UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

or

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission file number 1-37774

AdvanSix Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 81-2525089 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 300 Kimball Drive, Suite 101 Parsippany, New Jersey | 07054 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (973) 526-1800

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

| 1 |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

Large accelerated filer o Accelerated filer o Non-accelerated filer x Smaller reporting company o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 30, 2016, the registrant’s common stock was not publicly-traded.

There were 30,482,966 shares of Common Stock outstanding at February 1, 2017.

Documents Incorporated by Reference

Part III: Proxy Statement for Annual Meeting of Stockholders to be held June 1, 2017.

| 2 |

TABLE OF CONTENTS

| 3 |

In this Annual Report on Form 10-K, unless the context otherwise dictates, “AdvanSix”, the “Company”, “we” or “our” means AdvanSix Inc. and its consolidated subsidiaries.

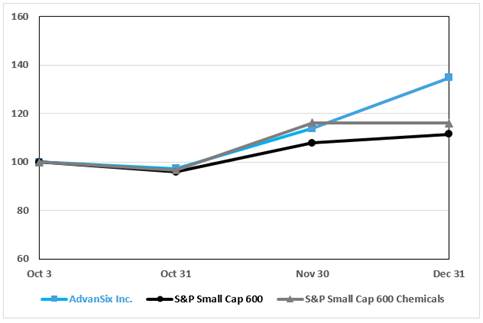

Separation from Honeywell

On October 1, 2016, Honeywell International Inc. (“Honeywell”) completed the previously announced separation of AdvanSix Inc. The separation was completed by Honeywell distributing (the “Distribution”) all of the then outstanding shares of common stock of AdvanSix on October 1, 2016 (the “Distribution Date”) through a dividend in kind of AdvanSix common stock, par value $0.01, to holders of Honeywell common stock as of the close of business on the record date of September 16, 2016 who held their shares through the Distribution Date (the “Spin-Off”). Each Honeywell stockholder who held their shares through the Distribution Date received one share of AdvanSix common stock for every 25 shares of Honeywell common stock held at the close of business on the record date of September 16, 2016. We filed our Form 10 describing the Spin-Off with the Securities and Exchange Commission (the “SEC”), which was declared effective by the SEC on September 8, 2016 (the “Form 10”). On October 3, 2016, AdvanSix stock began “regular-way” trading on the New York Stock Exchange under the “ASIX” stock symbol. The Spin-Off is further described in Note 1 to the Consolidated and Combined Financial Statements included in Item 8 of this Form 10-K.

Description of Business

AdvanSix Inc. is an integrated manufacturer of Nylon 6, a polymer resin which is a synthetic material used by our customers to produce engineered plastics, fibers, filaments and films that, in turn, are used in such end-products as automotive and electronic components, carpets, sports apparel, fishing nets and food and industrial packaging. As a result of our backward integration and the configuration of our manufacturing facilities, we also sell a variety of other products, all of which are produced as part of the Nylon 6 resin manufacturing process including caprolactam, ammonium sulfate fertilizers, and other chemical intermediates as follows:

| • | Caprolactam – Caprolactam is the key chemical compound used in the production of Nylon 6 resin. In recent years, approximately 60% of the caprolactam we have produced at our facility in Hopewell, Virginia has been shipped to our facility in Chesterfield, Virginia to manufacture Nylon 6 resin. We market and sell the caprolactam that is not consumed internally in Nylon 6 resin production to customers who manufacture polymer resins or use caprolactam to produce nylon fibers, films and other nylon products. Our Hopewell manufacturing facility is one of the world’s largest single-site producers of caprolactam as of December 31, 2016. |

| • | Ammonium Sulfate Fertilizer – Ammonium sulfate fertilizer is derived from the caprolactam manufacturing process. Because of our Hopewell facility’s size, scale and design, we are the world’s largest single-site producer of ammonium sulfate fertilizer as of December 31, 2016. We market and sell ammonium sulfate fertilizer primarily to North American and South American resellers and customers who use the product to grow crops. |

| • | Chemical Intermediates – We manufacture, market and sell a number of other chemical products that are derived from the chemical processes within our integrated supply chain. Most significant is acetone which is used by our customers in the production of adhesives, paints, coatings, solvents, herbicides and other engineered plastic resins. Other intermediate chemicals that we manufacture, market and sell include phenol, alpha-methylstyrene (“AMS”), cyclohexanone, methyl ethyl ketoxime (“MEKO”), cyclohexanol, acetaldehyde oxime, 2-pentanone oxime, sulfuric acid, ammonia and carbon dioxide. |

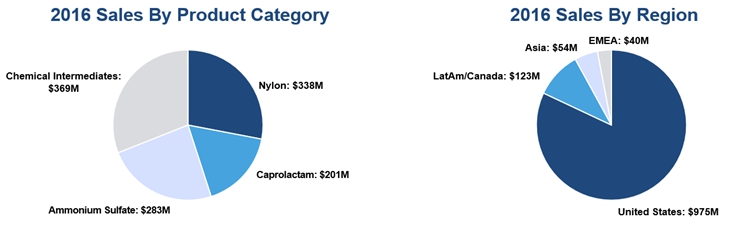

Each of these product lines represented the following approximate percentage of our sales:

| Years Ended December 31, | ||||||

| 2016 | 2015 | 2014 | ||||

| Nylon | 28% | 27% | 25% | |||

| Caprolactam | 17% | 18% | 21% | |||

| Ammonium Sulfate Fertilizers | 24% | 25% | 20% | |||

| Chemical Intermediates | 31% | 30% | 34% | |||

| 4 |

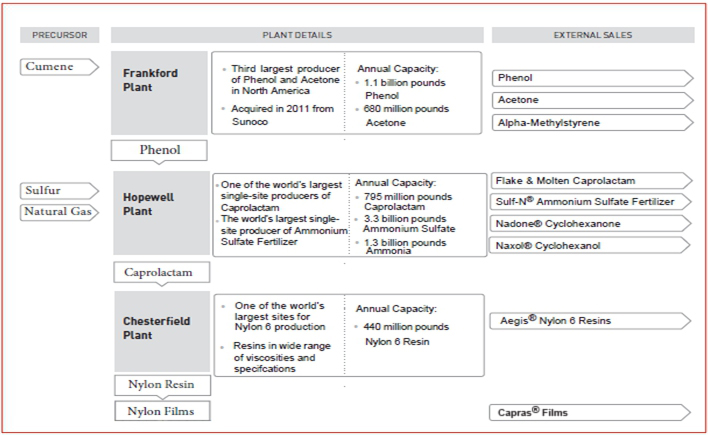

Our manufacturing process is fully backward integrated. We use cumene, a chemical compound produced from benzene and propylene, to manufacture phenol, acetone and AMS, at our Frankford, Pennsylvania plant. The majority of the phenol we manufacture is further processed at our Hopewell facility through an integrated series of unit operations which also consume natural gas and sulfur, to produce caprolactam and ammonium sulfate. Our caprolactam is then shipped to our Chesterfield plant, where it is polymerized into Nylon 6 resin.

Our integrated manufacturing process, scale and the quantity and range of our products make us one of the most efficient manufacturers in our industry. We consistently focus on and invest in improving production yields from our various manufacturing processes to build on our leading cost position. Our global logistics infrastructure supports our commercial mission by ensuring a reliable intraplant supply chain and consistent and timely delivery to our customers while maximizing our distribution resources and our operating efficiency. In addition, we strive to understand the product applications and end-markets into which our products are sold, which helps us upgrade the quality, chemical properties or packaging of our products in ways to attract price premiums and greater demand.

All of our manufacturing plants and operations are located in the United States. We serve approximately 500 customers globally located in more than 40 countries. For the years ended December 31, 2016, 2015 and 2014, we had sales of $1,191.5 million, $1,329.4 million and $1,790.4 million with net income of $34.1 million, $63.8 million and $83.9 million, respectively. For the years ended December 31, 2016, 2015 and 2014, our international sales were $216.4 million, $372.1 million and $510.7 million, respectively.

AdvanSix is a single reportable segment, operating through three integrated North American manufacturing sites located in Frankford, Pennsylvania, Hopewell, Virginia and Chesterfield, Virginia.

For information concerning revenues and assets by geographic region, see “Note 16 – Geographic Areas and Major Customers – Financial Data” to our Consolidated and Combined Financial Statements included in this Form 10-K, which information is incorporated here by reference.

| 5 |

The following charts illustrate the distribution of our sales by product category and by region, measured by the destination of each sale, for the year ended December 31, 2016:

Competitive Strengths

Our competitive strengths include the following:

Large-Scale Single-Site Producer of Caprolactam and Ammonium Sulfate. We operate one of the world’s largest single-site caprolactam and ammonium sulfate production facilities, which is a competitive advantage in our highly-fragmented industry. Our scale provides operating leverage and the opportunity to achieve stronger business performance than our competitors in several ways. Most fundamentally, our large scale enables us to spread fixed and overhead costs across more pounds of production, thereby enabling us to produce caprolactam at a lower per pound price than our competitors. In addition, the scale of our operations benefits our procurement activities for raw materials and services. Large scale also helps drive our sales. We believe that our reputation as one of the world’s largest producers of caprolactam, Nylon 6 resin, ammonium sulfate and associated chemical intermediates, encourages potential customers to approach us for stability of their supply requirements.

Low Cost Position Driven by Favorable Geographical Location, Integrated Manufacturing Footprint and High Utilization Rates. Our access to lower cost raw materials, backward integrated manufacturing facilities and high plant utilization rates help us maintain our position as the world’s lowest cost producer of caprolactam. First, the location of our manufacturing operations in the United States affords us access to the world’s lowest cost natural gas, which is a key raw material needed to manufacture the ammonia used in the production of caprolactam as well as the source of power for our manufacturing operations. By contrast, a significant number of our competitors are located in geographic locations where energy prices are substantially higher. Second, we are fully backward integrated into several key feedstock materials necessary to produce caprolactam and Nylon 6 resin, particularly phenol, ammonia and oleum/sulfuric acid, which we believe is a unique advantage in our industry. Backward integration contributes to higher operating margins by lowering raw material transportation, handling and storage costs. It also enables us to remain flexible, while optimizing sales from our diverse portfolio of products. Finally, our long-term customer relationships and contracts enable us to maintain high plant utilization rates, which, along with our large scale, provide significant operating and purchasing leverage.

Global Reach. The global reach of our sales and marketing capabilities enables us to compete everywhere nylon resin, caprolactam and ammonium sulfate are consumed. Our sales, marketing, technical and procurement staff reside in eight countries, and in 2016 approximately 18% of our sales were outside the United States. Our freight and logistics capabilities and terminal locations position us well to serve global markets, including the dock and loading facility at our Hopewell facility which is capable of serving ocean-going freight vessels. Our global reach enables us to arbitrage geographic price variations to ensure we are receiving the highest value for our products.

| 6 |

Technical Know-how, Customer Intimacy and Application Development Capabilities. Intimate knowledge of our customers and end-market applications, combined with our technical know-how, enables us to develop specialty products that are often valued higher by customers compared to commodity products. We have an R&D department consisting of nearly 50 scientists and engineers with advanced degrees in polymer synthesis, catalysis and chemical and polymer engineering, who work not only on developing new products for nylon resins but also drive exacting offerings for our chemical intermediates and ammonium sulfate customers. In June 2015, we expanded our capabilities to test and scale production of copolymer Nylon 6/6.6 resin, which is used in food packaging films and other applications. We have also invested in an R&D facility located in Shanghai, China that specializes in working with caprolactam and nylon resin customers to develop products for specialty applications. Further, our agronomists provide the latest scientific information on the importance of sulfur nutrition and how to optimize the benefits of ammonium sulfate fertilizer to our global customers through a variety of channels including webinars, an “Ask the Agronomist” blog, technical training sessions for retailers and direct grower meetings.

Diverse Revenue Sources from the Sale of Fertilizer, Acetone and Other Chemical Intermediates. Due to our specific chemical manufacturing processes, backward integration and scale, we produce ammonium sulfate fertilizer, acetone and a wide range of other chemical intermediates that enable us to diversify our revenue sources. Most significantly, for every pound of caprolactam produced, we produce approximately four pounds of ammonium sulfate, a fertilizer used by farmers around the world. For the past two decades we have employed agronomists to educate growers and retailers in the Americas on the yield value of using ammonium sulfate fertilizer on key crops including corn, coffee, sugar and cotton. Sales of ammonium sulfate in 2016 were $283.4 million and represented 24% of our total sales. Sales of acetone also help us diversify our revenue sources. We are among the most significant suppliers of acetone to a variety of end-markets in North America. Sales of acetone in 2016 were approximately $169 million and represented 14% of our total sales. In addition to fertilizer and acetone, other products from our manufacturing process include merchant phenol, AMS, cyclohexanone, cyclohexanol, sulfuric acid, ammonia, MEKO and carbon dioxide. The diversity of our sales portfolio helps to mitigate, to some extent, the cyclicality in our end-markets.

Business Strategies

Our business strategies include the following:

Build on our Low Cost Leadership Position. Through our size, access to low cost raw materials, backward integration and high utilization rates, we intend to continue expanding operating margins by continuing to lower our Nylon 6 resin, caprolactam and ammonium sulfate production costs. Our focus on operational excellence and continuing productivity improvements will be concentrated on the following:

| • | Selective investments to increase production volume through asset reliability, flexibility and capacity. For example, by investing in intermediate chemical buffer storage capacity, we can continue to produce Nylon 6 resin, caprolactam and ammonium sulfate even when the targeted production units are offline for routine maintenance or when there is an unplanned interruption in production; |

| • | Energy and direct material yield reduction initiatives aimed at increasing plant productivity and lowering costs; and |

| • | Further deployment of improved procurement processes, competitive bidding and supplier diversification to reduce raw material costs. |

Leverage our R&D Investments and Applications Expertise. Our customers typically buy caprolactam and nylon resin for compounding or extruding with additives and other materials, to increase strength or flexibility or to add color to make the resin more suitable for use in their end products such as textiles, packaging and industrial materials. We intend to leverage our R&D investments, customer intimacy and product applications know-how to develop new formulations of resin products to better serve our customers and increase the value of our resin products portfolio. For example, engineered plastics that utilize Nylon 6 and Nylon 6.6 resin are being increasingly used in automobiles to reduce weight as automobile manufacturers strive to meet stricter fuel efficiency standards. We intend to work with our customers serving this market to develop resin products specifically tailored for these product applications. Likewise, we are working to develop and sell nylon resin products with differentiated characteristics for wire and cable applications and flexible food packaging. Another focus of our R&D initiatives will be nylon resin processing technologies that can produce existing types of high value resins at lower costs. Working with existing and potential customers while understanding end-use applications, our R&D team will continue to build application development capabilities to better understand and protect the value proposition of our new products.

Selective Investments to Produce Higher Value Products. Historically, a significant portion of the Nylon 6 resin we produced was sold as a commodity product and, as a result, was subject to cyclicality. Over the past several years, we have invested in capabilities to increase the value of our product portfolio. For example, we recently announced the installation of a new production line at our Chesterfield facility that is capable of producing multiple grades of higher value Nylon 6 resin as well as copolymer Nylon 6/6.6 resin, both of which are used in engineered plastics for the automotive industry, films for food packaging, as well as other higher value applications. Similarly, we will explore other investments that will enable us to produce higher value products that meet the exacting specifications of customers in certain high value industries.

| 7 |

Pursue a Highly-Selective Acquisition Strategy. We expect to seek strategic acquisitions and alliances to supplement our organic sales by broadening our customer base, expanding our geographic reach and developing our technology and product portfolios. For example, we intend to evaluate the potential acquisition of, on a select basis, businesses that would enable us to produce higher value resin products, including copolymers, or would improve our access to certain geographic regions.

Use of Toll Manufacturers to Produce Higher Margin AdvanSix-Developed Specialty Products. We are adept at using our technical know-how and customer intimacy to develop products that blend our nylon resin with other types of nylon and non-nylon resin products and additives to produce higher value products. Where we do not have the in-house manufacturing capabilities to produce these products, we contract with third-party compounders to toll manufacture for us. By utilizing third-party toll manufacturing arrangements to either divert nylon resin away from more commoditized end-markets or expand the geographic end-markets available to us, we intend to increase sales and expand our operating margins.

Industry Overview

Nylon and Caprolactam. According to PCI Wood Mackenzie, the global demand for Nylon 6 resin as of December 31, 2016 was approximately 5,200 kMT, spanning a variety of end-uses such as engineered automotive plastics, carpets, textiles, industrial filament and food and industrial films. The market growth typically tracks global growth but varies by end-use. Some of these end-markets, such as engineered automotive plastics, are experiencing increased demand due to trends in light weighting to meet stricter fuel efficiency standards. We expect this trend of increasing demand to continue as our customers find new uses for Nylon 6 resin, both within existing and new end-markets.

Generally, prices for Nylon 6 resin and caprolactam reflect supply and demand in the marketplace as well as the value of the basic raw materials used in the production of caprolactam, consisting primarily of benzene, and, depending on the manufacturing process utilized, natural gas and sulfur. The price of benzene is a key driver of caprolactam prices because it is the common chemical compound used in the petrochemical derivatives, such as phenol and cyclohexane, which are the key feedstock materials for caprolactam depending on a given plant’s manufacturing technology. As a result, the global prices for caprolactam typically track as a spread over the price of benzene. Generally, Nylon 6 resin prices track the cyclicality of caprolactam prices, although, to the extent Nylon 6 resin producers are able to manufacture specialized nylon resin products, prices set above the spread are achievable.

The global market for Nylon 6 resin and caprolactam has undergone significant change in the past five years as Chinese manufacturers have entered the market and increased global supply at a time when demand has remained relatively stable. As a result of the increased capacity and competitive intensity, the margins for Nylon 6 resin and caprolactam have declined in recent years to historic lows in 2016.

Ammonium Sulfate and Other Chemical Intermediates. Our ammonium sulfate fertilizer products are primarily sold in North and South America. Ammonium sulfate is used as a nitrogen fertilizer on key crops that benefit from sulfur micronutrients and, as of December 31, 2016, accounts for approximately 4% of the global market for nitrogen fertilizer. Urea is one global price driver for all nitrogen fertilizers, including ammonium sulfate, and urea pricing has been under pressure recently due to the loosening of Chinese government export policies and the growth of both Chinese and broader global production capacity. A second global price driver for ammonium sulfate fertilizer is the price of future deliveries of crops, including corn, wheat and coffee, which are impacted by general trends in the agricultural industry.

Our chemical intermediates are used as key inputs for a variety of end-market products including construction materials, paints and coatings, packaging and consumer applications. The prices for our chemical intermediates generally correlate to the prices of their underlying raw materials.

Competition

Competition across all of our product offerings is based on a variety of factors such as price, reliability of supply, product innovation and quality. Other competitive factors include breadth of product line, R&D efforts and technical and managerial capability. While our competitive position varies among our products, we believe we are a significant competitor in each of our major product classes. The global market for Nylon 6 resin, caprolactam and ammonium sulfate is highly fragmented, and we compete with integrated manufacturers, such as BASF Corporation, Sinopec Limited, DOMO Chemicals GmbH, LANXESS AG and Ube Industries, Ltd. We also compete with manufacturers that only produce polymer resins, such as Li Peng Enterprise Co. Ltd. and Zig Sheng Industrial Co., Ltd. We also compete with synthetic manufacturers of ammonium sulfate, agricultural fertilizers, such as Pasadena Commodities International, and phenol producers, such as Ineos Phenol. A number of our products are sold in a market with many competitors, some of which have substantial financial resources and significant technological capabilities. Additionally, our competitors include companies that have global operations as well as those operating only within specific geographic regions.

| 8 |

Product Overview

Nylon

We manufacture our Nylon 6 resin in our Chesterfield plant. We sell our Nylon 6 resin globally, primarily under the Aegis® brand name. In addition, we use our Nylon 6 resin to produce nylon films at a leased facility located in Pottsville, Pennsylvania, which we primarily sell to our customers under the Capran® brand name. In 2016, our Nylon 6 resin products generated $338.0 million of sales. In 2016, 2015 and 2014, Nylon 6 sales were 28%, 27% and 25% of our total sales, respectively.

In June 2015, we expanded our capabilities at our Chesterfield facility to test and scale-up production of various copolymer resins, including Nylon 6/6.6 resin, which can be tailored to our customers’ requirements. As of December 31, 2016, the Chesterfield facility is the only manufacturing site in North America with a large-scale asset to produce Nylon 6/6.6 resin with high Nylon 6 content. Copolymer resins are used in product applications requiring higher levels of processing, melting points and strengths such as food packaging films and engineering plastics.

Caprolactam

We produce caprolactam, the key monomer used in the production of Nylon 6 resin, at our Hopewell plant using phenol that we produce at our Frankford plant and sulfur and natural gas that we obtain from third-party suppliers. In 2016, caprolactam generated $201.4 million of sales. In 2016, 2015 and 2014, caprolactam sales were 17%, 18% and 21% of our total sales, respectively.

Ammonium Sulfate

Ammonium sulfate fertilizer is produced simultaneously with caprolactam as part of our integrated caprolactam manufacturing process at Hopewell. We manufacture these products in a ratio of approximately four pounds of ammonium sulfate to one pound of caprolactam. Our competitors typically produce approximately two pounds or less of ammonium sulfate for each pound of caprolactam. Approximately 60% of the ammonium sulfate we produce is in granular form. We sell ammonium sulfate under the brand name Sulf-N®. In 2016, our ammonium sulfate products generated $283.4 million of sales. In 2016, 2015 and 2014, ammonium sulfate sales were 24%, 25% and 20% of our total sales, respectively.

Chemical Intermediates

We produce and sell our chemical intermediates to a range of customers for use in many different types of end-products. In 2016, our chemical intermediates products generated $368.7 million of sales, of which $281.7 million, or 76%, came from sales of phenol, acetone and AMS, and $86.9 million, or 24%, came from sales of our other chemical intermediates. In 2016, 2015 and 2014, chemical intermediate sales were 31%, 30% and 34% of our total sales, respectively.

Phenol is a key chemical intermediate of caprolactam, and we produce all of the phenol we use in our caprolactam manufacturing process at our Frankford plant. Approximately 75% to 80% of the phenol we produce is forward integrated into our production of caprolactam and other chemical intermediates at Hopewell, and approximately 20% to 25% of our production is sold to customers for use in their product applications. Our customers use phenol to produce a variety of end-products such as resins, epoxies and bisphenolA.

All of our acetone is sold to customers for use in end-products such as adhesives, paints, coatings, solvents, herbicides and other engineered plastic resins. Acetone is typically used by our customers as a key raw material in the production of a variety of other chemicals, used in the applications above

We also produce and sell AMS, MEKO, cyclohexanone, cyclohexanol, acetaldehyde oxime and 2-pentanone oxime. We use some of these products in our manufacturing process and also sell them to customers for use in end-products such as resins, inks, paints, coatings and agricultural chemical intermediates and detergents.

Raw Materials

The primary raw material used in our manufacturing process is cumene, which is produced from benzene and propylene by our suppliers. We purchase cumene from a number of suppliers to ensure stability of supply and optimal terms for this key raw material. Other important raw materials we use in our manufacturing process are sulfur and natural gas, which we use to produce ammonium sulfate and caprolactam. We purchase sulfur and natural gas from a diverse set of suppliers.

| 9 |

Historically, we have been able to renew contracts with our suppliers and obtain sufficient quantities of cumene, sulfur, natural gas or any of our other key raw materials. Global supply and demand can significantly impact the price of our key raw materials and historically prices have been cyclical. We continually seek to reduce costs of key raw materials and do not foresee any material constraints in the near term resulting from pricing or availability.

Sales, Marketing and Distribution

We have a global sales force with long-standing relationships with our customers and deep expertise with our products, product applications and end-markets. We predominantly sell directly to our customers, primarily under contracts but also through spot transactions under purchase orders.

All of our products are supported by our global logistics capability that we employ to ensure reliable and timely delivery to our customers while maximizing distribution resources and efficiency.

Customers

Globally, we serve approximately 500 customers in a wide variety of industries. In 2016, our ten largest customers accounted for approximately 40% of our total sales. Our largest customer is Shaw Industries Group, Inc., one of the world’s largest consumers of caprolactam and Nylon 6 resin. In 2016, 2015 and 2014, our sales to Shaw were 17%, 16% and 19%, respectively, of our total sales. We sell Nylon 6 resin and caprolactam to Shaw under a long-term contract. We typically sell to our other customers under short-term contracts, with one- to two-year terms, or by purchase orders. We have historically experienced low customer turnover.

Seasonality

Except for our ammonium sulfate fertilizer products, which are influenced by seasonal growing patterns in North and South America, sales of most of our products have been subject to minimal or no seasonality. Due to the fertilizer sales cycle, we occasionally build up higher inventory balances because the production volumes are generally steady month to month rather than tied to seasonal demand for fertilizers.

Backlog

In general, the Company does not manufacture its products against a backlog of orders and does not consider backlog to be a significant indicator of the level of future sales activity. Therefore, the Company believes that backlog information is not material to understanding its overall business and should not be considered a reliable indicator of the Company’s ability to achieve any particular level of revenue or financial return. However, we do have many long-term supply contracts which carry minimum order obligations.

Research & Development and Intellectual Property

We believe success in our industry is driven by technological strength and innovation. Our R&D activities focus equally on improving our chemical manufacturing processes to increase efficiency, capacity and productivity and lower costs and innovating for new product applications.

We benefit from numerous patents and trademarks that we own. We sell our Nylon 6 resin under the Aegis® brand name, our nylon films under the Capran® brand name and our ammonium sulfate fertilizer under the Sulf-N® brand name. Chemical intermediates are also sold under the brand names of Nadone®, Naxol® and EZ-Blox™. We also benefit from technology covered by trade secrets, including know-how and other proprietary information relating to many of our products, processes and technologies. We do not consider any individual patent, trademark or any licensing or distribution rights related to a specific process or product to be of material importance in relation to our total business. In our judgment, our intellectual property rights are adequate for the conduct of our business. We intend to continue taking steps as necessary to protect our intellectual property, including, when appropriate, filing patent applications for inventions that are deemed important to our business.

We conduct R&D at technology centers with approximately 50 researchers in total. We lease space at Honeywell’s technology centers in the United States in Colonial Heights, Virginia and in Shanghai, China. For the years ended December 31, 2016, 2015 and 2014, our R&D expenses were approximately $13.8 million, $12.8 million and $13.0 million, respectively.

| 10 |

Regulation and Environmental Matters

We are subject to various federal, state, local and foreign government requirements regarding protection of human health and the environment. Compliance with these laws and regulations results in higher capital expenditures and costs. We believe that, as a general matter, our policies, practices and procedures are properly designed to prevent unreasonable risk of environmental impact, and of resulting financial liability, in connection with our business. Some risk of environmental impact is, however, inherent in some of our operations and products, as it is with other companies engaged in similar businesses.

We are and have been engaged in the handling, manufacture, use and disposal of many substances classified as hazardous by one or more regulatory agencies. It is possible that future knowledge or other developments, such as improved capability to detect substances in the environment or increasingly strict environmental laws and standards and enforcement policies, could bring into question our current or past handling, manufacture, use or disposal of these substances.

Among other environmental laws and regulations, we are subject to the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA” or the “Federal Superfund law”), the Resource Conservation and Recovery Act (“RCRA”) and similar state, foreign and global laws for management and remediation of hazardous materials, the Clean Air Act (“CAA”) and the Clean Water Act, for protection of air and water resources, the Toxic Substance Control Act (“TSCA”), for regulation of chemicals in commerce and reporting of potential known adverse effects, and numerous other federal, state, local and foreign laws and regulations governing materials transport and packaging, under which we may be designated as a potentially responsible party that may be liable for cleanup costs associated with current operating sites and various hazardous waste sites.

In July 2013, a consent decree was finalized among the United States, the Commonwealth of Virginia and AdvanSix regarding alleged violations of the CAA and the air operating permit at our manufacturing facility in Hopewell, Virginia. In the consent decree, we agreed to pay a civil penalty of $3 million and, among other things, install certain pollution control and other equipment in accordance with a schedule ending in 2019. In October 2015, a consent order was finalized between the Virginia Water Control Board and AdvanSix regarding alleged violations of Hopewell’s Virginia Pollutant Discharge Elimination System permit and other discharge requirements. In the consent order, we agreed to pay a civil penalty of $300,000 and, among other things, take corrective action with respect to process sewers and sumps at our Hopewell facility in accordance with a schedule ending in 2018.

Our business may be impacted by pending climate change legislation, regulation or international treaties or accords in the foreseeable future. We will continue to monitor emerging developments in this area.

See “Risk Factors – We are subject to extensive environmental, health and safety laws and regulations that may result in unanticipated loss or liability, which could adversely affect our business, financial condition and results of operations.”

Our accounting policy for environmental expenditures is discussed in “Note 2 – Summary of Significant Accounting Policies” to the audited Consolidated and Combined Financial Statements included elsewhere in this Form 10-K. We continuously seek to improve our environment, health and safety performance. We have expended funds to comply with environmental laws and regulations and expect to continue to do so in the future.

Our Frankford and Hopewell facilities are regulated facilities under Chemical Facilities Anti-Terrorism Standards (“CFATS”) and the Maritime Transportation Security Act of 2002 (“MTSA”) due to the nature of our operations and the proximity of the facilities to the adjacent waterways. As a result, we are required to comply with numerous regulations administered by the Department of Homeland Security, including the development and implementation of compliant security procedures and protocols. Additionally, sales of acetone, which is a List II Chemical under the TSCA, are regulated by the Drug Enforcement Act. This classification subjects us to audits by the Drug Enforcement Administration and ongoing restrictions on our sales activities with respect to acetone.

Employees

As of December 31, 2016, we employ approximately 1,340 people. Of this total, approximately 530 are salaried employees and approximately 810 are hourly employees. Approximately 750 employees are covered under collective bargaining agreements that expire between 2017 and 2019.

| 11 |

Executive Officers of the Registrant

The executive officers of AdvanSix Inc., listed as follows, are appointed annually by the Board of Directors.

There are no family relationships among them.

| Name, Age, Date First Appointed an Executive Officer |

Position | Business Experience |

| Erin N. Kane, 40 2016 |

Chief Executive Officer and Director | Prior to joining the Company, Ms. Kane served as vice president and general manager of Honeywell Resins and Chemicals since October 2014. She joined Honeywell in 2002 as a Six Sigma Blackbelt of Honeywell’s Specialty Materials business. In 2004, she was named product marketing manager of Honeywell’s Specialty Additives business. From 2006 until 2008, Ms. Kane served as global marketing manager of Honeywell’s Authentication Technologies business, and in 2008 she was named global marketing manager of Honeywell’s Resins and Chemicals business. In 2011, she was named business director of chemical intermediates of Honeywell’s Resins and Chemicals business. Prior to joining Honeywell, Ms. Kane held Six Sigma and process engineering positions at Elementis Specialties and Kvaerner Process. Ms. Kane brings to the Board her knowledge of AdvanSix’s business and industry experience and expertise. |

|

Michael Preston, 45 2016 |

Senior Vice President and Chief Financial Officer | Prior to joining the Company, Mr. Preston held a number of finance roles with Honeywell for over 15 years. Most recently, Mr. Preston served as vice president and chief financial officer for Honeywell’s UOP division (2013-2016). Prior to this role, Mr. Preston was vice president of business analysis & planning (2012–2013) with Honeywell corporate. Mr. Preston also held several finance leadership roles within businesses and Honeywell corporate, including chief financial officer for Fluorine Products, director of financial planning & analysis for Performance Materials and Technologies, and director of business analysis & planning for Honeywell corporate. Mr. Preston began his career with Honeywell in September of 2001 as manager of investor relations. Prior to joining Honeywell, he spent seven years in investor relations consulting. Mr. Preston was awarded the Chartered Financial Analyst designation in September of 2001 and is a member of CFA Institute and New York Society of Security Analysts. |

|

John M. Quitmeyer, 66 2016 |

Senior Vice President, General Counsel and Corporate Secretary | Prior to joining the Company, Mr. Quitmeyer served as vice president and general counsel of Honeywell’s Automation and Control Solutions strategic business group since 2005. He joined Honeywell in 1997 as general counsel of Honeywell’s safety restraint business. From 1997 until 1998, Mr. Quitmeyer served as general counsel of Honeywell’s automotive products group. From 1998 until 2000, Mr. Quitmeyer served as general counsel of Honeywell’s consumer products group. From 2000 until 2002, Mr. Quitmeyer was Honeywell’s chief litigation counsel. From 2002 until 2005, Mr. Quitmeyer served as general counsel of Honeywell’s Specialty Materials business. Prior to joining Honeywell, Mr. Quitmeyer was a litigation partner at Rogers & Wells. |

| Jonathan Bellamy, 51 2016 |

Senior Vice President and Chief Human Resources Officer | Prior to joining the Company, Mr. Bellamy served as vice president of human resources of the Defense and Space business of Honeywell’s Aerospace division since 2015. He joined Honeywell in 1997 as human resources manager of the Turbo Technologies division. From March 2000 until February 2003, Mr. Bellamy served as human resources manager, then regional director of Honeywell’s Turbo Technologies division. From February 2003 until December 2004, he served as director of human resources of Honeywell Transportation Systems, Asia. From December 2004 until November 2005, Mr. Bellamy served as global human resources director of Honeywell’s Friction Materials division. From November 2005 until July 2010, Mr. Bellamy served as corporate human resources director. From 2010 to 2015, he was vice president of human resources of Honeywell UOP. Prior to joining Honeywell, Mr. Bellamy held human resources and operations positions at BTR Brook Hansen and N.S.K./RHP Bearings. |

| 12 |

| Name, Age, Date First Appointed an Executive Officer |

Position | Business Experience |

| Christopher Gramm, 47 2016 |

Vice President, Controller | Prior to joining the Company, Mr. Gramm served as vice president and controller of the aerospace and corporate government compliance divisions at Honeywell International Inc. From August 2014 to November 2015, Mr. Gramm served as vice president of finance for the integrated supply chain of the aerospace division at Honeywell International Inc. Prior to this, beginning in March 2011, he was vice president and controller of the aerospace division at Honeywell International Inc. Over the course of the period from 1997 to March 2011, Mr. Gramm held several positions at Honeywell International Inc., including controller and chief financial officer of various divisions focused on areas including specialty materials and resins and chemicals. He joined Honeywell International Inc. in 1997 as a senior staff accountant. Before joining Honeywell International Inc., Mr. Gramm was a manager at Corning Life Sciences. |

Other Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports are available free of charge on our website (www.Advan6.com) under the heading Investor Relations (see SEC filings) immediately after they are filed with, or furnished to, the Securities and Exchange Commission (SEC). In addition, in this Form 10-K, the Company incorporates by reference certain information from parts of its Proxy Statement for the 2017 Annual Meeting of Stockholders and which will also be available free of charge on our website. Information contained on, or connected to, our website does not and will not constitute part of this Form 10-K.

We are a Delaware corporation that was incorporated on May 4, 2016. Effective February 1, 2017, our principal executive offices are located at 300 Kimball Drive, Suite 101, Parsippany, NJ 07054. Prior to February 1, 2017, our principal executive offices were located at 115 Tabor Road, Morris Plains, NJ 07950. Our telephone number is (973) 526-1800. Our website address is www.Advan6.com. Information contained on, or connected to, our website or Honeywell’s website does not and will not constitute part of this Form 10-K.

Cautionary Statement Concerning Forward-Looking Statements

All statements other than statements of historical fact included in this Form 10-K including, without limitation, statements under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in other parts of this report regarding our financial position, business strategy and the plans and objectives of management for future operations, are forward looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. When used in this Form 10-K, words such as “anticipate,” “believe,” “estimate,” “expect,” “plan,” “intend” and similar expressions, as they relate to us or our management, identify forward looking statements. Such forward looking statements are based on the beliefs of management, as well as assumptions made by, and information currently available to, our management. They are not guarantees of future performance and actual results could differ materially from those contemplated by the forward looking statements as a result of certain factors detailed in our filings with the SEC. All subsequent written or oral forward looking statements attributable to us or persons acting on our behalf are qualified in their entirety by this paragraph. We do not undertake to update or revise any of our forward-looking statements. Our forward-looking statements are also subject to risks and uncertainties that can affect our performance in both the near-and long-term. These forward-looking statements should be considered in light of the information included in this Form 10-K, including, in particular, the factors discussed below. These factors may be revised or supplemented in subsequent reports on Forms 10-Q and 8-K.

| 13 |

Risk Factors

You should carefully consider all of the information in this Form 10-K and each of the risks described below, which we believe are the principal risks that we face. Some of the risks relate to our business, others to the Spin-Off. Some risks relate principally to the securities markets and ownership of our common stock.

Any of the following risks could materially and adversely affect our business, financial condition and results of operations and the actual outcome of matters as to which forward-looking statements are made in this Form 10-K.

Risks Relating to Our Business

Difficult and volatile conditions in the overall economy, particularly in the United States but also globally, and in the capital, credit and commodities markets could adversely affect our business, financial condition and results of operations.

Our business, financial condition and results of operations could be adversely affected by difficult global economic conditions and significant volatility in the capital, credit and commodities markets and in the overall economy. Difficult and volatile conditions in the United States and globally could affect our business in a number of ways. For example:

| • | Weak economic conditions, especially in our key markets, could reduce demand for our products, impacting our sales and margins; |

| • | As a result of the recent volatility in commodity prices, we may encounter difficulty in achieving sustained market acceptance of past or future price increases; |

| • | Under difficult market conditions, there can be no assurance that access to credit or the capital markets would be available or sufficient, and in such a case, we may not be able to successfully obtain additional financing on reasonable terms, or at all; and |

| • | Market conditions could result in our key customers experiencing financial difficulties and/or electing to limit spending, which in turn could result in decreased sales and earnings for us. |

The industry in which we operate is highly competitive and experiences cyclicality which can cause significant fluctuations in our cash flows. These industry dynamics may adversely affect our business, financial condition and results of operations.

The industry in which we operate is highly competitive. Competition in the nylon resin industry is based on a number of factors such as price, product quality and service. We face significant competition from major international and regional competitors. Our competitors may improve their competitive position in our core markets by successfully introducing new products or innovations in their manufacturing processes or improving their cost structures. If we are unable to keep pace with our competitors’ product and manufacturing process innovations or cost position improvements, our business, financial condition and results of operations could be adversely affected.

Our historical operating results reflect the cyclical and sometimes volatile nature of the caprolactam, Nylon 6 resin and ammonium sulfate industries. We experience cycles of fluctuating supply and demand for each of the products we sell which result in changes in selling prices. Periods of high demand, tight supply and increasing operating margins tend to result in increases in capacity and production until supply exceeds demand, generally followed by periods of oversupply and declining prices. For example, the global market for Nylon 6 resin and caprolactam has undergone significant change in the past five years as Chinese manufacturers have entered the market and increased global supply at a time when demand has remained relatively stable, causing a decline in price and product margins. As a result of the increased capacity and competitive intensity, the margins for Nylon 6 resin and caprolactam have declined in recent years to historic lows. Decreases in the average selling prices of our products could have an adverse effect on our profitability. While we strive to maintain or increase our profitability by reducing costs through improving production efficiency, emphasizing higher margin products and by controlling transportation, selling and administration expense, we cannot assure you that these efforts will be sufficient to offset fully the effect of possible decreases in pricing on operating results. Because of the cyclical nature of our businesses, we cannot assure you that pricing or profitability in the future will be comparable to any particular historical period, including the most recent period shown in our operating results.

Moreover, historically, information about our business and operations was presented as part of the broader Honeywell corporate organization. As an independent, publicly-traded company, we are required to publicly provide more detailed information about our business and operations, including financial information and material contract terms. This information will be accessible to our customers, suppliers and competitors, each of whom may factor the new information into their commercial dealings with us or the markets in which we operate. The use of such information by third parties in the marketplace could have an adverse effect on our business, financial condition and results of operations.

| 14 |

Any significant unplanned downtime or material disruption at one of our production facilities or logistics operations may adversely affect our business, financial condition and results of operations, and the age of our manufacturing facilities increases the risk for unplanned downtime, which may be significant.

We seek to run our complex production facilities on a nearly continuous basis for maximum efficiency and rely on the integrity of our logistics operations for the uninterrupted operations of business. While we have continued to make significant annual capital improvements at our manufacturing plants, operational issues have occurred in the past and may occur in the future, which could cause damage to our manufacturing and production equipment and ancillary facilities. Unplanned interruptions in our production capabilities adversely affect our production costs, product lead times and earnings during the affected period.

Our manufacturing process is fully backward integrated. We use cumene, a chemical compound produced from benzene and propylene, to manufacture phenol, acetone and AMS, at our Frankford plant. The majority of the phenol we manufacture is further processed at our Hopewell facility through an integrated series of unit operations which also consume natural gas and sulfur to produce caprolactam and ammonium sulfate. Our caprolactam is then shipped to our Chesterfield plant, where it is polymerized into Nylon 6 resin. Although our integrated manufacturing, scale and the quantity and range of our product offerings make us one of the most efficient manufacturers in our industry, we are also exposed to increased risk associated with unplanned downtime or material disruptions at any one of our production facilities which could impact our supply chain to downstream plants in our manufacturing process.

We seek to mitigate the risk of unplanned downtime through regularly scheduled maintenance both for major and minor repairs at all of our production facilities. We also utilize maintenance and mechanical integrity programs and maintain an appropriate buffer inventory of intermediate chemicals necessary for our manufacturing process, both of which are intended to mitigate the extent of any production losses as a result of unplanned downtime. However, unplanned outages may still occur or we may not have enough intermediate chemical inventory at any given time to offset such production losses. Moreover, taking our production facilities offline for regularly scheduled repairs can be an expensive and time-consuming operation with risk that discoverable items and delays during the repair process may cause significant additional unplanned downtime as well. Any such unplanned downtime at any of our production facilities may adversely affect our business, financial condition and results of operations.

Our production facilities and logistics operations are also subject to the risk of catastrophic loss and material disruptions due to unanticipated events such as fires, explosion, severe weather conditions, earthquake or other natural disasters, personal injury or major accidents, acts of terrorism, prolonged power failures, chemical spills, unexpected repairs or other operational and logistical problems that we or a third-party on which we rely may experience. Depending on the nature, extent and length of any operational interruption due to any such event, the results could adversely affect our business, financial condition and results of operations.

Raw material price fluctuations and the ability of key suppliers to meet delivery requirements can increase the cost of our products and services, impact our ability to meet commitments to customers and cause us to incur significant liabilities.

The cost of raw materials, including cumene, natural gas and sulfur, is a key element in the cost of our products. Our inability to offset material price inflation through increased prices to customers, formula-based or long-term fixed price contracts with suppliers, productivity actions or commodity hedges could adversely affect our business, financial condition and results of operations.

Although we believe that our sources of supply for raw materials are generally robust, it is difficult to predict what effects shortages of raw materials or price increases may have in the future. Our ability to manage inventory and meet delivery requirements may be constrained by our suppliers’ inability to scale production and adjust delivery of long lead-time products during periods of fluctuating demand. Our inability to fill our supply needs would jeopardize our ability to fulfill obligations under contracts, which could, in turn, result in reduced sales and profits, contract penalties or terminations and damage to customer relationships.

When possible we have purchased, and we plan to continue to purchase, raw materials, including cumene, natural gas and sulfur, through negotiated medium- or long-term contracts. To the extent that we have been able to achieve favorable terms in our existing negotiated contracts, we may not be able to renew such contracts at the current terms or at all, and this may adversely impact our results of operations. To the extent that the markets for our raw materials significantly change, we may be bound by the terms of our existing supplier contracts and obligated to purchase such raw materials at disadvantaged terms as compared to other market participants.

| 15 |

Our operations require substantial capital and we may not be able to obtain additional capital that we need in the future on favorable terms or at all.

We have historically relied on Honeywell for assistance in satisfying our capital requirements and are no longer able to rely on the earnings, assets or cash flow of Honeywell. As a result, we are responsible for obtaining and maintaining sufficient working capital and other funds to satisfy our cash requirements. Our industry is capital intensive, and we may require additional capital in the future to finance our growth and development, upgrade and improve our manufacturing capabilities, implement further marketing and sales activities, fund ongoing R&D activities, satisfy regulatory and environmental compliance obligations and meet general working capital needs. Our capital requirements will depend on many factors, including acceptance of and demand for our products, the extent to which we invest in new technology and R&D projects and the status and timing of these developments. We may need to seek additional capital in the future and debt or equity financing may not be available to us on terms we find acceptable, if at all. If we incur additional debt or raise equity through the issuance of our preferred stock, the terms of the debt or our preferred stock issued may give the holders rights, preferences and privileges senior to those of holders of our common stock, particularly in the event of liquidation. If we raise funds through the issuance of additional common equity, ownership in us would be diluted. Also, regardless of the terms of our debt or equity financing, our agreements and obligations under the Tax Matters Agreement entered into in connection with the Spin-Off and that address compliance with Section 355(e) of the Internal Revenue Code of 1986, as amended (the “Code”) may limit our ability to issue stock. We believe that we have adequate capital resources to meet our projected operating needs, capital expenditures and other cash requirements. However, we may need additional capital resources in the future and if we are unable to obtain sufficient resources for our operating needs, capital expenditures and other cash requirements for any reason, our business, financial condition and results of operations could be adversely affected.

Our operations are dependent on numerous required permits and approvals.

We hold numerous environmental and other governmental permits and approvals authorizing operations at each of our facilities. In addition, any expansion of our operations is dependent upon securing the necessary environmental or other permits or approvals.

A decision by a government agency to deny or delay issuing a new or renewed material permit or approval, or to revoke or substantially modify an existing material permit or approval, could have an adverse effect on our ability to continue operations at the affected facility and on our business, financial condition and results of operations.

The loss of one or more of our significant customers could adversely affect our business, financial condition and results of operations.

Our business depends on significant customers, many of whom have been doing business with us for decades, and the loss of one or several significant customers may have an adverse effect on our business, financial condition and results of operations. Additionally, our significant customers have the ability to influence pricing and other contract terms. Such influence could increase with the completion of the Spin-Off as our customers may have gained access to information that we otherwise in the past would not have publicly disclosed but are required to disclose as a public company.

In 2016, our ten largest customers accounted for approximately 40% of our total sales. Our largest customer is Shaw Industries Group, Inc. (“Shaw”), one of the world’s largest consumers of caprolactam and Nylon 6 resin. We sell Nylon 6 resin and caprolactam to Shaw under a long-term contract. In 2016, 2015 and 2014, our sales to Shaw were 17%, 16%, and 19%, respectively, of our total sales. We typically sell to our other customers under short-term contracts with one- to two-year terms or by purchase orders.

If our sales to any of our significant customers were to decline, we may not be able to find other customers to purchase the excess supply of our products. The loss of one or several of our significant customers, or a significant reduction in purchase volume by any of them or significant unfavorable changes to pricing or other terms in contracts with any of them, could have an adverse effect on our business, financial condition and results of operations. We are also subject to credit risk associated with customer concentration. If one or more of our largest customers were to become bankrupt or insolvent, or otherwise were unable to pay for our products, we may incur significant write-offs of accounts that may have an adverse effect on our business, financial condition and results of operations.

We are subject to risks related to adverse trade policies imposed against exports from the United States in certain important markets for our products.

We are subject to a series of antidumping investigations initiated by China’s Ministry of Commerce (“MOFCOM”) covering the import of caprolactam and Nylon 6 resin into China. As a result of these investigations, significant antidumping duties were imposed on our products.

| 16 |

In addition, the Mexican government initiated an antidumping investigation on imports of ammonium sulfate into Mexico from the United States which resulted in antidumping duties being imposed on this product. These duties are currently still in place and must be paid by our customers in these countries to purchase our products, placing us at a significant competitive disadvantage in those markets.

In each case, we diligently evaluated our commercial and legal options to defend these investigations and their subsequent sunset reviews. Historically, we have successfully mitigated these risks through geographical mix management so that imposition of duties does not materially affect our business results. However, such duties could have an adverse effect on the sales of key product lines and affect our business performance in the future.

There can be no assurance that any governmental or international trade body in the future will not institute trade policies or remedies that are adverse to exports from the United States. Any significant changes in international trade policies, practices or trade remedies, especially those instituted in our target markets or markets where our major customers are located, could potentially increase the price of our products relative to our competitors or decrease our customers’ demand for our products, which in turn may adversely affect our business, financial condition and results of operations.

We are subject to extensive environmental, health and safety laws and regulations that may result in unanticipated loss or liability, which could adversely affect our business, financial condition and results of operations.

Various federal, state, local and foreign governments regulate the discharge of materials into the environment and can impose substantial fines and criminal sanctions for violations and require installation of costly equipment or operational changes to limit emissions and/or decrease the likelihood of accidental hazardous substance releases. If we are found to be in violation of these laws or regulations, we may incur substantial costs, including fines, damages, criminal or civil sanctions and remediation costs, or experience interruptions in our operations. See “Item 1. Business – Regulation and Environmental Matters” for more information on the environmental laws and regulations to which we are subject.

Primarily because of our past operations at our current manufacturing locations and other locations used in our operations as currently conducted, we may be subject to potentially material liabilities related to the remediation of environmental hazards and to claims of personal injuries or property damages that may have been or may be caused by hazardous substance releases and exposures or other hazardous conditions. Lawsuits, claims and costs involving these matters may arise in the future. In addition, changes in laws, regulations and enforcement of policies, the discovery of previously unknown contamination or information related to individual sites, the establishment of stricter state or federal toxicity standards with respect to certain contaminants or the imposition of new clean-up requirements or remedial techniques could require us to incur additional costs in the future that would have a negative effect on our business, financial condition and results of operations.

Additionally, there are substantial uncertainties as to the nature, stringency and timing of any future regulations or changes in regulations, including greenhouse gas (“GHG”) and water nutrient regulations. More stringent regulations, especially of GHGs, may require us to make changes in our operating activities that would increase our operating costs, reduce our efficiency, limit our output, require us to make capital improvements to our facilities, increase our costs for or limit the availability of energy, raw materials or transportation or otherwise adversely affect our business, financial condition and results of operations. If enacted, more stringent GHG limitations are likely to have a significant impact on us because our production facilities emit GHGs such as carbon dioxide and nitrous oxide and because natural gas, a fossil fuel, is a primary raw material used in our production process. In addition, to the extent that GHG restrictions are not imposed in countries where our competitors operate or are less stringent than regulations that may be imposed in the United States, our competitors may have cost or other competitive advantages over us.

There is also a risk that one or more of our key raw materials or one or more of our products may be found to have, or be characterized as having, a toxicological or health-related impact on the environment or on our customers or employees, which could potentially result in us incurring liability in connection with such characterization and the associated effects of any toxicological or health-related impact. If such a discovery or characterization occurs, we may incur increased costs in order to comply with new regulatory requirements or the relevant materials or products, including products of our customers incorporating our materials or products, may be recalled or banned. Changes in laws and regulations, or their interpretation, and our customers’ perception of such changes or interpretations may also affect the marketability of certain of our products. Additionally, sales of acetone, which is a List II Chemical under TSCA, are regulated by the Drug Enforcement Act. This classification subjects us to periodic audits by the Drug Enforcement Administration and ongoing restrictions on our acetone sales activities.

| 17 |

Due to concerns related to terrorism, we are subject to various security laws including MTSA and CFATS regulations. Our Frankford and Hopewell facilities are regulated facilities under CFATS and MTSA due to the nature of our operations and the proximity of the facilities to the adjacent waterways. Federal, state, local and foreign governments could implement new or impose more stringent regulations affecting the security of our plants, terminals and warehouses or the transportation and use of fertilizers or other chemicals. These regulations could result in higher operating costs or limitations on the sale of our products and could result in significant unanticipated costs, lower sales and reduced profit margins. It is possible that federal, state, local and foreign governments could impose additional limitations on the use, sale or distribution of chemicals that we produce and sell, thereby limiting our ability to manufacture or sell those products, or that illicit use of our products could result in liability for us.

Hazards associated with chemical manufacturing, storage and transportation could adversely affect our business, financial condition and results of operations.

There are hazards associated with chemical manufacturing and the related storage and transportation of raw materials, products and wastes. These hazards could lead to an interruption or suspension of operations and have an adverse effect on the productivity and profitability of a particular manufacturing facility or on us as a whole. While we endeavor to provide adequate protection for the safe handling of these materials, issues could be created by various events, including natural disasters, severe weather events, acts of sabotage and performance by third parties, and as a result we could face potential hazards such as piping and storage tank leaks and ruptures, mechanical failure, employee exposure to hazardous substances and chemical spills and other discharges or releases of toxic or hazardous substances or gases.

These hazards may cause personal injury and loss of life, damage to property and contamination of the environment, which could lead to government fines, work stoppage injunctions, lawsuits by injured persons, damage to our public reputation and brand and diminished product acceptance. If such actions are determined adversely to us or there is an associated economic impact to our business, we may have inadequate insurance or cash flow to offset any associated costs. Such outcomes could adversely affect our business, financial condition and results of operations.

Our business, financial condition and results of operations could be adversely affected by litigation and other commitments and contingencies.

We face risks arising from various unasserted and asserted litigation matters, including, but not limited to, product liability and claims for third-party property damage or personal injury stemming from alleged environmental or other torts. We have noted a nationwide trend in purported class actions against chemical manufacturers generally seeking relief such as medical monitoring, property damages, off-site remediation and punitive damages arising from alleged environmental or other torts without claiming present personal injuries. We also have noted a trend in public and private nuisance suits being filed on behalf of states, counties, cities and utilities alleging harm to the general public.

Various factors or developments can lead to changes in current estimates of liabilities such as a final adverse judgment, significant settlement or changes in applicable law. An adverse outcome or unfavorable development in any one or more of these matters could be material to our financial results and could adversely impact the value of any of our brands that are associated with any such matters.

In the ordinary course of business, we may make certain commitments, including representations, warranties and indemnities relating to current and past operations, including those related to divested businesses, and issue guarantees of third-party obligations. Additionally, we will be required to indemnify Honeywell for amounts related to liabilities allocated to, or assumed by, us under each of the Separation and Distribution Agreement, the Employee Matters Agreement and the Tax Matters Agreement entered into in connection with the Spin-Off. If we are required to make any such payments, the payments could be significant and could exceed the amounts we have accrued with respect thereto, adversely affecting our business, financial condition and results of operations.

Our inability to successfully acquire and integrate other businesses, assets, products or technologies or realize the financial and strategic goals that were contemplated at the time of any transaction could adversely affect our business, financial condition and results of operations.

We actively evaluate acquisitions and strategic investments in businesses, products or technologies that we believe could complement or expand our business or otherwise offer growth or cost-saving opportunities. From time to time, we may enter into letters of intent with companies with which we are negotiating for potential acquisitions or investments, or as to which we are conducting due diligence. An investment in, or acquisition of, complementary businesses, products or technologies in the future could materially decrease the amount of our available cash or require us to seek additional equity or debt financing. We may not be successful in negotiating the terms of any potential acquisition, conducting thorough due diligence, financing the acquisition or effectively integrating the acquired business, product or technology into our existing business and operations. Our due diligence may fail to identify all of the problems, liabilities or other shortcomings or challenges of an acquired business, product or technology, including issues related to intellectual property, product quality or

| 18 |

product architecture, regulatory compliance practices, revenue recognition or other accounting practices or employee or customer issues.

Additionally, in connection with any acquisitions we complete, we may not achieve the synergies or other benefits we expected to achieve, and we may incur unanticipated expenses, write-downs, impairment charges or unforeseen liabilities that could negatively affect our business, financial condition and results of operations, have difficulty incorporating the acquired businesses, disrupt relationships with current and new employees, customers and vendors, incur significant debt or have to delay or not proceed with announced transactions. Further, contemplating or completing an acquisition and integrating an acquired business, product or technology could divert management and employee time and resources from other matters.

Failure to protect our intellectual property could adversely affect our business, financial condition and results of operations.

Intellectual property rights, including patents, trade secrets, confidential information, trademarks, trade names and trade dress, are important to our business. We will endeavor to protect our intellectual property rights in key jurisdictions in which our products are produced or used. However, we may be unable to obtain protection for our intellectual property in such key jurisdictions. Although we own and have applied for numerous patents and trademarks, we may have to rely on judicial enforcement of our patents and other proprietary rights. Our patents and other intellectual property rights may be challenged, invalidated, circumvented, and rendered unenforceable or otherwise compromised. If we must take legal action to protect, defend or enforce our intellectual property rights, any suits or proceedings could result in significant costs and diversion of our resources and our management’s attention, and we may not prevail in any such suits or proceedings. A failure to protect, defend or enforce our intellectual property could have an adverse effect on our business, financial condition and results of operations. Similarly, third parties may assert claims against us and our customers and distributors alleging our products infringe upon third-party intellectual property rights.

We also rely materially upon unpatented proprietary technology, know-how and other trade secrets to maintain our competitive position. While we maintain policies and internal security measures to protect our trade secrets and other intellectual property, failure to protect this intellectual property could negatively affect our future performance and growth.

We may be required to make significant cash contributions to our defined benefit pension plan.

After the Spin-Off, we sponsored a defined benefit pension plan under which certain eligible AdvanSix employees will earn pension benefits following the Spin-Off as if they remained employed by Honeywell. Significant changes in actual investment return on pension assets, discount rates, retirement rates and other factors could require cash pension contributions in future periods. Changes in discount rates and actual asset returns different than our anticipated asset returns can result in significant non-cash actuarial gains or losses. With regard to cash pension contributions, funding requirements for our pension plans are largely dependent upon interest rates, actual investment returns on pension assets and the impact of legislative or regulatory changes related to pension funding obligations. Our pension contributions may be material and could adversely impact our financial condition, cash flow and results of operations. We plan to make pension contributions during 2017 and in future periods sufficient to satisfy funding requirements.

Some of our workforce is represented by labor unions and our business could be harmed in the event of a prolonged work stoppage.