(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

☒ |

Smaller reporting company | |||||

| Emerging growth company | ||||||

The information in this prospectus is not complete and may be changed. The selling stockholders named in this prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission (the “SEC”) is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 22, 2023

PRELIMINARY PROSPECTUS

Spyre Therapeutics, Inc.

12,000,000 Shares

Common Stock

Offered by the Selling Stockholders

This prospectus relates to the proposed resale or other disposition by the selling stockholders identified herein (the “Selling Stockholders”) of up to (i) 6,000,000 shares (the “Private Placement Common Shares”) of our common stock, par value $0.0001 per share (“Common Stock”) and (ii) 6,000,000 shares of Common Stock (the “Private Placement Conversion Shares”) issuable upon the conversion of 150,000 shares (the “Private Placement Preferred Shares”) of Series B preferred stock, par value $0.0001 (the “Series B Preferred Stock”). Subject to receiving the requisite stockholder approval and certain beneficial ownership limitations set by each preferred stockholder, each share of Series B Preferred Stock will automatically convert upon the requisite stockholder approval into an aggregate of 40 shares of Common Stock. The shares of Common Stock registered by this prospectus are referred to herein as the “Resale Shares.”

The Private Placement Preferred Shares were issued and sold to accredited investors in a private placement (the “December 2023 PIPE”), which closed on December 11, 2023. We are not selling any Resale Shares under this prospectus and will not receive any of the proceeds from the sale or other disposition of Resale Shares by the Selling Stockholders.

The Selling Stockholders may sell the Resale Shares on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale, on the over-the-counter market, in one or more transactions otherwise than on these exchanges or systems, such as privately negotiated transactions, or using a combination of these methods, and at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. See the disclosure under the heading “Plan of Distribution” elsewhere in this prospectus for more information about how the Selling Stockholders may sell or otherwise dispose of their Resale Shares hereunder.

The Selling Stockholders may sell any, all or none of the securities offered by this prospectus and we do not know when or in what amount the Selling Stockholders may sell their Resale Shares hereunder following the effective date of the registration statement of which this prospectus forms a part.

You should carefully read this prospectus and any applicable prospectus supplement before you invest in any of the securities being offered.

Our Common Stock is traded on The Nasdaq Capital Market under the symbol “SYRE.” On December 21, 2023, the last reported sale price for our Common Stock was $17.22 per share.

An investment in our securities involves a high degree of risk. You should carefully consider the information under the heading “Risk Factors” beginning on page 11 of this prospectus and any applicable prospectus supplement.

We are a “smaller reporting company” as defined by Rule 12b-2 of the Exchange Act and are subject to reduced public company reporting requirements.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

| PAGE | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 9 | ||||

| 11 | ||||

| 47 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

48 | |||

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

64 | |||

| 65 | ||||

| 66 | ||||

| 93 | ||||

| 99 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

112 | |||

| 115 | ||||

| 117 | ||||

| 124 | ||||

| 127 | ||||

| 132 | ||||

| 133 | ||||

| 134 | ||||

| F-1 | ||||

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. Under this shelf registration process, the Selling Stockholders may, from time to time, sell the securities described in this prospectus in one or more offerings.

This prospectus contains information that you should consider when making your investment decision. Neither we, nor the Selling Stockholders, have authorized anyone to give any information or to make any representation other than those contained in this prospectus. The Selling Stockholders are offering to sell, and seeking offers to buy, our securities only in jurisdictions where it is lawful to do so. We have not authorized anyone to provide you with different information. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in any accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement and any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

In this prospectus, unless the context otherwise requires, the terms “Spyre,” “Aeglea BioTherapeutics, Inc.,” the “Company,” “we,” “us,” and “our” refer to Spyre Therapeutics, Inc., a Delaware corporation, and its consolidated subsidiaries.

This prospectus contains trade names, trademarks and service marks of others, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols.

All references to “our product candidates,” “our programs” and “our pipeline” in this prospectus refer to the research programs with respect to which we have exercised the option to acquire intellectual property license rights to or have the option to acquire intellectual property license rights to pursuant to that certain antibody discovery and option agreement, dated May 25, 2023 and subsequently amended and restated on September 29, 2023, by and among Spyre Therapeutics, LLC, Paragon Therapeutics, Inc. (“Paragon”) and Parapyre Holding LLC (“Parapyre”) (the “Paragon Agreement”).

Please be advised that on September 8, 2023, we effected a reverse stock split of our Common Stock at a ratio of 1-for-25 (the “Reverse Split”). Except as indicated otherwise, all share numbers related to our Common Stock disclosed in this prospectus have been adjusted on a post-Reverse Split basis. In addition, on November 28, 2023, we changed our name from “Aeglea Biotherapeutics, Inc.” to “Spyre Therapeutics, Inc.”

1

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements involve a number of risks and uncertainties. We caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. These statements are based on current expectations of future events.

All statements, other than statements of historical facts contained in this prospectus, including, without limitation, statements regarding: stockholder approval of the conversion rights of the Series B Preferred Stock; any future payouts under the CVR (as defined herein); our ability to achieve the expected benefits or opportunities and related timing with respect to our acquisition of Spyre Therapeutics, Inc. (“Pre-Merger Spyre”) or to monetize any of our legacy assets, our future results of operations and financial position, business strategy, the length of time that we believe our existing cash resources will fund our operations, our market size, our potential growth opportunities, our preclinical and future clinical development activities, the efficacy and safety profile of our product candidates, the potential therapeutic benefits and economic value of our product candidates, the timing and results of preclinical studies and clinical trials, the expected impact of macroeconomic conditions, including inflation, increasing interest rates and volatile market conditions, current or potential bank failures, as well as global events, including the ongoing military conflict in Ukraine, conflict in Israel and surrounding areas, and geopolitical tensions in China on our operations, and the receipt and timing of potential regulatory designations, approvals and commercialization of product candidates. Forward-looking statements generally relate to future events or our future financial or operating performance. Forward-looking statements generally relate to future events or our future financial or operating performance. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “predict,” “target,” “intend,” “could,” “would,” “should,” “project,” “plan,” “expect,” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Factors that might cause such a difference are disclosed in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should evaluate all forward-looking statements made in this prospectus in the context of these risks and uncertainties. We caution you that the risks, uncertainties and other factors referred to in this prospectus may not contain all of the risks, uncertainties and other factors that may affect our future results and operations.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this prospectus. While we believe that such information provides a reasonable basis for these statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

All subsequent written or oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events,

2

except as may be required under applicable U.S. securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

3

PROSPECTUS SUMMARY

This summary may not contain all the information that you should consider before investing in securities. You should read the entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision.

Company Overview

On June 22, 2023, we completed the Asset Acquisition pursuant to the Acquisition Agreement (as defined under the section titled “Recent Developments” below). Pre-Merger Spyre was a pre-clinical stage biotechnology company that was incorporated on April 28, 2023 under the direction of Peter Harwin, a Managing Member of Fairmount Funds Management LLC (“Fairmount”), for the purpose of holding rights to certain intellectual property being developed by Paragon. Fairmount is a founder of Paragon.

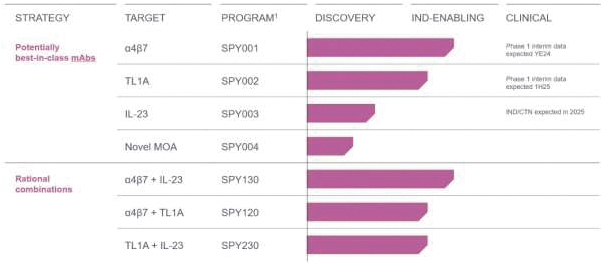

Through the Asset Acquisition, we received the option to acquire the intellectual property rights related to four research programs (collectively, the “Option”) pursuant to the Paragon Agreement. On July 12, 2023, we exercised the Option with respect to one of these research programs to exclusively license intellectual property rights related to such research program directed to antibodies that selectively bind to α4ß7 integrin and methods of using these antibodies, including methods of treating inflammatory bowel disease (“IBD”) using the SPY001 program. If this research program is pursued non-provisionally and matures into issued patents, we would expect those patents to expire no earlier than 2044 subject to any disclaimers or extensions. On December 14, 2023, we exercised the Option under the Paragon Agreement to be granted an exclusive license to all of Paragon’s rights, title and interest in and to intellectual property rights, including inventions, patents, sequence information and results, under SPY002, Spyre’s TL1A program, to develop and commercialize antibodies and products worldwide in all therapeutics disorders. The license agreements pertaining to such research programs are currently being finalized. Furthermore, as of the date of this registration statement, the Option remains unexercised with respect to the intellectual property rights related to the two remaining research programs under the Paragon Agreement. For more information on the Paragon Agreement, see discussion under the heading “Paragon Agreement” below.

On July 27, 2023, we announced that we entered into an agreement to sell the global rights to pegzilarginase, an investigational treatment for the rare metabolic disease Arginase 1 Deficiency, to Immedica Pharma AB (“Immedica”) for $15.0 million in upfront cash proceeds and up to $100.0 million in contingent milestone payments (the “Immedica APA”). The sale of pegzilarginase to Immedica supersedes and terminates the license agreement between us and Immedica dated March 2021. See the section titled “Recent Developments” below for more information regarding the Immedica APA.

Following the Asset Acquisition and the entry into the Immedica APA, we have significantly reshaped the business into a preclinical stage biotechnology company focused on developing next generation therapeutics for patients living with IBD, including ulcerative colitis (“UC”) and Crohn’s disease (“CD”). Through the Paragon Agreement, our portfolio of novel and proprietary monoclonal antibody product candidates has the potential to address unmet needs in IBD care by improving efficacy, safety, and/or dosing convenience relative to products currently available or product candidates in development. We have purposely engineered our product candidates to bind potently and selectively to target epitopes with extended half-lives. We plan to use combinations of our proprietary antibodies and patient enrichment strategies via companion diagnostics to enhance efficacy. We intend to deliver our product candidates through convenient, infrequently self-administered, subcutaneous (“SC”) injection as a pre-filled pen.

4

Recent Developments

On September 8th, 2023, we effected the Reverse Split, which resulted in the reverse split of our Common Stock at a ratio of 1-for-25. Readers should note that, except as indicated otherwise, all share numbers related to our Common Stock disclosed in this “Recent Developments” section have been adjusted on a post-Reverse Split basis.

On June 22, 2023, we acquired in accordance with the terms of the Agreement and Plan of Merger (the “Acquisition Agreement”), by and among the Company, Aspen Merger Sub I, Inc., a Delaware corporation and a wholly owned subsidiary of the Company, Sequoia Merger Sub II, LLC, a Delaware limited liability company and wholly owned subsidiary of the Company, and Pre-Merger Spyre, the assets of Pre-Merger Spyre, a privately held biotechnology company advancing a pipeline of antibody therapeutics through the Paragon Agreement. Pre-Merger Spyre was incorporated on April 28, 2023, for the purpose of holding rights to certain intellectual property being developed by Paragon.

The Asset Acquisition was structured as a stock-for-stock transaction pursuant to which all of Pre-Merger Spyre’s outstanding equity interests were exchanged based on a fixed exchange ratio of 0.5494488 to 1 for consideration from the Company of 517,809 shares of Common Stock and 364,887 shares of Series A Preferred Stock (convertible on a 40 to 1 basis) in addition to the assumption of outstanding and unexercised stock options to purchase 2,734 shares of Common Stock from the Amended and Restated Spyre 2023 Equity Incentive Plan. The Common Stock and the Series A Preferred Stock related to the Asset Acquisition were issued to Pre-Merger Spyre stockholders on July 7, 2023.

Concurrently with the Asset Acquisition, we entered into a definitive agreement (the “June 2023 SPA”) for a PIPE investment (the “June 2023 PIPE” and, together with the Asset Acquisition, the “June 2023 Transactions”) with existing and new investors (the “June 2023 Investors”) to raise approximately $210 million in which the June 2023 Investors were issued 721,452 shares of Series A Preferred Stock at a price of $291.08 per share. The Asset Acquisition was approved by our board of directors and the board of directors and stockholders of Pre-Merger Spyre. The closings of the June 2023 Transactions were not subject to the approval of the Company’s stockholders. Following receipt of stockholder approval of the conversion of Series A Preferred Stock, each share of Series A Preferred Stock automatically converted into 40 shares of Common Stock, subject to certain beneficial ownership limitations set by each holder. Except as otherwise required by law (e.g. voting on a change to the authorized shares of Series A Non-Voting Preferred Stock or the rights of such shares as required by Delaware General Corporation Law) and Spyre’s Certificate of Designation of Series A Non-Voting Convertible Preferred Stock (the “Series A Certificate of Designation”), the Series A Preferred Stock does not have voting rights.

In connection with the execution of the Acquisition Agreement, Spyre and Pre-Merger Spyre entered into stockholder support agreements (the “Support Agreements”) with certain of Spyre’s officers and directors, which collectively own an aggregate of less than 1% of the outstanding shares of the Common Stock. The Support Agreements provide that, among other things, each of the parties thereto would vote or cause to be voted all of the shares of Common Stock owned by such stockholder in favor of the approval of the conversion of shares of the Series A Preferred Stock into shares of Common Stock in accordance with Nasdaq Stock Market Rules at Spyre’s stockholders’ meeting held in connection therewith.

Concurrently and in connection with the execution of the Acquisition Agreement, certain Pre-Merger Spyre stockholders as of immediately prior to the Asset Acquisition, and certain of the directors and officers of Spyre as of immediately prior to the Asset Acquisition entered into lock-up agreements with Spyre and Pre-Merger Spyre, pursuant to which each such stockholder was subject to a 180-day lockup on the sale or transfer of shares of Common Stock held by each such stockholder at the closing of the Asset Acquisition, including those shares received by such Pre-Merger Spyre stockholders in the Asset Acquisition.

5

In connection with the Asset Acquisition, a non-transferrable contingent value right (a “CVR”) was distributed to Spyre stockholders of record as of the close of business on July 3, 2023, but was not distributed to holders of shares of Common Stock or Series A Preferred Stock issued to the June 2023 Investors or former stockholders of Pre- Merger Spyre in connection with the June 2023 Transactions. Holders of the CVRs will be entitled to receive cash payments from proceeds received by Spyre for a three-year period, if any, related to the disposition or monetization of certain legacy assets owned by us prior to the Asset Acquisition (the “Legacy Assets”) for a period of one year following the closing of the Asset Acquisition.

On July 27, 2023, we announced that we entered the Immedica APA. The sale of pegzilarginase to Immedica supersedes and terminates the license agreement between the us and Immedica dated March 2021.

The milestone payments under the Immedica APA are contingent on formal reimbursement decisions by national authorities in key European markets and pegzilarginase approval by the United States Food and Drug Administration (the “FDA”), among other events. The upfront payment has been paid and distributed and contingent milestone payments if paid, net of expenses and adjustments, will be distributed to holders of Spyre’s CVR pursuant to the CVR Agreement that was entered into in connection with the Asset Acquisition.

On December 7, 2023, we entered into a definitive agreement (the “December 2023 SPA”) for a PIPE investment with existing and new investors (the “December 2023 Investors”) to raise $180 million in which the December 2023 Investors were issued an aggregate of 6,000,000 shares of Common Stock at a price of $15.00 per share and 150,000 shares of Series B Preferred Stock at a price of $600.00 per share. The closing of the December 2023 PIPE was not subject to Spyre stockholder approval. Subject to Spyre stockholder approval and certain beneficial ownership limitations set by each holder, each share of Series B Preferred Stock will automatically convert into 40 shares of Common Stock. We will file a definitive proxy statement with the SEC to solicit such stockholder approval, among other matters, at the 2024 annual meeting of stockholders. Except as otherwise required by law (e.g. voting on a change to the authorized shares of Series B Non-Voting Preferred Stock or the rights of such shares as required by Delaware General Corporation Law) and Spyre’s Certificate of Designation of Series B Non-Voting Convertible Preferred Stock (“Series B Certificate of Designation”), the Series B Preferred Stock does not have voting rights.

Corporation Information

We were formed as a limited liability company under the laws of the State of Delaware in December 2013 and converted to a Delaware corporation in March 2015. On June 22, 2023, we completed the Asset Acquisition, pursuant to which all of Pre-Merger Spyre’s outstanding equity interests were exchanged based on a fixed exchange ratio of 0.5494488 to 1 for consideration from Spyre of 517,809 shares of Common Stock and 364,887 shares of Series A Preferred Stock in addition to the assumption of outstanding and unexercised stock options to purchase 2,734 shares of Common Stock from the Amended and Restated Spyre 2023 Equity Incentive Plan. On November 28, 2023, we changed our name from “Aeglea Biotherapeutics, Inc.” to “Spyre Therapeutics, Inc.” and our Nasdaq ticker symbol from “AGLE” to “SYRE”. Our principal executive offices are located at 221 Crescent Street, Building 23, Suite 105, Waltham, MA 02453, and our telephone number is (617) 651-5940.

On September 8, 2023, we effected a reverse stock split of our Common Stock at a ratio of 1-for-25. Except as indicated otherwise, all share numbers related to our Common Stock disclosed in this prospectus have been adjusted on a post-Reverse Split basis.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company,” meaning that the market value of our Common Stock held by non-affiliates is less than $700.0 million and our annual revenue is less than $100.0 million during the most

6

recently completed fiscal year. We may continue to be a smaller reporting company after this offering if either (i) the market value of our Common Stock held by non-affiliates is less than $250.0 million or (ii) our annual revenue is less than $100.0 million during the most recently completed fiscal year and the market value of our Common Stock held by non-affiliates is less than $700.0 million. As a smaller reporting company we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and smaller reporting companies have reduced disclosure obligations regarding executive compensation.

7

The Offering

| Shares Offered by the Selling Securityholders |

Up to (i) 6,000,000 shares of Common Stock and (ii) 6,000,000 shares of Common Stock issuable upon the conversion of 150,000 shares of Series B Preferred Stock. |

| Terms of the Offering |

The selling securityholders will determine when and how they will dispose of the shares of Common Stock and shares of Common Stock issuable upon conversion of Series B Preferred Stock registered under this prospectus for resale. |

| Shares Outstanding |

As of December 11, 2023, the closing date of the December 2023 PIPE, there were 36,021,007 shares of our Common Stock, 437,037 shares of Series A Preferred Stock and 150,000 shares of Series B Preferred Stock outstanding. |

| Use of Proceeds |

We will not receive any proceeds from the sale of the Resale Shares offered by the Selling Stockholders under this prospectus. The net proceeds from the sale of the Resale Shares offered by this prospectus will be received by the Selling Stockholders. See the section titled “Use of Proceeds.” |

| Risk Factors |

See the section titled “Risk Factors” and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our securities. |

| Trading Markets and Ticker Symbols |

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “SYRE.” |

The number of issued and outstanding shares of Common Stock does not include the following, as of December 11, 2023:

| • | 17,481,480 shares of Common Stock issuable upon the conversion of 437,037 shares of Series A Preferred Stock; |

| • | 6,000,000 shares of Common Stock issuable upon the conversion of 150,000 shares of Series B Preferred Stock; |

| • | 3,029 shares of Common Stock reserved for issuance under our 2015 Equity Incentive Plan; |

| • | 4,968,578 shares of Common Stock reserved for issuance under our Amended and Restated 2016 Equity Incentive Plan; |

| • | 6,044,000 shares of Common Stock reserved for issuance under our 2018 Equity Inducement Plan, as amended; |

| • | 72,404 shares of Common Stock reserved for issuance pursuant to our 2016 Employee Stock Purchase Plan; |

| • | 250,000 shares of Common Stock reserved for issuance upon the exercise of 250,000 pre-funded warrants to acquire shares of Common Stock; and |

| • | 121,871 shares of Common Stock reserved for issuance under the Spyre 2023 Equity Incentive Plan, as amended and assumed by us. |

Except as indicated otherwise, all share numbers related to our Common Stock disclosed in this prospectus have been adjusted on a post-Reverse Split basis.

For additional information concerning the offering, see the section titled “Plan of Distribution.”

8

RISK FACTOR SUMMARY

The following summarizes the principal factors that make an investment in the Company speculative or risky, all of which are more fully described in the Risk Factors section below. This summary should be read in conjunction with the Risk Factors section and should not be relied upon as an exhaustive summary of the material risks facing our business. The occurrence of any of these risks could harm our business, financial condition, results of operations and/or growth prospects or cause our actual results to differ materially from those contained in forward-looking statements we have made in this prospectus and those we may make from time to time. You should consider all of the risk factors described in our public filings when evaluating our business.

Risks Related to Our Financial Condition and Capital Requirements

| • | There is no guarantee that our acquisition of Pre-Merger Spyre will increase stockholder value. |

| • | We will not be able to continue as a going concern if we are unable to raise additional capital when needed. |

| • | We have never generated any revenue from product sales and may never be profitable. |

| • | We anticipate that we will continue to incur significant losses for the foreseeable future. |

| • | We may not be able to raise the capital that we need to support our business plans and raising additional capital may cause dilution to our stockholders and restrict our operations. |

Risks Related to the Discovery, Development and Commercialization

| • | We face competition from companies that have developed or may develop competing programs. |

| • | Our programs are in preclinical stages of development and may fail in development or suffer delays. |

| • | We are substantially dependent on the success of the SPY001 and SPY002 programs. |

| • | We may fail to achieve our projected development goals in the time frames we announce and expect. |

| • | We may not be successful in our efforts to build a pipeline of programs with commercial value. |

| • | Our studies and trials may not be sufficient to support regulatory approval of any of our programs. |

| • | We may encounter difficulties enrolling patients in our future clinical trials. |

| • | Preliminary or “topline” data from our clinical trials may change as more data becomes available. |

| • | Our future clinical trials may reveal significant adverse events or side effects. |

| • | We may fail to capitalize on more profitable or potentially successful programs than those we pursue. |

| • | Any of our future approved products may not achieve regulatory approval, market acceptance or commercial success. |

| • | Certain of our programs may compete with our other programs. |

| • | The FDA may not accept data from clinical trials we conduct at sites outside the United States. |

Risks Related to Government Regulation

| • | FDA and comparable foreign regulatory approval processes are lengthy and time-consuming and we may not be able to obtain or may be delayed in obtaining regulatory approvals for our programs. |

| • | We may not be able to meet requirements for chemistry, manufacturing and control of our programs. |

| • | Our programs may face competition sooner than anticipated. |

| • | Even if we receive regulatory approval, we will be subject to extensive ongoing regulatory obligations. |

| • | We may face difficulties from healthcare legislative reform measures. |

| • | Our operations and arrangements with third-parties are subject to healthcare regulatory laws. |

| • | We may be unable to offer programs at competitive prices. |

| • | We may face criminal liability or other consequences for violations of U.S. and foreign trade regulations. |

| • | Foreign governments may impose strict price controls, which may adversely affect our revenue. |

| • | Any Fast Track Designation we may pursue may not hasten development or regulatory review. |

Risks Related to Our Intellectual Property

| • | Our ability to protect our patents and other proprietary rights is uncertain. |

| • | We may fail in obtaining or maintaining necessary rights to our programs. |

9

| • | We may be subject to patent infringement claims or may need to file such claims. |

| • | We may subject to claims of wrongful hiring of employees or wrongful use of confidential information. |

| • | Our patents and our ability to protect our products may be impaired by changes to patent laws. |

| • | Our patent protection could be reduced or eliminated for non-compliance with regulatory requirements. |

| • | We may fail to identify or interpret relevant third-party patents. |

| • | We may become subject to claims challenging the inventorship or ownership of our intellectual property. |

| • | Patent terms may be inadequate to protect our competitive position of our programs. |

| • | Our technology licensed from various third parties may be subject to retained rights. |

Risks Related to Our Reliance on Third Parties

| • | We may fail to maintain collaborations and licensing arrangements with third parties that we rely on. |

| • | Third-parties we rely on for preclinical studies and clinical trials may fail to carry out their contractual duties. |

| • | We may be unable to use third-party manufacturing sites or our third-party manufacturers may encounter difficulties in production. |

Risks Related to Employee Matters, Managing Growth and Other Risks Related to Our Business

| • | We may experience difficulties in managing the growth of our organization. |

| • | We may fail to attract or retain highly qualified personnel. |

| • | Our ability to operate in foreign markets is subject to regulatory burdens, risks and uncertainties. |

| • | Our employees or third-parties may engage in misconduct or other improper activities. |

| • | We may be impacted by security or data breaches or other improper access to our data. |

| • | Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited. |

| • | We may fail to comply with privacy and data security regulations. |

| • | We may fail to comply with environmental, health and safety laws and regulations. |

| • | We may be subject to adverse legislative or regulatory tax changes. |

| • | We may fail to realize the benefits of our business or product acquisitions or our strategic alliances. |

| • | We may be impacted by the failure of financial institutions. |

Risks Related to Our Common Stock

| • | We may fail to obtain stockholder approval of the conversion of our Series B Preferred Stock. |

| • | Our certificate of incorporation, Delaware law and certain contracts include anti-takeover provisions. |

| • | Our certificate of incorporation and bylaws contain exclusive forum provisions. |

| • | We do not anticipate paying any dividends in the foreseeable future. |

| • | Future sales of shares by existing stockholders could cause our stock price to decline. |

| • | Future sales and issuances of equity and debt could result in additional dilution to our stockholders. |

| • | Our principal stockholders own a significant percentage of our stock. |

General Risk Factors

| • | The market price of our Common Stock has historically been volatile and may drop in the future. |

| • | We incur significant costs as associated with complying with public company reporting requirements. |

| • | A lack of analyst coverage may cause a decline in our stock price or trading volume. We may fail to maintain proper and effective internal controls. |

10

RISK FACTORS

Risks Related to Our Financial Condition and Capital Requirements

There is no guarantee that our Asset Acquisition will increase stockholder value.

In June 2023, we acquired Pre-Merger Spyre. We cannot guarantee that implementing the Asset Acquisition and related transactions will not impair stockholder value or otherwise adversely affect our business. The Asset Acquisition poses significant integration challenges between our businesses and management teams which could result in management and business disruptions, any of which could harm our results of operation, business prospects, and impair the value of the Asset Acquisition to our stockholders.

We will need to raise additional capital, and if we are unable to do so when needed, we will not be able to continue as a going concern.

Our most recent Quarterly Report on Form 10-Q filed on November 9, 2023 includes disclosures regarding our management’s substantial doubt assessment of our ability to continue as a going concern.

Developing our product candidates requires a substantial amount of capital. We expect our research and development expenses to increase in connection with our ongoing activities, particularly as we advance our product candidates through clinical trials. We will need to raise additional capital to fund our operations and such funding may not be available to us on acceptable terms, or at all, and such funding may become even more difficult to obtain due to rising interest rates and the current downturn in the U.S. capital markets and the biotechnology sector in general. Competition for additional capital among biotechnology companies may be particularly intense during this present economic downturn. We may be unable to raise capital through public offerings of our Common Stock and may need to turn to alternative financing arrangements. Such arrangements, if we pursue them, could involve issuances of one or more types of securities, including Common Stock, Preferred Stock, convertible debt, warrants to acquire Common Stock or other securities. These securities could be issued at or below the then prevailing market price for our Common Stock. In addition, if we issue debt securities, the holders of the debt would have a claim to our assets that would be superior to the rights of stockholders until the principal, accrued and unpaid interest and any premium or make-whole has been paid. Interest on any newly-issued debt securities and/or newly-incurred borrowings would increase our operating costs and reduce our net income (or increase our net loss), and these impacts may be material. If the issuance of new securities results in diminished rights to holders of our Common Stock, the market price of our Common Stock could be materially and adversely affected.

We do not currently have any products approved for sale and do not generate any revenue from product sales. Accordingly, we expect to rely primarily on equity and/or debt financings to fund our continued operations. Our ability to raise additional funds will depend, in part, on the success of our preclinical studies and clinical trials and other product development activities, regulatory events, our ability to identify and enter into licensing or other strategic arrangements, and other events or conditions that may affect our value or prospects, as well as factors related to financial, economic and market conditions, many of which are beyond our control. There can be no assurances that sufficient funds will be available to us when required or on acceptable terms, if at all.

If we are unable to raise additional capital when required or on acceptable terms, we may be required to:

| • | significantly delay, scale back, or discontinue the development or commercialization of our product candidates; |

| • | seek strategic partnerships, or amend existing partnerships, for research and development programs at an earlier stage than otherwise would be desirable or that we otherwise would have sought to develop independently, or on terms that are less favorable than might otherwise be available in the future; |

| • | dispose of technology assets, or relinquish or license on unfavorable terms, our rights to technologies or any of our product candidates that we otherwise would seek to develop or commercialize ourselves; |

11

| • | pursue the sale of our company to a third party at a price that may result in a loss on investment for our stockholders; or |

| • | file for bankruptcy or cease operations altogether (and face any related legal proceedings). |

Any of these events could have a material adverse effect on our business, operating results, and prospects.

Even if successful in raising new capital, we could be limited in the amount of capital we raise due to investor demand restrictions placed on the amount of capital we raise or other reasons. For example, we are currently subject to the limitations set forth in Instruction I.B.6 of Form S-3.

Additionally, any capital raising efforts are subject to significant risks and contingencies, as described in more detail under the risk factor titled “Raising additional capital may cause dilution to our stockholders, restrict our operations, or require us to relinquish rights.”

We have never generated any revenue from product sales and may never be profitable.

We have no products approved for commercialization and have never generated any revenue from product sales. Our ability to generate revenue and achieve profitability depends on our ability, alone or with strategic collaborators, to successfully complete the development of, and obtain the regulatory and marketing approvals necessary to commercialize one or more of our product candidates. We do not anticipate generating revenue from product sales for the foreseeable future. Our ability to generate future revenue from product sales depends heavily on our success in many areas, including but not limited to:

| • | completing research and development of our product candidates; |

| • | obtaining regulatory and marketing approvals for our product candidates for which we complete clinical trials; |

| • | manufacturing product candidates and establishing and maintaining supply and manufacturing relationships with third parties that are commercially feasible, meet regulatory requirements and our supply needs in sufficient quantities to meet market demand for our product candidates, if approved; |

| • | qualify for adequate coverage and reimbursement by government and third-party payors for any product candidates for which we obtain regulatory and marketing approval; |

| • | marketing, launching, and commercializing product candidates for which we obtain regulatory and marketing approval, either directly or with a collaborator or distributor; |

| • | gaining market acceptance of our product candidates as treatment options; |

| • | addressing any competing products and technological and market developments; |

| • | implementing internal systems and infrastructure, as needed; |

| • | protecting and enforcing our intellectual property rights, including patents, trade secrets, and know-how; |

| • | negotiating favorable terms in any collaboration, licensing, or other arrangements into which we may enter; |

| • | obtaining coverage and adequate reimbursement from third-party payors and maintaining pricing for our product candidates that supports profitability; and |

| • | attracting, hiring, and retaining qualified personnel. |

Even if one or more of the product candidates that we develop is approved for commercial sale, we anticipate incurring significant costs associated with commercializing any approved product candidate. Our expenses could

12

increase beyond expectations if we are required by regulatory authorities to perform clinical and other studies in addition to those that we anticipate. Even if we are able to generate revenues from the sale of any approved products, we may not become profitable and may need to obtain additional funding to continue operations. Portions of the research programs with respect to which we have exercised the Option to acquire intellectual property license rights to or have the Option to acquire intellectual property license rights to pursuant to the Paragon Agreement may be in-licensed from third parties, which make the commercial sale of such in-licensed products potentially subject to additional royalty and milestone payments to such third parties. We will also have to develop or acquire manufacturing capabilities or continue to contract with contract manufacturers in order to continue development and potential commercialization of our product candidates. For instance, if the costs of manufacturing our drug product are not commercially feasible, we will need to develop or procure our drug product in a commercially feasible manner in order to successfully commercialize a future approved product, if any. Additionally, if we are not able to generate revenue from the sale of any approved products, we may never become profitable.

We have historically incurred losses, have a limited operating history on which to assess our business, and anticipate that we will continue to incur significant losses for the foreseeable future.

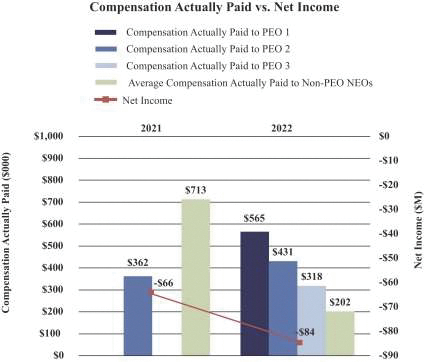

We are a biopharmaceutical company with a limited operating history. Since inception, we have incurred significant operating losses. For the three and nine months ended September 30, 2023, we reported a net loss of $40.1 million and $275.6 million, respectively. For the years ended December 31, 2022 and 2021, we reported a net loss of $83.8 million and $65.8 million, respectively. As of September 30, 2023, we had an accumulated deficit of $701.2 million. We will need to raise substantial additional capital to continue to fund our operations in the future. If our stockholders do not timely approve the conversion of our Series B Preferred Stock, then the holders of our Series B Preferred Stock may be entitled to require us to settle their shares of Series B Preferred Stock for cash at a price per share equal to the fair value of the Series B Preferred Stock, as described in our Series B Certificate of Designation relating to the Series B Preferred Stock. The cash redemption is not under our control and raises substantial doubt about our ability to continue as a going concern. The consolidated financial statements included in this prospectus assume the Company will continue as a going concern through the realization of assets and satisfaction of liabilities and commitments in the ordinary course of business.

Failure to raise capital as and when needed, on favorable terms or at all, would have a negative impact on our financial condition and our ability to develop our product candidates. Changing circumstances may cause us to consume capital significantly faster or slower than we currently anticipate. If we are unable to acquire additional capital or resources, we will be required to modify our operational plans to complete future milestones and we may be required to delay, limit, reduce or eliminate development or future commercialization efforts of product candidates and/or programs. We have based these estimates on assumptions that may prove to be wrong, and we could exhaust our available financial resources sooner than we currently anticipate. We may be forced to reduce our operating expenses and raise additional funds to meet our working capital needs, principally through the additional sales of our securities or debt financings or entering into strategic collaborations.

We have devoted substantially all of our financial resources to identify, acquire, and develop our product candidates, including conducting clinical trials and providing general and administrative support for our operations. To date, we have funded our operations primarily from the sale and issuance of convertible preferred and common equity securities, pre-funded warrants, the collection of grant proceeds, and the licensing of our product rights for commercialization of pegzilarginase in Europe and certain countries in the Middle East. The amount of our future net losses will depend, in part, on the rate of our future expenditures and our ability to obtain funding through equity or debt financings, strategic collaborations, or grants. Biopharmaceutical product development is a highly speculative undertaking and involves a substantial degree of risk. We expect our losses to increase as our product candidates enter more advanced clinical trials. It may be several years, if ever, before we complete pivotal clinical trials or have a product candidate approved for commercialization. We expect to invest significant funds into the research and development of our current product candidates to determine the potential to advance these product candidates to regulatory approval.

13

If we obtain regulatory approval to market a product candidate, our future revenue will depend upon the size of any markets in which our product candidates may receive approval, and our ability to achieve sufficient market acceptance, pricing, coverage and adequate reimbursement from third-party payors, and adequate market share for our product candidates in those markets. Even if we obtain adequate market share for our product candidates, because the potential markets in which our product candidates may ultimately receive regulatory approval could be very small, we may never become profitable despite obtaining such market share and acceptance of our products.

We expect to continue to incur significant expenses and increasing operating losses for the foreseeable future and our expenses will increase substantially if and as we:

| • | continue the preclinical development and initiate the clinical development of our product candidates; |

| • | continue efforts to discover and develop new product candidates; |

| • | continue the manufacturing of our product candidates or increase volumes manufactured by third parties; |

| • | advance our product candidates into larger, more expensive clinical trials; |

| • | initiate additional preclinical studies or clinical trials for our product candidates; |

| • | seek regulatory and marketing approvals and reimbursement for our product candidates; |

| • | establish a sales, marketing, and distribution infrastructure to commercialize any products for which we may obtain marketing approval and market for ourselves; |

| • | seek to identify, assess, acquire, and/or develop other product candidates; |

| • | make milestone, royalty, or other payments under third-party license agreements; |

| • | seek to maintain, protect, and expand our intellectual property portfolio; |

| • | pay penalties under our registration rights agreement for failing to timely register the applicable securities; |

| • | seek to attract and retain skilled personnel; and |

| • | experience any delays or encounter issues with the development and potential for regulatory approval of our clinical and product candidates such as safety issues, manufacturing delays, clinical trial accrual delays, longer follow-up for planned studies or trials, additional major studies or trials, or supportive trials necessary to support marketing approval. |

Further, the net losses we incur may fluctuate significantly from quarter to quarter and year to year, such that a period-to-period comparison of our results of operations may not be a good indication of our future performance.

Raising additional capital may cause dilution to our stockholders, restrict our operations, or require us to relinquish rights.

Until such time, if ever, as we can generate substantial revenue from the sale of our product candidates, we expect to finance our cash needs through a combination of equity offerings, debt financings and license and development agreements. To the extent that we raise additional capital through the sale of equity securities or convertible debt securities, the ownership interest of our stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a holder of Common Stock. Debt financing and preferred equity financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures, or declaring dividends.

14

If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may be required to relinquish valuable rights to our research programs or product candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings or other arrangements with third parties when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to third parties to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

To the extent that we raise additional capital through the sale of equity, including pursuant to any sales under convertible debt or other securities convertible into equity, the ownership interest of our stockholders will be diluted, and the terms of these new securities may include liquidation or other preferences that adversely affect the rights of our stockholders. For instance, in December 2023, we sold an aggregate of 6,000,000 shares of Common Stock and 150,000 shares of our Series B Preferred Stock in the December 2023 PIPE to the December 2023 Investors for gross proceeds of $180.0 million. Subject to receiving the requisite stockholder approval and certain beneficial ownership limitations set by each holder of Series B Preferred Stock, each share of Series B Preferred Stock will automatically convert into an aggregate of 40 shares of our Common Stock. We are required to solicit the consent of our stockholders with regard to conversion of the shares of our Series B Preferred Stock, which will be voted on at our 2024 annual meeting of stockholders. If our stockholders fail to approve such matters, we may be subject to financial penalties that could materially harm our business, including the forced settlement of shares of Series B Preferred Stock for cash, as described in our Series B Certificate of Designation.

Debt financing, if available, would likely involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures, making additional product acquisitions, or declaring dividends. If we raise additional funds through strategic collaborations or licensing arrangements with third parties, we may have to relinquish valuable rights to our product candidates or future revenue streams or grant licenses on terms that are not favorable to us. We cannot be assured that we will be able to obtain additional funding if and when necessary to fund our entire portfolio of product candidates to meet our projected plans. If we are unable to obtain funding on a timely basis, we may be required to delay or discontinue one or more of our development programs or the commercialization of any product candidates or be unable to expand our operations or otherwise capitalize on potential business opportunities, which could materially harm our business, financial condition, and results of operations.

Risks Related to Discovery, Development and Commercialization

We face competition from entities that have developed or may develop programs for the diseases addressed by our programs.

The development and commercialization of drugs is highly competitive. Our programs, if approved, will face significant competition and our failure to effectively compete may prevent us from achieving significant market penetration. We compete with a variety of multinational biopharmaceutical companies, specialized biotechnology companies and emerging biotechnology companies, as well as academic institutions, governmental agencies, and public and private research institutions, among others. Many of the companies with which we are currently competing or will complete against in the future have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals, and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical and biotechnology industry may result in even more resources being concentrated among a smaller number of our competitors. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel, establishing clinical trial sites, patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs.

15

Our competitors have developed, are developing or will develop programs and processes competitive with our programs and processes. Competitive therapeutic treatments include those that have already been approved and accepted by the medical community and any new treatments. Our success will depend partially on our ability to develop and commercialize products that have a competitive safety, efficacy, dosing and/or presentation profile. Our commercial opportunity and success will be reduced or eliminated if competing products are safer, more effective, have a more attractive dosing profile or presentation or are less expensive than the products we develop, or if our competitors develop competing products or if biosimilars enter the market more quickly than we do and are able to gain market acceptance.

In addition, because of the competitive landscape for inflammatory and immunology (“I&I”) indications, we may also face competition for clinical trial enrollment. Patient enrollment will depend on many factors, including if potential clinical trial patients choose to undergo treatment with approved products or enroll in competitors’ ongoing clinical trials for programs that are under development for the same indications as our programs. An increase in the number of approved products for the indications we are targeting with our programs may further exacerbate this competition. Our inability to enroll a sufficient number of patients could, among others, delay our development timeline, which may further harm our competitive position.

Our programs are in preclinical stages of development and may fail in development or suffer delays that materially and adversely affect their commercial viability. If we or our current or future collaborators are unable to complete development of, or commercialize our programs, or experience significant delays in doing so, our business will be materially harmed.

We have no products on the market and all of our programs are in preclinical stages of development and have not been tested in humans. As a result, we expect it will be many years before we commercialize any program, if ever. Our ability to achieve and sustain profitability depends on obtaining regulatory approvals for, and successfully commercializing, our programs, either alone or with third parties, and we cannot guarantee you that we will ever obtain regulatory approval for any of our programs. We have not yet demonstrated our ability to initiate or complete any clinical trials, obtain regulatory approvals, manufacture a clinical development or commercial scale product or arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful product commercialization. Before obtaining regulatory approval for the commercial distribution of our programs, we or an existing or future collaborator must conduct extensive preclinical tests and clinical trials to demonstrate the safety and efficacy in humans of our programs and future product candidates.

We or our collaborators may experience delays in initiating or completing clinical trials. We or our collaborators also may experience numerous unforeseen events during, or as a result of, any current or future clinical trials that we could conduct that could delay or prevent our ability to receive marketing approval or commercialize our current programs or any future programs, including:

| • | regulators or institutional review boards (“IRBs”), the FDA or ethics committees may not authorize us or our investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site; |

| • | we may experience delays in reaching, or fail to reach, agreement on acceptable terms with prospective trial sites and prospective contract research organizations (“CROs”), the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| • | clinical trial sites deviating from trial protocol or dropping out of a trial; |

| • | clinical trials of any programs may fail to show safety or efficacy, produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional preclinical studies or clinical trials or we may decide to abandon product development programs; |

| • | the number of subjects required for clinical trials of any programs may be larger than we anticipate, especially if regulatory bodies require completion of non-inferiority or superiority trials, enrollment in |

16

| these clinical trials may be slower than we anticipate or subjects may drop out of these clinical trials or fail to return for post-treatment follow-up at a higher rate than we anticipate; |

| • | our third-party contractors may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all, or may deviate from the clinical trial protocol or drop out of the trial, which may require that we add new clinical trial sites or investigators; |

| • | we may elect to, or regulators, IRBs or ethics committees may require that we or our investigators, suspend or terminate clinical research or trials for various reasons, including noncompliance with regulatory requirements or a finding that the participants in our trials are being exposed to unacceptable health risks; |

| • | the cost of clinical trials of any of our programs may be greater than we anticipate; |

| • | the quality of our programs or other materials necessary to conduct clinical trials of our programs may be inadequate to initiate or complete a given clinical trial; |

| • | our inability to manufacture sufficient quantities of our programs for use in clinical trials; |

| • | reports from clinical testing of other therapies may raise safety or efficacy concerns about our programs; |

| • | our failure to establish an appropriate safety profile for a program based on clinical or preclinical data for such programs as well as data emerging from other therapies in the same class as our programs; and |

| • | the FDA or other regulatory authorities may require us to submit additional data such as long-term toxicology studies, or impose other requirements before permitting us to initiate a clinical trial. |

Commencing clinical trials in the United States is subject to acceptance by the FDA of an investigational new drug application (“IND”), biologics license application (“BLA”) or similar application and finalizing the trial design based on discussions with the FDA and other regulatory authorities. In the event that the FDA requires us to complete additional preclinical studies or we are required to satisfy other FDA requests prior to commencing clinical trials, the start of our first clinical trials may be delayed. Even after we receive and incorporate guidance from these regulatory authorities, the FDA or other regulatory authorities could disagree that we have satisfied their requirements to commence any clinical trial or change their position on the acceptability of our trial design or the clinical endpoints selected, which may require us to complete additional preclinical studies or clinical trials, delay the enrollment of our clinical trials or impose stricter approval conditions than we currently expect. There are equivalent processes and risks applicable to clinical trial applications in other countries, including countries in the European Union (“EU”).

We may not have the financial resources to continue development of, or to modify existing or enter into new collaborations for, a program if we experience any issues that delay or prevent regulatory approval of, or our ability to commercialize, our programs. We or our current or future collaborators’ inability to complete development of, or commercialize our programs, or significant delays in doing so, could have a material and adverse effect on our business, financial condition, results of operations and prospects.

We are substantially dependent on the success of our two most advanced programs, SPY001 and SPY002, and our anticipated clinical trials of such programs may not be successful.

Our future success is substantially dependent on our ability to timely obtain marketing approval for, and then successfully commercialize, our two most advanced programs, SPY001 and SPY002. We exercised our Option with respect to the SPY001 and SPY002 programs on July 12, 2023 and December 14, 2023, respectively. We are investing a majority of our efforts and financial resources into the research and development of these programs. We anticipate initiating a Phase 1 clinical trial in healthy volunteers of SPY001 in the first half of 2024 and of SPY002 in the second half of 2024, each subject to the filing of an IND or foreign equivalent and regulatory approval. The success of our programs is dependent on observing a longer half-life of our programs in

17

humans than other mAbs currently marketed and in development as we believe this longer half-life has the potential to result in a more favorable dosing schedule for our programs, assuming they successfully complete clinical development and obtain marketing approval. This is based in part on the assumption that the longer half-life we have observed in non-human primates (“NHPs”) will translate into an extended half-life of our programs in humans. To the extent we do not observe this extended half-life when we dose humans with our programs, it would significantly and adversely affect the clinical and commercial potential of our programs.

Our programs will require additional clinical development, evaluation of clinical, preclinical and manufacturing activities, marketing approval in multiple jurisdictions, substantial investment and significant marketing efforts before we generate any revenues from product sales. We are not permitted to market or promote these programs, or any other programs, before we receive marketing approval from the FDA and comparable foreign regulatory authorities, and we may never receive such marketing approvals.

The success of our programs will depend on a variety of factors. We do not have complete control over many of these factors, including certain aspects of clinical development and the regulatory submission process, potential threats to our intellectual property rights and the manufacturing, marketing, distribution and sales efforts of any future collaborator. Accordingly, we cannot assure you that we will ever be able to generate revenue through the sale of these programs, even if approved. If we are not successful in commercializing our SPY001 or SPY002 programs, or are significantly delayed in doing so, our business will be materially harmed.

If we do not achieve our projected development goals in the time frames we announce and expect, the commercialization of our programs may be delayed and our expenses may increase and, as a result, our stock price may decline.

From time to time, we estimate the timing of the anticipated accomplishment of various scientific, clinical, regulatory and other product development goals, which we sometimes refer to as milestones. These milestones may include the commencement or completion of scientific studies and clinical trials, such as the expected timing for the anticipated commencement of our Phase 1 clinical trials in IBD, as well as the submission of regulatory filings. From time to time, we may publicly announce the expected timing of some of these milestones. All of these milestones are and will be based on numerous assumptions. The actual timing of these milestones can vary dramatically compared to our estimates, in some cases for reasons beyond our control. If we do not meet these milestones as publicly announced, or at all, the commercialization of our programs may be delayed or never achieved and, as a result, our stock price may decline. Additionally, delays relative to our projected timelines are likely to cause overall expenses to increase, which may require us to raise additional capital sooner than expected and prior to achieving targeted development milestones.

Our approach to the discovery and development of our programs is unproven, and we may not be successful in our efforts to build a pipeline of programs with commercial value.

Our approach to the discovery and development of the research programs with respect to which we have exercised the Option to acquire intellectual property license rights to or have the Option to acquire intellectual property license rights to pursuant to the Paragon Agreement leverages clinically validated mechanisms of action and incorporates advanced antibody engineering to optimize half-life and other properties designed to overcome limitations of existing therapies. Our programs are purposefully designed to improve upon existing product candidates and products while maintaining the same, well-established mechanisms of action. However, the scientific research that forms the basis of our efforts to develop programs using half-life extension technologies, including YTE and LS amino acid substitutions, is ongoing and may not result in viable programs. We have limited clinical data on product candidates utilizing YTE and LS half-life extension technologies, especially in I&I indications, demonstrating whether they are safe or effective for long-term treatment in humans. The long-term safety and efficacy of these technologies and the extended half-life and exposure profile of our programs compared to currently approved products is unknown.

18

We may ultimately discover that utilizing half-life extension technologies for our specific targets and indications and any programs resulting therefrom do not possess certain properties required for therapeutic effectiveness. We currently have only preclinical data regarding the increased half-life properties of our programs and the same results may not be seen in humans. In addition, programs using half-life extension technologies may demonstrate different chemical and pharmacological properties in patients than they do in laboratory studies. This technology and any programs resulting therefrom may not demonstrate the same chemical and pharmacological properties in humans and may interact with human biological systems in unforeseen, ineffective or harmful ways.

In addition, we may in the future seek to discover and develop programs that are based on novel targets and technologies that are unproven. If our discovery activities fail to identify novel targets or technologies for drug discovery, or such targets prove to be unsuitable for treating human disease, we may not be able to develop viable additional programs. We and our existing or future collaborators may never receive approval to market and commercialize any program. Even if we or an existing or future collaborator obtains regulatory approval, the approval may be for targets, disease indications or patient populations that are not as broad as we intended or desired or may require labeling that includes significant use or distribution restrictions or safety warnings. If the products resulting from the research programs with respect to which we have exercised the Option to acquire intellectual property license rights to or have the Option to acquire intellectual property license rights to pursuant to the Paragon Agreement prove to be ineffective, unsafe or commercially unviable, such programs would have little, if any, value, which would have a material and adverse effect on our business, financial condition, results of operations and prospects.

Preclinical and clinical development involves a lengthy and expensive process that is subject to delays and with uncertain outcomes, and results of earlier studies and trials may not be predictive of future clinical trial results. If our preclinical studies and clinical trials are not sufficient to support regulatory approval of any of our programs, we may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development of such program.

Before obtaining marketing approval from regulatory authorities for the sale of any program, we must complete preclinical studies and then conduct extensive clinical trials to demonstrate the safety and efficacy of our program in humans. Our clinical trials may not be conducted as planned or completed on schedule, if at all, and failure can occur at any time during the preclinical study or clinical trial process. For example, we depend on the availability of NHPs to conduct certain preclinical studies that we are required to complete prior to submitting an IND and initiating clinical development. There is currently a global shortage of NHPs available for drug development. This could cause the cost of obtaining NHPs for our future preclinical studies to increase significantly and, if the shortage continues, could also result in delays to our development timelines.

Furthermore, a failure of one or more clinical trials can occur at any stage of testing. The outcome of preclinical studies and early-stage clinical trials may not be predictive of the success of later clinical trials. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that have believed their programs performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain marketing approval of their programs. In addition, we expect to rely on patients to provide feedback on measures such as measures of quality of life, which are subjective and inherently difficult to evaluate. These measures can be influenced by factors outside of our control, and can vary widely from day to day for a particular patient, and from patient to patient and from site to site within a clinical trial.

We cannot be sure that the FDA will agree with our clinical development plan. We plan to use the data from our planned Phase 1 trials of our SPY001 and SPY002 programs in healthy volunteers to support Phase 2 trials in IBD and other I&I indications. If the FDA requires us to conduct additional trials or enroll additional patients, our development timelines may be delayed. We cannot be sure that submission of an IND, BLA or similar application will result in the FDA or comparable foreign regulatory authorities, as applicable, allowing clinical trials to begin in a timely manner, if at all. Moreover, even if these trials begin, issues may arise that could cause regulatory authorities to suspend or terminate such clinical trials. Events that may prevent successful or timely

19

initiation or completion of clinical trials include: inability to generate sufficient preclinical, toxicology or other in vivo or in vitro data to support the initiation or continuation of clinical trials; delays in reaching a consensus with regulatory authorities on study design or implementation of the clinical trials; delays or failure in obtaining regulatory authorization to commence a trial; delays in reaching agreement on acceptable terms with prospective CROs and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and clinical trial sites; delays in identifying, recruiting and training suitable clinical investigators; delays in obtaining required IRB approval at each clinical trial site; delays in manufacturing, testing, releasing, validating or importing/exporting sufficient stable quantities of our programs for use in clinical trials or the inability to do any of the foregoing; failure by our CROs, other third parties or us to adhere to clinical trial protocols; failure to perform in accordance with the FDA’s or any other regulatory authority’s good clinical practice requirements (“GCPs”) or applicable regulatory guidelines in other countries; changes to the clinical trial protocols; clinical sites deviating from trial protocol or dropping out of a trial; changes in regulatory requirements and guidance that require amending or submitting new clinical protocols; selection of clinical endpoints that require prolonged periods of observation or analyses of resulting data; transfer of manufacturing processes to larger-scale facilities operated by a contract manufacturing organization (“CMO”) and delays or failure by our CMOs or us to make any necessary changes to such manufacturing process; and third parties being unwilling or unable to satisfy their contractual obligations to us.