UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-37534

PLANET FITNESS, INC.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

38-3942097 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

26 Fox Run Road, Newington, NH 03801

(Address of Principal Executive Offices and Zip Code)

(603) 750-0001

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: Class A common stock, par value $.0001 per share; Traded on the New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☒ NO ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☒ (Do not check if a small reporting company) |

|

Small reporting company |

|

☐ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the registrant’s Class A common stock held by non-affiliates, computed by reference to the last reported sale price of the Class A common stock as reported on the New York Stock Exchange on June 30, 2016 was approximately $510.2 million.

The number of outstanding shares of the registrant’s Class A common stock, par value $0.0001 per share, and Class B common stock, par value $0.0001 per share, as of March 1, 2017 was 62,182,791 shares and 36,315,932 shares, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement for the registrant’s 2017 Annual Meeting of Stockholders to be held May 9, 2017, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A, are incorporated by reference into Part III, Items 10-14 of this Annual Report on Form 10-K.

|

|

|

Page |

|

PART I |

|

|

|

Item 1. |

3 |

|

|

Item 1A. |

17 |

|

|

Item 1B. |

34 |

|

|

Item 2. |

34 |

|

|

Item 3. |

34 |

|

|

Item 4. |

34 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

35 |

|

|

Item 6. |

37 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

39 |

|

Item 7A. |

65 |

|

|

Item 8. |

66 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

99 |

|

Item 9A. |

99 |

|

|

Item 9B. |

100 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

101 |

|

|

Item 11. |

101 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

101 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

101 |

|

Item 14. |

101 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

102 |

|

|

Item 16. |

102 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements reflect, among other things, our current expectations and anticipated results of operations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, or industry results to differ materially from those expressed or implied by such forward-looking statements. Therefore, any statements contained herein that are not statements of historical fact may be forward-looking statements and should be evaluated as such. Without limiting the foregoing, the words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “should,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Item 1A. – Risk Factors,” of this report. Unless legally required, we assume no obligation to update any such forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information.

2

Planet Fitness, Inc. is a Delaware corporation formed on March 16, 2015. Planet Fitness, Inc. Class A common stock trades on the New York Stock Exchange under the symbol “PLNT.” See Note 1 to the consolidated financial statements included in Part II, Item 8 for additional information about our business organization, our initial public offering (“IPO”) and transactions completed in connection with our IPO.

Our Company

Fitness for everyone

We are one of the largest and fastest-growing franchisors and operators of fitness centers in the United States by number of members and locations, with a highly recognized national brand. Our mission is to enhance people’s lives by providing a high-quality fitness experience in a welcoming, non-intimidating environment, which we call the Judgement Free Zone, where anyone—and we mean anyone—can feel they belong. Our bright, clean stores are typically 20,000 square feet, with a large selection of high-quality, purple and yellow Planet Fitness-branded cardio, circuit- and weight-training equipment and friendly staff trainers who offer unlimited free fitness instruction to all our members in small groups through our PE@PF program. We offer this differentiated fitness experience at only $10 per month for our standard membership. This exceptional value proposition is designed to appeal to a broad population, including occasional gym users and the approximately 80% of the U.S. and Canadian populations over age 14 who are not gym members, particularly those who find the traditional fitness club setting intimidating and expensive. We and our franchisees fiercely protect Planet Fitness’ community atmosphere—a place where you do not need to be fit before joining and where progress toward achieving your fitness goals (big or small) is supported and applauded by our staff and fellow members.

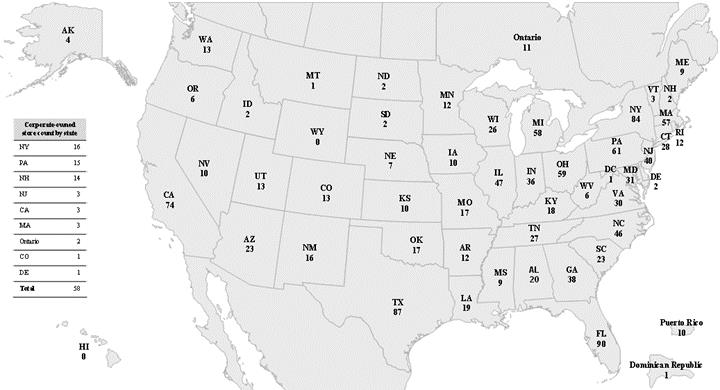

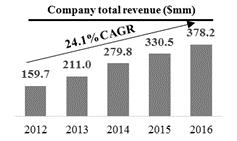

Our judgement-free approach to fitness and exceptional value proposition have enabled us to grow our revenues to $378.2 million in 2016 and to become an industry leader with $1.9 billion in system-wide sales during 2016 (which we define as monthly dues and annual fees billed by us and our franchisees), and approximately 8.9 million members and 1,313 stores in 48 states, the District of Columbia, Puerto Rico, Canada and the Dominican Republic as of December 31, 2016. System-wide sales for 2016 include $1.8 billion attributable to franchisee-owned stores, from which we generate royalty revenue, and $102.0 million attributable to our corporate-owned stores. Of our 1,313 stores, 1,255 are franchised and 58 are corporate-owned. Our stores are successful in a wide range of geographies and demographics. According to internal and third-party analysis, we believe we have the opportunity to grow our store count to over 4,000 stores in the U.S. alone. Under signed area development agreements (“ADAs”) as of December 31, 2016, our franchisees have committed to open more than 1,000 additional stores.

In 2016, our corporate-owned stores had segment EBITDA margin of 39.0% and had average unit volumes (“AUVs”) of approximately $1.8 million with four-wall EBITDA margins (an assessment of store-level profitability which includes local and national advertising expense) of approximately 40%, or approximately 35% after applying the 5% royalty rate, to be comparable to a franchise store, under our current franchise agreement. Based on a historical survey of franchisees, we believe that, on average, our franchise stores achieve four-wall EBITDA margins in line with these corporate-owned store EBITDA margins. Our strong member value proposition has also driven growth throughout a variety of economic cycles and conditions. For a reconciliation of segment EBITDA margin to four-wall EBITDA margin for corporate-owned stores, see “Management’s Discussion and Analysis of Results of Operations and Financial Condition.”

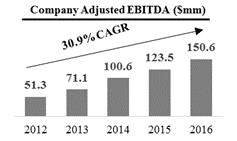

Our significant growth is reflected in:

|

• |

1,313 stores as of December 31, 2016, compared to 606 as of December 31, 2012, reflecting a compound annual growth rate (“CAGR”) of 21.3%; |

|

• |

8.9 million members as of December 31, 2016, compared to 3.7 million as of December 31, 2012, reflecting a CAGR of 24.2%; |

|

• |

2016 system-wide sales of $1.9 billion, reflecting a CAGR of 28.0%, or increase of $1.2 billion, since 2012 |

|

• |

2016 total revenue of $378.2 million, reflecting a CAGR of 24.1%, or increase of $218.6 million, since 2012, of which 2.1% is attributable to revenues from corporate-owned stores acquired from franchisees since 2012; |

|

• |

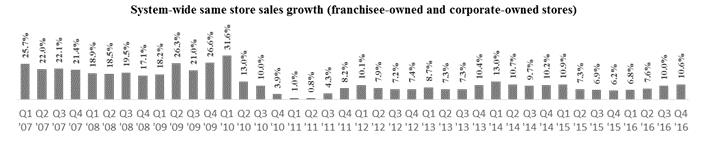

40 consecutive quarters of system-wide same store sales growth (which we define as year-over-year growth solely of monthly dues from stores that have been open and for which membership dues have been billed for longer than 12 months); |

|

• |

2016 net income of $71.2 million, reflecting a CAGR of 29.4%, or increase of $45.8 million, since 2012. Our historical results, prior to our initial public offering, benefit from insignificant income taxes due to our status as a pass-through entity for U.S. federal income tax purposes, and we anticipate future results will not be comparable to periods prior to our IPO as our income attributable to Planet Fitness, Inc. is now subject to U.S. federal and state taxes; |

|

• |

2016 Adjusted EBITDA of $150.6 million, reflecting a CAGR of 30.9%, or increase of $99.3 million, since 2012; and |

|

• |

2016 Adjusted net income of $67.6 million compared to $53.2 million in 2015, an increase of 26.9%. |

3

For a discussion of Adjusted EBITDA and Adjusted net income and a reconciliation of Adjusted EBITDA and Adjusted net income to net income, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” For a discussion of same store sales and the effect of a new point-of-sale and billing system implemented in early 2015, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—How we assess the performance of our business.”

The world judges. We don’t.

We believe our approach to fitness is revolutionizing the industry by bringing fitness to a large, previously underserved segment of the population. Our differentiated member experience is driven by three key elements:

|

• |

Judgement Free Zone: We believe every member should feel accepted and respected when they walk into a Planet Fitness. Our stores provide a Judgement Free Zone where members of all fitness levels can enjoy a non-intimidating environment. Our “come as you are” approach has fostered a strong sense of community among our members, allowing them not only to feel comfortable as they work toward their fitness goals but also to encourage others to do the same. The removal of heavy free weights reinforces our Judgement Free Zone by discouraging what we call “Lunk” behavior, such as dropping weights and grunting, that can be intimidating to new and occasional gym users. In addition, to help maintain our welcoming, judgement-free environment, each store has a purple and yellow branded “Lunk” alarm on the wall that staff occasionally rings as a light-hearted reminder of our policies. |

|

• |

Distinct store experience: Our bright, clean, large-format stores offer our members a selection of high-quality, purple and yellow Planet Fitness-branded cardio, circuit- and weight-training equipment that is commonly used by first-time and occasional gym users. Because our stores are typically 20,000 square feet and we do not offer non-essential amenities such as group exercise classes, pools, day care centers and juice bars, we have more space for the equipment our members do use, and we have not needed to impose time limits on our cardio machines. |

4

|

to attract new members. Our PF Black Card members also have access to exclusive areas in our stores that provide amenities such as water massage beds, massage chairs, tanning equipment and more. |

Our differentiated approach to fitness has allowed us to create an attractive franchise model that is both profitable and scalable. We recognize that our success depends on a shared passion with our franchisees for providing a distinctive store experience based on a judgement-free environment and an exceptional value for our members. We enhance the attractiveness of our streamlined, easy-to-operate franchise model by providing franchisees with extensive operational support relating to site selection and development, marketing and training. We also take a highly collaborative, teamwork approach to our relationship with franchisees, as captured by our motto “One Team, One Planet.” The strength of our brand and the attractiveness of our franchise model are evidenced by the fact that over 90% of our new stores in 2016 were opened by our existing franchisee base.

Our competitive strengths

We attribute our success to the following strengths:

|

• |

Market leader with differentiated member experience, nationally recognized brand and scale advantage. We believe we are the largest operator of fitness centers in the U.S. by number of members, with approximately 8.9 million members as of December 31, 2016. Our franchisee-owned and corporate-owned stores generated $1.9 billion in system-wide sales during 2016. Through our differentiated member experience, nationally recognized brand and scale advantage, we will continue to deliver a compelling value proposition to our members and our franchisees and, we believe, grow our store and total membership base. |

|

|

• |

Differentiated member experience. We seek to provide our members with a high-quality fitness experience in a non-intimidating, judgement-free environment at an exceptional value. We have a dedicated Brand Excellence team that seeks to ensure that all our franchise stores uphold our brand standards and deliver a consistent Planet Fitness member experience in every store. |

|

|

• |

Nationally recognized brand. We have developed a highly relatable and recognized brand that emphasizes our focus on providing our members with a judgement-free environment. We do so through fun and memorable marketing campaigns and in-store signage that highlights the judgement people face in their everyday lives and how at Planet Fitness, they can be free to be themselves. As a result, we have among the highest aided and unaided brand awareness scores in the U.S. fitness industry, according to our Brand Health research, an ongoing a third-party consumer study that we have executed bi-annually. Our brand strength also helps our franchisees attract members, with new stores in 2016 signing up an average of more than 1,300 members even before opening their doors. |

|

|

• |

Scale advantage. Our scale provides several competitive advantages, including enhanced purchasing power with our fitness equipment and other suppliers and the ability to attract high-quality franchisee partners. In addition, we estimate that our large U.S. national advertising fund, funded by franchisees and us, together with our requirement that franchisees generally spend 5 to 7% of their monthly membership dues on local advertising, have enabled us and our franchisees to spend over $350 million since 2011 on marketing to drive consumer brand awareness. |

|

• |

Exceptional value proposition that appeals to a broad member demographic. We offer a high-quality and consistent fitness experience throughout our entire store base at low monthly membership dues. Combined with our non-intimidating and welcoming environment, we are able to attract a broad member demographic based on age, household income, gender and ethnicity. Our member base is over 50% female and our members come from both high- and low-income households. Our broad appeal and ability to attract occasional and first-time gym users enable us to continue to target a large segment of the population in a variety of markets and geographies across North America, including Puerto Rico and the Dominican Republic. |

|

• |

Strong store-level economics. Our store model is designed to generate attractive four-wall EBITDA margins, strong free cash flow and high returns on invested capital for both our corporate-owned and franchise stores. Average four-wall EBITDA margins for our corporate-owned stores have increased significantly since 2012, driven by higher average members per store as well as a higher percentage of PF Black Card members, which leverage our relatively fixed costs. In 2016, our corporate-owned stores had segment EBITDA margin of 39.0% and had AUVs of approximately $1.8 million with four-wall EBITDA margins of approximately 40%, or approximately 35% after applying the 5% royalty rate, to be comparable to a franchise store, under our current franchise agreement. Based on a historical survey of franchisees, we believe that our franchise stores achieve four-wall EBITDA margins in line with these corporate-owned store EBITDA margins. We believe that our strong store-level economics are important to our ability to attract and retain successful franchisees and grow our store base. |

5

|

• |

Predictable and recurring revenue streams with high cash flow conversion. Our business model provides us with predictable and recurring revenue streams. In 2016, over 90% of both our corporate-owned store and franchise revenues consisted of recurring revenue streams, which include royalties, vendor commissions, monthly dues and annual fees. In addition, our franchisees are obligated to purchase fitness equipment from us or our required vendor for their new stores and to replace this equipment every four to seven years. As a result, these “equip” and “re-equip” requirements create a predictable and growing revenue stream as our franchisees open new stores under their ADAs. By re-investing in stores, we and our franchisees maintain and enhance our member experience. Our predictable and recurring revenue streams, combined with our attractive margins and minimal capital requirements, result in high cash flow conversion and increased capacity to invest in future growth initiatives. |

|

• |

Proven, experienced management team driving a strong culture. Our strategic vision and unique culture have been developed and fostered by our senior management team under the stewardship of Chief Executive Officer, Chris Rondeau. Mr. Rondeau has been with Planet Fitness for over 20 years and helped develop the Planet Fitness business model and brand elements that give us our distinct personality and spirited culture. Dorvin Lively, our Chief Financial Officer, brings valuable expertise from over 35 years of corporate finance experience with companies such as RadioShack and Ace Hardware, and from the initial public offering of Maidenform Brands. We have assembled a management team that shares our passion for “fitness for everyone” and has extensive experience across a broad range of disciplines, including retail, franchising, finance, consumer marketing, brand development and information technology. We believe our senior management team is a key driver of our success and has positioned us well to execute our long-term growth strategy. |

Our growth strategies

We believe there are significant opportunities to grow our brand awareness, increase our revenues and profitability and deliver shareholder value by executing on the following strategies:

|

• |

Continue to grow our store base across a broad range of markets. We have grown our store count over the last five years, expanding from 606 stores as of December 31, 2012 to 1,313 stores as of December 31, 2016. As of December 31, 2016, our franchisees have signed ADAs to open more than 1,000 additional stores over the next five years, including approximately 500 over the next three years. Because our stores are successful across a wide range of geographies and demographics with varying population densities, we believe that our high level of brand awareness and low per capita penetration outside of our original Northeast market create a significant opportunity to open new Planet Fitness stores. Based on our internal and third-party analysis, we believe we have the potential to grow our store base to over 4,000 stores in the U.S. alone. |

|

• |

Drive revenue growth and system-wide same store sales. Because we provide a high-quality, affordable, non-intimidating fitness experience that is designed for first-time and occasional gym users, we have achieved positive system-wide same store sales growth in each of the past 40 quarters. We expect to continue to grow system-wide same store sales primarily by: |

|

|

• |

Attracting new members to existing Planet Fitness stores. As the U.S. and Canadian populations continue to focus on health and wellness, we believe we are well-positioned to capture a disproportionate share of the population given our appeal to first-time and occasional gym users. In addition, because our stores offer a large, focused selection of equipment geared toward first-time and occasional gym users, we are able to service higher member volumes without sacrificing the member experience. We have also continued to evolve our offerings to appeal to our target member base, such as the introduction of our 30-minute express workout area, as well as new functional accessories (e.g., medicine balls, stability balls, kettlebells, etc.) and fitness programming to accompany our equipment. |

|

|

• |

Increasing mix of PF Black Card memberships by enhancing value and member experience. We expect to drive sales by continuing to convert our existing members with standard membership dues at $10 per month to our premium PF Black Card membership with dues at approximately $19.99 per month as well as attracting new members to join at the PF Black Card level. We encourage this upgrade by continuing to enhance the value of our PF Black Card benefits through additional in-store amenities, such as hydro-massage beds, and affinity partnerships for discounts and promotions. Since 2012, our PF Black Card members as a percentage of total membership has increased from 45% in 2012 to 59% in 2016, and our average monthly dues per member have increased from $14.49 to $15.79 over the same period. |

6

We may also explore other future revenue opportunities, such as optimizing member pricing and fees, offering new merchandise and services inside and outside our stores, and securing affinity and other corporate partnerships.

|

• |

Increase brand awareness to drive growth. We plan to continue to increase our strong brand awareness by leveraging significant marketing expenditures by our franchisees and us, which we believe will result in increasing membership in new and existing stores and continue to attract high-quality franchisee partners. Under our current franchise agreement, franchisees are required to contribute 2% of their monthly membership dues to our National Advertising Fund (“NAF”), from which we spent over $31 million in 2016 alone to support our national marketing campaigns, our social media platforms and the development of local advertising materials. Under our current franchise agreement, franchisees are also required to spend 7% of their monthly membership dues on local advertising. We expect both our NAF and local advertising spending to grow as our membership grows. |

|

• |

Continue to expand royalties from increases in average royalty rate and new franchisees. While our current franchise agreement stipulates monthly royalty rates of 5% of monthly dues and annual membership fees, only 52% of our stores are paying royalties at the current franchise agreement rate, primarily due to lower rates in historical agreements. As new franchisees enter our system and, generally, as current franchisees open new stores or renew their existing franchise agreements at the current royalty rate, our average system-wide royalty rate will increase. In 2016, our average royalty rate was 3.66% compared to 2.05% in 2012. In addition to rising average royalty rates, total royalty revenue will continue to grow as we expand our franchise store base and increase franchise same store sales. |

|

• |

Grow sales from fitness equipment and related services. Our franchisees are contractually obligated to purchase fitness equipment from us, and in international markets, from our required vendors. Due to our scale and negotiating power, we believe we offer competitive pricing for high-quality, purple and yellow Planet Fitness-branded fitness equipment. We expect our equipment sales to grow as our U.S. franchisees open new stores. In international markets, we earn a commission on the sale of equipment by our required vendors to franchisee-owned stores. Additionally, all franchisees are required to replace their existing equipment with new equipment every four to seven years. As the number of franchise stores continues to increase and existing franchise stores continue to mature, we anticipate incremental growth in revenue related to the sale of equipment to U.S. franchisees and commissions on the sale of equipment to international franchisees. In addition, we believe that regularly refreshing equipment helps our franchise stores maintain a consistent, high-quality fitness experience and is one of the contributing factors that drives new member growth. |

Our industry

Due to our unique positioning to a broader demographic, we believe Planet Fitness has an addressable market that is significantly larger than the traditional health club industry. We view our addressable market as approximately 255 million people, representing the U.S. population over 14 years of age. We compete broadly for consumer discretionary spending related to leisure, sports, entertainment and other non-fitness activities in addition to the traditional health club market.

According to the International Health, Racquet & Sportsclub Association (“IHRSA”), the U.S. health club industry generated approximately $25.8 billion in revenue in 2015. The industry is highly fragmented, with 36,130 clubs across the U.S. serving approximately 55 million members, according to IHRSA. In 2015, the U.S. health club industry grew by 4.8% in number of units and 2.2% in number of members compared to Planet Fitness, which grew by 22.4% and 20.0%, respectively. IHRSA data is not yet available for 2016, but Planet Fitness grew its number of stores by 16.8% and its number of members by 22.3% in 2016. Over the next five years, industry sources project that U.S. health club industry revenues will grow at an annualized rate of approximately 3%, primarily attributed to an increase in discretionary spending coupled with continued consumer awareness and public initiatives on the health benefits of exercise. We believe we are well-positioned to capitalize on these trends, and our impressive growth reinforces our distinct approach to fitness and broad demographic appeal.

Our brand philosophy

We are a brand built on passion and the belief that first-time gym users and casual fitness members can achieve their personal wellness goals in a non-intimidating, judgement-free environment. We have become a nationally recognized consumer brand that stands for the environment, value and quality we provide our members.

The Judgement Free Zone. Planet Fitness is the home of the Judgement Free Zone. It is a place where people of all fitness levels can feel comfortable working out at their own pace, feel supported in their efforts and not feel intimidated by pushy salespeople or other members who may ruin their fitness experience.

All This for Only That. Planet Fitness monthly membership dues typically range from only $10 to $19.99 in the U.S. We pride ourselves on providing a high-quality experience at an exceptional value, not an “economy” fitness experience.

No Gymtimidation. Gymtimidation is any behavior that makes others feel intimidated or uncomfortable in our stores. Our policy is simple: Planet Fitness is an environment where members can relax, go at their own pace and be themselves without ever having to worry about being judged. Behaviors such as grunting, dropping weights or judging others are not allowed in our stores.

7

No Lunks. Lunks are people who Gymtimidate. To help maintain our judgement-free environment, each store has a purple and yellow branded “Lunk” alarm on the wall that our staff occasionally rings as a light-hearted, gentle reminder of our policies.

You Belong. We do a lot of little things to make members feel like part of our community—like saying hello and goodbye to everyone who enters our stores, providing Tootsie Rolls at the front desk so that our staff has another opportunity to engage with members, and other membership appreciation gestures such as monthly Pizza Mondays and Bagel Tuesdays at no cost to our members.

Planet of Triumphs. All of our members are working toward their goals—from a single push-up to making it to Planet Fitness twice in a week to losing hundreds of pounds. No matter what size the goal, we believe that all of these accomplishments deserve to be celebrated. Planet of Triumphs (www.PlanetofTriumphs.com) is an elevating, inspiring, 100% Judgement Free social community of real members where all stories are welcome. Planet of Triumphs provides an online platform for members to recognize their triumphs (big and small), share their stories and encourage others, while spotlighting our unique brand belief that everyone belongs.

Membership

We make it simple for members to join, whether online or in-store—no pushy sales tactics, no pressure and no complicated rate structures. Our corporate store staff is not paid commissions based on membership sales but rather have the opportunity to earn a monthly bonus based primarily on store cleanliness, and we urge our franchisees to follow our lead. Our regional managers review our corporate stores multiple times per month for quality control, including generally one visit per month during which they evaluate store cleanliness based upon internally established criteria from which the monthly bonus is derived. Our members generally pay the following amounts (or an equivalent amount in the store’s local currency):

|

• |

monthly membership dues of only $10 for our standard membership or, approximately $19.99 for PF Black Card members; |

|

• |

current standard annual fees of approximately $39; and |

|

• |

enrollment fees of approximately $0 to $59. |

Belonging to a Planet Fitness store has perks whether members select the standard membership or the premium PF Black Card membership. Every member gets to take part in Pizza Mondays and Bagel Tuesdays and gets free, unlimited fitness instruction, plus a T-shirt or other Planet Fitness items. Our PF Black Card members also have the right to reciprocal use of all Planet Fitness stores, can bring a friend with them each time they work out, and have access to massage beds and chairs and tanning, among other benefits. PF Black Card benefits extend beyond our store as well, with exclusive specials and discount offers from third-party retail partners. While some of our memberships require a cancellation fee, we offer, and require our franchisees to offer, a non-committal membership option.

As of December 31, 2016, we had approximately 8.9 million members. We utilize electronic funds transfer (“EFT”) as our primary method of collecting monthly dues and annual membership fees. Over 80% of membership fee payments to our corporate-owned and franchise stores are collected via Automated Clearing House (“ACH”) direct debit. We believe there are certain advantages to receiving a higher concentration of ACH payments, as compared to credit cards payments, including less frequent expiration of billing information and reduced exposure to subjective chargeback or dispute claims and fees. Due to our scale and negotiating power, we believe that our third party payment processors offer a competitive bundle of transaction pricing and support services to our franchisees while facilitating revenue collection by us.

8

We had 1,313 stores system-wide as of December 31, 2016, of which 1,255 were franchised and 58 were corporate-owned, located in 48 states, the District of Columbia, Puerto Rico, Canada and the Dominican Republic. The map below shows our franchisee-owned stores by location, and the accompanying table shows our corporate-owned stores by location. Under signed ADAs, as of December 31, 2016, franchisees have committed to open more than 1,000 additional stores.

|

Franchisee-owned store count by location

|

Our format

Many traditional gyms include expensive add-ons such as pools, group exercise rooms, daycare facilities and juice bars that require additional maintenance expense and staffing. We have removed these unnecessary and expense-adding facilities and services and replaced them with additional cardio and strength equipment, which we believe allows us to serve more members without imposing time limits on equipment use. We believe our streamlined offerings appeal to the core needs of most gym users, especially first-time or occasional gym users.

Our stores are designed and outfitted to match our brand philosophy, with bright, bold purple and yellow color schemes and purple and yellow Planet Fitness-branded equipment and amenities. Our typical store is 20,000 square feet in single or multi-level retail space. Our stores generally include at least 75 to 100 pieces of co-branded cardio equipment, free weights, strength machines, a 30-minute circuit workout area, a small retail area and a drink cooler. For our PF Black Card members, our stores also generally feature a PF Black Card spa area with total body enhancement machines, massage beds or chairs and tanning.

Store model

Our store model is designed to generate attractive four-wall EBITDA margins, strong free cash flow and high returns on invested capital for both our corporate-owned and franchise stores. Based on a historical survey of franchisees and management estimates, we believe that our franchise stores achieve store-level profitability in line with our corporate-owned store base. The stores included in this survey represent those stores that voluntarily disclosed such information in response to our request, and we believe this information reflects a representative sample of franchisees based on the franchisee groups and geographic areas represented by these stores. Our average four-wall EBITDA margins for our corporate-owned stores have increased significantly since 2012, driven by higher average members per store as well as a higher percentage of PF Black Card members, which leverages our fixed costs. In 2016, our corporate-owned stores had segment EBITDA margin of 39.0% and had AUVs of approximately $1.8 million with four-wall EBITDA margins of approximately 40%, or approximately 35% after applying the 5% royalty rate, to be comparable to a franchise store, under our current franchise agreement. Based on survey data and management analysis, franchisees have historically earned, and we believe can continue to earn, in their second year of operations, on average, a cash-on-cash return on unlevered (i.e., not

9

debt-financed) initial investment greater than 25% after royalties and advertising, which is in line with our corporate-owned stores. A franchisee’s initial investment includes fitness equipment purchased from us (or from our required vendors in the case of our franchisees in international markets) as well as costs for non-fitness equipment and leasehold improvements. The attractiveness of our franchise model is further evidenced by the fact that over 90% of our new stores in 2016 were opened by our existing franchisee base. We believe that our strong store-level economics are important to our ability to attract and retain successful franchisees and grow our store base.

Fitness equipment

We provide our members with high-quality, Planet Fitness-branded fitness equipment from leading suppliers. In order to maintain a consistent experience across our store base, we stipulate specific pieces and quantities of cardio and strength-training equipment and provide general guidelines for layout and placement. Due to our scale, we are able to negotiate competitive pricing and secure extended warranties from our suppliers. As a result, we believe we offer equipment at more attractive pricing than franchisees could otherwise secure on their own.

Leases

We lease all of our corporate-owned stores and our corporate headquarters. Our store leases typically have initial terms of 10 years with two five-year renewal options, exercisable in our discretion. Our corporate headquarters is currently located at 26 Fox Run Road, Newington, New Hampshire and serve as our base of operations for substantially all of our executive management and employees who provide our primary corporate support functions, including finance, legal, marketing, technology, real estate, development and human resources. On October 18, 2016, we executed a lease for our new corporate headquarters at 4 Liberty Lane West, Hampton, New Hampshire, for an initial term of 15 years with one five-year renewal option, exercisable in our discretion. We anticipate moving into our new location prior to July 2017. We have the right to sublease our current corporate headquarters and are marketing the property actively. In the event we do not agree to a sublease, we will have to negotiate a buyout with our current landlord for the remaining term of our lease.

Franchisees own or directly lease from a third-party each Planet Fitness franchise location. We do not own or enter into leases for Planet Fitness franchise stores and generally do not guarantee franchisees’ lease agreements, although we have done so in a few isolated instances.

Franchising

Franchising strategy

We rely heavily on our franchising strategy to develop new Planet Fitness stores, leveraging the ownership of entrepreneurs with specific local market expertise and requiring a relatively minimal capital commitment by us. As of December 31, 2016, there were 1,255 franchised Planet Fitness stores operated by approximately 180 franchisee groups. The majority of our existing franchise operators are multi-unit operators. As of December 31, 2016, 93% of all franchise stores were owned and operated by a franchisee group that owns at least three stores. However, while our largest franchisee owns 63 stores, only 18% of our franchisee groups own more than ten stores. When considering a potential franchisee, we generally evaluate the potential franchisee’s prior experience in franchising or other multi-unit businesses, history in managing profit and loss operations, financial history and available capital and financing. We generally do not permit franchisees to borrow more than 80% of the initial investment for their Planet Fitness business.

Area development agreements

An ADA specifies the number of Planet Fitness stores to be developed by the franchisee in a designated geographic area, and requires the franchisee to meet certain scheduled deadlines for the development and opening of each Planet Fitness store authorized by the ADA. If the franchisee meets those obligations and otherwise complies with the terms of the ADA, we agree not to, during the term of the ADA, operate or franchise new Planet Fitness stores in the designated geographic area. The franchisee must sign a separate franchise agreement with us for each Planet Fitness store developed under an ADA and that franchise agreement governs the franchisee’s right to own and operate the Planet Fitness store.

10

For each franchised Planet Fitness store, we enter into a franchise agreement covering standard terms and conditions. Planet Fitness franchisees are not granted an exclusive area or territory under the franchise agreement. The franchise agreement requires that the franchisee operate the Planet Fitness store at a specific location and in compliance with our standard methods of operation, including providing the services, using the vendors and selling the merchandise that we require (or our required vendors in the case of our franchisees located in international markets). The typical franchise agreement has a 10-year term. Additionally, franchisees must purchase equipment from us and replace the fitness equipment in their stores every four to seven years and periodically refurbish and remodel their stores.

We currently require each franchisee to designate a responsible owner and an approved operator for each Planet Fitness store that will have primary management authority for that store. We require these franchisees to complete our initial and ongoing training programs, including minimum periods of classroom and on-the-job training.

Site selection and approval

Our stores are generally located in free-standing retail buildings or neighborhood shopping centers, and we consider locations in both high- and low-density markets. We seek out locations with (i) high visibility and accessibility, (ii) favorable traffic counts and patterns, (iii) availability of signage, (iv) ample parking or access to public transportation and (v) our targeted demographics. Our site analytics tools provide us with extensive demographic data and analysis that we use to review new and existing sites and markets for our corporate-owned stores and franchisees. We assess population density and drive time, current tenant mix, layout, potential competition and impact on existing Planet Fitness stores and comparative data based upon existing stores—all the way down to optimal ceiling heights and HVAC requirements. Our real estate team meets regularly to review sites for future development and follows a detailed review process to ensure each site aligns with our strategic growth objectives and critical success factors.

We help franchisees select sites and develop facilities in these stores that conform to the physical specifications for a Planet Fitness store. Each franchisee is responsible for selecting a site, but must obtain site approval from us. We primarily learn of new sites in two ways. First, we have a formal site-approval submission process for landlords and franchisees. Each site submitted to us is reviewed by a subcommittee of our real estate team for brand qualifications. Second, we proactively review real estate portfolios for appropriate sites that we may consider for corporate-owned stores or franchisee development, depending upon location. In 2016, we identified and evaluated a total of more than 2,000 sites on this basis.

We are also involved in real estate organizations such as the International Council of Shopping Centers (ICSC), a trade organization for the international shopping center industry. Our membership in ICSC allows us to gather data, meet prospective landlords and further enhance our reputation as a desired tenant for shopping centers.

Design and construction

Once we have approved a franchisee’s site selection, we assist in the design and layout of the store and track the franchisee’s progress from lease signing to grand opening. Franchisees work directly with our franchise support team to track key milestones, coordinate with vendors and make equipment purchases. Certain Planet Fitness brand elements are required to be incorporated into every new store, and we strive for a consistent appearance across all of our stores, emphasizing clean, attractive facilities, including full-size locker rooms, and modern equipment. Franchisees must abide by our standards related to fixtures, finishes and design elements, including distinctive touches such as our “Lunk” alarm. We believe these elements are critical to ensure brand consistency and member experience system-wide.

In 2016, based on a sample of U.S. franchisee data, we believe construction of franchise stores averaged approximately 14 weeks. In addition, based upon this sample of 50 stores across a wide range of U.S. geographies, we estimate that franchisees’ typical unlevered (i.e., not debt-financed) investment in 2016 to open a new store was approximately $1.6 million. This amount includes fitness equipment purchased from us as well as costs for non-fitness equipment and leasehold improvements and is based in part upon data we received from two general contractors that oversaw the construction of the 50 stores in the sample set. Additionally, this amount includes an estimate of other costs that are typically paid by the franchisee and not managed by the general contractor. These amounts can vary significantly depending on a number of factors, including landlord allowances for tenant improvements and construction costs from different geographies.

Franchisee support

We live and breathe the motto One Team, One Planet in our daily interactions with franchisees. Our franchise model is streamlined and easy-to-operate, with efficient staffing and minimal inventory, and is supported by an active, engaged franchise operations system. We provide our franchisees with operational support, marketing materials and training resources. Our strong and long-lasting partnership with our franchisees is reflected in the fact that over 90% of our new stores in 2016 were opened by our existing franchisee base.

11

Training. In 2014, we developed, and continue to update and expand, Planet Fitness University, a comprehensive training resource to help franchisees operate successful stores. Courses are delivered online, and content focuses on customer service, operational policies, brand standards, cleanliness, security awareness, crisis management and vendor product information. We are continually adding and improving the content available on Planet Fitness University as a no-cost service to help enhance training programs for franchisees. Additional training opportunities offered to our franchisees include new owner orientation, operations training and workshops held at Planet Fitness headquarters and in stores across the country as well as through webinars.

Operational support and communication. We believe spending quality time with our franchisees in person is an important opportunity to further strengthen our relationships and share best practices. We have dedicated operations and marketing teams providing ongoing support to franchisees. We are hands on—we often attend franchisees’ presales and grand openings, and we host franchisee meetings each year, known as “PF Huddles.” We also communicate regularly with our entire franchisee base to keep them informed, and we have hosted an Annual Franchise Conference every year that is geared towards franchisees and their operations teams.

We regularly communicate with the franchisee advisory groups described below and send a weekly email communication to all franchisees with timely “news you can use” information related to operations, marketing, financing and equipment. Every month, a franchisee newsletter is sent to all franchisees, which includes a personal letter from our Chief Executive Officer, important updates on the business and benchmarking reports.

Franchisee relations. Because our ability to execute our strategy is dependent upon the strength of our relationships with our franchisees, we maintain an ongoing dialogue and strong relationship with two franchise advisory groups, the Franchise Advisory Council (“FAC”) and the Planet Fitness Independent Franchise Association (“PFIFA”). The FAC includes seven franchisees elected by the franchisee base and numerous committees consisting of approximately 40 franchisees. The FAC and its committees provide feedback and input on major brand initiatives, new product and service introductions, technology initiatives, marketing programs and advertising campaigns. FAC leaders have regular dialogue with our executive team and work closely with us to advise on major initiatives impacting the brand. Our strong culture of working together is the driving force behind all we do, and we refer to our franchisees as “raving FANchisees.” In 2014, in cooperation with us, our franchisees also organized PFIFA. PFIFA assists our franchisees and us in working together to develop brand ideas, streamline legal agreements and provide advice on related topics to franchisees on issues such as succession and estate planning.

Compliance with brand standards—Brand Excellence

We have dedicated Brand Excellence and franchise operations teams focused on ensuring that our franchise stores adhere to brand standards and providing ongoing assistance, training and monitoring to those franchisees that have difficulty meeting those standards. We generally perform a detailed Brand Excellence review on each franchise store within 30 to 60 days of opening, and each franchise store is generally reviewed at least once per year thereafter. In 2016, our teams performed approximately 1,000 franchise store reviews covering all franchise ownership groups.

We review stores based on a wide range of criteria ranging from cleanliness to compliance with signage and layout requirements and operational standards. We record the results of each review in a third-party Planet Fitness-branded software system, which automatically sends a Brand Excellence report to the appropriate franchisee. Results are also available to the franchisee through the Brand Excellence software system, which provides access to regional and international benchmarking data, allowing franchisees to compare overall results among their peers as well as results based upon each criterion. Stores that do not receive a passing score are automatically flagged for follow-up by our team and will generally be reevaluated within 30 to 60 days to ensure all identified issues have been addressed. Our Brand Excellence system also enables franchisees to perform, track and benchmark self-assessments and online member surveys through the Brand Excellence software system.

We also use mystery shoppers to perform anonymous Brand Excellence reviews of franchise stores. We generally select franchise stores for review randomly but also target underperforming stores and stores that have not performed well in Brand Excellence reviews.

Marketing

Marketing strategy

Our marketing strategy is anchored by our key brand differentiators—the Judgement Free Zone, our exceptional value and our high-quality experience. We are well known for our memorable and creative advertising, which not only drives membership sales, but also showcases our brand philosophy, humor and innovation in the industry. We see Planet Fitness as a community gathering place, and the heart of our marketing strategy is to create a welcoming community for our members.

12

National advertising. We support our franchisees both at a national and local level. We manage the U.S. NAF and Canadian advertising fund for franchisees and corporate-owned stores, with the goals of generating national awareness through national advertising and media partnerships, developing and maintaining creative assets to support local sale periods throughout the year, and building and supporting the Planet Fitness community via digital and social media. Our current U.S. and Canadian franchise agreement requires franchisees to contribute 2% of their monthly EFT to the NAF and Canadian advertising fund, respectively. Since the NAF was founded in September 2011, it has enabled us to spend approximately $107 million to increase national brand awareness, including over $31 million in 2016. We believe this is a powerful marketing tool as it allows us to increase brand awareness in new and existing markets.

Local marketing. Our current franchise agreement requires franchisees to spend 7% of their monthly EFT on local marketing to support branding efforts and promotional sale periods throughout the year. In situations where multiple ownership groups exist in a geographic area, we have the ability to require franchisees to form or join regional marketing cooperatives to maximize the impact of their marketing spending. Our corporate-owned stores contribute to, and participate in, regional marketing cooperatives with franchisees where practical. All franchise stores are supported by our dedicated franchisee marketing team, which provides guidance, tracking, measurement and advice on best practices. Franchisees spend their marketing dollars in a variety of ways to promote business at their stores on a local level. These methods typically include media vehicles that are effective on a local level, including direct mail, outdoor (including billboards), television, radio and digital advertisements and local partnerships and sponsorships.

Media partnerships

Given our scale and marketing resources through our national advertising fund, we have aligned ourselves with high-profile media partners who have helped to extend the reach of our brand. We recognized the value of these media partnerships through our five-year partnership with “The Biggest Loser,” a popular television show running on NBC where competitors strive to lose weight and learn to live a healthier lifestyle. We showcased the power of our Judgement Free Zone by enabling everyday people (including those who may have never considered joining a gym before) to achieve healthier lifestyles. For the past two years, we have been the presenting sponsor of “Dick Clark’s New Year’s Rockin’ Eve with Ryan Seacrest.” This has allowed us to showcase the Planet Fitness brand and our judgement-free philosophy to over a billion people worldwide each year.

Judgement Free Generation

The Judgement Free Generation is Planet Fitness’ philanthropic initiative designed to combat the judgement and bullying faced by today’s youth by creating a culture of kindness and encouragement. With our Judgement Free Zone and No Gymtimidation principles as a solid foundation, The Judgement Free Generation aims to empower a generation to grow up contributing to a more judgement free planet— a place where everyone feels accepted and like they belong.

We have partnered with Boys & Girls Clubs of America and STOMP Out Bullying, to make a meaningful impact on the lives of today's youth. Together with our franchisees, Planet Fitness has donated more than $1.4 million to support anti-bullying, pro-kindness initiatives.

Competition

In a broad sense, because many of our members are first-time or occasional gym users, we believe we compete with both fitness and non-fitness consumer discretionary spending alternatives for members’ and prospective members’ time and discretionary resources.

To a great extent, we also compete with other industry participants, including:

|

• |

other fitness centers; |

|

• |

recreational facilities established by non-profit organizations such as YMCAs and by businesses for their employees; |

|

• |

private studios and other boutique fitness offerings; |

|

• |

racquet, tennis and other athletic clubs; |

|

• |

amenity and condominium/apartment clubs; |

|

• |

country clubs; |

|

• |

online personal training and fitness coaching; |

|

• |

the home-use fitness equipment industry; |

|

• |

local tanning salons; and |

|

• |

businesses offering similar services. |

13

The health club industry is highly competitive and fragmented, and the number, size and strength of competitors vary by region. Some of our competitors have name recognition in their respective countries or an established presence in local markets, and some are established in markets in which we have existing stores or intend to locate new stores. These risks are more significant internationally, where we have a limited number of stores and limited brand recognition.

We compete primarily based upon the membership value proposition we are able to offer due to our significant economies of scale, high-quality fitness experience, judgement-free atmosphere and superior customer service, all at an exceptional value, which we believe differentiates us from our competitors.

Our competition continues to increase as we continue to expand into new markets and add stores in existing markets. See also “Risk Factors—Risks related to our business and industry—The high level of competition in the health and fitness industry could materially and adversely affect our business.”

Suppliers

Franchisees are required to purchase fitness equipment from us (or our required vendors in the case of franchisees located in international markets) and are required to purchase various other items from vendors that we approve. We sell equipment purchased from third-party equipment manufacturers to franchise stores in the U.S. We also have one approved supplier of tanning beds, one approved supplier of massage beds and chairs, and various approved suppliers of non-fitness equipment and miscellaneous items such as paper towels and t-shirts. These vendors arrange for delivery of products and services directly to franchise stores. From time to time, we re-evaluate our supply relationships to ensure we obtain competitive pricing and high-quality equipment and other items.

Employees

As of December 31, 2016, we employed 754 employees at our corporate-owned stores and 209 employees at our corporate headquarters located at 26 Fox Run Road, Newington, New Hampshire. None of our employees are represented by labor unions, and we believe we have an excellent relationship with our employees.

Planet Fitness franchises are independently owned and operated businesses. As such, employees of our franchisees are not employees of the Company.

Information technology and systems

All stores use a computerized, third-party hosted store management system to process new in-store memberships, bill members, update member information, check-in members, process point of sale transactions as well as track and analyze sales, membership statistics, cross-store utilization, member tenure, amenity usage, billing performance and demographic profiles by member. Our websites are hosted by third parties, and we also rely on third-party vendors for related functions such as our system for processing and integrating new online memberships, updating member information and making online payments. We believe these systems are scalable to support our growth plans.

Our back-office computer systems are comprised of a variety of technologies designed to assist in the management and analysis of our revenues, costs and key operational metrics as well as support the daily operations of our headquarters. These include third-party hosted systems that support our real estate and construction processes, a third-party hosted financial system, a third-party hosted data warehouse and business intelligence system to consolidate multiple data sources for reporting, advanced analysis, and financial analysis and forecasting, a third-party hosted payroll system, on premise telephony systems and a third-party hosted call center software solution to manage and track member-related requests.

We also provide our franchisees access to a web-based, third-party hosted custom franchise management system to receive informational notices, operational resources and updates, training materials and other franchisee communications. In 2016, we continued our multi-phased project that we started in 2015 to replace our existing franchise management system and consolidate several back-office systems, onto a third-party hosted platform to drive greater cross-system integration and efficiency and provide a scalable platform to support our growth plans. We made substantial progress throughout 2016 on this project, further automating and consolidating franchise support processes, and expect to continue investing resources to complete the initial phase of this project in 2017. We expect that we will continue to have smaller, focused projects for our franchise management system to support the changing needs of our business.

We recognize the value of enhancing and extending the uses of information technology in virtually every area of our business. Our information technology strategy is aligned to support our business strategy and operating plans. We maintain an ongoing comprehensive multi-year program to replace or upgrade key systems, enhance security and optimize their performance.

14

We own many registered trademarks and service marks in the U.S. and in other countries, including “Planet Fitness,” “Judgement Free Zone,” “PE@PF,” “No Lunks,” “PF Black Card,” “No Gymtimidation,” “You Belong,” “Judgement Free Generation” and various other marks. We believe the Planet Fitness name and the many distinctive marks associated with it are of significant value and are very important to our business. Accordingly, as a general policy, we pursue registration of our marks in select international jurisdictions, monitor the use of our marks in the U.S. and internationally and vigorously oppose any unauthorized use of the marks.

We license the use of our marks to franchisees, third-party vendors and others through franchise agreements, vendor agreements and licensing agreements. These agreements restrict third parties’ activities with respect to use of the marks and impose brand standards requirements. We require licensees to inform us of any potential infringement of the marks.

We register some of our copyrighted material and otherwise rely on common law protection of our copyrighted works. Such copyrighted materials are not material to our business.

We also license some intellectual property from third parties for use in our stores but such licenses are not material to our business.

Government regulation

We and our franchisees are subject to various federal, state, provincial and local laws and regulations affecting our business.

We are subject to the FTC Franchise Rule promulgated by the FTC that regulates the offer and sale of franchises in the U.S. and its territories (including Puerto Rico) and requires us to provide to all prospective franchisees certain mandatory disclosure in a franchise disclosure document (“FDD”). In addition, we are subject to state franchise sales laws in approximately 14 states that regulate the offer and sale of franchises by requiring us to make a franchise filing or obtain franchise registration prior to our making any offer or sale of a franchise in those states and to provide a FDD to prospective franchisees in accordance with such laws.

We are subject to franchise sales laws in six provinces in Canada that regulate the offer and sale of franchises by requiring us to provide a FDD in a prescribed format to prospective franchisees in accordance with such laws, and that regulate certain aspects of the franchise relationship. We are also subject to franchise relationship laws in over 20 states that regulate many aspects of the franchisor-franchisee relationship, including renewals and terminations of franchise agreements, franchise transfers, the applicable law and venue in which franchise disputes must be resolved, discrimination, and franchisees’ right to associate, among others. In addition, we and our franchisees may also be subject to laws in other foreign countries (including the Dominican Republic) where we or they do business.

We and our franchisees are also subject to the U.S. Fair Labor Standards Act of 1938, as amended, similar state laws in certain jurisdictions, and various other laws in the U.S. and Canada governing such matters as minimum-wage requirements, overtime and other working conditions. A significant number of our and our franchisees’ employees are paid at rates related to the U.S. federal or state minimum wage, and past increases in the U.S. federal and/or state minimum wage have increased labor costs, as would future increases.

Our and our franchisees’ operations and properties are subject to extensive U.S. and Canadian federal, state, provincial and local laws and regulations, including those relating to environmental, building and zoning requirements. Our and our franchisees’ development of properties depends to a significant extent on the selection and acquisition of suitable sites, which are subject to zoning, land use, environmental, traffic and other regulations and requirements.

We and our franchisees are responsible at stores we each operate for compliance with U.S. state laws and Canadian provincial laws that regulate the relationship between health clubs and their members. Nearly all states and provinces have consumer protection regulations that limit the collection of monthly membership dues prior to opening, require certain disclosures of pricing information, mandate the maximum length of contracts and “cooling off” periods for members (after the purchase of a membership), set escrow and bond requirements for health clubs, govern member rights in the event of a member relocation or disability, provide for specific member rights when a health club closes or relocates, or preclude automatic membership renewals.

We and our franchisees primarily accept payments for our memberships through electronic fund transfers from members’ bank accounts, and, therefore, we and our franchisees are subject to federal, state and provincial laws legislation and certification requirements, including the Electronic Funds Transfer Act. Some states, such as New York, Massachusetts and Tennessee, have passed or have considered legislation requiring gyms and health clubs to offer a prepaid membership option at all times and/or limit the duration for which gym memberships can auto-renew through EFT payments, if at all. Our business relies heavily on the fact that our memberships continue on a month-to-month basis after the completion of any initial term requirements, and compliance with these laws, regulations, and similar requirements may be onerous and expensive, and variances and inconsistencies from jurisdiction to jurisdiction may further increase the cost of compliance and doing business. States that have such health club statutes provide harsh penalties for violations, including membership contracts being void or voidable.

15

Additionally, the collection, maintenance, use, disclosure and disposal of individually identifiable data by our, or our franchisees’, businesses are regulated at the federal, state and provincial levels as well as by certain financial industry groups, such as the Payment Card Industry, Security Standards Council, the National Automated Clearing House Association (“NACHA”) and the Canadian Payments Association. Federal, state, provincial and financial industry groups may also consider from time to time new privacy and security requirements that may apply to our businesses and may impose further restrictions on our collection, disclosure and use of individually identifiable information that are housed in one or more of our databases.

Many of the states and provinces where we and our franchisees operate stores have health and safety regulations that apply to health clubs and other facilities that offer indoor tanning services. In addition, U.S. federal healthcare legislation signed into law in March 2010 contains a 10% excise tax on indoor tanning services. Under the rule promulgated by the IRS imposing the tax, a portion of the cost of memberships that include access to our tanning services are subject to the tax.

Our organizational structure

Planet Fitness, Inc. is a holding company, and its principal asset is an equity interest in the membership units (“Holdings Units”) in Pla-Fit Holdings, LLC (“Pla-Fit Holdings”).

We are the sole managing member of Pla-Fit Holdings. We operate and control all of the business and affairs of Pla-Fit Holdings, and we hold 100% of the voting interest in Pla-Fit Holdings. As a result, we consolidate Pla-Fit Holdings’ financial results and report a non-controlling interest related to the Holdings Units not owned by us. See Note 1 to the consolidated financial statements included in Part II, Item 8 for more information.

Available information

Our website address is www.planetfitness.com, and our investor relations website is located at http://investor.planetfitness.com. Information on our website is not incorporated by reference herein. Copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and our Proxy Statements for our annual meetings of shareholders, and any amendments to those reports, as well as Section 16 reports filed by our insiders, are available free of charge on our website as soon as reasonably practicable after we file the reports with, or furnish the reports to, the Securities and Exchange Commission (the “SEC”). Our SEC filings are also available for reading and copying at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (http://www.sec.gov) containing reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

16

We could be adversely impacted by various risks and uncertainties. If any of these risks actually occur, our business, financial condition, operating results, cash flow and prospects may be materially and adversely affected. As a result, the trading price of our Class A common stock could decline.

Risks related to our business and industry

Our financial results are affected by the operating and financial results of and our relationships with our franchisees.

A substantial portion of our revenues come from royalties, which are generally based on a percentage of monthly membership dues and annual fees at our franchise stores, other fees and commissions generated from activities associated with our franchisees and equipment sales to our franchisees. As a result, our financial results are largely dependent upon the operational and financial results of our franchisees. As of December 31, 2016, we had approximately 180 franchisee groups operating 1,255 stores. Negative economic conditions, including inflation, increased unemployment levels and the effect of decreased consumer confidence or changes in consumer behavior, could materially harm our franchisees’ financial condition, which would cause our royalty and other revenues to decline and materially and adversely affect our results of operations and financial condition as a result. In addition, if our franchisees fail to renew their franchise agreements, these revenues may decrease, which in turn could materially and adversely affect our results of operations and financial condition.

Our franchisees could take actions that harm our business.

Our franchisees are contractually obligated to operate their stores in accordance with the operational, safety and health standards set forth in our agreements with them. However, franchisees are independent third parties, and their actions are outside of our control. In addition, we cannot be certain that our franchisees will have the business acumen or financial resources necessary to operate successful franchises in their approved locations, and certain state franchise laws may limit our ability to terminate or modify these franchise agreements. The franchisees own, operate and oversee the daily operations of their stores. As a result, the ultimate success and quality of any franchise store rests with the franchisee. If franchisees do not successfully operate stores in a manner consistent with required standards and comply with local laws and regulations, franchise fees and royalties paid to us may be adversely affected, and our brand image and reputation could be harmed, which in turn could adversely affect our results of operations and financial condition.

Moreover, although we believe we generally maintain positive working relationships with our franchisees, disputes with franchisees could damage our brand image and reputation and our relationships with our franchisees, generally.

Our success depends substantially on the value of our brand.

Our success is dependent in large part upon our ability to maintain and enhance the value of our brand, our store members’ connection to our brand and a positive relationship with our franchisees. Brand value can be severely damaged even by isolated incidents, particularly if the incidents receive considerable negative publicity or result in litigation. Some of these incidents may relate to our policies, the way we manage our relationships with our franchisees, our growth strategies, our development efforts or the ordinary course of our, or our franchisees’, businesses. Other incidents that could be damaging to our brand may arise from events that are or may be beyond our ability to control, such as:

|

• |

actions taken (or not taken) by one or more franchisees or their employees relating to health, safety, welfare or otherwise; |

|

• |

data security breaches or fraudulent activities associated with our and our franchisees’ electronic payment systems; |

|

• |

litigation and legal claims; |

|

• |

third-party misappropriation, dilution or infringement of our intellectual property; |

|

• |

regulatory, investigative or other actions relating to our and our franchisees’ provision of indoor tanning services; and |

|

• |

illegal activity targeted at us or others. |

Consumer demand for our stores and our brand’s value could diminish significantly if any such incidents or other matters erode consumer confidence in us or our stores, which would likely result in fewer memberships sold or renewed and, ultimately, lower royalty revenue, which in turn could materially and adversely affect our results of operations and financial condition.

17

If we fail to successfully implement our growth strategy, which includes new store development by existing and new franchisees, our ability to increase our revenues and operating profits could be adversely affected.

Our growth strategy relies in large part upon new store development by existing and new franchisees. Our franchisees face many challenges in opening new stores, including:

|

• |

availability and cost of financing; |

|

• |

selection and availability of suitable store locations; |

|

• |

competition for store sites; |

|

• |

negotiation of acceptable lease and financing terms; |

|

• |

securing required domestic or foreign governmental permits and approvals; |

|

• |

health and fitness trends in new geographic regions and acceptance of our offerings; |

|

• |

employment, training and retention of qualified personnel; |

|

• |

ability to open new stores during the timeframes we and our franchisees expect; and |

|

• |

general economic and business conditions. |

In particular, because the majority of our new store development is funded by franchisee investment, our growth strategy is dependent on our franchisees’ (or prospective franchisees’) ability to access funds to finance such development. If our franchisees (or prospective franchisees) are not able to obtain financing at commercially reasonable rates, or at all, they may be unwilling or unable to invest in the development of new stores, and our future growth could be adversely affected.