UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report |

For the transition period from to

Commission file number: 000-55899

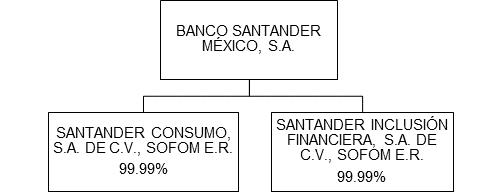

BANCO SANTANDER MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE,

GRUPO FINANCIERO SANTANDER MÉXICO

(Exact name of Registrant as specified in its charter)

United Mexican States

(Jurisdiction of incorporation or organization)

Avenida Prolongación Paseo de la Reforma 500

Colonia Lomas de Santa Fe

Alcaldía Álvaro Obregón

01219 Mexico City

(Address of principal executive offices)

Fernando Borja Mujica

Deputy General Legal and Compliance Director

BANCO SANTANDER MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE,

GRUPO FINANCIERO SANTANDER MÉXICO

Avenida Prolongación Paseo de la Reforma 500

Colonia Lomas de Santa Fe

Alcaldía Álvaro Obregón

01219 Mexico City

Telephone: +(52) 55-5257-8000

Fax: +52 55-5269-2701

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

American Depositary Shares, each representing five shares of the Series B common stock of Banco Santander México, S.A., Institución de Banca Múltiple, Grupo Financiero Santander México, par value of Ps.3.780782962 | BSMX | New York Stock Exchange |

Series B shares, par value of Ps.3.780782962 | BSMX | New York Stock Exchange* |

* | Banco Santander México, S.A., Institución de Banca Múltiple, Grupo Financiero Santander México’s Series B shares are not listed for trading, but are only listed in connection with the registration of the American Depositary Shares, pursuant to the requirements of the New York Stock Exchange. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of the period covered by the annual report.

Series B shares: 3,322,685,212

Series F shares: 3,464,309,145

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to post such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer," accelerated filer,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ |

| | Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | |

U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No