Delaware |

4924 |

47-1929160 | ||

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| ☒ | Smaller reporting company | |||||

| Emerging growth company |

* |

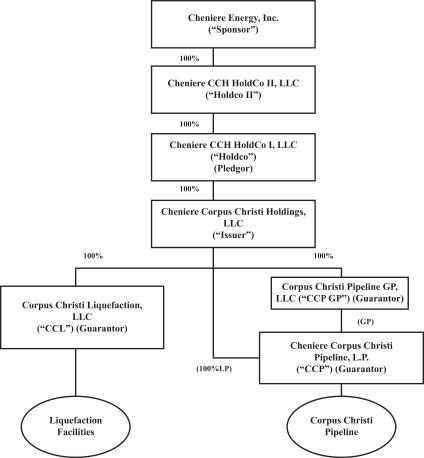

The following are additional registrants that are guaranteeing the securities registered hereby: |

| Exact Name of Registrant Guarantor as Specified in its Charter(1) |

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number | ||

| Corpus Christi Liquefaction, LLC |

Delaware |

35-2445602 | ||

| Cheniere Corpus Christi Pipeline, L.P. |

Delaware |

20-4711857 | ||

| Corpus Christi Pipeline GP, LLC |

Delaware |

47-1936771 |

(1) |

The address, including zip code, and telephone number, including area code, of each additional registrant guarantor’s executive offices is 700 Milam Street, Suite 1900, Houston, Texas 77002, (713) 375-5000. |

| • | We are offering to exchange up to $750,000,000 aggregate principal amount of registered 2.742% Senior Secured Notes due 2039 (CUSIP No. 16412X AL9) (the “New Notes”) for any and all of our $750,000,000 aggregate principal amount of unregistered 2.742% Senior Secured Notes due 2039 (CUSIP Nos. 16412X AK1 and U16327 AE5) (the “Old Notes” and together with the New Notes, the “notes”) that were issued on August 24, 2021. |

| • | We will exchange all outstanding Old Notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer for an equal principal amount of New Notes, as applicable. |

| • | The terms of the New Notes will be substantially identical to those of the outstanding Old Notes, except that the New Notes will be registered under the Securities Act of 1933, as amended (the “Securities Act”), and will not contain restrictions on transfer, registration rights or provisions for additional interest. |

| • | You may withdraw tenders of Old Notes at any time prior to the expiration of the exchange offer. |

| • | The exchange of Old Notes for New Notes will not be a taxable event for U.S. federal income tax purposes. |

| • | We will not receive any cash proceeds from the exchange offer. |

| • | The Old Notes are, and the New Notes will be, secured by first-priority liens on substantially all right, title and interest in or to substantially all of our assets and the assets of our current and any future guarantors along with certain other items listed under “Description of Senior Notes” (the “Collateral”). |

| • | The Old Notes are, and the New Notes will be, guaranteed on a senior basis by all of our existing subsidiaries and certain of our future domestic subsidiaries (as described herein). |

| • | There is no established trading market for the New Notes or the Old Notes. |

| • | We do not intend to apply for listing of the New Notes on any national securities exchange or for quotation through any quotation system. |

| ii | ||||

| ii | ||||

| ii | ||||

| iv | ||||

| 1 | ||||

| 16 | ||||

| 38 | ||||

| 39 | ||||

| 53 | ||||

| 62 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 86 | ||||

| 96 | ||||

| 146 | ||||

| 162 | ||||

| 207 | ||||

| 214 | ||||

| 216 | ||||

| 217 | ||||

| 218 | ||||

| 218 | ||||

| 219 | ||||

| 275 | ||||

F-1 |

| • | Bcf |

| • | Bcf/d |

| • | Bcfe |

| • | Bcf/yr |

| • | DOE |

| • | Dth/d |

| • | EPC |

| • | FERC |

| • | FOB |

| • | FTA |

| • | FTA countries |

| • | GAAP |

| • | Henry Hub |

| • | IPM Agreement |

| • | LIBOR |

| • | LNG |

| • | MMBtu |

| • | MMBtu/d |

| • | mtpa |

| • | non-FTA countries |

| • | SPA |

| • | SOFR |

| • | TBtu |

| • | Tcf |

| • | Train |

| • | statements that we expect to commence or complete construction of our proposed LNG terminal, liquefaction facility, pipeline facility or other projects, or any expansions or portions thereof, by certain dates, or at all; |

| • | statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products; |

| • | statements regarding any financing transactions or arrangements, or our ability to enter into such transactions; |

| • | statements regarding our future sources of liquidity and cash requirements; |

| • | statements relating to the construction of our Trains and pipeline, including statements concerning the engagement of any EPC contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; |

| • | statements regarding any SPA or other agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total natural gas liquefaction or storage capacities that are, or may become, subject to contracts; |

| • | statements regarding counterparties to our commercial contracts, construction contracts, and other contracts; |

| • | statements regarding our planned development and construction of additional Trains and pipelines, including the financing of such Trains and pipelines; |

| • | statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; |

| • | statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change; |

| • | statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; |

| • | statements regarding the COVID-19 pandemic and its impact on our business and operating results, including any customers not taking delivery of LNG cargoes, the ongoing creditworthiness of our contractual counterparties, any disruptions in our operations or construction of our Trains and the health and safety of Cheniere’s employees, and on our customers, the global economy and the demand for LNG; and |

| • | any other statements that relate to non-historical or future information. |

FERC Approved Volume |

DOE Approved Volume |

|||||||||||||||

(in Bcf/yr) |

(in mtpa) |

(in Bcf/yr) |

(in mtpa) |

|||||||||||||

| FTA countries |

875.16 | 17 | 875.16 | 17 | ||||||||||||

| Non-FTA countries |

875.16 | 17 | 767 | (1) | 15 | |||||||||||

| (1) | The authorization for an additional 108.16 Bcf/yr (approximately 2 mtpa) of natural gas is currently pending. |

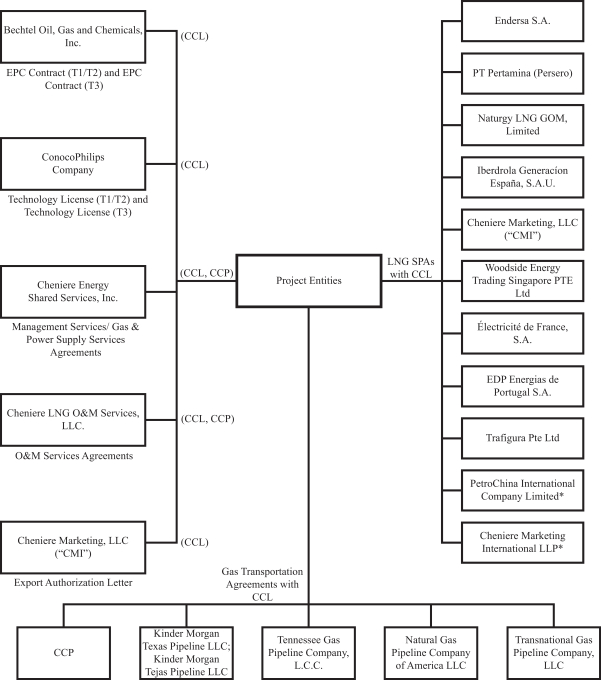

| * | This SPA is structurally linked to the SPA between Cheniere Marketing International LLP and PetroChina International Company Limited. See “Description of Material Project Agreements—LNG Sale and Purchase Agreements—Stage 2—DES-Linked SPA.” |

| • | safely, efficiently and reliably operating and maintaining our assets; |

| • | procuring natural gas and pipeline transport capacity to our facility; |

| • | commencing commercial delivery for our long-term SPA customers, of which we have initiated for nine of ten third party long-term SPA customers as of December 31, 2021; |

| • | maximizing the production of LNG to serve our customers and generating steady and stable revenues and operating cash flows; |

| • | further expanding and/or optimizing the Liquefaction Project by leveraging existing infrastructure; |

| • | maintaining a prudent and cost-effective capital structure; and |

| • | strategically identifying actionable environmental solutions. |

| Old Notes |

2.742% Senior Secured Notes due 2039, which were issued on August 24, 2021. |

| New Notes |

2.742% Senior Secured Notes due 2039. The terms of the New Notes are substantially identical to the terms of the outstanding Old Notes, except that the transfer restrictions, registration rights and provisions for additional interest relating to the Old Notes will not apply to the New Notes. |

| Exchange Offer |

We are offering to exchange up to $750 million aggregate principal amount of our New Notes that have been registered under the Securities Act for an equal amount of our outstanding Old Notes that have not been registered under the Securities Act to satisfy our obligations under the registration rights agreement. |

| The New Notes will evidence the same debt as the Old Notes for which they are being exchanged and will be issued under, and be entitled to the benefits of, the same indenture that governs the Old Notes. Holders of the Old Notes do not have any appraisal or dissenters’ rights in connection with the exchange offer. Because the New Notes will be registered, the New Notes will not be subject to transfer restrictions, and holders of Old Notes that have tendered and had their Old Notes accepted in the exchange offer will have no registration rights. The New Notes will have a CUSIP number different from that of any Old Notes that remain outstanding after the completion of the exchange offer. |

| Expiration Date |

The exchange offer will expire at 5:00 p.m., New York City time, on , 2022, unless we decide to extend the date. |

| Conditions to the Exchange Offer |

The exchange offer is subject to customary conditions, which we may waive. Please read “The Exchange Offer—Conditions to the Exchange Offer” for more information regarding the conditions to the exchange offer. |

| Procedures for Tendering Old Notes |

You must do one of the following on or prior to the expiration of the exchange offer to participate in the exchange offer: |

| • | tender your Old Notes by sending the certificates for your Old Notes, in proper form for transfer, a properly completed and duly executed letter of transmittal, with any required signature guarantees, and all other documents required by the letter of transmittal, to The Bank of New York Mellon, as registrar and |

| exchange agent, at the address listed under the caption “The Exchange Offer—Exchange Agent”; or |

| • | tender your Old Notes by using the book-entry transfer procedures described below and transmitting a properly completed and duly executed letter of transmittal, with any required signature guarantees, or an agent’s message instead of the letter of transmittal, to the exchange agent. In order for a book-entry transfer to constitute a valid tender of your Old Notes in the exchange offer, The Bank of New York Mellon, as registrar and exchange agent, must receive a confirmation of book-entry transfer of your Old Notes into the exchange agent’s account at The Depository Trust Company (“DTC”) prior to the expiration of the exchange offer. For more information regarding the use of book-entry transfer procedures, including a description of the required agent’s message, please read the discussion under the caption “The Exchange Offer—Procedures for Tendering—Book-entry Transfer.” |

| Withdrawal; Non-Acceptance |

You may withdraw any Old Notes tendered in the exchange offer at any time prior to 5:00 p.m., New York City time, on , 2022 by following the procedures described in this prospectus and the related letter of transmittal. If we decide for any reason not to accept any Old Notes tendered for exchange, the Old Notes will be returned to the registered holder at our expense promptly after the expiration or termination of the exchange offer. In the case of Old Notes tendered by book-entry transfer in to the exchange agent’s account at DTC, any withdrawn or unaccepted Old Notes will be credited to the tendering holder’s account at DTC. For further information regarding the withdrawal of tendered Old Notes, please read “The Exchange Offer—Withdrawal Rights.” |

| U.S. Federal Income Tax Consequences |

The exchange of New Notes for Old Notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. Please read the discussion under the caption “Material United States Federal Income Tax Consequences” for more information regarding the tax consequences to you of the exchange offer. |

| Use of Proceeds |

The issuance of the New Notes will not provide us with any new proceeds. We are making this exchange offer solely to satisfy our obligations under the registration rights agreement. |

| Fees and Expenses |

We will pay all of our expenses incident to the exchange offer. |

| Exchange Agent |

We have appointed The Bank of New York Mellon as exchange agent for the exchange offer. For the address, telephone number and fax number of the exchange agent, please read “The Exchange Offer—Exchange Agent.” |

| Resales of New Notes |

Based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties that are not related to us, we |

| believe that the New Notes you receive in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act so long as: |

| • | the New Notes are being acquired in the ordinary course of business; |

| • | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate in the distribution of the New Notes issued to you in the exchange offer; |

| • | you are not our affiliate or an affiliate of any of our subsidiary guarantors; and |

| • | you are not a broker-dealer tendering Old Notes acquired directly from us for your account. |

| The SEC has not considered this exchange offer in the context of a no-action letter, and we cannot assure you that the SEC would make similar determinations with respect to this exchange offer. If any of these conditions are not satisfied, or if our belief is not accurate, and you transfer any New Notes issued to you in the exchange offer without delivering a resale prospectus meeting the requirements of the Securities Act or without an exemption from registration of your New Notes from those requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. Each broker-dealer that receives New Notes for its own account in exchange for Old Notes, where the Old Notes were acquired by such broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such New Notes. Please read “Plan of Distribution.” |

| Please read “The Exchange Offer—Resales of New Notes” for more information regarding resales of the New Notes. |

| Consequences of Not Exchanging Your Old Notes |

If you do not exchange your Old Notes in this exchange offer, you will no longer be able to require us to register your Old Notes under the Securities Act, except in the limited circumstances provided under the registration rights agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer your Old Notes unless we have registered the Old Notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act. |

| For information regarding the consequences of not tendering your Old Notes and our obligation to file a registration statement, please read “The Exchange Offer—Consequences of Failure to Exchange Old Notes” and “Description of Senior Notes.” |

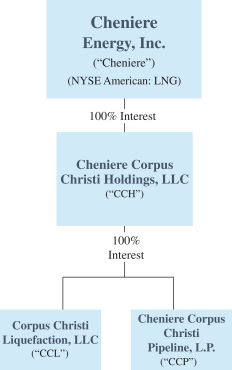

| Issuer |

Cheniere Corpus Christi Holdings, LLC. |

| Notes Offered |

$750,000,000 aggregate principal amount of 2.742% Senior Secured Notes due 2039. |

| Maturity Date |

The New Notes mature on December 31, 2039. |

| Interest |

Interest on the New Notes will accrue at a rate equal to 2.742% per annum, computed on the basis of a 360-day year comprising twelve 30-day months. |

| Interest Payment Dates |

We will pay interest on the New Notes semi-annually, in cash in arrears, on June 30 and December 31 of each year, commencing on June 30, 2022. |

| Guarantees |

The New Notes will be guaranteed by all of our existing Domestic Subsidiaries and certain of our future Domestic Subsidiaries. As of the date of this prospectus, the Guarantors consist of each of CCL, CCP and CCP GP. See “Description of Senior Notes—Guarantees of the Notes.” |

| Security and Collateral |

The New Notes will be secured by a first priority security interest in substantially all of our and the Guarantors’ assets. The Collateral securing the New Notes includes: |

| • | substantially all of our assets and the assets of our existing and any future Guarantors (including real and personal property whether owned or leased on the closing date of this exchange offer or thereafter acquired); |

| • | a pledge by Holdco of all ownership interests in CCH; |

| • | all contracts, agreements and documents, including the Material Project Agreements, hedging arrangements and insurance policies, and all of our rights thereunder; |

| • | certain Accounts; |

| • | cash flow and other revenues; and |

| • | other real and personal property which is subject, from time to time, to the Security Interests or liens granted by the Security Documents. |

| Ranking |

The New Notes will constitute direct and unconditional senior secured obligations, and will rank pari passu |

| The New Notes will be effectively senior to all of our future junior lien obligations and future unsecured senior indebtedness, to the extent of the value of the Collateral securing the notes. |

| The New Notes will be effectively junior to any of our or our Subsidiaries’ secured indebtedness that is secured by liens on assets other than the Collateral securing the notes, to the extent of the value of such assets. |

| The New Notes will be structurally subordinated to any future indebtedness of our non-Guarantor Subsidiaries. |

| As of December 31, 2021, we had $589 million of available commitments, $361 million aggregate amount of issued letters of credit and $250 million of loans outstanding under the $1.2 billion working capital facility (the “Working Capital Facility”). |

| As of December 31, 2021, we had approximately $10.4 billion of total debt outstanding (before unamortized discount and debt issuance costs). As of December 31, 2021, we had approximately $1.7 billion of outstanding borrowings under our Term Loan Facility, $1.25 billion of outstanding 7.000% Senior Secured Notes due 2024 (the “2024 Senior Notes”), $1.5 billion of outstanding 5.875% Senior Secured Notes due 2025 (the “2025 Senior Notes”), $1.5 billion of 5.125% Senior Secured Notes due 2027 (the “2027 Senior Notes”), $1.5 billion of outstanding 3.700% Senior Secured Notes due 2029 (the “2029 Senior Notes”), $750 million of outstanding Old Notes (the Old Notes, together with the 2024 Senior Notes, the 2025 Senior Notes, the 2027 Senior Notes and the 2029 Senior Notes, the “144A Senior Notes”), $727.0 million of outstanding 4.80% Senior Secured Notes due 2039 (the “4.80% Senior Notes”), $475.0 million of outstanding 3.925% Senior Secured Notes due 2039 (the “3.925% Senior Notes”) and $768.7 million of outstanding 3.52% Senior Secured Notes due 2039 (the “3.52% Senior Notes” and, together with the 144A Senior Notes, the 4.80% Senior Notes and the 3.925% Senior Notes, the “Outstanding Senior Notes”). |

| Optional Redemption |

At any time from time to time prior to July 4, 2039, we may redeem the New Notes, in whole or in part, at a redemption price equal to the Make-Whole Price as defined under the caption “Description of Senior Notes—Optional Redemption,” plus accrued and unpaid |

| interest to the redemption date. We also may, at any time on or after July 4, 2039, redeem the New Notes, in whole or in part, at a redemption price equal to 100% of the principal amount of the New Notes to be redeemed, plus accrued and unpaid interest on the New Notes redeemed to the redemption date. See “Description of Senior Notes—Optional Redemption.” |

| Change of Control |

Upon the occurrence of a Change of Control, we must commence, within 30 days, and subsequently consummate an offer to purchase all notes then outstanding at a purchase price in cash equal to 101% of their aggregate principal amount, plus accrued and unpaid interest on the notes repurchased to the date of repurchase. After the Project Completion Date, a Change of Control shall not be deemed to have occurred if we receive rating reaffirmations from two rating agencies (or one rating agency, if only one rating agency currently rates the New Notes) reaffirming the then-current rating of the New Notes as of the date of such change of control. We may not be able to repurchase notes upon a Change of Control in certain circumstances. See “Risk Factors —Risks Relating to the Exchange Offer and the New Notes—We may not be able to repurchase notes upon a Change of Control or upon the exercise of the holders’ options to require repurchase of notes if certain prepayment triggering events occur, and the occurrence of certain of these events and our repurchase of notes as a result thereof could result in an event of default under the indenture or other agreements governing our indebtedness.” |

| Additional Offers to Purchase |

If we sell assets under certain circumstances and do not use the proceeds for certain specified purposes, if we receive insurance proceeds following a Catastrophic Casualty Event and do not use the proceeds for certain specified purposes, if we receive Performance Liquidated Damages payments under certain circumstances and do not use the proceeds for certain specified purposes, if we fail to maintain our Qualifying LNG SPAs in accordance with the terms of the indenture, or if certain of our Required Export Authorizations are Impaired, we must offer to repurchase the New Notes and may be required to make a repayment of other Senior Debt in amounts specified in the indenture and in our agreements related to our other Senior Debt. In each case, under the indenture, the purchase price of the New Notes will be equal to 100% of the principal amount of the New Notes repurchased, plus accrued and unpaid interest on the New Notes to, but excluding, the applicable repurchase date. See “Description of Senior Notes—Repurchase at the Option of Noteholders—Asset Sales,” “—Events of Loss,” “—Performance Liquidated Damages,” and “—LNG SPA Mandatory Offer.” We may not be able to repurchase the New Notes upon an Asset Sale, Event of Loss, receipt of Performance Liquidated Damages or an Indenture LNG SPA Prepayment Event in certain circumstances. See “Risk Factors—Risks Relating to the Exchange Offer and the New Notes—We may not be able to repurchase notes upon a Change of Control or upon the exercise of the holders’ options to require repurchase of |

| notes if certain prepayment triggering events occur, and the occurrence of certain of these events and our repurchase of notes as a result thereof could result in an event of default under the indenture or other agreements governing our indebtedness.” |

| Pre-Completion Account Flows |

Disbursements of Loans will be deposited into the Construction Account subject to certain rules described in our CSAA (as defined herein). See “Description of Security Documents —Common Security and Account Agreement—Pre-Completion Cash Flows.” |

| Unless paid directly towards the purpose for which they are incurred, disbursements of Senior Debt in connection with an issuance of Senior Notes under any Indenture will be made into a Senior Note Disbursement Account(s), subject to certain rules described in our CSAA. See “Description of Security Documents—Common Security and Account Agreement—Pre-Completion Cash Flows.” |

| Prior to the Project Completion Date, the Construction Account will be funded with any funds withdrawn and transferred from the Equity Proceeds Account and proceeds from our Senior Debt, and may from time to time be funded with any Business Interruption Insurance Proceeds and Delay Liquidated Damages payments received by us. Amounts in the Construction Account will be used to pay Project Costs in accordance with the construction budget and schedule and any Operation and Maintenance Expenses. |

| Prior to the Project Completion Date, any revenues will be deposited into the Equity Proceeds Account and may be transferred to the Construction Account. |

| Prior to the Project Completion Date, we must fund the Operating Account from the Construction Account, and must use the Operating Account to pay Operation and Maintenance Expenses that are due in a manner consistent with our obligations under our Common Terms Agreement and our Finance Documents, then in effect. |

| Post-Completion Account Flows |

After the completion of Train One, Train Two and Train Three, revenues received by us will be applied in the following manner: |

| • | first |

| • | second |

| • | third pari passu |

| scheduled payments of hedge termination value and gas hedge termination value to be paid by us pursuant to Permitted Hedging Instruments secured on a pari passu |

| • | fourth |

| • | fifth |

| • | sixth |

| • | seventh |

| • | eighth |

| • | ninth |

| Covenants |

The indenture governing the New Notes will contain covenants that, among other things and subject to certain exceptions and/or conditions, limit our ability and the ability of our Restricted Subsidiaries to: |

| • | make Restricted Payments; |

| • | incur additional Indebtedness or issue preferred stock; |

| • | assume, incur, permit or suffer to exist any Lien on any asset of CCH or any Restricted Subsidiary; |

| • | create or permit to exist or become effective any consensual encumbrance or restriction on the ability of any Restricted Subsidiary to pay dividends, pay indebtedness owed to CCH or any of its Restricted Subsidiaries, make loans or advances to CCH or any of its Restricted Subsidiaries, or sell, lease or transfer any properties or assets to CCH or any of its Restricted Subsidiaries; |

| • | dissolve, liquidate, consolidate, merge, sell or lease all or substantially all of the assets or properties of CCH and its Restricted Subsidiaries taken as a whole in one or more related transactions or permit any Guarantor to dissolve, liquidate, consolidate, merge, sell or lease all or substantially all of its assets and properties; |

| • | enter into certain transactions or agreements with or for the benefit of any Affiliate of CCH or any of its Restricted Subsidiaries; |

| • | amend or modify Material Project Agreements; |

| • | enter into any lifting and balancing arrangement or Sharing Arrangement with an External Train Entity; and |

| • | amend or modify any Qualifying LNG SPA. |

| These covenants are subject to a number of important limitations and exceptions that are described in this prospectus under the caption “Description of Senior Notes—Covenants Applicable to the Notes.” |

| No Exchange Listing |

We do not intend to list the New Notes on any national securities exchange or to arrange for quotation on any automated dealer quotation systems. There can be no assurance that an active trading market will develop for the New Notes. If an active trading market does not develop, the market price and liquidity of the New Notes may be adversely affected. |

| Risk Factors |

You should refer to the section entitled “Risk Factors” beginning on page 16 of this prospectus for a discussion of factors you should carefully consider before deciding to participate in the exchange offer. |

| • | Our existing level of cash resources and significant debt |

| • | Our ability to generate cash |

| • | Our efforts to manage commodity and financial risks through derivative instruments |

| • | Catastrophic weather events or other disasters |

| • | Disruptions to the third party supply of natural gas to our pipeline and facilities |

| • | Inability to purchase or receive physical delivery of sufficient natural gas to satisfy our delivery obligations under the SPAs |

| • | Significant construction and operating hazards and uninsured risks |

| • | Cyclical or other changes in the demand for and price of LNG and natural gas |

| • | Failure of exported LNG to be a competitive source of energy for international markets |

| • | Competition based upon the international market price for LNG |

| • | A cyber attack involving our business, operational control systems or related infrastructure, or that of third party pipelines which supply the Liquefaction Facilities |

| • | Outbreaks of infectious diseases, such as the outbreak of COVID-19, at our facilities |

| • | Our dependency on Cheniere, including employees of Cheniere and its subsidiaries, for key personnel, and the unavailability of skilled workers or our failure to attract and retain qualified personnel |

| • | Our contractual and commercial relationships, and conflicts of interest, with Cheniere and its affiliates, including CMI UK |

| • | Failure to obtain and maintain approvals and permits from governmental and regulatory agencies |

| • | Subjectivity to FERC regulation |

| • | Existing and future environmental and similar laws and governmental regulations |

| • | Pipeline safety and compliance programs and repairs |

| • | Failure to properly tender your Old Notes |

| • | Our ability to incur substantially more indebtedness in the future |

| • | Our substantial indebtedness |

| • | Requirement of significant amounts of cash to service our indebtedness |

| • | Additional financing required to finance the construction of any additional Trains |

| • | Restrictions in the indenture governing the New Notes |

| • | Our ability to repurchase notes upon a Change of Control or upon the exercise of the holders’ options to require repurchase of notes |

| • | Federal and state statutes could require note holders to return payments received from us |

| • | Your ability to resell the New Notes |

| • | Sufficient collateral to pay all or any amounts due on the New Notes |

| • | Potential liens on the real property comprising the Trains and the Corpus Christi Pipeline that are senior to the security interests securing the New Notes |

| • | Certain real property rights that will not be mortgage prior to the issuance of the New Notes |

| • | Title insurance policy that has only been obtained on the real property rights of the Liquefaction Facilities and not for the Corpus Christi Pipeline |

| • | surveys obtained in connection with the real property rights underlying the Liquefaction Facilities and the Corpus Christi Pipeline may be inaccurate or not comprehensive |

| • | Limitation of remedies available to the Security Trustee |

| • | Termination of certain real property rights held by us constituting collateral for the New Notes |

| • | CSAA provisions that may limit the remedies that could be exercised in respect of an event of default |

| • | Remedies available to the holders of the notes and the Security Trustee in bankruptcy may be limited |

| • | Failure to perfect security interest in your collateral and other issues generally associated with the realization of security interest in your collateral |

| • | Casualty risks of the collateral |

| • | Representations and warranties, covenants or events of default contained in the Common Terms Agreement that are not contained in the indenture governing the New Notes |

| • | Any future pledge of collateral might be avoidable in bankruptcy |

| • | An existing or future subsidiary’s guarantee of the New Notes may not be sufficient |

| • | The New Notes will be structurally subordinated in right of payment to the indebtedness and other liabilities of any subsidiaries that do not guarantee the New Notes |

| • | Your right to receive payments under the New Notes will be effectively subordinated |

| • | The ratings of the New Notes may be lowered or withdrawn |

| • | Changes in our credit rating |

| • | competitive liquefaction capacity in North America; |

| • | insufficient or oversupply of natural gas liquefaction or receiving capacity worldwide; |

| • | insufficient LNG tanker capacity; |

| • | weather conditions, including temperature volatility resulting from climate change, and extreme weather events may lead to unexpected distortion in the balance of international LNG supply and demand. For example, LNG procurement in Japan rose dramatically in 2011 and several years thereafter following a tsunami that caused extensive destruction to its nuclear power infrastructure; |

| • | reduced demand and lower prices for natural gas; |

| • | increased natural gas production deliverable by pipelines, which could suppress demand for LNG; |

| • | decreased oil and natural gas exploration activities which may decrease the production of natural gas, including as a result of any potential ban on production of natural gas through hydraulic fracturing; |

| • | cost improvements that allow competitors to offer LNG regasification services or provide natural gas liquefaction capabilities at reduced prices; |

| • | changes in supplies of, and prices for, alternative energy sources such as coal, oil, nuclear, hydroelectric, wind and solar energy, which may reduce the demand for natural gas; |

| • | changes in regulatory, tax or other governmental policies regarding imported or exported LNG, natural gas or alternative energy sources, which may reduce the demand for imported or exported LNG and/or natural gas; |

| • | political conditions in natural gas producing regions; |

| • | sudden decreases in demand for LNG as a result of natural disasters or public health crises, including the occurrence of a pandemic, and other catastrophic events; |

| • | adverse relative demand for LNG compared to other markets, which may decrease LNG imports into or exports from North America; and |

| • | cyclical trends in general business and economic conditions that cause changes in the demand for natural gas. |

| • | increases in worldwide LNG production capacity and availability of LNG for market supply; |

| • | increases in demand for LNG but at levels below those required to maintain current price equilibrium with respect to supply; |

| • | increases in the cost to supply natural gas feedstock to our Liquefaction Project; |

| • | decreases in the cost of competing sources of natural gas or alternate fuels such as coal, heavy fuel oil and diesel; |

| • | decreases in the price of non-U.S. LNG, including decreases in price as a result of contracts indexed to lower oil prices; |

| • | increases in capacity and utilization of nuclear power and related facilities; and |

| • | displacement of LNG by pipeline natural gas or alternate fuels in locations where access to these energy sources is not currently available. |

| • | perform ongoing assessments of pipeline safety and compliance; |

| • | identify and characterize applicable threats to pipeline segments that could impact a high consequence area; |

| • | improve data collection, integration and analysis; |

| • | repair and remediate the pipeline as necessary; and |

| • | implement preventative and mitigating actions. |

| • | making it more difficult for us to satisfy our obligations with respect to the New Notes; |

| • | limiting our ability to obtain additional financing to fund our capital expenditures, working capital, acquisitions, debt service requirements or liquidity needs for general business or other purposes; |

| • | limiting our ability to replace the indebtedness under our Term Loan Facility with indebtedness with a longer maturity; |

| • | limiting our ability to use operating cash flow in other areas of our business because we must dedicate a substantial portion of these funds to service debt, including indebtedness that we may incur in the future; |

| • | limiting our ability to compete with other companies that are not as highly leveraged; |

| • | limiting our ability to react to changing market conditions in our industry and in our customers’ industries and to economic downturns; |

| • | limiting our flexibility in planning for, or reacting to, changes in our business and future business opportunities; |

| • | making us more vulnerable than a less leveraged company to a downturn in our business or in the economy; and |

| • | resulting in a material adverse effect on our business, operating results and financial condition if we are unable to service our indebtedness or obtain additional financing, as needed. |

| • | incur additional indebtedness; |

| • | provide certain guarantees; |

| • | create liens on our assets; |

| • | engage in certain asset sales; |

| • | engage in mergers or acquisitions and to make equity investments; and |

| • | engage in certain transactions with our affiliates. |

| • | received less than reasonably equivalent value or fair consideration for the incurrence of the indebtedness; and |

| • | were insolvent or rendered insolvent by reason of the incurrence of the indebtedness; or |

| • | were engaged, or about to engage, in a business or transaction for which our remaining assets constituted unreasonably small capital; or |

| • | intended to incur, or believed that we would incur, debts beyond our ability to pay such debts as they matured. |

| • | changes in the overall market for debt securities; |

| • | changes in our financial performance or prospects; |

| • | the prospects for companies in our industry generally; |

| • | the number of holders of the New Notes; |

| • | the interest of securities dealers in making a market for the New Notes; and |

| • | prevailing interest rates. |

| • | how long payments under the New Notes could be delayed following commencement of a bankruptcy case; |

| • | whether or when the Security Trustee could repossess or dispose of the collateral; or |

| • | whether or to what extent holders of the New Notes would be compensated for any delay in payment or loss of value of the collateral through the requirement of “adequate protection.” |

| • | Overview |

| • | Overview of Significant Events |

| • | Market Environment |

| • | Results of Operations |

| • | Liquidity and Capital Resources |

| • | Summary of Critical Accounting Estimates |

| • | Recent Accounting Standards |

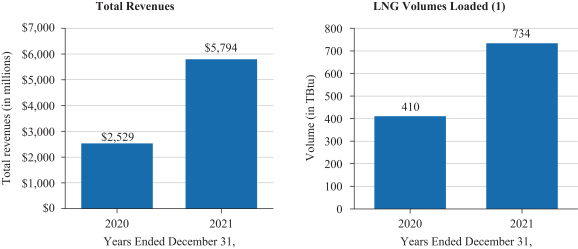

| • | As of February 18, 2022, approximately 450 cumulative LNG cargoes totaling over 30 million tonnes of LNG have been produced, loaded and exported from the Liquefaction Project. |

| • | In August 2021, we issued an aggregate principal amount of $750 million of the Old Notes. The proceeds of the Old Notes, net of related fees, costs and expenses, were used to prepay a portion of the principal amount outstanding under our amended and restated term loan credit facility (the “CCH Credit Facility”). |

| • | On March 26, 2021, substantial completion of Train Three of the Liquefaction Project was achieved. |

| • | CCL entered into an SPA with Engie SA in June 2021, which was subsequently amended in March 2022, for approximately 0.9 million tonnes per year of LNG for a term of approximately 20 years. |

| (1) | The year ended December 31, 2021 excludes four TBtu that were loaded at our affiliate’s facility. |

Year Ended December 31, |

||||||||||||

(in millions, except volumes) |

2021 |

2020 |

Variance ($) |

|||||||||

| LNG revenues |

$ | 3,907 | $ | 2,046 | $ | 1,861 | ||||||

| LNG revenues—affiliate |

1,887 | 483 | 1,404 | |||||||||

| |

|

|

|

|

|

|||||||

| Total revenues |

$ | 5,794 | $ | 2,529 | $ | 3,265 | ||||||

| |

|

|

|

|

|

|||||||

| LNG volumes recognized as revenues (in TBtu) (1) |

738 | 410 | 328 | |||||||||

| (1) | Excludes volume associated with cargoes for which customers notified us that they would not take delivery. During the year ended December 31, 2021, includes four TBtu that were loaded at our affiliate’s facility. |

Year Ended December 31, |

||||||||||||

(in millions) |

2021 |

2020 |

Variance ($) |

|||||||||

| Cost of sales |

$ | 4,326 | $ | 901 | $ | 3,425 | ||||||

| Cost of sales—affiliate |

50 | 30 | 20 | |||||||||

| Cost of sales—related party |

146 | 114 | 32 | |||||||||

| Operating and maintenance expense |

423 | 347 | 76 | |||||||||

| Operating and maintenance expense—affiliate |

106 | 90 | 16 | |||||||||

| Operating and maintenance expense—related party |

9 | 6 | 3 | |||||||||

| General and administrative expense |

7 | 7 | — | |||||||||

| General and administrative expense—affiliate |

28 | 20 | 8 | |||||||||

| Depreciation and amortization expense |

420 | 342 | 78 | |||||||||

| Impairment expense and loss on disposal of assets |

2 | 1 | 1 | |||||||||

| |

|

|

|

|

|

|||||||

| Total operating costs and expenses |

$ | 5,517 | $ | 1,858 | $ | 3,659 | ||||||

| |

|

|

|

|

|

|||||||

Year Ended December 31, |

||||||||||||

(in millions) |

2021 |

2020 |

Variance ($) |

|||||||||

| Interest expense, net of capitalized interest |

$ | 447 | $ | 365 | $ | 82 | ||||||

| Loss on modification or extinguishment of debt |

9 | 9 | — | |||||||||

| Interest rate derivative loss, net |

1 | 233 | (232 | ) | ||||||||

| Other income (expense), net |

— | 1 | (1 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Total other expense |

$ | 457 | $ | 608 | $ | (151 | ) | |||||

| |

|

|

|

|

|

|||||||

December 31, 2021 |

||||

| Restricted cash and cash equivalents designated for the Liquefaction Project |

$ | 44 | ||

| Available commitments under the $1.2 billion CCH Working Capital Facility (“CCH Working Capital Facility”) (1) |

589 | |||

| |

|

|||

| Total available liquidity |

$ | 633 | ||

| |

|

|||

| (1) | Available commitments represent total commitments less loans outstanding and letters of credit issued under each of the CCH Working Capital Facility as of December 31, 2021. See Note 10—Debt of our Notes to Consolidated Financial Statements included elsewhere in this prospectus for additional information on the CCH Working Capital Facility and other debt instruments. |

Estimated Revenues Under Executed Contracts by Period (1) |

||||||||||||||||

2022 |

2023 - 2026 |

Thereafter |

Total |

|||||||||||||

| LNG revenues (fixed fees) (2) |

$ | 2.0 | $ | 7.5 | $ | 23.2 | $ | 32.7 | ||||||||

| LNG revenues (variable fees) (2) (3) |

2.6 | 8.4 | 29.7 | 40.7 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 4.6 | $ | 15.9 | $ | 52.9 | $ | 73.4 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | Excludes contracts for which conditions precedent have not been met. Agreements in force as of December 31, 2021 that have terms dependent on project milestone dates are based on the estimated dates as of December 31, 2021. The timing of revenue recognition under GAAP may not align with cash receipts, although we do not consider the timing difference to be material. The estimates above reflect management’s assumptions and currently known market conditions and other factors as of December 31, 2021. Estimates are not guarantees of future performance and actual results may differ materially as a result of a variety of factors described in this prospectus. |

| (2) | LNG revenues (including $1.1 billion and $1.7 billion of fixed fees and variable fees, respectively, from affiliates) exclude revenues from contracts with original expected durations of one year or less. Fixed fees are fees that are due to us regardless of whether a customer exercises their contractual right to not take delivery of an LNG cargo under the contract. Variable fees are receivable only in connection with LNG cargoes that are delivered. |

| (3) | LNG revenues (variable fees, including affiliate) reflect the assumption that customers elect to take delivery of all cargoes made available under the contract. LNG revenues (variable fees, including affiliate) are based on estimated forward prices and basis spreads as of December 31, 2021. The pricing structure of our SPA arrangements with our customers incorporates a variable fee per MMBtu of LNG generally equal to 115% of Henry Hub, which is paid upon delivery, thus limiting our net exposure to future increases in natural gas prices. Certain of our contracts contain additional variable consideration based on the outcome of contingent events and the movement of various indexes. We have not included such variable consideration to the extent the consideration is considered constrained due to the uncertainty of ultimate pricing and receipt. |

Estimated Payments Due Under Executed Contracts by Period (1) |

||||||||||||||||

2022 |

2023 - 2026 |

Thereafter |

Total |

|||||||||||||

| Purchase obligations (2): |

||||||||||||||||

| Natural gas supply agreements (3) |

$ | 3.3 | $ | 5.1 | $ | 1.3 | $ | 9.7 | ||||||||

| Natural gas transportation and storage service agreements (4) |

0.2 | 0.8 | 2.3 | 3.3 | ||||||||||||

| Other purchase obligations (5) |

— | 0.1 | 0.5 | 0.6 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 3.5 | $ | 6.0 | $ | 4.1 | $ | 13.6 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | Excludes contracts for which conditions precedent have not been met. Agreements in force as of December 31, 2021 that have terms dependent on project milestone dates are based on the estimated dates as of December 31, 2021. The estimates above reflect management’s assumptions and currently known market conditions and other factors as of December 31, 2021. Estimates are not guarantees of future performance and actual results may differ materially as a result of a variety of factors described in this prospectus. |

| (2) | Purchase obligations consist of agreements to purchase goods or services that are enforceable and legally binding that specify fixed or minimum quantities to be purchased. As project milestones and other conditions precedent are achieved, our obligations are expected to increase accordingly. We include contracts for which we have an early termination option if the option is not currently expected to be exercised. |

| (3) | Pricing of natural gas supply agreements is based on estimated forward prices and basis spreads as of December 31, 2021. Natural gas supply agreements include payments under IPM agreements, which are based on global gas market prices less fixed liquefaction fees and certain costs incurred by us. |

| (4) | Includes $0.1 billion of purchase obligations to related parties under the natural gas transportation and storage service agreements. |

| (5) | Includes $0.5 billion of purchase obligations to affiliates under services agreements. |

Estimated Payments Due Under Executed Contracts by Period (1) |

||||||||||||||||

2022 |

2023 - 2026 |

Thereafter |

Total |

|||||||||||||

| Debt (2) |

$ | 0.4 | $ | 4.4 | $ | 5.6 | $ | 10.4 | ||||||||

| Interest payments (2) |

0.5 | 1.3 | 1.0 | 2.8 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 0.9 | $ | 5.7 | $ | 6.6 | $ | 13.2 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | The estimates above reflect management’s assumptions and currently known market conditions and other factors as of December 31, 2021. Estimates are not guarantees of future performance and actual results may differ materially as a result of a variety of factors described in this prospectus. |

| (2) | Debt and interest payments are based on the total debt balance, scheduled contractual maturities and fixed or estimated forward interest rates in effect at December 31, 2021. Debt and interest payments do not contemplate repurchases, repayments and retirements that we expect to make prior to contractual maturity. See further discussion in Note 10—Debt of our Notes to Consolidated Financial Statements included elsewhere in this prospectus. |

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Net cash provided by operating activities |

$ | 1,424 | $ | 396 | ||||

| Net cash used in investing activities |

(240 | ) | (796 | ) | ||||

| Net cash provided by (used in) financing activities |

(1,210 | ) | 390 | |||||

| |

|

|

|

|||||

| Net decrease in restricted cash and cash equivalents |

$ | (26 | ) | $ | (10 | ) | ||

| |

|

|

|

|||||

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Senior Secured Notes due 2039 |

$ | 750 | $ | 769 | ||||

| CCH Working Capital Facility |

400 | 281 | ||||||

| |

|

|

|

|||||

| Total issuances |

$ | 1,150 | $ | 1,050 | ||||

| |

|

|

|

|||||

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

| CCH Credit Facility |

$ | (898 | ) | $ | (656 | ) | ||

| CCH Working Capital Facility |

(290 | ) | (141 | ) | ||||

| |

|

|

|

|||||

| Total repayments |

$ | (1,188 | ) | $ | (797 | ) | ||

| |

|

|

|

|||||

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Change in unrealized gain (loss) relating to instruments still held at end of period |

$ | (1,276 | ) | $ | 28 | |||

December 31, 2021 |

December 31, 2020 |

|||||||||||||||

Fair Value |

Change in Fair Value |

Fair Value |

Change in Fair Value |

|||||||||||||

| Liquefaction Supply Derivatives |

$ | (1,212 | ) | $ | 186 | $ | 11 | $ | 77 | |||||||

December 31, 2021 |

December 31, 2020 |

|||||||||||||||

Fair Value |

Change in Fair Value |

Fair Value |

Change in Fair Value |

|||||||||||||

| CCH Interest Rate Derivatives |

$ | (40 | ) | $ | — | $ | (140 | ) | $ | 1 | ||||||

| • | safely, efficiently and reliably operating and maintaining our assets; |

| • | procuring natural gas and pipeline transport capacity to our facility; |

| • | commencing commercial delivery for our long-term SPA customers, of which we have initiated for nine of ten third party long-term SPA customers as of December 31, 2021; |

| • | maximizing the production of LNG to serve our customers and generating steady and stable revenues and operating cash flows; |

| • | further expanding and/or optimizing the Liquefaction Project by leveraging existing infrastructure; |

| • | maintaining a prudent and cost-effective capital structure; and |

| • | strategically identifying actionable environmental solutions. |

FERC Approved Volume |

DOE Approved Volume |

|||||||||||||||

(in Bcf/yr) |

(in mtpa) |

(in Bcf/yr) |

(in mtpa) |

|||||||||||||

| FTA countries |

875.16 | 17 | 875.16 | 17 | ||||||||||||

| Non-FTA countries |

875.16 | 17 | 767 (1 | ) | 15 | |||||||||||

| (1) | The authorization for an additional 108.16 Bcf/yr (approximately 2 mtpa) of natural gas is currently pending. |

Percentage of Total Revenues from External Customers |

||||||||||||

Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Endesa Generación, S.A. (which subsequently assigned its SPA to Endesa S.A.) and Endesa S.A. |

21 | % | 31 | % | 57 | % | ||||||

| PT Pertamina (Persero) |

16 | % | 16 | % | 23 | % | ||||||

| Naturgy LNG GOM, Limited |

15 | % | 14 | % | — | |||||||

| • | rates and charges, and terms and conditions for natural gas transportation, storage and related services; |

| • | the certification and construction of new facilities and modification of existing facilities; |

| • | the extension and abandonment of services and facilities; |

| • | the administration of accounting and financial reporting regulations, including the maintenance of accounts and records; |

| • | the acquisition and disposition of facilities; |

| • | the initiation and discontinuation of services; and |

| • | various other matters. |

| Name |

Age |

Position | ||||

| Aaron Stephenson |

66 | Manager | ||||

| Zach Davis |

37 | Manager, President and Chief Financial Officer | ||||

| Michelle A. Dreyer |

50 | Independent Manager | ||||

| Name |

Age |

Position | ||||

| Jack A. Fusco |

59 | Chief Executive Officer | ||||

| Zach Davis |

37 | President and Chief Financial Officer | ||||

| Name |

Age |

Position | ||||

| Aaron Stephenson |

66 | President | ||||

| Zach Davis |

37 | Chief Financial Officer | ||||

| Name |

Age |

Position | ||||

| Zach Davis |

37 | President and Chief Financial Officer | ||||

| Name |

Fees Earned or Paid in Cash |

Stock Awards |

Option Awards |

Non-Equity Incentive Plan Compensation |

Nonqualified Deferred Compensation Earnings |

All Other Compensation |

Total |

|||||||||||||||||||||

| Aaron Stephenson |

$ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||

| Zach Davis |

— | — | — | — | — | — | — | |||||||||||||||||||||

| Michelle A. Dreyer |

2,500 | — | — | — | — | — | 2,500 | |||||||||||||||||||||

| • | each person who beneficially owns more than 5% of our limited liability company interests; |

| • | each of our managers; |

| • | each of our executive officers; and |

| • | all of our managers and executive officers as a group. |

| Name of Beneficial Owner |

Limited Liability Company Interests Beneficially Owned |

Percentage of Limited Liability Company Interests Beneficially Owned |

||||||

| Holdco |

100 | % | 100 | % | ||||

| Aaron Stephenson |

— | — | ||||||

| Zach Davis |

— | — | ||||||

| Michelle A. Dreyer |

— | — | ||||||

| All executive officers and managers as a group (3 persons) |

— | — | ||||||

| • | Tranche 1: $2,801,737,202.53, which has been fully drawn |

| • | Tranche 2: $3,335,674,522.94, which has been fully drawn |

| (a) | any prepayments of the Loans required to be made with respect to certain Insurance Proceeds and Condemnation Proceeds in accordance with the CSAA; |

| (b) | upon receipt of any Performance Liquidated Damages in excess of $10 million, except to the extent such amounts are applied to restoration, repairs or improvements of the Project Facilities or to repay or reimburse providers of Equity Funding, which Equity Funding was used for restoration, repairs or improvements of the Project Facilities; |

| (c) | the amount of all proceeds received from any Escrowed Amounts (as defined in the Applicable EPC Contract) after the Project Completion Date, unless we are permitted to make a Restricted Payment under the Common Terms Agreement on the next succeeding Quarterly Payment Date; |

| (d) | in the event of a Change of Control occurring after the end of the Term Loan Availability Period, to the extent required in connection with a mandatory prepayment offer that we are obligated to make in connection therewith; |

| (e) | upon occurrence of an event triggering an LNG SPA Mandatory Prepayment; |

| (f) | to the extent of any Net Cash Proceeds received from sales of assets (other than asset sales permitted under the Common Terms Agreement) that are (i) in excess of $50 million individually or $200 million in the aggregate over the term of the Common Terms Agreement and (ii) not used to purchase replacement assets within 180 days following receipt thereof (or 270 days if a commitment to purchase replacement assets is entered into within 180 days following the receipt of such proceeds); and |

| (g) | subject to certain exceptions, due to a failure to meet the conditions to make a Restricted Payment pursuant to the Common Terms Agreement for four consecutive quarters. |

| (1) | change the limited nature of our business in any material respect; or |

| (2) | engage in retail sales of natural gas so as to become subject to regulation as a gas utility under the Texas Utilities Code. |

| (a) | Senior Debt, including any reborrowing of any Working Capital Debt in accordance with its terms; |

| (b) | Indebtedness expressly contemplated by a Finance Document or a Material Project Agreement; |

| (c) | Subordinated Debt; |

| (d) | Intercompany indebtedness between or among the Obligors, all of which shall be Subordinated Debt; |

| (e) | Indebtedness incurred under Permitted Hedging Instruments which are not Senior Debt; |

| (f) | Indebtedness in respect of any bankers’ acceptances, letters of credit, warehouse receipts or similar facilities incurred in the ordinary course of business; |

| (g) | purchase money Indebtedness and capital leases or guarantees of the same, in a principal amount not exceeding $50 million in the aggregate to finance the purchase or lease of assets for the Development other than those financed with the proceeds of Senior Debt; provided |

| (h) | any other unsecured Indebtedness incurred after the Project Completion Date in an aggregate amount outstanding at any one time not to exceed $500 million for general corporate purposes; |

| (i) | Indebtedness arising from honoring by a bank or other financial institution of a check, draft or similar instrument drawn against insufficient funds in the ordinary course of business, or cash management services in the ordinary course of business; |

| (j) | Indebtedness in respect of netting services, overdraft protections and otherwise in connection with deposit accounts; |

| (k) | contingent liabilities incurred in the ordinary course of business; |

| (l) | Indebtedness consisting of certain bonds and similar obligations incurred in the ordinary course of business; |

| (m) | trade or other similar Indebtedness incurred in the ordinary course of business, which is (i) not more than 90 days past due, or (ii) being contested in good faith and by appropriate proceedings; |

| (n) | Indebtedness consisting of the financing of insurance premiums in customary amounts in the ordinary course of business; and |

| (o) | other Indebtedness incurred with the consent of the Intercreditor Agent acting on the instructions of the Requisite Intercreditor Parties. |

| (a) | initiate or consent to (without the consent of the Intercreditor Agent in consultation with the Independent Engineer) any change order that: |

| (i) | increases the contract price of an Applicable EPC Contract. However, CCL may, without the consent of the Intercreditor Agent, enter into change orders or make payments of any claim under an Applicable EPC Contract if (A) the amount of such change orders or payments is less than $25 million individually or less than $300 million in the aggregate and (B) the Intercreditor Agent receives a certificate stating that after giving effect to such change order or payment, all Date of First Commercial Delivery deadlines shall be met and such change order or payment will not result in Project Costs exceeding the funds then available or reasonably expected to be available to pay such Project Costs. If the aggregate of all change orders or payments exceeds $300 million, CCL may enter into such change orders or make such payments if the amount of any such change order or payment is less than $2 million, and if the Intercreditor Agent receives a certificate from CCL (to which the Independent Engineer reasonably concurs as to certain matters set forth in the Common Terms Agreement). In addition, if an EPC Force Majeure or an |

| EPC Change in Law or, in the case of EPC Contract (T3), Adverse Weather Conditions, prompt Bechtel to request a change order to which it is entitled by the terms of the Applicable EPC Contract, CCL may authorize such change without the consent of the Intercreditor Agent if the amount of such change is within the remaining contingency set forth in the construction budget and schedule, or if the amount exceeds such contingency, CCL has an additional source of funds for such excess amount in addition to any Equity Funding. CCL may also enter into change orders that exceed $25 million individually or $300 million in the aggregate, subject to certain conditions, including, but not limited to, either (A) receipt and deposit into the Construction Account of any Equity Funding that is additional to Equity Funding otherwise committed to pay for Project Costs in the then-applicable construction budget and schedule and otherwise that is sufficient to pay the maximum amount that may become due and payable pursuant to such change order or (B) the amount and subject matter is a utilization of an unallocated contingency in the construction budget and schedule, and, in the case of either (A) or (B), receipt by the Intercreditor Agent of a certificate from CCL (to which the Independent Engineer reasonably concurs as to certain matters set forth in the Common Terms Agreement) and the Intercreditor Agent has not objected to such change order within 15 days of receipt of the proposed change order; |

| (ii) | extends the “guaranteed substantial completion date” for any Train of the Development or could reasonably be expected to have a material adverse effect on the likelihood of achieving Substantial Completion by such date; provided |

| (iii) | except as a result of a permitted buydown of the performance guarantees pursuant to Section 11.4 of an Applicable EPC Contract or a change order to which Bechtel is entitled for an EPC Change in Law (and provided that the Independent Engineer concurs to CCL’s consent to such change order), modifies the performance guarantees or any other performance guarantee of Bechtel or the criteria or procedures for the conduct or measuring the results of Performance Tests; |

| (iv) | adjusts the payment schedules (other than as a result of a permitted change order) or the amount of or timing for payment of the schedule bonus under an Applicable EPC Contract or otherwise provides for any additional bonus to be paid to Bechtel; |

| (v) | causes any material component or material design feature or aspect of the Project Facilities to deviate in any fundamental manner from the description thereof set forth in an Applicable EPC Contract (other than as a result of a permitted change order); |

| (vi) | except as a result of a change order to which Bechtel is entitled for an EPC Change in Law or event of EPC Force Majeure or, in the case of EPC Contract (T3), Adverse Weather Conditions (and provided that the Independent Engineer concurs to CCL’s consent to such change order), diminishes or otherwise materially alters Bechtel’s liquidated damages obligations under the Applicable EPC Contract; |

| (vii) | except as a result of a change order to which Bechtel is entitled for an EPC Change in Law or event of EPC Force Majeure or, in the case of EPC Contract (T3), Adverse Weather Conditions (and provided that the Independent Engineer concurs to CCL’s consent to such change order), waives or alters the provisions under an Applicable EPC Contract relating to default, termination or suspension or the waiver by CCL of any event that with the giving of notice or the lapse of time or both would entitle CCH to terminate the Applicable EPC Contract; |

| (viii) | except as a result of a change order to which Bechtel is entitled for an EPC Change in Law, adversely modifies or impairs the enforceability of any warranty for material items under an Applicable EPC Contract; |

| (ix) | except as a result of a change order to which Bechtel is entitled for an EPC Change in Law (and provided that the Independent Engineer concurs to CCL’s consent to such change order), impairs the ability of the Project Facilities to satisfy the Performance Tests or the Lenders’ Reliability Tests; |

| (x) | results in the revocation or adverse modification of any material Permit; or |

| (xi) | causes the Project Facilities not to comply in all material respects with applicable law or regulations or an Obligor’s contractual obligations; |

| (b) | collect on the letter of credit posted by Bechtel as required under an Applicable EPC Contract unless there are no future payments owed to Bechtel against which we may offset the amounts due to CCL; |

| (c) | approve any plans under Articles 11.1B or 11.1C of an Applicable EPC Contract without the concurrence of the Independent Engineer; or |

| (d) | except following notice to the Independent Engineer of its proposed action (to which the Independent Engineer reasonably concurred): |

| (i) | initiate or consent to any (A) change order that directly or indirectly specifies the capital spare parts to be delivered to the Site by Bechtel pursuant to an Applicable EPC Contract taking into account any other capital spare parts that we intend to acquire directly, or (B) material change to a two-year inventory of such capital spare parts; or |

| (ii) | consent to any initial integration plan proposed by Bechtel under an Applicable EPC Contract. |

| (a) | no Loan Facility Event of Default or Unmatured Loan Facility Event of Default has occurred and is Continuing or could occur as a result of such Restricted Payment; |

| (b) |

| (i) | the Historical DSCR for the last measurement period (calculated for this purpose by excluding any amount contributed during such measurement period under the cure right described in “Description of Other Senior Debt—Common Terms Agreement—Certain Other Covenants—Historical DSCR”) and |

| (ii) | the Fixed Projected DSCR for the 12-month period beginning on the Quarterly Payment Date on or immediately prior to the proposed date of the Restricted Payment are, in each case, at least 1.25:1; |

| (c) | the Senior Debt Service Reserve Account is funded (with cash or with Acceptable Debt Service Reserve LCs) with the then-applicable Reserve Amount, including the applicable debt service reserve requirements (if any) under any Senior Debt Instrument governing Additional Senior Debt; |

| (d) | the Project Completion Date has occurred; |

| (e) | no event triggering an LNG SPA Mandatory Prepayment has occurred and is Continuing in respect of which the prepayment and cancellation required by the occurrence of such event in accordance with the Common Terms Agreement has not been made in full; |

| (f) | the Intercreditor Agent must, two business days prior to the proposed date of the Restricted Payment, receive a certificate as to satisfaction of items (a)-(e) above; |

| (g) | each Senior Creditor Group Representative must have received a certificate as to clause (b) above setting forth the calculation of Historical DSCR and Fixed Projected DSCR in clause (b) above; and |

| (h) | as long as any Loans under the Term Loan Facility remain outstanding, the Restricted Payment must be made within 25 business days following the most recent Quarterly Payment Date. |

| (x) | if each of the conditions described above other than those in clauses (b), (d), (g) and (h) above have been satisfied; provided |

| (i) | Substantial Completion has occurred under the EPC Contract (T1/T2) with respect to Train One and Train Two; |

| (ii) | the Fixed Projected DSCR for the 12-month period beginning on the First Repayment Date is at least 1.25:1; |

| (iii) | we have delivered to the Intercreditor Agent a certification from the Independent Engineer confirming that the Obligors have sufficient cash on deposit in the Construction Account (after taking into account the proposed Restricted Payment) to fund all remaining Project Costs required to achieve the Project Completion Date by the Date Certain; and |

| (iv) | we include in the certificate delivered to the Intercreditor Agent pursuant to clause (f) above, a confirmation that each of these additional conditions have been satisfied and setting forth the calculation of the Fixed Projected DSCR in clause (x)(ii) above; and |

| (y) | solely from Non-Base Case Cash Flows (“Non-Base Case Restricted Payments”) if each of the conditions described above other than those in clauses (b), (d), (g) and (h) above have been satisfied; provided |

| (i) | Substantial Completion has occurred under the EPC Contract (T1/T2) with respect to Train One and Train Two; |

| (ii) | the aggregate amount of all Non-Base Case Restricted Payments does not exceed the amount of Non-Base Case Cash Flows received prior to the date of such Non-Base Case Restricted Payment less any such Non-Base Case Cash Flows that are attributable to Other Approved LNG SPAs included in the certification made pursuant to sub-clause (y)(iv) below; |

| (iii) | the Fixed Projected DSCR for the 12-month period beginning on the First Repayment Date is at least 1.25:1; and |

| (iv) | we include in the certificate delivered to the Intercreditor Agent pursuant to clause (f) above, a confirmation that each of these additional conditions have been satisfied and setting forth the calculation of the Fixed Projected DSCR and confirming that we have Facility Debt Commitments, Equity Funding commitments (including under the amended and restated equity contribution agreement with Cheniere (the “CEI Equity Contribution Agreement”)), funds in the Construction Account and projected contracted Cash Flow from the fixed component under each of the Qualifying LNG SPAs and Other Approved LNG SPAs under the updated Base Case Forecast sufficient to achieve the Project Completion Date by the Date Certain. |

| (i) | conduct front-end engineering, development and design work using Equity Funding not otherwise committed to other expenditures for the Development; |

| (ii) | prepare and submit applications for Permits related to any Expansion; and |

| (iii) | undertake pre-construction activities and early works activities associated with an Expansion; provided |

| (1) | default in the payment when due of principal amounts due under the Finance Documents; provided |

| (2) | default in the payment of interest or any Senior Debt Obligations due under the Finance Document which default continues unremedied for three Business Days after those amounts become due; |

| (3) | any representation or warranty made by any Obligor in the Common Terms Agreement (other than certain representations that are covered by other Events of Default) or in any certificate, financial statement, or other document furnished by any Obligor pursuant to the Common Terms Agreement, or any representation or warranty made by Holdco in the Holdco Pledge Agreement, is false when made and if such falsity is capable of being corrected or cured, is not corrected or cured within 60 days after the earlier of (A) the applicable Obligor becoming aware of such falsity and (B) notice from the Intercreditor Agent to CCH, and such falsity or the adverse effects therefrom could reasonably be expected to have a Material Adverse Effect; |

| (4) | an Obligor fails to maintain its existence or breaches the merger and liquidation covenant; |

| (5) | breach of the Historical DSCR or breach of the covenant not to amend organizational documents, in each case, that is not cured within 10 Business Days; |

| (6) | (A) any Obligor (x) materially breaches certain covenants regarding use of proceeds; changes to its legal name/structure; Material Project Agreements; limitations on Indebtedness; limitation on guarantees; limitation on Liens; or limitation on Investments and Loans; or (y) breaches certain covenants regarding taxes; compliance with applicable laws, including anti-terrorism laws, money laundering laws or laws of the Office of Foreign Assets Control of the U.S. Department of Treasury; Material Project Agreements; or sale of project property; or (B) Holdco materially breaches any covenant contained in the Holdco Pledge Agreement, and, in each case, such default continues uncured for a 30-day period after the earlier of (i) we receive written notice of such default from the Intercreditor Agent and (ii) the applicable Obligor or Holdco, as applicable, becomes aware of such default; |

| (7) | any Obligor (x) breaches certain covenants regarding project construction, maintenance of properties, books and records, nature of business, gas purchase and transportation contracts, and transactions with affiliates, or (y) materially breaches any other covenant under the Common Terms Agreement (other than covenants addressed in certain other events of default), and such default continues uncured for a 60-day period after the earlier of (i) the applicable Obligor becoming aware of such breach; and (ii) notice from the Intercreditor Agent to CCH, such cure period to be extended up to 90 days so long as the breach is subject to cure, such Obligor is diligently pursuing a cure and such additional cure period could not reasonably be expected to result in a Material Adverse Effect; |

| (8) | a Bankruptcy with respect to an Obligor or Holdco has occurred, or prior to the Project Completion Date, a Bankruptcy with respect to Bechtel or Bechtel’s guarantor under the Applicable EPC Contract; |

| (9) | prior to the Project Completion Date, any one or more of a judgment in excess of $200 million in the aggregate or a final judgment in excess of $120 million in the aggregate against an Obligor or Holdco (or against any other Person where an Obligor or Holdco is liable to satisfy such judgment), in each case net of insurance proceeds which are reasonably expected to be paid; or following the Project |

| Completion Date, one or more final judgments in excess of $120 million in the aggregate (net of insurance proceeds which are reasonably expected to be paid), in each case, remains unpaid, unstayed on appeal, undischarged, unbonded or undismissed for a period of 60 days after the date of entry of such judgment; |

| (10) | any Finance Document (other than (x) a Direct Agreement in respect of any LNG SPA that is not a Required LNG SPA then in full force and effect (except for the PetroChina Direct Agreements) or (y) any Direct Agreement in the case where the occurrence of a Loan Facility Event of Default has been triggered by an event affecting the underlying Material Project Agreement or a Senior Debt prepayment remedy or other Loan Facility Event of Default is applicable under the Finance Documents) or any material provision of any Finance Document, (i) is expressly repudiated in writing by any party thereto (other than the Security Trustee, the Account Bank, the Intercreditor Agent or any Facility Lender), (ii) shall have been terminated (other than pursuant to the terms thereof following discharge in full of all obligations thereof or otherwise by agreement in writing of the parties thereto and not as a result of a Loan Facility Event of Default under the Common Terms Agreement) or (iii) is declared unenforceable in a final judgment of a court of competent jurisdiction against any party (other than the Security Trustee, the Account Bank, the Intercreditor Agent or any Facility Lender) and such unenforceability is not cured (subject to any applicable Reservations) within five Business Days following the date of entry of such judgment; |

| (11) | any Material Project Agreement (other than an LNG SPA) or any material provision thereof: (i) is expressly repudiated in writing by any party, or (ii) is declared unenforceable in a final judgment of a court of competent jurisdiction against any party and such unenforceability is not cured (subject to any applicable Reservations) within 60 Business Days following the date of entry of such judgment if in either case, a Material Adverse Effect could reasonably be expected to result; |

| (12) | default with respect to Indebtedness (other than Indebtedness secured by the Security Documents and Subordinated Debt) of any Obligor that exceeds a principal amount of $100 million and continued beyond any applicable grace period and the effect of which has been to cause the entire amount of such Indebtedness to become due and such Indebtedness remains unpaid or the acceleration of its stated maturity unrescinded; |

| (13) | in respect of any Senior Notes outstanding, acceleration of such Senior Notes following an Indenture Event of Default; |