UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

|

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

(Exact name of registrant as specified in its charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

|

|

|

☒ |

Smaller Reporting Company |

|

|

|

|

|

|

|

Emerging Growth Company |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of May 9, 2022, the Registrant had the following shares of common stock outstanding:

TABLE OF CONTENTS

|

PART I FINANCIAL INFORMATION |

|

|

|

Item 1. |

Financial Statements |

|

|

|

|

|

|

|

Consolidated Balance Sheets as of March 31, 2022 (unaudited) and December 31, 2021 |

2 |

|

|

|

|

|

|

Unaudited Consolidated Statements of Operations for the three months ended March 31, 2022 and 2021 |

3 |

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

Unaudited Consolidated Statements of Cash Flows for the three months ended March 31, 2022 and 2021 |

5 |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 |

|

|

|

|

|

Item 3. |

38 |

|

|

|

|

|

|

Item 4. |

39 |

|

|

|

|

|

|

PART II OTHER INFORMATION |

|

|

|

|

|

|

|

Item 1. |

40 |

|

|

|

|

|

|

Item 1A. |

40 |

|

|

|

|

|

|

Item 2. |

40 |

|

|

|

|

|

|

Item 3. |

42 |

|

|

|

|

|

|

Item 4. |

42 |

|

|

|

|

|

|

Item 5. |

42 |

|

|

|

|

|

|

Item 6. |

43 |

|

|

|

|

|

|

44 |

||

1

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED BALANCE SHEETS

(Dollar amounts in thousands, except share data)

|

|

|

March 31, 2022 (unaudited) |

|

|

December 31, 2021 |

|

||

|

ASSETS |

|

|

|

|

|

|||

|

Cash and cash equivalents |

|

$ |

|

|

|

$ |

|

|

|

Commercial mortgage loans at cost, net of allowance for loan loss of $ |

|

|

|

|

|

|

|

|

|

Real estate owned, net of depreciation |

|

|

|

|

|

|

|

|

|

Finance lease right of use asset, net of amortization |

|

|

|

|

|

|

|

|

|

Deferred debt finance costs |

|

|

|

|

|

|

|

|

|

Accrued interest receivable |

|

|

|

|

|

|

|

|

|

Prepaid expenses and other assets |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

|

|

|

$ |

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Repurchase agreements |

|

|

|

|

|

|

|

|

|

Credit facility payable |

|

|

— |

|

|

|

|

|

|

Loan participations sold, net |

|

|

|

|

|

|

|

|

|

Finance lease liability |

|

|

|

|

|

|

|

|

|

Due to related parties |

|

|

|

|

|

|

|

|

|

Interest payable |

|

|

|

|

|

|

|

|

|

Distributions payable |

|

|

|

|

|

|

|

|

|

Accrued expenses |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $ |

|

|

|

|

|

|

|

|

|

shares authorized and 2022 and December 31, 2021 |

|

|

|

|

|

|

|

|

|

Class P common stock, $ 2022 and December 31, 2021, respectively |

|

|

|

|

|

|

|

|

|

Class A common stock, $ and 2021, respectively |

|

|

|

|

|

|

|

|

|

Class T common stock, $ and 2021, respectively |

|

|

|

|

|

|

|

|

|

Class S common stock, $ issued and outstanding as of March 31, 2022 and December 31, 2021, respectively |

|

|

|

|

|

|

|

|

|

Class D common stock, $ respectively |

|

|

|

|

|

|

|

|

|

Class I common stock, $ respectively |

|

|

|

|

|

|

|

|

|

Additional paid in capital (net of offering costs of $ 2022 and December 31, 2021, respectively) |

|

|

|

|

|

|

|

|

|

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

|

Total stockholders’ equity |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

|

|

|

$ |

|

|

The accompanying notes are an integral part of these consolidated financial statements

2

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, dollar amounts in thousands, except share data)

|

|

|

Three months ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Income: |

|

|

|

|

|

|

|

|

|

Interest income |

|

$ |

|

|

|

$ |

|

|

|

Less: Interest expense |

|

|

( |

) |

|

|

( |

) |

|

Net interest income |

|

|

|

|

|

|

|

|

|

Revenue from real estate owned |

|

|

|

|

|

|

|

|

|

Total income |

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Advisory fee |

|

|

|

|

|

|

|

|

|

Debt finance costs |

|

|

|

|

|

|

|

|

|

Directors compensation |

|

|

|

|

|

|

|

|

|

Professional service fees |

|

|

|

|

|

|

|

|

|

Real estate owned operating expenses |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

|

|

|

|

Other expenses |

|

|

|

|

|

|

|

|

|

Net operating expenses |

|

|

|

|

|

|

|

|

|

Net income |

|

|

|

|

|

|

|

|

|

Series A Preferred Stock dividends |

|

$ |

|

|

|

$ |

— |

|

|

Net income attributable to common stockholders |

|

$ |

|

|

|

$ |

|

|

|

Net income attributable to common stockholders per share basic and diluted |

|

$ |

|

|

|

$ |

|

|

|

Weighted average number of shares of common stock |

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements

3

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited, dollar amounts in thousands)

|

For the three months ended March 31, 2022 |

Par Value Preferred Stock |

|

|

Par Value Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

Series A |

|

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

|

Additional Paid in Capital |

|

|

Accumulated Deficit |

|

|

Total Stockholders’ Equity |

|

||||||||||

|

Balance as of December 31, 2021 |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

|

Proceeds from issuance of common stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Offering costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Net income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Common stock distributions declared |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Preferred stock distributions declared |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Distribution reinvestment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Redemptions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Equity-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Balance as of March 31, 2022 |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

|

For the three months ended March 31, 2021 |

Par Value Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

|

Additional Paid in Capital |

|

|

Accumulated Deficit |

|

|

Total Stockholders’ Equity |

|

|||||||||

|

Balance as of December 31, 2020 |

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

|

Proceeds from issuance of common stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Offering costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Net income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Common stock distributions declared |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Distribution reinvestment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Redemptions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Equity-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Balance as of March 31, 2021 |

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

The accompanying notes are an integral part of these consolidated financial statements

4

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, dollar amounts in thousands)

|

|

|

For the three months ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

|

|

|

$ |

|

|

|

Adjustments to reconcile net income to cash provided by operations: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

|

|

|

|

|

|

|

|

Reduction in the carrying amount of the right-of-use asset |

|

|

|

|

|

|

|

|

|

Amortization of equity-based compensation |

|

|

|

|

|

|

|

|

|

Amortization of debt finance costs to operating expense |

|

|

|

|

|

|

|

|

|

Amortization of debt finance costs to interest expense |

|

|

|

|

|

|

|

|

|

Amortization of origination fees |

|

|

( |

) |

|

|

( |

) |

|

Amortization of loan extension fees |

|

|

( |

) |

|

|

( |

) |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accrued interest receivable |

|

|

( |

) |

|

|

( |

) |

|

Accrued expenses |

|

|

|

|

|

|

|

|

|

Loan fees payable |

|

|

— |

|

|

|

( |

) |

|

Accrued interest payable |

|

|

|

|

|

|

|

|

|

Due to related parties |

|

|

|

|

|

|

|

|

|

Prepaid expenses and other assets |

|

|

|

|

|

|

( |

) |

|

Net cash provided by operating activities |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Origination of commercial loans |

|

|

( |

) |

|

|

( |

) |

|

Loan extension fees received on commercial loans |

|

|

|

|

|

|

|

|

|

Principal repayments of commercial loans |

|

|

|

|

|

|

|

|

|

Acquisition of real estate owned and capital expenditures |

|

|

( |

) |

|

|

( |

) |

|

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

|

|

|

|

|

|

|

|

Redemptions of common stock |

|

|

( |

) |

|

|

( |

) |

|

Payment of offering costs |

|

|

( |

) |

|

|

( |

) |

|

Proceeds from repurchase agreements |

|

|

|

|

|

|

|

|

|

Principal repayments of repurchase agreements |

|

|

( |

) |

|

|

— |

|

|

Principal repayments of credit facility |

|

|

( |

) |

|

|

( |

) |

|

Proceeds from sale of loan participations |

|

|

|

|

|

|

— |

|

|

Debt finance costs |

|

|

( |

) |

|

|

— |

|

|

Distributions paid to common stockholders |

|

|

( |

) |

|

|

( |

) |

|

Distributions paid to preferred stockholders |

|

|

( |

) |

|

|

— |

|

|

Net cash provided by financing activities |

|

|

|

|

|

|

|

|

|

Net change in cash, cash equivalents and restricted cash |

|

|

|

|

|

|

( |

) |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

|

|

|

$ |

|

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

|

Amortization of deferred exit fees due to related party |

|

$ |

( |

) |

|

$ |

|

|

|

Interest paid |

|

$ |

|

|

|

$ |

|

|

|

Accrued stockholder servicing fee due to related party |

|

$ |

|

|

|

$ |

( |

) |

|

Distribution reinvestment |

|

$ |

|

|

|

$ |

|

|

The accompanying notes are an integral part of these consolidated financial statements

5

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

Note 1 – Organization and Business Operations

InPoint Commercial Real Estate Income, Inc. (the “Company”) was incorporated in Maryland on September 13, 2016 to originate, acquire and manage a diversified portfolio of commercial real estate (“CRE”) investments primarily comprised of floating-rate CRE debt, including first mortgage loans, subordinate mortgage and mezzanine loans, and participations in such loans. The Company may also invest in floating-rate CRE securities, such as commercial mortgage-backed securities (“CMBS”), and senior unsecured debt of publicly traded real estate investment trusts (“REITs”), and select equity investments in single-tenant, net leased properties. Substantially all of the Company’s business is conducted through InPoint REIT Operating Partnership, LP (the “Operating Partnership”), a Delaware limited partnership. The Company is the sole general partner and directly or indirectly holds all limited partner interests in the Operating Partnership. The Company has elected to be taxed as a REIT for U.S. federal income tax purposes.

The Company is externally managed by Inland InPoint Advisor, LLC (the “Advisor”), a Delaware limited liability company formed in August 2016 that is a wholly owned indirect subsidiary of Inland Real Estate Investment Corporation, a member of The Inland Real Estate Group of Companies, Inc. The Advisor is responsible for coordinating the management of the day-to-day operations and originating, acquiring and managing the Company’s CRE investment portfolio, subject to the supervision of the Company’s board of directors (the “Board”). The Advisor performs its duties and responsibilities as the Company’s fiduciary pursuant to a second amended and restated advisory agreement dated July 1, 2021 among the Company, the Operating Partnership and the Advisor (the “Advisory Agreement”).

The Advisor has delegated certain of its duties to SPCRE InPoint Advisors, LLC (the “Sub-Advisor”), a Delaware limited liability company formed in September 2016 that is a wholly owned subsidiary of Sound Point CRE Management, LP, pursuant to a second amended and restated sub-advisory agreement between the Advisor and the Sub-Advisor dated July 1, 2021. Among other duties, the Sub-Advisor has the authority to identify, negotiate, acquire and originate the Company’s investments and provide portfolio management, disposition, property management and leasing services to the Company. Notwithstanding such delegation to the Sub-Advisor, the Advisor retains ultimate responsibility for the performance of all the matters entrusted to it under the Advisory Agreement, including those duties that the Advisor has not delegated to the Sub-Advisor, such as (i) valuation of the Company’s assets and calculation of the Company’s net asset value (“NAV”); (ii) management of the Company’s day-to-day operations; (iii) preparation of stockholder reports and communications and arrangement of the Company’s annual stockholder meeting; and (iv) monitoring the Company’s ongoing compliance with the REIT qualification requirements.

On October 25, 2016, the Company commenced a private offering (the “Private Offering”) of up to $

On March 22, 2019, the Company filed a Registration Statement on Form S-11 (File No. 333-230465) (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) to register up to $

On May 3, 2019, the SEC declared effective the Registration Statement and the Company commenced the IPO. The purchase price per share for each class of common stock in the IPO (Class A, Class I, Class D, Class S and Class T) varies and generally equals the prior month’s NAV per share, as determined monthly, plus applicable upfront selling commissions and dealer manager fees. Inland Securities Corporation (the “Dealer Manager”), an affiliate of the Advisor, serves as the Company’s exclusive dealer manager for the IPO on a best efforts basis. On April 28, 2022, the Company filed a Registration Statement on Form S-11 (File No. 333-264540) with the SEC to register up to $

On March 24, 2020, the Board suspended (i) the sale of shares in the IPO, (ii) the operation of the share repurchase program (the “SRP”), (iii) the payment of distributions to the Company’s stockholders, and (iv) the operation of the distribution reinvestment plan (the “DRP”), effective as of April 6, 2020. In determining to take these actions, the Board considered various factors, including the impact of the COVID-19 pandemic on the economy, the inability to accurately calculate the Company’s NAV per share due to uncertainty, volatility and lack of liquidity in the market, the Company’s need for liquidity due to financing challenges related to additional collateral required by the banks that regularly finance the Company’s assets and these uncertain and rapidly changing economic conditions.

Though the Company did not calculate the NAV for the months of March through May 2020, the Advisor resumed calculating the NAV beginning as of June 30, 2020 following its determination that volatility in the market for the Company’s investments had declined and the U.S. economic outlook had improved. In August 2020, the Company resumed paying distributions monthly to

6

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

stockholders of record for all classes of its common stock. On October 1, 2020, the SEC declared effective the Company’s post-effective amendment to the Registration Statement, thereby permitting the Company to resume offers and sales of shares of common stock in the IPO, including through the DRP.

On March 1, 2021, the SRP was reinstated for the Company’s stockholders requesting repurchase of shares as a result of the death or qualified disability of the holder, and on July 1, 2021, the SRP was reinstated for all stockholders. In accordance with the terms of the SRP that allow the Company to repurchase fewer shares than the maximum amount permitted under the SRP, the Company repurchased fewer shares than the maximum amount permitted for the months of July, August and September 2021 as directed by the Board. Beginning on October 1, 2021, the total amount of aggregate repurchases of shares was limited as set forth in the SRP (no more than

On September 22, 2021, the Company completed an underwritten public offering of

Please refer to “Note 15 – Subsequent Events” for updates to the Company’s business after March 31, 2022.

Note 2 – Summary of Significant Accounting Policies

Disclosures discussing all significant accounting policies are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the SEC on March 11, 2022 (the “Annual Report), under the heading “Note 2 – Summary of Significant Accounting Policies.” There have been no changes to the Company’s significant accounting policies for the three months ended March 31, 2022.

Basis of Accounting

The accompanying consolidated financial statements and related footnotes have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) and require management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reported periods. Actual results could differ from such estimates.

In the opinion of management, the accompanying unaudited consolidated financial statements reflect all adjustments, which are normal and recurring in nature, necessary for fair financial statement presentation.

Credit Facility Payable

The Company has a credit facility to finance the acquisition or origination of commercial mortgage loans. This credit facility, when drawn upon, is accounted for as debt. The fees paid for this credit facility are recorded in deferred debt finance costs on the consolidated balance sheet and are amortized straight line over the period of the agreement to debt finance costs on the consolidated statement of operations. For further information on the credit facility, see “Note 4 – Repurchase Agreements and Credit Facilities.”

7

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

Cash, Cash Equivalents and Restricted Cash

Restricted cash represents cash the Company is required to hold in a segregated account as additional collateral on real estate securities repurchase agreements. As of March 31, 2022 and December 31, 2021, the Company had repaid all outstanding repurchase agreements secured by real estate securities and, therefore,

Accounting Pronouncements Recently Issued but Not Yet Effective

In June 2016, the Financial Accounting Standards Board (“FASB”) issued ASU 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which changed how entities measure credit losses for financial assets carried at amortized cost. ASU 2016-13 eliminated the requirement that a credit loss must be probable before it can be recognized and instead required an entity to recognize the current estimate of all expected credit losses. ASU 2016-13 became effective for SEC filers for reporting periods beginning after December 15, 2019.

In November 2019, the FASB issued ASU 2019-10, “Financial Instruments – Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and Leases (Topic 842): Effective Dates”, which grants smaller reporting companies (as defined by the SEC) until reporting periods commencing after December 15, 2022 to implement ASU 2016-13. As a smaller reporting company, the Company will continue to evaluate the future impact ASU 2016-13, once implemented, will have on its allowance for loan losses estimate.

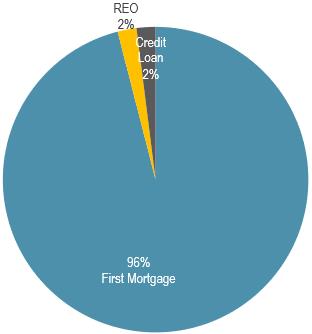

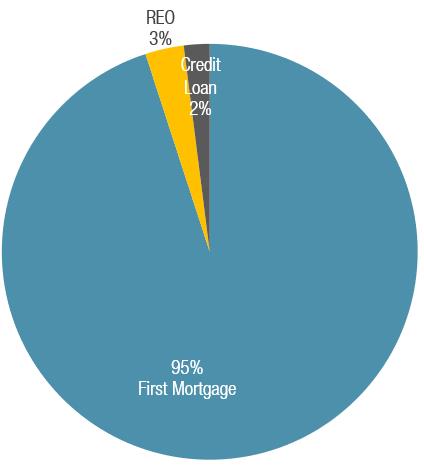

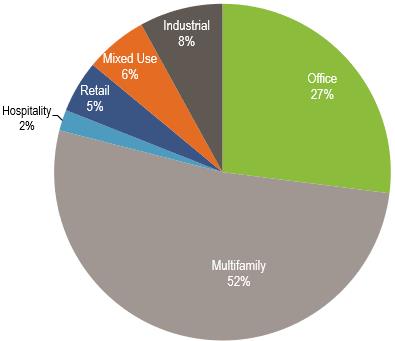

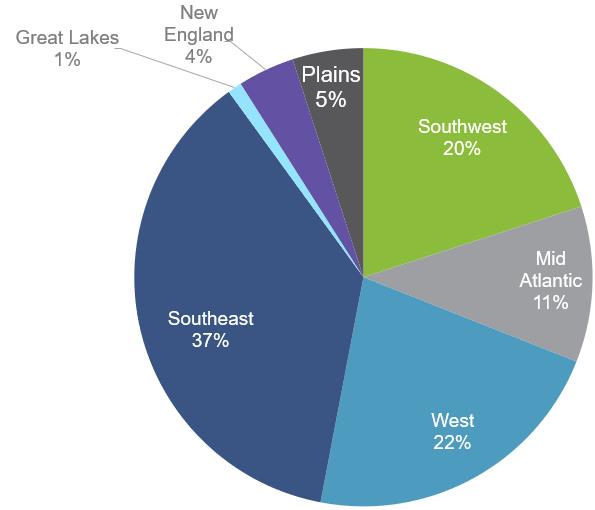

Note 3 – Commercial Mortgage Loans Held for Investment

The tables below show the Company’s commercial mortgage loans held for investment as of March 31, 2022 and December 31, 2021:

March 31, 2022

|

Loan Type (1) |

|

Number of Loans |

|

|

Principal Balance |

|

|

Unamortized (fees)/costs, net |

|

|

Carrying Value |

|

|

Weighted Average Interest Rate |

|

|

Weighted Average Years to Maturity |

|

||||||

|

First mortgage loans |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

|

|

|

|

Credit loans |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

Total and average |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

|

|

|

December 31, 2021

|

Loan Type (1) |

|

Number of Loans |

|

|

Principal Balance |

|

|

Unamortized (fees)/costs, net |

|

|

Carrying Value |

|

|

Weighted Average Interest Rate |

|

|

Weighted Average Years to Maturity |

|

||||||

|

First mortgage loans |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

|

|

|

|

Credit loans |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

Total and average |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

|

|

|

|

(1) |

First mortgage loans are first position mortgage loans and credit loans are mezzanine and subordinated loans. |

8

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

For the three months ended March 31, 2022 and the year ended December 31, 2021, the activity in the Company’s commercial mortgage loans, held-for-investment portfolio was as follows:

|

|

|

Three Months Ended March 31, 2022 |

|

|

Year Ended December 31, 2021 |

|

||

|

Balance at Beginning of Year |

|

$ |

|

|

|

$ |

|

|

|

Loan originations |

|

|

|

|

|

|

|

|

|

Principal repayments |

|

|

( |

) |

|

|

( |

) |

|

Amortization of loan origination, loan extension and deferred exit fees |

|

|

|

|

|

|

|

|

|

Origination fees and extension fees received on commercial loans |

|

|

( |

) |

|

|

( |

) |

|

Balance at End of Period |

|

$ |

|

|

|

$ |

|

|

Allowance for Loan Losses

During the three-month periods ended March 31, 2022 and 2021, the Company determined that no loan losses were probable and, therefore, did

Credit Characteristics

As part of the Company’s process for monitoring the credit quality of its investments, it performs a quarterly asset review of the investment portfolio and assigns risk ratings to each of its loans and certain securities it may own, such as CMBS. Risk factors include payment status, lien position, borrower financial resources and investment in collateral, collateral type, project economics and geographic location, as well as national and regional economic factors. To determine the likelihood of loss, the loans are rated on a 5-point scale as follows:

|

Investment Grade |

Investment Grade Definition |

|

1 |

|

|

2 |

|

|

3 |

|

|

4 |

|

|

5 |

|

All investments are assigned an initial risk rating of 2 at origination or acquisition.

As of March 31, 2022,

Note 4 – Repurchase Agreements and Credit Facilities

Commercial Mortgage Loans

On February 15, 2018, the Company, through a wholly owned subsidiary, entered into a master repurchase agreement (the “CF Repo Facility”) with Column Financial, Inc. as administrative agent for certain of its affiliates. As the Company’s business has grown, it has increased the borrowing limit and extended the maturity. The most recent extension was in November 2021 for a twelve-month term and the maximum advance amount was increased to $

9

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

Facility is subject to certain financial covenants. The Company was in compliance with all financial covenant requirements as of March 31, 2022 and December 31, 2021.

On May 6, 2019, the Company, through a wholly owned subsidiary, entered into an uncommitted master repurchase agreement (the “JPM Repo Facility”) with JPMorgan Chase Bank, National Association. The JPM Repo Facility provides up to $

On March 10, 2021, the Company, through a wholly owned subsidiary, entered into a loan and security agreement and a promissory note (collectively, the “WA Credit Facility”) with Western Alliance Bank (“Western Alliance”). The WA Credit Facility provides for loan advances up to the lesser of $

The JPM Repo Facility, CF Repo Facility and WA Credit Facility (collectively, the “Facilities”) are used to finance eligible loans and each act in the manner of a revolving credit facility that can be repaid as the Company’s assets are paid off and re-drawn as advances against new assets.

The tables below show the Facilities as of March 31, 2022 and December 31, 2021:

|

March 31, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

|||||

|

|

Committed Financing |

|

|

Amount Outstanding (1) |

|

|

Accrued Interest Payable |

|

|

Collateral Pledged |

|

|

Interest Rate |

|

|

Days to Maturity |

|

||||||

|

CF Repo Facility |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

|

|

|

|

JPM Repo Facility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

Total Repurchase Facilities - commercial mortgage loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

WA Credit Facility |

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

% |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

|

|

|

10

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

|

December 31, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

|||||

|

|

Committed Financing |

|

|

Amount Outstanding (1) |

|

|

Accrued Interest Payable |

|

|

Collateral Pledged |

|

|

Interest Rate |

|

|

Days to Maturity |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CF Repo Facility |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

|

|

|

|

JPM Repo Facility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

Total Repurchase Facilities - commercial mortgage loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

WA Credit Facility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

|

|

|

|

(1) |

Excludes $ |

Note 5 – Loan Participations Sold, Net

On November 15, 2021, the Company sold a non-recourse senior participation interest in

The third party, as the senior participation interest holder, will receive interest and principal payments from the borrower until they receive the amounts to which they are entitled. All expenses or losses on the underlying mortgages are allocated first to the Company and then to the third party. If the underlying mortgage is in default, the Company will have the option to purchase the third party’s participation interest and remove it from the loan participation agreement.

The financing or transfer of a portion of a loan by the non-recourse sale of a senior interest in the loan through a participation agreement generally does not qualify as a sale under GAAP. Therefore, in this instance, the Company presents the whole loan as an asset and the loan participation sold as a liability on the consolidated balance sheet until the loan is repaid. The obligation to pay principal and interest on these liabilities is generally based on the performance of the related loan obligation. The gross presentation of loan participations sold does not impact stockholders’ equity or net income.

The following table details the Company’s loan participations sold as of March 31, 2022 and December 31, 2021:

|

|

|

March 31, 2022 |

|

|||||||||||||||

|

Loan Participations Sold |

|

Count |

|

|

Principal Balance |

|

|

Book Value |

|

|

Yield/Cost (1) |

|

Weighted Average Maximum Maturity |

|

||||

|

Total Loans |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

Senior participations (2)(3) |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

11

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

|

|

|

December 31, 2021 |

|

|||||||||||||||

|

Loan Participations Sold |

|

Count |

|

|

Principal Balance |

|

|

Book Value |

|

|

Yield/Cost (1) |

|

Weighted Average Maximum Maturity |

|

||||

|

Total Loans |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

Senior participations (2)(3) |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

____________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

The yield/cost is the present value of all future principal and interest payments on the loan or participation interest and does not include any origination fees or deferred commitment fees. |

|

(2) |

As of March 31, 2022 and December 31, 2021, the loan participations sold were non-recourse to the Company. |

|

(3) |

During the three-months ended March 31, 2022, the Company recorded $ |

Note 6 – Stockholders’ Equity

Preferred Stock Offering

On September 22, 2021, the Company issued and sold

Dividends on the Series A Preferred Stock are cumulative and payable quarterly in arrears at a rate per annum equal to

The Company may not redeem the Series A Preferred Stock prior to

The Series A Preferred Stock is listed on the New York Stock Exchange under the symbol ICR PR A.

12

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

Share Activity for Common Stock and Preferred Stock

The following tables detail the change in the Company’s outstanding shares of all classes of common and preferred stock, including restricted common stock:

|

|

|

Preferred Stock |

|

|

Common Stock |

|

||||||||||||||||||||||

|

Three months ended March 31, 2022 |

|

Series A |

|

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

|||||||

|

Beginning balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Issuance of shares |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Distribution reinvestment |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Issuance of restricted shares |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Redemptions |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Ending balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|||||||||||||||||||||

|

Three months ended March 31, 2021 |

|

|

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

||||||

|

Beginning balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Issuance of shares |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Distribution reinvestment |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Issuance of restricted shares |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Redemptions |

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Ending balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

Distributions – Common Stock

The table below presents the aggregate annualized and monthly distributions declared on common stock by record date for all classes of shares.

|

Record date |

|

Aggregate annualized gross distribution declared per share |

|

|

Aggregate monthly gross distribution declared per share |

|

||

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

The gross distribution was reduced each month for Class D and Class T of the Company’s common stock for applicable class-specific stockholder servicing fees to arrive at a lower net distribution amount paid to those classes. For a description of the stockholder servicing fees applicable to Class D, Class S and Class T shares of the Company’s common stock, please see “Note 10 – Transactions with Related Parties” below. Since the IPO and through March 31, 2022, the Company has

13

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

The following table shows the monthly net distribution per share for shares of Class D and Class T common stock.

|

Record date |

|

Monthly net distribution declared per share of Class D common stock |

|

|

Monthly net distribution declared per share of Class T common stock |

|

||

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

The table below presents the aggregate and net distributions declared for each applicable class of common stock during the three months ended March 31, 2022 and 2021. The table excludes distributions declared for any month for a class of shares of stock when there were no shares of that class outstanding on the applicable record date.

|

|

|

Common Stock |

|

|||||||||||||||||||||

|

Three months ended March 31, 2022 |

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

||||||

|

Aggregate gross distributions declared per share |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

|

|

|

Stockholder servicing fee per share |

|

N/A |

|

|

N/A |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

N/A |

|

|||

|

Net distributions declared per share |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|||||||||||||||||||||

|

Three months ended March 31, 2021 |

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

||||||

|

Aggregate gross distributions declared per share |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

|

|

|

Stockholder servicing fee per share |

|

N/A |

|

|

N/A |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

N/A |

|

|||

|

Net distributions declared per share |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

|

|

Dividends - Series A Preferred Stock

Series A Preferred Stock dividends are paid quarterly in arrears based on an annualized distribution rate of

As of March 31, 2022, and December 31, 2021, distributions declared but not yet paid amounted to $

Note 7 – Net Income (Loss) Per Share

Basic earnings per share (“EPS”) are computed by dividing net income attributable to common stockholders by the weighted average number of common shares outstanding for the period. Diluted EPS is computed by dividing net income attributable to common stockholders by the common shares plus common share equivalents. The Company’s common share equivalents are unvested restricted shares. The Company excludes antidilutive restricted shares from the calculation of weighted-average shares for diluted earnings per share. There were

14

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

The following table is a summary of the basic and diluted net income (loss) per share computation for the three months ended March 31, 2022 and 2021:

|

|

|

Three months ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Net income attributable to common stockholders |

|

$ |

|

|

|

$ |

|

|

|

Weighted average shares outstanding, basic |

|

|

|

|

|

|

|

|

|

Dilutive effect of restricted stock |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, diluted |

|

|

|

|

|

|

|

|

|

Net income attributable to common stockholders per share, basic and diluted |

|

$ |

|

|

|

$ |

|

|

Note 8 – Commitments and Contingencies

In the ordinary course of business, the Company may become subject to litigation, claims and regulatory matters. The Company has no knowledge of material legal or regulatory proceedings pending or known to be contemplated against the Company at this time.

The Company has made a commitment to advance additional funds under certain of its CRE loans if the borrower meets certain conditions. As of March 31, 2022, the Company had

Note 9 – Segment Reporting

The Company has

Note 10 – Transactions with Related Parties

As of March 31, 2022, the Advisor had invested $

As of March 31, 2022, Sound Point Capital Management, LP (“Sound Point”), an affiliate of the Sub-Advisor, had invested $

15

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

The following table summarizes the Company’s related party transactions for the three months ended March 31, 2022 and 2021 and the amount due to related parties at March 31, 2022 and December 31, 2021:

|

|

|

Three months ended March 31, |

|

|

Payable as of March 31, |

|

|

Payable as of December 31, |

|

|||||||

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

|

Organization and offering expense reimbursement (1) |

|

$ |

|

|

|

$ |

— |

|

|

$ |

|

|

|

$ |

— |

|

|

Selling commissions and dealer manager fee (2) |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Advisory fee (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan fees(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued stockholder servicing fee (5) |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Operating expense reimbursement to advisor (6) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

Total |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

(1) |

The Company reimburses the Advisor, the Sub-Advisor and their respective affiliates for costs and other expenses related to the IPO, provided the Advisor has agreed to reimburse the Company to the extent that the organization and offering expenses that the Company incurs exceeds |

|

(2) |

For the IPO, the Dealer Manager is entitled to receive (a) upfront selling commissions of up to |

|

(3) |

The Advisor is entitled to receive an advisory fee comprised of two separate components: (1) a fixed component payable monthly and (2) a performance component payable annually. Prior to July 1, 2021, the fixed component of the advisory fee was paid in an amount equal to 1/12th of % per annum of the gross value of the Company’s assets, paid monthly in arrears, provided that any such monthly payment could not exceed 1/12th of % of the Company’s NAV. Effective July 1, 2021, the fixed component of the advisory fee is paid in an amount equal to 1/12th of % of the Company’s average NAV for each month, paid monthly in arrears. The performance component of the advisory fee is calculated and paid annually, such that for any year in which the Company’s total return per share exceeds |

|

(4) |

The Company pays the Advisor all new loan origination and administrative fees related to CRE loans held for investment, to the extent that such fees are paid by the borrower. Pursuant to the Sub-Advisory Agreement, the Advisor generally will reallow a portion of loan fees and all administrative fees to the Sub-Advisor. |

16

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

|

(5) |

Subject to the Financial Industry Regulatory Authority, Inc. limitations on underwriting compensation, the Company pays the Dealer Manager selling commissions over time as stockholder servicing fees for ongoing services rendered to stockholders by participating broker-dealers or broker-dealers servicing stockholders’ accounts as follows: (a) for Class T shares only, |

|

(6) |

Prior to July 1, 2021, the Company reimbursed the Advisor for expenses that it (or the Sub-Advisor acting on the Advisor’s behalf) incurs in connection with providing services to the Company, provided that the Company did not reimburse overhead costs, including rent and utilities or personnel costs (including salaries, bonuses, benefits and severance payments) and the Company only reimbursed the Advisor for fees payable to its affiliates if they are incurred for legal or marketing services rendered on the Company’s behalf. Effective July 1, 2021, the Company is obligated to reimburse for all of the expenses attributable to the Company or its subsidiaries, including the Operating Partnership, and paid or incurred and submitted to the Company for reimbursement by the Advisor, the Sub-Advisor or their respective affiliates in providing services to the Company under the Advisory Agreement, including personnel and related employment costs. |

Expense Limitation Agreement

Pursuant to an expense limitation agreement (the “Expense Limitation Agreement”) dated July 1, 2021, the Advisor and Sub-Advisor agree to

Separately from the limitation on ordinary operating expenses under the Expense Limitation Agreement, the Advisor and Sub-Advisor voluntarily chose not to seek reimbursement for certain expenses that they incurred or paid on behalf of the Company during the three months ended March 31, 2022, and for which they may have been entitled to be reimbursed. The Advisory Agreement and Sub-Advisory Agreement provide that expenses will be submitted monthly to the Company for reimbursement, and the amount of expenses submitted for reimbursement in any particular month is not necessarily indicative of the total amount of expenses actually incurred by the Advisor and the Sub-Advisor in providing services to the Company and for which reimbursement could have been received by the Advisor or Sub-Advisor.

Revolving Credit Liquidity Letter Agreements

Inland Real Estate Investment Corporation (“IREIC”), the Company’s sponsor, and Sound Point have agreed under separate letter agreements dated July 20, 2021, and July 15, 2021, respectively, to make revolving credit loans to the Company in an aggregate principal amount outstanding at any one time not to exceed $

17

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

arrears when principal is paid or repaid and on the Termination Date. Each of the following constitutes an “Event of Default” under the letter agreements: (y) the Company fails to perform or observe any covenant or condition to be performed or observed under the letter agreement (including the obligation to repay a loan in full on the Termination Date) and such failure is not remedied within three business days of its receipt of notice thereof; or (z) the Company becomes insolvent or the subject of any bankruptcy proceeding.

Note 11 – Equity-Based Compensation

With each stock grant, the Company awards each of its

|

Grant Date |

|

Class of common stock granted |

|

Total number of shares granted |

|

|

Grant Date Fair Value Per Share |

|

|

Total Fair Value of Grant |

|

|

Proportion of total shares that vest annually |

|

Vesting Date Year 1 |

|

Vesting Date Year 2 |

|

Vesting Date Year 3 |

|||

|

March 1, 2018 |

|

Class P |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

January 7, 2019 |

|

Class P |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

December 2, 2019 |

|

Class I |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

December 1, 2020 |

|

Class I |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

October 14, 2021 |

|

Class I |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

Under the Company’s Independent Director Restricted Share Plan, restricted shares generally vest over a vesting period from the date of the grant, subject to the specific terms of the grant. Restricted shares are included in common stock outstanding on the grant date. The grant-date value of the restricted shares is amortized over the vesting period representing the requisite service period. Compensation expense associated with the restricted shares issued to the independent directors was $

A summary table of the status of the restricted shares is presented below:

|

|

|

Restricted Shares |

|

|

Weighted Average Grant Date Fair Value Per Share |

|

||

|

Outstanding at December 31, 2021 |

|

|

|

|

|

$ |

|

|

|

Granted |

|

|

— |

|

|

- |

|

|

|

Vested |

|

|

( |

) |

|

|

|

|

|

Converted |

|

|

— |

|

|

|

— |

|

|

Forfeited |

|

|

— |

|

|

|

— |

|

|

Outstanding at March 31, 2022 |

|

|

|

|

|

$ |

|

|

18

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2022

(Unaudited, dollar amounts in thousands, except share data)

Note 12 – Fair Value of Financial Instruments

GAAP requires the disclosure of fair value information about financial instruments, whether or not they are recognized at fair value in the consolidated balance sheets, for which it is practicable to estimate that value.

|

|

March 31, 2022 |

|

|

December 31, 2021 |

|

||||||||||

|

|

Carrying Amount |

|

|

Estimated Fair Value |

|

|

Carrying Amount |

|

|

Estimated Fair Value |

|

||||

|

Financial assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Commercial mortgage loans, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Financial liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase agreements - commercial mortgage loans |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Credit facility payable |

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Loan participations - sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

$ |

|

|

|

$ |

|

|

|

$ |

|