UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☑ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934 for the transition period from to

Commission File Number: 001-37935

Acushnet Holdings Corp.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

45-2644353 |

|

(State or other jurisdiction of |

|

|

|

incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

333 Bridge Street

Fairhaven, Massachusetts 02719

(Address of principal executive offices)

(800) 225-8500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.001 per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|||||

|

Accelerated filer |

(Do not check if a smaller reporting company) |

Emerging growth company |

|||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2017), the aggregate market value of the registrant's common stock held by non-affiliates was approximately $667.6 million. The registrant's common stock trades on the New York Stock Exchange under the symbol “GOLF”.

The registrant had 74,744,536 shares of common stock outstanding as of March 2, 2018

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A relating to the Registrant’s Annual General Meeting of Shareholders, to be held on June 11, 2018, will be incorporated by reference in this Form 10-K in response to Items 10, 11, 12, 13 and 14 of Part III. The definitive proxy statement will be filed with the SEC not later than 120 days after the registrant’s fiscal year ended December 31, 2017.

In this Annual Report on Form 10‑K, the terms “Acushnet,” “we,” “us,” “our” and the “Company” refer to Acushnet Holdings Corp. and its consolidated subsidiaries.

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10‑K contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by that section. These forward-looking statements are included throughout this report, including in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and relate to matters such as our industry, business strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. We have used the words “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “future,” “will,” “seek,” “foreseeable” and similar terms and phrases to identify forward-looking statements in this report, although not all forward-looking statements use these identifying words.

The forward-looking statements contained in this report are based on management’s current expectations and are subject to uncertainty and changes in circumstances. We cannot assure you that future developments affecting us will be those that we have anticipated. Actual results may differ materially from these expectations due to changes in global, regional or local economic, business, competitive, market, regulatory and other factors, many of which are beyond our control. We believe that these factors include, but are not limited to those identified in the section entitled “Risk Factors.”

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, our actual results may vary in material respects from those projected in these forward-looking statements.

Any forward-looking statement made by us in this report speaks only as of the date of this report. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, investments or other strategic transactions we may make. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable securities laws.

INDUSTRY AND MARKET DATA

Within this Annual Report on Form 10‑K, we reference information and statistics regarding the golf industry and the golf equipment, wear and gear markets. We have obtained certain of this information and statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources for the most recent available date. We believe that these external sources and estimates are reliable, but have not independently verified them. Certain of this information and statistics are based on our good faith, reasonable estimates, which are derived from our review of internal surveys and independent sources. In addition, projections, assumptions and estimates of the future performance of the golf industry and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

WEBSITE DISCLOSURE

We use our website (www.acushnetholdingscorp.com) as a channel of distribution of company information. The information we post through this channel may be material. Accordingly, investors should monitor this channel, in addition to following our press releases, Securities and Exchange Commission (“SEC”) filings and public conference calls and webcasts. In addition, you may automatically receive e-mail alerts and other information about Acushnet Holdings Corp. when you enroll your e-mail address by visiting the “Resources” section of our website at https://www.acushnetholdingscorp.com/investors/resources. The contents of our website are not, however, a part of this report.

ii

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This Annual Report on Form 10‑K includes trademarks, trade names and service marks that we either own or license, such as “Titleist,” “FootJoy,” “Pro V1,” “Pro V1x,” “FJ,” “Pinnacle,” “Scotty Cameron,” and “Vokey Design” which are protected under applicable intellectual property laws. Solely for convenience, trademarks, trade names and service marks referred to in this report may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. This report may also contain trademarks, trade names and service marks of other parties, and we do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

iii

Overview

We are the global leader in the design, development, manufacture and distribution of performance‑driven golf products, which are widely recognized for their quality excellence. Our mission—to be the performance and quality leader in every golf product category in which we compete—has remained consistent since we entered the golf ball business in 1932. Today, we are the steward of two of the most revered brands in golf—Titleist, one of golf’s leading performance equipment brands, and FootJoy, one of golf’s leading performance wear brands. Titleist has been the #1 ball in professional golf for 69 years and FootJoy has been the #1 shoe on the PGA Tour for over six decades.

Our target market is dedicated golfers, who are the cornerstone of the worldwide golf industry. These dedicated golfers are avid and skill‑biased, prioritize performance and commit the time, effort and money to improve their game. We believe our focus on innovation and process excellence yields golf products that represent superior performance and consistent product quality, which are the key attributes sought after by dedicated golfers. Many of the game’s professional players, who represent the most dedicated golfers, prefer our products thereby validating our performance and quality promise, while also driving brand awareness. We seek to leverage a pyramid of influence product and promotion strategy, whereby our products are the most played by the best players, creating aspirational appeal for a broad range of golfers who want to emulate the performance of the game’s best players.

Dedicated golfers view premium golf shops, such as on‑course golf shops and golf specialty retailers, as preferred retail channels for golf products of superior performance and product quality. As a result, we have committed to being one of the preferred and trusted partners to premium golf shops worldwide. We believe this commitment provides us a retail environment where our product performance and quality advantage can most effectively be communicated to dedicated golfers. In addition, we also service other qualified retailers that sell golf products to consumers worldwide.

Our vision is to consistently be regarded by industry participants, from dedicated golfers to the golf shops that serve them, as the best golf company in the world. We have established leadership positions across all major golf equipment and golf wear categories under our globally recognized brands.

For the year ended December 31, 2017, we recorded net sales of $1,560.3 million, net income attributable to Acushnet Holdings Corp. of $92.1 million and Adjusted EBITDA of $223.4 million. See “Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a reconciliation of Adjusted EBITDA to net income attributable to Acushnet Holdings Corp., the most directly comparable GAAP financial measure.

Corporate History

Acushnet Company was originally founded as “Acushnet Process Company” in Acushnet, Massachusetts by Phil “Skipper” Young in 1910 and our golf business was established in 1932. In 1976, Acushnet Company was acquired by American Brands, Inc. (the predecessor company of Beam Suntory, Inc. (“Beam”)). We acquired FootJoy in 1985. On July 29, 2011, Acushnet Holdings Corp. (at the time known as Alexandria Holdings Corp.), an entity owned by Fila Korea and certain financial investors, acquired Acushnet Company from Beam. We completed an initial public offering of our common stock in November 2016. See “Notes to Consolidated Financial Statements– Note 2– Summary of Significant Accounting Policies,” for disclosures related to our initial public offering and other related transactions.

1

Our Core Focus

Dedicated Golfers

Our target market is dedicated golfers, who are avid and skill‑biased, prioritize performance and commit the time, effort and money to improve their game. We believe that dedicated golfers are the most consistent purchasers of golf products and account for an outsize share of golf equipment and gear spending outside the United States and purchase a significant portion of golf wear products worldwide.

Product Platform

Leveraging the success of our golf ball and golf shoe businesses, while maintaining the core values of the Titleist and FootJoy brands, we have strategically entered into product categories such as golf clubs, wedges, putters, golf gloves, golf gear and golf wear with an objective of being the performance and quality leader.

Since the dedicated golfer views each performance product category on its own merits, we have approached each category on its own terms by committing the necessary resources to become a performance and quality leader in each product category where we participate. As a result, we have built an industry leading platform across all performance product categories, driving a market‑differentiating mix of consumable products, which we consider to be golf balls and golf gloves, which collectively represented 40% of our net sales in 2017, and more durable products, which we consider to be golf clubs, golf shoes, golf apparel and golf gear, which collectively represented 60% of our net sales in 2017.

We operate under the following four reportable segments: Titleist golf balls; Titleist golf clubs; Titleist golf gear; and FootJoy golf wear, which represented approximately 33%, 26%, 9% and 28%, respectively, of net sales in 2017. For further information surrounding the principal products of each reportable segment, see “Our Products” further below. Financial information for our segments, including sales by geographic area, is included in “Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in “Notes to Consolidated Financial Statements – Note 20 – Segment Information.”

Pyramid of Influence

The game of golf is learned by observation and imitation, and golfers improve their own performance by attempting to emulate highly skilled golfers. Golfers are influenced not only by how other golfers swing but also by what they swing with and what they swing at. This is the essence of golf’s pyramid of influence, which is deeply ingrained in the mindset of the dedicated golfer. At the top of the pyramid is the most dedicated golfer, who attempts to make a living playing the game professionally. Adoption by most of the best golfers, whose professional success depends on their performance, validates the quality, features and benefits of using the best performing products. This, in turn, creates aspirational appeal for golfers who want to emulate the performance of the best players. Our primary marketing strategy is for our products to be the most played by the best players, including both professional and amateur golfers. We believe this strategy has proven to be enduring and effective in the long‑term and is not dependent on the transient success of a few elite players at any given point in time.

Innovation Leadership

We believe innovation is critical to dedicated golfers as they depend on the ability of new and innovative products to drive improved performance. We currently employ an R&D team of approximately 180 scientists, chemists, engineers and technicians. We also introduce new product innovations at a cadence that best aligns with the typical dedicated golfer’s replacement cycle within each product category.

Operational Excellence

The requirements of the game lead the dedicated golfer to seek out products of maximum performance and consistency. We own or control the design, sourcing, manufacturing, packaging and distribution of our products. In doing so, we are able to exercise control over every step of the manufacturing process and supply chain operations,

2

thereby setting the standard for quality and consistency. We have developed and refined distinct and independently managed supply chains for each of our product categories.

Route to Market Leadership

As one of the preferred partners to premium golf shops, we seek to ensure that the performance benefits derived from using our products are showcased and our products are properly merchandised. As we see our retail partners as a critical connection to dedicated golfers, we place great emphasis on building strong relationships and trust with them. This is the reason our sales associates are expected not simply to be salespeople, but to function as golf experts and enthusiasts in their respective territories, who advise and assist our retail partners to better serve their customers. We help generate golfer demand and sell‑through via in‑shop merchandising, promotions and advertising, and also provide product education to club professionals, coaches and instructors. Lastly, we place a strong focus on consumer engagement, starting with fitting and trial initiatives across our balls, clubs and shoes categories. We offer custom products across categories that we believe are better aligned with golfers’ personal styles, skill levels and preferences.

Market Overview and Opportunity

Market Overview

In 2016, there were over 50 million golfers worldwide playing over 800 million rounds annually on over 32,000 golf courses, and our addressable market, comprised of golf equipment, golf wear and golf gear, represented approximately $12 billion in retail sales and approximately $8 billion in wholesale sales. The United States accounted for over 40% of our addressable market, followed by Japan and Korea collectively accounting for over 30% of our addressable market, each in 2016. We believe the number of rounds of golf played by our target market of dedicated golfers has remained stable over the past few years.

We view emerging economies, such as the markets in Southeast Asia, as attractive long‑term opportunities based on our assessment of the five collectively necessary and sufficient conditions for a country to embrace golf: (1) sizeable middle‑class population; (2) educational infrastructure; (3) places to play and practice; (4) professional success that inspires the local golfers; and (5) corporate support.

We believe the golf industry is mainly driven by golfer demographics, dedicated golfers, weather and economic conditions.

Golfer Demographics. Golf is a recreational activity that requires time and money. The golf industry has been principally driven by the age cohort of 30 and above, currently “gen‑x” (age 30 to 49) and “baby boomers” (age 50 to 69), who have the time and money to engage in the sport. Since a significant number of baby boomers have yet to retire, we anticipate growth in spending from this demographic as it has been demonstrated that rounds of play increase significantly as those in this cohort reach retirement. Further, we also believe that the percentage of women golfers will continue to grow, as a higher percentage of new golfers in recent years have been women. Beyond the gen‑x and baby boomer generation, another promising development in golf has been the generational shift with millennial golfers making their marks at both professional and amateur levels.

Dedicated Golfers. Dedicated golfers are largely gen‑x and baby boomers who have demonstrated the propensity to pay a premium for products that help them perform better. We believe dedicated golfers, who comprise our target market, will continue to be a key driver for the global golf industry.

Weather Conditions. Weather conditions determine the number of playable days in a year and thus influence the amount of time people spend on golf. Weather conditions in most parts of the world, including our primary geographic markets, generally restrict golf from being played year‑round, with many of our on‑course customers closed during the cold weather months. Therefore, favorable weather conditions generally result in more playable days in a given year and more golf rounds played, which generally results in increased demand for all golf products.

Economic Conditions. The state of the economy influences the amount of money people spend on golf. Golf equipment, including clubs, balls and accessories, is recreational in nature and is therefore a discretionary purchase for consumers. Consumers are generally more willing to make discretionary purchases of golf products when economic conditions are favorable and when consumers are feeling confident and prosperous.

3

Our Growth Strategies

We plan to continue to pursue organic growth initiatives across all product categories, brands, geographies and marketing channels.

Introduce New Products and Extend Market Share Leadership in Equipment Categories. We expect to sustain our strong performance in our core categories of golf balls and golf clubs through several targeted strategies:

|

· |

Titleist Golf Balls. We continuously invest in design innovation and refining our sell‑in and sell‑through route to market capabilities and effectiveness in the golf ball product category. We are currently focused on improving our sales team training in product, merchandising, local promotion and selling skills, as well as enhancing trade partnerships in those channels where dedicated golfers shop. To grow our custom golf ball business, we have in place several new initiatives designed to develop strategic partnerships with corporations heavily invested in golf and to drive growth with a particular focus on the areas of corporate, country club, tournament and personalized sales. The 2016 launch of the “My Pro V1” online golf shop allows golfers to create and purchase their own unique Titleist Pro V1 / Pro V1x golf balls with special play numbers, logos or personalization. |

|

· |

Titleist Clubs, Wedges and Putters. We intend to continue to launch innovative, high performance golf clubs by further leveraging Titleist clubs’ R&D platform. We believe concept and specialty products and premium quality digital content will further drive customer awareness and market share gains across all premium club categories. To enhance trial and fitting, we plan to continue our consumer connection initiatives, grow our fitting network in opportunistic markets and further promote the utilization of our distinctive fitting operations. We are also executing several initiatives to further elevate Vokey Design wedges and Scotty Cameron putters as golf’s leaders in short‑game performance, technology, craftsmanship and selection. |

Increase Penetration in Golf Gear and Wear Categories. We intend to build on the brand loyalty that the dedicated golfer has developed for our Titleist ball and club categories and FootJoy shoe and glove categories in order to increase our penetration in the adjacent categories of golf gear and golf wear. We expect to continue to drive growth across these categories by employing the following initiatives:

|

· |

Titleist Golf Gear. We are committed to providing dedicated golfers with golf gear—including golf bags, headwear, gloves, travel gear, head covers and other accessories—of performance and quality excellence that is faithful to the Titleist brand promise. We are making significant investments in design and engineering resources and are leveraging dedicated player research methodologies and insights to drive innovation in this product category. We also plan to expand our custom and limited edition product offerings. |

|

· |

FootJoy Women’s Apparel Initiative. We are currently building out a focused, performance‑based FootJoy women’s apparel line consistent with the brand’s successful positioning in men’s apparel. The women’s apparel line, which launched in early 2016, pairs sophisticated performance fabrics and design with layering technology pioneered by FootJoy to create comfort and protection from the elements. |

|

· |

FootJoy eCommerce Launch. We launched eCommerce websites for FootJoy in the U.S. in 2016 and in Canada and certain European markets in 2017. Over 6,000 SKUs are offered across all FootJoy categories, including shoes, gloves and apparel. The eCommerce initiative is expected to yield incremental sales and profitability, and enriched data on preferences and trends, as well as foster a deeper and more real time connection with dedicated golfers. |

4

Strategically Pursue Global Growth. The Titleist and FootJoy brands are both global brands. While we believe that a majority of the near‑term growth will be driven by the developed economies, emerging economies, such as the markets in Southeast Asia, represent longer‑term growth opportunities. To meet future demand, we are ensuring that local capabilities and expertise in sales, customer service, merchandising, online presence, golf education and fitting initiatives are in place to support our operations. We continue to hire local talent across all functions in order to better position Titleist and FootJoy products in those markets where participation and popularity of the sport are expected to increase.

Our Products

We design, manufacture and market a broad range of products under the Titleist and FootJoy brands. Both brands are recognized as industry leaders in performance, quality, innovation and design. Our products include golf balls, golf clubs, wedges and putters, golf shoes, golf gloves, golf gear and golf outerwear and apparel.

|

|

||

|

Titleist Golf Balls |

Titleist Golf Clubs, |

Titleist Golf Gear |

|

|

|

|

|

Pro V1 |

Drivers |

Golf bags |

|

Pro V1x |

Fairways |

Headwear |

|

Tour Soft |

Hybrids |

Golf gloves |

|

Velocity |

Irons |

Travel gear |

|

DT TruSoft |

Vokey Design wedges |

Head covers |

|

Pinnacle |

Scotty Cameron putters |

Other golf gear |

|

|

||

|

FootJoy Shoes |

FootJoy Gloves |

FootJoy Outerwear and Apparel |

|

|

|

|

|

Traditional |

Leather construction |

Performance outerwear |

|

Spikeless |

Synthetic |

Performance golf apparel |

|

Athletic |

Leather/synthetic combination |

Golfleisure women’s apparel |

|

Casual |

Specialty |

|

Titleist

We design, manufacture and sell golf balls, golf clubs, wedges and putters and golf gear under the Titleist brand. Net sales of Titleist products for the years ended December 31, 2017, 2016 and 2015 were $1,122.8 million, $1,139.2 million, and $1,084.1 million, respectively, in each case approximately 72% of our total net sales.

Titleist Golf Balls

Titleist is the #1 ball in golf. The Titleist golf ball was founded with a purpose of designing and manufacturing a performance oriented, high quality golf ball that was superior to all other products available in the market. We believe the golf ball is the most important piece of equipment in the game, as it is the only piece of equipment used by every player for every shot. The golf ball is also the most important category for us as it generates the largest portion of our sales and profits. Since its introduction in 2000, the Titleist Pro V1 has been the best‑selling golf ball globally and continues to set the bar in terms of product design, quality and performance. We also design, manufacture and sell other golf balls under the Titleist brand, such as Tour Soft, Velocity and DT TruSoft, as well as under the Pinnacle brand. We have continually improved our golf balls through innovation in materials, construction and manufacturing processes, which has enabled us to build the #1 golf ball franchise in the world.

Pro V1 and Pro V1x are designed to be the highest performing and highest quality golf balls for golfers at every level of the game and best demonstrate Titleist’s design, innovation and technology leadership. The first Pro V1 golf ball

5

was introduced on the PGA Tour in October 2000 and launched to the consumer market in December 2000. It represented the coalescence of three of Titleist’s industry leading technologies: large solid core; multi‑component construction; and high performance, thermoset cast urethane elastomer covers. In its first four months, the Pro V1 golf ball became the best‑selling golf ball and holds that position to this day. During this time, we also set out to create a ball that produced lower driver spin and higher launch characteristics than the Pro V1 while retaining its high performance scoring spin. With its four‑piece, dual core design, the first Pro V1x golf ball was introduced in 2003. In 2017, we launched new versions of the Pro V1 and Pro V1x. The New Pro V1 is designed to offer significantly longer distance from faster ball speed and lower long game spin. Advancements in aerodynamics for both Pro V1 and Pro V1x are designed to produce even more consistent flight. We believe these improvements, along with benefits such as our renowned Drop-and-Stop control, soft feel and long lasting durability, make Pro V1 and Pro V1x golf balls the best performance choice for all golfers. We also provide best‑in‑class performance with the Tour Soft, Velocity and DT TruSoft models.

With two major models, Rush and Soft, Pinnacle golf balls are also available in different optic colors and play numbers. Our Pinnacle Brand competes in the price market segment, which allows the Titleist brand to focus on the premium performance and performance market segments and reduces the need to extend the Titleist brand to the price market segment. This also helps to support the thousands of golf shops that choose to exclusively stock Titleist and Pinnacle golf balls, allowing them to offer golf balls in each market segment which market segments we discussed and defined below.

Titleist and Pinnacle golf balls accounted for $512.0 million, or 33%, $513.9 million, or 33%, and $535.5 million, or 36%, of our total net sales for the years ended December 31, 2017, 2016 and 2015, respectively.

We are also a leader in custom imprinted golf balls. This includes printing high quality reproductions of corporate logos, tournament logos, country club or resort logos, and personalization on Titleist and Pinnacle golf balls. Our service includes design capabilities, special packaging options and fast turnaround times. The majority of custom imprinting is done for corporate logos, as there has long been a strong connection between the business community and golf. Custom imprinted golf balls represented over 30% of our global net golf ball sales for the year ended December 31, 2017.

Titleist Golf Clubs, Wedges and Putters

We design, assemble and sell golf clubs (drivers, fairways, hybrids and irons) under the Titleist brand, wedges under the Vokey Design brand and putters under the Scotty Cameron brand. The mission of our golf club business is to design and develop the best performing golf clubs in the world for dedicated golfers. We believe dedicated golfers do not buy brands across categories but seek out best‑in‑class products in each category. This is the reason we have partnered with dedicated engineers and craftsmen such as Bob Vokey and Scotty Cameron, who understand the nuances, subtleties and impact mechanics of their respective golf club categories. Titleist golf clubs, Vokey Design wedges and Scotty Cameron putters are widely used by professional and competitive amateur players, which validates the products’ performance and quality excellence. We are also committed to a leading club fitting and trial platform to maximize dedicated golfers’ performance experience.

We view and operate the Titleist golf club business in three distinct categories: clubs (which includes drivers, fairways, hybrids and irons), wedges and putters. Our products are generally priced at or above the premium price points in the marketplace, driven by higher‑end technologies (including design, materials and processes) we employ to generate superior quality and performance. We have different models within each category to address the distinct performance needs of our dedicated golfer target audience. Titleist golf clubs, wedges and putters accounted for $398.0 million, or 26%, $431.0 million, or 27%, and $388.3 million, or 26%, of our total net sales for the years ended December 31, 2017, 2016 and 2015, respectively.

Titleist Clubs

Our current global club line consists of the 917 product line of drivers and fairways, the 818 product line of hybrids and the 718 product line of irons. Every product in our club line features premium, tour‑proven stock shafts and grips, complemented by a broad range of custom options.

6

Titleist 917 drivers and fairways are designed to deliver superior performance through tour‑proven technologies that increase ball speed, decrease spin, and optimize flight without sacrificing forgiveness. We design our drivers and fairways to deliver complete performance with tour‑preferred looks, sound and feel, and we offer the ability to precisely fit individual golfers’ needs.

Titleist 818 hybrids generate long game performance through advanced technology. The advanced features of our hybrids aim to facilitate precision fitting and generate high ball speed, low spin and high launch for increased distance and forgiveness.

Titleist 718 irons are innovative, technologically advanced products designed to deliver distance, forgiveness, proper shot control and feel. While we offer stock set configurations for our iron sets, a significant portion of our worldwide iron sales are custom fit to help deliver a better fit and performance.

Vokey Design Wedges

Bob Vokey champions the Titleist wedge effort by creating high performance wedges to meet the demands of dedicated golfers and the best players in the world. The Vokey Design wedge product offering is a compilation of the most popular wedges resulting from Bob Vokey’s hands‑on work with golf’s best players to develop shapes and soles that address varying techniques and course conditions. In total, we offer 23 unique loft, sole grind and bounce combinations and three unique finishes to create golf’s most complete wedge product performance range. In addition, Vokey’s online Wedgeworks program promotes limited edition models and allows golfers to customize and personalize their wedges. Vokey Design wedges are the most played wedges by tour professionals.

Scotty Cameron Putters

Scotty Cameron Fine Milled Putters are developed through a specialized and iterative process that blends art and science to create high performance putters. Scotty’s design inspiration begins with studying the best players in the world and working with them to identify the consistent strengths and attributes of their putting. Scotty Cameron encourages a selection process that identifies the putter length, toe flow and appearance to deliver proper balance, shaft flex and feel to golfers and to encourage proper technique. Scotty Cameron putters consist of a range of products for each of these key selection criteria.

Using the scottycameron.com website as an information and services hub, we offer the opportunity to connect more closely with the Scotty Cameron brand. Golfers can customize and personalize their putter(s) in the online Scotty Cameron Custom Shop. Through the popular “Club Cameron” loyalty program and Scotty’s online “Studio Store,” brand fans can purchase unique Scotty Cameron accessories. In 2014, we also opened the Scotty Cameron Gallery in Encinitas, California, and in 2016, we entered into a license agreement whereby a third party opened and operates a similar facility in Tokyo, Japan. Each of these facilities is a premium retail boutique which offers consumers the ability to experience the tour fitting process as well as purchase unique accessory items.

Titleist Golf Gear

We offer a diversified portfolio of Titleist‑branded performance golf gear across the golf bags, headwear, gloves, travel gear, head covers and other golf gear categories. Our golf gear is focused on superior performance and quality excellence, which is the mission of any product bearing the Titleist brand name.

Titleist golf gear products are designed and engineered using premium materials, paying particular attention to superior performance, function and style. We focus on the design and development of golf bags, headwear, gloves, travel gear, head covers and other golf gear. We provide personalization and customization within each category of Titleist golf gear, as well as certain licensed products, in order to meet the needs of the dedicated golfer and as part of our service to our accounts. We believe the golf gear business represents a sizable but highly fragmented opportunity with numerous competitors in each product category and geographical market. Titleist golf gear, which includes golf bags, headwear, golf gloves, travel gear, head covers and other golf gear, accounted for $142.9 million, or 9%, $136.2 million, or 9%, and $129.4 million, or 9%, of our net sales for the years ended December 31, 2017, 2016 and 2015, respectively.

7

FootJoy Golf Wear

FootJoy is one of golf’s leading performance wear brands, which consists collectively of golf shoes, gloves and apparel. Net sales of FootJoy products for the years ended December 31, 2017, 2016 and 2015 were $437.5 million, $433.1 million, and $418.9 million, respectively, in each case approximately 28% of our total net sales.

FootJoy Golf Shoes

FootJoy is the #1 shoe in golf and has been the #1 shoe on the PGA Tour for over six decades. With an exclusive focus on golf, FootJoy shoes are designed, developed and manufactured for all golfers in all golf shoe categories, including traditional, casual, athletic and spikeless.

The golf shoe category is one of the most demanding of all wearables, as golf shoes must perform in all weather conditions, including extreme temperature and moisture exposure; be resistant to pesticides and fungicides; withstand frequent usage and extensive rounds of play; and provide consistent comfort, support and protection to the golfer in an average of over five miles in a walked round. Hence, golf shoes require extensive knowledge and expertise in foot morphology, walking and swing biomechanics, material science and application and sophisticated manufacturing and construction techniques.

Golf shoes are also a style and fashion driven category. FootJoy offers a large assortment of styles to suit the needs and tastes of all golfers. The breadth and scope of the FootJoy product line is commensurate with its leading sales position. To maintain and grow this leadership position in the category, new product launches and new styles comprise over 50% of its offerings each year in all significant markets around the world.

In addition to its stock offerings, FootJoy is a leader in the customization of golf shoe styles and designs. FootJoy’s MyJoys custom golf shoe portal provides individual choices for style, color, personal IDs and team logos that are produced to order for golfers around the world. We believe it is the largest choice offering in the golf shoe category and provides a service and personal expression capability that creates brand loyalty and repeat purchases.

FootJoy Gloves

FootJoy is the #1 glove in golf. FootJoy is the leader in sales for all sub‑categories of the glove business, including leather construction, synthetic, leather/synthetic combinations and all specialty gloves including rain and winter specific offerings.

FootJoy Outerwear and Apparel

FootJoy’s most recent brand extensions have been the entry into the golf outerwear and golf apparel markets. FootJoy’s goal for outerwear is to “make every day playable” and extend the golf season by providing products for rain, wind and cold conditions. FootJoy entered the outerwear category in 1996 with innovative designs and materials, became the leader in net sales in the United States by 2005 and still holds this position today.

FootJoy more broadly entered the U.S. women’s golf apparel market in early 2016 under the trademark Golfleisure. The styling is appropriate for golf and inspired by the current athleisure segment of women’s apparel in other categories and uses.

8

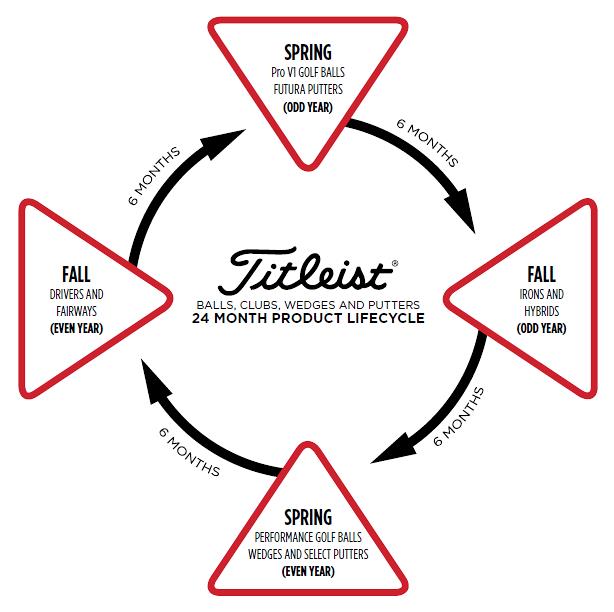

Product Launch Cycles

We maintain differentiated and disciplined product launch cycles across our portfolio, which we believe has contributed to stable and resilient growth over the long‑run. This approach gives our R&D teams a period of time we believe is necessary to develop superior performing products versus the prior generation models. As a result, we are able to manage our product transitions and inventory from one generation to the next more efficiently and effectively, both internally and with our trade partners.

Product introductions generally stimulate net sales as the golf retail channel takes on inventory of new products. Reorders of these new products then depend on the rate of sell‑through. Announcements of new products can often cause our customers to defer purchasing additional golf equipment until our new products are available. The varying product introduction cycles may cause our results of operations to fluctuate as each product line has different volumes, prices and margins.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Key Factors Affecting our Results of Operations – Product Launch Cycles”, Item 7 of Part II to this report, for further information surrounding our product launch cycles.

Manufacturing

Our manufacturing processes and management of supply chain operations ensure consistency of product performance and quality. We own or control the design, sourcing, manufacturing, packaging and distribution of our products.

Our manufacturing network is comprised of our owned facilities and partners around the globe. Our scale and global reach are intended to enable us to maximize cost efficiency, reduce lead time, provide regional customization and gain insights into local markets.

We have three company‑owned and operated golf ball manufacturing facilities, two located in the United States and one in Thailand, encompassing approximately 600,000 total square feet with sufficient production capacity to meet anticipated growth. We also have local custom golf ball imprinting operations in the United States, Japan, Canada, the United Kingdom (“U.K.”) (servicing the U.K., Ireland and continental Europe), Korea and China. We utilize local vendors for imprinting capabilities in other geographic markets.

We assemble clubs at six global locations, allowing us to provide custom fitted golf clubs with regional customization with efficient turnaround times. Each of our six custom manufacturing locations is responsible for supply chain execution for golf clubs and wedges, from forecast generation to component procurement to club assembly and distribution, allowing each region to respond to market specific needs or trends. Scotty Cameron putters are assembled solely at our Carlsbad, California manufacturing facility.

We own and operate the largest golf glove manufacturing operation in the world in Chonburi, Thailand, where we manufacture both FootJoy and Titleist golf gloves. The factory produces over 10 million FootJoy and Titleist gloves annually.

All of our FootJoy golf shoes are manufactured in a 525,000 square foot facility in Fuzhou, China, owned by a joint venture in which we have a 40% interest with the remaining 60% owned by our long‑standing Taiwan supply partners. In our consolidated financial statements, we consolidate the accounts of this joint venture, which is a variable interest entity, or VIE. The joint venture was established in 1995 and has been in its current facility since 2000. The sole purpose of the joint venture is to manufacture our golf shoes and as such we are deemed to be the primary beneficiary of the VIE as defined by ASC 810. The multi‑floor/multi‑building complex owned by the joint venture is devoted exclusively to FootJoy golf shoes, has production capacity of nearly five million pairs per annum. See “Notes to Consolidated Financial Statements– Note 2– Summary of Significant Accounting Policies – Variable Interest Entities,” Item 8 of Part II included elsewhere in this report, for a discussion of our FootJoy golf shoe joint venture and the material terms of the agreement which governs such joint venture arrangement.

9

Sales and Distribution

Our accounts consist of premium golf shops, which include on‑course golf shops and golf specialty retailers, as well as other qualified retailers that sell golf products to consumers worldwide. We have a selective sales and distribution strategy, differentiated by product line and geography, which focuses on effectively serving those accounts that provide best access to our dedicated golfer target market in each geographic market.

We operate, and have our own field sales representation, in those countries that represent the substantial majority of golf equipment and wearable sales, including the United States, Japan, Korea, the United Kingdom, Canada, Germany, Sweden, France, Greater China, Australia, New Zealand, Thailand, Singapore and Malaysia. In other countries in which we sell our products, we rely on select distributors in order to deepen our reach into those markets. Each country administers its own in‑country channel of distribution strategy given the unique characteristics of each market.

Our sales and distribution takes a “category management” approach that encompasses all aspects of customer service and fulfillment, including product selection; space and display planning; sales staff training; and inventory control and replenishment. Each sales representative advises on topics such as shop layout, merchandise display techniques and effective use of signage and product information and methods of improving inventory turns and sales conversions through merchandising. Our sales force has been recognized worldwide for its professionalism and service excellence.

We employ over 370 sales representatives worldwide, who are compensated through a combination of salary and a performance bonus. We currently service nearly 30,000 direct accounts worldwide. In both our direct sales and distributor markets, our trade partners are subject to our redistribution policy.

Supplementing our core field sales partnerships are certain Internet‑based initiatives. In Canada and certain European markets in 2017, we launched eCommerce websites for FootJoy. In the U.S. in 2016, we launched eCommerce websites for FootJoy and the MyProV1.com online golf shop.

Marketing

Throughout our history, we believe our commitment to marketing has helped further elevate our brands and strengthen our reputation for product performance and quality, with a particular focus on the perception of dedicated golfers. Our strategy is to deliver equipment that is superior in performance and quality, validated by the pyramid of influence. It is best‑in‑class performance and quality products that earn and maintain dedicated golfers’ loyalty and trust. Our marketing strategy, developed and refined over many years, is to reinforce this loyalty and trust, driving connectivity with our brands.

Seasonality

Weather conditions in most parts of the world, including our primary geographic markets, generally restrict golf from being played year‑round, with many of our on‑course customers closed during the cold weather months. In general, during the first quarter, we begin selling our products into the golf retail channel for the new golf season. This initial sell‑in generally continues into the second quarter. Our second‑quarter sales are significantly affected by the amount of sell‑through, in particular the amount of higher value discretionary purchases made by customers, which drives the level of reorders of the products sold during the first quarter. Our third‑quarter sales are generally dependent on reorder business, and are generally lower than the second quarter, as many retailers begin decreasing their inventory levels in anticipation of the end of the golf season. Our fourth‑quarter sales are generally less than the other quarters due to the end of the golf season in many of our key markets, but can also be affected by key product launches, particularly golf clubs. This seasonality, and therefore quarter to quarter fluctuations, can be affected by many factors, including the timing of new product introductions as discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Key Factors Affecting our Results of Operations – Product Launch Cycles”, Item 7 of Part II to this report, as well as weather conditions. This seasonality affects sales in each of our reportable segments differently. In general, however, because of this seasonality, a majority of our sales and most of our profitability generally occurs during the first half of the year.

10

Research and Product Development

Innovating within a highly regulated environment presents unique challenges and opportunities that require a significant investment in people, facilities and financial resources, with separate dedicated R&D teams for each product category. We have six R&D facilities and/or test centers supported by approximately 180 scientists, chemists, engineers and technicians in aggregate. We are committed to continuous improvement and each R&D team is tasked to develop technology that will deliver better quality and performance products in each generation.

For the years ended December 31, 2017, 2016 and 2015 we invested $48.1 million, $48.8 million and $46.0 million, respectively, in R&D.

Patents, Trademarks and Licenses

We consider our patents and trademarks to be among our most valuable assets. We are dedicated to protecting the innovations created by our R&D teams by developing broad and deep patent and trademark portfolios across all product categories.

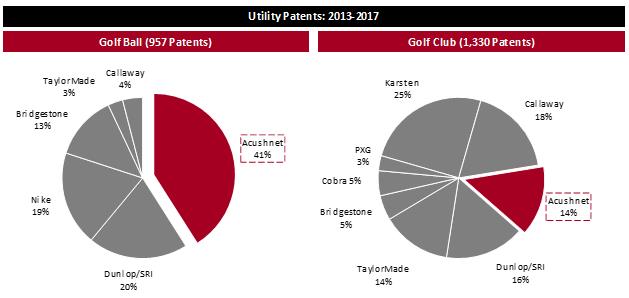

As a result, we have strong patent positions across our product categories and innovation spaces in which we operate, and have become the leader in obtaining golf ball and golf club patents worldwide. In addition, we believe we have more combined golf shoe and golf glove utility patents than all competitors combined. We have over 1,250 active U.S. utility patents in golf balls, nearly 350 active U.S. utility patents in golf clubs, wedges and putters and approximately 300 active patents (including ex-U.S. and design patents) in golf shoes and gloves.

The following charts show our percentage of golf ball and golf club patents obtained in the last five years compared to our peers.

We own or license a large portfolio of trademarks, including for Titleist, Pro V1, Pro V1x, Pinnacle, AP1, AP2, Vokey Design, Scotty Cameron, FootJoy, FJ, DryJoys, StaSof and ProDry. We protect our trademarks by obtaining registrations where appropriate and opposing or cancelling material infringements. We also have rights in several common law marks.

11

Competition

There are unique aspects to the competitive dynamic in each of our product categories.

The golf ball business is highly competitive. There are a number of well‑established and well‑financed competitors, including Callaway, SRI Sports Limited (Dunlop and Srixon brands) and Bridgestone (Bridgestone and Precept brands).

The golf club, wedge and putters markets in which we compete are also highly competitive and are served by a number of well‑established and well‑financed companies with recognized brand names, including Callaway, TaylorMade and Ping.

For golf balls and golf clubs, wedges and putters, we generally compete on the basis of technology, quality, performance and customer service.

In the golf gear market, there are numerous competitors in each product category and geographical market. Titleist golf gear generally competes on the basis of quality, performance, styling and customer service.

FootJoy’s significant worldwide competitors in golf shoes include Nike, Adidas and Ecco. FootJoy’s primary worldwide competitors in golf gloves include Callaway, Nike, TaylorMade and Adidas and a significant number of smaller companies with regional offerings and specialized golf glove products. In the golf apparel category, FootJoy has numerous competitors in each geographical market, including Nike, Adidas and Under Armour. FootJoy products generally compete on the basis of quality, performance, styling and price.

Environmental Matters

Our operations are subject to federal, state and local environmental laws and regulations that impose limitations on the discharge of pollutants into the environment and establish standards for the handling, generation, emission, release, discharge, treatment, storage and disposal of certain materials, substances and wastes and the remediation of environmental contaminants. In the ordinary course of our manufacturing processes, we use paints, chemical solvents and other materials, and generate waste by‑products that are subject to these environmental laws. We have incurred expenses in connection with environmental compliance.

We are also involved in ongoing investigations with federal and state environmental protection agencies and expect to incur future costs for past and current environmental issues relating to ongoing closure activities at certain sites.

Regulation

The Rules of Golf

The Rules of Golf set forth the rules of play and the rules for equipment used in the game of golf. The first documented rules of golf date to 1744 and the modern Rules of Golf have been in place for over 100 years. Dedicated golfers respect the traditions of the game and play by the Rules of Golf. As a result, premium‑positioned products are designed and manufactured to conform to the Rules of Golf.

The United States Golf Association, or the USGA, is the governing body for golf in the United States and Mexico. The USGA, in conjunction with the Royal and Ancient, or R&A, in St. Andrews, Scotland, writes, interprets and maintains the Rules of Golf. The R&A is the governing body for golf in all jurisdictions outside of the United States and Mexico. The R&A jointly writes, interprets and maintains the Rules of Golf with the USGA.

In addition to their role as rule makers, both the USGA and R&A conduct national championships and are involved in other efforts to maintain the history of golf and promote the health of the game.

The Rules of Golf set the standards and establish limitations for the design and performance of all balls and clubs. Many new regulations on golf balls and golf clubs have been introduced in the past 10 to 15 years, which we believe was one of the most active periods for golf equipment regulation in the history of golf.

12

Golf Balls

Historically, the USGA and R&A have regulated the size, weight, spherical symmetry, initial velocity and overall distance performance of golf balls. The overall distance standard was last revised in 2004.

Golf Clubs

The USGA and R&A have also focused on golf club regulations. In 1998, a limitation was placed on the spring‑like effect of driver faces. In 2003, limits were placed on club head dimensions and volume, as well as shaft length. In 2007, club head moment of inertia was limited. A rule change to allow greater adjustability in golf clubs went into effect on January 1, 2008. In August 2008, the USGA and R&A adopted a rule change further restricting golf club grooves by reducing the groove volume and limiting the groove edge angle allowable on irons and wedges. This rule change will not apply to most golfers until January 1, 2024. It was implemented on professional tours beginning in 2010 and was implemented in elite amateur competitions beginning in 2014. All products manufactured after December 31, 2010 must comply with the new groove specifications.

Our Position

In response to this regulatory dynamic, our senior management and R&D teams spend significant time and effort in developing and maintaining relationships with the USGA and R&A. We are an active participant in discussions with the ruling bodies regarding potential new rules and the rule making process. More importantly, our R&D teams are driven to innovate and continuously improve product technology and performance within the Rules of Golf. The development and protection of these innovations through aggressive patenting are essential to competing in the current market. As a long‑time industry participant and market leader, we are well‑positioned to continue to outperform the market in a rules constrained environment.

Employees

As of December 31, 2017, we employed 5,230 associates worldwide. The geographic concentration of associates is as follows: 2,368 in the Americas, 459 in EMEA, and 2,403 employed in Asia Pacific. None of our associates are represented by a union. We believe that relations with our associates are positive.

You should carefully consider each of the following risk factors, as well as the other information in this report, including our consolidated financial statements and the related notes and “Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations.” If any of the following risks actually occurs, our business, financial condition and results of operations could be materially adversely affected. In that event, the market price of our common stock could decline significantly and you could lose all or part of your investment. The risks described below are not the only risks we face. Additional risks we are not presently aware of or that we currently believe are immaterial could also materially adversely affect our business, financial condition and results of operations.

Risks Related to Our Business and Industry

A reduction in the number of rounds of golf played or in the number of golf participants could materially adversely affect our business, financial condition and results of operations.

We generate substantially all of our sales from the sale of golf‑related products, including golf balls, golf clubs, golf shoes, golf gloves, golf gear and golf apparel. The demand for golf‑related products in general, and golf balls in particular, is directly related to the number of golf participants and the number of rounds of golf being played by these participants. The number of rounds of golf played in the United States declined from 2006 to 2014 and have been largely flat since then. If golf participation or the number of rounds of golf played declines, sales of our products may be adversely impacted, which could materially adversely affect our business, financial condition and results of operations.

13

Unfavorable weather conditions may impact the number of playable days and rounds played in a given year.

Weather conditions in most parts of the world, including our primary geographic markets, generally restrict golf from being played year‑round, with many of our on‑course customers closed during the cold weather months and, to a lesser extent, during the hot weather months. Unfavorable weather conditions in our major markets, such as a particularly long winter, a cold and wet spring, or an extremely hot summer, would impact the number of playable days and rounds played in a given year, which would result in a decrease in the amount spent by golfers and golf retailers on our products, particularly with respect to consumable products such as golf balls and golf gloves. In addition, unfavorable weather conditions and natural disasters can adversely affect the number of custom club fitting and trial events that we can perform during the key selling period. Unusual or severe weather conditions throughout the year, such as storms or droughts or other water shortages, can negatively affect golf rounds played both during the events and afterward, as weather damaged golf courses are repaired and golfers focus on repairing the damage to their homes, businesses and communities. Consequently, sustained adverse weather conditions, especially during the warm weather months, could impact our sales, which could materially adversely affect our business, financial condition and results of operations. Adverse weather conditions may have a greater impact on us than other golf equipment companies as we have a large percentage of consumable products in our product portfolio, and the purchase of consumable products is generally more dependent on the number of rounds played in a given year.

Consumer spending habits and macroeconomic factors may affect the number of rounds of golf played and related spending on golf products.

Our products are recreational in nature and are therefore discretionary purchases for consumers. Consumers are generally more willing to spend their time and money to play golf and make discretionary purchases of golf products when economic conditions are favorable and when consumers feel confident and prosperous. Discretionary spending on golf and the golf products we sell is affected by consumer spending habits as well as by many macroeconomic factors, including general business conditions, stock market prices and volatility, corporate spending, housing prices, interest rates, the availability of consumer credit, taxes and consumer confidence in future economic conditions. Consumers may reduce or postpone purchases of our products as a result of shifts in consumer spending habits as well as during periods when economic uncertainty increases, disposable income is lower, or during periods of actual or perceived unfavorable economic conditions. A future significant or prolonged decline in general economic conditions or uncertainties regarding future economic prospects that adversely affects consumer discretionary spending, whether in the United States or in our international markets, could result in reduced sales of our products, which could materially adversely affect our business, financial condition and results of operations.

Demographic factors may affect the number of golf participants and related spending on our products.

Golf is a recreational activity that requires time and money and different generations and socioeconomic and ethnic groups use their leisure time and discretionary funds in different ways. Golf participation among younger generations and certain socioeconomic and ethnic groups may not prove to be as popular as it is among the current “gen‑x” (age 30 – 49) and “baby boomer” (age 50 – 69) generations. If golf participation or the number of rounds of golf played declines, due to factors such as demographic changes in the United States and our international markets or lack of interest in the sport among young people or certain socioeconomic and ethnic groups, sales of our products could be negatively impacted, which could materially adversely affect our business, financial condition and results of operations.

14

A significant disruption in the operations of our manufacturing, assembly or distribution facilities could materially adversely affect our business, financial condition and results of operations.

We rely on our manufacturing facilities in the United States, Thailand and China and assembly and distribution facilities in many of our major markets, certain of which constitute our sole manufacturing facility for a particular product category, including our joint venture facility in China where substantially all of our golf shoes are manufactured and our facility in Thailand where we manufacture the majority of our golf gloves. Because substantially all of our products are manufactured and assembled in and distributed from a few locations, our operations could be interrupted by events beyond our control, including:

|

· |

power loss or network connectivity or telecommunications failure or downtime; |

|

· |

equipment failure; |

|

· |

human error or accidents; |

|

· |

sabotage or vandalism; |

|

· |

physical or electronic security breaches; |

|

· |

floods, fires, earthquakes, hurricanes, tornadoes, tsunamis or other natural disasters; |

|

· |

political unrest; |

|

· |

labor difficulties, including work stoppages or slowdowns; |

|

· |

water damage or water shortage; |

|

· |

government orders and regulations; |

|

· |

pandemics and other health and safety issues; and |

|

· |

terrorism. |

Our manufacturing, assembly and distribution capacity is also dependent on the performance of services by third parties, including vendors, landlords and transportation providers. If we encounter problems with our manufacturing, assembly and distribution facilities, our ability to meet customer expectations, manage inventory, complete sales and achieve objectives for operating efficiencies could be harmed, which could materially adversely affect our business, financial condition and results of operations. We maintain business interruption insurance, but it may not adequately protect us from the adverse effects that could result from significant disruptions to our manufacturing, assembly and distribution facilities, such as the long‑term loss of customers or an erosion of our brand image.

Our manufacturing, assembly and distribution networks include computer processes, software and automated equipment that may be subject to a number of risks related to security or computer viruses, the proper operation of software and hardware, electronic or power interruptions or other system failures.

Many of our raw materials or components of our products are provided by a sole or limited number of third‑party suppliers and manufacturers.

We rely on a sole or limited number of third‑party suppliers and manufacturers for many of our raw materials and the components in our golf balls, golf clubs, golf gloves and certain of our other products. We also use specialized sources for certain of the raw materials used to make our golf gloves and other products, and these sources are limited to certain geographical locations. Furthermore, many of these materials are customized for us and some of our products require specially developed manufacturing techniques and processes which make it difficult to identify and utilize alternative suppliers quickly. If we were to experience any delay or interruption in such supplies, we may not be able to

15

find adequate alternative suppliers at a reasonable cost or without significant disruption to our business, which could materially adversely affect our business, financial condition and results of operations.

A disruption in the operations of our suppliers could materially adversely affect our business, financial condition and results of operations.

Our ability to continue to select reliable suppliers who provide timely deliveries of quality materials and components will impact our success in meeting customer demand for timely delivery of quality products. If we experience significantly increased demand, or if, for any reason, we need to replace an existing manufacturer or supplier, there can be no assurance that additional supplies of raw materials or additional manufacturing capacity will be available when required on terms that are acceptable to us, or at all, or that any new supplier or manufacturer would allocate sufficient capacity to us in order to meet our requirements. In addition, should we decide to transition existing manufacturing between third‑party manufacturers or should we decide to transition existing in‑house manufacturing to third‑party manufacturers, the risk of such a problem could increase. Even if we are able to expand existing or find new manufacturing sources, we may encounter delays in production and added costs as a result of the time it takes to train our suppliers and manufacturers in our methods, products and quality control standards. Any material delays, interruption or increased costs in the supply of raw materials or components of our products could impact our ability to meet customer demand for our products, which could materially adversely affect our business, financial condition and results of operations.

In addition, there can be no assurance that our suppliers and manufacturers will continue to provide raw materials and components that are consistent with our standards and that comply with all applicable laws and regulations. We have occasionally received, and may in the future receive, shipments of supplies or components that fail to conform to our quality control standards. In that event, unless we are able to obtain replacement supplies or components in a timely manner, we risk the loss of sales resulting from the inability to manufacture our products and could incur related increased administrative and shipping costs, and there also could be a negative impact to our brands, any of which could materially adversely affect our business, financial condition and results of operations.

While we do not control our suppliers or their labor practices, negative publicity regarding the management of facilities, production methods of or materials used by any of our suppliers could adversely affect our reputation, which could materially adversely affect our business, financial condition and results of operations and may force us to locate alternative suppliers. In addition, our suppliers may not be well capitalized and they may not be able to fulfill their obligations to us or go out of business. Furthermore, the ability of third‑party suppliers to timely deliver raw materials or components may be affected by events beyond their control, such as work stoppages or slowdowns, transportation issues, changes in trade or tariff laws, or significant weather and health conditions.

The cost of raw materials and components could affect our operating results.

The materials and components used by us, our suppliers and our manufacturers involve raw materials, including polybutadiene, urethane and Surlyn for the manufacturing of our golf balls, titanium and steel for the assembly of our golf clubs, leather and synthetic fabrics for the manufacturing of our golf shoes, golf gloves, golf gear and golf apparel, and resin and other petroleum‑based materials for a number of our products. Significant price fluctuations or shortages in such raw materials or components, including the costs to transport such materials or components of our products, the uncertainty of currency fluctuations against the U.S. dollar, increases in labor rates, trade duties or tariffs, and/or the introduction of new and expensive raw materials, could materially adversely affect our business, financial condition and results of operations.

Our operations are conducted worldwide and our results of operations are subject to currency transaction risk and currency translation risk that could materially adversely affect our business, financial condition and results of operations.

For the year ended December 31, 2017, $770.4 million of our net sales were generated outside of the United States by our non‑U.S. subsidiaries. Sales by geographic area are included in “Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in “Notes to Consolidated Financial Statements –Note 20 – Segment Information.” Substantially all of these net sales generated outside of the United States were generated in the applicable local currency, which include, but are not limited to, the Japanese yen, the Korean won, the British pound sterling, the euro and the Canadian dollar. In contrast, substantially all of the purchases of inventory, raw

16

materials or components by our non‑U.S. subsidiaries are made in U.S. dollars. For the year ended December 31, 2017, approximately 88% of our cost of goods sold incurred by our non‑U.S. subsidiaries were denominated in U.S. dollars. Because our non‑U.S. subsidiaries incur substantially all of their cost of goods sold in currencies that are different from the currencies in which they generate substantially all of their sales, we are exposed to transaction risk attributable to fluctuations in such exchange rates, which can impact the gross profit of our non‑U.S. subsidiaries. If the U.S. dollar strengthens against the applicable local currency, more local currency will be needed to purchase the same amount of cost of goods sold denominated in U.S. dollars, which could materially adversely affect our business, financial condition and results of operations.

We have entered and expect to continue to enter into various foreign currency exchange contracts in an effort to protect against adverse changes in foreign exchange rates and attempt to minimize foreign currency transaction risk. Our hedging activities can reduce, but will not eliminate, the effects of foreign currency transaction risk on our financial results. The extent to which our hedging activities mitigate foreign currency transaction risks varies based upon many factors, including the amount of transactions being hedged. Other factors that could affect the effectiveness of our hedging activities include accuracy of sales forecasts, volatility of currency markets, the availability of hedging instruments and limitations on the duration of such hedging instruments. Since the hedging activities are designed to reduce volatility, they not only reduce the negative impact of a stronger U.S. dollar but could also reduce the positive impact of a weaker U.S. dollar. We are also exposed to credit risk from the counterparties to our hedging activities and market conditions could cause such counterparties to experience financial difficulties. As a result, our efforts to hedge these exposures could prove unsuccessful and, furthermore, our ability to engage in additional hedging activities may decrease or become more costly.

Because our consolidated accounts are reported in U.S. dollars, we are also exposed to currency translation risk when we translate the financial results of our consolidated non‑U.S. subsidiaries from their local currency into U.S. dollars. For the year ended December 31, 2017, 49% of our sales were denominated in foreign currencies. In addition, for the year ended December 31, 2017, 31% of our operating expenses were denominated in foreign currencies (which amounts represent substantially all of the operating expenses incurred by our non‑U.S. subsidiaries). Fluctuations in foreign currency exchange rates may positively or negatively affect our reported financial results and can significantly affect period‑over‑period comparisons. A strengthening of the U.S. dollar relative to our foreign currencies could materially adversely affect our business, financial condition and results of operations. For example, our reported net sales for the 2015 fiscal year were negatively affected by a strengthening U.S. dollar in 2015.

We may not successfully manage the frequent introduction of new products that satisfy changing consumer preferences, quality and regulatory standards.

The golf equipment and golf wear industries are subject to constantly and rapidly changing consumer demands based, in large part, on performance benefits. Our golf ball and golf club products generally have launch cycles of two years, and our sales in a particular year are affected by when we launch such products. We generally introduce new product offerings and styles in our golf wear and gear businesses each year and at different times during the year. Factors driving these short product launch cycles include the rapid introduction of competitive products and consumer demands for the latest technology, style or fashion. In this marketplace, a substantial portion of our annual sales are generated each year by new products.