UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended June 30, 2022

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Numbers: 001-38329

(Exact name of Registrant as specified in its charter)

| (State or other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |||||||

(212 ) 372-2000

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||||||||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at August 2, 2022 | |||||||

| Class A Common Stock, par value $0.01 per share | ||||||||

| Class B Common Stock, par value $0.01 per share | ||||||||

1

NEWMARK GROUP, INC.

TABLE OF CONTENTS

| Page | ||||||||

| PART I - FINANCIAL INFORMATION | ||||||||

| ITEM 1. | FINANCIAL STATEMENTS (unaudited) | |||||||

| Condensed Consolidated Balance Sheets | ||||||||

| Condensed Consolidated Statements of Operations | ||||||||

| Condensed Consolidated Statements of Comprehensive Income | ||||||||

| Condensed Consolidated Statements of Changes in Equity | ||||||||

| Condensed Consolidated Statements of Cash Flows | ||||||||

| Notes to Condensed Consolidated Financial Statements | ||||||||

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |||||||

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |||||||

| ITEM 4. | CONTROLS AND PROCEDURES | |||||||

| PART II - OTHER INFORMATION | ||||||||

| ITEM 1. | LEGAL PROCEEDINGS | |||||||

| ITEM 1A. | RISK FACTORS | |||||||

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |||||||

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES | |||||||

| ITEM 4. | ||||||||

| ITEM 5. | OTHER INFORMATION | |||||||

| ITEM 6. | ||||||||

2

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q (this “Form 10-Q”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements are based upon current expectations that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “possible,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends,” and similar expressions are intended to identify forward-looking statements.

Our actual results and the outcome and timing of certain events may differ significantly from the expectations discussed in the forward-looking statements. Factors that might cause or contribute to such a discrepancy include, but are not limited to, the factors set forth below:

•macroeconomic and other challenges and uncertainties resulting from the COVID-19 pandemic ("COVID-19"), the ongoing conflict in the Ukraine, inflation and the Federal Reserve's responses thereto, including increasing interest rates, the strengthening U.S. Dollar, changes in the economy, the commercial real estate services industry and the global financial markets, employment levels, and increasing energy costs, and including the effect on demand for commercial real estate including office space, levels of new lease activity and renewals, frequency of loan defaults and forbearance, and fluctuations in the mortgage-backed securities market;

•challenges relating to our repositioning of certain aspects of our business to adapt to and better address the needs of our clients in the future as a result of the acceleration of pre-existing long-term social and economic trends, or emergence of new trends resulting from the COVID-19 pandemic, and other legal, cultural and political events and conflicts, and governmental measures taken in response thereto, including changes in the mix of demand for commercial real estate space, including decreased demand for urban office and retail space generally, which may be offset in whole or in part by increased demand for suburban office, data storage, fulfillment, and distribution centers and life sciences facilities, that could materially reduce demand for commercial space and have a material adverse effect on the nature of and demand for our commercial real estate services, including the time and expense related to such repositioning, as well as risks related to our entry into new geographic markets or lines of business;

•the impact of the COVID-19 pandemic, including any successive waves or variants of the virus, the emergence of new viruses, the continued distribution of effective vaccines and governmental and public reactions thereto, and the impact of a return to office for our employees on our operations, as well as the cybersecurity risks of remote working, and our ability to continue providing on-site commercial property management services;

•market conditions, transaction volumes, possible disruptions in transactions, potential deterioration of equity and debt capital markets for commercial real estate and related services, supply chain issues and other factors, and our ability to access the capital markets as needed or on reasonable terms and conditions;

•pricing, commissions and fees, and market position with respect to any of our products and services and those of our competitors;

•the effect of industry concentration and reorganization, reduction of customers and consolidation;

•uncertainties related to integrating certain assets of Knotel, Inc. ("Knotel") and Space Management

(DBA “Deskeo”) as we build out our international flexible office business;

•liquidity, regulatory requirements and the impact of credit market events, including the impact of COVID-19 and political events and conflicts and actions taken by governments and businesses in responses thereto on the credit markets and interest rates;

•our relationship and transactions with Cantor Fitzgerald, L.P. (“Cantor”) and its affiliates, Newmark’s structure, including Newmark Holdings, L.P. (“Newmark Holdings”), which is owned by Newmark, Cantor, Newmark’s employee partners and other partners, and our operating partnership, which is owned jointly by us and Newmark Holdings (which we refer to as “Newmark OpCo” ) any related transactions, conflicts of interest, or litigation, any loans to or from Newmark or Cantor, Newmark Holdings or Newmark OpCo, including the balances and interest rates thereof from time to time and any convertible or equity features of any such loans, repurchase agreements, joint ventures, and competition for and retention of brokers and other managers and key employees;

•the impact on our stock price from the reduction of our dividend and potential future changes in our capital deployment priorities, including repurchases of shares, purchases of limited partnership interests, and our dividend policy, and in Newmark Holdings distributions to partners and the related impact of such reductions, as well as the effect of layoffs, furloughs, salary cuts, and expected lower commissions or bonuses on the repayment of partner loans;

1

•market volatility as a result of the effects of COVID-19, global inflation rates, potential downturns including recessions, and similar effects, or other market conditions, which may not be sustainable or predictable in future periods;

•our ability to grow in other geographic regions and to manage our continued overseas growth and the impact of the COVID-19 pandemic on these regions and transactions;

•our ability to maintain or develop relationships with independently owned offices or affiliated businesses or partners in our business;

•the impact of any restructuring or similar transaction on our business and financial results in current or future periods, including with respect to any assumed liabilities or indemnification obligations with respect to such transactions, the integration of any completed acquisitions and the use of proceeds of any completed dispositions;

•our ability to effectively deploy the proceeds of our Nasdaq, Inc. (“Nasdaq”) shares to repurchase shares or limited partnership interests, reduce our debt, and invest in growing our business;

•risks related to changes in our relationships with the Government Sponsored Enterprises (“GSEs”) and Housing and Urban Development (“HUD”), including the impact of COVID-19 and related changes in the credit markets, changes in prevailing interest rates and the risk of loss in connection with loan defaults;

•risks related to changes in the future of the GSEs, including changes in the terms of applicable conservatorships and changes in their capabilities;

•economic or geopolitical conditions or uncertainties, the actions of governments or central banks, including the impact of COVID-19 on the global markets and government responses, and restrictions on business and commercial activity, uncertainty regarding the nature, timing and consequences of the United Kingdom (“U.K.”)’s exit from the European Union (“EU”) following the withdrawal process, including potential reduction in investment in the U.K., and the pursuit of trade, border control or other related policies by the U.S. and/or other countries (including U.S. - China trade relations), rising political and other tensions between the U.S. and China, political and civil unrest in the U.S., including demonstrations, riots, boycotts, rising tensions with law enforcement, the impact of elections, or other social and political responses to governmental mandates and other restrictions related to COVID-19 in the U.S. or abroad, political and labor unrest in Hong Kong, China and other jurisdictions, conflict in the Middle East, Russia, Ukraine, or other jurisdictions, the impact of U.S. government shutdowns or impasses, the impact of terrorist acts, acts of war or other violence or political unrest, as well as natural disasters or weather-related or similar events, including hurricanes and heat waves as well as power failures, communication and transportation disruptions, and other interruptions of utilities or other essential services, and the impact of pandemics and other international health incidents;

•risks inherent in doing business in international markets, and any failure to identify and manage those risks, as well as the impact of Russia's ongoing invasion of Ukraine and additional sanctions and regulations imposed by governments and related counter-sanctions;

•the effect on our business, clients, the markets in which we operate, and the economy in general of inflationary pressures and the Federal Reserve's response thereto, infrastructure spending, changes in the U.S. and foreign tax and other laws, including changes in tax rates, repatriation rules, and deductibility of interest, potential policy and regulatory changes in Mexico and other countries, sequestrations, uncertainties regarding the debt ceiling and the federal budget, and future changes to tax policy and other potential political policies resulting from elections and changes in governments;

•our dependence upon our key employees, our ability to build out successful succession plans, the impact of absence due to illness or leave of certain key executive officers or employees and our ability to attract, retain, motivate and integrate new employees, as well as the competing demands on the time of certain of our executive officers who also provide services to Cantor, BGC and various other ventures and investments sponsored by Cantor (throughout this document, unless otherwise stated, the term "employees" includes both our employees and those real estate professionals who qualify as statutory non-employees under Section 3408 of the Internal Revenue Code of 1986, as amended);

•the effect on our business of changes in interest rates, changes in benchmarks, including the transition away from LIBOR, the effect on our businesses and revenues of the strengthening U.S. Dollar, the transition to alternative benchmarks such as SOFR, and federal and state legislation relating thereto, the level of worldwide governmental debt issuances, austerity programs, government stimulus packages, including those related to COVID-19, increases and decreases in the federal funds interest rate and other actions to moderate inflation, increases or decreases in deficits and the impact of increased government tax rates, and other changes to monetary policy, and potential political impasses or regulatory requirements, including increased capital requirements for banks and other institutions or changes in legislation, regulations and priorities;

2

•extensive regulation of our business and clients, changes in regulations relating to commercial real estate and other industries, and risks relating to compliance matters, including regulatory examinations, inspections, investigations and enforcement actions, and any resulting costs, increased financial and capital requirements, enhanced oversight, remediation, fines, penalties, sanctions, and changes to or restrictions or limitations on specific activities, operations, compensatory arrangements, and growth opportunities, including acquisitions, hiring, and new businesses, products, or services, as well as risks related to our taking actions to ensure that we and Newmark Holdings are not deemed investment companies under the Investment Company Act of 1940;

•the impact of illness or governmental actions preventing a significant portion of our workforce or the workforce of our clients or third-party vendors from performing functions that can only be conducted in-person, including on-site tours and inspections of buildings;

•factors related to specific transactions or series of transactions as well as counterparty failure;

•costs and expenses of developing, maintaining and protecting our intellectual property, as well as employment, regulatory, and other litigation, proceedings and their related costs, including related to acquisitions and other matters, including judgments, fines, or settlements paid, reputational risk, and the impact thereof on our financial results and cash flow in any given period;

•our ability to maintain continued access to credit and availability of financing necessary to support our ongoing business needs, including to refinance indebtedness, and the risks associated with the resulting leverage, as well as fluctuations in interest rates;

•certain other financial risks, including the possibility of future losses, indemnification obligations, assumed liabilities, reduced cash flows from operations, increased leverage, reduced availability under our various credit facilities, and the need for short or long-term borrowings, including from Cantor, the ability of Newmark to refinance our indebtedness, including in the credit markets, and our ability to satisfy eligibility criteria for government-sponsored loan programs and changes to interest rates and market liquidity or our access to other sources of cash relating to acquisitions, dispositions, or other matters, potential liquidity and other risks relating to our ability to maintain continued access to credit and availability of financing necessary to support ongoing business needs on terms acceptable to us, if at all, and risks associated with the resulting leverage, including potentially causing a reduction in credit ratings and the associated outlooks and increased borrowing costs as well as interest rate and foreign currency exchange rate fluctuations;

•risks associated with the temporary or longer-term investment of our available cash, including in Newmark OpCo, defaults or impairments on the Company’s investments (including investments in non-marketable securities), joint venture interests, stock loans or cash management vehicles and collectability of loan balances owed to us by partners, employees, Newmark OpCo or others;

•the impact of any reduction in the willingness of commercial property owners to outsource their property management needs;

•our ability to enter new markets or develop new products or services and to induce clients to use these products or services and to secure and maintain market share, and the impact of COVID-19 generally and on the commercial real estate services business in particular;

•our ability to enter into marketing and strategic alliances, business combinations, attract investors or partners or engage in, restructuring, rebranding or other transactions, including acquisitions, dispositions, reorganizations, partnering opportunities and joint ventures, the anticipated benefits of any such transactions, relationships or growth and the future impact of any such transactions, relationships or growth on other businesses and financial results for current or future periods, the integration of any completed acquisitions and the use of proceeds of any completed dispositions, the impact of amendments and/or terminations of any strategic arrangements, and the value of any hedging entered into in connection with consideration received or to be received in connection with such dispositions and any transfers thereof;

•our estimates or determinations of potential value with respect to various assets or portions of the Company’s business, including with respect to the accuracy of the assumptions or the valuation models or multiples used;

•the impact of near- or off-shoring on our business, including on our ability to manage turnover and hire, train, integrate and retain personnel, including brokerage professionals, salespeople, managers, and other professionals;

•our ability to effectively manage any growth that may be achieved, including outside of the U.S., while ensuring compliance with all applicable financial reporting, internal control, legal compliance, and regulatory requirements;

•our ability to identify and remediate any material weaknesses or significant deficiencies in internal controls that could affect our ability to properly maintain books and records, prepare financial statements and reports in a timely manner, control policies, practices and procedures, operations and assets, assess and manage the

3

Company’s operational, regulatory and financial risks, and integrate acquired businesses and brokers, salespeople, managers and other professionals;

•the impact of unexpected market moves and similar events;

•information technology risks, including capacity constraints, failures, or disruptions in our systems or those of clients, counterparties, or other parties with which we interact, increased demands on such systems and on the telecommunications infrastructure from remote working during the COVID-19 pandemic, including cyber-security risks and incidents, compliance with regulations requiring data minimization and protection and preservation of records of access and transfers of data, privacy risk and exposure to potential liability and regulatory focus;

•the impact of our reductions to our dividends and distributions and the timing and amounts of any future dividends or distributions and our increased stock and unit repurchase authorization, including our ability to meet expectations with respect to payment of dividends and repurchases of common stock or purchases of Newmark Holdings limited partnership interests or other equity interests in subsidiaries, including Newmark OpCo, including from Cantor or our executive officers, other employees, partners and others and the effect on the market for and trading price of our Class A common stock as a result of any such transactions;

•the effectiveness of our governance, risks management, and oversight procedures and the impact of any potential transactions or relationships with related parties;

•the impact of our environmental, social and governance (“ESG”) or “sustainability” ratings on the decisions by clients, investors, potential clients and other parties with respect to our business, investments in us, our borrowing opportunities or the market for and trading price of Newmark Class A common stock or other matters;

•the fact that the prices at which shares of our Class A common stock are or may be sold in offerings or other transactions may vary significantly, and purchasers of shares in such offerings or other transactions, as well as existing stockholders, may suffer significant dilution if the price they paid for their shares is higher than the price paid by other purchasers in such offerings or transactions;

•the effect on the markets for and trading prices of our Class A common stock due to market factors, as well as on various offerings and other transactions, including offerings of Class A common stock and convertible or exchangeable debt or other securities, repurchases of shares of Class A common stock and purchases or redemptions of Newmark Holdings limited partnership interests or other equity interests in us or its subsidiaries, any exchanges by Cantor of shares of Class A common stock for shares of Class B common stock, any exchanges or redemptions of limited partnership units and issuances of shares of Class A common stock in connection therewith, including in corporate or partnership restructurings, payment of dividends on Class A common stock and distributions on limited partnership interests of Newmark Holdings and Newmark OpCo, convertible arbitrage, hedging, and other transactions engaged in by us or holders of outstanding shares, debt or other securities, share sales and stock pledge, stock loans, and other financing transactions by holders of shares or units (including by Cantor executive officers, partners, employees or others), including of shares acquired pursuant to employee benefit plans, unit exchanges and redemptions, corporate or partnership restructurings, acquisitions, conversions of shares of our Class B common stock and other convertible securities into shares of our Class A common stock, stock pledge, stock loans, or other financing transactions, distributions of our Class A common stock by Cantor to its partners, including deferred distribution rights shares.

The foregoing risks and uncertainties, as well as those risks and uncertainties set forth in this Quarterly Report on this Form 10-Q, may cause actual results and events to differ materially from the forward-looking statements. The information included herein is given as of the filing date of this Form 10-Q with the Securities and Exchange Commission (the “SEC”), and future results or events could differ significantly from these forward-looking statements. We do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

4

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. These filings are also available to the public from the SEC’s website at www.sec.gov.

Our website address is www.nmrk.com. Through our website, we make available, free of charge, the following documents as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC: our Annual Reports on Form 10-K; our proxy statements for our annual and special stockholder meetings; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; Forms 3, 4 and 5 and Schedules 13D filed on behalf of Cantor., CF Group Management, Inc., our directors and our executive officers; and amendments to those documents. Our website also contains additional information with respect to our industry and business. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this Quarterly Report on Form 10-Q.

5

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

NEWMARK GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

(unaudited)

| June 30, 2022 | December 31, 2021 | ||||||||||

| Assets: | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Marketable securities | |||||||||||

| Loans held for sale, at fair value | |||||||||||

| Receivables, net | |||||||||||

| Receivables from related parties | |||||||||||

| Other current assets (see Note 19) | |||||||||||

| Total current assets | |||||||||||

| Goodwill | |||||||||||

| Mortgage servicing rights, net | |||||||||||

| Loans, forgivable loans and other receivables from employees and partners, net | |||||||||||

| Right-of-use assets | |||||||||||

| Fixed assets, net | |||||||||||

| Other intangible assets, net | |||||||||||

| Other assets (see Note 19) | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities, Redeemable Partnership Interests, and Equity: | |||||||||||

| Current liabilities: | |||||||||||

| Warehouse facilities collateralized by U.S. Government Sponsored Enterprises | $ | $ | |||||||||

| Accrued compensation | |||||||||||

| Accounts payable, accrued expenses and other liabilities (see Note 29) | |||||||||||

| Repurchase agreements and securities loaned | |||||||||||

| Payables to related parties | |||||||||||

| Total current liabilities | |||||||||||

| Long-term debt | |||||||||||

| Right-of-use liabilities | |||||||||||

| Other long-term liabilities (see Note 29) | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies (see Note 31) | |||||||||||

| Redeemable partnership interests | |||||||||||

| Equity: | |||||||||||

Class A common stock, par value of $ and | |||||||||||

Class B common stock, par value of $ and outstanding at June 30, 2022 and December 31, 2021, convertible into Class A common stock | |||||||||||

| Additional paid-in capital | |||||||||||

| Retained earnings | |||||||||||

| Contingent Class A common stock | |||||||||||

Treasury stock at cost: | ( | ( | |||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Total stockholders’ equity | |||||||||||

| Noncontrolling interests | |||||||||||

| Total equity | |||||||||||

| Total liabilities, redeemable partnership interests, and equity | $ | $ | |||||||||

The accompanying Notes to the Condensed Consolidated Financial Statements are an integral part of these financial statements.

6

NEWMARK GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||

| Management services, servicing fees and other | $ | $ | $ | $ | ||||||||||||||||||||||

| Leasing and other commissions | ||||||||||||||||||||||||||

| Investment sales | ||||||||||||||||||||||||||

| Commercial mortgage origination, net | ||||||||||||||||||||||||||

| Total revenues | ||||||||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||

| Compensation and employee benefits | ||||||||||||||||||||||||||

| Equity-based compensation and allocations of net income to limited partnership units and FPUs | ||||||||||||||||||||||||||

| Total compensation and employee benefits | ||||||||||||||||||||||||||

| Operating, administrative and other | ||||||||||||||||||||||||||

| Fees to related parties | ||||||||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||||||||

| Total operating expenses | ||||||||||||||||||||||||||

| Other (loss) income, net | ( | ( | ||||||||||||||||||||||||

| Income from operations | ||||||||||||||||||||||||||

| Interest expense, net | ( | ( | ( | ( | ||||||||||||||||||||||

| Income before income taxes and noncontrolling interests | ||||||||||||||||||||||||||

| Provision for income taxes | ||||||||||||||||||||||||||

| Consolidated net income | ||||||||||||||||||||||||||

| Less: Net income attributable to noncontrolling interests | ||||||||||||||||||||||||||

| Net income available to common stockholders | $ | $ | $ | $ | ||||||||||||||||||||||

| Per share data: | ||||||||||||||||||||||||||

| Basic earnings per share | ||||||||||||||||||||||||||

Net income available to common stockholders (1) | $ | $ | $ | $ | ||||||||||||||||||||||

| Basic earnings per share | $ | $ | $ | $ | ||||||||||||||||||||||

| Basic weighted-average shares of common stock outstanding | ||||||||||||||||||||||||||

| Fully diluted earnings per share | ||||||||||||||||||||||||||

| Net income for fully diluted shares | $ | $ | $ | $ | ||||||||||||||||||||||

| Fully diluted earnings per share | $ | $ | $ | $ | ||||||||||||||||||||||

| Fully diluted weighted-average shares of common stock outstanding | ||||||||||||||||||||||||||

(1)Includes a reduction for dividends on preferred stock or EPUs in the amount of $4.6 million and $6.2 million for the three and six months ended June 30, 2021, respectively. (see Note 1 — “Organization and Basis of Presentation”).

The accompanying Notes to the Condensed Consolidated Financial Statements are an integral part of these financial statements.

7

NEWMARK GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands)

(unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||

| Consolidated net income | $ | $ | $ | $ | ||||||||||||||||||||||

| Foreign currency translation adjustments | ( | ( | ( | |||||||||||||||||||||||

| Comprehensive income, net of tax | ||||||||||||||||||||||||||

| Less: Comprehensive income attributable to noncontrolling interests, net of tax | ||||||||||||||||||||||||||

| Comprehensive income available to common stockholders | $ | $ | $ | $ | ||||||||||||||||||||||

The accompanying Notes to the Condensed Consolidated Financial Statements are an integral part of these financial statements.

8

NEWMARK GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(In thousands, except share and per share amounts)

(unaudited)

| Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Contingent Class A Common Stock | Treasury Stock | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interests | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Balance, April 1, 2022 | $ | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Consolidated net income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | — | — | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

Cantor purchase of Cantor units from Newmark Holdings upon redemption/ exchange of FPU's, | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Dividends to common stockholders | — | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Earnings distributions to limited partnership interests and other noncontrolling interests | — | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

Grant of exchangeability, redemption and issuance of Class A common stock, | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contributions of capital to and from Cantor for equity-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

Repurchase of | — | — | — | — | ( | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Restricted stock units compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2022 | $ | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Contingent Class A Common Stock | Treasury Stock | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interests | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Balance, January 1, 2022 | $ | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Consolidated net income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | — | — | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

Cantor purchase of Cantor units from Newmark Holdings upon redemption/ exchange of FPU's, | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Dividends to common stockholders | — | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Earnings distributions to limited partnership interests and other noncontrolling interests | — | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

Grant of exchangeability, redemption and issuance of Class A common stock, | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contributions of capital to and from Cantor for equity-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

Repurchase of | — | — | — | — | ( | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Restricted stock units compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2022 | $ | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

9

NEWMARK GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (CONTINUED)

(In thousands, except share and per share amounts)

(unaudited)

| Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Contingent Class A Common Stock | Treasury Stock | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interests | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Balance, April 1, 2021 | $ | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Consolidated net income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Dividends to common stockholders | — | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Preferred dividend on EPUs | — | — | — | — | — | ( | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Earnings distributions to limited partnership interests and other noncontrolling interests | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

Grant of exchangeability, redemption and issuance of Class A common stock, | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contributions of capital to and from Cantor for equity-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

Repurchase of | — | — | — | — | ( | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Restricted stock units compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Redemption of EPU's | — | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2021 | $ | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Contingent Class A Common Stock | Treasury Stock | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interests | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Balance, January 1, 2021 | $ | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Consolidated net income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | — | — | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

Cantor purchase of Cantor units from Newmark upon redemption of FPU's, | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Dividends to common stockholders | — | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Preferred dividend on EPUs | — | — | — | — | — | ( | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Earnings distributions to limited partnership interests and other noncontrolling interests | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

Grant of exchangeability, redemption and issuance of Class A common stock, | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contributions of capital to and from Cantor for equity-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

Repurchase of | — | — | — | — | ( | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Restricted stock units compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Redemption of EPU's | — | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2021 | $ | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||

| Dividends declared per share of common stock | $ | $ | $ | $ | ||||||||||||||||||||||

| Dividends declared and paid per share of common stock | $ | $ | $ | $ | ||||||||||||||||||||||

The accompanying Notes to the Condensed Consolidated Financial Statements are an integral part of these financial statements.

10

NEWMARK GROUP INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(unaudited)

| Six Months Ended June 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||||

| Consolidated net income | $ | $ | |||||||||

| Adjustments to reconcile net income to net cash (used in) provided by operating activities: | |||||||||||

| Gain on originated mortgage servicing rights | ( | ( | |||||||||

| Depreciation and amortization | |||||||||||

| Nasdaq earn-out recognition | ( | ||||||||||

| Provision/(reversals) for/of credit losses on the financial guarantee liability | ( | ( | |||||||||

| Provision for doubtful accounts | |||||||||||

| Equity-based compensation and allocation of net income to limited partnership units and FPUs | |||||||||||

| Employee loan amortization | |||||||||||

| Deferred tax (benefit) provision | ( | ||||||||||

| Non-cash changes in acquisition related earn-outs | |||||||||||

| Unrealized (gains) on loans held for sale | ( | ( | |||||||||

| Realized loss (gain) on marketable securities | ( | ||||||||||

| Unrealized loss (gain) on marketable securities | |||||||||||

| Unrealized loss (gains) on non-marketable investments | ( | ||||||||||

| Change in valuation of derivative asset | |||||||||||

| Loan originations—loans held for sale | ( | ( | |||||||||

| Loan sales—loans held for sale | |||||||||||

| Other | |||||||||||

| Consolidated net income, adjusted for non-cash and non-operating items | |||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Receivables, net | ( | ||||||||||

| Loans, forgivable loans and other receivables from employees and partners | ( | ( | |||||||||

| Right of use asset | ( | ||||||||||

| Receivable from related parties | |||||||||||

| Other assets | |||||||||||

| Accrued compensation | ( | ||||||||||

| Right of use liability | ( | ||||||||||

| Accounts payable, accrued expenses and other liabilities | ( | ||||||||||

| Payables to related parties | ( | ( | |||||||||

| Net cash provided by operating activities | |||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||||||

| Payments for acquisitions, net of cash acquired | ( | ( | |||||||||

| Proceeds from the sale of marketable securities | |||||||||||

| Purchase of non-marketable investments | ( | ||||||||||

| Purchases of fixed assets | ( | ( | |||||||||

| Net cash provided by investing activities | ( | ||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||||||

| Proceeds from warehouse facilities | |||||||||||

| Principal payments on warehouse facilities | ( | ( | |||||||||

| Proceeds from the sale of limited partnership interests | |||||||||||

| Borrowing of debt | |||||||||||

| Repayment of debt | ( | ||||||||||

Repurchase agreements and securities loaned | ( | ( | |||||||||

| Redemption and repurchase of limited partnership interests | ( | ||||||||||

| Treasury stock repurchases | ( | ( | |||||||||

| Earnings and tax distributions to limited partnership interests and other noncontrolling interests | ( | ( | |||||||||

| Dividends to stockholders | ( | ( | |||||||||

| Payments on acquisition earn-outs | ( | ( | |||||||||

| Deferred financing costs | ( | ( | |||||||||

| Net cash used in financing activities | ( | ( | |||||||||

| Net increase in cash and cash equivalents and restricted cash | ( | ||||||||||

| Cash and cash equivalents and restricted cash at beginning of period | |||||||||||

| Cash and cash equivalents and restricted cash at end of period | $ | $ | |||||||||

11

| Six Months Ended June 30, | |||||||||||

| Supplemental disclosures of cash flow information: | 2022 | 2021 | |||||||||

| Supplemental disclosures of cash flow information: | |||||||||||

| Cash paid during the period for: | |||||||||||

| Interest | $ | $ | |||||||||

| Taxes | $ | $ | |||||||||

| Supplemental disclosure of non-cash operating, investing and financing activities: | |||||||||||

| Right-of-use assets and liabilities | $ | $ | |||||||||

The accompanying Notes to the Condensed Consolidated Financial Statements are an integral part of these financial statements.

12

NEWMARK GROUP, INC.

Notes to the Condensed Consolidated Financial Statements

(unaudited)

(1) Organization and Basis of Presentation

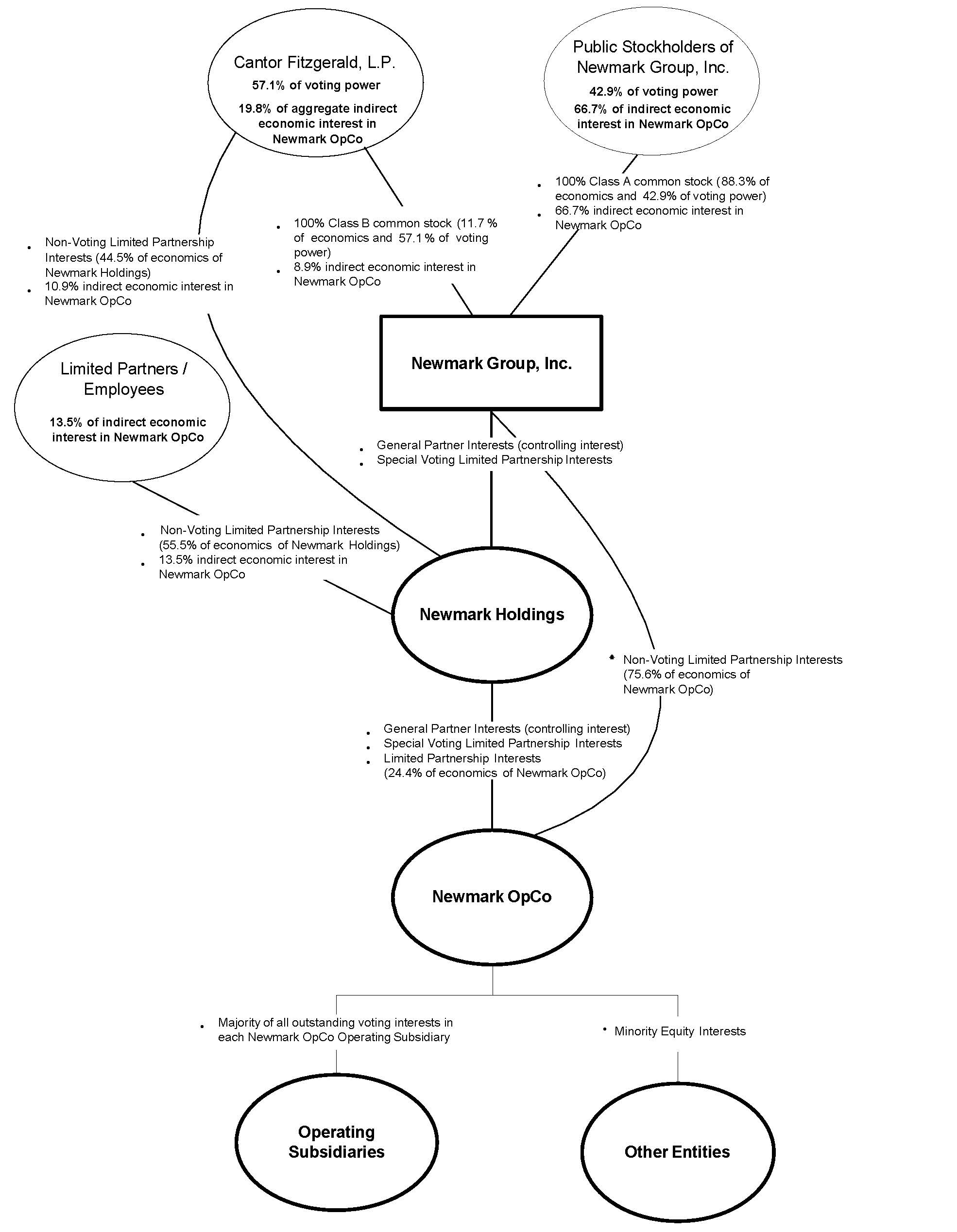

Newmark Group, Inc. (together with its subsidiaries, “Newmark” or the “Company”), a Delaware corporation, was formed as NRE Delaware, Inc. on November 18, 2016. Newmark changed its name to Newmark Group, Inc. on October 18, 2017. Newmark Holdings, L.P. (“Newmark Holdings”) is a consolidated subsidiary of Newmark for which Newmark is the general partner. Newmark and Newmark Holdings jointly own Newmark Partners, L.P. (“Newmark OpCo”), the operating partnership. Newmark is a leading commercial real estate services firm. Newmark offers a diverse array of integrated services and products designed to meet the full needs of both real estate investors/owners and occupiers. Newmark’s investor/owner services and products include capital markets, which consists of investment sales, debt and structured finance and loan sales, agency leasing, property management, valuation and advisory, commercial real estate due diligence consulting and advisory services and Government Sponsored Enterprise (“GSE”) lending and loan servicing, mortgage brokerage and equity-raising. Newmark’s occupier services and products include tenant representation, real estate management technology systems, workplace and occupancy strategy, global corporate consulting services, project management, lease administration and facilities management. Newmark's global flexible workspace platform, which operates under the names Knotel and Deskeo, is a product that is offered to owners and investors. Newmark enhances these services and products through innovative real estate technology solutions and data analytics that enable clients to increase their efficiency and profits by optimizing their real estate portfolio. Newmark has relationships with many of the world’s largest commercial property owners, real estate developers and investors, as well as Fortune 500 and Forbes Global 2000 companies.

Nasdaq Monetization Transactions

On June 28, 2013, BGC Partners, Inc. ("BGC") had sold certain assets of its on-the-run, electronic benchmark U.S. Treasury platform (“eSpeed”) to Nasdaq, Inc. ("Nasdaq"). The total consideration received in the transaction included $750.0 million in cash paid upon closing and an earn-out of up to 14,883,705 shares of Nasdaq shares to be paid ratably over 15 years, provided that Nasdaq, as a whole, produces at least $25.0 million in consolidated gross revenues each year (the “Nasdaq Earn-out”). The remaining rights under the Nasdaq Earn-out were transferred to Newmark on September 28, 2017. From September of 2017 through March 31, 2022, Newmark received 10.2 million shares of Nasdaq. Over this period, Newmark sold 7.6 million shares of Nasdaq and delivered 2.6 million shares of Nasdaq to RBC, and recognized $1,474.2 million of realized gains and dividend income. Newmark did not hold any Nasdaq shares as of June 30, 2022. See below for further discussion and Note 7 — “Marketable Securities” for additional information.

Exchangeable Preferred Partnership Units and Nasdaq Forward Contracts

On June 18, 2018 and September 26, 2018, Newmark OpCo issued approximately 175.0 million and 150.0 million of exchangeable preferred partnership units (“EPUs”), respectively, in private transactions to the Royal Bank of Canada (“RBC”) (the “Newmark OpCo Preferred Investment”). Newmark received $266.1 million of cash in 2018 with respect to these transactions. The EPUs were issued in four tranches and are separately convertible by either RBC or Newmark into a fixed number of shares of Newmark Class A common stock, subject to a revenue hurdle in each of the fourth quarters of 2019 through 2022 for each of the respective four tranches. The ability to convert the EPUs into Newmark Class A common stock is subject to the special purpose vehicle's (the “SPVs”) option to settle the postpaid forward contracts as described below. As the EPUs represent equity ownership of a consolidated subsidiary of Newmark, they have been included in “Noncontrolling interests” on the accompanying unaudited condensed consolidated balance sheets and unaudited condensed consolidated statements of changes in equity. The EPUs are entitled to a preferred payable-in-kind dividend, which is recorded as accretion to the carrying amount of the EPUs through Retained earnings on the accompanying unaudited condensed consolidated statements of changes in equity and are reductions to “Net income (loss) available to common stockholders” for the purpose of calculating earnings per share.

Contemporaneously with the issuance of the EPUs, an SPV that is a consolidated subsidiary of Newmark entered into variable postpaid forward contracts with RBC (together, the “Nasdaq Forwards”). The SPV is an indirect subsidiary of Newmark whose sole assets are the Nasdaq Earn-outs for 2019 through 2022. The Nasdaq Forwards provide the SPV the option to settle using up to 992,247 Nasdaq shares, to be received by the SPV pursuant to the Nasdaq Earn-out shares to be received (see Note 7 — “Marketable Securities”), or Newmark Class A common stock, in exchange for either cash or redemption of the EPUs, notice of which must be provided to RBC prior to November 1 of each year from 2019 through 2022.

In September 2020, the SPV notified RBC of its decision to settle the second Nasdaq Forward using the Nasdaq shares the SPV received in November 2020 in exchange for the second tranche of the EPUs, which resulted in a payable to RBC that was settled upon receipt of Nasdaq Earn-out shares. The fair value of the Nasdaq common shares that Newmark received was

13

$121.9 million. On November 30, 2020, Newmark settled the second Nasdaq Forward 741,505 Nasdaq shares, with a fair value of $93.5 million and Newmark retained 250,742 Nasdaq shares.

In September 2019, the SPV notified RBC of its decision to settle the first Nasdaq Forward using the Nasdaq shares the SPV received in November 2019 in exchange for the first tranche of the EPUs, which resulted in a payable to RBC that was settled upon receipt of Nasdaq Earn-out shares. The fair value of the Nasdaq shares that Newmark received was $98.6 million. On December 2, 2019, Newmark settled the first Nasdaq forward contract with 898,685 Nasdaq shares, with a fair value of $93.5 million and Newmark retained 93,562 Nasdaq shares.

Acceleration of Nasdaq Earn-out

On February 2, 2021, Nasdaq announced that it entered into a definitive agreement to sell its U.S. fixed income business to Tradeweb. On June 25, 2021, Nasdaq announced the close of the sale of its U.S. fixed income business, which accelerated Newmark’s receipt of Nasdaq shares. Newmark received 6,222,340 Nasdaq shares, with a fair value of $1,093.9 million based on the closing price on June 30, 2021 included in “Other (loss) income, net” for the three months ended June 30, 2021. Newmark has no remaining Nasdaq shares as of June 30, 2022.

On June 25, 2021, the SPV notified RBC of its decision to settle the third and fourth Nasdaq Forwards using the Nasdaq shares the SPV received on June 25, 2021. On July 2, 2021, Newmark settled the third and the fourth Nasdaq Forwards with 944,329 Nasdaq shares, with a fair value of $166.0 million based on the closing price of June 30, 2021. Newmark had no remaining Nasdaq Forward contracts as of June 30, 2022.

2021 Equity Event and Share Count Reduction

In connection with the acceleration of the Nasdaq Earn-out, on June 28, 2021, the Compensation Committee of Newmark’s Board of Directors (the "Compensation Committee") approved a plan to expedite the tax deductible exchange and redemption of a substantial number of limited partnership units held by partners of the Company (the "2021 Equity Event"). The 2021 Equity Event also accelerated certain compensation expenses resulting in $428.6 million of compensation charges. These charges, along with the use of $101.0 million of net deferred tax assets, are expected to offset a significant percentage of the Company's taxes related to the 2021 Equity Event. These partnership units were settled using a $12.50 share price. In July 2021, the Compensation Committee approved increasing to $13.01 the price to settle certain units.

Some of the key components of the 2021 Equity Event are as follows:

•8.3 million and 8.0 million compensatory limited partnership units, respectively, of Newmark Holdings and BGC Holdings, L.P. ("BGC Holdings") held by the Company's partners who are employees were redeemed or exchanged.

•23.2 million and 17.4 million compensatory limited partnership units, respectively, of Newmark Holdings and BGC Holdings held by the Company's partners who are independent contractors were redeemed or exchanged. The Company also accelerated the payment of related withholding taxes to them with respect to their Newmark units. Independent contractors received one BGC Class A common share for each redeemed non-preferred BGC unit or cash and are responsible for paying any related withholding taxes.

•Partners with nonexchangeable non-preferred compensatory units exchanged or redeemed in connection with the 2021 Equity Event generally received restricted Class A common shares of Newmark and/or BGC to the extent tax deductible. A portion of the BGC Class A common shares received by independent contractors were unrestricted to facilitate their payment of withholding taxes.

•The issuance of Newmark Class A common stock related to the 2021 Equity Event reflected the June 28, 2021 exchange ratio of 0.9403 .

•Newmark Holdings and BGC Holdings limited partnership interests with rights to convert into HDUs for cash were also redeemed in connection with the 2021 Equity Event.

See Note 27 — "Related Party Transactions" for the transactions with the Company's executive officers in connection with the 2021 Equity Event.

14

(a) Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the U.S. Securities and Exchange Commission and in conformity with accounting principles generally accepted in the U.S. (“U.S. GAAP”). For the year ended December 31, 2019, Newmark changed the line item formerly known as “Allocations of net income and grant of exchangeability to limited partnership units and FPUs and issuance of common stock” to “Equity-based compensation and allocations of net income to limited partnership units and FPUs” on the accompanying unaudited condensed consolidated statements of operations and statements of cash flow. The change resulted in the reclassification of amortization charges related to equity-based awards, such as REUs and Restricted Stock Units (“RSUs”), from “Compensation and employee benefits” to “Equity-based compensation and allocations of net income to limited partnership units and FPUs.”

“Equity-based compensation and allocations of net income to limited partnership units and FPUs” reflect the following items related to cash and equity-based compensation:

•Charges with respect to the grant of shares of common stock or limited partnership units, such as HDUs, including in connection with the redemption of non-exchangeable limited partnership units, including PSUs;

•Charges with respect to grants of exchangeability, such as the right of holders of limited partnership units with no capital accounts, such as PSUs, to exchange the units into shares of common stock, or HDUs, as well as the cash paid in the settlement of the related exchangeable preferred units to pay withholding taxes owed by the unit holder upon such exchange;

•Preferred units are granted in connection with the grant of certain limited partnership units, such as PSUs, that may be granted exchangeability to cover the withholding taxes owed by the unit holder, rather than issuing the gross amount of shares to employees, subject to cashless withholding of shares to pay applicable withholding taxes;

•Charges related to the amortization of RSUs and REUs; and

•Allocations of net income to limited partnership units and founding/working partner units (“FPUs”), including the Preferred Distribution (as hereinafter defined).

Intercompany balances and transactions within Newmark have been eliminated. Transactions between Cantor Fitzgerald, L.P. ("Cantor") and Newmark pursuant to service agreements with Cantor (see Note 27 — “Related Party Transactions”), representing valid receivables and liabilities of Newmark which are periodically cash settled, have been included on the accompanying unaudited condensed consolidated financial statements as either receivables from or payables to related parties.

Newmark receives administrative services to support its operations, and in return, Cantor allocates certain of its expenses to Newmark. Such expenses represent costs related, but not limited to, treasury, legal, accounting, information technology, payroll administration, human resources, incentive compensation plans and other services. These costs, together with an allocation of Cantor's overhead costs, are included as expenses on the accompanying unaudited condensed consolidated statements of operations. Where it is possible to specifically attribute such expenses to activities of Newmark, these amounts have been expensed directly to Newmark. Allocation of all other such expenses is based on a services agreement between Cantor which reflects the utilization of service provided or benefits received by Newmark during the periods presented on a consistent basis, such as headcount, square footage, revenue, etc. Management believes the assumptions underlying the stand-alone financial statements, including the assumptions regarding allocated expenses, reasonably reflect the utilization of services provided to or the benefit received by Newmark during the periods presented. However, these shared expenses may not represent the amounts that would have been incurred had Newmark operated independently from Cantor. Actual costs that would have been incurred if Newmark had performed the services itself would depend on multiple factors, including organizational structure and strategic decisions in various areas, including information technology and infrastructure (see Note 27 — “Related Party Transactions” for an additional discussion of expense allocations).

Transfers of cash, both to and from Cantor, as well as amounts due to Newmark from BGC are included in “Receivables from related parties or Payables to related parties” on the accompanying unaudited condensed consolidated balance sheets and as part of the change in payments to and borrowings from related parties in the financing section prior to the Spin-Off and in the operating section after the Spin-Off on the accompanying unaudited condensed consolidated statements of cash flows.

The income tax provision on the accompanying unaudited condensed consolidated statements of operations and unaudited condensed consolidated statements of comprehensive income has been calculated as if Newmark had been operating

15

(b) Recently Adopted Accounting Pronouncements

In December 2019, the FASB issued ASU No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. The ASU is part of the FASB’s simplification initiative, and it is expected to reduce cost and complexity related to accounting for income taxes by eliminating certain exceptions to the guidance in ASC 740, Income Taxes related to the approach for intraperiod tax allocation, the methodology for calculating income taxes in an interim period and the recognition of deferred tax liabilities for outside basis differences. The new guidance also simplifies aspects of the accounting for franchise taxes and enacted changes in tax laws or rates, and clarifies the accounting for transactions that result in a step-up in the tax basis of goodwill. Newmark adopted the standard on the required effective date beginning January 1, 2021 and, with certain exceptions, it was applied prospectively. The adoption of this guidance did not have a material impact on the accompanying unaudited condensed consolidated financial statements.

In January 2020, the FASB issued ASU No. 2020-01, Investments—Equity Securities (Topic 321), Investments—Equity Method and Joint Ventures (Topic 323), and Derivatives and Hedging (Topic 815)—Clarifying the Interactions between Topic 321, Topic 323, and Topic 815 (a consensus of the FASB Emerging Issues Task Force). These amendments improve previous guidance by reducing diversity in practice and increasing comparability of the accounting for the interactions between these codification topics as they pertain to certain equity securities, investments under the equity method of accounting and forward contracts or purchased options to purchase securities that, upon settlement of the forward contract or exercise of the purchased option, would be accounted for under the equity method of accounting or the fair value option. Newmark adopted the standard on the required effective date beginning January 1, 2021 on a prospective basis. The adoption of this guidance did not have a material impact on the accompanying unaudited condensed consolidated financial statements.

In October 2020, the FASB issued ASU No. 2020-10, Codification Improvements. The standard amends the Codification by moving existing disclosure requirements to (or adding appropriate references in) the relevant disclosure sections. The ASU also clarifies various provisions of the Codification by amending and adding new headings, cross-referencing, and refining or correcting terminology. Newmark adopted the standard on the required effective date beginning January 1, 2021 and was applied using a modified retrospective method of transition. The adoption of this guidance did not have a material impact on the accompanying unaudited condensed consolidated financial statements.

In August 2020, the FASB issued ASU No. 2020-06, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity. The standard is expected to reduce complexity and improve comparability of financial reporting associated with accounting for convertible instruments and contracts in an entity’s own equity. The ASU also enhances information transparency by making targeted improvements to the related disclosures guidance. Additionally, the amendments affect the diluted EPS calculation for instruments that may be settled in cash or shares and for convertible instruments. Newmark adopted the standard on the required effective date beginning January 1, 2022, and it was applied using a modified retrospective method of transition. The adoption of this guidance did not have a material impact on the accompanying unaudited condensed consolidated financial statements.

In March 2020, the FASB issued ASU No. 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The guidance is designed to provide relief from the accounting analysis and impacts that may otherwise be required for modifications to agreements (e.g., loans, debt securities, derivatives, and borrowings) necessitated by reference rate reform as entities transition away from LIBOR and other interbank offered rates to alternative reference rates. This ASU also provides optional expedients to enable companies to continue to apply hedge accounting to certain hedging relationships impacted by reference rate reform. Application of the guidance is optional and only available in certain situations. The ASU is effective upon issuance and generally can be applied through December 31, 2022. In January 2021, the FASB issued ASU No. 2021-01, Reference Rate Reform (Topic 848): Scope. The amendments in this standard are elective and principally apply to entities that have derivative instruments that use an interest rate for margining, discounting, or contract price alignment that is modified as a result of reference rate reform (referred to as the “discounting

16

transition”). The standard expands the scope of ASC 848, Reference Rate Reform and allows entities to elect optional expedients to derivative contracts impacted by the discounting transition. Similar to ASU No. 2020-04, provisions of this ASU are effective upon issuance and generally can be applied through December 31, 2022. During the first quarter of 2022, Newmark elected to apply the practical expedients to modifications of qualifying contracts as continuation of the existing contract rather than as a new contract. The adoption of the new guidance did not have a material impact on the accompanying unaudited condensed consolidated financial statements. Management will continue to evaluate the impacts of reference rate reform through December 31, 2022.

(c) New Accounting Pronouncements

In October 2021, the FASB issued ASU No. 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers. The standard improves the accounting for acquired revenue contracts with customers in a business combination by addressing diversity in practice and inconsistency related to the recognition of an acquired contract liability, as well as payment terms and their effect on subsequent revenue recognized by the acquirer. The ASU requires companies to apply guidance in ASC 606, Revenue from Contracts with Customers, to recognize and measure contract assets and contract liabilities from contracts with customers acquired in a business combination, and, thus, creates an exception to the general recognition and measurement principle in ASC 805, Business Combinations. The new standard will become effective for Newmark beginning January 1, 2023, can be applied prospectively for business combinations occurring on or after the effective date, and early adoption is permitted. Management is currently evaluating the impact of the new standard on the accompanying unaudited condensed consolidated financial statements.

In November 2021, the FASB issued ASU No. 2021-10, Government Assistance (Topic 832): Disclosures by Business Entities about Government Assistance. The standard requires business entities to make annual disclosures about transactions with a government they account for by analogizing to a grant or contribution accounting model. The guidance is aimed at increasing transparency about government assistance transactions that are not in the scope of other U.S. GAAP guidance. The ASU requires disclosure of the nature and significant terms and considerations of the transactions, the accounting policies used and the effects of those transactions on an entity’s financial statements. The new standard will become effective for the Newmark’s financial statements issued for annual reporting periods beginning on January 1, 2022, can be applied prospectively or retrospectively, and early adoption is permitted. Management is currently evaluating the impact of the new standard on the accompanying unaudited condensed consolidated financial statements.

In March 2022, the FASB issued ASU No. 2022-02, Financial Instruments—Credit Losses (Topic 326): Troubled Debt Restructurings and Vintage Disclosures. The guidance is intended to improve the decision usefulness of information provided to investors about certain loan refinancings, restructurings, and write-offs. The standard eliminates the recognition and measurement guidance on troubled debt restructurings (“TDRs”) for creditors that have adopted ASC 326, Financial Instruments — Credit Losses and requires them to make enhanced disclosures about loan modifications for borrowers experiencing financial difficulty. The new guidance also requires public business entities to present current-period gross write-offs (on a current year-to-date basis for interim-period disclosures) by year of origination in their vintage disclosures. The new standard will become effective for Newmark beginning January 1, 2023. The guidance for recognition and measurement of TDRs can be applied using either a prospective or modified retrospective transition method, and the amendments related to disclosures can be applied prospectively. Early adoption is permitted, and an entity may elect to early adopt the amendments related to TDRs separately from the amendments related to vintage disclosures. Management is currently evaluating the impact of the new standard on the accompanying unaudited condensed consolidated financial statements.

(2) Limited Partnership Interests in Newmark Holdings and BGC Holdings

Newmark is a holding company with no direct operations and conducts substantially all of its operations through its operating subsidiaries. Virtually all of Newmark’s consolidated net assets and net income are those of consolidated variable interest entities. Newmark Holdings is a consolidated subsidiary of Newmark for which Newmark is the general partner. Newmark and Newmark Holdings jointly own Newmark OpCo, the operating partnership. In connection with the Separation and BGC Holdings Distribution, holders of BGC Holdings partnership interests received partnership interests in Newmark Holdings, described below (see Note 27 — “Related Party Transactions”). These collectively represent all of the “limited partnership interests” in BGC Holdings and Newmark Holdings.

As a result of the Separation, the limited partnership interests in Newmark Holdings were distributed to the holders of limited partnership interests in BGC Holdings, whereby each holder of BGC Holdings limited partnership interests at that time received a corresponding Newmark Holdings limited partnership interest, determined by the contribution ratio (as hereafter defined), which was equal to a BGC Holdings limited partnership interest multiplied by one divided by 2.2 (the “contribution ratio”), divided by the exchange ratio (which is the ratio by which a Newmark Holdings limited partnership interest can be

17

exchanged for a number of shares of Newmark Class A common stock (the “exchange ratio”)). Initially, the exchange ratio equaled one , so that each Newmark Holdings limited partnership interest was exchangeable for one share of Newmark Class A common stock; however, such exchange ratio is subject to adjustment. For reinvestment, acquisition or other purposes, Newmark may determine on a quarterly basis to distribute to its stockholders a smaller percentage of its income than Newmark Holdings distributes to its equity holders (excluding tax distributions from Newmark Holdings) of the cash that it received from Newmark OpCo. In such circumstances, the Separation and Distribution Agreement provides that the exchange ratio will be reduced to reflect the amount of additional cash retained by Newmark as a result of the distribution of such smaller percentage, after the payment of taxes. As of June 30, 2022, the exchange ratio equaled 0.9393 .

Redeemable Partnership Interests

Founding/working partners have limited partnership interests (“FPUs”) in BGC Holdings and Newmark Holdings. Newmark accounts for FPUs outside of permanent capital as “Redeemable partnership interests,” on the accompanying unaudited condensed consolidated balance sheets. This classification is applicable to FPUs because these units are redeemable upon termination of a partner, including a termination of employment, which can be at the option of the partner and not within the control of the issuer.

FPUs are held by limited partners who are primarily employees of BGC and generally receive quarterly allocations of net income. Upon termination of employment or otherwise ceasing to provide substantive services, the FPUs are generally redeemed, and the unit holders are no longer entitled to participate in the quarterly allocations of net income. These quarterly allocations of net income are contingent upon services being provided by the unit holder and are reflected as a component of compensation expense under “Equity-based compensation and allocations of net income to limited partnership units and FPUs” on the accompanying unaudited condensed consolidated statements of operations to the extent they relate to FPUs held by Newmark employees.

Limited Partnership Units

Certain employees of Newmark hold limited partnership interests in Newmark Holdings and BGC Holdings (e.g., REUs, RPUs, PSUs, PSIs, HDUs, and LPUs, collectively the “limited partnership units”).

Prior to the Separation, certain employees of both BGC and Newmark generally received limited partnership units in BGC Holdings. As a result of the Separation, these employees were distributed limited partnership units in Newmark Holdings equal to a BGC Holdings limited partnership unit multiplied by the contribution ratio. In addition, in the BGC Holdings Distribution, these employees also received additional limited partnership units in Newmark Holdings. Subsequent to the Separation, Newmark employees generally have been granted limited partnership units in Newmark Holdings.

Generally, such limited partnership units receive quarterly allocations of net income and generally are contingent upon services being provided by the unit holders. As prescribed in U.S. GAAP guidance, prior to the Spin-Off, the quarterly allocations of net income on such limited partnership units were reflected as a component of compensation expense under “Equity-based compensation and allocations of net income to limited partnership units and FPUs” on the accompanying unaudited condensed consolidated statements of operations. Following the Spin-Off, the quarterly allocations of net income on BGC Holdings and Newmark Holdings limited partnership units held by Newmark employees are reflected as a component of compensation expense under “Equity-based compensation and allocations of net income to limited partnership units and FPUs” on the accompanying unaudited condensed consolidated statements of operations, and the quarterly allocations of net income on Newmark Holdings limited partnership units held by BGC employees are reflected as a component of “Net income (loss) attributable to noncontrolling interests” on the accompanying unaudited condensed consolidated statements of operations. From time to time, Newmark issues limited partnership units as part of the consideration for acquisitions.

Certain of these limited partnership units held by Newmark and BGC employees entitle the holders to receive post-termination payments equal to the notional amount of the units in equal yearly installments after the holder’s termination. These limited partnership units are accounted for as post-termination liability awards and are included on the accompanying unaudited condensed consolidated balance sheets as part of "Accrued compensation", and in accordance with U.S. GAAP guidance, Newmark records compensation expense for the awards based on the change in value at each reporting date on the accompanying unaudited condensed consolidated statements of operations as part of “Equity-based compensation and allocations of net income to limited partnership units and FPUs.”

Certain Newmark employees hold preferred partnership units (“Preferred Units”). Each quarter, the net profits of Newmark Holdings are allocated to such units at a rate of either 0.6875 % (which is 2.75 % per calendar year) or such other amount as set forth in the award documentation (the “Preferred Distribution”). These allocations are deducted before the calculation and distribution of the quarterly partnership distribution for the remaining partnership units and are generally contingent upon services being provided by the unit holder. The Preferred Units are not entitled to participate in partnership

18

distributions other than with respect to the Preferred Distribution. Preferred Units may not be made exchangeable into Newmark’s Class A common stock and are only entitled to the Preferred Distribution, and accordingly are not included in Newmark’s fully diluted share count. The quarterly allocations of net income on Preferred Units are reflected in compensation expense under “Equity-based compensation and allocations of net income to limited partnership units and FPUs” on the accompanying unaudited condensed consolidated statements of operations. After deduction of the Preferred Distribution, the remaining partnership units generally receive quarterly allocation of net income based on their weighted-average pro rata share of economic ownership of the operating subsidiaries. In addition, Preferred Units are granted in connection with the grant of certain limited partnership units, such as PSUs, that may be granted exchangeability to cover the withholding taxes owed by the unit holder, rather than issuing the gross amount of shares to employees, subject to cashless withholding of shares to pay applicable withholding taxes.

Certain Newmark employees hold non-distribution earning units (e.g. NPSUs and NREUs, collectively “N Units”) that do not participate in quarterly partnership distributions and are not allocated any items of profit or loss. N Units become distribution earning limited partnership units, ratably over a four-year vesting term, if certain revenue thresholds are met at the end of each vesting term.

Cantor Units

Cantor holds limited partnership interests in Newmark Holdings (“Cantor units”). Cantor units are reflected as a component of “Noncontrolling interests” on the accompanying unaudited condensed consolidated balance sheets. Cantor receives quarterly allocations of net income (loss) and are reflected as a component of “Net income (loss) attributable to noncontrolling interests” on the accompanying unaudited condensed consolidated statements of operations.