2022, per the Company’s amended and restated Certificate of Incorporation, the Company was authorized to issue shares of $par value common stock.

The Company had and shares of common stock issued and outstanding as of September 30, 2023 and December 31, 2022, respectively.

The Company currently has shares of common stock reserved for future issuance for the potential exercise of stock options and warrants outstanding at September 30, 2023.

Preferred Stock

At September 30, 2023 and December 31, 2022, per the Company’s amended and restated Certificate of Incorporation, the Company has authorized shares of $par value preferred stock.

In

January 2023, the Company issued shares of its Series B Preferred Stock related to conversion of the 2021 Convertible Note at

a conversion price of $

The Series A, Series A-1, and Series B Preferred Stock have the following rights, preferences and privileges:

Conversion

The

preferred stock is convertible, at the option of the holder, into common shares based upon a predefined formula. A holder of preferred

stock may convert such shares into common shares at any time. For purpose of conversion, the initial conversion price is $

Upon the Company’s IPO in June 2023, all of the outstanding preferred stock converted to common stock, resulting in the issuance of , , and shares of common stock in exchange for outstanding Series A, Series A-1, and Series B Preferred Stock, respectively. There was no gain or loss upon conversion.

| F-14 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Voting Rights

The holders of the Series A, Series A-1, and Series B Preferred Stock are entitled to vote on any matter presented to the stockholders of the Corporation for their action or consideration at any meeting of stockholders of the Corporation (or by written consent of stockholders in lieu of meeting), each holder of outstanding shares of preferred stock shall be entitled to cast the number of votes equal to the number of whole shares of Common Stock into which the shares of preferred stock held by such holder are convertible as of the record date for determining stockholders entitled to vote on such matter. The holders of the Series A and Series A-1 Preferred Stock are each entitled to elect one director of the Corporation. The holders of the Series B Stock are entitled to elect two members of the Board. Each class of preferred stock can remove from office such directors and to fill any vacancy caused by the resignation, death or removal of such directors under certain circumstances as described in the Certificate of Incorporation.

Dividends

The

holders of Series A Preferred Stock are entitled to receive dividends at a rate of

The

holders of Series A-1 Stock are entitled to receive dividends at a rate of

The

holders of Series B Stock are entitled to receive dividends at a rate of

Liquidation

In the event of any liquidation, dissolution or winding up of the Company, the holders of the preferred stock are entitled to receive, prior to and in preference to the holders of the common shares, an amount equal to the Series A, Series A-1, or Series B Preferred Stock original issue price, plus declared and/or accrued but unpaid dividends. In the event of any such liquidation event, after the payment of all preferential amounts required to be paid to the holders of shares of preferred stock, the remaining assets of the Corporation available for distribution to its stockholders shall be distributed among the holders of the shares of preferred stock and Common Stock, pro rata based on the number of shares held by each such holder, treating for this purpose all such securities as if they had been converted into Common Stock pursuant to the terms of the Certificate of Incorporation immediately prior to such liquidation event.

9. Warrants

The

Company issued warrants to purchase

| F-15 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The Company also issued warrants in 2016 and 2019 which did not meet the criteria under ASC 480 to be classified as a liability, and instead meet equity classification criteria. The warrants issued in 2016 expired upon the initial public offering in June 2023.

The following table summarizes information about warrants outstanding at September 30, 2023:

| Warrants Outstanding | Warrant Exercisable | |||||||||||||||||||||||||||

| Year Granted | Exercise Price | Number of Warrants at 9/30/2023 | Weight Average Remaining Contractual Life | Weight Average Exercise Price | Number of Warrants at 9/30/2023 | Weighted Average Remaining Contractual Life | Weighted Average Exercise Price | |||||||||||||||||||||

| 2018 | $ | years | $ | years | $ | |||||||||||||||||||||||

| 2019 | $ | years | $ | years | $ | |||||||||||||||||||||||

| 2023 | $ | years | $ | years | $ | |||||||||||||||||||||||

| $ | $ | |||||||||||||||||||||||||||

10. Stock Options

In March 2023, the Company’s Board of Directors and stockholders approved the 2023 Stock Incentive Plan (“2023 Plan”). The 2023 Plan allows the Committee to grant up to shares of Common Stock in the form of incentive and non-statutory stock options, restricted stock awards, restricted stock units, and other stock-based awards to employees, directors, and non-employees. As of September 30, 2023, options to purchase shares of common stock had been granted and were outstanding under the 2023 Plan and shares of common stock were available for grant under the plan.

During 2016, the Company established the Azitra Inc. 2016 Stock Incentive Plan (the Plan) which provides for the granting of stock options and restricted shares to the Company’s employees, officers, directors, advisors and consultants. As of September 30, 2023, options to purchase shares of common stock had been granted and were outstanding under the 2016 Plan and shares of common stock were available for grant under the plan.

During

the three and nine months ended September 30, 2023 the Company granted stock options to purchase shares of common stock and

during the three and nine months ended September 30, 2022 the Company did not grant any stock options under this plan. During the three and nine months

ended September 30, 2023, the Company recognized stock compensation expense of $

| F-16 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| Options Outstanding | Options Exercisable | |||||||||||||||||||||||||

| Exercise Price | Number of Options at 9/30/2023 | Weight Average Remaining Contractual Life | Weight Average Exercise Price | Number of Options at 9/30/2023 | Weighted Average Remaining Contractual Life | Weighted Average Exercise Price | ||||||||||||||||||||

| $ | years | $ | years | $ | ||||||||||||||||||||||

| $ | years | $ | year | $ | ||||||||||||||||||||||

| $ | years | $ | years | $ | ||||||||||||||||||||||

| $ | years | $ | years | $ | ||||||||||||||||||||||

| Shares | Weighted Average Exercise Price | |||||||

| Outstanding at December 31, 2022 | $ | |||||||

| Granted | ||||||||

| Exercised | ||||||||

| Forfeited | ( | ) | ||||||

| Outstanding at September 30, 2023 | $ | |||||||

There are shares available for future grant under the 2016 Plan and available under the 2023 Plan at September 30, 2023.

11. Fair Value Measurements

The following tables summarize the fair values and levels within the fair value hierarchy in which the fair value measurements fall for assets and liabilities measured on a recurring basis as of:

September 30, 2023

| Description | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Liabilities | ||||||||||||||||

| Common stock warrants | $ | $ | $ | $ | ||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

December 31, 2022

| Description | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Liabilities | ||||||||||||||||

| Common stock warrants | $ | $ | $ | $ | ||||||||||||

| 2022 Convertible Notes | $ | $ | $ | $ | ||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

| F-17 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The following table presents the changes in Level 3 instruments measured on a recurring basis for the period ended September 30, 2023:

| Balance at December 31, 2022 | $ | |||

| Changes in fair value of warrants | ( | ) | ||

| Changes in fair value of 2022 Convertible Notes | ||||

| Balance at March 31, 2023 | $ | |||

| Changes in fair value of warrants | ||||

| Changes in fair value of 2022 Convertible Notes | ||||

| Conversion of 2022 Convertible Notes | ( | ) | ||

| Balance at June 30, 2023 | $ | |||

| Changes in fair value of warrants | ( | ) | ||

| Balance at September 30, 2023 | $ |

| September 30, 2023 | December 31, 2022 | |||||||

| Underlying common stock value | $ | $ | ||||||

| Expected term (years) | ||||||||

| Expected volatility | % | % | ||||||

| Risk free interest rate | % | % | ||||||

| Dividend yield | % | % | ||||||

Fluctuation in the fair value of the Company’s Common stock is the primary driver for the change in the Common Stock Warrant liability valuation during each year. As the fair value of the Common stock increases the value to the holder of the instrument generally increases.

Prior to their redemption, fluctuations in the various inputs, including the enterprise value, time to liquidity, volatility, and discount rate are the primary drivers for the changes in valuation of the 2022 Convertible Notes each reporting period. As the fair value of the enterprise value, estimated time to liquidity, volatility, and discount rate increase, the value to the holder of the 2022 Convertible Notes generally increases.

Basic and diluted net loss per share were calculated as follows:

| Three Months Ended | Nine Months Ended | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Net loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Dividends on preferred stock | ( | ) | ( | ) | ( | ) | ||||||||||

| Net loss attributable to common stockholders | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| F-18 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| Three Months Ended | Nine Months Ended | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Weighted average common stock outstanding, basic and diluted | ||||||||||||||||

| $0.01 warrants | ||||||||||||||||

| Total | ||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Net Loss per share, basic and diluted | $ | ) | $ | ) | $ | ) | $ | ) | ||||||||

| September 30, | ||||||||

| 2023 | 2022 | |||||||

| Options to purchase shares of common stock | ||||||||

| Warrants outstanding | ||||||||

| Total | ||||||||

13. Commitments and Contingencies

Legal

The Company is subject to legal proceedings or claims which arise in the ordinary course of its business. Although occasional adverse decisions or settlements may occur, the Company believes that the final disposition of such matters should not have a material adverse effect on its financial position, results of operations or liquidity.

License Agreement

Effective January 26, 2022, the Company entered into an Exclusive License Agreement (the License Agreement) with an unrelated third party. Under the License Agreement, the Company is granted an exclusive license for certain patents and a non-exclusive license for certain know-how. The License Agreement continues until the later of the expiration of the last to expire licensed patent or ten years after the first commercial sale of the first licensed therapeutic or non-therapeutic product. The Company may terminate the License Agreement at any time by providing at least 30 days written notice to the third party. The License Agreement is also terminated upon breach of a material obligation under the agreement or bankruptcy. Upon any termination of the License Agreement, neither party is relieved of obligations incurred prior to the termination.

During

the three and nine months ended September 30, 2023 and 2022, the Company capitalized payments made under this license agreement in the

amount of $

Operating Leases

The Company leases office and lab space in Branford, CT; Groton, CT; and Laval, Quebec. The Company’s leases expire at various dates through May 31, 2027. Most leases are for a fixed term and for a fixed amount. The Company is not a party to any leases that have step rent provisions, escalation clauses, capital improvement funding or payment increases based on any index or rate.

| F-19 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

During

2020, the Company entered into a new lease agreement for the Company’s primary office and laboratory space in Branford, CT. The

Branford lease requires monthly payments of $

During

May 2021, the Company entered into a new lease for office and laboratory space in Groton, CT. The Groton lease required monthly payments

of $

Future minimum payments under non-cancelable operating leases with initial or remaining terms in excess of one year during each of the next five years follow:

| 2023 | $ | |||

| 2024 | ||||

| 2025 | ||||

| 2026 | ||||

| 2027 | ||||

| Thereafter | ||||

| Total future undiscounted lease payments | ||||

| Less interest | ( | ) | ||

| Present value of minimum lease payments | $ |

Rent

expense for all operating leases was $

Finance Leases

During

2023, the Company entered into an agreement with Hewlett Packard to lease equipment. The lease requires monthly payments of $

The following is a schedule showing the future minimum lease payments under finance leases by years and the present value of the minimum payments as of September 30, 2023. value of the minimum payments as of September 30, 2023.

| 2023 | ||||

| 2024 | $ | |||

| 2025 | ||||

| 2026 | ||||

| Thereafter | ||||

| Total future undiscounted lease payments | ||||

| Less interest | ( | ) | ||

| Present value of minimum lease payments | $ |

Lease

expense for the finance lease was $

| F-20 |

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

14. Retirement Plan

Effective

January 1, 2019,

15. Concentration of Credit Risk

Financial instruments that potentially subject the Company to credit risk consist principally of cash and accounts receivable.

For the three and nine months ended September 30, 2023 and 2022, all service revenue was from one customer. For the three and nine months ended September 30, 2023, there was no grant revenue and for the three and nine months ended September 30, 2022, all grant revenue was from one grantor.

The

cash balance identified in the balance sheet is held in an account with a financial institution and insured by the Federal Deposit Insurance

Corporation (FDIC) up to $

16. Related Parties

Total

related party revenue was $

In

September 2022 the Company entered into a convertible promissory note totaling $

17. Subsequent Events

The Company has evaluated events subsequent to the balance sheet date through November 14, 2023, the date these condensed financial statements are issued.

| F-21 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Statement

The following discussion and analysis should be read in conjunction with our unaudited condensed consolidated financial statements and the related notes thereto contained elsewhere in this report. The information contained in this quarterly report on Form 10-Q is not a complete description of our business or the risks associated with an investment in our common stock. We urge you to carefully review and consider the various disclosures made by us in this report and in our other filings with the Securities and Exchange Commission, or SEC, including our Prospectus dated June 15, 2023 and filed with the SEC on June 21, 2023.

In this report we make, and from time to time we otherwise make written and oral statements regarding our business and prospects, such as projections of future performance, statements of management’s plans and objectives, forecasts of market trends, and other matters that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements containing the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimates,” “projects,” “believes,” “expects,” “anticipates,” “intends,” “target,” “goal,” “plans,” “objective,” “should” or similar expressions identify forward-looking statements, which may appear in our documents, reports, filings with the SEC, and news releases, and in written or oral presentations made by officers or other representatives to analysts, stockholders, investors, news organizations and others, and in discussions with management and other of our representatives.

Our future results, including results related to forward-looking statements, involve a number of risks and uncertainties, including those risks included in the “Risk Factors” section in our Prospectus dated June 15, 2023 and filed with the SEC on June 21, 2023. No assurance can be given that the results reflected in any forward-looking statements will be achieved. Any forward-looking statement speaks only as of the date on which such statement is made. Our forward-looking statements are based upon assumptions that are sometimes based upon estimates, data, communications and other information from suppliers, government agencies and other sources that may be subject to revision. Except as required by law, we do not undertake any obligation to update or keep current either (i) any forward-looking statement to reflect events or circumstances arising after the date of such statement or (ii) the important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or which are reflected from time to time in any forward-looking statement.

General

We were formed in January 2014 as a biopharmaceutical company focused on developing innovative therapies for precision dermatology using engineered proteins and live biotherapeutic products. We are an early-stage clinical biopharmaceutical company and have not commenced commercial operations.

To date, we have capitalized our operations primarily through a series of private placements of our convertible preferred stock and convertible promissory notes and our initial public offering, IPO, of common stock which closed on June 21, 2023. In connection with our IPO, we issued 1.5 million shares of our common stock at a public offering price of $5 per share. Concurrent with the close of our IPO, all of our outstanding shares of convertible preferred stock and convertible promissory notes converted into a total of 8,951,526 shares of our common stock. As of November 14, 2023, we had 12,097,643 shares of our common stock issued and outstanding. Except as otherwise indicated, all share and share price this report gives effect to a forward stock split effected on May 17, 2023 at a ratio of 7.1-for-1.

Overview

We focused on developing innovative therapies for precision dermatology using engineered proteins and topical live biotherapeutic products. We have built a proprietary platform that includes a microbial library comprised of approximately 1,500 unique bacterial strains that can be screened for unique therapeutic characteristics. The platform is augmented by an artificial intelligence and machine learning technology that analyzes, predicts and helps screen our library of strains for drug like molecules. The platform also utilizes a licensed genetic engineering technology, which can enable the transformation of previously genetically intractable strains. Our initial focus is on the development of genetically engineered strains of Staphylococcus epidermidis, or S. epidermidis, which we consider to be an optimal therapeutic candidate species for engineering of dermatologic therapies. The particular species demonstrates a number of well-described properties in the skin. As of the date of this report, we have identified among our microbial library over 60 distinct bacterial species that we believe are capable of being engineered to create living organisms or engineered proteins with significant therapeutic effect.

| 1 |

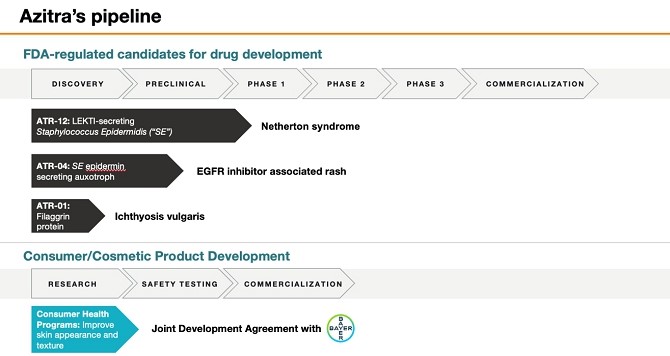

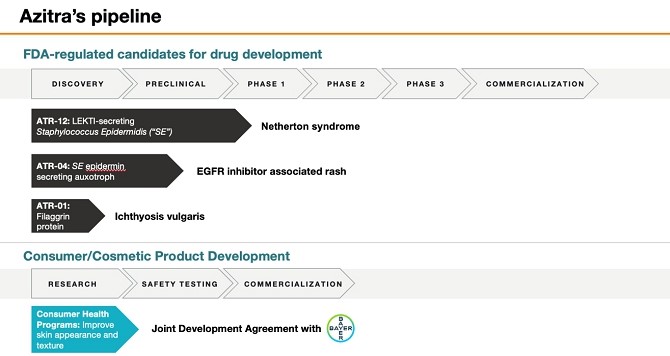

We are a pioneer in genetically engineered bacteria for therapeutic use in dermatology. Our goal is to leverage our platforms and internal microbial library bacterial strains to create new therapeutics that are either engineered living organisms or engineered proteins or peptides to treat skin diseases. Our initial focus is on the development of our current product candidates, including:

| ● | ATR-12, a genetically modified strain of S. epidermidis for treating the orphan disease, Netherton syndrome, a chronic and sometimes fatal disease of the skin estimated to affect approximately one in every 100,000, but its prevalence may be underestimated due to misdiagnosis caused by similarities to other skin diseases. We received Pediatric Rare Disease Designation for ATR-12 by the United States Food and Drug Administration, or FDA, in 2019. In December 2022, we submitted an investigational new drug application, or IND, for a Phase 1b clinical trial of ATR-12 in Netherton syndrome patients, and on January 27, 2023 we received notification from the FDA that the “study may proceed” with respect to the proposed Phase 1b clinical trial. We expect to commence our Phase 1b clinical trial in December of 2023 and report initial results in mid-2024. |

| ● | ATR-04, a genetically modified strain of S. epidermidis for treating the papulopustular rash experienced by cancer patients undergoing epidermal growth factor receptor inhibitor, or EGFRi, targeted therapy. We intend to submit an IND for a Phase 1b clinical trial in certain cancer patients undergoing EGFRi targeted therapy by the first half of 2024. Subject to FDA clearance of our IND, we expect to commence our Phase 1b clinical trial in the second half of 2024. |

| ● | ATR-01, an engineered recombinant human filaggrin protein for treating ichthyosis vulgaris, a chronic, xerotic (abnormally dry), scaly skin disease with an estimated incidence and prevalence of 1 in 250, which suggests a total patient population of 1.3 million in the United States. We are planning to complete lead optimization and IND-enabling studies in 2023 and 2024 to support an IND filing target in late 2024 or early 2025. |

| ● | Two separate strains of bacterial microbes being investigated and developed by us and Bayer Consumer Care AG, the consumer products division of Bayer AG, or Bayer, the international life science company. We entered into a Joint Development Agreement, or JDA, with Bayer in December 2019. Under the terms of the JDA, we are responsible for testing our library of bacterial strains and their natural products for key preclinical properties. After screening through hundreds of strains, we and Bayer have selected two particular strains to move forward into further development. Bayer holds the exclusive option to license the patent rights to these strains. In December 2020, Bayer purchased $8 million of our Series B preferred stock, which converted into 1,449,743 shares of our common stock, representing approximately 12.0%, of our outstanding common shares. |

| 2 |

We also have established partnerships with teams from Carnegie Mellon University and the Fred Hutchinson Cancer Center, or Fred Hutch, two of the premier academic centers in the United States. Our collaboration with the Carnegie Mellon based team also takes advantage of the power of whole genome sequencing. This partnership is mining our proprietary library of bacterial strains for novel, drug like peptides and proteins. The artificial intelligence/machine learning technology developed by this team predicts the molecules made by microbes from their genetic sequences. The system then compares the predictions to the products actually made through tandem mass spectroscopy and/or nuclear magnetic resonance imaging to refine future predictions. The predictions can be compared to publicly available 2D and 3D protein databases to select drug like structures.

We hold an exclusive, worldwide license from Fred Hutch regarding the use of its patented SyngenicDNA Minicircle Plasmid, or SyMPL, technologies for all fields of genetic engineering, including to discover, develop and commercialize engineered microbial therapies and microbial-derived peptides and proteins for skin diseases. We are utilizing our licensed patent rights to build plasmids in order to make genetic transformations that have never been previously achieved. To date, our team has successfully engineered our lead therapeutic candidates without the SyMPL technology. However, we believe that SyMPL will open up the ability to make genetic transformations of an expanded universe of microbial species, and we expect that some or all of our future product candidates will incorporate the SyMPL technology. Our collaboration with Fred Hutch is led by Dr. Christopher Johnston, an expert in microbial engineering, and the innovator behind the SyMPL technology.

Our Strategy

Beyond our three lead product candidates and collaboration with Bayer, our goal is to develop a broad portfolio of product candidates focused on expanding the application of our platforms for precision dermatology. We believe that we have established a unique position in advancing the development of biologics for precision dermatology.

We intend to create a broad portfolio of product candidates for precision dermatology through our development of genetically engineered proteins selected from our proprietary microbial library of approximately 1,500 unique bacterial strains. Our strategy is as follows:

| ● | Build a sustainable precision dermatology company. Our goal is to build a leading precision dermatology company with a sustainable pipeline of product candidates. To that end, we are focused on rapidly advancing our current pipeline of live biotherapeutic candidates while actively developing additional product candidates. Each of our current product candidates are proprietary and subject to pending patent applications. We expect that most, if not all, genetically engineered product candidates we develop will be eligible for patent protection. |

| ● | Advance our lead product candidates, ATR-12 and ATR-04, through clinical trials. In 2022, we obtained pre-IND correspondence with the FDA for purposes of discussing our proposed regulatory pathway for ATR-12 and obtaining guidance from the FDA on the preclinical plan leading to the filing and acceptance of an IND for ATR-12. In December 2022, we filed an IND for a first-in-human trial of ATR-12 in Netherton syndrome patients. On January 27, 2023, we received notification from the FDA that the “study may proceed” with respect to the proposed Phase 1b clinical trial, and we expect to commence our Phase 1b clinical trial in December of 2023, with initial results expected by mid-2024. We also plan to conduct a Phase 1b trial of our ATR-04 in certain cancer patients undergoing EGFRi therapy and expect to file an IND for ATR-04 by the first half of 2024. |

| 3 |

| ● | Broaden our platform by selectively exploring strategic partnerships that maximize the potential of our precision dermatology programs. We intend to maintain significant rights to all of our core technologies and product candidates. However, we will continue to evaluate partnering opportunities in which a strategic partner could help us to accelerate development of our technologies and product candidates, provide access to synergistic combinations, or provide expertise that could allow us to expand into the treatment of different types of skin diseases. We may also broaden the reach of our platform by selectively in-licensing technologies or product candidates. In addition, we will consider potentially out-licensing certain of our proprietary technologies for indications and industries that we are not ourselves pursuing. We believe our genetic engineering techniques and technologies have applicability outside of the field of medicine, including cosmetics and in the generation of clean fuels and bioremediation. |

| ● | Leverage our academic partnerships. We currently have partnerships with investigators at the Fred Hutchinson Cancer Center, Yale University, Jackson Laboratory for Genomic Medicine, and Carnegie Mellon University. We expect to leverage these partnerships and potentially expand them or form other academic partnerships to bolster our engineering platforms and expand our research and development pipeline. |

| ● | Expand on our other potential product candidates. Beyond our three lead product candidates, our goal is to develop a broad portfolio of product candidates focused on expanding the application of our platforms for precision dermatology. We have a proprietary platform for discovering and developing therapeutic products for precision dermatology. Our platform is built around a microbial library comprised of approximately 1,500 unique bacterial strains to allow screening for unique therapeutic characteristics and utilizes a microbial genetic technology that analyzes, predicts and engineers the proteins, peptides and molecules made by skin microbes. Our ability to genetically engineer intractable microbial species is uniquely leveraged by our exclusive license to the SyMPL technology. |

Results of Operations

We are an early-stage clinical biopharmaceutical company, formed in January 2014, and have limited operating history. We have not commenced revenue-producing operations apart from limited service revenue derived through our JDA with Bayer. Under the terms of the JDA, we are responsible for testing our library of microbial strains and their natural products for key preclinical properties and Bayer reimburses us for our development costs. To date, our operations have consisted of the development of our proprietary microbial library, the identification, characterization and testing of certain bacterial species from our microbial library that we believe are capable of being engineered to provide significant therapeutic effect and the development of our initial product candidates.

| 4 |

Three Months Ended September 30, 2023 Compared to Three Months Ended September 30, 2022

The following table summarizes our results of operations with respect to the items set forth below for the three months ended September 30, 2023 and 2022, together with the percentage change for those items.

| Three Months Ended September 30, | ||||||||||||||||

| 2023 | 2022 | $ Change | % Change | |||||||||||||

| Service revenue - related party | $ | 310,700 | $ | 48,500 | $ | 262,200 | 541 | % | ||||||||

| Total revenue | 310,700 | 48,500 | 262,200 | 541 | % | |||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | 1,755,908 | 1,054,570 | 701,338 | 67 | % | |||||||||||

| Research and development | 548,524 | 1,364,380 | (815,856 | ) | (60 | )% | ||||||||||

| Total operating expenses | 2,304,432 | 2,418,950 | (114,518 | ) | (5 | )% | ||||||||||

| Loss from operations | (1,993,732 | ) | (2,370,450 | ) | 376,718 | (16 | )% | |||||||||

| Other income (expense): | ||||||||||||||||

| Interest income | 634 | 3,201 | (2,567 | ) | (80 | )% | ||||||||||

| Interest expense | (710 | ) | (31,333 | ) | 30,623 | (98 | )% | |||||||||

| Employee retention credit | — | — | — | — | % | |||||||||||

| Forgiveness of accounts payable | — | — | — | — | % | |||||||||||

| Change in fair value of convertible note | — | — | — | — | % | |||||||||||

| Other expense | 50,519 | (19,038 | ) | 69,557 | (365 | )% | ||||||||||

| Total other income (expense) | 50,443 | (47,170 | ) | 97,613 | (207 | )% | ||||||||||

| Net loss | (1,943,289 | ) | (2,417,620 | ) | 474,331 | (20 | )% | |||||||||

| Net loss | (1,943,289 | ) | (2,417,620 | ) | 474,331 | (20 | )% | |||||||||

| Dividends on preferred stock | — | (692,246 | ) | 692,246 | (100 | )% | ||||||||||

| Net loss attributable to common shareholders | $ | (1,943,289 | ) | $ | (3,109,866 | ) | $ | 1,166,577 | (38 | )% | ||||||

Service Revenue - Related Party

We generated $310,700 of service revenue under the Bayer JDA during the third quarter of fiscal 2023 compared to service revenue of $48,500 under the JDA for the comparable period in fiscal 2022. The increase of $262,200 in service revenue is attributable to an increase in the amount of reimbursable development costs incurred in 2023.

| 5 |

General and Administrative

General and administrative costs during the third quarter of fiscal 2023 increased by $701,338, or 67%, to $1,755,908 from the prior year period. The increase was primarily related to an increase of $856,000 in accounting, legal, financing, and insurance costs offset by a decrease of $154,662 in payroll and related costs.

Research and Development