As filed with the Securities and Exchange Commission on July 27, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization)

(Primary Standard Industrial Classification Code Number)

N/A

(I.R.S. Employer Identification Number)

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

302-738-6680

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies of all Correspondence to:

Joseph

M. Lucosky, Esq. Lucosky

Brookman LLP |

Carl M. Sherer, Esq. Rimon PC 100 Park Ave, 16th Floor New York, NY 10017 Tel. No.: (800) 930-7271 Fax No.: (617) 997-0098 |

Louis Taubman, Esq. Guillaume de Sampigny, Esq Hunter Taubman Fischer & Li LLC 48 Wall Street, Suite 1100 New York, NY 10005 Tel. No.: (212) 530-2210 Fax No.: (212) 202-6380 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | ||

| Smaller

reporting company | |||

| Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| Preliminary Prospectus | Subject to Completion. Dated: July 27, 2022 |

TODOS MEDICAL LTD.

___________ Units

Each Unit Consisting of One Ordinary Share, and One Warrant to Purchase One Ordinary Share, as Described Below

We are offering an aggregate of Units (the “Units”) based on a public offering price of $ per Unit. Each Unit consists of one ordinary share of Todos Medical, Ltd., an Israel corporation, par value NIS 0.01 per share, and one warrant (“Warrant”) to purchase one ordinary share of Todos Medical Ltd. The Warrants may be exercised in whole, with an exercise price equal to 120% of the public offering price of each Unit sold in this offering. This offering also relates to the ordinary shares issuable upon exercise of any Warrants sold in this offering.

Our ordinary shares are presently quoted on the OTCQB Marketplace operated by OTC Markets Group, Inc. (“OTCQB”) under the symbol “TOMDF.” We will apply to list our ordinary shares and Warrants on a national securities exchange. No assurance can be given that our application will be approved. If our ordinary shares and Warrants are not approved for listing on a national securities exchange, we will not consummate this offering. As of July 27, 2022, the last reported sale price for our ordinary shares on the OTCQB was $0.019 per share.

The offering is being underwritten on a firm commitment basis. The underwriters may offer the securities from time to time to purchasers directly or through agents, or through brokers in brokerage transactions on a national securities exchange, or to dealers in negotiated transactions or in a combination of such methods of sale, or otherwise, at fixed price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices related to such prevailing market prices.

The final public offering price per Unit will be determined through negotiation between us and the underwriter in this offering and will take into account the recent market price of our ordinary shares, the general condition of the securities market at the time of this offering, the history of, and the prospects for, the industry in which we compete, and our past and present operations and our prospects for future revenues. The recent market price per share of our ordinary shares used throughout this prospectus may not be indicative of the final public offering price per Unit.

All references to “shares” in this prospectus refer to the pre-reverse split ordinary shares of Todos Medical Ltd., par value NIS 0.01 per share. As is discussed elsewhere in this prospectus, on August __, 2022, shareholders approved a reverse split of its shares based upon a ratio to be determined by Todos’ management.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 15 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Unit (1) | Total (1) | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (2) | $ | $ | ||||||

| Proceeds to us, before expenses (3) | $ | $ | ||||||

| (1) | The public offering price and underwriting discount in respect of the Units corresponds to a public offering price per ordinary share of $ and a public offering price per Warrant of $ . |

| (2) | We have agreed to reimburse the underwriters for certain expenses. The underwriters will receive an underwriting discount equal to 8% of the gross proceeds in this offering. In addition, we have agreed to pay the fees and expenses of Westpark Capital, Inc. the representative of the underwriters in this offering (the “Representative”) in connection with this offering, which includes the fees and expenses of underwriters’ counsel, and we have agreed to issue ordinary share purchase warrants (the “Representative’s Warrants”) to the Representative, which are exercisable for up to ordinary shares. See “Underwriting” for more information. |

| (3) | The amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) option (if any) we have granted to the Representative of the underwriters as described below and (ii) the Warrants or the Representative’s Warrants being issued in this offering. |

We have granted a 45-day option to the Representative exercisable one or more times in whole or in part, to purchase up to an additional Units (equal to 15% of the number of Units sold in this offering) less the underwriting discounts payable by us, solely to cover over-allotments, if any.

The underwriters expect to deliver our securities to purchasers in the offering on or about , 2022.

Westpark Capital, Inc.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

| i |

ABOUT THIS PROSPECTUS

You should rely only on information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are not making an offer of these securities in any state or other jurisdiction where the offer is not permitted. The information in this prospectus may only be accurate as of the date on the front of this prospectus regardless of time of delivery of this prospectus or any sale of our securities.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the Units offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy our securities in any circumstance under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of our securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus.

For investors outside the United States: We have not done anything that would permit offerings under this prospectus, or possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this prospectus outside of the United States.

Unless the context clearly indicates otherwise, references in this prospectus to “we,” “our,” “ours,” “us,” “the Company” and “Todos” refer to Todos Medical Ltd. and its subsidiaries.

| 1 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties and include statements regarding, among other things, our projected revenue growth and profitability, our growth strategies and opportunity, anticipated trends in our market and our anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. These statements may be found under the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products, market acceptance, future performance or results of current and anticipated products, sales efforts, expenses, and the outcome of contingencies such as legal proceedings and financial results.

Examples of forward-looking statements in this prospectus include, but are not limited to, our expectations regarding our business strategy, business prospects, operating results, operating expenses, working capital, liquidity and capital expenditure requirements. Important assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our products, the cost, terms and availability of components, pricing levels, the timing and cost of capital expenditures, competitive conditions and general economic conditions. These statements are based on our management’s expectations, beliefs and assumptions concerning future events affecting us, which in turn are based on currently available information. These assumptions could prove inaccurate. Although we believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations may prove to be incorrect.

Important factors that could cause actual results to differ materially from the results and events anticipated or implied by such forward-looking statements include, but are not limited to:

| ● | changes in the market acceptance of our products; | |

| ● | increased levels of competition; | |

| ● | changes in political, economic or regulatory conditions generally and in the markets in which we operate; | |

| ● | our relationships with our key customers; | |

| ● | our ability to retain and attract senior management and other key employees; | |

| ● | our ability to quickly and effectively respond to new technological developments; | |

| ● | our ability to protect our trade secrets or other proprietary rights, operate without infringing upon the proprietary rights of others and prevent others from infringing on the proprietary rights of the Company; and | |

| ● | other risks, including those described in the “Risk Factors” discussion of this prospectus. |

We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor may cause actual results to differ materially from those contained in any forward-looking statement. The forward-looking statements in this prospectus are based on assumptions management believes are reasonable. However, due to the uncertainties associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly update any of them in light of new information, future events, or otherwise.

| 2 |

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be important information about us, you should carefully read this entire prospectus before investing in our securities, especially the risks and other information we discuss under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes beginning on page F-1. Our fiscal year end is December 31 and our fiscal years ended December 31, 2021, and 2020 are sometimes referred to herein as fiscal years 2021, and 2020, respectively. Some of the statements made in this prospectus discuss future events and developments, including our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks and uncertainties which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”. Unless otherwise indicated or the context requires otherwise, the words “we,” “us,” “our”, the “Company” or “our Company” or “Todos” refer to Todos Medical Ltd., a State of Israel corporation, and our subsidiaries.

Overview

| Todos Medical Ltd. (“Todos Medical,” “Todos,” the “Company,” “we,” “our,” “us”), is a comprehensive medical diagnostics and related solutions company focused on developing and distributing comprehensive solutions for COVID-19 screening and diagnosis, and immune resisting treatments and supplements, and on developing blood tests for the early detection of cancer and Alzheimer’s disease. |

| Todos has entered into distribution agreements with companies to distribute certain novel coronavirus (COVID-19) test kits. The agreements cover multiple international suppliers of PCR testing kits and related materials and supplies, as well as antibody testing kits from multiple manufacturers after completing validation of said testing kits and supplies in its partner CLIA/CAP certified laboratory in the United States. Todos has combined the PCR testing kits with automated lab equipment to create lab workflows capable of performing up to 40,000 PCR tests per day. Todos has entered into supply agreements with CLIA/CAP certified laboratories in the United States to deploy these PCR workflows. Todos has formed strategic partnerships with Meridian Health and other strategic partners to deploy COVID-19 antigen and antibody testing in the United States. Additionally, the Company is developing a lab-based COVID-19 3CL protease test to determine whether a COVID-19 positive patient remains contagious after quarantine is complete and is further developing point-of-care-based embodiments of the lab test for use in screening programs worldwide. |

In December 2020, Todos announced the commercial launch of its proprietary 3CL protease inhibitor dietary supplement Tollovid™ at The Alchemist’s Kitchen in the SoHo district in Manhattan, New York. Tollovid, a mix of botanical extracts, is being targeted to support healthy immune function against circulating coronaviruses. Tollovid’s mechanism of action is to inhibit the activity of the 3CL protease, a key protease required for the intracellular replication of coronaviruses. Tollovid was granted a Certificate of Free Sale by the US Food & Drug Administration in August 2020, allowing its commercial sale anywhere in the United States.

On July 22, 2021, the US Food & Drug Administration (FDA) granted a new Certificate of Free Sale for Tollovid Daily™, the newest member of the Company’s Tollovid™ dietary supplement product line.

The Certificate of Free Sale is for a twice-daily dosing regimen and, critically, a 3CL protease inhibitor claim. Each 60-pill bottle of Tollovid Daily can help support and maintain healthy immune function for 30 days. The Company intends to establish a monthly subscription model as part of its marketing launch campaign for Tollovid Daily immune system support. Tollovid™ and Tollovid Daily are both 3CL protease inhibitor products developed under a joint venture with NLC Pharma which preceded the establishment of our subsidiary, 3CL Sciences Ltd. |

On March 11, 2022, the Company entered into a Share Purchase Agreement (the “SPA”) with 3CL Sciences Ltd. (“3CL”), an Israeli corporation, and NLC Pharma Ltd. (“NLC”), an Israeli corporation, pursuant to which (a) 3CL Sciences will purchase all therapeutic, diagnostic, dietary supplement and pharmaceutical assets from NLC that relate to 3CL protease biology (which is used in the development, manufacture, sale and distribution of Tollovid™ and Tollovir™) from NLC in exchange for a 100% equity interest in 3CL, (b) 3CL will allot 30.5% of its shares to the Company in exchange for a total cash commitment of $8 million, (c) NLC will sell 7.54% of 3CL’s issued and outstanding shares to the Company in exchange for a total cash commitment of $2 million, and (d) NLC will exchange 14.31% of 3CL’s issued and outstanding shares for shares of the Company having a market value of $3,800,000 on the day prior to the Closing, such that the Company will own 52% of 3CL’s issued and outstanding share capital and NLC will own 48% of 3CL’s issued and outstanding share capital. The Company and NLC have agreed to identify a seasoned biopharmaceutical CEO to manage 3CL going forward. The board of directors of 3CL Sciences will be made up of five (5) individuals: three (3) appointed by the Company and two (2) appointed by NLC. |

|

Additionally, the Company’s patented Todos Biochemical Infrared Analyses (TBIA) is a cancer-screening technology using peripheral blood analysis that deploys deep examination into cancer’s influence on the immune system, looking for biochemical changes in blood mononuclear cells and plasma. Todos’ two internally developed cancer-screening tests, TMB-1 and TMB-2 have received a CE mark in Europe. In July 2021, Todos completed the acquisition of U.S.-based medical diagnostics company Provista Diagnostics, Inc. to gain rights to its Alpharetta, Georgia-based CLIA/CAP certified lab and Provista’s proprietary commercial-stage Videssa® breast cancer blood test. |

| Todos is also developing blood tests for the early detection of neurodegenerative disorders, such as Alzheimer’s disease. |

| In July 2020, Todos completed the acquisition of Breakthrough Diagnostics, Inc., the owner of the LymPro Test intellectual property, from Amarantus Bioscience Holdings, Inc. (a company whose Executive Chairman has served as our CEO since January 2020). |

| At our annual general meeting of shareholders held on August __, 2022, our shareholders voted to approve a reverse share split of the Company’s Ordinary Shares within a range of 1:2 to 1:1,000, to be effective at the ratio and on a date to be determined by the Board of Directors of the Company (the “Reverse Split”). Although our shareholders approved the Reverse Split, all per share amounts and calculations in this prospectus and the accompanying consolidated financial statements do not reflect the effects of the Reverse Split, as the Board of Directors has not determined the final ratio or the effective date of the Reverse Split. |

| 3 |

Recent Developments

3CL Acquisition

On March 11, 2022, the Company entered into a Share Purchase Agreement (the “SPA”) with 3CL Sciences Ltd. (“3CL”), an Israeli corporation, and NLC Pharma Ltd. (“NLC”), an Israeli corporation, pursuant to which (a) 3CL Sciences will purchase all therapeutic, diagnostic, dietary supplement and pharmaceutical assets from NLC that relate to 3CL protease biology (which is used in the development, manufacture, sale and distribution of Tollovid™ and Tollovir™) from NLC in exchange for a 100% equity interest in 3CL, (b) 3CL will allot 30.5% of its shares to the Company in exchange for a total cash commitment of $8 million, (c) NLC will sell 7.54% of 3CL’s issued and outstanding shares to the Company in exchange for a total cash commitment of $2 million, and (d) NLC will exchange 14.31% of 3CL’s issued and outstanding shares for shares of the Company having a market value of $3,800,000 on the day prior to the Closing, such that the Company will own 52% of 3CL’s issued and outstanding share capital and NLC will own 48% of 3CL’s issued and outstanding share capital. The Company and NLC have agreed to identify a seasoned biopharmaceutical CEO to manage 3CL going forward. The board of directors of 3CL Sciences will be made up of five (5) individuals: three (3) appointed by the Company and two (2) appointed by NLC.

Provista Acquisition

On April 19, 2021, the Company entered into an Agreement to Purchase Provista Diagnostics, Inc. (“Agreement to Purchase”) with Strategic Investment Holdings, LLC (“SIH”), Ascenda BioSciences LLC (“Ascenda”) and Provista Diagnostics, Inc. (“Provista”). Ascenda was the sole owner of the outstanding securities of Provista and SIH is the sole owner of all the outstanding securities of Ascenda.

Pursuant to the Agreement to Purchase, the Company acquired Provista from Ascenda and SIH for an aggregate purchase price of $7.5 million consisting of an initial cash payment of $1.25 million, the issuance of $1.5 million in Ordinary Shares priced at $0.0512 per share, the issuance to SIH of a $3.5 million convertible promissory note dated April 19, 2021 (the “Note”) and the payment on for before July 1, 2021 of $1.25 million in cash (the “July Payment”), which payment the Company had the right to, and did, extend to July 15, 2021. The Provista shares acquired by the Company remained in an escrow account until the July Payment was made.

The Note has a maturity date of April 8, 2025, and is convertible into Ordinary Shares of the Company at a conversion price equal to the lesser of $0.05 or the volume weighted average price of the last 20 trading days for the Ordinary Shares prior to the date of conversion. In the event SIH delivers a Notice of Conversion to the Company at a per share price less than $0.05 ($0.05), the Company has the right to immediately notify SIH of its intention to pay the conversion amount in cash within three (3) business days of receipt of the Notice of Conversion (i.e., before SIH would take possession of shares converted under the Notice of Conversion).

In the event that the Company lists its Ordinary Shares on a national securities exchange, the Note shall automatically be exchanged into ordinary shares with a conversion price equal to the lesser of (a) $0.05 (subject to adjustment for any reverse stock splits), (b) the opening price on the day of the uplisting provides there is no transaction associated with the uplisting or (c) the deal price of an uplisting transaction.

As of the date of this registration statement on Form S-1, SIH has not submitted a Notice of Conversion.

| 4 |

Products

On July 22, 2021, the US Food & Drug Administration (FDA) granted a new Certificate of Free Sale for Tollovid Daily™, the newest member of the Company’s Tollovid™ dietary supplement product line.

The Certificate of Free Sale is for a twice-daily dosing regimen and, critically, a 3CL protease inhibitor claim. Each 60-pill bottle of Tollovid Daily can help support and maintain healthy immune function for 30 days. The Company intends to establish a monthly subscription model as part of its marketing launch campaign for Tollovid Daily immune system support. Tollovid™ and Tollovid Daily are both 3CL protease inhibitor products developed under a joint venture with NLC Pharma.

On April 8, 2021, we received a notice of allowance (‘Letter of Intent to Grant a Patent’) from the European Patent Office covering the use of the Company’s proprietary Total Biochemical Infrared Analysis (‘TBIA’) method that uses blood (plasma and/or peripheral blood mononuclear cells ‘PBMCs’) to distinguish between patients with benign tumors vs. malignant tumors vs. no tumors (healthy controls).

The patent application specifically covers methods for capturing consistent data from infrared spectroscopy readers, as well as the application of various artificial intelligence algorithm development methods to the data. The ability of TBIA to make a diagnosis of cancer has first been applied to the detection of breast and colon cancers, where Todos has received CE Marks in Europe paving the way for commercialization initially focused on TMB-2 (dense breast / inconclusive mammogram secondary screening) and TMB-1 (general breast cancer screening) cancer detection tests.

Financing and Fundraising Other Than Crossover Notes

Toledo

On June 19, 2020, the Company and its subsidiaries, Todos Medical USA and Corona Diagnostics, LLC (“Corona”) entered into a Receivables Financing Agreement with Toledo Advisors, LLC (“Toledo”) for up to $25,000,000 in a revolving receivables financing facility (the “Facility”). The availability of the Facility shall terminate on the earlier of June 19, 2025 and the date on which more than $25,000,000 has been advanced. The financing is secured by all of the assets of the Company’s wholly-owned subsidiary Todos Medical USA, Inc. In addition, Todos Medical USA pledged all of the outstanding equity of Corona to the Lender. The initial draw under the Facility was on June 19, 2020 for $165,000 which was due on the earlier to occur of (i) ninety days following the date the draw was made by the Lender and (ii) the date the receivable, for which the draw was made, is paid. The Facility has since been repaid.

In November 2020, the parties agreed to amend the Facility to reduce the cost of funding to Todos Medical USA, and to make the relationship between Corona and Toledo nonexclusive in exchange for Toledo being granted a percentage of Corona’s revenues from diagnostic testing.

On January 7, 2022, Toledo filed a complaint against Corona, Todos Medical USA, and the Company (the “Todos Defendants”), seeking unspecified damages for breach of the aforesaid agreements and claiming that at least $139,000 is due under the royalty agreement. The Todos Defendants filed an answer and counterclaim on February 9, 2022, wherein various affirmative defenses were asserted, the allegations of the complaint were denied, and the Company asserted counterclaims for breach of contract and other relief.

On April 7, 2022, the Company and Toledo signed a Settlement Agreement pursuant to which upon execution of the agreement the Company paid Toledo $130,000 and issued to Toledo $200,000 worth of ordinary shares. The parties agreed that upon delivery of the cash payment and shares, the parties would discontinue the complaint filed by Toledo on January 7, 2022, and that Toledo irrevocably and unconditionally releases and discharges the Company from its June 19, 2020 financing agreement and July 28, 2020 Royalty Agreement.

Leviston

The Company and Leviston Resources LLC, a Delaware limited liability company are parties to that certain Securities Purchase Agreement, dated as of July 9, 2020, pursuant to which Leviston purchased an aggregate principal amount of $850,000 of convertible notes from the Company (the “July 2020 Convertible Notes”) from the Company. On March 3, 2021, the Company and Leviston entered into a Closing Agreement pursuant to which the Purchaser exercised its right to invest an additional $847,570 into the Company of July 2020 Convertible Notes (the “Tranche 2 Securities”).

The July 2020 Convertible Notes and the Tranche 2 Securities (collectively, the “Leviston Notes”) bear interest at a rate of 2% per annum. The Leviston Notes are convertible into ordinary shares of the Company at a conversion price that equals the lower of (i) 60% of the lowest VWAP trading price of the ordinary shares during the eleven trading days immediately prior to the date of conversion, (ii) 150% of the closing bid price of the ordinary shares on such closing date and (iii) 150% of the closing bid price on the date of effectiveness of the Company’s registration statement covering the converted shares.

As of the date of this prospectus, $389,250 remains outstanding on the Leviston Notes (the remainder having previously been converted into ordinary shares).

Lincoln Park

On August 4, 2020, we entered into a purchase agreement (the “LPC Purchase Agreement”) with Lincoln Park Capital, LLC (“Lincoln Park”), pursuant to which Lincoln Park agreed to purchase from us up to an aggregate of $10,275,000 of our ordinary shares (subject to certain limitations) from time to time over the term of the LPC Purchase Agreement. Also on August 4, 2020, we entered into a registration rights agreement with Lincoln Park, pursuant to which on August 11, 2020, we filed with the Securities and Exchange Commission, or the SEC, a registration statement (the “LPC Registration Statement”) to register for resale under the Securities Act of 1933, as amended, or the Securities Act, the ordinary shares that have been or may be issued to Lincoln Park under the LPC Purchase Agreement. That registration statement became effective on August 18, 2020.

| 5 |

The LPC Registration Statement covers the resale by Lincoln Park of up to 50,000,000 ordinary shares, comprised of: (i) 5,812,500 ordinary shares that we issued to Lincoln Park as a fee for making its irrevocable commitment to purchase our ordinary shares under the LPC Purchase Agreement, which we refer to in this registration statement on Form S-1 as the Commitment Shares, (ii) 3,437,500 ordinary shares that we sold to Lincoln Park on August 5, 2020 for a total purchase price of $275,000 in an initial purchase under the LPC Purchase Agreement the (“Initial Purchase Shares”), and (iii) up to an additional 40,750,000 ordinary shares that we have reserved for sale to Lincoln Park under the LPC Purchase Agreement from time to time after the date of the LPC Registration Statement, if and when we determine to sell additional ordinary shares to Lincoln Park under the LPC Purchase Agreement. Since August 18, 2020, Lincoln Park has purchased 37,977,388 of our ordinary shares under the LPC Purchase Agreement, at prices ranging from $ 0.038 per share to $ 0.115 per share. The Company does not currently expect to sell any more shares to Lincoln Park under the LPC Purchase Agreement.

The LPC Purchase Agreement prohibits us from directing Lincoln Park to purchase any ordinary shares if those ordinary shares, when aggregated with all other ordinary shares then beneficially owned by Lincoln Park and its affiliates, would result in Lincoln Park having beneficial ownership, at any single point in time, of more than 4.99% of the then total outstanding ordinary shares, as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Rule 13d-3 thereunder, which limitation we refer to as the Beneficial Ownership Cap.

Issuances of our ordinary shares to Lincoln Park under the LPC Purchase Agreement will not affect the rights or privileges of our existing shareholders, except that the economic and voting interests of each of our existing shareholders will be diluted as a result of any such issuance. Although the number of ordinary shares that our existing shareholders own will not decrease, the ordinary shares owned by our existing shareholders will represent a smaller percentage of our total outstanding ordinary shares after any such issuance of ordinary shares to Lincoln Park under the LPC Purchase Agreement.

Yeshiva Orot Hateshuva

On November 4, 2020, we entered into a Secured Convertible Equipment Loan Agreement with Friends of Yeshiva Orot Hateshuva Inc. (“Friends”), pursuant to which Friends lent us $450,000 to purchase two liquid handler machines. Under the terms of the agreement, the note was issued with 41.4% Original Issue Discount, with Friends receiving a royalty of 12.5% of all amounts resulting from any diagnostic tests performed by the two liquid handler machines. During the initial payback period and up until the earlier of either (a) the Maturity Date, or (b) the aggregate loan amount is paid in full, all Royalty payments made to Investor will be counted towards their loan balance. Thereafter, the royalties continue so long as the machines are in use. The Maturity Date was March 4, 2021. On March 4, 2021, the Company and Friends agreed to extend the maturity date of the note to May 1, 2021, in exchange for a payment of $100,000 and the issuance of 2,000,000 ordinary shares, in each case to a charity designated by Friends. As of March 25, 2022, the Company has not made any royalty payments to Friends. The note has been repaid.

Harper Advance

On December 31, 2020, we entered into a Secured Convertible Equipment Loan Agreement with Harper Advance LLC (“Harper”), pursuant to which Harper lent us $450,000 to purchase two liquid handler machines. Under the terms of the agreement, the note was issued with 40% Original Issue Discount, with Harper receiving a royalty of 12.5% of all amounts resulting from any diagnostic tests performed by the two liquid handler machines. During the initial payback period and up until the earlier of either (a) the Maturity Date, or (b) the aggregate loan amount is paid in full, all Royalty payments made to Investor will be counted towards their loan balance. Thereafter, the royalties continue so long as the machines are in use. The Maturity Date was April 30, 2021. As of March 25, 2022, the Company has not made any royalty payments to Harper. Harper’s note was purchased by another investor and converted into ordinary shares of the Company.

T-Cell Protect Hellas S.A.

On November 22, 2021, the Company entered into a Securities Purchase Agreement with T-Cell Protect Hellas S.A. (“T-Cell”) pursuant to which the Company agreed to issue a convertible promissory note (the “Note”) to T-Cell Protect in the principal amount of €1,000,000. To date, T-Cell has not fulfilled its obligation to pay for the Note, and therefore the Company has not yet issued the Note. The proceeds from this Transaction are intended to be used for the clinical development of Tollovir, the Company’s therapeutic candidate for hospitalized COVID-19 patients.

Testing 123, LLC

On March 14, 2022, the Company and Testing 123, LLC (the “Lender”) signed a Revolving Line of Credit Agreement, pursuant to which the Lender will provide the Company with a credit facility of up to $1,250,000 bearing a monthly interest of 5% calculated for a minimum period of 60 days. The Company may request advances under the agreement from the date of the agreement and until March 14, 2023. The Maturity Date of each draw will be the earlier of (i) 60 days from the date of the loan, (ii) the occurrence of an event of default as defined in the agreement and (iii) with respect to funds received by the Company through collections on receivables included in a Receivables Pool, as defined in the agreement, 3 days after such funds have been received by the escrow account agent or the Company. Additionally, under the terms of the Revolving Line of Credit Agreement, the Company agreed to issue to Testing 123, LLC, shares equal to a 10% ownership stake in Provista, which interest is protected against dilution. As of March 31, 2022, the Company utilized $999,000 out of the credit facility. The Company has estimated the portion of the 10% shares of Provista at $740,000 and recorded $598,000 as interest expenses and $142,000 as prepaid interest expenses under Other Current Assets.

Crossover Notes

Yozma

On January 22, 2021, we entered into a Securities Purchase Agreement with Yozma Group Korea Ltd. (the “First Yozma Purchaser”) pursuant to which on January 29, 2021, the Company issued a convertible promissory note to the Purchaser in the principal amount of $4,857,142.86 for proceeds of $3,400,000 (the “Transaction”). The note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. In addition, the First Yozma Purchaser received a warrant to purchase up to 16,956,929 Ordinary Shares of the Company with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. In the event that the Company effectuates a reverse split of its ordinary shares for a ratio in excess of 1:20, the resulting adjusted warrant shares and exercise price are limited to a 1:20 ratio.

The note is convertible into Ordinary Shares of the Company at a conversion price of $0.0599. In the event that the Company lists its Ordinary Shares on a national securities exchange, the First Yozma Purchaser, upon request of the Company, will be obligated to exchange its note for Preferred A Shares that convert, solely at the discretion of the Company’s Board of Directors, into Ordinary Shares at a conversion rate of 1,000 Ordinary Shares per Preferred A Share. As of July 22, 2022, there are 50,000 Preferred A Shares authorized which equals a total possible issuance of 50 million Ordinary Shares pursuant to the conversion of the Preferred A Shares.

On April 27, 2021, we entered into a Securities Purchase Agreement (the “SPA”) with Yozma Global Genomic Fund (the “Second Yozma Purchaser” and together with the First Yozma Purchaser, the “Yozma Purchasers”) pursuant to which on April 28, 2021, the Company issued a convertible promissory note to the Purchaser in the principal amount of $4,714,285.71 for proceeds of $3,300,000. The note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The note is convertible into Ordinary Shares of the Company at a conversion price of $0.0599. In the event that the Company lists its Ordinary Shares on a national securities exchange, the Second Yozma Purchaser, upon request of the Company, will be obligated to exchange its note for Preferred A Shares that convert, solely at the discretion of the Company’s Board of Directors, into Ordinary Shares at a conversion rate of 1,000 Ordinary Shares per Preferred A Share.

The notes issued to the Yozma Purchasers are currently past due, and the Company is negotiating an extension of the maturity dates with Yozma.

| 6 |

Kips Bay

On April 8, 2021, the Company entered into a Securities Purchase Agreement with Kips Bay Select LP (the “Purchaser”) pursuant to which the Company agreed to issue a convertible promissory note (the “First Kips Bay Note”) to the Purchaser in the principal amount of $4,285,714.29 for proceeds of $3,000,000. The closing occurred on April 12, 2021. The First Kips Bay Note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. In addition, the Purchaser received a warrant to purchase up to 16,000,000 Ordinary Shares of the Company with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. In the event that the Company effectuates a reverse split of its Ordinary Shares for a ratio in excess of 1:20, the resulting adjusted warrant shares and exercise price are limited to a 1:20 ratio. The Company used the net proceeds from the First Kips Bay Note to initiate the Phase 2 for Tollovir™ clinical trial in COVID-19 patients, complete the acquisition of Provista Diagnostics, Inc. and for general corporate purposes.

The First Kips Bay Note is convertible into Ordinary Shares at a conversion price of $0.0599. In the event that the Company lists its Ordinary Shares on a national securities exchange, the Purchaser, upon request of the Company, will be obligated to exchange the Original Issue Discount portion of the First Kips Bay Note for Preferred A Shares, while the Purchaser may elect to convert the remaining principal amount of its notes.

The First Kips Bay Note is currently past due and the Company is negotiating an extension of the maturity date with the Purchaser.

Until May 5, 2022, the Purchaser had the option to purchase an additional note in the principal amount of $5,285,714.20 for proceeds of $3,700,000 and an additional warrant to purchase 16,000,000 Ordinary Shares. The purchaser did not exercise the option.

On July 7, 2021, the Company entered into a Securities Purchase Agreement with the Purchaser pursuant to which the Company agreed to issue a convertible promissory note (the “Second Kips Bay Note”) to the Purchaser in the principal amount of $1,535,714 for proceeds of $1,075,000. The closing occurred on July 7, 2021. In addition, the Purchaser received a warrant to purchase up to 3,440,000 Ordinary Shares of the Company with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. The Second Kips Bay Note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The Second Kips Bay Note is convertible into Ordinary Shares of the Company at a conversion price of $0.0599. In the event that the Company lists its Ordinary Shares on a national securities exchange, the Purchaser, upon request of the Company, will be obligated to exchange the Original Issue Discount portion of the Second Kips Bay Note for Preferred A Shares, while the Purchaser may elect to convert the remaining principal amount of its notes. The Company used the net proceeds for general corporate purposes.

The Second Kips Bay Note is currently past due and the Company is negotiating an extension of the maturity date with the Purchaser.

On October 21, 2021, Todos Medical Ltd. (the “Company”) entered into a Securities Purchase Agreement with the Purchaser pursuant to which the Company agreed to issue a convertible promissory note (the “Third Kips Bay Note”) to the Purchaser in the principal amount of $1,428,571.43 for proceeds of $1,000,000. The closing occurred on October 22, 2021. In addition, the Purchaser received a warrant to purchase up to 3,440,000 ordinary shares with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. The Third Kips Bay Note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The Third Kips Bay Note is convertible into ordinary shares at a conversion price of $0.0599. In the event that the Company lists its Ordinary Shares on a national securities exchange, the Purchaser, upon request of the Company, will be obligated to exchange the Original Issue Discount portion of its Third Kips Bay Note for Preferred A Shares, while the Purchaser may elect to convert the remaining principal amount of its notes. The Company intends to use the net proceeds from this Third Kips Bay Note to continue funding the ongoing Phase 2 clinical trial of Tollovir® in hospitalized COVID-19 patients, beginning the initial marketing campaign for the cPass neutralizing antibody test launch at Provista Diagnostics and general corporate purposes.

Mekarkain

On July 6, 2021, the Company entered into a Securities Purchase Agreement with S.B. Nihul Mekarkain pursuant to which the Company issued a convertible promissory note to Mekarkain in the principal amount of $285,714 for proceeds of $200,000. The closing occurred on July 6, 2021. In addition, Mekarkain received a warrant to purchase up to 997,466 Ordinary Shares of the Company with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. The Company used the net proceeds for general corporate purposes. The note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The note is convertible into Ordinary Shares at a conversion price of $0.0599. In the event that the Company lists its Ordinary Shares on a national securities exchange, Mekarkain, upon request of the Company, will be obligated to exchange its note for Preferred A Shares that convert, solely at the discretion of the Company’s Board of Directors, into Ordinary Shares at a conversion rate of 1,000 Ordinary Shares per Preferred A Share.

The note is currently past due and the Company is negotiating an extension of the maturity date with Mekarkain.

Mercer Street

On September 23, 2021, the Company completed the conditions precedent required to enter into a Securities Purchase Agreement with Mercer Street Global Opportunity Fund, LLC pursuant to which the Company issued a convertible promissory note to Mercer Street in the principal amount of $2,285,142.86 for proceeds of $2,000,000. In addition, the Purchaser received a warrant to purchase up to 11,924,636 Ordinary Shares of the Company with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. The Company intends to use the net proceeds from the conversion shares and the warrant shares to initiate Phase 2/3 trials for Tollovir™ COVID-19 patients, initiate digital marketing for its dietary supplement Tollovid®, increase sales & marketing for Provista Diagnostics, and for general corporate purposes. The note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The note is convertible into Ordinary Shares of the Company at a conversion price of $0.0599. In the event that the Company lists its Ordinary Shares on a national securities exchange, Mercer Street, upon request of the Company, will be obligated to exchange the Original Issue Discount portion of its note for Preferred A Shares, while Mercer Street may elect to convert the remaining principal amount of its notes.

Quick Capital

On August 9, 2021, the Company entered into a Securities Purchase Agreement with Quick Capital, LLC pursuant to which the Company issued a convertible promissory note to Quick Capital in the principal amount of $142,857 for proceeds of $100,000. The closing occurred on August 9, 2021 . In addition, Quick Capital received a warrant to purchase up to 498,733 Ordinary Shares of the Company with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. The Company used the net proceeds for general corporate purposes. The note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The note is convertible into Ordinary Shares at a conversion price of $0.0599. In the event that the Company lists its Ordinary Shares on a national securities exchange, Quick Capital, upon request of the Company, will be obligated to exchange its note for Preferred A Shares that convert, solely at the discretion of the Company’s Board of Directors, into Ordinary Shares at a conversion rate of 1,000 Ordinary Shares per Preferred A Share.

On December 14, 2021, the Company entered into a Securities Purchase Agreement with Quick Capital pursuant to which the Company issued a convertible promissory note to Quick Capital in the principal amount of $142,857 for proceeds of $100,000. The note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The note is convertible into Ordinary Shares at a conversion price of $0.0599. In addition, Quick Capital received a warrant to purchase up to 5,613,334 Ordinary Shares of the Company with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. The Company intends to use the net proceeds for general corporate purposes. In the event that the Company lists its Ordinary Shares on a national securities exchange, Quick Capital, upon request of the Company, will be obligated to exchange its note for Preferred A Shares that convert, solely at the discretion of the Company’s Board of Directors, into Ordinary Shares at a conversion rate of 1,000 Ordinary Shares per Preferred A Share.

| 7 |

Greentree

On October 11, 2021, the Company entered into a Securities Purchase Agreement with Greentree Financial Group pursuant to which the Company issued a convertible promissory note to the Purchaser in the principal amount of $428,571 for proceeds of $300,000. In addition, Greentree received a warrant to purchase up to 1,252,087 Ordinary Shares of the Company with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. The Company used the net proceeds for general corporate purposes. The note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The note is convertible into Ordinary Shares at a conversion price of $0.0599. In the event that the Company lists its Ordinary Shares on a national securities exchange, Greentree, upon request of the Company, will be obligated to exchange the Original Issue Discount portion of its note for Preferred A Shares, while Greentree may elect to convert the remaining principal amount of its notes.

Leonite

On November 2, and November 24, 2021, the Company entered into a Securities Purchase and other related documents with Leonite Fund I, LP pursuant to which the Company issued a convertible promissory note to Leonite in the principal amount of $1,432,142 for proceeds of $1,002,500. The closing occurred on November 2, 2021. The note has a maturity date of one year from the date of a issuance and pays interest at a rate of 4% per annum. The note is convertible into Ordinary Shares at a conversion price of $0.0599.

In addition, the Purchaser received a warrant to purchase up to 5,613,334 Ordinary Shares of the Company with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. The Company intends to use the net proceeds for general corporate purposes.

In the event that the Company lists its Ordinary Shares on a national securities exchange, Leonite, upon request of the Company, will be obligated to exchange the Original Issue Discount portion of its note for Preferred A Shares, while Leonite may elect to convert the remaining principal amount of its notes.

Ascendant

On December 21, 2021, the Company entered into a Securities Purchase Agreement with Ascendant, LLC pursuant to which the Company issued a convertible promissory note to Ascendant in the principal amount of $300,000 for proceeds of $210,000. The closing occurred on December 21, 2021. In addition, Ascendant received a warrant to purchase up to 1,252,087 Ordinary Shares of the Company with an exercise price equal to $0.107415 per share. The warrant is exercisable for 5 years from the date of issuance. The Company used the net proceeds for general corporate purposes. The note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The note is convertible into Ordinary Shares at a conversion price of $0.0599. In the event that the Company lists its Ordinary Shares on a national securities exchange, Ascendant, upon request of the Company, will be obligated to exchange the Original Issue Discount portion of its note for Preferred A Shares, while Ascendant may elect to convert the remaining principal amount of its notes.

Crossover Notes Registration Statement

On May 13, 2021, the Company filed a registration statement on Form S-1, registering for resale all of the conversion shares and the warrant shares described above under the headings of Kips Bay, Mekarkain, Mercer Street, Quick Capital, Greentree, Leonite, and Ascendant (the “Registration Statement), except for the conversion shares issuable to Yozma Purchasers and the conversion shares issuable under the First Kips Bay Note, all of which were already saleable under Rule 144. The Registration Statement was subsequently amended in January 2022 and February 2022 and was declared effective on February 4, 2022. Subsequent to the effective date of the Registration Statement, if the closing sale price of the Ordinary Shares averages less than the then conversion price over a period of ten (10) consecutive trading days, the conversion price shall reset to such average price. If the 10 day volume weighted average price of the Ordinary Shares continues to be less than the conversion price then the conversion price should reset to such 10-day average price with a maximum of a 20% discount from the initial Conversion Price.

| 8 |

Reverse Split

At an extraordinary general meeting of our shareholders held on August __, 2022, our shareholders voted to approve a reverse share split of the Company’s ordinary shares within a range of 1:2 to 1:1,000, to be effective at the ratio and on a date to be determined by the Board of Directors of the Company (the “Reverse Split”). Although our shareholders approved the Reverse Split, all per share amounts and calculations in this registration statement on Form S-1 and the accompanying financial statements do not reflect the effects of the Reverse Split, as the Board of Directors has not determined the ratio or the effective date of the Reverse Split.

SARS-nCoV-2 Related Business

With the onset of COVID-19, Todos sought to apply its expertise in developing blood tests for the early detection of cancer and Alzheimer’s disease to distributing and then developing screening tests for the pandemic.

On March 23, 2021, we announced that we have entered into an automation and reagent supply agreement with MAJL Diagnostics (“MAJL”). Under the terms of the agreement, Todos will implement its automation solution, including Tecan™ liquid handlers, automated RNA extraction machines, as well as a 384-well PCR machine capable of conducting COVID, cancer genetics and pharmacogenomics testing, in order to become the provider of all COVID-19 PCR testing reagents and supplies.

On March 29, 2021, we announced the successful installation of automated lab equipment and completion of training for a lab client in Brooklyn, NY. The implementation of the Todos automation solution has expanded the lab’s processing capacity to 6,000 PCR tests per day from 500 PCR tests per day, with the potential to quickly expand to up to 12,000 PCR tests per day. The lab will be implementing EUA approved PCR testing for COVID-19 testing, as well as COVID + influenza A & B PCR testing upon request for select clients. Additionally, through the future implementation of pooling, the lab could potentially increase processing capacity to in excess of 40,000 PCR tests per day at a 4:1 ratio.

On March 30, 2021, we announced that we have entered into a distribution partnership with Osang Healthcare (OHC) of South Korea, to distribute the GeneFinder™ COVID-19 Plus RealAMP Kit in the United States. Todos intends to make GeneFinder Plus the primary kit used for distribution in its fully integrated and automated COVID-19 PCR testing lab solutions. GeneFinder Plus has been granted Emergency Use Authorization (EUA) by the US FDA.

We market our COVID-19 test kits directly to clinical laboratories throughout the U.S. as well as through our distributors, who include Meridian, Dynamic Distributors, LLC, and others.

On March 11, 2022, the Company entered into a Share Purchase Agreement (the “SPA”) with 3CL Sciences Ltd. (“3CL”), an Israeli corporation, and NLC Pharma Ltd. (“NLC”), an Israeli corporation, pursuant to which (a) 3CL Sciences will purchase all therapeutic, diagnostic, dietary supplement and pharmaceutical assets from NLC that relate to 3CL protease biology (which is used in the development, manufacture, sale and distribution of Tollovid™ and Tollovir™) from NLC in exchange for a 100% equity interest in 3CL, (b) 3CL will allot 30.5% of its shares to the Company in exchange for a total cash commitment of $8 million, (c) NLC will sell 7.54% of 3CL’s issued and outstanding shares to the Company in exchange for a total cash commitment of $2 million, and (d) NLC will exchange 14.31% of 3CL’s issued and outstanding shares for shares of the Company having a market value of $3,800,000 on the day prior to the Closing, such that the Company will own 52% of 3CL’s issued and outstanding share capital and NLC will own 48% of 3CL’s issued and outstanding share capital. The Company and NLC have agreed to identify a seasoned biopharmaceutical CEO to manage 3CL going forward. The board of directors of 3CL Sciences will be made up of five (5) individuals: three (3) appointed by the Company and two (2) appointed by NLC.

| 9 |

On April 19, 2021, the Company entered into an Agreement to Purchase Provista Diagnostics, Inc. (“Agreement to Purchase”) with Strategic Investment Holdings, LLC (“SIH”), Ascenda BioSciences LLC (“Ascenda”) and Provista Diagnostics, Inc. (“Provista”). Ascenda was the sole owner of the outstanding securities of Provista and SIH is the sole owner of all the outstanding securities of Ascenda.

Pursuant to the Agreement to Purchase, the Company acquired Provista from Ascenda and SIH for an aggregate purchase price of $7.5 million consisting of an initial cash payment of $1.25 million, the issuance of $1.5 million in Ordinary Shares priced at $0.0512 per share, the issuance to SIH of a $3.5 million convertible promissory note dated April 19, 2021 (the “Note”) and the payment on for before July 1, 2021 of $1.25 million in cash (the “July Payment”), which payment the Company had the right to, and did, extend to July 15, 2021. The Provista shares acquired by the Company remained in an escrow account until the July Payment was made.

The Note has a maturity date of April 8, 2025, and is convertible beginning on October 20, 2021, into Ordinary Shares of the Company at a conversion price equal to the lesser of $0.05 or the volume weighted average price of the last 20 trading days for the Ordinary Shares prior to the date of conversion. In the event SIH delivers a Notice of Conversion to the Company at a per share price less than $0.05 ($0.05), the Company has the right to immediately notify SIH of its intention to pay the conversion amount in cash within three (3) business days of receipt of the Notice of Conversion (i.e., before SIH would take possession of shares converted under the Notice of Conversion). If, at any time between October 20, 2021 and April 20, 2022, the average of the lowest bid and closing sale price at 4:00:00 p.m., New York time (or such other time as such market publicly announces is the official close of trading) is below ($0.05), the Company has the option to buy out all or any portion of the Note (the “Buyback Option”). In the event the Company exercises the Buyback Option for an amount equal to or greater than one million, one hundred seventy thousand dollars ($1,170,000) (the “Buyback Amount”), SIH may not submit any conversions below five cents ($0.05) for ninety (90) days from receipt of the Buyback Amount (“90 Day Period”).

In the event that the Company uplists its Ordinary Shares to a national securities exchange, the Note shall automatically be exchanged into ordinary shares with a conversion price equal to the lesser of (a) $0.05, (b) the opening price on the day of the uplisting provides there is no transaction associated with the uplisting or (c) the deal price of an uplisting transaction.

As of the date of this registration statement on Form S-1, SIH has not submitted a Conversion Notice.

During 2021, the Company recognized approximately $12,277,000 in revenue related to its COVID-19 business, and in January and February of 2022, the Company recognized approximately $540,000 in such revenue. There is no assurance that the Company will generate any additional revenues in the future pursuant to any of these arrangements.

Employees and Consultants

During 2021, the Company hired 23 new employees, including management and staffing of laboratory, sales and marketing and general administrative staffing.

Corporate Information

We were incorporated in the State of Israel in April 2010, and are subject to the Israel Companies Law, 5760-1999 (the “Companies Law”). Since March 7, 2017, our Ordinary Shares have been quoted on the OTCQB under the symbol TOMDF.

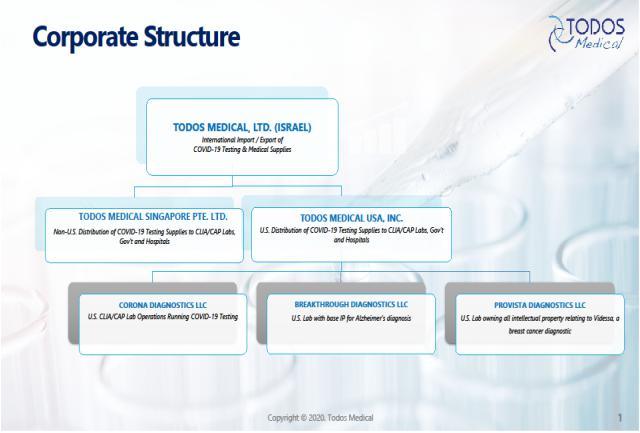

In January 2016, we incorporated our wholly owned subsidiary, Todos (Singapore) Pte. Ltd. In March 2016, Todos (Singapore) Pte. Ltd. changed its name to Todos Medical Singapore Pte. Ltd., or Todos Singapore. Todos Singapore has not yet commenced its business operations.

In January 2020, we incorporated Todos Medical USA, a Nevada corporation (“Todos US”), for the purpose of conducting business as a medical importer and distributor focused on the distribution the Company’s testing products and services to customers in North America and Latin America. In addition, in March 2020, Todos US formed a subsidiary, Corona Diagnostics, LLC, in the State of Nevada, for the purpose of marketing COVID-19 related products in the United States. In July 2020, we completed the acquisition of Breakthrough Diagnostics, Inc, which is now a wholly owned subsidiary of Todos. In July 2021, we completed the acquisition of Provista Diagnostics, Inc., which is now a wholly owned subsidiary of Todos.

| 10 |

The current corporate organizational structure of the Company and how we have operated substantially for the past year appears below.

Additionally, we anticipate that 3CL Sciences Ltd. will be a 52% owned subsidiary upon the closing of the .Share Purchase Agreement with 3CL Sciences Ltd. (“3CL”) and NLC Pharma Ltd. (“NLC”).

Our principal executive office is located at 121 Derech Menachem Begin, 30th Floor, Tel Aviv, 6701203 Israel, and our telephone number in Israel is +972-52-642-0126. Our web address is www.todosmedical.com. The information contained on our website or available through our website is not incorporated by reference into and should not be considered a part of this prospectus, and the reference to our website in this prospectus is an inactive textual reference only. Puglisi & Associates is our agent in the United States, and its address is 850 Library Avenue, Suite 204 Newark, Delaware 19711.

All per share amounts and calculations in this prospectus and the accompanying financial statements do not reflect the effects of the Reverse Split discussed elsewhere in this prospectus.

| 11 |

THE OFFERING

| Securities offered by us: | Units, based on a public offering price of $ per Unit. Each Unit consists of one ordinary share of Todos Medical, Ltd., an Israel corporation, par value NIS 0.01 per share, and one warrant. The Warrants may be exercised in whole, with an exercise price equal to 120% of the public offering price of each Unit sold in this offering. This offering also relates to the ordinary shares issuable upon exercise of any Warrants sold in this offering.. | |

| Public offering price per Unit | An assumed public offering price of $ per Unit, which is the last reported sale price of our ordinary shares on the OTCQB as of , 2022. (1) | |

| Ordinary shares outstanding before the offering | As of July 22, 2022, the Company had 1,193,175,121 ordinary shares outstanding. | |

| Ordinary shares to be outstanding after the offering (1)(2) | Ordinary shares, based on the issuance of (i) ordinary shares at a public offering price of $ per Unit, assuming no exercise of any option granted to the underwriter or exercise of the Representative’s Warrants; and (ii) the exercise of all warrants offered with the Units. If the underwriter’s option is exercised in full, the total number of ordinary shares outstanding immediately after this offering would be , based on a public offering price of $ per Unit. | |

| Underwriter’s Option | We have granted the Representative a 30-day option to purchase up to additional ordinary shares and/or additional Warrants to purchase up to ordinary shares (equal to 15% of the number of ordinary shares and/or Warrants sold in this offering) from us at a price per ordinary share and/or Warrant equal to the public offering price per ordinary share and/or Warrant, less the underwriting discounts payable by us, solely to cover over-allotments, if any. | |

| Description of Warrants | The exercise price of the Warrants is $ per share (with an exercise price equal to 120% of the public offering price per Unit). Each Warrant is exercisable for one ordinary share, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our ordinary shares as described herein. A holder may not exercise any portion of a Warrant to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would own more than 4.99% of the outstanding ordinary shares after exercise, as such percentage ownership is determined in accordance with the terms of the Warrants, except that upon notice from the holder to us, the holder may waive such limitation up to a percentage, not in excess of 9.99%. Each Warrant will be exercisable immediately upon issuance and will expire five years after the initial issuance date. The terms of the Warrants will be governed by a warrant agreement, dated as of the closing date of this offering, between us and Worldwide Stock Transfer, as the warrant agent (the “Warrant Agent”). This prospectus also relates to the offering of the ordinary shares issuable upon exercise of the Warrants. For more information regarding the Warrants, you should carefully read the section titled “Description of Warrants” in this prospectus. | |

| Representative’s Warrant (1) | The registration statement of which this prospectus is a part also registers the Representative’s Warrants to purchase up to ___________ ordinary shares (5% of the number of shares of ordinary shares sold in this offering (including any ordinary shares sold pursuant to the option to be issued to the underwriters, as a portion of the underwriting compensation payable in connection with this offering. The Representative’s Warrants will be exercisable immediately upon issuance, and from time to time, in whole or in part, and will expire five years from the commencement of sales at an exercise price of $ (120% of the public offering price of the Units). Please see “Underwriting Representative’s Warrants” for a description of these warrants. | |

| Risk factors | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 15 before deciding to invest in our securities. |

| 12 |

| Trading symbols | Our ordinary shares are currently quoted on OTCQB under the trading symbol “TOMDF”. We will apply to list our Ordinary Shares and Warrants on a national securities exchange. No assurance can be given that our application will be approved. We will not consummate this offering unless our application is approved. |

| Lock-ups | We and our directors, officers and any other holders of three percent (1%) or more of the outstanding ordinary shares as of the effective date of the registration statement, of which this prospectus forms a part, have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge, encumber grant any option for the sale of or otherwise dispose of any of our securities, including the issuance of ordinary shares upon the exercise of the Company’s currently outstanding options, without the prior written consent of the Representative for a period of twelve (12) months after the closing of this offering. See “Underwriting” section on page 88. | |

| Use of Proceeds | We estimate that the net proceeds from the sale of the Units in the offering, at an assumed public offering price per Unit of $ , will be approximately $ , after deducting the underwriting discounts and commissions and estimated offering expenses, or $ if the underwriters exercise their option in full, assuming no exercise of the Representative Warrants. We currently expect to use the net proceeds of this offering primarily for the following purposes: |

| ● | Approximately $__________ to hire professional service providers to assist in addressing our internal control issues. | ||

| ● | Approximately $ for development of new products and improvements to existing products; | ||

| ● | Approximately $ to expand sales and marketing capabilities; and | ||

| ● | The remaining proceeds of approximately $ for general corporate purposes, including working capital and possibly acquisitions of other companies.

See “Use of Proceeds” section on page 41. |

| (1) | The actual number of Units, ordinary shares and Representative’s Warrants that we will offer and that will be outstanding after this offering will be determined based on the actual public offering price and the reverse split ratio will be determined based in part on the price of our ordinary shares on the OTCQB at the time of the determination. |

| (2) | The ordinary shares outstanding prior to this offering and to be outstanding after this offering is based on shares outstanding as of July 22, 2022 and excludes the following: |

| ● | (i) 516,330,608 ordinary shares, (the “Convertible Note Shares”), issuable upon the exercise of outstanding convertible notes (the “Convertible Notes”), (ii) 78,332,201 ordinary shares, (the “Purchaser Warrant Shares”), issuable upon exercise of outstanding warrants (the “2021 Warrants”), and (iii) 59,648,748 ordinary shares (the “Prior Warrant Shares”) issuable upon the exercise of outstanding warrants (the “2020 Warrants”). |

Unless we indicate otherwise, all information in this prospectus:

| ● | Assumes no exercise by the underwriter of its option to purchase up to an additional ordinary shares and/or Warrants to purchase up to ordinary shares to cover over-allotments, if any. | |

| ● | Assumes no exercise of the Warrants issued in this offering. | |

| ● | Assumes no exercise of the Representative Warrants issued in this offering. |

| 13 |

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following tables summarize our financial data for the periods and as of the dates indicated. We have derived the statements of operations data for the three months ended March 31, 2022 and 2021 from our unaudited financial statements and related notes included elsewhere in this prospectus. You should read the following summary consolidated financial data together with our consolidated financial statements and the related notes appearing elsewhere in this prospectus and the information in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Selected Summary Consolidated Statements of Operations for the three months ended March 31, 2022 and 2021

(U.S. dollars in thousands except share and per share amounts)

Three months period ended March 31, | ||||||||

| 2022 | 2021 | |||||||

| Unaudited | ||||||||

| Revenues | $ | 2,199 | $ | 5,031 | ||||

| Cost of revenues | (1,317 | ) | (3,235 | ) | ||||

| Gross profit | 882 | 1,796 | ||||||

| Research and development expenses | (442 | ) | (713 | ) | ||||

| Sales and marketing expenses | (1,081 | ) | (1,358 | ) | ||||

| General and administrative expenses | (3,476 | ) | (1,562 | ) | ||||

| Operating loss | (4,117 | ) | (1,837 | ) | ||||

| Financing expenses, net | (3,471 | ) | (15,654 | ) | ||||

| Share in losses of affiliated companies accounted for under equity method, net | - | (66 | ) | |||||

| Net loss | $ | (7,588 | ) | $ | (17,557 | ) | ||

| Basic net loss per share | $ | (0.01 | ) | $ | (0.04 | ) | ||

| Diluted net loss per share | $ | (0.01 | ) | $ | (0.04 | ) | ||

| Weighted average number of ordinary shares outstanding attributable to ordinary shareholders used in computation of basic net loss per share | 1,036,898,212 | 462,650,478 | ||||||

| Weighted average number of ordinary shares outstanding attributable to ordinary shareholders used in computation of diluted net loss per share | 1,036,898,212 | 464,214,552 | ||||||

The following table presents our summary consolidated balance sheet data as of March 31, 2022 and December 31, 2021

| As of March 31, | As of December 31, | |||||||

| 2022 | 2021 | |||||||

| Unaudited | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 74 | $ | 189 | ||||

| Total assets | $ | 13,717 | $ | 15,115 | ||||

| Total current liabilities | 10,820 | 8,960 | ||||||

| Total non-current liabilities | 28,058 | 30,367 | ||||||

| Additional paid-in capital | 69,599 | 63,470 | ||||||

| Accumulated deficit | (98,183 | ) | (90,595 | ) | ||||

| Total shareholders’ deficit | (25,161 | ) | (24,212 | ) | ||||

| 14 |

RISK FACTORS

Summary of Risk Factors

Our business is subject to significant risks and uncertainties that make an investment in us speculative and risky. Below we summarize what we believe are the principal risk factors, but these risks are not the only ones we face, and you should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors”, together with the other information in this prospectus. If any of the following risks actually occurs (or if any of those listed elsewhere in this prospectus occur), our business, reputation, financial condition, results of operations, revenue, and future prospects could be seriously harmed. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business.

We have a history of losses, may incur future losses and may not achieve profitability.

We have a need for substantial additional financing and will have to significantly delay, curtail or cease operations if we are unable to secure such financing.

The report of our independent registered public accounting firm expresses substantial doubt about our ability to continue as a going concern.

There can be no assurance of market acceptance for our COVID-19 antibody test.

We rely on third parties to manufacture the COVID-19 antibody tests for us, and if such third party refuses or is unable to supply us with the COVID-19 test kits, our business will be materially harmed.

There can be no assurance that we will be able to purchase ingredients for our Tollovid™ and Tollovir™ Covid-19 remedies.

We rely on a third party to manufacture Tollovid and Tollovir for us, and if such third party refuses or is unable to supply us with Tollovid or Tollovir, our business will be materially harmed.

There can be no assurance of market acceptance for Tollovid and/or Tollovir.

Drug development is a long, expensive and uncertain process, and delay or failure can occur at any stage of any of our clinical trials.

We may not succeed in completing the development of our cancer detection products, commercializing our products or generating significant revenues.

We are currently in the process of improving our technology and adapting to the high throughput methodology.

We will require additional funding in order to commercialize our cancer detection kits and to develop and commercialize any future products.

We may not successfully maintain our existing license agreement with BGU and Soroka, and we are currently not in compliance with the repayment terms of the license agreement, which could adversely affect our ability to develop and commercialize our product candidates.

If we are unable to protect our intellectual property rights, our competitive position could be harmed.

| 15 |